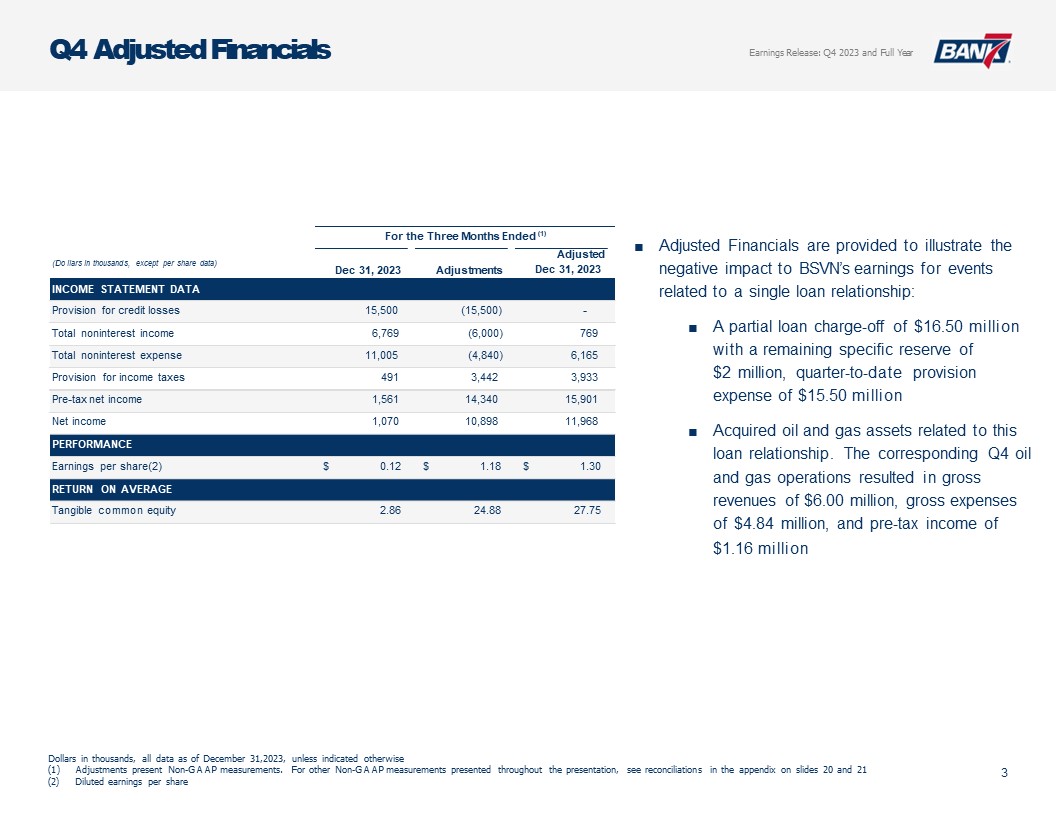

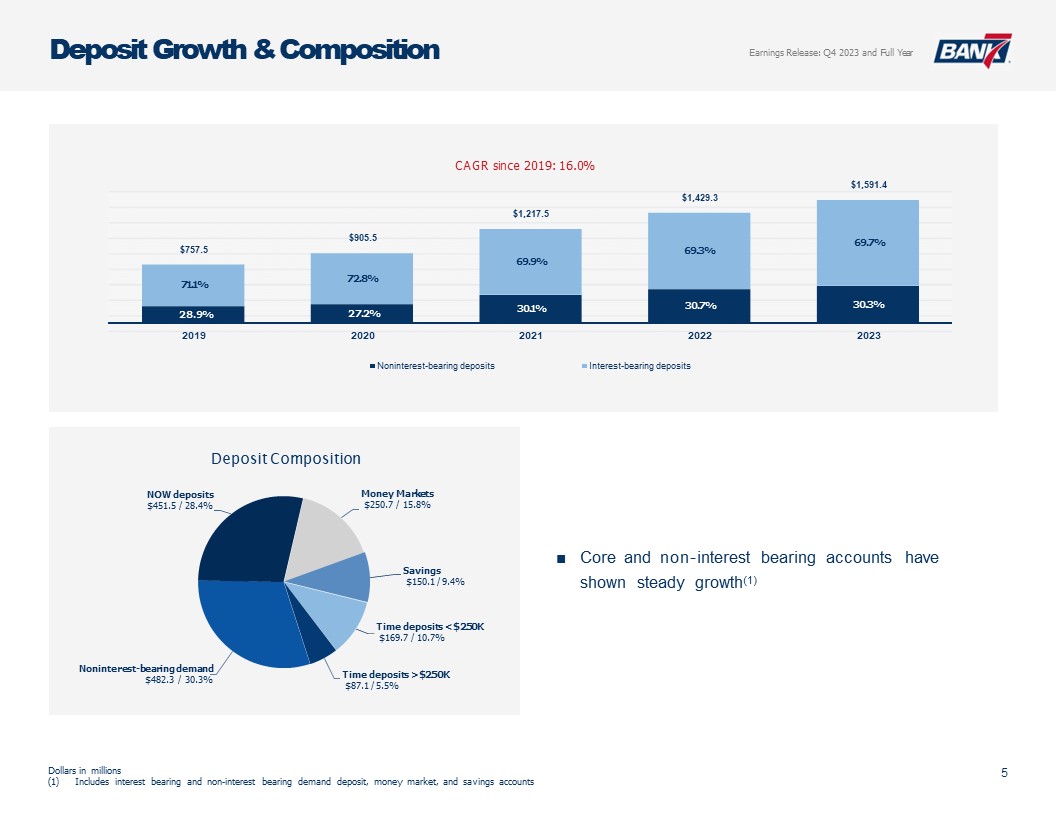

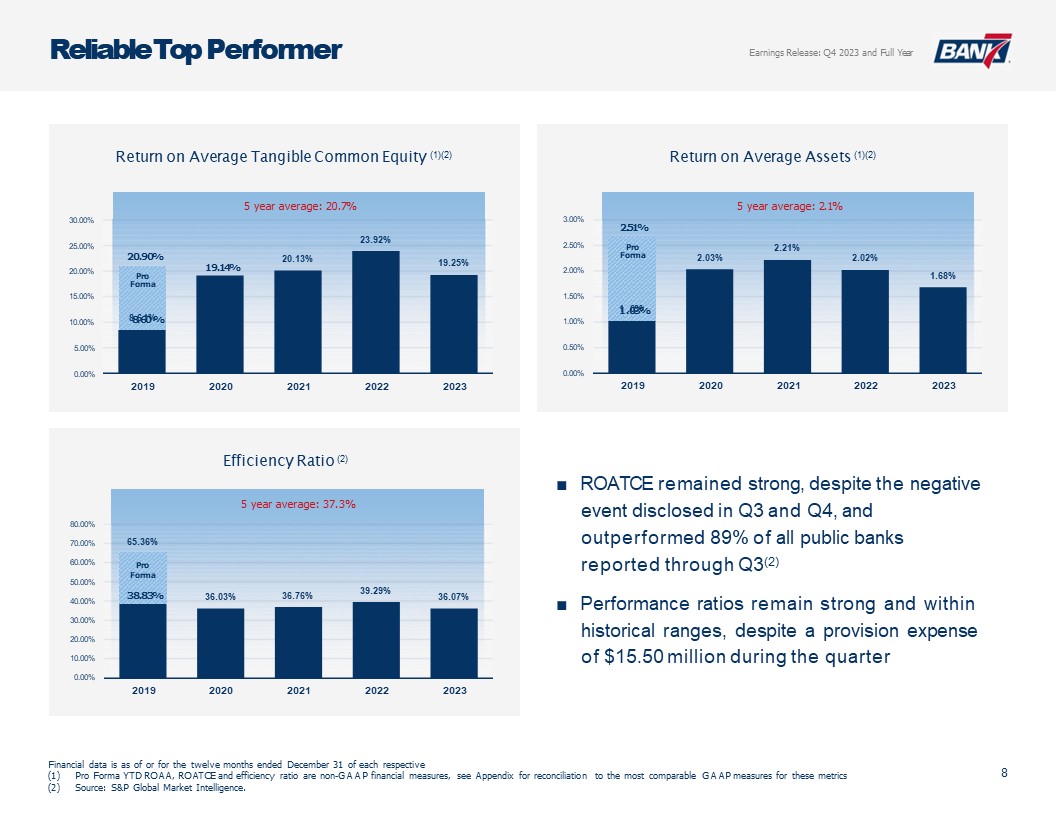

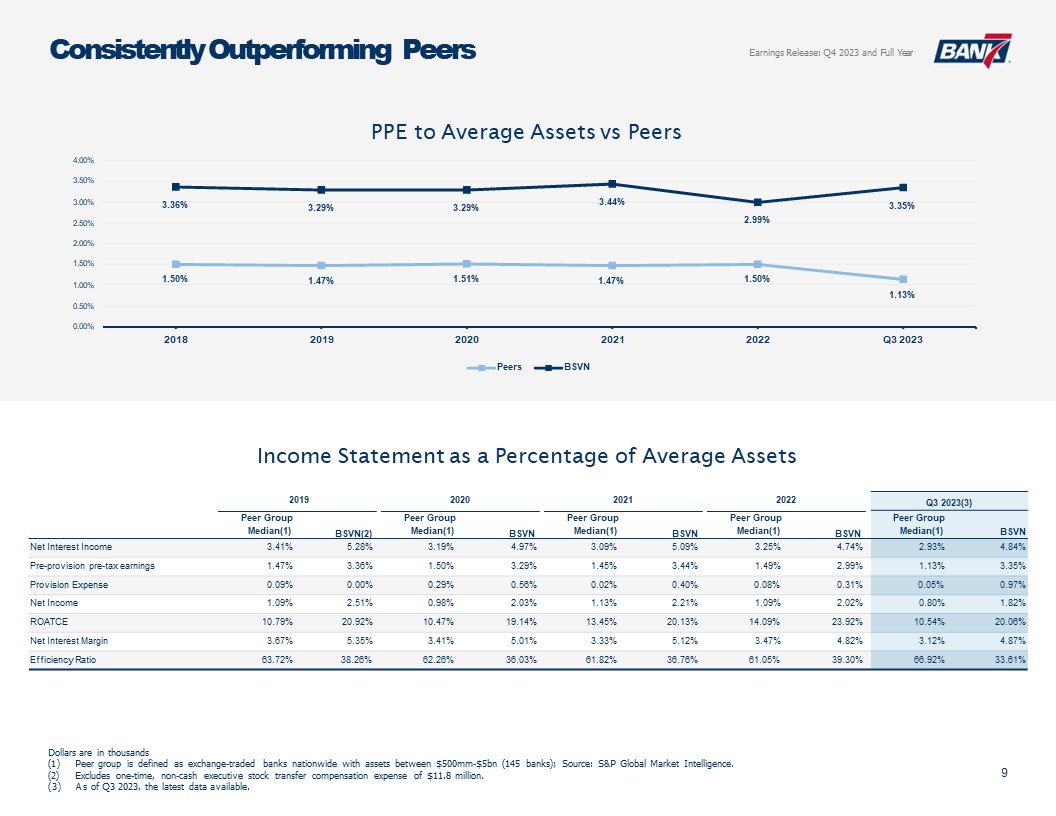

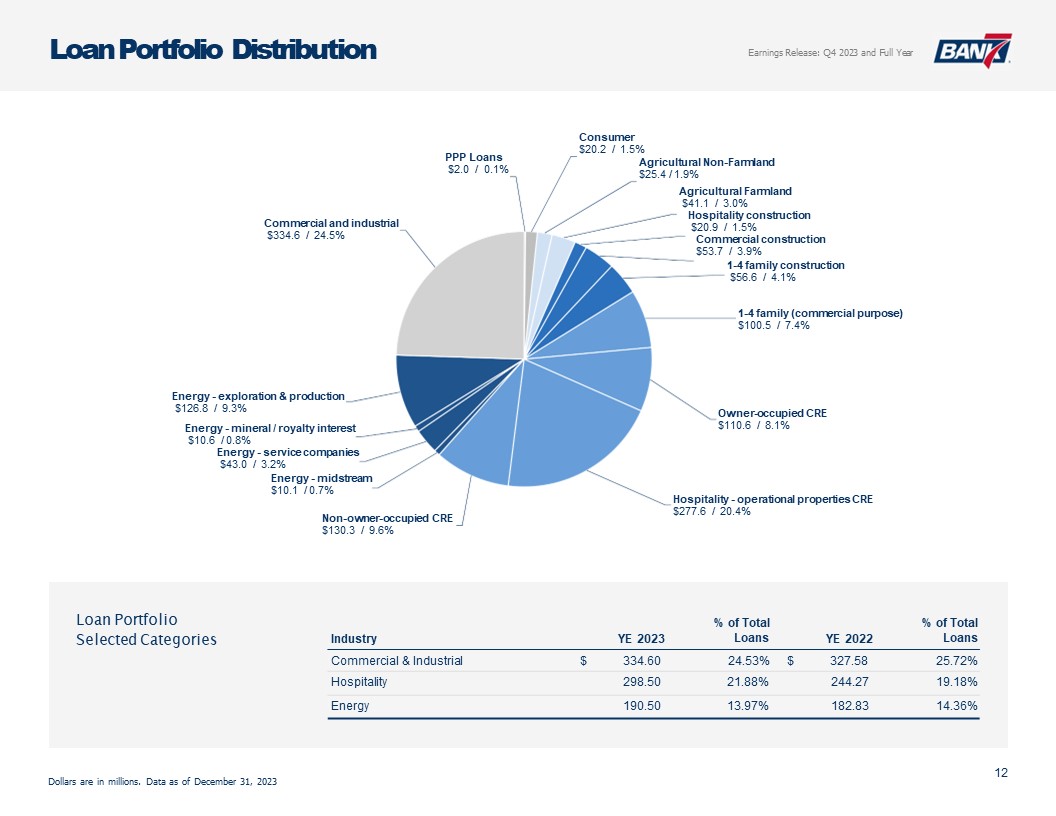

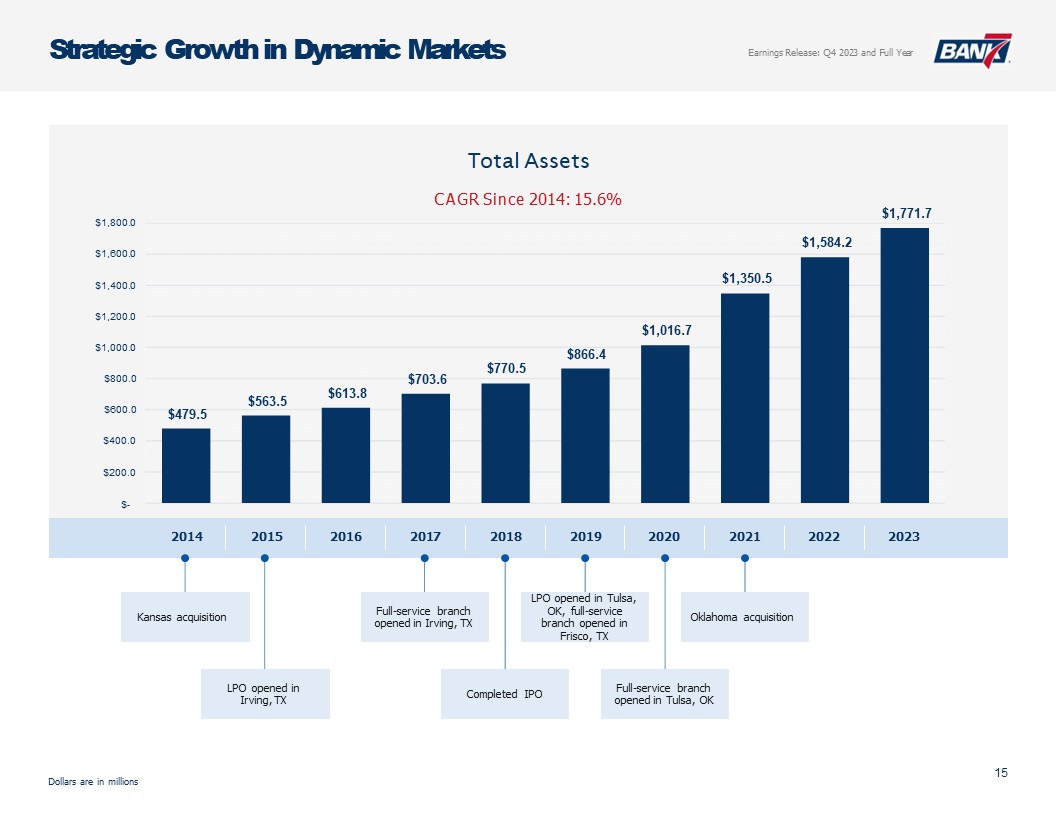

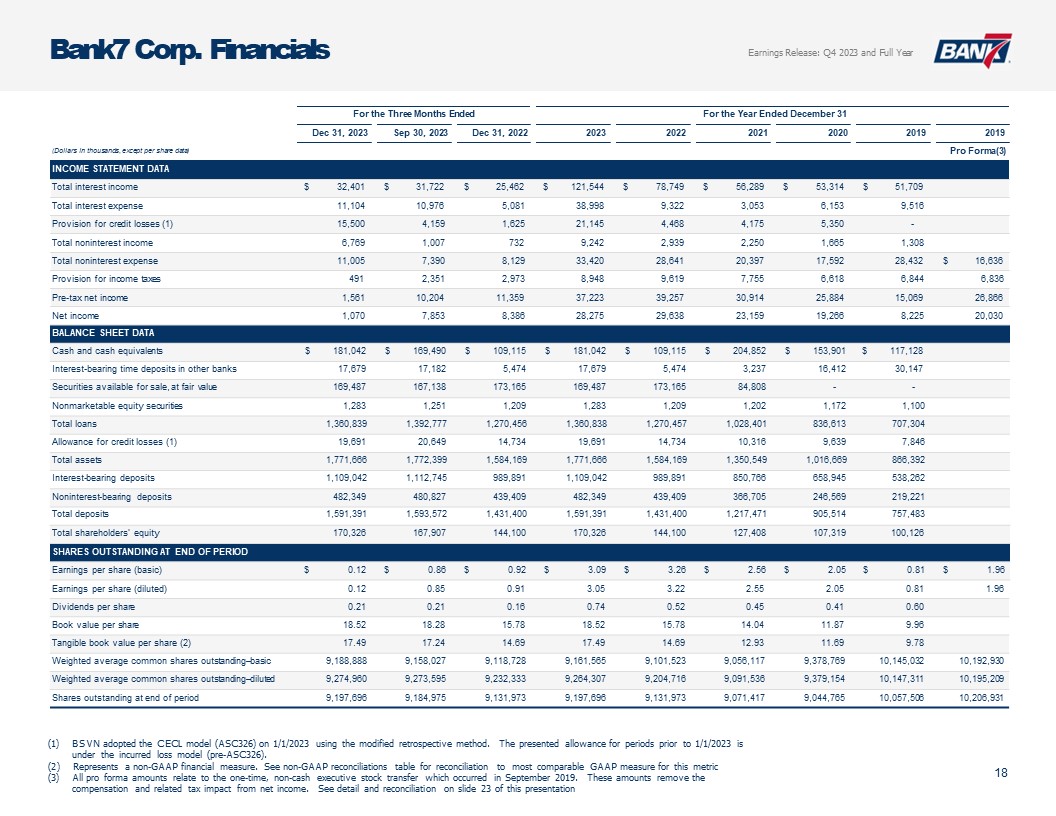

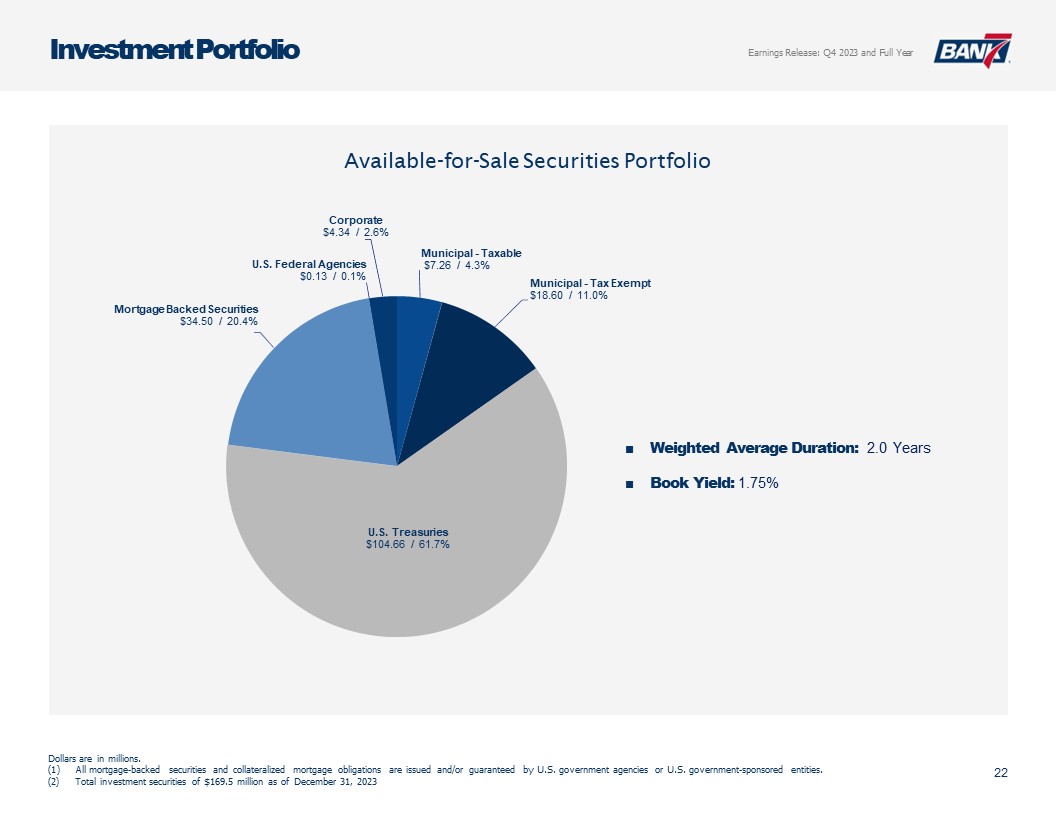

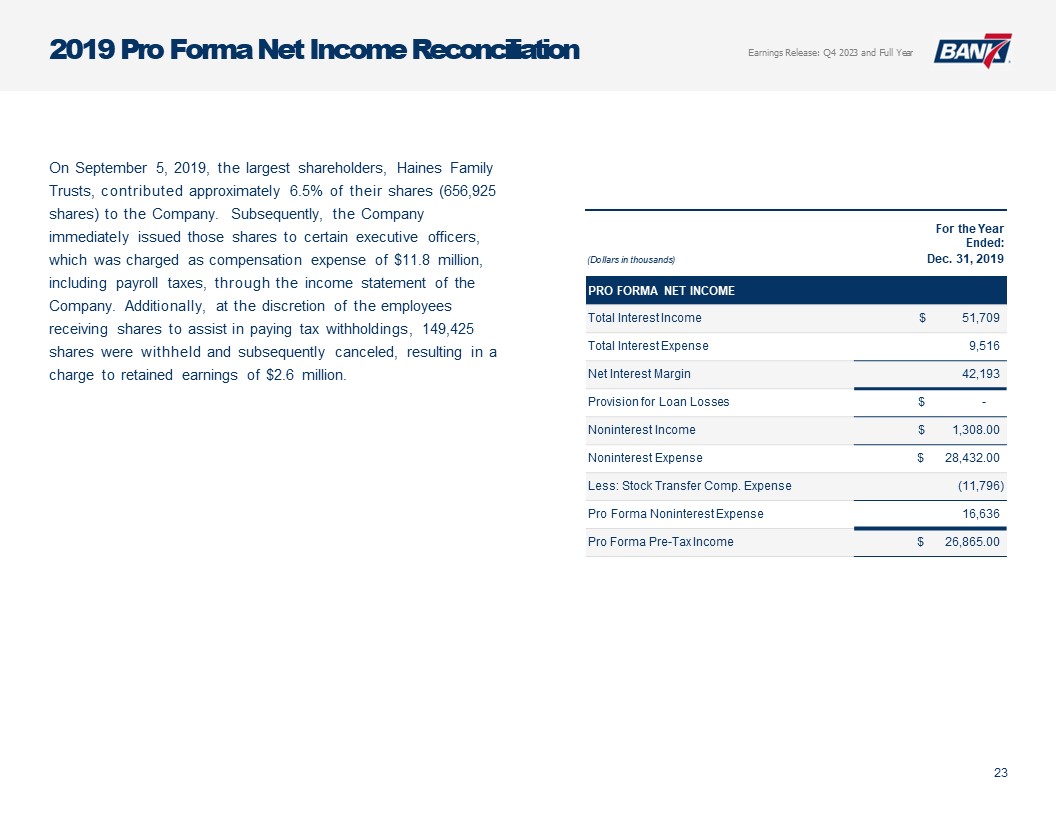

18 Earnings Release: Q4 2023 and Full Year Bank7 Corp. Financials BSVN adopted the CECL model (ASC326) on 1/1/2023 using the modified retrospective method. The presented allowance for periods prior to 1/1/2023 is under the incurred loss model (pre-ASC326). Represents a non-GAAP financial measure. See non-GAAP reconciliations table for reconciliation to most comparable GAAP measure for this metric All pro forma amounts relate to the one-time, non-cash executive stock transfer which occurred in September 2019. These amounts remove the compensation and related tax impact from net income. See detail and reconciliation on slide 23 of this presentation BALANCE SHEET DATA Cash and cash equivalents $ 181,042 $ 169,490 $ 109,115 $ 181,042 $ 109,115 $ 204,852 $ 153,901 $ 117,128 Interest-bearing time deposits in other banks 17,679 17,182 5,474 17,679 5,474 3,237 16,412 30,147 Securities available for sale, at fair value 169,487 167,138 173,165 169,487 173,165 84,808 - - Nonmarketable equity securities 1,283 1,251 1,209 1,283 1,209 1,202 1,172 1,100 Total loans 1,360,839 1,392,777 1,270,456 1,360,838 1,270,457 1,028,401 836,613 707,304 Allowance for credit losses (1) 19,691 20,649 14,734 19,691 14,734 10,316 9,639 7,846 Total assets 1,771,666 1,772,399 1,584,169 1,771,666 1,584,169 1,350,549 1,016,669 866,392 Interest-bearing deposits 1,109,042 1,112,745 989,891 1,109,042 989,891 850,766 658,945 538,262 Noninterest-bearing deposits 482,349 480,827 439,409 482,349 439,409 366,705 246,569 219,221 Total deposits 1,591,391 1,593,572 1,431,400 1,591,391 1,431,400 1,217,471 905,514 757,483 Total shareholders’ equity 170,326 167,907 144,100 170,326 144,100 127,408 107,319 100,126 SHARES OUTSTANDING AT END OF PERIOD Earnings per share (basic) $ 0.12 $ 0.86 $ 0.92 $ 3.09 $ 3.26 $ 2.56 $ 2.05 $ 0.81 $ 1.96 Earnings per share (diluted) 0.12 0.85 0.91 3.05 3.22 2.55 2.05 0.81 1.96 Dividends per share 0.21 0.21 0.16 0.74 0.52 0.45 0.41 0.60 Book value per share 18.52 18.28 15.78 18.52 15.78 14.04 11.87 9.96 Tangible book value per share (2) 17.49 17.24 14.69 17.49 14.69 12.93 11.69 9.78 Weighted average common shares outstanding–basic 9,188,888 9,158,027 9,118,728 9,161,565 9,101,523 9,056,117 9,378,769 10,145,032 10,192,930 Weighted average common shares outstanding–diluted 9,274,960 9,273,595 9,232,333 9,264,307 9,204,716 9,091,536 9,379,154 10,147,311 10,195,209 Shares outstanding at end of period 9,197,696 9,184,975 9,131,973 9,197,696 9,131,973 9,071,417 9,044,765 10,057,506 10,206,931 Dec 31, 2023 Sep 30, 2023 Dec 31, 2022 2023 2022 For the Year Ended December 31 2021 2020 2019 2019 (Dollars in thousands, except per share data) Pro Forma(3) INCOME STATEMENT DATA Total interest income $ 32,401 $ 31,722 $ 25,462 $ 121,544 $ 78,749 $ 56,289 $ 53,314 $ 51,709 Total interest expense 11,104 10,976 5,081 38,998 9,322 3,053 6,153 9,516 Provision for credit losses (1) 15,500 4,159 1,625 21,145 4,468 4,175 5,350 - Total noninterest income 6,769 1,007 732 9,242 2,939 2,250 1,665 1,308 Total noninterest expense 11,005 7,390 8,129 33,420 28,641 20,397 17,592 28,432 $ 16,636 Provision for income taxes 491 2,351 2,973 8,948 9,619 7,755 6,618 6,844 6,836 Pre-tax net income 1,561 10,204 11,359 37,223 39,257 30,914 25,884 15,069 26,866 Net income 1,070 7,853 8,386 28,275 29,638 23,159 19,266 8,225 20,030 For the Three Months Ended