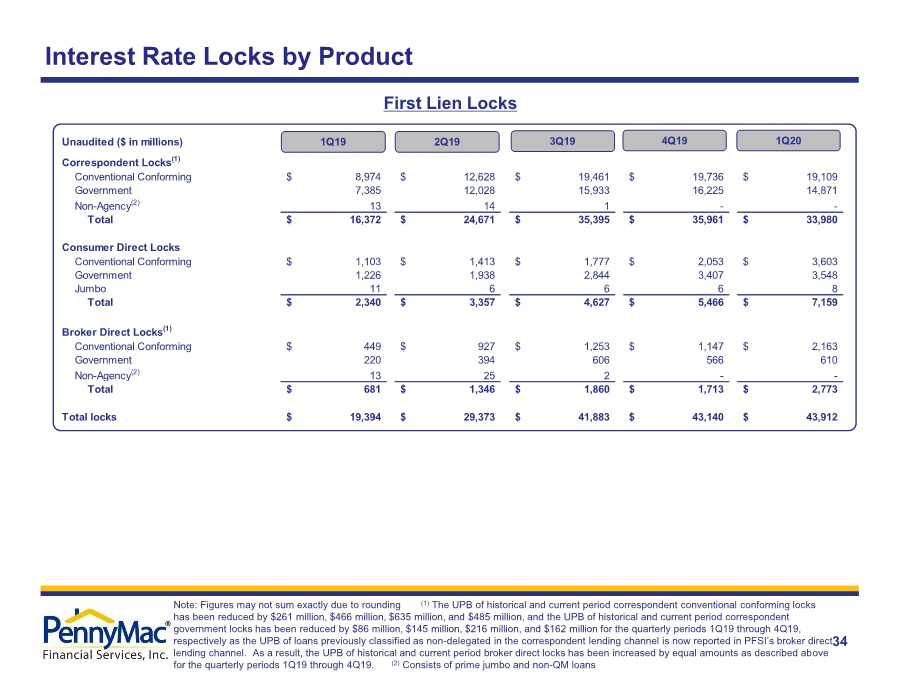

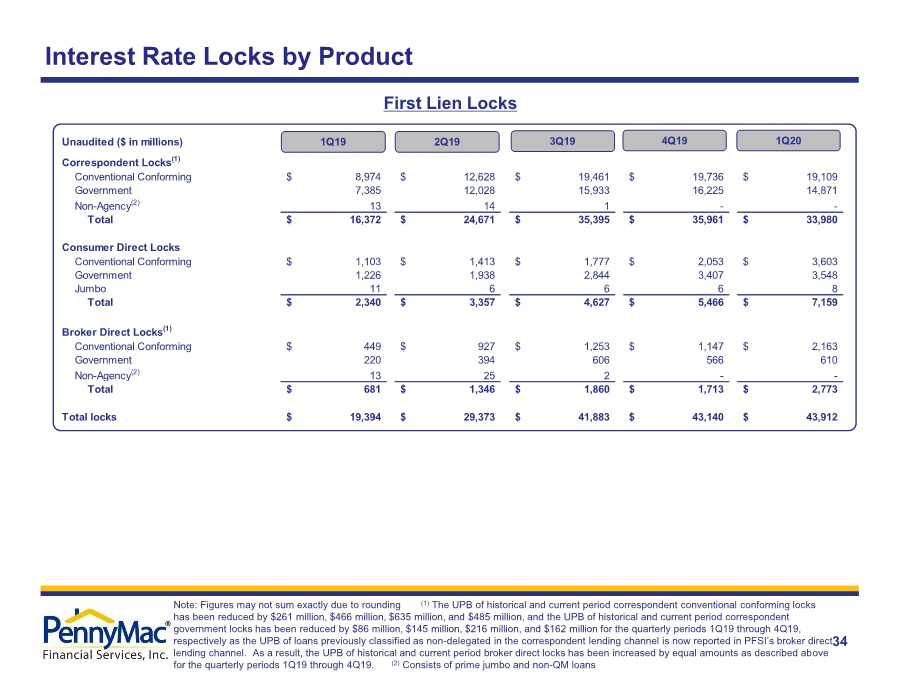

| 34 Interest Rate Locks by Product First Lien Locks Unaudited ($ in millions) Correspondent Locks(1) Conventional Conforming 8,974 $ 12,628 $ 19,461 $ 19,736 $ 19,109 $ Government 7,385 12,028 15,933 16,225 14,871 Non-Agency(2) 13 14 1 - - Total 16,372 $ 24,671 $ 35,395 $ 35,961 $ 33,980 $ Consumer Direct Locks Conventional Conforming 1,103 $ 1,413 $ 1,777 $ 2,053 $ 3,603 $ Government 1,226 1,938 2,844 3,407 3,548 Jumbo 11 6 6 6 8 Total 2,340 $ 3,357 $ 4,627 $ 5,466 $ 7,159 $ Broker Direct Locks(1) Conventional Conforming 449 $ 927 $ 1,253 $ 1,147 $ 2,163 $ Government 220 394 606 566 610 Non-Agency(2) 13 25 2 - - Total 681 $ 1,346 $ 1,860 $ 1,713 $ 2,773 $ Total locks 19,394 $ 29,373 $ 41,883 $ 43,140 $ 43,912 $ 1Q19 2Q19 3Q19 4Q19 1Q20 Note: Figures may not sum exactly due to rounding (1) The UPB of historical and current period correspondent conventional conforming locks has been reduced by $261 million, $466 million, $635 million, and $485 million, and the UPB of historical and current period correspondent government locks has been reduced by $86 million, $145 million, $216 million, and $162 million for the quarterly periods 1Q19 through 4Q19, respectively as the UPB of loans previously classified as non-delegated in the correspondent lending channel is now reported in PFSI’s broker direct lending channel. As a result, the UPB of historical and current period broker direct locks has been increased by equal amounts as described above for the quarterly periods 1Q19 through 4Q19. (2) Consists of prime jumbo and non-QM loans |