Exhibit 99.1

ANNUAL SHAREHOLDER MEETING June 12, 2023

2 MICHAEL B. MOLEPSKE Chairman and Chief Executive Officer

Bank First Corporation Board of Directors 3 WELCOME

Bank First Senior Management Team 4 WELCOME

Special Guests 5 WELCOME MARK KANALY Partner at Alston & Bird, LLP SARAH SAUNDERS Partner at Forvis

6 ROBERT W. HOLMES RETIRING DIRECTOR • Joined Bank First Corporation in 2020 after serving as Executive Chairman of the Board of Tomah Bancshares, Inc. • 40+ years of financial service experience • Founded First Insurance Services, Inc.(Wisconsin Savings Bank) and Timberwood Bank • Founded Advanced Bioenergy Thank You!

7 TIMOTHY J. MCFARLANE NEW DIRECTOR • Joined Bank First as President in February 2023 as part of the Hometown Bancorp, Ltd. merger • 35+ years of financial service experience • Grew Hometown Bank from $189 million in assets to $654 million in assets • Oversees retail and business banking operations, as well as marketing, human resources, credit administration, and deposit/loan operations Welcome!

• Determination of Quorum • Approval of Minutes • Business to be Conducted 8 MEETING BUSINESS

Election of Directors 9 PROPOSAL 1 TIMOTHY J. MCFARLANE STEPHEN E. JOHNSON DAVID R. SACHSE

Ratify the appointment of FORVIS, LLP (f/k/a Dixon Hughes Goodman, LLP) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. 10 PROPOSAL 2

Forward Looking Statements : This presentation may contain certain “forward looking statements” that represent Bank First Corporation’s expectations or beliefs concerning future events . Such forward looking statements are about matters that are inherently subject to risks and uncertainties . Because of the risks and uncertainties inherent in forward looking statements, readers are cautioned not to place undue reliance on them, whether included in this presentation or made elsewhere from time to time by Bank First Corporation or on its behalf . Bank First Corporation disclaims any obligation to update such forward looking statements . In addition, statements regarding historical stock price performance are not indicative of or guarantees of future price performance . 11 FORWARD LOOKING STATEMENTS

12 KEVIN LEMAHIEU Chief Financial Officer

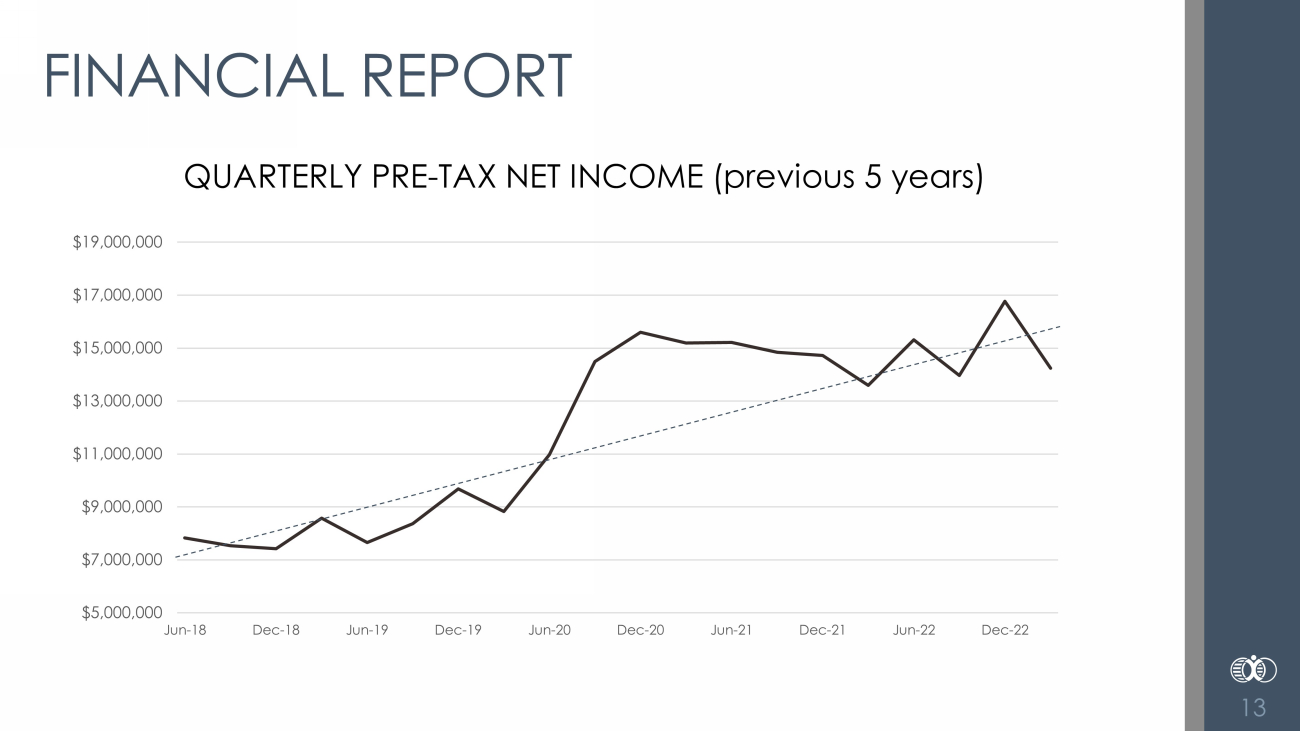

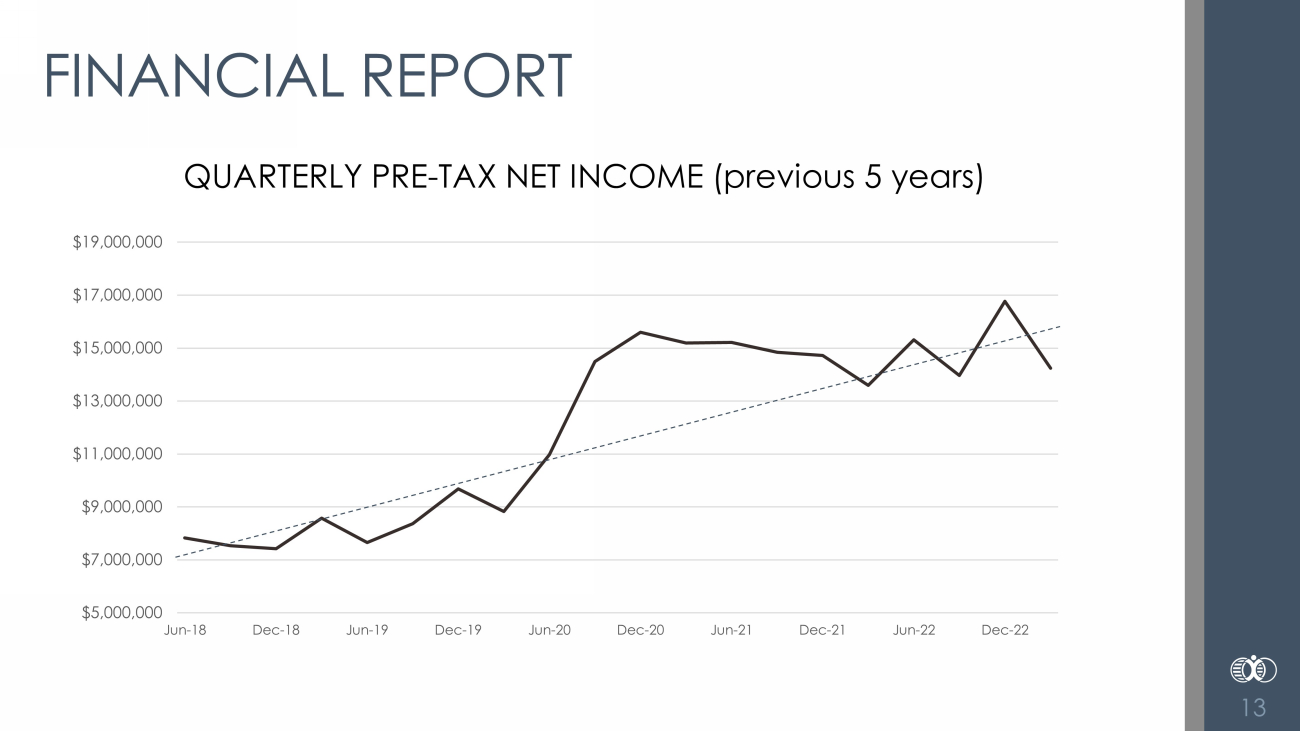

QUARTERLY PRE - TAX NET INCOME (previous 5 years) 13 FINANCIAL REPORT $5,000,000 $7,000,000 $9,000,000 $11,000,000 $13,000,000 $15,000,000 $17,000,000 $19,000,000 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22

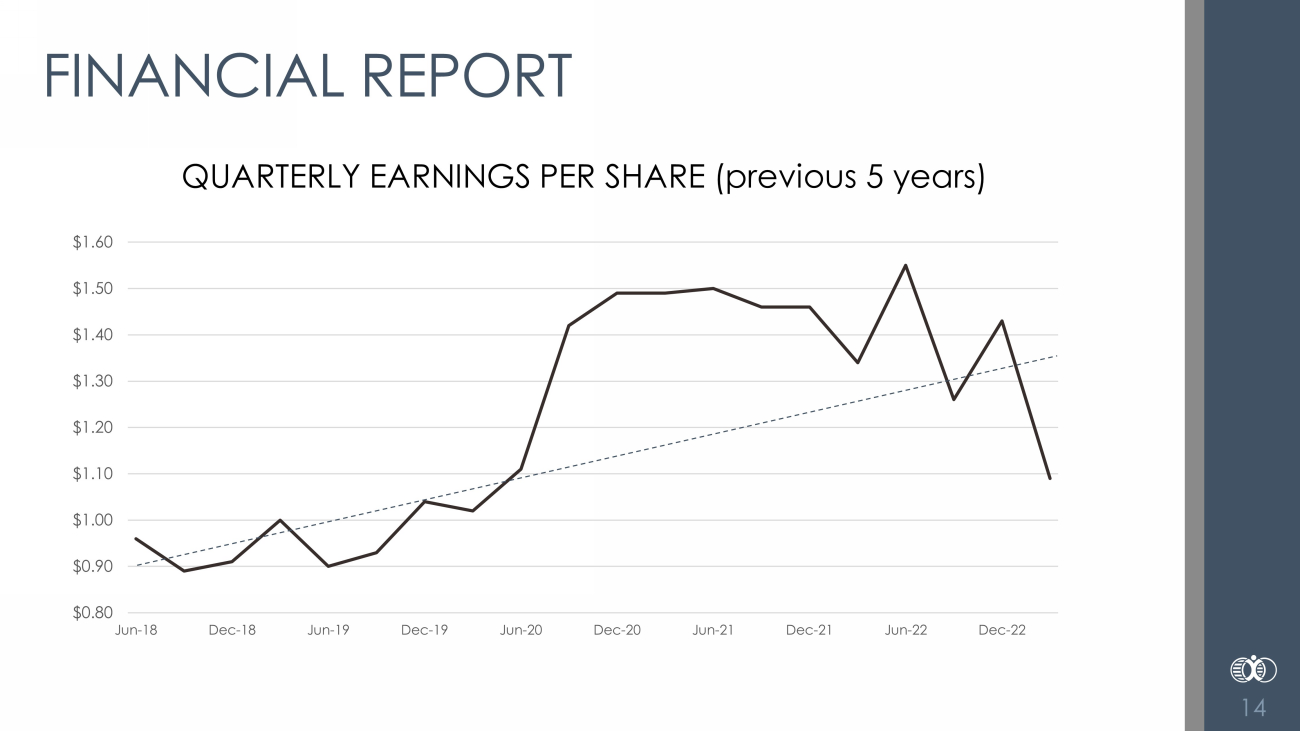

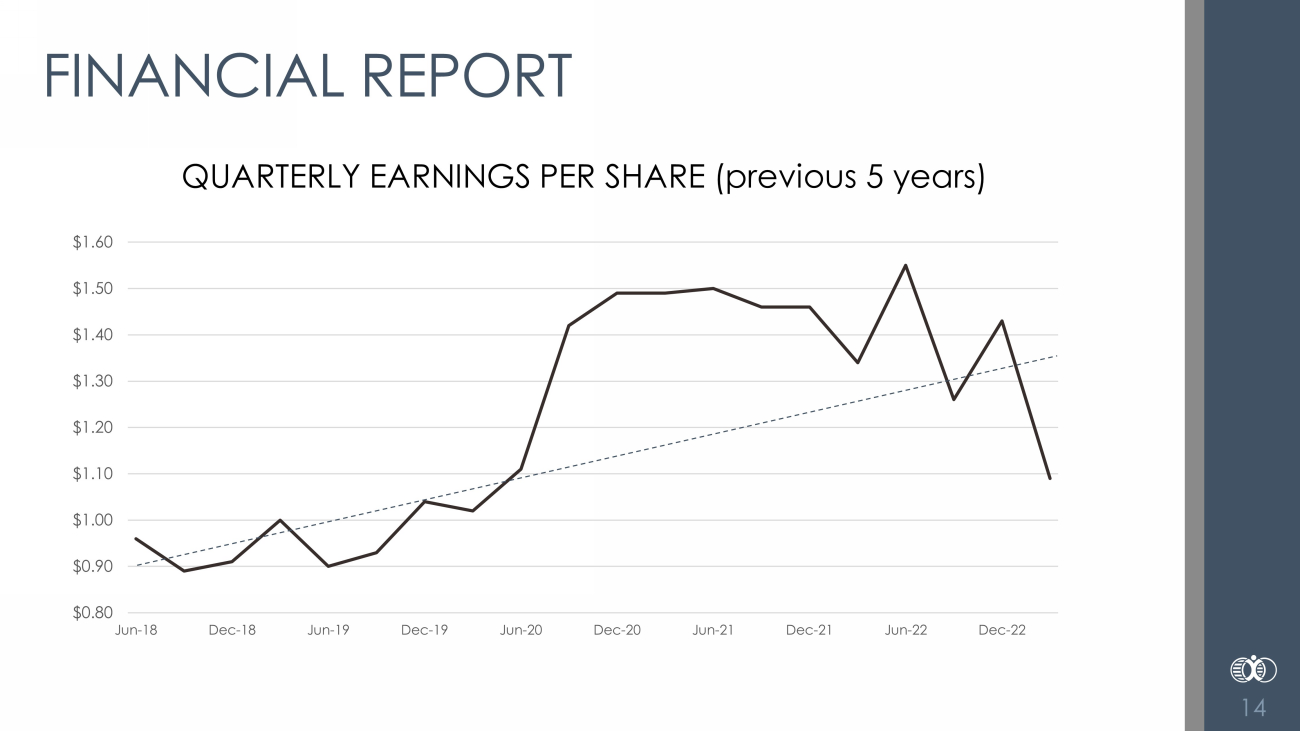

QUARTERLY EARNINGS PER SHARE (previous 5 years) 14 FINANCIAL REPORT $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 $1.50 $1.60 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22

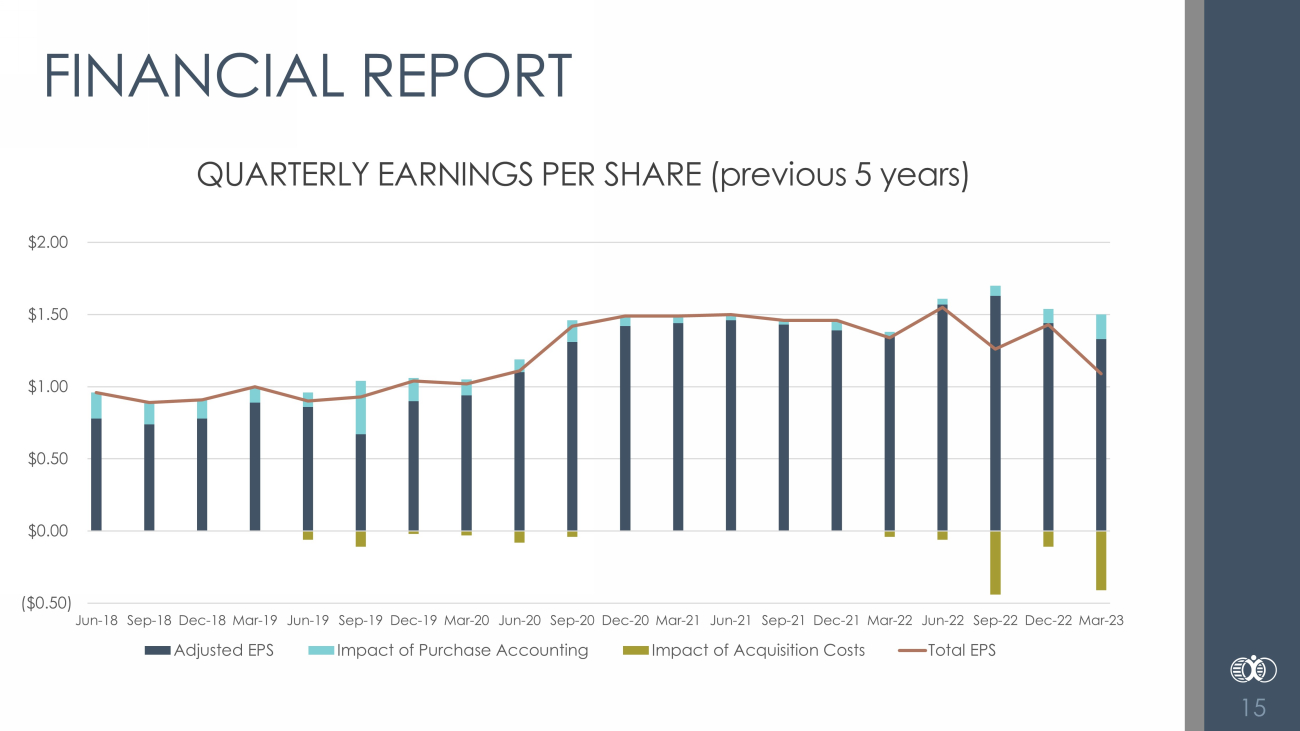

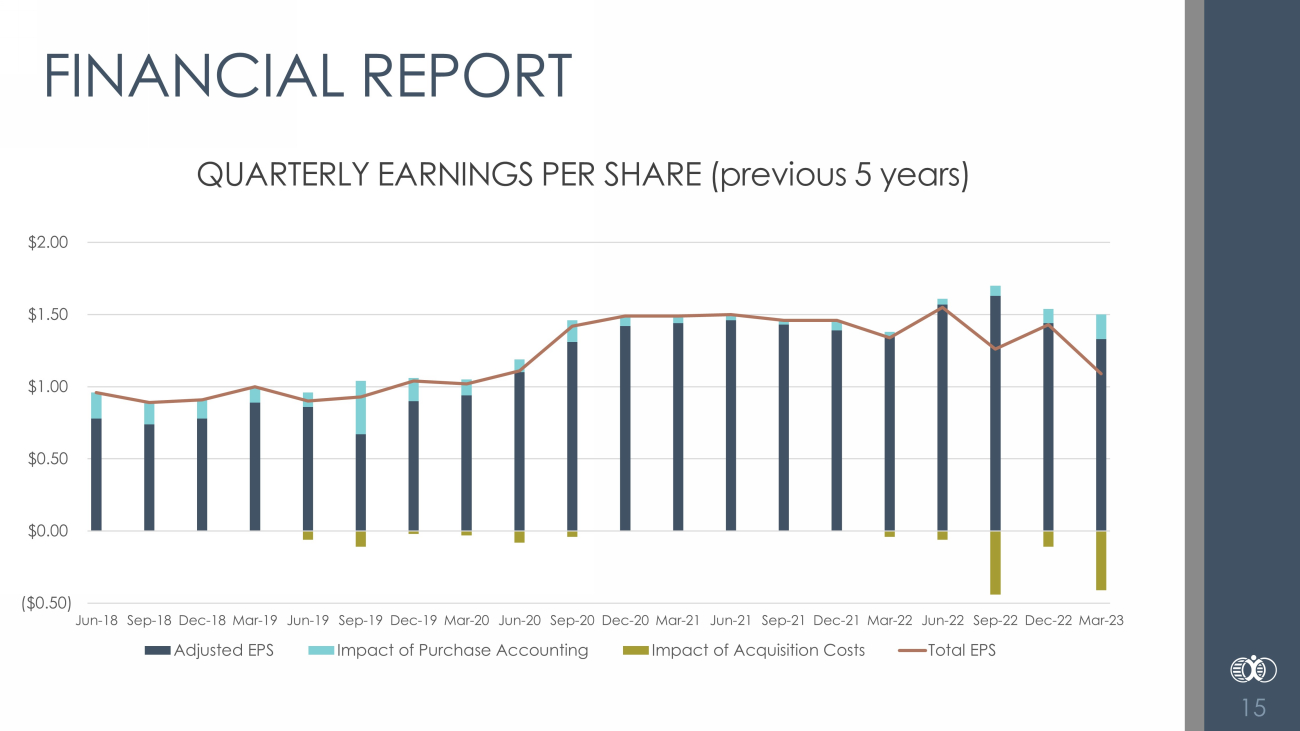

15 FINANCIAL REPORT QUARTERLY EARNINGS PER SHARE (previous 5 years) ($0.50) $0.00 $0.50 $1.00 $1.50 $2.00 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Adjusted EPS Impact of Purchase Accounting Impact of Acquisition Costs Total EPS

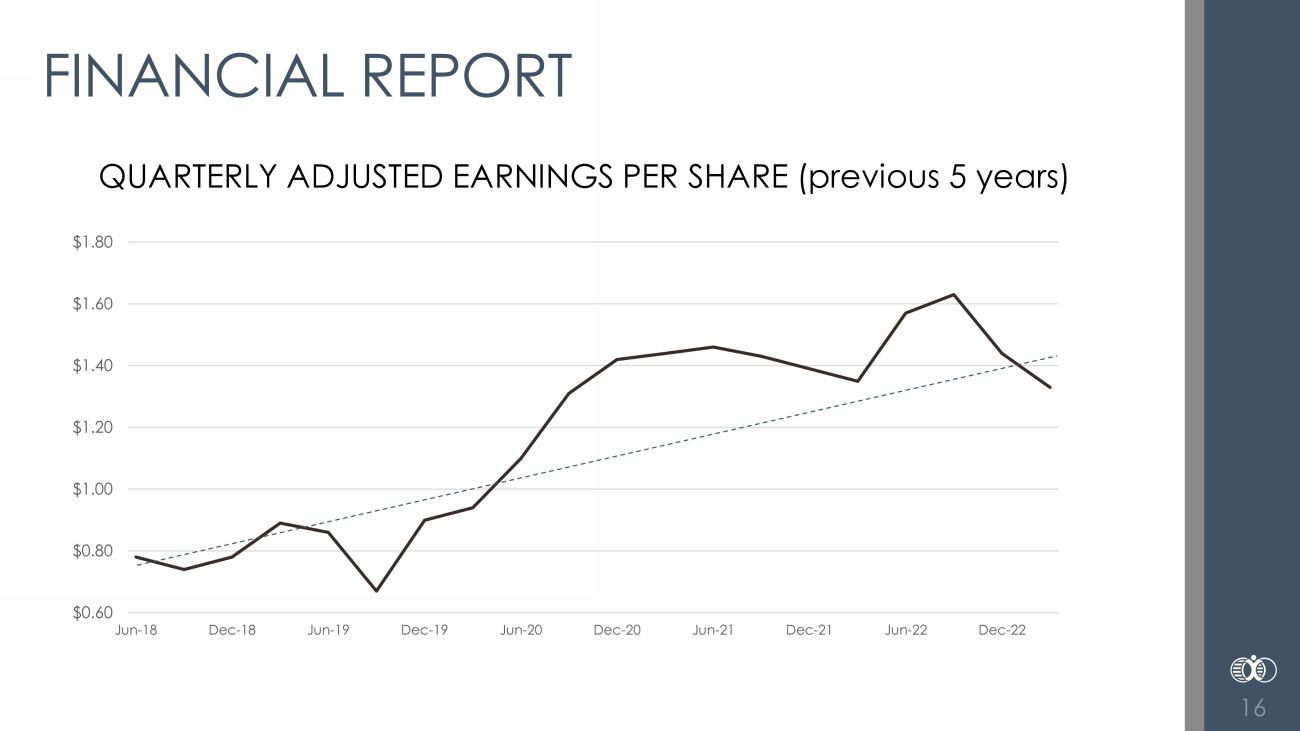

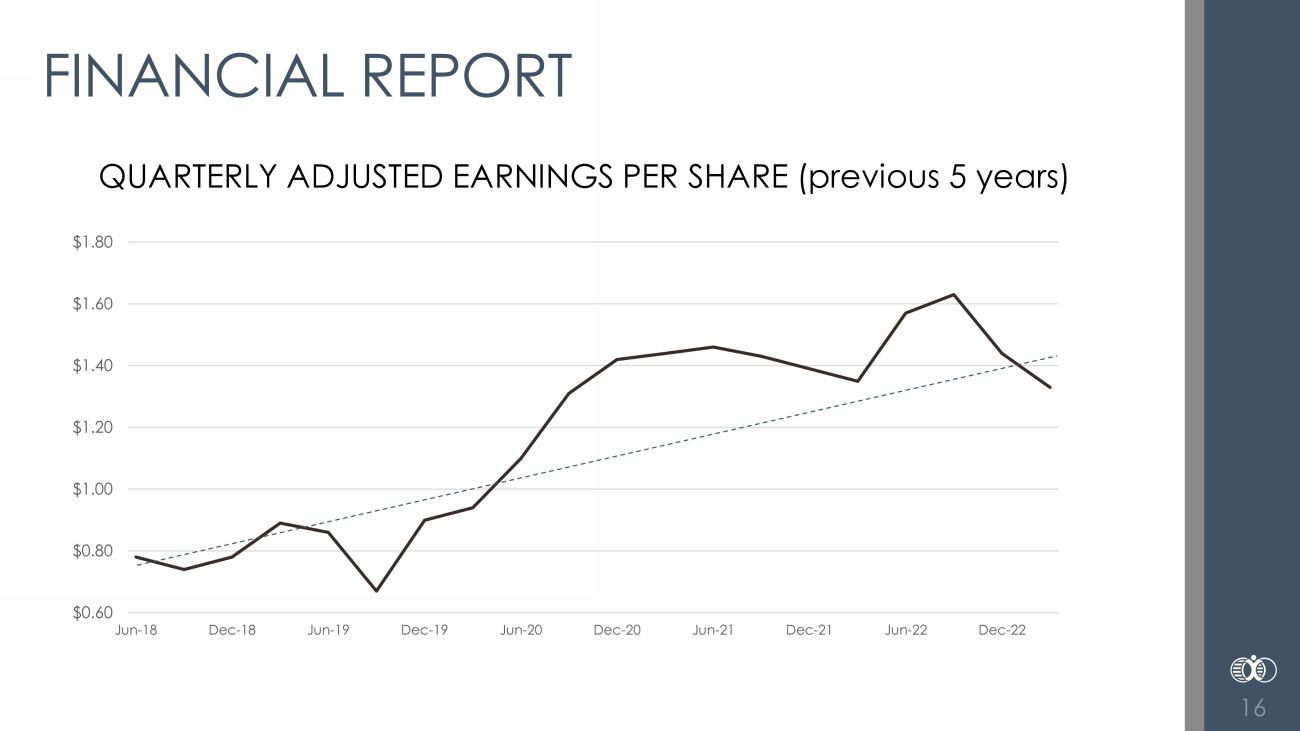

QUARTERLY ADJUSTED EARNINGS PER SHARE (previous 5 years) 16 FINANCIAL REPORT $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22

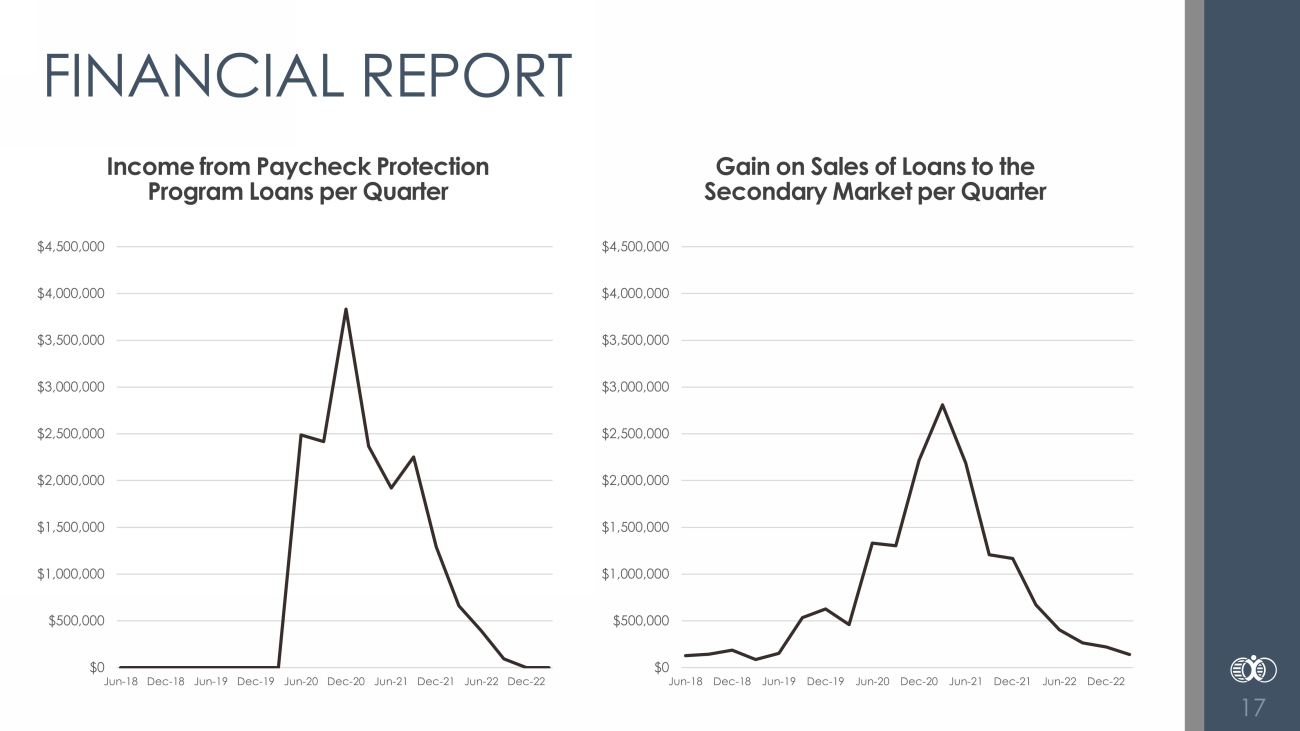

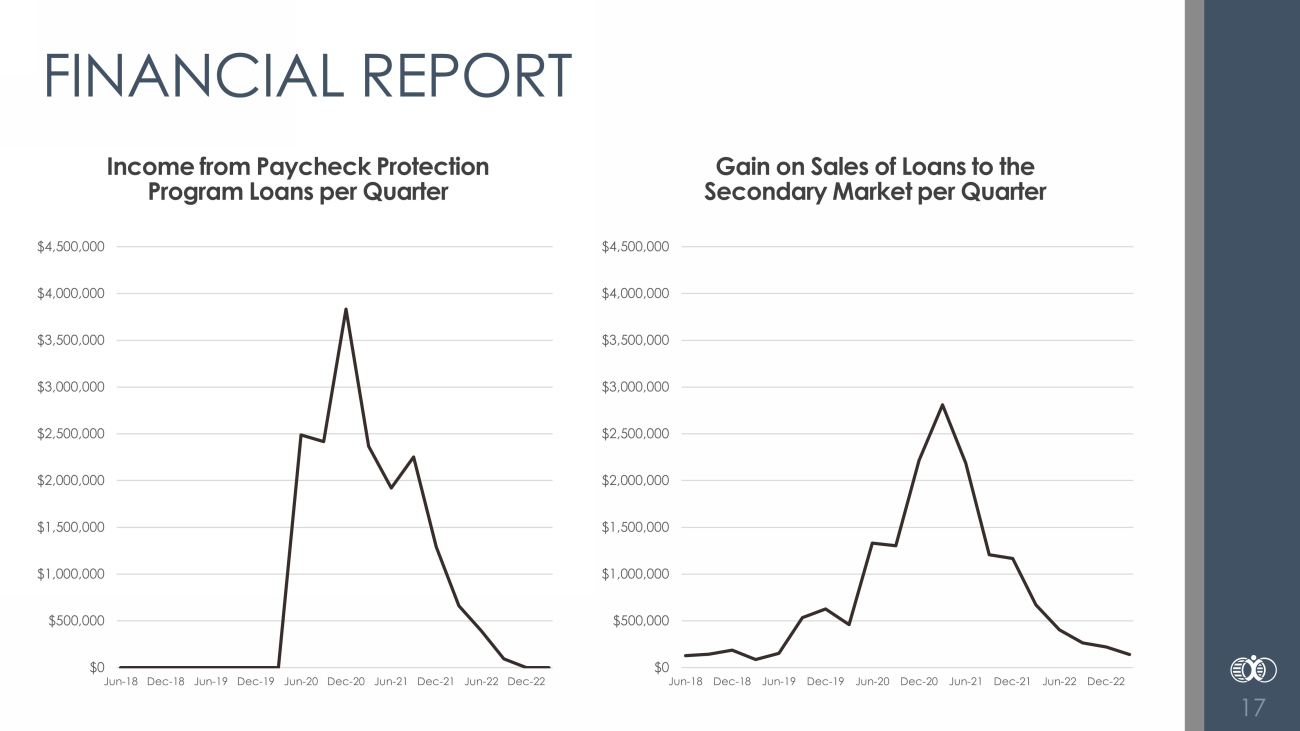

17 FINANCIAL REPORT Gain on Sales of Loans to the Secondary Market per Quarter $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Income from Paycheck Protection Program Loans per Quarter $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22

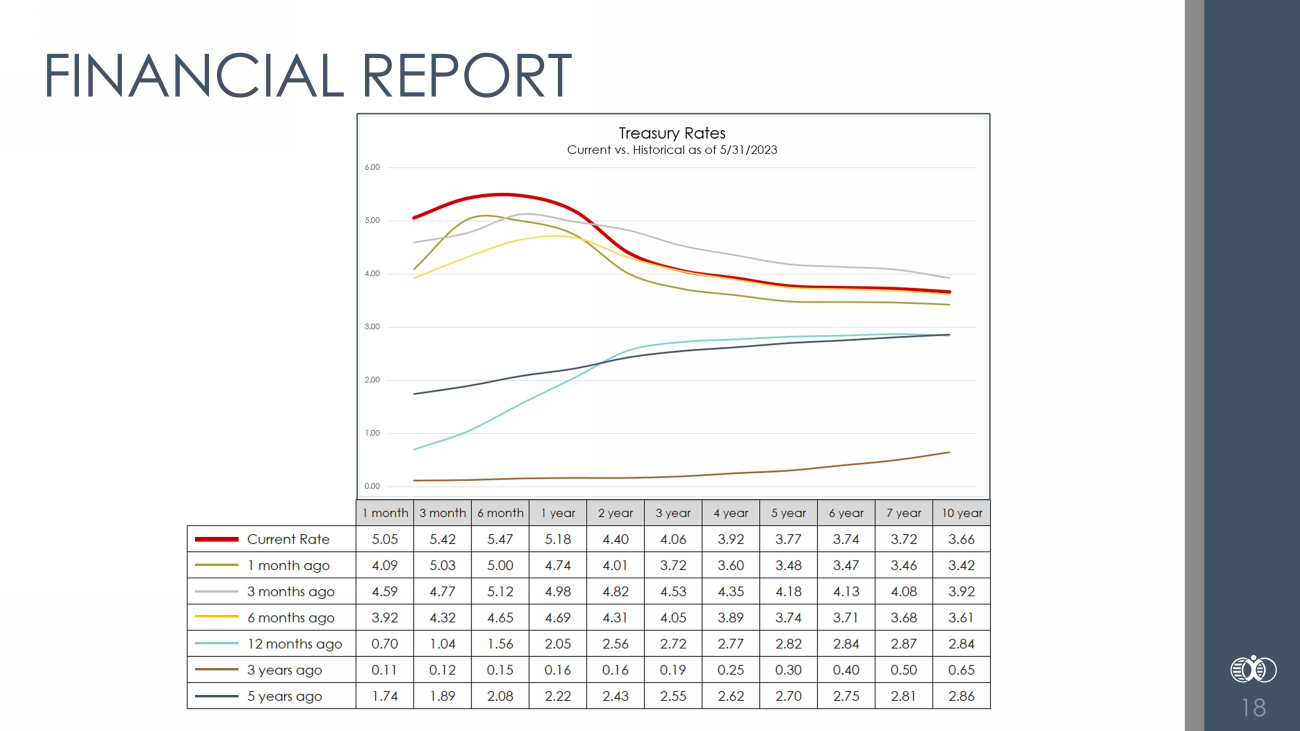

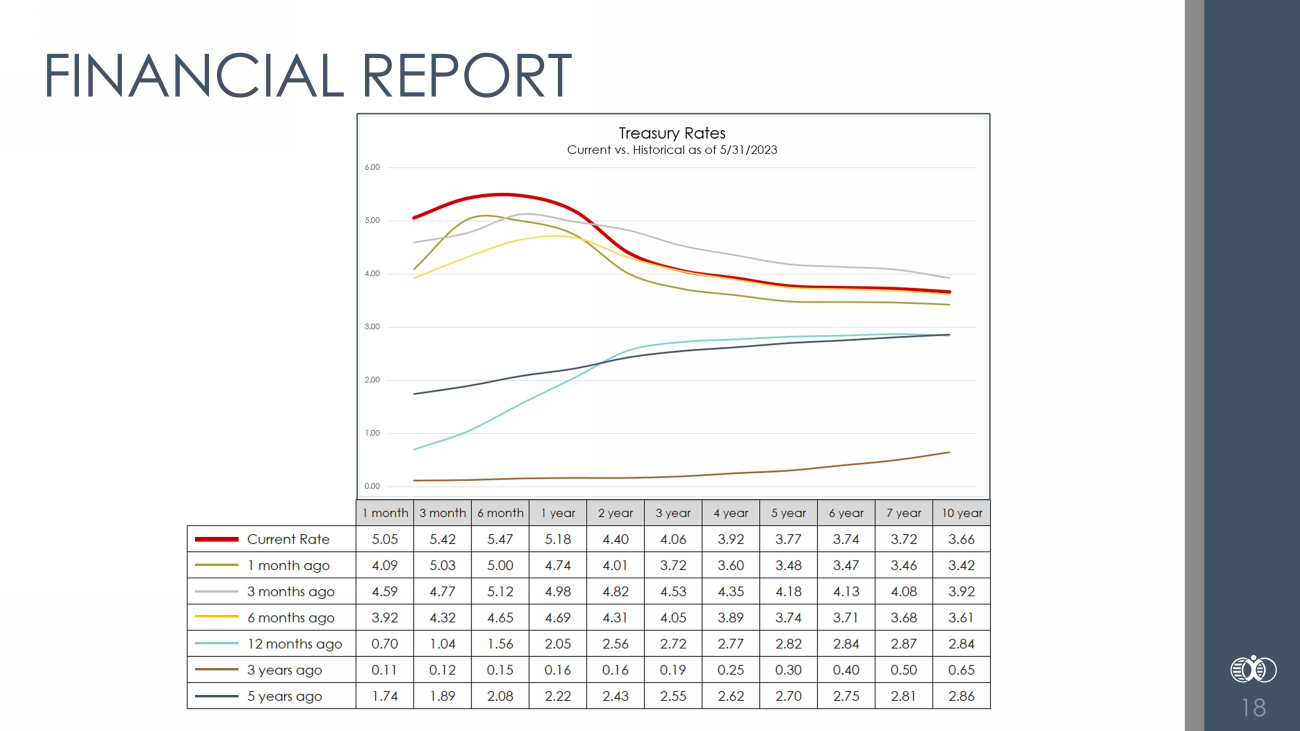

18 FINANCIAL REPORT

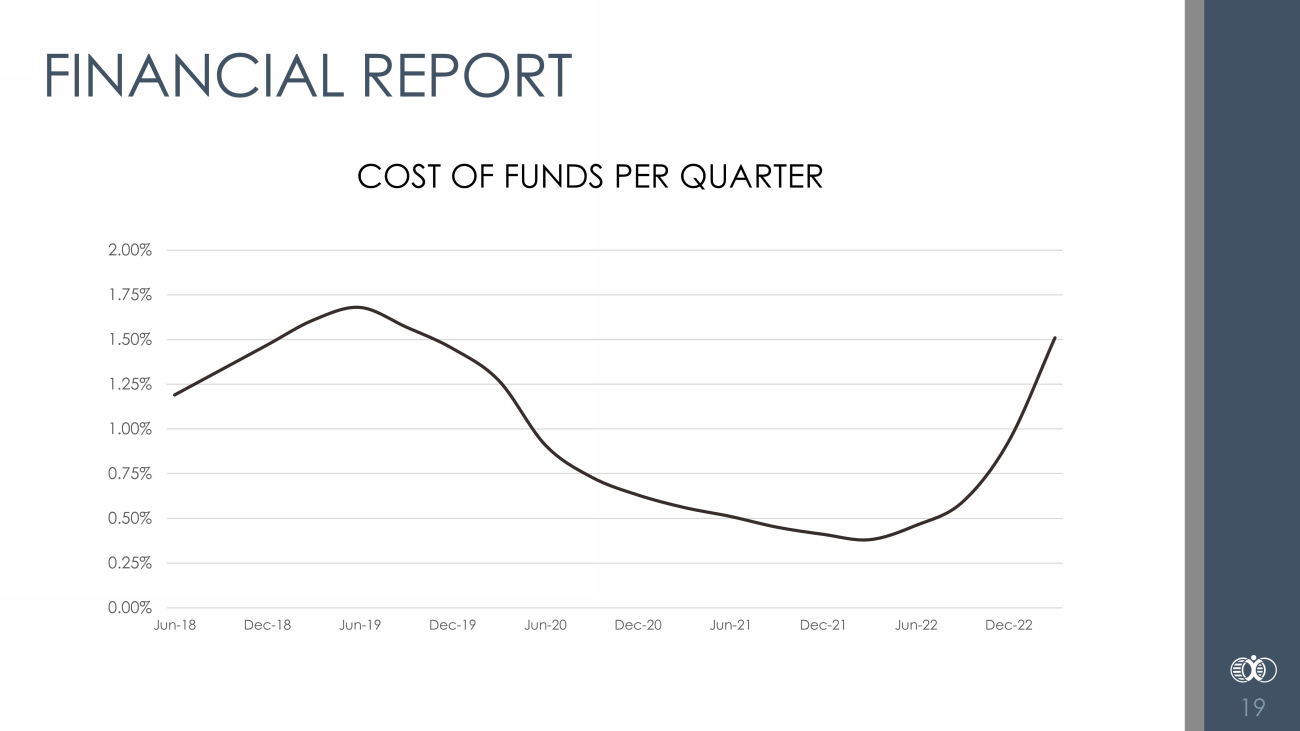

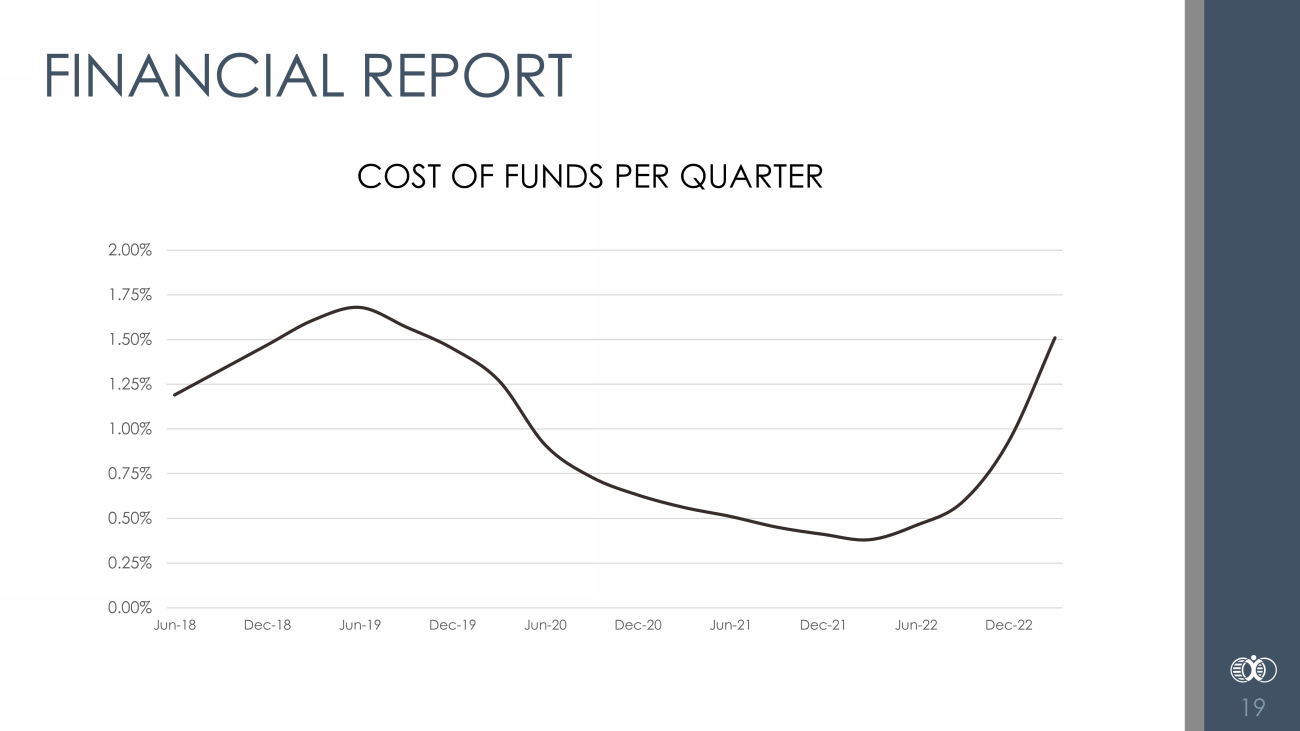

COST OF FUNDS PER QUARTER 19 FINANCIAL REPORT 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22

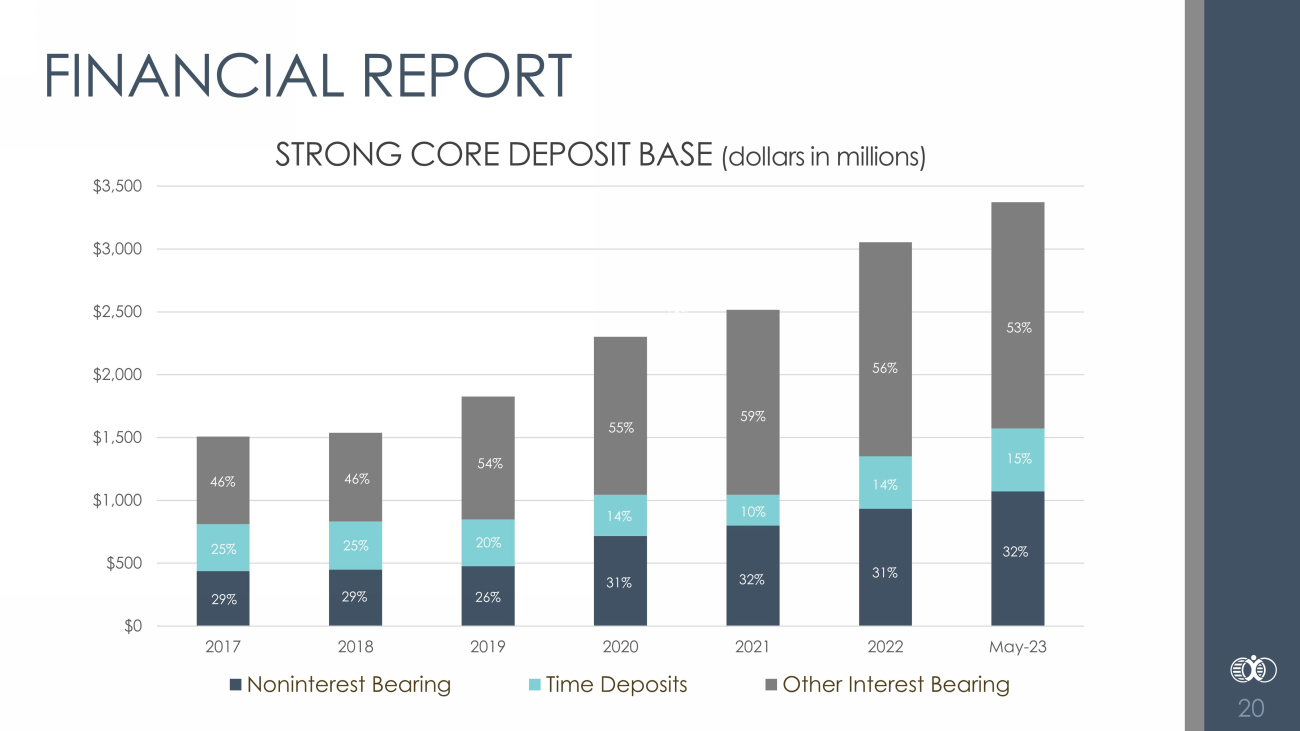

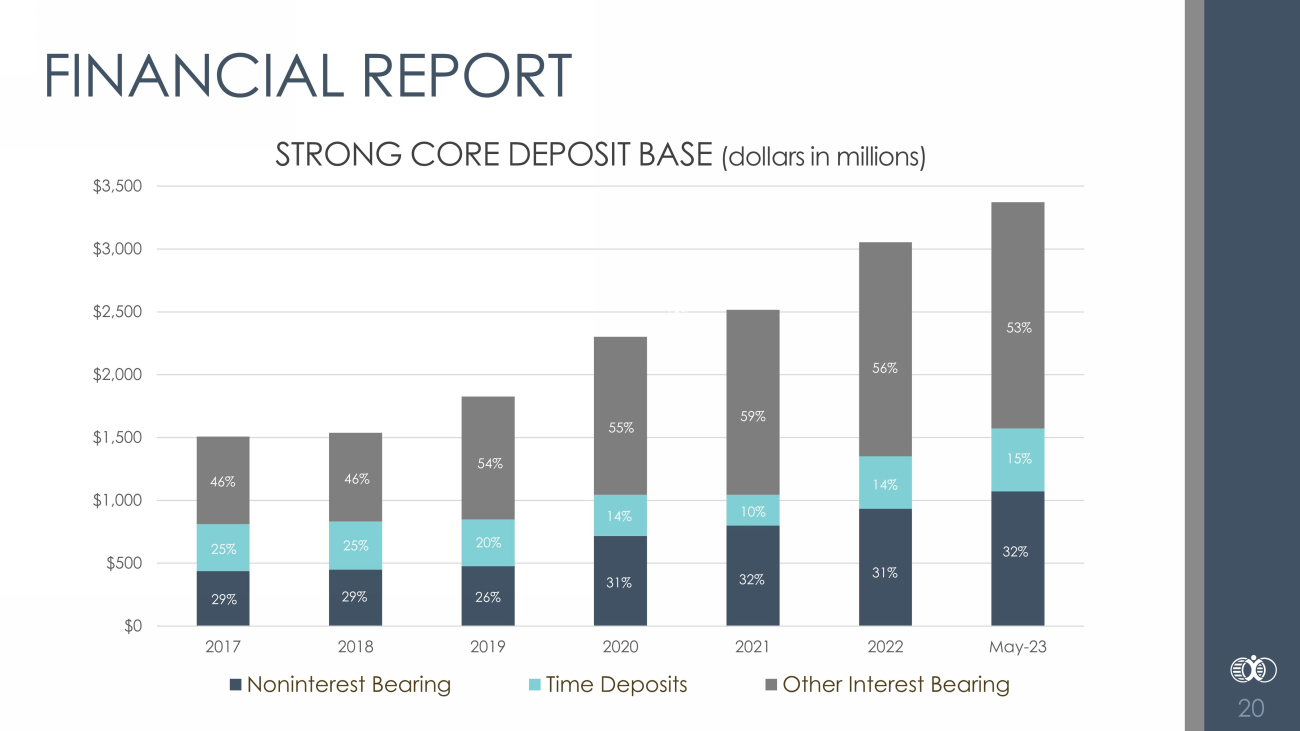

20 FINANCIAL REPORT STRONG CORE DEPOSIT BASE (dollars in millions) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2017 2018 2019 2020 2021 2022 May-23 Noninterest Bearing Time Deposits Other Interest Bearing 46% 54% 55% 59% 56% 53% 32% 26% 21% 15% 10% 25% 29% 46% 25% 29% 20% 26% 14% 31% 10% 32% 14% 31% 15%

21 FINANCIAL REPORT $1,061 $1,124 $1,238 $1,316 $1,753 $1,793 $2,210 $2,718 $2,938 $3,660 $4,110 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 5/31/2023 ASSET GROWTH (in millions)

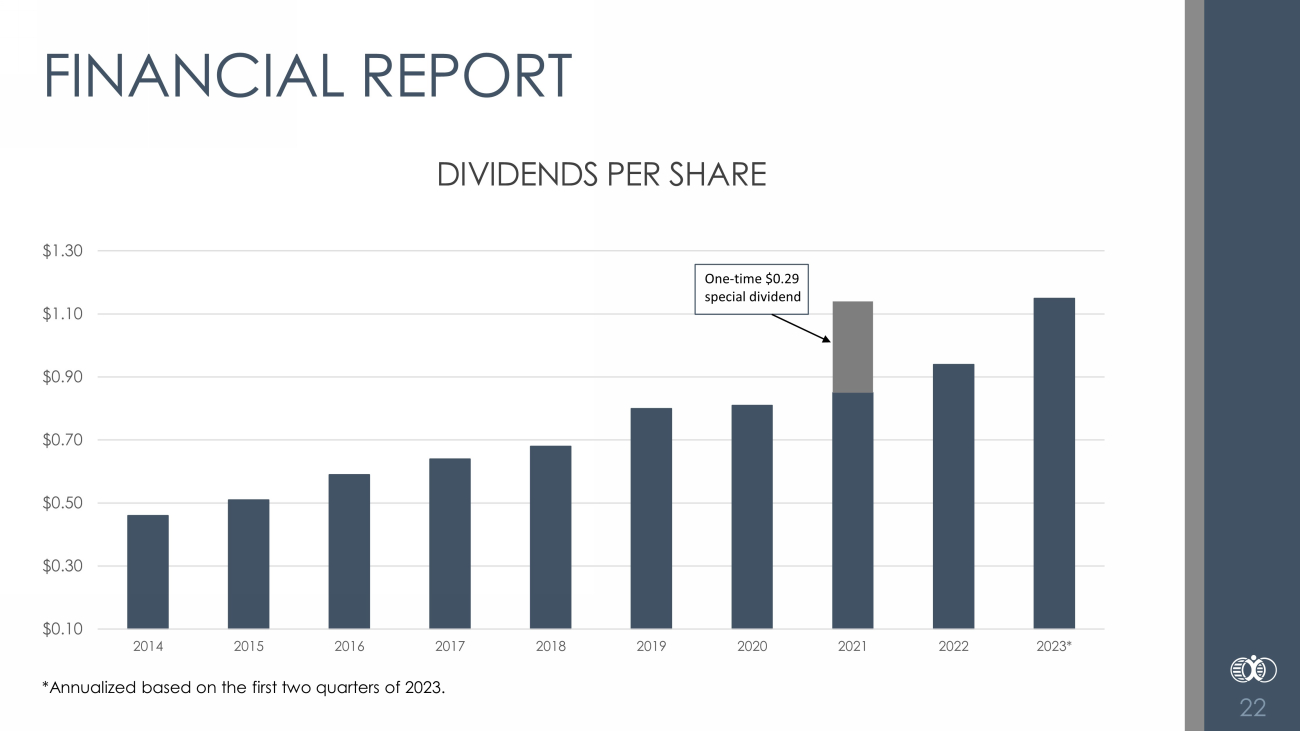

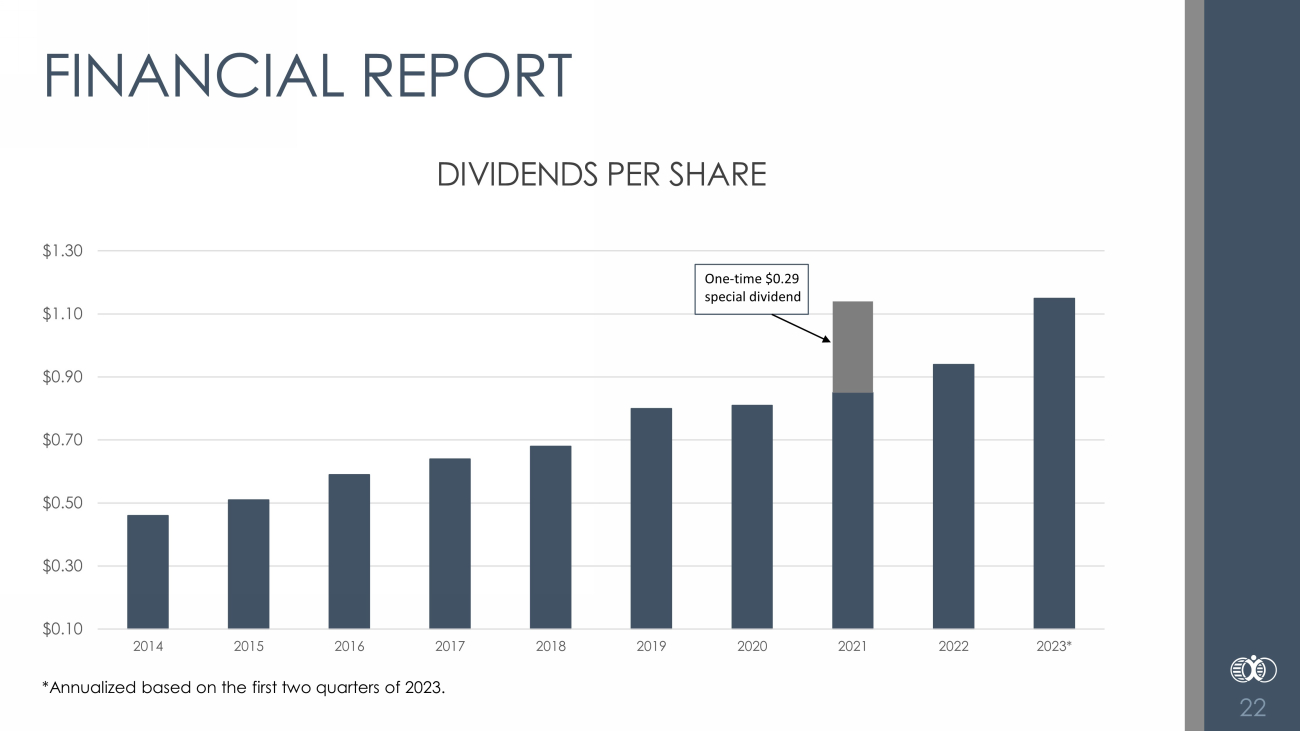

22 FINANCIAL REPORT DIVIDENDS PER SHARE *Annualized based on the first two quarters of 2023. $0.10 $0.30 $0.50 $0.70 $0.90 $1.10 $1.30 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023* One - time $0.29 special dividend

23 STOCK PERFORMANCE (Total Return) $0 $100 $200 $300 $400 $500 $600 $700 Value of $100 invested on June 1, 2013 (10 year) BFC Russell 2000 S&P Regional Banking ETF $574.10 $ 177.78 $146.84

24 TIM MCFARLANE President

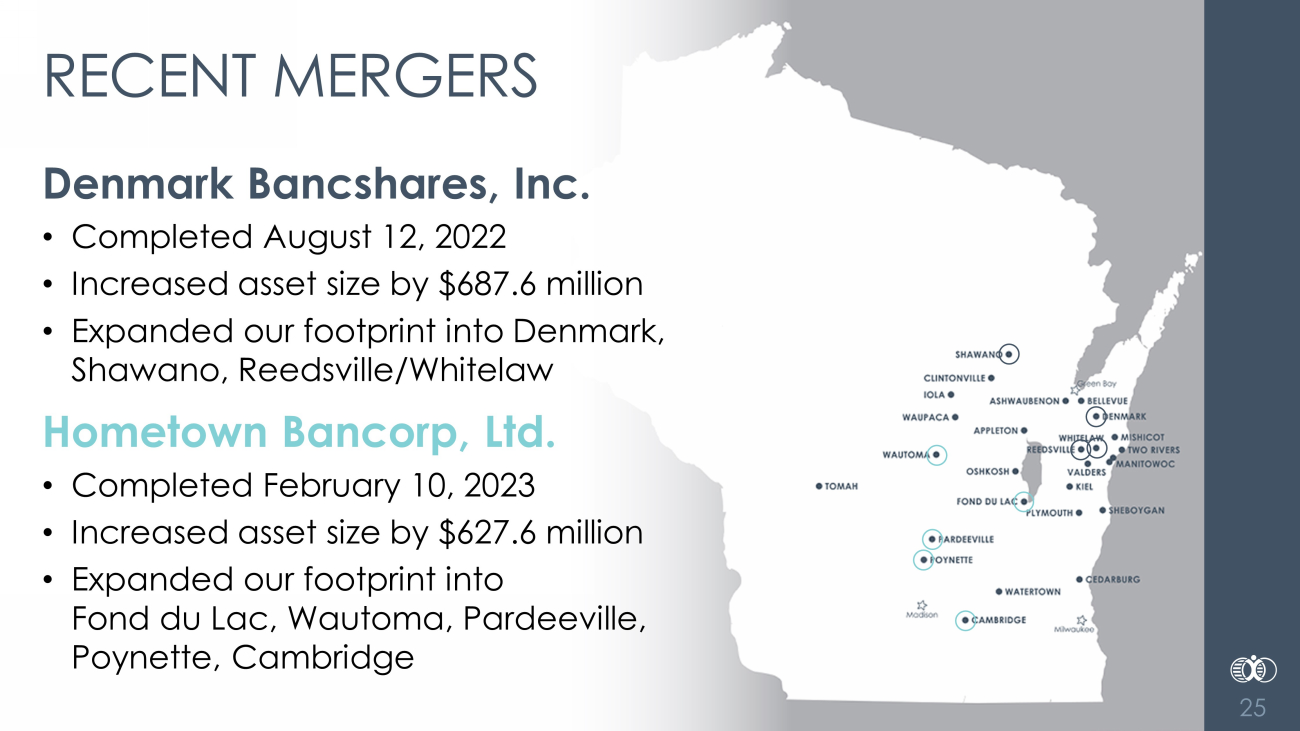

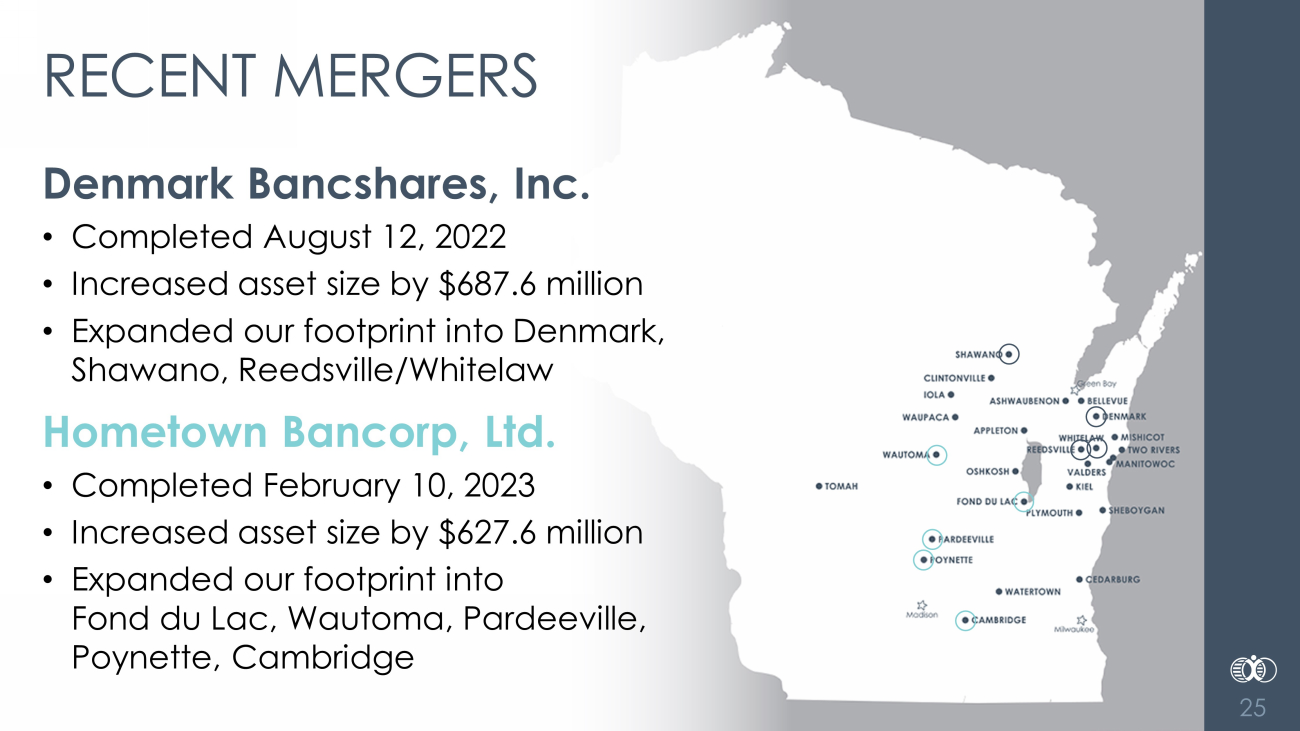

25 RECENT MERGERS Denmark Bancshares, Inc. • Completed August 12, 2022 • Increased asset size by $687.6 million • Expanded our footprint into Denmark, Shawano, Reedsville/Whitelaw Hometown Bancorp, Ltd. • Completed February 10, 2023 • Increased asset size by $627.6 million • Expanded our footprint into Fond du Lac, Wautoma, Pardeeville, Poynette, Cambridge

26 OUR PROMISE We are a relationship - based bank focused on providing innovative solutions that are value driven to the communities we serve.

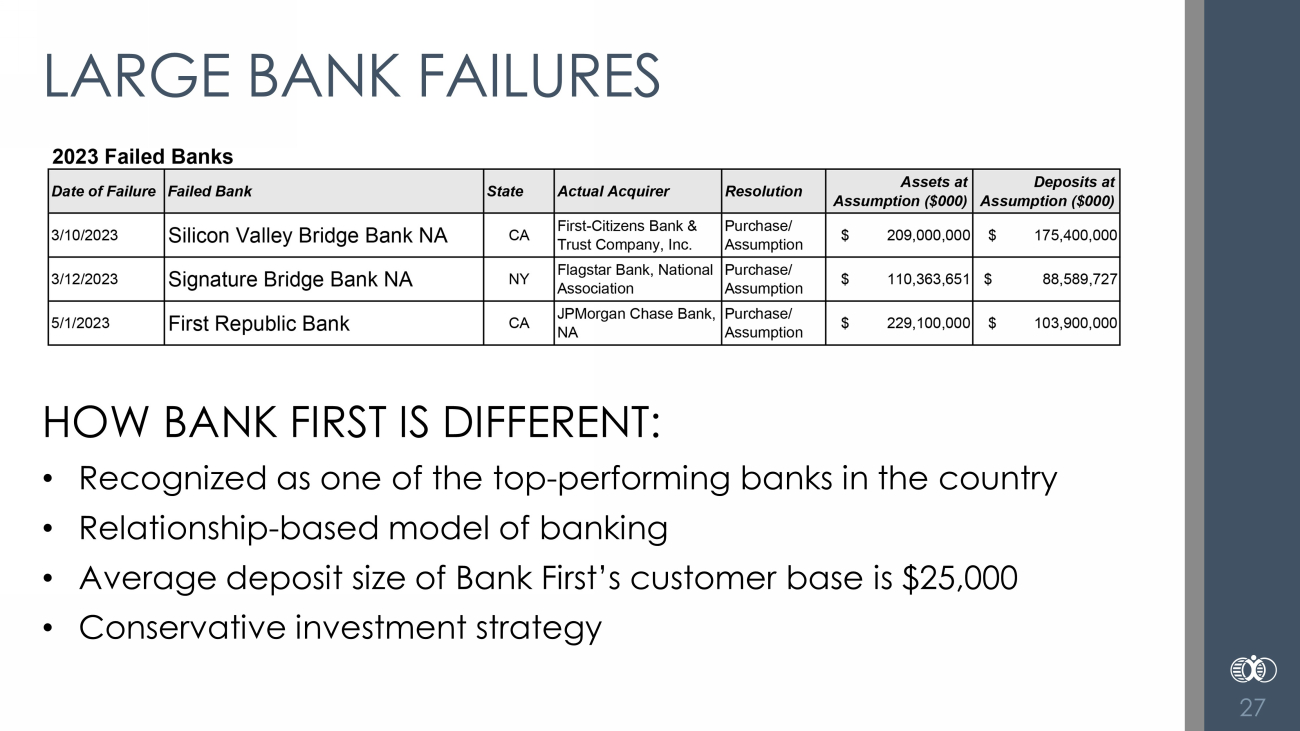

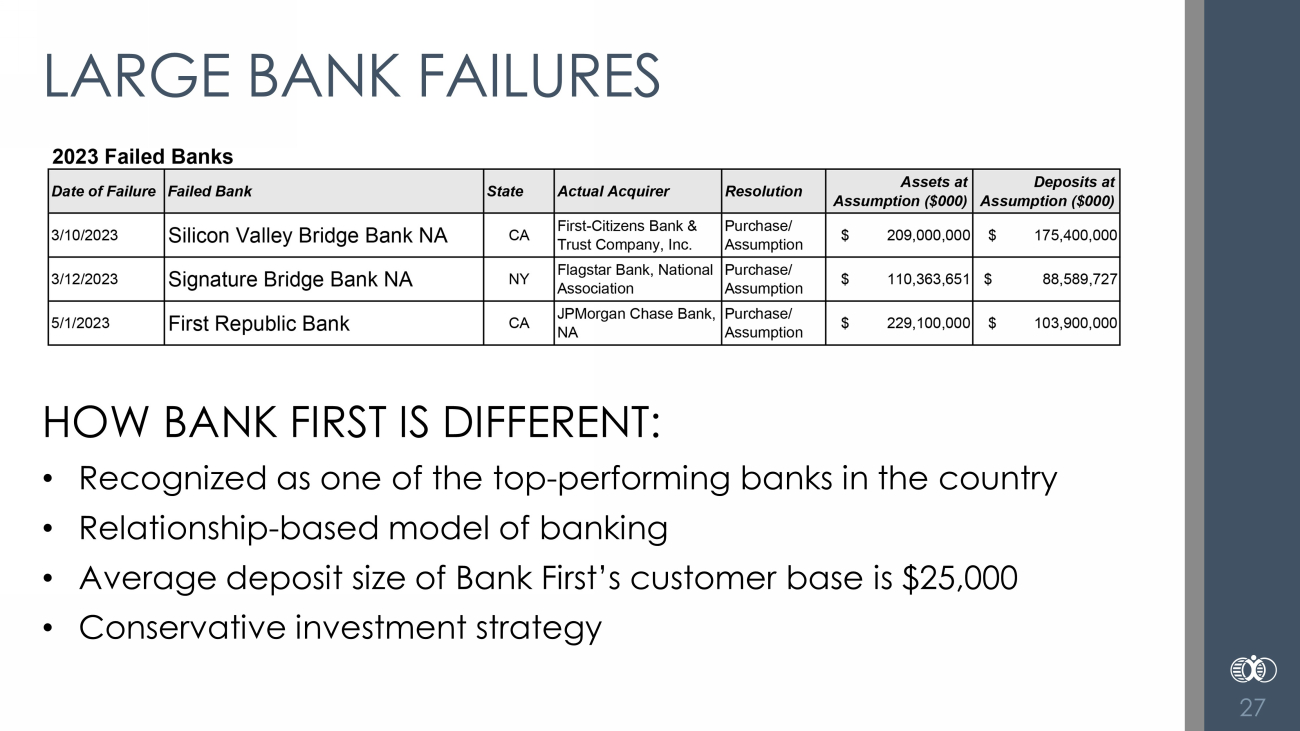

27 LARGE BANK FAILURES HOW BANK FIRST IS DIFFERENT: • Recognized as one of the top - performing banks in the country • Relationship - based model of banking • Average deposit size of Bank First’s customer base is $25,000 • Conservative investment strategy

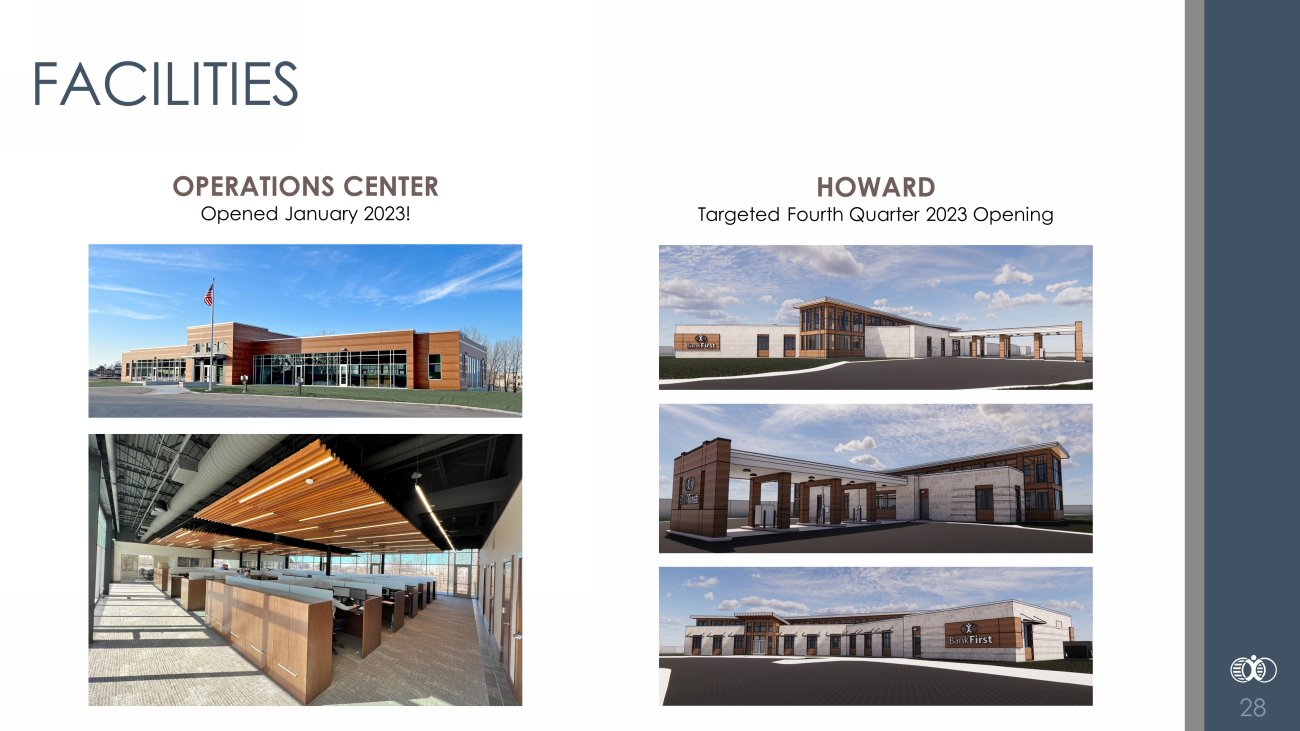

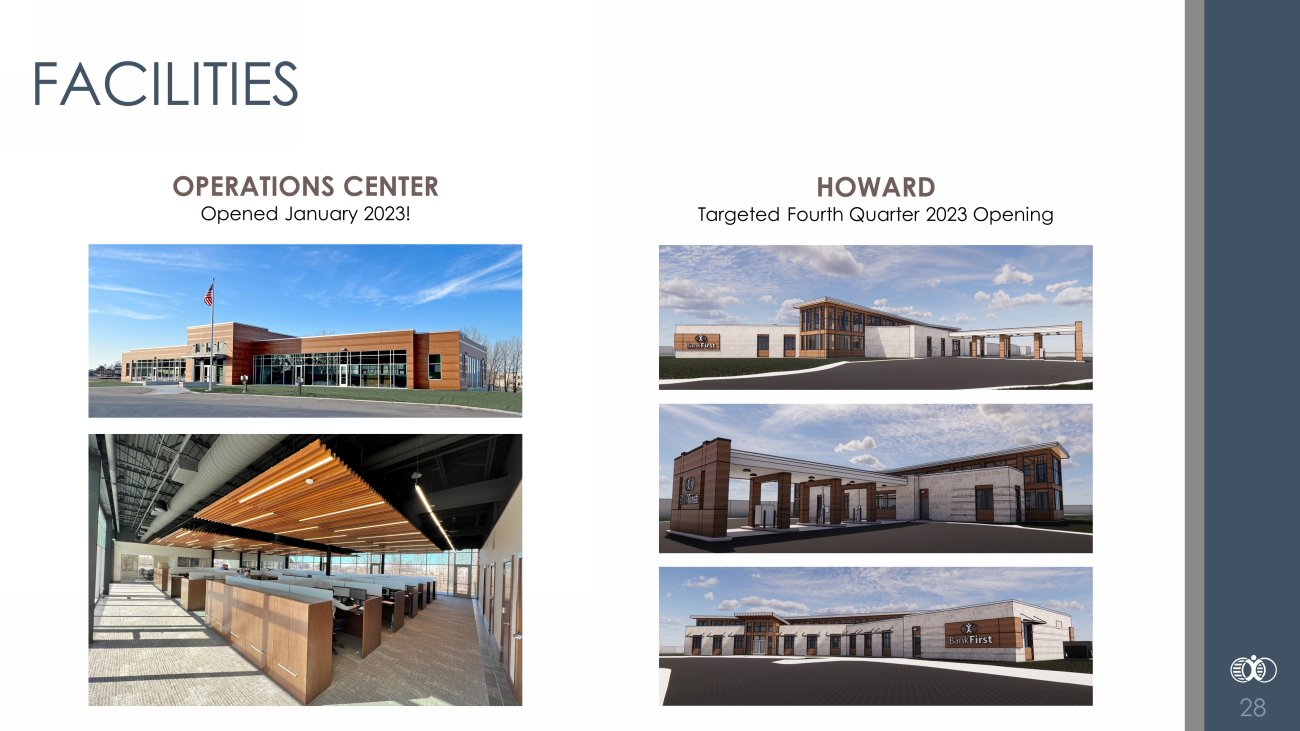

28 FACILITIES HOWARD Targeted Fourth Quarter 2023 Opening OPERATIONS CENTER Opened January 2023!

29 FACILITIES FOND DU LAC Targeted for 2024 REEDSVILLE Targeted Fourth Quarter 2023 Opening

30 FACILITIES Office Timeline Description Reedsville/Whitelaw 2023 Consolidating the Reedsville/Whitelaw locations to a new facility located along Hwy. 10 in Reedsville. Targeted completion is October 2023. Howard 2023 New construction on Shawano Avenue in progress. Target completion is December 2023. Clintonville 2023 Interior remodel scheduled for 2023. Shawano 2023 Interior remodel scheduled for 2023. Fond du Lac 2024 Consolidating into N. Peters Avenue location in September. New location coming in 2024 with site announcement coming soon! Denmark 2024 Exploring options for a remodel or rebuild on existing site. Sturgeon Bay TBD Site location announcement coming soon! PROJECTS IN PROCESS

31 QUESTIONS / COMMENTS

Who to contact: 32 SHAREHOLDER SERVICES TEAM Please reach out to Bank First Shareholder Services at shareholderservices@bankfirst.com or 920 - 652 - 3360. Our dedicated team will be able to assist with any questions or concerns you may have. Business cards are available at the entrance.

THANK YOU!