Exhibit 99.1

SHAREHOLDER NEWS AUGUST 2019 Bank First announces corporate name change to Bank First Corporation On June 26, 2019, Bank First announced its corporate name has been changed from Bank First National Corporation to Bank First Corporation. Shareholders approved the name change at the company’s Annual Meeting of the Shareholders on June 10, 2019. The company’s board of directors and management team agreed the name change of the holding company will better align with the bank’s name, the company’s ticker symbol, and will be less confusing to customers and potential investors. Current shareholders do not need to take any action regarding their stock registration or dividends, nor will they need new stock certificates issued. BFC Stock Repurchase Program Bank First has a stock repurchase program under which the Corporation may repurchase shares of outstanding BFC stock. Please contact Mike Molepske at (920) 652-3202 or Bridget Bonde at (920) 652-3222 for further information. MESSAGE FROM THE CEO MIKE MOLEPSKE To our shareholders, Thus far, 2019 has been a very busy and productive year at Bank First as we have invested in our future and made significant progress on a number of our key strategic initiatives. During the remainder of the year, we will continue our efforts to grow the Bank, and work through the remaining asset quality issues that arose with our acquisition of First National Bank of Waupaca. First, we were excited to welcome the customers, shareholders and employees of Partnership Bank to Bank First on July 12th. Our two teams of engaged bankers worked seamlessly together, resulting in a smooth conversion. We are very proud of the way the staff at both institutions took personal ownership of the process, making the transition of Partnership Bank’s customers to Bank First as easy as possible. Partnership Bank’s philosophies on relationship banking and asset quality are closely aligned with those of Bank First. This allowed Bank First to realize improved efficiency and asset quality after acquiring Partnership Bank. Second, Bank First completed its data conversion to the new private cloud services offered by UFS, the Bank’s core data processing and fintech subsidiary. Prior to the data conversion, we had computer servers in each of our branches, which communicated to servers at our headquarters in Manitowoc, which then communicated to UFS in Grafton. This data structure required extensive maintenance, had numerous potential failure points and resulted in slow systems speeds during our busy times. The new computer system structure brings improved data security and allows us to more easily add improved customer solutions, such as Bank First’s new and highly automated online loan application system, which will be rolled out later this year. Lastly, Bank First relationship managers in our Western Region and our Special Assets Group continue to work through the large number of troubled loans we acquired with the Bank’s acquisition of First National Bank of Waupaca. From the month after the merger with Waupaca to June 30, 2019, the ratio of Classified Assets to Total Risk-Based Capital, at the Bank level, improved from 46.4% to 24.4%. We anticipate making further strides in working through the remaining troubled Waupaca related loans during the remainder of 2019. 2019 promises to be a transformational year for Bank First. We will continue to make investments in technology to better serve our customers; leverage our new offices in Cedarburg, Mequon, Tomah and Watertown for growth; and return our asset quality metrics to their strong historical levels. As we grow, it is imperative that we remain consistent with our promise – a strong customer focus, paired with innovative products and services that make banking easier, for both the customer and our employees. Sincerely, Michael B. Molepske, CEO and President (920) 652-3202 www.BankFirstWI.bank Ticker: BFC

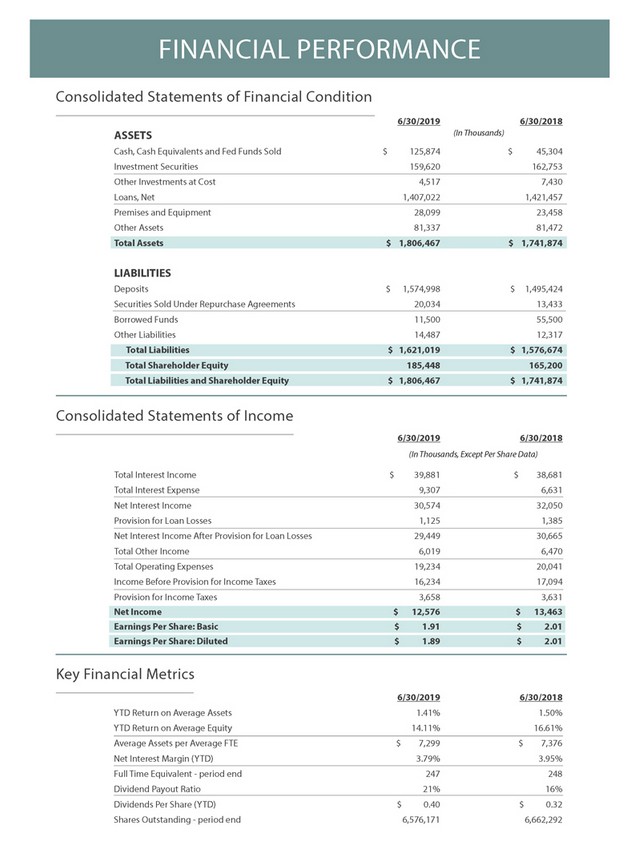

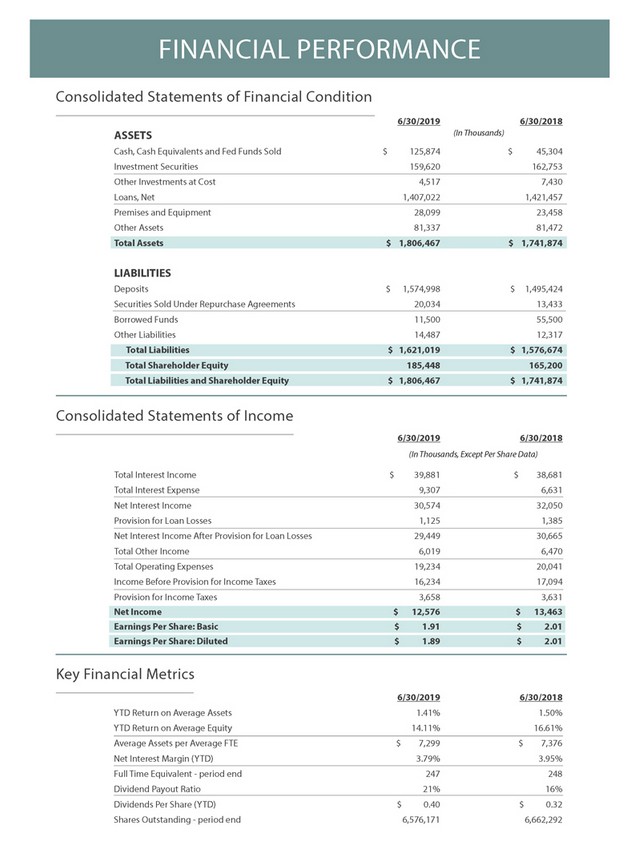

SECONDQUARTER QUARTER KEVIN LEMAHIEU Chief Financial Officer (920) 652-3362 Total assets for the Company increased by 3.7% to $1.81 billion at June 30, 2019, compared to $1.74 billion at June 30, 2018. Loans declined by $14.4 million, representing a 1.0% decline in loans year-over-year. This decline in loans was primarily due to the planned divestiture of certain loans in our western region, which were acquired near the end of 2017. We are nearly through the planned divestiture, and this headwind to loan growth should be complete by the end of 2019. Deposits increased by $79.5 million during this same period, or 5.3%. Growth in noninterest-bearing deposits totaled $71.0 million, or 17.3%, year-over-year. Earnings per share for the quarter ended June 30, 2019, was $0.91, compared to $0.96 per share for the second quarter of 2018. Accounting treatment of loans and deposits acquired near the end of 2017 led to a decline of $0.08 in earnings per share for the year-over-year second quarters, leaving an increase in earnings of $0.03 per share for the core operations of the Company. Net income was $6.0 million for the quarter ended June 30, 2019, compared to $6.4 million during the quarter ended June 30, 2018, once again negatively impacted by the accounting treatment of acquired loans and deposits. Net interest income decreased by $0.4 million to $15.4 million for the quarter ended June 30, 2019. Once again, this decline was due to the impact of the accounting for the purchased loans and deposits acquired near the end of 2017, which led to a decline in net interest income of $0.7 million for the year-over-year quarters. We recorded $0.5 million in provisions for loan losses during the quarter ended June 30, 2019, down from $0.9 million in the prior year quarter. Noninterest income totaled $2.7 million for the quarter ended June 30, 2019, compared to $3.0 million during the second quarter of 2018. The primary cause of the decline in noninterest income was a reduction of $0.4 million in income from loan servicing. Twice each year we have the value of our mortgage servicing rights revalued by a third-party. During the second quarter of 2018 this revaluation led to an increase of $0.4 million. The revaluation during the second quarter of 2019 did not support a similar upward valuation, leading to the negative year-over-year variance. Noninterest expense totaled $9.9 million for the quarter ended June 30, 2019, down from $10.1 million for the second quarter of 2018. Expenses related to the Company’s acquisition of Partnership Community Bancshares, Inc., which closed on July 12, 2019, totaled $0.5 million during the second quarter of 2019. Outside of this impact, noninterest expenses fell in line with our expectations and longer-term trends. Noninterest expense as a percentage of total gross revenue declined from 44.4% in the second quarter of 2018 to 41.9% during the second quarter of 2019, indicating that the Company experienced an improvement in efficiency of its operations year-over-year. Total shareholders’ equity increased by 12.3% to $185.4 million at June 30, 2019, compared to $165.2 million at June 30, 2018. Quarterly Common Stock Cash Dividend The Corporation’s Board of Directors approved a quarterly cash dividend of $0.20 per common share, payable on October 8, 2019, to shareholders of record as of September 24, 2019. Bank First Corporation announces board changes ROBERT WAGNER has retired from the Bank First Coporation board of directors. Wagner had been a Director of the Corporation and the Bank since 2017, where he most recently served on the Audit Committee, Executive Committee, and Governance & Nominating Committee. Mr. Wagner served on the board of directors of Waupaca Bancorporation from 2012 to 2017. Mr. Wagner formerly served as President of Weyauwega Milk Products and Chairman of the Board of Trega Foods, a leading cheese maker whose primary products include cheddar, mozzarella, provolone, and dairy ingredients. MARY-KAY BOURBULAS has joined the board of directors of the Corporation and the Bank. Ms. Bourbulas previously served on the board of directors of Partnership Community Bancshares, Inc. since 2013. She is co-owner, founder and manager of Handen Distillery, an award-winning grain-to-bottle craft distillery located in historic Cedarburg. Prior to Handen Distillery, she worked as an asset-based work-out consultant at Creekhouse Con-sulting, where she provided evaluations of secured assets and distressed loans. She also served as a municipal portfolio manager at Strong Capital Management, and established the firm’s municipal division. She earned a Bachelor of Arts degree in economics from Northwestern University. A leader in the community, Ms. Bourbulas is a member of the Cedarburg Junior Woman’s Club, former board member of the Cedarburg Community Foundation, a volunteer at the Cedarburg School District, and a supporter of St. Marcus School in Milwaukee.

FINANCIAL PERFORMANCE Consolidated Statements of Financial Condition 6/30/2019 6/30/2018 (In Thousands) ASSETS Cash, Cash Equivalents and Fed Funds Sold $125,874 $45,304 Investment Securities 159,620 162,753 Other Investments at Cost 4,517 7,430 Loans, Net 1,407,022 1,421,457 Premises and Equipment 28,099 23,458 Other Assets 81,337 81,472 Total Assets $1,806,467 $1,741,874 LIABILITIES Deposits $1,574,998 $1,495,424 Securities Sold Under Repurchase Agreements 20,034 13,433 Borrowed Funds 11,500 55,500 Other Liabilities 14,487 12,317 Total Liabilities $1,621,019 $1,576,674 Total Shareholder Equity 185,448 165,200 Total Liabilities and Shareholder Equity $1,806,467 $1,741,874 Consolidated Statements of Income 6/30/2019 6/30/2018 (In Thousands, Except Per Share Data) Total Interest Income $39,881 $38,681 Total Interest Expense 9,307 6,631 Net Interest Income 30,574 32,050 Provision for Loan Losses 1,125 1,385 Net Interest Income After Provision for Loan Losses 29,449 30,665 Total Other Income 6,019 6,470 Total Operating Expenses 19,234 20,041 Income Before Provision for Income Taxes 16,234 17,094 Provision for Income Taxes 3,658 3,631 Net Income $12,576 $13,463 Earnings Per Share: Basic $1.91 $2.01 Earnings Per Share: Diluted $1.89 $2.01 Key Financial Metrics 6/30/2019 6/30/2018 YTD Return on Average Assets 1.41% 1.50% YTD Return on Average Equity 14.11% 16.61% Average Assets per Average FTE $7,299 $7,376 Net Interest Margin (YTD) 3.79% 3.95% Full Time Equivalent - period end 247 248 Dividend Payout Ratio 21% 16% Dividends Per Share (YTD) $0.40 $0.32 Shares Outstanding - period end 6,576,171 6,662,292

Bank First announces new hires and promotions ROGER PILLSBURY has joined the bank as Senior Vice President Business Banking. Pillsbury joins Vince Cameranesi, Market President, and his team of bankers in the Mequon and Cedarburg markets. Pillsbury has over 35 years of experience developing and managing banking teams. Previously, he directed a team of commercial bankers at The Private Bank, now known as CIBC. He also served as SVP/Commercial Lending Division Head at LaSalle Bank, which is now part of Bank of America. In addition, Pillsbury led a team of business bankers at Associated Bank, where he served as President of Associated Bank in Sheboygan and Commercial Division Head in the Lakeshore and Milwaukee-area. MATT BOOKTER has joined the bank as Vice President Business Banking in our Green Bay market. Bookter has over 18 years of banking experience, most recently with Huntington National Bank where he excelled at managing business banking relationships, commercial loans and cash management in northeast Wisconsin and in the upper peninsula in Michigan. Bookter will be responsible for the growth and continued development of the bank’s Green Bay market. Bookter earned his Bachelor’s degree in Business and Communication at Lake Forest College in Lake Forest, Ill. MEGHANN KASPER has been promoted to Chief Credit Officer and has joined the Bank’s Senior Management Team. Kasper joined Bank First in 2010 and has over sixteen years of banking experience. Most recently, Meghann served as Senior Vice President & Market Manager of the bank’s Oshkosh territory, where she was responsible for developing new and enhancing existing business banking relationships. She was also heavily engaged in the growth and development of the bank’s future business bankers, business analysts, and commercial administrative assistants. In her new role, Kasper will be responsible for the overall management of the bank’s Credit Department, including overseeing the underwriting of all bank loans, providing direction on the bank’s loan policy, and implementing processes and procedures to ensure the bank’s lending portfolio remains in line with Bank First’s culture of superior credit quality. Kasper earned her Bachelor and Master of Business Administration degrees from the University of Wisconsin – Oshkosh. She then went on to attend the Graduate School of Banking at the University of Wisconsin – Madison. NANCY KOCH has been promoted to Assistant Branch Manager and Officer of the bank. Nancy joined Bank First in 1993 as a teller and since then, has evolved into a key member of the Bank First team. In her new role, Nancy will be responsible for the overall administration and efficiency of the daily operations of the bank’s 8th Street office in Manitowoc, including communication of the bank’s products and services, delivery of exceptional customer service, and assurance of the security and safety of the bank’s employees and customers. She is also actively engaged in promoting a strong sales and service culture at the bank through coaching, guidance, and motivating those around her to achieve excellence. GLENN CURRAN has been promoted to SVP Market Manager for the bank’s Oshkosh area market. Curran joined the bank in 2018 and has over 18 years of business banking experience. Curran earned his Bachelor of Business Administration degree in Finance and Marketing from the University of Wisconsin - Oshkosh. ELI STEIMLE has been promoted to Business Banking Representative at Bank First. Steimle joined the bank in 2010 as a youth apprentice on the teller line, performed an internship in the Treasury Management department, and recently worked as a business analyst at the bank. He received a Bachelor of Business Administration degree and a Master’s degree in Accounting from the University of Wisconsin – Madison. He is currently enrolled at Lakeland University where he is attending classes to receive his MBA. Steimle also has earned his CPA designation.