UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23360

Broadstone Real Estate Access Fund

(Exact name of registrant as specified in charter)

800 Clinton Square

Rochester, New York 14604

(Address of principal executive offices) (Zip code)

Christopher J. Czarnecki

c/o Broadstone Asset Management, LLC

Chief Executive Officer

800 Clinton Square

Rochester, New York 14604

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (585) 287-6500

Date of fiscal year end:September 30

Date of reporting period:September 30, 2019

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Consolidated Schedule of Investments | 5 |

| Consolidated Statement of Assets and Liabilities | 8 |

| Consolidated Statement of Operations | 9 |

| Consolidated Statement of Changes in Net Assets | 10 |

| Consolidated Statement of Cash Flows | 11 |

| Consolidated Financial Highlights | 12 |

| Notes to Consolidated Financial Statements | 16 |

| Report of Independent Registered Public Accounting Firm | 25 |

| Additional Information | 26 |

| Trustees and Officers | 27 |

| Privacy Notice | 29 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at www.bdrex.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call (833) 280-4479 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling (833) 280-4479.

| Broadstone Real Estate Access Fund | Shareholder Letter |

September 30, 2019 (Unaudited)

Dear Shareholders:

We are pleased to present you with the Broadstone Real Estate Access Fund (the “Fund”) Annual Report. Since the Fund’s inception on October 4, 20181 through September 30, 2019, the Fund’s Class I shares generated a total return of 14.96%. The Fund’s total return to date is comprised of current income as well as capital appreciation.

In its first year of operations, the Fund has met and exceeded its objectives. Our most recent distribution for the I share equates to an annualized rate of 8.7%2 while for the year we distributed 6.5%2 for the I share, well above our target distribution yield of 5%. All distributions made by the Fund since inception have been covered by the income and realized gains received from the portfolio’s underlying investments.

The intent of the Broadstone Real Estate Access Fund is to provide investors unique access to a broadly diversified portfolio of real estate investments via three sleeves: Public Real Estate Equities; Private Real Estate Funds; and Direct Real Estate Transactions. These sleeves work in concert to provide access to real estate with low to moderate volatility and lower correlation to broader markets in the following ways:

| 1) | The Public Real Estate Equities sleeve not only provides the Fund with ample liquidity, it also provides significant diversification to the portfolio; the covered call strategy overlay on the portfolio further enhances yield while dampening the volatility of that sleeve of the strategy. |

| 2) | Investments into Private Real Estate Funds offer access to institutional quality real estate, with a focus on stable growth, income, and total return. The Fund diversifies this sleeve of the portfolio into strategies beyond traditional core funds and looks also to add value via a select group of historically well performing strategies managed by best-in-class institutional real estate managers. |

| 3) | While the Fund’s strategy today is significantly diversified, we also plan to expand into Direct Real Estate Transactions in the near term. These direct investments will continue to enhance the broader strategy of producing strong current income and moderate capital appreciation, with low to moderate volatility and low correlation to the broader markets. |

We believe that this three-prong approach to providing diversified access to real estate investing is unique in the marketplace.

We have been able to achieve a great deal of diversification in the Fund to-date. As a shareholder of the Fund, you are invested in Office, Multifamily, Industrial, and Retail assets along with exposure to more niche property types like Healthcare, Self-storage, Data Centers, and Student Housing. These assets are spread geographically across the US and range from trophy office buildings in primary markets like Manhattan and San Francisco, to quality multifamily assets in secondary markets like Nashville and Dallas. While the Fund is very diversified geographically, the strategy is targeted toward markets positioned well for what we believe is the future of real estate fundamentals: real estate assets supported by demographic growth driven by technology, urbanization, and education, and which otherwise provide a favorable quality of life. We expect to continue the theme of “intelligent diversification” as we look to build out the Direct Real Estate Transactions sleeve.

In addition to diversification, we believe risk mitigation is a key component of portfolio management. A primary benefit of the Fund is its ability to allocate investments to each of the three sleeves as market conditions change. Over the course of our first year of operations, we were able to take advantage of a somewhat volatile market through our allocations, helping to reduce risk and drive returns. We also feel, as most investors do, that we are in the later stages of the economic cycle. In consideration of this, the Fund is diversified across the capital stack via our investments as well. Commercial real estate debt comprises a meaningful part of the portfolio and, by allocating to real estate debt as well as equity, we believe we enhance the Fund’s exposure to real estate while providing additional downside protection.

Thank you for being an early shareholder. We are proud of the Fund’s performance and, as we look to the coming year, we endeavor to continue to deliver on our key objective of providing you a well-diversified real estate portfolio that provides returns comprised of durable income and appreciation with low to moderate volatility and low correlation to the broader markets.

Kate Davis

President and Portfolio Manager

Broadstone Real Estate Access Fund

| 1 | Commencement of operations is October 5, 2018. |

| 2 | Quarterly distribution of $.235 per I share annualized over the NAV of $10.81 on 9/30/2019. Annual distribution is 4 distributions totaling $.65 divided by $10 initial price per I share. Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

| Annual Report | September 30, 2019 | 1 |

| Broadstone Real Estate Access Fund | Shareholder Letter |

September 30, 2019 (Unaudited)

Past performance is no guarantee of future results.

The Fund intends to make a dividend distribution each quarter to its shareholders. As portfolio and market conditions change, distributions will vary and targeted quarterly distributions may not be obtained in the future. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. Portions of the distributions that the Fund makes may be a return of the money that shareholders originally invested and represent a return of capital to shareholders for tax purposes.

The views in this shareholder letter were as of the letter’s publication date and may not reflect the views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

| Broadstone Real Estate Access Fund | Portfolio Update |

September 30, 2019 (Unaudited)

Investment Objective

The Fund’s investment objective is to seek to generate a return comprised of both current income and long-term capital appreciation with low to moderate volatility and low correlation to the broader markets. There can be no assurance that the Fund will achieve its investment objective.

Average Annual Total Returns(as of September 30, 2019)

| | Calendar YTD | Since Inception* |

| Broadstone Real Estate Access Fund - Class I | 16.65% | 14.96%(a) |

| Broadstone Real Estate Access Fund - Class W | 16.50% | 14.74%(a) |

| Bloomberg Barclays US Aggregate Bond Index(b) | 8.52% | 11.14% |

| Wilshire US Real Estate Securities Index(c) | 27.15% | 22.01% |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling (833) 280-4479 or by visiting www.bdrex.com.

| * | Fund’s inception date is October 4, 2018, with commencement of operations on October 5, 2018. |

| (a) | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

| (b) | The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). |

| (c) | The Wilshire US Real Estate Securities Index measures U.S. publicly-traded real estate securities. Designed to offer a market-based index that is more reflective of real estate held by pension funds, the index is comprised of publicly-traded real estate equity securities and unencumbered by limitations of other appraisal-based indexes. It can serve as a proxy for direct real estate investing by excluding securities whose value is not always tied to the value of the underlying real estate. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, if repurchased, may be worth more or less than their original cost. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The Broadstone Real Estate Access Fund is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund. The Fund is suitable only for investors who can bear the risks associated with the Fund's limited liquidity and should be viewed as a long-term investment. The Fund’s shares have no history of public trading, nor is it intended that our shares will be listed on a national securities exchange at this time, if ever. Investing in the Fund’s shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risk, including the risk that shareholders may receive little or no return on their investment or that shareholders may lose part or all of their investment.

| Annual Report | September 30, 2019 | 3 |

| Broadstone Real Estate Access Fund | Portfolio Update |

September 30, 2019 (Unaudited)

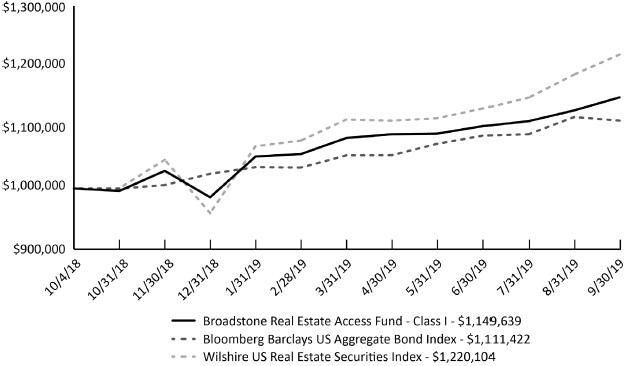

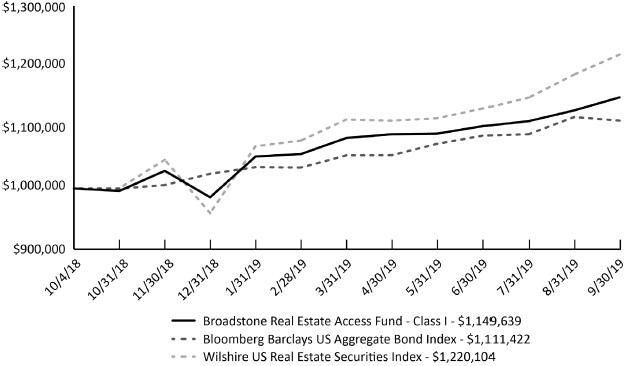

Performance of $1,000,000 Initial Investment(as of September 30, 2019)

The graph shown above represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Sector Allocation(as a % of Net Assets)*

| Public Equity Real Estate Securities | 64.71% |

| Private Real Estate Securities | 59.72% |

| Cash, Cash Equivalents, Leverage, & Other Net Assets | -24.43% |

| | 100.00% |

Top Ten Holdings(as a % of Net Assets)*

| TCM CRE Credit Fund, LP | 21.25% |

| USAA US Government Building Open-End Feeder Fund | 10.03% |

| Sentinel Real Estate Fund, LP | 8.32% |

| CBRE U.S. Core Partners, LP | 8.25% |

| Clarion Lion Properties Fund | 8.22% |

| Prologis, Inc. | 4.64% |

| PA MAC FUND, LP | 3.65% |

| Simon Property Group, Inc. | 3.37% |

| Ventas, Inc. | 3.27% |

| Equity Residential | 2.95% |

| Top Ten Holdings | 73.95% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. Tables present indicative values only. |

| Broadstone Real Estate Access Fund | Consolidated Schedule of Investments |

September 30, 2019

| | | Shares | | | Value (Note 2) | |

| PRIVATE REAL ESTATE SECURITIES (59.72%) | | | | | | | | |

| CBRE U.S. Core Partners, LP(a) | | | 2,825,857 | | | $ | 4,078,763 | |

| Clarion Lion Properties Fund(a) | | | 2,648 | | | | 4,062,927 | |

| PA MAC FUND, LP(b) | | | N/A | | | | 1,805,024 | |

| Sentinel Real Estate Fund, LP(a) | | | 46 | | | | 4,112,871 | |

| TCM CRE Credit Fund, LP(a) | | | 10,482 | | | | 10,501,467 | |

| USAA US Government Building Open-End Feeder Fund(b) | | | N/A | | | | 4,955,323 | |

| TOTAL PRIVATE REAL ESTATE SECURITIES (Cost $29,305,024) | | | | | | | 29,516,375 | |

| | | | | | | | | |

| PUBLIC EQUITY REAL ESTATE SECURITIES (64.71%)(c) | | | | | | | | |

| Acadia Realty Trust | | | 17,600 | | | | 503,008 | |

| Agree Realty Corp. | | | 9,800 | | | | 716,870 | |

| American Assets Trust, Inc. | | | 7,300 | | | | 341,202 | |

| AvalonBay Communities, Inc. | | | 1,700 | | | | 366,061 | |

| Boston Properties, Inc. | | | 8,800 | | | | 1,141,008 | |

| Camden Property Trust | | | 11,500 | | | | 1,276,615 | |

| Cousins Properties, Inc. | | | 21,900 | | | | 823,221 | |

| CyrusOne, Inc. | | | 16,400 | | | | 1,297,240 | |

| DiamondRock Hospitality Co. | | | 73,460 | | | | 752,965 | |

| Digital Realty Trust, Inc. | | | 2,000 | | | | 259,620 | |

| Duke Realty Corp. | | | 30,400 | | | | 1,032,688 | |

| Equinix, Inc. | | | 1,660 | | | | 957,488 | |

| Equity Residential | | | 16,900 | | | | 1,457,794 | |

| Extra Space Storage, Inc. | | | 5,700 | | | | 665,874 | |

| Four Corners Property Trust, Inc. | | | 20,300 | | | | 574,084 | |

| HCP, Inc. | | | 37,517 | | | | 1,336,731 | |

| Highwoods Properties, Inc. | | | 13,500 | | | | 606,690 | |

| Hudson Pacific Properties, Inc. | | | 19,800 | | | | 662,508 | |

| Invitation Homes, Inc. | | | 31,800 | | | | 941,598 | |

| Liberty Property Trust | | | 11,400 | | | | 585,162 | |

| New Senior Investment Group, Inc. | | | 21,900 | | | | 146,292 | |

| Pebblebrook Hotel Trust | | | 22,642 | | | | 629,900 | |

| Physicians Realty Trust | | | 40,340 | | | | 716,035 | |

| Prologis, Inc. | | | 26,900 | | | | 2,292,417 | |

| Public Storage | | | 5,700 | | | | 1,398,039 | |

| QTS Realty Trust, Inc. | | | 17,180 | | | | 883,224 | |

| Realty Income Corp. | | | 17,000 | | | | 1,303,560 | |

| Regency Centers Corp. | | | 10,700 | | | | 743,543 | |

| Sabra Health Care REIT, Inc. | | | 19,300 | | | | 443,128 | |

| Simon Property Group, Inc. | | | 10,700 | | | | 1,665,455 | |

| SITE Centers Corp. | | | 48,100 | | | | 726,791 | |

| Sun Communities, Inc. | | | 4,879 | | | | 724,288 | |

| UDR, Inc. | | | 20,300 | | | | 984,144 | |

| Ventas, Inc. | | | 22,140 | | | | 1,616,884 | |

| VICI Properties, Inc. | | | 41,800 | | | | 946,770 | |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2019 | 5 |

| Broadstone Real Estate Access Fund | Consolidated Schedule of Investments |

September 30, 2019

| | | Shares | | | Value (Note 2) | |

| PUBLIC EQUITY REAL ESTATE SECURITIES (continued) | | | | | | | | |

| Welltower, Inc. | | | 5,100 | | | $ | 462,315 | |

| TOTAL PUBLIC EQUITY REAL ESTATE SECURITIES (Cost $30,565,159) | | | | | | | 31,981,212 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS (0.98%) | | | | | | | | |

| Fidelity Government Portfolio, Class I, 1.856%(d)(Cost $483,033) | | | 483,033 | | | | 483,033 | |

| TOTAL SHORT TERM INVESTMENTS (Cost $483,033) | | | | | | | 483,033 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (125.41%) (Cost $60,353,216) | | | | | | $ | 61,980,620 | |

| | | | | | | | | |

| Liabilities In Excess Of Other Assets (-25.41%) | | | | | | | (12,556,792 | ) |

| | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | $ | 49,423,828 | |

| (b) | Investment represents a non-public partnership interest and is not unitized. |

| (c) | Securities are segregated as collateral for the Line of Credit as of September 30, 2019. |

| (d) | Money market fund; interest rate reflects seven-day yield as of September 30, 2019. |

Common Abbreviations

LP - Limited Partnership.

REIT - Real Estate Investment Trust.

See Notes to Consolidated Financial Statements.

| Broadstone Real Estate Access Fund | Consolidated Schedule of Investments |

September 30, 2019

WRITTEN OPTION CONTRACTS

| | | Expiration Date | | Exercise Price | | | Contracts | | | Premiums Received | | | Notional Value | | | Value | |

| WRITTEN CALL OPTIONS | | | | | | | | | | | | | | | | | | | | | | |

| AvalonBay Communities, Inc. | | 11/15/2019 | | $ | 220.00 | | | | (14 | ) | | $ | 4,311 | | | $ | (301,462 | ) | | $ | (4,760 | ) |

| Boston Properties, Inc. | | 10/18/2019 | | | 135.00 | | | | (35 | ) | | | 2,169 | | | | (453,810 | ) | | | (1,225 | ) |

| Digital Realty Trust, Inc. | | 11/15/2019 | | | 135.00 | | | | (16 | ) | | | 2,847 | | | | (207,696 | ) | | | (3,120 | ) |

| Duke Realty Corp. | | 10/18/2019 | | | 35.00 | | | | (243 | ) | | | 11,655 | | | | (825,471 | ) | | | (4,860 | ) |

| Equinix, Inc. | | 10/18/2019 | | | 590.00 | | | | (4 | ) | | | 2,072 | | | | (230,720 | ) | | | (2,440 | ) |

| Equinix, Inc. | | 10/18/2019 | | | 580.00 | | | | (12 | ) | | | 8,415 | | | | (692,160 | ) | | | (12,000 | ) |

| Equity Residential | | 10/21/2019 | | | 87.50 | | | | (96 | ) | | | 6,236 | | | | (828,096 | ) | | | (6,327 | ) |

| Equity Residential | | 11/15/2019 | | | 90.00 | | | | (39 | ) | | | 3,040 | | | | (336,414 | ) | | | (3,218 | ) |

| Extra Space Storage, Inc. | | 11/15/2019 | | | 125.00 | | | | (46 | ) | | | 3,916 | | | | (537,372 | ) | | | (3,450 | ) |

| HCP, Inc. | | 10/21/2019 | | | 36.00 | | | | (280 | ) | | | 10,069 | | | | (997,640 | ) | | | (14,047 | ) |

| Invitation Homes, Inc. | | 10/18/2019 | | | 30.00 | | | | (315 | ) | | | 8,833 | | | | (932,715 | ) | | | (8,663 | ) |

| Prologis, Inc. | | 11/15/2019 | | | 90.00 | | | | (215 | ) | | | 22,397 | | | | (1,832,230 | ) | | | (18,275 | ) |

| Public Storage | | 11/15/2019 | | | 260.00 | | | | (46 | ) | | | 11,281 | | | | (1,128,242 | ) | | | (8,740 | ) |

| Simon Property Group, Inc. | | 10/18/2019 | | | 155.00 | | | | (86 | ) | | | 18,436 | | | | (1,338,590 | ) | | | (27,519 | ) |

| Welltower, Inc. | | 10/18/2019 | | | 92.50 | | | | (41 | ) | | | 5,691 | | | | (371,665 | ) | | | (3,178 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Written Call Options | | | | | | | | | | | | $ | 121,368 | | | | | | | $ | (121,822 | ) |

Additional information on investments in Private Real Estate Securities:

| Value | | | Security | | Redemption Frequency | | Redemption Notice (Days) | | | Unfunded Commitments as of September 30, 2019 | |

| $ | 4,078,763 | | | CBRE U.S. Core Partners, LP | | Quarterly | | 60 | | | $ | 750,000 | |

| | 4,062,927 | | | Clarion Lion Properties Fund | | Quarterly | | 90 | | | | – | |

| | 4,112,871 | | | Sentinel Real Estate Fund, LP | | Quarterly | | N/A* | | | | – | |

| | 10,501,467 | | | TCM CRE Credit Fund, LP | | Quarterly | | 90 | | | | – | |

| | 4,955,323 | | | USAA US Government Building Fund Open-End Feeder, LP | | Quarterly | | 60 | | | | – | |

| | 1,805,024 | | | PA MAC FUND, LP** | | N/A | | N/A* | | | | 5,000,000 | |

| | – | | | Clarion Lion Industrial Trust | | Quarterly | | 90 | | | | 4,000,000 | |

| $ | 29,516,375 | | | | | | | | | | $ | 9,750,000 | |

| * | Written notice required for redemption, no minimum timeline required. |

| ** | Capital call is expected to take place in March 2021. |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2019 | 7 |

| Broadstone Real Estate Access Fund | Consolidated Statement of

Assets and Liabilities |

September 30, 2019

| ASSETS | | | |

| Investments, at value (Cost $60,353,216) | | $ | 61,980,620 | |

| Receivable for investments sold | | | 92,727 | |

| Receivable for shares sold | | | 440,697 | |

| Dividends and interest receivable | | | 471,628 | |

| Receivable due from Adviser (Note 4) | | | 5,426 | |

| Prepaid offering costs (Note 2) | | | 5,751 | |

| Prepaid expenses and other assets | | | 12,857 | |

| Total Assets | | | 63,009,706 | |

| LIABILITIES | | | | |

| Written options, at value (premiums received $121,368) | | | 121,822 | |

| Payable for investments purchased | | | 92,105 | |

| Shareholder servicing fees payable (Note 4) | | | 94 | |

| Lines of credit payable (Note 9) | | | 11,678,541 | |

| Lines of credit interest payable (Note 9) | | | 29,459 | |

| Administration fees payable (Note 4) | | | 16,083 | |

| Transfer agency fees payable (Note 4) | | | 10,869 | |

| Payable for distributions | | | 1,063,217 | |

| Chief compliance officer fees payable (Note 4) | | | 3,542 | |

| Trustees' fees payable (Note 4) | | | 25,460 | |

| Professional fees payable | | | 125,600 | |

| Custody fees payable | | | 9,372 | |

| Organizational fees payable | | | 119,643 | |

| Accrued expenses and other liabilities | | | 290,071 | |

| Total Liabilities | | | 13,585,878 | |

| Total Commitments and Contingencies (Note 2) | | | – | |

| NET ASSETS | | $ | 49,423,828 | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 46,326,932 | |

| Total distributable earnings | | | 3,096,896 | |

| NET ASSETS | | $ | 49,423,828 | |

| PRICING OF SHARES | | | | |

| Class I | | | | |

| Net asset value and offering | | $ | 10.82 | |

| Net assets | | $ | 49,174,773 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 4,542,800 | |

| Class W | | | | |

| Net asset value and offering | | $ | 10.82 | |

| Net assets | | $ | 249,055 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 23,010 | |

See Notes to Consolidated Financial Statements.

| Broadstone Real Estate Access Fund | Consolidated Statement of Operations |

| | | For the Period October 5, 2018 (Commencement of Operations) to September 30, 2019 | |

| INVESTMENT INCOME | | | | |

| Dividend income | | $ | 1,832,247 | |

| Total Investment Income | | | 1,832,247 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 4) | | | 425,326 | |

| Administration fees (Note 4) | | | 172,441 | |

| Transfer agency fees (Note 4) | | | 64,827 | |

| Shareholder servicing fees (Note 4) | | | | |

| Class W | | | 373 | |

| Professional fees | | | 189,550 | |

| Reports to shareholders and printing fees | | | 14,721 | |

| State registration fees | | | 7,880 | |

| Insurance fees | | | 43,000 | |

| Custody fees | | | 48,226 | |

| Chief compliance officer fees (Note 4) | | | 42,043 | |

| Organizational cost | | | 133,028 | |

| Offering cost (Note 2) | | | 460,970 | |

| Interest expense (Note 9) | | | 327,727 | |

| Trustees' fees (Note 4) | | | 101,818 | |

| Other expenses | | | 8,865 | |

| Total Expenses | | | 2,040,795 | |

| Fees waived/expenses reimbursed by Adviser (Note 4) | | | (1,118,756 | ) |

| Net Expenses | | | 922,039 | |

| Net Investment Income | | | 910,208 | |

| Net realized gain on investments | | | 2,247,298 | |

| Net realized gain on written options | | | 426,432 | |

| Net realized gain | | | 2,673,730 | |

| Net change in unrealized appreciation on investments | | | 1,627,403 | |

| Net change in unrealized depreciation on written options | | | (454 | ) |

| Net change in unrealized appreciation | | | 1,626,949 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 4,300,679 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 5,210,887 | |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2019 | 9 |

| Broadstone Real Estate Access Fund | Consolidated Statement of

Changes in Net Assets |

| | | For the Period October 5, 2018 (Commencement of Operations) to September 30, 2019 | |

| OPERATIONS | | | |

| Net investment income | | $ | 910,208 | |

| Net realized gain on investments | | | 2,673,730 | |

| Net change in unrealized appreciation on investments | | | 1,626,949 | |

| Net Increase in Net Assets Resulting from Operations | | | 5,210,887 | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | |

| Class I | | | | |

| From distributable earnings | | | (2,362,633 | ) |

| Class W | | | | |

| From distributable earnings | | | (10,791 | ) |

| Total Distributions to Shareholders | | | (2,373,424 | ) |

| BENEFICIAL INTEREST TRANSACTIONS, IN DOLLARS | | | | |

| Class I | | | | |

| Shares sold | | $ | 46,018,922 | |

| Distributions reinvested | | | 742,436 | |

| Shares redeemed, net of redemption fees (Note 8) | | | (413,744 | ) |

| Class W | | | | |

| Shares sold | | | 235,075 | |

| Distributions reinvested | | | 3,676 | |

| Shares redeemed | | | – | |

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 46,586,365 | |

| Net increase in net assets | | | 49,423,828 | |

| NET ASSETS | | | | |

| Beginning of period | | | – | |

| End of period | | $ | 49,423,828 | |

| Other Information | | | | |

| BENEFICIAL INTEREST TRANSACTIONS, IN SHARES | | | | |

| Class I | | | | |

| Beginning shares | | | – | |

| Shares sold | | | 4,511,912 | |

| Distributions reinvested | | | 69,874 | |

| Shares redeemed | | | (38,986 | ) |

| Net increase in shares outstanding | | | 4,542,800 | |

| Ending shares | | | 4,542,800 | |

| Class W | | | | |

| Beginning shares | | | – | |

| Shares sold | | | 22,665 | |

| Distributions reinvested | | | 345 | |

| Net increase in shares outstanding | | | 23,010 | |

| Ending shares | | | 23,010 | |

See Notes to Consolidated Financial Statements.

| Broadstone Real Estate Access Fund | Consolidated Statement of Cash Flows |

| | | For the Period October 5, 2018 (Commencement of Operations) to September 30, 2019 | |

| Cash Flows from Operating Activities: | | | | |

| Net increase in net assets resulting from operations | | $ | 5,210,887 | |

| Purchase of investments | | | (109,411,482 | ) |

| Proceeds from sales | | | 51,421,513 | |

| Premiums received on closing written options transactions | | | 914,261 | |

| Net purchases of short-term investment securities | | | (483,033 | ) |

| Net realized gain on investments | | | (2,247,297 | ) |

| Net realized gain on written options | | | (426,432 | ) |

| Net change in unrealized appreciation on investments | | | (1,627,404 | ) |

| Net change in unrealized depreciation on written options | | | 454 | |

| (Increase)/Decrease in Assets: | | | | |

| Dividends and interest receivable | | | (471,628 | ) |

| Receivable due from Adviser | | | (5,426 | ) |

| Prepaid offering costs | | | (5,751 | ) |

| Prepaid expenses and other assets | | | (12,857 | ) |

| Increase/(Decrease) in Liabilities: | | | | |

| Shareholder servicing fees payable | | | 94 | |

| Administration fees payable | | | 16,083 | |

| Transfer agency fees payable | | | 10,869 | |

| Chief compliance officer fees payable | | | 3,542 | |

| Trustees' fees payable | | | 25,460 | |

| Professional fees payable | | | 125,600 | |

| Custody fees payable | | | 9,372 | |

| Interest due on loan payable | | | 29,459 | |

| Organizational fees payable | | | 119,643 | |

| Accrued expenses and other liabilities | | | 290,071 | |

| Net cash used for operating activities | | | (56,514,002 | ) |

| | | | | |

| Cash Flows from Financing Activities: | | | | |

| Lines of credit borrowings | | | 22,100,696 | |

| Lines of credit repayment | | | (10,422,155 | ) |

| Proceeds from shares sold | | | 45,813,300 | |

| Payment on shares redeemed | | | (413,744 | ) |

| Cash distributions paid | | | (564,095 | ) |

| Net cash provided by financing activities | | | 56,514,002 | |

| | | | | |

| Net Change in Cash and Cash Equivalents | | | – | |

| | | | | |

| Cash and cash equivalents, beginning of period | | $ | – | |

| Cash and cash equivalents, end of period | | $ | – | |

| | | | | |

| Non-cash financing activities herein consist of reinvestment of distributions of: | | $ | 746,112 | |

| Cash paid during the period for interest from bank borrowing: | | $ | 298,268 | |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2019 | 11 |

| Broadstone Real Estate Access Fund – Class I | Consolidated

Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period October 5, 2018 (Commencement of Operations) to September 30, 2019 | |

| Net asset value, beginning of period | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

| Net investment income(a) | | | 0.28 | |

| Net realized and unrealized gain | | | 1.19 | |

| Total from investment operations | | | 1.47 | |

| | | | | |

| DISTRIBUTIONS | | | | |

| From net investment income | | | (0.06 | ) |

| From net realized gain on investments | | | (0.59 | ) |

| Total distributions(b) | | | (0.65 | ) |

| | | | | |

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 8) | | | – | |

| Net increase in net asset value | | | 0.82 | |

| Net asset value, end of period | | $ | 10.82 | |

| TOTAL RETURN(c) | | | 15.07 | % |

| | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (000s) | | $ | 49,175 | |

| Ratios to Average Net Assets (including interest expense) | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d) | | | 5.98 | %(e) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(d) | | | 2.70 | %(e) |

| Ratio of net investment income to average net assets(d)(f) | | | 2.67 | %(e) |

| | | | | |

| Ratios to Average Net Assets (excluding interest expense) | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d) | | | 5.02 | %(e) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(d) | | | 1.74 | %(e) |

| Ratio of net investment income to average net assets(d)(f) | | | 1.71 | %(e) |

| Portfolio turnover rate | | | 123 | %(g) |

See Notes to Consolidated Financial Statements.

| Broadstone Real Estate Access Fund – Class I | Consolidated

Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| (a) | Calculated using the average shares method. |

| (b) | Total distributions during a calendar year generally will be made from the Fund’s net investment income, net realized gains on investments and net unrealized gains on investments, if any. The portion of distributions paid not attributable to net investment income or net realized gains on investments, if any, is distributed from the Fund’s assets and is treated by shareholders as a nontaxable distribution (“Return of Capital”) for tax purposes. Return of Capital is a tax concept, not an economic concept. The tax character of the Fund’s distributions, in isolation, does not reveal much information about whether the distributions are supported by the Fund’s returns. Reported distributions from net investment income and realized gains on investments are not an indication as to whether or not the Fund’s distributions are supported by the Fund’s returns. A Fund can have distributions from net investment income and realized capital gains in years in which it incurs an economic loss due to unrealized losses not being recognized for tax purposes. A common method in which to determine if the Fund’s distributions are supported by economic returns is to examine the Fund’s Net Asset Value (“NAV”) over the course of a year. If the Fund’s NAV has increased, the Fund will have economically earned more than it has distributed, regardless of whether such distributions are reported as being from net investment income, net realized gains on investments or return of capital. If a Fund’s NAV decreases, the Fund will have distributed more than it has economically earned or it will have incurred an economic loss. |

| (c) | Total returns are calculated based on the October 5, 2018 commencement date and have not been annualized and do not reflect the impact of sales charge. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | The ratios of expenses to average net assets and net investment income to average net assets do not reflect the expenses of the underlying private real estate funds in which the Fund invests which typically range from 0.80% to 1.25% on an annual basis. However, the Fund invests in each underlying private real estate investment fund based upon the NAV of each such fund which reflects the costs of investing in the applicable fund, including the management fee of the underlying fund and other operating expenses. |

| (f) | Recognition of net investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2019 | 13 |

| Broadstone Real Estate Access Fund – Class W | Consolidated

Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period October 5, 2018 (Commencement of Operations) to September 30, 2019 | |

| Net asset value, beginning of period | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

| Net investment income(a) | | | 0.25 | |

| Net realized and unrealized gain | | | 1.20 | |

| Total from investment operations | | | 1.45 | |

| | | | | |

| DISTRIBUTIONS | | | | |

| From net investment income | | | (0.05 | ) |

| From net realized gain on investments | | | (0.58 | ) |

| Total distributions(b) | | | (0.63 | ) |

| | | | | |

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 8) | | | – | |

| Net increase in net asset value | | | 0.82 | |

| Net asset value, end of period | | $ | 10.82 | |

| TOTAL RETURN(c) | | | 14.85 | % |

| | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (000s) | | $ | 249 | |

| Ratios to Average Net Assets (including interest expense) | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d) | | | 6.54 | %(e) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(d) | | | 2.95 | %(e) |

| Ratio of net investment income to average net assets(d)(f) | | | 2.40 | %(e) |

| | | | | |

| Ratios to Average Net Assets (excluding interest expense) | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d) | | | 5.58 | %(e) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(d) | | | 1.99 | %(e) |

| Ratio of net investment income to average net assets(d)(f) | | | 1.44 | %(e) |

| Portfolio turnover rate | | | 123 | %(g) |

See Notes to Consolidated Financial Statements.

| Broadstone Real Estate Access Fund – Class W | Consolidated

Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| (a) | Calculated using the average shares method. |

| (b) | Total distributions during a calendar year generally will be made from the Fund’s net investment income, net realized gains on investments and net unrealized gains on investments, if any. The portion of distributions paid not attributable to net investment income or net realized gains on investments, if any, is distributed from the Fund’s assets and is treated by shareholders as a nontaxable distribution (“Return of Capital”) for tax purposes. Return of Capital is a tax concept, not an economic concept. The tax character of the Fund’s distributions, in isolation, does not reveal much information about whether the distributions are supported by the Fund’s returns. Reported distributions from net investment income and realized gains on investments are not an indication as to whether or not the Fund’s distributions are supported by the Fund’s returns. A Fund can have distributions from net investment income and realized capital gains in years in which it incurs an economic loss due to unrealized losses not being recognized for tax purposes. A common method in which to determine if the Fund’s distributions are supported by economic returns is to examine the Fund’s Net Asset Value (“NAV”) over the course of a year. If the Fund’s NAV has increased, the Fund will have economically earned more than it has distributed, regardless of whether such distributions are reported as being from net investment income, net realized gains on investments or return of capital. If a Fund’s NAV decreases, the Fund will have distributed more than it has economically earned or it will have incurred an economic loss. |

| (c) | Total returns are calculated based on the October 5, 2018 commencement date and have not been annualized and do not reflect the impact of sales charge. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | The ratios of expenses to average net assets and net investment income to average net assets do not reflect the expenses of the underlying private real estate funds in which the Fund invests which typically range from 0.80% to 1.25% on an annual basis. However, the Fund invests in each underlying private real estate investment fund based upon the NAV of each such fund which reflects the costs of investing in the applicable fund, including the management fee of the underlying fund and other operating expenses. |

| (f) | Recognition of net investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2019 | 15 |

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

1. ORGANIZATION

Broadstone Real Estate Access Fund (together with its consolidated subsidiary, the “Fund”) was organized as a Delaware statutory trust on May 25, 2018 and is registered with the U.S. Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund operates as an interval fund with a continuous offering of Fund shares and will offer to make quarterly repurchases of shares at net asset value (“NAV”). The Fund’s investment adviser is Broadstone Asset Management, LLC (the “Adviser”). The Fund’s investment objective is to seek to generate a return comprised of both current income and long-term capital appreciation with low-to-moderate volatility and low correlation to the broader markets. The Fund intends to pursue its investment objective by strategically investing across Public Real Estate Equities, Private Real Estate Funds, and Direct Real Estate Transactions.

The Fund currently offers Class W and Class I shares. Class W and Class I shares commenced operations on October 5, 2018 and are offered at NAV. Prior to that the Fund had no operations other than matters relating to its organization. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their ongoing shareholder service plan charges. Both classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its shareholder servicing plan. The Fund’s income, expenses (other than class specific shareholder servicing fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation– The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standards Update (“ASU”) 2013-08.

Principles of Consolidation– The financial statements include the accounts and operations of the Fund and its consolidated subsidiary, which is wholly owned by the Fund. All intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates– The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from these estimates.

Securities Valuation– Investments in securities are valued at fair value as determined by the Valuation Committee of the Adviser (the “Valuation Committee”), pursuant to delegation from the Fund’s Board of Trustees (the “Board”). Investments in securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price (“NOCP”). Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at fair value as determined in good faith by the Valuation Committee, using procedures adopted by and under the supervision of the Board. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV.

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The fair value of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair value methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the U.S. Treasury yield curve, and credit quality.

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

In making its determination of fair value, the Valuation Committee may retain and rely upon valuations obtained from independent valuation firms; provided that the Valuation Committee shall not be required to determine fair value in accordance with the valuation provided by any single source, and the Valuation Committee shall retain the discretion to use any relevant data, including information obtained from any independent third-party valuation or pricing service, that the Valuation Committee deems to be reliable in determining fair value under the circumstances.

Valuation of Private Real Estate Investment Trusts– The Fund may invest a portion of its assets in Private Real Estate Investment Trusts (each, a “Private REIT”). The Private REITs measure their investment assets at fair value, and report a NAV on a calendar quarter basis. In accordance with ASC 820, the Fund has elected to apply the practical expedient and to value its investments in Private REITs at their respective NAVs at each quarter. As of September 30, 2019, all of the Fund’s investments in Private REITs were valued at their respective sponsor issued NAVs and have not been classified in the fair value hierarchy.

Fair Value Measurements– A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods as follows:

| Level 1 - | Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access on the measurement date and on an on-going basis |

| Level 2 - | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| Level 3 - | Significant unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund's own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| Annual Report | September 30, 2019 | 17 |

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

The inputs or methodology used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following tables summarize the valuation of the Fund’s investments under the fair value hierarchy levels as of September 30, 2019:

| Investments in Securities at Value | | Level 1 - Unadjusted Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Private Real Estate Securities(a) | | $ | – | | | $ | – | | | $ | – | | | $ | 29,516,375 | |

| Public Equity Real Estate Securities | | | 31,981,212 | | | | – | | | | – | | | | 31,981,212 | |

| Short Term Investments | | | 483,033 | | | | – | | | | – | | | | 483,033 | |

| Total | | $ | 32,464,245 | | | $ | – | | | $ | – | | | $ | 61,980,620 | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Written Call Options | | $ | (101,448 | ) | | $ | (20,374 | ) | | $ | – | | | $ | (121,822 | ) |

| Total | | $ | (101,448 | ) | | $ | (20,374 | ) | | $ | – | | | $ | (121,822 | ) |

| (a) | In accordance with Subtopic 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

For the period ended September 30, 2019, the Fund did not use any significant unobservable inputs (Level 3) when determining fair value.

Unfunded Commitments– Typically, when the Fund invests in a Private REIT, the Fund makes a commitment to invest a specified amount of capital in the applicable Private REIT. The capital commitment may be drawn by the general partner of the Private REIT either all at once or through a series of capital calls at the discretion of the general partner. Thus, an unfunded commitment represents the portion of the Fund’s overall capital commitment to a particular Private REIT that has not yet been called by the general partner of the Private REIT. Unfunded commitments may subject the Fund to certain risks. For example, the Fund may be required to: liquidate other portfolio investments, potentially at inopportune times, in order to obtain the cash needed to satisfy its obligations with respect to a capital call; borrow under a credit facility which may result in additional expenses to the Fund; or, to the extent a buyer can be identified and subject to the provisions of the limited partnership agreement of the relevant Private REIT, seek to sell/assign the interest subject to the capital call to a third party thereby eliminating the obligation. Fund management recognizes these risks as potentially detrimental to the overall strategy and so has structured its current agreements around capital commitments in such a way so as to mitigate these risks. As of September 30, 2019, the Fund had total unfunded commitments in the amount of $9,750,000.

Securities Transactions and Investment Income– Investment security transactions are accounted for on a trade date basis. Gains and losses on securities sold are determined on a specific identification basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis.

Real Estate Industry Concentration– Because the Fund will concentrate its investments in real estate securities, its portfolio will be significantly impacted by the performance of the real estate market and may experience more volatility and be exposed to greater risk than a more diversified portfolio. Significant investments in the securities of issuers within the real estate industry and any development affecting the real estate industry will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in the real estate industry. The Fund’s investment in real estate equity or debt may be subject to risks similar to those associated with direct investment in real property. The value of the Fund’s shares will be affected by factors affecting the value of real estate and the earnings of companies engaged in the real estate industry. These factors include, among others: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing and (ix) changes in interest rates. Many real estate companies utilize leverage, which increases investment risk and could adversely affect a company’s operations and market value in periods of rising interest rates. The value of securities of companies in the real estate industry may go through cycles of relative under-performance and outperformance in comparison to equity securities markets in general. As of September 30, 2019, the Fund had 124.43% of the value of its net assets invested within the real estate industry.

Concentration of Credit Risk– The Fund places its cash with one banking institution, which is insured by Federal Deposit Insurance Corporation (“FDIC”). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

Distributions to Shareholders– Distributions from investment income are declared and paid quarterly. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from U.S. GAAP.

Distributions from Underlying REITS– Distributions made to the Fund by the underlying REITs in which the Fund invests may take several forms. The Fund re-characterizes distributions received from the underlying REIT investments based on information provided by the REIT into the following categories: ordinary income, long-term capital gains, and return of capital. If information is not available on a timely basis from the REIT, the re-characterization will be estimated based on available information which may include the previous year’s allocation. If new or additional information becomes available from the REIT at a later date, a re-characterization will be made in the following year.

Offering Costs– Offering costs incurred by the Fund were treated as deferred charges until operations commenced and are being amortized over a 12-month period using the straight line method. As of September 30, 2019, $455,219 in offering costs has been amortized. Unamortized amounts are included in prepaid offering costs in the Statement of Assets and Liabilities.

Organizational Costs– Organizational expenses associated with the establishment of the Fund were expensed by the Fund and subject to the expense limitation and reimbursement agreement and were reimbursed by the Adviser. As of September 30, 2019, $119,643 in organization costs were still payable and are included in organizational fees payable on the Statement of Assets and Liabilities. The Fund reimbursed the Adviser for the full amount on October 21, 2019.

Indemnification– The Fund indemnifies its Officers and Trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

Federal Income Taxes– The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute substantially all of its taxable income, if any to shareholders. Accordingly, no provision for Federal income taxes is required in the financial statements.

The Fund has a wholly owned subsidiary that is expected to be used to hold Direct Real Estate Investments and will qualify as a REIT for federal income tax purposes (a “REIT Subsidiary”). REITs are companies that invest primarily in real estate or real estate-related assets. To qualify as a REIT for U.S. federal income tax purposes, a company must meet certain requirements, including, among other things, distributing at least 90 percent of its taxable income to its stockholders annually in the form of dividends. As of September 30, 2019, the REIT subsidiary of the Fund did not have any investment or operations.

As of and during the period ended September 30, 2019, the Fund did not have a liability for any unrecognized tax benefits in the accompanying financial statements. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

3. DERIVATIVE TRANSACTIONS

The Fund may engage in transactions involving options and futures and other derivative financial instruments. Derivatives can be volatile and involve various types and degrees of risk. By using derivatives, the Fund may be permitted to increase or decrease the level of risk, or change the character of the risk, to which the portfolio is exposed.

When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is recorded on the Statement of Assets and Liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the current market value of the option written. When an option expires, the Fund realizes a gain on the option to the extent of the premium received. Premiums received from writing options which are exercised or closed are added to or offset against the proceeds or amount paid on the transaction to determine the realized gain or loss. The Fund, as writer of an option, might be exposed to other risks, such as being required to continue holding a security that the Fund might otherwise have sold to protect against depreciation in the market price of the security.

When writing options, the Fund may economically offset its position by purchasing an option on the same security or commodity with the same exercise price and expiration date as the option that it has previously written on the security. If the amount paid to purchase an option is less or more than the amount received from the sale, the Fund will, accordingly, realize a profit or loss. To close out a position as a purchaser of an option, the Fund would liquidate the position by selling the option previously purchased.

| Annual Report | September 30, 2019 | 19 |

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

The Fund also uses Flexible Exchange-Traded Options (“FLEX Options”), which are customized equity or index option contracts that trade on an exchange that provide the writer of the purchaser with the ability to customize key contract terms like exercise prices, styles and expiration dates. Like standardized exchange-traded options, FLEX Options are guaranteed for settlement by The Options Clearing Corporation (“OCC”), a market clearinghouse. FLEX Options are valued by a third-party pricing service using techniques that consider factors including the value of the underlying instrument, the volatility of the underlying instrument and the period of time until option expiration.

The effect of derivative instruments on the Statement of Assets and Liabilities as of September 30, 2019:

| | | Liability Derivatives | |

| Risk Exposure | | Statement of Assets and Liabilities Location | | Fair Value | |

| Equity Contracts (Written Options) | | Written Options, at value | | $ | (121,822 | ) |

| Total | | | | $ | (121,822 | ) |

The effect of derivative instruments on the Statement of Operations for the period ended September 30, 2019:

| Risk Exposure | | Statement of Operations Location | | Realized Gain/(Loss) on Derivatives | | | Change in Unrealized Appreciation/(Depreciation) on Derivatives Recognized in Income | |

| Equity Contracts (Written Options) | | Net realized gain on written options/Net change in unrealized (depreciation) on written options | | $ | 426,432 | | | $ | (454 | ) |

| Total | | | | $ | 426,432 | | | $ | (454 | ) |

The monthly average notional amount and monthly average number of contracts of written options held by the Fund during the period ended September 30, 2019 was $9,948,194 and 1,718, respectively.

Certain derivative contracts are executed under either standardized netting agreements or, for exchange-traded derivatives, the relevant contracts for a particular exchange which contain enforceable netting provisions. A derivative netting arrangement creates an enforceable right of set-off that becomes effective, and affects the realization of settlement on individual assets, liabilities and collateral amounts, only following a specified event of default or early termination. Default events may include the failure to make payments or deliver securities timely, material adverse changes in financial condition or insolvency, the breach of minimum regulatory capital requirements, or loss of license, charter or other legal authorization necessary to perform under the contract. The following table presents derivative financial instruments that are subject to enforceable netting arrangements or other similar agreements as of September 30, 2019:

| | | | | | | | | | | | Gross Amounts Not Offset in the Statement of Financial Position | |

| | | Gross Amounts of Recognized Liabilities | | | Gross Amounts Offset in the Statement of Assets and Liabilities | | | Net Amounts Presented in the Statement of Assets and Liabilities | | | Financial Instruments(a) | | | Cash Collateral Pledged(a) | | | Net Amount | |

| Written Option Contracts | | $ | 121,822 | | | | | | | $ | 121,822 | | | $ | (121,822 | ) | | $ | – | | | $ | – | |

| Total | | $ | 121,822 | | | $ | – | | | $ | 121,822 | | | $ | (121,822 | ) | | $ | – | | | $ | – | |

| (a) | These amounts are limited to the derivative asset/liability balance and, accordingly, do not include excess collateral received/pledged. |

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

4. ADVISORY FEE AND OTHER RELATED PARTY TRANSACTIONS

Advisory Fees – Pursuant to an investment advisory agreement with the Fund, (the “Advisory Agreement”), investment advisory services are provided to the Fund by the Adviser. Under the terms of the Advisory Agreement, the Adviser receives monthly fees calculated at an annual rate of 1.25% of the average daily net assets of the Fund. The advisory fee is paid on a monthly basis.

The Adviser and the Fund have entered into an operating expenses limitation and reimbursement agreement (the “Expense Limitation Agreement”) pursuant to which the Adviser has contractually agreed to waive its fees and to defer reimbursement for the ordinary operating expenses of the Fund (including all expenses necessary or appropriate for the operation of the Fund and including the Adviser’s investment advisory or management fee detailed in the Advisory Agreement, any other expenses described in the Advisory Agreement, but does not include any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes and extraordinary expenses such as litigation), to the extent that such expenses exceed 1.99% and 1.74% per annum of the Fund’s average daily net assets attributable to Class W and Class I shares, respectively. In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable within three years from the date on which they were incurred; and (2) the reimbursement may not be made if it would cause the Expense Limitation in effect at the time of the waiver or currently in effect, whichever is lower, to be exceeded. The Expense Limitation Agreement will remain in effect through September 25, 2020.

During the period ended September 30, 2019, the fees waived/reimbursed and recoupment of previously waived fees under the Expense Limitation Agreement were as follows:

| | Fees Waived/Reimbursed By Adviser | |

| Class I | $ | 1,113,394 | |

| Class W | | 5,362 | |

As of September 30, 2019, the balances of recoupable expenses for the Fund were as follows:

| Fund | Expires 2022 | |

| Class I | $ | 1,113,394 | |

| Class W | | 5,362 | |

Sub-advisory services are provided to the Fund pursuant to an agreement between the Adviser and Heitman Real Estate Securities, LLC (the “Sub-Adviser” or “Heitman”). Under the terms of the sub-advisory agreement, the Adviser compensates the Sub-Adviser based on the Fund’s assets allocated to the Sub-Adviser.

Distributor – The distributor of the Fund is ALPS Distributors, Inc. (the “Distributor”). The Board has adopted, on behalf of the Fund, a Shareholder Services Plan (the “Plan”) and a Distribution Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect to clients with whom they have distributed shares of the Fund. Under the Plan, the Fund pays up to 0.25% per year of the average daily net assets of Class W shares for such services. Class I shares are not subject to a fee for such services. Plan fees in the amount of $373 are disclosed in the Statement of Operations for the period ended September 30, 2019 as shareholder servicing fees.

Officer and Trustee Compensation – Each Independent Trustee who is not affiliated with the Trust or Adviser receives an annual retainer of $25,000, (to be pro-rated for a partial term), as well as reimbursement for any reasonable expenses incurred attending the meetings. Each Independent Trustee also receives a fee of $1,000 for each meeting of the Board (or committees of our Board) attended, provided that an Independent Trustee will not receive separate meeting fees for attending committee meetings held on the same day that the Independent Trustee received a fee for attending a meeting of our Board. In addition, the chairman of each of the Audit Committee and the Nominating and Corporate Governance Committee will receive an annual retainer of $5,000. None of the Fund’s executive officers receive compensation from the Fund.

Certain Trustees and officers of the Fund are also officers of the Adviser and are not paid by the Fund for serving in such capacities.

| Annual Report | September 30, 2019 | 21 |

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

ALPS Fund Services, Inc. (“ALPS”) – ALPS provides administration and fund accounting services to the Trust. Pursuant to separate servicing agreements with ALPS, the Fund pays ALPS customary fees for providing administration and fund accounting services to the Fund.

Transfer Agent – DST Systems, Inc. serves as transfer, dividend paying and shareholder servicing agent for the Fund (“Transfer Agent”).

5. PURCHASES AND SALES OF INVESTMENT SECURITIES

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the period ended September 30, 2019 were as follows:

| | Purchases of Securities | | Proceeds from Sales of Securities |

| Broadstone Real Estate Access Fund | $ | 109,137,126 | | $ | 51,005,875 | |

6. REPURCHASE OFFERS

Pursuant to Rule 23c-3 under the 1940 Act, the Fund offers shareholders on a quarterly basis the option of having their shares repurchased, at NAV, of no less than 5% and no more than 25% of the shares outstanding on the Repurchase Request Deadline. There is no guarantee that shareholders will be able to sell all of the shares they desire to sell in a quarterly repurchase offer, although each shareholder will have the right to require the Fund to purchase at least 5% of such shareholder’s shares in each quarterly repurchase. Limited liquidity will be provided to shareholders only through the Fund's quarterly repurchases.

During the period ended September 30, 2019, the Fund completed two quarterly repurchase offers. The result of those repurchase offers were as follows:

| | Repurchase Offer #1 | Repurchase Offer #2 |

| Commencement Date | March 18, 2019 | June 17, 2019 |

| Repurchase Request Deadline | April 17, 2019 | July 17, 2019 |

| Repurchase Pricing Date | May 1, 2019 | July 17, 2019 |

| Amount Repurchased | $375,141 | $39,112 |

| Shares Repurchased | 35,324 | 3,662 |

| Percentage of Outstanding Shares the Fund Offered by Repurchase | 5.00% | 5.00% |

| Percentage of Outstanding Shares Repurchased | 1.07% | 0.08% |

7. TAX BASIS INFORMATION

Distributions are determined in accordance with federal income tax regulations, which differ from U.S. GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end.

The tax character of Fund distributions for the following year was as follows:

| Year | | Ordinary Income | | | Long-Term

Capital Gain | | | Return of Capital | |

| 2019 | | $ | 2,373,424 | | | $ | – | | | $ | – | |

For the period ended September 30, 2019, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character.

| | | Paid-in Capital | | | Total Distributable Earnings | |

| Broadstone Real Estate Access Fund | | $ | (259,433 | ) | | $ | 259,433 | |

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

As of September 30, 2019, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| | Undistributed net investment income | | Undistributed long-term capital gain | | Other cumulative effect of timing differences | | Net unrealized appreciation/(depreciation) on investments | | Total |

| Broadstone Real Estate Access Fund | $ | 618,898 | | $ | 68,325 | | $ | – | | $ | 2,409,673 | | $ | 3,096,896 | |

As of September 30, 2019, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| | | Gross Appreciation (excess of value over tax cost) | | Gross Depreciation (excess of tax cost over value) | | Net Unrealized Appreciation/(Depreciation) | | Cost of Investments for Income Tax Purposes |

| Broadstone Real Estate Access Fund | | $ | 2,737,559 | | $ | (327,886 | ) | $ | 2,409,673 | | $ | 59,570,492 | |

The difference between book basis and tax basis net unrealized appreciation is primarily attributable to the investments in partnerships, wash sales and certain other investments.

8. REPURCHASE FEES

Shareholders of the Fund who tender for repurchase shares that have been held less than 90 days from the purchase date will be subject to an early withdrawal charge of 2.00% as a percent of proceeds with respect to such shares. The redemption fee does not apply to shares that were acquired through reinvestment of distributions or in connection with the death or disability of the shareholder. The redemption fee is paid directly to the Fund. For the period ended September 30, 2019, the Fund received $509 in redemption fees, which is reflected in “Shares redeemed, net of redemption fees” in the Statement of Changes in Net Assets.

9. LINE OF CREDIT

The Fund has a secured revolving bank line of credit through BNP Paribas Prime Brokerage International, Ltd. (the “Bank”) for the purpose of investment purchases subject to the limitations of the 1940 Act for borrowings.

Borrowings under this arrangement bear interest at the Bank’s 1 month LIBOR plus 1.25 basis points at the time of borrowing. As of September 30, 2019, the Fund had $11,678,541 of outstanding borrowings with an average interest rate of 3.615%.

During the period ended September 30, 2019, the Fund incurred $327,727 of interest expense related to the borrowings. As collateral security for the revolving line of credit, the Fund grants the Bank a first position security interest in and lien on all securities of any kind or description held by the Fund in the pledge account. As of September 30, 2019, the Fund had $31,981,212 in securities pledged as collateral for the line of credit.

10. NEW ACCOUNTING PRONOUNCEMENTS

The Fund considers the applicability and impact of all Accounting Standard Updates (“ASU”) issued by the Financial Accounting Standards Board ("FASB"). There have been no new or material changes to the significant accounting policies discussed in Note 2 for the period from October 5, 2018 (commencement) to September 30, 2019, that are of significance, or potential significance, to the Fund.

| Annual Report | September 30, 2019 | 23 |

| Broadstone Real Estate Access Fund | Notes to Consolidated Financial Statements |

September 30, 2019

11. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

The Fund completed a quarterly repurchase offer on October 16, 2019, which resulted in 1,223 Fund shares being repurchased for $13,274.

On October 15, 2019 BDREX invested $1,005,299 in Voya Commercial Lending Fund, LP and committed to an additional $9M to the Fund as an unfunded commitment.

Management has determined that there were no other subsequent events to report through the issuance of these financial statements.