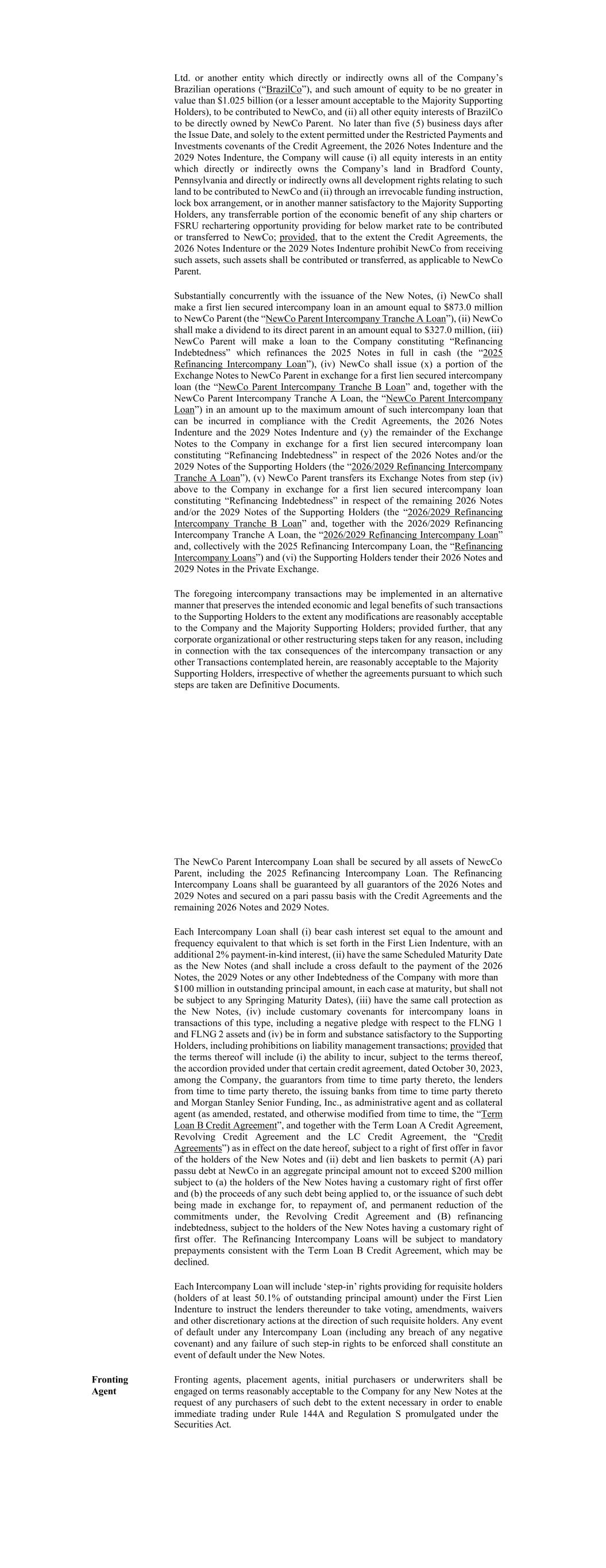

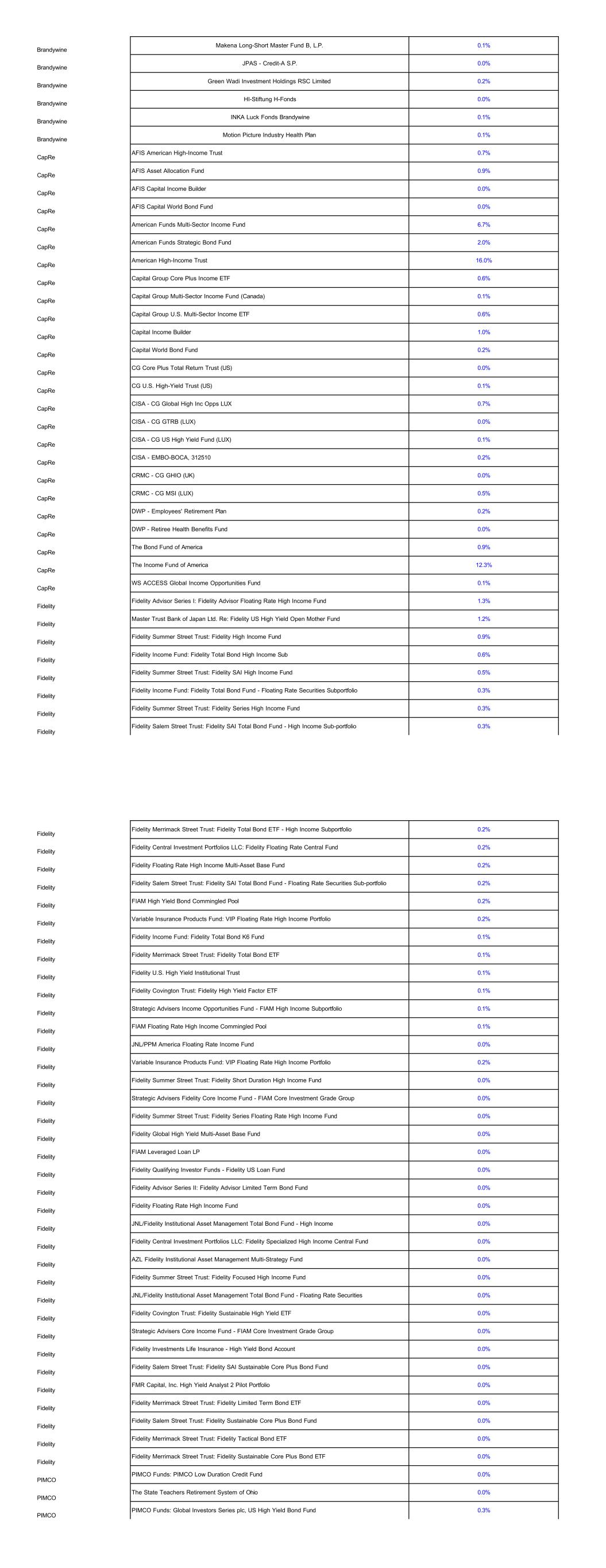

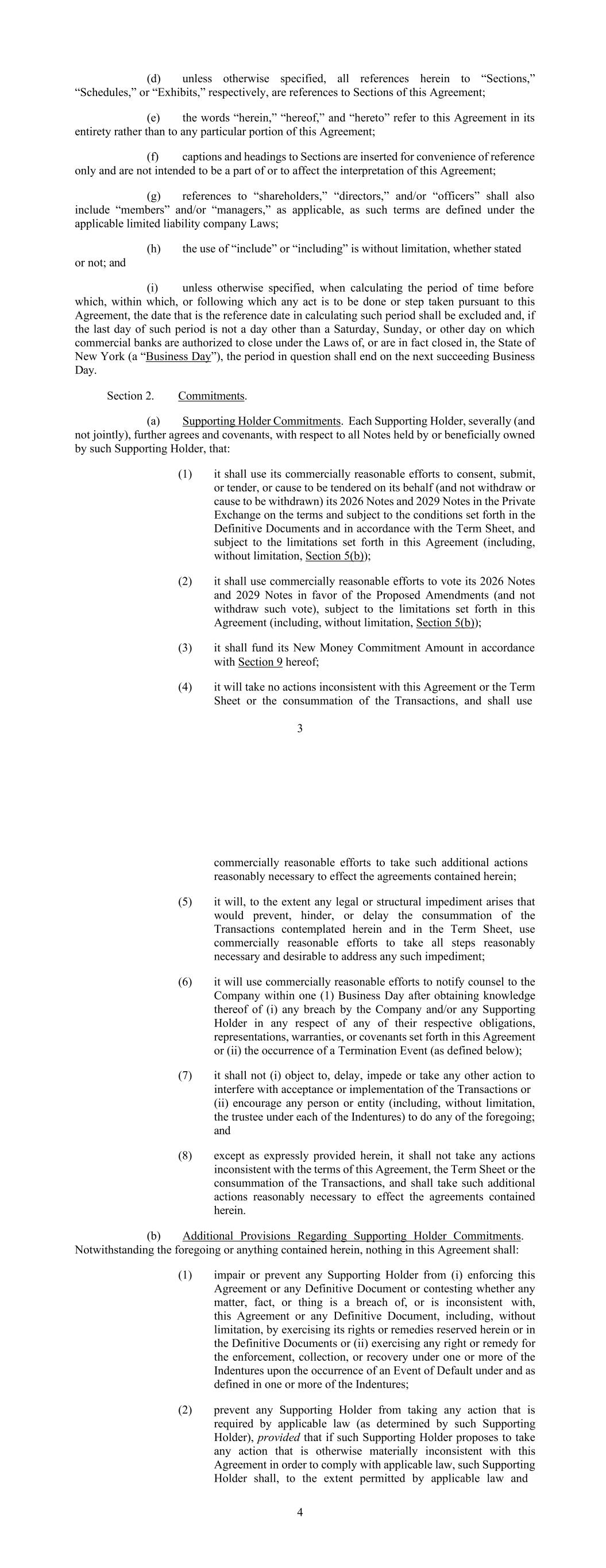

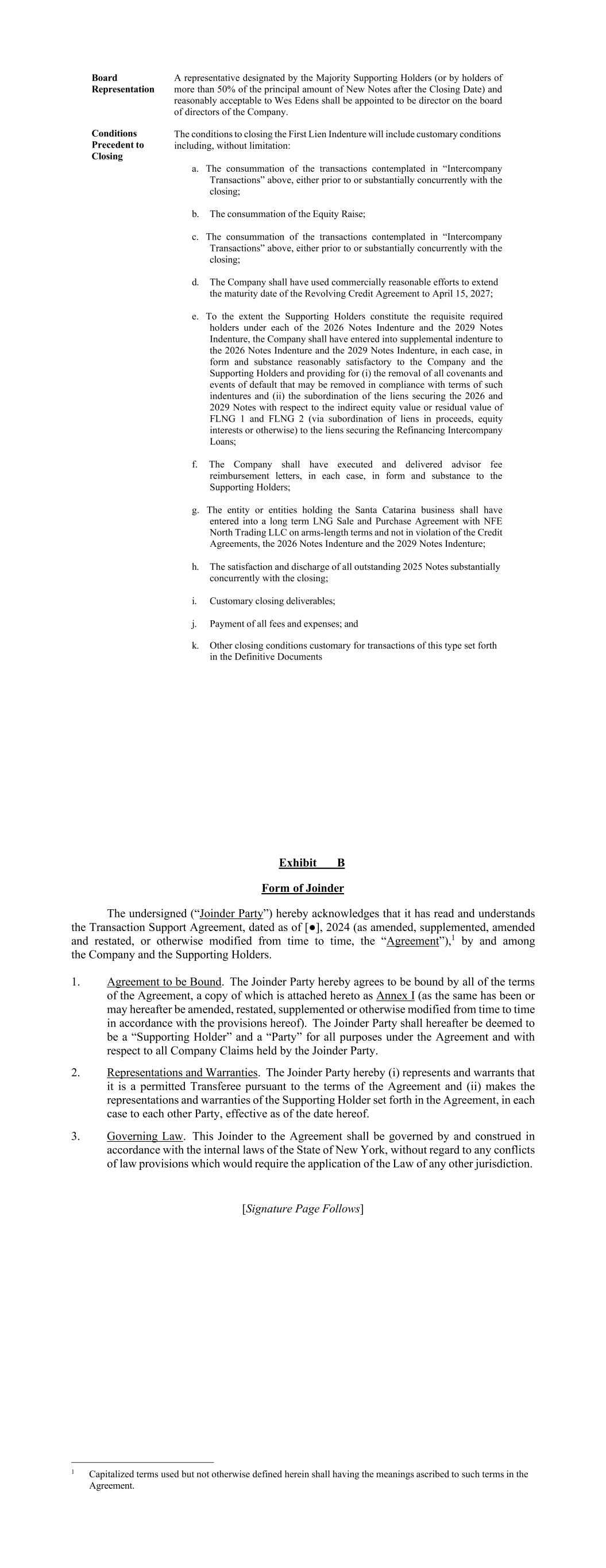

Execution Version THIS TRANSACTION SUPPORT AGREEMENT IS NOT AN OFFER OR ACCEPTANCE WITH RESPECT TO ANY SECURITIES. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS. UNTIL THE OCCURRENCE OF THE AGREEMENT EFFECTIVE DATE ON THE TERMS DESCRIBED HEREIN, NOTHING CONTAINED IN THIS TRANSACTION SUPPORT AGREEMENT SHALL BE AN ADMISSION OF FACT OR LIABILITY OR DEEMED BINDING ON ANY OF THE PARTIES HERETO. THIS TRANSACTION SUPPORT AGREEMENT DOES NOT PURPORT TO SUMMARIZE ALL OF THE TERMS, CONDITIONS, REPRESENTATIONS, WARRANTIES, AND OTHER PROVISIONS WITH RESPECT TO THE TRANSACTIONS DESCRIBED HEREIN, WHICH TRANSACTIONS WILL BE SUBJECT TO THE COMPLETION OF DEFINITIVE DOCUMENTS INCORPORATING THE TERMS SET FORTH HEREIN AND THE CLOSING OF ANY TRANSACTION SHALL BE SUBJECT TO THE TERMS AND CONDITIONS SET FORTH IN SUCH DEFINITIVE DOCUMENTS AND THE APPROVAL RIGHTS OF THE PARTIES SET FORTH HEREIN AND IN SUCH DEFINITIVE DOCUMENTS, IN EACH CASE, SUBJECT TO THE TERMS HEREOF. TRANSACTION SUPPORT AGREEMENT This Transaction Support Agreement (this “Agreement”), dated as of September 30, 2024, is entered into by and among New Fortress Energy Inc., a Delaware corporation (the “Company”) and each of the undersigned holders of, or the investment advisor or manager to a beneficial or legal holder or holders of (and in such capacity having the power to direct the voting and disposition of the notes held by such holder(s)) the Notes as defined herein (each a “Supporting Holder” and, collectively, the “Supporting Holders”). The Company, the Supporting Holders and any subsequent person that becomes a party hereto in accordance with the terms hereof are referred to herein as the “Parties.” WHEREAS, the Company has issued an outstanding $875,000,000 aggregate principal amount of its 6.750% Senior Notes due 2025 (the “2025 Notes”) pursuant to that certain Indenture, dated as of September 2, 2020, by and between the Company, certain guarantors and U.S. Bank National Association, as trustee and collateral agent (the “2025 Notes Indenture”), an outstanding $1,500,000,000 aggregate principal amount of its 6.500% Senior Notes due 2026 (the “2026 Notes”), pursuant to that certain Indenture, dated as of April 12, 2021, by and between the Company, certain guarantors and U.S. Bank National Association, as trustee and collateral agent (the “2026 Notes Indenture”), and an outstanding $750,000,000 aggregate principal amount of its 8.750% Senior Secured Notes (the “2029 Notes” and, together with the 2025 Notes and 2026 Notes, the “Notes”) pursuant to that certain Indenture, dated as of March 8, 2024, by and between the Company, certain guarantors and U.S. Bank National Association, as trustee and collateral agent (the “2029 Notes Indenture” and, together with the 2025 Notes Indenture and 2026 Notes Indenture, the “Indentures”); WHEREAS, the Company and the Supporting Holders have engaged in arm’s-length, good faith negotiations regarding the terms of a recapitalization of the Company’s indebtedness (the “Transactions”) on the terms and subject to the conditions set forth in this Agreement and as 2 specified in the term sheet attached as Exhibit A hereto (the “Term Sheet”) and as will be specified in the Definitive Documents (as defined below); WHEREAS, the Transactions shall be implemented through a series of out-of-court transactions in which (i) the Supporting Holders shall purchase $1,200,000,000 aggregate principal amount of 12.000% Senior Secured Notes (the “New Notes”) of a newly-formed unrestricted subsidiary of the Company (“NewCo”) pursuant to the terms hereof, (ii) the Company shall capitalize NewCo and consummate the other intercompany transactions (the “Intercompany Transactions”) as set forth in the Term Sheet, (iii) the Company shall use the proceeds of the New Notes and the Intercompany Transactions to (a) satisfy and discharge all outstanding 2025 Notes and (b) for general corporate purposes, (iv) the Supporting Holders shall exchange (the “Private Exchange”) their 2026 Notes and 2029 Notes for additional New Notes at a price of $1,000 New Notes for each $1,000 of 2026 Notes or 2029 Notes so exchanged, and (v) the Company shall seek certain amendments to, or consents under, each of the Indentures that, as described in the Term Sheet (the “Proposed Amendments”), will result in the subordination of the 2026 Notes and 2029 Notes that remain outstanding after giving effect to the Transactions with respect to certain specified assets and/or proceeds thereof as set forth in the Term Sheet; WHEREAS, subject to the limitations set forth herein, the Supporting Holders collectively beneficially own as of the Agreement Effective Date (as defined below) the aggregate principal amount of Notes set forth on Schedule 1 hereto (and/or serve as the investment advisor or manager for the beneficial holder(s) of such Notes having the power to vote and dispose of such holdings on behalf of such beneficial holder(s)), and each Supporting Holder is hereby willing to exchange such Notes, and grant its consent to the Proposed Amendments, in the manner, on the terms and subject to the conditions set forth herein and in the Term Sheet. NOW, THEREFORE, in consideration of the premises and mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows: Section 1. Interpretation. (a) in the appropriate context, each term, whether stated in the singular or the plural, shall include both the singular and the plural, and pronouns stated in the masculine, feminine, or neuter gender shall include the masculine, feminine, and the neuter gender; (b) capitalized terms defined only in the plural or singular form shall nonetheless have their defined meanings when used in the opposite form; (c) unless otherwise specified, any reference herein to an existing document, schedule, or exhibit shall mean such document, schedule, or exhibit, as it may have been or may be amended, restated, supplemented, or otherwise modified from time to time prior; provided, that, any capitalized terms herein which are defined with reference to another agreement, are defined with reference to such other agreement as of the date of this Agreement, without giving effect to any termination of such other agreement or amendments to such capitalized terms in any such other agreement following the date hereof;

3 (d) unless otherwise specified, all references herein to “Sections,” “Schedules,” or “Exhibits,” respectively, are references to Sections of this Agreement; (e) the words “herein,” “hereof,” and “hereto” refer to this Agreement in its entirety rather than to any particular portion of this Agreement; (f) captions and headings to Sections are inserted for convenience of reference only and are not intended to be a part of or to affect the interpretation of this Agreement; (g) references to “shareholders,” “directors,” and/or “officers” shall also include “members” and/or “managers,” as applicable, as such terms are defined under the applicable limited liability company Laws; (h) the use of “include” or “including” is without limitation, whether stated or not; and (i) unless otherwise specified, when calculating the period of time before which, within which, or following which any act is to be done or step taken pursuant to this Agreement, the date that is the reference date in calculating such period shall be excluded and, if the last day of such period is not a day other than a Saturday, Sunday, or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the State of New York (a “Business Day”), the period in question shall end on the next succeeding Business Day. Section 2. Commitments. (a) Supporting Holder Commitments. Each Supporting Holder, severally (and not jointly), further agrees and covenants, with respect to all Notes held by or beneficially owned by such Supporting Holder, that: (1) it shall use its commercially reasonable efforts to consent, submit, or tender, or cause to be tendered on its behalf (and not withdraw or cause to be withdrawn) its 2026 Notes and 2029 Notes in the Private Exchange on the terms and subject to the conditions set forth in the Definitive Documents and in accordance with the Term Sheet, and subject to the limitations set forth in this Agreement (including, without limitation, Section 5(b)); (2) it shall use commercially reasonable efforts to vote its 2026 Notes and 2029 Notes in favor of the Proposed Amendments (and not withdraw such vote), subject to the limitations set forth in this Agreement (including, without limitation, Section 5(b)); (3) it shall fund its New Money Commitment Amount in accordance with Section 9 hereof; (4) it will take no actions inconsistent with this Agreement or the Term Sheet or the consummation of the Transactions, and shall use 4 commercially reasonable efforts to take such additional actions reasonably necessary to effect the agreements contained herein; (5) it will, to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Transactions contemplated herein and in the Term Sheet, use commercially reasonable efforts to take all steps reasonably necessary and desirable to address any such impediment; (6) it will use commercially reasonable efforts to notify counsel to the Company within one (1) Business Day after obtaining knowledge thereof of (i) any breach by the Company and/or any Supporting Holder in any respect of any of their respective obligations, representations, warranties, or covenants set forth in this Agreement or (ii) the occurrence of a Termination Event (as defined below); (7) it shall not (i) object to, delay, impede or take any other action to interfere with acceptance or implementation of the Transactions or (ii) encourage any person or entity (including, without limitation, the trustee under each of the Indentures) to do any of the foregoing; and (8) except as expressly provided herein, it shall not take any actions inconsistent with the terms of this Agreement, the Term Sheet or the consummation of the Transactions, and shall take such additional actions reasonably necessary to effect the agreements contained herein. (b) Additional Provisions Regarding Supporting Holder Commitments. Notwithstanding the foregoing or anything contained herein, nothing in this Agreement shall: (1) impair or prevent any Supporting Holder from (i) enforcing this Agreement or any Definitive Document or contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement or any Definitive Document, including, without limitation, by exercising its rights or remedies reserved herein or in the Definitive Documents or (ii) exercising any right or remedy for the enforcement, collection, or recovery under one or more of the Indentures upon the occurrence of an Event of Default under and as defined in one or more of the Indentures; (2) prevent any Supporting Holder from taking any action that is required by applicable law (as determined by such Supporting Holder), provided that if such Supporting Holder proposes to take any action that is otherwise materially inconsistent with this Agreement in order to comply with applicable law, such Supporting Holder shall, to the extent permitted by applicable law and

5 reasonably practicable, provide at least two (2) Business Days’ advance written notice to the other Parties prior to taking any such action; (3) require any Supporting Holder to take any action that is prohibited by applicable law or to waive or forego the benefit of any applicable legal privilege (as determined by such Supporting Holder in good faith), provided that if such Supporting Holder plans to refuse to take any action in a manner that is otherwise inconsistent with this Agreement in order to comply with applicable law, such Supporting Holder shall provide at least two (2) Business Days’ advance written notice to the other Parties prior to taking such action; (4) be construed to prevent the Supporting Holders from exercising any consent rights or their rights or remedies specifically reserved herein or in the Definitive Documents; or (5) except as expressly provided herein, require any Supporting Holder to incur any expenses, liabilities, or other obligations, or to agree to any commitments, undertakings, concessions, indemnities, or other arrangements that could result in expenses, liabilities, or other obligations. (c) Company Commitments. The Company agrees and covenants, subject to its obligations under applicable law and regulations, that, from the Agreement Effective Date through any Termination Date: (1) it will use commercially reasonable best efforts to take or cause to be taken all actions necessary to consummate the Transactions on the terms and subject to the conditions set forth in the Term Sheet and the Definitive Documents (as defined below); (2) it shall comply in all respects with the obligations set forth in Section 10, Exclusivity, hereof; (3) it will negotiate in good faith and use commercially reasonable efforts to execute, deliver, perform its obligations under, and consummate the transactions contemplated by, the Definitive Documents, the terms of which shall be in accordance with the Term Sheet; (4) it will use commercially reasonable efforts to obtain any and all consents, regulatory (including self-regulatory) approvals, and third-party approvals that are necessary and/or advisable for the implementation or consummation of any part of the Transactions; (5) it will take no actions inconsistent with this Agreement or the Term Sheet or the consummation of the Transactions, and shall take such 6 additional actions reasonably necessary to effect the agreements contained herein; (6) it will, to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Transactions contemplated herein and in the Term Sheet, take all steps reasonably necessary and desirable to address any such impediment; (7) it will satisfy and discharge, in accordance with the Term Sheet and the Definitive Documents, all 2026 Notes and 2029 Notes held by the Company or its Subsidiaries after giving effect to the Transactions; (8) it will (i) complete the preparation, as soon as practicable after the Agreement Effective Date, of each of the Definitive Documents necessary to implement the Transactions, (ii) provide each of the Definitive Documents to, and afford reasonable opportunity for comment and review of each of the Definitive Documents by, counsel to the Supporting Holders, and (iii) in accordance with Section 8, obtain the written consent (with email from counsel being sufficient) of the Majority Supporting Holders (as defined below) to the form and substance of each of the Definitive Documents; (9) it will execute a supplemental indenture, intercreditor agreement and/or a subordination agreement (each, a “Supplemental Indenture”) with respect to each of the 2026 Indenture and 2029 Indenture to effect the Proposed Amendments, so that each is operative concurrently with the settlement of the consummation of the Transactions in accordance with the terms and subject to the conditions set forth herein and in the Term Sheet; (10) it will maintain the good standing and legal existence of the Company and any joint ventures or other entity (including NewCo, once formed) in which the Company has a direct or indirect equity interest under the laws of the state or jurisdiction in which it is incorporated, organized or formed, excluding any dormant or immaterial subsidiaries; (11) it will, except for such matters that are approved by the Majority Supporting Holders (including by counsel to the Majority Supporting Holders on their behalf) in writing from time to time, conduct its businesses and operations in the ordinary course and in compliance with applicable law; (12) it will promptly provide any Supporting Holder with any documentation or information related to the Transactions that is

7 reasonably requested by such Supporting Holder or is reasonably necessary to consummate the Transactions, including “know your customer” and like materials, which documentation and information shall be subject to any confidentiality restrictions to which the Supporting Holder may be subject; (13) it will, upon reasonable request by the Majority Supporting Holders (which, in each case, may be through the counsel), cause management and advisors of the Company to inform and/or confer with the Supporting Holders or their advisors as to (i) the status and progress of the Transactions, including progress in relation to the negotiations of the Definitive Documents; (ii) the status of obtaining any necessary authorizations (including any consents) with respect to the Transactions from each Supporting Holder, any competent judicial body, governmental authority, banking, taxation, supervisory, regulatory body, or any stock exchange; (iii) operational and financial performance matters (including liquidity), collateral matters, and the general status of ongoing operations, and (iv), reasonable responses to all reasonable diligence requests, subject to any applicable restrictions and limitations set forth in any Confidentiality Agreements then in effect, which the Company agrees to provide in a timely manner; it being understood that any confidential information provided hereunder shall be governed by the non-disclosure agreement or other confidentiality obligations then in effect between the Company and each Supporting Holder receiving such information; (14) it will promptly notify counsel to the Supporting Holders, and in any event within one (1) Business Day after obtaining knowledge thereof, of (i) any breach by the Company and/or any Supporting Holder in any respect of any of their respective obligations, representations, warranties, or covenants set forth in this Agreement or (ii) the occurrence of a Termination Event (as defined below); (15) it will not: (i) consummate the Transactions unless each of the conditions to the consummation of such transactions set forth in this Agreement and/or the Definitive Documents has been satisfied (or waived by the applicable Parties as required herein or in the applicable Definitive Document); (ii) object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Transactions; 8 (iii) solicit, initiate, encourage, or propose any Alternative Transaction (as defined below); (iv) amend the articles of incorporation, bylaws or other similar organizational documents (whether by merger, consolidation or otherwise) of it or Newco in a manner that would be adverse to the Supporting Holders, other than in connection with any amendment of the terms of the Company’s existing Series A convertible preferred stock, or the issuance of new convertible preferred stock in exchange for Company’s existing Series A convertible preferred stock, with such terms that would not be materially adverse to the Supporting Holders; (v) other than as contemplated by the Transactions, make any payment in satisfaction of any existing funded indebtedness other than regularly scheduled payments of interest and any required principal payment required under a finance or capital lease and as would otherwise be permitted under the Indentures; (vi) other than pursuant to an agreement in effect as of the date hereof pursuant to the Company’s executive compensation plans, (i) issue, deliver or sell, or authorize the issuance, delivery or sale of, any Company securities, repurchase, redeem or retire any Company securities (except pursuant to the Transactions, the Equity Raise and/or as contemplated in the Term Sheet, or any issuance of convertible preferred stock as described in clause (iv) above or any shares of the Company’s common stock issuable upon conversion of the Company’s convertible preferred stock) or (ii) amend any term of any Company security (in each case, whether by merger, consolidation or otherwise) in a manner that would be adverse to the Supporting Holders; (vii) enter into any agreement or arrangement that waives, releases or assigns, or modifies in any material respect, any of its material rights, claims or benefits, other than in the ordinary course of business substantially consistent with past practice or in furtherance of the Transactions; (viii) sell, lease or otherwise transfer, or create or incur any lien on, any of its assets, securities, properties, interests or businesses, other than in the ordinary course of business or consistent with past practice or in furtherance of the Transactions;

9 (ix) make any loans, advances or capital contributions to, or investments in, any other person or entity, other than in the ordinary course of business or consistent with past practice or in furtherance of the Transactions; (x) (1) execute or file any agreement, instrument, form, or other document that is utilized to implement or effectuate, or that otherwise relates to, this Agreement and/or the Transactions that, in whole or in part, is not consistent in all material respects with this Agreement or the Definitive Documents, as applicable, including the consent rights of the Supporting Holders set forth herein or (2) waive, amend, or modify any of the Definitive Documents, which waiver, amendment, modification, or filing contains any provision that is not consistent in all material respects with this Agreement, including the consent rights set forth herein; or (xi) (1) seek discovery in connection with, prepare, or commence any proceeding or other action that challenges (A) the amount, validity, allowance, character, enforceability, or priority of any claims of the Supporting Holders arising under the Notes or the Indentures, or (B) the validity, enforceability, or perfection of any lien or other encumbrance securing any such claims or (2) support any Person in connection with any of the acts described this Section 2(c)(15)(xi). (d) Additional Provisions Regarding Company Commitments. Notwithstanding the foregoing or anything contained herein, nothing in this Agreement shall: (1) impair or prevent the Company from enforcing this Agreement or any Definitive Document or contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement or any Definitive Document, including, without limitation, by exercising its rights or remedies reserved herein or in the Definitive Documents; or (2) be construed to prevent the Company from exercising any consent rights or its rights or remedies specifically reserved herein or in the Definitive Documents. Section 3. Effectiveness. (a) Agreement Effective Date. This Agreement shall become effective and binding upon each of the Parties that has executed and delivered counterpart signature pages to this Agreement at 11:59 p.m., prevailing Eastern Time, on the date on which all of the following 10 conditions have been satisfied or waived in accordance with this Agreement (the “Agreement Effective Date”): (1) the Company shall have executed and delivered counterpart signature pages of this Agreement to counsel to each of the Parties as specified in Section 21; (2) each Supporting Holder listed on Schedule 1 hereof shall have executed and delivered counterpart signature pages of this Agreement to counsel to each of the Parties specified in Section 22; (3) the Company shall have sold equity of the Company yielding gross cash proceeds to the Company of not less than $250,000,000 upon terms satisfactory to the Majority Supporting Holders (the “Equity Raise”); and (4) the Company shall have obtained amendments to each of (i) that certain Credit Agreement, entered into on April 15, 2021, among the Company, the guarantors from time to time party thereto, the lenders from time to time party thereto, the issuing banks from time to time party thereto, and MUFG Bank, Ltd., as administrative agent and as collateral agent (as amended, restated, and otherwise modified from time to time, the “Revolving Credit Agreement”), (ii) that certain Credit Agreement entered into on July 19, 2024, among the Company, the guarantors from time to time party thereto, the lenders from time to time party thereto, and Morgan Stanley Senior Funding, Inc., as administrative agent and collateral agent (as amended, restated, and otherwise modified from time to time, the “Term Loan A Credit Agreement”), and (iii) that certain Uncommitted Letter of Credit and Reimbursement Agreement, entered into on July 16, 2021, among the Company, the guarantors from time to time party thereto, the lenders from time to time party thereto, the issuing banks from time to time party thereto, and Natixis, New York Branch, as administrative agent and as collateral agent (as amended, restated, or otherwise modified from time to time, the “LC Credit Agreement”) in the form attached as Exhibit C attached hereto. (b) Termination Date. This Agreement shall be effective as of the Agreement Effective Date until validly terminated in accordance with the terms hereof (the date on which such termination occurs, the “Termination Date”). Section 4. Representations and Warranties of Each Party. Each of the Parties severally (and not jointly) represents and warrants as to itself only to each of the other Parties hereto that the following statements are true and correct as of the Agreement Effective Date:

11 (a) Power and Authority. It has all requisite power and authority to enter into this Agreement and to carry out the transactions contemplated by, and perform its respective obligations under, this Agreement. (b) Authorization. The execution and delivery of this Agreement and the performance of its obligations hereunder have been duly authorized by all necessary action on its part. (c) No Conflicts. The execution, delivery and performance by it of this Agreement do not and shall not (i) violate any provision of law, rule or regulation applicable to it or its certificate of incorporation or by-laws (or other organizational documents) or (ii) conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default under any material contractual obligations to which it is a party. (d) Governmental Consents. The execution, delivery and performance by it of this Agreement do not and shall not require any registration or filing with, consent or approval of, or notice to, or other action to, with or by, any federal, state or other governmental authority or regulatory body, assuming the accuracy of the Supporting Holders’ representations in Section 5 hereof. (e) Binding Obligation. Upon the occurrence of the Agreement Effective Date, this Agreement is the legally valid and binding obligation of it, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability. (f) Alternative Transaction Negotiations. It is not a party to, or in discussions regarding, any contract, agreement, commitment, understanding or other binding agreement or obligation (written or oral) with any other person with respect to an Alternative Transaction (as defined below). (g) Good Standing. It is validly existing and in good standing under the laws of the state or jurisdiction of its organization. Section 5. Representations and Warranties of the Supporting Holders. Each of the Supporting Holders severally (and not jointly) represents and warrants as to itself only to each of the other Parties hereto that the following statements are true and correct as of the Agreement Effective Date: that it: (a) Nature of Purchase. Each Supporting Holder acknowledges and agrees (1) is either a “qualified institutional buyer” within the meaning of Rule 144A promulgated under the Securities Act of 1933, as amended (the “Securities Act”) or, for a Supporting Holder located outside the United States, a “non-U.S. person” as defined in Regulation S promulgated under the Securities Act; 12 (2) is acquiring the New Notes for its own account, for investment, and not with a view to or for sale in connection with any distribution thereof in violation of the registration provisions of the Securities Act or the rules and regulations promulgated thereunder; (3) is aware that an investment in the New Notes involves economic risk and that it may lose its entire investment in the New Notes and that the New Notes will be “restricted securities” under the federal securities laws, will not be registered under the Securities Act or any state securities or “blue sky” laws and may not be sold except pursuant to an effective registration statement thereunder or an exemption from registration under the Securities Act and applicable state securities laws and; (4) has adequate information concerning the business and affairs of the Company to make an informed decision regarding the exchange by it of the 2026 Notes and 2029 Notes for the New Notes, and has independently and without reliance upon the Company (other than reliance on the accuracy of the Company’s representations and warranties set forth herein), and based upon such information such Supporting Holder has deemed appropriate, made its own analysis and decision to enter into this Agreement. provided, however it is understood and agreed that the representations and warranties (whether set forth in Section 4 above or this Section 5) made by a Supporting Holder that is an investment manager, advisor, or subadvisor of a beneficial owner of Notes are made with respect to, and on behalf of, such beneficial owner and not such investment manager, advisor, or subadvisor, and, if applicable, are made severally (and not jointly) with respect to the investment funds, accounts, and other investment vehicles managed by such investment manager, advisor, or subadvisor, (b) Ownership of the Notes. Each Supporting Holder severally (and not jointly) represents and warrants as to itself only that it beneficially owns (and/or (i) serves as the investment advisor or manager for the beneficial holder(s) of such Notes having the power to vote and dispose of such holdings on behalf of such beneficial holder(s) or (ii) to the extent it has loaned or transferred any Notes to any third-party on a temporary basis pursuant to any loan or repurchase agreement (any such notes, “Loaned Notes”), it has recalled any Loaned Notes to the extent possible, and will use commercially reasonable efforts to beneficially own any such Notes as of the closing date of the Transactions) as of the Agreement Effective Date the aggregate principal amount of Notes set forth opposite its name on Schedule 1 hereto, which represent all the Notes beneficially owned (or recalled or managed as set forth above) by such Supporting Holder as of the Agreement Effective Date, and such Notes, and any Additional Notes (defined below) acquired by the Supporting Holder following the Agreement Effective Date, in each case, shall be owned by the Supporting Holder free and clear of any pledge, security interest, claim, lien or other encumbrance of any kind or, with respect to any recalled notes as set forth above, shall be so owned if such Notes are successfully recalled prior to the consummation of the Transactions. For the avoidance of doubt and notwithstanding anything in this Agreement to the contrary, any Supporting Holder’s inability to participate in the Private Exchange or consent to

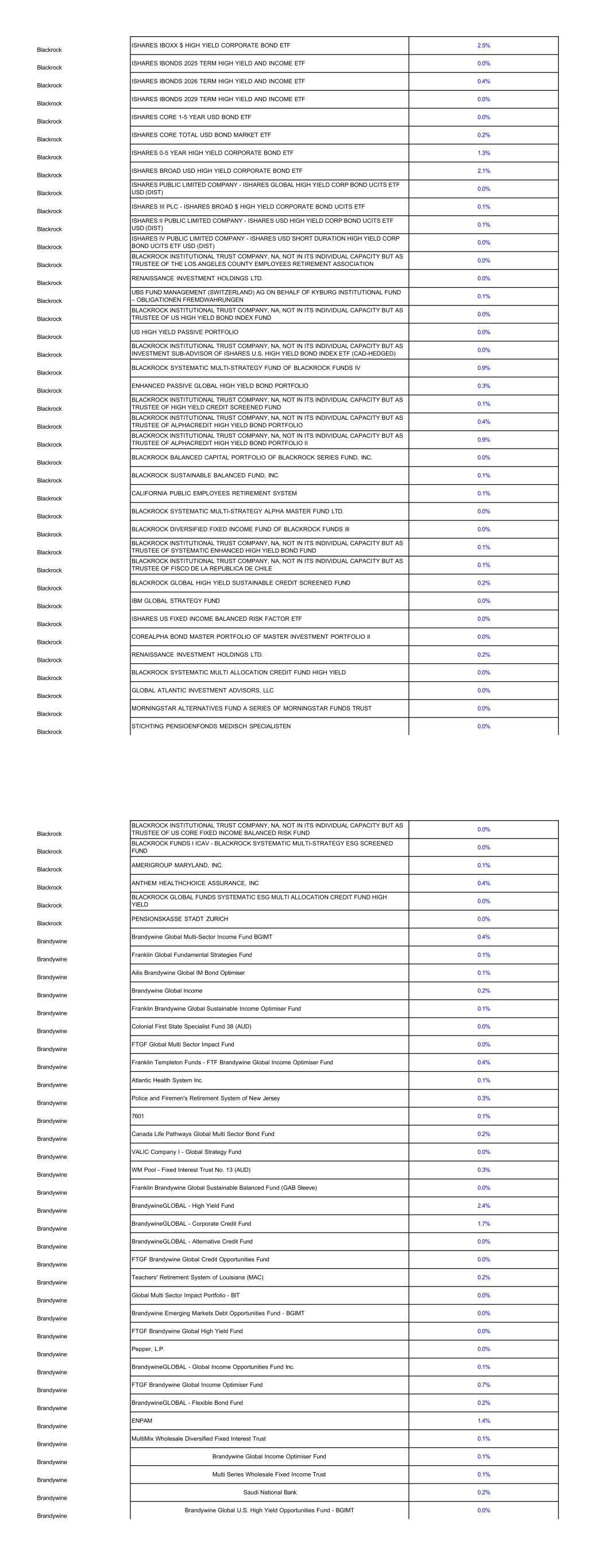

13 the Proposed Amendments with respect to any Notes on account of an inability to recall Loaned Notes, if any, prior to consummation of the Transactions, or on account of applicable internal and external guidelines and restrictions, shall not be a default with respect to such Supporting Holder’s obligations under this Agreement or any Definitive Document. Section 6. Representations and Warranties of the Company. The Company represents and warrants to each of the other Parties hereto that the following statements are true and correct as of the Agreement Effective Date, that: (a) Diligence Materials. The diligence materials and other information concerning the Company that the Company or its advisors provided to any other Party are true and correct in all material respects. (b) Fiduciary Duties. The Company believes that entry into this Agreement is consistent with the exercise of the Company’s fiduciary duties. Section 7. Transfer Restrictions; Joinder. Each Supporting Holder severally (and not jointly) covenants that, from the Agreement Effective Date until the earlier of (i) the termination of this Agreement pursuant to Section 12, Section 13, Section 14 or Section 15 hereof or (ii) the consummation of the Transactions, such Supporting Holder shall be bound by the following transfer restrictions provisions set forth in this Section 7 (including with respect to any Additional Notes (as defined below) acquired by the Supporting Holder following the Agreement Effective Date): (a) from the Agreement Effective Date through any Termination Date, no Supporting Holder shall sell, resell, reallocate, use, pledge, assign, transfer, loan, grant, hypothecate, participate, donate, or otherwise encumber or dispose of, directly or indirectly (including through derivatives, options, swaps, pledges, forward sales, or other transactions) (each of the foregoing transactions, a “Transfer”) any ownership (including any beneficial ownership as defined in the Rule 13d-3 under the Exchange Act) in any 2025 Notes, 2026 Notes, or 2029 Notes to any Affiliated1 or unaffiliated party (a “Transferee”), including any party in which it may hold a direct or indirect beneficial interest, unless either (i) the Transferee executes and delivers to counsel to the Company and counsel to the Supporting Holders, at or before the time of the proposed Transfer, an executed form of joinder, substantially in the form attached hereto as Exhibit B, providing that, among other things, that such Person signatory thereto is bound by the terms of this Agreement, and following such execution, shall be a “Party” under this Agreement (a “Joinder”), (ii) the Transferee is a Supporting Holder or an Affiliate thereof that has executed a Joinder at or before the time of the proposed Transfer and the Transferee provides notice of such Transfer (including the amount and type of Notes Transferred) to counsel to the Company and counsel to the Supporting Holders within three (3) Business Days after the time of the Transfer, 1 “Affiliate” means any other entity directly or indirectly controlling, controlled by, or under direct or indirect common control with, such specified entity. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling,” “controlled by,” and “under common control with”) as used with respect to any entity shall mean the possession, directly or indirectly, of the right or power to direct or cause the direction of the management or policies of such entity, whether through the ownership of voting securities, by agreement, or otherwise. 14 or (iii) such Transfer is in connection with the bona fide liquidation, dissolution, reorganization or wind-down of a collateralized loan obligation, collateralized debt obligation or similar investment vehicle for which the underlying Notes serve as collateral and the Transferee in connection therewith has executed a Joinder at or before the time of the proposed Transfer. (b) Upon compliance with the requirements of Section 7(a) above, the Transferee shall be deemed a “Supporting Holder” and a “Party” under this Agreement and the transferor shall be deemed to relinquish its rights (and be released from its obligations) under this Agreement to the extent of the rights and obligations in respect of such transferred Notes; provided that, for the avoidance of doubt and as set forth in Section 9(c) of this Agreement, no Transfer of Notes to any third party, regardless of whether such transfer is permitted pursuant to the terms of this Agreement, shall result in the transfer of any transferor’s obligations to fund the New Money Commitment Amount, nor shall any Transfer release any Supporting Holder of its commitments or obligations hereunder with respect to its obligation fund its New Money Commitment Amount. Any Transfer in violation of Section 7(a) above shall be void ab initio and of no force or effect until such a Joinder is executed and effective. (c) Except as expressly provided in this Section 7(c), this Agreement shall in no way be construed to preclude the Supporting Holders from acquiring additional Notes (“Additional Notes”); provided, however, that (i) such additional Notes shall automatically and immediately upon acquisition by a Supporting Holder be deemed subject to the terms of this Agreement (regardless of when or whether notice of such acquisition is given to counsel to the Company or counsel to the Supporting Holders), (ii) such Supporting Holders must provide notice of such acquisition (including the amount and type of Notes acquired) to counsel to the Company and counsel to the Supporting Holders within five (5) Business Days of such acquisition, and (iii) any acquisition of Additional Notes which are 2026 Notes or 2029 Notes shall require the consent of the Majority Supporting Holders (with such consent not to be unreasonably withheld by any individual Supporting Holder). For the avoidance of doubt, and notwithstanding anything to the contrary set forth herein, all Transfers of Notes shall remain subject to the terms of the Indentures. (d) Notwithstanding Section 7(a), any entity that (a) holds itself out to the public or the applicable private markets as standing ready in the ordinary course of business to purchase from customers and sell to customers Notes (or enter with customers into long and/or short positions in Notes), in its capacity as a dealer or market maker in Notes and (b) is, in fact, regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt) (a “Qualified Marketmaker”) that acquires any Notes with the purpose and intent of acting as a Qualified Marketmaker for such Notes shall not be required to execute and deliver a Joinder in respect of such notes if (i) such Qualified Marketmaker subsequently transfers such Notes (by purchase, sale, assignment, participation, or otherwise) within ten (10) Business Days of its acquisition to a Transferee that is an entity that is not an Affiliate, Affiliated fund, or Affiliated entity with a common investment advisor; and (ii) such transferee has executed a Joinder at or before the time of the proposed Transfer; and (iii) the Transfer otherwise is permitted under Section 7(a). To the extent that a Supporting Holder is acting in its capacity as a Qualified Marketmaker, it may Transfer (by purchase, sale, assignment, participation, or otherwise) any right, title, or interests in Notes that the Qualified Marketmaker acquires from a holder of the Notes who is not a Supporting Holder without the requirement that the Transferee be a permitted Transferee pursuant to Section 7(a).

15 (e) The Company understands that the Supporting Holders are engaged in a wide range of financial services and businesses, and, in furtherance of the foregoing, the Company acknowledges and agrees that, notwithstanding anything in this Agreement to the contrary, the obligations set forth in this Agreement shall only apply to the trading desk(s) and/or business group(s) of the Supporting Holders that principally manage and/or supervise each Supporting Holder’s investment in the Company as set forth in the signature pages hereto, and shall not apply to any other trading desk or business group of each Supporting Holder, so long as they are not acting at the direction or for the benefit of such Supporting Holder or in connection with such Supporting Holder’s investment in the Company. (f) Further, notwithstanding anything in this Agreement to the contrary, the Parties agree that, in connection with the delivery of signature pages to this Agreement by a Supporting Holder that is a Qualified Marketmaker before the occurrence of conditions giving rise to the effective date for the obligations and the support hereunder, such Supporting Holder shall be a Supporting Holder hereunder solely with respect to the Notes listed on such signature pages and shall not be required to comply with this Agreement for any other Notes it may hold from time to time in its role as a Qualified Marketmaker. (g) Notwithstanding anything to the contrary in this Section 7, the restrictions on Transfer set forth in this Section 7 shall not apply to the grant of any liens or encumbrances on any Notes in favor of a bank or broker-dealer holding custody of such Notes in the ordinary course of business and which lien or encumbrance is released upon the Transfer of such Notes (h) Any holder of 2026 Notes or 2029 Notes may, subject to the consent of the Majority Supporting Holders (with such consent not to be unreasonably withheld by any individual Supporting Holder), become a Supporting Holder (any such Supporting Holder, a “Subsequent Supporting Holder”) party to this Agreement by executing and delivering a Joinder to the Supporting Holders and the Company pursuant to Section 21 hereof. Section 8. Definitive Documents. (a) The “Definitive Documents” governing the Transactions shall include this Agreement, the Term Sheet, the Supplemental Indentures, intercreditor agreement, subordination agreement and or other documents effectuating the Proposed Amendments, the definitive documents governing the New Notes (including an indenture and guarantee and security documents), the definitive documents governing all intercompany loans contemplated by the Term Sheet (including loan or credit agreements and guarantee and security documents), a notes purchase agreement or similar document with respect to the purchase of the New Notes, the corporate governance documents of NewCo, and all other documents (including all exhibits, schedules, supplements, appendices, annexes, instructions and attachments thereto) that are utilized to implement or effectuate, or that otherwise relate to, the Transactions. (b) Each of the Definitive Documents not executed or in a form attached to this Agreement as of the Agreement Effective Date remains subject to negotiation and completion. Upon completion, the Definitive Documents and every other document, deed, agreement, filing, notification, letter, or instrument related to the Transactions shall each contain terms, conditions, representations, warranties, and covenants consistent with the terms of this Agreement and the 16 Term Sheet. The Definitive Documents not otherwise executed as of the Agreement Effective Date or attached hereto shall be, to the extent permitted by law, consistent with this Agreement in all respects and otherwise acceptable in form and substance to the Majority Supporting Holders (as defined below). (c) Notwithstanding the foregoing or anything to the contrary in this Agreement, any change after the Agreement Effective Date, the Parties acknowledge and agree that (i) as of the consummation of the transactions, the Company’s corporate organizational structure and compliance with its corporate governance documents and applicable law shall be satisfactory to the Majority Supporting Holders, and that the Definitive Documents shall contain, as applicable, conditions precedent providing that each of the foregoing is reasonably acceptable to each Supporting Holder as of the consummation of the Transactions, and (ii) any corporate organizational or other restructuring steps taken for any reason, including, without limitation, in connection with the tax consequences of the Transactions, shall be reasonably acceptable to the Majority Supporting Holders, irrespective of whether the agreements pursuant to which such steps are taken are Definitive Documents. Section 9. New Money Commitment. (a) Each Supporting Holder hereby commits, subject to the terms and conditions of this Agreement and the Definitive Documents, to fund, via purchase for cash on the closing date of the Transactions, its respective portion of the aggregate principal amount of the New Notes as set forth on Schedule 2 (the “New Money Commitment Percentage” and each Supporting Holder’s portion its “New Money Commitment Amount"). The commitments of the Supporting Holders to fund their respective New Money Commitment Amounts are several, not joint, such that no Supporting Holder shall be liable or otherwise responsible for the New Money Commitment Amount of any other Supporting Holder. (b) Each Supporting Holder shall have the right to employ the services of its Affiliates (including, without limitation, funds, entities, accounts and clients managed or advised by such Supporting Holders) in providing all or a portion of its New Money Commitment Amount; provided, the foregoing shall not release any Supporting Holder of its commitments or obligations hereunder. Each Supporting Holder shall also have the right to allocate all or a portion of any fees (in the form of cash, additional New Notes or other securities) due with respect to its New Money Commitment to its Affiliates (including, without limitation, funds, entities, accounts and clients managed or advised by such Supporting Holders) as it may designate. Except as expressly provided in this Section 9(b), no Holder may Transfer any portion of its obligation to fund its New Money Commitment Amount and any attempted Transfer in violation of this provision shall be ineffective and void ab initio. (c) In the event that any Supporting Holder fails to timely fund its New Money Commitment Amount (a “Funding Default” and such holder, a “Funding Default Holder”), the Supporting Holders (other than any Funding Default Holder) shall have the right, but not the obligation, within five (5) Business Days after receipt of written notice from the Company to all Supporting Holders of such Funding Default, which notice shall be given within one (1) Business Day following the occurrence of such Funding Default and to all Supporting Holders substantially concurrently (such five (5) Business Day period, the “Replacement Period”), to elect, by written

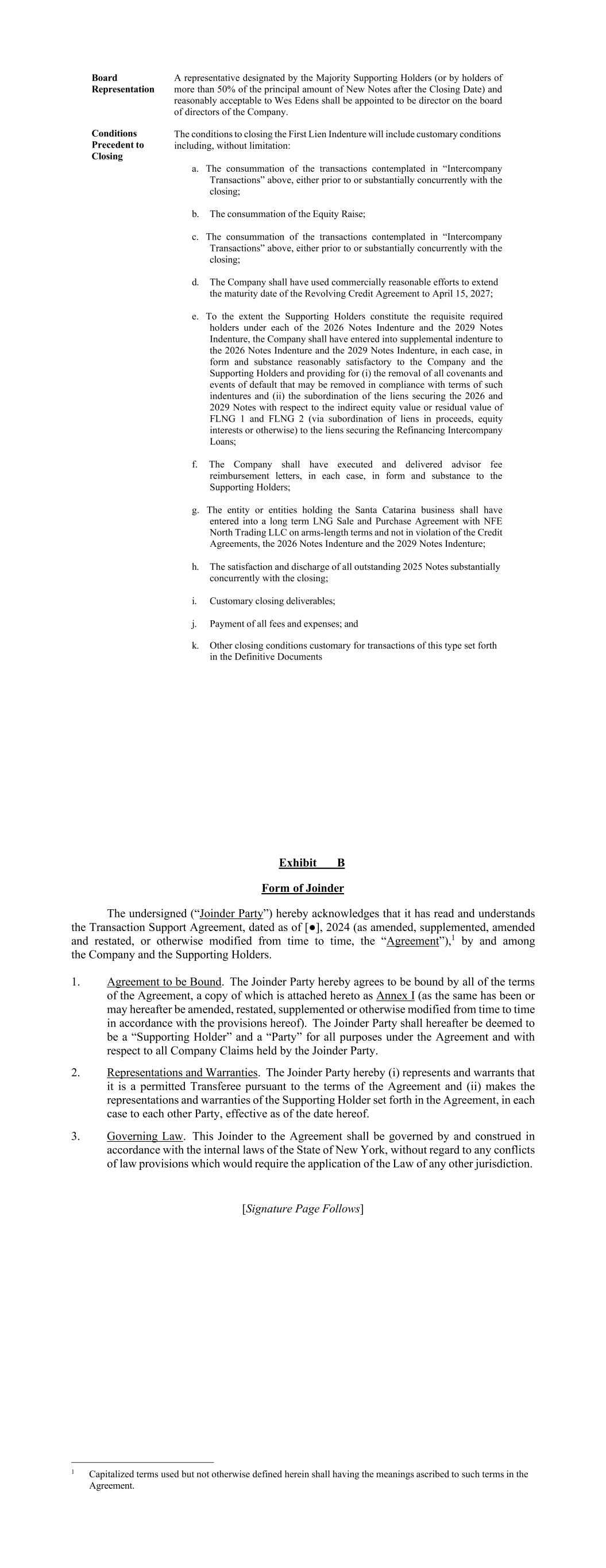

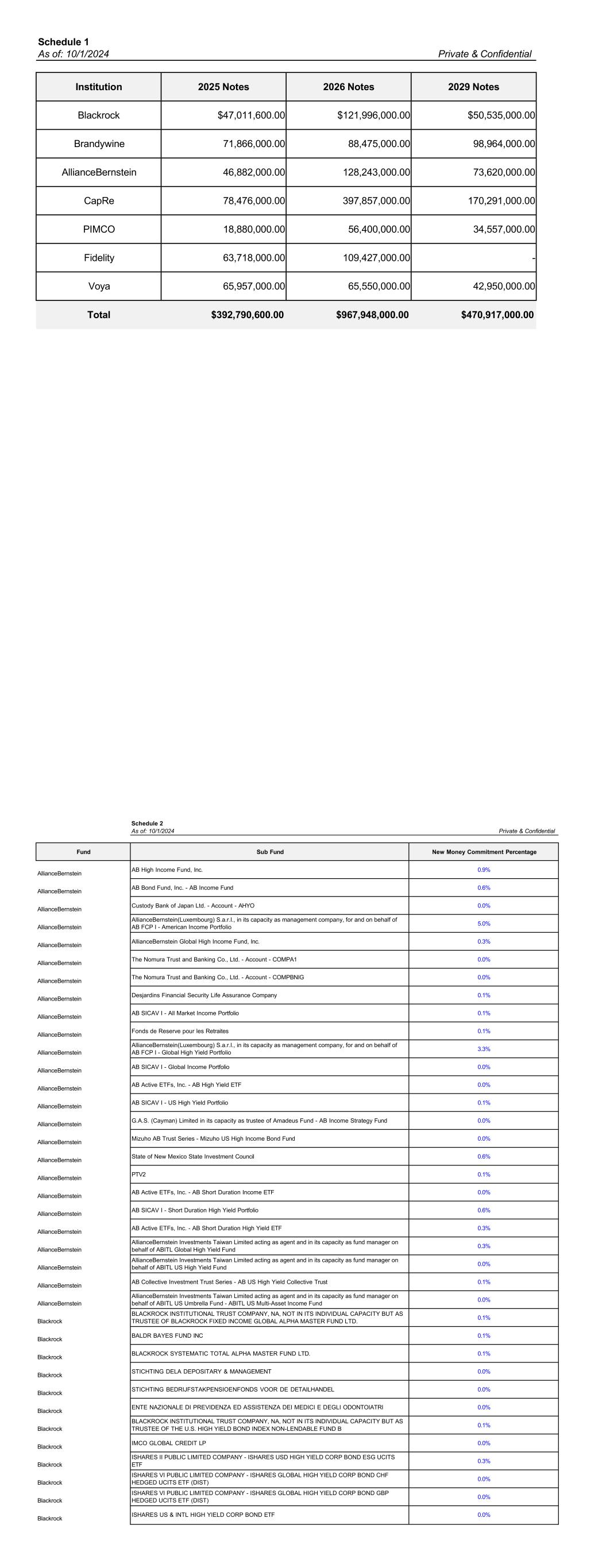

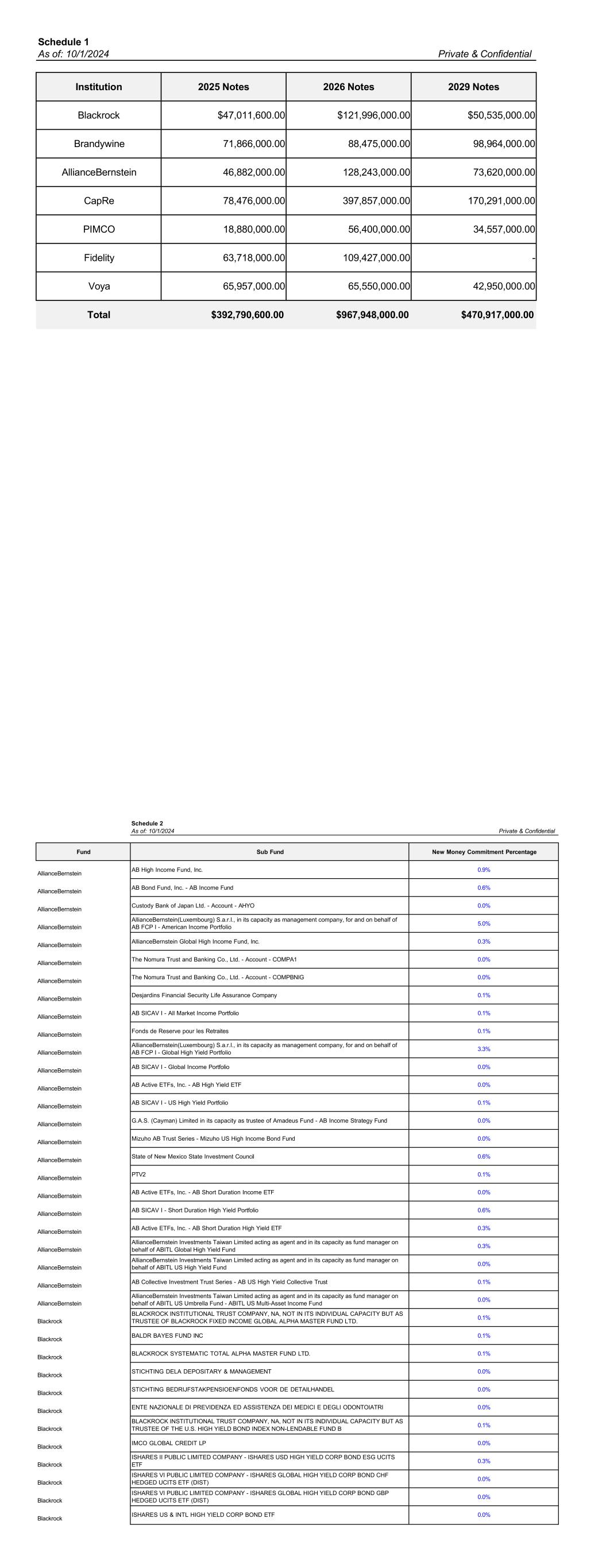

17 notice to the Company, to fund all or any portion of such Funding Default Holder’s unfunded New Money Commitment Amount (such funding, a “Replacement Funding,” and any Supporting Holders providing Replacement Funding, the “Replacing Funding Holders”) on the terms and subject to the conditions set forth in this Agreement and in such amounts as may be agreed upon by all of the non-defaulting Supporting Holders that elect to fund all or any portion of such Funding Default Holder’s New Money Commitment Amount, or, if no such agreement is reached by the date upon which the Replacement Period expires, based upon each such electing Supporting Holder’s pro rata share of such unfunded New Money Commitment Amount, determined based on the New Money Commitment Amounts of the applicable Replacing Funding Holders. Within one (1) Business Day following the expiration of the Replacement Period, the Company shall provide each Replacing Funding Holder with a written notice (the “Replacement Funding Notice”) of the additional New Money Commitment Amount it shall fund with respect to the Replacement Funding. Within one (1) Business Day from receipt of the Replacement Funding Notice, each Replacing Funding Holder will fund its allocated portion of the Replacement Funding, with any failure to do so being treating as a Funding Default in accordance with this Section 9(c). If a Funding Default occurs, the closing date of the Transactions shall be delayed only to the extent necessary to allow for the Replacement Funding to be completed within the Replacement Period. (d) For the avoidance of doubt, nothing in this Agreement shall require any Supporting Holder to fund more of the New Money Commitment Amount than its New Money Commitment Percentage as of the Agreement Effective Date, except as agreed otherwise pursuant to Section 9(c) above. (e) Notwithstanding anything to the contrary set forth in Section 16, no provision of this Agreement shall relieve any Funding Default Holder from liability hereunder, or limit the availability of the remedies available to the non-defaulting parties hereto, in connection with any such Funding Default Holder’s Funding Default. (f) The commitment fee contemplated in the Term Sheet (the “Commitment Fee”) shall be paid to the Supporting Holders in accordance therewith; provided that (i) no Subsequent Supporting Holder shall receive any Commitment Fee on account of the Private Exchange and (ii) except with the consent of the Majority Supporting Holders, no Commitment Fee shall be paid with respect to the exchange of any Additional Notes. Section 10. Exclusivity. The Company agrees that, from the Agreement Effective Date through November 30, 2024 (the “Exclusivity Period”), the Company will not and will direct its Affiliates, representatives or agents not to, directly or indirectly, (i) solicit, initiate or knowingly encourage the initiation of, facilitate or cooperate with any inquiry, proposal, indication of interest or offer from any person or entity relating to any debt financing transaction to recapitalize the Company’s corporate indebtedness in lieu of the Transaction (other than any refinancing of the Company’s Term Loan B loans subject to the right of first offer for the Supporting Holders, including without limitation any debt financing that refinances any of the Notes (any such inquiry, proposal, indication of interest or offer, an “Alternative Transaction”); (ii) participate in any discussions or negotiations (or continue discussions) with any third party regarding, or furnish to any third party (other than the Company’s own representatives) any information in connection with, any Alternative Transaction or potential Alternative Transaction; or (iii) enter into any 18 agreement, arrangement or understanding regarding any Alternative Transaction or potential Alternative Transaction. The Company further agrees to, and shall direct its representatives to, immediately cease (i) existing discussions or negotiations with any person or entity regarding any Alternative Transaction and (ii) the sharing of any Confidential Information to any other person or entity regarding any Alternative Transaction. The Company shall notify counsel to the Supporting Holders of the receipt of any Alternative Transaction proposal by the Company during the Exclusivity Period within two (2) Business Days of such receipt, with such notice to a copy of such proposed Alternative Transaction (including the identity of the proposing party). The Company’s obligations under this Section 10 shall survive any termination of this Agreement and shall continue in full force and effect for the remaining duration of the Exclusivity Period thereafter, if any, unless such termination is a result of a Company Termination Event (as defined below) pursuant to Section 13, an automatic termination pursuant to Section 14 or by mutual consent pursuant to Section 15. For the avoidance of doubt, this Section 10 shall not apply to, nor restrict in any way, the Company’s ability to continue to access financing to fund Brazil construction, solely with respect to amounts consistent with the Company’s financial projections provided to the Supporting Holders as of the date hereof. Section 11. [Reserved]. Section 12. Termination of Obligations by Supporting Holders. Upon the occurrence of a Termination Event (as defined below), this Agreement may be terminated by, and such termination shall be effective upon, delivery of a written notice executed by the Supporting Holders holding a majority in principal amount of each individual series of the Notes (the “Majority Supporting Holders”) in accordance with Section 21 hereof to the other Parties and the obligations of each of the Parties hereunder shall thereupon terminate and be of no further force or effect with respect to each Party. “Termination Event” means that: (a) the Company shall have publicly announced its intention to terminate the pursuit of consummation of the Transactions (which announcement may, for the avoidance of doubt, also constitute a breach of this Agreement by the Company); (b) the Transactions have not been consummated or before November 30, 2024 (the “Outside Date”); (c) the Company (A) breaches in any material respect (without giving effect to any “materiality” qualifiers set forth therein) any of the representations, warranties, or covenants of the Company set forth in this Agreement that, to the extent curable, remains uncured for five (5) Business Days after the Majority Supporting Holders transmit a written notice in accordance with Section 21 detailing any such breach or (B) amends or modifies any of (or consents to any amendment or modification of any of) the Definitive Documents other than, in each case, in a non-material or ministerial respect, unless such amendment or modification is otherwise consented to in accordance with the terms hereof; (d) the issuance by any governmental entity, including any regulatory authority or court of competent jurisdiction, of any final, non-appealable ruling or order that (i) enjoins the consummation of a material portion of Transactions and (ii) remains in effect for ten (10) Business Days after the Majority Supporting Holders transmit a written notice in

19 accordance with Section 21 detailing any such issuance; provided, that, this termination right may not be exercised by any Party that sought or requested such ruling or order in contravention of any obligation set out in this Agreement; (e) without the prior consent of the Majority Supporting Holders, the Company (A) voluntarily commences any case or files any petition seeking bankruptcy, winding up, dissolution, liquidation, administration, moratorium, reorganization or other relief under any federal, state, or foreign bankruptcy, insolvency, administrative receivership or similar law now or hereafter in effect except consistent with this Agreement, (B) consents to the institution of, or fails to contest in a timely and appropriate manner, any involuntary proceeding or petition described above, (C) makes a general assignment or arrangement for the benefit of creditors or (D) takes any corporate action for the purpose of authorizing any of the foregoing; or (f) any of the conditions set forth herein or in the Term Sheet to be satisfied by the Company have not been satisfied or, as permitted herein or in the Term Sheet, waived on or prior to the Outside Date. At any time after a Termination Event has occurred, the Majority Supporting Holders may waive the occurrence of the Termination Event. No such waiver of a Termination Event shall affect any subsequent Termination Event or impair any right consequent thereon and such Supporting Holders shall have no liability to the other Parties or each other in respect of any termination of this Agreement in accordance with the terms hereof. Notwithstanding anything to the contrary herein, any termination pursuant to this Section 12 shall not be effective with respect to a given Supporting Holder if such Supporting Holder failed to perform or comply in all material respects with the terms and conditions of this Agreement, with such failure to perform or comply causing, or resulting in, the occurrence of the Termination Event giving rise to such termination. Section 13. Termination of Obligations by the Company. Upon the occurrence of a Company Termination Event (as defined below), this Agreement may be terminated by delivery of a written notice in accordance with Section 21 below by the Company to the other Parties and the obligations of each of the Parties hereunder shall thereupon terminate and be of no further force or effect with respect to each Party. “Company Termination Event” means: (a) the consummation of the Transactions has not occurred on or prior to the Outside Date; (b) any of the conditions set forth herein or in the Term Sheet to be satisfied by the Supporting Holders have not been satisfied or, as permitted herein or in the Term Sheet, waived on or prior to the Outside Date; (c) any Supporting Holder breaches in any material respect (without giving effect to any “materiality” qualifiers set forth therein) any of the representations, warranties, or covenants of the Supporting Holders set forth in this Agreement that, to the extent curable, remains uncured for five (5) Business Days after the Company transmits a written notice in accordance with Section 21 detailing any such breach; provided, however, that the Company may terminate this Agreement pursuant to this Section 13(c) only as to the breaching Supporting Holder, unless such breach would or would reasonably be expected to (i) materially delay or 20 materially impair the consummation of the Transactions or (ii) materially and adversely affect the rights and benefits available to the Company as a result of the Transactions, in which case the Company may terminate this Agreement as to all Parties; or (d) either (i) the occurrence of one or more Funding Defaults, for which Replacement Funding is not obtained during the Replacement Period, or (ii) the Private Exchange results in the exchange of less than 50% of the 2026 Notes and 2029 Notes outstanding, on a per- series basis and in aggregate principal amount. At any time after a Company Termination Event has occurred, the Company in its sole discretion may waive the occurrence of the Company Termination Event. No such waiver shall affect any Supporting Holder’s rights with respect to any Termination Event or the Company’s rights with respect to any subsequent Company Termination Event or impair any right consequent thereon and the Company shall have no liability to the other Parties or each other in respect of any termination of this Agreement in accordance with the terms hereof. Notwithstanding anything to the contrary herein, the Company may not terminate this Agreement pursuant to this section if prior to a material breach by a Supporting Holder the Company failed to perform or comply in all material respects with the terms and conditions of this Agreement, with such failure to perform or comply causing, or resulting in, the occurrence of the Termination Event giving rise to such termination. Section 14. Automatic Termination. This Agreement shall, except as expressly provided herein, automatically terminate without any further required action or notice upon the consummation of the Transactions and the obligations of each of the Parties hereunder shall thereupon terminate and be of no further force or effect with respect to each Party. Section 15. Termination by Mutual Consent. This Agreement may be terminated at any time prior to the consummation of the Transactions by mutual written consent of the Company and the Majority Supporting Holders. Section 16. Effect of Termination. Except as set forth herein, upon the occurrence of the Termination Date as to a Party, this Agreement shall be of no further force and effect as to such Party and each Party subject to such termination shall be released from its commitments, undertakings, and agreements under or related to this Agreement and shall have the rights and remedies that it would have had, had it not entered into this Agreement, and shall be entitled to take all actions, whether with respect to the Transactions or otherwise, that it would have been entitled to take had it not entered into this Agreement, including with respect to any and all claims; provided, however, that in no event shall any such termination relieve any Party from (a) liability for its breach or non-performance of its obligations under this Agreement prior to the Termination Date or (b) obligations under this Agreement which by their terms expressly survive termination of this Agreement. Upon the occurrence of the Termination Date prior to the Settlement Date, any and all tendering of any Notes and consents given by the Parties subject to such termination with respect to the Transactions, in each case before the Termination Date, shall be deemed, for all purposes, to be null and void from the first instance and shall not be considered or otherwise used in any manner by the Parties in connection with the Transactions, this Agreement, or otherwise (without the need to seek an order of a court of competent jurisdiction or consent from the Company or any other applicable Party allowing such change). Nothing in this Agreement shall

21 be construed as prohibiting the Company or any of the Supporting Holders from contesting whether any such termination is in accordance with its terms or to seek enforcement of any rights under this Agreement that arose or existed before the Termination Date. Except as expressly provided in this Agreement, nothing herein is intended to, or does, in any manner waive, limit, impair, or restrict any right of any Supporting Holder, or the ability of any Supporting Holder, to protect and preserve its rights (including rights under this Agreement), remedies, and interests, including its claims against any other Party. For the avoidance of doubt, no purported termination of this Agreement shall be effective if the Party seeking to terminate this Agreement is in material breach of this Agreement. This Section 16 shall survive any termination of this Agreement and shall continue in full force and effect. Section 17. Specific Performance; Damages. Each Party hereto recognizes and acknowledges that a breach by it of any covenants or agreements contained in this Agreement will cause the other Parties to sustain damages for which such Parties shall not have an adequate remedy at law for money damages, and therefore each Party hereto agrees that in the event of any such breach the other Parties shall be entitled to the remedy of specific performance of such covenants and agreements and injunctive and other equitable relief in addition to any other remedy to which such Parties may be entitled, at law or in equity. Notwithstanding anything to the contrary in this Agreement, no Party or its representatives will be liable to any other Party for any punitive, incidental, consequential, special, or indirect damages, including the loss of future revenue or income or opportunity, relating to a breach or alleged breach of this Agreement; provided, that any consequential or indirect damages arising out of any Alternative Transaction entered into by the Company in violation of this Agreement including, without limitation, Section 10, shall not be waived. Notwithstanding the foregoing sentence nor anything to the contrary in this Agreement and for the avoidance of doubt, no Party shall be precluded from seeking actual damages arising out of or relating to any breach or alleged breach of this Agreement. Section 18. Amendments. (a) This Agreement may not be modified, amended or supplemented, and compliance with any provision may not be waived (each of the foregoing, an “Amendment”), except in a writing signed by the Company and the Majority Supporting Holders; provided, however, that (i) any such modification, amendment, waiver or supplement that relates solely to a specific Supporting Holder or group of Supporting Holders and does not adversely affect any other Supporting Holder shall require only a writing signed by the Company and such specific Supporting Holder or group of Supporting Holders, and (ii) if the proposed modification, amendment, waiver or supplement adversely affects any of the Supporting Holders in a manner that is disproportionately adverse in any material respect from the effect such modification, amendment, supplement or waiver has on the other Supporting Holders, other than in proportion to the amount of such Notes held by such Supporting Holder, then the consent of each such disproportionately affected Supporting Holder shall also be required to effectuate such modification, amendment, waiver or supplement. (b) Any (i) Amendment to this Agreement that affects the New Money Commitment Percentage of any Supporting Holder shall require the consent of such Supporting 22 Holder or (ii) change, modification, or amendment to this Agreement or any Definitive Document which extends the maturity, decrease interest rate or call protection, adversely modifies collateralization, or decreases the fees payable in connection with the issuance of the New Notes, or materially affects the outcome of the Intercompany Transactions, in each case as set forth in the Term Sheet, shall require the consent of each Supporting Holder and, if such consent is withheld by a given Supporting Holder, such Supporting Holder may terminate its obligations hereunder. (c) Any Amendment to this Agreement that does not comply with this Section 18 shall be ineffective and void ab initio. Section 19. No Waiver. The failure of any Party hereto to exercise any right, power or remedy provided under this Agreement or otherwise available in respect hereof at law or in equity, or to insist upon compliance by any other Party hereto with its obligations hereunder, and any custom or practice of the Parties at variance with the terms hereof, shall not constitute a waiver by such Party of its right to exercise any such or other right, power or remedy or to demand such compliance. The waiver by any Party of a breach of any provision of this Agreement shall not operate or be construed as a further or continuing waiver of such breach or as a waiver of any other or subsequent breach. Section 20. Governing Law; Jurisdiction; WAIVER OF JURY TRIAL. This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, without regard to such state’s choice of law provisions which would require the application of the law of any other jurisdiction. By its execution and delivery of this Agreement, the Parties irrevocably and unconditionally agrees for itself that any legal action, suit or proceeding against it with respect to any matter arising under or arising out of or in connection with this Agreement or for recognition or enforcement of any judgment rendered in any such action, suit or proceeding, may be brought in the United States District Court for the Southern District of New York, located in the Borough of Manhattan, and by execution and delivery of this Agreement, each of the Parties irrevocably accepts and submits itself to the exclusive jurisdiction of such court, generally and unconditionally, with respect to any such action, suit or proceeding. EACH PARTY HERETO UNCONDITIONALLY WAIVES TRIAL BY JURY IN ANY ACTION, SUIT, OR PROCEEDING REFERRED TO ABOVE. Section 21. Notices. All demands, notices, requests, consents, and communications hereunder shall be in writing and shall be deemed given if delivered personally, transmitted by facsimile or e-mail (and confirmed), mailed by registered or certified mail with postage prepaid and return receipt requested, or sent by commercial overnight courier, courier fees prepaid (if available; otherwise, by the next best class of service available), to the parties at the following addresses, or such other addresses as may be furnished hereafter by notice in writing, to the following parties: (a) if to the Company, to: New Fortress Energy Inc. 111 W. 19th Street, 8th Floor New York, New York 10011

23 Attention: Cameron D. MacDougall, Esq. Email: cmacdougall@fortress.com with copies (which shall not constitute notice) to: Skadden, Arps, Slate, Meagher & Flom LLP One Manhattan West New York, New York 10001 Telephone: (212) 735-3694 Attention: Michael J. Schwartz (b) if to any Supporting Holder, to: such Supporting Holder at the address shown for such Supporting Holder on the applicable signature page hereto or to the attention of the person who has signed this Agreement on behalf of such Supporting Holder with a copy to: with copies (which shall not constitute notice) to: Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, NY 10019 Telephone: (212) 373-3158 Attention: Andrew N. Rosenberg Email: arosenberg@paulweiss.com Cc: spak@paulweiss.com alongenbach@paulweiss.com tzelinger@paulweiss.com Section 22. Entire Agreement. This Agreement (together with the exhibits hereto) constitutes the entire understanding and agreement among the Parties with regard to the subject matter hereof, and supersedes all prior agreements with respect thereto. Section 23. Headings. The section headings of this Agreement are for convenience of reference only and shall not, for any purpose, be deemed a part of this Agreement. Section 24. Successors and Assigns. This Agreement is intended to bind and inure to the benefit of each of the Parties and their respective successors, assigns, heirs, executors, administrators and representatives. Section 25. Several, Not Joint, Obligations. The agreements, representations and obligations of the Parties (including, for the avoidance of doubt, each Supporting Holder) under this Agreement are, in all respects, several and not joint. Section 26. Remedies Cumulative. All rights, powers and remedies provided under this Agreement or otherwise available in respect hereof at law or in equity shall be cumulative and not 24 alternative, and the exercise of any right, power or remedy thereof by any Party shall not preclude the simultaneous or later exercise of any other such right, power or remedy by such Party. Section 27. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which shall constitute one and the same Agreement. Delivery of an executed signature page of this Agreement by email shall be effective as delivery of a manually executed signature page of this Agreement. Section 28. No Third-Party Beneficiaries. Unless expressly stated herein, this Agreement shall be solely for the benefit of the Parties hereto, and no other person or entity shall be a third party beneficiary hereof. Section 29. Severability. Any provision of this Agreement which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof or affecting the validity or enforceability of such provision in any other jurisdiction. Section 30. Additional Parties. Without in any way limiting the provisions hereof, additional holders of Notes may elect to become Parties by executing and delivering to the Company a counterpart hereof. Such additional holders shall become a party to this Agreement as a Supporting Holder in accordance with the terms of this Agreement. Section 31. Public Disclosure. Each of the Supporting Holders hereby consents to the disclosure of the entry into this Agreement to the extent required by law or regulation, including in any so-required filings by the Company with the Securities and Exchange Commission (the “SEC”); provided, that it is expressly understood by the Parties that none of the Supporting Holders consent to any disclosure of their identities or individual holdings of the Notes and the Company hereby agrees to keep such information confidential, unless such disclosure is required by applicable law or regulations of any applicable stock exchange or governmental authority (each, an “Authority”), in which case, the Company shall (x) provide each of the Supporting Holders with notice of the intent to disclose and provide such Supporting Holders with the reasonable opportunity to review and comment on the proposed disclosure to be provided by the Company in advance of such disclosure (if permitted by the applicable Authority), (y) take all reasonable measures to limit such disclosure to the extent permitted by applicable law and only disclose such information as is required to be disclosed by the applicable Authority and (z) to the extent this Agreement will be filed publicly with the SEC by the Company, the Company shall either (i) file with the SEC a form of this Agreement that does not include the identities and individual holdings of the Supporting Holders in lieu of filing an executed version or (ii) use commercially reasonable efforts to obtain confidential treatment with respect to the identities and individual holdings of the Supporting Holders included in this Agreement at or prior to filing the executed version of this Agreement with the SEC. The Company shall submit drafts to counsel to the Supporting Holders of any press releases and/or public filings announcing or related to this Agreement, the Transactions, and the Definitive Documents, and shall afford them a reasonable opportunity under the circumstances to review and comment on such documents and disclosures and shall incorporate any such reasonable comments in good faith.

25 Section 32. Interpretation. This Agreement is the product of negotiations among the Parties, and the enforcement or interpretation of this Agreement is to be interpreted in a neutral manner; and any presumption with regard to interpretation for or against any Party by reason of that Party having drafted or caused to be drafted this Agreement or any portion of this Agreement, shall not be effective in regard to the interpretation of this Agreement. Section 33. Relationship Among Parties. It is understood and agreed that no Supporting Holder owes any fiduciary duty or duty of trust or confidence of any kind or form to any other Party. In this regard, it is understood and agreed that any Supporting Holder may trade in Notes without the consent of the Company or any other Supporting Holder, subject to applicable securities laws and the terms of this Agreement; provided, however, that no Supporting Holder shall have any responsibility for any such trading to any other person by virtue of this Agreement. No prior history, pattern, or practice of sharing confidences among or between the Parties shall in any way affect or negate this understanding and agreement. No Supporting Holder shall, as a result of its entering into and performing its obligations under this Agreement, be deemed to be part of a “group” (as that term is used in Section 13(d) of the Exchange Act) with any other Party. For the avoidance of doubt, no action taken by a Supporting Holder pursuant to this Agreement shall be deemed to constitute or to create a presumption by any of the Parties that the Supporting Holders are in any way acting in concert or as such a “group.” Section 34. FRE 408. Pursuant to Federal Rule of Evidence 408 and any other applicable rules of evidence in any applicable jurisdiction, this Agreement and all negotiations relating hereto shall not be admissible into evidence in any proceeding other than a proceeding to enforce its terms. Section 35. Email Consents. Notwithstanding anything to the contrary herein, where a written consent, acceptance, approval, notice or waiver is required pursuant to or contemplated by this Agreement, including a written approval by any Party, such written consent, acceptance, approval, or waiver shall be deemed to have occurred if, by agreement between counsel identified in Section 21 to the applicable Parties submitting and receiving such consent, acceptance, approval, or waiver, it is conveyed in writing (including electronic mail) between each such counsel. Section 36. Transaction Expenses. (a) The Company shall, with (2) Business Days following the Agreement Effective Date, pay (i) all accrued and unpaid fees, costs, and expenses of the advisors to the Supporting Holders party to this Agreement as of the Agreement Effective Date (such Supporting Holders, the “Ad Hoc Committee”) (including legal counsel) incurred in connection with the negotiation, formulation, preparation, execution, delivery, implementation, consummation, and/or enforcement of this Agreement and/or any of the other Definitive Documents, and/or the transactions contemplated hereby or thereby, and/or any amendments, waivers, consents, supplements, or other modifications to any of the foregoing (the “Fees”), and (ii) a go-forward retainer in the amount of $400,000 to be applied towards the fees and expenses of one outside counsel (the “Retainer” and, collectively with the Fees, the “Transaction Expenses”), to the Ad Hoc Committee (or directly to such advisors on the Ad Hoc Committee’s behalf) by wire transfer 26 in immediately available funds, for which an invoice has been received by the Company on or prior to the Agreement Effective Date. (b) Whether or not the Transactions contemplated by this Agreement or any of the Definitive Documents are consummated, the Company hereby agrees to pay in cash the Transaction Expenses as follows: (i) all accrued and unpaid Transaction Expenses of the Supporting Holders’ advisors incurred up to (and including) the Agreement Effective Date shall be paid in full in cash on the Agreement Effective Date hereof, (ii) upon termination of this Agreement, all accrued and unpaid Transaction Expenses of the Supporting Holders’ advisors incurred up to (and including) the Termination Date shall be paid in full in cash promptly (but in any event within five (5) Business Days) following receipt of reasonably detailed invoices, and (iii) subject to and upon consummation of the Transactions, all accrued and unpaid Transaction Expenses incurred up to (and including) such date shall be paid in full in cash following receipt of reasonably detailed invoices. (c) The terms set forth in this Section 36 shall survive termination of this Agreement and shall remain in full force and effect regardless of whether the Transactions contemplated by this Agreement or any of the Definitive Documents are consummated. Section 37. No Solicitation. Each Party acknowledges that this Agreement is not, and is not intended to be, an offer for the purchase, sale, exchange, hypothecation, or other transfer of securities for purposes of any federal or local securities laws. [Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date set forth above. THE COMPANY: NEW FORTRESS ENERGY INC. By: /s/Christopher Guinta Name: Christopher Guinta Title: Chief Financial Officer [Signature Page to NFE Support Agreement] BLACKROCK SYSTEMATIC MULTI-STRATEGY FUND OF BLACKROCK FUNDS IV, By: BlackRock Advisors, LLC, in its capacity as adviser By: /s/Scott Radell Name: Scott Radell Title: Authorized Signatory Address: 400 Howard Street San Franciso, Ca. 94105 E-mail address(es): David.Dulski@Blackrock.com / Jonathan.Graves@BlackRock.com ENHANCED PASSIVE GLOBAL HIGH YIELD BOND PORTFOLIO, By: BlackRock Investment Management (UK) Limited, its Sub-Advisor By: /s/Alex Claringbull Name: Alex Claringbull Title: Managing Director Address: 400 Howard Street San Franciso, Ca. 94105 E-mail address(es): David.Dulski@Blackrock.com / Jonathan.Graves@BlackRock.com BLACKROCK INSTITUTIONAL TRUST COMPANY, NA, NOT IN ITS INDIVIDUAL CAPACITY BUT AS TRUSTEE OF HIGH YIELD CREDIT SCREENED FUND, By: /s/Scott Radell Name: Scott Radell Title: Authorized Signatory Address: 400 Howard Street San Franciso, Ca. 94105 E-mail address(es): David.Dulski@Blackrock.com / Jonathan.Graves@BlackRock.com