Exhibit 6

March 18, 2019

Dear Shareholders of

B.O.S. Better On-Line Solutions Ltd.,

Re: Response to B.O.S. Better On-Line Solutions Ltd.’s Position Statement

On February 6, 2019, we, L.I.A Pure Capital Ltd. (“Pure Capital”) requested that B.O.S. Better On-Line Solutions Ltd. (the “Company”) convene a special general meeting in order to allow the shareholders of the Company to vote upon resolutions to remove the current directors of the Company and appoint Pure Capital’s director nominees their stead.

Pure Capital’s letter to the directors of the Company can be found athttps://www.sec.gov/Archives/edgar/data/1005516/000121390019001799/sc13d0219ex4liapure_bos.htm.

Pure Capital’s position statement, further substantiating its arguments can be found at https://www.sec.gov/Archives/edgar/data/1005516/000121390019001799/sc13d0219ex5liapure_bos.htm.

On March 7, 2019, the Company called a special general meeting of its shareholders, and issued a position statement full of misleading and irrelevant information on Pure Capital and its director nominees.

Unfortunately, the Company’s board of directors presented a false picture on the share performance of companies previously held by Pure Capital and Kfir Silberman, without providing the full history on these companies.

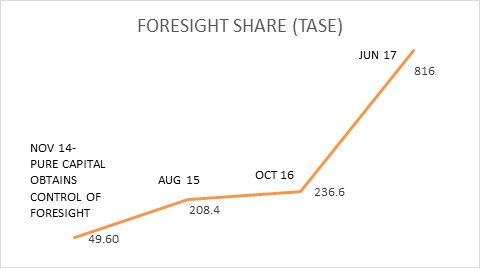

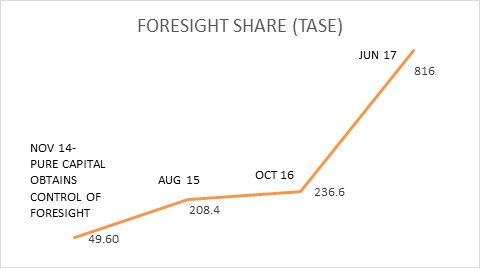

Foresight Autonomous Holdings Ltd. (NASDAQ:FRSX, TASE: FRSX)

On November 12, 2014, Pure Capital became the controlling shareholder of Asia Development (A.D.B.M) Ltd. (“Asia Development”). At the time of acquiring control, Asia Development’s share price was 49.60 NIS cents per share. Upon Pure Capital becoming the controlling shareholder of Asia Development, Pure Capital acted vigorously to bring value to such company’s shareholders and eventually, only a year later, a merger transaction was consummated, in which Foresight Autonomies Holdings Ltd.’s operations were merged with Asia Development. As of March 17, 2019, the share price of Foresight (formerly Asia Development) is approx. 119 NIS cents per share (approximately 2.40 times the price at the time of the acquisition of control by Pure Capital). During 2017, Foresight’s share price reached a peak of 816 NIS cents per share (approximately 16.5 times the price at the time of the acquisition of control by Pure Capital).

Furthermore, following the merger transaction, Foresight, led by Pure Capital, raised approximately NIS 150 million at rising prices through private placements by institutional investors in Israel and abroad, together with strategic investors from the automobile industry.

These facts are included in public reports of Foresight that are accessible to all. It is most puzzling how the members of the Company’s board of directors chose not to examine these facts prior to the publication of their position statement.

Moreover, the Company’s board of directors tried to paint a picture that Foresight is not profitable, without letting their shareholders know that Foresight is basically a research and development Company still working to bring its product to the market.

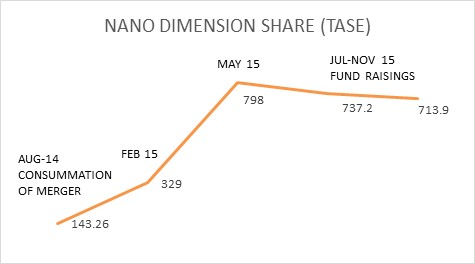

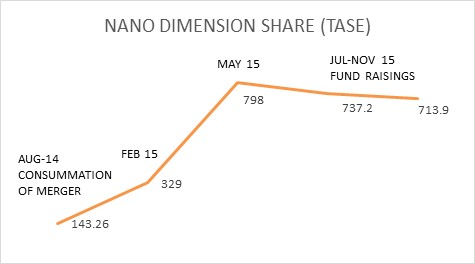

Nano Dimension Ltd. (NASDAQ:NNDM, TASE: NNDM)

On April 2, 2014, Kfir Silberman, the controlling shareholder of Pure Capital, became, together with Itschak Shrem, the holder of approximately 22% of Z.B.I. Ltd (“ZBI”). At the time of acquiring their stake, ZBI’s share price was 120 NIS cents per share. Here as well, Mr. Silberman acted vigorously to bring value to such company’s shareholders and eventually, only four months later, a merger transaction was consummated, in which the current operations of the company were merged with ZBI. The name of ZBI has changed to Nano Dimension Ltd. at the beginning of 2015. During 2015, Nano Dimension’ share price peaked to 798 NIS cents (approximately 6.6 times the price at the time of the acquisition of shares by Mr. Silberman(.Furthermore after the merger transaction, Mr. Silberman raised approximately NIS 200 million for Nano Dimension through private placements by institutional investors in Israel and abroad.

Insuline Medical Ltd.

The Company’s board of directors noted that in September 2017 the shareholders of Insuline Medical Ltd. rejected Mr. Silberman’s candidates in a proxy contest, denying from the Company’s shareholders the true set of events.

On July 4, 2017, Mr. Silberman became an interested party in Insulin. At that time, Insuline’s share price was 617 NIS cents per share. Upon becoming an interested party and with the assistance of another shareholder, Insuline’s board was replaced and a private placement of shares was performed based on the trading price on the stock exchange at that time (price of 2,475 NIS cents per share). After the performance of the successful private placement as aforesaid, Insuline executed a successful merger with a non-bank financing company, while raising NIS 10 million in debt from an institutional investor.

On April 12, 2018, Mr. Silberman ceased to be an interested party in Insuline. At the same time, Insuline’s share price was approximately 3,300 NIS cents per share (approx. 5.3 times the price compared to the price when Mr. Silberman became an interested party in Insuline).

Prior to Mr. Silberman’s becoming an interested party in Insuline and under the previous board of Insuline, the value of Insuline’s share price decreased by approximately 95%, while performing various capital raising and capital dilutions, which are similar in essence to the steps taken and are currently being taken by the Company.

Itschak Shrem

The Company’s board of directors further published misleading information on Mr. Itshak Shrem, Pure Capital director nominee stating that Mr. Shrem was questioned by the police on certain matters and then was released by the court under restrictive provisions. However, the board of directors forgot to state, in what can only be understood asdeliberate bad faith, is that all claims against Mr. Itshak Shrem were laterinstantaneously dropped by the police. The Company’s board of directors was in possession of this information, as it was included in the letter sent by pure Capital to the Company on February 6, 2019.

Pure Capital’s Plans for the Company

As stated in our previously filed position statement, Pure Capital’s sole purpose is to cease the mismanagement of the Company’s directors and management which has lead the Company into stagnation and disarray,including cutting exaggerated costs, such as salary payments to officers, which amounted more than $1 million dollars in 2017 for the five highest paid executive compared to a net income of the Company of only $773,000 in 2017.

In addition, Pure Capital will act to bring strategic investors to back up the Company and allow the Company to raise capital at higher valuations, unlike the dilutive fund raisings carried out by the Company’s current management in the last five years, which has led to extensive pressure on the Company’s share price.

Pure Capital’s position is that the current directors have failed miserably in fulfilling their duties and should therefore be removed from their respective positions. Pure Capital recommends that all of the Company’s shareholdersVOTE FOR the removal from office, immediately following the meeting, of each of the Company’s current directors as stated under Proposal no. 1 of the proxy statement published by the Company on March 7, 2019.

In addition, Pure Capital believes that its director nominees are the most suitable candidates to serve as directors of the board of directors of the Company. Pure Capital recommends that all of the Company’s shareholdersVOTE FOR the election of the Pure Capital director nominees, as stated under Proposal No. 2 of the proxy statement published by the Company on March 7, 2019.

| Sincerely |

| | |

| | /s/ Kfir Silberman |

| | Mr. Kfir Silberman |

| | L.I.A Pure Capital Ltd. |

3