UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23366

(Investment Company Act File Number)

RiverNorth Opportunistic Municipal Income Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

325 North LaSalle Street, Suite 645

Chicago, Illinois 60654

(Address of Principal Executive Offices)

Marcus L. Collins, Esq.

RiverNorth Capital Management, LLC

325 North LaSalle Street, Suite 645

Chicago, Illinois 60654

(Name and Address of Agent for Service)

(312) 832-1440

(Registrant’s Telephone Number)

Date of Fiscal Year End:June 30

Date of Reporting Period:June 30, 2019

| Item 1. | Reports to Stockholders. |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at www.RiverNorth.com and you will be notified by mail each time a report is posted and provided with a website link to access the report.

Beginning on January 1, 2019, you may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact you financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-888-848-7569 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder repots and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at www.RiverNorth.com.

RiverNorth Opportunistic Municipal Income Fund, Inc.

Table of Contents

| Performance Overview | 2 |

| Schedule of Investments | 5 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statement of Changes in Net Assets | 10 |

| Statement of Cash Flows | 11 |

| Financial Highlights | 13 |

| Notes to Financial Statements | 14 |

| Report of Independent Registered Public Accounting Firm | 29 |

| Dividend Reinvestment Plan | 30 |

| Directors and Officers | 32 |

| Additional Information | 36 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Performance Overview | June 30, 2019 (Unaudited) |

WHAT IS THE FUND’S INVESTMENT STRATEGY?

The RiverNorth Opportunistic Municipal Income Fund, Inc. seeks to provide current income exempt from regular U.S. federal income taxes (but which may be included in taxable income for purposes of Federal alternative minimum tax), with a secondary objective of total return.

The Fund’s Managed Assets are allocated among two principal strategies: Tactical Municipal Closed-End Fund (CEF) Strategy managed by RiverNorth Capital Management, LLC (“RiverNorth”), and Municipal Bond Income Strategy managed by MacKay Shields LLC.

RiverNorth determines the portion of the Fund’s assets to allocate to each strategy and may, from time to time, adjust the allocations. The Fund may allocate between 25% to 50% of its Managed Assets to the Tactical Municipal CEF Strategy and 50% to 75% of its Managed Assets to the Municipal Bond Income Strategy.

The Tactical Municipal CEF Strategy typically invests in municipal CEFs and exchange-traded funds (ETFs) seeking to derive value from the discount and premium spreads associated with CEFs. The Municipal Bond Income Strategy primarily invests in municipal debt securities of any credit quality, including securities that are rated below investment grade.

HOW DID THE RIVERNORTH OPPORTUNISTIC MUNICIPAL INCOME FUND PERFORM RELATIVE TO ITS BENCHMARK DURING THE REPORTING PERIOD?

Since the Fund’s inception on October 26, 2018 through June 30, 2019, the Fund returned 17.24% on a net asset value (NAV) basis and 10.04% on a market price basis. The Bloomberg Barclays U.S. Municipal Bond Index returned 7.40% during the same period.

WHAT CONTRIBUTING FACTORS WERE RESPONSIBLE FOR THE RIVERNORTH OPPORTUNISTIC MUNICIPAL INCOME FUND’S RELATIVE PERFORMANCE DURING THE PERIOD?

RiverNorth Tactical Municipal Closed-End Fund Strategy

The RiverNorth sleeve’s performance relative to the Fund’s index benefitted from narrowing discounts among municipal bond closed-end funds over the period. The sleeve held some cash as the initial public offering (IPO) proceeds were invested and this detracted from performance relative to the index.

MacKay Shields Municipal Bond Income Strategy

The MacKay Shields sleeve outperformed the Bloomberg Barclays U.S. Municipal Bond Index since inception. The outperformance can be largely attributed to the combination of overweight exposure to state and local governments, lower investment grade and high yield securities. Specifically, the sleeve’s exposure to both Illinois and Connecticut general obligation credits performed well as positive news in both states caused significant spread narrowing in both credits. Strong technicals from retail investors increased demand for incremental yield, allowing credit spreads in general to perform well. Also contributing to performance was the sleeve’s overweight to longer maturities, as the municipal yield curve flattened during the reporting period.

The sleeve’s underweight in the transportation sector detracted from performance. In addition, the Fund’s underweight positions in education, electric utilities and hospital sectors detracted from performance. The underweight in New Jersey paper also detracted from performance as credit spreads narrowed on New Jersey exempt securities, even though the fundamentals are still negative.

| 2 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Performance Overview | June 30, 2019 (Unaudited) |

HOW WAS THE RIVERNORTH OPPORTUNISTIC MUNICIPAL INCOME POSITIONED AT THE END OF JUNE 2019?

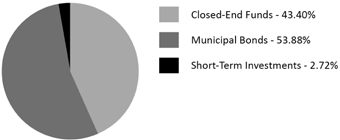

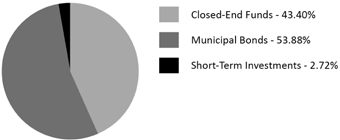

The Fund allocation was 43% RiverNorth Tactical Municipal Closed-End Fund Strategy and 57% MacKay Shields Municipal Bond Income Strategy.

Past performance is no guarantee of future results.

General obligation bond is a municipal bond backed by the credit and “taxing power” of the issuing jurisdiction rather than the revenue from a given project.

The price at which a closed-end fund trades often varies from its NAV. Some funds have market prices below their net asset values - referred to as a discount. Conversely, some funds have market prices above their net asset values - referred to as a premium.

The Bloomberg Barclays U.S. Municipal Bond Index is considered representative of the broad market for investment grade, tax-exempt bonds with a maturity of at least one year. The index cannot be invested in directly and does not reflect fees and expenses.

Yield is the income return on an investment. This refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

A credit spread is the difference in yield between two bonds of similar maturity but different credit quality. Widening credit spreads indicate growing concern about the ability of corporate (and other private) borrowers to service their debt. Narrowing credit spreads indicate improving private creditworthiness.

Yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The shape of the yield curve is closely scrutinized because it helps to give an idea of future interest rate change and economic activity. There are three main types of yield curve shapes: normal (steep), inverted (negative), and flat. A normal yield curve is one in which longer maturity bonds have a higher yield compared to shorter-term bonds due to the risks associated with time. An inverted yield curve is one in which the shorter-term yields are higher than the longer-term yields. A flat yield curve is one in which the shorter- and longer-term yields are very close to each other. The slope of the yield curve is also seen as important: the greater the slope, the greater the gap between short- and long-term rates.

PERFORMANCEas of June 30, 2019

| TOTAL RETURN(1) | 3 Month | 6 Month | Since Inception(2) |

| RiverNorth Opportunistic Municipal Income Fund - NAV(3) | 4.00% | 13.51% | 17.24% |

| RiverNorth Opportunistic Municipal Income Fund - Market Price(4) | 3.82% | 9.43% | 10.04% |

| Bloomberg Barclays U.S. Municipal Bond Index(5) | 2.14% | 5.09% | 7.40% |

| (1) | Total returns assume reinvestment of all distributions. |

| (2) | The Fund commenced operations on October 25, 2018. |

| (3) | Performance returns are net of management fees and other Fund expenses. |

| (4) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV. |

| (5) | The Bloomberg Barclays U.S. Municipal Bond Index covers the US Dollar-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds. |

| Annual Report | June 30, 2019 | 3 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Performance Overview | June 30, 2019 (Unaudited) |

The total annual expense ratio as a percentage of net assets attributable to common shares as of June 30, 2019 is 2.09% (excluding interest on short term floating rate obligations). Including interest on short term floating rate obligations, the expense ratio is 3.28%.

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling 844.569.4750. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

TOP TEN HOLDINGS*as of June 30, 2019

| | % of Net Assets |

| State of Connecticut, General Obligation Unlimited Bonds 5.0% 10/15/2033 | 6.75% |

| City of New York NY, General Obligation Unlimited Bonds 5.25% 3/1/2035 | 6.49% |

| City & County of Honolulu HI, General Obligation Unlimited Bonds 5.0% 9/1/2042 | 6.49% |

| Commonwealth of Massachusetts, General Obligation Limited Bonds 5.25% 9/1/2043 | 6.42% |

| County of Will IL, General Obligation Unlimited Bonds 5.0% 11/15/2045 | 6.33% |

| Spring Branch Independent School District, General Obligation Unlimited Bonds 5.0% 2/1/2043 | 6.30% |

| County of Miami-Dade FL, General Obligation Unlimited Bonds 5.0% 7/1/2045 | 5.97% |

| State of Illinois, General Obligation Unlimited Bonds 5.0% 11/01/2027 | 5.94% |

| Los Angeles Unified School District, General Obligation Unlimited Bonds 5.25% 7/01/2042 | 4.23% |

| County of Bexar TX, General Obligation Limited Bonds 5.0% 6/15/2042 | 4.10% |

| | 59.02% |

| * | Holdings are subject to change and exclude short-term investments. |

ASSET ALLOCATIONas of June 30, 2019^

| ^ | Holdings are subject to change. |

Percentages are based on total investments of the Fund and do not include derivatives.

| 4 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Schedule of Investments | June 30, 2019 |

| Shares/Description | | Value | |

| CLOSED-END FUNDS (66.79%) | | | |

| | 212,612 | | | AllianceBernstein National Municipal Income Fund, Inc. | | $ | 2,859,631 | |

| | 96,373 | | | BlackRock California Municipal Income Trust | | | 1,276,942 | |

| | 40,795 | | | BlackRock Muni Intermediate Duration Fund, Inc. | | | 573,170 | |

| | 87,042 | | | BlackRock Muni New York Intermediate Duration Fund, Inc. | | | 1,246,442 | |

| | 94,510 | | | BlackRock Municipal 2030 Target Term Trust | | | 2,195,467 | |

| | 179,991 | | | BlackRock Municipal Income Quality Trust | | | 2,476,676 | |

| | 159,947 | | | BlackRock MuniHoldings California Quality Fund, Inc. | | | 2,183,277 | |

| | 150,977 | | | BlackRock MuniHoldings New York Quality Fund, Inc. | | | 1,986,857 | |

| | 26,725 | | | BlackRock MuniYield Quality Fund II, Inc. | | | 335,666 | |

| | 425,682 | | | BlackRock MuniYield Quality Fund III, Inc. | | | 5,619,002 | |

| | 335,552 | | | BNY Mellon Strategic Municipals, Inc. | | | 2,741,460 | |

| | 95,099 | | | DWS Municipal Income Trust | | | 1,071,766 | |

| | 132,168 | | | Eaton Vance California Municipal Income Trust | | | 1,636,240 | |

| | 470,617 | | | Eaton Vance Municipal Bond Fund | | | 5,849,769 | |

| | 692,518 | | | Invesco Municipal Opportunity Trust | | | 8,517,971 | |

| | 48,704 | | | Invesco Municipal Trust | | | 600,033 | |

| | 124,370 | | | Invesco Quality Municipal Income Trust | | | 1,544,675 | |

| | 73,226 | | | MFS California Municipal Fund | | | 873,586 | |

| | 543,791 | | | Nuveen AMT-Free Quality Municipal Income Fund | | | 7,509,754 | |

| | 409,848 | | | Nuveen California Quality Municipal Income Fund | | | 5,934,599 | |

| | 121,895 | | | Nuveen Connecticut Quality Municipal Income Fund | | | 1,580,978 | |

| | 488,781 | | | Nuveen Dividend Advantage Municipal Income Fund | | | 7,756,955 | |

| | 174,378 | | | Nuveen Georgia Quality Municipal Income Fund | | | 2,157,928 | |

| | 289,179 | | | Nuveen New York AMT-Free Quality Municipal Income Fund | | | 3,785,353 | |

| | 108,500 | | | Nuveen New York Quality Municipal Income Fund | | | 1,503,810 | |

| | 147,083 | | | Nuveen North Carolina Quality Municipal Income Fund | | | 1,960,602 | |

| | 73,758 | | | Nuveen Ohio Quality Municipal Income Fund | | | 1,099,732 | |

| | 555,649 | | | Nuveen Quality Municipal Income Fund | | | 7,779,086 | |

| | 268,982 | | | Pioneer Municipal High Income Trust | | | 3,281,580 | |

| | 683,213 | | | Putnam Municipal Opportunities Trust | | | 8,649,477 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUNDS | | | | |

| (Cost $87,666,934) | | | 96,588,484 | |

| Principal Amount/Description | | Rate | | Maturity | | Value | |

| MUNICIPAL BONDS (82.93%) | | | | | | | |

| California (7.84%) | | | | | | | | | |

| $ | 4,500,000 | | | Coast Community College District, General Obligation Unlimited Bonds(a) | | | 4.50% | | 08/01/39 | | $ | 5,215,680 | |

| | 5,000,000 | | | Los Angeles Unified School District, General Obligation UnlimitedBonds(a) | | | 5.25% | | 07/01/42 | | | 6,119,400 | |

| | | | | | | | | | | | | 11,335,080 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2019 | 5 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Schedule of Investments | June 30, 2019 |

| Principal Amount/Description | | Rate | | Maturity | | Value | |

| Colorado (6.63%) | | | | | | | |

| $ | 4,000,000 | | | City & County of Denver Co. Airport System Revenue, Revenue Bonds(a) | | | 5.25% | | 12/01/43 | | $ | 4,837,360 | |

| | 4,420,000 | | | Regional Transportation District, Certificate Participation Bonds(a) | | | 4.50% | | 06/01/44 | | | 4,746,726 | |

| | | | | | | | | | | | | 9,584,086 | |

| Connecticut (6.75%) | | | | | | | | | |

| | 8,300,000 | | | State of Connecticut, General Obligation Unlimited Bonds(a) | | | 5.00% | | 10/15/33 | | | 9,758,476 | |

| | | | | | | | | | | | | | |

| Florida (5.97%) | | | | | | | | | |

| | 7,430,000 | | | County of Miami-Dade FL, General Obligation Unlimited Bonds(a) | | | 5.00% | | 07/01/45 | | | 8,630,762 | |

| | | | | | | | | | | | | | |

| Hawaii (6.40%) | | | | | | | | | |

| | 7,650,000 | | | City & County of Honolulu HI, General Obligation Unlimited Bonds(a) | | | 5.00% | | 09/01/42 | | | 9,254,740 | |

| | | | | | | | | | | | | | |

| Illinois (12.27%) | | | | | | | | | |

| | 8,125,000 | | | County of Will IL, General Obligation Unlimited Bonds(a) | | | 5.00% | | 11/15/45 | | | 9,152,569 | |

| | 7,415,000 | | | State of Illinois, General Obligation Unlimited Bonds(a) | | | 5.00% | | 11/01/27 | | | 8,589,462 | |

| | | | | | | | | | | | | 17,742,031 | |

| Massachusetts (6.42%) | | | | | | | | | |

| | 7,500,000 | | | Commonwealth of Massachusetts, General Obligation Limited Bonds(a) | | | 5.25% | | 09/01/43 | | | 9,281,925 | |

| | | | | | | | | | | | | | |

| Michigan (6.99%) | | | | | | | | | |

| | 4,915,000 | | | Detroit Downtown Development Authority, Tax Allocation Bonds(a) | | | 5.00% | | 07/01/43 | | | 5,418,247 | |

| | 4,000,000 | | | Michigan Finance Authority, Revenue Bonds(a) | | | 5.25% | | 12/01/41 | | | 4,700,320 | |

| | | | | | | | | | | | | 10,118,567 | |

| New York (6.49%) | | | | | | | | | |

| | 7,500,000 | | | City of New York NY, General Obligation Unlimited Bonds(a) | | | 5.25% | | 03/01/35 | | | 9,382,875 | |

| | | | | | | | | | | | | | |

| Oklahoma (3.25%) | | | | | | | | | |

| | 4,000,000 | | | Oklahoma City Airport Trust, Revenue Bonds(a) | | | 5.00% | | 07/01/43 | | | 4,709,320 | |

| See Notes to Financial Statements. | |

| 6 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Opportunistic Municipal Income Fund, Inc. | |

| Schedule of Investments | June 30, 2019 |

| Principal Amount/Description | | Rate | | Maturity | | Value | |

| Texas (13.92%) | | | | | | | |

| $ | 5,000,000 | | | County of Bexar TX, General Obligation Limited Bonds(a) | | | 5.00% | | 06/15/42 | | $ | 5,932,200 | |

| | 7,725,000 | | | Spring Branch Independent School District, General Obligation Unlimited Bonds(a) | | | 5.00% | | 02/01/43 | | | 9,111,483 | |

| | 4,220,000 | | | Texas Water Development Board, Revenue Bonds(a) | | | 5.00% | | 04/15/49 | | | 5,091,177 | |

| | | | | | | | | | | | | 20,134,860 | |

| | | | | | | | | | | | | | |

| TOTAL MUNICIPAL BONDS | | | | | | | | | |

| (Cost $111,509,758) | | | | | | | | 119,932,722 | |

| Shares/Description | | Value | |

| SHORT-TERM INVESTMENTS (4.19%) | | | |

| 6,061,626 | | | BlackRock Liquidity Funds MuniCash Portfolio (7 Day Yield 1.65%) | | $ | 6,062,839 | |

| | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (Cost $6,062,811) | | | 6,062,839 | |

| | | | | |

| TOTAL INVESTMENTS (153.91%) | | | | |

| (Cost $205,239,503) | | $ | 222,584,045 | |

| | | | | |

| Floating Rate Note Obligations (-53.88%)(b) | | | (77,925,000 | ) |

| Liabilities in Excess of Other Assets (-0.03%) | | | (41,117 | ) |

| NET ASSETS (100.00%) | | $ | 144,617,928 | |

| (a) | All or portion of principal amount transferred to a Tender Option Bond (“TOB”) Issuer in exchange for TOB Residuals and cash. |

| (b) | Face value of Floating Rate Notes issued in TOB transactions. |

| Futures Contracts Sold: | |

| Description | | Contracts (Short) | | Expiration Date | | Notional Value | | | Value and Unrealized Appreciation/(Depreciation) | |

| US 10 Yr Note Future | | | (200) | | September 2019 | | $ | 25,593,750 | | | $ | (479,256 | ) |

| US Long Bond Future | | | (135) | | September 2019 | | | 21,005,156 | | | | (626,356 | ) |

| | | | | | | | $ | 46,598,906 | | | $ | (1,105,612 | ) |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2019 | 7 |

| RiverNorth Opportunistic Municipal Income Fund, Inc. | |

| Statement of Assets and Liabilities | June 30, 2019 |

| ASSETS: | | | |

| Investments in securities: | | | |

| At cost | | $ | 205,239,503 | |

| At value | | $ | 222,584,045 | |

| | | | | |

| Variation margin receivable | | | 10,625 | |

| Deposit with broker for futures contracts | | | 534,000 | |

| Receivable for investments sold | | | 636,717 | |

| Interest receivable | | | 1,433,860 | |

| Dividends receivable | | | 247,735 | |

| Prepaid and other assets | | | 11,008 | |

| Total Assets | | | 225,457,990 | |

| | | | | |

| LIABILITIES: | | | | |

Payable for Floating Rate Note Obligations | | | 77,925,000 | |

| Payable to custodian due to overdraft | | | 1,338,208 | |

| Payable for interest expense and fees on Floating Rate Note Obligations | | | 535,918 | |

| Payable for investments purchased | | | 757,623 | |

| Payable for shareholder servicing | | | 13,761 | |

| Payable to Adviser | | | 192,654 | |

| Payable for Fund Accounting and Administration fees | | | 15,683 | |

| Payable to Transfer agency | | | 7,007 | |

| Payable to Directors and Officers | | | 415 | |

| Payable for Compliance fees | | | 1,910 | |

| Payable for Custodian fees | | | 7,051 | |

| Payable for Audit fees | | | 31,000 | |

| Other payables | | | 13,832 | |

| Total Liabilities | | | 80,840,062 | |

| Net Assets | | $ | 144,617,928 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 127,794,954 | |

| Total distributable earnings | | | 16,822,974 | |

| Net Assets | | $ | 144,617,928 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 144,617,928 | |

| Shares of common stock outstanding (50,000,000 of shares authorized, at $0.0001 par value per share) | | | 6,373,268 | |

| Net asset value per share | | $ | 22.69 | |

| See Notes to Financial Statements. | |

| 8 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Statement of Operations | For the Period October 25, 2018 (Commencement |

| | of Operations) to June 30, 2019 |

| INVESTMENT INCOME: | | | |

| Interest | | $ | 2,386,310 | |

| Dividends | | | 2,830,344 | |

| Total Investment Income | | | 5,216,654 | |

| | | | | |

| EXPENSES: | | | | |

| Investment Adviser fee | | | 1,488,749 | |

| Accounting and Administration fees | | | 112,815 | |

| Compliance fees | | | 28,221 | |

| Transfer agent expenses | | | 16,682 | |

| Interest expense and fees on Floating Rate Note Obligations | | | 1,093,143 | |

| Audit expenses | | | 34,000 | |

| Legal expenses | | | 11,277 | |

| Custodian fees | | | 18,438 | |

| Shareholder servicing expenses | | | 105,080 | |

| Director expenses | | | 60,602 | |

| Printing expenses | | | 9,959 | |

| Insurance fee | | | 52 | |

| Other expenses | | | 32,067 | |

| Total Expenses | | | 3,011,085 | |

| Net Investment Income | | | 2,205,569 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS): | | | | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | 4,391,674 | |

| Futures | | | (1,412,936 | ) |

| Net realized gain | | | 2,978,738 | |

| Long-term capital gains from other investment companies | | | 75,262 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | 17,344,542 | |

| Futures | | | (1,105,612 | ) |

| Net change in unrealized appreciation/depreciation | | | 16,238,930 | |

| Net Realized and Unrealized Gain on Investments and Futures Contracts | | | 19,292,930 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 21,498,499 | |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2019 | 9 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

Statement of Changes in Net Assets

| | | For the Period October 25, 2018 (Commencement of Operations) to June 30, 2019 | |

| NET INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | | | |

| Net investment income | | $ | 2,205,569 | |

| Net realized gain | | | 2,978,738 | |

| Long-term capital gains from other investment companies | | | 75,262 | |

| Net change in unrealized appreciation/depreciation | | | 16,238,930 | |

| Net increase in net assets resulting from operations | | | 21,498,499 | |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| From distributable earnings | | | (2,774,713 | ) |

| From tax return of capital | | | (1,316,288 | ) |

| Net decrease in net assets from distributions to shareholders | | | (4,091,001 | ) |

| | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Proceeds from shares sold, net of offering costs | | | 127,110,430 | |

| Net increase in net assets from capital share transactions | | | 127,110,430 | |

| | | | | |

| Net Increase in Net Assets | | | 144,517,928 | |

| | | | | |

| NET ASSETS: | | | | |

| Beginning of period | | | 100,000 | |

| End of period | | $ | 144,617,928 | |

| | | | | |

| OTHER INFORMATION: | | | | |

| Share Transactions: | | | | |

| Shares outstanding- beginning of period | | | 5,010 | |

| Shares sold | | | 6,368,258 | |

| Shares outstanding - end of period | | | 6,373,268 | |

| See Notes to Financial Statements. | |

| 10 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Statement of Cash Flows | For the Period October 25, 2018 (Commencement |

| | of Operations) to June 30, 2019 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets resulting from operations | | $ | 21,498,499 | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

| Purchases of investment securities | | | (446,890,958 | ) |

| Proceeds from disposition of investment securities | | | 251,522,837 | |

| Amortization of premium and accretion of discount on investments, net | | | 701,928 | |

| Net purchases of short-term investment securities | | | (6,062,839 | ) |

| Net realized (gain)/loss on: | | | | |

| Investments | | | (4,391,674 | ) |

| Return of capital from other investment companies | | | 2,109 | |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investments | | | (17,344,542 | ) |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (1,433,860 | ) |

| Dividends receivable | | | (247,735 | ) |

| Variation margin receivable on futures contracts | | | (10,625 | ) |

| Prepaid and other assets | | | (11,008 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Payable for shareholder servicing | | | 13,761 | |

| Payable for interest expense and fees on Floating Rate Note Obligations | | | 535,918 | |

| Payable to transfer agency | | | 7,007 | |

| Payable to Adviser | | | 192,654 | |

| Payable for administrative fees | | | 15,683 | |

| Payable to Directors and Officers | | | 415 | |

| Payable for Audit fees | | | 31,000 | |

| Payable for Compliance fees | | | 1,910 | |

| Payable for Custodian fees | | | 7,051 | |

| Other payables | | | 13,832 | |

| Net cash used in operating activities | | $ | (201,848,637 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Payments and proceeds from floating rate note obligations | | $ | 77,925,000 | |

| Proceeds from sale of capital shares | | | 127,110,430 | |

| Cash distributions paid | | | (4,091,001 | ) |

| Payable to custodian due to overdraft | | | 1,338,208 | |

| Net cash provided by financing activities | | $ | 202,282,637 | |

| | | | | |

| Net increase in cash and restricted cash | | $ | 434,000 | |

| Cash and restricted cash, beginning of period | | $ | 100,000 | |

| Cash and restricted cash, end of period | | $ | 534,000 | |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2019 | 11 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Statement of Cash Flows | For the Period October 25, 2018 (Commencement |

| | of Operations) to June 30, 2019 |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | |

| Cash paid during the period for interest expense and fees on floating rate note obligations | | $ | 557,225 | |

| | | | | |

| Reconciliation of restricted and unrestricted cash at the beginning of period to the statement of assets and liabilities | | | | |

| Cash | | $ | 100,000 | |

| | | | | |

| Reconciliation of restricted and unrestricted cash at the end of the period to the statement of assets and liabilities | | | | |

| Deposit with broker for futures contracts/collateral | | $ | 534,000 | |

| See Notes to Financial Statements. | |

| 12 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Financial Highlights | For a share outstanding throughout the periods presented |

| | | For the Period October 25, 2018 (Commencement of Operations) to June 30, 2019 | |

| Net asset value - beginning of period | | $ | 19.96 | |

| Income/(loss) from investment operations: | | | | |

| Net investment income(a) | | | 0.35 | |

| Net realized and unrealized gain | | | 3.02 | |

| Total income from investment operations | | | 3.37 | |

| Less distributions: | | | | |

| From net investment income | | | (0.43 | ) |

| From tax return of capital | | | (0.21 | ) |

| Total distributions | | | (0.64 | ) |

| Net increase in net asset value | | | 2.73 | |

| Net asset value - end of period | | $ | 22.69 | |

| Market price - end of period | | $ | 21.34 | |

| Total Return(b) | | | 17.24 | %(c) |

| Total Return - Market Price(b) | | | 10.04 | %(c) |

| Supplemental Data: | | | | |

| Net assets, end of period (in thousands) | | $ | 144,618 | |

| Ratios to Average Net Assets (including interest on short term floating rate obligations)(d) | | | | |

| Ratio of expenses to average net assets | | | 3.28 | %(e)(f) |

| Ratio of net investment income to average net assets | | | 2.40 | %(e)(f) |

| Ratios to Average Net Assets (excluding interest on short term floating rate obligations) | | | | |

| Ratio of expenses to average net assets | | | 2.09 | %(e)(f) |

| Ratio of net investment income to average net assets | | | 3.59 | %(e)(f) |

| Portfolio turnover rate | | | 120 | %(c) |

| Payable for floating rate obligations (in thousands) | | $ | 77,925 | |

| Asset coverage per $1,000 of floating rate obligations payable | | | 2,856 | |

| (a) | Calculated using average shares throughout the period. |

| (b) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported. For purposes of this calculation, dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any. Periods less than one year are not annualized. |

| (c) | Not annualized. |

| (d) | Interest expense relates to the cost of tender option bond transactions (See Note 2). |

| (e) | Annualized. |

| (f) | The ratios exclude the impact of expenses of the underlying funds in which the Fund invests as represented in the Schedule of Investments. |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2019 | 13 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

RiverNorth Opportunistic Municipal Income Fund, Inc. (the “Fund”) was organized as a Maryland corporation on July 16, 2018, pursuant to an Articles of Incorporation, which was amended and restated on October 19, 2018 (“Articles of Incorporation”). The Fund had no operations until October 25, 2018 (commencement of operations), other than those related to organizational matters and the registration of its shares under applicable securities laws.

The Fund is a diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Articles of Incorporation permit the Board of Directors (the “Board” or “Directors”) to authorize and issue fifty million shares of common stock with $0.0001 par value per share. The Fund is considered an investment company and therefore follows the Investment Company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards codification Topic 946Financial Services – Investment Companies.

The Fund will terminate on or before October 25, 2030; provided, that if the Board of Directors believes that under then-current market conditions it is in the best interests of the Fund to do so, the Fund may extend the Termination Date once for up to one year, and once for an additional six months. The Fund may be converted to an open-end investment company at any time if approved by the Board of Directors and the shareholders.

The Fund’s investment adviser is RiverNorth Capital Management, LLC (the “Adviser”) and the Fund’s sub-adviser is MacKay Shields, LLC (the “Sub-Adviser”). The Fund’s investment objective is to seek current income exempt from regular U.S. federal income taxes (but which may be includable in taxable income for purposes of the Federal alternative minimum tax). The Fund’s secondary investment objective is total return.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”). The financial statements are prepared in accordance with U.S. GAAP, which requires management to make estimates and assumptions that affect the reported amounts and disclosures, including the disclosure of contingent assets and liabilities, in the financial statements during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) on June 30, 2019.

The Fund invests in closed end funds, each of which has its own investment risks. Those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one closed end fund than in another, the Fund will have greater exposure to the risks of that closed end fund.

| 14 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

Security Valuation: The Fund’s investments are generally valued at their fair value using market quotations. If a market value quotation is unavailable a security may be valued at its estimated fair value as described in Note 3.

Security Transactions and Investment Income: The Fund follows industry practice and records securities transactions on the trade date basis. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date, and interest income and expenses are recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method over the life of the respective securities.

Federal Income Taxes: The Fund makes no provision for federal income tax. The Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “IRC”), by distributing substantially all of its taxable income. If the required amount of net investment income is not distributed, the Fund could incur a tax expense.

As of and during the period from October 25, 2018 (commencement of operations) to June 30, 2019, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses on the Statement of Operations. During the period from October 25, 2018 (commencement of operations) to June 30, 2019, the Fund did not incur any interest or penalties.

Distributions to Shareholders: Distributions to shareholders, which are paid monthly and determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification will have no effect on net assets, results of operations or net asset value per share of the Fund.

The Fund distributes to shareholders regular monthly cash distributions of its net investment income. In addition, the Fund distributes its net realized capital gains, if any, at least annually. At times, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return capital, in addition to current net investment income. Any distribution that is treated as a return of capital generally will reduce a shareholder’s basis in his or her shares, which may increase the capital gain or reduce the capital loss realized upon the sale of such shares. Any amounts received in excess of a shareholder’s basis are generally treated as capital gain, assuming the shares are held as capital assets.

| Annual Report | June 30, 2019 | 15 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

Tender Option Bonds: The Fund may leverage its assets through the use of proceeds received from tender option bond (“TOB”) transactions. In a TOB transaction, a tender option bond trust (a “TOB Issuer”) is typically established, which forms a special purpose trust into which the Fund, or an agent on behalf of the Fund, transfers municipal bonds or other municipal securities (“Underlying Securities”). A TOB Issuer typically issues two classes of beneficial interests: short-term floating rate notes (“TOB Floaters”) with a fixed principal amount representing a senior interest in the Underlying Securities, and which are generally sold to third party investors, and residual interest municipal tender option bonds (“TOB Residuals”) representing a subordinate interest in the Underlying Securities, and which are generally issued to the Fund. The interest rate on the TOB Floaters resets periodically, usually weekly, to a prevailing market rate, and holders of the TOB Floaters are granted the option to tender their TOB Floaters back to the TOB Issuer for repurchase at their principal amount plus accrued interest thereon periodically, usually daily or weekly. The Fund may invest in both TOB Floaters and TOB Residuals, including TOB Floaters and TOB Residuals issued by the same TOB Issuer. The Fund may not invest more than 5% of its “Managed Assets” in any single TOB Issuer. Managed Assets is defined as total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be outstanding).

As a result of Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules thereunder (collectively, the “Volcker Rule”), banking entities are generally prohibited from sponsoring the TOB Issuer, and instead the Fund may serve as the sponsor of a TOB issuer (“Fund-sponsored TOB”) and establish, structure and “sponsor” a TOB Issuer in which it holds TOB Residuals. In connection with Fund-sponsored TOBs, the Fund may contract with a third-party to perform some or all of the Fund’s duties as sponsor. The Fund’s role under the Fund-sponsored TOB structure may increase its operational and regulatory risk. If the third-party is unable to perform its obligations as an administrative agent, the Fund itself would be subject to such obligations or would need to secure a replacement agent. The obligations that the Fund may be required to undertake could include reporting and recordkeeping obligations under the IRC and federal securities laws and contractual obligations with other TOB service providers.

Under the Fund-sponsored TOB structure, the TOB Issuer receives Underlying Securities from the Fund through (or as) the sponsor and then issues TOB Floaters to third party investors and TOB Residuals to the Fund. The Fund is paid the cash (less transaction expenses, which are borne by the Fund) received by the TOB Issuer from the sale of TOB Floaters and typically will invest the cash in additional municipal bonds or other investments permitted by its investment policies. TOB Floaters may have first priority on the cash flow from the securities held by the TOB Issuer and are enhanced with a liquidity support arrangement from a bank or an affiliate of the sponsor (the “liquidity provider”), which allows holders to tender their position back to the TOB Issuer at par (plus accrued interest). The Fund, in addition to receiving cash from the sale of TOB Floaters, also receives TOB Residuals. TOB Residuals provide the Fund with the right to (1) cause the holders of TOB Floaters to tender their notes to the TOB Issuer at par (plus accrued interest), and (2) acquire the Underlying Securities from the TOB Issuer. In addition, all voting rights and decisions to be made with respect to any other rights relating to the Underlying Securities deposited in the TOB Issuer are passed through to the Fund, as the holder of TOB Residuals. Such a transaction, in effect, creates exposure for the Fund to the entire return of the Underlying Securities deposited in the TOB Issuer, with a net cash investment by the Fund that is less than the value of the Underlying Securities deposited in the TOB Issuer. This multiplies the positive or negative impact of the Underlying Securities’ return within the Fund (thereby creating leverage). Income received from TOB Residuals will vary inversely with the short term rate paid to holders of TOB Floaters and in most circumstances, TOB Residuals represent substantially all of the Underlying Securities’ downside investment risk and also benefits disproportionately from any potential appreciation of the Underlying Securities’ value. The amount of such increase or decrease is a function, in part, of the amount of TOB Floaters sold by the TOB Issuer of these securities relative to the amount of TOB Residuals that it sells. The greater the amount of TOB Floaters sold relative to TOB Residuals, the more volatile the income paid on TOB Residuals will be. The price of TOB Residuals will be more volatile than that of the Underlying Securities because the interest rate is dependent on not only the fixed coupon rate of the Underlying Securities, but also on the short-term interest rate paid on TOB Floaters.

| 16 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

For TOB Floaters, generally, the interest rate earned will be based upon the market rates for municipal securities with maturities or remarketing provisions that are comparable in duration to the periodic interval of the tender option, which may vary from weekly, to monthly, to extended periods of one year or multiple years. Since the option feature has a shorter term than the final maturity or first call date of the Underlying Securities deposited in the TOB Issuer, the Fund, if it is the holder of the TOB Floaters, relies upon the terms of the agreement with the financial institution furnishing the option as well as the credit strength of that institution. As further assurance of liquidity, the terms of the TOB Issuer provide for a liquidation of the Underlying Security deposited in the TOB Issuer and the application of the proceeds to pay off the TOB Floaters.

The TOB Issuer may be terminated without the consent of the Fund upon the occurrence of certain events, such as the bankruptcy or default of the issuer of the Underlying Securities deposited in the TOB Issuer, a substantial downgrade in the credit quality of the issuer of the securities deposited in the TOB Issuer, the inability of the TOB Issuer to obtain liquidity support for the TOB Floaters, a substantial decline in the market value of the Underlying Securities deposited in the TOB Issuer, or the inability of the sponsor to remarket any TOB Floaters tendered to it by holders of the TOB Floaters. In such an event, the TOB Floaters would be redeemed by the TOB Issuer at par (plus accrued interest) out of the proceeds from a sale of the Underlying Securities deposited in the TOB Issuer. If this happens, the Fund would be entitled to the assets of the TOB Issuer, if any, that remain after the TOB Floaters have been redeemed at par (plus accrued interest). If there are insufficient proceeds from the sale of these Underlying Securities to redeem all of the TOB Floaters at par (plus accrued interest), the liquidity provider or holders of the TOB Floaters would bear the losses on those securities and there would be no recourse to the Fund’s assets (unless the Fund held a recourse TOB Residual).

Pursuant to the Volcker Rule, to the extent that the remarketing agent is a banking entity, it would not be able to repurchase tendered TOB Floaters for its own account upon a failed remarketing. In the event of a failed remarketing, a banking entity serving as liquidity provider may loan the necessary funds to the TOB Issuer to purchase the tendered TOB Floaters. The TOB Issuer, not the Fund, would be the borrower and the loan from the liquidity provider will be secured by the purchased TOB Floaters now held by the TOB Issuer. However, the Fund would bear the risk of loss with respect to any liquidity shortfall to the extent it entered into a reimbursement agreement with the liquidity provider.

| Annual Report | June 30, 2019 | 17 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

For financial reporting purposes, Underlying Securities that are deposited into a TOB Issuer are treated as investments of the Fund, and are presented in the Fund’s Schedule of Investments. Outstanding TOB Floaters issued by a TOB Issuer are presented as a liability at their face value as “Payable for Floating Rate Note Obligations” in the Fund’s Statement of Assets and Liabilities. The face value of the TOB Floaters approximates the fair value of the floating rate notes. Interest income from the Underlying Securities is recorded by the Fund on an accrual basis. Interest expense incurred on the TOB Floaters and other expenses related to remarketing, administration and trustee services to a TOB Issuer are recognized as a component of “Interest expense and fees on floating rate note obligations” in the Statement of Operations. Fees paid upon creation of the TOB Trust are recorded as debt issuance costs and are amortized to “Interest expense and fees on floating rate note obligations” in the Statement of Operations.

At June 30, 2019, the aggregate value of the Underlying Securities transferred to the TOB Issuer and the related liability for TOB Floaters was as follows:

| Underlying Securities Transferred to TOB Issuers | Liability for Floating Rate Note Obligations |

| $119,932,722 | $77,925,000 |

During the period from October 25, 2018 (commencement of operations) to June 30, 2019, the Fund’s average TOB Floaters outstanding and the daily weighted average interest rate, including fees, were as follows:

| Average Floating Rate Note Obligations Outstanding | Daily Weighted Average Interest Rate |

| $73,157,711 | 2.20% |

Other: The Fund holds certain investments which pay dividends to their shareholders based upon available funds from operations. It is possible for these dividends to exceed the underlying investments’ taxable earnings and profits resulting in the excess portion of such dividends being designated as a return of capital. Distributions received from investments in securities that represent a return of capital or long-term capital gains are recorded as a reduction of the cost of investments or as a realized gain, respectively.

| 3. | SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS |

Fair value is defined as the price that the Fund might reasonably expect to receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. U.S. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including using such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

| 18 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| | | |

| | Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | | |

| | Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including closed-end funds, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Adviser or the Sub-Adviser believes such prices more accurately reflect the fair market value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations are not readily available, when the Adviser or the Sub-Adviser determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Adviser, Sub-Adviser, or valuation committee in conformity with guidelines adopted by and subject to review by the Board. These securities will be categorized as Level 3 securities.

Investments in mutual funds, including short term investments, are generally priced at the ending net asset value (“NAV”) provided by the service agent of the funds. These securities will be classified as Level 1 securities.

| Annual Report | June 30, 2019 | 19 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

Fixed income securities, including municipal bonds, are normally valued at the mean between the closing bid and asked prices provided by independent pricing services. Prices obtained from independent pricing services typically use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. These securities will be classified as Level 2 securities.

Futures contracts are normally valued at the final settlement price or official closing price provided by independent pricing services.

In accordance with the Fund’s good faith pricing guidelines, the Adviser, Sub-Adviser, or valuation committee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Adviser, Sub-Adviser, or valuation committee would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) discounted cash flow models; (iii) weighted average cost or weighted average price; (iv) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (v) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Adviser’s, a Sub-Adviser’s, or the valuation committee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser or a Sub-Adviser is aware of any other data that calls into question the reliability of market quotations.

Good faith pricing may also be used in instances when the bonds in which the Fund invests default or otherwise cease to have market quotations readily available.

| 20 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

The following is a summary of the inputs used at June 30, 2019 in valuing the Fund’s assets and liabilities:

| Investments in Securities at Value* | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Closed-End Funds | | $ | 96,588,484 | | | $ | – | | | $ | – | | | $ | 96,588,484 | |

| Municipal Bonds | | | – | | | | 119,932,722 | | | | – | | | | 119,932,722 | |

| Short-Term Investments | | | 6,062,839 | | | | – | | | | – | | | | 6,062,839 | |

| Total | | $ | 102,651,323 | | | $ | 119,932,722 | | | $ | – | | | $ | 222,584,045 | |

| Other Financial Instruments** | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Future Contracts | | $ | (1,105,612 | ) | | $ | – | | | $ | – | | | $ | (1,105,612 | ) |

| Total | | $ | (1,105,612 | ) | | $ | – | | | $ | – | | | $ | (1,105,612 | ) |

| * | Refer to the Fund’s Schedule of Investments for a listing of securities by type. |

| ** | Other financial instruments are derivative instruments reflected in the Schedule of Investments. Futures contracts are reported at their unrealized appreciation/(depreciation). |

| 4. | DERIVATIVE FINANCIAL INSTRUMENTS |

The following discloses the Fund’s use of derivative instruments. The Fund’s investment objective not only permits the Fund to purchase investment securities, but also allow the Fund to enter into various types of derivative contracts such as futures. In doing so, the Fund will employ strategies in differing combinations to permit it to increase, decrease, or change the level or types of exposure to market factors. Central to those strategies are features inherent to derivatives that make them more attractive for this purpose than equity or debt securities; they require little or no initial cash investment, they can focus exposure on only selected risk factors, and they may not require the ultimate receipt or delivery of the underlying security (or securities) to the contract. This may allow the Fund to pursue its objective more quickly and efficiently than if it were to make direct purchases or sales of securities capable of affecting a similar response to market factors.

Market Risk Factors: In pursuit of its investment objectives, the Fund may seek to use derivatives to increase or decrease its exposure to the following market risk factors:

Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Interest Rate Risk: Interest rate risk relates to the risk that the municipal securities in the Fund’s portfolio will decline in value because of increases in market interest rates.

| Annual Report | June 30, 2019 | 21 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

Risk of Investing in Derivatives

The Fund’s use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses in excess of their cost. This use of embedded leverage allows the Fund to increase its market value exposure relative to its net assets and can substantially increase the volatility of the Fund’s performance.

Additional associated risks from investing in derivatives also exist and potentially could have significant effects on the valuation of the derivative and the Fund. Typically, the associated risks are not the risks that the Fund is attempting to increase or decrease exposure to, per its investment objective, but are the additional risks from investing in derivatives.

Examples of these associated risks are liquidity risk, which is the risk that the Fund will not be able to sell the derivative in the open market in a timely manner, and counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund.

Futures

The Fund may invest in futures contracts in accordance with its investment objectives. The Fund does so for a variety of reasons including for cash management, hedging or non-hedging purposes in an attempt to achieve the Fund’s investment objective. A futures contract provides for the future sale by one party and purchase by another party of a specified quantity of the security or other financial instrument at a specified price and time. A futures contract on an index is an agreement pursuant to which two parties agree to take or make delivery of an amount of cash equal to the difference between the value of the index at the close of the last trading day of the contract and the price at which the index contract was originally written. Futures transactions may result in losses in excess of the amount invested in the futures contract. There can be no guarantee that there will be a correlation between price movements in the hedging vehicle and in the portfolio securities being hedged. An incorrect correlation could result in a loss on both the hedged securities in a fund and the hedging vehicle so that the portfolio return might have been greater had hedging not been attempted. There can be no assurance that a liquid market will exist at a time when a fund seeks to close out a futures contract or a futures option position. Lack of a liquid market for any reason may prevent a fund from liquidating an unfavorable position, and the fund would remain obligated to meet margin requirements until the position is closed. In addition, a fund could be exposed to risk if the counterparties to the contracts are unable to meet the terms of their contracts. With exchange traded futures, there is minimal counterparty credit risk to the Fund since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default. The Fund is party to certain enforceable master netting arrangements, which provide for the right of offset under certain circumstances, such as the event of default.

When a purchase or sale of a futures contract is made by a fund, the fund is required to deposit with its custodian (or broker, if legally permitted) a specified amount of liquid assets (“initial margin”). The margin required for a futures contract is set by the exchange on which the contract is traded and may be modified during the term of the contract. The initial margin is in the nature of a performance bond or good faith deposit on the futures contract that is returned to the Fund upon termination of the contract, assuming all contractual obligations have been satisfied. These amounts are included in Deposit with broker for futures contracts on the Statement of Assets and Liabilities. Each day the Fund may pay or receive cash, called “variation margin,” equal to the daily change in value of the futures contract. Such payments or receipts are recorded for financial statement purposes as unrealized gains or losses by the Fund. Variation margin does not represent a borrowing or loan by the Fund but instead is a settlement between the Fund and the broker of the amount one would owe the other if the futures contract expired. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

| 22 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

Derivative Instruments: The following tables disclose the amounts related to the Fund’s use of derivative instruments.

The effect of derivatives instruments on the Fund’s Statement of Assets and Liabilities as of June 30, 2019:

| Liability Derivatives |

| Risk Exposure | | Statements of Assets and LiabilitiesLocation | | Fair Value | |

| Interest Rate Risk (Futures Contracts)* | | Unrealized depreciation on futures contracts | | $ | (1,105,612 | ) |

| * | The value presented includes cumulative loss on open futures contracts; however the value reflected on the accompanying Statement of Assets and Liabilities is only the unsettled variation margin receivable as of June 30, 2019. |

The effect of derivative instruments on the Statement of Operations for the fiscal period ended June 30, 2019:

| Risk Exposure | | Statement of Operations Location | | Realized Gain/(Loss) on Derivatives | | | Change in Unrealized Appreciation/ Depreciation on Derivatives | |

| Interest rate risk (Futures contracts) | | Net realized gain/(loss) on futures contracts; Net change in unrealized appreciation/(depreciation) on futures contracts | | $ | (1,412,936 | ) | | $ | (1,105,612 | ) |

| Annual Report | June 30, 2019 | 23 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

The futures contracts average notional amount during the period ended June 30, 2019, is noted below.

| Fund | | Average Notional Amount of Futures Contracts | |

| RiverNorth Opportunistic Municipal Income Fund, Inc. | | $ | 30,573,926 | |

5. ADVISORY FEES, DIRECTOR FEES AND OTHER AGREEMENTS

The Adviser serves as the investment adviser to the Fund. Under the terms of the management agreement, the Adviser, subject to the supervision of the Board, provides or arranges to be provided to the Fund such investment advice as it deems advisable and will furnish or arrange to be furnished a continuous investment program for the Fund consistent with its investment objectives and policies. As compensation for its management services, the Fund will pay the Adviser a fee of 1.05% of the Fund’s average daily managed assets calculated as the total assets of the Fund, including assets attributable to leverage, less liabilities other than debt representing leverage and any preferred stock that may be outstanding. This fee is payable at the end of each calendar month.

The Sub-Adviser is the investment sub-adviser to the Fund. Under the terms of the sub-advisory agreement, the Sub-Adviser, subject to the supervision of the Adviser and the Board of Directors, provides to the Fund such investment advice as is deemed advisable and will furnish a continuous investment program for the portion of assets managed, consistent with the Fund’s investment objective and policies. As compensation for its sub-advisory services, the Adviser is obligated to pay the Sub-Adviser a fee computed and accrued daily and paid monthly in arrears based on an annual rate of 0.20% of the average daily managed assets of the Fund.

The Chief Compliance Officer (“CCO”) of the Fund is an affiliated person. For the period October 25, 2018 (commencement of operations) to June 30, 2019, the total related amount paid by the Fund for CCO fees is included in compliance expenses on the Fund’s Statement of Operations.

ALPS Fund Services, Inc. (“ALPS”), serves as administrator to the Fund. Under an Administration, Bookkeeping and Pricing Services Agreement, ALPS is responsible for calculating the net asset and Daily Managed Assets values, providing additional fund accounting and tax services, and providing fund administration and compliance-related services to the Fund. ALPS is entitled to receive the greater of an annual minimum fee or a monthly fee based on the Fund’s average net assets, plus out-of-pocket expenses.

DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying, and shareholder servicing agent for the Fund (the “Transfer Agent”).

State Street Bank & Trust, Co. serves as the Fund’s custodian.

Certain Officers and Directors of the Fund are “interested persons” of the Fund as they are also employees of the Adviser or ALPS. Officers and Directors who are “interested persons” of the Fund received no salary or fees from the Fund except for the Chief Compliance Officer for compliance expenses. Directors who are not “interested persons” receive a fee from the Fund of $16,500 per year, plus $1,500 per Board of Directors meeting attended. In addition, the lead Independent Director receives $250 annually, the Chair of the Audit Committee receives $500 annually, and the Chair of the Nominating and Corporate Governance Committee receives $250 annually. The Independent Directors are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at meetings of the Board of Directors.

| 24 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

6. TAX BASIS INFORMATION

Tax Basis of Distributions to Shareholders: The character of distributions made during the period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain were recorded by the Fund.

The tax character of distributions paid by the Fund during the period October 25, 2018 (commencement of operations) to June 30, 2019, was as follows:

| | | For the Period Ended June 30, 2019 | |

| Ordinary Income | | $ | 120,145 | |

| Tax-Exempt Income | | | 2,654,568 | |

| Return of Capital | | | 1,316,288 | |

| Total | | $ | 4,091,001 | |

Components of Distributable Earnings on a Tax Basis: The tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the composition of net assets reported under GAAP. Accordingly, for the period October 25, 2018 (commencement of operations) to June 30, 2019, certain differences were reclassified. The amounts reclassified did not affect net assets and were primarily related to the treatment of tender option bonds. The reclassifications were as follows:

| Paid-in capital | Total distributable earnings |

| $1,900,812 | $(1,900,812) |

| Annual Report | June 30, 2019 | 25 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

At June 30, 2019, the components of distributable earnings on a tax basis for the Fund were as follows:

| Accumulated Capital Loss | | | (521,568 | ) |

| Unrealized Appreciation | | $ | 17,344,542 | |

| Total | | $ | 16,822,974 | |

The Fund has elected to defer to the year ending June 30, 2020, post-October capital losses recognized during the period November 1, 2018 to June 30, 2019, in the amount of $521,568.

Unrealized Appreciation and Depreciation on Investments: The amount of net unrealized appreciation/(depreciation) and the cost of investment securities for tax purposes, adjusted for tender option bonds, including short-term securities and excluding derivative instruments at June 30, 2019, was as follows:

| Cost of investments for income tax purposes | | $ | 127,314,503 | |

| Gross appreciation on investments (excess of value over tax cost) | | | 17,349,499 | |

| Gross depreciation on investments (excess of tax cost over value) | | | (4,957 | ) |

| Net unrealized appreciation on investments | | $ | 17,344,542 | |

7. INVESTMENT TRANSACTIONS

Investment transactions for the period October 25, 2018 (commencement of operations) to June 30, 2019, excluding short-term investments, were as follows:

| Purchases | Sales |

| $447,648,581 | $252,236,822 |

| 26 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

8. CAPITAL SHARE TRANSACTIONS

On October 25, 2018, 5,950,000 shares were issued in connection with the Fund’s initial public offering. Proceeds from the sale of shares was $119,000,000.

During the period October 25, 2018 (commencement of operations) to June 30, 2019, $8,365,160 was paid in newly issued shares resulting in the issuance of 418,258 shares.

Offering costs of $254,730 (representing $0.04 per common share) were offset against proceeds of the offerings and have been charged to paid-in capital of the shares. The Adviser has agreed to pay all organization costs of the Fund and those offering costs of the Fund that exceeded $0.04 per share.

Additional shares of the Fund may be issued under certain circumstances, including pursuant to the Fund’s Automatic Dividend Reinvestment Plan, as defined within the Fund’s organizational documents. Additional information concerning the Automatic Dividend Reinvestment Plan is included within this report.

9. INDEMNIFICATIONS

Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that may contain general indemnification clauses. The Fund’s maximum exposure under those arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

10. SEC REGULATIONS

On October 4, 2018, the SEC amended Regulation S-X to require certain financial statement disclosure requirements to conform them to US GAAP for investment companies. Effective November 4, 2018, the Fund adopted disclosure requirement changes for Regulation S-X and these changes are reflected throughout this report. The Fund’s adoption of these amendments, effective with the financial statements prepared as of June 30, 2019, had no effect on the Fund’s net assets or results of operations.

| Annual Report | June 30, 2019 | 27 |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Notes to Financial Statements | June 30, 2019 |

11. RECENT ACCOUNTING PRONOUNCEMENTS

In March 2017, the Financial Accounting Standards Board issued Accounting Standards Update No. 2017-08 (“ASU 2017-08”), “Receivables–Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities”. ASU 2017-08 changed the amortization period for certain callable debt securities held at a premium. Specifically, it required the premium to be amortized from the earliest call date. The Fund has adopted and applied ASU 2017-08 noting that it had no effect on the financial statements for the period October 25, 2018 (commencement of operations) to June 30, 2019.

In August 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework – changes to the Disclosure Requirements for Fair Value Measurements, which amended guidance on the disclosure requirements for fair value measurement. The update to Topic 820 includes added, eliminated, and modified disclosure requirements for investments measured at fair value. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods. Early adoption is permitted for any eliminated or modified disclosures. The impact of the amended guidance on the Fund was the removal of the requirements to disclose (a) amount of and reasons for transfers between Level 1 and 2 fair value measurements, (b) the valuation process for Level 3 fair value measurements, and (c) the policy for timing of transfers between levels. Management has evaluated the impact of this ASU and has adopted the changes into the Fund’s financial statements.

12. SUBSEQUENT EVENTS

Subsequent to June 30, 2019, the Fund paid the following distributions:

| Ex-Date | Record Date | Payable Date | Rate (per share) |

| July 10, 2019 | July 11, 2019 | July 31, 2019 | $0.0917 |

| 28 | (888) 848-7569 | www.rivernorth.com |

RiverNorth Opportunistic Municipal Income Fund, Inc.

| Report of Independent Registered Public Accounting Firm | June 30, 2019 |

To the Shareholders and Board of Directors of

RiverNorth Opportunistic Municipal Income Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of RiverNorth Opportunistic Municipal Income Fund, Inc. (the “Fund”) as of June 30, 2019, and the related statements of operations, cash flows, and changes in net assets, including the related notes, and the financial highlights for the period October 25, 2018 (commencement of operations) to June 30, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2019, the results of its operations, its cash flows, the changes in its net assets, and the financial highlights for the period October 25, 2018 (commencement of operations) to June 30, 2019, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion