- VLDR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

Velodyne Lidar (VLDR) S-1/AIPO registration (amended)

Filed: 22 Sep 20, 9:19am

As filed with the Securities and Exchange Commission on September 22, 2020

Registration No. 333-248434

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GRAF INDUSTRIAL CORP.

(Exact name of registrant as specified in its charter)

Delaware |

| 3569 |

| 83-1138508 |

118 Vintage Park Boulevard, Suite W-222

Houston, Texas 77070

(310) 745-8669

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael Dee

President, Chief Financial Officer and Director

118 Vintage Park Boulevard, Suite W-222

Houston, Texas 77070

(310) 745-8669

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joel L. Rubinstein |

| Trevor S. Knapp |

| Anand Gopalan |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ⌧

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ◻

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ◻

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ◻ |

| Accelerated filer | ⌧ |

Non-accelerated filer | ◻ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| | | |||||||||

Title of Securities to be Registered(1) |

| Amount to be |

| | Proposed |

| | Proposed |

| | Amount of |

Common stock, par value $0.0001 per share | | 15,000,000 | | $ | 17.90 | | $ | 268,500,000 | | $ | 34,851.30 |

(1) All securities being registered will be issued by Graf Industrial Corp., a Delaware corporation (“GRAF”) in connection with GRAF’s previously announced initial business combination (the “Business Combination”) with VL Merger Sub Inc. (“Merger Sub”) and Velodyne Lidar, Inc. (“Velodyne”), pursuant to which Velodyne will become a wholly owned subsidiary of GRAF and GRAF will change its name to Velodyne Lidar, Inc.

(2) Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting of any stock dividend, stock split, recapitalization or other similar transaction. These securities are being registered solely in connection with the resale of common stock by certain selling stockholders (the “PIPE Investors”) that entered into subscription agreements with GRAF, pursuant to which GRAF agreed to issue and sell to the PIPE Investors, in private placements that are expected to close immediately prior to the closing of the Business Combination, an aggregate of 15,000,000 shares of its common stock, par value $0.0001 per share (the “common stock”).

(3) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act, based on the average of the high and low prices of the registrant’s ordinary shares as reported on August 21, 2020, which was approximately $17.90 per share.

(4) Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement registers the resale of up to 15,000,000 shares of common stock (the “PIPE Shares”), par value $0.0001 per share (the “common stock”) of Graf Industrial Corp., a Delaware corporation (“GRAF”), by the selling stockholders named in the prospectus (or their permitted transferees) who are to be issued the PIPE Shares in a private placement immediately prior to the closing of the proposed business combination (the “Business Combination”) by and among GRAF, VL Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of GRAF (“Merger Sub”), and Velodyne Lidar, Inc., a Delaware corporation (“Velodyne”). The PIPE Shares will not be issued and outstanding at the time of at the special meeting of GRAF’s stockholders to be held to approve the Business Combination. Further, the holders of the PIPE Shares will not receive any proceeds from the trust account established in connection with GRAF’s initial public offering in the event GRAF does not consummate an initial business combination by the October 31, 2020 deadline in its current certificate of incorporation. In the event the Business Combination is not approved by GRAF stockholders or the other conditions precedent to the consummation of the Business Combination are not met, then the PIPE Shares will not be issued and GRAF will seek to withdraw the registration statement prior to its effectiveness.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 22, 2020

PRELIMINARY PROSPECTUS

GRAF INDUSTRIAL CORP.

15,000,000 Shares of Common Stock

This prospectus relates to the resale from time to time by the selling stockholders named in this prospectus or their permitted transferees (collectively, the “Selling Stockholders”) of up to 15,000,000 shares of common stock (the “PIPE Shares”), par value $0.0001 per share (“common stock”), of Graf Industrial Corp., a Delaware corporation (“GRAF”), which are expected to be issued in a private placement pursuant to the terms of the Subscription Agreements (as defined below) in connection with, and as part of the consideration for, the Business Combination (as described below). If the Business Combination is not consummated, the shares of common stock registered pursuant to this prospectus will not be issued.

On July 2, 2020, GRAF entered into an Agreement and Plan of Merger (the “Merger Agreement”) with VL Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of GRAF (“Merger Sub”), and Velodyne Lidar, Inc., a Delaware corporation (“Velodyne”). In connection with the Business Combination, Velodyne will merge with and into Merger Sub, with Velodyne surviving the merger as a wholly owned subsidiary of GRAF and GRAF will change its name to “Velodyne Lidar, Inc.”

In connection with the Business Combination, GRAF entered into subscription agreements, each dated as of July 2, 2020 (the “Subscription Agreements”), with certain institutional investors (collectively, the “PIPE Investors”), pursuant to which GRAF agreed to issue and sell to the PIPE Investors, in private placements to close immediately prior to the closing of the Business Combination, an aggregate of 15,000,000 PIPE Shares at $10.00 per share, for an aggregate purchase price of $150,000,000.

The Selling Stockholders may offer, sell or distribute all or a portion of the shares of common stock registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices. We will pay certain offering fees and expenses and fees in connection with the registration of the common stock and will not receive proceeds from the sale of the shares of common stock by the Selling Stockholders. Our common stock is currently listed on the New York Stock Exchange and trades under the symbol “GRAF.” Upon the consummation of the Business Combination, the post-Business Combination company’s common stock is expected trade on the Nasdaq Stock Market under the symbol “VLDR”.

We are an “emerging growth company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 12 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires, the terms “we,” “us,” “our,” and “GRAF” refer to Graf Industrial Corp., a Delaware corporation, and the term “post-combination company” refers to the company following the consummation of the Business Combination. In this prospectus:

| ● | “ADAS” means Advanced Driver Assistance Systems. |

| ● | “Amended and Restated Certificate of Incorporation” means the proposed Amended and Restated Certificate of Incorporation of GRAF, which will become the post-combination company’s certificate of incorporation upon the approval of the proposals presented at the Special Meeting, assuming the consummation of the Business Combination. |

| ● | “applicable deadline” means October 31, 2020. |

| ● | “Board” or “Board of Directors” means the board of directors of GRAF. |

| ● | “Business Combination” means the transactions contemplated by the Merger Agreement, including the Merger. |

| ● | “Closing” means the closing of the Business Combination. |

| ● | “Code” means the Internal Revenue Code of 1986, as amended. |

| ● | “common stock” means the shares of common stock, par value $0.0001 per share, of GRAF. |

| ● | “current certificate of incorporation” means our second amended and restated certificate of incorporation, dated October 15, 2018, as amended on April 16, 2020 and further amended on July 23, 2020. |

| ● | “DGCL” means the General Corporation Law of the State of Delaware. |

| ● | “Earnout Condition” means the condition in the Merger Agreement specifying that Velodyne equity holders will receive the earn-out shares if the closing price of GRAF common stock equals or exceeds $15.00 for 20 trading days out of any 30 trading day period commencing on the date of the Merger Agreement. The Earnout Condition was met on July 30, 2020. |

| ● | “Earnout” or “earn-out shares” means the additional shares of common stock, stock options and/or restricted stock units that are settleable into shares of common stock that former Velodyne equity holders are entitled to receive pursuant to the satisfaction of the Earnout Condition under the Merger Agreement. |

| ● | “ESPP” means the Velodyne Lidar, Inc. 2020 Employee Stock Purchase Plan. |

| ● | “Exchange Act” means the Securities Exchange Act of 1934, as amended. |

| ● | “Founder Shares” means, as of the date of this prospectus, the 6,094,128 shares of common stock that currently are owned by our Initial Stockholders, of which 6,026,128 shares are held by our Sponsor, 25,000 shares are held by Keith W. Abell, 25,000 shares are held by Sabrina Mckee and 18,000 shares are held by Julie Levenson. |

| ● | “GAAP” means U.S. generally accepted accounting principles. |

| ● | “HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. |

| ● | “Incentive Plan” means the Velodyne Lidar, Inc. 2020 Equity Incentive Plan. |

| ● | “Initial Stockholders” means our Sponsor together with Keith W. Abell, Sabrina Mckee and Julie Levenson, GRAF’s independent directors. |

| ● | “Investment Company Act” means the Investment Company Act of 1940, as amended. |

| ● | “IPO” means GRAF’s initial public offering, consummated on October 18, 2018, of 24,376,512 units (including 1,876,512 units that were subsequently issued to the underwriters in connection with the partial exercise of their over-allotment option) at $10.00 per unit. |

ii

| ● | “leader,” “leading,” “industry leadership,” “industry leading,” and other similar statements included in this prospectus regarding Velodyne and its services are based on Velodyne's belief that none of its competitors holds a combined market position greater than Velodyne's market position in its sector. Velodyne bases its beliefs regarding these matters, including its estimates of its market share in its sector, on its collective institutional knowledge and expertise regarding its industries, markets and technology, which are based on, among other things, publicly available information, reports of government agencies, RFPs and the results of contract bids and awards, and industry research firms, as well as Velodyne's internal research, calculations and assumptions based on its analysis of such information and data. Velodyne believes these assertions to be reasonable and accurate as of the date of this prospectus. |

| ● | “JOBS Act” means the Jumpstart Our Business Startups Act of 2012. |

| ● | “Merger Agreement” means that certain Agreement and Plan of Merger, dated as of July 2, 2020, by and among GRAF, Merger Sub and Velodyne, as amended by the Merger Agreement Amendment. |

| ● | “Merger Agreement Amendment” means that certain Amendment to Agreement and Plan of Merger, dated as of August 20, 2020, by and among GRAF, Merger Sub and Velodyne. |

| ● | “Maximum Share Consideration” means the aggregate maximum amount of merger consideration that GRAF has agreed to pay Velodyne equity holders, consisting of (1) 143,575,763 shares of GRAF common stock, including shares issuable in respect of vested equity awards of Velodyne, plus (2) up to 2,000,000 shares of GRAF common stock earned due to the satisfaction of the Earnout Condition on July 30, 2020 pursuant to the terms of the Merger Agreement, including the Earnout RSUs (as described on page 110), which are subject to vesting as described on page 110 and will not be legally issued and outstanding shares of GRAF common stock at Closing, plus (3) up to 4,878,048 shares of GRAF common stock that (i) will only be issued in full if no Velodyne capital stock is repurchased for cash in the Pre-Closing Velodyne Tender Offer or (ii) to the extent shares of Velodyne capital stock are repurchased in the Pre-Closing Velodyne Tender Offer for less than the Maximum Tender Consideration, such 4,878,048 shares of GRAF Common Stock will decrease accordingly, for a total of up to a maximum of 150,453,811 shares of GRAF common stock, in the event no shares of Velodyne capital stock are repurchased in the Pre-Closing Velodyne Tender Offer. |

| ● | “Merger” means the merger of Merger Sub with and into Velodyne, with Velodyne continuing as the surviving company. |

| ● | “Merger Sub” means VL Merger Sub Inc. |

| ● | “Nasdaq” means the Nasdaq Stock Market. |

| ● | “NHTSA” means the National Highway Traffic Safety Administration. |

| ● | “NYSE” means the New York Stock Exchange LLC. |

| ● | “PIPE Investment” means the private placement pursuant to which the PIPE Investors have collectively subscribed for 15,000,000 shares of common stock at $10.00 per share, for an aggregate purchase price of $150,000,000. |

| ● | “PIPE Investors” means certain institutional investors, including the Sponsor, that will invest in the PIPE Investment. |

| ● | “PIPE Shares” means the 15,000,000 shares of common stock to be issued in the PIPE Investment. |

| ● | “Pre-Closing Velodyne Tender Offer” means the tender offer expected to be consummated prior to the Closing in which Velodyne will offer to repurchase and cancel shares of the holders of Velodyne common and preferred stock who accept Velodyne’s offer to exchange their shares for a per share amount of cash, payable concurrently with or immediately following the Closing and equal to $10.25 times the number of shares of GRAF common stock that would have been issued as merger consideration in respect of such shares. The cash consideration with respect to the Pre-Closing Velodyne Tender Offer (up to the Maximum Tender Consideration) will be payable concurrently with or immediately following the Closing by GRAF. |

iii

| ● | “private placement warrants” means the warrants held by our Sponsor that were issued to our Sponsor in connection with our IPO, each of which is exercisable for three-quarters of one share of common stock, in accordance with its terms. |

| ● | “public shares” means shares of common stock included in the units issued in the our IPO. |

| ● | “public stockholders” means holders of public shares, including our Initial Stockholders to the extent our Initial Stockholders hold public shares; provided, that our Initial Stockholders are considered a “public stockholder” only with respect to any public shares held by them. |

| ● | “public units” means the units sold in our IPO, consisting of one share of common stock and one public warrant of GRAF. |

| ● | “public warrants” means the warrants included in the public units issued in the our IPO, each of which is exercisable for three-quarters of one share of common stock, in accordance with its terms. |

| ● | “Related Agreements” means, collectively, the Support Agreement, the Sponsor Agreement and the Subscription Agreements. |

| ● | “RSUs” means restricted stock units granted under the Incentive Plan in accordance with the terms of the Merger Agreement. |

| ● | “SEC” means the U.S. Securities and Exchange Commission. |

| ● | “Securities Act” means the Securities Act of 1933, as amended. |

| ● | “SOX” means the Sarbanes-Oxley Act of 2002. |

| ● | “Special Meeting” means the special meeting of the stockholders of GRAF convened on September 29, 2020 at 10:00 a.m., New York City Time, at http://www.cstproxy.com/grafindustrialcorp/sms2020 by a virtual meeting conducted exclusively via live webcast to vote on the Business Combination and related matters. |

| ● | “Sponsor” means Graf Acquisition LLC, a Delaware limited liability company. |

| ● | “Stock Consideration” means the common stock to be issued to the Velodyne equity holders pursuant to the transactions contemplated by the Merger Agreement, including any earn-out shares issuable pursuant to Article III thereof. |

| ● | “Subscription Agreements” means, collectively, those certain subscription agreements entered into on July 2, 2020, between GRAF and certain investors, including our Sponsor, pursuant to which such investors have agreed to purchase an aggregate of 15,000,000 shares of common stock in the PIPE Investment. |

| ● | “Transfer Agent” means Continental Stock Transfer & Trust Company. |

| ● | “Trust Account” means the trust account of GRAF that holds the proceeds from GRAF’s IPO and a portion of the proceeds from the sale of the private placement warrants. |

| ● | “Velodyne” means Velodyne Lidar, Inc., a Delaware corporation. |

| ● | “Velodyne capital stock” means Velodyne common stock, par value $0.0001 per share, series A preferred stock, par value $0.0001 per share, series B preferred stock, par value $0.0001 per share, and series B-1 preferred stock, $0.0001 per share, in each case, that is issued and outstanding immediately prior to the Closing. |

| ● | “Velodyne equity holder” means each holder of Velodyne capital stock or a vested equity award. |

iv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, including with respect to the anticipated timing, completion and effects of the Business Combination. All statements, other than statements of historical facts, may be forward-looking statements. These statements are based on the expectations and beliefs of management of GRAF and Velodyne in light of historical results and trends, current conditions and potential future developments, and are subject to a number of factors and uncertainties that could cause actual results to differ materially from forward-looking statements. These forward-looking statements include statements about the future performance and opportunities of Velodyne; benefits of the Business Combination; statements of the plans, strategies and objectives of management for future operations of Velodyne; statements regarding future economic conditions or performance; and other statements regarding the Business Combination. Forward-looking statements may contain words such as “will be,” “will,” “expect,” “anticipate,” “continue,” “project,” “believe,” “plan,” “could,” “estimate,” “forecast,” “guidance,” “intend,” “may,” “plan,” “possible,” “potential,” “predict,” “pursue,” “should,” “target” or similar expressions, and include the assumptions that underlie such statements.

The following factors, among others, could cause actual results to differ materially from forward-looking statements:

Operating Factors

| ● | Velodyne’s future performance, including Velodyne’s revenue, costs of revenue, gross profit or gross margin, and operating expenses; |

| ● | the sufficiency of Velodyne’s cash and cash equivalents to meet its operating requirements; |

| ● | Velodyne’s ability to sell its products to new customers; |

| ● | the success of Velodyne’s customers in developing and commercializing products using Velodyne’s solutions, and the market acceptance of those products; |

| ● | the amount and timing of future sales; |

| ● | Velodyne’s future market share; |

| ● | competition from existing or future businesses and technologies; |

| ● | the impact of the COVID-19 pandemic on Velodyne’s business and the business of its customers; |

| ● | the market for and adoption of lidar and related technology; |

| ● | Velodyne’s ability to effectively manage its growth and future expenses; |

| ● | Velodyne’s ability to compete in a market that is rapidly evolving and subject to technological developments; |

| ● | Velodyne’s estimated total addressable market and the market for autonomous solutions; |

| ● | Velodyne’s ability to maintain, protect, and enhance its intellectual property; |

| ● | Velodyne’s ability to comply with modified or new laws and regulations applying to its business; |

| ● | the attraction and retention of qualified employees and key personnel; |

| ● | Velodyne’s ability to introduce new products that meet its customers’ requirements and to continue successfully transitioning the manufacturing of its products to third-party manufacturers; |

| ● | Velodyne’s anticipated investments in and results from sales and marketing and research and development; |

| ● | the increased expenses associated with Velodyne being a public company; and |

| ● | our use of the net proceeds from the PIPE and the Trust Account. |

v

Transaction-Related Factors

| ● | occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement or the failure to satisfy the closing conditions; |

| ● | possibility that the consummation of the Business Combination is delayed or does not occur, including the failure of the stockholders of GRAF and Velodyne to approve the Business Combination Proposal, the Nasdaq Stock Issuance Proposal presented at the Special Meeting; |

| ● | uncertainty as to whether GRAF and Velodyne will be able to complete the Business Combination on the terms set forth in the Merger Agreement; |

| ● | outcome of any legal proceedings that have been or may be instituted against GRAF, Velodyne or others following announcement of the transactions contemplated by the Merger Agreement; |

| ● | uncertainty as to the long-term value of common stock; |

| ● | the risk that the proposed Business Combination disrupts current plans and operations of Velodyne as a result of the announcement and consummation of the transactions described herein; and |

| ● | the ability to obtain and maintain the listing of common stock on Nasdaq following the Business Combination. |

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other risk factors included herein. Forward-looking statements reflect current views about GRAF’s plans, strategies and prospects, which are based on information available as of the date of this prospectus. Except to the extent required by applicable law, GRAF undertakes no obligation (and expressly disclaims any such obligation) to update or revise the forward-looking statements whether as a result of new information, future events or otherwise.

Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not place undue reliance on those statements.

vi

SUMMARY OF THE PROSPECTUS

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the information under “Risk Factors,” “GRAF’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Velodyne’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements included elsewhere in this prospectus.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “we,” “our,” “us” and other similar terms refer to GRAF or Velodyne, as the context suggests.

GRAF

GRAF, a Delaware corporation, is a blank check company that was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

The mailing address of GRAF’s principal executive office is 118 Vintage Park Boulevard, Suite W-222, Houston, Texas 77070.

Velodyne

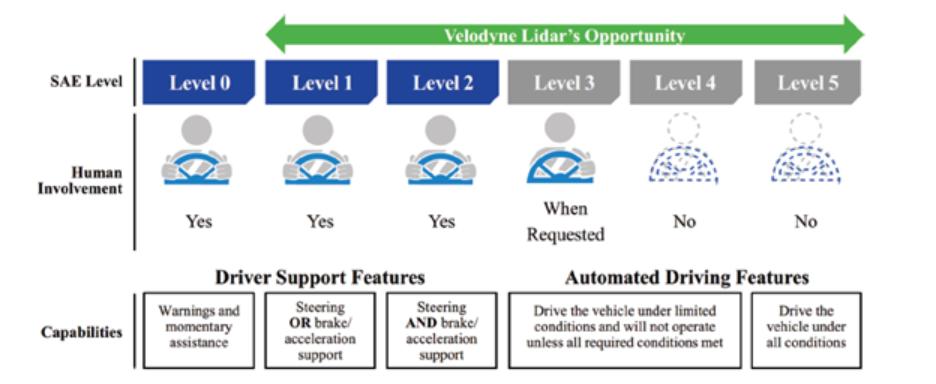

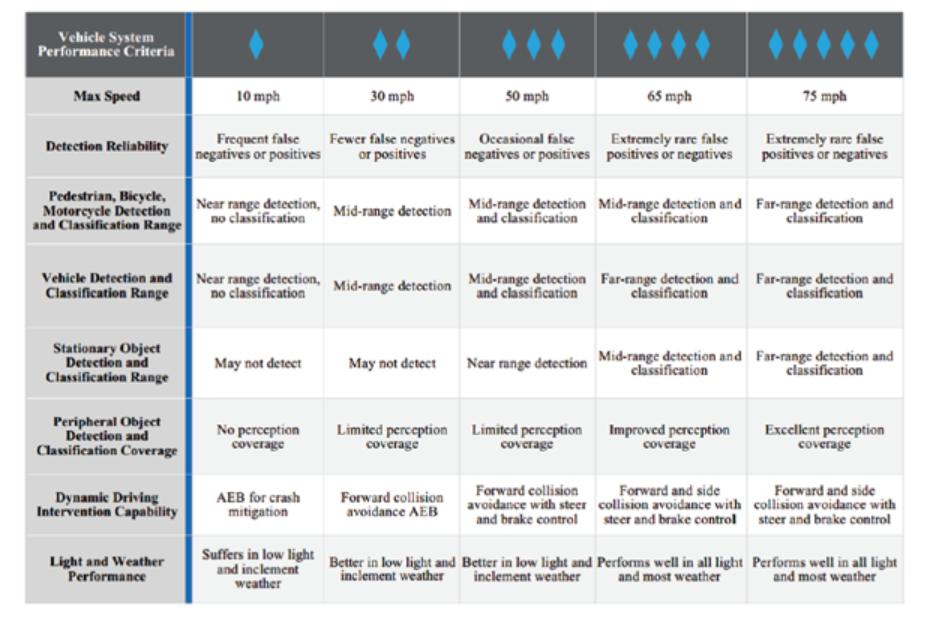

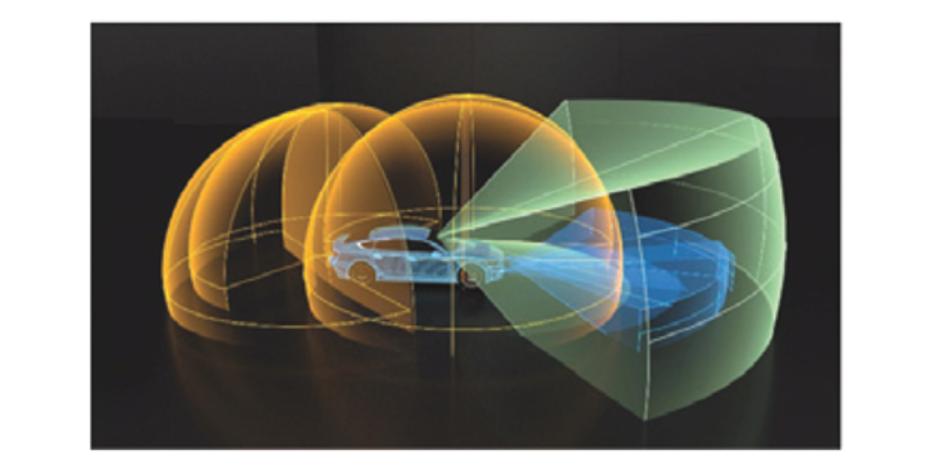

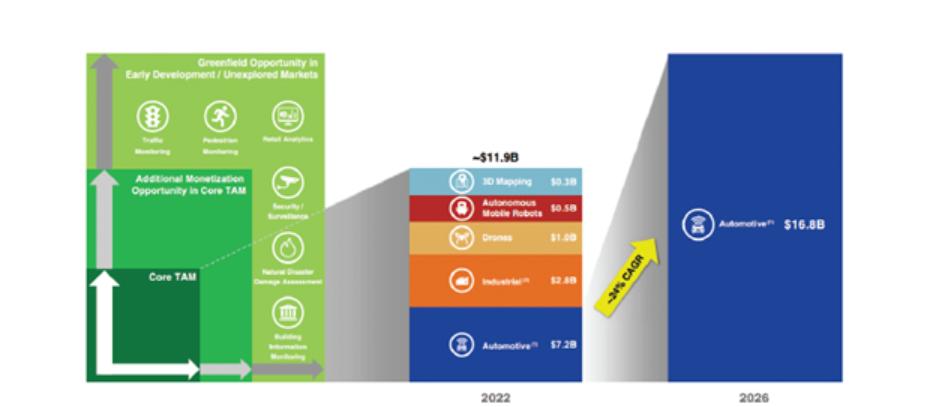

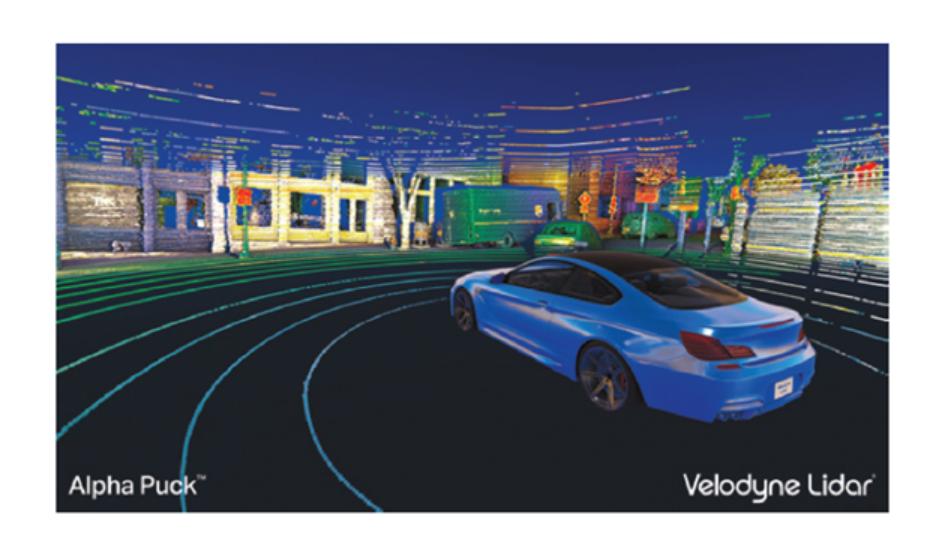

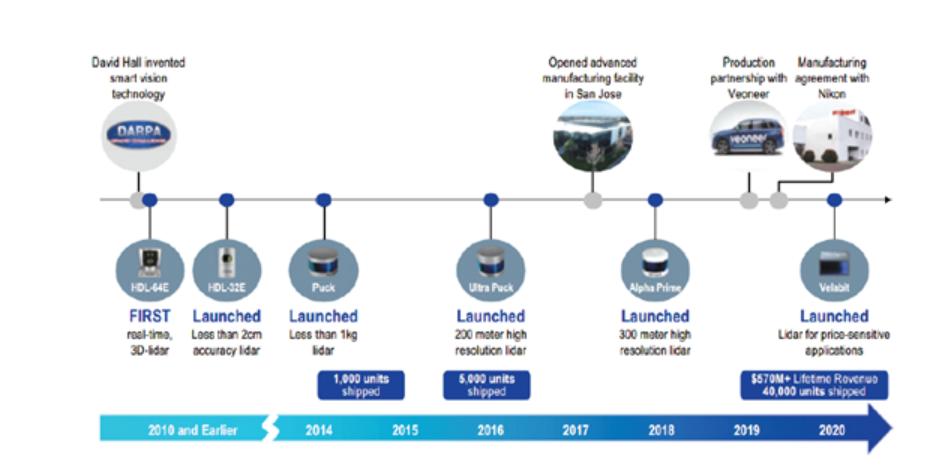

Velodyne is the global leader in lidar technology providing real-time 3D vision for autonomous systems, which Velodyne calls smart vision. Velodyne’s smart vision solutions are advancing the development of safe automated systems throughout the world, thereby empowering the autonomous revolution by allowing machines to see their surroundings. In automotive applications, Velodyne’s products improve roadway safety by providing perception data for reliable object avoidance and safe path-planning. Velodyne has a vision called LIVE, Lidar in Vehicles Everywhere, which encompasses a mass-produced lower cost lidar sold for every model of car and truck. Velodyne believes safety on the roadways is for everyone. To improve roadway, bicycle, and pedestrian safety, Velodyne sells automotive solutions to the rapidly expanding ADAS market, which will incrementally address the requirements of the NHTSA 5-Star Safety Ratings System. Velodyne’s lidar-based smart vision solutions are also deployed in many non-automotive applications, such as autonomous mobile robots, UAVs, last-mile delivery, precision agriculture, advanced security systems, and smart city initiatives, among others. Velodyne’s first products were commercially available in 2010. Since then, Velodyne has shipped over 40,000 units and generated cumulative sales of over $570 million. While purchases have been primarily focused on research in development projects, several of Velodyne’s non-automotive customers are in commercial production with their offerings. Velodyne estimates that Velodyne is addressing a market opportunity for its technology solutions of approximately $11.9 billion in 2022, with roughly 60% attributable to automotive applications. Velodyne believes that it is approaching the inflection point of adoption of lidar solutions across multiple end markets and that Velodyne is well-positioned, with strong customer relationships and a growing government interest in urban safety, to take advantage of these opportunities.

The mailing address of Velodyne’s principal executive office is 5521 Hellyer Avenue, San Jose, California 95138, and its telephone number is (669) 275-2251.

The Business Combination

Merger Agreement

On July 2, 2020, GRAF and Merger Sub entered into the Merger Agreement with Velodyne. Furthermore, on August 20, 2020, the Company and Merger Sub entered into the Merger Agreement Amendment and the Letter Acknowledgment with Velodyne. On September 7, 2020, Graf and Velodyne executed a letter agreement agreeing to list the shares of the post-combination company on Nasdaq, instead of the NYSE. Graf shares arecurrently listed on the NYSE and will be delisted concurrently with the listing of the post-combination company shares on Nasdaq at Closing. If the Merger Agreement is adopted by Velodyne stockholders and the Merger Agreement is approved by stockholders of GRAF at the Special Meeting, Velodyne will become a wholly owned subsidiary of GRAF and GRAF will change its name to Velodyne Lidar, Inc. The consummation of the Merger is subject to the receipt of the requisite approval of the stockholders of each of GRAF and Velodyne (such approvals, the “the Company

1

stockholder approval” and the “Velodyne stockholder approval,” respectively) and the fulfillment of certain other conditions.

The consummation of the Merger is conditioned upon, among other things, (i) the expiration or termination of the waiting period under the HSR Act, (ii) the absence of any governmental order, statute, rule or regulation enjoining or prohibiting the consummation of the Merger, (iii) receipt of GRAF stockholder approval, (iv) receipt of Velodyne stockholder approval, (v) the approval of the Extension (as defined in the Merger Agreement) and the other matters presented for GRAF. On July 23, 2020, the Graf’s shareholders approved the Extension. On August 4, 2020, GRAF received notice that the Federal Trade Commission granted early termination of the waiting period under the HSR Act with respect to the transactions contemplated by the Merger Agreement. On August 20, 2020, Velodyne received stockholder approval for the Merger Agreement and the transactions contemplated thereby from a majority of its stockholders.

The obligations of GRAF to consummate the Merger are also conditioned upon, among other things, customary closing conditions and the entering into employment agreements with certain officers of Velodyne on terms and conditions reasonably satisfactory to GRAF (but no less favorable to such employees than their current employment arrangements).

The obligations of Velodyne to consummate the Merger also are conditioned upon, among other things, (i) customary closing conditions, (ii) the amendment and restatement of Graf’s certificate of incorporation in substantially the form attached to the Merger Agreement and (iii) evidence that, immediately after the Closing, the funds in the Trust Account (as defined in the Merger Agreement), together with the funding of any amounts payable under the Subscription Agreements (as defined in the Merger Agreement), will be no less than an aggregate amount of $200,000,000.

Subscription Agreements

In connection with the Business Combination, GRAF entered into the Subscription Agreements with the PIPE Investors, pursuant to which, among other things, GRAF agreed to issue and sell to the PIPE Investors, in private placements to close immediately prior to the Closing, an aggregate of 15,000,000 PIPE Shares of common stock at $10.00 per share, for an aggregate purchase price of $150,000,000. The obligations to consummate the subscriptions are conditioned upon, among other things, customary closing conditions and the consummation of the transactions contemplated by the Merger Agreement. The PIPE Investment is expected to close immediately prior to the Closing. If the Business Combination is not approved by the GRAF stockholders or the other conditions precedent to closing the Business Combination are not fulfilled and the Business Combination does not close, then the PIPE Investment will not occur and the PIPE Shares will not be issued. In this event, the registration statement of which this prospectus forms a part will be withdrawn by the issuer prior to the effectiveness of the registration statement.

Risks Related to Our Business

Investing in our securities involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page 12 before making a decision to invest in our common stock. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our securities would likely decline, and you may lose all or part of your investment. Set forth below is a summary of some of the principal risks we face:

| ● | Velodyne's business could be materially and adversely affected by the current global COVID-19 pandemic. |

| ● | Since many of the markets in which Velodyne competes are new and rapidly evolving, it is difficult to forecast long-term end-customer adoption rates and demand for Velodyne’s products. |

| ● | Despite the actions Velodyne is taking to defend and protect its intellectual property, Velodyne may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its solutions. Velodyne’s efforts to protect and enforce its intellectual property rights and prevent third parties from violating its rights may be costly. |

| ● | Velodyne continues to implement strategic initiatives designed to grow its business. These initiatives may prove more costly than anticipated and Velodyne may not succeed in increasing its revenue in an amount sufficient to offset the costs of these initiatives and to achieve and maintain profitability. |

2

| ● | Because Velodyne’s sales have been primarily to customers making purchases for research and development projects and its orders are project-based, Velodyne expects its results of operations to fluctuate on a quarterly and annual basis, which could cause the stock price of the post-combination company to fluctuate or decline. |

| ● | Velodyne’s transition to an outsourced manufacturing business model may not be successful, which could harm its ability to deliver products and recognize revenue. |

| ● | Adverse conditions in the automotive industry or the global economy more generally could have adverse effects on Velodyne’s results of operations. |

| ● | Although Velodyne believes that lidar is the industry standard for autonomous vehicles and other emerging markets, market adoption of lidar is uncertain. If market adoption of lidar does not continue to develop, or develops more slowly than Velodyne expects, its business will be adversely affected. |

| ● | Because lidar is new in the market, forecasts of market growth in this prospectus may not be accurate. |

| ● | Velodyne’s investments in educating its customers and potential customers about the advantages of lidar and its applications may not result in sales of Velodyne’s products. |

Business Combination Litigation

On August 4, 2020, a purported shareholder of GRAF commenced a putative class action against GRAF and its directors in the Supreme Court of the State of New York, New York County. The Plaintiff alleges that the Board members, aided and abetted by GRAF, breached their fiduciary duties by entering into the Merger Agreement with Velodyne. The Plaintiff alleges that the Merger Agreement undervalues GRAF, was the result of an improper process and that GRAF’s disclosure concerning the proposed Merger is inadequate. As a result of these alleged breaches of fiduciary duty, the Plaintiff seeks, among other things, to enjoin the Merger or, in the event it is consummated, an award of rescissory damages. GRAF believes the claim is without merit and intends to defend itself vigorously. Velodyne is not party to this litigation.

3

THE OFFERING

| ||

Issuer |

| Graf Industrial Corp. In connection with the closing of the Business Combination, GRAF will change its name to Velodyne Lidar, Inc. If the Business Combination is not consummated, the shares of common stock registered pursuant to this prospectus will not be issued. |

Common stock offered by the Selling Stockholders | | Up to 15,000,000 shares of common stock, which are expected to be issued pursuant to the terms of the Subscription Agreements in a private placement in connection with, and as part of the consideration for, the Business Combination. |

Common stock to be issued and outstanding after the consummation of this offering and the Business Combination (assuming no redemptions)(1) | | 174,604,895 |

Common stock to be issued and outstanding after the consummation of this offering and the Business Combination (assuming maximum redemptions)(2) | | 168,040,110 |

Use of proceeds | | We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders. |

Market for our shares of common stock | | Prior to the Business Combination, our common stock is currently listed on the NYSE under the symbol “GRAF.” Following the closing of the Business Combination, we expect that our common stock will be listed on Nasdaq under the symbol “VLDR.” |

Risk factors | | Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

| (1) | Represents the number of shares of the post-combination company’s common stock outstanding at Closing assuming that none of GRAF’s public stockholders exercise their redemption rights in connection with the Special Meeting. The number of issued and outstanding shares reflected above assumes the issuance of approximately (i) 6,032,676 shares of common stock underlying restricted stock units and options expected to be vested as of September 7, 2020 and (ii) 189,868 shares of Company common stock underlying restricted stock units and options to be issued as a result of the satisfaction of the Earnout Condition. These restricted stock units and options will not represent issued and outstanding shares of common stock at the Closing. See “Beneficial Ownership of Securities” for more information. |

| (2) | Represents the number of shares of the post-combination company’s common stock outstanding at Closing assuming that 6,564,785 of GRAF’s public shares are redeemed in connection with the Special Meeting. The number of issued and outstanding shares reflected above assumes the issuance of approximately (i) 6,032,676 shares of common stock underlying restricted stock units and options expected to be vested as of September 7, 2020 and (ii) 189,868 shares of Company common stock underlying restricted stock units and options to be issued as a result of the satisfaction of the Earnout Condition. These restricted stock units and options will not represent issued and outstanding shares of common stock at the Closing. See “Beneficial Ownership of Securities” for more information. |

4

SELECTED HISTORICAL FINANCIAL INFORMATION OF GRAF

The following table contains summary historical financial data for GRAF as of and for the six months ended June 30, 2020 and for the six months ended June 30, 2019, as of and for the year ended December 31, 2019 and for the period from June 26, 2018 (inception) through December 31, 2018. Such data for the period from June 26, 2018 through December 31, 2018 and as of December 31, 2018 and for the year ended and as of December 31, 2019 have been derived from the audited financial statements of GRAF, which are included elsewhere in this prospectus. Such data as of and for the six months ended June 30, 2020 and for the six months ended June 30, 2019 have been derived from the unaudited financial statements of GRAF included elsewhere in this prospectus. Results from interim periods are not necessarily indicative of results that may be expected for the entire year.

The information is only a summary and should be read in conjunction with GRAF’s consolidated financial statements and related notes and “GRAF’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained elsewhere herein. The historical results included below and elsewhere in this prospectus are not indicative of the future performance of GRAF.

| | | | | |||||||

| | | | | | | | Period from | | ||

| | | | | | | | June 26, |

| ||

| | | | | | | | 2018 | | ||

| | For the Six Months Ended | | Year Ended | | (inception) to | | ||||

| | June 30, | | December 31, | | December 31, | | ||||

|

| 2020 |

| 2019 |

| 2019 |

| 2018 | | ||

Revenue | | | | | | | | | | ||

General and administrative costs | | $ | 795,361 | | $ | 224,803 | | 617,187 | | 179,880 | |

Franchise Tax Expense | | | 100,150 | | | 100,000 | | 100,350 | | 103,013 | |

Loss from operations | | | (895,511) | | | (324,803) | | (717,537) | | (282,893) | |

Other incomes (expenses): | | | | | | | | | | | |

Investment income on Trust Account | | | 845,679 | | | 2,893,394 | | 5,239,790 | | 1,125,181 | |

Change in fair value of warrant liability | | | (2,800,110) | | | (3,376,517) | | (17,365,901) | | 3,448,173 | |

Total other income (expenses) | | | (1,954,431) | | | (483,123) | | (12,126,111) | | 4,573,354 | |

Income (loss) before income tax expense | | | (2,849,942) | | | (807,926) | | (12,843,648) | | 4,290,461 | |

Income tax expense | | | 156,571 | | | 611,714 | | 1,079,282 | | 214,655 | |

Net income (loss) | | $ | (3,006,513) | | $ | (1,419,640) | | (13,922,930) | | 4,075,806 | |

Weighted average shares outstanding of Public Shares | | | 18,980,815 | | | 24,376,512 | | 24,376,512 | | 24,201,371 | |

Basic and diluted net income per share, Public Shares | | $ | 0.03 | | $ | 0.09 | | 0.17 | | 0.03 | |

Weighted average shares outstanding of Founder Shares | | | 6,094,128 | | | 6,094,128 | | 6,094,128 | | 6,094,128 | |

Basic and diluted net loss per share, Founder Shares | | $ | (0.59) | | $ | (0.61) | | (2.94) | | 0.54 | |

| | | | |||||||

| | As of |

| |||||||

| | June 30, | | | | | | |||

|

| 2020 |

| December 31, |

| December 31, | | |||

Balance Sheet Data | | (unaudited) | | 2019 | | 2018 | | |||

| | (in actual dollars) | | |||||||

Total assets | | $ | 117,725,426 | | $ | 249,715,936 | | $ | 246,432,561 | |

Total liabilities | | | 698,912 | | | 32,886,462 | | | 15,664,594 | |

Total stockholders’ equity | | | 5,000,004 | | | 5,000,004 | | | 5,000,007 | |

5

SELECTED HISTORICAL FINANCIAL INFORMATION OF VELODYNE

The following table shows selected historical financial information of Velodyne for the periods and as of the dates indicated.

The selected historical consolidated statements of operations data of Velodyne for the years ended December 31, 2017, 2018 and 2019 and the historical consolidated balance sheet data as of December 31, 2018 and 2019 are derived from Velodyne’s audited consolidated financial statements included elsewhere in this prospectus. The selected historical condensed consolidated statements of operations data of Velodyne for the six months ended June 30, 2019 and 2020 and the condensed consolidated balance sheet data as of June 30, 2020 are derived from Velodyne’s unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. In Velodyne management’s opinion, the unaudited interim condensed consolidated financial statements include all adjustments necessary to state fairly Velodyne’s financial position as of June 30, 2020 and the results of operations and cash flows for the six months ended June 30, 2019 and 2020.

The following selected historical financial information should be read together with the consolidated financial statements and accompanying notes and “Velodyne’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this prospectus. The selected historical financial information in this section is not intended to replace Velodyne’s consolidated financial statements and the related notes. Velodyne’s historical results are not necessarily indicative of the results that may be expected in the future and Velodyne’s results for the six months ended June 30, 2020 are not necessarily indicative of the results that may be expected for the full year ending December 31, 2020 or any other period.

As explained elsewhere in this prospectus, the financial information contained in this section relates to Velodyne, prior to and without giving pro forma effect to the impact of the Business Combination and, as a result, the results reflected in this section may not be indicative of the results of the post-combination company going forward. See the

6

section entitled “Unaudited Pro Forma Condensed Combined Financial Information” included elsewhere in this prospectus.

| | | | | | |||||||||||

| | | | Six Months Ended | | |||||||||||

| | Year Ended December 31, | | June 30, |

| |||||||||||

(in thousands, except share and per share data) |

| 2017 |

| 2018 |

| 2019 |

| 2019 |

| 2020 | | |||||

| | | | | | | | (unaudited) | | |||||||

Revenue | | $ | 182,090 | | $ | 142,946 | | $ | 101,398 | | $ | 68,909 | | $ | 45,417 | |

Cost of revenue(1) | | | 101,713 | | | 112,066 | | | 71,630 | | | 38,272 | | | 29,929 | |

Gross profit | | | 80,377 | | | 30,880 | | | 29,768 | | | 30,637 | | | 15,488 | |

Operating expenses(1): | | | | | | | | | | | | | | | | |

Research and development | | | 31,610 | | | 51,993 | | | 56,850 | | | 25,690 | | | 29,118 | |

Sales and marketing | | | 13,956 | | | 22,137 | | | 21,873 | | | 10,819 | | | 8,672 | |

General and administrative | | | 9,978 | | | 12,902 | | | 20,058 | | | 6,489 | | | 16,363 | |

Restructuring | | | — | | | — | | | — | | | — | | | 1,043 | |

Total operating expenses | | | 55,544 | | | 87,032 | | | 98,781 | | | 42,998 | | | 55,196 | |

Operating income (loss) | | | 24,833 | | | (56,152) | | | (69,013) | | | (12,361) | | | (39,708) | |

Interest income | | | 489 | | | 630 | | | 1,146 | | | 755 | | | 117 | |

Interest expense | | | — | | | (14) | | | (77) | | | (27) | | | (38) | |

Other income (expense), net | | | 249 | | | (136) | | | 35 | | | 27 | | | (143) | |

Income (loss) before income taxes | | | 25,571 | | | (55,672) | | | (67,909) | | | (11,606) | | | (39,772) | |

Provision for (benefit from) income taxes | | | 9,810 | | | 6,628 | | | (683) | | | 52 | | | (6,660) | |

Net income (loss) | | $ | 15,761 | | $ | (62,300) | | $ | (67,226) | | $ | (11,658) | | $ | (33,112) | |

Net income (loss) attributable to common stockholders: | | | | | | | | | | | | | | | | |

Basic | | $ | 12,139 | | $ | (62,300) | | $ | (67,226) | | $ | (11,658) | | $ | (33,112) | |

Diluted | | $ | 12,328 | | $ | (62,300) | | $ | (67,226) | | $ | (11,658) | | $ | (33,112) | |

Net income (loss) per share attributable to common stockholders(2) | | | | | | | | | | | | | | | | |

Basic | | $ | 0.35 | | $ | (1.82) | | $ | (1.96) | | $ | (0.34) | | $ | (0.97) | |

Diluted | | $ | 0.34 | | $ | (1.82) | | $ | (1.96) | | $ | (0.34) | | $ | (0.97) | |

Weighted-average shares used in computing net income (loss) per share attributable to common stockholders(2) | | | | | | | | | | | | | | | | |

Basic | | | 34,325,728 | | | 34,320,311 | | | 34,252,578 | | | 34,252,578 | | | 34,252,578 | |

Diluted | | | 36,779,701 | | | 34,320,311 | | | 34,252,578 | | | 34,252,578 | | | 34,252,578 | |

7

| | | | | | | | | |

| | As of December 31, | | June 30, |

| ||||

(in thousands) |

| 2018 |

| 2019 |

| 2020 | | ||

| | | | | | (unaudited) | | ||

Consolidated Balance Sheet Data | | | | | | | | | |

Cash, cash equivalents and short-term investments | | $ | 59,391 | | $ | 62,203 | | 36,629 | |

Working capital(3) | | | 56,352 | | | 45,627 | | 62,517 | |

Total assets | | | 141,760 | | | 136,175 | | 136,927 | |

Convertible preferred stock | | | 1 | | | 1 | | 1 | |

Total stockholders’ equity | | | 93,615 | | | 76,246 | | 63,175 | |

| (1) | Includes stock-based compensation expense as follows: |

| | | | | | | ||||||||||

| | Year Ended December 31, | | Six Months Ended June 30, |

| |||||||||||

(in thousands) |

| 2017 |

| 2018 |

| 2019 |

| 2019 |

| 2020 | | |||||

| | | | | | | | (unaudited) | | |||||||

Cost of revenue | | $ | — | | $ | — | | $ | — | | | — | | $ | — | |

Research and development | | | 156 | | | 93 | | | 97 | | | 48 | | | 21 | |

Sales and marketing | | | — | | | — | | | — | | | — | | | — | |

General and administrative | | | 78 | | | 114 | | | 38 | | | 38 | | | 135 | |

Total stock-based compensation expense | | $ | 234 | | $ | 207 | | $ | 135 | | $ | 86 | | $ | 156 | |

Our stock-based compensation expense primarily related to our stock options for all periods presented. As of June 30, 2020, no compensation expense related to restricted stock awards and units (“RSAs and RSUs”) had been recognized because the performance vesting condition, which is (i) an initial public offering, or (ii) a Company sale event, was not probable of being met. If the performance vesting condition had occurred on June 30, 2020, we would have recorded $67.1 million of stock-based compensation expense related to the RSAs and RSUs.

| (2) | See Notes 9 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the calculations of our basic and diluted net income (loss) per share and the weighted-average shares used to compute net income (loss) per share. |

| (3) | Working capital is defined as current assets less current liabilities. |

8

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following summary unaudited pro forma condensed combined financial data (the “Summary Pro Forma Data”) gives effect to the transaction contemplated by the Business Combination. The Business Combination will be accounted for as a reverse recapitalization in accordance with GAAP. Under this method of accounting, GRAF will be treated as the “acquired” company for financial reporting purposes. Accordingly, for accounting purposes, the Business Combination will be treated as the equivalent of Velodyne issuing stock for the net assets of GRAF, accompanied by a recapitalization whereby no goodwill or other intangible assets are recorded. Operations prior to the Business Combination will be those of Velodyne. The summary unaudited pro forma condensed combined balance sheet data as of June 30, 2020 gives effect to the Business Combination as if it had occurred on June 30, 2020. The summary unaudited pro forma condensed combined statement of operations data for the six months ended June 30, 2020 and year ended December 31, 2019 gives effect to the Business Combination as if it had occurred on January 1, 2019.

The Summary Pro Forma Data have been derived from, and should be read in conjunction with, the more detailed unaudited pro forma condensed combined financial information of the post-combination company appearing elsewhere in this prospectus and the accompanying notes to the unaudited pro forma condensed combined financial statements. The unaudited pro forma condensed combined financial information is based upon, and should be read in conjunction with, the historical consolidated financial statements and related notes of GRAF and Velodyne for the applicable periods included in this prospectus. The Summary Pro Forma Data have been presented for informational purposes only and are not necessarily indicative of what the post-combination company’s financial position or results of operations actually would have been had the Business Combination been completed as of the dates indicated. In addition, the Summary Pro Forma Data does not purport to project the future financial position or operating results of the post-combination company.

The unaudited pro forma condensed combined financial information has been prepared using the assumptions below with respect to the potential redemption into cash of common stock:

| ● | Assuming Minimum Redemptions: In connection with the extension amendment proposal to extend the date by which GRAF has to consummate transaction from July 31, 2020 to October 31, 2020 included in the definitive proxy statement filed by GRAF on July 8, 2020 (the “Extension Amendment Proposal”), an aggregate 1,105 shares of GRAF’s common stock were redeemed, and approximately $11,000 was withdrawn out of the Trust Account to pay for such redemption (estimated per share redemption value of $10.23). After redemptions, there were 11,454,132 public shares outstanding. This presentation takes into consideration the redemptions in connection with the Extension Amendment Proposal, but it assumes that no additional public stockholders of GRAF exercise redemption rights with respect to their public shares for a pro rata share of the funds in Graf’s Trust Account. |

| ● | Assuming Maximum Redemptions: This presentation assumes that in addition to the 1,105 public shares redeemed in July 2020, stockholders holding 6,564,785 of the GRAF’s public shares will exercise their redemption rights for their pro rata share (approximately $10.23 per share as of June 30, 2020) of the funds in the GRAF’s Trust Account. The Merger Agreement provides that Velodyne’s obligation to consummate the Business Combination is conditioned on the funds in the Trust Account, together with the funding of any amounts payable under the Subscription Agreements, being no less than an aggregate amount of $200.0 million. This scenario gives effect to $50.0 million being retained in the Trust Account, in accordance with the Subscription Agreements with respect to the PIPE Investment, and the minimum cash requirement of |

9

| $200.0 million, in accordance with the Merger Agreement. This results in public share redemptions of 6,564,785 shares for aggregate redemption payments of $67.1 million. |

| |||||

|

| Pro Forma Combined |

| Pro Forma Combined |

|

Summary Unaudited Pro Forma Condensed Combined | | | | | |

Statement of Operations Data | | | | | |

Six Months Ended June 30, 2020 | | | | | |

Revenue | | 45,417 | | 45,417 | |

Net loss per share – basic and diluted | | (0.20) | | (0.20) | |

Weighted-average common stock outstanding – basic and diluted | | 174,415,027 | | 167,850,242 | |

Summary Unaudited Pro Forma Condensed Combined | | | | | |

Statement of Operations Data | | | | | |

Year Ended December 31, 2019 | | | | | |

Revenue | | 101,398 | | 101,398 | |

Net loss per share – basic and diluted | | (0.41) | | (0.43) | |

Weighted-average common stock outstanding – basic and diluted | | 174,415,027 | | 167,850,242 | |

Summary Unaudited Pro Forma Condensed Combined | | | | | |

Balance Sheet Data as of June 30, 2020 | | | | | |

Total assets | | 319,399 | | 252,265 | |

Total liabilities | | 73,123 | | 73,123 | |

Total deficit | | 246,276 | | 179,142 | |

10

COMPARATIVE SHARE INFORMATION

The following table sets forth summary historical comparative share information for GRAF and Velodyne and unaudited pro forma condensed combined per share information after giving effect to the Business Combination, assuming two redemption scenarios as follows:

| ● | Assuming Minimum Redemptions: In connection with the Extension Amendment Proposal, an aggregate 1,105 shares of Graf’s common stock was redeemed, and approximately $11,000 was withdrawn out of the Trust Account to pay for such redemption (estimated per share redemption value of $10.23). After redemptions, there were 11,454,132 public shares outstanding. This presentation takes into consideration the redemptions in connection with the extension of the date by which GRAF has to consummate a transaction (the “First Extension”) from April 18, 2020 to July 31, 2020 (the “Combination Period”), but it assumes that no additional public stockholders of GRAF exercise redemption rights with respect to their public shares for a pro rata share of the funds in GRAF’s Trust Account. |

| ● | Assuming Maximum Redemptions: This presentation assumes that in addition to the 1,105 public shares redeemed in July 2020, stockholders holding 6,564,785 of Graf’s public shares will exercise their redemption rights for their pro rata share (approximately $10.23 per share as of June 30, 2020) of the funds in Graf’s Trust Account. The Merger Agreement provides that Velodyne’s obligation to consummate the Business Combination is conditioned on the funds in the Trust Account, together with the funding of any amounts payable under the Subscription Agreements, being no less than an aggregate amount of $200.0 million. This scenario gives effect to $50.0 million being retained in the Trust Account, in accordance with the Subscription Agreements with respect to the PIPE Investment, and the minimum cash requirement of $200.0 million, in accordance with the Merger Agreement. This results in public share redemptions of 6,564,785 shares for aggregate redemption payments of $67.1 million. |

The pro forma book value information reflects the Business Combination as if it had occurred on June 30, 2020. The weighted average shares outstanding and net earnings per share information reflect the Business Combination as if it had occurred on January 1, 2019.

This information is only a summary and should be read together with the selected historical financial information summary included elsewhere in this prospectus, and the historical financial statements of GRAF and Velodyne and related notes. The unaudited pro forma combined per share information of GRAF and Velodyne is derived from, and should be read in conjunction with, the unaudited pro forma condensed combined financial statements and related notes included elsewhere in this prospectus.

The unaudited pro forma combined earnings per share information below does not purport to represent the earnings per share which would have occurred had the companies been combined during the periods presented, nor earnings per share for any future date or period. The unaudited pro forma combined book value per share information below does not purport to represent what the value of GRAF and Velodyne would have been had the companies been combined during the periods presented.

11

| | | | | | | | | | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Velodyne | | Graf | | Combined Pro Forma | | Velodyne Equivalent Per Share Pro Forma (2) | | |||||||||||||||||||

| | Historical | | As Adjusted | | Historical | | As Adjusted, assuming Minimum Redemptions | | As Adjusted, assuming Maximum Redemptions | | Assuming Minimum Redemptions | | Assuming Maximum Redemptions | | Assuming Minimum Redemptions | | Assuming Maximum Redemptions | | |||||||||

As of and for the Quarter ended June 30, 2020 (3) |

| |

|

| |

|

| |

|

| |

|

| |

| | |

|

| |

|

| |

|

| |

|

|

Book Value per share (1) | | $ | 1.84 | | $ | 0.30 | | $ | 0.20 | | $ | 6.66 | | $ | 5.96 | | $ | 1.41 | | $ | 1.07 | | $ | 4.13 | | $ | 3.13 | |

Weighted averages shares outstanding - basic and diluted | | | 34,252,578 | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss per share - basic and diluted | | $ | (0.97) | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares outstanding of Public common stock - basic and diluted | | | | | | | | | 18,980,815 | | | | | | | | | 174,415,027 | | | 167,850,242 | | | 145,385,895 | | | 145,385,895 | |

Weighted average shares outstanding of Founder common stock - basic and diluted | | | | | | | | | 6,094,128 | | | | | | | | | | | | | | | | | | | |

Net income per share of Public common stock - basic and diluted | | | | | | | | $ | 0.03 | | | | | | | | | | | | | | | | | | | |

Net loss per share of Founder common stock - basic and diluted | | | | | | | | $ | (0.59) | | | | | | | | | | | | | | | | | | | |

Net loss per share of common stock - basic and diluted | | | | | | | | | | | | | | | | | $ | (0.20) | | $ | (0.20) | | $ | (0.58) | | $ | (0.60) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of and for the Year ended December 31, 2019 (3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted averages shares outstanding - basic and diluted | | | 34,252,578 | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss per share - basic and diluted | | $ | (1.96) | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares outstanding of Public common stock - basic and diluted | | | | | | | | | 24,376,512 | | | | | | | | | 174,415,027 | | | 167,850,242 | | | 145,385,895 | | | 145,385,895 | |

Weighted average shares outstanding of Founder common stock - basic and diluted | | | | | | | | | 6,094,128 | | | | | | | | | | | | | | | | | | | |

Net income per share of Public common stock - basic and diluted | | | | | | | | $ | 0.17 | | | | | | | | | | | | | | | | | | | |

Net loss per share of Founder common stock - basic and diluted | | | | | | | | $ | (2.94) | | | | | | | | | | | | | | | | | | | |

Net loss per share of common stock - basic and diluted | | | | | | | | | | | | | | | | | $ | (0.41) | | $ | (0.43) | | $ | (1.21) | | $ | (1.26) | |

(1) Book value per share = Total equity excluding preferred equity/shares outstanding.

(2) The equivalent pro forma basic and diluted per share data for Velodyne is calculated using a weighted-average exchange ratio based on the number of shares allocated to common stock, Series A, Series B, and Series B-1 shares.

(3) No cash dividends were declared during the periods presented.

12

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. Our business, prospects, financial condition, or operating results could be harmed by any of these risks, as well as other risks not known to us or that we consider immaterial as of the date of this prospectus. The trading price of our securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment.

Risks Related to Velodyne’s Business

Velodyne’s business could be materially and adversely affected by the current global COVID-19 pandemic.

The recent COVID-19 pandemic has disrupted and affected Velodyne’s business. For example, from March until June of 2020, due to the rapid spread of COVID-19, Velodyne’s manufacturing facility in San Jose, California was operating at approximately 50% capacity. Additionally, Velodyne observed delayed customer purchases and longer sales cycles with customers that are addressing budget constraints, delayed projects or other hardships related to the COVID-19 pandemic. Velodyne has a global customer base operating in a wide range of industries that has been impacted in different ways by the pandemic. Velodyne also depends on suppliers and manufacturers worldwide. Depending upon the duration of the pandemic, the associated business interruptions and the recovery, Velodyne’s customers, suppliers, manufacturers and partners may suspend or delay their engagement with Velodyne. If the pandemic worsens, if the economic recovery is delayed or if there are further business interruptions or changes in customer purchasing behavior, Velodyne’s business, results of operations and ability to raise capital may be materially and adversely affected. Velodyne’s response to the COVID-19 pandemic may prove to be inadequate and it may be unable to continue its operations in the manner it had prior to the outbreak, and may endure further interruptions, reputational harm, delays in its product development and shipments, all of which could have an adverse effect on its business, operating results, and financial condition. In addition, when the pandemic subsides, Velodyne cannot assure you as to the timing of any economic recovery, which could continue to have a material adverse effect on its target markets and its business.

Since many of the markets in which Velodyne competes are new and rapidly evolving, it is difficult to forecast long-term end-customer adoption rates and demand for Velodyne’s products.

Velodyne is pursuing opportunities in markets that are undergoing rapid changes, including technological and regulatory changes, and it is difficult to predict the timing and size of the opportunities. For example, autonomous driving and lidar-based ADAS applications require complex technology. Because these automotive systems depend on technology from many companies, commercialization of autonomous driving or ADAS products could be delayed or impaired on account of certain technological components of Velodyne or others not being ready to be deployed in vehicles. Although some companies have released systems and vehicles using Velodyne’s products, others may not be able to commercialize this technology immediately, or at all. Regulatory, safety or reliability developments, many of which are outside of Velodyne’s control, could also cause delays or otherwise impair commercial adoption of these new technologies, which will adversely affect Velodyne’s growth. Velodyne’s future financial performance will depend on its ability to make timely investments in the correct market opportunities. If one or more of these markets experience a shift in customer or prospective customer demand, Velodyne’s products may not compete as effectively, if at all, and they may not be designed into commercialized products. Given the evolving nature of the markets in which Velodyne operates, it is difficult to predict customer demand or adoption rates for its products or the future growth of the markets in which it operates. As a result, the financial projections in this prospectus necessarily reflect various estimates and assumptions that may not prove accurate and these projections could differ materially from actual results. If demand does not develop or if Velodyne cannot accurately forecast customer demand, the size of its markets, inventory requirements or its future financial results, its business, results of operations and financial condition will be adversely affected.

Despite the actions Velodyne is taking to defend and protect its intellectual property, Velodyne may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its solutions. Velodyne’s efforts to protect and enforce its intellectual property rights and prevent third parties from violating its rights may be costly.

The success of Velodyne’s products and its business depends in part on Velodyne’s ability to obtain patents and other intellectual property rights and maintain adequate legal protection for its products in the United States and other

13

international jurisdictions. Velodyne relies on a combination of patent, copyright, service mark, trademark and trade secret laws, as well as confidentiality procedures and contractual restrictions, to establish and protect its proprietary rights, all of which provide only limited protection. Velodyne cannot assure you that any patents will be issued with respect to its currently pending patent applications or that any trademarks will be registered with respect to its currently pending applications in a manner that gives Velodyne adequate defensive protection or competitive advantages, if at all, or that any patents issued to Velodyne or any trademarks registered by it will not be challenged, invalidated or circumvented. Velodyne has filed for patents and trademarks in the United States and in certain international jurisdictions, but such protections may not be available in all countries in which it operates or in which Velodyne seeks to enforce its intellectual property rights, or may be difficult to enforce in practice. Velodyne’s currently issued patents and trademarks and any patents and trademarks that may be issued or registered, as applicable, in the future with respect to pending or future applications may not provide sufficiently broad protection or may not prove to be enforceable in actions against alleged infringers. Velodyne cannot be certain that the steps it has taken will prevent unauthorized use of its technology or the reverse engineering of its technology. Moreover, others may independently develop technologies that are competitive to Velodyne or infringe Velodyne’s intellectual property.

Protecting against the unauthorized use of Velodyne’s intellectual property, products and other proprietary rights is expensive and difficult, particularly internationally. Velodyne believes that its patents are foundational in the area of lidar products and intends to enforce the intellectual property portfolio it has built over the years. Unauthorized parties may attempt to copy or reverse engineer Velodyne’s smart vision solutions or certain aspects of Velodyne’s solutions that it considers proprietary. Litigation may be necessary in the future to enforce or defend Velodyne’s intellectual property rights, to prevent unauthorized parties from copying or reverse engineering its solutions, to determine the validity and scope of the proprietary rights of others or to block the importation of infringing products into the U.S.

For example, Velodyne recently achieved a favorable result in two proceedings before the U.S. Patent Trial and Appeal Board (“PTAB”) where the PTAB upheld the validity of Velodyne’s patent claims that were being challenged as unpatentable by one of its competitors. Velodyne’s competitor filed a request for rehearing that was denied by the PTAB. The matter may proceed to an appeal in the future. In addition, that same competitor initiated a lawsuit in the U.S. District Court for the Northern District of California, and while that case is stayed pending PTAB proceedings, Velodyne cannot guarantee a favorable outcome in the litigation.

Additionally, to protect its intellectual property, Velodyne filed patent infringement cases in August 2019 with the U.S. International Trade Commission (“ITC”) and the U.S. District Court for the Northern District of California against Hesai Photonics Technology Co., Ltd. (“Hesai”) and Suteng Innovation Technology Co., Ltd. (“RoboSense”). Velodyne resolved its disputes with Hesai in June 2020 and entered into an agreement to settle its disputes with Robosense in September 2020.

Any such litigation, whether initiated by Velodyne or a third party, could result in substantial costs and diversion of management resources, either of which could adversely affect Velodyne’s business, operating results and financial condition. Even if it obtains favorable outcomes in litigation, Velodyne may not be able to obtain adequate remedies, especially in the context of unauthorized parties copying or reverse engineering its smart vision solutions. Further, many of Velodyne’s current and potential competitors have the ability to dedicate substantially greater resources to defending intellectual property infringement claims and to enforcing their intellectual property rights than Velodyne has. Attempts to enforce its rights against third parties could also provoke these third parties to assert their own intellectual property or other rights against Velodyne, or result in a holding that invalidates or narrows the scope of Velodyne’s rights, in whole or in part. Effective patent, trademark, service mark, copyright and trade secret protection may not be available in every country in which Velodyne’s products are available and competitors based in other countries may sell infringing products in one or more markets. An inability to adequately protect and enforce Velodyne’s intellectual property and other proprietary rights or an inability to prevent authorized parties from copying or reverse engineering its smart vision solutions or certain aspects of its solutions that Velodyne considers proprietary could seriously adversely affect its business, operating results, financial condition and prospects.

14

Velodyne continues to implement strategic initiatives designed to grow its business. These initiatives may prove more costly than it currently anticipates and Velodyne may not succeed in increasing its revenue in an amount sufficient to offset the costs of these initiatives and to achieve and maintain profitability.

Velodyne continues to make investments and implement initiatives designed to grow its business, including:

| ● | investing in research and development; |

| ● | expanding its sales and marketing efforts to attract new customers across industries; |

| ● | investing in new applications and markets for its products; |

| ● | further enhancing its manufacturing processes and partnerships; |

| ● | pursuing litigation to protect its intellectual property; and |

| ● | investing in legal, accounting, and other administrative functions necessary to support its operations as a public company. |

These initiatives may prove more expensive than it currently anticipates, and Velodyne may not succeed in increasing its revenue, if at all, in an amount sufficient to offset these higher expenses and to achieve and maintain profitability. Although Velodyne generated net income of $15.8 million for 2017, it has incurred net losses in the past, including net losses of $62.3 million for 2018 and $67.2 million for 2019 and $33.1 million for the six months ended June 30, 2020. The market opportunities Velodyne is pursuing are at an early stage of development, and it may be many years before the end markets Velodyne expects to serve generate demand for its products at scale, if at all. Velodyne’s revenue may be adversely affected for a number of reasons, including the development and/or market acceptance of new technology that competes with its lidar products, if certain automotive original equipment manufacturers (“OEMs”) or other market participants change their autonomous vehicle technology, failure of Velodyne’s customers to commercialize autonomous systems that include its smart vision solutions, Velodyne’s inability to effectively manage its inventory or manufacture products at scale, Velodyne’s inability to enter new markets or help its customers adapt its products for new applications or Velodyne’s failure to attract new customers or expand orders from existing customers or increasing competition. Furthermore, it is difficult to predict the size and growth rate of Velodyne’s target markets, customer demand for its products, commercialization timelines, developments in autonomous sensing and related technology, the entry of competitive products, or the success of existing competitive products and services. For these reasons, Velodyne does not expect to achieve profitability over the near term. If Velodyne’s revenue does not grow over the long term, its ability to achieve and maintain profitability may be adversely affected, and the value of its business may significantly decrease.