- AMCR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Amcor (AMCR) DEF 14ADefinitive proxy

Filed: 29 Sep 21, 8:01am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to Section 240.14a-12 |

AMCOR PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: | |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: (2) Form. Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: | |

Dear Amcor

Shareholders

September 29, 2021

| Graeme Liebelt Chairman |

| Ron Delia CEO |

Amcor delivered an outstanding fiscal year 2021 (FY21), defined by growing momentum and record results. Our teams delivered growth and increased EBIT margins despite a highly dynamic operating environment with global supply chain disruptions, high raw material inflation and continued effects from the pandemic.

We advanced our strategic agenda across multiple key dimensions – investing for organic growth in our most attractive segments, accelerating innovation, commercializing more sustainable product platforms and integrating the Bemis acquisition. The foundations of our business are stronger than ever, which means we are uniquely positioned for future growth and continued success.

Safety first

Safety has long been a core value at Amcor. This past year we continued advancing toward our ultimate goal of an injury-free workplace: we experienced 23% fewer injuries compared to the prior year and 53% of our sites worldwide were injury-free for at least 12 consecutive months.

The health of our colleagues and their families was especially front and center due to COVID-19. Throughout the pandemic, we stayed true to three guiding principles: keeping our people safe and healthy; keeping our business running; and supporting our communities. Our sites remained operational thanks to high employee engagement and disciplined adherence to thorough protocols.

Our teams also contributed with hundreds of initiatives to donate resources, time and essential supplies to local communities around the world. We are extremely proud of and thankful for how our people live the value of safety every day.

Record results

The business achieved record results in FY21: year over year, adjusted EBIT was 8% higher and adjusted earnings per share grew by 16%, both on a comparable basis.

As the year progressed, we saw strong momentum building across our businesses through a combination of organic growth, disciplined margin management and cost control. Both our Flexibles and Rigid Packaging segments contributed to margins expanding to 12.6% despite supply chain constraints and steep raw material cost increases. Rigorous focus on elements under our control was key in delivering $1.1 billion of free cash flow while increasing capital investments to grow in higher value, faster growing segments.

We generated $75 million in synergy benefits from the Bemis acquisition and expect to exceed the original $180 million three-year target by at least 10%.

Delivering value

Our strong results translated into free cash flow of $1.1 billion and enabled more than $1 billion in cash returns to shareholders through a higher annual dividend and the repurchase of $350 million in shares – about 2% of total shares outstanding.

Amcor continues to generate value for shareholders in three ways:

| • | Organic earnings growth supported by disciplined capital expenditure. |

| • | An attractive, growing dividend paid quarterly. |

| • | Strategic acquisitions and regular share repurchases. |

Through those three factors, Amcor provided shareholders with a total return of 21% in fiscal year 2021, exceeding our long-term average range of 10%-15% per year.

Stronger foundations

With the integration of our transformational Bemis acquisition essentially complete, Amcor now enjoys a truly global footprint in flexible packaging and an even more compelling customer value proposition – especially in high value market segments.

Across both rigid and flexible packaging, we are in a stronger strategic position than we have ever been and hold leadership positions in every major geographic region. These market positions combined with our unique capabilities will unlock new growth opportunities and drive sustainable value for all stakeholders.

Continued demand from our customers and their consumers for more sustainable, responsible packaging solutions presents a substantial growth opportunity. Amcor is uniquely positioned to seize it thanks to our expanding portfolio of innovative solutions and our close partnership with some of the world’s biggest brands.

We have continued to invest in our innovation capabilities, expanding our network of research and development centers globally. We recently announced plans to construct two new innovation centers in Asia and Europe to give our customers access to best-in-class facilities wherever they are in the world.

We have also been looking outside to augment our own capabilities and open avenues for additional growth. To this end, we established a new partnership with Michigan State University’s School of Packaging – the first, largest and most prestigious school in the US dedicated to packaging – to help ensure we are fostering the future generation of talent in our industry. We also created a new corporate venturing team, who made their first investment in ePac Flexible Packaging, a leader in the high quality, short run length digital printing segment for flexible packaging.

Bright outlook

Amcor finishes the year having made considerable progress towards our ambition of being THE leading global packaging company. Our continued success confirms our strategy is sound, resilient and working.

Looking ahead, our unique combination of scale, footprint, segment participation and capabilities pave the way for further growth and value creation for shareholders. There is clear momentum building across our business and we expect another year of strong results in fiscal 2022.

We hope you can see the investment case in Amcor today is the strongest it has ever been, and we thank you for your continued support.

Very truly yours,

Notice of Annual Meeting of Shareholders

| When: November 10, 2021 |  | Items of Business: 3 Proposals are listed below.

|  | Who Can Vote: Shareholders of Amcor’s common stock and CHESS depositary interests at the close of business on September 15, 2021. |  | Attending the Meeting: See page 49 for information.

|

| Where: The Langham Hotel |  | Date of Mailing: The date of mailing of this Proxy Statement is on or about September 29, 2021. |

Items of Business

| 1. | To elect eleven Directors for a term of one year; |

| 2. | To ratify the appointment of PricewaterhouseCoopers AG as our independent registered public accounting firm for fiscal year 2022; |

| 3. | To cast a non-binding, advisory vote on the Company’s executive compensation (“Say-on-Pay Vote”); and |

| 4. | To transact such other business as may properly come before the meeting. |

Your vote is important to us. Please execute your proxy promptly.

September 29, 2021

By Order of the Board of Directors

Damien Clayton,

Secretary

83 Tower Road North

Warmley, Bristol BS30 8XP

United Kingdom

Record Date

Only shareholders of record at the close of business on September 15, 2021, will be entitled to receive notice of and to vote at the meeting. Most shareholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card or voting instruction form. Please refer to the attached proxy materials or the information forwarded to you by your bank, broker or other holder of record to see voting methods available to you.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on November 10, 2021:

The Proxy Statement, 2021 Annual Report and 2021 Form 10-K are available on our website at www.amcor.com/investors.

| How to Cast Your Vote (See page 46) | ||||

| You can vote by any of the following methods: | ||||

|  |  | ||

| By internet | By telephone | By mailing your proxy card | ||

Our proxy statement contains information about the matters that will be voted on at our Annual General Meeting of Shareholders (the “Annual Meeting”) as well as other helpful information about Amcor plc (the “Company”). Below is an executive summary that highlights certain information contained elsewhere in our proxy statement. We encourage you to read the entire proxy statement carefully before voting.

Matters to Be Voted on at the 2021 Annual Meeting

| Proposal | Board Recommendation | For More Detail, See Page: | |

| 1. | Election of Directors |  FOR each Nominee FOR each Nominee | 9 |

| 2. | Ratification of PricewaterhouseCoopers AG as our independent registered public accounting firm for fiscal year 2022 |  FOR FOR | 42 |

| 3. | Non-binding, advisory vote to approve the Company’s executive compensation |  FOR FOR | 43 |

Amcor plc is a holding company incorporated under the laws of the Bailiwick of Jersey in July 2018 in order to effect the merger (the “Bemis Transaction”) of Amcor Limited and Bemis Company, Inc. (“Bemis”), which closed on June 11, 2019. Amcor is a global leader in developing and producing responsible packaging for food, beverage, pharmaceutical, medical, home and personal-care, and other products. Amcor has the global reach, scale and technical capabilities to offer an unrivaled value proposition for customers and works with leading companies around the world to protect their products and the people who rely on them, differentiate brands, and improve supply chains.

| Fiscal 2021 was an outstanding year on multiple dimensions |

| Momentum building through the year and we expect another strong year in FY22 |

| Bemis integration complete, exceeding expectations and creating a stronger foundation for future growth |

| Investing behind organic growth drivers, including sustainability |

| AMCOR plc | 2021 Proxy Statement | 4 |

| Director | Committee Memberships | |||||||

| Name | Age | Since | Primary Occupation | Independent | A | NG | C | E |

Graeme Liebelt  | 67 | 2012 | Former Managing Director & CEO, Orica Limited |  |  |  |  | |

Armin Meyer  | 72 | 2010 | Former CEO & Chairman, Ciba Ltd. |  |  |  | ||

| Ron Delia | 50 | 2015 | CEO, Amcor plc |  | ||||

| Achal Agarwal | 62 | Nominee | Former Chief Strategy & Transformation Officer, Kimberly-Clark Corporation |  | ||||

| Andrea Bertone | 60 | 2019 | Former President, Duke Energy International LLC |  |  | |||

| Susan Carter | 62 | 2021 | Former SVP & CFO, Ingersoll-Rand Plc |  |  | |||

| Karen Guerra | 65 | 2010 | Former President & Director General, Colgate Palmolive France |  |  | |||

| Nicholas (Tom) Long | 62 | 2017 | Former CEO, MillerCoors, LLC |  |  |  |  | |

| Arun Nayar | 70 | 2019 | Former EVP & CFO, Tyco International |  |  | |||

| Jeremy Sutcliffe | 64 | 2009 | Former Chairman, CSR Limited |  |  | |||

| David Szczupak | 66 | 2019 | Former EVP, Whirlpool |  |  | |||

Chairman of the Board

Chairman of the Board  Deputy Chairman of the Board

Deputy Chairman of the Board  Committee Chair

Committee Chair

A: Audit Committee NG: Nominating & Corporate Governance Committee C: Compensation Committee E: Executive Committee

| AMCOR plc | 2021 Proxy Statement | 5 |

Corporate Governance Highlights

| All non-employee Directors are independent |

| Independent Chairman of the Board |

| Regular executive sessions of independent Directors |

| Annual election of all Directors |

| Proactive shareholder engagement program |

| Single class of shares |

| No shareholder rights plan (poison pill) |

| Shareholder right to call special meeting |

| Stock ownership requirements for Directors and Executive Officers |

| Active Board and Audit Committee oversight of risk management, including cybersecurity |

| Annual Comprehensive Board and committee evaluations |

| Ongoing Board refreshment with an emphasis on diversity |

| Mandatory Director retirement at age 75 |

Executive Compensation Highlights

Amcor’s executive compensation framework has played a key role in aligning the organization following the Bemis Transaction, in addition to incentivizing delivery of synergies, earnings growth and value creation for shareholders. The key highlights are as follows:

| • | An outstanding fiscal year 2021 result; a reduction in safety recordable cases by 23%, an increase in adjusted EPS by 16%, cash flow of $1.1 billion, and approximately $75 million of cost synergies from the Bemis Transaction (with total synergies expected to exceed original $180 million target by at least 10%). |

| • | Continuing review of the compensation structure to better reflect a company that has an increasing presence in the United States, which is also a key source of executive talent. |

| • | Variable compensation is 100% performance-based and at-risk ensuring strong alignment to shareholder value creation. |

| WHAT WE DO | |

| Variable incentives are 100% performance-based and 100% at-risk |

| To ensure alignment with shareholders, the shareholder value creation model is the basis for the performance conditions used for incentives |

| For the LTI to vest in full, it requires adjusted EPS to grow by 10% per annum, returns to be 12% or more, and upper quartile relative total shareholder return performance |

| Stock ownership requirements for Executive Officers |

| Clawback policy applicable to awards in event of fraud, dishonesty, breach of obligations and certain restatements |

| WHAT WE DON’T DO | |

| No multi-year employment agreements or excessive executive severance |

| No repricing of options without shareholder approval |

| No excise tax reimbursement for payments made in connection with a change in control |

| No hedging of equity awards |

| No payment of dividends on unearned performance-based awards |

| No evergreen provision in our 2019 Omnibus Management Share Plan |

| AMCOR plc | 2021 Proxy Statement | 6 |

Sustainability at Amcor

We are excited about the progress we made in fiscal year 2021 to accelerate momentum around responsible packaging and respond to the challenge of keeping products out of the environment at the end of their use. This progress has been achieved through the combination of advances in innovation for packaging design, collaboration for waste management infrastructure and education for greater consumer participation.

Our expertise in developing more responsible packaging, combined with our global presence, makes us the partner of choice for market-leading, sustainability-focused brands and is a key opportunity that fuels our continued growth.

One such example is our partnership with Mars Food for the application of HeatFlex – a designed to be recycled solution in the retort pouch segment that is transforming the recyclability of packaging in flexibles. Launched as a pilot early in 2021, we brought the industry’s first food-safe microwaveable rice pouch to market in a ground-breaking move that represents significant progress toward our commitment to deliver more sustainable products.

In addition to our $100 million annual R&D spend, we are investing in innovation pilots and developing talent in packaging sustainability in cooperation with Michigan State University to create continuous value for all stakeholders and to deliver innovative, more sustainable packaging solutions.

Sustainability informs every aspect of Amcor’s activities – from employment practices to sourcing and manufacturing. Through our EnviroAction program, we are continuously reducing our carbon footprint, cutting down on waste and minimizing water usage. By 2030, Amcor will reduce its greenhouse gas emissions intensity by 60% compared to the 2006 baseline.

We are pleased that, this year, Amcor was recognized for our sustainability leadership by FTSE4Good, Ethibel Excellence Investment Register, the Institutional Shareholder Services ESG program, Ecovadis and the MSCI and achieved an A- score in climate change from the Carbon Disclosure Project (CDP).

Sustainability remains our most significant long-term

organic growth opportunity

Responsible packaging is the answer

Amcor is uniquely positioned as industry leader with

Scale, Resources and Capabilities

| AMCOR plc | 2021 Proxy Statement | 7 |

| TABLE OF CONTENTS |

| AMCOR plc | 2021 Proxy Statement | 8 |

Proposal 1 Election of Directors

The Nominating and Corporate Governance Committee of our Board of Directors (the “Board”) has nominated eleven individuals to be elected at the meeting. Each Director is elected to a one-year term to serve until his or her successor has been duly elected and qualified. Each nominee has indicated a willingness to serve as a Director. If a Director does not receive a majority of the votes for his or her election, then that Director will not be elected to the Board, and the Board may fill the vacancy with a different person, or the Board may reduce the number of Directors to eliminate the vacancy.

Philip Weaver, a Director and member of the Compensation Committee, will retire from the Board at the Annual Meeting. The Board extends its appreciation to Mr. Weaver for his service and thoughtful insight and advice.

In addition to certain biographical information about each Director and nominee, listed below are the specific experiences, qualifications, attributes or skills that led to the conclusion that the person should serve as a Director on the Board.

| The Board of Directors recommends a vote “FOR” all nominees to serve as Directors. |

GRAEME LIEBELT

Age 67 Director since: 2012 Chairman Executive

INDEPENDENT | PROFESSIONAL BACKGROUND: • Managing Director and Chief Executive Officer of Orica Limited – 2005 to 2012 • Executive Director of Orica Group – 1997 to 2012 • Numerous senior positions with the ICI Australia/Orica group including Managing Director of Dulux Australia, Chairman of Incitec Ltd, Director of Incitec Pivot Ltd and Chief Executive of Orica Mining Services – 1989 to 2012

OTHER DIRECTORSHIPS: • Australia and New Zealand Banking Group Limited • Australian Foundation Investment Company Limited • DuluxGroup Ltd (previous)

KEY QUALIFICATIONS AND EXPERIENCES: In addition to the professional background noted above, Mr. Liebelt is a Fellow of the Australian Academy of Technological Sciences and Engineering and a Fellow of the Australian Institute of Company Directors. Mr. Liebelt’s past leadership experiences and expertise in global manufacturing and operations make him particularly qualified to act as Chairman of the Board for Amcor. |

DR. ARMIN MEYER

Age 72 Director since: 2010 Deputy Chairman Committees: Executive

INDEPENDENT | PROFESSIONAL BACKGROUND: • Chairman of the Board of Ciba Ltd. – 2000 to 2009 • Chief Executive Officer of Ciba Ltd. – 2001 to 2007 • Executive Vice President of ABB Ltd – 1995 to 2000

OTHER DIRECTORSHIPS: • Bracell Limited (previous) • Zurich Financial Services (previous) • International Institute for Management Development (IMD) (previous)

KEY QUALIFICATIONS AND EXPERIENCES: Dr. Meyer is a qualified electrical engineer with a Ph.D from the Swiss Federal Institute of Technology. Having served as a Chairman and CEO, Dr. Meyer’s significant experience in executive leadership and his familiarity with financial matters and global manufacturing provide valuable contributions to Amcor’s Board of Directors. |

| AMCOR plc | 2021 Proxy Statement | 9 |

RON DELIA

Age 50 Director since: 2015 Committees: Executive | PROFESSIONAL BACKGROUND: • Chief Executive Officer, Amcor – 2015 to current • Executive Vice President Finance and Chief Financial Officer, Amcor – 2011 to 2015 • Vice President and General Manager, Amcor Rigid Plastics Latin America – 2008 to 2011 • Executive Vice President Corporate Operations, Amcor – 2005 to 2008 • Associate Principal, McKinsey & Company – 2000 to 2005 • Senior Commercial Roles, American National Can Company – 1994 to 1998

KEY QUALIFICATIONS AND EXPERIENCES: Mr. Delia holds a Masters of Business Administration from Harvard Business School and a Bachelor of Science from Fairfield University. Mr. Delia has an intimate knowledge of the Company’s business, operations and customers. His experience in global commercial and operational leadership, strategy and M&A, and finance, contribute invaluable skills and capabilities to Amcor’s Board of Directors. |

| ACHAL AGARWAL | |

Age 62 Director Nominee

INDEPENDENT | PROFESSIONAL BACKGROUND: • Global Chief Strategy and Transformation Officer, Kimberly-Clark – 2020 to 2021 • President, Asia Pacific Region, Kimberly-Clark – 2012 to 2020 • President, North Asia Region, Kimberly-Clark – 2008 to 2012 • Chief Operating Officer – Beverages (Greater China), PepsiCo – 2002 to 2008 • Vice President, Beverages (China), PepsiCo – 1998 to 2002 • Market Unit General Manager – Beverages (India), PepsiCo – 1994 to 1997 • Commercial Manager, Corporate, ICI India – 1993 to 1994 • Commercial Functions in Pharmaceutical, Agrochemical, Paints and Commercial Explosives businesses, ICI India – 1981 to 1993

OTHER DIRECTORSHIPS: • World-Wide Fund Singapore • SATS Ltd • Singapore International Chamber of Commerce (previous) • Asia Venture Philanthropy Network (previous) • Singapore Business Federation (previous)

KEY QUALIFICATIONS AND EXPERIENCES: Mr. Agarwal holds a degree and a Masters of Business Administration from the University of Delhi, and an Advanced Management Program degree from The Wharton School, University of Pennsylvania. He is a global consumer executive with four decades of experience, of which 30 years have been in leadership roles in the Asia-Pacific across developed and emerging markets. He is passionate about coaching leaders to grow scalable and sustainable businesses in the midst of a changeable environment, contributing invaluable knowledge and skills to Amcor’s Board of Directors. Mr. Agarwal was originally recommended as a Director nominee by a third party search firm. |

| ANDREA BERTONE | |

Age 60 Director Since: 2019 Committees: Compensation

INDEPENDENT | PROFESSIONAL BACKGROUND: • President, Duke Energy International LLC (an electric power generation company) – 2009 to 2016 • Associate General Counsel, Duke Energy – 2003 to 2009

OTHER DIRECTORSHIPS: • DMC Global Inc. • Peabody Energy, Inc. • Yamana Gold Inc. (previous) • Duke Energy International Geração Paranapanema S.A. (previous)

KEY QUALIFICATIONS AND EXPERIENCES: Ms. Bertone is a graduate of the University of São Paulo, Brazil, where she earned a juris doctorate degree, and Chicago-Kent College of Law, where she earned a Master of Laws degree. She also completed a finance program for senior executives at Harvard Business School. Ms. Bertone’s depth of experience with multinational companies operating in global markets and her experience in executive leadership, global strategy, legal and regulatory, finance, and sales and marketing provide valuable contributions to Amcor’s Board of Directors. |

| AMCOR plc | 2021 Proxy Statement | 10 |

SUSAN CARTER

Age 62 Director since: 2021 Committees: Audit

INDEPENDENT | PROFESSIONAL BACKGROUND: • Senior Vice President and Chief Financial Officer, Ingersoll-Rand Plc – 2013 to 2020 • Executive Vice President and Chief Financial Officer, KBR, Inc. – 2009 to 2013 • Executive Vice President and Chief Financial Officer, Lennox International Inc. – 2004 to 2009 • Vice President and Corporate Controller/Chief Accounting Officer, Cummins, Inc. – 2002 to 2004

OTHER DIRECTORSHIPS: • ON Semiconductor Corporation • Air Products and Chemicals, Inc. (previous) • Lyondell Chemical Company (previous)

KEY QUALIFICATIONS AND EXPERIENCES: Ms. Carter received a Bachelor’s degree in Accounting from Indiana University and a Master’s degree in Business Administration from Northern Illinois University. Ms. Carter’s expertise in accounting and finance, and her experience as a chief financial officer of a public company, enable her to bring a thorough understanding of financial reporting, generally accepted accounting principles, financial analytics, budgeting, capital markets financing and auditing to Amcor’s Board of Directors. |

| KAREN GUERRA | |

Age 65 Director since: 2010 Committees: NG

INDEPENDENT | PROFESSIONAL BACKGROUND: • President and Directeur Générale, Colgate Palmolive France – 1999 to 2006 • Chairman and Managing Director, Colgate Palmolive UK Ltd. – 1996 to 1999

OTHER DIRECTORSHIPS: • British American Tobacco p. l. c. • Electrocomponents PLC (previous) • Davide Campari-Milano S.p.A. (previous) • Paysafe PLC (previous) • Inchcape PLC (previous) • Samlerhuset BV (previous) • Swedish Match AB (previous)

KEY QUALIFICATIONS AND EXPERIENCES: Mrs. Guerra holds a degree in Management Sciences from the University of Manchester. Mrs. Guerra’s experience in executive leadership, business turnaround and global sales and marketing provide valuable contributions to Amcor’s Board of Directors. |

| NICHOLAS (TOM) LONG | |

Age 62 Director Since: 2017 Committees: Executive Compensation NG

INDEPENDENT | PROFESSIONAL BACKGROUND: • Managing Partner, Bridger Growth Partners, LLC (a private equity fund) – 2015 to current • Chief Executive Officer, MillerCoors, LLC (a brewing company) – 2011 to 2015 • President and Chief Commercial Officer, MillerCoors, LLC – 2008 to 2011 • Chief Executive Officer, MillerBrewing Company (a brewing company) – 2006 to 2008 • Chief Marketing Officer, MillerBrewing Company – 2005 to 2006 • President Northwest Europe Division, The Coca-Cola Company – 2003 to 2005

OTHER DIRECTORSHIPS: • Wolverine World Wide, Inc.

KEY QUALIFICATIONS AND EXPERIENCES: Mr. Long holds a Masters of Business Administration from Harvard Business School and a Bachelor of Arts from the University of North Carolina. Mr. Long has significant experience in executive leadership in large, global companies, global strategy and international business operations, finance, and sales and marketing. In light of these experiences, Mr. Long provides valuable contributions to Amcor’s Board of Directors. |

| AMCOR plc | 2021 Proxy Statement | 11 |

ARUN NAYAR

Age 70 Director Since: 2019 Committees: Audit (Chair)

INDEPENDENT | PROFESSIONAL BACKGROUND: • Senior Advisor, McKinsey & Company (a global management consulting firm) – 2016 to current • Executive Vice President and Chief Financial Officer, Tyco International plc (a securities system company) – 2012 to 2016 • Senior Vice President, Treasurer and Chief Financial Officer, ADT Worldwide (Tyco) – 2008 to 2012

OTHER DIRECTORSHIPS: • Rite Aid • GFL Environmental Inc. • TFI International Inc. (previous) • Bemis Company, Inc. (previous)

KEY QUALIFICATIONS AND EXPERIENCES: Mr. Nayar’s global experience and expertise in financial reporting, financial analytics, capital market financing, mergers and acquisitions and treasury matters provide important insight into the global financial matters for Amcor’s Board of Directors. His experiences make him well suited to serve as Chair of the Audit Committee. |

| JEREMY SUTCLIFFE | |

Age 64 Director Since: 2009 Committees: NG

INDEPENDENT | PROFESSIONAL BACKGROUND: • Chairman, CSR Limited (a manufacturer and supplier of buildings products) – 2011 to 2018 • Interim Managing Director and Chief Executive Officer, CSR Limited – 2010 • Group Chief Executive Officer and Managing Director, Sims Metal Management Limited – 2002 to 2008

OTHER DIRECTORSHIPS: • Orora Limited • CSR Limited (previous)

KEY QUALIFICATIONS AND EXPERIENCES: Mr. Sutcliffe holds a Bachelor of Laws (Honours) from the University of Sheffield, U.K. and is a qualified attorney in Australia where he began his professional career in the practice of law. Mr. Sutcliffe’s experience in legal matters, executive leadership, global manufacturing and operations and sustainability provide valuable contributions to Amcor’s Board of Directors. |

| DAVID SZCZUPAK | |

Age 66 Director Since: 2019 Committees: Audit

INDEPENDENT | PROFESSIONAL BACKGROUND: • Executive Vice President Global Product Organization, Whirlpool Corporation (a major home appliance company) – 2008 to 2017 • Chief Operation Officer, Dura Automotive Systems – 2006 to 2008

OTHER DIRECTORSHIPS: • Bemis Company, Inc. (previous)

KEY QUALIFICATIONS AND EXPERIENCES: In his professional roles, Mr. Szczupak gained specific experience in product development, purchasing, manufacturing and product quality. In addition to these roles, Mr. Szczupak worked for Ford Motor Company for 22 years in a variety of leadership roles. Mr. Szczupak’s extensive background in product innovation, strategic planning, engineering, and global manufacturing give him unique and valuable insights and perspective to our global operations, research and development and innovation. |

| AMCOR plc | 2021 Proxy Statement | 12 |

Director compensation is approved by the Board of Directors. The Board of Directors considers benchmark data when determining appropriate pay. The components of Director pay include a fixed retainer plus additional fees for members and chairs of committees. Effective December 1, 2020, the Board of Directors agreed upon the following Director fee levels and structure (unless otherwise indicated, all dollar amounts in this proxy statement are in U.S. Dollars):

| Description | Fee |

| Retainer fees | • Chair: $520,200(1) • Deputy Chair: $312,120 • Directors, other than the Chair and Deputy Chair: $260,100 |

| Committee fees | • Audit Committee Chair: $31,212 • Audit Committee Member: $15,606 • Compensation Committee Chair: $20,808 • Compensation Committee Member: $10,404 • Nominating and Corporate Governance Committee Chair: $15,606 • Nominating and Corporate Governance Committee Member: $7,283 |

| Delivery of fee | • 50% restricted share units (restricted for two years) • 50% cash |

| Minimum shareholding requirements | • 5x cash retainer, accumulated over five years |

| (1) | The retainer for the Chair represents his total fee. He does not receive additional fees for his involvement with Board Committees. |

Fiscal Year 2021 Director Compensation

The table below sets forth certain information concerning the compensation earned in fiscal year 2021 by Amcor’s non-executive Directors (non-management and independent Directors).

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($) | Employer Contributions to defined contribution pension plans ($)(2) | Total ($) | ||||

| Graeme Liebelt | 241,788 | 260,111 | 16,187 | 518,086 | ||||

| Armin Meyer | 165,104 | 166,465 | 331,569 | |||||

| Andrea Bertone | 134,147 | 135,257 | 269,404 | |||||

| Susan Carter(3) | 68,927 | 126,150 | 195,076 | |||||

| Karen Guerra | 132,599 | 133,695 | 266,294 | |||||

| Nicholas (Tom) Long | 137,759 | 138,902 | 276,661 | |||||

| Arun Nayar | 144,466 | 145,660 | 290,126 | |||||

| Jeremy Sutcliffe | 123,311 | 133,695 | 9,288 | 266,294 | ||||

| David Szczupak | 136,727 | 137,860 | 274,587 | |||||

| Philip Weaver | 134,147 | 135,257 | 269,404 |

| (1) | Directors received a fixed “base” fee for their role as board members, plus additional fees for members and chairs of committees. The Chair does not receive additional fees for his involvement with board committees. |

| (2) | Certain Directors live in jurisdictions requiring statutory pension contributions. For those Directors, the cash portion of the retainer fees are reduced by the amount of the statutory pension contributions. |

| (3) | Ms. Carter joined the Amcor Board of Directors effective January 1, 2021. Amounts listed in the table above are pro-rated based on her start date. |

| AMCOR plc | 2021 Proxy Statement | 13 |

The Board has determined that all Directors, except Mr. Delia, are “independent” as that term is defined in the applicable listing standards of the New York Stock Exchange (“NYSE listing standards”). In addition, the Board has determined that each member of the Audit, Compensation, and Nominating and Corporate Governance Committees, is independent pursuant to the NYSE listing standards and any relevant Securities and Exchange Commission (“SEC”) standards. In accordance with the NYSE listing standards, the Board looked at the totality of the circumstances to determine a Director’s independence including reviewing any relationships and transactions between each Director and the Company (including its independent registered public accounting firm). To be independent, a Director must be, among other things, able to exercise independent judgment in the discharge of his or her duties without undue influence from management.

The Board recognizes the value of diversity. The Board believes that a diverse membership provides a variety of perspectives, improves the quality of dialogue, and contributes to a more balanced and effective decision-making process. In evaluating candidates for Board membership, the Board and the Nominating and Corporate Governance Committee consider many factors to create a balanced Board with diverse viewpoints and deep expertise. Relevant factors include diversity of professional experience, skill set, perspective, and background, including gender, race, ethnicity, cultural background and geography (Please see page 5 for additional detail regarding the composition of our Board and its diversity characteristics).

Amcor has maintained a steady, proactive focus on Board composition and refreshment, having added five new Directors since 2019, and recommending another new Director as nominee at our Annual Meeting. As a key element of ensuring a diverse Board, the Nominating and Corporate Governance Committee regularly reviews Director tenure and succession. The disciplined Board succession planning, together with annual Board self-evaluations, enables optimal Board effectiveness and ensures the appropriate level of Board refreshment to meet the Company’s strategic needs and priorities. In addition to refreshing the Board’s composition generally, the Board routinely adjusts its committee chair and membership assignments which promotes Director development and succession planning.

We do not have an express policy concerning whether the role of Chairman of the Board should be held by an independent Director. Instead, the Board prefers to remain flexible to determine which leadership structure is most appropriate for the Company and its shareholders based upon the specific circumstances at any given point in time. Mr. Liebelt, an independent Director, currently serves as our Chairman of the Board.

| AMCOR plc | 2021 Proxy Statement | 14 |

Corporate Governance Documents

The following materials relating to the corporate governance of the Company are accessible on our website at: http://www.amcor.com/investors/corporate-gov/policies-standards

| • | Memorandum of Association and Articles of Association | • | Compensation Committee Charter | |

| • | Corporate Governance Guidelines | • | Nominating and Corporate Governance Committee Charter | |

| • | Executive Committee Charter | • | Code of Business Conduct and Ethics | |

| • | Audit Committee Charter |

Hard copies will be provided at no charge to any shareholder or any interested party upon request. To submit such request, write to us at Amcor plc, Attention: Corporate Secretary at 83 Tower Road North, Warmley, Bristol BS30 8XP, United Kingdom. The information contained on the Company’s website is not incorporated by reference into this proxy statement and should not be considered to be part of this proxy statement.

The Board has the following standing committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Executive Committee. Below is certain information relating to these committees.

Audit Committee

During fiscal year 2021, the Audit Committee met six times. The Audit Committee is comprised of four Directors: Arun Nayar, Susan Carter, Graeme Liebelt and David Szczupak. Mr. Nayar serves as the chair of the Audit Committee. Each member of the Audit Committee is “independent,” as defined by NYSE listing standards. The Board has determined that Mr. Nayar and Ms. Carter each qualify as an “audit committee financial expert” as that term is defined by the applicable SEC rules. Furthermore, each member of the Audit Committee is “financially literate” as that term is defined by the NYSE listing standards.

The Audit Committee charter details the purpose and responsibilities of the Audit Committee, including to assist the Board in its oversight of:

| • | The integrity and fair presentation of the financial statements of Amcor and related disclosure; |

| • | The qualifications, performance and independence of Amcor’s independent auditor; |

| • | The performance of Amcor’s internal audit function; |

| • | Amcor’s systems of internal controls over financial reporting; and |

| • | Amcor’s legal and ethical compliance policies and programs. |

In addition, the Audit Committee is directly responsible for the selection, compensation and oversight of the work of Amcor’s independent auditor.

| AMCOR plc | 2021 Proxy Statement | 15 |

Compensation Committee

During fiscal year 2021, the Compensation Committee met six times. The Compensation Committee is comprised of four Directors: Armin Meyer, Andrea Bertone, Nicholas (Tom) Long and Philip Weaver. Mr. Meyer serves as the chair of the Compensation Committee. Each member of the Compensation Committee is “independent,” as defined by the NYSE listing standards.

The Compensation Committee charter details the purpose and responsibilities of the Compensation Committee, including:

| • | Reviewing and recommending the compensation of the CEO and Directors, and determining and approving compensation for Amcor’s executive officers who report directly to the CEO; |

| • | Evaluating the performance of Amcor’s CEO and performance of executive officers who report directly to the CEO; |

| • | Evaluating officer and Director compensation plans, policies and programs generally; |

| • | Reviewing the Compensation Discussion and Analysis for inclusion in the proxy statement; and |

| • | Reviewing Amcor’s management succession planning. |

Nominating and Corporate Governance Committee

During fiscal year 2021, the Nominating and Corporate Governance Committee met five times. The Nominating and Corporate Governance Committee is comprised of four Directors: Graeme Liebelt, Karen Guerra, Nicholas (Tom) Long and Jeremy Sutcliffe. Mr. Liebelt serves as the chair of the Nominating and Corporate Governance Committee. Each member of the Nominating and Corporate Governance Committee is “independent,” as defined by the NYSE listing standards.

The Nominating and Corporate Governance Committee charter details the purpose and responsibilities of the Nominating and Corporate Governance Committee, including:

| • | Identifying and recommending to Amcor’s Board individuals qualified to serve as Directors of Amcor; |

| • | Reviewing the nominations for new Directors from all sources against criteria established for selection of new Directors and nominees for vacancies on the Board; |

| • | Overseeing the annual evaluations of the Board and the Board committees; and |

| • | Advising Amcor’s Board with respect to its composition, governance practices and procedures. |

Executive Committee

During fiscal year 2021, the Executive Committee met two times. The Executive Committee is comprised of four Directors: Graeme Liebelt, Armin Meyer, Nicholas (Tom) Long and Ron Delia. Mr. Meyer serves as the chair of the Executive Committee. The Executive Committee charter details the purpose and responsibilities of the Executive Committee, which generally consist of exercising the powers and authority of the Board to direct the business and affairs of the Company in intervals between meetings of the Board, in emergency situations or when requested by the full Board.

Directors are expected to attend all Board meetings, applicable committee meetings and the annual shareholder meeting. The Board met six times in fiscal year 2021. Each Director attended at least 75 percent of the aggregate of the total number of Board meetings and committee meetings on which they served. All then-current Directors attended the annual shareholder meeting as well.

The Board meets in regularly scheduled executive sessions without non-independent Directors in connection with each regularly scheduled Board meeting and at other times as necessary. Our independent Chairman of the Board presides at the executive sessions.

| AMCOR plc | 2021 Proxy Statement | 16 |

Taking purposeful and calculated risks is an essential part of our business and is critical to the achievement of our long-term strategic objectives. Our Board of Directors and the committees take an active role in the oversight of our Company’s most significant risks. Enterprise risk management processes are embedded in all critical business processes and are designed to identify operational, financial, strategic, compliance, cybersecurity, and reputational risks that could adversely affect the execution of the Company’s plans, strategy, or effectiveness of its business model.

BOARD OF DIRECTORS Oversee the company risk management processes to support achievement of the Company’s organizational and strategic objectives Oversight of the long-term financial plan, which is updated in a process that aligns with the Company’s annual corporate and business unit risk assessments Delegate certain risk management oversight responsibilities to Board committees, and receive regular reports from Board committees AUDIT COMMITTEE COMPENSATION COMMITTEE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Oversee risks associated with financial reporting, internal controls, and cybersecurity Assess the steps management has taken to control risks to the Company Review the Company’s business risk management framework and policy for risk appetite including the procedures for identifying strategic and business risks and controlling their financial impact on the Company Review internal audit’s analysis and independent appraisal of the adequacy and effectiveness of the Company’s risk management and internal control systems Monitor risks associated with the design and administration of the Company’s compensation and benefits program, including performance-based compensation programs, to promote appropriate incentives that do not encourage excessive risk taking Oversee risks associated with the governance structure of the Company including Board composition and independence

In addition to the management of the risks described above, we engage in an annual enterprise-wide risk assessment process. Identified risks are evaluated based on the potential exposure to the business and measured as a function of severity of impact and likelihood of occurrence. Assessments include identifying and evaluating risks and the steps being taken to mitigate the risks. Bi-annually, a report summarizing these assessments is compiled, reviewed by the Chief Executive Officer and Chief Financial Officer and is presented to the full Board. Interim reports on specific risks are provided if requested by the Board or recommended by management.

Environmental, Social and Governance (ESG) Matters

The Board and its committees oversee the execution of Amcor’s environmental, social and governance strategies and initiatives as an integrated part of their oversight of the Company’s overall strategy and risk management. The Board is actively engaged with management on related topics such as sustainability, product and service demand; scenario analysis of potential pathways; customer, investor and other stakeholder expectations; and the environmental impact of our Company.

| AMCOR plc | 2021 Proxy Statement | 17 |

The Board recognizes the importance of securing the information of the Company’s customers, vendors, and employees. The Company has adopted physical, technological and administrative controls on data security, and has a defined procedure for data incident detection, containment, response and remediation. While everyone at the Company plays a part in managing these risks, oversight responsibility is shared by the Board, the Audit Committee, and management. The Audit Committee receives a quarterly cybersecurity report from management, which outlines the Company’s cybersecurity risk management framework and includes an update on the Company’s completed, on-going and planned actions relating to cybersecurity risks. The full Board receives an annual information technology report from management, which includes an update on the Company’s cybersecurity efforts.

The Board believes that human capital management is critical to the Company’s success. The Board and Compensation Committee oversee and engage with executives across the Company on a broad range of human capital management topics, including organizational development and succession planning, health and safety matters, diversity and inclusion initiatives, ethics and governance, and employee engagement feedback gathered from periodic employee surveys.

Safety is a core value at Amcor. The Company champions safe and responsible behavior among all employees to achieve its goal of zero workplace injuries. The Board receives monthly reports on safety performance and compliance of the Company’s operations with its Global EHS standards.

Amcor is dedicated to attracting, developing, engaging, and retaining the best talent and strengthening the Company’s succession pipeline for the future. The Company has developed a range of training and education programs to help employees progress across all functions and experience levels. The Board’s involvement in leadership development and succession planning is ongoing throughout the year, and the Board provides input on important decisions in each of these areas. The Board has primary responsibility for succession planning for the CEO and oversight of other senior management positions. The Compensation Committee oversees the development of the process, and the Board meets regularly with high-potential executives at many levels across the company through formal presentations and informal events throughout the year. The Compensation Committee is also regularly updated on key talent indicators for the overall workforce, including recruiting and attrition, diversity and inclusion, and development programs.

Amcor values the diverse experience, strengths, styles, nationalities and cultures of all its people. The Company is focusing its diversity and inclusion efforts in three main areas: developing inclusive leaders, learning from employee resource groups, and ensuring that the Company’s practices help attract, develop, engage and retain diverse top talent. The Board receives an annual report on the Company’s progress towards its diversity and inclusion efforts.

All Company employees and Directors are expected to act with integrity and objectivity, striving always to enhance the Company’s reputation and performance. The Company maintains a code of business conduct and ethics policy which is signed by all Amcor employees and provides a framework for making ethical business decisions.

The Board recognizes that a robust and constructive evaluation process is an essential component of Board effectiveness and good corporate governance. Accordingly, the Board and each committee will conduct an annual self-evaluation, and the Board will engage in periodic external assessments, to gauge their effectiveness and consider opportunities for improvement. The entire evaluation process, overseen by the Nominating and Corporate Governance Committee, assesses the performance of each committee and the Board as a whole. The self-evaluation results and any recommendations made by the Nominating and Corporate Governance Committee to enhance the Board’s effectiveness are discussed by the full Board.

| AMCOR plc | 2021 Proxy Statement | 18 |

Amcor has active engagement with shareholders and proxy advisors regarding its performance, strategy and operations. Members of senior management and our Chairman of the Board conduct an annual governance roadshow to solicit shareholder perspectives and receive valuable, direct feedback on governance, executive compensation, sustainability and related matters, communicating with the holders of a significant amount of our shares. Our engagement efforts and the shareholder feedback we receive are reviewed with our Board of Directors, and help to promote greater alignment of our governance and executive compensation practices with shareholder interests.

Consistent with the long-term interests of the shareholders, Directors must be able to participate constructively, drawing upon their diverse individual experience, knowledge and background to provide perspectives and insights. The Board also understands the importance of balancing tenure, turnover, diversity and skills of the individual Board members by pairing fresh perspectives with valuable experience. The Nominating and Corporate Governance Committee and the Board establish different search criteria for recruiting new Directors at different times, depending upon the Company’s needs and the then-current Board composition. In every case, however, candidates are required to have certain qualifications and attributes that enable such individuals to contribute to the Board.

The Nominating and Corporate Governance Committee will consider Director candidates recommended by shareholders in the same manner that it considers all Director candidates. Director candidates must meet the minimum qualifications set forth in the Corporate Governance Guidelines, and the Nominating and Corporate Governance Committee will assess Director candidates in accordance with those factors. Shareholders who wish to suggest qualified candidates to the Nominating and Corporate Governance Committee should write the Corporate Secretary of the Company at Amcor plc, 83 Tower Road North, Warmley, Bristol BS30 8XP, United Kingdom, stating in detail the candidate’s qualifications for consideration by the Nominating and Corporate Governance Committee.

If a shareholder wishes to nominate a Director other than a person nominated by or on behalf of the Board of Directors, he or she must comply with certain procedures outlined in our Articles of Association (“Articles”) by the deadlines described below under “Submission of Shareholder Proposals and Nominations.”

The Board provides a process for shareholders and other interested parties to send communications to the Board or any of the Directors. Interested parties may communicate with the Board or any of the Directors by sending a written communication to the address below. All communications will be compiled by the Corporate Secretary of the Company and submitted to the Board or the individual Directors.

Amcor plc

c/o Corporate Secretary

83 Tower Road North

Warmley, Bristol BS30 8XP

United Kingdom

| AMCOR plc | 2021 Proxy Statement | 19 |

Transactions with Related Parties

Our Board has approved a written policy whereby the Audit Committee must review and approve any transaction in which (a) the Company was, is or will be a participant and (b) any of the Company’s Directors, nominees for Director, Executive Officers, greater than five percent shareholders or any of their immediate family members (each, a “Related Party”) have a direct or indirect material interest (including any transactions requiring disclosure under Item 404 of Regulation S-K) (“Related Party Transaction”).

The Audit Committee may delegate authority to review Related Party Transactions to one or more Audit Committee members, except for a transaction involving an Audit Committee member. Any determinations made under such delegated authority must be promptly reported to the full Audit Committee, which may ratify or reverse such determination.

Standards for Approval of Transactions

The Audit Committee will analyze the following factors, in addition to any other factors the Audit Committee deems appropriate, in determining whether to approve a Related Party Transaction:

| • | The position within or relationship of the Related Party with the Company; |

| • | The materiality of the transaction to the Related Party and the Company; |

| • | The business purpose for and reasonableness of the transaction; |

| • | Whether the transaction is comparable to a transaction that could be available to an unrelated party, or is on terms that the Company offers generally to persons who are not Related Parties; |

| • | Whether the transaction is in the ordinary course of the Company’s business; and |

| • | The effect of the transaction on the Company’s business and operations. |

A Related Party Transaction will only be approved by the Audit Committee if the Audit Committee determines that the Related Party Transaction is in the best interests of the Company and its shareholders.

Transactions with Related Parties during Fiscal Year 2021

Item 404 of Regulation S-K requires that we disclose any transactions between Amcor and any related parties, as defined by Item 404, in which the amount involved exceeds $120,000 and in which any related party had or will have a direct or indirect material interest. During fiscal year 2021, there were no Related Party Transactions meeting the requirements of Item 404 of Regulation S-K.

| AMCOR plc | 2021 Proxy Statement | 20 |

Security Ownership of Directors and Executive Officers

The following table lists the beneficial ownership of our ordinary shares as of September 15, 2021, by each Director, each of our Executive Officers named in the Summary Compensation Table in this proxy statement, and all of our current Directors and Executive Officers as a group. Percentage of outstanding shares is based on 1,535,040,785 shares outstanding as of September 15, 2021.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percentage of Outstanding Shares |

| Graeme Liebelt | 104,191 | * |

| Armin Meyer | 56,801 | * |

| Ron Delia | 1,454,346 | * |

| Achal Agarwal | 0 | |

| Andrea Bertone | 962 | * |

| Susan Carter | 0 | |

| Karen Guerra | 52,183 | * |

| Nicholas (Tom) Long | 9,945 | * |

| Arun Nayar | 54,046 | * |

| Jeremy Sutcliffe | 69,095 | * |

| David Szczupak | 100,124 | * |

| Philip Weaver | 203,537 | * |

| Michael Casamento | 367,248 | * |

| Peter Konieczny | 479,260 | * |

| Eric Roegner | 454,283 | * |

| Fred Stephan | 129,459 | * |

| Michael Zacka | 1,290,152 | * |

| All Executive Officers and Directors as a Group (18 persons) | 5,935,562 | * |

| * | Indicates less than 1%. |

| (1) | Includes any ordinary shares that the named individuals may acquire beneficial ownership of within 60 days of September 15, 2021 pursuant to restricted stock units or performance rights or upon exercise of options as follows: Mr. Delia – 0, Mr. Casamento – 0, Mr. Konieczny – 0, Mr. Roegner – 303,548, Mr. Stephan – 35,061, and Mr. Zacka – 1,110,288. The amounts disclosed here include securities over which the individual has, or, with another shares, directly or indirectly, voting or investment power, including ownership by certain relatives and ownership by trusts for the benefit of such relatives. |

| AMCOR plc | 2021 Proxy Statement | 21 |

Security Ownership of Certain Beneficial Owners

The only persons known to us to beneficially own, as of September 15, 2021, more than 5% of our outstanding ordinary shares are set forth in the following table.

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Outstanding Shares |

| BlackRock, Inc.(1) | 107,754,819 | 6.90% |

| 55 East 52nd Street | ||

| New York, NY 10022 | ||

| State Street Corporation(2) | 84,272,982 | 5.37% |

| One Lincoln Street | ||

| Boston, MA 02111 |

| (1) | Based on information contained in a Schedule 13G filed by such beneficial holder with the SEC on January 29, 2021, BlackRock has sole voting power over 95,698,584 shares, and sole dispositive power over 107,754,819 shares. |

| (2) | Based on information contained in a Schedule 13G filed by such beneficial holder with the SEC on February 16, 2021, State Street has shared voting power over 76,613,286 shares and shared dispositive power over 84,261,234 shares. |

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our Directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, such as our ordinary shares, to file with the SEC initial reports of ownership and reports of changes in ownership of ordinary shares and other equity securities of the Company. To our knowledge, based solely on a review of the copies of the reports and amendments thereto filed electronically with the SEC and representations that no other reports were required, we believe that during fiscal 2021, no Director, executive officer or greater than 10% shareholder failed to file on a timely basis the reports required by Section 16(a), except that Mr. Long made one late filing relating to transactions executed in his brokerage account.

| AMCOR plc | 2021 Proxy Statement | 22 |

Executive Compensation Discussion and Analysis

The Executive Compensation Discussion and Analysis section describes the key elements of Amcor’s compensation program and 2021 compensation decisions for its named executive officers (“NEOs”).

For fiscal year 2021 (July 1, 2020 – June 30, 2021), Amcor’s NEOs were:

| RONALD DELIA | Chief Executive Officer |

| MICHAEL CASAMENTO | Executive Vice President, Finance and Chief Financial Officer |

| PETER KONIECZNY(1) | Former President, Amcor Flexibles Europe, Middle East and Africa |

| ERIC ROEGNER | President, Amcor Rigid Packaging |

| L. FREDERICK STEPHAN | President, Amcor Flexibles North America |

| MICHAEL ZACKA(2) | President, Amcor Flexibles Europe, Middle East & Africa |

| (1) | Effective September 1, 2020, Mr. Konieczny became Chief Commercial Officer, at which time he ceased to be an executive officer. |

| (2) | Effective September 1, 2020, Mr. Zacka became President, Amcor Flexibles Europe, Middle East & Africa, at which time he became an executive officer. |

Introduction and 2021 Highlights

Amcor’s executive compensation framework has played a key role in aligning the organization following the Bemis Transaction, in addition to incentivizing delivery of synergies, earnings growth and value creation for shareholders.

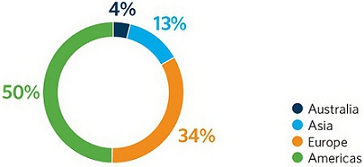

A Compensation Approach Appropriate for a Truly Global Company

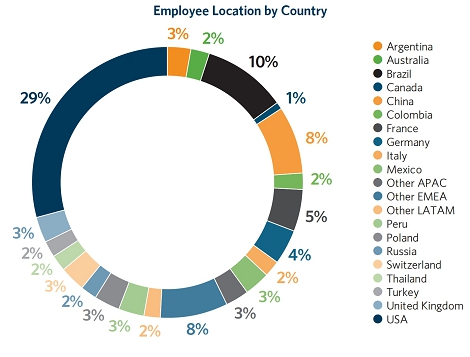

Amcor is a truly global company made up of a diverse group of executives working in a range of different countries with responsibilities that extend beyond their respective geographic locations. Amcor’s compensation approach is designed to attract and retain executives who are global leaders with the experience and ability to perform in this environment. These same leaders are attractive potential candidates for competitors both within the packaging sector and other industries - many of which are US-based.

Location of Amcor Executives

(CEO, direct reports, and their reports. n = 111)

| AMCOR plc | 2021 Proxy Statement | 23 |

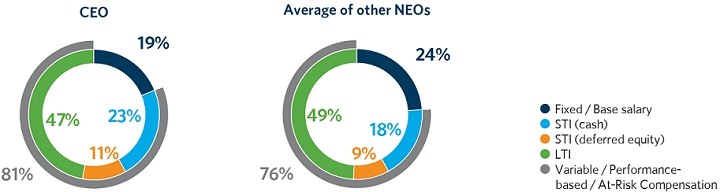

Emphasis on Variable, Performance-Based, At-Risk Compensation

To ensure Amcor remains competitive as a truly global company, it considers market benchmarks in the major regions in which it operates. The Company’s remuneration programs aim to maintain appropriate internal relativities despite regional differences, while ensuring and encouraging global mobility of talent. The programs focus on variable, performance-based, at-risk compensation to incentivize strong performance and delivery of outcomes that align with the interests of shareholders.

Variable, Performance-Based, At-Risk Compensation is based on Amcor’s Shareholder Value Creation Model

Alignment of metrics in incentive plans support delivery of shareholder value.

Amcor Shareholder Value Creation Model

| AMCOR plc | 2021 Proxy Statement | 24 |

2021 Incentive Outcomes - Highlights

The business posted strong financial performance in 2021. Incentive outcomes reflect that performance, and demonstrate the strong link between financial performance, incentive outcomes, and delivery of value to shareholders.

| Short Term Incentive | Long Term Incentive | ||

| Outcome | Targets met and exceeded | Targets partly met | |

Highlights

| • Reduction in safety recordable cases by 23% • Increase in adjusted EPS, including synergy capture, of 16% • Cash flow of $1.1 billion • Bemis integration completed – synergy capture ahead of expectations ($75 million in fiscal year 2021) with total synergies expected to exceed original $180 million target by at least 10% • Talent and organizational alignment, delivery of strategic projects | • Average adjusted EPS growth of 14.6% against target range of 5-10% • Return on Average Funds Employed (“RoAFE”) gateway exceeded • Relative Total Shareholder Returns (“TSR”) performance partly met |

Compensation Objectives

Amcor’s executive compensation strategy, frameworks and programs are designed to:

| • | Align compensation to business strategy and outcomes that deliver value to shareholders. |

| • | Drive a high-performance culture by setting challenging objectives and rewarding high-performing individuals. |

| • | Ensure compensation is competitive in the relevant employment marketplace to support the attraction, engagement and retention of executive talent. |

Compensation Decision-Making

The Compensation Committee is responsible for determining, in consultation with Amcor’s Board of Directors, a framework for the compensation of Amcor’s NEOs, and other executives reporting to the CEO. This is to ensure that Amcor’s NEOs are motivated to pursue the long-term growth and success of Amcor and that there is a clear relationship between performance and executive compensation. Amcor’s CEO recommends to the Compensation Committee the annual compensation levels for each of Amcor’s other NEOs and executive officers reporting to the CEO, and the Compensation Committee ultimately approves annual compensation levels, taking into account those recommendations and other considerations the Compensation Committee deems appropriate. The Compensation Committee reviews the annual compensation levels for the CEO and makes recommendations for any changes to the Amcor Board, who approves any changes. The CEO makes no recommendation with respect to his own compensation levels.

The Compensation Committee is also responsible for reviewing leadership talent to ensure that Amcor’s leaders are of world-class quality and that succession depth for key leadership roles is sufficient to deliver sustainable business success. It also undertakes an annual formal evaluation of the performance of the CEO.

Use of Compensation Consultants

Where appropriate, the Compensation Committee seeks advice from independent compensation consultants in determining appropriate executive compensation. In fiscal year 2021, the Compensation Committee sought input from external compensation consultants, FW Cook and Willis Towers Watson, to understand market practice and review market data relevant for making compensation determinations for key executive roles. FW Cook and Willis Towers Watson did not prepare specific recommendations with respect to the compensation of any of Amcor’s NEOs.

| AMCOR plc | 2021 Proxy Statement | 25 |

Use of Peer Company and Competitive Market Data

Due to the global scope of Amcor’s business and the unique competitive environment in which Amcor operates, a range of benchmarking data was used in making individual compensation decisions during the last fiscal year. At Amcor, compensation for NEOs and other executives reporting to the CEO is determined by reviewing general pay structures for similar roles in relevant markets around the world. Amcor is an international company made up of a diverse group of executives working in a range of different countries. Furthermore, the responsibilities of these executives extend beyond their own geographic location. This requires Amcor to attract and retain executives who are global leaders with the experience and ability to perform in this environment.

For fiscal year 2021 compensation benchmarking purposes, the Compensation Committee referenced multiple compensation benchmarks from carefully selected US and global companies and markets that include executives with global or regional responsibilities. This approach assists the Compensation Committee in understanding and considering general market practice across a number of international markets when determining competitive pay structures for Amcor executives.

Amcor compensates its executives using a combination of fixed and variable compensation plans. The primary elements of its executive compensation programs are:

| • | Base salaries |

| • | Short-term incentive (STI); delivered through a combination of cash and deferred equity |

| • | Long-term incentive (LTI) |

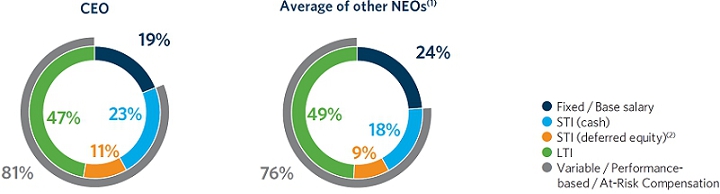

Greater emphasis is placed on variable compensation with the CEO receiving 81% of his target compensation as variable compensation and the other NEO’s receiving 76% (on average), as shown below.

| (1) | Represents an average across all NEOs, other than the CEO. |

| (2) | Deferred component of the STI delivered as restricted share units over Amcor shares that are restricted for two years following payment of the cash portion of the STI. |

Amcor believes that these components, taken together, promote the compensation objectives described above.

In determining the amounts payable with respect to each element, and the relative weighting of the various elements for each of Amcor’s NEOs, the Compensation Committee considers the compensation elements, weightings and levels generally paid for similar roles in relevant markets around the world. Amcor does not have a formal policy regarding allocation among types of compensation other than to ensure overall competitiveness and to emphasize variable, performance-based, at-risk compensation. Its goal is to award compensation that is competitive in relation to the compensation objectives and in the best interest of shareholders.

| AMCOR plc | 2021 Proxy Statement | 26 |

Base Salaries

The base salary is intended to provide a fixed component of compensation commensurate with the executive’s seniority, skill set, experience, role and responsibilities. Over the course of fiscal year 2021, base salaries were modestly increased.

Short-Term Incentive (STI)

Amcor provides STI compensation opportunities in the form of an annual, performance-based incentive program. The STI is intended to provide compensation based on achievement of annual business objectives. Part of any STI earned based on achievement of annual business objectives is delivered in restricted share units (“RSUs”) that are deferred for an additional period of two years—called STI deferred equity awards. The payment of STI deferred equity awards is intended to build equity ownership, to align management incentives with shareholder value creation, and to act as a retention incentive.

Details of the range of potential STI cash payments, the proportion to be received at “target” performance, the actual payments made, and RSUs awarded under the STI Deferred Equity plan in respect of fiscal year 2021 are shown below. The actual outcomes are based on the performance of Amcor’s NEOs against a selected range of safety, financial and strategy and organization development goals both on an Amcor and a business group level. Above-target outcomes are only payable based on outperformance against selected financial metrics.

| Name | STI % at Target (as % of Base Salary) | STI % Range | STI % Actual | STI Payment (USD)(1) | Deferred Equity Awarded (USD) | Deferred Equity Award (No. RSUs)(1) | ||||||||||

| Ron Delia | 120% | 0% to 180% of base salary | 180% | $ | 3,008,167 | $ | 1,504,084 | 130,414 | ||||||||

| Michael Casamento | 75% | 0% to 150% of base salary | 150% | $ | 1,385,922 | $ | 692,961 | 60,084 | ||||||||

| Peter Konieczny | 75% | 0% to 150% of base salary | 139% | $ | 1,779,464 | $ | 889,732 | 77,145 | ||||||||

| Eric Roegner | 75% | 0% to 150% of base salary | 150% | $ | 1,473,467 | $ | 736,733 | 63,879 | ||||||||

| Fred Stephan | 75% | 0% to 150% of base salary | 149% | $ | 1,308,472 | $ | 654,236 | 56,726 | ||||||||

| Michael Zacka | 75% | 0% to 150% of base salary | 104% | $ | 1,248,521 | $ | 624,261 | 54,127 | ||||||||

| (1) | Equity allocations were determined based on the volume weighted average price (“VWAP”) of Amcor shares for the five trading days prior to and including June 30, 2021 ($11.53 per share). Where short-term cash incentives are determined in currencies other than USD, the average foreign exchange rate for the same five-day period was applied to determine the USD equivalent. |

The table below also includes a more detailed analysis of the targets and outcomes for the CEO and CFO.

| Category | Safety Targets | Financial Targets | Strategy and Organizational Development Goals | |||

| Weighting | 5% | 80-85% | 10-15% | |||

| Outcome | Target met and exceeded | Targets met and exceeded | Targets met and exceeded | |||

| Comments | • 23% fewer recordable cases than fiscal year 2020 | • Increase in adjusted EPS, including synergy capture, of 16% • Cash flow of $1.1 billion • Bemis integration completed – synergy capture ahead of expectations ($75 million in fiscal year 2021) with total synergies expected to exceed original $180 million target by at least 10% | • Talent and organizational alignment, delivery of strategic projects |

The remaining NEOs’ targets and weighting were specific to their scope of accountability and business group.

| • | All NEOs had a safety objective to reduce recordable cases. |

| • | Financial metrics included both consolidated and Business Group specific metrics including earnings, cash flow, average working capital, and sales growth metrics. Metrics and weighting for each ensured NEOs were incentivized to focus on objectives specific to their respective business groups. |

| • | These NEOs were assigned strategy and organizational development goals, where applicable to the role, with a focus on talent and organizational alignment. This was essential to the successful integration of the Bemis business. |

| AMCOR plc | 2021 Proxy Statement | 27 |

The performance targets for consolidated results are consistent with those of the CEO and CFO. Performance targets related to business group or unit performance are established based on annual operating plans (which are considered commercially sensitive), and are determined by definitive and objective criteria set at levels intended to be challenging and require significant leadership effort, substantial achievement, and measurable value creation for payout to occur. Amcor does not publicly report financial results for businesses within a reportable segment to protect the commercially sensitive nature of that information and the Company’s competitive positions.

Long-Term Incentive (LTI)

The objective of Amcor’s LTI is to reward the achievement of long-term sustainable business outcomes which is consistent with the Company’s objective of value creation for shareholders.

Each LTI award vests over a period of three years and consists of a grant of options and performance rights (performance shares are awarded to U.S. participants in place of performance rights).

The vesting outcome of the LTI award is based on the following:

| • | Half of the award is determined based on constant currency adjusted EPS growth over a three-year performance period, with 5% average annual adjusted EPS growth resulting in 50% of this portion of the award vesting, and 10% average annual adjusted EPS growth resulting in full vesting of this portion of the award (subject to linear interpolation between these two points). There is a further condition that Amcor’s adjusted RoAFE is at or above 12%. If average annual adjusted EPS growth is less than 5%, or RoAFE is less than 12%, this portion of the award will not vest.1 |

| • | The other half of the award is based on relative TSR performance over a three-year performance period against two peer groups with equal weighting; an ASX-based group and an international packaging group, with 50th percentile TSR resulting in 50% of this portion of the award vesting, and 75th percentile TSR resulting in full vesting of this portion of the award (subject to linear interpolation between these two points). There is no vesting of this portion of the award for performance below the 50th percentile. The use of these two peer groups reflect Amcor’s Australian and international shareholder base. |

The combination of adjusted EPS with a RoAFE condition ensures that management is rewarded for achieving profitable growth while sustaining strong returns. The use of relative TSR provides a shareholder perspective of Amcor’s relative performance against comparable companies both in Australia and internationally.

The TSR peer groups for the LTI granted in fiscal year 2021 were:

| ASX-BASED TSR GROUP2: | ||||

| The A2 Milk Company | CSL Limited | ResMed Inc | ||

| Ansell Limited | Downer EDI Limited | Sonic Healthcare Limited | ||

| Boral Limited | Fletcher Building Limited | Sydney Airport Holdings Limited | ||

| Brambles Limited | Goodman Group | Telstra Corporation Limited | ||

| CIMIC Group Limited | Incitec Pivot Limited | Transurban Group | ||

| Cleanaway Waste Management Limited | James Hardie Industries plc | Treasury Wine Estates Limited | ||

| Coca-Cola Amatil Limited | Orora Limited | Wesfarmers Limited | ||

| Cochlear Limited | Qantas Airways Limited | Woolworths Group Limited | ||

| Coles Group Limited | Ramsay Health Care Limited | |||

| Computershare Limited | Reliance Worldwide Corporate Limited | |||

| INTERNATIONAL PACKAGING TSR GROUP2: | ||||

| AptarGroup, Inc. | Graphic Packaging International, Inc. | Sealed Air Corporation | ||

| Ball Corporation | Huhtamäki Oyj | Silgan Holdings, Inc. | ||

| Berry Global Group, Inc. | International Paper Company | Sonoco Products Company | ||

| CCL Industries Inc. | Mayr-Melnhof Karton AG | WestRock Company | ||

| Crown Holdings, Inc. | O-I Glass, Inc. | |||

| (1) | Amcor’s Board of Directors has flexibility to adjust the EPS and RoAFE hurdles, or adjust the structure of these hurdles, to ensure they remain appropriate in the event of material events or strategic initiatives that affect the relevance of the performance conditions. |

| (2) | Certain events may occur (e.g. M&A, public to private transactions) that could affect the composition of the peer group. The Board has, accordingly, retained discretion to determine how those events will be treated at the time they arise. This may result in the alteration of the composition of the peer group from time to time. The Board also retains the discretion to deal with any other material event that affects the relevance of any member in the peer group. |

| AMCOR plc | 2021 Proxy Statement | 28 |

LTI vested during fiscal year 2021

The LTI awards that vested during fiscal year 2021 were part of the 2019 LTI grant that was delayed until the completion of the Bemis Transaction. The Bemis Transaction closed with just 19 days remaining in fiscal year 2019, resulting in this LTI award being granted early in fiscal year 2020. This LTI award was therefore granted over a two-year performance period ending June 30, 2021. The annual vesting schedule of LTI grants did not change as a result of this delayed grant and only one LTI grant continues to vest each fiscal year.