Exhibit 99.1

ANNUAL SHAREHOLDER MEETING June 13, 2022

2 MICHAEL G. ANSAY Chairman of the Board

Bank First Senior Management Team 3 WELCOME

Bank First Corporation Board of Directors 4 WELCOME

• Determination of Quorum • Approval of Minutes • Business to be Conducted 5 WELCOME

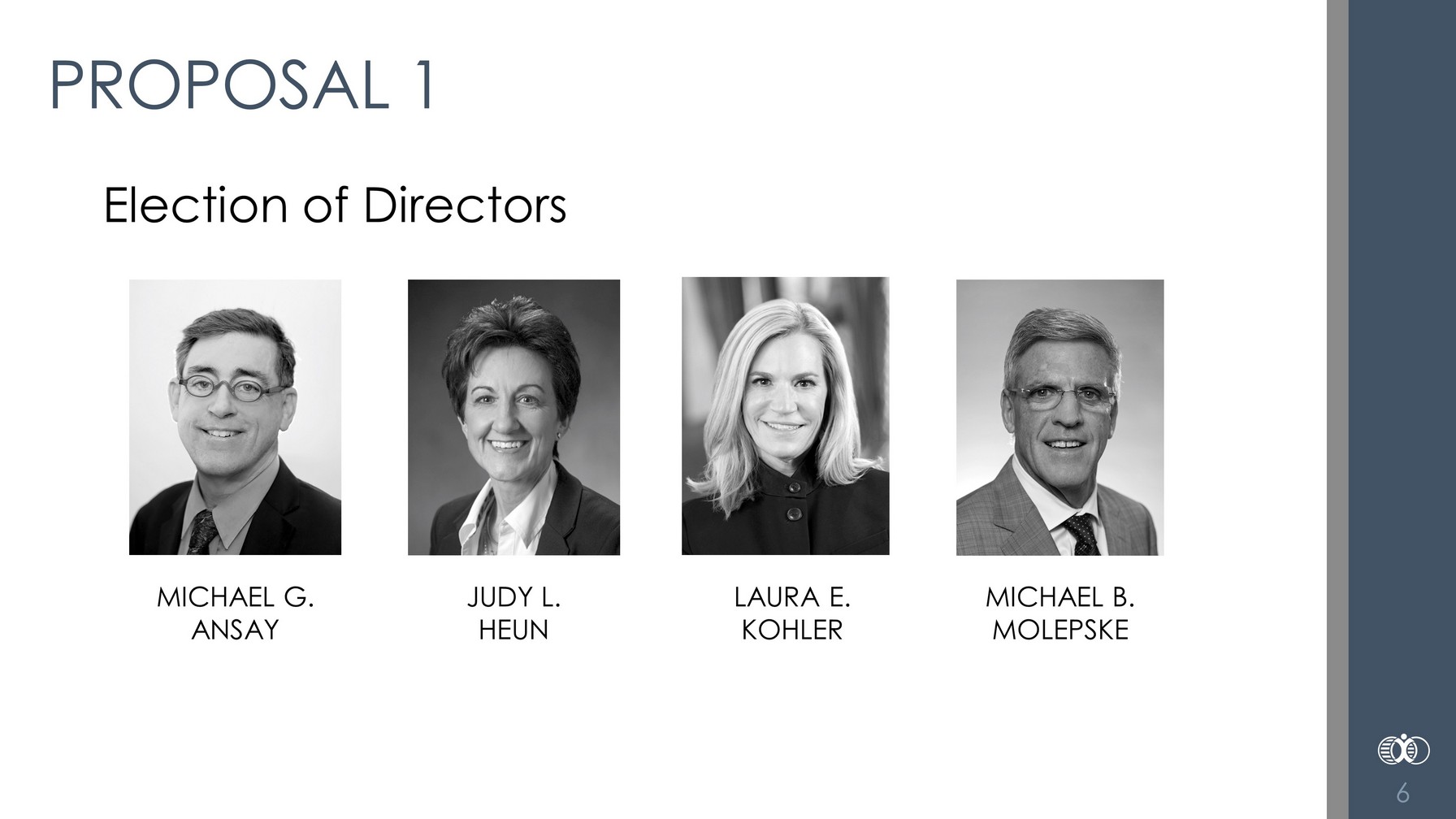

JUDY L. HEUN Election of Directors 6 PROPOSAL 1 MICHAEL G. ANSAY LAURA E. KOHLER MICHAEL B. MOLEPSKE

Ratify the appointment of Dixon Hughes Goodman, LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2022. 7 PROPOSAL 2

Forward Looking Statements: This presentation may contain certain “forward looking statements” that represent Bank First Corporation’s expectations or beliefs concerning future events. Such forward looking statements are about matters that are inherently subject to risks and uncertainties. Because of the risks and uncertainties inherent in forward looking statements, readers are cautioned not to place undue reliance on them, whether included in this presentation or made elsewhere from time to time by Bank First Corporation or on its behalf. Bank First Corporation disclaims any obligation to update such forward looking statements. In addition, statements regarding historical stock price performance are not indicative of or guarantees of future price performance. 8 FORWARD LOOKING STATEMENTS

9 MICHAEL B. MOLEPSKE CEO & President

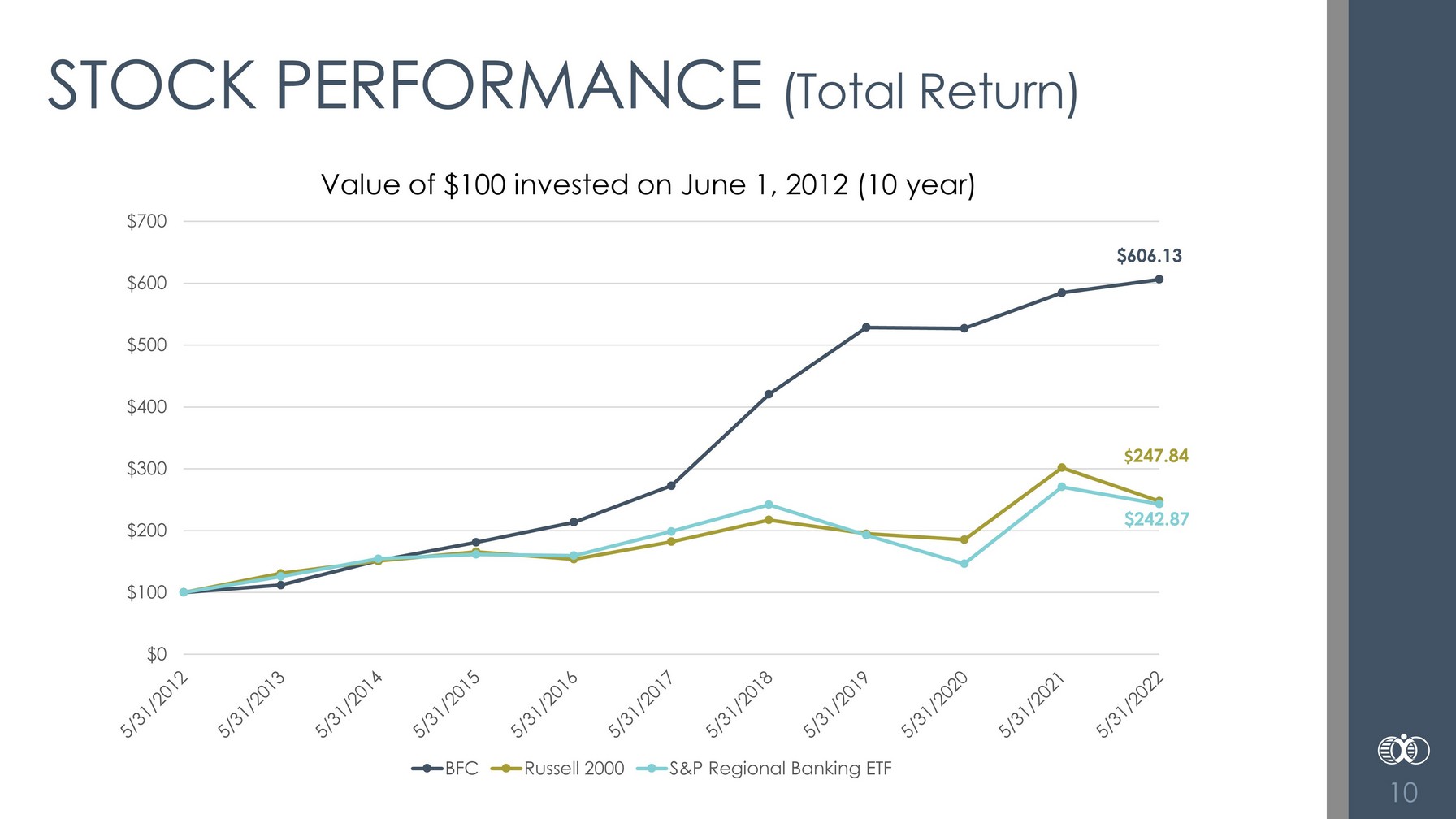

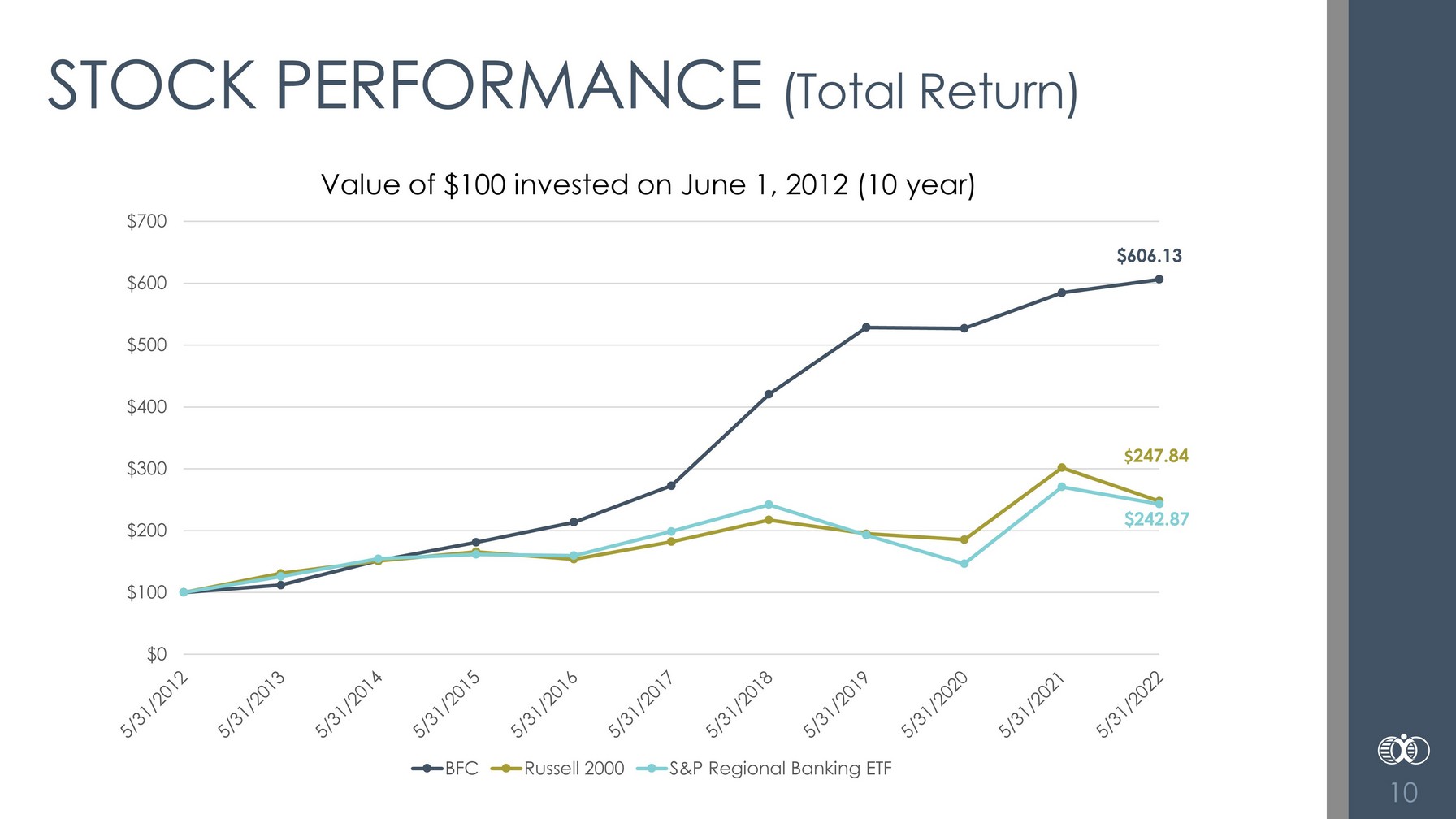

10 STOCK PERFORMANCE (Total Return) $0 $100 $200 $300 $400 $500 $600 $700 Value of $100 invested on June 1, 2012 (10 year) BFC Russell 2000 S&P Regional Banking ETF $606.13 $ 247.84 $242.87

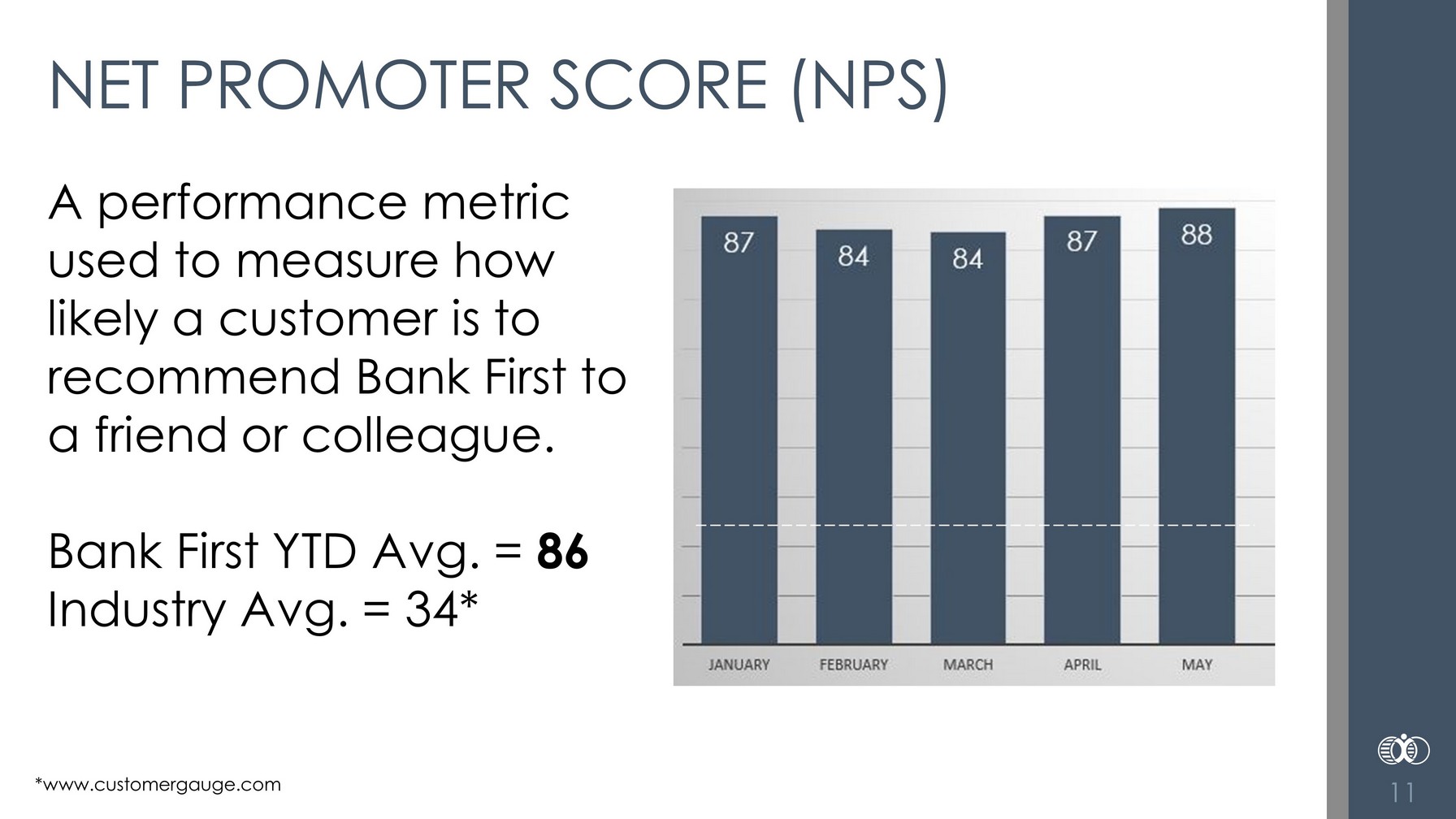

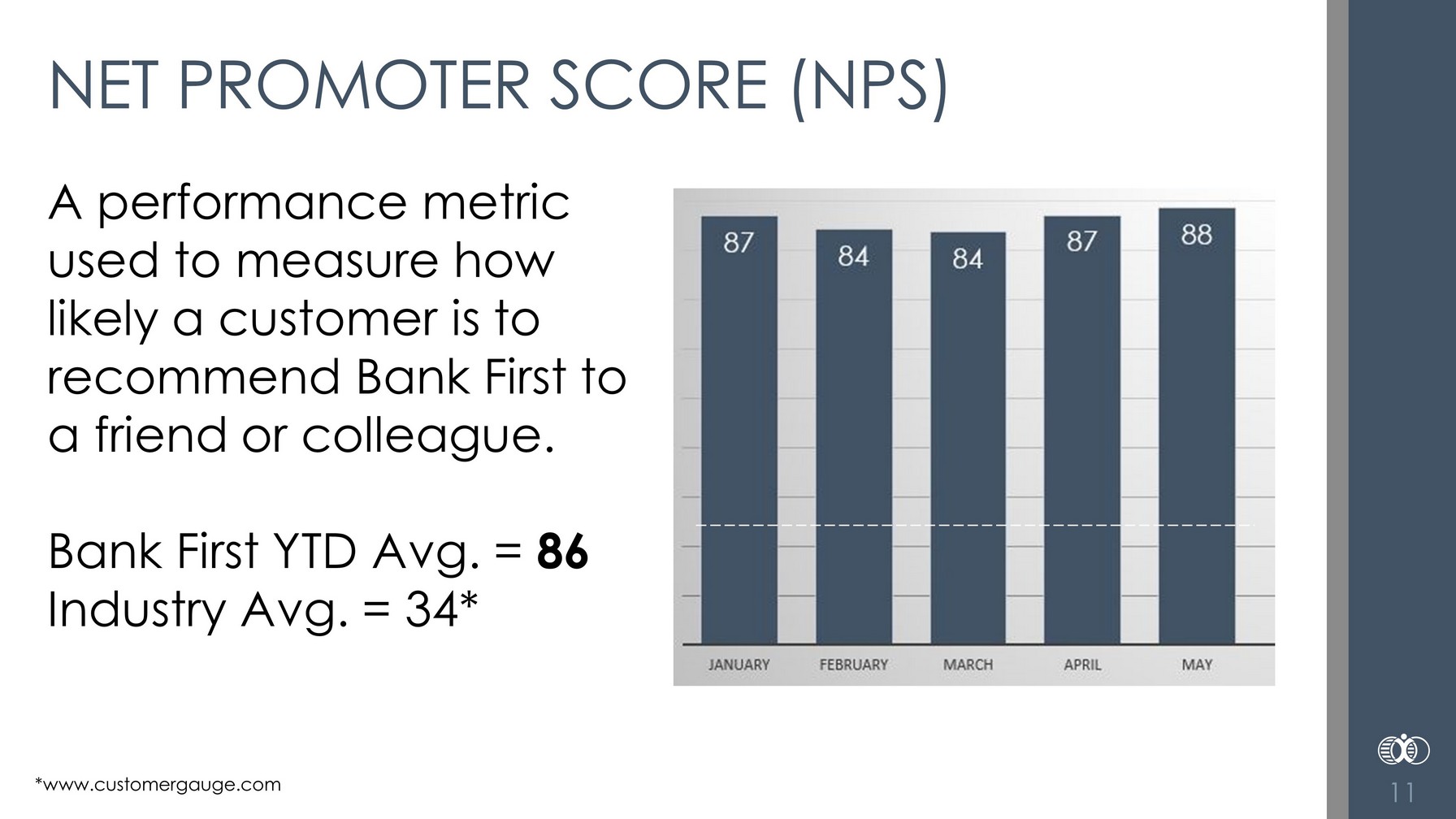

11 NET PROMOTER SCORE (NPS) A performance metric used to measure how likely a customer is to recommend Bank First to a friend or colleague. Bank First YTD Avg. = 86 Industry Avg. = 34* *www.customergauge.com

12 CREATING A SUCCESSFUL CULTURE Tuition Reimbursement Program Annual Clothing Allowance Paid Parental Leave Go365 Wellness Program Paid Volunteer Time Off Generous Paid Time Off Cellphone Allowance New Hire Referral Program

13 KEVIN LEMAHIEU Chief Financial Officer

14 FINANCIAL REPORT

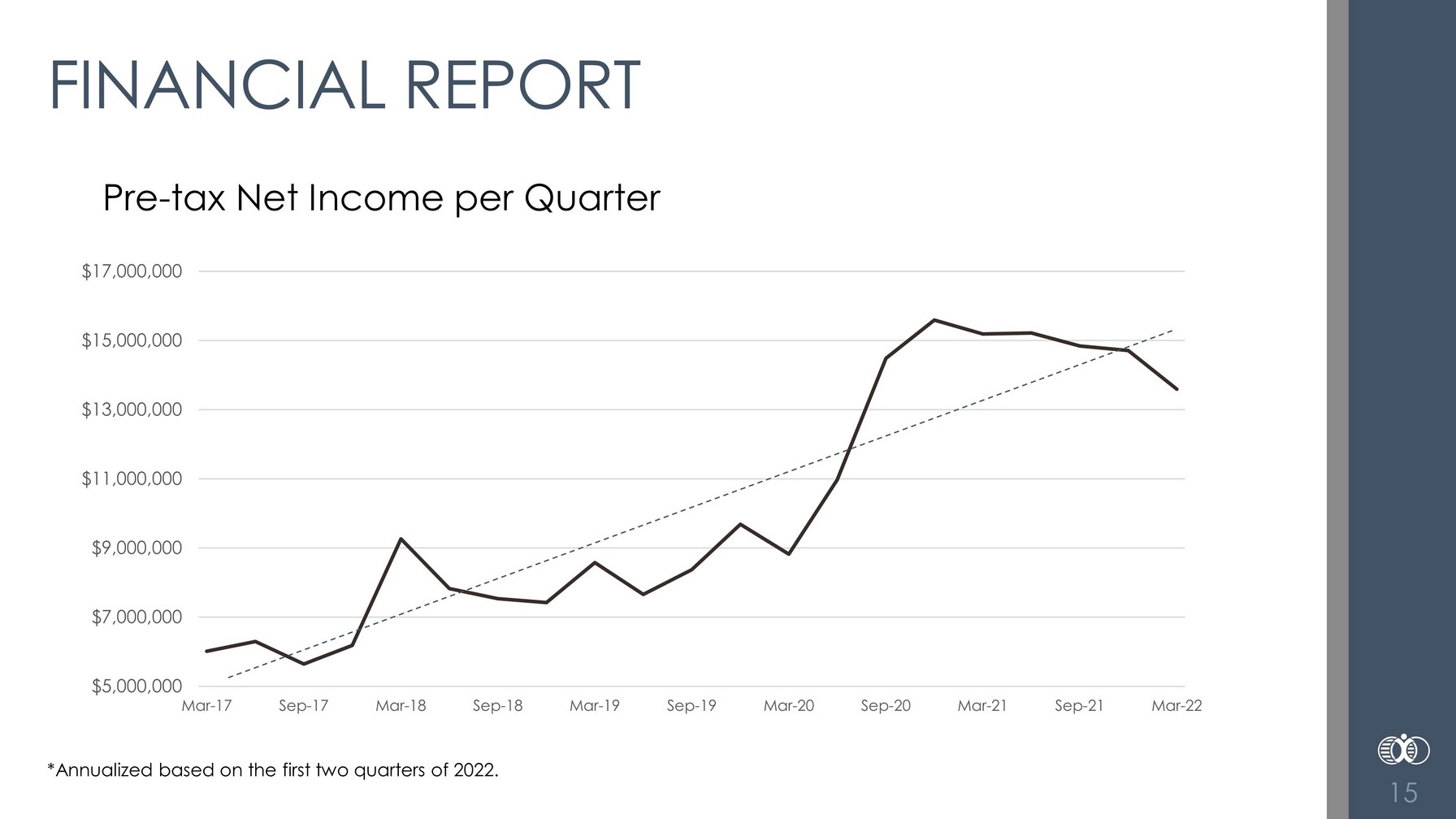

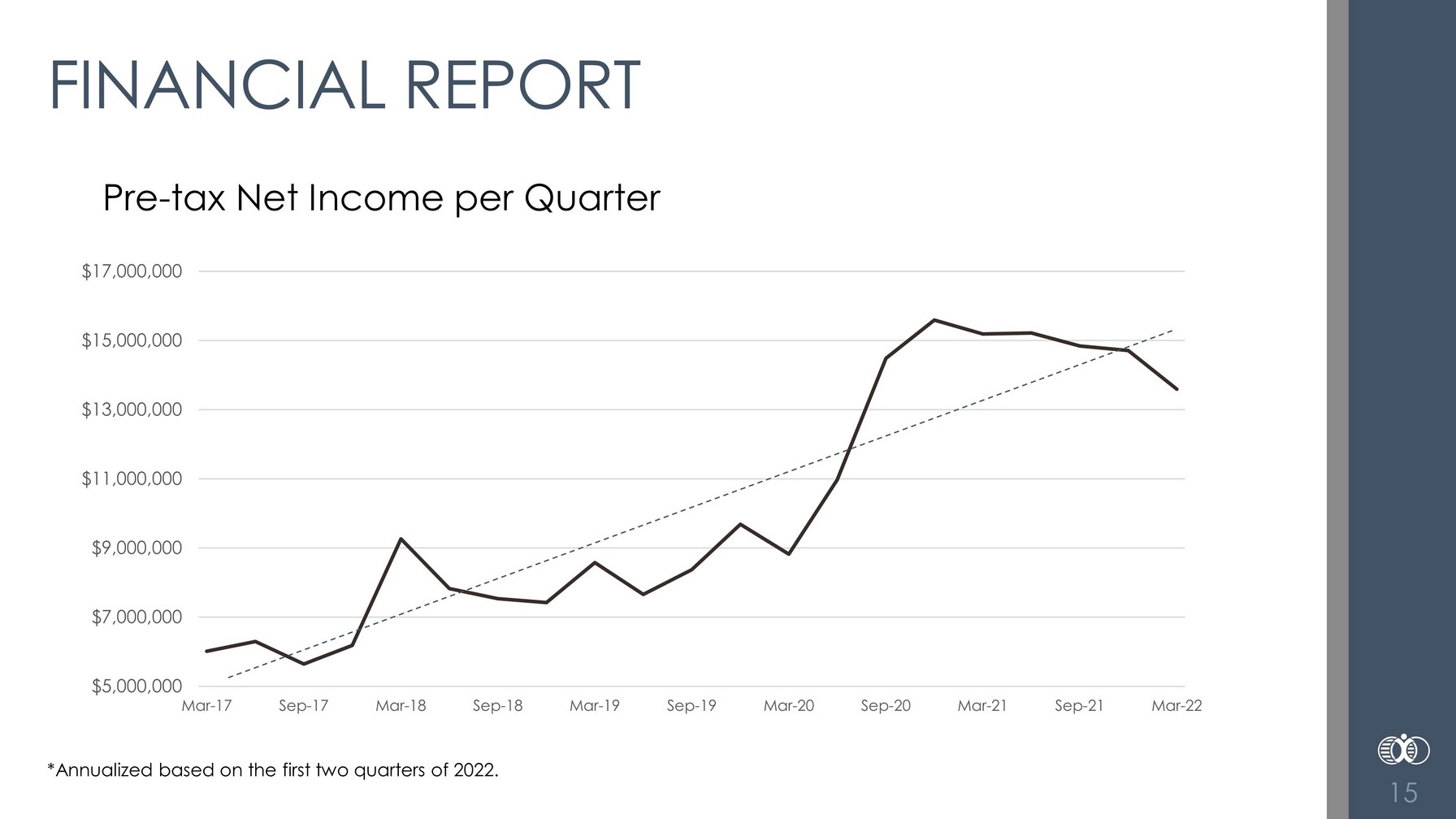

Pre - tax Net Income per Quarter *Annualized based on the first two quarters of 2022. 15 FINANCIAL REPORT $5,000,000 $7,000,000 $9,000,000 $11,000,000 $13,000,000 $15,000,000 $17,000,000 Mar-17 Sep-17 Mar-18 Sep-18 Mar-19 Sep-19 Mar-20 Sep-20 Mar-21 Sep-21 Mar-22

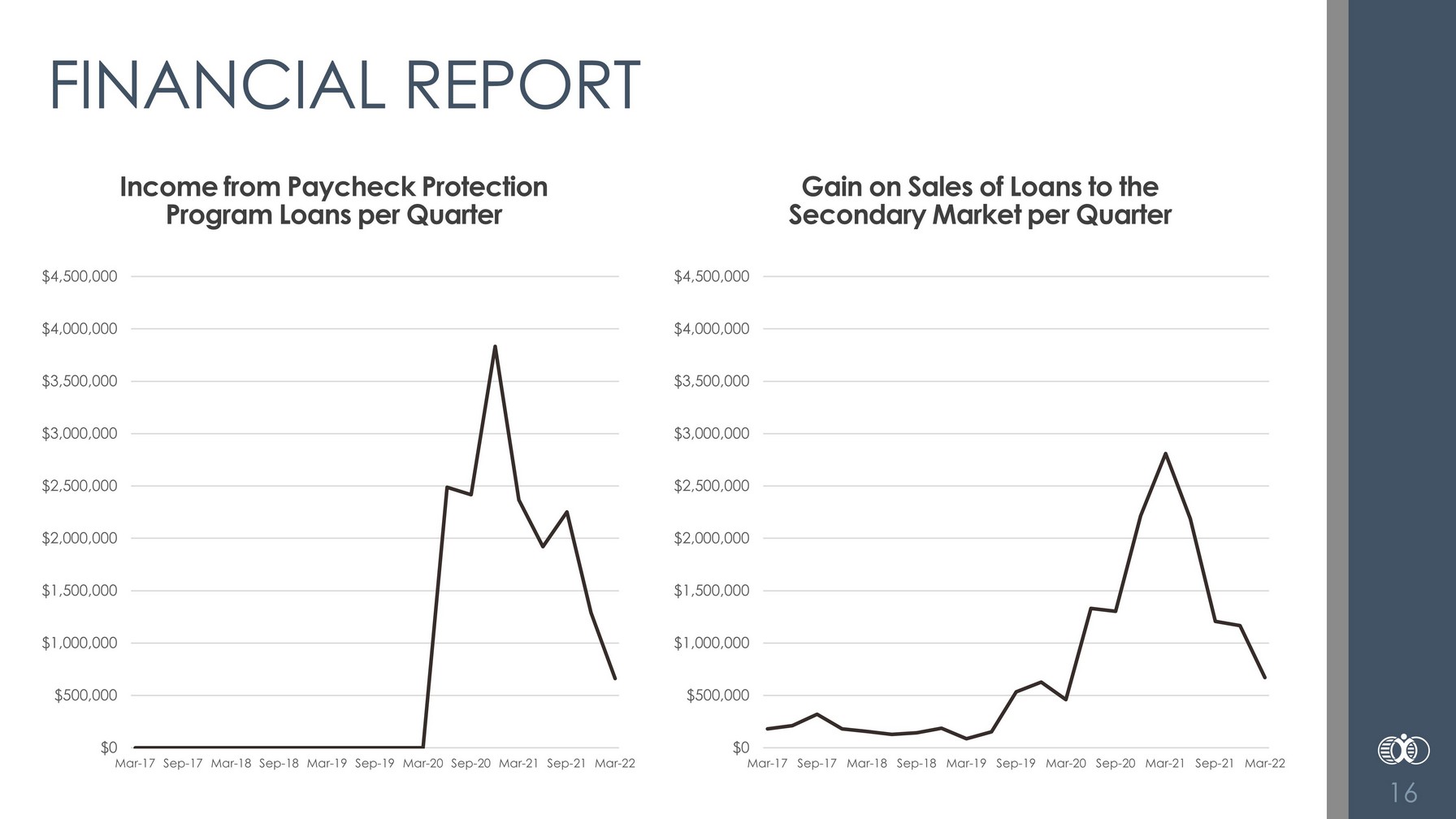

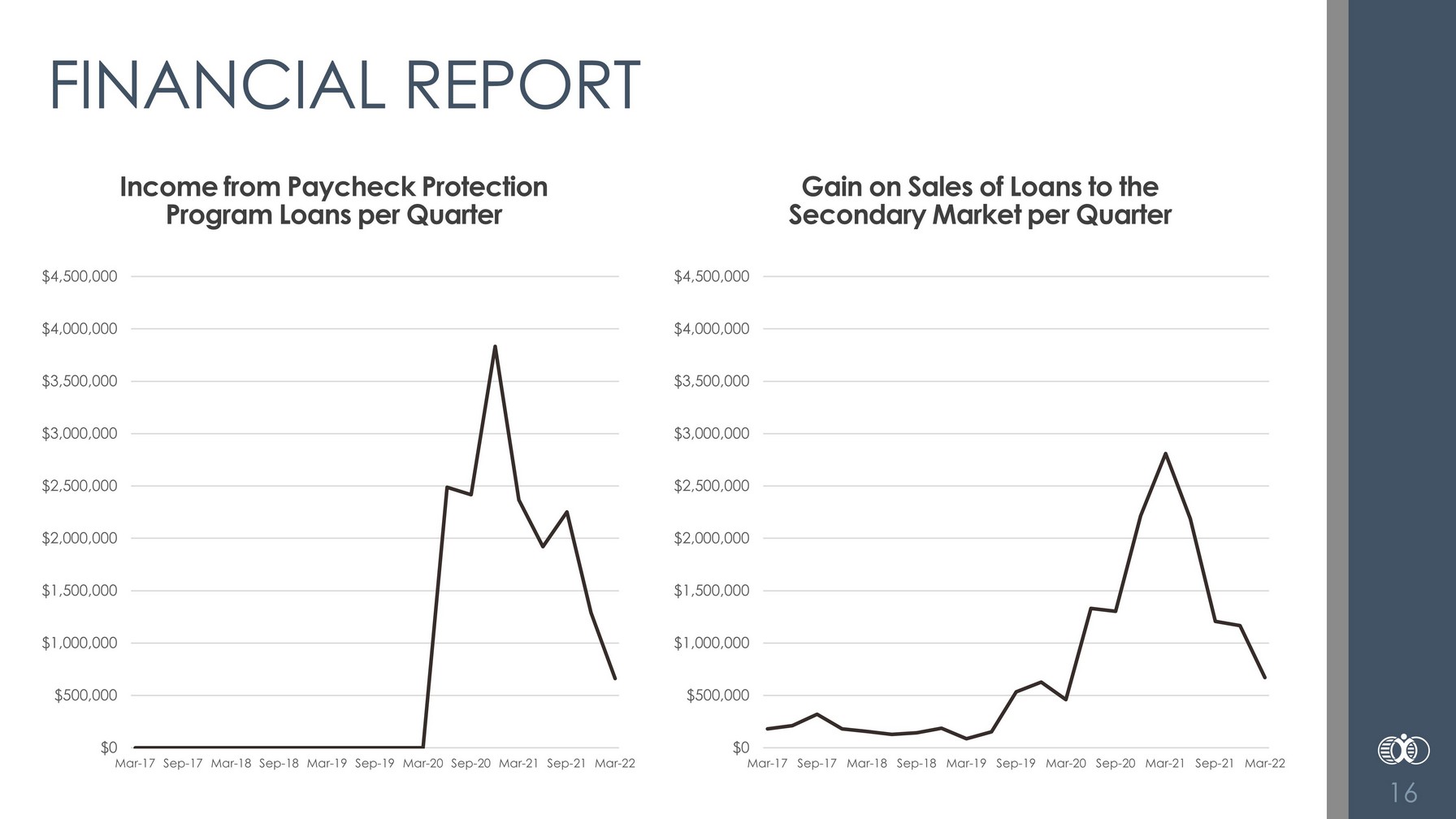

16 FINANCIAL REPORT Gain on Sales of Loans to the Secondary Market per Quarter $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 Mar-17 Sep-17 Mar-18 Sep-18 Mar-19 Sep-19 Mar-20 Sep-20 Mar-21 Sep-21 Mar-22 Income from Paycheck Protection Program Loans per Quarter $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 Mar-17 Sep-17 Mar-18 Sep-18 Mar-19 Sep-19 Mar-20 Sep-20 Mar-21 Sep-21 Mar-22

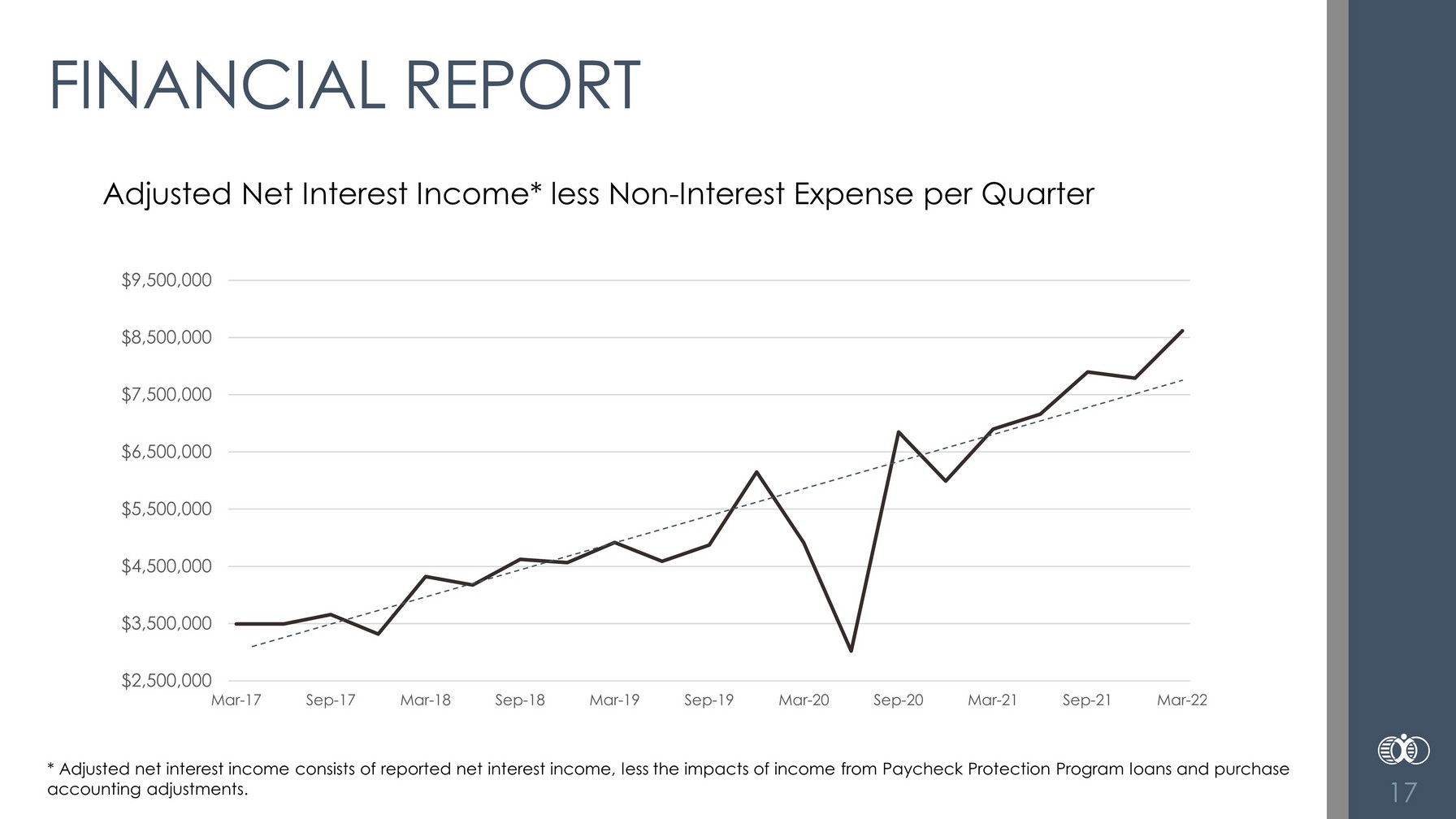

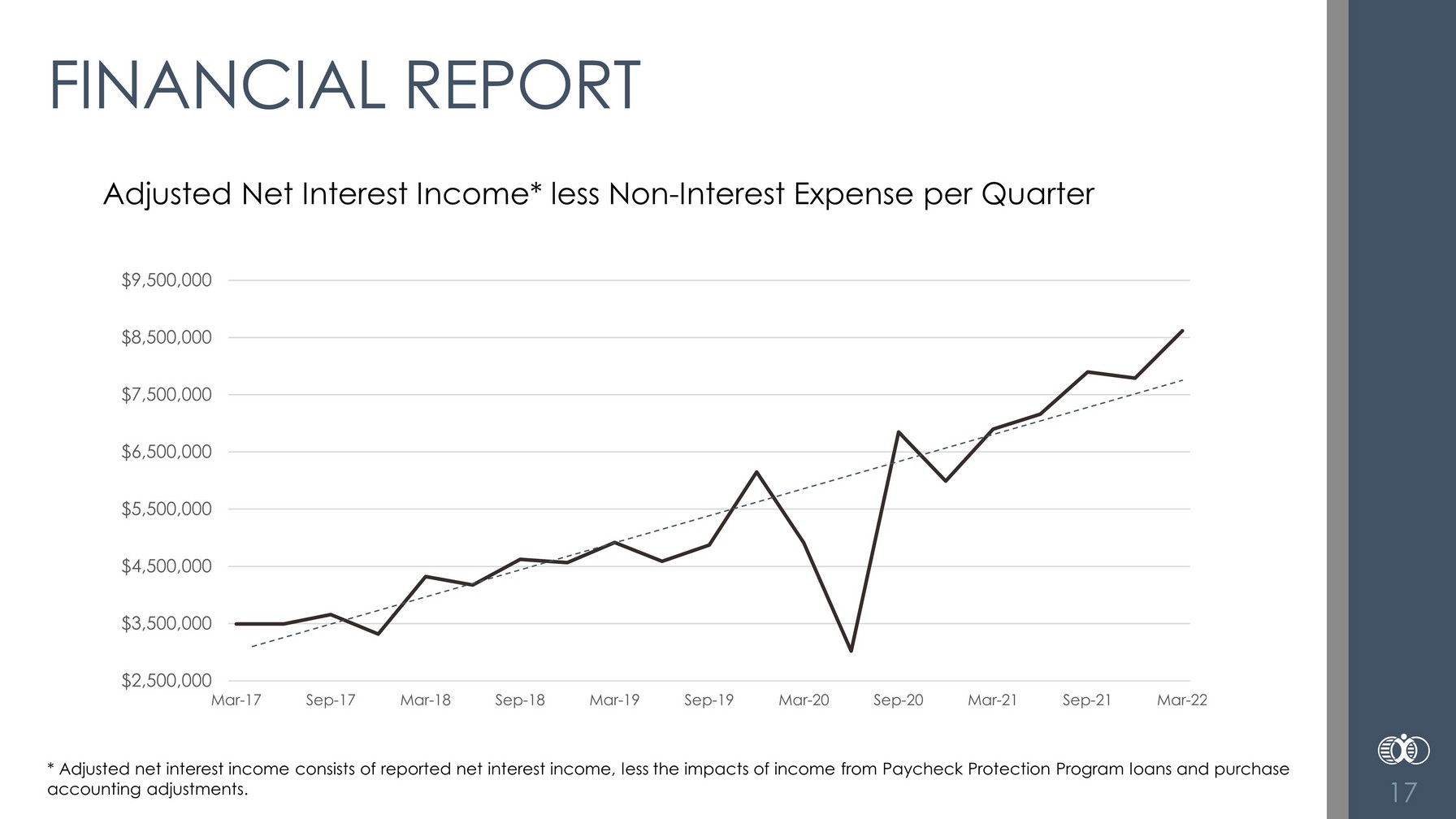

Adjusted Net Interest Income* less Non - Interest Expense per Quarter * Adjusted net interest income consists of reported net interest income, less the impacts of income from Paycheck Protection Pro gram loans and purchase accounting adjustments. 17 FINANCIAL REPORT $2,500,000 $3,500,000 $4,500,000 $5,500,000 $6,500,000 $7,500,000 $8,500,000 $9,500,000 Mar-17 Sep-17 Mar-18 Sep-18 Mar-19 Sep-19 Mar-20 Sep-20 Mar-21 Sep-21 Mar-22

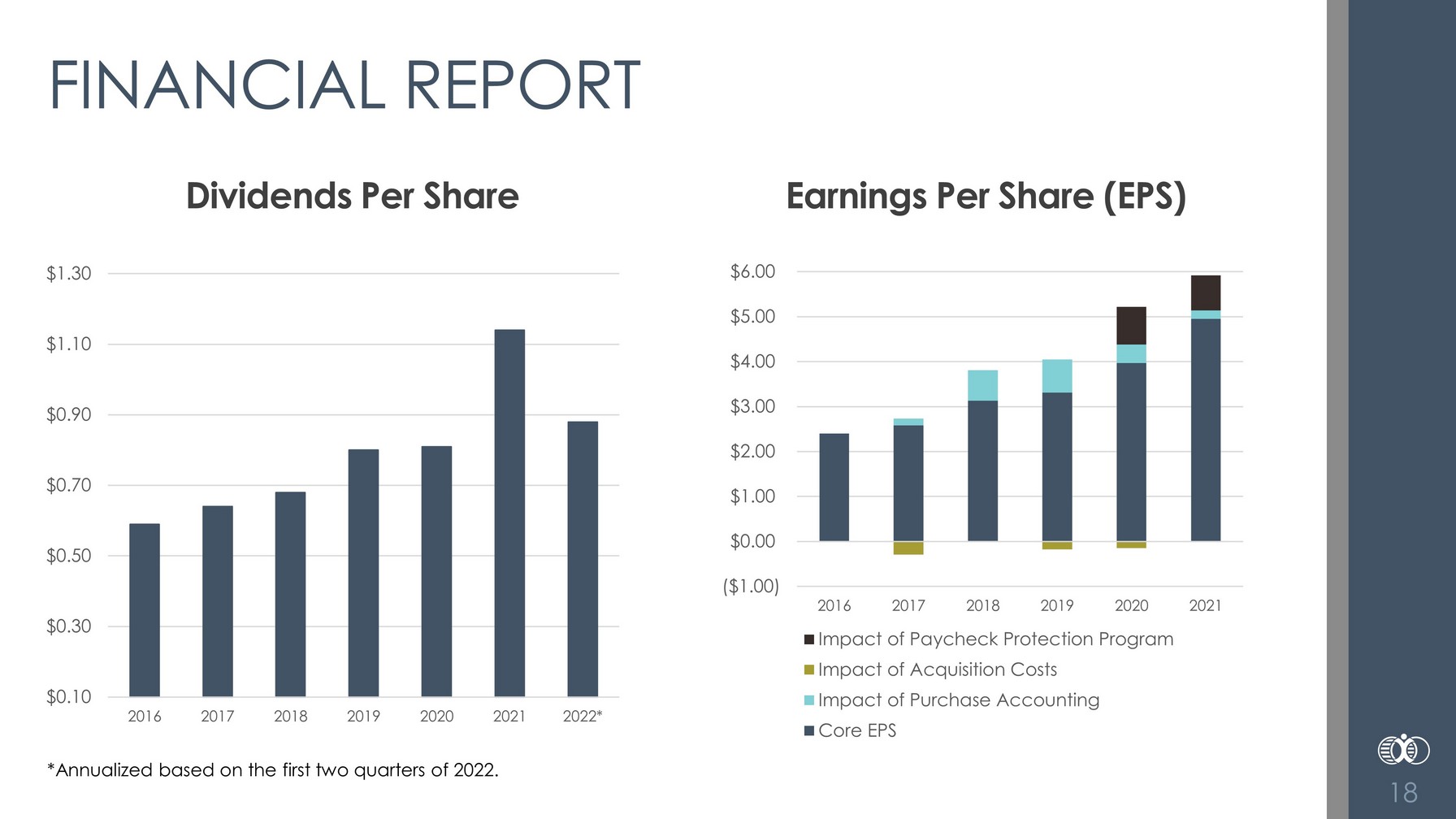

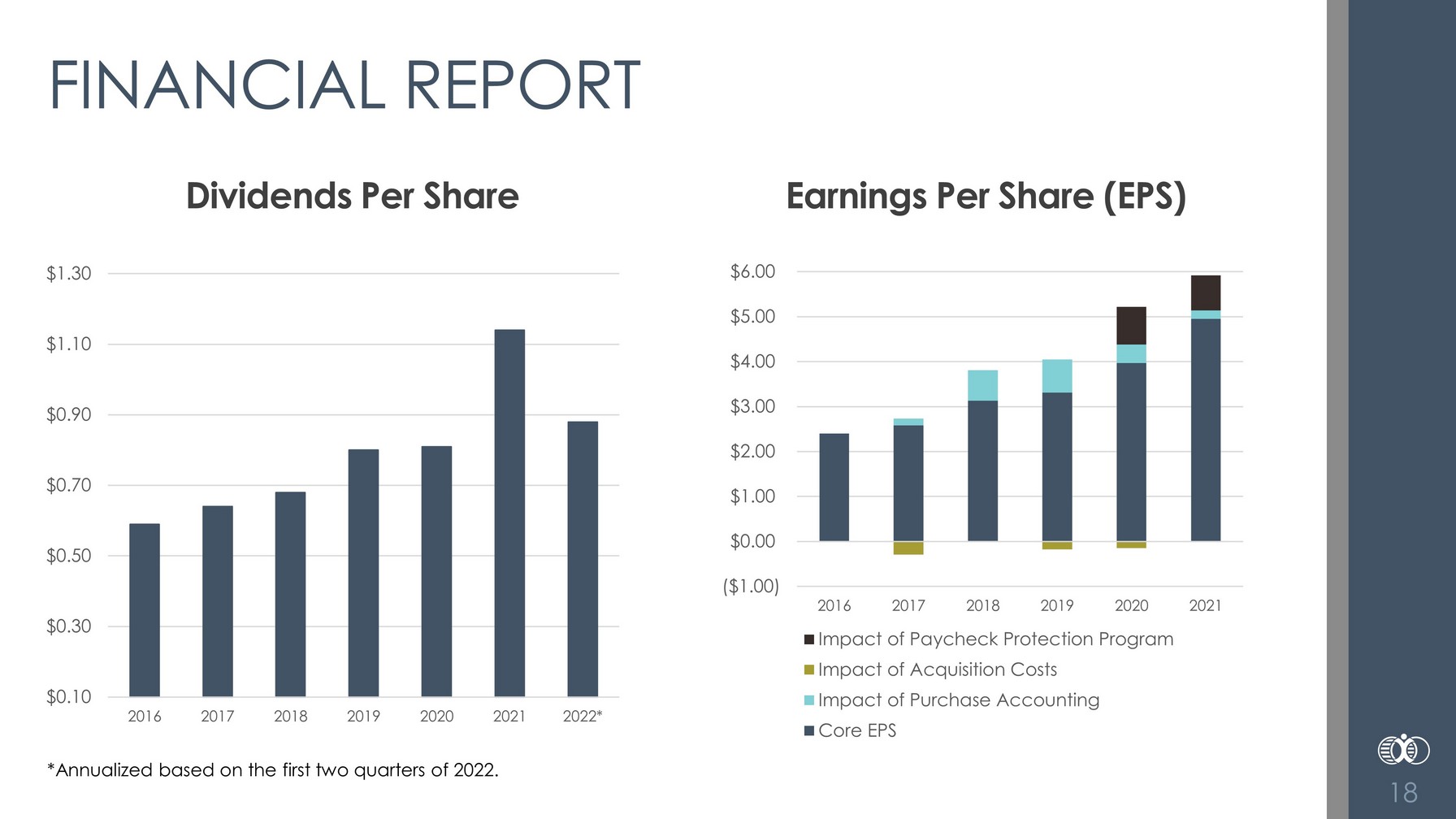

18 FINANCIAL REPORT Dividends Per Share Earnings Per Share (EPS) *Annualized based on the first two quarters of 2022. $0.10 $0.30 $0.50 $0.70 $0.90 $1.10 $1.30 2016 2017 2018 2019 2020 2021 2022* ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 2016 2017 2018 2019 2020 2021 Impact of Paycheck Protection Program Impact of Acquisition Costs Impact of Purchase Accounting Core EPS

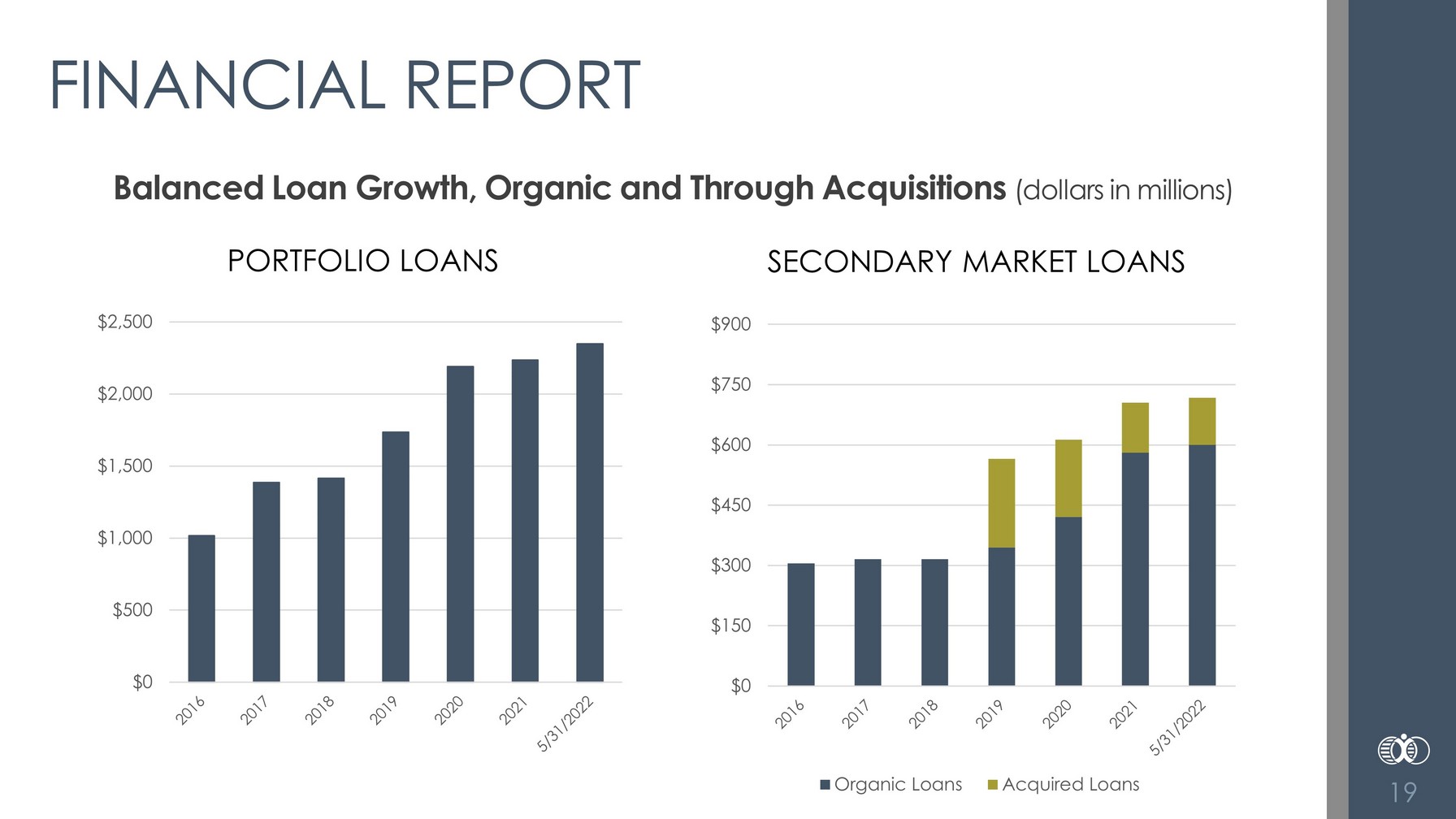

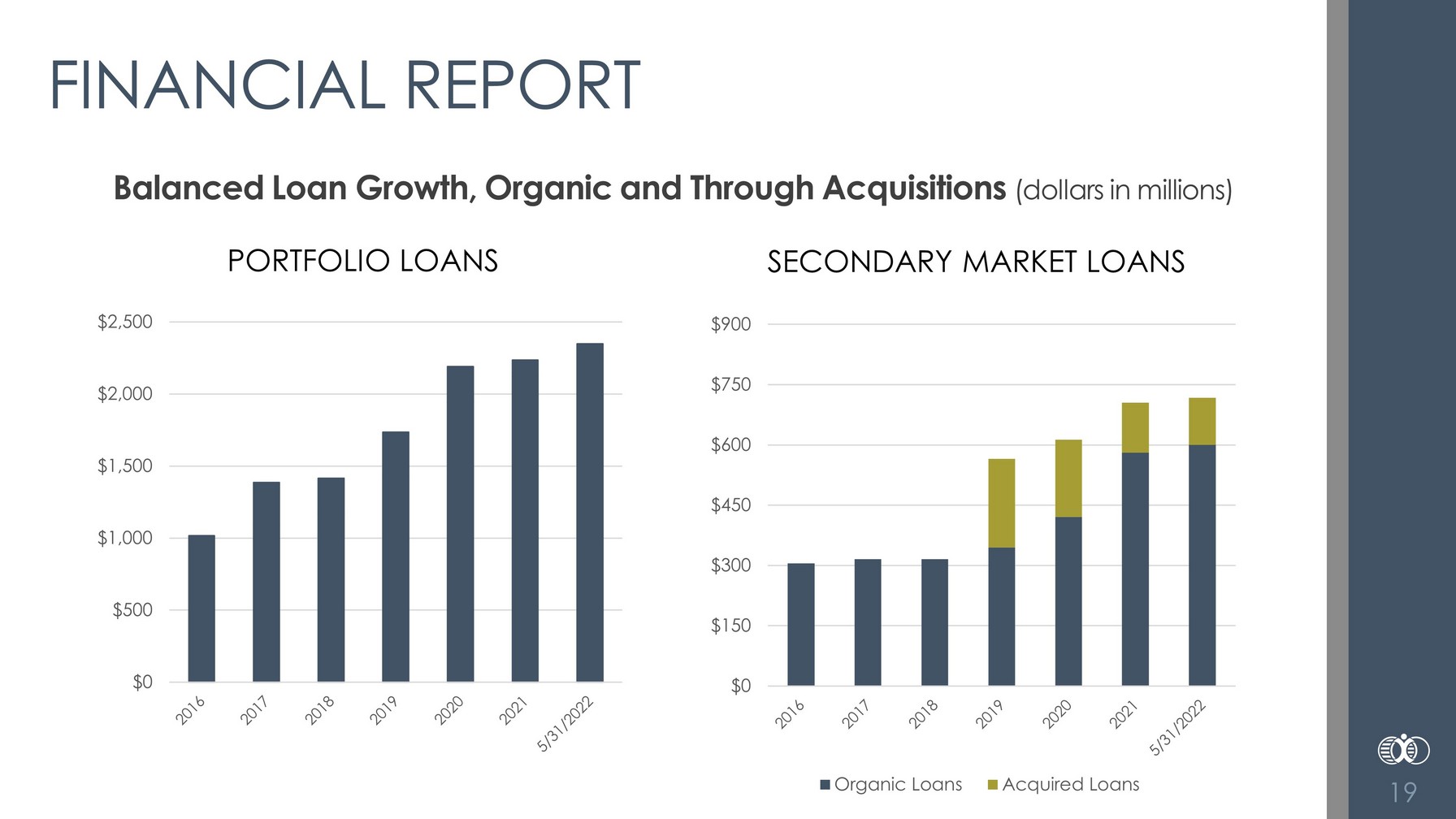

19 FINANCIAL REPORT Balanced Loan Growth, Organic and Through Acquisitions (dollars in millions) PORTFOLIO LOANS $0 $500 $1,000 $1,500 $2,000 $2,500 SECONDARY MARKET LOANS $0 $150 $300 $450 $600 $750 $900 Organic Loans Acquired Loans

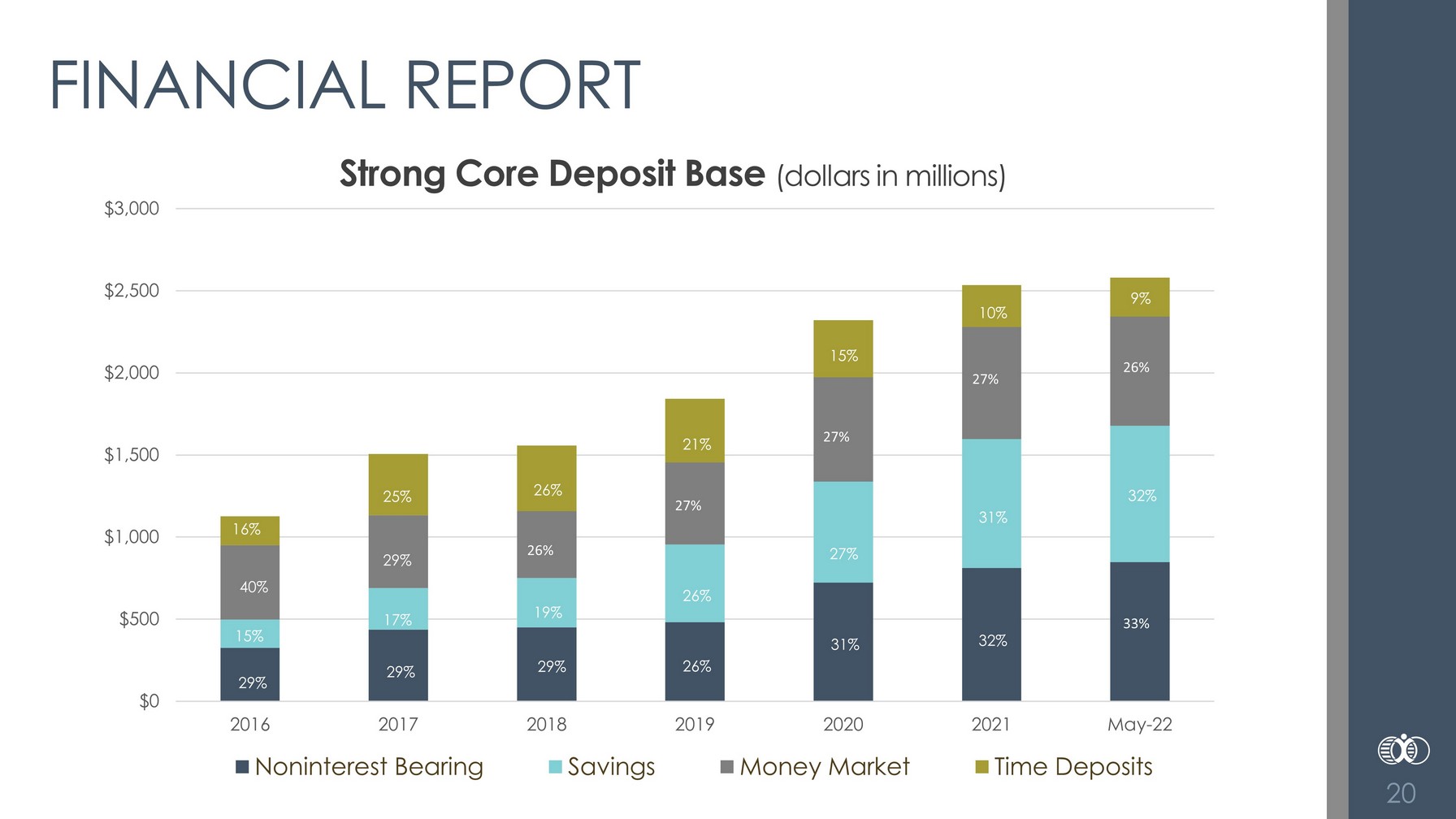

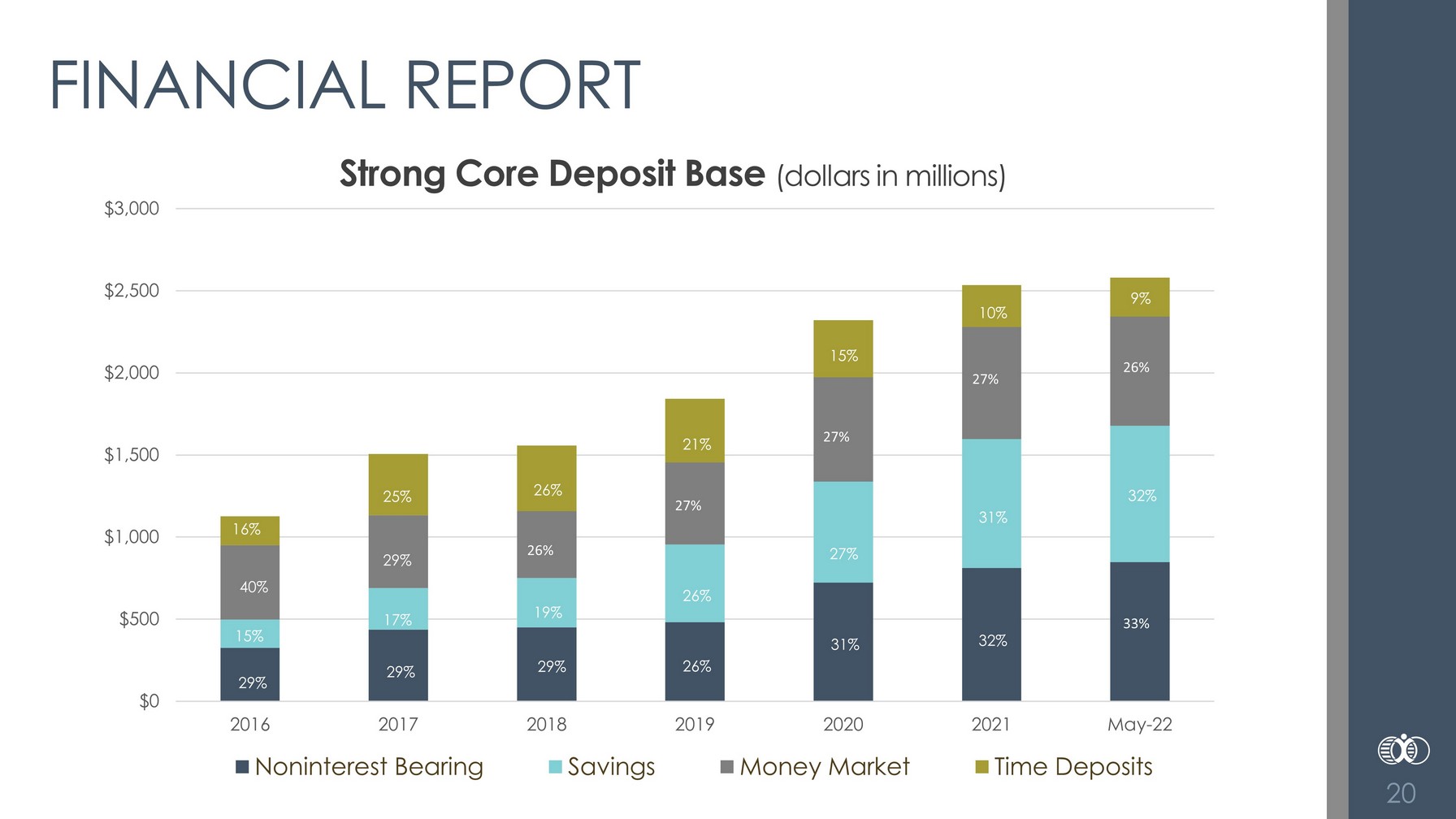

20 FINANCIAL REPORT Strong Core Deposit Base (dollars in millions) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2016 2017 2018 2019 2020 2021 May-22 Noninterest Bearing Savings Money Market Time Deposits 16% 26% 27% 27% 27% 26% 33% 25% 26% 21% 15% 10% 9% 40% 15% 29% 29% 17% 29% 19% 29% 26% 26% 27% 31% 31% 32% 32%

21 MIKE MOLEPSKE CEO & President

22 TIMELINE OF EVENTS DURING DON’S BOARD TENURE Donald Brisch THANK YOU! • Served on the Francis Creek Advisory Board in 2002 • Joined Bank First Corporation Board in 2006 • Director during the transition from Tom Bare to Mike Molepske

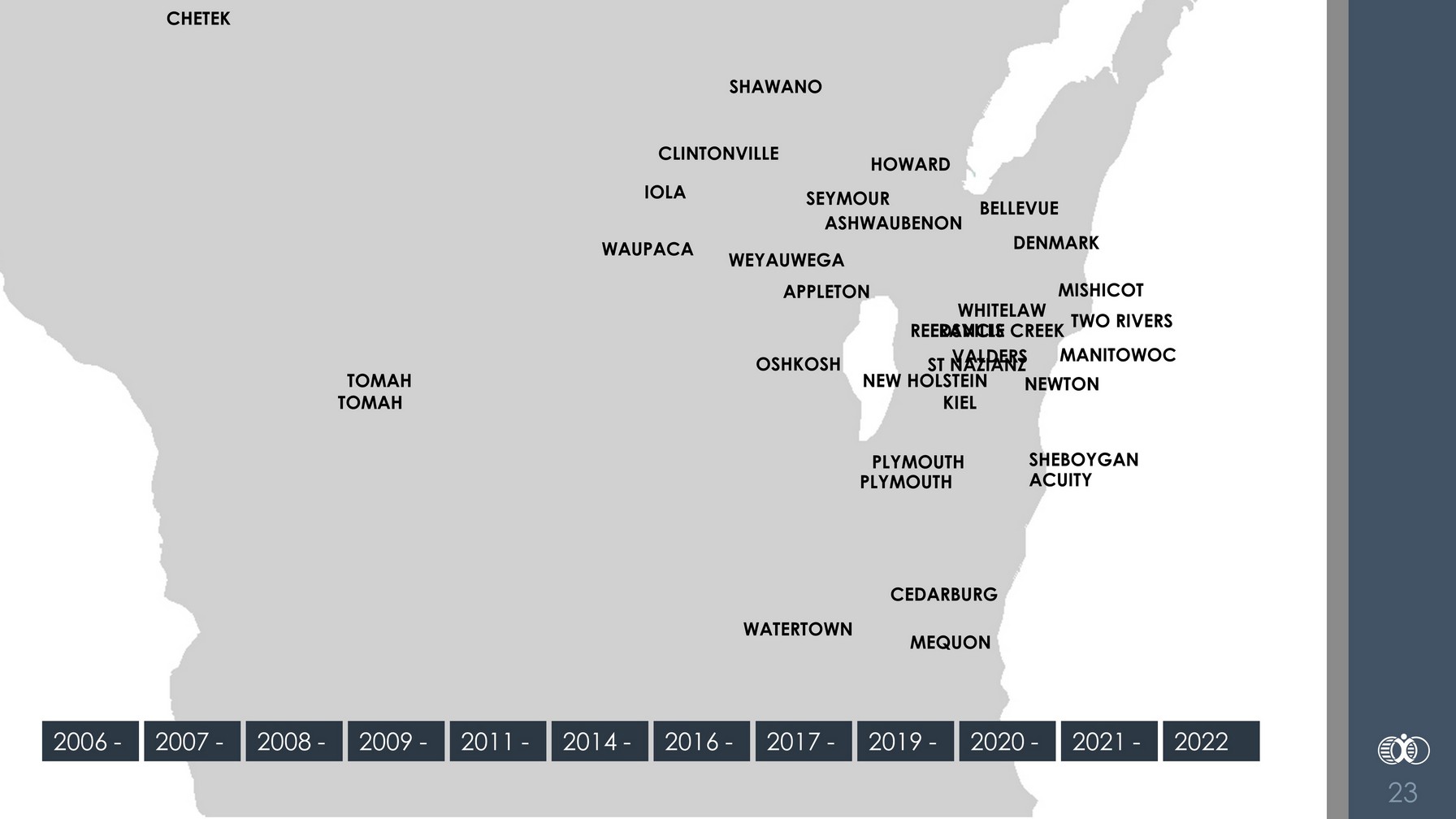

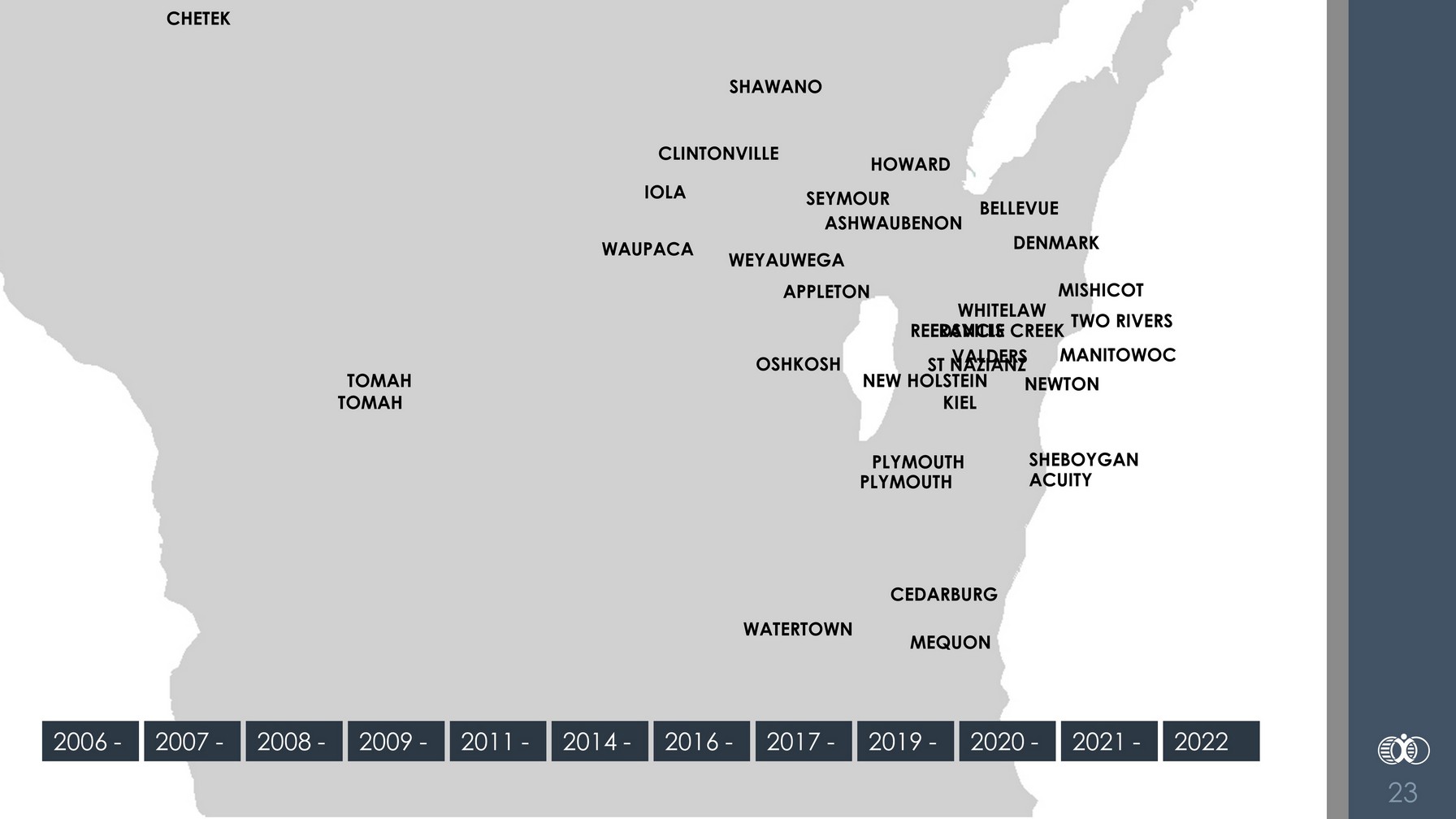

23 MANITOWOC TWO RIVERS MISHICOT DENMARK BELLEVUE HOWARD SHAWANO CLINTONVILLE IOLA WAUPACA SEYMOUR ASHWAUBENON WEYAUWEGA APPLETON OSHKOSH WHITELAW REEDSVILLE VALDERS KIEL PLYMOUTH SHEBOYGAN ACUITY CEDARBURG WATERTOWN MEQUON TOMAH CHETEK NEW HOLSTEIN NEWTON PLYMOUTH FRANCIS CREEK ST NAZIANZ TOMAH 2006 - 2007 - 2008 - 2009 - 2011 - 2014 - 2016 - 2019 - 2020 - 2021 - 2022 2017 -

Michael Dempsey 24 THANK YOU! • Joined Bank First in June 2010 • Appointed to Board of Directors in 2014 • Named President of the Bank in 2015

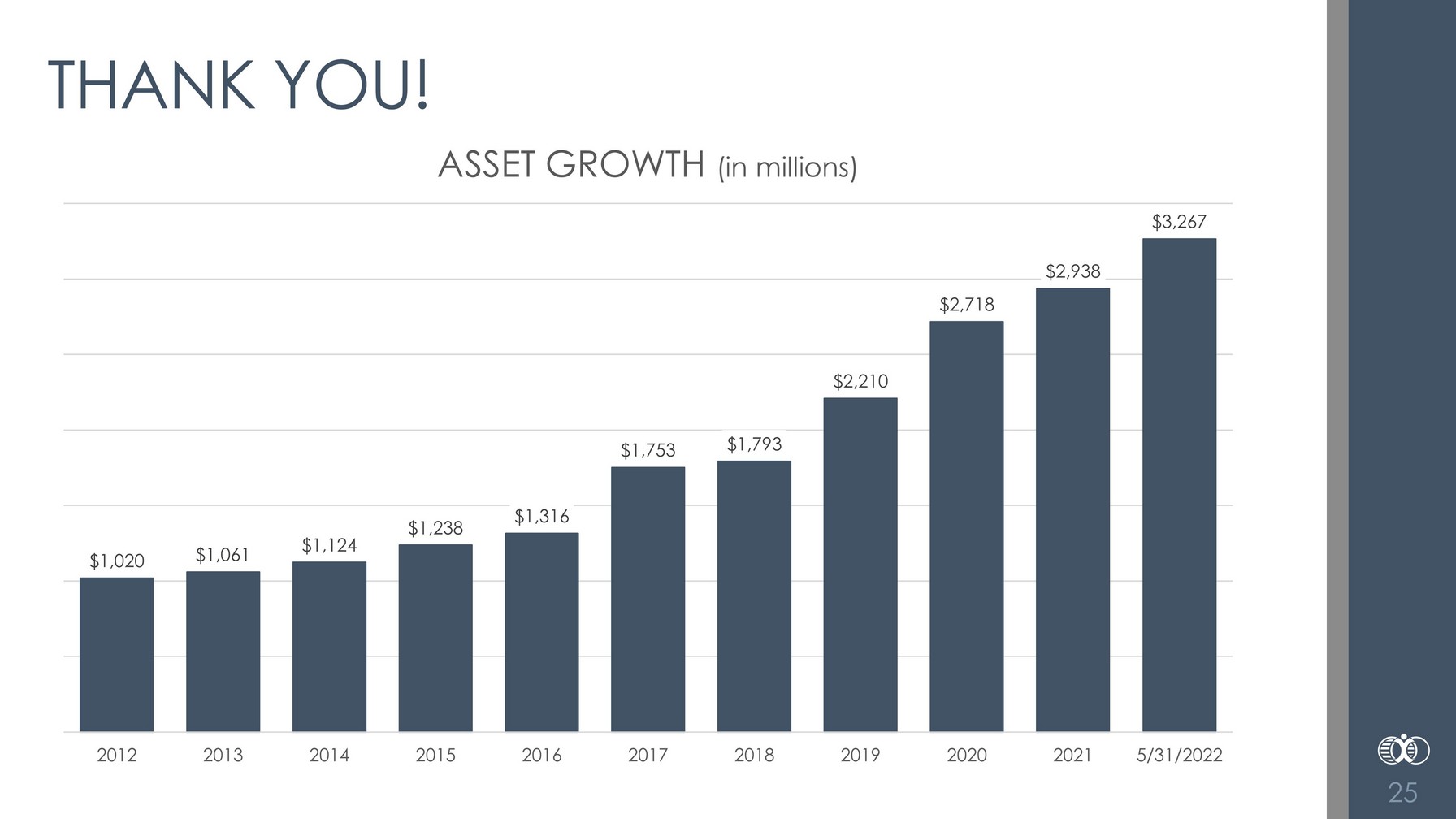

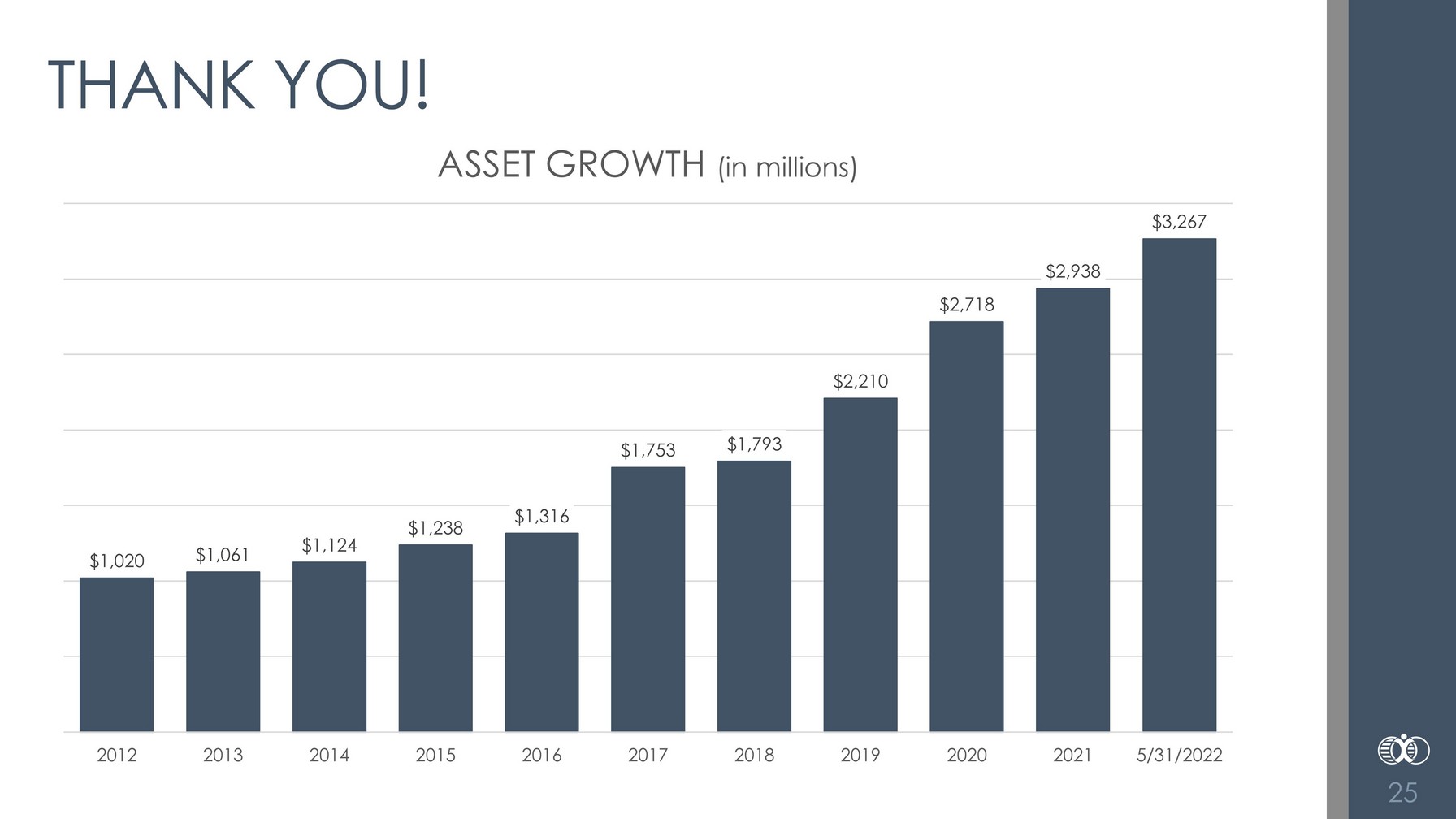

25 THANK YOU! $1,020 $1,061 $1,124 $1,238 $1,316 $1,753 $1,793 $2,210 $2,718 $2,938 $3,267 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 5/31/2022 ASSET GROWTH (in millions)

26 THANK YOU! $1.13 $1.30 $1.59 $1.79 $1.99 $2.13 $2.40 $2.44 $3.81 $3.91 $5.07 $5.92 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 EARNINGS PER SHARE

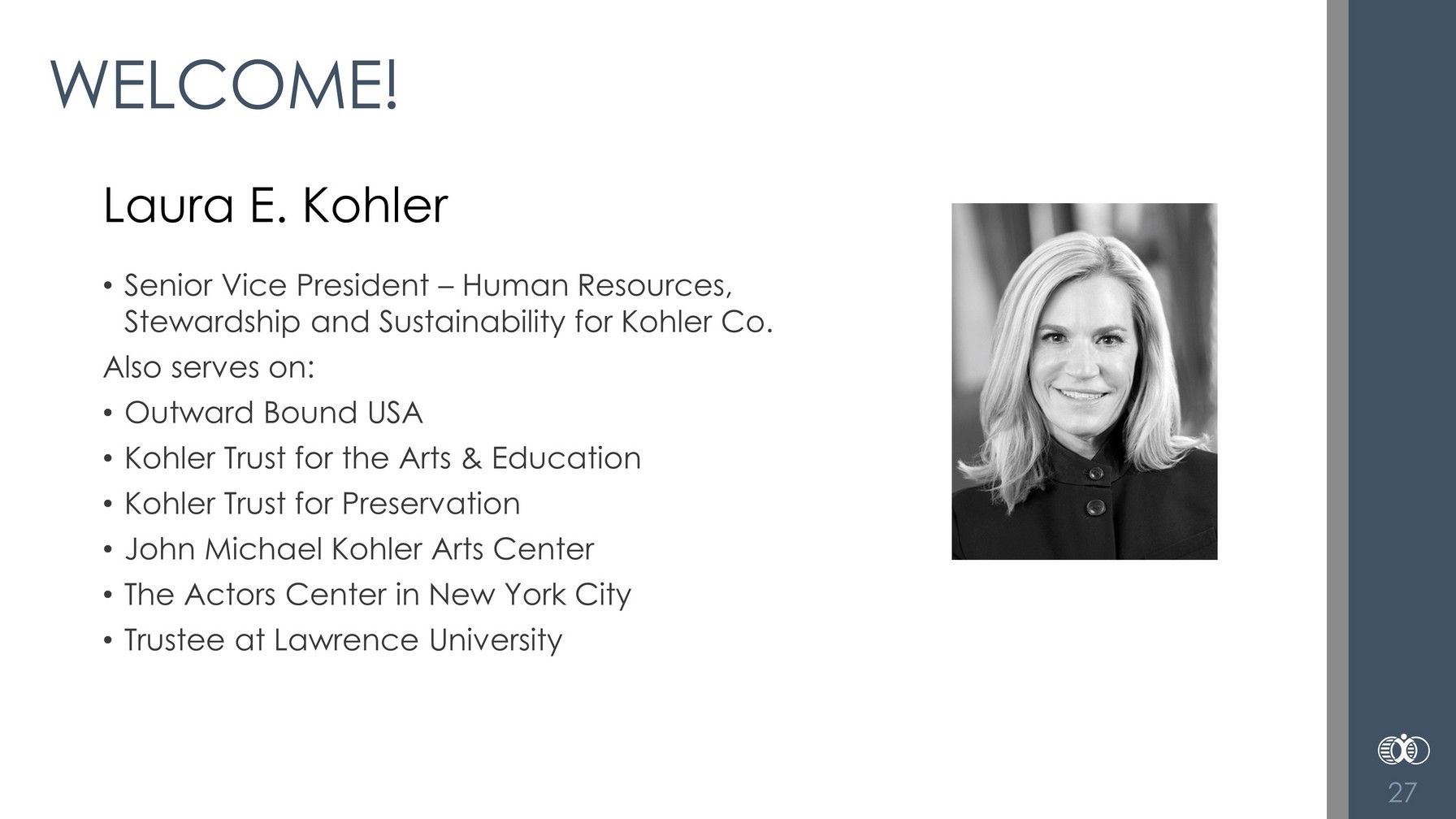

Laura E. Kohler 27 WELCOME! • Senior Vice President – Human Resources, Stewardship and Sustainability for Kohler Co. Also serves on: • Outward Bound USA • Kohler Trust for the Arts & Education • Kohler Trust for Preservation • John Michael Kohler Arts Center • The Actors Center in New York City • Trustee at Lawrence University

Who to contact: 28 INVESTOR RELATIONS TEAM Please reach out to Bank First Shareholder Services at IR@bankfirst.com or 920 - 652 - 3360. Our dedicated team will be able to assist with any questions or concerns you may have. Business cards are available at the entrance.

29 QUESTIONS / COMMENTS

30 ADJOURNMENT

SPECIAL MEETING TO APPROVE MERGER June 13, 2022

THANK YOU!