Exhibit 8.3

| | Crowe LLP Independent Member Crowe Global 15233 Ventura Blvd, 9th Floor Sherman Oaks, California 91403-2250 Tel 818.325.8412 Fax 818.907.9632 www.crowe.com |

, 2019

Dr. Lei Hua, CIO and Head of Investment Management Division

Fang Holdings Limited

Block A, No. 20 Guogongzhuang Middle Market Street

Fengtai District, Beijing 10070

The People’s Republic of China

Re: | Tax Opinion Concerning US Federal Income Tax Consequences of Fang Holdings Limited’s Distribution of China Index Holdings Limited under Internal Revenue Code §3551 |

Dear Dr. Lei Hua:

Fang Holdings Limited has requested our opinion on the U.S. federal income tax consequences under Internal Revenue Code Section 355 (“IRC §355”) as it relates to the Separation and Distribution (hereinafter also referred to as “spin-off”) of China Index Holdings Limited’s (“CIHL”) shares to Fang Holdings Limited (“Fang”) shareholders2 (“Opinion”). We have not considered any non-income tax, or state, local or foreign income tax consequences, and, therefore, do not express any opinion regarding the treatment that would be given the transaction by the applicable authorities on any state, local or foreign tax issues. We also express no opinion on nontax issues such as corporate law or securities law matters. We express no opinion other than that as stated immediately herein, and neither this Opinion nor any prior statements are intended to imply or to be an opinion on any other matters.

In rendering our Opinion, we have relied upon the facts, information, assumptions and representations as contained in the Corporate History and Separation and Distribution sections of this Opinion. We have examined such other documents and materials (as listed in Exhibit A) as we have determined in our professional judgement to be necessary to provide the Opinion contained herein. We have also relied on various Management Representations as included in Exhibit B. We have assumed that these facts are complete and accurate and have not independently audited or otherwise verified any of these facts or assumptions. You have represented to us that we have been provided all of the facts necessary to render our opinion. A misstatement or omission of any fact or a change or amendment in any of the facts, assumptions or representations we have relied upon may require a modification of all or a part of this Opinion.

Our Opinion is as of , 2019 and we have no responsibility to update this Opinion for events transactions, circumstances or changes in any of the facts, assumptions or representations occurring after this date.

1 Unless otherwise stated, all Section references herein are to be the Internal Revenue Code of 1986, as amended, and the Treasury Regulations promulgated thereunder.

2 Pursuant to the Preliminary Prospectus Form F-1 filed on August 17, 2018 and an advanced draft of Form F-1 dated [April 16], 2019 (hereinafter referred to as “Form F-1”), Fang Holdings Limited (“Fang”) announced its intention to separate into two publicly traded companies: the spun-off business comprising Fang’s information and analytics service and marketing services, which will be China Index Holdings Limited’s business, and the retained business that will comprise Fang’s remaining operations, which will continue to be operated by Fang. Fang anticipates distributing all of the issued and outstanding ordinary shares (including Class A ordinary shares represented by ADSs) to Fang equity holders (including Fang ADS holders) holding Fang ordinary shares or Fang ADSs. Throughout the remainder of the memo, references to the “Separation and Distribution” refer to this spin-off.

The discussion and conclusions set forth herein are based upon the Internal Revenue Code of 1986, as amended, the Treasury Regulations promulgated thereunder, and existing administrative and judicial interpretations thereof, as of , 2019 all of which are subject to change. If there is a change, including a change having retroactive effect, in these referenced authorities, or in the prevailing judicial interpretation of the foregoing, the Opinions expressed herein would necessarily have to be re-evaluated in light of any such changes. We have no responsibility to update this Opinion for any such changes occurring after the date of this letter.

The Opinions expressed herein are based solely upon our interpretation of the Internal Revenue Code and Treasury Regulations as interpreted by court decisions, and by rulings and procedures issued by the Internal Revenue Service (“IRS”) as of the date of this letter. The Opinions expressed herein are not binding on the IRS and there can be no assurance that the IRS will not take a position contrary to any of the Opinions expressed herein.

The Opinions expressed herein reflect our assessment of the probable outcome of litigation and other adversarial proceedings based solely on an analysis of the existing tax authorities relating to the issues. It is important, however, to note that litigation and other adversarial proceedings are frequently decided on the basis of such matters as negotiation and pragmatism upon the outcome of such potential litigation or other adversarial proceedings.

The Opinions expressed herein reflect what we regard to be the material federal income tax effects to Fang Holdings Limited Inc.’s shareholders of the transaction as described herein; nevertheless, they are Opinions only and should not be taken as assurance of the ultimate tax treatment.

Corporate History

1. Fang Holdings Limited

Fang Holdings Limited was incorporated on June 18, 1999 as Fly High Holdings Limited, under the laws of the British Virgin Islands, and went through a series of name changes and corporate domicile, until September 23, 2016, when it changed its name to Fang Holdings Limited (hereinafter “Fang”, “Distributing”, “ListCo”).3 Since inception, Fang has conducted its operations in China primarily through its People’s Republic of China (“PRC”) subsidiaries and consolidated controlled entities.4

On September 17, 2010, Fang completed an initial public offering and listing of 2,933,238 ADSs5, each representing four Class A ordinary shares, on the New York Stock Exchange, which are traded under the symbol of “SFUN.”6

Fang operates the leading real estate Internet portal in China in terms of the number of page views and visitors to its websites in 2017.7 Fang’s websites and mobile apps support active online communities and networks of users seeking information on, and services for, the real estate and home-related sectors in China.8 Its service offerings include, among others, marketing services, e-commerce services, financial services, listing services, promotion services and information and analytic services.9 Each of its main service offerings are described in greater detail below:10

· Listing services: Fang offers basic and special listing services on its websites and mobile apps. Basic listing services are primarily offered to real estate agents, brokers, developers, property owners and managers and suppliers of home furnishing and improvement and other home related products and services. Basic listing services allow its customers to post information of their products and services on Fang’s websites. Fang’s special listing services offer specialized marketing programs through both online channels and offline themed events. Listing services were Fang’s largest source of revenues in 2017.

3 On July 14, 1999, Fang changed its name to SouFun.com Limited. On June 17, 2004, Fang changed its corporate domicile to the Cayman Islands, becoming a Cayman Islands exempted company with limited liability. On June 22, 2004, Fang changed its name to SouFun Holdings Limited.

4 See 2017 Form 20-F, p. 37.

5 Refer to 2017 Form 20-F.

6 Id.

7 Id

8 Id.

9 Id.

10 See 2017 Annual Form 20-F, pgs. 37 - 41.

2

· Marketing services: Fang offers marketing services on its websites and mobile apps, mainly through advertisements, to real estate developers in the marketing phase of new property developments, as well as to real estate agencies and suppliers of home furnishing and improvement and other home-related products and services who wish to promote their products and services. Marketing services were its second largest source of revenues in 2017.

· E-commerce services: Fang’s e-commerce services primarily include Fang’s membership services, online real estate brokerage services, direct sales services for new homes, online home-decorating services and online sublease services. Fang provides both free and paid Fang membership services to its registered members. Fang’s free services include primarily regular updates regarding local property developments, tours to visit property developments and other services relating to property purchases. Fang’s paid services primarily include offers to purchase properties at a discount from Fang’s partner developers and dedicated information and related services to facilitate property purchases. In August 2014, Fang launched Fang’s direct sales services, whereby Fang promotes and sells properties primarily through Fang’s websites and mobile apps to home buyers for a predetermined percentage of fees charged to Fang’s developer clients. As part of Fang’s effort to develop its transaction platform, Fang began to offer online real estate brokerage services in January 2015, online home-decorating services and online sublease services in the second quarter of 2015. E-commerce services were its third largest source of revenues in 2017.

· Financial services: Fang provides financial services through its online financial platform, www.fangtx.com, and offline micro loan subsidiaries. Fang provides primarily secured consumer loans to individuals that meet its credit assessment requirements.

· Other value-added services: Fang provides other value-added services including subscription services for access to its information database and consulting services for customized and industry-related research reports and indices.

Fang has built a large and active community of users, who are attracted by the comprehensive real estate and home related content available on its portal that forms the foundation of its service offerings. Fang currently maintains approximately 100 offices across China to focus on local market needs. Fang’s user base has also attracted numerous customers, which includes real estate developers, real estate agents and brokers, property owners, property managers, mortgage brokers, lenders and suppliers of home furnishing and improvement and other home-related products and services.11

Fang’s diverse offerings and broad geographic coverage have resulted in an active and dynamic online community that provides an effective and targeted channel for advertisers to market their products and services, and serves as a centralized source of information, products and services for consumers in the real estate and home furnishing and improvement and other home-related markets. With Fang’s leading Internet portal, Fang believes that it is well positioned to develop integrated media, transaction and financing platforms, increase synergy and capture additional growth opportunities in the real estate market in China.12

2. China Index Holdings Limited

China Index Holdings Limited (hereinafter, “CIHL”, “Controlled”, “SpinCo”) are an exempted company with limited liability registered under the laws of Cayman Islands and a holding company of CIHL’s business. CIHL traces its history back to the founding of China Real Estate Index System in 1994. Formerly known as Selovo Investments Limited, CIHL was incorporated under the laws of British Virgin Islands on August 10, 2007. In anticipation of the Separation and Distribution, CIHL re-domiciled as an exempted company with limited liability registered under the laws of the Cayman Islands on July 26, 2018 and changed its name to China Index Holdings Limited.13 Prior to the Separation and Distribution, CIHL’s sole shareholder is Fang. CIHL primarily conducts its business and operations through CIHL’s subsidiaries in Hong Kong and China.14

11 Id., p. 38.

12 Id.

13 See Form F-1, p. 5.

14 CIHL and its subsidiaries are members of the same affiliated group since their inception and collectively conducted an active trade or business for more than five years prior to the spin-off and continue to conduct an active trade or business after the spin-off.

3

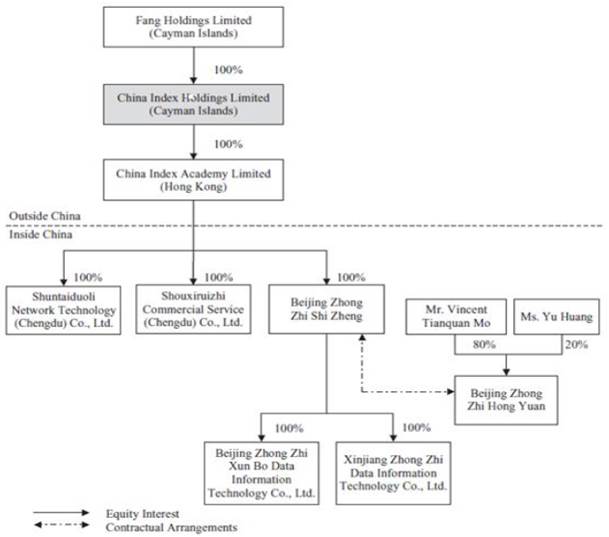

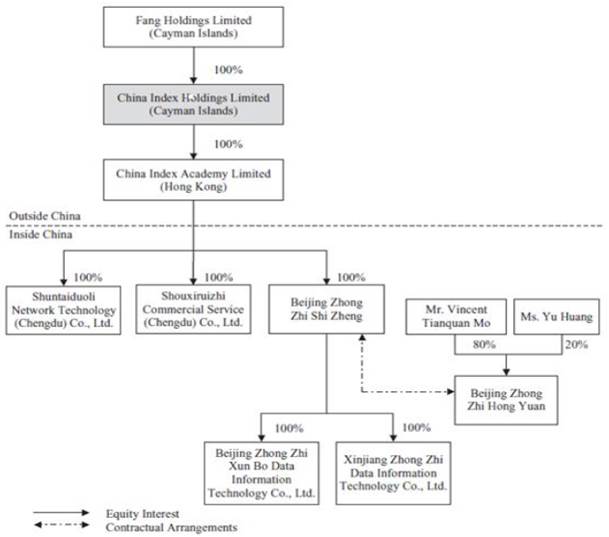

CIHL’s principal subsidiaries after the contemplated Separation and Distribution consist of the following entities:

· China Index Academy Limited (“CIAL”), a wholly-owned subsidiary of CIHL incorporated under the laws of Hong Kong on October 26, 2007;

· Beijing Zhong Zhi Shi Zheng (“Zheng”), a wholly-owned subsidiary of CIAL established under the laws of the PRC on June 5, 2007.

· Beijing Zhong Zhi Xun Bo (“Bo”), a wholly owned subsidiary of Zheng established under the laws of the PRC on January 6, 2012.

· Xinjiang Zhong Zhi (“Zhi”), a wholly owned subsidiary of Zheng established under the laws of the PRC on August 10, 2017.15

The following diagram illustrates CIHL’s main corporate and operating structure as of the date of the draft Form F-1 on [April 16], 201916.

CIHL operate the largest real estate information and analytics service platform in China in terms of geographical coverage and volume of data points as of June 30, 2018, according to the Frost & Sullivan report.17 CIHL serves real estate participants in China with authoritative, comprehensive and seasonable collection of real estate data and with a variety of powerful tools to navigate through and analyze complex information.

15 See Form F-1, p. 78.

16 See Form F-1, p. 5.

17 See Form F-1, p. 1.

4

As mentioned above, Fang formed CIHL’s wholly owned subsidiary, CIAL on October 26, 2007, with the aim of providing industry professionals and consumers with the critical knowledge and tools to conduct business in China’s real estate market. Over a span of 20 years, CIHL along with Fang had developed a proprietary real estate information and analytics service platform in China, known as “China Index Suite,” based on CIHL’s China Real Estate Index System, or CREIS,19 a comprehensive set of benchmarks and data points initiated by us and widely adopted by industry participants to track, understand and analyze the real estate industry and real estate information in China. China Index Suite consists of various integrated data-driven information and analytics service modules that are subscription-based online solutions similar to Software as a Service.20

As of December 31, 2018, the CREIS database encompassed detailed real estate information of over 2,300 cities, 850,000 plots of land, 350,000 residential property projects and 45,000 commercial property projects in China, which we believe represent the widest geographical coverage and the most data points among all real estate-related databases in China.21 CIHL’s service platform delivers significant value to its clients due to the richness of associated analytic functionalities, including fair market value appraisals, property and district ratings, interactive analytics and reporting tools, property price indices and investment decision-making analyses.22

Leveraging its comprehensive information access and robust data analytics capabilities as well as leadership in the market, CIHL also offers promotion services to China’s real estate participants. They disseminate influential enterprise and property rankings and industry reports on select key topics and help its clients promote their brand names and development projects through an integrated suite of customized, omni-channel solutions consisting of promotion campaigns across various online channels and themed events.23

As commercial property-related business requires a sophisticated level of expertise and industry experience, CIHL believes that it is in a unique position to operate the online marketing portals for China’s commercial property market and empower it with big data and innovative technologies. CIHL is also exploring other commercial property-related services to capture the enormous market opportunity arising from the rapid development of China’s commercial property sector.24

CIHL’s clients primarily consist of real estate developers, brokers and agents, property management companies, financial institutions and individual professionals. As of December 31, 2018, over 90% real estate developers listed in the Top 100 Real Estate Developers in China as ranked by the Top Ten Research Committee of China’s Real Estate Industry were its clients. CIHL has had experienced stable growth in recent years. CIHL’s revenues increased from RMB275.3 million in 2016 to RMB335.0 million in 2017 and further to RMB421.0 million (US$61.2 million) in 2018. Its net income increased from RMB111.0 million in 2016 to RMB128.2 million in 2017 and further to RMB165.4 million (US$24.1 million) in 2018.25

Historically, CIHL, and more specifically CIAL, has been reflected on the financial statements of Fang in the following manner:

· The promotion service business of CIAL is reflected within Listing Services,

· The China Index Suite database business has been reflected on Other Value Added Services.26

19 The China Real Estate Index System was founded in 1994 by, among others, governmental authorities and reputable real estate industry participants.

20 These businesses were conducted for over five years prior to the spin-off and continue to be conducted following the spin-off.

21 See Form F-1, p. 1, citing Frost and Sullivan Report.

22 Id. As one of the most recognized brands among real estate participants in China, CIHL has been selected by China’s National Bureau of Statistics as a key data source for real estate industry from 2014 to 2017.

23 Id.

24 Id.

25 See Form F-1, p. 2.

26 See Form F-1, pages F-1 – F-36 for stand-alone financial statements as of December 31, 2016, 2017 and 2018, prepared for purposes of the Separation and Distribution.

5

3. Fang’s Related Party Transactions

To comply with applicable PRC laws, rules and regulations, Fang conducts its operations in China primarily through its wholly-owned PRC subsidiaries and our consolidated controlled entities. Fang’s wholly-owned PRC subsidiaries, Fang’s consolidated controlled entities (excluding their subsidiaries) and their respective shareholders have entered into a series of contractual arrangements, which consist of exclusive technical consultancy and service agreements, equity pledge agreements, operating agreements, shareholders’ proxy agreements, loan agreements and exclusive call option agreements (collectively, the “Structure Contracts”).27

Separation and Distribution Transaction

1. Reasons for the Separation and Distribution

CIHL was formed to operate real estate related information and analytics services in China, which primarily serves real estate participants, including real estate developers, brokers and financial institutions. With the rapid development of China’s commercial real estate industry and the synergy in its business, Fang’s board of directors believe that it is in the best interests of Fang and its shareholders for CIHL to operate the commercial real estate related business independently. Fang will continue to retain its business operating a real estate Internet portal in China and will pursue its strategy of enhancing its online operations and residential property-related business.28

A wide variety of factors were considered by Fang’s board of directors in evaluating the spin-off of CIHL. Given the distinction in the business focuses and models of Fang and CIHL, Fang’s board of directors determined that a separation of the spun-off business would improve both companies’ performance and create more focused investment opportunities for shareholders, and that the proposed Separation and Distribution would accomplish this goal in the most straightforward manner.29

Fang’s board of directors also considered the potential disadvantages of the Separation and Distribution, including that execution of the Separation and Distribution will require significant time and attention from Fang’s management, that the process of the Separation and Distribution is complex and may be affected by unanticipated developments, and that Fang may experience difficulties in attracting, retaining, and motivating key employees during the pendency of such process. Ultimately, however, Fang’s board of directors concluded that the expected benefits associated with the Separation and Distribution outweighed its potential disadvantages. Among other things, Fang’s board of directors considered the following expected major benefits:30

· Enhanced strategic and business focus. The Separation and Distribution will allow each company to focus on, and more effectively pursue, its own distinct operating priorities and strategies, and will enable the management of each company to concentrate efforts on the unique needs of each business and pursue distinct opportunities for long-term growth and profitability. Specifically, CIHL will strategically focus primarily on the commercial property sector in China to capture the enormous market opportunity from its rapid development, while Fang will retain its business operating a real estate Internet portal focusing primarily on serving the residential property sector.

· More efficient allocation of capital. The Separation and Distribution will permit each company to concentrate its financial resources solely on its own operations, providing greater flexibility to invest capital in its business in a timely manner appropriate for its distinct strategy and business needs and facilitate a more efficient allocation of capital.

· Alignment of incentives with performance objectives. The Separation and Distribution will facilitate incentive compensation arrangements for employees more directly tied to the performance of the relevant company’s business, and may enhance employee hiring and retention by, among other things, improving the alignment of management and employee incentives with performance and growth objectives.

27 See 2017 Form 20-F, Item 7.B, starting on p. 98. Major Shareholders and Related Party Transactions—Related Party Transactions—Structure Contracts.

28 See Form F-1, p. 81.

29 Id.

30 Id., p. 81-82.

6

· Direct access to capital markets. The Separation and Distribution will create an independent equity structure that will afford CIHL direct access to capital markets and facilitate CIHL’s ability to capitalize on its unique growth opportunities and effect future acquisitions utilizing its ordinary shares.

· Capital market profile. The Separation and Distribution will allow investors to separately value Fang and CIHL based on their unique investment identities, including the merits, performance and future prospects of their respective businesses. The Separation and Distribution will also provide investors with two distinct and targeted investment opportunities. The investment community, including analysts, stockholders and prospective investors in each company, will be better able to realize the value of each company fully and independently and enhance the brand recognition of each company.

2. Pre-distribution Internal Restructuring

As discussed above, to comply with applicable PRC laws, rules and regulations, Fang conducts its operations in China primarily through its wholly-owned subsidiaries and Fang’s consolidated controlled entities, and its controlled entities have entered into various Structure Contracts. These entities include CIHL, CIAL and Zheng. In anticipation of the Separation and Distribution, Fang underwent a series of corporate restructurings31, including:

· Re-domicile of CIHL holding company: CIHL was a company incorporated as Selovo Investments Limited under the laws of British Virgin Islands on August 10, 2007. In anticipation of the Separation and Distribution Transaction, Selovo Investments Limited changed its name to China Index Holdings Limited and re-domiciled as an exempted company with limited liability under the laws of the Cayman Islands on July 26, 2018.32

· Termination of certain existing Structure Contracts: Prior to the Reorganization, CIAL entered into a series of Structure Contracts with Shanghai China Index, Beijing Yi Ran Ju Ke, Beijing Technology, Beijing JTX Technology, Shanghai Century JTX and their nominee shareholders to operate its business. Fang and CIHL have determined that the business under these contractual arrangements is irrelevant to CIHL’s business after the separation, and therefore the parties terminated the foregoing contractual arrangements on May 15, 2018. Fang will continue to control these entities by directly establishing contractual arrangements with these entities.33

· Disposal of Zheng’s interest in Beijing Zhongruihang: Zheng previously entered into an Entrusted Shareholding Agreement with Ms. Huang Yu, Mr. Jiang Yunfeng, Mr. Zhang Huaxue and Ms. Kang Xiaoyun, pursuant to which Zheng designated the above-mentioned individuals to hold the entire equity interest in Beijing Zhongruihang on its behalf through a nominee agreement dated February 2017. As Fang’s Board of Directors determined that the business under Beijing Zhongruihang was irrelevant to CIHL’s business after a separation, Zheng is terminating the nominee agreement and designate another entity controlled by Fang to hold the equity interest in Beijing Zhongruihang for its benefit.34

· Establishment of new contractual arrangement: CIHL’s subsidiary, Zheng, entered into new contractual arrangements with Beijing Zhong Zhi Hong Yuan, a newly established company and CIHL’s variable interest entity (“VIE”), on June 11, 2018, effective from the same date. Pursuant to these arrangements, CIHL will, through Zheng, have controlling financial interest in Beijing Zhong Zhi Hong Yuan and its online marketplace business.35

31 The tax implications of the corporate restructurings are described in a draft Reorganization Memorandum dated July 25, 2018 provided to Crowe; however, the section on US taxation was not completed. Fang and CIHL’s legal counsel indicated in an email dated September 4, 2018, “The pre-spin-off reorganization consists primarily of restructuring of certain Chinese companies and the re-domiciliation of the holding company from BVI to Cayman. Although we have not done an analysis, we do not believe there are material U.S. tax consequences involved.” Crowe LLP was not engaged to analyze the U.S. tax implications of the steps in the reorganization. Our analysis assumes the conclusions are as they are describe therein, and there are no material US tax consequences.

32 See Form F-1, p. 75.

33 Id.

34 Id.

35 Id. In order to comply with PRC regulatory requirements restricting foreign ownership of value-added telecommunications, and certain other businesses in China, CIHL, through Zheng, which is its PRC subsidiary and a wholly foreign-owned enterprise, has entered into a series of contractual arrangements with (1) Beijing Zhong Zhi Hong Yuan, CIHL’s variable interest entity (“VIE”), and (2) the shareholders of the VIE, namely Mr. Vincent Tianquan Mo and Ms. Yu Huang, which enables it to: (1) exercise effective control over the VIE, (2) receive substantially all of the economic benefits of the VIE, and (3) have an exclusive option to purchase all or part of the equity interests and assets in the VIE when and to the extent permitted by PRC law. As a result of these contractual arrangements, CIHL has control over and is the primary beneficiary of its VIE, and hence will consolidate its financial results as our affiliated entities under U.S. GAAP — Id., p. 75-76. See also, 2017 Form 20-F, p. 18.

7

· Separation of CIHL from Fang: The business, employees, management team, assets, properties and all other aspects with respect to CIHL will be separated from Fang to be independently owned and operated by CIHL to the extent feasible. In the meantime, CIHL shall transfer all the business, assets, properties and all other aspects with respect to the Fang held by it to the Fang to the extent feasible.

· Entering into Business Cooperation Agreement - CIHL will enter into a business cooperation agreement with Fang in connection with commercial property marketing business, pursuant to which, (1) CIHL have the exclusive right to operate the commercial property marketing business; (2) Fang will provide exclusive advertising agent services and channels to CIHL for operating such services.

· Entering into Intellectual Property License Agreement - CIHL will enter into an intellectual property license agreement with Fang pursuant to which CIHL will be granted a license to use certain of Fang’s relevant intellectual properties.

· Entering into Data Purchase Agreement - CIHL will enter into a data purchase agreement with Fang, pursuant to which, Fang and CIHL agrees to provide certain data to each other.

3. The Separation and Distribution

The Separation and Distribution (supra Footnote 2) is the method by which CIHL will initially separate from Fang. Fang will, pursuant to a series of agreements and arrangements between CIHL and Fang (highlighted above), spin-off its business. Simultaneously, Fang will distribute to its equity holders as of record on the record date identified herein all the issued and outstanding ordinary shares of CIHL immediately prior to the Separation and Distribution on a pro-rata basis. The number of ordinary shares that Fang will distribute will constitute all the issued and outstanding ordinary shares of CIHL on an as-converted basis immediately prior to the Separation and Distribution.36

Holders of Fang Class A ordinary shares will receive a CIHL Class A ordinary share[s] for every one Fang Class A ordinary share held on the record date. Holders of Fang Class B ordinary shares will receive CIHL Class A ordinary share[s] for every one Fang Class B ordinary share held on the record date. Holders of Fang ADSs will receive CIHL ADSs for every one Fang ADS held on record date identified herein37. Immediately following the distribution, the Class A ordinary shares to be distributed to Mr. Vincent Tianquan Mo for his Fang Class B ordinary shares will be re-designated as Class B ordinary shares.38 The ordinary shares to be distributed will constitute all of the outstanding ordinary shares of CIHL immediately prior to the Separation and Distribution.

Each Class A ordinary share will be entitled to one vote on all matters subject to a shareholder vote, and each Class B ordinary share will be entitled to 10 votes on all matters subject to a shareholder vote. Each Class B ordinary share will be convertible into one Class A ordinary share at any time at the election of the holder. Class A ordinary shares will not be convertible into Class B ordinary shares unless approved by CIHL’s board of directors.39

CIHL fractional ADSs will not be distributed. Instead, the depositary will aggregate CIHL fractional ADSs into whole ADSs, sell such whole ADSs in the open market at prevailing rates promptly after CIHL ADSs commence trading on the NASDAQ Stock Market and distribute the net cash proceeds from the sales pro rata to each Fang ADSs holder who would otherwise have been entitled to receive fractional ADSs in the distribution.

36 See Form F-1, pages 9 – 20, confidentially submitted on [April 16], 2019. All other references to Form F-1 relate to the Form F-1 confidentially submitted on August 17, 2018.

37 Internal Revenue Bulletin 2010-47, regarding the discussion for regulation 6045 related to returns of brokers, reflects the Service indicating that ADSs are stock for basis reporting purposes, under section b regarding the discussion of the identification of a security as a stock, page 9.

38 See Form F-1, Offering page, and capitalization table above, and pages 9 - 20.

39 See Form F-1, p. 153.

8

After completion of this offering and the Separation and Distribution, CIHL will be an independent publicly-traded company, and Fang will no longer hold any ownership interests in CIHL.

4. Post-close interaction between Distributing and Controlled

Following the Separation and Distribution, Fang and CIHL will be separate companies with separate management teams and separate boards of directors. CIHL will enter into a Separation and Distribution agreement and related ancillary agreements with Fang, providing for the allocation between CIHL and Fang of business, assets, employees, liabilities and obligations (including investment, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after CIHL’s separation from Fang and will govern certain relationships between CIHL and Fang after the separation.41 After the Separation and Distribution, Mr. Vincent Tianquan Mo, Fang’s chairman and chief executive officer, will serve as CIHL’s chairman. He and other members of our management will also have significant financial interests in Fang’s equity.

Opinion

Based on the foregoing facts, representations and certifications below, and subject to the limitations and discussions set forth herein, we are of the opinion that, under current law as of , 2019, the Separation and Distribution should satisfy the requirements of IRC §355 and, that therefore neither Fang nor the Fang shareholders will recognize gain or loss by reason of the Separation and Distribution.

The conclusions expressed in this opinion are based on our good faith belief that the tax treatment of the Separation and Distribution described herein should be upheld by a court. This standard is higher than the “more likely than not” standard which is greater than 50% chance of success on the merits if the tax treatment of the Separation and Distribution were to be challenged in litigation, and represents our professional judgment based upon our analysis of the applicable law and the facts and assumptions described in this opinion. The possibility that the return will not be audited, or if audited, that an item will not be raised in audit, is not relevant in determining whether the “should” standard is satisfied, and the rules governing practice before the Service prohibit us from considering the likelihood of audit or settlement into consideration in reaching our conclusions. As such, in our determination, we have not taken into consideration the possibility that a return will not be audited or, if audited, that an item will not be raised in audit.

41 See Form F-1, p. 3 - 4.

9

Analysis

Generally, corporate distributions of appreciated property, including stock of a subsidiary,42 are subject to corporate level federal income tax to the extent that the property’s value exceeds the corporation’s basis in the property.43 In addition, the shareholder receiving a distribution of appreciated property will be treated as having received a taxable distribution equal to the fair market value of the property received.44 Thus, a corporate distribution of appreciated property is generally taxable at both the corporate and shareholder levels. However, under IRC §355, the distribution of stock of a controlled subsidiary may be nontaxable at both the corporate and shareholder levels if certain statutory and judicially-imposed requirements are satisfied.

I. IRC §355 Analysis Framework

IRC §355 provides that, under certain circumstances, a shareholder does not recognize gain or loss upon the receipt from a controlling corporation of stock or securities of a Controlled Corporation.45 More specifically, IRC §355 provides for the separation, without recognition of gain or loss to (or the inclusion in income of) shareholders, of one or more existing businesses formerly operated, directly or indirectly, by a single corporation (the “Distributing Corporation”).46 IRC §355 applies only to the separation of existing businesses which have been in active operation for at least five years, and which, in general, have been owned, directly or indirectly, for at least five years by the Distributing Corporation.47 A separation is achieved under IRC §355 through the distribution by the Distributing Corporation of stock (or stock and securities) of a subsidiary corporation (the “Controlled Corporation”) to shareholders.48

The IRC §355 analysis is guided by a seven-prong analysis which consists of four statutory requirements and three judicially-imposed requirements (which are now reflected in treasury regulations). These seven requirements are summarized as follows:

1. Distribution of a Controlled Corporation Requirement

2. Non-Device Requirement

3. Active Trade or Business Requirement

4. Retention Requirements

5. Business Purpose Requirement

6. Continuity of Business Enterprise (COBE) Requirement

7. Continuity of Proprietary Interest (COPI) Requirement

a. Distribution of a Controlled Corporation Requirement

Pursuant to IRC §355(a)(1)(A), the Distributing Corporation must distribute solely stock or securities of a Controlled Corporation to its shareholders. For this purpose, control is defined as ownership of stock possessing at least 80% of the total combined voting power of all classes of stock entitled to vote and at least 80% of the total number of shares of all other classes of the corporation.49

42 IRC §317.

43 IRC §311(b).

44 IRC §301.

45 IRC §355(a).

46 Treas. Reg. §1.355-1(b).

47 Treas. Reg. §1.355-1(b).

48 Treas. Reg. §1.355-1(b).

49 IRC §368(c).

10

Such distributions may take one of the following three forms —

1. Spin-Off: A Distributing Corporation distributes stock of the Controlled Corporation to shareholders of the Distributing Corporation without any surrender of stock by them.

2. Split-Off: A Distributing Corporation distributes stock of the Controlled Corporation to some or all of the shareholders of the Distributing Corporation in exchange for some or all of their shares in such Distributing Corporation.

3. Split-Up: A Distributing Corporation distributes stock of two or more Controlled Corporations to shareholders of the Distributing Corporation in complete liquidation.

The contemplated Separation and Distribution is a spin-off and meets this requirement. As discussed above, Fang will distribute to its equity holders as of record on the record date identified herein all of the issued and outstanding ordinary shares of CIHL company immediately prior to the Separation and Distribution on an as converted basis. All of the shares (classes combined), representing 100% of the voting power from all shares (classes combined), of CIHL will be distributed, and therefore, this requirement is met.

Pre-Separation and Distribution Reorganization

The tax treatment of a transaction or a broader transaction that includes a transaction — such as a reorganization followed by an IRC §355 transaction — is determined under the IRC and general principles of tax law, including the step transaction doctrine.

Prior to the Separation and Distribution, to comply with applicable PRC laws, rules and regulations, Fang conducted its operations in China primarily through its wholly-owned PRC subsidiaries and our consolidated controlled entities, which included CIHL, CIAL and Zheng, and other controlled entities through various Structure Contracts. In anticipation of the Separation and Distribution, Fang underwent a process to separate and transfer certain businesses, employees, management team, assets, properties and other items with respect to CIHL, furthering CIHL’s goal of being independently owned and operated, to the extent feasible. Additionally, to continue compliance with applicable PRC laws, rules and regulations regarding ownership, Fang had to terminate various Structure Contracts, assign entrusted shareholder agreements to new ownership, and enter into new Structure Contracts, which included business cooperation agreements, property license agreements, and data purchase agreements.

The activities described above will not negatively impact the qualification as an IRC §355 spin-off, assuming the other requirements of IRC §355 are met.

b. Non-Device Requirement

A tax-free distribution of the stock of a Controlled Corporation presents a potential risk of tax avoidance insofar as taxpayers may attempt to circumvent the dividend provisions of the IRC by utilizing an IRC §355 distribution, followed by a subsequent sale or exchange of the stock of one corporation and retention of the stock of another corporation. Any gain realized on the subsequent sale would qualify for capital gain treatment even though the selling shareholder continues to hold stock of the other corporation. In this way, a spin-off can be used as a device to extract corporate E&P while avoiding dividend treatment.50

To prevent abuse relative to spin-off transactions, IRC §355(a)(1)(B) provides that, in order to obtain non-recognition treatment under IRC §355, a distribution must not be a device for distributing the E&P of either the Distributing Corporation or the Controlled Corporation. For this purpose, the determination of whether a transaction was used principally as a device to distribute E&P will be made from all of the facts and circumstances, including, but not limited to, the presence of certain device factors specified in Treas. Reg. §1.355-2(d)(2) and the presence of certain non-device factors specified in Treas. Reg. §1.355-2(d)(3).51 In addition, if a transaction satisfies the criteria specified in Treas. Reg. §1.355-2(d)(5) (relating to absence of E&P), then the distribution ordinarily will not be considered to have been used principally as a device.

50 Historically, the IRS has viewed the non-device requirement as intended solely to prevent conversion of dividend income into capital gains. See e.g., Rev. Rul. 71-383 (ruling that “the transaction [was] not a device to distribute earnings and profits (that is, to convert dividend income into capital gains).”). In this regard, the non-device requirement has become somewhat less significant given the similarity of tax rates applicable to capital gains and dividends under current tax law. Nonetheless, even in the absence of a significant capital gain tax rate differential, capital gains treatment can still provide shareholders with certain tax benefits as compared to dividend treatment — namely, taxable gain on a capital stock sale is limited to the excess of proceeds over stock basis; whereas a dividend is taxed on the full amount distributed, without any corresponding offset for basis. See Treas. Reg. §1.355-2(d)(1) (providing that a device can include a transaction that effects a recovery of basis). Thus, the non-device requirement does remain of significance in the IRC §355 analysis, notwithstanding the absence of a significant rate differential between capital gains and dividends.

51 Treas. Reg. §1.355-2(d)(1).

11

Device Factor

Treas. Reg. §1.355-2(d)(2) lists the following three factors as evidence of device —

1. Pro rata distribution;

2. Subsequent sale or exchange of stock; and

3. Nature and use of assets.

Pursuant to Treas. Reg. §1.355-2(d)(2)(ii), a distribution that is pro rata or substantially pro rata among the shareholders of the Distributing Corporation presents the greatest potential for effectually constituting a distribution of profits in the nature of a dividend, and thus a pro rata spin-off has the greatest potential for use as a device. As such, a pro rata distribution may be indicative of a device.

It is expected that Holders of Fang Class A ordinary shares will receive Class A ordinary share[s] for every one Fang Class A ordinary shares held on the record date. Holders of Fang Class B ordinary shares will receive Class A ordinary share[s] for every one Fang Class B ordinary share held on the record date. Holders of Fang ADSs will receive CIHL ADSs for every one Fang ADS held on record date identified herein. Immediately following the distribution, the Class A ordinary shares to be distributed to Mr. Vincent Tianquan Mo for his Fang Class B ordinary shares will be re-designated as Class B ordinary shares.

The exchange ratios described herein reflect a pro rata or substantially pro rata distribution to the shareholders of Fang. However, although CIHL shares were distributed pro rata or substantially pro rata to Fang shareholders, this fact alone does not mean that the distribution is being utilized as a device to extract E&P from the company. To the contrary, when viewed in conjunction with the business purpose for the transaction and other evidence of non-device, it becomes clear that the pro rata distribution of CIHL shares is not motivated by an improper purpose.

Pursuant to Treas. Reg. §1.355-2(d)(2)(iii)(A), sale or exchange of the stock of the Distributing or Controlled Corporation following the distribution is evidence of device. Relative to this, the shorter the period of time between the distribution and sale/exchange transaction, the stronger the evidence of device.52 In addition, a sale or exchange made following the distribution pursuant to negotiations or agreement reached before the distribution will be viewed as substantial evidence of device.53 In the case of the distribution of CIHL shares by Fang, there are no plans for shareholders to sell, exchange, or otherwise dispose of shares in CIHL or Fang following the distribution. Accordingly, no issues are anticipated relative to this device factor.

Pursuant to Treas. Reg. §1.355-2(d)(2)(iv)(A), the determination of whether a transaction was used principally as a device will take into account the nature, kind, amount, and use of the assets of the Distributing and the Controlled Corporations (and corporations controlled by them) immediately after the transaction. In this respect, the existence of assets which are not used in an active trade or business or distribution of a secondary business constitute evidence of device.54 Essentially, the focus is on what percentage of “investment assets” are being utilized.

As discussed below in greater detail regarding the active trade or business, the active business of CIHL is being separated from the overall umbrella of Fang. More specifically, CIHL was formed to operate real estate related information and analytics services in China, which primarily serves real estate participants, including real estate developers, brokers and financial institutions. These are primarily commercial real estate related business activities. Fang, on the other hand, is retaining its business operating a real estate Internet portal in China and will primarily focus on residential real estate-related business in the future. These distinct lines of businesses were tracked by Fang in its financial statements — promotion services of CIAL were reflected within Listing Services, and the China Index Suite database business has been reflected on Other Value Added Services, and makes up approximately [90%] of Fang’s service line. In 2017, CIHL’s revenues increased 21.7% to US$51.5 million, gross profit increased by 20.5% to US$38.7 million, and net income increased by 15.5% to US$19.7 million). These factors are all indicative of not running afoul of this non-device requirement.

52 Treas. Reg. §1.355-2(d)(2)(iii)(A).

53 Treas. Reg. §1.355-2(d)(2)(iii)(B).

54 Treas. Reg. §1.355-2(d)(2)(iv)(B)-(C).

12

Non-Device Factors

In addition to the factors listed in Treas. Reg. §1.355-2(d)(2) as evidence of device, Treas. Reg. §1.355-2(d)(3) lists the following three factors as evidence of non-device —

1. Corporate business purpose;

2. Distributing is publicly traded and widely held; and

3. Distribution to domestic corporate shareholders.

Pursuant to Treas. Reg. §1.355-2(d)(3)(ii), a strong corporate business purpose is evidence of non-device. As previously highlighted, and discussed in greater detail below, Fang’s board of directors determined a number of factors supporting the distribution of CIHL shares to Fang shareholders: differing business focuses and models of Fang and CIHL, improvement in both companies’ performance and the creation of more focused investment opportunities for shareholders, a desire to create an environment conducive to attracting investors and generating of capital for CIHL. These are all solid business purposes bolstering the determination of the transaction as a non-device transaction.

Pursuant to Treas. Reg. §1.355-2(d)(3)(iii), the fact that the Distributing Corporation is publicly traded and has no shareholder who is directly or indirectly the beneficial owner of more than five percent of any class of stock is evidence of non-device. Fang is publicly traded on the New York Stock Exchange, traded under the symbol of “SFUN” and does have greater-than 5% shareholders. However, this fact alone does not mean that the distribution is being utilized as a device to impermissibly extract E&P from the company. To the contrary, when viewed in conjunction with the business purpose for the transaction and other evidence of non-device, it becomes clear that the distribution of CIHL shares was not motivated by an improper purpose.

Pursuant to Treas. Reg. §1.355-2(d)(3)(iv), the fact that the stock of the Controlled Corporation is distributed to one or more domestic corporations that, if IRC §355 did not apply, would be entitled to a dividend received deduction under IRC §243 is evidence of non-device. The shareholders of Fang include domestic and foreign corporations, individuals, and other kinds of shareholders, of which some would benefit from the divided received deduction. Therefore, this factor is met.

Transactions Ordinarily Not Considered As a Device

In addition to the foregoing factors which provide evidence of device and non-device, Treas. Reg. §1.355-2(d)(5) specifies circumstances where a transaction will ordinarily not be considered to be a device. Specifically, a distribution is ordinarily considered not to have been used principally as a device if —

1. The Distributing and Controlled Corporations have no accumulated earnings and profits at the beginning of their respective taxable years;

2. The Distributing and Controlled Corporations have no current earnings and profits as of the date of the distribution; and

3. No distribution of property by the Distributing Corporation immediately before the separation would require recognition of gain resulting in current earnings and profits for the taxable year of the distribution.55

Based upon an analysis of book retained earnings as of December 31, 2017, it does appear that Fang has accumulated earnings and profits. However, based upon an analysis of the other device and non-device factors, including substantial business purpose, having earnings and profits is not determinative of a device.

55 Treas. Reg. §1.355-2(d)(5)(ii)(A)-(C).

13

IRS Proposed Regulations Regarding IRC §355 Device Requirement

On July 14, 2016, the IRS issued proposed regulations (REG-134016-15) that would modify and strengthen the device prohibition under Section 355(a)(1)(B). The proposed regulations would modify the corporate business purpose nondevice factor in Reg. Section 1.355-2(d)(3)(ii) and the nature and use of the assets device factor in Reg. Section 1.355-2(d)(2)(iv). Rather than focusing on “investment assets”, the proposed regulations focus on a percentage of a corporation’s assets that are “Business Assets” versus “Nonbusiness Assets”, and the percentage of these kinds of assets between Distributing and Controlled, to determine evidence of a device under Reg. Section 1.355-2(d)(2)(iv). Additionally, the proposed regulations introduce a new minimum threshold beyond which a transaction will be considered a device — a “Per Se” device rule.

c. Active Trade or Business Requirement

Pursuant to IRC §355(a)(1)(C), in order to obtain non-recognition treatment under IRC §355, a spin-off transaction must satisfy the active business requirements contained in IRC §355(b). For this purpose, IRC §355(b)(1)(A) requires that the Distributing and Controlled Corporations must each be engaged in the active conduct of a trade or business immediately after the spin-off transaction. Alternatively, if the Distributing Corporation has no assets other than stock or securities in Controlled Corporations, then the active trade or business requirement is satisfied if each of the Controlled Corporations is engaged in the active conduct of a trade or business immediately after the spin-off transaction.56

Pursuant to IRC §355(b)(2), a corporation is treated as engaged in the active conduct of a trade or business if and only if:

1. it is engaged in the active conduct of a trade or business;

2. such trade or business has been actively conducted throughout the five-year period ending on the date of the distribution;

3. such trade or business was not acquired in a transaction in which gain or loss was recognized in whole or in part within the five-year period ending on the date of the distribution; and

4. control of a corporation which (at the time of acquisition of control) was conducting such trade or business:

a. was not acquired by any distributee corporation directly (or through 1 or more corporations, whether through the Distributing Corporation or otherwise) within the five-year period and was not acquired by the Distributing Corporation directly (or through 1 or more corporations) within such period, or

b. was so acquired by any such corporation within the five-year period, but, in each case in which such control was so acquired, it was so acquired, only by reason of transactions in which gain or loss was not recognized in whole or in part, or only by reason of such transactions combined with acquisitions before the beginning of such period.

Under IRC §355(b)(2)(A) and (3) the active trade or business test of §355 is applied on an affiliated group basis, and §355(b)(3) treats all members of a corporation’s “separate affiliated group” (“SAG”) as one corporation. The SAG of any corporation is the affiliated group that would be determined under §1504(a) if that corporation were the common parent and §1504(b) did not apply, i.e., if the types of corporations enumerated in § 1504(b) were included in the affiliated group.57 Like the five-year look-back rule for testing active trade or business, this rule would apply for the five years preceding a distribution.58

56 IRC §355(b)(1)(B).

57 § 355(b)(3)(B). See also PLR 201010018.

58 Prop. Regs. § 1.355-3(b)(1)(ii), REG-123365-03.

14

Fang has been engaged in an active trade or business as defined by IRC §355 since 1999. Fang has been operating a leading real estate Internet portal in China, with Fang’s websites and mobile apps supporting active online communities and networks of users seeking information on, and services for, the real estate and home-related sectors in China. Fang’s service offerings include, among others, marketing services, e-commerce services, financial services, listing services, promotion services and information and analytic services.

Part of Fang’s service offerings include the business of CIHL, which is a holding company that does not have any substantive operations. CIHL primarily conducts its business and operations through CIHL’s 4 main subsidiaries in Hong Kong and China. Fang formed CIHL’s wholly owned subsidiary, CIAL on October 26, 2007, with the aim of providing industry professionals and consumers with the critical knowledge and tools to conduct business in China’s real estate market.

The business started nearly 20 years ago when Fang obtained and further developed a proprietary real estate information and analytics service platform in China, known as “China Index Suite,” based on CIHL’s China Real Estate Index System, or CREIS, a comprehensive set of benchmarks and data points initiated by CIHL and, widely adopted by industry participants to track, understand and analyze the real estate industry and real estate information in China. CIHL operates the largest real estate information, analytics and marketing service platforms in China in terms of geographical coverage and the volume of data points in 2017, primarily focusing on the commercial real estate industry. CIHL and Fang have been engaged in an active trade or business as defined by IRC §355 at least since 2007.

Based upon the facts above, the business operations of Fang and CIHL have been actively conducted for more than five years. In addition, such businesses were not acquired in a transaction in which gain or loss was recognized, in whole or in part, within the five-year period ending on the date of the distribution transaction.59 Following the distribution of CIHL shares, Fang will continue to retain its business operating a real estate internet portal in China primarily focusing on residential real estate, and CIHL will operate its data analytics and marketing business primarily focused on the commercial real estate industry.

Additionally, CIHL and its subsidiaries (referenced and described in facts above) are the kinds of entities which would be treated as corporations and a SAG under §1504 rules, and would have been part of a consolidated tax group in the prior 5 years.

As discussed above, Fang and CIHL have conducted the active trade or business requirement imposed by IRC §355(a)(1)(C).

IRS Proposed Regulations Regarding IRC §355 ATB Requirement

Prop. Reg. Section 1.355-9 establishes a new 5% minimum threshold with respect to the ATB requirement. To satisfy the ATB requirement, the “Five-Year-Active-Business Asset Percentage” (i.e., the percentage determined by dividing the fair market value of a corporation’s “Five-Year-Active-Business Assets” by the fair market value of its Total Assets) of each of Controlled and Distributing (and their respective separate affiliated groups) must be at least 5%. The Proposed Regulations will be effective for spin-offs occurring on or after the date the Proposed Regulations are published as final regulations.60

d. Retention Requirements

Pursuant to IRC §355(a)(1)(D), the Distributing Corporation must distribute all of the stock of the Controlled Corporation, or enough shares to constitute control of the Controlled Corporation. As noted above, Fang will distribute all of the shares issued and outstanding constituting control of the stock of CIHL to shareholders. Accordingly, there are no issues relative to retention of stock by Fang as the Distributing Corporation.

59 If a corporation could invest its cash or other liquid assets in acquiring an active business and then distribute the active business in a tax-free spin-off less than five years after the acquisition, the purpose of the five-year requirement would be frustrated. See H.R. Rep. No. 2543, 83d Cong., 2d Sess. 37 (1954). To prevent this, IRC §355(b)(2)(C) provides that a trade or business cannot meet the active business requirement if the trade or business was acquired within five years of the distribution in a transaction in which gain or loss was recognized in whole or in part.

60 Although the Final Regulations have not been issued as of the date of this memorandum, Fang and CIHL would meet the new proposed 5% minimum threshold with respect to the ATB requirement based on the facts described herein and representations by Fang and CIHL.

15

e. Business Purpose Requirement

The business purpose requirement is a judicially developed doctrine which has been codified in the treasury regulations and which requires that a legitimate non-tax business purpose exist for consummating a transaction in order to qualify for non-recognition treatment. In this regard, the business purpose requirement serves a general “substance over form” purpose — i.e. mere observance of the formal procedures described in the IRC does not entitle a transaction to non-recognition treatment under IRC §368 or IRC §355. As it relates to spin-off transactions, to merit non-recognition treatment, a spin-off transaction must be carried out for legitimate corporate business purposes and not merely as a means of distributing profits on a tax-free basis.61

Because IRC §355 is the only provision in the IRC which allows for the removal of assets from corporate solution without a corporate level tax, the business purpose analysis is most stringent and has the highest sensitivity in the IRC §355 context. In this regard, a transaction can fail to qualify under IRC §355 even in the absence of evidence of a tax-avoidance purpose if a valid business purpose cannot be established for the spin-off.62 In other words, a spin-off transaction does not merit non-recognition treatment simply because it does not have a tax avoidance purpose. Accordingly, it is essential to establish an independent corporate purpose for engaging in a spin-off transaction in order to ensure non-recognition treatment under IRC §355. For this purpose, Treas. Reg. §1.355-2(b) provides guidance relative to what constitutes an acceptable business purpose in the IRC §355 context.

Pursuant to Treas. Reg. §1.355-2(b)(1), IRC §355 applies to a transaction only if it is carried out for one or more corporate business purposes. For this purpose, a transaction is carried out for a corporate business purpose if it is motivated, in whole or substantial part, by one or more corporate business purposes.63 Pursuant to Treas. Reg. §1.355-2(b)(2), a corporate business purpose is defined as a real and substantial non Federal tax purpose germane to the business of the Distributing Corporation, the Controlled Corporation, or the affiliated group to which the Distributing Corporation belongs. For this purpose, a purpose of reducing taxes is not a corporate business purpose.64 In addition, a shareholder purpose (for example, the personal planning purposes of a shareholder) is not a corporate business purpose.65 However, depending upon the facts of a particular case, a shareholder purpose for a transaction may be so nearly coextensive with a corporate business purpose as to preclude any distinction between them in which case the shareholder purpose may constitute a valid business purpose.66

Significantly, there must not only be a business purpose for restructuring in general, but there must also be a specific corporate business purpose for structuring a transaction as a distribution under IRC §355. In this regard, Treas. Reg. §1.355-2(b)(3) provides that if a corporate business purpose can be achieved through a nontaxable transaction that does not involve the distribution of stock of a Controlled Corporation and which is neither impractical nor unduly expensive, then, the transaction will not be treated as carried out for such corporate business purpose.67 In other words, if a business purpose can be achieved utilizing another nonrecognition provision (e.g., IRC §332, IRC §351, IRC §368), then the business purpose requirement will not be satisfied with respect to IRC §355.

Pursuant to Rev. Proc. 96-30,68 in order to establish that a corporate business purpose for the distribution is to facilitate the raising of capital (via a stock offering), Distributing management must document and establish the following five factors relative to Controlled —

61 Treas. Reg. §1.355-2(b)(1). See also BNA Portfolio 776, Section II.E.I.

62 See e.g., Commissioner v. Wilson, 353 F.2d 184 (9th Cir. 1965), rev’g and rem’g 42 TC 914 (1964) (failed 355 transaction where taxpayer could not establish valid business purpose even though IRS could not establish tax-avoidance purpose).

63 Treas. Reg. §1.355-2(b)(1).

64 Treas. Reg. §1.355-2(b)(2). See also Treas. Reg. §1.355-2(b)(5), Examples (7) and (8).

65 Treas. Reg. §1.355-2(b)(2).

66 Treas. Reg. §1.355-2(b)(5), Example (2).

67 See also Treas. Reg. §1.355-2(b)(5), Examples (3)( and (4).

68 Rev. Proc. 96-30 provides specific guidelines relative to the information required to obtain a private letter ruling under IRC §355. IRS no longer issues private letter rulings on factual determinations relative to business purpose, non-device, and IRC §355(e) plan issues. See Rev. Proc. 2003-48. Accordingly, Rev. Proc. 96-30 has become somewhat irrelevant as a technical matter. However, Rev. Proc. 96-30 remains of tremendous practical significance insofar as it provides evidence of IRS position and provides guidance relative to the factual elements required to establish the validity of an IRC §355 spin-off transaction.

16

1. The corporation needs to raise a substantial amount of capital in the near future to fund operations, capital expenditures, acquisitions, the retirement of indebtedness, or other business needs.

2. The stock offering will raise significantly more funds per share, or is otherwise more advantageous, if Controlled is separated from Distributing.

3. The funds raised in a future capital raise with respect to Controlled will, under all circumstances, be used for the business needs of Controlled.

4. The Controlled capital raise will be completed within one year of the share distribution.

5. If the Controlled capital raise will involve the purchase of Controlled shares by a limited number of investors who require the separation of Controlled from Distributing as a pre-condition to their participation, it is recommended that substantiation in the form of a statement or similar documentation be obtained from such investors if possible.

As highlighted above, CIHL was formed to operate real estate related information and analytics services in China, which primarily serves real estate participants, including real estate developers, brokers and financial institutions. With the rapid development of China’s commercial property sector and the synergy associated with CIHL’s combined business, Fang’s board of directors believe that it is in the best interests of Fang and its shareholders for CIHL to operate the commercial property-related business independently with Fang continuing its business operating a real estate Internet portal in China and pursuing its strategy of enhancing its online operations and residential property-related business.69

Fang’s board of directors determined that a separation of the spun-off business would improve both companies’ performance and create more focused investment opportunities for shareholders, and that the proposed Separation and Distribution would accomplish this goal in the most straightforward manner.70 More specifically, Fang’s board of directors considered the following expected major benefits:

· Enhanced strategic and business focus. The Separation and Distribution will allow each company to focus on, and more effectively pursue, its own distinct operating priorities and strategies, and will enable the management of each company to concentrate efforts on the unique needs of each business and pursue distinct opportunities for long-term growth and profitability. Specifically, CIHL will strategically focus primarily on the commercial property sector in China to capture the enormous market opportunity from its rapid development, while Fang will retain its business operating a real estate Internet portal focusing primarily on serving the residential property sector.

· More efficient allocation of capital. The Separation and Distribution will permit each company to concentrate its financial resources solely on its own operations, providing greater flexibility to invest capital in its business in a timely manner appropriate for its distinct strategy and business needs and facilitate a more efficient allocation of capital.

· Alignment of incentives with performance objectives. The Separation and Distribution will facilitate incentive compensation arrangements for employees more directly tied to the performance of the relevant company’s business, and may enhance employee hiring and retention by, among other things, improving the alignment of management and employee incentives with performance and growth objectives.

· Direct access to capital markets. The Separation and Distribution will create an independent equity structure that will afford CIHL direct access to capital markets and facilitate CIHL’s ability to capitalize on its unique growth opportunities and effect future acquisitions utilizing its ordinary shares.

69 See Form F-1, p. 81.

70 Id.

17

· Capital market profile. The Separation and Distribution will allow investors to separately value Fang and CIHL based on their unique investment identities, including the merits, performance and future prospects of their respective businesses. The Separation and Distribution will also provide investors with two distinct and targeted investment opportunities. The investment community, including analysts, stockholders and prospective investors in each company, will be better able to realize the value of each company fully and independently and enhance the brand recognition of each company. 71

Thus, the distribution of CIHL shares is supported by a valid corporate business purpose. Moreover, given the need to separate CIHL from Fang so that CIHL could operate on a separate and independent basis, this corporate business purpose could not be achieved through a nontaxable transaction that did not involve the distribution of Controlled in an IRC §355 transaction. Accordingly, the business purpose requirement is met.

f. Continuity of Business Enterprise Requirement

The continuity of business enterprise requirement (“COBE”) is a judicially developed doctrine which has been codified in the treasury regulations and which serves a general “substance over form” purpose — i.e. mere observance of the formal procedures described in the IRC does not entitle a transaction to non-recognition treatment under IRC §368 or IRC §355; to merit non-recognition treatment, the substance of the transaction must effectively be a mere adjustment of a continuing business. In addition, the COBE doctrine provides supplemental protection against the use of a spin-off as a device to distribute earnings and profits in the context of IRC §355 spin-off transactions by preventing a corporation from “cashing out” of a qualified active business by spinning off the subsidiary conducting the business and letting the newly independent subsidiary sell the business.73

Pursuant to Treas. Reg. §1.355-1(b), IRC §355 contemplates the continued operation of the business or businesses existing prior to the separation. In this way, the treasury regulations import into the IRC §355 regime the general requirement applicable to IRC §368 reorganizations that continuity of the business enterprise must exist post-transaction.74 In this regard, the COBE requirement in the IRC §355 spin-off context has traditionally been regarded as essentially the same as the COBE requirement imposed in the contexts of reorganizations generally.75 Thus, the guidance provided in the treasury regulations under IRC §368 relative to COBE is relevant for purposes of satisfying the COBE doctrine in the IRC §355 context.

Consistent with the treasury regulations under IRC §368, in order for the COBE requirement to be satisfied, the Distributing Corporation and the Controlled Corporation must each continue at least one of their businesses or use a significant portion of their historic business assets in a business following the spin-off transaction.76 Following the distribution of CIHL shares, Fang will continue to retain its business operating a real estate internet portal in China including its business service offerings which include, among others, marketing services, e-commerce services, financial services, listing services, promotion services and information and analytic services with a primary focus on residential real estate; CIHL will operate its data analytics and marketing business primarily focused on the commercial real estate industry. In addition, the existing operations of CIHL will be continued following the distribution of Controlled shares. Consequently, the requisite continuity of business enterprise will exist with respect to both Fang and CIHL following the distribution of CIHL shares, and the COBE requirement is, therefore, satisfied.

71 See Form F-1, p. 81-82.

73 BNA Portfolio 776, Section II.E.I. Such a transaction would provide the same economic effect as if the business was sold and the sale proceeds were distributed to shareholders, but with the shareholders taxed at capital gains rates rather than ordinary income rates.

74 Bittker & Eustice, Federal Income Taxation of Corporations & Shareholders, ¶11.09.

75 BNA Portfolio 776, Section VII.B.

76 Treas. Reg. §1.368-1(d); BNA Portfolio 776, Section VII.B.

18

g. Continuity of Proprietary Interest Requirement

The continuity of proprietary (shareholder) interest requirement (“COPI”), is a judicially developed doctrine which has been codified in the treasury regulations for both reorganization and spin-off transactions.77 Similar to the continuity of business enterprise and business purpose requirements, the COPI requirement has its origin in substance over form principles, requiring that the substance of the transaction must be a mere adjustment of continuing interests in the corporations involved in the transaction to merit non-recognition treatment. In the case of an IRC §355 spin-off transaction, the continuity of shareholder interest requirement can additionally be viewed as supplemental protection against the use of a spin-off as a device to distribute earnings and profits by preventing shareholders from “cashing out” of either the Distributing or Controlled Corporation while maintaining a continuing interest in the other.78

Under the COPI doctrine, in order for a reorganization to qualify for non-recognition treatment, there must be a “continuity of interest” in the resulting entity on the part of the shareholders of the acquired corporation.79 For this purpose, the requisite continuity of shareholder interest exists if one or more persons who, directly or indirectly, were the owners of the enterprise prior to the IRC §355 distribution own, in the aggregate, an amount of stock establishing a continuity of interest in each of the modified corporate forms in which the enterprise is conducted after the separation.80

While the treasury regulations do not clearly establish a minimum level of continuity required to satisfy the COPI requirement, they do provide some guidance. In this regard, examples contained in Treas. Reg. §1.355-2(c)(2) indicate that 20% continuity is inadequate and that 50% continuity is sufficient for purposes of satisfying the COPI requirement in the IRC §355 context. In addition, Rev. Proc. 96-30 provides that the IRS will generally view the COPI requirement as satisfied if there is 50% or more continuity relative to the ownership of both the Distributing and Controlled Corporations. Thus, 50% continuity should be sufficient to satisfy the COPI requirement. It should also be noted that pre- and post-spin-off transactions, as well as transactions taken in conjunction with a spin-off, are relevant to the COPI analysis. In this regard, certain transactions undertaken before or after a spin-off can violate the COPI doctrine and cause the transaction to fail under IRC §355.

In the case of the distribution of CIHL shares by Fang, the existing shareholders of Fang will continue to own all of the outstanding shares of Fang and will additionally own all of the outstanding shares of CIHL following the transaction. Consequently, the requisite continuity of shareholder interest will exist with respect to both Fang and CIHL, and the COPI requirement is, therefore, satisfied. Moreover, it is not anticipated that shareholders will engage in any disposition or other transaction before or after the spin-off transaction which would violate the COPI doctrine and cause the transaction to fail under IRC §355.

h. Summary of Eligibility Under IRC §355

Among other items, in summary —

1. Fang distributed all of the shares of CIHL to Fang shareholders without any surrender of stock by Fang shareholders, thereby satisfying the requirement under IRC §355(a)(1)(A) that solely stock or securities in a Controlled Corporation be distributed to shareholders.

77 Treas. Reg. §1.368-1(e); Treas. Reg. §1.355-2(c)(1).

78 BNA Portfolio 776, Section II.E.I.

79 See e.g., LeTulle v. Scofield, 308 U.S. 415 (1940); Helvering v. Minnesota Tea Co., 296 U.S. 378 (1935); Pinellas Ice & Cold Storage Co. v. Comr., 287 U.S. 462 (1933); Cortland Specialty Co. v. Comr., 60 F.2d 937 (2d Cir. 1932). Congress embraced this doctrine in H.R. Rep. No. 704, 73d Cong. 2d Sess. (1934), and Treasury incorporated it into the treasury regulations under IRC 368 at Treas. Reg. §§1.368-1(b) and (e).

80 Treas. Reg. §1.355-2(c)(1).

19

2. The distribution of CIHL shares is generally of a type which would not be considered to be a device for extracting E&P, thereby satisfying the non-device requirement under IRC §355(a)(1)(B).

3. Both Fang and CIHL have been in existence and engaged in the conduct of an active trade or business for more than five years, and both entities will continue to engage in their historic businesses following the distribution of CIHL shares, thereby satisfying the active trade or business requirement under IRC §355(a)(1)(C).

4. Fang distributed all of its CIHL shares to Fang shareholders, thereby satisfying the non-retention requirements imposed under IRC §355(a)(1)(D).

5. The distribution of CIHL shares was consummated for good and valid business purposes relating to capital market considerations, allows each management team to concentrate on strategic and operational issues relevant to its distinct business, and allows CIHL to access and generate capital. Therefore, the business purpose requirement imposed under Treas. Reg. §1.355-2(b) is satisfied.

6. Following the distribution of CIHL shares, Fang will continue to engage in its active Internet portal business in China focusing on residential real estate, and CIHL will continue to engage in its active data analytics and marketing business focusing on the commercial real estate market. Therefore, the continuity of business enterprise requirement imposed under Treas. Reg. §1.355-1(b) is satisfied.

7. Following the distribution of CIHL shares, Fang shareholders directly own [100%] of the outstanding common stock of Fang, as well as [100%] of the [outstanding common] stock of CIHL. Therefore, the continuity of proprietary interest requirement imposed under Treas. Reg. §1.355-2(c) is satisfied.