- BFC Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Bank First (BFC) 425Business combination disclosure

Filed: 23 Jan 19, 4:57pm

Filed by Bank First National Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Bank First National Corporation

Partnership Community Bancshares, Inc.

Filer’s Commission File No.: 001-38676

Date: January 23, 2019

GROWING TOGETHER.

JANUARY 23, 2019

JANUARY 23, 2019

| TABLE OF CONTENTS |

JANUARY 23, 2019

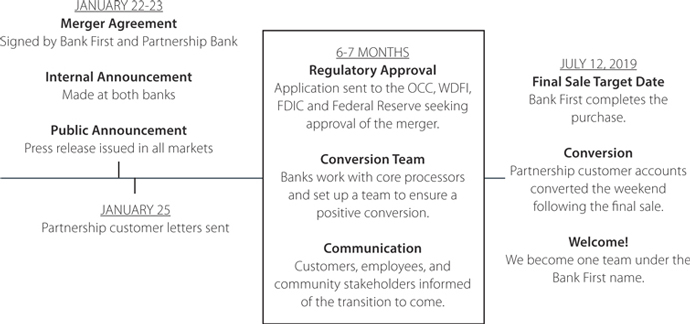

On Tuesday, January 22, 2019, Bank First National Corporation, parent company of Bank First, entered into a merger agreement with Partnership Community Bancshares, Inc., the parent company of Partnership Bank, to purchase the company and their banking offices in Cedarburg, Mequon, Watertown and Tomah (see attached News Release for complete information).

WHAT HAPPENS NEXT?

For Partnership Bank customers, employees and the general public, things will look and feel the same for a period of time. Transition teams will begin working diligently behind the scenes obtaining approval from our regulators, planning for system conversions, creating customer communication, and working with employees prior to the merger.

During the next few weeks, our teams will begin introductions and begin planning for a smooth conversion that benefits both organizations and our customers.

PROJECTED TIMELINE:

| 3 |

JANUARY 23, 2019

| We are arelationship-basedcommunity bank focused on providinginnovative products and services that arevalue driven. |

Relationship Based

At Bank First, we recognize the importance of family, community, and financial growth and strive to deliver a superior banking experience by providing personalized customer service and beneficial financial solutions. We accomplish this by building relationships and being active and involved in the communities we serve. We know our customers by name, and all decisions are made by an experienced team of bankers who live in the community and understand the needs of local families and businesses.

Community Bank

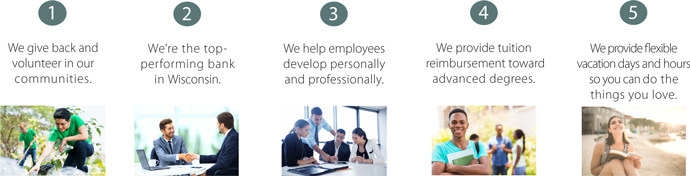

Bank First takes great pride in supporting our community. We believe by working together, we can transform lives and build stronger communities for our future generations. In 2018, Bank First contributed over $750,000 to more than 400 Wisconsin community events and organizations, and employees donated over 11,600 hours of their time volunteering as well.

Innovative Products & Services

As technology advances, Bank First is able to stay at the forefront of change through our co-ownership of UFS, LLC, a data processing facility headquartered in Grafton, Wisconsin. UFS provides data and technology services for 60 Midwest banks. The bank’s relationship with UFS allows quick access to the latest advancements in banking technology, as well as the ability to officer customizable solutions that match or exceed our competitors’ offerings at a lower cost. Our relationship with UFS also allows us to challenge the status quo. We actively seek feedback from our customers regarding features or enhancements they would like to see, and in turn work one-on-one with UFS to implement their suggestions.

Value Driven

The relationships we develop with families and businesses allow us to know and understand our customers on a personal level. This gives us the ability to provide flexible, customizable solutions that are value driven. We foster a culture focused on excellence and work hard every day to add value to the banking experience.

QUICK FACTS: • 18 Locations • 275 Employees • Founded in 1894 (celebrating 125 years this year!) • Top-performing bank in Wisconsin • Recognized as a “Best Bank to Work For” • Stock Ticker Symbol: BFC • Website: www.bankfirstwi.bank • Find us on Facebook: bankfirstwi • Connect with us on LinkedIn: Bank First - WI |  |

| Consolidated Financial Performance - YTD as of 12/31 | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Net Income (in millions) | $ | 25.45 | $ | 15.31 | $ | 14.93 | ||||||

| Total Assets (in millions) | $ | 1,793 | $ | 1,753 | $ | 1,316 | ||||||

| Total Loans (in millions) | $ | 1,428 | $ | 1,398 | $ | 1,027 | ||||||

| Total Deposits (in millions) | $ | 1,557 | $ | 1,507 | $ | 1,127 | ||||||

| Net Interest Margin | 3.89 | % | 3.45 | % | 3.26 | % | ||||||

| Efficiency Ratio | 52.16 | % | 53.28 | % | 50.81 | % | ||||||

| Return on Average Assets | 1.43 | % | 1.04 | % | 1.13 | % | ||||||

| Return on Average Equity | 15.36 | % | 11.17 | % | 12.01 | % | ||||||

| Non-Performing Assets to Total Assets | 1.30 | % | 1.42 | % | 0.16 | % | ||||||

| Book Value (consolidated) | $ | 26.37 | $ | 23.76 | $ | 20.53 | ||||||

| EPS (consolidated) | $ | 3.81 | $ | 2.44 | $ | 2.40 | ||||||

| 4 |

| IT’S DIFFERENT AT FIRST | Recognized by American Banker as one of the “Best Banks to Work For” in 2017! |

Bank First is headquartered in Manitowoc, Wisconsin. Through a combination of acquisitions and de novo offices, the bank has expanded to serve the community banking needs of those throughout Wisconsin. Our growth has been achieved through our relationship-based model of banking. We take pride in knowing our customers on a personal level and working together to create value for themselves, their families, and the communities in which we live.

| WE BELIEVE IN EXCELLENCE. | WE BELIEVE IN STRENGTHENING OUR COMMUNITY. | |

Bank First is proud to be the top-performing provider of financial services in Wisconsin. Our success is attributed to our dedicated team of bankers who are committed to excellence and exceeding customer expectations. It is also due to our relationship-based model of banking. This model facilitates a culture of high credit quality standards and gives us an opportunity to know our customers on a personal level, allowing us to provide superior financial solutions that are value driven.

Bank First continues to outperform its peers and has been recognized as one of the top 100 performing banks in the United States and the top performing bank in Wisconsin. In addition, we have been recognized by American Banker as one of the “Best Banks to Work For” in 2017.

WE BELIEVE IN HELPING YOU GROW.

It is the mission of Bank First to help employees grow both personally and within their role by creating employee-centric development plans and giving people the autonomy to succeed while holding them accountable to deliver results. Development plans are focused on career growth, personal development, training, mentoring, and community involvement. Employees are encouraged to further enhance their skills and seek additional training if desired. Bank First also promotes leadership training for its staff, in addition to providing tuition reimbursement for those looking to further their education. | Bank First takes great pride in supporting our community. We believe by working together we can transform lives and build stronger communities for our future generations. In 2018, Bank First contributed over $750,000 to more than 400 Wisconsin community events and organizations, and employees donated over 11,600 hours of their time volunteering as well. Giving back has allowed Bank First to develop meaningful relationships with local families, businesses, and non-profit organizations. We believe these relationships strengthen us, our families, and our communities.

WE BELIEVE IN PERSONAL WELL-BEING.

Bank First is committed to helping employees balance work and family commitments. Employees are afforded favorable vacation days and flexible hours to accommodate doctor appointments, family obligations, volunteer efforts, school events for children, and any other life event that arises. We also offer a confidential employee assistance program for personal or work related issues.

WE BELIEVE IN ETHICAL INTEGRITY.

Bank First’s culture celebrates diversity, creativity, and responsiveness, with the highest ethical standards. Employees are encouraged and empowered to always do the right thing. We are committed to fostering an environment in which all employees, directors, and officers adhere to the same high standards of ethical conduct in the performance of the bank’s business activities. This contributes to our overall success. |

SO MANY REASONS TO THINKFIRST!

| 5 |

JANUARY 23, 2019

Brief History

On December 3, 2012, Partnership Bank opened its doors in the former Barth’s at the Bridge restaurant located on Columbia Road in Cedarburg. The Bank is completely staffed by former Ozaukee Bank associates.

As reported in the Milwaukee Journal, “the familiar faces of the employees, the community involvement efforts, the voice on the after-hours recorded message – even the copper sculpture of a frog outside the bank - are intentional throwbacks to Ozaukee Bank, a popular hometown financial institution acquired by Harris Bank in 2008.”

Who are we?

We are a community bank. That means our associates and board of directors are deeply involved in the community. In addition, many of our shareholders live and work in this community. We believe that it is the responsibility of all of us to help the families and businesses of this community grow and thrive.

| What we believe: |

| Our Mission: Make banking easy. |

| Our Vision: To be known as the #1 Relationship-Driven Bank. As a community bank we believe in client experience, community engagement by offering our time and talent to make the community a better place to live. |

| QUICK FACTS: |

| • 4 Locations |

| • 73 Employees |

| • Founded in 2012 |

| • Top-performing bank |

| • Website: www.mypartnershipbank.com |

| • Find us on Facebook: Partnership Bank |

| • Connect with us on LinkedIn: Partnership Bank |

| Consolidated Financial Performance - YTD as of 12/31 | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Net Income (in millions) | $ | 3.25 | $ | 2.07 | $ | 1.30 | ||||||

| Total Assets (in millions) | $ | 306 | $ | 275 | $ | 261 | ||||||

| Total Loans (in millions) | $ | 269 | $ | 233 | $ | 214 | ||||||

| Total Deposits (in millions) | $ | 262 | $ | 236 | $ | 227 | ||||||

| Net Interest Margin | 3.82 | % | 3.60 | % | 3.49 | % | ||||||

| Efficiency Ratio | 63.66 | % | 67.19 | % | 76.13 | % | ||||||

| Return on Average Assets | 1.12 | % | 0.77 | % | 0.52 | % | ||||||

| Return on Average Equity | 12.29 | % | 8.44 | % | 5.67 | % | ||||||

| Non-Performing Assets to Total Assets | 0.17 | % | 0.93 | % | 1.14 | % | ||||||

| Book Value (consolidated) | $ | 9.29 | $ | 8.22 | $ | 7.56 | ||||||

| EPS (consolidated) | $ | 1.15 | $ | 0.62 | $ | 0.26 | ||||||

| 6 |

JANUARY 23, 2019

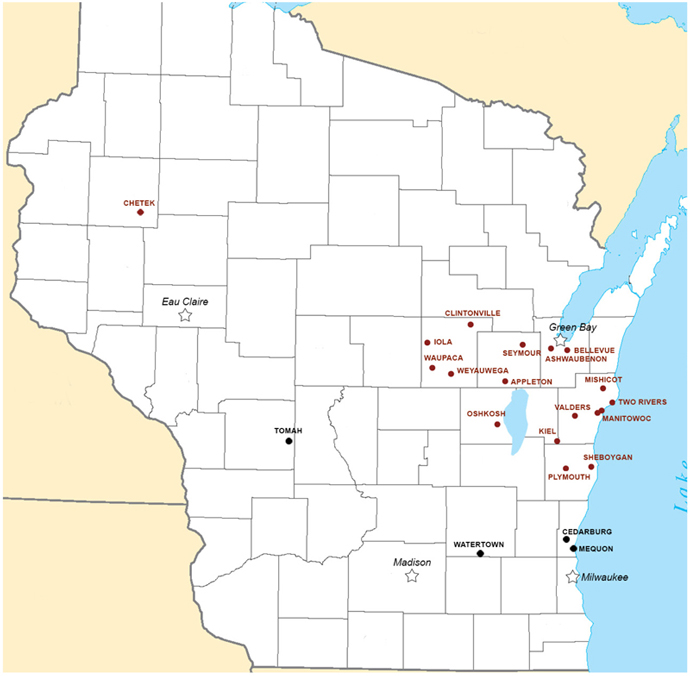

| • | Our branch network will contain a total of 23 locations (including the office inside of Acuity Insurance, Sheboygan). |

| • | Our branch network will contain loans of $1.7 billion, deposits of $1.8 billion, and have an overall asset size of $2.1 billion. |

| 7 |

JANUARY 23, 2019

QUESTIONS AND ANSWERS ABOUT THE MERGER

Why did Partnership Bank merge?

| • | Merging with a larger organization will ensure we have the resources required to meet the demands of a competitive market place and continue to deliver innovative products and services to our clients. |

Why did Partnership Bank choose Bank First?

| • | Bank First is a Wisconsin-based homegrown community bank just like us. |

| • | Our values, vision for building relationships and delivery of remarkable client service closely align. |

| • | They value their employees as much as we value ours. They are committed to excellence and believe in helping their employees grow and reach their fullest potential. |

| • | Through Bank First’s 30% ownership of Ansay & Associates (Ansay), Partnership’s customers will benefit from a closer connection to superior insurance and risk management solutions. Ansay’s headquarters is in Port Washington and they have a total of 22 offices located throughout the state of Wisconsin. They are the largest and fastest growing independent insurance agency in the state and are listed as one of the Top 100 Independent agencies in the nation. |

| • | Our clients will benefit from Bank First’s 49.8% ownership of UFS, LLC, a data processing company located in Grafton, WI. UFS provides data and technology services to 60 Midwest banks. Bank First’s ownership of UFS gives it the buying power of a large regional bank, creating opportunities to access the latest advancements in banking technology at a faster rate than our peers. In addition, some of Partnership Bank’s former associates from Ozaukee Bank have key positions at UFS helping us to feel confident in a smooth data processing conversion for our clients. |

| • | Another opportunity for the combined organization is to leverage Bank First’s sophisticated suite of treasury management products and services for our business clients. |

| • | Bank First will also be an excellent fit for our employees and the communities we serve. Bank First takes great pride in creating a culture that focuses on community involvement and encourages its employees to volunteer and give back in many ways. In 2018, Bank First contributed over $750,000 to more than 400 northeast Wisconsin community events and organizations. Employees donated over 11,600 hours of their time volunteering in 2018 as well. Additionally, Bank First has been recognized by American Banker as one of the “Best Banks to Work For”, which is awarded to the top 40 banks in the United States. These values and accomplishments align well with those of Partnership Bank who recently was awarded the Torch Award for Ethics from the Wisconsin Better Business Bureau. |

Why did Bank First choose Partnership?

| • | The merger brings together two strong organizations focused on relationship banking. |

| • | The merger aligns with Bank First’s strategy to grow within specific markets in the state of Wisconsin. Partnership has established itself as a leading provider of financial products and services in Ozaukee, Monroe, and Jefferson counties, resulting in a strong deposit base. This complements Bank First’s already strong customer relationships in Ozaukee County (as shown below) and allows those customers closer access to physical branch locations. |

| DEPOSITS | BANK FIRST | PARTNERSHIP | LOANS | BANK FIRST | PARTNERSHIP | |||||||||||||

| Ozaukee County | $ | 27,317,900 | $ | 93,176,000 | Ozaukee County | $ | 118,737,847 | $ | 92,564,000 | |||||||||

| *Balances as of 12/31/18 | COMBINED: | $ | 120,493,900 | COMBINED: | $ | 211,301,847 | ||||||||||||

| • | Bank First currently services the needs of the $88.3 billion* agriculture market in the state of Wisconsin and Partnership Bank’s rural offices of Watertown and Tomah will strengthen their agricultural business. They look forward to bringing their agricultural products and services to those markets. *Source: https://www.farmflavor.com/wisconsin-agriculture/ |

| 8 |

JANUARY 23, 2019

QUESTIONS AND ANSWERS (continued)

How does this impact the Bank First (Ticker: BFC) stock price?

| • | It’s difficult to predict what the merger will do to the stock price of either corporation. |

How does this impact our financials?

| • | Combined, we will have loans of $1.7 billion and deposits of $1.8 billion. Our overall asset size will be $2.1 billion. |

Will there be job losses?

| • | Understandably, there will be overlapping roles once the two institutions are combined. Although there are no job guarantees, we will make every effort to assess our business needs and retain top talent. If we are unable to do so, displaced employees will be offered a severance package to assist them with pay and benefits. |

What’s the difference between an acquisition and merger?

| • | When two banks combine, it’s called a merger. The surviving entity (Bank First in this case) is considered the acquiring bank. |

What data processing system are the banks running on?

| • | Partnership Bank currently works off of Jack Henry and Bank First currently works off of Fiserv. The end processing system after the merger will be Fiserv, hosted by UFS, LLC in Grafton. |

When will the merger be complete?

| • | The merger date has a target date of July 12. Conversion will take place the following weekend. First, we need to obtain regulatory approvals. |

| 9 |

JANUARY 23, 2019

| BANK FIRST | ||

| Mike Molepske, CEO | mmolepske@bankfirstwi.bank | (920) 652-3202 |

| Kevin LeMahieu, CFO | klemahieu@bankfirstwi.bank | (920) 652-3362 |

| Kelly Fischer, COO | kfischer@bankfirstwi.bank | (920) 652-3263 |

| Jason Krepline, EVP Senior Lender | jkrepline@bankfirstwi.bank | (920) 694-1903 |

| Joan Woldt, EVP Regional President | jwoldt@bankfirstwi.bank | (920) 901-7971 |

| Deb Weyker, VP Marketing | dweyker@bankfirstwi.bank | (920) 652-3274 |

| Sherry Jonet, VP Human Resources | sjonet@bankfirstwi.bank | (920) 652-3291 |

| PARTNERSHIP BANK | ||

| David Braaten, CEO | braaten@mypartnershipbank.com | (262) 573-0670 |

| Dean Fitting, Chairman | fitting@mypartnershipbank.com | (262) 993-2233 |

| Sue Loken, CFO | loken@mypartnershipbank.com | (262) 204-4091 |

| 10 |

|

P.O. Box 10, Manitowoc, WI 54221-0010

For further information, contact:

Deb Weyker, Vice President Marketing

Phone: (920) 652-3274

dweyker@bankfirstwi.bank

Company Release – 01/23/2019

Bank First National Corporation Signs Definitive Agreement

to Acquire Partnership Community Bancshares, Inc.

Highlights of the Announced Transaction

| · | Aligns with Bank First’s strategic growth plans within the State of Wisconsin | |

| · | Benefits customers of both institutions through additional branch locations and enhanced suite of products and services | |

| · | Companies share a similar culture and relationship-based banking philosophy | |

| · | Strengthens Bank First’s franchise through greater deposit market share |

MANITOWOC, Wis. and CEDARBURG, Wis., January 23, 2019 /PRNewswire/ — Bank First National Corporation (Nasdaq: BFC) (“Bank First” or “the Company”), the holding company of Bank First, National Association, announced today the signing of an Agreement and Plan of Merger with Partnership Community Bancshares, Inc. (“Partnership”), parent company of Partnership Bank, a Wisconsin state-chartered bank, under which Bank First has agreed to acquire 100% of the common stock of Partnership in a combined stock-and-cash transaction.

Under the terms of the Agreement and Plan of Merger, each Partnership shareholder will have the option to receive either $17.3832 in cash or 0.35047 of a share of Bank First’s common stock in exchange for each share of Partnership common stock, subject to customary proration and allocation procedures such that 65% of Partnership shares will receive the stock consideration and 35% will receive the cash consideration. The aggregate consideration is valued at approximately $41.0 million.

| 11 |

As of December 31, 2018, Partnership had approximately $306.8 million in consolidated assets, $267.1 million in net loans, $261.6 million in deposits and $21.6 million in consolidated stockholders’ equity. Based on the financial results as of December 31, 2018, the combined company will have total assets of approximately $2.1 billion, loans of approximately $1.7 billion and deposits of approximately $1.8 billion.

The Agreement and Plan of Merger has been approved by the Boards of Directors of Bank First and Partnership. The closing of the transaction, which has a target date of July 12, 2019, is subject to customary conditions, including regulatory approval and approval by shareholders of Partnership.

The two institutions offer a diverse set of competencies that when combined, result in a stronger organization. Partnership has established itself as a leading provider of financial products and services in Ozaukee, Monroe, and Jefferson counties, resulting in a strong deposit base. This complements Bank First’s already strong customer relationships in Ozaukee County (as shown below) and allows those customers closer access to physical branch locations.

| DEPOSITS | BANK FIRST | PARTNERSHIP | LOANS | BANK FIRST | PARTNERSHIP | |||||||||||||

| Ozaukee County | $ | 27,317,900 | $ | 93,176,000 | Ozaukee County | $ | 118,737,847 | $ | 92,564,000 | |||||||||

| *Balances as of 12/31/18 | COMBINED: | $ | 120,493,900 | COMBINED: | $ | 211,301,847 | ||||||||||||

Through Bank First’s 30% ownership of Ansay & Associates (Ansay), Partnership’s customers will benefit from a closer connection to superior insurance and risk management solutions. Ansay’s headquarters is in Port Washington and they have a total of 22 offices located throughout the state of Wisconsin. They are the largest and fastest growing independent insurance agency in the state and are listed as one of the top 100 independent agencies in the nation.

Additionally, Partnership’s customers will benefit from Bank First’s 49.8% ownership of UFS, LLC, a company that provides data and technology services to 60 Midwest banks. Bank First’s relationship with UFS gives it the buying power of a large regional bank, creating opportunities to access the latest advancements in banking technology at a faster rate than its peers.

Another opportunity for the combined organization is to leverage Bank First’s sophisticated suite of treasury management products and services. The integration of Bank First’s treasury management services will add significant value for Partnership Bank customers.

| 12 |

“We are very excited to be uniting with Partnership Bank and increasing our footprint in Wisconsin,” stated Mike Molepske, President and Chief Executive Officer of Bank First. “With Partnership’s community involvement, strong deposit base, superior credit quality, and relationship model of banking, it was evident from the start this would be the perfect fit for both banks as well as their employees, customers, and shareholders. We look forward to our future together as a combined institution and the substantial impact we will have in the communities we serve.”

“Bank First is a Wisconsin-based homegrown community bank just like us. Our values, vision for building relationships and delivery of remarkable client service closely align,” stated David Braaten, President and Chief Executive Officer of Partnership Bank. “Merging with Bank First provides us additional strength and resources for growth in our markets and the ability to efficiently deliver innovative products and services to our clients.”

Sandler O'Neill + Partners, L.P. served as financial advisor to Bank First and Alston & Bird LLP served as legal counsel. Piper Jaffray & Co. served as financial advisor to Partnership and Godfrey & Kahn S.C. served as legal counsel.

Bank First National Corporation

Bank First National Corporation is a bank holding company headquartered in Manitowoc, Wisconsin with total assets of approximately $1.8 billion. Its principal activity is the ownership and operation of Bank First, a nationally-chartered community bank that operates 18 branches in Wisconsin. The bank’s history dates back to 1894 when it was founded as the Bank of Manitowoc. For more information on Bank First, please visitwww.bankfirstwi.bank.

Partnership Community Bancshares, Inc.

Partnership Community Bancshares, Inc., is a bank holding company headquartered in Cedarburg, Wisconsin with total assets of $307 million. Its principal activity is the ownership and operation of Partnership Bank, a community bank that operates 4 branches in Wisconsin. For more information on Partnership, please visitwww.mypartnershipbank.com.

| 13 |

Forward-Looking Statements

This news release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward-looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the Merger, the expected returns and other benefits of the Merger, to shareholders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on Bank First’s capital ratios. Forward-looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger with customers, suppliers, employee or other business partners relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (4) the risk of successful integration of Partnership’s business into Bank First, (5) the failure to obtain the necessary approval by the shareholders of Partnership, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7) the ability by Bank First to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing of the Merger, (10) the risk that the integration of Partnership’s operations into the operations of Bank First will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by Bank First’s issuance of additional shares of its common stock in the Merger transaction, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Bank First’s Registration Statement on Form 10 filed with the Securities and Exchange Commission (the “SEC”) on October 17, 2018 and other documents subsequently filed by Bank First with the SEC. Consequently, no forward-looking statement can be guaranteed. Neither Bank First nor Partnership undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For any forward-looking statements made in this news release or any related documents, Bank First and Partnership claim protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Additional Information about the Merger and Where to Find It

In connection with the proposed Merger, Bank First will file with SEC a registration statement on Form S-4 that will include a proxy statement of Partnership and a prospectus of Bank First, as well as other relevant documents concerning the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BANK FIRST, PARTNERSHIP AND THE PROPOSED MERGER. The proxy statement/prospectus will be sent to the shareholders of Partnership seeking the required shareholder approval. Investors and security holders will be able to obtain free copies of the registration statement on Form S-4 and the related proxy statement/prospectus, when filed, as well as other documents filed with the SEC by Bank First through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by Bank First will also be available free of charge by directing a written request to Bank First National Corporation, P.O. Box 10, Manitowoc, Wisconsin 54221-0010, Attn: Kelly Dvorak. Bank First’s telephone number is (920) 652-3100.

| 14 |

Participants in the Transaction

Bank First, Partnership and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Partnership in connection with the proposed transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about Bank First and its directors and officers may be found in Bank First’s Registration Statement on Form 10 filed with the SEC on October 17, 2018.

Contacts

For Bank First: Mike Molepske, CEO, at mmolepske@bankfirstwi.bank or (920) 652-3202

For Partnership: David Braaten, CEO, at braaten@mypartnershipbank.com or (262) 573-0670

COMBINED BRANCH LOCATIONS:

| 15 |

January 25, 2019

Dear Valued Customer,

As you may have heard, we are excited to announce Partnership Bank will soon become part of the Bank First family. On January 22, 2019, we formally agreed to merge with Bank First. This move will expand our bank footprint and make our bank stronger.

Why did Partnership Bank merge?

| · | Merging with a larger organization will ensure we have the resources required to meet the demands of a competitive market place and continue to deliver innovative products and services to our clients. |

Why did Partnership Bank choose Bank First?

| · | Bank First is a Wisconsin-based homegrown community bank just like us. |

| · | Our values, vision for building relationships and delivery of remarkable client service closely align. |

| · | They value their employees as much as we value ours. They are committed to excellence and believe in helping their employees grow and reach their fullest potential. |

| · | Through Bank First’s 30% ownership of Ansay & Associates (Ansay), Partnership’s customers will benefit from a closer connection to superior insurance and risk management solutions. Ansay’s headquarters is in Port Washington and they have a total of 22 offices located throughout the state of Wisconsin. They are the largest and fastest growing independent insurance agency in the state and are listed as one of the Top 100 Independent agencies in the nation. |

| · | Our clients will benefit from Bank First’s 49.8% ownership of UFS, LLC, a data processing company located in Grafton, WI. UFS provides data and technology services to 60 Midwest banks. Bank First’s ownership of UFS gives it the buying power of a large regional bank, creating opportunities to access the latest advancements in banking technology at a faster rate than our peers. In addition, some of Partnership Bank’s former associates from Ozaukee Bank have key positions at UFS helping us to feel confident in a smooth data processing conversion for our clients. |

| · | Another opportunity for the combined organization is to leverage Bank First’s sophisticated suite of treasury management products and services for our business clients. |

| · | Bank First will also be an excellent fit for our employees and the communities we serve. Bank First takes great pride in creating a culture that focuses on community involvement and encourages its employees to volunteer and give back in many ways. In 2018, Bank First contributed over $750,000 to more than 400 northeast Wisconsin community events and organizations. Employees donated over 11,600 hours of their time volunteering in 2018 as well. Additionally, Bank First has been recognized by American Banker as one of the “Best Banks to Work For”, which is awarded to the top 40 banks in the United States. These values and accomplishments align well with those of Partnership Bank who recently was awarded the Torch Award for Ethics from the Wisconsin Better Business Bureau. |

W61 N529 Washington Avenue, Cedarburg, WI 53012 • 262.377.3800

| Member FDIC |  |

| 16 |

Why did Bank First choose Partnership?

| · | The merger brings together two strong organizations focused on relationship banking. |

| · | The merger aligns with Bank First’s strategy to grow within specific markets in the state of Wisconsin. Partnership has established itself as a leading provider of financial products and services in Ozaukee, Monroe, and Jefferson counties, resulting in a strong deposit base. This complements Bank First’s already strong customer relationships in Ozaukee County (as shown below) and allows those customers closer access to physical branch locations. |

| DEPOSITS | BANK FIRST | PARTNERSHIP | LOANS | BANK FIRST | PARTNERSHIP | |||||||||||||

| Ozaukee County | $ | 27,317,900 | $ | 93,176,000 | Ozaukee County | $ | 118,737,847 | $ | 92,564,000 | |||||||||

| *Balances as of 12/31/18 | COMBINED: | $ | 120,493,000 | COMBINED: | $ | 211,301,847 | ||||||||||||

| · | Bank First currently services the needs of the $88.3 billion* agriculture market in the state of Wisconsin and Partnership Bank’s rural offices of Watertown and Tomah will strengthen their agricultural business. They look forward to bringing their agricultural products and services to those markets. *Source: https://www.farmflavor.com/wisconsin-agriculture/ |

What can you expect?

You can expect to see no change in the high-quality, personalized level of care and service you currently receive. The transaction has a target sale date of July 12, 2019. As the merger approaches, you can expect to receive communication regarding a suite of products and services that will be available to you.

We are confident the merger of Partnership Bank with Bank First will allow us to better meet the needs of the customers and communities we serve.

Sincerely,

|  |  |

| Vince Cameranesi | David Braaten | Dean Fitting |

| President & Chief Relationship Officer | CEO | Chairman |

| (262) 375-7100 | (262) 573-0670 | (262) 993-2233 |

W61 N529 Washington Avenue, Cedarburg, WI 53012 • 262.377.3800

| Member FDIC |  |

| 17 |

| New release |  |

P.O. Box 10, Manitowoc, WI 54221-0010

For further information, contact:

Shannon Klahn, Marketing Communications Officer

Phone: (920) 652-3118 sklahn@bankfirstwi.bank

FOR IMMEDIATE RELEASE

Bank First celebrates 125 years of relationship-based banking

MANITOWOC, Wis, / January 15, 2019 / — Bank First (NASDAQ: BFC), the subsidiary of Bank First National Corporation, is celebrating 125 years of relationship-based banking in Wisconsin. Headquartered, in Manitowoc, Wisconsin, Bank First was founded in 1894 with a capitalization of $50,000. The bank was located on the southwest corner of York and North 8th Streets in downtown Manitowoc.

Early Years

| The bank achieved great financial success during its first 33 years in business, and by 1927 it outgrew its original location. On August 20, 1927, Bank First moved from the southwest corner of North Eighth and York Streets to just across the street on the first floor of the Hotel Manitowoc building at the northwest corner of North Eighth and York Streets (known today as Dali’s Café). The new bank building had a state-of-the art security system and a very elaborate interior. The nameplate of the bank was centered above the entrance with a monogram in the center. The elaborate bank entrance is still visible from Eighth Street to this day. |

The original location of Bank First on the southwest corner of York and North 8th Streets in downtown Manitowoc. |

The next 45 years of Bank First’s history saw physical as well as monetary growth. In 1971, Bank First acquired the assets of the Francis Creek bank. The bank soon needed additional space at its headquarters to support its growth, and selected a new site in the 400 block of North Eighth Street in Manitowoc. The construction of the new bank with approximately 22,000 square feet of space began in August of 1973 and was completed in September 1974.

| 18 |

Strategic Growth

In 1983, Bank First’s Board of Directors appointed Thomas Bare to the role of President and Chief Executive Officer. During Mr. Bare’s 25-year tenure, Bank First grew from $75 million in assets to $794 million in assets. Additionally, Bank First engaged in a number of strategic acquisitions and de novo offices, growing from two to fifteen locations in northeastern Wisconsin. In 2001, under the leadership of Thomas Bare, Bank First expanded its offerings by purchasing the Vincent Group, an independent insurance agency in Manitowoc.

In 2008, Thomas Bare retired from his role as President, and the Board of Directors appointed Michael Molepske as his successor. Bank First’s Board of Directors recognized Mr. Molepske as a proven leader with remarkable vision and the ability to successfully execute the Bank’s strategic initiatives. The Board felt he was the right fit to grow the Bank and increase its footprint in Wisconsin. With Mr. Bare’s direction, Molepske assembled a team of bankers in 2006 and was responsible for opening the bank’s Sheboygan office in 2008. The office experienced tremendous success under his leadership, and it currently leads the organization in loan growth.

Under Molepske’s leadership, Bank First opened a new office in Valders and merged its St. Nazianz office into it. Additionally, after completing extensive remodels of its Mishicot and Custer Street offices, Bank First merged its Francis Creek and Newton offices into each, respectively. In 2015, Bank First constructed a new state-of-the-art facility in Two Rivers and relocated to 1703 Lake Street, overlooking beautiful Lake Michigan. Bank First also strategically combined its insurance subsidiary with A.N. Ansay & Associates, an independent insurance agency headquartered in Port Washington, in an effort to focus solely on its core banking business. In recent years, Bank First has expanded into new markets, including Appleton and Oshkosh.

In October 2017, Bank First closed on its merger with First National Bank of Waupaca, making it the third largest publicly traded bank headquartered in Wisconsin. This was the largest acquisition carried out by Bank First to date, increasing its asset size by approximately $500 million. With the addition of six new offices, Bank First’s customers gained access to an increased lending capacity, a wider range of products and services, an expanded branch network, and a larger team of bankers dedicated to providing superior financial solutions that are value driven.

Bank First Today

| Today, Bank First has assets in excess of $1.8 billion and operates out of 19 locations throughout Wisconsin. It has become one of the top performing financial institutions in the State of Wisconsin. Bank First attributes its success to attracting and retaining top talent who are committed to excellence and adhering to the principles of the bank’s promise:“We are a relationship-based community bank focused on providing innovative products and services that are value driven”. |

Today, Bank First’s offices feature a contemporary design and efficient use of space, allowing the bank to provide exceptional service in a more customer friendly environment. |

| 19 |

“As we prepare to celebrate our 125th anniversary in 2019, we would like to thank our wonderful employees, customers, shareholders, and communities we serve for the continued support over the years,”stated Mike Molepske, Chief Executive Officer of Bank First.“It is our mission to continually reinvest in the organization our founders created in 1894 and uphold their legacy of developing meaningful relationships with those in the community while delivering superior financial solutions.”

As Bank First looks to the future, it will continue to focus on its relationship-based model of community banking and expanding its reach throughout the State of Wisconsin. The bank will continue to expand through organic growth and in the form of de novo branches and strategic acquisitions in the coming years and is excited for the opportunity to provide superior products and services to a larger base.

Bank First looks forward to celebrating its milestone anniversary by hosting special events at each of their 19 offices throughout the year as well as offering special products and gifts as a thank you to the community for 125 years of support and patronage. For more information on these events, please visit their website:www.BankFirstWI.bank.

Attached:

| · | Timeline of Bank First |

| · | Leadership History of Bank First |

| · | Asset Growth of Bank First |

Bank First National Corporation (BFC) provides financial services through its subsidiary, Bank First N.A., which was incorporated in 1894. The Bank is an independent community bank with 18 banking locations in Manitowoc, Brown, Sheboygan, Outagamie, Winnebago, Waupaca and Barron counties. The Bank has grown through both acquisitions and de novo branch expansion. The Bank offers loan, deposit and treasury management products at each of its banking offices. Insurance services are available through our bond with Ansay & Associates, LLC. Trust, investment advisory and other financial services are offered through the Bank’s partnership with Legacy Private Trust, an alliance with Morgan Stanley and an affiliation with McKenzie Financial Services, LLC. The Bank is a co-owner of a data processing subsidiary, UFS, LLC, which provides data and technology services for over 50 Midwest banks. The company employs approximately 253 full-time equivalent staff and has assets of $1.74 billion as of September 30, 2018. Further information about Bank First National Corporation is available by clicking on the Investor Relations tab at www.bankfirstwi.bank.

| # # # | 20 |

| 21 |

Forward-Looking Statements

This information contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward-looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the Merger, the expected returns and other benefits of the Merger, to shareholders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on Bank First’s capital ratios. Forward-looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger with customers, suppliers, employee or other business partners relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (4) the risk of successful integration of Partnership’s business into Bank First, (5) the failure to obtain the necessary approval by the shareholders of Partnership, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7) the ability by Bank First to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing of the Merger, (10) the risk that the integration of Partnership’s operations into the operations of Bank First will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by Bank First’s issuance of additional shares of its common stock in the Merger transaction, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward-looking statements can be found in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Bank First’s Registration Statement on Form 10 filed with the Securities and Exchange Commission (the “SEC”) on October 17, 2018 and other documents subsequently filed by Bank First with the SEC. Consequently, no forward-looking statement can be guaranteed. Neither Bank First nor Partnership undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For any forward-looking statements made herein or any related documents, Bank First and Partnership claim protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Additional Information about the Merger and Where to Find It

In connection with the proposed Merger, Bank First will file with SEC a registration statement on Form S-4 that will include a proxy statement of Partnership and a prospectus of Bank First, as well as other relevant documents concerning the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BANK FIRST, PARTNERSHIP AND THE PROPOSED MERGER. The proxy statement/prospectus will be sent to the shareholders of Partnership seeking the required shareholder approval. Investors and security holders will be able to obtain free copies of the registration statement on Form S-4 and the related proxy statement/prospectus, when filed, as well as other documents filed with the SEC by Bank First through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by Bank First will also be available free of charge by directing a written request to Bank First National Corporation, P.O. Box 10, Manitowoc, Wisconsin 54221-0010, Attn: Kelly Dvorak. Bank First’s telephone number is (920) 652-3100.

Participants in the Transaction

Bank First, Partnership and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Partnership in connection with the proposed transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxystatement/prospectus regarding the proposed transaction when it becomes available. Additional information about Bank First and its directors and officers may be found in Bank First’s Registration Statement on Form 10 filed with the SEC on October 17, 2018.

| 22 |