Exhibit 99.1

SHAREHOLDER

NEWSMIKE MOLEPSKEBANK FIRST APPOINTS COMPUTERSHARE AS STOCK TRANSFER AGENT AND REGISTRARBank First Corporation is pleased to announce the appointment of Computershare Trust Company, N.A. (“Computershare”) as stock transfer agent and registrar for Bank First. Computershare assumed this responsibility from Bank First’s current transfer agent, EQ by Equiniti, on January 27, 2020. “We are looking forward to the many benefits Computershare will provide our valued shareholders,” stated Mike Molepske, President and CEO of Bank First. Computershare will aid in facilitating shareholder recordkeeping, stock transfers for individual holders, and dividend disbursement. Shareholders will benefit from increased flexibility in accessing information and processing transactions using Computershare’s toll-free shareholder services center, automated telephone support system and internet capabilities. To learn more about Computershare, including the company’s robust Investor Center, please visit them online at www.computershare.com/investor. MESSAGE FROM THE CEO To our shareholders, In March, we will begin our annual strategic planning process with the bank’s board of directors and our senior management team. The strategic plan for Bank First considers capital, asset quality, management, earnings, liquidity, sensitivity to market risk, and information technology. In this newsletter, I will discuss some of the considerations that go into our capital plan, including the recently approved Dividend Reinvestment Plan (DRIP). As you are aware, banking is a highly regulated industry and by law, Bank First is required to maintain a minimum capital level. In addition, the bank needs to retain additional capital to fund both organic and acquisitive growth and provide a capital buffer. Bank First also distributes capital to its shareholders through dividends and stock repurchases. In 2019, Bank First marked its tenth consecutive year of record earnings. These earnings grew capital at the bank. However, continued organic growth and the acquisitions of Waupaca Bancorporation and Partnership Community Bancshares in the last three years have depleted some of that capital. In addition, over that same period, Bank First repurchased 377,167 shares of its stock, at an average price of $41.73, and paid out $14,042,000 in dividends. In response, the bank did not increase the dividends per share paid to you, our shareholders, in 2019. The board of directors is committed to paying dividends to its shareholders as capital levels allow. Many of the bank’s shareholders count on the dividends they receive as a source of income. However, others do not need the dividends and would prefer the bank reinvest in itself instead of paying a dividend. For those latter shareholders, we are excited to announce the bank will be introducing a DRIP for the first time in its history. Beginning in the second quarter of 2020, shareholders will have the option to enroll in the DRIP, which allows you to receive additional shares of Bank First in place of cash. We will be sending out more information about the DRIP and instructions on how to enroll in the coming months. Over the years, the bank has received numerous requests from shareholders to start a DRIP. Due to Securities and Exchange Commission rules, the bank had to wait a year after becoming a fully public company before it could offer a DRIP to its shareholders. The DRIP is an example of the strategic planning process at work. This year, as always, our shareholders will be at the center of our strategic planning process. We strive to continue growing earnings per share to fuel growth in the bank’s stock price. The board of directors will continue to review the bank’s ability to pay dividends to you, our shareholder, on a quarterly basis. In the meantime, our 2020 Annual Shareholder Meeting has been scheduled for Monday, June 8 at 4:00 p.m. at Holy Family College-Franciscan Center for Music Education and Performance, 2406 S. Alverno Road, Manitowoc. This is a wonderful opportunity for our shareholders to learn about the bank’s performance, ask questions, and meet the board of directors. Holy Family College (formerly Silver Lake College) has graciously agreed to host our meeting again this year in their beautiful Franciscan Center for Music Education and Performance. The meeting will be followed by a cocktail reception. Sincerely, Michael B. Molepske, CEO and President (920) 652-3202www.BankFirstWI.bank Ticker: BFC

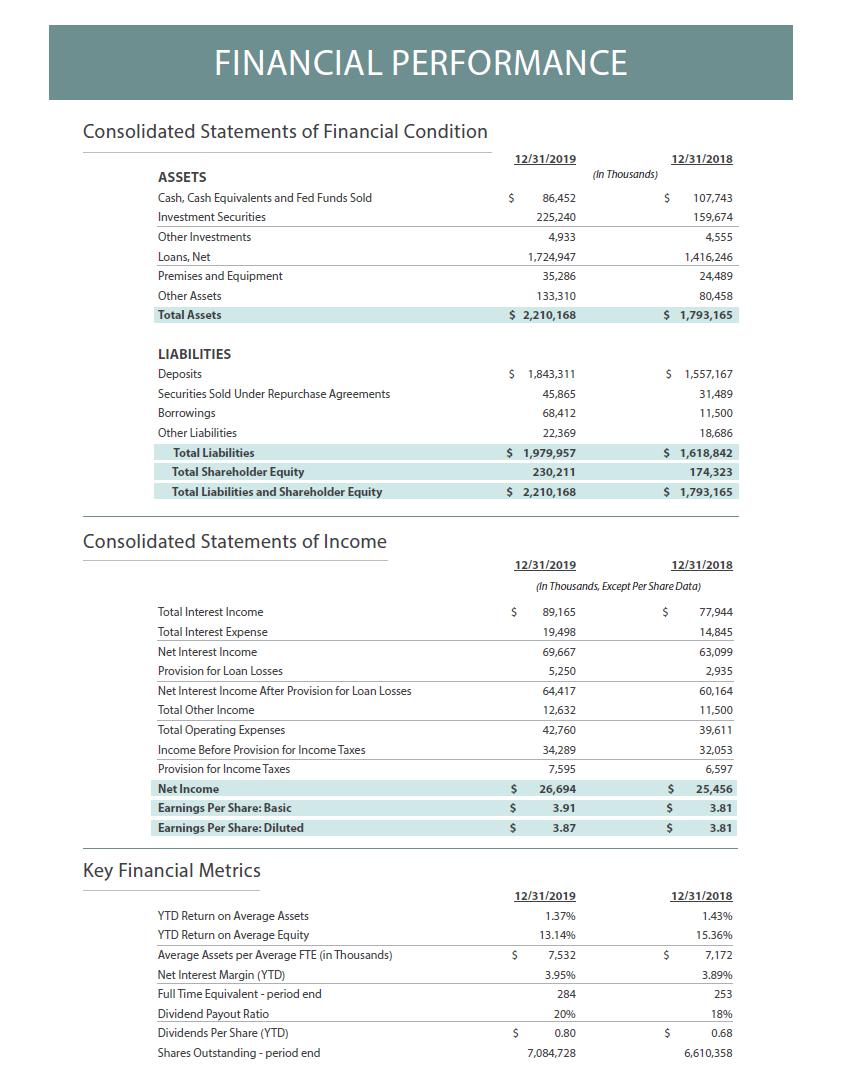

FOURTH QUARTERKEVIN LEMAHIEUChief Financial Officer (920) 652-3362Total assets for the Company increased by 23.3% to $2.21 billion at December 31, 2019, compared to $1.79 billion at December 31, 2018. Loans grew by nearly $308.0 million on a year-over-year basis, ending 2019 at $1.74 billion. Deposits grew by over $286.1 million on a year-over-year basis, ending 2019 at $1.84 billion. Loan and deposit growth was amplified during 2019 by the acquisition of Partnership Community Bancshares (“Partnership”). Noninterest-bearing demand deposits made up 26.2% of our overall core deposits, representing a low-cost source of funding for our loan portfolio. Earnings per share for the year ended December 31, 2019, was $3.91. This represents an increase of 2.6% compared to earnings per share of $3.81 during 2018. Net income was $26.7 million for the year ended December 31, 2019, compared to $25.5 million during 2018. Net income and earnings per share were negatively impacted during 2019 by expenses related to the aforementioned acquisition of Partnership, which totaled $1.5 million and reduced earnings per share by $0.15. Net interest margin was 3.95% for 2019, up from 3.89% during 2018. The Company’s average assets per full-time equivalent staffincreased to $7.5 million for the year ended December 31, 2019, up from $7.2 million for 2018, as operations in our recently added markets saw improved efficiency throughout 2019. Total non-interest income was $12.6 million for 2019, compared to $11.5 million for 2018, an increase of $1.1 million, or 9.8%. Gains on sales of mortgage loans on the secondary market increased by 127.1% from $0.6 million during 2018 to $1.4 million during 2019, the result of the Company capitalizing on a very robust retail lending environment. Loan servicing income experienced a decline of $0.9 million due to a negative valuation adjustment to the Company’s mortgage servicing rights asset. This typically occurs when mortgage refinancing accelerates as it reduces the assumption of how long the underlying serviced loans will exist. We also experienced a gain on sale of investments totaling $0.9 million late in 2019 as we restructured portions of the Company’s investment portfolio to take advantage of anomalies in the pricing of certain investment types. Total non-interest expense increased by $3.1 million for 2019, from $39.6 million in 2018 to $42.8 million in 2019. The acquisition of Partnership led to increases in the areas of occupancy and equipment, up 10.4%, data processing, up 24.6%, and amortization of intangible assets, up 41.4%. These three areas led to 49.7% of the increase in non-interest expense year-over-year. Personnel expense increased by $1.4 million, or 6.5%, from 2018 to 2019, the result of four additional offices acquired from Partnership as well as standard inflationary increases in salary expense for our legacy operations. The Company’s efficiency ratio for the year ended December 31, 2019 was 51.3%, improving on 52.2% for the year ended December 31, 2018, indicating that efficiency remains a point of emphasis for the organization. Total shareholders’ equity increased by 32.1% to $230.2 million at December 31, 2019, compared to $174.3 million at December 31, 2018. This $55.9 million increase in shareholders’ equity was accomplished through strong earnings and the positive impact of the Partnership acquisition, offset by distributing $5.5 million to our shareholders’ in dividends and utilizing another $4.2 million for share repurchases during 2019. Period Ending

| Index | 12/31/14 | 12/31/15 | 12/31/16 | 12/31/17 | 12/31/18 | 12/31/19 |

| BFC | $100.00 | $127.41 | $153.39 | $204.99 | $221.17 | $336.81 |

| Russell 2000 | 100.00 | 94.29 | 112.65 | 127.46 | 111.94 | 115.53 |

| Nasdaq Bank | 100.00 | 98.41 | 123.61 | 143.70 | 115.53 | 152.29 |

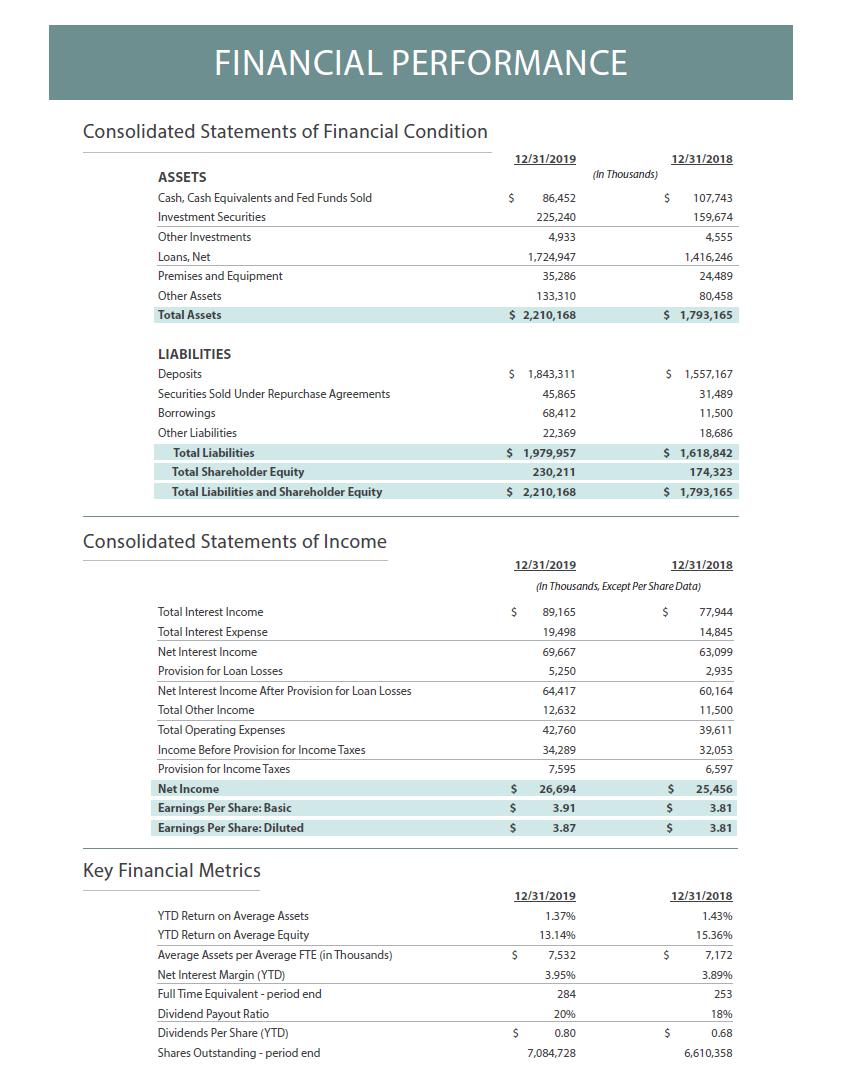

FINANCIAL PERFORMANCE Consolidated Statements of Financial Condition Consolidated Statements of Income Key Financial MetricsASSETS Cash, Cash Equivalents and Fed Funds Sold $ 86,452 $ 107,743 Investment Securities 225,240 159,674 Other Investments 4,933 4,555 Loans, Net 1,724,947 1,416,246 Premises and Equipment 35,286 24,489 Other Assets 133,310 80,458Total Assets $ 2,210,168 $ 1,793,165 LIABILITIES Deposits $ 1,843,311 $ 1,557,167 Securities Sold Under Repurchase Agreements 45,865 31,489 Borrowings 68,412 11,500 Other Liabilities 22,369 18,686Total Liabilities $ 1,979,957 $ 1,618,842 Total Shareholder Equity 230,211 174,323 Total Liabilities and Shareholder Equity $ 2,210,168 $ 1,793,165 12/31/2019 12/31/2018 Total Interest Income $ 89,165 $ 77,944 Total Interest Expense 19,498 14,845 Net Interest Income 69,667 63,099 Provision for Loan Losses 5,250 2,935 Net Interest Income After Provision for Loan Losses 64,417 60,164 Total Other Income 12,632 11,500 Total Operating Expenses 42,760 39,611 Income Before Provision for Income Taxes 34,289 32,053 Provision for Income Taxes 7,595 6,597Net Income $ 26,694 $ 25,456 Earnings Per Share: Basic $ 3.91 $ 3.81 Earnings Per Share: Diluted $ 3.87 $ 3.81 12/31/2019 12/31/2018YTD Return on Average Assets 1.37% 1.43% YTD Return on Average Equity 13.14% 15.36% Average Assets per Average FTE (in Thousands) $ 7,532 $ 7 172 Net Interest Margin (YTD) 3.95% 3.89% Full Time Equivalent - period end 284 253 Dividend Payout Ratio 20% 18% Dividends Per Share (YTD) $ 0.80 $ 0.68 Shares Outstanding - period end 7,084,728 6,610,358

Bank First announces promotions SHANNON KLAHNhas been promoted to Assistant Executive Officer. Klahn joined the bank in 2014 as a Business Analyst and in 2017 she joined the marketing department where she most recently held the role of Marketing Communications Officer. In her new role, Shannon is responsible for supporting the Chief Executive Officer and Senior Management team with the overall strategic and operational performance of the bank. Klahn earned her Bachelor of Business Administration degree from the University of Wisconsin – Madison and her Master of Business Administration degree from the University of Wisconsin – Milwaukee. With a focus on community involvement, she serves on the Board of Directors of Family Service Association of Sheboygan and Advocacy Programs of Sheboygan. She also serves on the Board of Directors of the American Barefoot Club, a division of U.S.A. Waterski, as Executive Director of the Midwest Region. In her free time, Shannon enjoys running, biking, barefoot waterskiing, and spending time with family and friends. She resides in Sheboygan with her husband, Derek, and their son, Bryson.SCOTT TUMAhas been promoted to Enterprise Risk Manager. Tuma joined Bank First in 2014 and most recently served as the bank’s Card Operations Manager. In his new role, Scott is responsible for ensuring Bank First maintains optimum compliance with Federal and State laws, rules and regulations as well as internal policies and procedures. He is also responsible for the management of compliance, information security systems, vendor management, internal audit, and third-party exams. Tuma earned his Bachelor of Business Administration degree in Economics from UW – Green Bay and earned his Masters of Business Administration degree from Lakeland University in 2012. In his free time, Scott enjoys running, spending time with family and friends, and weekend visits with his family at their cabin up north. Scott also enjoys volunteering his time in the community alongside fellow coworkers.KLAHN TUMAThe Corporation’s board of directors approved a quarterly cash dividend of $0.20 per common share, payable on April 7, 2020, to shareholders of record as of March 23, 2020. Bank First has a stock repurchase program under which the Corporation may repurchase shares of outstanding BFC stock. Please contact Mike Molepske at (920) 652-3202 or Shannon Klahn at (920) 652-3222 for further information.Oshkosh office celebrates Grand Opening! Forward Looking Statements: This newsletter may contain certain “forward-looking statements” that represent Bank First Corporation’s expectations or beliefs concerning future events. Such forward-looking statements are about matters that are inherently subject to risks and uncertainties. Because of the risks and uncertainties inherent in forward looking statements, readers are cautioned not to place undue reliance on them, whether included in this newsletter or made elsewhere from time to time by Bank First Corporation or on its behalf. Bank First Corporation disclaims any obligation to update such forward-looking statements. In addition, statements regarding historical stock price performance are not indicative of or guarantees of future price performance. Find us on Facebook