- KBDC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Kayne Anderson BDC (KBDC) DEF 14ADefinitive proxy

Filed: 30 Apr 21, 4:33pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

SCHEDULE 14A

________________________

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant | S | |

Filed by a Party other than the Registrant | £ |

Check the appropriate box:

£ | Preliminary Proxy Statement | |

£ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

S | Definitive Proxy Statement | |

£ | Definitive Additional Materials | |

£ | Soliciting Material Pursuant to §240.14a-12 |

KAYNE ANDERSON BDC, INC.

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||||

S | No fee required. | |||

£ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| ||||

(2) | Aggregate number of securities to which transaction applies: | |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

(4) | Proposed maximum aggregate value of transaction: | |||

| ||||

(5) | Total fee paid: | |||

| ||||

£ | Fee paid previously with preliminary materials. | |||

£ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| ||||

(2) | Form, Schedule or Registration Statement No.: | |||

| ||||

(3) | Filing Party: | |||

| ||||

(4) | Date Filed: | |||

| ||||

Kayne Anderson BDC, Inc.

April 30, 2021

Dear Fellow Stockholder:

You are cordially invited to attend the virtual 2021 Annual Meeting (“Annual Meeting or the “Meeting”) of Stockholders of Kayne Anderson BDC, Inc. (the “Company”) to be held on June 17, 2021, at 1:00 p.m. Central Time. In light of public health concerns regarding the COVID-19 pandemic, the Annual Meeting will be held in a virtual meeting format only. Stockholders will not be able to attend the meeting in person.

You will be asked to (i) elect one director of the Company and (ii) ratify PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2021.

Enclosed with this letter are (i) answers to questions you may have about the proposals, (ii) the formal notice of the meeting, and (iii) the proxy statement, which gives detailed information about the proposals and why the Board of Directors of the Company recommends that you vote to approve them.

The close of business on April 27, 2021, has been fixed as the record date (“Record Date”) for the determination of stockholders entitled to notice of and to vote at the Meeting and any adjournments or postponements thereof.

The Company has elected to provide access to its proxy materials to certain of its stockholders over the internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. On or about May 7, 2021, the Company intends to mail a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy statement and annual report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”), and how to submit proxies over the internet or by telephone. The Notice of Internet Availability of Proxy Materials also contains instructions on how you can elect to receive a printed copy of the proxy statement, proxy card and Annual Report. The Company believes that providing its proxy materials over the internet will expedite stockholders’ receipt of proxy materials, lower the costs associated with the Annual Meeting and conserve resources.

If you are a stockholder of record of the Company (shares are held in your name as reflected in the Company’s records), it is important that your shares be represented at the Annual Meeting. If you are unable to attend the Annual Meeting, we encourage you to vote your proxy on the internet or by telephone by following the instructions provided on the Notice of Internet Availability of Proxy Materials. If you are a stockholder of record of the Company, and wish to attend and vote at the Annual Meeting, please send an email including your full name and address to AST at attendameeting@astfinancial.com with “Kayne Anderson virtual meeting” in the subject line. AST will then email you the virtual meeting access information and instructions for voting during the Annual Meeting.

The Annual Meeting will begin promptly at 1:00 p.m. Central Time. Stockholders are encouraged to access the meeting prior to the meeting start time.

Sincerely, | ||

| ||

Michael J. Levitt |

KAYNE ANDERSON BDC, INC.

ANSWERS TO SOME IMPORTANT QUESTIONS

Q. WHAT AM I BEING ASKED TO VOTE “FOR” ON THIS PROXY?

A. This proxy contains the following proposals for the Company:

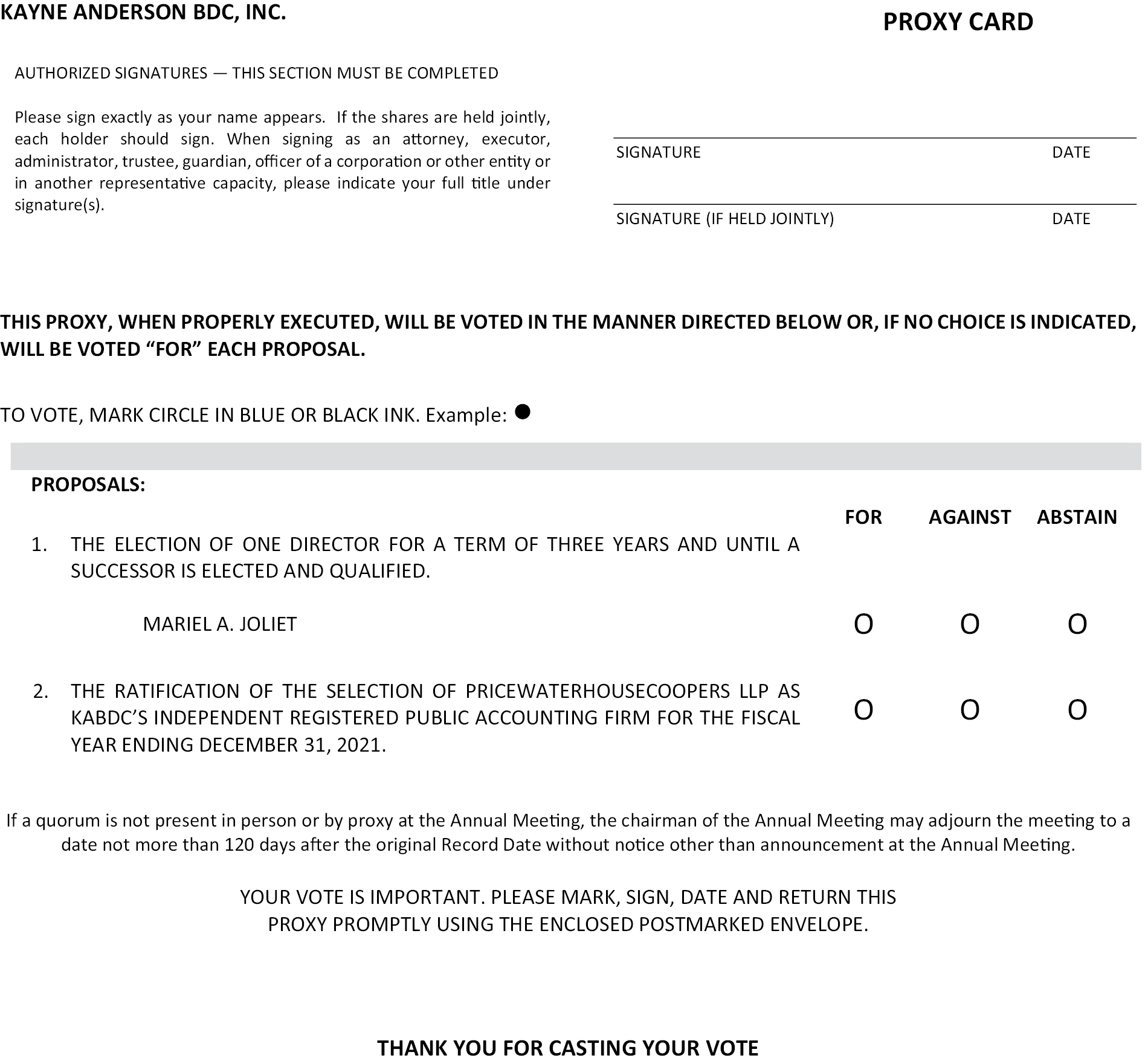

• Proposal One — to elect one director to serve until the Company’s 2024 Annual Meeting of Stockholders and until their successors are duly elected and qualified.

• Proposal Two — to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

Q. HOW DOES THE BOARD OF DIRECTORS SUGGEST THAT I VOTE?

A. The Board of Directors of the Company unanimously recommends that you vote “FOR” all proposals on the enclosed proxy card.

Q. HOW CAN I VOTE?

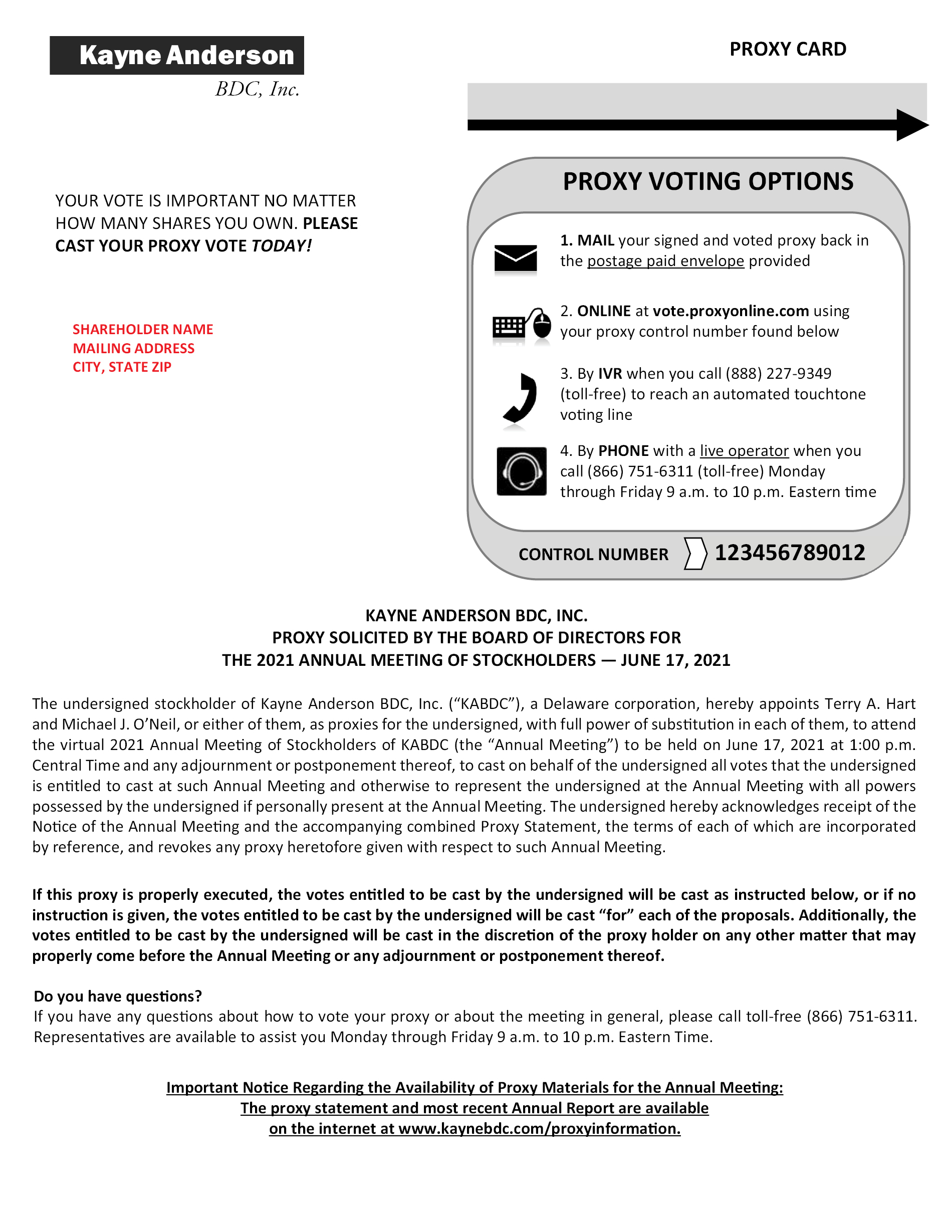

A. Voting is quick and easy. You may vote your shares via the internet, by telephone (for internet and telephone voting, please follow the instructions on the proxy ballot), or by simply completing and signing the enclosed proxy ballot, and mailing it in the postage-paid envelope included in this package. You may also vote during the meeting if you are able to attend the virtual meeting. However, even if you plan to attend the meeting, we urge you to cast your vote early. That will ensure your vote is counted should your plans change.

This information summarizes information that is included in more

detail in the proxy statement. We urge you to read the proxy statement carefully.

If you have questions, call 1-877-657-3863.

KAYNE ANDERSON BDC, INC.

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of: Kayne Anderson BDC, Inc.

NOTICE IS HEREBY GIVEN that the virtual 2021 Annual Meeting of Stockholders of Kayne Anderson BDC, Inc., a Delaware corporation (the “Company”), will be held on June 17, 2021, at 1:00 p.m. Central Time for the following purposes:

1. To elect one director of the Company to hold office until the 2024 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified; and

2. To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

3. To consider and vote upon such other matters, including adjournments, as may properly come before said Meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Stockholders of record as of the close of business on April 27, 2021, are entitled to notice of and to vote at the meeting (or any adjournment or postponement of the meeting thereof).

Important notice regarding the availability of proxy materials for the Annual Meeting: The Company’s proxy statement, the proxy card, and the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2020 (the “Annual Report”) are available at www.kaynebdc.com/proxyinformation.

Your vote is important regardless of the number of shares that you own. If you are unable to attend the Annual Meeting, we encourage you to vote your proxy on the Internet or by telephone by following the instructions provided on the Notice of Internet Availability of Proxy Materials. You may also request from us, free of charge, hard copies of the proxy statement and proxy card for the Company by following the instructions on the Notice of Internet Availability of Proxy Materials.

By Order of the Board of Directors of the Company, | ||

| ||

Jarvis V. Hollingsworth Secretary |

April 30, 2021

Houston, Texas

i

KAYNE ANDERSON BDC, INC.

811 Main Street, 14th Floor

Houston, TX 77002

1-877-657-3863

Proxy Statement

2021 ANNUAL MEETING OF STOCKHOLDERS

APRIL 30, 2021

This proxy statement is being sent to you by the Board of Directors of Kayne Anderson BDC, Inc. (the “Company”), a Delaware corporation. The Board of Directors of the Company is asking you to complete and return the enclosed proxy card, permitting your votes to be cast at the virtual Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 17, 2021, at 1:00 p.m. Central Time. In light of public health concerns regarding the COVID-19 pandemic, the Annual Meeting will be held in a virtual meeting format only. Stockholders will not be able to attend the meeting in person.

Stockholders of record of the Company at the close of business on April 27, 2021 (the “Record Date”), are entitled to vote at the Annual Meeting. As a stockholder of the Company, you are entitled to one vote for each share of Common Stock of the Company you hold on each matter on which holders of such shares are entitled to vote.

Important notice regarding the availability of proxy materials for the 2021 Annual Meeting of Stockholders to be held on June 17, 2021: This proxy statement and the Company’s annual report are available at www.kaynebdc.com/proxyinformation or on the website of the Securities and Exchange Commission (“SEC”) at www.sec.gov. To request a hard copy of these reports be mailed to you, free of charge, please contact the Company at 1-877-657-3863 or email kaynebdc@kaynecapital.com.

The Company is managed by KA Credit Advisors, LLC (the “Advisor”), an affiliate of Kayne Anderson Capital Advisors, L.P. (“KACALP” and, together with its affiliates, “Kayne Anderson”). The Advisor is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. Kayne Anderson is a leading alternative investment adviser focused on infrastructure/energy, renewables, real estate, credit, and growth equity. Kayne Anderson’s investment philosophy is to pursue niches, with an emphasis on cash flow, where our knowledge and sourcing advantages enable us to seek to deliver above average, risk-adjusted investment returns. As responsible stewards of capital, Kayne’s philosophy extends to promoting responsible investment practices and sustainable business practices to create long-term value for our investors. Kayne Anderson manages over $33 billion in assets (as of February 28, 2021) for institutional investors, family offices, high net worth, and retail clients and employs over 350 professionals in five core offices across the U.S. Kayne Anderson may be contacted at the address listed above.

This proxy statement sets forth the information that the Company’s stockholders should know in order to evaluate each of the following proposals. The following table presents a summary of the proposals for the Company being solicited with respect to each proposal. Please refer to the discussion of each proposal in this proxy statement for information regarding votes required for the approval of each proposal.

1

Proposals for the Company

5. To elect the following individual as director for terms of three years and until their successors are duly elected and qualified:

• Mariel A. Joliet

6. To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

Notice of Internet Availability of Proxy Materials

In accordance with regulations promulgated by the SEC, the Company has made this Proxy Statement, the Notice of Annual Meeting of Stockholders, and the Annual Report available to stockholders on the internet. Stockholders may (i) access and review the Company’s proxy materials and (ii) authorize their proxies, as described in “Answers to Some Important Questions,”, via the internet at vote.proxyonline.com.

This Proxy Statement, the Notice of Annual Meeting and the Annual Report are available at www.kaynebdc.com/proxyinformation.

Electronic Delivery of Proxy Materials

Pursuant to the rules adopted by the SEC, the Company furnishes proxy materials by email to those stockholders who have elected to receive their proxy materials electronically. While the Company encourages stockholders to take advantage of electronic delivery of proxy materials, which helps to reduce the environmental impact of annual meetings and the cost associated with the physical printing and mailing of materials, stockholders who have elected to receive proxy materials electronically by email may request a printed set of proxy materials. The Notice of Internet Availability of Proxy Materials contains instructions on how you can elect to receive a printed copy of the Proxy Statement and Annual Report.

2

Proposal One

Election of Directors

The Company’s Board of Directors (the “Board”) unanimously nominated Mariel A. Joliet for re-election as director at the Annual Meeting. Ms. Joliet is nominated to serve for a term of three years (until the 2024 Annual Meeting of Stockholders) and until a successor has been duly elected and qualified.

The nominee has consented to be named in this proxy statement and has agreed to serve if elected. The Company has no reason to believe that the nominee will be unavailable to serve. The persons named on the accompanying proxy card intend to vote at the meeting (unless otherwise directed) “FOR” the election of the nominees. If the nominee is unable to serve because of an event not now anticipated, the persons named as proxies may vote for another person designated by the Company’s Board.

In accordance with the Company’s charter, the Board is divided into three classes of approximately equal size. Currently, the Company has five directors as follows:

Class | Term* | Directors | ||

I | Until 2021 | Mariel A. Joliet | ||

II | Until 2022 | George E. Marucci, Jr. | ||

Terrence J. Quinn | ||||

III | Until 2023 | Michael J. Levitt | ||

Susan C. Schnabel |

____________

* Each director serves a three-year term until the Annual Meeting of Stockholders for the designated year and until his or her successor has been duly elected and qualified.

The term “Independent Director” is used to refer to a director who is not an “interested person,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Company, of Kayne Anderson or of the Company’s underwriters in offerings of its securities from time to time as defined in the 1940 Act. None of the Independent Directors, nor any of their immediate family members, has ever been a director, officer or employee of Kayne Anderson or its affiliates. Mr. Marruci’s son is the Chief Operating Officer and Chief Financial Officer of Wurrly LLC (“Wurrly”). Wurrly is controlled by Mr. Levitt’s spouse. Mr. Marucci does not have a financial interest in Wurrly. The Company believes that Mr. Marucci qualifies as an independent director and is not an “interested person” as set forth in Section 2(a)(19) of the 1940 Act. Each of Michael J. Levitt and Terrence J. Quinn is an “interested person” or “Interested Director” by virtue of his employment relationship with Kayne Anderson.

For information regarding the Company’s executive officers and their compensation, please refer to “Information About Executive Officers” and “Compensation Discussion and Analysis”.

The following tables set forth the nominee’s and each remaining director’s name and year of birth; position(s) with the Company and length of time served; principal occupations during the past five years; and other directorships held during the past five years. The address for the nominee and other directors is 811 Main Street, 14th Floor, Houston, TX 77002.

3

INFORMATION REGARDING DIRECTOR NOMINEES AND DIRECTORS

NOMINEE FOR INDEPENDENT DIRECTOR

Name | Position(s) Held | Principal Occupations | Other Directorships | |||

Mariel A. Joliet | Director. Appointed 2020 to serve until the 2021 Annual Meeting of Stockholders) 2020. Chairperson of the Board. Member of the Nominating and Corporate Governance Committee (Chairperson). Member of Audit Committee. | Senior vice president and treasurer of Hilton Hotels Corporation from 1998 to 2008. | Current: • ASGN, Incorporated (NYSE: ASGN) Prior: • Vision Center at Children’s Hospital Los Angeles • Know the Glow Foundation |

Remaining Independent Directors

Name | Position(s) Held | Principal Occupations | Other Directorships | |||

George E. Marucci, Jr. (born 1952) | Director. Appointed 2020 until the 2022 Annual Meeting of Stockholders. Member of Audit Committee (Lead Valuation Director) and Nominating and Corporate Governance Committee | Marketing consultant for BMW North America. Chair of leading automotive family office in Baltimore, MD. Golf commentator for NBC Sports. Previously, co-owner, president and acting chief financial officer for Pennmark Automotive Enterprises and co-owner and president of Pennmark Real Estate Investment Group. Prior to this, investment advisor and stockbroker for White Weld and Co. and Merrill Lynch. | None | |||

Susan C. Schnabel (born 1961) | Director. Appointed 2020 for a 3-year term (until the 2023 Annual Meeting of Stockholders). Member of Audit Committee (Chairperson) and Nominating and Corporate Governance Committee. | Co-founder and managing partner of aPriori Capital Partners. Managing director in the asset management division of Credit Suisse from 1998 to 2014. Prior to that, co-head of DLJ merchant banking. | Current: • Board of Trustees of Cornell University • California Institute • US Olympic and Paralympic Foundation Prior: • Neiman Marcus • STR Holdings • Rockwood Holdings Inc. • Shoppers Drug Mart |

4

Name(1) | Position(s) Held | Principal Occupations | Other Directorships | |||

Michael J. Levitt (born 1958) | Director. Appointed 2020 for 3-year term (until the 2023 Annual Meeting of Stockholders) | Chief Executive Officer of Kayne Anderson since July 2016 and of the Company since 2020. Vice Chairman of Apollo Global Management, LP from April 2012 to June 2016. | Current: • Kayne Anderson Energy Infrastructure Fund, Inc. (NYSE: KYN) • Kayne Anderson NextGen Energy & Infrastructure, Inc. (NYSE: KMF) • Core Scientific, Inc. • The Music Acquisition Corporation Prior: • Hostess Holdings GP, LLC | |||

Terrence J. Quinn (born 1951) | Director. Appointed 2020 until the 2022 Annual Meeting of Stockholders. | Vice Chairman of Kayne Anderson and of the Company. | Prior: • KYN • Kayne Anderson Energy Total Return Fund, Inc. |

____________

(1) Mr. Levitt and Mr. Quinn are “interested persons” of the Company as defined in the 1940 Act by virtue of their employment relationship with Kayne Anderson.

5

Directors and officers who are “interested persons” by virtue of their employment by Kayne Anderson, including all executive officers, serve without any compensation from the Company. For the Company, for the fiscal year ended December 31, 2020:

• Each Independent Director receives an annual retainer of $90,000 ($22,500 for the quarter ended December 31, 2020) for his or her service. The Independent Directors, voting separately, have authority to set their compensation.

• The chairperson of the Board receives an annual retainer of $15,000 ($3,750 for the quarter ended December 31, 2020).

• The chairperson of the Audit Committee receives an annual retainer of $7,500 ($1,875 for the quarter ended December 31, 2020).

• The lead valuation director of the Audit Committee receives an annual retainer of $7,500 ($1,875 for the quarter ended December 31, 2020).

• Each Independent Director receives $2,500 per special board meeting attended, whether in-person or telephonic.

• Each Independent Director receives $1,000 per committee meeting attended, whether in-person or telephonic, provided if the duration of the committee meeting is more than fifteen minutes in length.

�� The Independent Directors are reimbursed for expenses incurred as a result of attendance at meetings of the Board and its committees.

The following table sets forth the compensation paid by the Company for service during the fiscal year ended December 31, 2020, to the Independent Directors. The Company does not have a retirement or pension plan or any compensation plans under which the Company’s equity securities are authorized for issuance.

DIRECTOR COMPENSATION TABLE

Total | |||

Independent Directors |

| ||

Mariel A. Joliet | $ | 29,750 | |

George E. Marucci, Jr. |

| 27,875 | |

Susan C. Schnabel |

| 27,875 | |

Interested Directors |

| ||

Michael J. Levitt |

| None | |

Terrence J. Quinn |

| None | |

____________

(1) The Company started to pay independent directors beginning with the quarter ended December 31, 2020. Such compensation consisted of the annual retainers for each member and the annual retainers for the board chairperson, audit committee chair and lead valuation director of the audit committee.

6

Committees of the Board of Directors

The Board of Directors currently has two standing committees: The Audit Committee and the Nominating and Corporate Governance Committee (the “Nominating Committee”). The table below shows the directors currently serving on the committees of the Company:

Audit Committee | Nominating Committee | |||

Independent Directors | ||||

Mariel A. Joliet(1) | X | X | ||

George E. Marucci, Jr.(2) | X | X | ||

Susan C. Schnabel(3) | X | X | ||

Interested Directors | ||||

Michael J. Levitt | — | — | ||

Terrence J. Quinn | — | — |

____________

(1) Chairperson of the Nominating Committee.

(2) Lead valuation director of the Audit Committee.

(3) Chairperson of the Audit Committee. Designated as an “audit committee financial expert” by the Board.

• Audit Committee. The Audit Committee operates under a written charter (the “Audit Committee Charter”), which was adopted and approved by the Board and established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “1934 Act”). The Audit Committee Charter conforms to the applicable listing standards of the New York Stock Exchange (the “NYSE”). The Audit Committee Charter is available on the Companies’ website (www.kaynebdc.com). The Audit Committee, among others, approves and recommends to the Board the election, retention or termination of the Company’s independent auditors; approves services to be rendered by such auditors; monitors and evaluates each auditors’ performance; reviews the results of the Company’s audit; determines whether to recommend to the Board that the Company’s audited financial statements be included in the Company’s Annual Report; monitors the accounting and reporting policies and procedures of the Company and the Company’s compliance with regulatory requirements; and responds to other matters as outlined in the Audit Committee Charter. The Audit Committee is responsible for the oversight of the Company’s valuation procedures and the valuation of the Company’s securities in accordance with such procedures. Each Audit Committee member is not considered “interested persons” of the Company, as that term is defined in Section 2(a)(19) of the 1940 Act, and meet the independence requirements of Rule 10A(m)(3) of the Exchange Act. During the fiscal year ended December 31, 2020, the Audit Committee met one time.

• Nominating Committee. The Nominating Committee is responsible for appointing and nominating Independent Directors to the Board. Each Nominating Committee member is not considered “interested persons” of the Company, as that term is defined in Section 2(a)(19) of the 1940 Act, and meet the independence requirements of Rule 10A(m)(3) of the Exchange Act. The Nominating Committee operates under a written charter adopted and approved by the Board (the “Nominating and Corporate Governance Committee Charter”), a copy of which is available on the Companies’ website (www.kaynebdc.com). In determining whether to recommend a director nominee, the Nominating Committee considers and discusses director diversity, among other factors, with a view toward the needs of our Board of Directors as a whole. The Nominating Committee generally conceptualizes diversity expansively to include concepts such as race, gender, national origin, differences of viewpoint, professional experience, education, skill, and other qualities that contribute to our Board of Directors, when identifying and recommending director nominees. The Nominating Committee believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Nominating Committee’s goal of creating a Board of Directors that best serves our needs and the interests of our stockholders. During the fiscal year ended December 31, 2020, the Nominating Committee met one time.

7

Board of Director and Committee Meetings Held

During the fiscal year ended December 31, 2020, the Company had one meeting of the Board of Directors. During the 2020 fiscal year, all of the directors of the Company attended at least 75% of the aggregate of (1) the total number of meetings of the Board and (2) the total number of meetings held by all committees of the Board on which they served. The Company does not currently have a policy with respect to board member attendance at annual meetings.

For the Company, please refer to “Corporate Governance” for a review of the Board’s leadership structure, role in risk oversight and other matters.

8

Information about Each Director’s Qualifications,

Experience, Attributes or Skills

The Board of the Company believes that each of its directors has the qualifications, experience, attributes, and skills (“Director Attributes”) appropriate to their continued service as directors of the Company in light of the Company’s business and structure. Each of the directors has a demonstrated record of business and/or professional accomplishment that indicates that they have the ability to critically review, evaluate and access information provided to them. Certain of these business and professional experiences are set forth in detail in the tables above under “Information Regarding Director Nominees and Directors.” Many of the directors have served as members of the board of other public companies, non-profit entities, or other organizations. Therefore, they have substantial boardroom experience and have demonstrated a commitment to discharging oversight duties as directors in the interests of stockholders.

In addition to the information provided in the tables above, certain additional information regarding the directors and their Director Attributes is provided below. The information provided below, and in the tables above, is not all-inclusive. Many Director Attributes involve intangible elements, such as intelligence, integrity and work ethic, along with the ability to work with other members of the Board, to communicate effectively, to exercise judgment and to ask incisive questions, and commitment to stockholder interests. The Board of the Company will annually conduct a self-assessment wherein the effectiveness of the Board and individual directors is reviewed.

Independent Directors

Mariel A. Joliet. Ms. Joliet serves as Chairperson of our Board of Directors and Chairperson of our Nominating Committee. Ms. Joliet also serves as a director on the Board of Directors of ASGN, Incorporated (NYSE: ASGN) and is also a member of ASGN’s Audit Committee. ASGN Incorporated is one of the foremost providers of IT and professional services in the technology, digital, creative, engineering and life sciences fields across commercial and government sectors. From 1998 to 2008, Ms. Joliet was employed by the Hilton Hotels Corporation, a publicly traded hotel company, as senior vice president and treasurer. During her time at the Hilton Hotels Corporation, Ms. Joliet participated in its sale to the Blackstone Group for $27 billion, one of the ten-largest leveraged buyouts in history at the time. As Treasurer, Ms. Joliet was responsible for capital markets and financial investment initiatives, including credit ratings, debt/equity issuances, interest rate risk management, cash management and foreign exchange. Prior to her employment with Hilton Hotels Corporation, Ms. Joliet worked for ten years as a coverage officer and corporate banker at Wachovia Bank and Corestates Bank, where she was responsible for client relationships and portfolio management. Ms. Joliet also served as an advisory board member for the Vision Center at Children’s Hospital Los Angeles, and a member of Know the Glow Foundation. She received a B.S. at the University of Scranton and earned an M.B.A. from Marywood University. Ms. Joliet has a strong background in financing, acquisitions, deal structuring, strategic planning, and operational integration. Ms. Joliet’s experiences as a corporate executive led our Nominating Committee to conclude that Ms. Joliet is qualified to serve as a director.

George E. Marucci, Jr. Mr. Marucci is an accomplished finance executive and entrepreneur in various industries and fields. Mr. Marucci serves as the Lead Valuation Director on our Audit Committee. Mr. Marucci currently serves as a marketing consultant for BMW North America, chair of a leading automotive family office in Baltimore and golf commentator for NBC Sports. Previously, Mr. Marucci was the co-owner, president and acting chief financial officer for Pennmark Automotive Enterprises, a luxury automobile dealership which employed 450 employees and generated $300 million in annual sales. Previously, Mr. Marucci was the co-owner and president of Pennmark Real Estate Investment Group, which specialized in commercial real estate and development, including the development and operation of 50 Walmart retail centers. Prior to owning and operating these companies, Mr. Marucci served as an investment advisor and stockbroker at White Weld and Co. and Merrill Lynch. In those roles, Mr. Marucci was responsible for institutional sales and client development. Mr. Marucci began his career with a family-based accounting firm, Marucci, Ortals and Co. Mr. Marucci received a B.A. in Accounting in 1974 from The University of Maryland. Mr. Marucci’s diverse experiences in real estate, investment advisory and marketing consultant roles led our Nominating Committee to conclude that Mr. Marucci is qualified to serve as a director.

Susan C. Schnabel. Ms. Schnabel serves as Chairperson of our Audit Committee of our Board of Directors. Ms. Schnabel is the co-founder and managing partner of aPriori Capital Partners, an independent leveraged buyout fund advisor. aPriori Capital Partners was created in connection with the spin-off of DLJ Merchant Banking Partners from Credit Suisse in 2014. Prior to forming aPriori Capital, Ms. Schnabel worked at Credit Suisse from 1998 to 2014 where she served as a managing director in the Asset Management Division and co-head of DLJ Merchant Banking.

9

Ms. Schnabel formerly served on the boards of numerous public companies, including Neiman Marcus, STR Holdings, Rockwood Holdings Inc., and Shoppers Drug Mart. She also serves on the Board of Trustees of Cornell University, the California Institute of Technology - Investment Committee, and the US Olympic and Paralympic Foundation Board of Directors. Ms. Schnabel earned a Bachelor of Science in Chemical Engineering from Cornell University and an M.B.A. from Harvard Business School. Ms. Schnabel’s experience as an investment banker, private equity investor and a corporate director led our Nominating Committee to conclude that Ms. Schnabel is qualified to serve as a director.

Interested Directors

Michael J. Levitt. Mr. Levitt is our Chief Executive Officer. Mr. Levitt is the chief executive officer of Kayne Anderson. He brings to the Board of Directors expertise in private equity and debt transactions. Mr. Levitt is a member of the Board of Kayne Anderson Energy Infrastructure Fund, Inc. (“KYN”) and Kayne Anderson NextGen Energy & Infrastructure, Inc. (“KMF”). Mr. Levitt is chairman of Core Scientific, Inc. and serves on the board of directors of The Music Acquisition Corporation. Prior to joining Kayne Anderson, Mr. Levitt served as a vice chairman with Apollo Global Management, LLC. At Apollo, he was a partner in the private equity and credit groups. In 2001, Mr. Levitt founded Stone Tower Capital LLC (“Stone Tower”), where he served as chairman, chief executive officer and chief investment officer and grew Stone Tower to $17 billion in credit-focused alternative investments. Stone Tower was acquired by Apollo in 2012. Before founding Stone Tower, Mr. Levitt worked as a partner at the private equity firm Hicks, Muse, Tate & Furst Incorporated, where he was involved in media and consumer investments. Mr. Levitt also served as the co-head of the investment banking division of Smith Barney Inc. Mr. Levitt began his investment banking career at Morgan Stanley & Co., Inc., where he oversaw corporate finance and advisory businesses related to private equity firms and non-investment grade companies. Mr. Levitt holds a B.B.A. and J.D. from the University of Michigan and serves on the University’s Investment Advisory Board. He is also a member of the Visiting Committee of the Ross School of Business and the Trustee of the Law School’s Cook Trust. Mr. Levitt’s experience at Kayne Anderson and as a senior executive officer and adviser of various companies make him a valued member of the Board of the Company.

Terrence J. Quinn. Mr. Quinn is our Vice Chairman. Mr. Quinn is the vice chairman for Kayne Anderson and is responsible for managing our new business opportunities and select client relations. He oversees the private credit group and serves on the firm’s Credit, Real Estate and Growth Private Equity Investment Committees. Mr. Quinn was a founding member of the Board of KYN and the Board of Kayne Anderson Energy Total Return Fund, Inc. Prior to joining Kayne Anderson in 2006, Mr. Quinn was a founding partner of a merchant banking firm specializing in private equity and advisory services. He was president and chief executive officer of five operating companies and member of the executive committee of a leading regional bank. Mr. Quinn was manager of pensions and investments for the 3M Company and founding chief executive officer of a leading mezzanine fund group. Mr. Quinn has served on the boards of directors of several public and private firms. Mr. Quinn earned a B.A. in Economics in 1973 and an M.B.A. from the University of Minnesota in 1974. Mr. Quinn’s experience as an executive officer of various banking companies led our Nominating Committee to conclude that Mr. Quinn is qualified to serve as a director.

Required Vote

With respect to the Company, the election of Ms. Joliet as a director under this proposal requires the affirmative vote of the holders of a majority of the Company’s Common Stock outstanding as of the Record Date. For purposes of this proposal, each share of Common Stock is entitled to one vote.

Abstentions, if any, will have the same effect as votes against the election of the nominees, although they will be considered present for purposes of determining the presence of a quorum at the Annual Meeting.

BOARD RECOMMENDATION

THE BOARD OF DIRECTORS OF THE COMPANY, INCLUDING ALL OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTIONS OF THE NOMINEE TO THE BOARD.

10

Proposal Two

Ratification of Selection of Independent Registered Public Accounting

Firm

The Audit Committee and the Board of Directors of the Company, including all of the Company’s Independent Directors, have selected PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2021, and are submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification.

PricewaterhouseCoopers LLP has audited the financial statements of the Company since inception and has informed the Company that it has no direct or indirect material financial interest in the Company or in Kayne Anderson.

A representative of PricewaterhouseCoopers LLP will not be available at the Annual Meeting.

The Audit Committee of the Company will meet periodically with representatives of PricewaterhouseCoopers LLP to discuss the scope of their engagement, review the financial statements of the Company and the results of their examination.

Independent Accounting Fees and Policies

Audit and Other Fees

The following table sets forth the approximate amounts of the aggregate fees billed to the Company for the fiscal year ended December 31, 2020 by PricewaterhouseCoopers LLP:

2020 | |||

Audit Fees(1) | $ | 72,000 | |

Audit-Related Fees(2) |

| — | |

Tax Fees(3) |

| — | |

All Other Fees |

| — | |

Total | $ | 72,000 | |

____________

(1) For professional services rendered with respect to the audit of the Company’s annual financial statements and the quarterly review of the Company’s financial statements (as applicable). For 2020, this also included the audit of the December 31, 2020 financial statements in the Form 10-K and the audit of the September 30, 2020 seed financial statements in the Company’s Form 10-G/A.

(2) For professional services rendered with respect to assurance and related services reasonably related to the performance of the audits of the Company’s annual financial statements not included in “Audit Fees” above.

(3) For professional services for tax compliance, tax advice and tax planning.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee reviews, negotiates and approves in advance the scope of work, any related engagement letter and the fees to be charged by the independent registered public accounting firm for audit services and permitted non-audit services for the Company and for permitted non-audit services for the Company’s investment advisers and any affiliates thereof that provide services to the Company if such non-audit services have a direct impact on the operations or financial reporting of the Company. All of the audit and non-audit services described above, for which fees were incurred by the Company for the fiscal years ended December 31, 2020, were pre-approved by the Audit Committee, in accordance with its pre-approval policy.

11

The Audit Committee of the Board of Directors (the “Board”) of Kayne Anderson BDC, Inc. (the “Company”) is responsible for assisting the Board in monitoring (1) the accounting and reporting policies and procedures of the Company, (2) the quality and integrity of the Company’s financial statements, (3) the Company’s compliance with regulatory requirements, and (4) the independence and performance of the Company’s independent auditors and any internal auditors. Among other responsibilities, the Audit Committee of the Company reviews, in its oversight capacity, the Company’s annual financial statements with both management and the independent auditors, and the Audit Committee of the Company meets periodically with the independent auditors and any internal auditors to consider their evaluation of the Company’s financial and internal controls. The Audit Committee of the Company also selects, retains and evaluates and may replace the Company’s independent auditors and determines their compensation, subject to ratification of the Board, if required. The Audit Committee of the Company is currently composed of three directors. The Audit Committee of the Company operates under a written charter (the “Audit Committee Charter”) adopted and approved by the Board, a copy of which is available upon request.

The Audit Committee of the Company, in discharging its duties, has met with, and held discussions with management and the Company’s independent auditors. The Audit Committee of the Company has reviewed and discussed the Company’s audited financial statements with management. Management has represented to the independent auditors that the Company’s financial statements were prepared in accordance with accounting principles generally accepted in the U.S. The Audit Committee of the Company has also discussed with the independent auditors the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board. The Audit Committee of the Company has received the written disclosures and the letter from the Company’s independent auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the Audit Committee of the Company concerning independence, and has discussed with the independent auditors the independent auditors’ independence. As provided in the Audit Committee Charter of the Company, it is not the Audit Committee’s responsibility to determine, and the considerations and discussions referenced above do not ensure, that the Company’s financial statements are complete and accurate and presented in accordance with accounting principles generally accepted in the U.S.

The Audit Committee has pre-approved, consistent with its pre-approval policy, the permitted audit, audit-related, tax, and non-audit services to be provided by PwC, the Company’s independent registered public accounting firm, in order to assure that the provision of such service does not impair the firm’s independence.

Any requests for audit, audit-related, tax and other services that have not received general pre-approval must be submitted to the Audit Committee for specific pre-approval in accordance with its pre-approval policy, and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings of the Audit Committee. The Audit Committee does not delegate its responsibilities to pre-approve services performed by PwC to management.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the financial statements as of and for the fiscal year ended December 31, 2020, be included in the Company’s annual report on Form 10-K for 2020, for filing with the Securities and Exchange Commission.

Audit Committee Members:

Mariel A. Joliet

George E. Marucci, Jr.

Susan C. Schnabel

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.”

12

Required Vote

With respect to the Company, the approval of this proposal requires the affirmative vote of a majority of the votes cast by the holders of the Company’s Common Stock outstanding as of the Record Date.

For purposes of the vote on this proposal, abstentions will not be counted as votes cast and will have no effect on the result of the vote.

BOARD RECOMMENDATION

THE BOARD OF DIRECTORS OF THE COMPANY, INCLUDING ALL OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

13

INFORMATION ABOUT EXECUTIVE OFFICERS

The following table sets forth each executive officer’s name and year of birth; position(s) with the Company, term of office, and length of time served; principal occupations during the past five years; and directorships. The address for the Company’s offices is 811 Main Street, 14th Floor, Houston, TX 77002.

Name | Position(s) | Principal | Other | |||

Michael J. Levitt | See information on page 5. | |||||

Terrence J. Quinn | See information on page 5. | |||||

James C. Baker | President. Elected annually as an officer/served since inception. | Partner and Senior Managing | Current: • Expression Therapeutics • Kayne Anderson Energy Infrastructure Fund, Inc. (NYSE: KYN) • Kayne Anderson NextGen Energy & Infrastructure, Inc. (NYSE: KMF) Prior: • Kayne Anderson Energy Development Company • K-Sea Transportation Partners L.P. • Petris Technology, Inc. • ProPetro Services, Inc. | |||

Douglas L. Goodwillie (born 1975) | Co-Chief Investment Officer. Elected annually as an officer/served since inception. | Managing partner and co-head of Kayne Anderson’s private credit group since 2011. Prior to joining Kayne Anderson, director at LBC Capital partners and rotational member of LBC’s Investment Committee. Prior to LBC, operating director at Arsenal Capital Partners. | None | |||

Terry A. Hart | Chief Financial Officer and Treasurer. Elected annually as an officer/served since inception. | Senior Managing Director of Kayne Anderson since January 2020. Managing Director of Kayne Anderson from December 2005 to January 2020 and Chief Financial Officer of KAFA since 2006. Chief Financial Officer and Treasurer of KYN since December 2005 and of KMF since August 2010. Assistant Secretary of KYN and KMF since January 2019. Chief Financial Officer of Kayne Anderson Acquisition Corp. from December 2016 to November 2018. | Current: • The Source for Women Prior: • Kayne Anderson Energy Development Company |

14

Name | Position(s) | Principal | Other | |||

Jarvis V. Hollingsworth | Secretary. Elected annually as an officer/served since inception. | General Counsel of Kayne Anderson and Secretary of KYN and KMF since 2019. Private practice of law at Fulbright & Jaworski LLP (1993-1999); Brobeck Phleger & Harrison (1999-2001); and Bracewell LLP (2001-2019). Chairman of the Board of Trustees of the Teacher Retirement System of Texas (2017 to Present). | Current: • Blockcap Inc. • Laredo Petroleum, Inc. • Teacher Retirement System of Texas Prior: • Cullen/Frost Bankers, Inc. • Emergent Technologies, LP • Infogroup, Inc. • University of Houston System Board of Regents | |||

Kenneth B. Leonard | Co-Chief Investment Officer. Elected annually as an officer/served since inception. | Managing partner and co-head of Kayne Anderson’s private credit group since 2011. Prior to joining Kayne Anderson, co-founder of Dymas Capital Management with Cerberus Capital Management. Senior vice president in the Merchant Banking Syndications Team at GE Capital from 2001 to 2002. | None | |||

Michael J. O’Neil | Chief Compliance Officer. Elected annually as an officer/served since inception. | Chief Compliance Officer of Kayne Anderson since March 2012 and of KYN and KMF since December 2013 and of KA Associates, Inc. (broker-dealer) since January 2013. A compliance officer at BlackRock Inc. from January 2008 to February 2012. | None | |||

John B. Riley | Vice President. Elected annually as an officer/served since inception. | Controller of Kayne Anderson since October 2006. | None |

15

Compensation Discussion and Analysis

Pursuant to an investment management agreement between the Company and KA Credit Advisors, LLC (the ”Advisor”), the Advisor is responsible for supervising the investments and reinvestments of the Company’s assets. The Advisors, at its own expense, maintains staff and employs personnel as it determines is necessary to perform its obligations under the investment management agreement. The Company pays various management fees to the Advisor for the advisory and other services performed by the Advisor under the investment management agreement.

The executive officers who manage the Company’s regular business are employees of the Advisor or its affiliates. None of the Company’s executive officers receive direct compensation from the Company. Compensation paid for services relating to financial reporting and compliance functions are paid by the Advisor. Accordingly, the Company does not directly pay salaries, bonuses or other compensation to its executive officers but instead indirectly bears such cost. The Company does not have employment agreements with its executive officers. The Company does not provide pension or retirement benefits, perquisites, or other personal benefits to its executive officers. The Company does not maintain compensation plans under which its equity securities are authorized for issuance. The Company does not have arrangements to make payments to its executive officers upon their termination or in the event of a change in control of the Company.

The investment management agreement for the Company does not require the Advisor to dedicate specific personnel to fulfilling its obligation to the Company under the investment management agreement, or require personnel of the Advisor to dedicate a specific amount of time to the management of the Company. In their capacities as executive officers or employees of the Advisor or its affiliates, they devote such portion of their time to the Company’s affairs as required for the performance of the Advisor’s duties under the investment management agreement.

The executive officers for the Company are compensated by the Advisor or its affiliates. The Company understands that the Advisor takes into account the performance of the Company as a factor in determining the compensation of certain of its senior managers, and such compensation may be increased depending on the Company’s performance. In addition to compensation for services performed for the Company, certain of the executive officers receive compensation for services performed for various investment funds of the Advisor or its affiliates.

Our investment activities are managed by our Advisor, an investment advisor that is registered with the SEC under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), under an investment advisory agreement between us and the Advisor (the “Investment Advisory Agreement”). Our Advisor is responsible for originating prospective investments, conducting research and due diligence investigations on potential investments, analyzing investment opportunities, negotiating, and structuring investments and monitoring our investments and portfolio companies on an ongoing basis. While we do not have any employees, the Advisor and its affiliates have a team of approximately 50 investment professionals who are primarily focused on private credit investments and liquid credit investments. The investment team is supported by a team of finance, legal, compliance, operations, and administrative professionals.

On February 5, 2021, we entered into the Investment Advisory Agreement with our Advisor. Pursuant to the Investment Advisory Agreement with our Advisor, we pay our Advisor a fee for investment advisory and management services consisting of two components — a base management fee and an incentive fee. Our Advisor may, from time-to-time, grant waivers on our obligations, including waivers of the base management fee and/or incentive fee, under the Investment Advisory Agreement. The Investment Advisory Agreement may be terminated by either party with 60 days’ written notice.

16

On February 5, 2021, we entered into an Administration Agreement with our Advisor, which serves as our Administrator and provides or oversees the performance of our required administrative services and professional services rendered by others, which includes (but not limited to), accounting, payment of our expenses, legal, compliance, operations, technology and investor relations, preparation and filing of our tax returns, and preparation of financial reports provided to our stockholders and filed with the SEC.

We reimburse the Administrator for its costs and expenses incurred in performing its obligations under the Administration Agreement. As we reimburse the Administrator for its expenses, we indirectly bear such cost. The Administration Agreement may be terminated by either party with 60 days’ written notice.

Our Administrator engaged U.S. Bank Global Fund Services under a sub-administration agreement to assist the Administrator in performing certain of its administrative duties. The Administrator may enter into additional sub-administration agreements with third parties to perform other administrative and professional services on behalf of the Administrator.

17

Security Ownership of Management and Certain Beneficial Owners

The following tables set forth the number of shares of the Company’s Common Stock as of April 27, 2021 beneficially owned by the Company’s current directors and executive officers as a group, and certain other beneficial owners, according to information furnished to the Company by such persons. As of April 27, 2021, five persons beneficially owned more than 5% of the Company’s outstanding Common Stock. Beneficial ownership is determined in accordance with Rule 13d-3 under the 1934 Act and, unless indicated otherwise, includes voting or investment power with respect to the securities.

Common Stock

Number of Shares | Percent of | |||||

Interested Directors & Executive Officers |

|

| ||||

James C. Baker | 9,181 |

| * |

| ||

Terry A. Hart | 3,672 |

| * |

| ||

Kenneth B. Leonard | 14,690 |

| * |

| ||

Michael J. Levitt | 183,619 |

| 2.0 | % | ||

Terrence J. Quinn | 12,853 |

| * |

| ||

All Interested Directors & Executive Officers as a Group (5 persons) | 224,015 | (2) | 2.4 | % | ||

Number of Shares | Percent of | ||||

Name of Beneficial Owner of Common Stock |

| ||||

San Bernardino County Employees’ Retirement Association | 2,754,285 | 29.9 | % | ||

State of Michigan Retirement System | 2,695,486 | 29.3 | % | ||

DTE Company/Affiliates Employee Benefit Plans Master Trust | 807,924 | 8.8 | % | ||

Detroit Edison Qualified Nuclear Decommissioning Trust | 550,857 | 6.0 | % | ||

Buaite Againn, LLLP | 734,476 | 8.0 | % | ||

____________

* Less than 1% of class.

(1) Based on 9,199,767 shares outstanding as of April 27, 2021.

(2) Does not include 667 shares of common stock held by Kayne Anderson. Certain executive officers have ownership interests in Kayne Anderson and its affiliates; however, such officers may not exercise voting or investment power with respect to shares held by these entities. The Company believes by virtue of these arrangements that those officers should not be deemed to have indirect beneficial ownership of such shares.

18

The table below sets forth information about securities owned by the independent directors of both Companies and their respective immediate family members, as of December 31, 2020, in entities directly or indirectly controlling, controlled by, or under common control with, the Company’s investment adviser or underwriters.

Director | Name of | Company(1) | Title of | Dollar | Percent of | |||||

Susan C. Schnabel | Self | Kayne Anderson Energy Fund VII, L.P. | Partnership Units | Over $100,000 | * | |||||

Kayne Anderson Energy Fund VIII, L.P. | Partnership Units | Over $100,000 | * | |||||||

Kayne CLO Partners Fund II, L.P.(3) | Partnership Units | None | * |

____________

* Less than 1% of class.

(1) KACALP may be deemed to “control” the Company by virtue of its role as the fund’s general partner.

(2) The dollar ranges of the securities are as follows: None: $1 – $10,000; $10,000 – $50,000; $50,001 – $100,000; over $100,000.

(3) For Kayne CLO Partners Fund II, L.P., the commitment was made on December 30, 2020, with none drawn on December 31, 2020.

19

Section 16(A) Beneficial Ownership Reporting Compliance

Based solely on the Company’s review of Forms 3, 4 and 5 filed by such persons and information provided by the Company’s directors and officers, the Company believes that during the year ended December 31, 2020, all Section 16(a) filing requirements applicable to such persons were met in a timely manner, with the following inadvertent exceptions: KA Credit Advisors, LLC, filed late its initial statement of beneficial ownership (667 shares) on Form 3 during the reporting period.

Board Leadership Structure

The Company’s business and affairs are managed under the direction of its Board, including the duties performed for the Company pursuant to its investment advisory agreement. Among other things, the Board sets broad policies for the Company, approves the appointment of the Company’s investment adviser, administrator, and officers, and approves the engagement, and reviews the performance of the Company’s independent registered public accounting firm. The role of the Board and of any individual director is one of oversight and not of management of the day-to-day affairs of the Company.

The Board currently consists of five directors, three of whom are Independent Directors with one lead Independent Director. As part of each regular Board meeting, the Independent Directors meet separately from Kayne Anderson officers and Interested Directors and, as part of at least one Board meeting each year, with the Company’s Chief Compliance Officer. The Board reviews its leadership structure periodically as part of its annual self-assessment process and believes that its structure is appropriate to enable the Board to exercise its oversight of the Company.

Under the Company’s Bylaws, the Board may designate a Chairperson to preside over meetings of the Board and meetings of stockholders, and to perform such other duties as may be assigned to him or her by the Board. The Company has not established a policy as to whether the Chairperson of the Board shall be an Independent Director and believes that having the flexibility to designate its Chairperson and reorganize its leadership structure from time to time is in the best interests of the Company and its stockholders.

Presently, Ms. Joliet serves as Chairperson of the Board. While Ms. Joliet is the Chairperson of the Board, all of the Independent Directors play an active role in serving on the Board. The Independent Directors constitute a majority of the Company’s Board and are closely involved in all material deliberations related to the Company. The Board of the Company believes that, with these practices, each Independent Director has a stake in the Board’s actions and oversight role and accountability to the Company and its stockholders.

Board Role in Risk Oversight

The Board oversees the services provided by Kayne Anderson, including certain risk management functions. Risk management is a broad concept comprised of many disparate elements (such as, for example, investment risk, issuer and counterparty risk, compliance risk, operational risk, and business continuity risk). Consequently, Board oversight of different types of risks is handled in different ways, and the Board implements its risk oversight function both as a whole and through Board committees. In the course of providing oversight, the Board and its committees receive reports on the Company’s activities, including those related to the Company’s investment portfolio and its financial accounting and reporting. The Board also meets at least quarterly with the Company’s Chief Compliance Officer, who reports on the compliance of the Company with the federal securities laws and the Company’s internal compliance policies and procedures. The meetings of the Audit Committee with the Company’s independent registered public accounting firm also contribute to Board oversight of certain internal control risks. In addition, the Board meets periodically with representatives of the Company and Kayne Anderson to receive reports regarding the management of the Company, including those related to certain investment and operational risks, and the Independent Directors of the Company are encouraged to communicate directly with senior management.

The Company believes that Board roles in risk oversight must be evaluated on a case-by-case basis and that the Board’s existing role in risk oversight is appropriate. Management believes that the Company has robust internal processes in place and a strong internal control environment to identify and manage risks. However, not all risks that may affect a Company can be identified or processes and controls developed to eliminate or mitigate their occurrence or effects, and some risks are beyond any control of the Company or Kayne Anderson, its affiliates or other service providers.

20

Diversity in Nominees for Director

The Nominating Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, the Nominating Committee considers and discusses director diversity, among other factors, with a view toward the needs of our Board of Directors as a whole. The Nominating Committee generally conceptualizes diversity expansively to include concepts such as race, gender, national origin, differences of viewpoint, professional experience, education, skill, and other qualities that contribute to our Board of Directors, when identifying and recommending director nominees. The Nominating Committee believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Nominating Committee’s goal of creating a Board of Directors that best serves our needs and the interests of our stockholders.

Communications Between Stockholders and the Board of Directors

Stockholders of the Company may send communications to the Board of Directors. Communications should be addressed to the Secretary of the Company at 811 Main Street, 14th Floor, Houston, TX 77002. The Secretary will forward any communications received directly to the Board.

The Company expects that the 2022 annual meeting of stockholders will be held in June 2022. A Stockholder who intends to present a proposal at that annual meeting, including nomination of a director, must submit the proposal in writing to the Secretary of the Company at the Company, c/o Kayne Anderson BDC, Inc., 811 Main Street, 14th Floor, Houston, TX 77002. Notices of intention to present proposals, including nomination of a director, at the 2022 annual meeting must be received by the Company no later than 120 days, and no earlier than 90 days, prior to the anniversary of the previous year’s annual meeting. Accordingly, in order for a proposal to be considered for inclusion in the Company’s proxy statement for the 2022 annual meeting, the Company must receive the proposal no later than March 19, 2022, and no earlier than February 17, 2022. The submission of a proposal does not guarantee its inclusion in the Company’s proxy statement or presentation at the meeting unless certain securities law requirements are met. The Company reserves the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

Code of Ethics and Policies Regarding Transactions with Related Parties

The Company, the Adviser and the Company’s respective, officers, directors, employees, agents, and affiliates may be subject to certain potential conflicts of interest in connection with the Company’s activities and investments. For example, the terms of the Advisor’s management and incentive fees may create an incentive for the Advisor to approve and cause the Company to make more speculative investments than it would otherwise make in the absence of such fee structure. In addition, the Advisor’s other funds and separate accounts may take positions in securities and/or issuers that are in a different part of the capital structure of an issuer or adverse to the Company.

The members of the senior management and investment teams and the investment committee of the Advisor serve or may serve as officers, directors or principals of entities that operate in the same or a related line of business as the Company, or of investment funds managed by the Advisor or its affiliates. In serving in these multiple capacities, they may have obligations to other clients or investors in those entities, the fulfillment of which may not be in the Company’s best interests or in the best interest of Company stockholders.

The Company’s investment objective may overlap with the investment objectives of such investment funds, accounts, or other investment vehicles. For example, the Advisor concurrently manages accounts that are pursuing an investment strategy similar to the Company’s strategy, and the Company may compete with these and other entities managed by affiliates of the Advisor for capital and investment opportunities. As a result, those individuals at the Advisor may face conflicts in the allocation of investment opportunities between the Company and other investment funds or accounts advised by principals of, or affiliated with, the Advisor. The Advisor has agreed with the Board that, when the Company is able to co-invest with other investment funds or accounts managed by the Advisor, allocations among the Company and other investment funds or accounts will generally be made consistent with the 1940 Act. The Company and Kayne Anderson have received an exemptive order from the SEC that permits the Company to co-invest with affiliates of the Advisor, including private funds managed by the Adviser, if the Board determines that

21

it would be advantageous for the Company to co-invest with other funds managed by the Advisor or its affiliates in a manner consistent with the Company’s investment objective, positions, policies, strategies and restrictions, as well as regulatory requirements and other pertinent factors.

The Company has adopted a code of ethics, as required by federal securities laws, which applies to, among others, its directors and officers. Copies of the code of ethics of the Company may be obtained from the Company free of charge by calling (877) 657-3863, or visiting the Company’s website at www.kaynebdc.com.

The Company has adopted policies with respect to affiliated and related party transactions to the extent required by the 1940 Act and related regulatory guidance.

ANNUAL AND QUARTERLY REPORTS

Copies of the Company’s Annual Report dated December 31, 2020, and Current Reports on Form 8-K are available upon request, without charge, by writing Kayne Anderson BDC, Inc., 811 Main Street, 14th Floor, Houston, TX 77002. Copies of such reports are also posted and are available without charge on the SEC’s website at www.sec.gov.

EXPENSES OF PROXY SOLICITATION

The cost of preparing, mailing, and assembling material in connection with this solicitation of proxies will be borne by the Company. In addition to the use of the mail, proxies may be solicited personally by officers of the Company or by regular employees of the Advisor. Brokerage houses, banks and other fiduciaries will be requested to forward proxy solicitation material to their principals to obtain authorization for the execution of proxies, and they will be reimbursed by the Company for out-of-pocket expenses incurred in connection therewith.

The Company’s Board knows of no other matters that are intended to be brought before the meeting. If other matters are properly presented at the Annual Meeting, the proxies named in the enclosed form of proxy will vote on those matters in their sole discretion.

22