Our capital expenditures were $0.6 million for fiscal year ended December 31, 2017 and $2.6 million for the fiscal year ended December 31, 2016. These expenditures were primarily related to vehicles and computer software and hardware purchases. A portion of these capital expenditures is recoverable under our ongoing contracts.

Net Cash provided by Financing Activities

Cash provided by financing activities totaled $233.9 million for the fiscal year ended December 31, 2017 primarily as a result of the acquisition of Janus, which drove member contributions of $76.0 million and proceeds from a note payable of $67.5 million and a subordinated note of $38.5 million. In addition, the refinancing of Michael Baker International, LLC’s debt in November 2017 resulted in an allocation to us of $175.2 million of the new Michael Baker International, LLC term loan, which was partially offset by the net reductions in allocated debt that was refinanced. Cash used in financing activities totaled $4.0 million for the fiscal year ended December 31, 2016 as a result of net draws on the Previous Credit Agreements, as defined below, for working capital needs.

Description of Indebtedness

Refinanced Indebtedness

We entered into a credit agreement with Bank of America, N.A. and certain other parties on December 15, 2017 and another credit agreement with SunTrust Robinson Humphrey, Inc. and certain other parties on March 22, 2018 (together, the “Previous Credit Agreements”). We also entered into a subordinated loan agreement on December 15, 2017 with certain noteholders (the “Subordinated Loan Agreement”). In addition, we were a party of Michael Baker International’s consolidated debt structure, which included a revolving credit facility and a term loan. We were allocated a ratable portion of such debt, as reflected in our combined financial statements (together, with the Previous Credit Agreements and the Subordinated Loan Agreement, the “Refinanced Indebtedness.”)

We repaid the Refinanced Indebtedness on August 14, 2018 with the proceeds of the New Credit Facilities as described in “New Credit Facilities” below.

New Credit Facilities

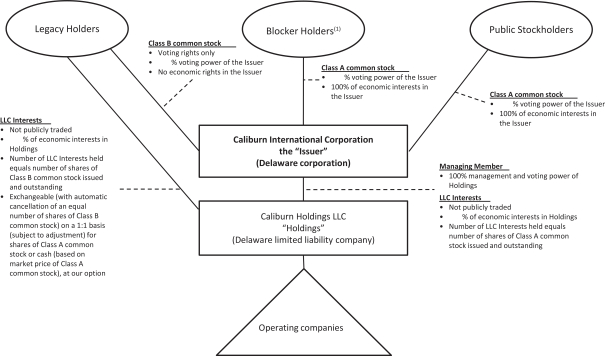

Overview. On August 14, 2018, we entered into senior secured credit facilities (the “New Credit Facilities”) pursuant to a Credit Agreement (the “Credit Agreement”), by and among, among others, Caliburn International LLC, as borrower, its direct parent company, Caliburn Holdings LLC (“Holdings”), as guarantor, certain subsidiaries of Caliburn International LLC, as guarantors, Bank of America, N.A., as administrative agent (the “Administrative Agent”), and the lenders from time to time party thereto. Obligations under the New Credit Facilities are secured by a first lien on substantially all of the assets of the borrower and the guarantors.

The New Credit Facilities comprise a $380.0 million term loan facility (the “Term Loan Facility”) and a $75.0 million revolving credit facility (the “Revolving Credit Facility”). We used the proceeds from borrowing under the Term Loan Facility, and a $15.0 million borrowing under the Revolving Credit Facility, to finance certain transactions in connection with the Combination, including (i) repaying $382.3 million of outstanding indebtedness, preferred stock and bridge equity of Holdings and certain of its subsidiaries, (ii) making a $15.0 million cash distribution and a $12.5 million non-cash distribution to certain equity holders of Holdings and certain of its subsidiaries, and (iii) paying fees and expenses in connection with the foregoing. We also use borrowings under the Revolving Credit Facility to finance working capital and other general corporate purposes.

As of August 24, 2018, we had $19.5 million outstanding under the Revolving Credit Facility, and $0.2 million outstanding under letters of credit, and we had availability of $55.3 million. As of August 24, 2018, we had $380.0 million outstanding under the Term Loan Facility.

The interest rates for the Term Loan Facility and the Revolving Credit Facility are variable. Based on LIBOR rates in effect at August 24, 2018, we would be subject to interest payments on the Term Loan Facility and the Revolving Credit Facility at a blended effective rate of 5.3%. The loans under the Term Loan Facility are repayable in quarterly installments equal to (i) from December 31, 2018 to September 30, 2020, approximately $4.8 million, (ii) from December 31, 2020 to September 30, 2021, approximately $7.1 million and (iii) from December 31, 2021 to March 31, 2023, approximately $9.5 million, with the remaining principal and interest due thereon due on the maturity date. The revolving loans under the Revolving Credit Facility do not require periodic principal payments.

94