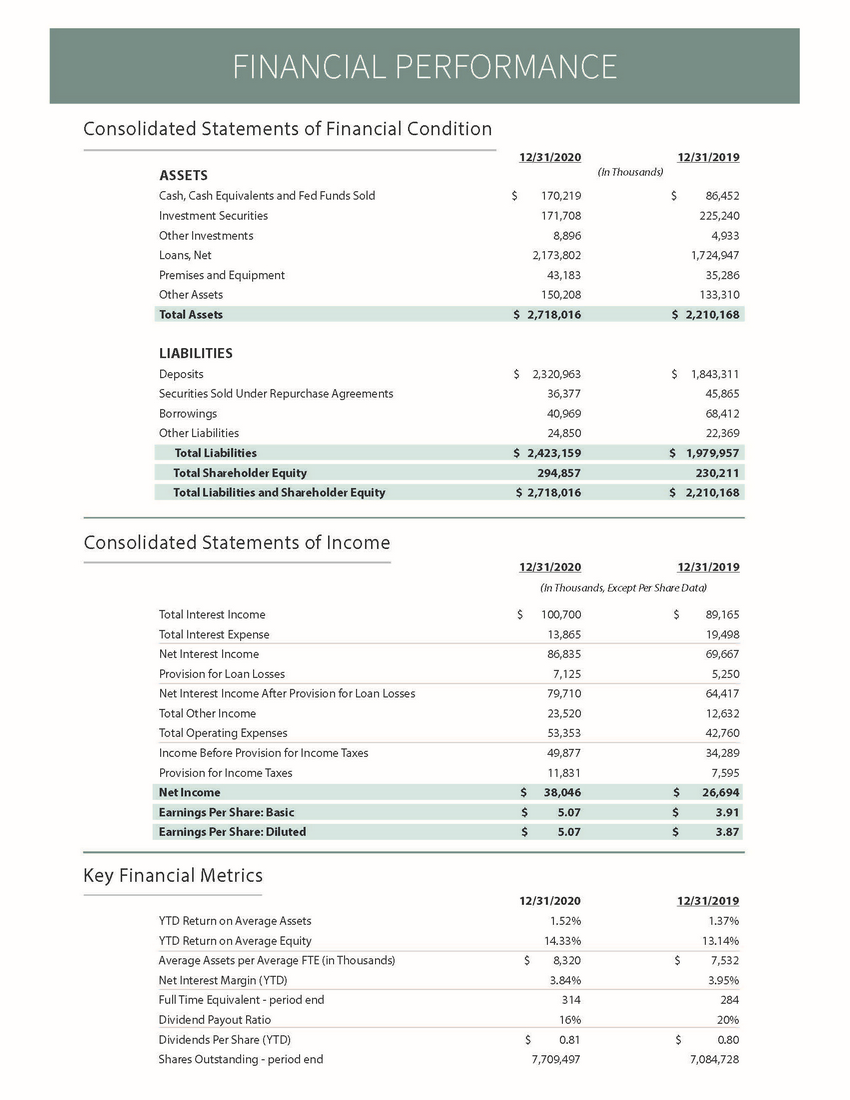

| 2019 to 3.66% for 2020, representing one of the most resilient year-over-year NIM comparisons nationally during this timeframe. Total non-interest income was $23.5 million for 2020, compared to $12.6 million for 2019, an increase of $10.9 million, or 86.2%. Gains on sales of mortgage loans on the secondary market increased by 279.0% from $1.4 million during 2019 to $5.3 million during 2020, the result of a very robust retail lending environment. While these gains can be unpredictable from year-to-year, the resulting income that Bank First earns from servicing these sold loans continues into future years. Loan servicing income experienced an increase of $0.9 million, or 158.2% for 2020 compared to 2019. Income from service charges increased $1.5 million, or 42.7% year-over-year, the result of new markets from three acquisitions in a little more than three years. Finally, gains on sales of investments and our Chetek branch totaled $4.9 million during 2020, compared to $0.9 million in gains on sales of investments in 2019. Total non-interest expense increased by $10.6 million, or 24.8%, from $42.8 million in 2019 to $53.4 million in 2020. Once again, three acquisitions in a little over three years has led to increases in the areas of personnel expense, up 19.1%, occupancy and equipment, up 22.3%, data processing, up 22.3%, professional fees, up 35.2%, and amortization of intangible assets, up 53.0%. Beyond these areas, postage, stationery and supplies expense increased by 47.6% year-over-year due to expenses related to Bank First’s response to the COVID-19 pandemic. Finally, due to a surplus of liquidity that developed at the Company during 2020, $30.0 million in borrowings from the Federal Home Loan Bank were paid back prior to maturity, leading to a prepayment fee of $1.3 million, but saving the Company $1.7 million in interest expense over the next three years. The Company’s efficiency ratio for the year ended December 31, 2020 was 47.8%, improving from 51.3% for the year ended December 31, 2019. Total shareholders’ equity increased by 28.1% to $294.9 million at December 31, 2020, compared to $230.2 million at December 31, 2019. This $64.7 million increase in shareholders’ equity was accomplished through strong earnings and the positive impact of the Timberwood acquisition, offset by distributing $6.1 million to shareholders in dividends and utilizing another $4.4 million for share repurchases during 2020. FOURTH QUARTER KEVIN LEMAHIEU Chief Financial Officer (920) 652-3362 Total assets for the Company increased by 23.0% to $2.72 billion at December 31, 2020, compared to $2.21 billion at December 31, 2019. Loans grew by $455.1 million on a year-over-year basis, ending 2020 at $2.19 billion. Deposits grew by $477.7 million on a year-over-year basis, ending 2020 at $2.32 billion. Growth was amplified in these areas during 2020 by the acquisition of Tomah Bancshares, Inc. (“Timberwood”), which included $118.4 million in loans and $171.1 million in deposits. Noninterest-bearing demand deposits made up 31.2% of our overall core deposits at December 31, 2020, representing a low-cost source of funding for the loan portfolio. Earnings per share for the year ended December 31, 2020, was $5.07. This represents an increase of 29.7% compared to earnings per share of $3.91 during 2019. Net income was $38.0 million for the year ended December 31, 2020, compared to $26.7 million during 2019. As Mike mentioned in his “Message from the CEO”, this growth was the result of incredibly hard work by our dedicated team of bankers who rose to the challenge of 2020 and accomplished great things in support of our customers and communities. Net interest margin (“NIM”) was 3.84% for 2020, down from 3.95% during 2019. When the impacts of accounting rules for acquired loans and deposits are removed from Bank First’s reported NIM, the resulting core NIM actually increased from 3.58% for Cash Dividend approved a quarterly cash dividend of 2021, to shareholders of record as of Dempsey announces plans for retirement continued from previous page --President in a regional capacity at Associated Bank, and was a member of Associated Bank’s Corporate Executive Loan Committee, Corporate Pricing Committee, and Corporate Key Leadership Committee. Prior to his tenure at Associated Bank, Mike dedicated 17 years to Firstar Bank in a variety of regional capacities, including Senior Credit Officer, Senior Vice President, and Manager of the Fox Valley Regional Trust Division. “Mike has been extremely instrumental in growing the bank’s footprint in the Fox Valley region, as well as guiding us through our period of growth during recent mergers and acquisitions,” stated Mike Molepske. “We are grateful for his commitment to the bank and the communities we serve. While we wish him the best in his future retirement, we are very fortunate to utilize his expertise during this time of transition.” Dempsey stated, “Joining Bank First has been an exceptional experience. I share the organization’s deserving confidence in Joan, as she has been a large part of our success. The transition offers a natural evolution of leadership within the organization.” Quarterly Common Stock The Corporation’s Board of Directors $0.21 per common share. The dividend is payable on April 7, March 24, 2021. BFC Stock Repurchase Program Bank First has a stock repurchase program under which the Corporation may repurchase shares of outstanding BFC stock. Please contact Mike Molepske at (920) 652-3202. Shareholder Contact Information Questions about Bank First Corporation? Contact us at: Email: ir@bankfirstwi.bank Phone: (920) 652-3360 |