UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23568

Gabelli ETFs Trust

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

John C. Ball

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| (a) | The Report to Shareholders is attached herewith. |

Gabelli Automation ETF

Annual Report — December 31, 2023

(Y)our Portfolio Management Team

| |  | |  | |

| | Justin Bergner, CFA Portfolio Manager

BA, Yale University

MBA, University of Pennsylvania | | Hendi Susanto Portfolio Manager BS, University of Minnesota MBA, Wharton School of

Business | |

To Our Shareholders,

For the year ended December 31, 2023, the net asset value (NAV) total return of Gabelli Automation ETF (the Fund) was 18.2% compared with a total return of 26.3% for the Standard & Poor’s (S&P) S&P 500 Index. The total return based on the Fund’s Market Price was 18.1%. The Fund’s NAV per share was $24.45, while the price of the publicly traded shares closed at $24.44 on the New York Stock Exchange (NYSE) Arca. See page 4 for additional performance information.

Enclosed are the financial statements, including the schedule of investments, as of December 31, 2023.

Investment Objective and Strategy (Unaudited)

The Fund primarily seeks to provide growth of capital.

The Fund will primarily invest in U.S. exchange listed common stock and preferred stock. The Fund may also invest in foreign securities by investing in American Depositary Receipts. The Fund focuses on companies which appear underpriced relative to their Private Market Value (“PMV”). PMV is the value the Adviser believes informed investors would be willing to pay for a company. Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, plus borrowings for investment purposes, in publicly traded equity securities of automation firms (“Automation Companies”) listed on a domestic or foreign exchange, throughout the world, including the United States (the “80% Policy”).

| As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.gabelli.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call 800-422-3554 or send an email request to info@gabelli.com. |

The Fund defines Automation Companies as any company that is engaged in designing, developing, supporting, or manufacturing automation equipment, related technology, or processes, and also firms that use these technologies, equipment, and processes to automate parts of their own businesses. These firms include industrial and service automation, robotics, artificial intelligence, autonomous driving, and related equipment, technology, and services. In pursuing the investment theme, the Fund may invest in firms in any economic sector and in any geographic region.

Performance Discussion (Unaudited)

Full year Portfolio Observations-

L.B. Foster Company (2.9% of net assets as of December 31, 2023) is a leading provider of products and services for the rail industry and solutions to support critical infrastructure projects. The company’s consistent performance in 2023 allowed the financially and operationally levered stock to reduce risk significantly and lower its material discount to Private Market Value. Specifically, the increase in Earnings before Interest, Taxes, Depreciation, and Amortization (“EBITDA”) from $24mm to $30mm+, along with free cash flow generated from operations, the continuing use of a Net Operating Loss, and the sale of a small, non-profitable asset, has allowed the company to de-lever to its target of 2x. Underpinning the strength has been the strong performance of the precast concrete business, buttressed by the VanHooseCo acquisition in August 2022, which provides materials for residential and non-residential structures in the southeastern U.S. Execution in the rail, technologies, and services segment and the steel products and measurement segment have also been good.

ITT, Inc. (2.9%) is a diversified manufacturer of highly engineered critical components and customized technology solutions across three segments: Industrial Process, manufacturing fluid handling equipment; Motion Technologies, manufacturing brake pads and other technologies for auto and other transport markets; and Connect & Control Technologies, providing a broad portfolio of switches, actuators, and specialized connectors for the aerospace, defense, and industrial markets. ITT’s stock was up 22% in the fourth quarter, primarily on earnings and alongside the broader market move. The company modestly raised organic sales and margin guidance for 2023 on strength in pump projects, aerospace and defense components, and outgrowth in its friction business in the automotive and rail markets. Robust pricing was also a driver.

Allient Inc. (3.7%) designs, manufactures, and sells precision controlled motion products and solutions in transportation, medical, aerospace and defense, and industrial markets. The company delivered strong year-over-year growth of 18% in the first nine months of 2023, driven by strong demand in Industrial and Aerospace and Defense markets and sales contribution from acquisitions. The company experienced macroeconomic challenges and demand softness in Europe, including lower demand within agricultural vehicle programs due to the Ukraine War.

DISH Network Corporation (no longer held) operates pay-TV and wireless businesses. The company provides television entertainment and technology with its satellite DISH TV and streaming Sling TV services. Utilizing its spectrum portfolio and other assets, DISH serves the wireless market as a facilities-based provider of wireless services with a nationwide consumer offering and development of the first virtualized, standalone 5G broadband network in the U.S. Although the company met its FCC build-out deadlines, DISH was unable to show meaningful progress in generating revenue from its wireless network. The stock declined as the market became increasingly skeptical it could refinance its heavy debt load on attractive terms. The company closed its merger with EchoStar at year end which should extend its financial runway beyond 2024.

Top contributors to the Fund’s performance in 2023 included: L.B. Foster Co. (2.9%); ITT, Inc. (2.9%); and Rockwell Automation, Inc. (4.8%).

Some of our weaker performing stocks during the year were: Allient Inc. (3.7%); DISH Network Corp. (no longer held); and RPC Inc. (1.2%)

We appreciate your investment in Gabelli Automation ETF.

Thank you for your confidence and trust.

| The views expressed reflect the opinions of the Fund’s portfolio managers and Gabelli Funds, LLC, the Adviser, as of the date of this report and are subject to change without notice based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Comparative Results

Average Annual Returns through December 31, 2023

Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses.

| | | | | | Since Inception | |

| | | 1 Year | | | (1/3/22) (a) | |

| Gabelli Automation ETF (GAST) | | | | | | | | |

| NAV Total Return | | | 18.23 | % | | | (0.30 | )% |

| Investment Total Return (b) | | | 18.14 | | | | (0.33 | ) |

| S&P 500 Index (c) | | | 26.29 | | | | 1.38 | |

| (a) | GAST first issued shares January 3, 2022, and shares commenced trading on the NYSE Arca January 5, 2022. |

| (b) | Investment total returns are based on the closing market price on the NYSE Arca at the end of the period. |

| (c) | The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. Dividends are considered reinvested. You cannot invest directly in an index. |

In the current prospectus of the Gabelli Automation ETF dated April 28, 2023, the gross expense ratio for the Fund is 0.90%. The net expense ratio for the Fund after contractual expense waiver by Gabelli Funds, LLC (the Adviser) was 0.00%. The waiver is in effect through April 30, 2024. Investors should carefully consider the investment objec-tives, risks, charges, and expenses of the Fund before investing. The prospectus contains information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.gabelli.com/funds/etfs.

Returns represent past performance and do not guarantee future results. Investment returns and the principal value of an investment will fluctuate. When shares are sold, they may be worth more or less than their original cost. Cur-rent performance may be lower or higher than the performance data presented. Visit www.gabelli.com/funds/etfs for performance information as of the most recent month end.

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

GABELLI AUTOMATION ETF AND S&P 500 INDEX (Unaudited)

| Average Annual Total Returns* |

| | 1 Year | Since Inception** |

| Investment | 18.14% | (0.33)% |

* Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption/sale of Fund shares.

** Since Fund’s inception on 1/3/22.

Discount & Premium Information

Information regarding how often shares of the Fund traded on the New York Stock Exchange Arca at a price above, i.e., at a premium, or below, i.e., at a discount, the NAV can be found at www.gabelli.com/funds/etfs.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.gabelli.com/funds/etfs.

This ETF is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day. This ETF will not. This may create additional risks for your investment. For example:

You may have to pay more money to trade the ETF’s shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information.

The price you pay to buy ETF shares on an exchange may not match the value of the ETF’s portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared with other ETFs because it provides less information to traders.

These additional risks may be even greater in bad or uncertain market conditions.

The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF secret, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF’s performance. If other traders are able to copy or predict the ETF’s investment strategy, however, this may hurt the ETF’s performance. For additional information regarding the unique attributes and risks of the ETF, see the Active Shares prospectus/registration statement.

Gabelli Automation ETF

Disclosure of Fund Expenses (Unaudited)

| For the Six Months Period from July 1, 2023 through December 31, 2023 | Expense Table |

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All funds have operating expenses. As a shareholder of a fund, you incur two types of costs, transaction costs, which include brokerage commissions on purchases and sales of fund shares, and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the period ended December 31, 2023, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used is not the Fund’s actual return – the results do

not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which would be described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the period ended December 31, 2023.

| | | Beginning

Account Value

07/01/23 | | | Ending

Account Value

12/31/23 | | | Annualized

Expense

Ratio | | | Expenses

Paid During

Period* | |

| Gabelli Automation ETF |

| Actual Fund Return | | | | | | | | | | | | |

| | | $ | 1,000.00 | | | $ | 1,059.40 | | | 0.00% | | | $ | 0.00 | |

| Hypothetical 5% Return | | | | | | | | | | | | |

| | | $ | 1,000.00 | | | $ | 1,025.21 | | | 0.00% | | | $ | 0.00 | |

| * | Expenses are equal to the Fund’s annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184 days), then divided by 365. |

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of net assets as of December 31, 2023:

GABELLI AUTOMATION ETF

| Prepackaged Software | | | 11.0 | % |

| Aerospace and Defense | | | 7.0 | % |

| Equipment and Supplies | | | 6.3 | % |

| Metal Cans | | | 5.8 | % |

| Electronics | | | 5.2 | % |

| Energy and Utilities | | | 5.0 | % |

| Measuring & Controlling Devices, NEC | | | 4.8 | % |

| Electronic & Other Electrical Equipment | | | 4.4 | % |

| Financial Services | | | 4.2 | % |

| Consumer Services | | | 4.2 | % |

| Consumer Products | | | 3.9 | % |

| General Industrial Machinery & Equipment | | | 3.9 | % |

| Electric Lighting & Wiring Equipment | | | 3.1 | % |

| Pumps & Pumping Equipment | | | 2.9 | % |

| Diversified Industrial | | | 2.9 | % |

| Computer Programming, Data Processing, Etc. | | | 2.5 | % |

| Environmental Services | | | 2.5 | % |

| Wholesale-Durable Goods | | | 2.4 | % |

| Industrial Instruments For Measurement, Display, and Control | | | 2.0 | % |

| Computer Integrated Systems Design | | | 1.7 | % |

| Building and Construction | | | 1.5 | % |

| Computer Software and Services | | | 1.0 | % |

| Fabricated Structural Metal Products | | | 0.9 | % |

| Other Assets and Liabilities (Net) | | | 10.9 | % |

| | | | 100.0 | % |

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI (800-422-3554). The Fund’s Form N-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how each Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

Gabelli Automation ETF

Schedule of Investments — December 31, 2023

| Shares | | | | | Cost | | | Market

Value | |

| | | | | COMMON STOCKS – 89.1% | | | | | | | | |

| | | | | Aerospace and Defense – 7.0% | | | | | | | | |

| | 5,699 | | | Allient Inc. | | $ | 227,739 | | | $ | 172,167 | |

| | 2,034 | | | Mercury Systems Inc.† | | | 85,655 | | | | 74,383 | |

| | 172 | | | Northrop Grumman Corp. | | | 80,960 | | | | 80,520 | |

| | | | | | | | 394,354 | | | | 327,070 | |

| | | | | Building and Construction – 1.5% | | | | | | | | |

| | 1,183 | | | Johnson Controls International plc | | | 95,281 | | | | 68,188 | |

| | | | | | | | | | | | | |

| | | | | Computer Integrated Systems Design – 1.7% | | | | | | | | |

| | 3,828 | | | Kyndryl Holdings Inc.† | | | 71,209 | | | | 79,546 | |

| | | | | | | | | | | | | |

| | | | | Computer Programming, Data Processing, Etc. – 2.5% | | | | | |

| | 832 | | | Alphabet Inc., Cl. A† | | | 118,514 | | | | 116,222 | |

| | | | | | | | | | | | | |

| | | | | Computer Software and Services – 1.0% | | | | | | | | |

| | 2,716 | | | NCR Voyix Corp.† | | | 32,979 | | | | 45,928 | |

| | | | | | | | | | | | | |

| | | | | Consumer Products – 3.9% | | | | | | | | |

| | 1,294 | | | Spectrum Brands Holdings Inc. | | | 97,842 | | | | 103,222 | |

| | 2,067 | | | The AZEK Co. Inc.† | | | 93,878 | | | | 79,063 | |

| | | | | | | | 191,720 | | | | 182,285 | |

| | | | | Consumer Services – 4.2% | | | | | | | | |

| | 472 | | | Amazon.com Inc.† | | | 78,598 | | | | 71,716 | |

| | 6,592 | | | Resideo Technologies Inc.† | | | 172,407 | | | | 124,061 | |

| | | | | | | | 251,005 | | | | 195,777 | |

| | | | | Diversified Industrial – 2.9% | | | | | | | | |

| | 6,106 | | | L.B. Foster Co., Cl. A† | | | 60,427 | | | | 134,271 | |

| | | | | | | | | | | | | |

| | | | | Electric Lighting & Wiring Equipment – 3.1% | | | | | | | | |

| | 2,435 | | | AZZ Inc. | | | 122,875 | | | | 141,449 | |

| | | | | | | | | | | | | |

| | | | | Electronic & Other Electrical Equipment – 4.4% | | | | | | | | |

| | 2,080 | | | Emerson Electric Co. | | | 200,176 | | | | 202,446 | |

| | | | | | | | | | | | | |

| | | | | Electronics – 5.2% | | | | | | | | |

| | 1,019 | | | Itron Inc.† | | | 71,145 | | | | 76,945 | |

| | 4,177 | | | Kimball Electronics Inc.† | | | 96,178 | | | | 112,570 | |

| | 300 | | | Texas Instruments Inc. | | | 44,616 | | | | 51,138 | |

| | | | | | | | 211,939 | | | | 240,653 | |

| | | | | Energy and Utilities – 5.0% | | | | | | | | |

| | 1,181 | | | Halliburton Co. | | | 45,306 | | | | 42,693 | |

| | 873 | | | Occidental Petroleum Corp. | | | 55,113 | | | | 52,127 | |

| Shares | | | | | Cost | | | Market

Value | |

| | 3,826 | | | Oceaneering International Inc.† | | $ | 86,851 | | | $ | 81,417 | |

| | 7,744 | | | RPC Inc. | | | 68,321 | | | | 56,377 | |

| | | | | | | | 255,591 | | | | 232,614 | |

| | | | | Environmental Services – 2.5% | | | | | | | | |

| | 697 | | | Republic Services Inc. | | | 95,087 | | | | 114,942 | |

| | | | | | | | | | | | | |

| | | | | Equipment and Supplies – 6.3% | | | | | | | | |

| | 1,134 | | | AMETEK Inc. | | | 166,536 | | | | 186,985 | |

| | 1,140 | | | Tennant Co. | | | 95,260 | | | | 105,667 | |

| | | | | | | | 261,796 | | | | 292,652 | |

| | | | | Fabricated Structural Metal Products – 0.9% | | | | | | | | |

| | 1,113 | | | Proto Labs Inc.† | | | 60,317 | | | | 43,362 | |

| | | | | | | | | | | | | |

| | | | | Financial Services – 4.2% | | | | | | | | |

| | 1,064 | | | Intercontinental Exchange Inc. | | | 142,167 | | | | 136,650 | |

| | 456 | | | Nasdaq Inc. | | | 29,803 | | | | 26,512 | |

| | 1,356 | | | NCR Atleos Corp.† | | | 20,458 | | | | 32,937 | |

| | | | | | | | 192,428 | | | | 196,099 | |

| | | | | General Industrial Machinery & Equipment –3.9% | | | | | |

| | 1,787 | | | Flowserve Corp. | | | 67,440 | | | | 73,660 | |

| | 2,896 | | | Matthews International Corp., Cl. A | | | 107,135 | | | | 106,139 | |

| | | | | | | | 174,575 | | | | 179,799 | |

| | | | | Industrial Instruments For Measurement, Display, and Control – 2.0% | | | | | |

| | 1,275 | | | Fortive Corp. | | | 94,606 | | | | 93,878 | |

| | | | | | | | | | | | | |

| | | | | Measuring & Controlling Devices, NEC – 4.8% | | | | | | | | |

| | 724 | | | Rockwell Automation Inc. | | | 208,581 | | | | 224,788 | |

| | | | | | | | | | | | | |

| | | | | Metal Cans – 5.8% | | | | | | | | |

| | 883 | | | Agnico Eagle Mines Ltd. | | | 45,409 | | | | 48,432 | |

| | 4,609 | | | Barrick Gold Corp. | | | 87,211 | | | | 83,377 | |

| | 1,237 | | | Cameco Corp. | | | 45,258 | | | | 53,315 | |

| | 2,013 | | | Newmont Corp. | | | 91,471 | | | | 83,318 | |

| | | | | | | | 269,349 | | | | 268,442 | |

| | | | | Prepackaged Software – 11.0% | | | | | | | | |

| | 360 | | | Aspen Technology Inc.† | | | 64,971 | | | | 79,254 | |

| | 1,041 | | | Check Point Software Technologies Ltd.† | | | 119,927 | | | | 159,054 | |

| | 6,372 | | | N-able Inc.† | | | 70,152 | | | | 84,429 | |

| | 812 | | | Oracle Corp. | | | 71,038 | | | | 85,609 | |

See accompanying notes to financial statements.

Gabelli Automation ETF

Schedule of Investments (Continued) — December 31, 2023

| Shares | | | | | Cost | | | Market

Value | |

| | | | | COMMON STOCKS (Continued) | | | | | | | | |

| | | | | Prepackaged Software (Continued) | | | | | | | | |

| | 588 | | | PTC Inc.† | | $ | 71,930 | | | $ | 102,877 | |

| | | | | | | | 398,018 | | | | 511,223 | |

| | | | | Pumps & Pumping Equipment – 2.9% | | | | | | | | |

| | 1,139 | | | ITT Inc. | | | 118,830 | | | | 135,905 | |

| | | | | | | | | | | | | |

| | | | | Wholesale-Durable Goods – 2.4% | | | | | | | | |

| | 136 | | | WW Grainger Inc. | | | 70,883 | | | | 112,702 | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 89.1% | | $ | 3,950,540 | | | | 4,140,241 | |

| | | | | | | | | | | | | |

| | | | | Other Assets and Liabilities (Net) — 10.9% | | | | | | | 505,481 | |

| | | | | | | | | | | | | |

| | | | | NET ASSETS — 100.0% | | | | | | $ | 4,645,722 | |

| † | Non-income producing security. |

See accompanying notes to financial statements.

Gabelli Automation ETF

Statement of Assets and Liabilities

December 31, 2023

| Assets: | | | | |

| Investments at value (cost $3,950,540) | | $ | 4,140,241 | |

| Cash | | | 543,195 | |

| Dividends receivable | | | 1,325 | |

| Total Assets | | | 4,684,761 | |

| Liabilities: | | | | |

| Distributions payable | | | 39,039 | |

| Total Liabilities | | | 39,039 | |

| Net Assets | | $ | 4,645,722 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 4,805,607 | |

| Total accumulated loss | | | (159,885 | ) |

| Net Assets | | $ | 4,645,722 | |

| | | | | |

| Shares of Beneficial Interest issued and outstanding, no par value; unlimited number of shares authorized: | | | 190,000 | |

| Net Asset Value per share: | | $ | 24.45 | |

Statement of Operations

For the Year Ended December 31, 2023

| Investment Income: | | | | |

| Dividends (net of foreign withholding taxes of $2,460) | | $ | 38,922 | |

| Total Investment Income | | | 38,922 | |

| Expenses: | | | | |

| Investment advisory fees | | | 41,798 | |

| Total Expenses | | | 41,798 | |

| Less: | | | | |

| Expenses waived by Adviser (See Note 3) | | | (41,798 | ) |

| Net Expenses | | | — | |

| Net Investment Income | | | 38,922 | |

| | | | | |

| Net Realized and Unrealized Gain/(Loss) on Investments | | | | |

| Net realized loss on investments | | | (233,506 | ) |

| Net change in unrealized appreciation on investments | | | 953,525 | |

| Net Realized and Unrealized Gain on Investments | | | 720,019 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 758,941 | |

See accompanying notes to financial statements.

Gabelli Automation ETF

Statement of Changes in Net Assets

| | | Year Ended

December 31,

2023 | | | For the

Period Ended

December 31,

2022(a) | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 38,922 | | | $ | 34,135 | |

| Net realized loss on investments | | | (233,506 | ) | | | (101,430 | ) |

| Net change in unrealized appreciation/(depreciation) on investments | | | 953,525 | | | | (763,824 | ) |

| Net Increase/(Decrease) in Net Assets Resulting from Operations | | | 758,941 | | | | (831,119 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Accumulated earnings | | | (39,039 | ) | | | (34,045 | ) |

| Total Distributions to Shareholders | | | (39,039 | ) | | | (34,045 | ) |

| | | | | | | | | |

| Shares of Beneficial Interest Transactions: | | | | | | | | |

| Proceeds from sales of shares (See Note 6) | | | — | | | | 5,244,383 | |

| Cost of shares redeemed (See Note 6) | | | (453,399 | ) | | | — | |

| Net Increase/(Decrease) in Net Assets from Shares of Beneficial Interest Transactions | | | (453,399 | ) | | | 5,244,383 | |

| Net Increase in Net Assets | | | 266,503 | | | | 4,379,219 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 4,379,219 | | | | — | |

| End of period | | $ | 4,645,722 | | | $ | 4,379,219 | |

| | | | | | | | | |

| Changes in Shares Outstanding: | | | | | | | | |

| Shares outstanding, beginning of period | | | 210,000 | | | | — | |

| Shares sold | | | — | | | | 210,000 | |

| Shares redeemed | | | (20,000 | ) | | | — | |

| Shares outstanding, end of period | | | 190,000 | | | | 210,000 | |

| (a) | The Fund commenced investment operations on January 5, 2022. The Fund first sold shares on January 3, 2022. |

See accompanying notes to financial statements.

Gabelli Automation ETF

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the period:

| | | Year Ended

December 31,

2023 | | | Period Ended

December 31,

2022(a) | |

| Operating Performance: | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 20.85 | | | $ | 25.00 | |

| Net Investment Income(b) | | | 0.19 | | | | 0.16 | |

| Net Realized and Unrealized Gain/(Loss) on Investments | | | 3.62 | | | | (4.15 | ) |

| Total from Investment Operations | | | 3.81 | | | | (3.99 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Net Investment Income | | | (0.21 | ) | | | (0.16 | ) |

| Net Asset Value, End of Period | | $ | 24.45 | | | $ | 20.85 | |

| NAV total return† | | | 18.23 | % | | | (15.90 | )% |

| Market price, End of Period | | $ | 24.44 | | | $ | 20.86 | |

| Investment total return†† | | | 18.14 | % | | | (15.90 | )% |

| Net Assets, End of Period (in 000’s) | | $ | 4,646 | | | $ | 4,379 | |

| | | | | | | | | |

| Ratio to average net assets of: | | | | | | | | |

| Net Investment Income | | | 0.84 | % | | | 0.78 | %(c) |

| Operating Expenses Before Waiver | | | 0.90 | % | | | 0.90 | %(c) |

| Operating Expenses Net of Waiver | | | 0.00 | % | | | 0.00 | %(c) |

| Portfolio Turnover Rate | | | 13 | % | | | 28 | % |

| † | Total return represents aggregate total return of a hypothetical investment at the beginning of the period and sold at the end of the period. Total return for a period of less than one year is not annualized. Based on net asset value per share, adjusted for reinvestment of distributions at net asset value on the ex-dividend dates. |

| †† | Based on market price per share. Total return for a period of less than one year is not annualized. |

| (a) | The Fund commenced investment operations on January 5, 2022. The Fund first sold shares on January 3, 2022. |

| (b) | Per share data are calculated using the average shares outstanding method. |

| (c) | Annualized. |

See accompanying notes to financial statements.

Gabelli Automation ETF

Notes to Financial Statements

1. Organization. The Gabelli ETFs Trust (the Trust) was organized on July 26, 2018 as a Delaware statutory trust and Gabelli Automation ETF (the Fund) commenced investment operations on January 5, 2022. The Fund is a diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The Fund is an actively managed ETF, whose investment objective is to provide growth of capital.

2. Significant Accounting Policies. As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (GAAP) that may require the use of management estimates and assumptions in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation. Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S. over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board of Trustees (the Board) so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by Gabelli Funds, LLC (the Adviser).

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S. dollar value American Depositary Receipt securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| ● | Level 1 — quoted prices in active markets for identical securities; |

| ● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| ● | Level 3 — significant unobservable inputs (including the Board’s determinations as to the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of December 31, 2023 is as follows:

Gabelli Automation ETF

Notes to Financial Statements (Continued)

| | | Valuation Inputs | |

| | | Level 1 | | | Total Market Value | |

| | | Quoted Prices | | | at 12/31/23 | |

| INVESTMENTS IN SECURITIES: | | | | | | | | |

| ASSETS (Market Value): | | | | | | | | |

| Common Stocks (a) | | $ | 4,140,241 | | | $ | 4,140,241 | |

| TOTAL INVESTMENTS IN SECURITIES - ASSETS | | $ | 4,140,241 | | | $ | 4,140,241 | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

There were no Level 2 or Level 3 investments held at December 31, 2023 or December 31, 2022. The Fund’s policy is to recognize transfers among levels as of the beginning of the reporting period.

Additional Information to Evaluate Qualitative Information

General. The Fund uses recognized industry pricing services – approved by the Board and unaffiliated with the Adviser to value most of its securities, and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. Several different pricing feeds are received to value domestic equity securities, international equity securities, preferred equity securities, and fixed income securities. The data within these feeds are ultimately sourced from major stock exchanges and trading systems where these securities trade. The prices supplied by external sources are checked by obtaining quotations or actual transaction prices from market participants. If a price obtained from the pricing source is deemed unreliable, prices will be sought from another pricing service or from a broker/dealer that trades that security or similar securities.

Fair Valuation. Fair valued securities may be common and preferred equities, warrants, options, rights, and fixed income obligations. Where appropriate, Level 3 securities are those for which market quotations are not available, such as securities not traded for several days, or for which current bids are not available, or which are restricted as to transfer. When fair valuing a security, factors to consider are recent prices of comparable securities that are publicly traded, reliable prices of securities not publicly traded, and the use of valuation models, current analyst reports, valuing the income or cash flow of the issuer, or cost if the preceding factors do not apply. A significant change in the unobservable inputs could result in a lower or higher value in Level 3 securities. The circumstances of Level 3 securities are frequently monitored to determine if fair valuation measures continue to apply.

The Adviser reports quarterly to the Board the results of the application of fair valuation policies and procedures. These may include back testing the prices realized in subsequent trades of these fair valued securities to fair values previously recognized.

Foreign Taxes. The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Securities Transactions and Investment Income. Securities transactions are accounted for on the trade date with realized gain/(loss) on investments determined by using the identified cost method. Interest income (including amortization of premium and accretion of discount) is recorded on an accrual basis. Premiums and

Gabelli Automation ETF

Notes to Financial Statements (Continued)

discounts on debt securities are amortized using the effective yield to maturity method. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities that are recorded as soon after the ex-dividend date as the Fund becomes aware of such dividends.

Distributions to Shareholders. Distributions to shareholders are recorded on the ex-dividend date. Distributions to shareholders are based on income and capital gains as determined in accordance with federal income tax regulations, which may differ from income and capital gains as determined under GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by a fund and timing differences. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, adjustments are made to the appropriate capital accounts in the period when the differences arise. Permanent differences were primarily due to the reversal of redemption in-kind losses. These reclassifications have no impact on the NAV of the Fund. For the year ended December 31, 2023, reclassifications were made to increase paid-in capital by $14,623, with an offsetting adjustment to total accumulated losses.

The tax character of distributions paid during the year ended December 31, 2023 and the period ended December 31, 2022 was as follows:

| | | Year Ended | | | Period Ended | |

| | | December 31,

2023 | | | December 31,

2022 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 39,039 | | | $ | 34,045 | |

| Total distributions paid | | $ | 39,039 | | | $ | 34,045 | |

Provision for Income Taxes. The Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the Code). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of the Fund’s net investment company taxable income and net capital gains on an annual basis. Therefore, no provision for federal income taxes is required.

At December 31, 2023, the components of accumulated earnings/losses on a tax basis were as follows:

| Accumulated capital loss carryforwards | | $ | (349,586 | ) |

| Unrealized appreciation on investments | | | 189,701 | |

| Total accumulated earnings | | $ | (159,885 | ) |

At December 31, 2023, the Fund had net capital loss carryforwards for federal income tax purposes which are available to reduce future required distributions of net capital gains to shareholders. The Fund is permitted to carry capital losses forward for an unlimited period. Capital losses that are carried forward will retain their character as either short term or long term capital losses.

| Short term capital loss carryforward with no expiration | | $ | 95,386 | |

| Long term capital loss carryforward with no expiration | | | 254,200 | |

| Total Capital Loss Carryforward | | $ | 349,586 | |

Gabelli Automation ETF

Notes to Financial Statements (Continued)

The following summarizes the tax cost on investments and the net unrealized appreciation at December 31, 2023:

| | | Cost | | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation | |

| Investments | | $ | 3,950,540 | | | $ | 428,459 | | | $ | (238,758 | ) | | $ | 189,701 | |

The Fund is required to evaluate tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Income tax and related interest and penalties would be recognized by the Fund as tax expense in the Statement of Operations if the tax positions were deemed not to meet the more-likely-than-not threshold. For the year ended December 31, 2023, the Fund did not incur any income tax, interest, or penalties. The Fund’s federal and state tax returns will remain open and subject to examination for three years. On an ongoing basis, the Adviser will monitor the Fund’s tax positions to determine if adjustments to these conclusions are necessary.

3. Investment Advisory Agreement and Other Transactions. Pursuant to an Investment Advisory Agreement with the Trust, the Adviser manages the investments of the Fund’s assets. Under the Investment Advisory Agreement, the Fund will pay the Adviser a fee, computed daily and paid monthly, at the annual rate of 0.90% of the value of its average daily net assets and the Adviser is responsible for substantially all expenses of the Fund, except (i) interest and taxes; (ii) brokerage commissions and other expenses connected with the execution of portfolio transactions; (iii) distribution fees; (iv) the advisory fee payable to the Adviser; and (v) litigation expenses and any extraordinary expenses.

The Adviser has contractually agreed to waive its investment advisory fee of 0.90% on the first $25 million in net assets (the Fee Waiver). The Fee Waiver will continue until at least April 30, 2024 and shall not apply to any brokerage costs, acquired Fund fees and expenses, interest, taxes, and extraordinary expenses that the Fund may incur. This agreement may be terminated only by, or with the consent of, the Fund’s Board of Trustees.

During the year ended December 31, 2023, the Adviser waived expenses in the amount of $41,798.

4. Portfolio Securities. Purchases and sales of securities during the year ended December 31, 2023, other than short term securities and U.S. Government obligations, aggregated $1,023,897 and $479,966, respectively.

5. Capital Share Transactions. Capital shares are issued and redeemed by the Fund only in aggregations of a specified number of shares or multiples thereof (Creation Units) at NAV, in return for securities, other instruments, and/or cash (the Basket). Except when aggregated in Creation Units, shares of the Fund are not redeemable. Transactions in capital shares of the Fund are disclosed in detail in the Statement of Changes in Net Assets. Purchasers and redeemers of Creation Units are charged a transaction fee to cover the estimated cost to the Fund of processing the purchase or redemption, including costs charged to it by the NSCC (National Securities Clearing Corporation) or DTC (Depository Trust Company), and the estimated transaction costs, e.g., brokerage commissions, bid-ask spread, and market impact trading costs, incurred in converting the Basket to or from the desired portfolio composition. The transaction fee is determined daily and will be limited to amounts approved by the Board and determined by the Adviser to be appropriate to defray the expenses that the Fund incurs in connection with the purchase or redemption. The purpose of transaction fees is to protect the Fund’s existing shareholders from the dilutive costs associated with the purchase and redemption of Creation Units.

Gabelli Automation ETF

Notes to Financial Statements (Continued)

The amount of transaction fees will differ depending on the estimated trading costs for portfolio positions and Basket processing costs and other considerations. Transaction fees may include fixed amounts per creation or redemption transactions, amounts varying with the number of Creation Units purchased or redeemed, and varying amounts based on the time an order is placed. The Fund may impose higher transaction fees when cash is substituted for Basket instruments. Higher transaction fees may apply to purchases and redemptions through the DTC than through the NSCC.

6. Redemptions-in-kind. When considered to be in the best interest of all shareholders, the Fund may distribute portfolio securities as payment for redemptions of Fund shares (redemptions-in-kind). Gains and losses realized on redemptions-in-kind are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended December 31, 2023, the Fund realized net gain of $14,650 on $453,399 of redemptions-in-kind, including cash of $59,609.

7. Transactions with Affiliates and Other Arrangements. During the year ended December 31, 2023, the Fund paid $2,709 in brokerage commissions on security trades to G.research, LLC, an affiliate of the Adviser.

The Adviser pays retainer and per meeting fees to Trustees not affiliated with the Adviser, plus specified amounts to the Lead Trustee and Audit Committee Chairman. Trustees are also reimbursed for out of pocket expenses incurred in attending meetings. Trustees who are directors or employees of the Adviser or an affiliated company receive no compensation or expense reimbursement from the Trust.

8. Significant Shareholder. As of December 31, 2023, the Fund’s Adviser and its affiliates beneficially owned 96.4% of the voting securities of the Fund.

9. Indemnifications. The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

10. Subsequent Events. Management has evaluated the impact on the Fund of all subsequent events occurring through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

Gabelli Automation ETF

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Gabelli ETFs Trust and Shareholders of Gabelli Automation ETF

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Gabelli Automation ETF (one of the funds constituting Gabelli ETFs Trust, referred to hereafter as the “Fund”) as of December 31, 2023, the related statement of operations for the year ended December 31, 2023 and the statement of changes in net assets and the financial highlights for the year ended December 31, 2023 and for the period January 5, 2022 (commencement of operations) through December 31, 2022, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, the results of its operations for the year ended December 31, 2023, and the changes in its net assets and the financial highlights for the year ended December 31, 2023 and for the period January 5, 2022 (commencement of operations) through December 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

New York, New York

February 29, 2024

We have served as the auditor of one or more investment companies in the Gabelli Fund Complex since 1986.

Gabelli Automation ETF

Liquidity Risk Management Program (Unaudited)

In accordance with Rule 22e-4 under the 1940 Act, the Fund has established a liquidity risk management program (the LRM Program) to govern its approach to managing liquidity risk. The LRM Program is administered by the Liquidity Committee (the Committee), which is comprised of members of Gabelli Funds, LLC management. The Board has designated the Committee to administer the LRM Program.

The LRM Program’s principal objectives include supporting the Fund’s compliance with limits on investments in illiquid assets and mitigating the risk that the Fund will be unable to meet its redemption obligations in a timely manner. The LRM Program also includes elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the Fund’s liquidity and the monthly classification and re-classification of certain investments that reflect the Committee’s assessment of their relative liquidity under current market conditions.

At a meeting of the Board held on May 16, 2023, the Board received a written report from the Committee regarding the design and operational effectiveness of the LRM Program. The Committee determined, and reported to the Board, that the LRM Program is reasonably designed to assess and manage the Fund’s liquidity risk and has operated adequately and effectively since its implementation. The Committee reported that there were no liquidity events that impacted the Fund or its ability to timely meet redemptions without dilution to existing shareholders. The Committee noted that the Fund is primarily invested in highly liquid securities and, accordingly, continues to be exempt from the requirement to determine a “highly liquid investment minimum” as defined in the Rule 22e-4. Because of that continued qualification for the exemption, the Fund has not adopted a “highly liquid investment minimum” amount. The Committee further noted that while changes to the LRM Program were made during the Review Period and reported to the Board, no material changes were made to the LRM Program as a result of the Committee’s annual review.

There can be no assurance that the LRM Program will achieve its objectives in the future. Please refer to the Fund’s Prospectus for more information regarding its exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

Gabelli Automation ETF

Additional Fund Information (Unaudited)

The business and affairs of the Fund are managed under the direction of the Fund’s Board of Trustees. Information pertaining to the Trustees and officers of the Fund is set forth below. The Fund’s Statement of Additional Information includes additional information about the Fund’s Trustees and is available without charge, upon request, by calling 800-GABELLI (800-422-3554) or by writing to Gabelli Automation ETF at One Corporate Center, Rye, NY 10580-1422.

Name, Position(s)

Address1

and Year of Birth | | Term of Office

and Length of

Time Served2 | | Number of

Funds in

Fund Complex

Overseen by

Trustee3 | | Principal Occupation(s)

During Past Five Years | | Other Directorships

Held by Trustee4 |

| | | | | | | | | |

| INTERESTED TRUSTEES5: | | | | | | | | |

| | | | | | | | | |

Christopher J. Marangi

Trustee

1974 | | Since 2021 | | 6 | | Managing Director and Co-Chief Investment Officer of the Value team of GAMCO Investors, Inc.; Portfolio Manager for Gabelli Funds, LLC and GAMCO Asset Management Inc. | | — |

| | | | | | | | | |

Agnes Mullady

Trustee

1958 | | Since 2021 | | 14 | | Senior Vice President of GAMCO Investors, Inc. (2008 - 2019); Executive Vice President of Associated Capital Group, Inc. (November 2016 - 2019); President and Chief Operating Officer of the Fund Division of Gabelli Funds, LLC (2010 - 2019); Vice President of Gabelli Funds, LLC (2006 - 2019); Chief Executive Officer of G.distributors, LLC (2011 - 2019); and an officer of all of the Gabelli/Teton Funds (2006 - 2019) | | — |

| | | | | | | | | |

| INDEPENDENT TRUSTEES6: | | | | | | | | |

| | | | | | | | | |

John Birch

Trustee

1950 | | Since 2021 | | 10 | | Partner, The Cardinal Partners Global; Chief Operating Officer of Sentinel Asset Management and Chief Financial Officer and Chief Risk Officer of Sentinel Group Funds (2005-2015) | | — |

| | | | | | | | | |

Anthony S. Colavita7

Trustee

1961 | | Since 2021 | | 23 | | Attorney, Anthony S. Colavita, P.C., Supervisor, Town of Eastchester, NY | | — |

| | | | | | | | | |

Michael J. Ferrantino7

Trustee

1971 | | Since 2021 | | 7 | | Chief Executive Officer of InterEx Inc. | | President, CEO, and Director of LGL Group; Director of LGL Systems Acquisition Corp. (Aerospace and Defense Communications) |

Gabelli Automation ETF

Additional Fund Information (Unaudited) (Continued)

Name, Position(s)

Address1

and Year of Birth | | Term of Office

and Length of

Time Served2 | | Number of

Funds in

Fund Complex

Overseen by

Trustee3 | | Principal Occupation(s)

During Past Five Years | | Other Directorships

Held by Trustee4 |

| | | | | | | | | |

Leslie F. Foley7

Trustee

1968 | | Since 2021 | | 16 | | Attorney; Serves on the Board of the Addison Gallery of American Art at Phillips Academy Andover; Vice President, Global Ethics & Compliance and Associate General Counsel for News Corporation (2008-2010) | | — |

| | | | | | | | | |

Michael J. Melarkey

Trustee

1949 | | Since 2021 | | 24 | | Of Counsel in the law firm of McDonald Carano Wilson LLP; Partner in the law firm of Avansino, Melarkey, Knobel, Mulligan & McKenzie (1980-2015) | | Chairman of Southwest Gas Corporation (natural gas utility) |

| | | | | | | | | |

Salvatore J. Zizza7,8

Trustee

1945 | | Since 2021 | | 35 | | President, Zizza & Associates Corp. (private holding company); Chairman of Bergen Cove Realty Inc. (residential real estate) | | Director and Chairman of Trans-Lux Corporation (business services); Director and Chairman of Harbor Diversified Inc. (pharmaceuticals) (2009-2018); Retired Chairman of BAM (semiconductor and aerospace manufacturing); Director of Bion Environmental Technologies, Inc. |

Gabelli Automation ETF

Additional Fund Information (Unaudited) (Continued)

Name, Position(s)

Address1

and Year of Birth | | Term of Office

and Length of

Time Served2 | | Principal Occupation(s)

During Past Five Years |

| | | | | |

| OFFICERS: | | | | |

| | | | | |

John C. Ball

President, Treasurer,

Principal Financial &

Accounting Officer

1976 | | Since 2021 | | Senior Vice President (since 2018) and other positions (2017 - 2018) of GAMCO Investors, Inc.; Chief Executive Officer, G.distributors, LLC since 2020; Officer of registered investment companies within the Gabelli Fund Complex since 2017 |

| | | | | |

Peter Goldstein

Secretary & Vice

President

1953 | | Since 2021 | | General Counsel, GAMCO Investors, Inc. and Chief Legal Officer, Associated Capital Group, Inc. since 2021; General Counsel and Chief Compliance Officer, Buckingham Capital Management, Inc. (2012-2020); Chief Legal Officer and Chief Compliance Officer, The Buckingham Research Group, Inc. (2012-2020) |

| | | | | |

Richard J. Walz

Chief Compliance

Officer

1959 | | Since 2021 | | Chief Compliance Officer of registered investment companies within the Gabelli Fund Complex since 2013 |

| 1 | Address: One Corporate Center, Rye, NY 10580-1422, unless otherwise noted. |

| 2 | Each Trustee will hold office for an indefinite term until the earliest of (i) the next meeting of shareholders if any, called for the purpose of considering the election or re-election of such Trustee and until the election and qualification of his or her successor, if any, elected at such meeting, or (ii) the date a Trustee resigns or retires, or a Trustee is removed by the Board or shareholders, in accordance with the Company By-Laws and Declaration of Trust. For officers, includes time served in prior officer positions with the Trust. Each officer will hold office for an indefinite term or until the date he or she resigns or retires or until his or her successor is elected and qualified. |

| 3 | The “Fund Complex” or the “Gabelli Fund Complex” includes all the U.S. registered investment companies that are considered part of the same Fund complex as the Fund because they have common or affiliated investment advisers. |

| 4 | This column includes only directorships of companies required to report to the SEC under the Securities Exchange Act of 1934 (the “1934 Act”), as amended, i.e. public companies, or other investment companies registered under the 1940 Act. |

| 5 | “Interested persons” of a Fund as defined in the 1940 Act. Mr. Christopher J. Marangi and Ms. Agnes Mullady are considered to be “interested persons” because of their affiliation with the Trust’s Adviser. |

| 6 | Trustees who are not considered to be “interested persons” of a Fund as defined in the 1940 Act are considered to be Independent Trustees. |

| 7 | Mr. Colavita’s father, Anthony J. Colavita, and Ms. Foley’s father, Frank J. Fahrenkopf, Jr., serve as directors of other funds in the Gabelli Fund Complex. Mr. Ferrantino is the President, CEO and a Director of the LGL Group, Inc. and a Director of LGL Systems Acquisition Corp., Mr. Zizza is an independent director of Gabelli International Ltd., and Mr. Birch is a director of Gabelli Merger Plus+ Trust Plc, GAMCO International SICAV, Gabelli Associates Limited, and Gabelli Associates Limited IIE, all of which may be deemed to be controlled by Mario J. Gabelli and/or affiliates and in that event would be deemed to be under common control with the Fund’s Adviser. |

| 8 | Mr. Zizza is an independent director of Gabelli International Ltd., which may be deemed to be controlled by Mario J. Gabelli and/or affiliates and in that event would be deemed to be under common control with the Fund’s Adviser. On September 9, 2015, Mr. Zizza entered into a settlement with the SEC to resolve an inquiry relating to an alleged violation regarding the making of false statements or omissions to the accountants of a company concerning a related party transaction. The company in question is not an affiliate of, nor has any connection to, the Fund. Under the terms of the settlement, Mr. Zizza, without admitting or denying the SEC’s findings and allegation, paid $150,000 and agreed to cease and desist committing or causing any future violations of Rule 13b2-2 of the Securities Exchange Act of 1934, as amended. The Board has discussed this matter and has determined that it does not disqualify Mr. Zizza from serving as an independent director. |

Gabelli Automation ETF

2023 TAX NOTICE TO SHAREHOLDERS (Unaudited)

During the year December 31, 2023, the Fund paid to shareholders ordinary income distributions totaling $0.21 per share. For the year ended December 31, 2023, 83.32% of the ordinary income distribution qualifies for the dividends received deduction available to corporations. The Fund designates 88.75% of the ordinary income distribution as qualified dividend income pursuant to the Jobs and Growth Tax Relief Reconciliation Act of 2003. The Fund designates 0.00% of the ordinary income distribution as qualified interest income pursuant to the Tax Relief, Unemployment Reauthorization, and Job Creation Act of 2010.

All designations are based on financial information available as of the date of this annual report and, accordingly, are subject to change. For each item, it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

This page was intentionally left blank.

This page was intentionally left blank.

Gabelli Automation ETF

One Corporate Center

Rye, NY 10580-1422

Portfolio Management Team Biographies

Justin Bergner, CFA, is a Vice President at Gabelli & Company and a portfolio manager for Gabelli Funds LLC, the adviser. Justin rejoined Gabelli & Company in 2013 as a research analyst covering diversified industrials, Home Improvement, and Transport Companies. He began his investment carrier at Gabelli & Company in 2005 as a metals and mining analyst, and subsequently spent five years at Axiom International Investors as a senior analyst focused on industrial and healthcare stocks. Prior to business school, Mr. Bergner worked in management consulting at both Bain & Company and Dean & Company. Mr. Bergner graduated cum laude from Yale University with a BA in Economics and Mathematics and received an MBA in Finance and Accounting from the Wharton School at the University of Pennsylvania.

Hendi Susanto joined Gabelli in 2007 as the lead technology research analyst. He spent his early career in supply chain management consulting and operations in the technology industry. He currently is a portfolio manager of Gabelli Funds, LLC and a vice president of Associated Capital Group Inc. Mr. Susanto received a BS degree summa cum laude from the University of Minnesota, an MS from Massachusetts Institute of Technology, and an MBA degree from the Wharton School of Business.

| We have separated the portfolio managers’ commentary from the financial statements and investment portfolio due to corporate governance regulations stipulated by the Sarbanes-Oxley Act of 2002. We have done this to ensure that the contents of the portfolio managers’ commentary are unrestricted. Both the commentary and the financial statements, including the portfolios of investments, will be available on our website at www.gabelli.com. |

Gabelli Financial Services Opportunities ETF

Annual Report — December 31, 2023

Macrae Sykes

Portfolio Manager

BA, Hamilton College

MBA, Columbia Business School

To Our Shareholders,

For the year ended December 31, 2023, the net asset value (NAV) total return of Gabelli Financial Services Opportunities ETF (the Fund) was 38.8% compared with a total return of 12.2% for the Standard & Poor’s (S&P) 500 Financials Index. The total return based on the Fund’s Market Price was 38.9%. The Fund’s NAV per share was $32.78, while the price of the publicly traded shares closed at $32.79 on the New York Stock Exchange (NYSE) Arca. See page 4 for additional performance information.

Enclosed are the financial statements, including the schedule of investments, for the Fund’s annual report as of December 31, 2023.

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.gabelli.com/funds/etfs, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call 800-422-3554 or send an email request to info@gabelli.com. |

Investment Objective and Strategy (Unaudited)

The Fund seeks to provide capital appreciation.

Under normal market conditions, the Fund invests at least 80% of the value of its net assets, in the securities of companies principally engaged in the group of industries comprising the financial services sector. As a fundamental policy, the Fund will concentrate (invest at least 25% of the value of its net assets) in the securities of companies principally engaged in the group of industries comprising the financial services sector. The Fund may invest in the equity securities of such companies, such as common stock, or preferred stock of such companies in accordance with the foregoing 80% policy. The Fund may also invest in foreign securities by investing in American Depositary Receipts. The Fund may invest in companies without regard to market capitalization.

The Fund considers a company to be principally engaged in the group of industries comprising the financial services sector if it devotes a significant portion of its assets to, or derives a significant portion of its revenues from, providing financial services. The Fund considers a company to be principally engaged in the group of industries comprising the financial services sector if it devotes 50% of its assets to, or derives 50% of its revenues from, providing financial services. Such services include but are not limited to the following: commercial, consumer, and specialized banking and financing; asset management; publicly-traded, government sponsored financial enterprises; insurance; accountancy; mortgage REITs; brokerage; securities exchanges and electronic trading platforms; financial data, technology, and analysis; and financial transaction and other financial processing services.

Performance Discussion (Unaudited)

Last year, everyone wanted to talk like economists and offer dramatic forecasts for rates. Pick your favorite topic – “sticky inflation,” “higher for longer,” “the Fed has lost control,” or “we need a recession.” Interestingly though, after several major bank failures, 100bps of Fed hikes, and all the prognostications, the 10-Year Treasury yield finished the year almost exactly where it started.

The landscape for markets and picking stocks remains fluid, but our research process remains well entrenched. We look for great companies trading below our estimate of intrinsic value and a catalyst to narrow that discount. We follow a bottom-up, fundamental process.

Steve Squeri, CEO of American Express Co. (4.8% of net assets as of December 31, 2023), accelerated marketing and spending during the COVID-19 Pandemic when others were pulling back, and shareholders today have been rewarded with share gains and new account growth with desirable younger cohort clients. Rob Berkley, CEO of W.R. Berkley Corp. (3.9%), along with his father (and founder) has a long tenure of smart capital allocation. By optimizing capital deployment to written premium, firm investments, repurchases, and dividends, the duo generated a 23.7% annual gain for shareholders from 1974 to 2022 vs. 12.4% for the S&P 500 (Source: Page 11, 2022 W.R. Berkley Corporation Annual Report). Not bad for a boring insurance operation and an entrepreneurial mindset.

Berkshire Hathaway (6.3%) remains a top holding. In the third quarter of 2023, the firm generated over $800 million per week in operating earnings. In the fourth quarter, we estimate the firm generated over $35bn of investment gains on a securities portfolio of $318bn. Combined with $152bn of cash, the Omaha conglomerate has lots of firepower for capital allocation and a deep leadership bench that is full of inspiration to continue to drive shareholder returns. On that note, it is with deep sadness we commemorate Charlie Munger who passed away just before the end of the year.

The top contributors to the Fund’s performance in 2023 included FTAI Aviation Ltd (8.2%); First Citizens BancShares Inc. (3.8%); and Blackstone Inc. (4.8%).

The leading detractors during the year were: First Republic Bank (no longer held); Paysafe Ltd (3.5%); and Citizens Financial Group, Inc. (no longer held).

Thank you for your investment in Gabelli Financial Services Opportunities ETF.

Respectfully,

Mac

| The views expressed reflect the opinions of the Fund’s portfolio manager and Gabelli Funds, LLC, the Adviser, as of the date of this report and are subject to change without notice based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Comparative Results

Average Annual Returns through December 31, 2023

Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses.

| | | 1 Year | | | Since Inception

(5/09/22) (a) | |

| Gabelli Financial Services Opportunities ETF (GABF) | | | | | | | | |

| NAV Total Return | | | 38.83 | % | | | 22.39 | % |

| Investment Total Return (b) | | | 38.89 | | | | 22.42 | |

| S&P 500 Financials Index (c) | | | 12.15 | | | | 8.96 | |

| (a) | GABF first issued shares May 9, 2022, and shares commenced trading on the NYSE Arca May 10, 2022. |

| (b) | Investment total returns are based on the closing market price on the NYSE Arca at the end of the period. |

| (c) | The S&P 500 Financials Index comprises companies included in the S&P 500 that are classified as members of the financials sector. Dividends are considered reinvested. You cannot invest directly in an index. |

In the current prospectus of Gabelli Financial Services Opportunities ETF dated April 28, 2023, the gross expense ratio for the Fund is 0.94%. The net expense ratio for the Fund after contractual expense waiver by Gabelli Funds, LLC (the Adviser) is 0.04%. The waiver is in effect through April 30, 2024. Investors should carefully consider the investment objectives, risks, sales charges, and expenses of the Fund before investing. The prospectus contains information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.gabelli.com/funds/etfs.

Returns represent past performance and do not guarantee future results. Investment returns and the principal value of an investment will fluctuate. When shares are sold they may be worth more or less than their original cost. Cur-rent performance may be lower or higher than the performance data presented. Visit www.gabelli.com/funds/etfs for performance information as of the most recent month end.

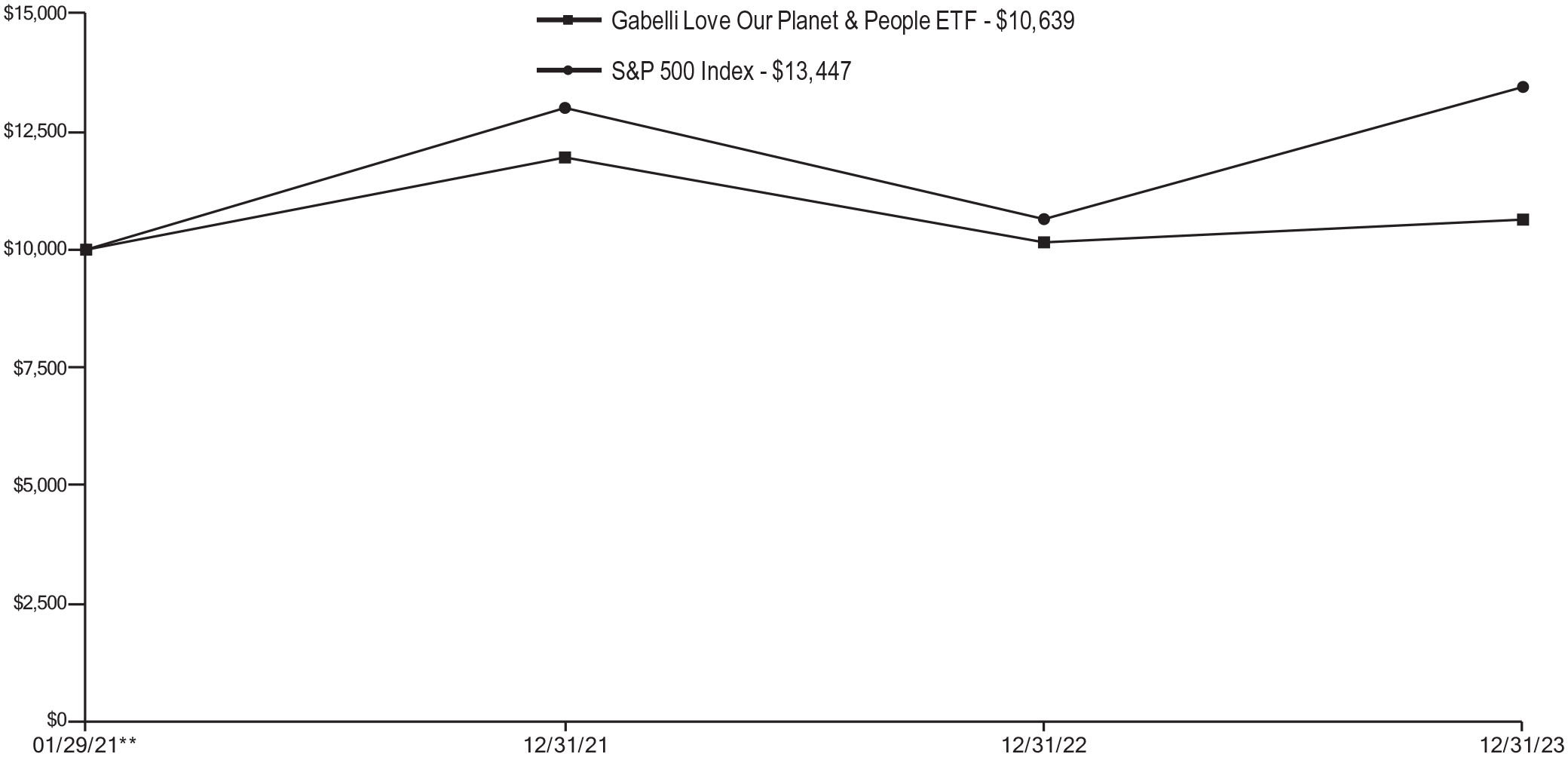

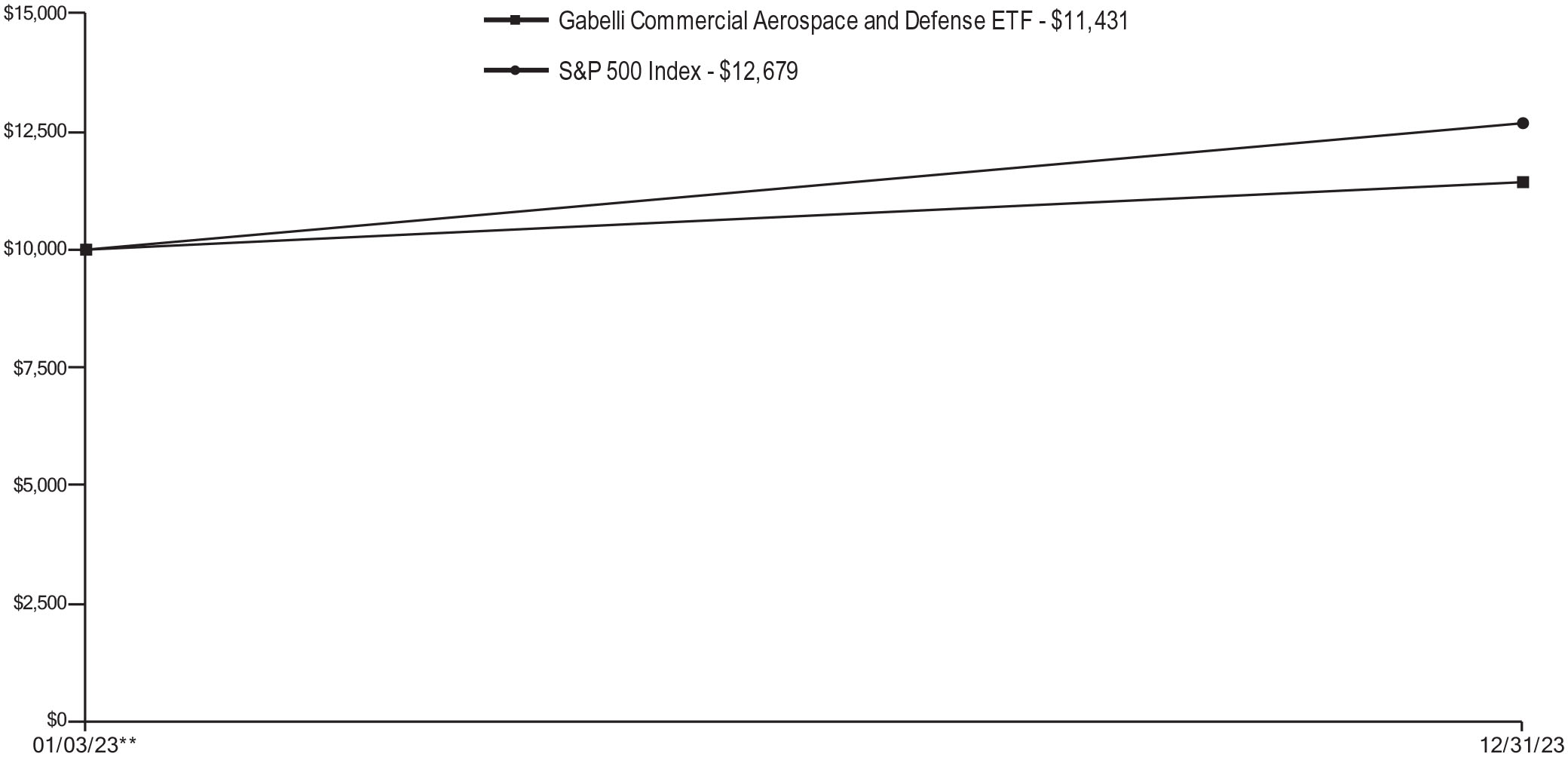

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

GABELLI FINANCIAL SERVICES OPPORTUNITIES ETF AND S&P 500 FINANCIALS INDEX (Unaudited)

| Average Annual Total Returns* |

| | 1 Year | Since Inception** |

| Investment | 38.89% | 22.42% |

* Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption/sale of Fund shares.

** Since Fund’s inception on 5/09/22.

Discount & Premium Information

Information regarding how often shares of the Fund traded on the New York Stock Exchange Arca at a price above, i.e., at a premium, or below, i.e., at a discount, the NAV can be found at www.gabelli.com/funds/etfs.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.gabelli.com/funds/etfs.

This ETF is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day. This ETF will not. This may create additional risks for your investment. For example:

You may have to pay more money to trade the ETF’s shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information.

The price you pay to buy ETF shares on an exchange may not match the value of the ETF’s portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared with other ETFs because it provides less information to traders.

These additional risks may be even greater in bad or uncertain market conditions.

The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF secret, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF’s performance. If other traders are able to copy or predict the ETF’s investment strategy, however, this may hurt the ETF’s performance. For additional information regarding the unique attributes and risks of the ETF, see the Active Shares prospectus/registration statement.

Gabelli Financial Services Opportunities ETF

Disclosure of Fund Expenses (Unaudited)

| For the Six Months Period from July 1, 2023 through December 31, 2023 | Expense Table |

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All funds have operating expenses. As a shareholder of a fund, you incur two types of costs, transaction costs, which include brokerage commissions on purchases and sales of fund shares, and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways: