Southern Delaware Basin leasehold and related assets, including certain mineral and royalty interests owned by Brigham Resources, to a third-party public entity. The proceeds for mineral and royalty interests represented $156.7 million of the net adjusted sales price and consisted of cash of $111.1 million and shares valued at $45.6 million. The mineral and royalty interests sold represented approximately 12% in aggregate of Brigham Resources’ total proved reserves as of December 31, 2016. As a result of the sale, the relationship between capitalized costs and proved reserves was altered significantly and Brigham Resources recorded a gain of $94.6 million.

Operating and other expenses

Gathering, transportation and marketing expenses for the year ended December 31, 2018 increased by 125%, or $2.2 million, as compared to the year ended December 31, 2017, which was largely driven by the 65% increase in our production volumes.

Severance and ad valorem taxes for the year ended December 31, 2018 increased by 121%, or $1.9 million, as compared to the year ended December 31, 2017, which was primarily due to higher severance taxes associated with oil revenue as a result of higher oil production volumes and higher oil prices.

Depreciation, depletion and amortization (DD&A) expense for the year ended December 31, 2018 increased by 100%, or $7.0 million, compared to the year ended December 31, 2017, which was primarily due to an increase in depletion expense of $7.1 million. Higher production volumes increased our depletion expense by $4.1 million, and a higher depletion rate increased our depletion expense by $3.0 million.

General and administrative expense for the year ended December 31, 2018 increased by 69%, or $2.7 million, compared to the year ended December 31, 2017 as a result of increased headcount and incremental business development expenses.

Interest expense for the year ended December 31, 2018 increased $6.9 million compared to the year ended December 31, 2017 due to greater average outstanding borrowings and higher interest rates under our credit facility. The need for greater borrowings was driven by our increased acquisition pace in 2018 relative to 2017.

For the year ended December 31, 2018, we recognized a gain on derivative instruments, net of $0.4 million, which is attributable to oil derivative instruments. We realized $0.8 million of losses on our settled derivative instruments during the year ended December 31, 2018. For the year ended December 31, 2017, we recognized a net loss on derivative instruments of $0.1 million, which is attributable to derivative instruments based on the price of oil.

Factors Affecting the Comparability of Our Results of Operations to the

Historical Results of Operations of Our Predecessor

Our future results of operations may not be comparable to the historical results of operations of our predecessor for the periods presented, primarily for the reasons described below.

Corporate Reorganization

The historical consolidated financial statements included in this prospectus are based on the financial statements of our accounting predecessor, Brigham Resources, excluding the historical results and operations of Brigham Operating, prior to our corporate reorganization. As a result, the historical consolidated financial data may not give you an accurate indication of what our actual results would have been if the corporate reorganization had been completed at the beginning of the periods presented or of what our future results of operations are likely to be.

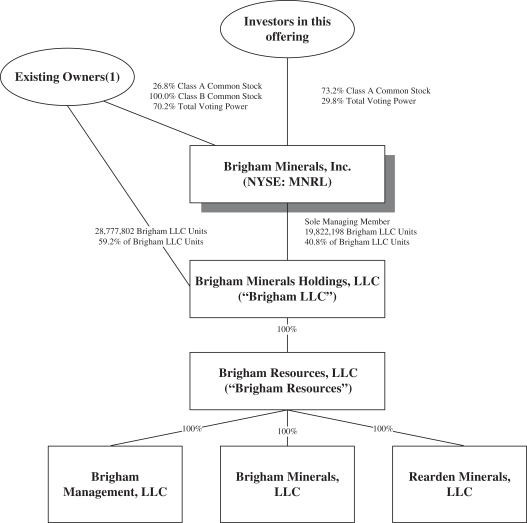

Brigham Resources will be a wholly owned subsidiary of Brigham LLC. After giving effect to the corporate reorganization and this offering, Brigham Minerals will own an approximate 40.8% interest in Brigham LLC (or

72