Equillium & Ono Pharmaceutical Exclusive Option and Asset Purchase Agreement for the Development and Commercialization of Itolizumab 6 December 2022 Exhibit 99.2

Statements contained in this presentation regarding matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "anticipate", "believe", “could”, “continue”, "expect", "estimate", “may”, "plan", "outlook", “future” and "project" and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Because such statements are subject to risks and uncertainties, many of which are outside of the Company’s control, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to statements regarding the potential benefits and risks of the transactions contemplated by the option and asset purchase agreement entered into by the Company and Ono, including the possibility that Ono does not exercise the option, the Company receives no further payments under the option and asset purchase agreement other than those payable upon signing, the possibility that, if commercialized, itolizumab proves to be more valuable than contemplated by the option and asset purchase agreement, the fluctuation of the foreign exchange rate, the benefit of treating patients with aGVHD or lupus/lupus nephritis with itolizumab, the Company’s plans and expected timing for developing itolizumab including the expected timing of initiating, completing and announcing further results from the EQUATE, EQUIP, and EQUALISE studies, the Company’s plans and expected timing for developing EQ101 and EQ102 including the expected timing of initiating, completing and announcing further results from Phase 2 and Phase 1 studies, respectively, the potential for any of the Company’s ongoing or planned clinical studies to show safety or efficacy, the Company’s anticipated timing of regulatory review and feedback, the Company’s cash runway, and the Company’s plans and expected timing for developing its product candidates and potential benefits of its product candidates. Risks that contribute to the uncertain nature of the forward-looking statements include: uncertainties related to the abilities of the leadership team to perform as expected; the Company’s ability to execute its plans and strategies; risks related to performing clinical studies; the risk that interim results of a clinical study do not necessarily predict final results and that one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data, and as more patient data become available; potential delays in the commencement, enrollment and completion of clinical studies and the reporting of data therefrom; the risk that studies will not be completed as planned; the Company’s plans and product development, including the initiation and completion of clinical studies and the reporting of data therefrom; whether the results from clinical studies will validate and support the safety and efficacy of the Company’s product candidates; risks related to Ono’s financial condition, willingness to continue to fund the development of itolizumab, and decision to exercise its option to purchase itolizumab or terminate the option and asset purchase agreement; changes in the competitive landscape; uncertainties related to the Company’s capital requirements; and having to use cash in ways or on timing other than expected and the impact of market volatility on cash reserves. These and other risks and uncertainties are described more fully under the caption "Risk Factors" and elsewhere in the Company’s filings and reports, which may be accessed for free by visiting EDGAR on the SEC web site at http://www.sec.gov and on the Company’s website under the heading “Investors.” Investors should take such risks into account and should not rely on forward-looking statements when making investment decisions. All forward-looking statements contained in this Current Report on Form 8-K speak only as of the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made. Forward-Looking Statements

Additional Information Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger or otherwise. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. In connection with Metacrine, Inc.’s pending acquisition by Equillium, Inc., Equillium filed a registration statement on Form S-4 (File No. 333-268024) containing a joint proxy statement/prospectus of Equillium and Metacrine and other documents concerning the proposed merger with the Securities and Exchange Commission (the “SEC”). EQUILLIUM URGES INVESTORS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND THESE OTHER MATERIALS CAREFULLY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT EQUILLIUM, METACRINE AND THE PROPOSED MERGER. Investors may obtain free copies of the joint proxy statement/prospectus and other documents filed by Equillium and Metacrine with the SEC at the SEC’s website at www.sec.gov. Free copies of the joint proxy statement/prospectus and Equillium’s other SEC filings are also available on Equillium’s website at www.equilliumbio.com. Equillium, Metacrine and their respective directors, executive officers, certain members of management and certain employees may be deemed, under SEC rules, to be participants in the solicitation of proxies with respect to the proposed merger. Information regarding Equillium’s officers and directors is included in Equillium’s Definitive Proxy Statement on Schedule 14A filed with the SEC on April 13, 2022 with respect to its 2022 Annual Meeting of Stockholders. Information regarding Metacrine’s officers and directors is included in Metacrine’s Definitive Proxy Statement on Schedule 14A filed with the SEC on April 7, 2022 with respect to its 2022 Annual Meeting of Stockholders. This document is available free of charge at the SEC’s website at www.sec.gov or by going to Metacrine’s Investors page on its corporate website at www.metacrine.com.This document is available free of charge at the SEC’s website at www.sec.gov or by going to Equillium’s Investors page on its corporate website at www.equilliumbio.com. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed Merger, and a description of their direct and indirect interests in the proposed Merger, which may differ from the interests of Equillium’s or Metacrine’s stockholders generally, will be set forth in the joint proxy statement/prospectus when it is filed with the SEC.

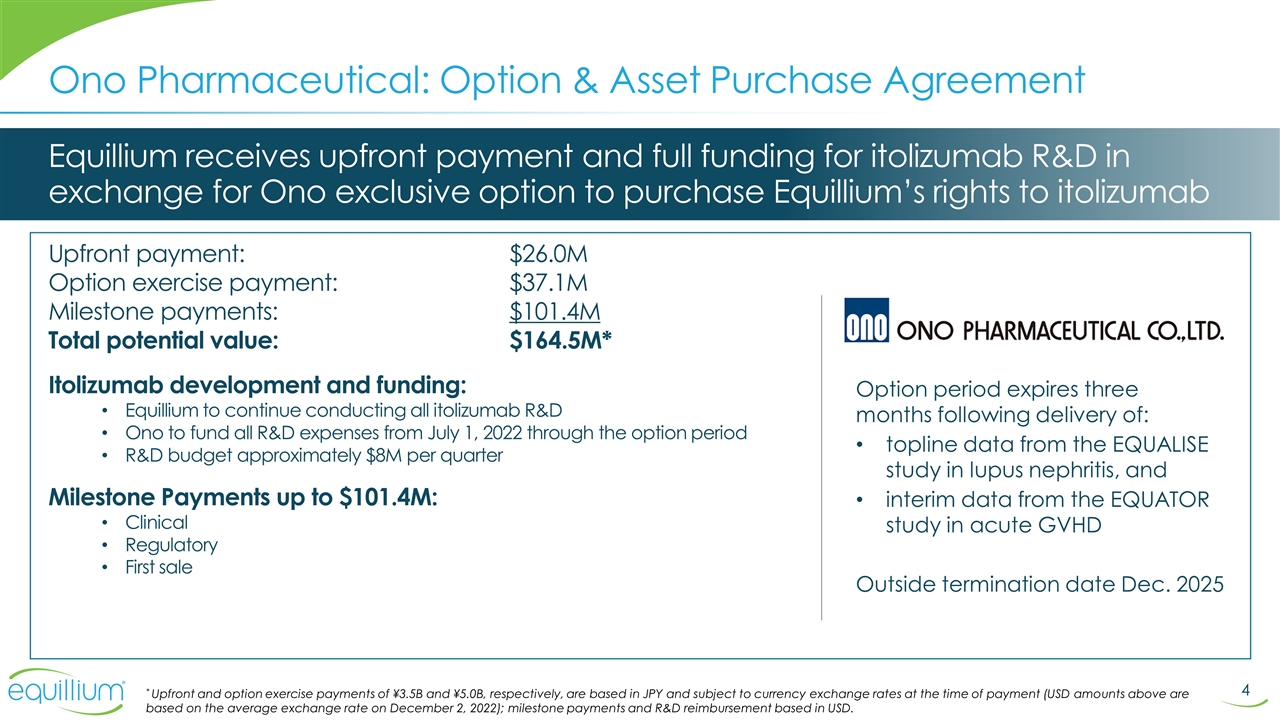

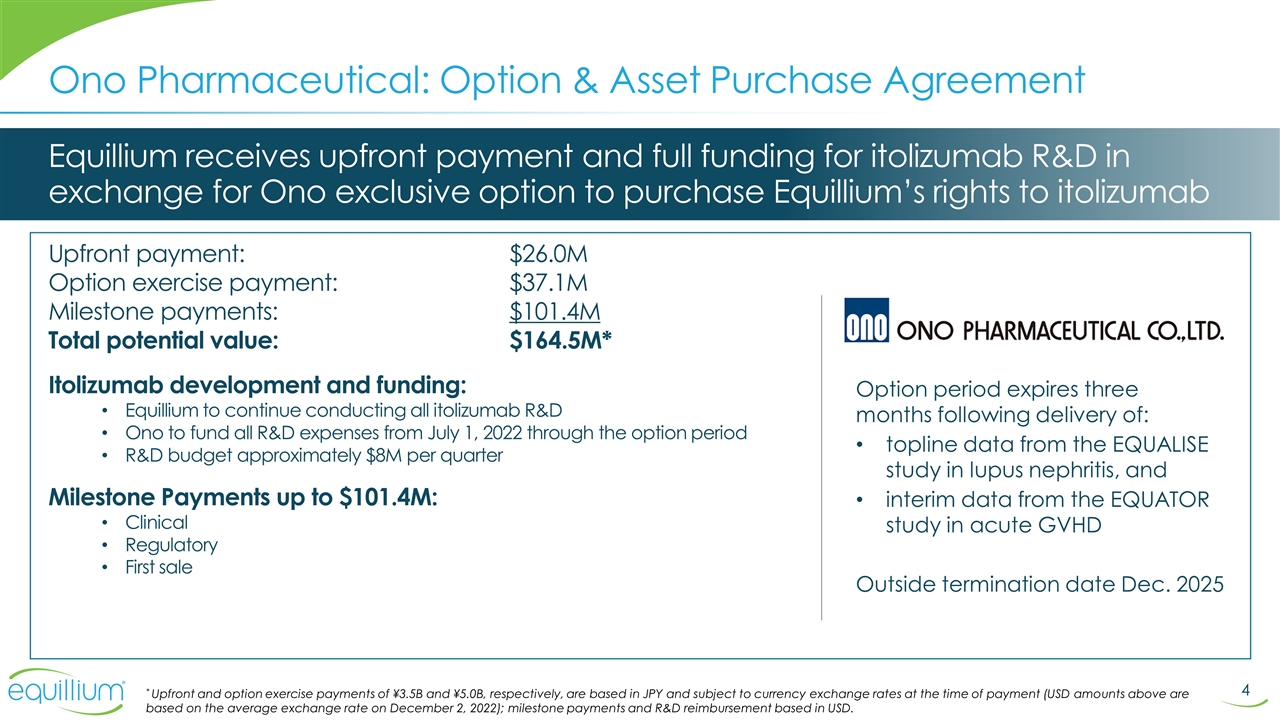

Ono Pharmaceutical: Option & Asset Purchase Agreement Equillium receives upfront payment and full funding for itolizumab R&D in exchange for Ono exclusive option to purchase Equillium’s rights to itolizumab Option period expires three months following delivery of: topline data from the EQUALISE study in lupus nephritis, and interim data from the EQUATOR study in acute GVHD Outside termination date Dec. 2025 Upfront payment: $26.0M Option exercise payment:$37.1M Milestone payments:$101.4M Total potential value:$164.5M* Itolizumab development and funding: Equillium to continue conducting all itolizumab R&D Ono to fund all R&D expenses from July 1, 2022 through the option period R&D budget approximately $8M per quarter Milestone Payments up to $101.4M: Clinical Regulatory First sale * Upfront and option exercise payments of ¥3.5B and ¥5.0B, respectively, are based in JPY and subject to currency exchange rates at the time of payment (USD amounts above are based on the average exchange rate on December 2, 2022); milestone payments and R&D reimbursement based in USD.

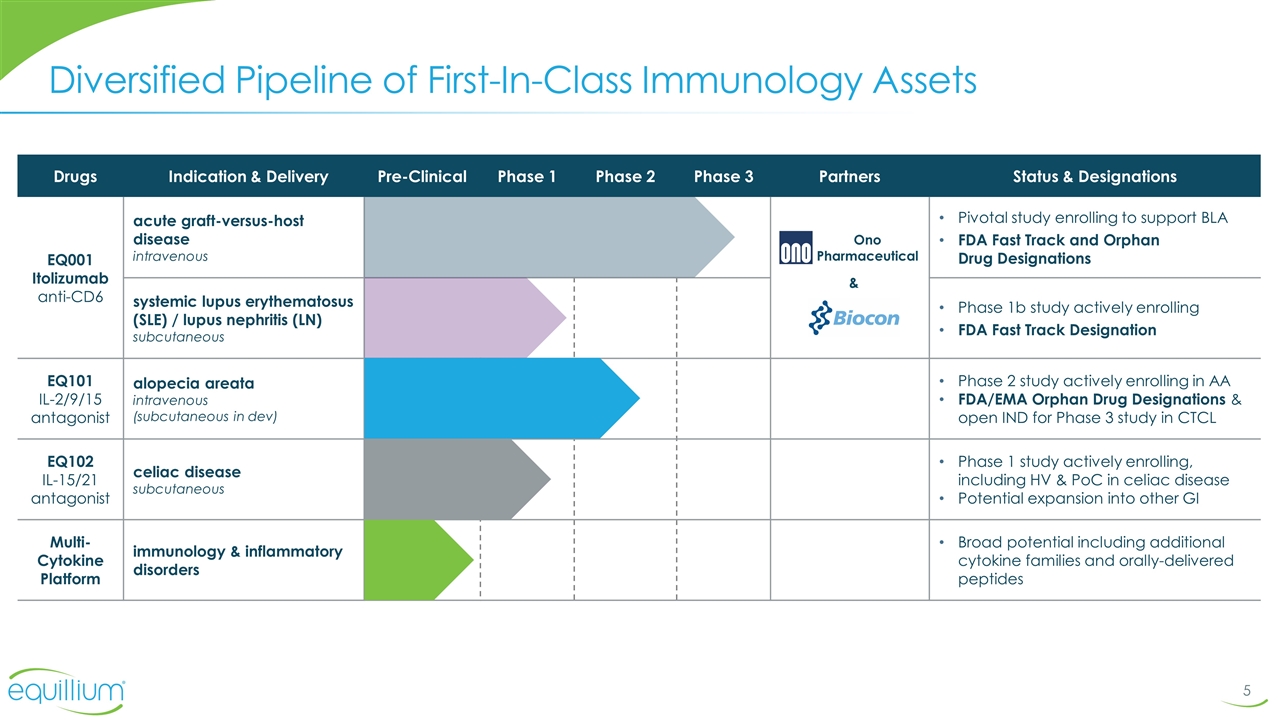

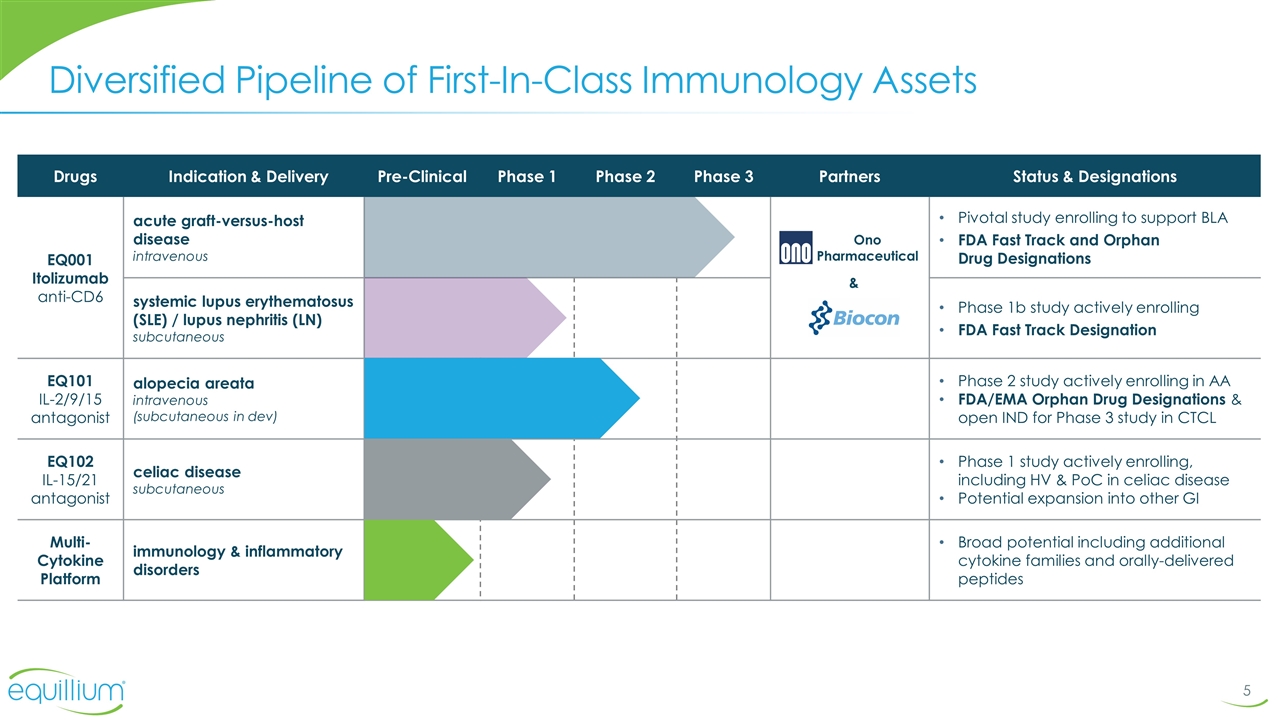

Diversified Pipeline of First-In-Class Immunology Assets Drugs Indication & Delivery Pre-Clinical Phase 1 Phase 2 Phase 3 Partners Status & Designations EQ001 Itolizumab anti-CD6 acute graft-versus-host disease intravenous Pivotal study enrolling to support BLA FDA Fast Track and Orphan Drug Designations systemic lupus erythematosus (SLE) / lupus nephritis (LN) subcutaneous Phase 1b study actively enrolling FDA Fast Track Designation EQ101 IL-2/9/15 antagonist alopecia areata intravenous (subcutaneous in dev) Phase 2 study actively enrolling in AA FDA/EMA Orphan Drug Designations & open IND for Phase 3 study in CTCL EQ102 IL-15/21 antagonist celiac disease subcutaneous Phase 1 study actively enrolling, including HV & PoC in celiac disease Potential expansion into other GI Multi-Cytokine Platform immunology & inflammatory disorders Broad potential including additional cytokine families and orally-delivered peptides Ono Pharmaceutical &

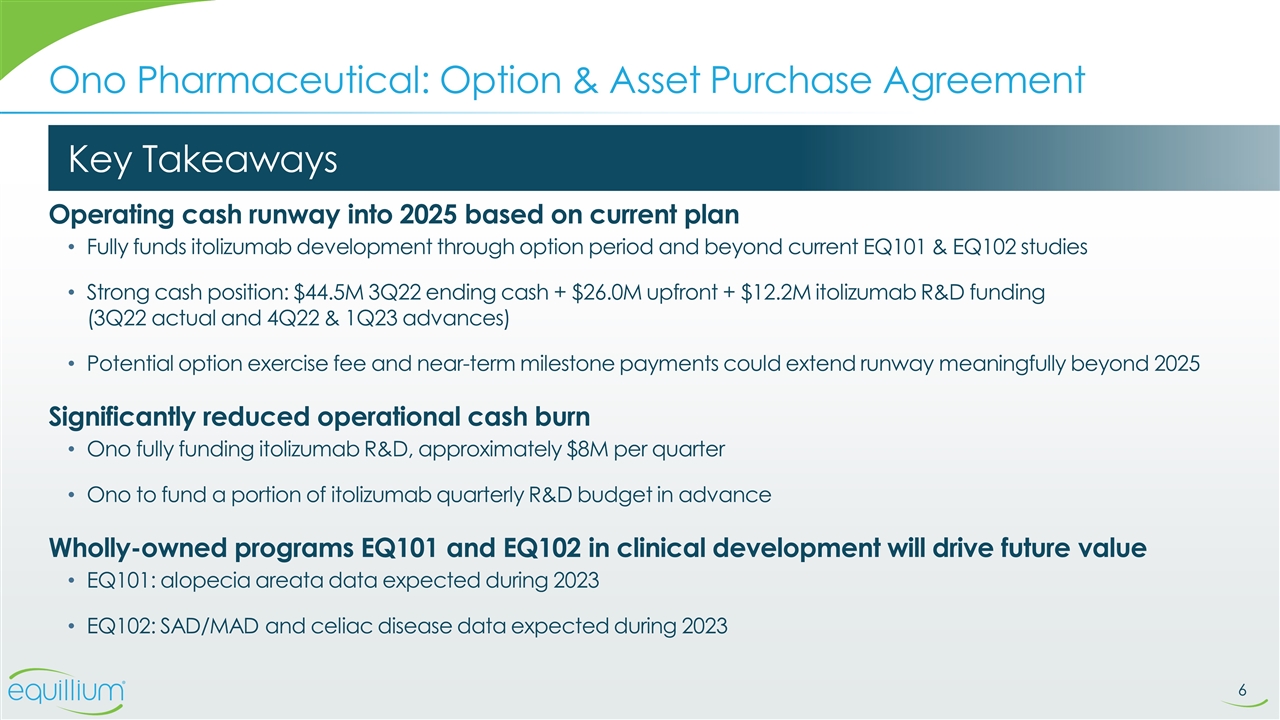

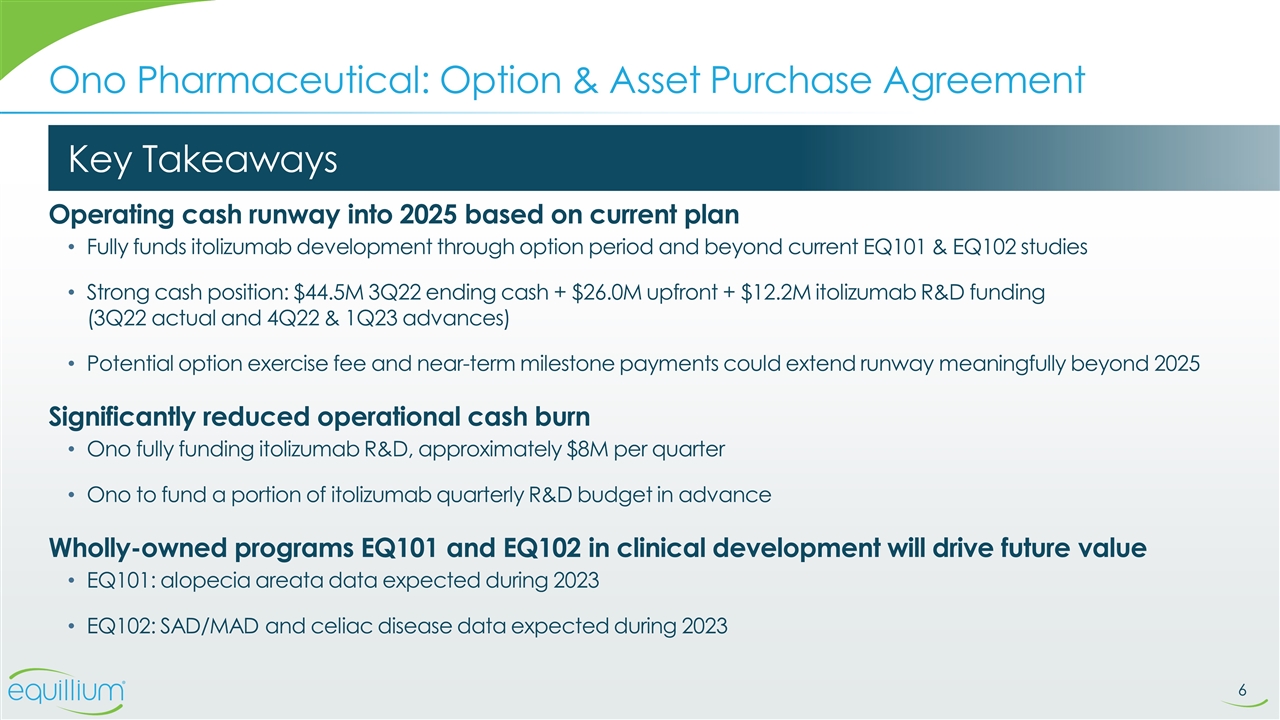

Operating cash runway into 2025 based on current plan Fully funds itolizumab development through option period and beyond current EQ101 & EQ102 studies Strong cash position: $44.5M 3Q22 ending cash + $26.0M upfront + $12.2M itolizumab R&D funding (3Q22 actual and 4Q22 & 1Q23 advances) Potential option exercise fee and near-term milestone payments could extend runway meaningfully beyond 2025 Significantly reduced operational cash burn Ono fully funding itolizumab R&D, approximately $8M per quarter Ono to fund a portion of itolizumab quarterly R&D budget in advance Wholly-owned programs EQ101 and EQ102 in clinical development will drive future value EQ101: alopecia areata data expected during 2023 EQ102: SAD/MAD and celiac disease data expected during 2023 Ono Pharmaceutical: Option & Asset Purchase Agreement Key Takeaways

Thank you www.equilliumbio.com