Table of Contents

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR

December 18, 2018

Subject to Completion

RENTALIST, INC.

1 N. Church Street, 3rd Floor

West Chester, Pennsylvania 19380

(929) 273-1569

Rentalist.com

2,500,000 RNTL Tokens

$2.25 Per Token

Rentalist, Inc. (the “Company”) is a recently-formed Delaware corporation that operates a peer-to-peer digital platform that connects filmmakers with owners of filmmaking gear and equipment. The Company is offering platform users and investors (collectively referred to as our “Community”) the opportunity to purchase shares of our Class B Non-Voting Common Stock, par value $0.001 per share (each share, a “RNTL Token” or “Token”). We are offering a maximum of 2,500,000 RNTL Tokens at $2.25 per Token, on a best efforts basis, for an aggregate amount of $5,625,000 (the “Maximum Offering”), in a public offering pursuant to Regulation A, Tier 2 (the “Offering”). For a description of the RNTL Tokens, please see “The RNTL Tokens.” None of the Tokens offered are being sold by present security holders of the Company.

We expect to commence the Offering on or within two (2) calendar days after the date on which the offering statement of which this Offering Circular is a part (the “Offering Statement”) is qualified by the United States Securities and Exchange Commission (the “SEC”). The Offering will terminate on the earlier of (i) the date on which all of the RNTL Tokens offered have been issued or (ii) the close of business on the date three (3) years from the date the Offering Statement is qualified by the SEC, unless sooner terminated by the Company in its sole discretion (collectively, the “Termination Date”). We will hold closings upon the receipt of investors’ subscriptions and acceptance of such subscriptions by the Company. We will hold additional closings until the Termination Date. There is no aggregate minimum requirement for the Offering Statement to become effective; therefore, we reserve the right, subject to applicable securities laws, to begin applying the proceeds from the Offering towards our business strategy as more specifically set forth in this offering circular (“Offering Circular”).

Table of Contents

The shares of our Class B Non-Voting Common Stock initially will be non-certificated and recorded in book-entry form only. We intend to generate the shares in security token form utilizing blockchain technology after one or more SEC-approved marketplaces suitable for trading the RNTL Tokens have become operational.

Generally, no sale may be made to you in the Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to visit www.investor.gov.

THE RNTL TOKENS ARE SPECULATIVE SECURITIES. INVESTING IN THEM INVOLVES SIGNIFICANT RISKS. YOU SHOULD INVEST IN THEM ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 10.

This Offering Circular is following the Regulation A disclosure format of Part II of Form 1-A.

| | Price

to

Public | | Underwriting

Discounts and

Commissions (2) | | Proceeds

to

Issuer (3) | |

Per Token (1) | | $ | 2.25 | | $ | 0 | | $ | 2.25 | |

Total Maximum | | $ | 5,625,000 | | $ | 0 | | $ | 5,625,000 | |

(1) Please refer to the section entitled “The RNTL Tokens” for a description of the offered securities.

(2) The Tokens will be offered and sold directly by the Company and its officers and directors, who will not receive any compensation for such sales.

(3) Does not reflect deduction of expenses of the Offering. The Company estimates that it will incur approximately $300,000 in offering expenses. All offering expenses will be paid by the Company. See “Estimated Use of Proceeds.”

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

We are offering to sell, and seeking offers to buy, the Tokens only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of Tokens. Neither the delivery of this Offering Circular, nor any sale or delivery of Tokens shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

In this Offering Circular, unless the context indicates otherwise, (i) references to “we,” “us,” “our,” “Company,” and “Rentalist” refer to Rentalist, Inc., and (ii) references to “investor” or “you” refer to a purchaser or recipient of the Tokens pursuant to the Offering.

2

Table of Contents

STATEMENTS REGARDING FORWARD LOOKING INFORMATION

We make statements in this Offering Circular that are forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” and similar expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Offering Circular or in the information incorporated by reference into this Offering Circular.

The forward-looking statements included in this Offering Circular are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements.

Summary of Key Risk Factors

Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to the following. See “Risk Factors” on beginning page 10 for important additional information.

· | | our ability to raise and use the proceeds of the Offering in an efficient and effective manner; |

| | |

· | | our ability to attract and retain users to our platform; |

| | |

· | | our cash flows (or lack thereof) and operating performance; |

| | |

· | | changes in economic conditions generally and within our industry and affecting blockchain-based securities or trading; |

| | |

· | | industry, legal and regulatory changes, and government approvals, actions, and initiatives, including without limitation SEC regulations and interpretations, states, self-regulatory organizations such as FINRA, and taxing authorities; |

| | |

· | | the launch of venues for trading of token securities and increased market acceptance, trade volume and liquidity for Regulation A securities (including, but not limited to token securities); |

| | |

· | | our ability to compete effectively; |

| | |

· | | our ability to retain key employees and attract qualified personnel, upon whom the success of our business is highly dependent; and |

| | |

· | | other risks and uncertainties referred to under “Risk Factors.” |

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements in order to update our forward-looking statements beyond the date of this Offering Circular.

4

Table of Contents

OVERVIEW

This overview highlights material information regarding our business and the Offering. Because it is a summary, it may not contain all of the information that is important to you. To understand the Offering fully, you should read the entire Offering Circular carefully, including the “Risk Factors” section before making a decision to invest in our Tokens.

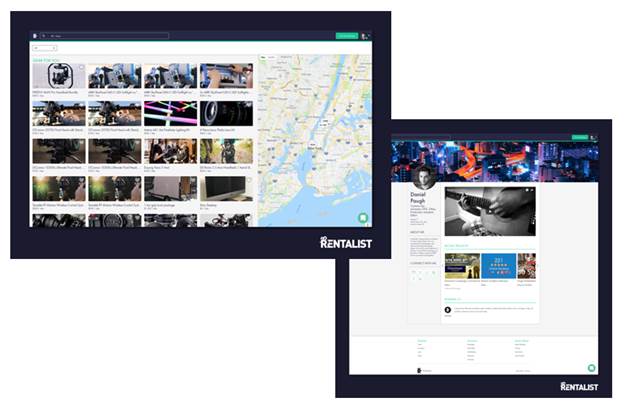

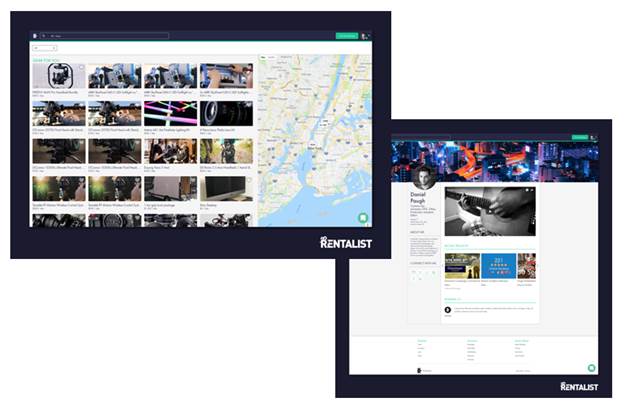

About Rentalist and the Rentalist Platform

Rentalist, Inc. is a newly organized Delaware corporation with its headquarters in West Chester, Pennsylvania (“Rentalist” or “Company”). Rentalist operates a peer-to-peer digital platform that connects filmmakers with owners of film-related gear and equipment, such as cameras, lenses, and lighting. Rentalist offers an easy-to-use interface for posting images and descriptions of gear, making it easier for creative filmmakers to find the right equipment and pay for it and easier for gear owners to securely rent out gear. Renters are screened prior to renting on the platform, and equipment rentals on the platform are protected by insurance. Rentalist utilizes a secure payment platform to process the rental transactions and collects a transaction fee for the transactions conducted on the platform.

Rentalist is part of the new decentralized entertainment industry. Historically, major movie studios, distributors, theater chains, and other gatekeepers have controlled the film industry, determining what films were made and where and when fans could see them. Recent advances in technology have disrupted the entire industry. Films are no longer digitally recorded and edited, no longer in need of raw film and splicing. Movies that were once only shipped to movie theaters in tins are now streaming on-demand. These shifts have enabled filmmakers to streamline distribution and connect directly with their fans. These developments have ushered in a new era for the film industry and substantial growth in independent filmmaking. The Rentalist platform provides a decentralized tool to serve a market we believe will continue to grow.

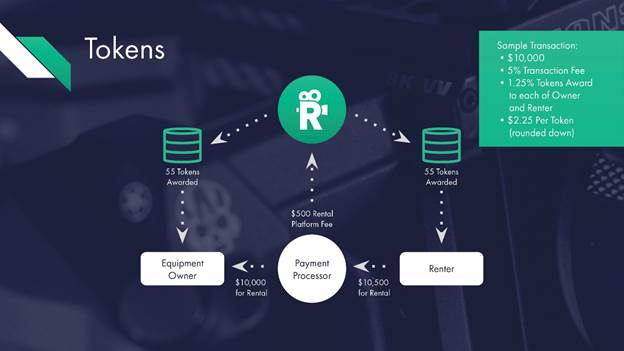

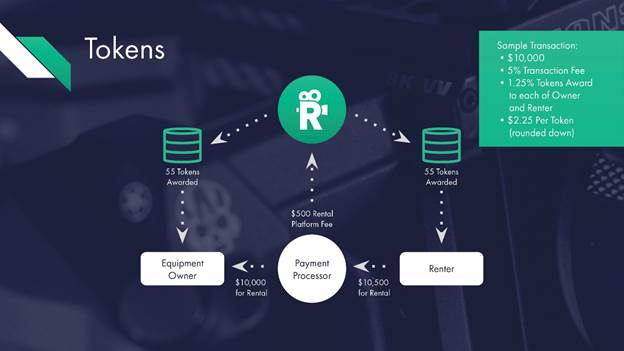

What makes Rentalist unique is that it rewards its users with equity ownership in the company through a return of a portion of rental transaction fees in the form of RNTL Tokens. As platform users help Rentalist grow and succeed, they receive equity shares of the company, and the opportunity to benefit from the profits and stock appreciation they help generate. We believe film community ownership is a key component, culturally and financially, of success in the modern independent film industry.

Rentalist was formed in 2018 by its parent company, Rentalist, LLC (the “Parent Company”) to provide a suitable corporate structure for a public offering. The Parent Company was formed in 2014. Prior to forming Rentalist, the Parent Company built out the platform, purchased equipment and began renting equipment out to generate revenue while preparing to launch the platform to the public. To form Rentalist, the Parent Company contributed all of its assets and liabilities to Rentalist in exchange for 2,000,000 shares of Class A Common Stock of Rentalist. Rentalist owns the platform, brand, and equipment. Rentalist launched the platform in August 2018.

The RNTL Tokens

Each RNTL Token is one share of Rentalist’s Class B Common Stock. The shares initially will be recorded in book-entry form. However, the RNTL Tokens are intended to be “security tokens” — stock that is generated and/or traded using blocking technology.

5

Table of Contents

We believe blockchain technology allows securities to be issued and traded more efficiently and with greater transparency and fewer intermediaries. However, there currently is no established secondary market for trading security tokens. FINRA-registered broker dealers are developing secondary markets utilizing different blockchain protocols, technology, and settlement procedures and, in some cases, focusing on particular industries, investor types, and markets, among other factors. After one or more such SEC-approved marketplaces suitable for trading in security tokens such as the RNTL Tokens become available, we intend to apply to have the RNTL Tokens listed or quoted for trading and generate the RNTL Tokens using blockchain technology. If or when the Tokens are issued using blockchain technology, all recorded issuances of the Tokens will be transferred to the chosen blockchain protocol, and future issuances will be recorded in the blockchain protocol as well. The use of a transfer agent along with the blockchain technology enables the Company to maintain a stock ledger. The RNTL Tokens will be freely tradeable, but a trade will not be valid until recorded by the registered transfer agent. The RNTL Tokens will be stored in a digital wallet, but a lost Token can be replaced by the Company. The RNTL Tokens are not a virtual currency or cryptocurrency; they will not be used to access or pay for transactions on the platform or elsewhere. The Tokens represent half of the equity ownership of the Company. They do not have full voting rights, but they do have the same economic rights as the Class A Common Stock, including the right to receive dividends if and when the Company declares dividends. See “Description of Capital Stock.”

The Offering

Through the Offering, Rentalist is raising capital to fund the Company’s growth, marketing, continuous improvement of the platform, hiring of personnel and contractors, and general operations. See “Estimated Use of Proceeds.” Consistent with the Rentalist culture, the Regulation A offering structure enables Rentalist to accept investments from platform users, independent film enthusiasts, and a wide range of investors, rather than conducting a private offering of restricted stock only to accredited investors. Rentalist expects to be 50% Community-owned once it distributes all of the authorized RNTL Tokens.

6

Table of Contents

THE OFFERING

Issuer | | Rentalist, Inc., a Delaware corporation |

Securities Offered | | RNTL Tokens (Class B Non-Voting Common Stock) |

Offering Amount | | 2,500,000 Tokens $5,625,000 Maximum Offering (no minimum) |

| | |

Price per Token | | $2.25 |

| | |

Offering Type | | Regulation A, Tier 2 (See “Plan of Distribution”) |

| | |

Minimum Investment | | 1,000 Tokens ($2,250) which may be waived at the discretion of the Company |

Closings | | After Qualification of this Offering Statement by the SEC, we will hold closings upon the receipt of investors’ subscriptions and acceptance of such subscriptions by the Company. We will hold additional closings until the Termination Date. There is no aggregate minimum requirement for the Offering. Subject to applicable securities laws, we will begin applying the proceeds from the Offering towards our business strategy as more specifically set forth in this Offering Circular upon each closing. Subscriptions may be revoked until the Offering Statement is qualified by the SEC and the subscription has been accepted by the Company. |

Limitations on Your Investment Amount | | Non-Accredited Investors Generally, no sale may be made to you in the Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d) (2)(i)(C) of Regulation A, which states: “In a Tier 2 offering of securities that are not listed on a registered national securities exchange upon qualification, unless the purchaser is either an accredited investor (as defined in Rule 501 (§230.501)) or the aggregate purchase price to be paid by the purchaser for the securities (including the actual or maximum estimated conversion, exercise, or exchange price for any underlying securities that have been qualified) is no more than ten percent (10%) of the greater of such purchaser’s: (1) Annual income or net worth if a natural person (with annual income and net worth for such natural person purchasers determined as provided in Rule 501 (§230.501)); or (2) Revenue or net assets for such purchaser’s most recently completed fiscal year end if a non-natural person.” Accredited Investors There is no limit to the amount of investment made by accredited investors. To be an accredited investor, an investor must meet one of the following: |

7

Table of Contents

| | (1) An individual who had income in excess of $200,000 in each of the two most recent years (or joint income with his or her spouse in excess of $300,000 in each of those years) and has a reasonable expectation of reaching the same income level in the coming year; (2) An individual who has a net worth (or joint net worth with his or her spouse) in excess of $1,000,000 (excluding the value of such individual’s primary residence); (3) An individual retirement account (“IRA”) or revocable trust and the individual who established the IRA or each grantor of the trust is an accredited investor based on (1) or (2) above; (4) A self-directed pension plan and the participant who directed that assets of his or her account be invested in the Company is an accredited investor on the basis of (1) or (2) above and such participant is the only participant whose account is being invested in the Company; (5) A pension plan which is not a self-directed plan and which has total assets in excess of $5,000,000; (6) An irrevocable trust which consists of a single trust (i) with total assets in excess of $5,000,000, (ii) which was not formed for the specific purpose of investing in the Company and (iii) whose purchase is directed by a person who has such knowledge and experience in financial and business matters that he or she is capable of evaluating the merits and risk of the prospective investment; (7) A corporation, partnership or a Massachusetts or similar business trust, that was not formed for the specific purpose of acquiring an interest in the Company, with total assets in excess of $5,000,000; or (8) An entity in which all of the equity owners are accredited investors. For general information on investing, we encourage you to visit www.investor.gov. |

| | |

Offering Proceeds | | All of the Offering proceeds will be proceeds of the Company. See “Estimated Use of Proceeds.” |

| | |

Transferability | | The RNTL Tokens are not restricted stock and may be transferred or sold without a holding period. |

| | |

Capitalization | | All shares have the same economic rights. Shares of Class B Common Stock are non-voting. The Company has authorized 5,000,000 shares of stock, of which 2,500,000 have been designated as Class A Common Stock and 2,500,000 shares have been designated as Class B Common Stock (RNTL Tokens). The Company has issued 2,000,000 shares of Class A Common Stock to its parent company, Rentalist, LLC, and reserved 500,000 shares for future issuance to advisors, contractors, and employees through the Company’s 2018 Equity Incentive Plan (the “Equity Incentive Plan”). The Company issued no Tokens prior to the Offering. |

| | |

Voting Rights | | Token holders do not have voting rights, except as provided in the Bylaws or under applicable law. |

8

Table of Contents

Risk Factors | | Our Tokens are speculative securities. Investing in them involves significant risks. You should invest in them only if you can afford a complete loss of your investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding whether to invest. |

Offering Termination | | The Offering will terminate on the first of: (i) the date on which all of the Tokens offered are sold; or (ii) the close of business three (3) years after the date that this Offering Circular is deemed qualified by the SEC, unless sooner terminated by the Company in its sole discretion (collectively, the “Termination Date”). |

| | |

How to Subscribe | | To subscribe to purchase RNTL Tokens, complete and execute the Subscription Agreement accompanying this Offering Circular and deliver it to Rentalist before the Termination Date, together with full payment. To subscribe to receive RNTL Token rewards for equipment rentals, a platform user must complete and execute a Subscription Agreement. The Company may reject subscriptions in its sole discretion, at any time prior to issuance of the subscribed Tokens. The Company will not accept or solicit any money or accept subscriptions until the Offering Statement is qualified by the SEC. |

9

Table of Contents

RISK FACTORS

Investors should carefully consider the risks described below before making an investment decision. For the reasons set forth below, and elsewhere in this Offering Circular, investing in the RNTL Tokens involves a high degree of risk. If any of the following risks actually occur, the Company’s business, financial condition or results of operation could be harmed, which could cause the value of the RNTL Tokens to decline and investors could potentially lose all or part of their investment. The risks and conflicts set forth below are not the only risks and conflicts involved in an investment in the Company. See also “Statements Regarding Forward-Looking Information.”

Risks Related to the Company

Because we are an early stage company, we have a very short operating history.

Rentalist was formed in 2018, and our Parent Company was formed in 2014 and commenced operations in September 2017. We launched the Rentalist platform to the public in August 2018. We are an early stage company, and we lack significant operating history. As a result, there can be no assurance that we will be able to execute our business plans as well or as quickly as desired.

We are not currently profitable and may never become profitable.

Our expenses currently exceed our revenues. We may continue to experience negative operating cash flow for some time, and we may never achieve or maintain profitability. Our expenses will increase as we pursue our business plans. Our failure to achieve or maintain profitability could negatively impact operations or the value of the Tokens.

The Rentalist platform may not be widely adopted and may have limited users.

Rentalist faces competition, and the platform may not be used by a large number of equipment owners and filmmakers. Such a lack of use or interest would negatively impact our financial results and Token value. Alternative platforms may be established that compete with or are more widely used than Rentalist.

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our audited financial statements for the year ended December 31, 2017, and for the period September 27, 2017 (commencement of operations) to December 31, 2017, were prepared under the assumption that we would continue our operations as a going concern. Our independent registered public accounting firm has included a “going concern” disclosure in its report on our financial statements indicating that the amount of working capital at December 31, 2017, was not sufficient to meet the cash requirements to fund planned operations through December 31, 2018, without additional sources of cash. This raises substantial doubt about our ability to continue as a going concern. Without additional funds from operations, this offering, other offerings, or loans, we cannot continue as a viable entity, and our stockholders would likely lose most or all of their investment.

Additional financing or indebtedness may be needed.

We may need to finance our future cash needs through public or private equity offerings, debt financings, additional token offerings or other arrangements. Additional financing may not be available, and any additional funds that we obtain may not be on terms favorable to the Company.

10

Table of Contents

We believe that the net proceeds from the Offering, if fully subscribed, will be sufficient to enable us to fund our projected operation requirements for at least the next twelve (12) months. However, we may need to raise additional funds more quickly if one or more of our assumptions prove to be incorrect or if we choose to expand more rapidly than we presently anticipate, and we may decide to raise additional funds even before we need them if the conditions for raising capital are favorable.

You may be diluted.

We may seek to sell additional tokens, equity or debt securities, or obtain a loan or bank credit facility. The sale of additional equity, or debt securities convertible into equity, could result in dilution to our stockholders. The sale of additional equity could affect the value of Tokens generally. The incurrence of indebtedness would result in increased fixed obligations and could also result in covenants that would restrict our operations. Rentalist anticipates that it will issue all of the initial authorized Tokens in less than three years. At that time, Rentalist may elect to authorize the issuance of additional Tokens.

In addition, given that the Offering will be conducted on a “best efforts” basis, the success of the Offering may dilute the interests of early Investors. Further, any issuance of Tokens to platform users as rewards will dilute the interests of the Company’s existing stockholders. Investors making an investment expecting to own a certain percentage of the company or expecting each Token to hold a certain amount of value, should realize how the value of those Tokens can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share or token, ownership percentage, and earnings per token or share.

Our results of operations are difficult to predict.

There can be no assurance that we will successfully execute our strategy and market our platform. Furthermore, we may incur significant unanticipated expenses which would include, for example, additional expenses for platform development or marketing. If we are unsuccessful in marketing our platform, or if we incur significant unanticipated expenses, our business, financial condition, results of operations and prospects may be materially adversely affected. This Offering Circular contains our best estimates of future operations that are based on uncertainties and other factors beyond our control and are difficult to predict.

Our Parent Company will effectively control the Company and there may be conflicts of interest.

We have two classes of stock: Class A Common Stock, each share of which entitles the holder to one vote on any matter submitted to our stockholders, and Class B Common Stock (the Tokens), which is non-voting. Our Parent Company owns 100% of the issued and outstanding Class A Common Stock and therefore controls the Company and our Board of Directors. Members of the Company’s Board of Directors also are indirect and direct owners and managers of the Parent Company. Specifically, SingularDTV GmbH owns a majority of the equity units of the Parent Company, one of its owners is a manager of the Parent Company and serves on the Company’s Board of Directors. SingularDTV GmbH also has provided debt financing to Rentalist. There is a risk that there will be situations when the interests of the Parent Company, the Parent Company’s owners and their affiliates, will conflict with the interests of the Company and/or the Company’s stockholders.

Disruption of our platform or systems that host our platform, process payments, or connect users could result in a loss of service and decreased revenue.

These systems may be subject to damage or interruption from earthquakes, adverse weather conditions, other natural disasters, terrorist attacks, power loss, telecommunications failures, computer viruses, computer denial of service attacks, or other events. Interruptions in these systems could make our platform unavailable or impaired and affect our revenue and reputation.

11

Table of Contents

We are required to make payments for the equipment loan.

Some of the camera equipment owned by the Company is subject to a financing agreement between the Parent Company and SingularDTV GmbH. In connection with the Parent Company’s contribution of the camera equipment to Rentalist, Rentalist assumed the obligations under such financing agreements. These payments will result in a portion of Rentalist’s revenues or offering proceeds being paid to SingularDTV GmbH.

We are less diversified than some of our competitors.

We initially serve only the New York market. While we plan to expand to other parts of the country in the future, some of our competitors already have a wider market.

We may not be able to adequately protect our intellectual property, which could harm the value of our brands and adversely affect our business.

We believe that intellectual property will be critical to our success, and that we will rely on trademark, copyright and patent law, trade secret protection and confidentiality and/or license agreements to protect our proprietary rights. If we are not successful in protecting our intellectual property, it could have a material adverse effect on our business, results of operations and financial condition. While we believe that we will be issued trademarks, copyrights and other intellectual property to protect our business, there can be no assurance that our operations do not, or will not, infringe valid, enforceable third-party patents of third parties or that competitors will not devise new methods of competing with us that are not covered by our anticipated patent applications. Moreover, it is intended that we will rely on intellectual property and technology developed or licensed by third parties, and we may not be able to obtain or continue to obtain licenses and technologies from these third parties at all or on reasonable terms. Effective trademark, service mark, copyright and trade secret protection may not be available in every country in which our intended services will be provided. The laws of certain countries do not protect proprietary rights to the same extent as the laws of the U.S. and, therefore, in certain jurisdictions, we may be unable to protect our proprietary technology adequately against unauthorized third party copying or use, which could adversely affect our competitive position. We may license in the future, certain proprietary rights, such as trademarks or copyrighted material, to third parties. These licensees may take actions that might diminish the value of our proprietary rights or harm our reputation, even if we have agreements prohibiting such activity. Also, to the extent third parties are obligated to indemnify us for breaches of our intellectual property rights, these third parties may be unable to meet these obligations. Any of these events could have a material adverse effect on our business, results of operations or financial condition.

We rely on key personnel and we need to attract and retain additional qualified personnel.

Our founders are meaningfully engaged with the Company, and our Chief Executive Officer currently works primarily on matters related to the Company. However, we have no full-time employees. We expect to hire additional personnel and retain service providers to accomplish our business strategy. Our success will depend to a significant extent on our ability to retain key employees and identify, attract, hire, train and retain qualified personnel and contractors. Competition for talent is substantial. If we are unable to hire and retain qualified personnel in the future, it could have a material adverse effect on our business, financial condition, operating results, and liquidity.

Our certificate of incorporation designates the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees.

Our certificate of incorporation provides that, to the fullest extent permitted by law, the Court of Chancery of the State of Delaware will be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action asserting a claim against the Corporation arising pursuant to any provision of the DGCL or this Certificate of Incorporation or Bylaws, (iv) any action to interpret, apply, enforce or determine the validity of this Certificate of Incorporation or the Bylaws, or (v) any action asserting a claim against the Corporation governed by the internal affairs doctrine. Any person or entity purchasing or otherwise acquiring any interest in shares of our capital stock shall be deemed to have notice of and to have consented to the provisions of our certificate of incorporation described above. This choice of forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers or other employees, which may discourage such lawsuits against us and our directors, officers and employees. Alternatively, if a court were to find these provisions of our certificate of incorporation inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings, we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business and financial condition.

Risks Related to the Offering

Our proposed security tokens and plan of distribution are new untested concepts and may not achieve market acceptance.

Security tokens are a relatively new concept, and the issuance of security tokens in a Regulation A offering is untested. Our concept of awarding security tokens as a rebate of transaction fees also is untested. Investors acquiring Tokens will bear the risks of investing in a novel, untested type of securities transaction that will trade exclusively on a novel type of trading platform and be subject to a number of unusual restrictions, as well as the risks of investing in our business. The Company has not selected a blockchain protocol for issuance of the Tokens, because it intends to base the protocol it selects on its compatibility with an SEC-approved national exchange or alternative trading system. If or when the Company proceeds with issuance utilizing blockchain technology, Token holders will be required to open a compatible wallet to receive their Tokens. Token transfers will not be valid until recorded by the Company’s registered transfer agent. If a Token holder loses their key, they may request replacement Tokens from the Company, similar to a lost stock certificate. As with other methods of stock trading and transfers, investors generally will have no recourse in the event a malfunction, delay, or other performance error affects their ability to buy or sell Tokens at the specific time they may seek to execute that transaction. Any failure of the Tokens to perform as expected will have a material adverse effect on our prospects.

There may not be a market for resale of the Tokens.

Securities issued in a Regulation A offering are freely tradeable. However, securities that are not listed on an exchange or quoted on an exempt ATS have limited liquidity, availability of market quotations, and news and analyst coverage. We believe the market for secondary trading in securities (including token securities) issued pursuant to Regulation A is currently underdeveloped, but we believe that it will grow in part through token security offerings. As of the date of this Offering Statement, no exchange or exempt ATS has begun trading security tokens, though entities have announced plans to launch token security operations this year. Crypto exchanges may not trade security tokens unless or until they satisfy FINRA and SEC requirements. Although Rentalist intends to apply for quotation or listing, RNTL Tokens will not be listed on an exchange or quoted on an ATS initially. Even if RNTL Tokens are quoted or listed, there can be no assurances of trading volume or liquidity.

The Offering will be conducted on a “best efforts” basis and does not require a minimum amount to be raised, meaning the Company may not be able to raise enough funds to fully implement its business plan and investors may lose their entire investment.

The Tokens are being offered by the Company on a “Best Efforts” basis with no minimum and without the benefit of a Placement Agent. The Company can provide no assurance that this Offering will be completely sold out. If less than the maximum proceeds are available, the Company’s business plans and prospects for the current fiscal year could be adversely affected.

Given that there is no minimum offering amount, investors bear the risk of losing their entire investment if the Company is unable to raise enough proceeds from this Offering to continue operations. If the Company is not able to raise a significant portion of $5,625,000 from the Common Stock Offering, the Company may have to limit or eliminate important expenditures, such as the hiring of essential labor and marking and community building activities, any and all of which may hinder the Company’s ability to generate significant revenues and cause a delay in the implementation of the Company’s business plan. Moreover, the less money that the Company is able to raise through this Offering, the more risk that Investors may lose their entire investment.

12

Table of Contents

Investors in the Offering may not receive a return on their investment.

There is no assurance that investors will realize a return on their investments or that their entire investments will not be lost. For this reason, each investor should carefully read this Offering Circular and the exhibits to the Offering Circular and should consult with their own attorney and business advisors prior to making any investment decision with respect to the Tokens.

Regulations governing blockchain and token securities is uncertain, and new regulations or policies may materially adversely affect the value of the Tokens.

Regulation of token securities, blockchain technologies, and exchanges is evolving and creates uncertainty. New laws, regulations, guidance, or other actions may severely impact the Company’s Offering model and the value of the Tokens. Failure by the Company to comply with any laws, rules and regulations could result in a variety of adverse consequences, including civil penalties and fines. As blockchain networks and blockchain assets have grown in popularity and in market size, federal and state agencies have begun to take interest in, and in some cases regulate, their use and operation. Future regulations may affect the Company’s ability to utilize tokens to represent its securities as planned.

Tax consequences may be unpredictable.

The tax characterization of Tokens received by platform users is uncertain and may affect taxable income of the recipient and taxes and accounting treatment by the Company. As with any investment, an investment in the Tokens will have tax consequences that will depend on the investor’s circumstances. All investors are encouraged to consult with a tax advisor to assess the tax implications of an investment in Tokens.

PROSPECTIVE INVESTORS ARE URGED TO CONSULT THEIR OWN LEGAL COUNSEL OR OTHER PROFESSIONAL ADVISORS AS TO ANY LEGAL RESTRICTIONS ON THEIR ABILITY TO OWN THE TOKENS AND AS TO THE PRECISE FEDERAL, STATE, LOCAL AND OTHER TAX CONSEQUENCES OF ACQUIRING, OWNING AND DISPOSING OF THE TOKENS.

13

Table of Contents

ESTIMATED USE OF PROCEEDS

The table below sets forth our estimated use of proceeds from the Offering, assuming we sell all of the Tokens in the Offering.

We expect to use substantially all of the net proceeds from the Offering (after paying offering expenses) to operate the Company and pursue our business strategy. Many of the amounts set forth in the table below represent our best estimate since they cannot be precisely calculated at this time.

| | If 25% of

Tokens

are sold | | If 50% of

Tokens

are Sold | | If 100% of

Tokens

are sold | |

Gross Proceeds | | $ | 1,406,250 | | 2,812,500 | | 5,625,000 | |

Our intended use of the gross proceeds is as follows: | | | | | | | |

Fees for qualification of Offering Statement under Regulation A (includes legal, accounting, and marketing) auditing, accounting, broker/dealer and other professional fees) | | $ | 215,000 | | 215,000 | | 215,000 | |

Platform marketing and community building | | $ | 500,000 | | 1,000,000 | | 1,500,000 | |

Continuous platform improvement | | $ | 60,000 | | 125,000 | | 250,000 | |

Hiring of personnel and contractors | | $ | 60,000 | | 125,000 | | 250,000 | |

Working capital and general corporate purposes | | $ | 200,000 | | 900,000 | | 3,000,000 | |

Contingency Funds | | Balance | | Balance | | Balance | |

The Company may utilize a portion of the proceeds to pay interest and principal on current and/or future loans made pursuant to the secured revolving debt agreement described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations; Related-Party Transactions and Agreements.”

The foregoing information is an estimate based on our current business plan. We may find it necessary or advisable to re-allocate portions of the net proceeds reserved for one category to another, and we will have broad discretion in doing so.

If we sell less than all of the Tokens in the Offering, we anticipate reducing primarily the amount spent on working capital and general corporate purposes, and secondarily the amounts spent on platform marketing, community development, and hiring on an approximately pro rata basis.

14

Table of Contents

THE COMPANY

Rentalist, Inc. is a newly organized Delaware corporation with its headquarters in West Chester, Pennsylvania (“Rentalist” or “Company”). Rentalist is a wholly-owned subsidiary of Rentalist, LLC. Rentalist operates an online peer-to-peer platform for film-related equipment rentals.

Who We Are.

Rentalist was launched through a collaboration of artists and entrepreneurs to serve the independent filmmaking industry. The business concept arose in 2014, when filmmaker Henry Roosevelt began renting his camera to other filmmakers.

Henry Roosevelt. Henry is an award winning Director, Producer & Cinematographer. His feature film debut, TOUGH GUYS was purchased and distributed by Showtime. He has directed commercials for ESPN and ABC. He won Best Short at the USA Film Festival for his directorial debut, NATIVE BOY. He operated as the cinematographer for HBO’s NIGHT OF TOO MANY STARS, as well as SXSW film HALLWAY. As an actor, Henry appeared in the film in THE SOCIAL NETWORK. Henry is co-founder of Rentalist, LLC, and is Rentalist’s President and Chief Creative Officer.

Christopher Dima. Chris is an entrepreneur. He is the founder and CEO of a product development consultancy which he founded in 2014. He specializes in rapid prototyping, strategic business development and financial management. Chris began his career at Economy.com (later acquired by Moody’s), an economic analytics firm. While at Economy.com, Chris managed and developed products for international clients ranging from government to banks to insurance companies. He focused on all aspects of the business, including strategy, design, sales, marketing, product delivery and client support and training. Later, he lead marketing and business development at SlamData, an enterprise analytics startup based in Boulder, CO. Chris was part of the team that raised over $10M from leading Silicon Valley VCs, True Ventures and Shasta Ventures. Chris is co-founder of Rentalist, LLC, and is Rentalist’s Chief Executive Officer.

Zachary LeBeau. Zach is a writer, artist and entrepreneur. He is the co-founder and CEO of the blockchain-based entertainment technology company, SingularDTV GmbH. He is the writer of the novel MONKEY ME, and the producer of several music albums. He wrote and directed the sci-fi drama film, THE SCIENTIST, and conceived the noir music video for Gramatik and BRANX’s dance track, FUTURE CRYPTO. Through SingularDTV, he produced the soon-to-be-released feature documentary, TRUST MACHINE, by Alex Winter, is producing the upcoming feature narrative, THE HAPPY WORKER, by director Duwayne Dunham and executive producer David Lynch, and is distributing sci-fi thriller PERFECT, executive produced by Steven Soderbergh.

The Platform.

Henry and Chris teamed up in 2014 to pursue the concept of a peer-to-peer camera rental marketplace, and Zach joined them in 2017. They created Rentalist.com, a digital peer-to-peer platform that connects filmmakers with owners of film-related gear and equipment, such as cameras, lenses, and lighting. They began renting equipment in the first quarter of 2018, and they launched the platform to the public in August 2018.

15

Table of Contents

The Rentalist platform offers an easy-to-use interface for posting images and descriptions of gear, making it easier for creative filmmakers to find the right equipment and pay for it and easier for gear owners to securely rent out gear.

The New Film Industry Creates Demand for Access to Filmmaking Equipment.

Rentalist is part of the new decentralized entertainment industry. Historically, major movie studios, distributors, theater chains, and other gatekeepers have controlled the film industry, determining everything from what films were made to where and when fans could see them. Recent advances in technology have disrupted the entire industry. Films are no longer digitally recorded and edited; no longer in need of raw film and splicing. Movies that were once only shipped to movie theaters in tins are now streaming on demand. These shifts have enabled filmmakers to bypass gatekeepers, streamline distribution, and connect directly with their fans, giving artists the opportunity to pursue their creative vision and giving fans access the films they want to see wherever they have a digital device.

16

Table of Contents

These developments have ushered in a new era for the film industry and substantial growth in independent filmmaking. The changes also have created a demand for cost-effective and efficient access to filmmaking equipment. We believe that demand will grow.

The Rentalist Solution.

The Rentalist platform provides a tool to solve the problem of connecting equipment and gear owners with filmmakers in this decentralized industry. Rentalist recruits equipment owners to make their equipment available via the Rentalist platform. Potential renters find their way to the platform via internet searches, advertising, and referrals from other professionals. A renter may be an independent filmmaker looking for equipment to shoot an film or a producer or director from a major studio looking for a gear for a shoot on-location or for a specialty piece of equipment.

The platform is designed to be easy to use, efficient, and secure. Renters are required to provide detailed information to enable equipment owners to assess their fitness. Transaction fees are processed up-front through a third party electronic payment processor, providing renters and equipment owners with additional protection and avoiding the potential for unpaid rental fees.

The transparency provided by the platform lets the market and the owners and renters determine the rental prices. Rentalist collects transaction fees for the rentals based on its agreement with the equipment owner. The amount and calculation of the transaction fees will vary depending on volume, value, and other factors. Transaction fees are transmitted directly to Rentalist up-front by the third party payment processor out of the rental payment made by the renter to the owner.

Equipment owners and renters communicate directly on the platform to arrange for delivery and return of the equipment in person, by courier, by mail, or other means. Renters are expected to have replacement cost insurance coverage. However, equipment owners are protected by insurance procured by Rentalist that may provide coverage to supplement the renter’s coverage or provide coverage in the absence of another policy.

Community Empowered. Community Owned.

This concept of a peer-to-peer platform isn’t novel. Amazon and eBay launched the first generation of online peer-to-peer marketplaces over twenty years ago, and well-known brands such as Etsy, Airbnb, and Lyft have joined in the success of this now established industry. Each of these brands began as a marketplace for niche products: Books, collectibles, handmade crafts, spare bedrooms, and shared car rides, respectively. Since then, other companies have launched peer-to-peer platforms to serve other niche markets, such as tool sharing, money lending, cooking classes, and camera rentals.

Like other digital peer-to-peer marketplaces, Rentalist’s success will depend on users engaging in transactions on its platform. What makes Rentalist unique is that it will be owned by the community that it serves: Equipment owners, filmmakers, film enthusiasts, actors, fans, and others who see value in independent filmmaking and invest in the Tokens.

17

Table of Contents

The New Offering Model.

Amazon, eBay and most other well-known online marketplaces funded their early growth stages by privately offering shares of stock to venture capital firms and angel investors who qualified as “accredited investors.” These investors are often sourced by broker-dealers for a share of the funds raised and an award of stock. The securities rules limited the ability of start-up companies to offer investments publicly or accept investments from individuals who were not wealthy and sophisticated. These rules were intended to protect individuals who cannot afford to take the risk of losing funds they needed to pay for basic living and who may not have sufficient information and investment acumen to make investment decisions in high-risk start-ups. Unfortunately, these rules also prevented people who were not wealthy from participating in the returns that may come with early stage investing in successful entities. In the extreme case of eBay, the result was that a venture capital firm made hundreds of millions of dollars on its early investment, while the people who generated the income for eBay by buying and selling items on the platform missed out.

In June 2015, the SEC adopted new rules that have modernized and expanded the means of raising capital, through offerings conducted publicly pursuant to amended Regulation A (See SEC Release No. 33-9741). Just as digitization and the internet allowed filmmakers to make films and deliver them to fans, Regulation A provides an opportunity for startups to offer ownership to the public, and provides the public the opportunity to participate in the potential rewards—and accompanying risks— of early stage investments. See “Risk Factors.”

Rentalist’s Goal — 50% Community Ownership.

Rentalist’s goal is to issue half of its equity ownership to platform users and investors (collectively, the “Community”) through the Offering by selling shares to investors and rewarding platform users. We believe community ownership is a key component, culturally and financially, to the success of a peer-to-peer business that serves the modern independent film industry.

Rentalist has authorized the issuance of 5,000,000 shares of stock, of which 2,000,000 has been issued in the form of Class A Common Stock to the Parent Company. An additional 500,000 shares of Class A Common Stock have been reserved for issuance pursuant to the Company’s Equity Incentive Plan to advisers from the Community. The remaining 2,500,000 shares (50% of the equity) are being issued in the form of Class B Common Stock (the RNTL Tokens) in two ways:

· Token Sales to Investors. Platform users, members of the film community, film enthusiasts and others (the general public) invest in the company by purchasing Tokens with cash at the $2.25 per Token Offering Price.

· Rewards to Platform Users. Rentalist rewards its users with equity ownership in the company through a return of a portion of rental transactions fees in the form of RNTL Tokens. As platform users help Rentalist grow and succeed, they receive equity shares of the company, and the opportunity to benefit from the profits and stock appreciation they help generate.

For each transaction completed on the Rentalist platform, the Owner and Renter may each receive an award of RNTL Tokens worth 1.25% of the rental fee. The number of RNTL Tokens awarded to each user is determined by (a) multiplying the rental fee by 1.25% and (b) dividing the result by the $2.25 per Token Offering Price (rounded down to the nearest whole token). This award is treated as a rebate of half of the rental transaction fee, similar to a mileage plan program, for accounting and tax purposes. The Company has not reserved a specific amount of Tokens for issuance to platform users. If the Company issues substantially all of the Tokens through sales to investors, the Company may award only the remaining Tokens to platform users, which may be very few. If all of the authorized Tokens are issued, the Company will not be able to issue any additional Tokens to platform users as rewards unless the Company amends this Offering or conducts a new Offering. See “Plan of Distribution”.

18

Table of Contents

If all of the Tokens are issued in this Offering, Tokenholders will own 50% of the equity of the Company:

Class | | Shares

Authorized | | Currently

Issued and

Outstanding | | Reserved for

Equity Plan | | To Be Issued

in Offering | | Ownership

(fully diluted) | |

| | | | | | | | | | | |

Class A Common Stock | | 2,500,000 | | 2,000,000 | | 500,000 | | — | | 50 | % |

| | | | | | | | | | | |

Class B Common Stock (Tokens) | | 2,500,000 | | — | | — | | 2,500,000 | | 50 | % |

| | | | | | | | | | | |

TOTAL | | 5,000,000 | | 2,000,000 | | 500,000 | | 2,500,000 | | 100 | % |

The RNTL Tokens.

Each RNTL Token is one share of Rentalist’s Class B Common Stock. The shares initially will be recorded in book-entry form. However, the RNTL Tokens are intended to be “security tokens” — stock that is generated and/or traded using blocking technology.

19

Table of Contents

We believe blockchain technology allows securities to be issued and traded more efficiently and with greater transparency and fewer intermediaries. However, there currently is no established secondary market for trading security tokens. FINRA-registered broker dealers are developing secondary markets utilizing different blockchain protocols, technology, and settlement procedures and, in some cases, focusing on particular industries, investor types, and markets, among other factors. After one or more such SEC-approved marketplaces suitable for trading in security tokens such as the RNTL Tokens become available, we intend to apply to have the RNTL Tokens listed or quoted for trading and generate the RNTL Tokens using blockchain technology. If or when the Tokens are issued using blockchain technology, all recorded issuances of the Tokens will be transferred to the chosen blockchain protocol, and future issuances will be recorded in the blockchain protocol as well.

The use of a transfer agent along with the blockchain technology enables the Company to maintain a stock ledger. The RNTL Tokens will be freely tradeable, but a trade will not be valid until recorded by the registered transfer agent, providing additional security to Token holders. The RNTL Tokens are not a virtual currency or cryptocurrency; they will not be used to access or pay for transactions on the platform or elsewhere. The Tokens represent half of the equity ownership of the Company. They do not have full voting rights, but they do have the same economic rights as the Class A Common Stock, including the right to receive dividends if and when the Company declares dividends. See “Description of Capital Stock.”

The RNTL Tokens may be held for investment or traded. Their trading value is the price at which the RNTL Tokens are bought or sold in the secondary marketplaces at any given time. The market price will increase (or decrease) along with the Company’s financial performance, market conditions, regulatory conditions, investor confidence, trading volume, and numerous other factors that influence the price at which any stock trades at any given time. See “Risk Factors.”

20

Table of Contents

MANAGEMENT

General

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. Our charter and bylaws provide that the number of directors on our board of directors may be established by a majority of the entire board of directors, but may not be more than seven, nor, upon and after the commencement of the Offering, fewer than three. There are no family relationships among any of our directors or officers, or officers of our advisor. As of the date of this Offering Circular, we have a total of three directors.

Each director will serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualifies. Although the number of directors may be increased or decreased, a decrease will not have the effect of shortening the term of any incumbent director.

Any director may resign at any time and may be removed with or without cause by the stockholders upon the affirmative vote of at least a majority of all the votes entitled to be cast generally in the election of directors.

Any vacancy created by an increase in the number of directors or the death, resignation, removal, adjudicated incompetence or other incapacity of a director may be filled only by an affirmative vote of a majority of the remaining directors, even if the remaining directors do not constitute a quorum, and any director elected to fill a vacancy will serve for the remainder of the full term of the directorship in which the vacancy occurred. If at any time there are no directors in office, successor directors shall be elected by the stockholders. Each director will be bound by our charter and bylaws.

Our directors will not be required to devote all of their time to our business and only are required to devote the time to our affairs as their duties require. No director or executive officer has received compensation from the Company in the last fiscal year. Our board of directors is empowered to fix the compensation of all officers that it selects and approve the payment of compensation to independent directors for services rendered to us.

Executive Officers and Directors

We currently have two executive officers and three directors. We have provided below certain information about our executive officers and directors. The term for each officer and director commenced effective with Rentalist’s formation and shall continue until such officer’s or director’s resignation or removal.

Name | | Position(s) | | Age (1) | | Hours Per

Week (2) |

Christopher Dima | | Chief Executive Officer, Board Member | | 45 | | 40 |

| | | | | | |

Henry Roosevelt | | President & Chief Creative Officer, Vice Chair | | 33 | | 40 |

| | | | | | |

Zachary LeBeau | | Board Chair | | 43 | | |

(1) As of July 10, 2018

21

Table of Contents

(2) Approximate average weekly amount of hours the Company anticipates these officers will work for the Company.

Christopher Dima, Chief Executive Officer and Board Member; Co-Founder of Rentalist, LLC. Chris is the Director of Marketing for SlamData and provides product development consulting services to startups. Chris served as an executive and founder for several technology-based startups and managed global marketing for Moody’s Analytics and strategy and marketing for Moody’s Economy.com. Chris holds a Bachelors of Arts in English from West Chester University of Pennsylvania and a Master of Education from the College of New Jersey, and he resides in the Philadelphia area.

Henry Roosevelt, President & Chief Creative Officer and Board Vice Chair; Co-Founder of Rentalist, LLC. Henry is a director, producer, and cinematographer. He is a graduate of the Lawrenceville School. He holds a Bachelors of Arts in Communications, with a minor in film, from the George Washington University, and he resides in New York.

Zachary LeBeau, Board Chair. Zach is Co-Founder and CEO of SingularDTV GmbH, and an author, musician, screenwriter, and film director with over twenty years of entrepreneurial experience in a range of industries, including entertainment, global real estate development, alternative energy, and luxury clothing. Zach resides in New York.

Compensation of Directors and Executive Officers

Rentalist’s Directors are not compensated for their role as directors. As of June 30, 2018, Rentalist had no employees, and its officers had not been compensated directly by Rentalist. Effective November 2018, Rentalist will begin directly compensating its executive officers, Christopher Dima and Henry Roosevelt. They each will receive $10,000 per month in base salary.

Principal Stockholders

The following table sets forth the beneficial ownership of our shares of common stock as of the date of this Offering Circular for each person or group that holds more than 5% of our common stock, for each director and executive officer of our sponsor and for the directors and executive officers of our sponsor as a group. To our knowledge, each person that beneficially owns our common stock has sole voting and disposition power with regard to such shares.

Unless otherwise indicated below, each person or entity has an address in care of our principal executive offices at 1 N. Church Street, 3rd Floor, West Chester, Pennsylvania 19380.

Name of Beneficial Owner(1) | | Number of Shares

Beneficially

Owned | | Percent of

All Shares | |

Rentalist, LLC (1) | | 2,000,000 | | 100 | % |

Total | | 2,000,000 | | 100 | % |

(1) | | All voting and investment decisions with respect to our shares of common stock that are held by Rentalist, LLC, are controlled by Rentalist, LLC. Rentalist LLC is owned by Christopher Dima (through an entity he wholly owns), Henry Roosevelt, and SingularDTV GmbH. Zachary LeBeau is an officer and owner of Singular DTV GmbH. |

22

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the financial statements and notes thereto.

Overview

Rentalist, Inc. was incorporated in 2018 the state of Delaware. Our headquarters are located in West Chester, Pennsylvania. We operate a peer-to-peer rental platform for filmmaking equipment. Rentalist was formed by Rentalist, LLC (the “Parent Company”). The Parent Company was formed in 2014, and commenced operations in 2017. On July 19, 2018, the Parent Company transferred substantially all of its assets and liabilities to Rentalist and received 2,000,000 Shares of Rentalist Class A Common Stock. Accordingly, this discussion of financial condition and results of operations, and the financial statements presented, incorporate the financial condition and results of operations of the Parent Company. References in this discussion to the performance of Rentalist refer to the consolidated performance of Rentalist and the Parent Company.

Results of Operations

Rentalist commenced operations on September 27, 2017, and launched the Rentalist platform to the public in August 2018. As of December 31, 2017, we had generated no revenue. As of the same date, cash used in operating activities was $144,072 for consulting and accounting, equipment, guaranteed payments, platform development and expenses, and general expenses.

As of June 30, 2018, we had generated $57,107 in cash through rentals of camera equipment owned by the Company, and sustained a net loss of $339,012.

Liquidity and Capital Resources

As of December 31, 2017, we had $62,090 in cash. As of June 30, 2018, we had $171,867 in cash. The funds raised in the Offering will be primarily used to grow the Rentalist platform and fund general operating expenses. We believe that cash on hand and cash we expect to generate from operating activities and raise in this Offering will be sufficient to meet our obligations and fund day-to-day operations for at least twelve months. However, our independent registered public accounting firm has included a “going concern” disclosure in its report on our financial statements indicating that the amount of working capital at December 31, 2017, was not sufficient to meet the cash requirements to fund planned operations through December 31, 2018, without additional sources of cash. This raises substantial doubt about our ability to continue as a going concern.

The Company has two primary recurring expenses: (a) employee compensation and (b) independent contractors. Now that the platform has been developed and launched, the Company believes that it can operate from a baseline monthly recurring budget of $30,000 to $50,000. The Company has two primary sources of revenue: (a) platform fees charged for rentals by third parties on the platform; and (b) rental fees on equipment owned by the Company. The Company expects that its monthly revenue from these sources will begin to exceed its monthly expenses in 2019. The Company anticipates that it will require less than $100,000 in additional funds to reach that positive cash flow. Funds received in the Offering will be used primarily to fund the Company’s marketing and community building efforts fund strategic growth and increase revenue. See “Use of Proceeds.”

Application of Critical Accounting Policies

Our accounting policies have been established to conform to GAAP. The preparation of financial statements in conformity with GAAP requires management to use judgment in the application of accounting policies, including making estimates and assumptions. Below are the accounting policies we believe will be critical. We consider these policies critical because they require our management to use judgment in their application, including making estimates and assumptions. These judgments will affect how we report our financial condition. If management’s judgment or interpretation of the facts and circumstances relating to various transactions were to be different, it is possible that different accounting policies will be applied, thus, resulting in a different presentation of the financial statements. Additionally, other companies in similar businesses may utilize different estimates that may impact comparability of our results of operations to such companies.

Token Sale — Through this Offering, Rentalist plans to issue tokens to platform users and investors:

23

Table of Contents

Awards to Platform Users (de facto incentives): For each transaction completed on the Rentalist platform, the owner and renter each receive an award of Tokens worth 1.25% of the rental fee (rounded down to the nearest whole token). This award is treated as a rebate of half of the rental transaction fee for accounting and tax purposes.

Investors: Platform users, members of the film community, film enthusiasts and others (the general public) also may invest in the company by purchasing tokens for cash. Tokens will note have voting rights, they will have the same economic rights as the Class A Common Stock. The price used to calculate award tokens is the same as the cash price paid by investors in this Offering.

Estimates — The Company prepares the financial statements in accordance with accounting principles generally accepted in the U.S. which requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses, costs, and disclosure of contingent assets and liabilities as of the date of the financial statements. Actual results are reconciled with these estimates as they occur but they may differ from initial reporting.

Revenue Recognition — The Company’s policy is to recognize revenue and costs in accordance with the terms of the agreements. Revenue is earned upon the beginning of the rental period between owner and renter. As of December 31, 2017, the Company had not yet had any revenue. As of June 30, 2018, the Company earned revenue in the amount of $57,107.

In May 2014, the Financial Accounting Statements Board (“FASB”) issued Accounting Standards Update No. 2014-09 which significantly updates the standards for revenue recognition for all entities, public, private and not-for-profit, that have contracts with customers to provide goods or services. For private entities, such as the Company, the effective date for implementation of the new standard is for annual periods beginning after December 15, 2018. Revenue is recognized when all the following elements are present: (a) persuasive evidence of an arrangement exists, (b) delivery has occurred or services have been rendered to the customer, (c) the fee is fixed or determinable, and (d) collectability is reasonably assured. In 2017 the Company had no sales and did not recognize any revenue. The new standard, if applied to the Company, would have no impact on the Company’s 2017 or 2018 revenue. The Company plans to defer application of the new standard until it becomes effective.

Accounts Receivable — The Company’s policy is to state its accounts receivable as amounts due from customers as of the reporting date. Customer accounts past due greater than 90 days are reviewed to identify amounts that are uncollectible. Uncollectible customer accounts receivable are written off and included in the statement of operations in general and administrative. As of June 30, 2018, the Company had accounts receivable in the amount of $20,681.

Property and Equipment — Property and equipment is recorded at cost. Maintenance and repairs are charged to expense as incurred; major renewals and betterments are capitalized. When items of property or equipment are sold or retired, the related cost and accumulated depreciation and amortization is removed from the accounts and any gain or loss is included in the results of operations. Depreciation and amortization is calculated on a straight-line basis over the estimated useful lives of the respective assets, which generally ranges from 3-5 years for equipment. From commencement of operations, September 27, 2017, through year end, December 31, 2017, no assets were placed in service and no depreciation expense was taken. For the period ending June 30, 2018, depreciation expense was recognized in the amount of $81,856.

Long Lived Assets - The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the asset’s carrying amount may not be recoverable. From commencement of operations, September 27, 2017, through June 30, 2018, the Company did not have any long-lived assets that needed impairment charges.

24

Table of Contents

Income Taxes — The Company follows the provisions of Financial Accounting Standards Board Accounting Standards Codification 740, “Income Taxes,” related to the accounting for uncertainty in income taxes. As of June 30, 2018, the Company has no unrecognized tax benefits. The Company classifies interest and penalties related to unrecognized tax benefits as a component of the provision for income tax expense.

Related-Party Transactions and Agreements

The Parent Company has paid Christopher Dima’s consulting firm for design and software management services. This expense from commencement of operations, September 27, 2017, through year end, December 31, 2017, was $874, and for the period ending June 30, 2018, was $30,905.

On December 21, 2017, the Parent Company entered a secured revolving debt agreement with SingularDTV GmbH for up to $1.25 million (US) (the “Loan Agreement”), and the Parent Company granted SingularDTV GmbH a security interest in all of the assets of the Parent Company. On July 19, 2018, the Parent Company transferred all assets and liabilities to Rentalist in exchange for shares in Rentalist. The transaction will be accounted for as a recapitalization of the Parent Company, and Rentalist will be the reporting company for the year ended December 31, 2018. In connection with the foregoing recapitalization, the Parent Company assigned the Loan Agreement to Rentalist, Rentalist granted SingularDTV GmbH a security interest in all of the assets of Rentalist, and the security agreement between the Parent Company and Singular DTV GmbH was terminated. As of December 31, 2017, $210,272 was outstanding, and as of June 30, 2018, $1.25 million of principal was outstanding. The amounts loaned to Parent Company under the Loan Agreement have been used to purchase filmmaking equipment (all of which has been contributed to Company) and for general working capital purposes. The principal accrues interest at a rate of 5% per annum. Interest only payments to be paid for six (6) months commenced on December 1, 2018, and thereafter the remaining principal and interest are to be repaid in eighteen (18) equal monthly installments.

25

Table of Contents

DESCRIPTION OF CAPITAL STOCK

We were formed under the laws of the state of Delaware. The rights of our stockholders are governed by Delaware law as well as our charter and bylaws. The following summary of the material terms of our common stock is only a summary, and you should refer to the Delaware General Corporation Law and our charter and bylaws for a full description. The following summary is qualified in its entirety by the more detailed information contained in our charter and bylaws. Our charter and bylaws are on file with the Securities and Exchange Commission as Exhibits to our Offering Statement on Form 1-A and can be accessed over the Internet at the Securities and Exchange Commission’s website at www.sec.gov. In addition, copies of our charter and bylaws are available at no cost upon request. See the “Additional Information” section of this Offering Circular.

Our charter authorizes us to issue up to 5,000,000 shares of common stock at $0.001 par value per share, of which 2,500,000 shares are classified as Class A Common Stock and 2,500,000 share are classified as Class B Common Stock (RNTL Tokens). As of the date of this Offering Statement, 2,000,000 shares of our Class A Common Stock were issued and outstanding, and no shares of Class B Common Stock were issued and outstanding. The Company has reserved 500,000 shares of Class A Common Stock for issuance to advisors, contractors, and employees pursuant to an equity incentive plan. Our board of directors may amend our charter from time to time to increase or decrease the aggregate number of our authorized shares or the number of shares of any class or series that we have authority to issue without any action by our stockholders.

Common Stock