Exhibit 10.2

Execution Version

SHARE PURCHASE AGREEMENT

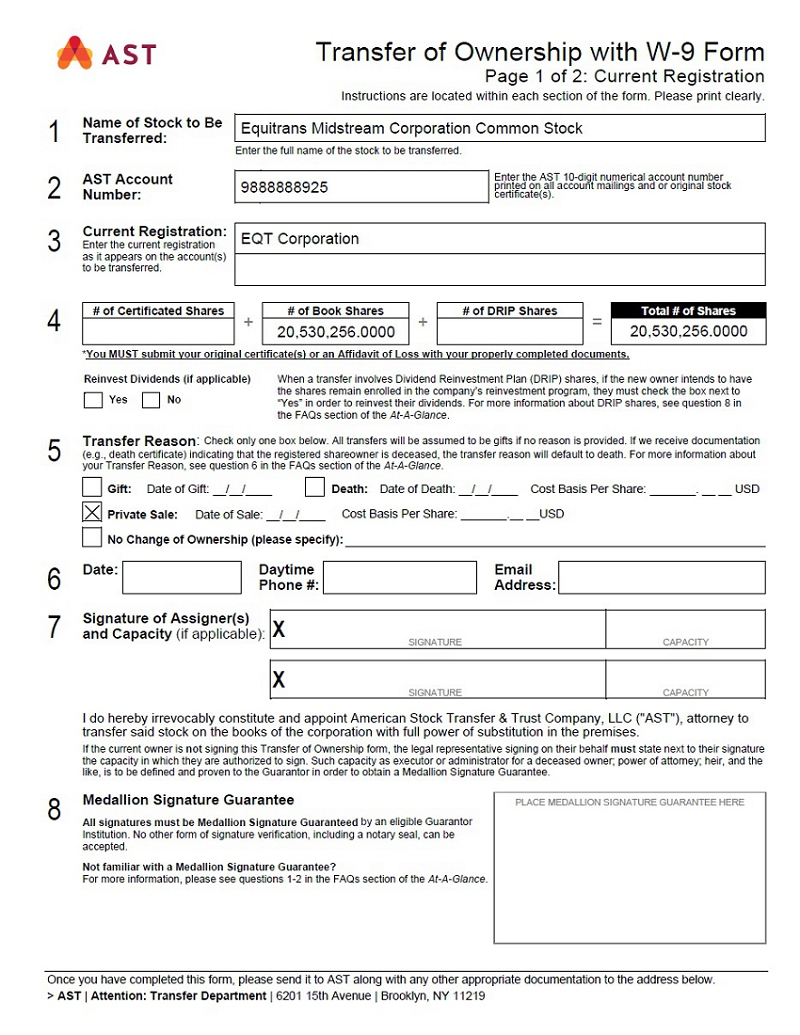

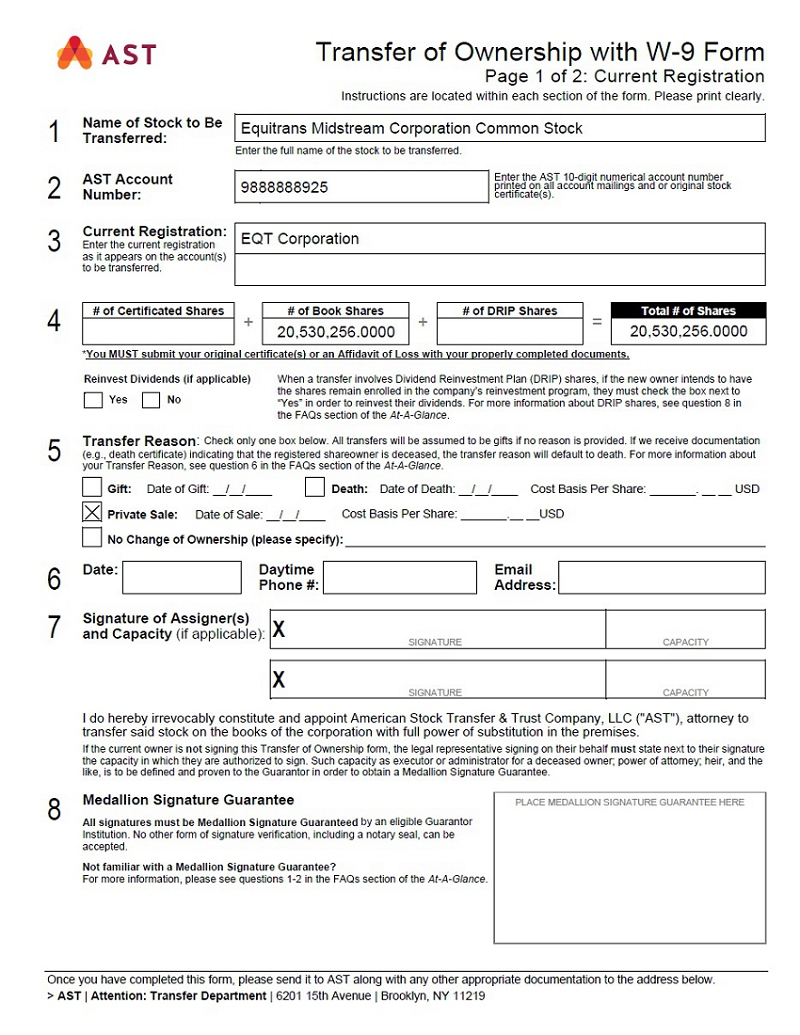

ThisSHARE PURCHASE AGREEMENT (this “Agreement”) is made as of February 26, 2020, by and between EQT Corporation, a Pennsylvania corporation (“Seller”), and Equitrans Midstream Corporation, a Pennsylvania corporation (the “Company”). Seller and the Company are referred to herein collectively as the “Parties” and each, individually, as a “Party.”

WHEREAS, as of the date hereof, Seller is the record and beneficial owner (as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of 50,599,503 shares of common stock, no par value, of the Company (the “Common Stock”);

WHEREAS, Seller desires to sell to the Company, and the Company desires to repurchase from Seller, 20,530,256 shares of Common Stock (the “Subject Shares”) on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, contemporaneously with the execution of this Agreement, Seller and EQM Midstream Partners, LP, a Delaware limited partnership (“EQM”), and/or one or more of their respective Affiliates (as defined below) will enter into that certain Gas Gathering and Compression Agreement, dated as of the date hereof, pursuant to which, among other things, Seller shall dedicate certain hydrocarbon production from properties located in West Virginia and Pennsylvania for gathering by EQM and/or one or more of its Affiliates and shall be provided with certain commercial terms, including potential reservation rates (the “GGA”);

WHEREAS, contemporaneously with the execution of this Agreement, Seller and EQM and/or one or more of their respective Affiliates will enter into that certain letter agreement, dated as of the date hereof, pursuant to which, among other things, the parties thereto shall set forth certain agreements relating to the in-service date of the Mountain Valley Pipeline and the reservation rates related thereto (the “Fee Letter Agreement”);

WHEREAS, the Company has received the TMA Signing Opinion (as defined below) on or prior to the date hereof; and

WHEREAS, in exchange for the Subject Shares, the Company desires to issue a promissory note, in the form attached hereto asExhibit A, representing $195,820,075.29 in aggregate principal amount (the “Share Purchase Price”), which is based on a 20-day volume-weighted average of $9.54 per Subject Share (the “Price per Share”), in favor of Seller (or its assignee) (the “Note”) at the Closing (as defined below), which Seller immediately will transfer, convey and assign to EQM in consideration of certain commercial terms, including potential reservation rates, contemplated in the GGA and the Fee Letter Agreement. The Company shall additionally pay to Seller cash in the amount of $6,830,932.95 (the “Cash Amount” and, together with the Share Purchase Price, the “Purchase Price”). The Cash Amount shall be payable at the Closing in accordance withSection 2.2 hereof.

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, do hereby agree as follows:

Article I.

Purchase and Sale

1.1 Purchase and Sale. On the terms and subject to the conditions set forth in this Agreement, at the Closing, Seller shall sell, transfer, convey, assign and deliver to the Company (or its designee), and the Company (or its designee) shall purchase, accept and assume from Seller, all of Seller’s right, title and interest to the Subject Shares, and the Company shall (a) issue the Note in favor of Seller (or its assignee) in an aggregate principal amount equal to the Share Purchase Price and (b) pay the Cash Amount to Seller in cash.

1.2 Assignment of Note; Appointment of Proxy.

(a) At the Closing, Seller shall assign all of Seller’s right, title and interest to the Note by execution of an assignment agreement, in the form attached hereto asExhibit B (the “Note Assignment”), to EQM in consideration of certain commercial terms, including potential reservation rates, contemplated in the GGA.

(b) Simultaneous with the execution of this Agreement, Seller hereby irrevocably appoints and constitutes the Company (or its designee) as the sole and exclusive proxy and attorney-in-fact of Seller with respect to the Note Assignment (the “Proxy”). The foregoing Proxy shall include the right of the Company to sign, as holder of the irrevocable Proxy on behalf of Seller, the Note Assignment or other documents relating to Seller that may be required to cause Seller to execute the Note Assignment at the Closing. The proxy granted hereby shall be irrevocable and is coupled with an interest sufficient in Law (as defined below) to support an irrevocable proxy (including, without limitation, such irrevocable proxy granted hereunder) and shall not be terminated by any act of the Parties hereto, by lack of appropriate power or authority or by the occurrence of any other event or events (including, without limitation, any bankruptcy, insolvency or dissolution of Seller).

Article II.

Closing

2.1 Closing. The closing (the “Closing”) of the transactions contemplated by this Agreement shall take place at the offices of Latham & Watkins LLP, 811 Main St., Suite 3700, Houston, Texas 77002, at 2:00 p.m., local time, on the twenty-first (21st) calendar day following the date hereof, or such other time and place as both Parties may agree in writing, provided that the Closing shall not occur prior to the fulfillment or waiver (in accordance with the provisions hereof) of all of the conditions set forth inArticle VI hereof (other than those conditions that by their nature are to be fulfilled at or upon the Closing, but subject to the fulfillment or waiver of such conditions). The date on which the Closing occurs is hereinafter referred to as the “Closing Date.”

2.2 Deliveries at the Closing. At the Closing, (a) Seller will deliver to the Company a fully executed stock power, in the form attached hereto asExhibit C, representing the Subject Shares and deliver to EQM a fully executed Note Assignment, and (b) the Company will deliver to Seller a fully executed Note and the Cash Amount by wire transfer of immediately available funds to the account designated in writing by Seller at least two (2) Business Days (as defined below) prior to the Closing Date.

Article III.

Representations and Warranties of SelleR

Seller hereby represents and warrants to the Company, as of the date hereof and as of the Closing Date, as follows:

3.1 Organization. Seller is a corporation duly incorporated, validly existing and in good standing under the laws of its jurisdiction of organization and has all requisite corporate power and authority to own, operate and lease its properties and assets and to carry on its business as now conducted.

3.2 Authority and Approval. Seller has full corporate power and authority to execute and deliver this Agreement, to consummate the transactions contemplated hereby and to perform all of the obligations hereof to be performed by it. This Agreement has been duly executed and delivered by Seller and, assuming due authorization, execution and delivery of this Agreement by the Company, constitutes the valid and legally binding obligation of Seller, enforceable against it in accordance with its terms, except as such enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar Laws (as defined below) affecting the enforcement of creditors’ rights and remedies generally and by general principles of equity (whether applied in a proceeding at Law or in equity).

3.3 No Conflicts. The execution, delivery and performance of this Agreement by Seller does not, and the fulfillment and compliance with the terms and conditions hereof and the consummation of the transactions contemplated hereby will not, (a) violate, conflict with, result in any breach of or require the consent of any Person (as defined below) under, any of the terms, conditions or provisions of the Restated Articles of Incorporation or Amended and Restated Bylaws of Seller, each as amended through November 13, 2017; (b) conflict with or violate any Law applicable to Seller; or (c) conflict with, result in a breach of, constitute a default under (whether with notice or the lapse of time or both), result in the creation of any Encumbrance (as defined below) on any of Seller’s assets under, or accelerate or permit the acceleration of the performance required by, or require any consent, authorization or approval under, or result in the suspension, termination or cancellation of, or in a right of suspension, termination or cancellation of, any indenture, mortgage, agreement, contract, commitment, license, concession, permit, lease, joint venture or other instrument to which Seller is a party or by which it is bound; except in the case of clauses (b) and (c), for those items which, individually or in the aggregate, would not reasonably be expected to have a material adverse effect on Seller’s ability to perform its obligations under this Agreement.

3.4 Ownership of the Subject Shares. Seller is the record and beneficial owner (as defined in Rule 13d-3 under the Exchange Act) of all the Subject Shares and has good and marketable title to all the Subject Shares free and clear of any encumbrances, liens, charges, levies, proxies, voting trusts or agreements, options or rights, understandings or arrangements inconsistent with this Agreement or the transactions contemplated hereby, or any other encumbrances or restrictions whatsoever on title, transfer or exercise of any rights of a shareholder in respect of the Subject Shares (collectively, “Encumbrances”), except for any such Encumbrance that may be imposed pursuant to (x) this Agreement, (y) the Shareholder and Registration Rights Agreement, dated as of November 12, 2018, by and between Seller and the Company or (z) any applicable restrictions on transfer under the Securities Act of 1933, as amended, or any state securities Law. Upon the Closing, the Company (or its designee) will own the Subject Shares, free and clear of all Encumbrances.

3.5 Dispositive Power. Seller has sole power of disposition and sole power to issue instructions with respect to the matters set forth inSection 1.1, and sole power to agree to all of the matters set forth in this Agreement, in each case with respect to all the Subject Shares.

3.6 No Consents. No consent, approval, permit, governmental or regulatory order, declaration or filing with, or notice to, any Governmental Authority (as defined below) or any third party is required to be made or obtained by Seller in connection with the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby, except as has been made or obtained on or prior to the date hereof.

3.7 No Litigation. There are no actions, suits, claims, investigations or other legal proceedings pending or, to the knowledge of Seller, threatened against or by Seller that challenge or seek to prevent, enjoin or could otherwise potentially delay the transactions contemplated by this Agreement.

3.8 Informed Seller.

(a) Seller has (i) such knowledge and experience in financial and business matters as to be capable of evaluating the merits, risks and suitability of the transactions contemplated by this Agreement and (ii) evaluated the merits and risks of the transactions contemplated by this Agreement based exclusively on its own independent review and consultations with such investment, legal, Tax (as defined below), accounting and other advisors as it deemed necessary, and has made its own decision concerning the transactions contemplated by this Agreement without reliance on any representation or warranty of, or advice from, the Company. Upon the Closing, Seller will be consummating the transactions contemplated by this Agreement with full understanding of the terms, conditions and risks and willingly assumes those terms, conditions and risks.

(b) Seller has received and carefully reviewed the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and subsequent public filings of the Company with the U.S. Securities and Exchange Commission (the “SEC”), other publicly available information regarding the Company, and such other information that it and its financial, legal and other advisors deem necessary in connection with Seller’s decision to enter into this Agreement and, upon the Closing, consummate the transactions contemplated by this Agreement. Seller has not requested any advice or other information with respect to the Subject Shares from the Company, its Affiliates or any of its or their respective Representatives (as defined below), and no such information or advice is necessary or desired.

Article IV.

Representations and Warranties of the COMPANY

The Company hereby represents and warrants to Seller, as of the date hereof and as of the Closing Date, as follows:

4.1 Organization. The Company is a corporation duly incorporated, validly existing and in good standing under the laws of its jurisdiction of organization and has all requisite corporate power and authority to own, operate and lease its properties and assets and to carry on its business as now conducted.

4.2 Authority and Approval. The Company has full corporate power and authority to execute and deliver this Agreement, to consummate the transactions contemplated hereby and to perform all of the obligations hereof to be performed by it. This Agreement has been duly executed and delivered by the Company and, assuming due authorization, execution and delivery of this Agreement by Seller, constitutes the valid and legally binding obligation of the Company, enforceable against it in accordance with its terms, except as such enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar Laws affecting the enforcement of creditors’ rights and remedies generally and by general principles of equity (whether applied in a proceeding at Law or in equity).

4.3 No Conflicts.

(a) The execution and delivery of this Agreement by the Company do not (a) violate, conflict with, result in any breach of or require the consent of any Person under, any of the terms, conditions or provisions of the governing agreements of the Company; (b) conflict with or violate any Law applicable to the Company; or (c) conflict with, result in a breach of, constitute a default under (whether with notice or the lapse of time or both), result in the creation of any Encumbrance on any of the Company’s assets under, or accelerate or permit the acceleration of the performance required by, or require any consent, authorization or approval under, or result in the suspension, termination or cancellation of, or in a right of suspension, termination or cancellation of, any indenture, mortgage, agreement, contract, commitment, license, concession, permit, lease, joint venture or other instrument to which the Company is a party or by which it is bound; except in the case of clauses (b) and (c) for those items which, individually or in the aggregate, would not reasonably be expected to have a material adverse effect on the Company’s ability to perform its obligations under this Agreement.

(b) As of the Closing Date, the performance of this Agreement by the Company will not, and the fulfillment and compliance with the terms and conditions hereof and the consummation of the transactions contemplated hereby will not, (a) violate, conflict with, result in any breach of or require the consent of any Person under, any of the terms, conditions or provisions of the governing agreements of the Company; (b) conflict with or violate any Law applicable to the Company; or (c) conflict with, result in a breach of, constitute a default under (whether with notice or the lapse of time or both), result in the creation of any Encumbrance on any of the Company’s assets under, or accelerate or permit the acceleration of the performance required by, or require any consent, authorization or approval under, or result in the suspension, termination or cancellation of, or in a right of suspension, termination or cancellation of, any indenture, mortgage, agreement, contract, commitment, license, concession, permit, lease, joint venture or other instrument to which the Company is a party or by which it is bound; except in the case of clauses (b) and (c) for those items which, individually or in the aggregate, would not reasonably be expected to have a material adverse effect on the Company’s ability to perform its obligations under this Agreement.

4.4 No Consents.

(a) No consent, approval, permit, governmental or regulatory order, declaration or filing with, or notice to, any Governmental Authority or any third party is required to be made or obtained by the Company in connection with the execution and delivery of this Agreement, except as has been made or obtained on or prior to the date hereof.

(b) No consent, approval, permit, governmental or regulatory order, declaration or filing with, or notice to, any Governmental Authority or any third party is required to be made or obtained by the Company in connection with the consummation of the transactions contemplated hereby, except as will have been made or obtained on or prior to the Closing Date.

4.5 No Litigation. There are no actions, suits, claims, investigations or other legal proceedings pending or, to the knowledge of the Company, threatened against or by the Company that challenge or seek to prevent, enjoin or could otherwise potentially delay the transactions contemplated by this Agreement.

4.6 Informed Purchaser.

(a) The Company has (a) such knowledge and experience in financial and business matters as to be capable of evaluating the merits, risks and suitability of the transactions contemplated by this Agreement and (b) evaluated the merits and risks of the transactions contemplated by this Agreement based exclusively on its own independent review and consultations with such investment, legal, Tax, accounting and other advisors as it deemed necessary, and has made its own decision concerning the transactions contemplated by this Agreement without reliance on any representation or warranty of, or advice from, Seller. Upon the Closing, the Company will be consummating the transactions contemplated by this Agreement with full understanding of the terms, conditions and risks and willingly assumes those terms, conditions and risks.

(b) The Company has not requested any advice or other information with respect to the Subject Shares from Seller, its Affiliates, or any of its or their respective Representatives, and no such information or advice is necessary or desired.

Article V.

Covenants

5.1 No Inconsistent Arrangements. Except as provided hereunder, neither Party shall, directly or indirectly, take or permit any other action that would in any way restrict, limit or interfere with the performance of such Party’s obligations hereunder or otherwise make any representation or warranty of such Party herein untrue or incorrect (including, for the avoidance of doubt, any transfer, sale, assignment, gift, hedge, or other disposition, directly or indirectly, of the Subject Shares). Any action taken in violation of the foregoing sentence shall be null and void ab initio.

5.2 Documentation and Information. Neither Party shall make any public announcement regarding this Agreement and the transactions contemplated hereby without the prior written consent of the other Party (such consent not to be unreasonably withheld, conditioned or delayed), except as may be required by applicable Law (provided that reasonable notice of any such disclosure will be provided to such other Party). Each Party consents to and hereby authorizes such other Party and its Affiliates to publish and disclose in all documents and schedules filed with the SEC or any other Governmental Authority or applicable securities exchange, and any press release or other disclosure document, each Party’s identity and the ownership of the Subject Shares, the existence of this Agreement and the nature of each Party’s commitments and obligations under this Agreement, and each Party acknowledges that such other Party and its Affiliates may, in their sole discretion, file this Agreement or a form hereof with the SEC or any other Governmental Authority or applicable securities exchange.

5.3 Litigation. Each Party shall provide such other Party with prompt notice of any claim, action, suit, litigation or proceeding (including any class action or derivative litigation) brought, asserted or commenced by, on behalf of or in the name of, against or otherwise involving either Party relating to this Agreement or any of the transactions contemplated hereby, and shall keep such other Party informed on a reasonably prompt basis with respect to the status thereof. Each Party shall give such other Party the opportunity to participate (at such other Party’s expense) in the defense or settlement of any such litigation, and no such settlement shall be agreed to without such other Party’s prior written consent.

5.4 Tax Matters Opinion.The Company and Seller shall, and shall cause their respective Affiliates to, use their respective reasonable best efforts to obtain the TMA Closing Opinion (as defined below) and the Kirkland Opinion (as defined below), including by (a) providing any information reasonably requested by Tax Counsel (as defined below) or Kirkland & Ellis (as defined below) and (b) delivering to Tax Counsel and Kirkland & Ellis representation letters dated as of the Closing Date in form and substance substantially similar to the representation letters delivered by the Company and Seller to Tax Counsel and Kirkland & Ellis in connection with the TMA Signing Opinion, with such modifications in form and substance thereto that are reasonably requested and agreed to by Tax Counsel and Kirkland & Ellis.

Article VI.

Conditions to Closing

6.1 Mutual Conditions. The respective obligations of the Parties to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment, at or prior to the Closing, of the following conditions, each of which may, to the extent permitted by applicable Law, be waived in a writing signed by both Seller and the Company, each at its sole discretion:

(a) No Litigation. No Governmental Authority shall have enacted, issued, promulgated, enforced or entered any Law (whether temporary, preliminary or permanent) that is then in effect and that enjoins, restrains, conditions, makes illegal or otherwise prohibits the consummation of the transactions contemplated by this Agreement.

(b) Consents and Approvals. All authorizations, consents, orders and approvals of all Governmental Authorities or third parties required in connection with the transactions contemplated by this Agreement shall have been received or waived by such Governmental Authority or third party and shall be reasonably satisfactory in form and substance to the Parties hereto, and all notices required to be delivered to such Governmental Authorities or third parties shall have been delivered and all notice periods with respect thereto shall have expired or been waived by such Governmental Authority or third parties entitled to such notice.

6.2 Conditions to the Obligations of the Company. The obligations of the Company to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment, at or prior to the Closing, of the following conditions, which may, to the extent permitted by applicable Law, be waived in writing by the Company in its sole discretion:

(a) Closing Deliverables. Seller shall deliver to the Company or EQM, as applicable, the closing deliverables set forth inSection 2.2(a).

(b) Representations and Warranties. The representations and warranties of Seller contained in this Agreement or any schedule, certificate or other document delivered pursuant hereto or in connection with the transactions contemplated hereby shall be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or material adverse effect, which representations and warranties shall be true in all respects) both when made and as of the Closing Date, or in the case of representations and warranties that are made as of a specified date, such representations and warranties shall be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or material adverse effect, which representations and warranties shall be true in all respects) as of such specified date. Seller shall have performed in all material respects all obligations and agreements and complied in all material respects with all covenants and conditions required by this Agreement to be performed or complied with by it prior to or at the Closing.

(c) Officer’s Certificate. Seller shall deliver to the Company a certificate signed by the Chief Financial Officer of Seller, dated as of the Closing Date, to the effect set forth inSection 6.2(b).

(d) FIRPTA Certificate. Seller shall deliver to the Company at the Closing a properly executed affidavit prepared in accordance with Treasury Regulations Section 1.1445-2(b) certifying Seller’s non-foreign status.

(e) Tax Matters Opinion. The Company shall have received the TMA Closing Opinion. In rendering such opinion, Tax Counsel shall be entitled to rely upon customary assumptions, representations, warranties and covenants from each of the Company and Seller (and any other relevant parties), in each case, in form and substance reasonably satisfactory to Tax Counsel.

(f) Existing Credit Agreements. The pay-off and termination (including the release of any liens or other security interests granted in connection therewith) of the Existing Credit Agreements (as defined below) shall occur prior to or substantially concurrently with the Closing.

6.3 Conditions to the Obligations of Seller. The obligations of Seller to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment, at or prior to the Closing, of the following conditions, which may, to the extent permitted by applicable Law, be waived in writing by Seller in its sole discretion:

(a) Closing Deliverables. The Company shall deliver to Seller the closing deliverables set forth inSection 2.2(b).

(b) Representations and Warranties. The representations and warranties of the Company contained in this Agreement or any schedule, certificate or other document delivered pursuant hereto or in connection with the transactions contemplated hereby shall be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or material adverse effect, which representations and warranties shall be true in all respects) both when made and as of the Closing Date, or in the case of representations and warranties that are made as of a specified date, such representations and warranties shall be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or material adverse effect, which representations and warranties shall be true in all respects) as of such specified date. The Company shall have performed in all material respects all obligations and agreements and complied in all material respects with all covenants and conditions required by this Agreement to be performed or complied with by it prior to or at the Closing.

(c) Officer’s Certificate. The Company shall deliver to Seller a certificate signed by the Chief Executive Officer of the Company, dated as of the Closing Date, to the effect set forth inSection 6.3(b).

Article VII.

Release

7.1 Release.

(a) Notwithstanding anything to the contrary herein, each Party acknowledges and agrees that nothing in this Agreement shall release the Company or Seller from any of their respective liabilities or obligations under the Tax Matters Agreement (as defined below).

(b) Subject to Section 7.1(a), upon the Closing, Seller acknowledges that, subject to delivery by the Company of the executed Note, Seller, on behalf of itself, its Affiliates, Subsidiaries (as defined below), partners, prior and existing shareholders, partnerships, unincorporated entities, divisions, and their respective representatives, directors, officers, employees, servants, agents, attorneys, accountants, auditors, advisors, administrators, predecessors, successors, insurers and assigns (collectively, the “Releasors”), fully and forever releases, relinquishes and discharges the Company and each of its Affiliates, Subsidiaries, partners, prior and existing shareholders, partnerships, unincorporated entities, divisions, and their respective representatives, directors, officers, employees, servants, agents, attorneys, accountants, auditors, advisors, administrators, predecessors, successors, insurers and assigns, in any and all capacities (the “Releasees”), from any and all causes of action in Law and equity, claims, surcharges, suits, contracts, debts, obligations, contributions, liens, indemnities, promises, demands, damages, losses, attorneys’ fees, other fees, costs, expenses, loss of service, compensation, injuries or liability of any nature, type or description, whether known or unknown, suspected or unsuspected, patent or latent, fixed or contingent, without limitations (“Claims”), that the Releasors may have now, or may have in the future, that directly or indirectly arise from or relate to, in whole or in part, any act, omission, event, transaction, communication or any other matter related to, arising out of or in connection with Seller’s acquisition, ownership or sale of the Subject Shares, excluding, for the avoidance of doubt, any Claims with respect to the Tax Matters Agreement (the “Released Claims”).

(c) Seller represents and warrants that (i) it has not assigned, transferred, conveyed or otherwise disposed of any Released Claims, or any direct or indirect interest in any such Released Claim, in whole or in part, and (ii) to the best of its knowledge, no other Person has any interest in the Released Claims. Seller agrees, for itself and for each of the Releasors, not to initiate any action, suit, proceeding, dispute or litigation against any of the Releasees with respect to the Released Claims. Seller further agrees to take such actions as necessary to prevent the other Releasors from commencing any suit based on a Released Claim.

(d) It is the intention of Seller and the Company that the Company’s purchase of the Subject Shares and the release contained in thisArticle VII shall be effective as a full and final accord, satisfaction, and agreement as to the Released Claims.

(e) Seller agrees that except for an action or proceeding brought to enforce (but not to rescind or reform) the release contained in thisArticle VII, Seller will forever refrain and forbear from commencing, instituting or prosecuting, or assisting or participating in, any lawsuit, action, or other proceeding, in Law, equity or otherwise, against any of the Releasees, in any way arising out of or relating to any Released Claim, and/or any action alleging that the release of the Released Claims contained in this Agreement, or any portion thereof, was fraudulently induced.

(f) Seller expressly acknowledges, on behalf of itself and the Releasors, that it will not have any right to recover against the Company for any Released Claims, even if other shareholders of the Company are successful in any suit or other action arising from any such claim.

Article VIII.

Miscellaneous

8.1 Defined Terms. As used herein, the following terms shall have the following meanings:

(a) “Affiliate” means, with respect to any Person, any other Person that directly or indirectly through one or more intermediaries controls, is controlled by or is under common control with, the Person in question. As used herein, the term “control” means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise. For the avoidance of doubt, EQM is an Affiliate of the Company for all purposes under this Agreement, includingSection 8.4.

(b) “Business Day” means any day other than Saturday, Sunday, or any day on which banks located in the Commonwealth of Pennsylvania are authorized or required by Law to be closed.

(c) “Existing Credit Agreements” means, collectively, (i) that certain Credit Agreement, dated as of December 31, 2018, by and among the Company, as borrower, Goldman Sachs Bank USA, as administrative agent, PNC Bank, National Association, as collateral agent, and the lenders party thereto and any other parties thereto, as amended, restated, supplemented or otherwise modified from time to time and (ii) that certain Credit Agreement, dated as of October 31, 2018, by and among the Company, as borrower, PNC Bank, National Association, as administrative agent, the lenders and other parties thereto, as amended, modified or supplemented from time to time.

(d) “Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority, or any arbitrator, court or tribunal of competent jurisdiction.

(e) “Kirkland & Ellis” means Kirkland & Ellis LLP.

(f) “Kirkland Opinion” means a written tax opinion delivered to Seller from Kirkland & Ellis, dated as of the Closing Date, satisfying the requirements of an “Unqualified Tax Opinion” (as defined in the Tax Matters Agreement), with respect to the transactions contemplated by this Agreement.

(g) “Law” means any provision of any law or administrative rule or regulation or any judicial, administrative or arbitration order, award, judgment, writ, injunction or decree.

(h) “Person” means an individual or a corporation, firm, limited liability company, partnership, joint venture, trust, estate, unincorporated organization, association, Governmental Authority or other entity.

(i) “Representative” means, with respect to any Person, such Person’s directors, officers, employees, partners, members, shareholders, agents or representatives.

(j) “Subsidiary” when used with respect to any Person, means any Person of which securities or other ownership interests representing more than 50% of the equity or more than 50% of the ordinary voting power (or in the case of a partnership, more than 50% of the general partner interests, or in the case of a limited liability company, more than 50% of the ownership interests in the managing member) are, as of such date, owned by such Person or one or more Subsidiaries of such Person.

(k) “Tax” means any federal, state, local or foreign income, gross receipts, branch profits, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, escheat, environmental, customs duties, capital stock, franchise, profits, withholding, social security, unemployment, disability, real property, personal property, sales, use, transfer, registration, ad valorem, value added, alternative or add-on minimum or estimated tax or other tax of any kind whatsoever, including any interest, penalty or addition thereto, whether disputed or not and including any obligation to indemnify or otherwise assume or succeed to the Tax liability of any other Person by Law, by contract or otherwise.

(l) “Tax Counsel” means Latham & Watkins LLP.

(m) “Tax Matters Agreement” means the Tax Matters Agreement by and between Seller and the Company, dated as of November 12, 2018.

(n) “Tax Return” means any return, report, information return or other such statement or document (including, without limitation, any schedule or attachment thereto any amendment thereof) filed or required to be filed with any federal, state, local or non-U.S. taxing authority in connection with the determination, assessment, collection, administration or imposition of any Tax.

(o) “TMA Closing Opinion” means a written Tax opinion from Tax Counsel, dated as of the Closing Date, the form and substance of which have been approved in writing by Seller on or prior to the Closing Date, satisfying the requirements of an “Unqualified Tax Opinion” (as defined in the Tax Matters Agreement) with respect to the transactions contemplated by this Agreement.

(p) “TMA Signing Opinion” means a written Tax opinion from Tax Counsel, dated as of the date hereof, the form and substance of which have been approved in writing by Seller on or prior to the date hereof, satisfying the requirements of an “Unqualified Tax Opinion” (as defined in the Tax Matters Agreement) with respect to the Company’s and Seller’s entry into this Agreement.

8.2 Notices. All notices and other communications hereunder must be in writing and will be deemed duly given if delivered personally or by email transmission, or mailed through a nationally recognized overnight courier, postage prepaid, to the Parties at the following addresses (or at such other address for a Party as specified by like notice,provided,however, that notices of a change of address will be effective only upon receipt thereof):

| if to the Company: | Equitrans Midstream Corporation |

| | 2200 Energy Drive |

| | Canonsburg, PA 15317 |

| | Attn: Kirk R. Oliver (koliver@equitransmidstream.com) and |

| | Stephen M. Moore (smoore@equitransmidstream.com) |

| | |

| with a copy to: | Latham & Watkins LLP |

| | 811 Main Street, Suite 3700 |

| | Houston, TX 77002 |

| | Attn: Ryan Maierson (ryan.maierson@lw.com) and |

| | Nick Dhesi (nick.dhesi@lw.com) |

| | |

| if to Seller: | EQT Corporation |

| | 625 Liberty Avenue, Suite 1700 |

| | Pittsburgh, PA 15222 |

| | Attn: David M. Khani (David.Khani@eqt.com) and |

| | William E. Jordan (WiJordan@eqt.com) |

| | |

| with a copy to: | Kirkland & Ellis LLP |

| | 609 Main Street, 45th Floor |

| | Houston, TX 77002 |

| | Attn: Matthew R. Pacey (matt.pacey@kirkland.com) |

Notices will be deemed to have been received on the date of receipt (a) if delivered by hand or nationally recognized overnight courier service or (b) upon receipt of an appropriate confirmation by the recipient when so delivered by email.

8.3 Termination. This Agreement may only be terminated by (i) mutual written consent of the Parties to terminate this Agreement prior to Closing, (ii) by either Party if such other Party is in breach of the terms of this Agreement if such breach continues unremedied for a period of five (5) calendar days after notice to the breaching Party or (iii) by either Party if the Closing has not occurred by March 31, 2020. Upon termination of this Agreement, no Party shall have any further obligations or liabilities under this Agreement; provided, however, that (i) nothing in thisSection 8.3 shall relieve either Party from liability for fraud or any willful breach of this Agreement prior to the termination hereof and (ii) the provisions of thisArticle VIII shall survive any termination of this Agreement.

8.4 Acknowledgements.

(a) Seller acknowledges and understands (i) that the Company and its Affiliates possess material nonpublic information regarding the Company, its Affiliates and the Subject Shares not known to Seller that may impact the value of the Subject Shares, including, without limitation, (A) information received by principals and employees of the Company in their respective capacities as Representatives of the Company and its Affiliates, and (B) information received on a privileged basis from the attorneys and financial advisors representing the Company and/or its Affiliates (collectively, the “Information”); (ii) that the Company is unable or unwilling to disclose the Information to Seller, (iii) the Information, if disclosed to Seller, could affect Seller’s decision to enter into this Agreement; and (iv) the risks to and disadvantage of Seller due to the disparity of information between Seller and the Company.

(b) Notwithstanding such disparity of information (including any non-disclosure of the Information), Seller has deemed it appropriate to enter into this Agreement and to consummate the transactions contemplated hereby.

(c) Seller agrees that none of the Company, its Affiliates, or any of its or their respective Representatives shall have any liability to Seller, its Affiliates, or any of its or their respective Representatives whatsoever due to or in connection with the Company’s and its Affiliates’ use or non-disclosure of the Information or otherwise as a result of the transactions contemplated hereby, and Seller hereby irrevocably waives any claim that it might have based on the failure of the Company and its Affiliates to disclose the Information.

(d) Seller acknowledges that (i) the Company is relying on Seller’s representations, warranties, acknowledgements and agreements in this Agreement as a condition to proceeding with the transactions contemplated hereby and (ii) without such representations, warranties, acknowledgements and agreements, the Company would not enter into this Agreement or engage in the transactions contemplated hereby.

8.5 Amendment; Waiver. This Agreement may not be amended except by an instrument in writing signed on behalf of each of the Parties. Any agreement on the part of either Party to any extension or waiver with respect to this Agreement shall be valid only if set forth in an instrument in writing signed on behalf of such Party. The failure of either Party to assert any of its rights under this Agreement or otherwise shall not constitute a waiver of such rights.

8.6 Expenses. All fees and expenses incurred in connection this Agreement and the transactions contemplated hereby shall be paid by the Party incurring such fees and expenses, whether or not the transactions contemplated by this Agreement are consummated.

8.7 Entire Agreement. This Agreement, together with the GGA, the Fee Letter Agreement and the other documents and certificates delivered pursuant hereto, constitute the entire agreement, and supersede all prior agreements and understandings, both written and oral, between the Parties with respect to the subject matter of this Agreement.

8.8 Assignment. Neither this Agreement nor any of the rights, interests or obligations under this Agreement shall be assigned, in whole or in part, by operation of Law or otherwise by either Party without the prior written consent of the other Party. Any purported assignment without such consent shall be void. Subject to the preceding sentences, this Agreement will be binding upon, inure to the benefit of, and be enforceable by, the Parties and their respective successors and assigns.

8.9 Specific Enforcement; Jurisdiction.

(a) The Parties acknowledge and agree that irreparable damage would occur in the event that any of the provisions of this Agreement were not performed in accordance with its specific terms or were otherwise breached, and that monetary damages, even if available, would not be an adequate remedy therefor. It is accordingly agreed that the Parties shall be entitled to an injunction or injunctions, or any other appropriate form of equitable relief, to prevent breaches of this Agreement and to enforce specifically the performance of the terms and provisions of this Agreement in any court referred to inSection 8.9(b), without the necessity of proving the inadequacy of money damages as a remedy (and each Party hereby waives any requirement for the securing or posting of any bond in connection with such remedy), this being in addition to any other remedy to which they are entitled at Law or in equity. Each of the Parties acknowledges and agrees that the right of specific enforcement is an integral part of the transactions contemplated by this Agreement and without such right, neither of the Parties would have entered into this Agreement.

(b) Each of the Parties hereby irrevocably submits to the exclusive jurisdiction of the courts of the State of Delaware for the purpose of any legal action, suit or proceeding arising out of or relating to this Agreement or any of the transactions contemplated hereby, and each of the Parties hereby irrevocably agrees that all claims with respect to such legal action, suit or proceeding may be heard and determined exclusively in such court. Each of the Parties (i) consents to submit itself to the personal jurisdiction of the courts of the State of Delaware in the event any legal action, suit or proceeding arises out of this Agreement or any of the transactions contemplated hereby, (ii) agrees that it will not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such court, (iii) irrevocably consents to the service of process in any legal action, suit or proceeding arising out of or relating to this Agreement or any of the transactions contemplated hereby, on behalf of itself or its property, in accordance withSection 8.2 (provided that nothing in thisSection 8.9(b) shall affect the right of either Party to serve legal process in any other manner permitted by applicable Law) and (iv) agrees that it will not bring any legal action, suit or proceeding relating to this Agreement or any of the transactions contemplated hereby in any court other than the courts of the State of Delaware. The Parties agree that a final trial court judgment in any such legal action, suit or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by applicable Law;provided,however, that nothing in the foregoing shall restrict either Party’s rights to seek any post-judgment relief regarding, or any appeal from, such final trial court judgment.

8.10 Waiver of Jury Trial. Each Party hereby waives, to the fullest extent permitted by applicable Law, any right it may have to a trial by jury in respect of any legal action, suit or proceeding arising out of this Agreement or any of the transactions contemplated hereby. Each Party (a) certifies that no Representative, agent or attorney of the other Party has represented, expressly or otherwise, that such Party would not, in the event of any legal action, suit or proceeding, seek to enforce the foregoing waiver and (b) acknowledges that it and the other Party have been induced to enter into this Agreement by, among other things, the mutual waiver and certifications in thisSection 8.10.

8.11 Governing Law. This Agreement shall be governed by, and construed in accordance with, the Laws of the State of Delaware, regardless of the Laws that might otherwise govern under applicable principles of conflicts of Laws thereof.

8.12 Severability. If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule or Law, or public policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated by this Agreement is not affected in any manner adverse to either Party.

8.13 Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement and shall become effective when one or more counterparts have been signed by each of the Parties and delivered to the other Party. Delivery of an executed counterpart of a signature page of this Agreement by facsimile or other electronic image scan transmission shall be effective as delivery of a manually executed counterpart of this Agreement.

8.14 Further Assurances. Each Party will execute and deliver, or cause to be executed and delivered, all further documents and instruments and use its reasonable best efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under applicable Law to perform its obligations under this Agreement. Each Party shall use its reasonable best efforts to take, or cause to be taken, any and all actions and to do, or cause to be done, and to assist such other Party in doing, any and all things, necessary, proper or advisable to consummate and make effective the transactions contemplated by this Agreement.

8.15 Certain Transaction-Related Taxes. All transfer, documentary, sales, use, stamp, recording fees, registration and similar Taxes and fees (including, without limitation, any penalties and interest) attributable to Seller’s sale of the Subject Shares to the Company pursuant to this Agreement shall be paid equally by the Company and Seller when due, and Seller shall, at its expense, file all necessary Tax Returns and other documentation with respect to all such transfer, documentary, sales, use, stamp, recording fees, registration and other Taxes. The Company shall be entitled to deduct and withhold from the Purchase Price all Taxes that the Company may be required to deduct and withhold under any provision of applicable Tax Law; provided that, the Company shall use commercially reasonable efforts to notify Seller at least three (3) days prior to the Closing Date) of any such determination and the Parties shall cooperate in good faith to minimize, to the extent permissible under applicable Law, the amount of any such deduction or withholding. To the extent such amounts are so deducted or withheld, and remitted to the applicable Governmental Authority in accordance with applicable Tax Law, all such withheld amounts shall be treated as delivered to Seller hereunder.

[Remainder of this page is intentionally left blank.]

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first written above.

| | THE COMPANY: |

| | |

| | EQUITRANS MIDSTREAM CORPORATION, |

| | a Pennsylvania corporation |

| | | |

| | By: | /s/ Kirk R. Oliver |

| | | Kirk R. Oliver |

| | | Senior Vice President and Chief Financial Officer |

[Signature Page to Share Purchase Agreement]

| | SELLER: |

| | |

| | EQT Corporation, |

| | a Pennsylvania corporation |

| | | |

| | By: | /s/ David M. Khani |

| | | David M. Khani |

| | | Chief Financial Officer |

[Signature Page to Share Purchase Agreement]

EXHIBIT A

Form of PROMISSORY Note

[Attached]

Final Form

PROMISSORY NOTE

| $195,820,075.29 | | March , 2020 |

FOR VALUE RECEIVED, this promissory note (this “Note”) is made by Equitrans Midstream Corporation, a Pennsylvania corporation (the “Borrower”), in favor of EQT Corporation, a Pennsylvania corporation (together with its successors and permitted assigns who become registered holders of this Note, the “Lender”). The Borrower and the Lender are referred to herein collectively as the “Parties” and each, individually, as a “Party.”

THIS NOTE HAS BEEN ISSUED WITH “ORIGINAL ISSUE DISCOUNT” (WITHIN THE MEANING OF SECTION 1273 OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED). UPON WRITTEN REQUEST, THE BORROWER WILL PROMPTLY MAKE AVAILABLE TO ANY HOLDER OF THIS NOTE THE FOLLOWING INFORMATION: (1) THE ISSUE PRICE AND ISSUE DATE OF THE NOTE, (2) THE AMOUNT OF ORIGINAL ISSUE DISCOUNT ON THE NOTE AND (3) THE YIELD TO MATURITY OF THE NOTE.

Section 1. Amount, Maturity, Payment and Interest

1.01 Amount. This Note is in the aggregate principal amount of one hundred ninety-five million, eight hundred twenty thousand, seventy-five dollars and twenty-nine cents ($195,820,075.29) (the “Loan”).

1.02 Maturity Date. On or prior to February 29, 2024 (the “Maturity Date”), the Borrower agrees and promises to pay the Lender the unpaid principal balance of the Loan and all other amounts outstanding hereunder, together with interest until such sums are repaid in full, at the Rate set forth inSection 1.04 below.

1.03 Prepayment. The Borrower may prepay to the Lender, without premium or penalty, all or a portion of the Loan hereunder at any time prior to the Maturity Date by providing two (2) business days’ advanced written notice to the Lender. Such prepayment shall be accompanied by prepayment of all accrued but unpaid interest on the principal amount prepaid. Any portion of the Loan that is repaid may not be re-borrowed.

1.04 Interest. The Loan hereunder shall accrue interest at a rate (expressed as a per annum percentage and calculated based upon a year of 360 days for the actual number of days elapsed) equal to 7.0% per annum (the “Rate”) (plus, during the continuance of an Event of Default, an additional 2.0% per annum on the amount of the Loan outstanding), commencing on the date hereof;provided,however, that if the interest rate payable hereunder is limited by applicable law, the Rate shall be the lesser of: (a) the rate described above and (b) the maximum interest rate permitted by applicable law. The Borrower promises to pay interest at the Rate on the unpaid principal balance of the Loan from time to time outstanding semi-annually on the last business day of each of March and September of each year (each, an “Interest Payment Date”), commencing on the earlier of (a) March 31, 2022 and (b) the MVP In-Service Date (as defined in that certain Gas Gathering and Compression Agreement, dated as of the date hereof, by and among the Lender and EQM Midstream Partners, LP and/or one or more of their respective affiliates).

Section 2. Notes Register

2.01 Notes Register. The Borrower shall maintain a register for the Note (the “Notes Register”), which includes identifying information (including at least name and address) of the Lender, as well as the outstanding principal amount of the Loan owing to the Lender from time to time. Subject toSection 2.02, the entries in the Notes Register shall be conclusive, and the Borrower shall treat each person or entity whose name is recorded in the Notes Register pursuant to the terms hereof as the Lender hereunder for all purposes of the Note. The Notes Register shall be available for inspection by the Lender, at any reasonable time and from time to time upon reasonable prior notice. No assignment, transfer or other disposition of the Note (or any portion thereof) shall be effective unless it has been recorded in the Notes Register. The Parties hereto shall take all actions reasonably necessary from time to time to establish that this Note and the amounts owing hereunder are in registered form under Section 5f.103-1(c) of the Treasury Regulations.

2.02 Entries. The entries made in the Notes Register shall, to the extent permitted by applicable law and absent manifest error, be conclusive evidence of the existence and amounts of the obligations recorded therein;provided,however, that the failure of the Borrower to maintain such Notes Register or any error therein shall not in any manner affect the obligations of the Borrower to repay the Note in accordance with its terms. No changes to the Note Register (other than to evidence an assignment or transfer pursuant toSection 4.02 or a change of address pursuant toSection 4.04) shall be effective without the written consent of the Lender.

Section 3. Events of Default

3.01 Event of Default. It shall be an “Event of Default” for the purposes of this Note if (a) the Borrower defaults in the payment on or prior to the Maturity Date of any principal or interest when due under this Note and, with respect to any default prior to the Maturity Date, such default continues unremedied for a period of fifteen (15) days after notice thereof to the Borrower; (b) the Borrower shall commence a proceeding under any applicable bankruptcy or insolvency laws as now or hereafter in effect or any successor thereto, or any other proceeding under any reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar law of any jurisdiction whether now or hereafter in effect relating to the Borrower; (c) there is commenced against the Borrower any such bankruptcy, insolvency or other proceeding that remains undismissed for a period of sixty (60) days; (d) the Borrower is adjudicated insolvent or bankrupt, or any order of relief or other order approving any such case or proceeding is entered; (e) the Borrower suffers any appointment of any custodian, private or court appointed receiver or the like for it or any substantial part of its property (taken as a whole) which continues undischarged or unstayed for a period of sixty (60) days; (f) the Borrower makes a general assignment for the benefit of creditors; (g) the Borrower shall fail to pay, or shall admit in writing that it is unable to pay, or shall be unable to pay, its debts generally as they become due; (h) the Borrower shall by any act or failure to act expressly indicate in writing (or in a filed answer in respect of a proceeding) its consent to, approval of or acquiescence in any of the foregoing; or (i) this Note shall for any reason be asserted in writing by the Borrower not to be a legal, valid and binding obligation of the Borrower.

3.02 Consequences of an Event of Default. During the existence of any Event of Default, the Lender may declare by written notice to the Borrower the outstanding principal balance of the Loan outstanding, all accrued but unpaid interest thereon, and all other amounts payable by the Borrower under this Note to be immediately due and payable, whereupon the same shall become immediately due and payable, without presentment, demand, protest, notice of intent to accelerate, notice of actual acceleration or further notice of any kind, all of which are hereby expressly waived by the Borrower. During the existence of any Event of Default, the Lender may exercise all of its rights under this Note and all other rights at law or in equity. During the existence of any Event of Default, all payments and collections received by the Lender shall be applied in the order determined by the Lender.

3.03 General Offset. In addition to any other rights or remedies available to the Lender (including other rights of set-off), the Lender reserves the right, during the continuance of an Event of Default, to apply any amounts otherwise owing to the Borrower (whether such amounts constitute indebtedness owed by the Lender, distributions on equity interests of the Lender or otherwise) as an offset of amounts owed to the Lender under this Note, including as an offset against any outstanding principal or interest on this Note. The Lender agrees to promptly notify the Borrower after any such offset and/or application made by the Lender;provided,however, that the failure to give such notice shall not affect the validity of such offset and/or application.

Section 4. Miscellaneous

4.01 Governing Law. This Note shall be governed by and construed in accordance with the laws of the State of Delaware without giving effect to the principles of conflict of laws thereof. EACH OF THE PARTIES HERETO AGREES THAT THIS NOTE INVOLVES AT LEAST U.S. $100,000.00 AND THAT THIS NOTE HAS BEEN ENTERED INTO IN EXPRESS RELIANCE UPON 6 Del. C. § 2708. The parties hereby irrevocably and unconditionally (a) consent to submit to the personal jurisdiction of the courts of the State of Delaware in the event any legal action, suit or proceeding arises in connection with this Note, (b) agree that they will not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such court, (c) consent to the service of process in any legal action, suit or proceeding arising out of or relating to this Note, on behalf of themselves or their property, including, without limitation, service of process effected in accordance withSection 4.04 hereof, and (d) agree that they will not bring any legal action, suit or proceeding relating to this Note in any court other than the courts of the State of Delaware. The Parties agree that a final trial court judgment in any such legal action, suit or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by applicable law;provided,however, that nothing in the foregoing shall restrict either Party’s rights to seek any post-judgment relief regarding, or any appeal from, such final trial court judgment.

4.02 Successors and Assigns. No Party may assign or transfer this Note without the prior written consent of the other Party (and any attempted assignment or transfer without such consent shall be null and void);provided,however, that the Borrower hereby consents to the assignment of this Note to EQM Midstream Partners, LP, a Delaware limited partnership (“EQM”), or any wholly owned subsidiary of EQM. Upon a permitted assignment or other permitted transfer of this Note, (a) the Borrower shall update the Notes Register to account for such assignment or transfer and (b) the assignee or transferee may request that the Borrower reissue a promissory note for the assigned or transferred amount in the name of the assignee or transferee and the Borrower shall promptly take steps to accommodate such request. Subject to the foregoing, the obligations of the Borrower and the Lender under this Note shall be binding upon, and inure to the benefit of, and be enforceable by, the Borrower and the Lender, and their respective successors and permitted assigns, whether or not so expressed. Notwithstanding the foregoing, this Note may be pledged by the Lender to third party creditors, as security for the Lender’s obligations, if any, under applicable financing documents to which the Lender is a party.

4.03 Costs and Expenses. If this Note is not paid at maturity, whether by acceleration or otherwise, and is placed in the hands of an attorney for collection, or suit is filed hereon, or proceedings are had in bankruptcy, receivership, reorganization, arrangement or other legal or judicial proceedings for collection hereof, the Borrower agrees to pay the Lender’s reasonable costs and expenses, including attorneys’ fees.

4.04 Notice. All notices and other communications hereunder must be in writing and will be deemed duly given if delivered personally or by email transmission, or mailed through a nationally recognized overnight courier, postage prepaid, to the Parties at the following addresses (or at such other address for a Party as specified by like notice,provided,however, that notices of a change of address will be effective only upon confirmation of receipt of notice of such change by the other Party;provided further, that if the Lender delivers a notice of a change of address to the Borrower, the Borrower will confirm receipt of such notice and make entry in the Notes Register of such change promptly thereafter):

| if to the Borrower: | Equitrans Midstream Corporation |

| | 2200 Energy Drive |

| | Canonsburg, PA 15317 |

| | Attn: Kirk R. Oliver (koliver@equitransmidstream.com) and |

| | Stephen M. Moore (smoore@equitransmidstream.com) |

| | |

| with a copy to: | Latham & Watkins LLP |

| | 811 Main Street, Suite 3700 |

| | Houston, TX 77002, |

| | Attn: Ryan Maierson (ryan.maierson@lw.com) and |

| | Nick Dhesi (nick.dhesi@lw.com), |

| | |

| if to the Lender: | as recorded on the Notes Register |

Notices will be deemed to have been received on the date of receipt (a) if delivered by hand or nationally recognized overnight courier service or (b) upon receipt of an appropriate confirmation by the recipient when so delivered by email.

4.05 Rights and Remedies. No failure to exercise and no delay in exercising, on the part of the Lender, any right, remedy, power or privilege under this Note, or provided by law and no course of dealing between any such person or entity and the Borrower, nor any release or extension of time for payment of this Note, shall imply or otherwise operate as a waiver of any such right, remedy, power or privilege, nor shall any single or partial exercise of any right, remedy, power or privilege under this Note preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege or release, modify, amend, waive, extend, discharge, terminate or limit or otherwise affect the liability of the Borrower, and its successors and assigns, under this Note. The rights, remedies, powers and privileges under this Note are cumulative and not exclusive of any rights, remedies, powers and privileges provided by law.

4.06 Status of Note. The Note is a general unsecured, senior obligation of the Borrower.

4.07 Counterparts. This Note may be executed in one or more counterparts, all of which shall be considered one and the same agreement and shall become effective when one or more counterparts have been signed by each of the Parties and delivered to the other Party.

4.08 Amendment. This Note may be modified, amended, waived, extended, changed, discharged or terminated only by an agreement in writing signed by the party against whom enforcement of any such modification, amendment, waiver, extension, change, discharge or termination is sought.

4.09 Severability. If any provision of this Note is declared or found to be illegal, unenforceable or void, in whole or in part, then the parties shall be relieved of all obligations arising under such provision, but only to the extent that it is illegal, unenforceable or void, it being the intent and agreement of the parties that this Note shall be deemed amended by modifying such provision to the extent necessary to make it legal and enforceable while preserving its intent or, if that is not possible, by substituting therefor another provision that is legal and enforceable and achieves the same objectives.

[Signature page follows]

IN WITNESS WHEREOF, the Parties have executed this Note as of the date first written above.

| | EQUITRANS MIDSTREAM CORPORATION, |

| | a Pennsylvania corporation |

| | | |

| | By: | |

| | Name: | Kirk R. Oliver |

| | Title: | Senior Vice President and Chief Financial Officer |

| | EQT Corporation, |

| | a Pennsylvania corporation |

| | | |

| | By: | |

| | Name: | David M. Khani |

| | Title: | Chief Financial Officer |

EXHIBIT B

Form of ASSIGNMENT AGREEMENT

[Attached]

Final Form

ASSIGNMENT AND ASSUMPTION AGREEMENT

This Assignment and Assumption Agreement (this “Agreement”) is made and entered into this day of March, 2020 (the “Effective Date”), by and between EQT Corporation, a Pennsylvania corporation (the “Assignor”), and EQM Midstream Partners, LP, a Delaware limited partnership (the “Assignee”), and agreed and consented to by Equitrans Midstream Corporation, a Pennsylvania corporation (“ETRN”). The Assignor and the Assignee are individually referred to as a “Party” and collectively as the “Parties.”

W I T N E S S E T H:

WHEREAS, the Assignor is party to that certain Share Purchase Agreement, dated as of the date hereof (the “Note Share Purchase Agreement”), with ETRN, pursuant to which the Assignor agreed, among other things, to sell to ETRN 20,530,256 shares of common stock, no par value, of ETRN in exchange for a promissory note, entered into by ETRN in favor of Assignor, representing $195,820,075.29 in aggregate principal amount (the “Note”);

WHEREAS, pursuant to Section 1.2 of the Note Share Purchase Agreement, the Assignor shall assign all of the Assignor’s right and title to, and interest in, the Note (the “Assigned Rights”) to the Assignee in exchange for the consideration contemplated to be delivered to Assignor in connection with (i) that certain Gas Gathering and Compression Agreement, dated as of February 26, 2020, by and between the Assignee and the Assignor and and/or one or more of their respective affiliates (the “GGA”) and (ii) that certain letter agreement, dated as of February 26, 2020, by and between the Assignee and the Assignor (the “Fee Letter Agreement”), pursuant to which, among other things, the parties thereto shall set forth certain agreements relating to the in-service date of the Mountain Valley Pipeline and the reservation rates related thereto; and

WHEREAS, the Assignor desires to transfer the Assigned Rights to the Assignee, and the Assignee desires to accept from the Assignor, the Assigned Rights in accordance with and subject to the terms and conditions of this Agreement.

NOW,THEREFORE, in consideration of the promises contained herein, the Parties hereby agree as follows:

1. Assignment and Assumption of Assigned Rights. Effective as of the Effective Date, for good and valuable consideration set forth herein and in the GGA and the Fee Letter Agreement, the receipt and sufficiency of which are hereby acknowledged, (a) the Assignor (or its designee) hereby transfers, assigns, conveys and delivers to the Assignee the Assigned Rights, and (b) the Assignee hereby accepts the assignment of the Assigned Rights (jointly, the “Assignment”).

2. Surviving Assignor Obligations. Notwithstanding anything to the contrary set forth in this Agreement, the Assignor retains all obligations, indemnities and liabilities due to ETRN under the Note Share Purchase Agreement unless and until expressly released by ETRN or its successors or permitted assigns thereto.

3. Notes Register. Effective as of the Effective Date, ETRN shall record the Assignment in the Notes Register (as defined in the Note) and treat the Assignee as the Lender (as defined in the Note) for all purposes of the Note.

4. General Offset. ETRN hereby confirms that, in addition to any other rights or remedies available to the Assignee (including other rights of set-off), during the continuance of an Event of Default (as defined in the Note), the Assignee shall have the right to apply any amounts otherwise owing to ETRN (whether such amounts constitute indebtedness owed by the Assignee, distributions on equity interests of the Assignee or otherwise) as an offset of amounts owed to the Assignee under the Note, including as an offset against any outstanding principal or interest on the Note. The Assignee agrees to promptly notify ETRN after any such application made by the Assignee;provided,however, that the failure to give such notice shall not affect the validity of such application.

5. General Provisions.

(a) Binding Effect. This Agreement will be binding upon, and will inure to the benefit of, the Parties and their respective successors, permitted assigns and legal representatives.

(b) Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware without giving effect to the principles of conflict of laws thereof. EACH OF THE PARTIES HERETO AGREES THAT THIS AGREEMENT INVOLVES AT LEAST U.S. $100,000.00 AND THAT THIS AGREEMENT HAS BEEN ENTERED INTO IN EXPRESS RELIANCE UPON 6 Del. C. § 2708. Each of the Parties hereby irrevocably submits to the exclusive jurisdiction of the courts of the State of Delaware for the purpose of any legal action, suit or proceeding arising out of or relating to this Agreement, and each of the Parties hereby irrevocably agrees that all claims with respect to such legal action, suit or proceeding may be heard and determined exclusively in such court. Each of the Parties (i) consents to submit itself to the personal jurisdiction of the courts of the State of Delaware in the event any legal action, suit or proceeding arises out of this Agreement or any of the transactions contemplated hereby, (ii) agrees that it will not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such court, (iii) irrevocably consents to the service of process in any legal action, suit or proceeding arising out of or relating to this Agreement or any of the transactions contemplated hereby, on behalf of itself or its property, including, without limitation, service of process effected in the manner set forth inSection 5(j), and (iv) agrees that it will not bring any legal action, suit or proceeding relating to this Agreement or any of the transactions contemplated hereby in any court other than the courts of the State of Delaware. The Parties agree that a final trial court judgment in any such legal action, suit or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by applicable Law;provided,however, that nothing in the foregoing shall restrict either Party’s rights to seek any post-judgment relief regarding, or any appeal from, such final trial court judgment.

(c) Amendment; Waiver. This Agreement may not be amended except by an instrument in writing signed on behalf of each of the Parties. Any agreement on the part of either Party to any extension or waiver with respect to this Agreement shall be valid only if set forth in an instrument in writing signed on behalf of such Party. The failure of either Party to assert any of its rights under this Agreement or otherwise shall not constitute a waiver of such rights.

(d) Further Assurances. Each Party will execute and deliver, or cause to be executed and delivered, all further documents and instruments and use its reasonable best efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under applicable Law to perform its obligations under this Agreement. Each Party shall use its reasonable best efforts to take, or cause to be taken, any and all actions and to do, or cause to be done, and to assist such other Party in doing, any and all things, necessary, proper or advisable to consummate and make effective the transactions contemplated by this Agreement. For purposes of this Agreement, “Law” shall mean any provision of any law or administrative rule or regulation or any judicial, administrative or arbitration order, award, judgement, writ, induction or decree.

(e) Interpretation. Whenever possible, each provision of this Agreement shall be interpreted in such a manner as to be effective and valid under applicable Law. If any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable Law, the validity, legality and enforceability of the remaining provisions hereof shall not be affected or impaired thereby.

(f) Expenses. All fees and expenses incurred in connection this Agreement and the transactions contemplated hereby shall be paid by the Party incurring such fees and expenses, whether or not the transactions contemplated by this Agreement are consummated.

(g) No Third Party Rights. The provisions of this Agreement are intended to bind the Parties and their successors and permitted assigns as to each other and are not intended to and do not create rights in any other person or confer upon any other person any benefits, rights or remedies and no person is or is intended to be a third party beneficiary of any of the provisions of this Agreement.

(h) Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement and shall become effective when one or more counterparts have been signed by each of the Parties and delivered to the other Party. Delivery of an executed counterpart of a signature page of this Agreement by facsimile or other electronic image scan transmission shall be effective as delivery of a manually executed counterpart of this Agreement.

(i)Severability. If any provision of this Agreement is declared or found to be illegal, unenforceable or void, in whole or in part, then the parties shall be relieved of all obligations arising under such provision, but only to the extent that it is illegal, unenforceable or void, it being the intent and agreement of the parties that this Agreement shall be deemed amended by modifying such provision to the extent necessary to make it legal and enforceable while preserving its intent or, if that is not possible, by substituting therefor another provision that is legal and enforceable and achieves the same objectives.

(j) Notice. All notices and other communications hereunder must be in writing and will be deemed duly given if delivered personally or by email transmission, or mailed through a nationally recognized overnight courier, postage prepaid, to the Parties or ETRN at the following addresses (or at such other address for a Party or ETRN as specified by like notice,provided,however, that notices of a change of address will be effective only upon confirmation of receipt of notice of such change by the other Party or ETRN, as applicable;provided further, that if the Assignee delivers a notice of a change of address to ETRN, ETRN will confirm receipt of such notice and make entry in the Notes Register of such change promptly thereafter):

| if to Assignor: | EQT Corporation |

| | 625 Liberty Avenue, Suite 1700 |

| | Pittsburgh, PA 15222 |

| | Attn: David M. Khani (David.Khani@eqt.com) and |

| | William E. Jordan (WiJordan@eqt.com) |

| | |

| if to Assignee: | EQM Midstream Partners, LP |

| | 2200 Energy Drive |

| | Canonsburg, PA 15317 |

| | Attn: Kirk R. Oliver (koliver@equitransmidstream.com) and |

| | Stephen M. Moore (smoore@equitransmidstream.com) |

| | |

| if to ETRN: | Equitrans Midstream Corporation |

| | 2200 Energy Drive |

| | Canonsburg, PA 15317 |

| | Attn: Kirk R. Oliver (koliver@equitransmidstream.com) and |

| | Stephen M. Moore (smoore@equitransmidstream.com) |

Notices will be deemed to have been received on the date of receipt (a) if delivered by hand or nationally recognized overnight courier service or (b) upon receipt of an appropriate confirmation by the recipient when so delivered by email

[Signature Pages Follow]

IN WITNESS WHEREOF, the Assignor, the Assignee and ETRN have executed this Agreement as of the Effective Date.

| | ASSIGNOR: |

| | |

| | EQT Corporation, |

| | a Pennsylvania corporation |

| | |

| | By: | |

| | Name: | David M. Khani |

| | Title: | Chief Financial Officer |

| | Address: | 625 Liberty Ave., Suite 1700 |

| | | Pittsburgh, Pennsylvania 15222 |

| | ASSIGNEE: |

| | |

| | EQM Midstream Partners, LP, |

| | a Delaware limited partnership |

| | |

| | By: EQGP Services, LLC, its general partner |

| | | |