This is a confidential draft submission to the U.S. Securities and Exchange Commission pursuant to Section 106(a) of the Jumpstart

Our Business Startups Act of 2012 on August 28, 2017 and is not being filed publicly under the Securities Act of 1933, as amended.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FIT BOXX HOLDINGS LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | 5940 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employee Identification number) |

13/F, Le Diamant

703 Nathan Road

Mongkok, Kowloon

Hong Kong

Tel: +852.2944.6856

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

10 E. 40th Street, 10th Floor

New York, NY 10016

Tel: +1.800.221.0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Lawrence S. Venick, Esq. Loeb & Loeb LLP 21st Floor, CCB Tower 3 Connaught Road Central Hong Kong SAR Tel: +852.3923.1111 Fax: +852.3923.1100 | Ralph De Martino, Esq. Cavas Pavri, Esq. Schiff Hardin LLP 901 K Street NW Suite 700 Washington, DC 20001 Tel: +1.202.778.6400 Fax: +1.202.778.6460 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Calculation of Registration Fee

| Title of Class of Securities to be Registered | Amount to Be Registered(1) | Proposed Maximum Offering Price per Share(3) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Ordinary shares, par value HK$0.01 per share | $ | $ | $ | |||||||||||||

| Underwriter Warrants(2) | - | - | - | |||||||||||||

| Ordinary shares underlying Underwriter Warrants(2) | $ | $ | ||||||||||||||

| Total | $ | $ | $ | |||||||||||||

| (1) | In accordance with Rule 416(a), the Registrant is also registering an indeterminate number of additional ordinary shares that shall be issuable pursuant to Rule 416 to prevent dilution resulting from share splits, share dividends or similar transactions. Includes up to ordinary shares, subject to the underwriter’s over-subscription option. |

| (2) | We have agreed to issue, on the closing date of this offering, warrants to our underwriter, WestPark Capital, Inc. (the “Underwriter”), in an amount equal to 7% of the aggregate number of ordinary shares sold by the Registrant (the “Underwriter Warrants”). The exercise price of the Underwriter Warrants is equal to 120% of the price of the ordinary shares offered hereby. |

| (3) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(a) under the Securities Act of 1933. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS (Subject to Completion) | Dated |

FIT BOXX HOLDINGS LIMITED

This is the initial public offering of our ordinary shares. It is currently estimated that the initial public offering price per ordinary share will be between US$ and US$ . Currently, no public market exists for our ordinary shares. We will apply to have our ordinary shares listed on the NASDAQ Capital Market (“NASDAQ”) under the symbol “FBOX”. There is no guarantee or assurance that our ordinary shares will be approved for listing on NASDAQ.

We are an “emerging growth company”, as that term is used in the Jumpstart Our Business Startups Act of 2012, and will be subject to reduced public company reporting requirements.

Investing in our ordinary shares is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 6 of this prospectus for a discussion of information that should be considered before making a decision to purchase our ordinary shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

PRICE US$ PER ORDINARY SHARE

| Price to Public | Underwriting Discounts and Commissions(1) | Proceeds to us | ||||||

| Per Ordinary Share | US$ | US$ | US$ | |||||

| Total | US$ | US$ | US$ |

(1) See “Underwriting” for additional disclosure regarding underwriting compensation payable by us.

We have granted the underwriters the right to purchase up to an additional ordinary shares to cover over-allotments.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares against payment in U.S. dollars in New York, New York on or about , 2018.

WestPark Capital, Inc.

The date of this prospectus is

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or any free-writing prospectus. We are offering to sell, and seeking offers to buy, the ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the ordinary shares.

We have not taken any action to permit a public offering of the ordinary shares outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the ordinary shares and the distribution of the prospectus outside the United States.

i

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our financial statements and related notes, and especially the risks described under “Risk Factors” beginning on page 6. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

All references to “we,” “us,” “our,” “Company,” “Registrant” or similar terms used in this prospectus refer to Fit Boxx Holdings Limited, a Cayman Islands company, unless the context otherwise indicates.

Overview

We were founded in 2009 and are principally engaged in the sourcing, marketing, selling and distribution of a variety of beauty device products and fitness and health care products, as well as other products, which are mainly for home use, under various brands through our sales and distribution network in Hong Kong and the People’s Republic of China (PRC).

Our revenue is principally derived from the sales of (i) beauty device product, (ii) fitness and health care product and (iii) other products. Our beauty device product segment mainly consists of beauty devices for hair removal, wrinkle reduction, skin lifting, anti-acne treatment, rejuvenation of the skin’s appearance and body slimming and other health accessories. Our fitness and health care product segment mainly consists of treadmills, exercise bikes, elliptical trainers, steppers and other fitness accessories, such as trampolines, yoga gears, dumbbells, boxing gears, heart rate monitors and diagnostic scales. Other products include traveler’s items, anti-pollution masks, sandals and electrical heated blankets.

We have experienced rapid growth since our inception. Our total revenues increased from US$15.8 million in 2016 to US$30.7 million in 2017. Our net income was US$1.9 million and US$3.6 million in 2016 and 2017, respectively.

Strategic Initiatives

Our mission statement is to improve the quality of people’s lifestyle at home and become one of the leading wellness solutions retailers in Asia. We focus on providing compelling value proposition by offering a unique combination of product breadth, value, mix and convenience with a distinctive specialty retail experience and environment. We are currently selling more than 500 products across the categories of beauty devices, fitness and health care products and other lifestyle products.

We have created a welcoming shopping environment desired for convenience. Our stores are predominantly located in convenient, high-traffic locations such as shopping malls and department stores. We have also developed a highly effective key opinion leader (“KOL”) based online sales strategy that we believe has translated into a unique competitive advantage contributing to our financial success.

We aim to become a go-to operator in the beauty and lifestyle industry with direct operation in China’s major online channels by developing strong partnerships with Chinese distributors in other different online and retail channels from different provinces. We plan to implement the following strategies to further develop and expand our business:

| ● | acquire and obtain rights for innovative and exclusive products from suppliers; |

| ● | deliver a distinctive and personalized customer experience across all channels; |

| ● | deliver an exceptional merchandise mix of beauty device and lifestyle products; |

| ● | promote our trading name of “CosmoBoxx” and create our own-brand products with the brand name of “CosmoBoxx”; |

| ● | diversify the format of our stores to include pop-up stores and grow e-commerce to serve more customers; | |

| ● | invest in infrastructure to support customer experience and growth, and scale efficiencies; and | |

| ● | improve on timing and effectiveness of our marketing activities. |

1

The Chinese beauty device product and lifestyle markets are continuing to expand while distribution channels continue to shift from department stores to specialty retail and online stores. According to iResearch, China’s retail e-commerce is expected to reach RMB12.7 trillion by 2022, taking over 24% of the total consumer goods retail value. We believe our competitive strengths will position us to capture additional market share in the industry. Our long term growth strategy is to increase total net sales by opening new stores, entering new markets in Asia, adding stores to existing markets, remodeling old stores, and increasing e-commerce sales. We intend to increase profitability by offering an optimal mix of products and leveraging our fixed store costs. We also intend to expand our margins by increasing our market appearance, brand recognition and image. We believe we will increase operating efficiencies through our incremental investment in people, systems and supply chain required to support our in-store shops and pop-up stores, coupled with a successful e-commerce platform.

Competitive Strengths

We believe the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | Diversified portfolio of beauty devices, fitness and health care products and other products offered by us | |

| ● | Multiple sales and distribution channels | |

| ● | Experienced and dedicated management team |

History and Corporate Structure

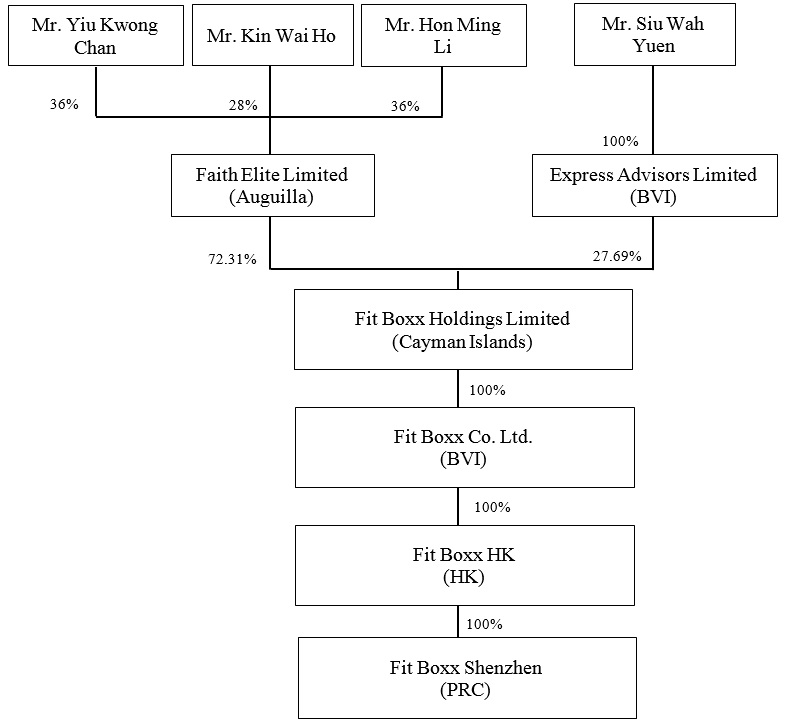

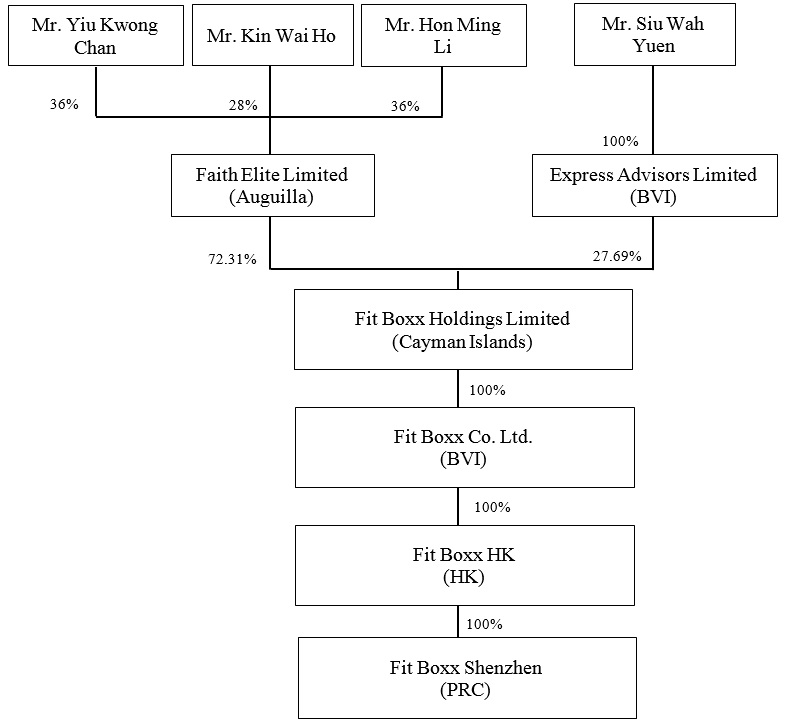

The Company was incorporated under the laws of the Cayman Islands as the offshore holding company on May 14, 2015. The Company owns 100% of the equity interest in Fit Boxx Co. Ltd., a company incorporated under the laws of the British Virgin Islands on May 20, 2015. Through Fit Boxx Co. Ltd. (“Fit Boxx BVI”), the Company indirectly own 100% of the equity interest in Fit Boxx Trading Company Limited (“Fit Boxx HK”), a company incorporated under the laws of Hong Kong on June 18, 2009. Fit Boxx HK owns 100% of the equity interest in Fit Boxx Import and Export Trading (Shenzhen) Company Limited (“Fit Boxx Shenzhen”), a company established in the PRC on October 31, 2012.

The following diagram illustrates our current corporate structure:

2

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; | |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; | |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; | |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and | |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies, that are not emerging growth companies, including, but not limited to, (1)presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus, (2)not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, investors may find investing in our Ordinary shares less attractive.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We could remain an emerging growth company for up to five years, or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Corporate Information

Our principal executive offices are located at 13/F, Le Diamant, 703 Nathan Road, Mongkok, Kowloon, Hong Kong. Our telephone number at this address is +852.2944.6856. Our registered office in the Cayman Islands is located at c/o Conyers Trust Company (Cayman) Limited, Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our agent for service of process in the United States is Cogency Global Inc., 10 E. 40th Street, 10th Floor, New York, NY 10016.

Our website is http://www.fitboxx.com. The information contained on our website or any third party websites is not a part of this prospectus.

3

The Offering

| Shares being offered: | ordinary shares (or ordinary shares if the underwriters exercise their over-allotment option in full). | |

| Initial offering price: | We currently estimate that the initial public offering price will be between US$ and US$ per share. | |

| Number of ordinary shares outstanding before the offering: | of our ordinary shares are outstanding as of the date of this prospectus. | |

| Number of ordinary shares outstanding after the offering: | ordinary shares (or ordinary shares if the underwriter exercise its over-allotment option in full, comprised of ordinary shares). | |

| Gross proceeds to us, net of underwriting discount but before expenses: | $ , assuming no exercise of the underwriter’s warrants and full exercise of the over-subscription option. | |

| Over-allotment option: | We have granted to the underwriter an option, exercisable within 60 days from the date of this prospectus, to purchase up to an aggregate of additional ordinary shares. | |

| Use of proceeds: | We plan to use the net proceeds of this offering primarily for general corporate purposes. For more information on the use of proceeds, see “Use of Proceeds” on page 19. | |

| Lock-up | We, all of our directors and officers and certain shareholders have agreed with the underwriter, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our ordinary shares or securities convertible into or exercisable or exchangeable for our ordinary shares for a period of six months after the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting” for more information. | |

| Proposed NASDAQ Symbol: | FBOX | |

| Risk factors: | Investing in our ordinary shares involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 6. |

4

Summary Consolidated Financial and Operating Data

The following summary consolidated financial statements for the years ended December 31, 2016 and 2017 are derived from our consolidated financial statements included elsewhere in this prospectus. Our consolidated financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP.

Our historical results for any period are not necessarily indicative of results to be expected for any future period. You should read the following summary financial information in conjunction with the consolidated financial statements and related notes and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

| For years ended December 31, | ||||||||

| 2017 | 2016 | |||||||

| Consolidated Statements of Operations and Comprehensive Income Data: | ||||||||

| Revenues | $ | 30,715,414 | $ | 15,807,491 | ||||

| Gross profit | 14,603,089 | 8,702,022 | ||||||

| Operating costs and expenses | (9,390,134 | ) | (6,293,720 | ) | ||||

| Income from operations | 5,212,955 | 2,408,302 | ||||||

| Net other expense | (43,973 | ) | (25,238 | ) | ||||

| Provision for income taxes | 1,540,685 | 458,325 | ||||||

| Net income | 3,628,297 | 1,924,739 | ||||||

| Other comprehensive loss: | ||||||||

| Foreign currency translation gain (loss) | 153,629 | (48,886 | ) | |||||

| Comprehensive income | 3,781,926 | 1,875,853 | ||||||

| Net income per share – basic and diluted | 181.41 | 96.24 | ||||||

| Weighted average number of shares - basic and diluted | 20,000 | 20,000 | ||||||

| As of December 31, | ||||||||

| 2017 | 2016 | |||||||

| Consolidated Balance Sheet Data: | ||||||||

| Cash and cash equivalents | $ | 3,643,141 | $ | 1,489,899 | ||||

| Total current assets | 13,419,192 | 8,386,184 | ||||||

| Total assets | 14,440,042 | 8,750,817 | ||||||

| Total current liabilities | 4,412,823 | 2,474,707 | ||||||

| Total non-current liabilities | 136,191 | 167,008 | ||||||

| Total liabilities | 4,549,014 | 2,641,715 | ||||||

| Total equity | 9,891,028 | 6,109,102 | ||||||

| Total liabilities and equity | 14,440,042 | 8,750,817 | ||||||

5

An investment in our ordinary shares involves significant risks. You should carefully consider all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our ordinary shares. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ordinary shares could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We rely on the supply of products by a few major suppliers

For each of the two years ended December 31, 2017 and December 31, 2016, our top five suppliers accounted for approximately 93% and 83% of our total purchases, respectively. We cannot assure you that we will successfully maintain our business relationship with our top five suppliers or diversify our supplier portfolio, and there is no assurance that our suppliers will continue to supply their products to us in the future at all or maintain a stable source of supply of products to us. If any of our top five suppliers cease doing business with us or reduces its business volume or any of our top five suppliers suffers a decline, there is also no assurance that we would be able to source similar products from alternative channels at all, or at commercially reasonable prices, or in a timely manner or at favorable terms, our business and financial results would be adversely affected.

The success of our business depends, to a large extent, on our ability to secure distribution rights with certain major brand owners

Currently, we have entered into distribution agreements with 6 brand owners, which accounted for approximately 94% and 83% of our purchases for the two years ended December 31, 2017 and December 31, 2016, respectively. Pursuant to the agreements, they have granted distribution rights to us for distribution of certain beauty devices and fitness and health care products in Hong Kong, the PRC and/or Macau. If we cannot fulfil our obligations under the distribution agreements, the brand owners are entitled to revoke the distribution rights or terminate the distribution agreements with us.

Furthermore, the duration of each of these distribution agreements with brand owners is generally from one to three years. We cannot assure that such distribution agreements can be renewed, or can be renewed on commercially reasonable terms in the future. If we fail to renew the distribution agreements with the major brand owners, our business and financial results would be materially and adversely affected.

If we are unable to rely on the services and connections of our key personnel, or retain the current key personnel, our business could be adversely affected

Our growth has been heavily dependent on the services provided by our management team, in particular our founders, Mr. Yiu Kwong Chan and Mr. Hon Ming Li. They manage our business operation, develop and execute our business strategies and manage the relationship with our key product suppliers and corporate customers. Therefore, our future success relies on our ability to retain the services of these key management personnel. If any of these key personnel are unable or unwilling to continue to provide services to us in his or her original position, and we are unable to find suitable replacements, we may not be able to continue our operations effectively and efficiently, and our business and financial conditions could be adversely affected.

We are exposed to risks of obsolete and slow-moving inventory which may adversely impact our cash flow and liquidity

The total amount of our inventories were approximately $6.5 million and $3.2 million as of December 31, 2017 and 2016, and accounted for approximately 45% and 36% of our total assets, respectively. The demand for our beauty device products and fitness and health care products is highly dependent on customers’ preferences, which are beyond our control. Any increase in inventory may adversely affect our working capital. If we cannot manage our inventory level efficiently in the future, our liquidity and cash flow may be adversely affected. Further, if we fail to source appropriate products to suit consumer preferences in the future, the volume of obsolete and slow-moving inventory may increase and we may need to either sell off such inventory at a lower price or write off such inventory, in the event of which our financial position and results of operations may be materially and adversely affected.

6

We have not entered into long-term agreements with the customers and there is no assurance that our current relationship with any customer can be continued in the future

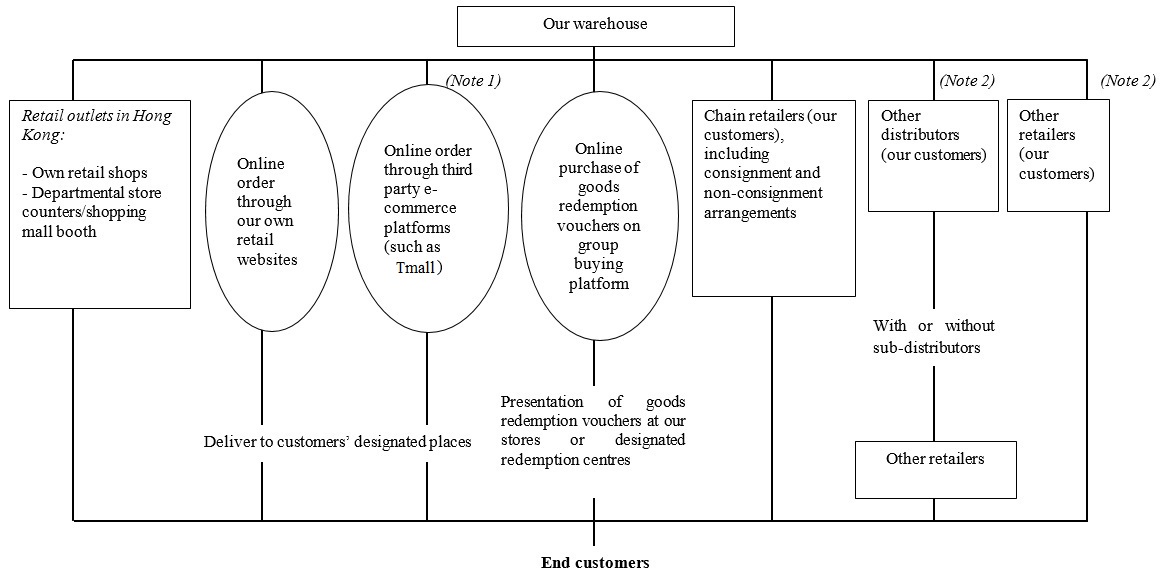

During the two years ended December 31, 2017 and December 31, 2016, approximately 30%, and 48% respectively of our sales were direct sales to general public consumers. They generally place a single purchase order with us for each purchase. The remainder of our sales of 70% and 52% are sales to our corporate customers, such as chain retailers and other distributors and retailers. None of them have entered into any long-term purchase agreements with us. The volume of the customers’ purchase orders and the product mix may vary significantly subject to trends and needs, and we may be difficult to forecast the number of future orders. As a result, our business, results of operations and financial condition may vary from period to period, depending on the volume of purchase orders from the customers, whether existing or new. Moreover, as there is no long-term agreement with us, there is no assurance that our relationship with any customer will continue on the same or similar terms, and the customers are free to terminate their respective relationship with us at any time in the future.

Our business and sales are subject to the business strategies of the brand owners

For the two years ended December 31, 2017 and December 31, 2016, approximately 97% and 97% of our revenue were attributed to sales of branded products sourced from brand owners around the world. Our business and sales are heavily dependent on the market receptiveness of, and demand for, the products being provided by various brand owners. The overall business strategies and product development plans adopted by these brand owners and their ability to maintain and develop the brands are therefore essential to our business.

As we have limited or no influence on the decisions made by the brand owners in relation to their business strategies, in particular, the production of their existing products and development of new products, we cannot assure that the brand owners will be able to maintain and further develop their brands and/or products, or that our customers will continue to show preferences to their brands and/or products. If the strategies of the brand owners turn out to be unsuccessful or due to any other reasons the marketability of the brands falls substantially, the profitability of the our business would be materially and adversely affected.

We cannot assure that our products can meet consumer preferences and needs, and will continue to gain market acceptance and secure market share

We sell and distribute a variety of beauty device products and fitness and health care products to the general public through our distribution network, which includes chain retailers, third party e-commerce platforms, online group buying platforms, other distributors and retailers and our own retail outlets and websites. The general acceptance by consumers of the brands and products marketed by us is of vital importance to our success and it hinges on a number of factors such as brand image, product quality and customer loyalty. Our success also depends, to a large extent, on our ability to offer a diversified portfolio of products that can meet the changing consumer preferences and needs. There is no assurance that the existing products distributed and sold by us will be able to satisfy changes in consumer preferences and needs.

We may also fail to anticipate, identify or respond to the constant changes in relation to consumer preferences and needs on a timely basis, nor can we assure that we will be able to gain or increase market receptiveness and market share for our products.

Consumer preferences and needs for products and brands can change from time to time for various reasons, including negative publicity regarding our products, emergence of competitive products and brands, or a general decrease in demand for the beauty device products and fitness and health care products distributed and sold us. Any of these events could adversely affect our competitive advantage and market share, which in turn could materially and adversely affect our business, financial condition and results of operation.

7

We may not be able to renew our existing leases for our retail outlets when they expire, or if they are terminated, on terms acceptable to us

We enter into leases in order to obtain retail space for our retail outlets. Generally, the terms of our leases of retail outlets are for a period of six months to three years. We typically negotiate with the landlords three to six months prior to the expiration of the leases for their renewal. We cannot assure that we will be able to renew any of our leases on favorable or otherwise acceptable terms and conditions, in particular, those regarding rental amount. If existing leases cannot be renewed, we will have to find alternative premises that may not be located in areas that offer similar business environments and competitive advantage or similar pricing. In addition, failure to renew such leases will provide an opportunity for competitors to move into such retail spaces previously identified and occupied by us as strategically favorable point of sale. Accordingly, failure to secure such retail spaces on terms that are acceptable to us may materially and adversely affect our business, financial condition and results of operations.

Our marketing activities are essential to maintain and enhance the brand images of our products and the success of our business

Our success depends considerably on our ability to develop, maintain and enhance the brand image of both the branded products sold by us and our own-brand products. The ability to maintain and enhance our brand recognition and reputation depends primarily on the success of our marketing and promotional efforts. We have put substantial resources into promoting the products by various media advertisements and sponsorships of events in order to enhance the brand recognition of our products. However, there is no assurance that our marketing and promotional efforts will achieve the expected results. If we fail to successfully market and promote the carried brands, the brand recognition of the products distributed and sold by us may be adversely affected and there may be a possible decline in demand.

Further, our advertising activities are subject to the relevant laws and regulations of the jurisdictions where we operate. For instance, the Trade Description Ordinance (Cap. 362, Laws of Hong Kong) provides that no person shall publish any advertisements that contain misleading information and/or a false trade description of the goods. If our marketing materials or advertisements contain anything contrary to the relevant laws and regulations, we would be liable for breach of the relevant laws and regulations. Our reputation would also be adversely affected.

We conduct our business in the PRC through e-commerce platforms. Risks associated with e-commerce platforms may adversely affect our business and reputation

We sell our beauty device products to the PRC market significantly via a third party e-commerce platform, namely, Tmall. We cannot assure that technical error, system failure, computer virus, loss of data or other electronic related system failures would not occur when a transaction is made via the trading platform. As it is normally a term of use that these e-commerce platforms will not be liable for any losses or damages caused by technical error, system failure, computer virus or such, we may have to bear the loss of any business due to the interruption to the transaction.

Furthermore, if any e-commerce platform is found or perceived to be associated with selling of counterfeit products, our brand image and reputation may be tarnished and our business may be adversely affected accordingly.

8

Restrictions on the remittance of Renminbi into and out of China and governmental control of currency conversion may limit our ability to utilize our net revenues effectively and affect the value of your investment.

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. We receive a substantial part of our revenues in Renminbi. Under our current corporate structure, our Cayman Islands holding company relies on dividend payments from our PRC subsidiary to fund cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements, including provision of relevant documentary evidence of such transactions and conducting such transactions at designated foreign exchange banks within the PRC that have the licenses to carry out foreign exchange business. However, approval from or registration or filing with appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. As a result, we need to obtain SAFE approval to use cash generated from the operations of our PRC subsidiary to pay off debt in a currency other than Renminbi owed to entities outside China, or to make other capital expenditure payments outside China in a currency other than Renminbi. The PRC government may at its discretion restrict access to foreign currencies for current account transactions or capital account transactions in the future. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders. Further, there is no assurance that new regulations will not be promulgated in the future that would have the effect of further restricting the remittance of Renminbi into or out of China.

We rely on external manufacturers for production of our own-brand products

We do not have any production facilities or production lines of our own. Our major own-brand products are fitness and health care products sourced from independent external manufacturers in the PRC. For the two years ended December 31, 2017 and December 31, 2016, sales of own-brand products both accounted for approximately 3% of our revenue, respectively. Thus, our control over these external manufacturers in respect of their production process and quality of products is limited. The Company cannot assure that (i) there will not be any unexpected interruption of supply of products by these external manufacturers due to any reason beyond our control or expectation, such as introduction of new regulatory requirements, import restrictions, revocation of business licenses, power interruptions, fires or other force majeure; or (ii) the products provided to us by these external manufacturers can meet our quality requirements. Any such problems in relation to the supply of our own-brand products by external manufacturers could have a material adverse impact on our business.

We are exposed to credit risks of our corporate customers. If any of our major corporate customer experiences any financial difficulty, our business with such corporate customers and the settlement process of their outstanding amounts owing to us may be adversely affected which may in turn adversely affect our liquidity, results of operations and profitability

Aside from the business generated from the general public consumers, we also rely on the business generated from our corporate customers. We normally grant corporate customers a credit period of 30 to 60 days. We do not have access to all information of our corporate customers to determine their creditworthiness. The complete financial and operational conditions of the corporate customers are not always available to us, and we may not be in any position to obtain such information. As a result, if any of our major corporate customers experience any financial difficulty, our business with such corporate customers and the settlement process of their outstanding amounts owing to us may be adversely affected, which may in turn adversely affect our liquidity, the results of operations and profitability.

Our products may cause unexpected or undesirable side effects unknown to us that may result in costly product returns or recalls, or even legal actions against us

Our own-brand products are assembled with various mechanical parts and are produced by external manufacturers, who may have inconsistencies in relation to the product quality. Although we believe that there are measures in place to control the quality of the finished products, we cannot assure that we will be able to detect defective products in every circumstance.

In relation to the branded products distributed by us, we have no control of the manufacturing process of the brand owners and can only rely on the product warranty, quality control report and/or clinical study certificates/reports provided by them.

9

However, if any side effects occur or if our products are perceived to have certain side effects, we may have to recall the products sold to the market. Substantial amount of product returns or recalls could materially and adversely affect our business, financial condition and results of operations.

In addition, we may be exposed to the risk of product liability claims, litigation, complaints or adverse publicity under the circumstance. Currently, we do not maintain any product liability insurance and the product liability insurance policies maintained by the brand owners may not be able to be extended to cover us in a legally effective way. If we face any litigation proceedings and we are held liable for any product liability claim, we will have to bear the costs, damages and other legal and related expenses arising therefrom to the extent that we may not be able to recover them from the relevant brand owner or manufacturer. As a result, our business, financial condition and results of operations may be materially and adversely affected.

Our products may be subject to counterfeiting, imitation, and/or infringement by third parties

The Company cannot assure that counterfeiting or imitation of our products will not occur in the future or, if it does occur, that we will be able to detect or address the problem effectively. Any occurrence of counterfeiting or imitation of our products could negatively affect our reputation and brand image and the products that we sell, leading to a loss of consumer confidence in us and our products, and as a consequence, adversely affect our results of operations. Any litigation to prosecute counterfeiting and infringements of our rights and products will be expensive and will divert the management’s attention as well as other resources away from our business.

Furthermore, we have acquired intellectual property rights in our own-brand products. We rely on trademark registrations to protect our intellectual property rights. However, it may be possible for third parties to use our intellectual property without authorization. Any unauthorized use or infringement of our intellectual property rights may have an adverse impact on our business. If we have to resort to litigation to enforce our intellectual property rights, significant costs may be incurred.

Conversely, there can be no assurance that our own-brand products sourced from external manufacturers will not infringe any third parties’ alleged design right. Should any infringement claim be initiated against us, we may incur significant legal expenditure to defend our rights and interests or be required to pay substantial damages. As a result, our reputation and business can be materially and adversely affected.

Our operating results may fluctuate due to seasonality and other factors

Our sales is subject to certain degree of seasonal fluctuations. Generally, demand for our beauty device products is relatively higher during spring season in March and June. We also experienced higher sales during the “Double Eleven” sales when our third party e-commerce platforms, such as Tmall, launched special promotional activities to boost online shopping. Sales may also fluctuate during the course of a financial year for a number of other reasons, including the timing of launching new products and advertising and promotional campaigns. As a result, these seasonal consumption patterns may cause our operating results to fluctuate from period to period.

We may be unable to maintain rapid growth and implement our future plans

Our future business growth primarily depends on the successful implementation of our business objectives, business strategies and future plans. These business objectives are based on our existing plans and intentions, most of which are at initial stages and have not been proceeded to the stage of actual implementation and are therefore subject to high degree of risks and uncertainties. Furthermore, we may not be able to achieve the anticipated growth and expansion of our business due to factors which are beyond our control, such as changes in economic environment, market demands, government policies and relevant laws and regulations. As such, there is no assurance that our business objectives, business strategies and future plans will be accomplished, whether in whole or in part or be implemented within the estimated timeline. In the event that our future plans are not implemented and our business objectives are not accomplished, our business, profitability and financial positions in the future may be materially and adversely affected.

Furthermore, our future business plans may be hindered by other factors beyond our control, such as competition from other retailers and distributors selling similar products. Therefore, there is no assurance that our future business plans will materialize, or result in the conclusion or execution of any agreement within the planned time frame, or that our objectives will be fully or partially accomplished.

10

The Company operates in a highly competitive industry

We face keen competition in respect of, inter alia, pricing, product quality and brand identification. Some of our competitors may have greater financial, technological and informational resources than us, which may enable them to provide products superior to our products, or to adapt more quickly than we do to evolving industry trends and consumer preferences. Conversely, some of our competitors may, out of various commercial considerations, adopt low-margin sales strategies and compete against us based on lower prices to increase their market shares. We may be forced to lower the prices and profit margins of our products or our market share would drop.

There is no assurance that we will be able to compete successfully with our competitors in the future in view of the changing market environment. Increasing competition within the industry may have an adverse impact on our sales volume, market share, profit margin and financial result.

A severe or prolonged downturn in the Chinese or global economy could materially and adversely affect our business and financial condition.

Any prolonged slowdown in the Chinese or global economy may have a negative impact on our business, results of operations and financial condition. There is uncertainty over the global economic condition such as the trade war between the United States and China. There is uncertainty in financial markets over the decision by the United Kingdom to exit the European Union. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies, including the United States and China. There have also been concerns about the economic effect of the tensions in the relationship between China and surrounding Asian countries. Adverse economic conditions could also reduce the number of customers and interests in our services and products. Should any of these situations occur, our net revenues will decline, and our business and financial conditions will be negatively impacted. Additionally, continued turbulence in the international markets may adversely affect our ability to access the capital markets to meet liquidity needs.

Our quarterly and annual results may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our quarterly and annual results of operations, including the levels of our net revenues, expenses, net (loss)/income and other key metrics, may vary significantly in the future due to a variety of factors, some of which are outside of our control, and period-to-period comparisons of our operating results may not be meaningful. Accordingly, the results for any one quarter or any one year are not necessarily an indication of future performance. Fluctuations in quarterly and/or annual results may adversely affect the price of our ordinary shares. Factors that may cause fluctuations in our quarterly and annual financial results include:

| ● | our ability to maintain relationships with existing suppliers and attract new suppliers; |

| ● | our ability to attract new customers and maintain existing customers; |

| ● | the amount and timing of operating expenses related to marketing and the maintenance and expansion of our business; and |

| ● | general economic, industry and market conditions. |

11

If we are unable to implement and maintain effective internal control over financial reporting in the future, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our Ordinary Shares may decline.

As a public company, we will be required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. In addition, in the future, we will be required to furnish a report by management on the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. We are in the process of designing, implementing, and testing the internal control over financial reporting required to comply with this obligation, which process is time consuming, costly, and complicated. In addition, our independent registered public accounting firm will be required to attest to the effectiveness of our internal control over financial reporting beginning with our annual report on Form 20-F following the date on which we are no longer an “emerging growth company,” which may be up to five full years following the date of this offering. If we identify material weaknesses in our internal control over financial reporting, if we are unable to comply with the requirements of Section 404 in a timely manner or assert that our internal control over financial reporting is effective, or if our independent registered public accounting firm is unable to express an opinion as to the effectiveness of our internal control over financial reporting when required, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our Ordinary Shares could be negatively affected, and we could become subject to investigations by the stock exchange on which our securities are listed, the Securities and Exchange Commission, or the SEC, or other regulatory authorities, which could require additional financial and management resources.

We may need additional capital, and financing may not be available on terms acceptable to us, or at all.

There is no guarantee that in the future we will generate enough profits to support our business. Although we believe that our anticipated cash flows from operating activities, together with cash on hand and additional capital contributions we expect to receive from existing investors, will be sufficient to meet our anticipated working capital requirements and capital expenditures in the ordinary course of business for the next twelve months, we cannot assure you this will be the case. We may need additional cash resources in the future if we experience changes in business conditions or other developments. We may also need additional cash resources in the future if we find and wish to pursue opportunities for investment, acquisition, capital expenditure or similar actions. If we determine that our cash requirements exceed the amount of cash and cash equivalents we have on hand at the time, we may seek to issue equity or debt securities or obtain credit facilities. The issuance and sale of additional equity would result in further dilution to our shareholders. The incurrence of indebtedness would result in increased fixed obligations and could result in operating covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

From time to time we may evaluate and potentially consummate strategic investments or acquisitions, which could require significant management attention, disrupt our business and adversely affect our financial results.

We may evaluate and consider strategic investments, combinations, acquisitions or alliances to further increase the value of our marketplace and better serve borrowers and investors. These transactions could be material to our financial condition and results of operations if consummated. If we are able to identify an appropriate business opportunity, we may not be able to successfully consummate the transaction and, even if we do consummate such a transaction, we may be unable to obtain the benefits or avoid the difficulties and risks of such transaction.

Strategic investments or acquisitions will involve risks commonly encountered in business relationships, including:

| ● | difficulties in assimilating and integrating the operations, personnel, systems, data, technologies, products and services of the acquired business; |

| ● | inability of the acquired technologies, products or businesses to achieve expected levels of revenue, profitability, productivity or other benefits; |

| ● | difficulties in retaining, training, motivating and integrating key personnel; |

12

| ● | diversion of management’s time and resources from our normal daily operations; |

| ● | difficulties in maintaining uniform standards, controls, procedures and policies within the combined organizations; |

| ● | difficulties in retaining relationships with customers, employees and suppliers of the acquired business; |

| ● | risks of entering markets in which we have limited or no prior experience; |

| ● | regulatory risks, including remaining in good standing with existing regulatory bodies or receiving any necessary pre-closing or post-closing approvals, as well as being subject to new regulators with oversight over an acquired business; |

| ● | assumption of contractual obligations that contain terms that are not beneficial to us, require us to license or waive intellectual property rights or increase our risk for liability; |

| ● | failure to successfully further develop the acquired technology; |

| ● | liability for activities of the acquired business before the acquisition, including intellectual property infringement claims, violations of laws, commercial disputes, tax liabilities and other known and unknown liabilities; |

| ● | potential disruptions to our ongoing businesses; and |

| ● | unexpected costs and unknown risks and liabilities associated with strategic investments or acquisitions. |

We may not make any investments or acquisitions, or any future investments or acquisitions may not be successful, may not benefit our business strategy, may not generate sufficient revenues to offset the associated acquisition costs or may not otherwise result in the intended benefits. In addition, we cannot assure you that any future investment in or acquisition of new businesses or technology will lead to the successful development of new or enhanced products and services or that any new or enhanced products and services, if developed, will achieve market acceptance or prove to be profitable.

Risks Related to Our Ordinary Shares and This Offering

There has been no public market for our ordinary shares prior to this offering, and if an active trading market does not develop you may not be able to resell our shares at or above the price you paid, or at all.

Prior to this public offering, there has been no public market for our ordinary shares. We intend to apply to have our ordinary shares listed on NASDAQ. If an active trading market for our ordinary shares does not develop after this offering, the market price and liquidity of our ordinary shares will be materially adversely affected. The public offering price for our ordinary shares will be determined by negotiations between us and the underwriters and may bear little or no relationship to the market price for our ordinary shares after the public offering. You may not be able to sell any ordinary shares that you purchase in the offering at or above the public offering price. Accordingly, investors should be prepared to face a complete loss of their investment.

Our ordinary shares may be thinly traded and you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

Assuming our ordinary shares begin trading on NASDAQ, our ordinary shares may be “thinly-traded”, meaning that the number of persons interested in purchasing our Ordinary shares at or near bid prices at any given time may be relatively small or non-existent. This situation may be attributable to a number of factors, including the fact that we are relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and might be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. Broad or active public trading market for our Ordinary shares may not develop or be sustained.

13

The market price for our ordinary shares may be volatile.

The market price for our ordinary shares may be volatile and subject to wide fluctuations due to factors such as:

| ● | the perception of U.S. investors and regulators of U.S. listed Chinese companies; | |

| ● | actual or anticipated fluctuations in our operating results; | |

| ● | changes in financial estimates by securities research analysts; | |

| ● | negative publicity, studies or reports; | |

| ● | our capability to stay current with the market trends in the industry; | |

| ● | changes in the economic performance or market valuations of other companies operating in our industry; | |

| ● | announcements by us or our competitors of acquisitions, strategic partnerships, joint ventures or capital commitments; | |

| ● | addition or departure of key personnel; and | |

| ● | general economic or political conditions in Hong Kong and China. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our ordinary shares.

Volatility in our ordinary shares price may subject us to securities litigation.

The market for our ordinary shares may have, when compared to seasoned issuers, significant price volatility and we expect that our share price may continue to be more volatile than that of a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could harm our business.

14

In order to raise sufficient funds to enhance operations, we may have to issue additional securities at prices which may result in substantial dilution to our shareholders.

If we raise additional funds through the sale of equity or convertible debt, our current shareholders’ percentage ownership will be reduced. In addition, these transactions may dilute the value of ordinary shares outstanding. We may have to issue securities that may have rights, preferences and privileges senior to our ordinary shares. We cannot provide assurance that we will be able to raise additional funds on terms acceptable to us, if at all. If future financing is not available or is not available on acceptable terms, we may not be able to fund our future needs, which would have a material adverse effect on our business plans, prospects, results of operations and financial condition.

We are not likely to pay cash dividends in the foreseeable future.

We currently intend to retain any future earnings for use in the operation and expansion of our business. Accordingly, we do not expect to pay any cash dividends in the foreseeable future.

You may face difficulties in protecting your interests as a shareholder, as Cayman Islands law provides substantially less protection when compared to the laws of the United States and it may be difficult for a shareholder to effect service of process or to enforce judgments obtained in the United States courts.

Our corporate affairs are governed by our memorandum and articles of association and by the Companies Law, Cap. 22 (Law 3 of 1961, as consolidated and revised) of the Cayman Islands and common law of the Cayman Islands. The rights of shareholders to take legal action against our directors and us, actions by minority shareholders and the fiduciary responsibilities of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from English common law. Decisions of the Privy Council (which is the final court of appeal for British overseas territories such as the Cayman Islands) are binding on a court in the Cayman Islands. Decisions of the English courts, and particularly the Supreme Court of the United Kingdom and the Court of Appeal are generally of persuasive authority but are not binding on the courts of the Cayman Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under Cayman Islands law are not as clearly established as they would be under statutes or judicial precedents in the United States. In particular, the Cayman Islands has a less developed body of securities laws as compared to the United States. In addition, Cayman Islands companies may not have standing to initiate a shareholder derivative action before the United States federal courts.

Currently, substantially all of our operations are conducted outside the United States, and substantially all of our assets are located outside the United States. All of our officers are nationals or residents of jurisdictions other than the United States and a substantial portion of their assets are located outside the United States. As a result, it may be difficult for a shareholder to effect service of process within the United States upon these persons, or to enforce against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States.

As a result of all of the above, our shareholders may have more difficulty in protecting their interests through actions against us or our officers, directors or major shareholders than would shareholders of a corporation incorporated in a jurisdiction in the United States.

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies.

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; | |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

15

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; | |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and | |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

We currently intend to file annual reports on Form 20-F and reports on Form 6-K as a foreign private issuer. Accordingly, our shareholders may not have access to certain information they may deem important.

We are an “emerging growth company” within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make it more difficult to compare our performance with other public companies.

We are an “emerging growth company” within the meaning of the Securities Act, as modified by the JOBS Act. Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accountant standards used.

As an “emerging growth company” under applicable law, we will be subject to lessened disclosure requirements. Such reduced disclosure may make our ordinary shares less attractive to investors.

For as long as we remain an “emerging growth company”, as defined in the JOBS Act, we will elect to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. Because of these lessened regulatory requirements, our shareholders would be left without information or rights available to shareholders of more mature companies. If some investors find our ordinary shares less attractive as a result, there may be a less active trading market for our ordinary shares and our share price may be more volatile.

If we are classified as a passive foreign investment company, United States taxpayers who own our ordinary shares may have adverse United States federal income tax consequences.

A non-U.S. corporation such as ourselves will be classified as a passive foreign investment company, which is known as a PFIC, for any taxable year if, for such year, either

| ● | At least 75% of our gross income for the year is passive income; or | |

| ● | The average percentage of our assets (determined at the end of each quarter) during the taxable year which produce passive income or which are held for the production of passive income is at least 50%. |

16

Passive income generally includes dividends, interest, rents and royalties (other than rents or royalties derived from the active conduct of a trade or business) and gains from the disposition of passive assets.

If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. taxpayer who holds our ordinary shares, the U.S. taxpayer may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements.

Depending on the amount of cash we raise in this offering, together with any other assets held for the production of passive income, it is possible that, for our 2018 taxable year or for any subsequent year, more than 50% of our assets may be assets which produce passive income. We will make this determination following the end of any particular tax year.

We will incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company.”

Upon consummation of this offering, we will incur significant legal, accounting and other expenses as a public company that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC and NASDAQ Capital Market, impose various requirements on the corporate governance practices of public companies. We are an “emerging growth company,” as defined in the JOBS Act and will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404 in the assessment of the emerging growth company’s internal control over financial reporting and permission to delay adopting new or revised accounting standards until such time as those standards apply to private companies.

Compliance with these rules and regulations increases our legal and financial compliance costs and makes some corporate activities more time-consuming and costly. After we are no longer an “emerging growth company,” or until five years following the completion of our initial public offering, whichever is earlier, we expect to incur significant expenses and devote substantial management effort toward ensuring compliance with the requirements of Section 404 and the other rules and regulations of the SEC. For example, as a public company, we have been required to increase the number of independent directors and adopt policies regarding internal controls and disclosure controls and procedures. We have incurred additional costs in obtaining director and officer liability insurance. In addition, we incur additional costs associated with our public company reporting requirements. It may also be more difficult for us to find qualified persons to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these rules and regulations, and we cannot predict or estimate with any degree of certainty the amount of additional costs we may incur or the timing of such costs.

17

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that reflect our current expectations and views of future events. The forward looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| ● | our goals and strategies; |

| ● | our future business development, financial conditions and results of operations; |

| ● | our expectations regarding demand for and market acceptance of our products and services; |

| ● | our expectations regarding our relationships with investors and borrowers; |

| ● | competition in our industry; and |

| ● | relevant government policies and regulations relating to our industry. |

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” “Regulation” and other sections in this prospectus. You should thoroughly read this prospectus and the documents that we refer to with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This prospectus contains certain data and information that we obtained from private publications. Statistical data in these publications also include projections based on a number of assumptions. Our industry may not grow at the rate projected by market data, or at all. Failure of this market to grow at the projected rate may have a material and adverse effect on our business and the market price of our ordinary shares. In addition, the rapidly changing nature of the home improvement industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our market. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we refer to in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

18