239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 NASDAQ: MRBK Q4'2023 Earnings Supplement

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 2Meridian Corporation FORWARD-LOOKING STATEMENTS Meridian Corporation (the “Corporation”) may from time to time make written or oral “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Meridian Corporation’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Meridian Corporation’s control). Numerous competitive, economic, regulatory, legal and technological factors, risks and uncertainties that could cause actual results to differ materially include, without limitation, credit losses and the credit risk of our commercial and consumer loan products; changes in the level of charge-offs and changes in estimates of the adequacy of the allowance for credit losses, or ACL; cyber-security concerns; rapid technological developments and changes; increased competitive pressures; changes in spreads on interest-earning assets and interest-bearing liabilities; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and the effects of inflation, a potential recession, among others, could cause Meridian Corporation’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements. Meridian Corporation cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward- looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Meridian Corporation’s filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2022 and subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Meridian Corporation does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by Meridian Corporation or by or on behalf of Meridian Bank.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 3Meridian Corporation MRBK INVESTMENT HIGHLIGHTS • "Go to" bank in the Delaware Valley - comfortably handles all but largest companies. • Technology driven with valuable customer base trained to solely use electronic channel. • Skilled management team with extensive in-market experience. • Strong sales culture that capitalizes on market disruption. • Demonstrated organic growth engine in diversified loan segments. • Financial services business model with significant non-interest revenue. • Historically well capitalized with strong net interest margin. • Excellent historical asset quality. • Strong net interest margin driven by loan yield. • Nationally recognized as a great place to work.

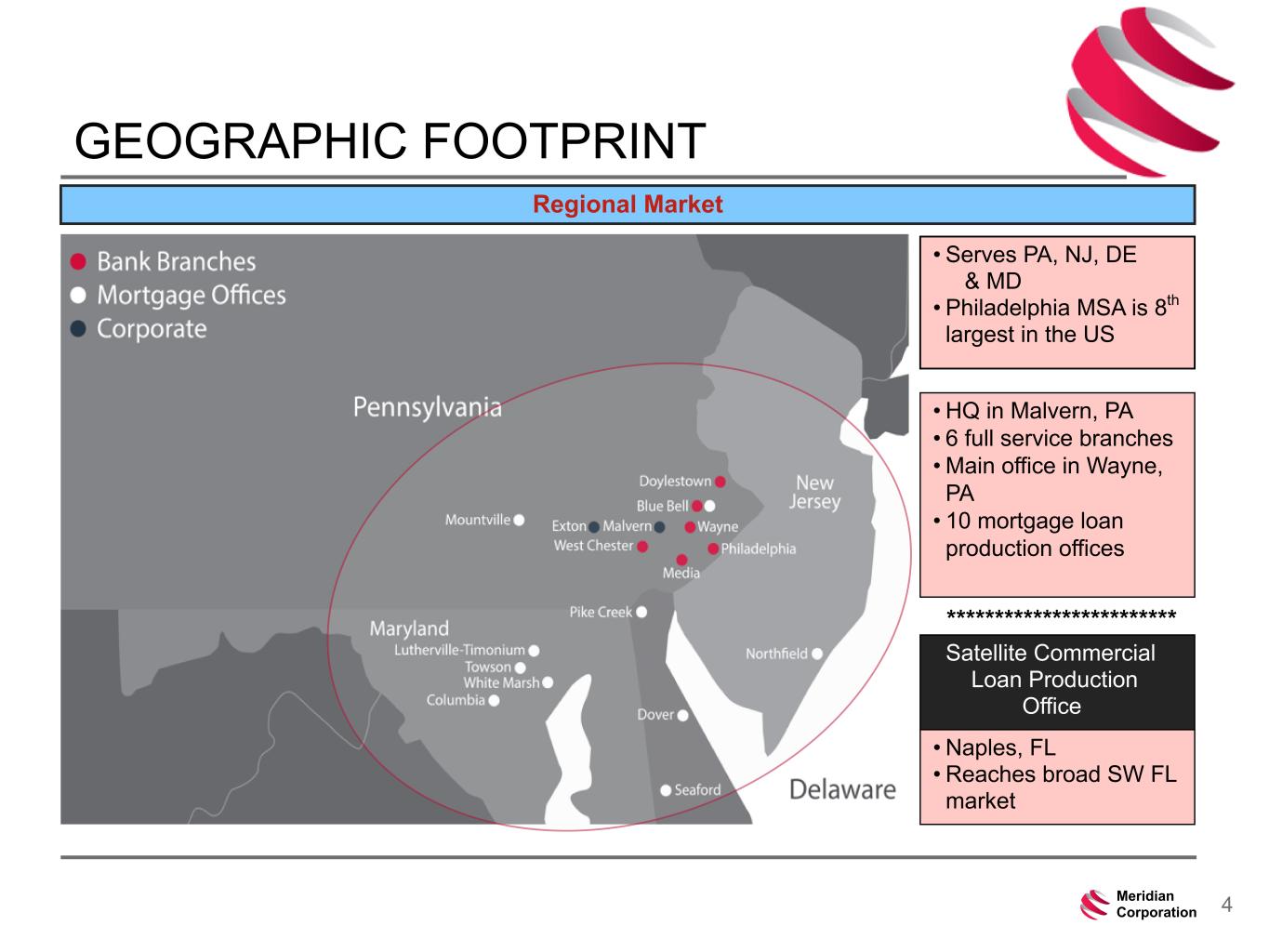

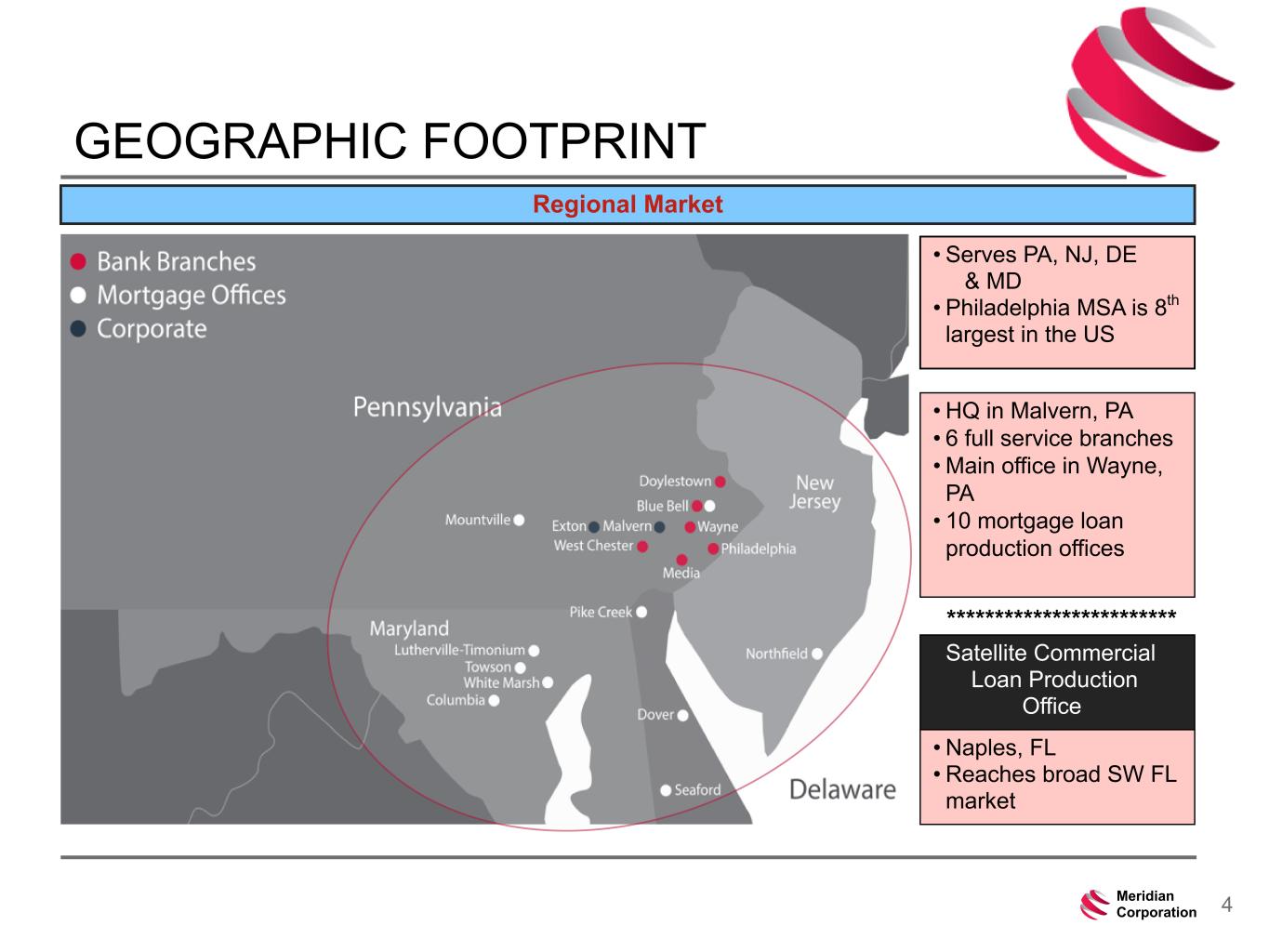

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 4Meridian Corporation GEOGRAPHIC FOOTPRINT • Serves PA, NJ, DE & MD • Philadelphia MSA is 8th largest in the US Regional Market • HQ in Malvern, PA • 6 full service branches • Main office in Wayne, PA • 10 mortgage loan production offices • Naples, FL • Reaches broad SW FL market ************************ Satellite Commercial Loan Production Office

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 5Meridian Corporation COMPANY SNAPSHOT (1) Includes home equity loans, residential mortgage loans held in portfolio and individual consumer loans. • Meridian is an innovative, growth oriented commercial bank serving the Tri-State area and the Baltimore /DC market. • We focus on customer success and helping to build the economics of our markets. • Meridian specializes in business and industrial lending, retail and commercial real estate lending, along with a broad menu of high- yielding depository products. • We deliver these services with great technology, supported by robust online and mobile access, and physical locations convenient to our customers. Cash & investments 11% C & I loans 27% CRE loans 29% Construction loans 13% Consumer loans (1) 14% Residential loans HFS 2% FF & E 0% Other assets 4% Asset Mix at December 31, 2023 Profile and Business Lines

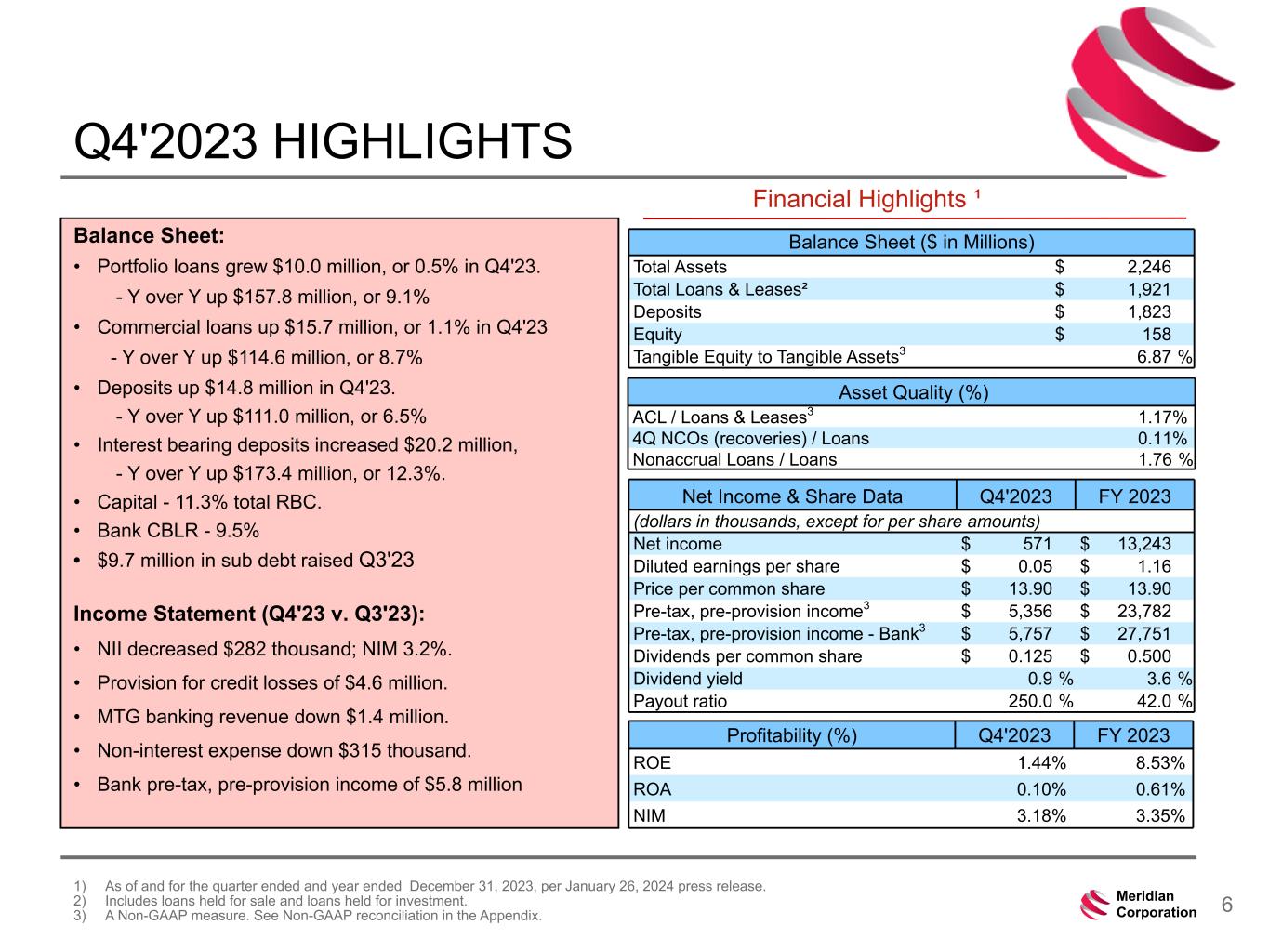

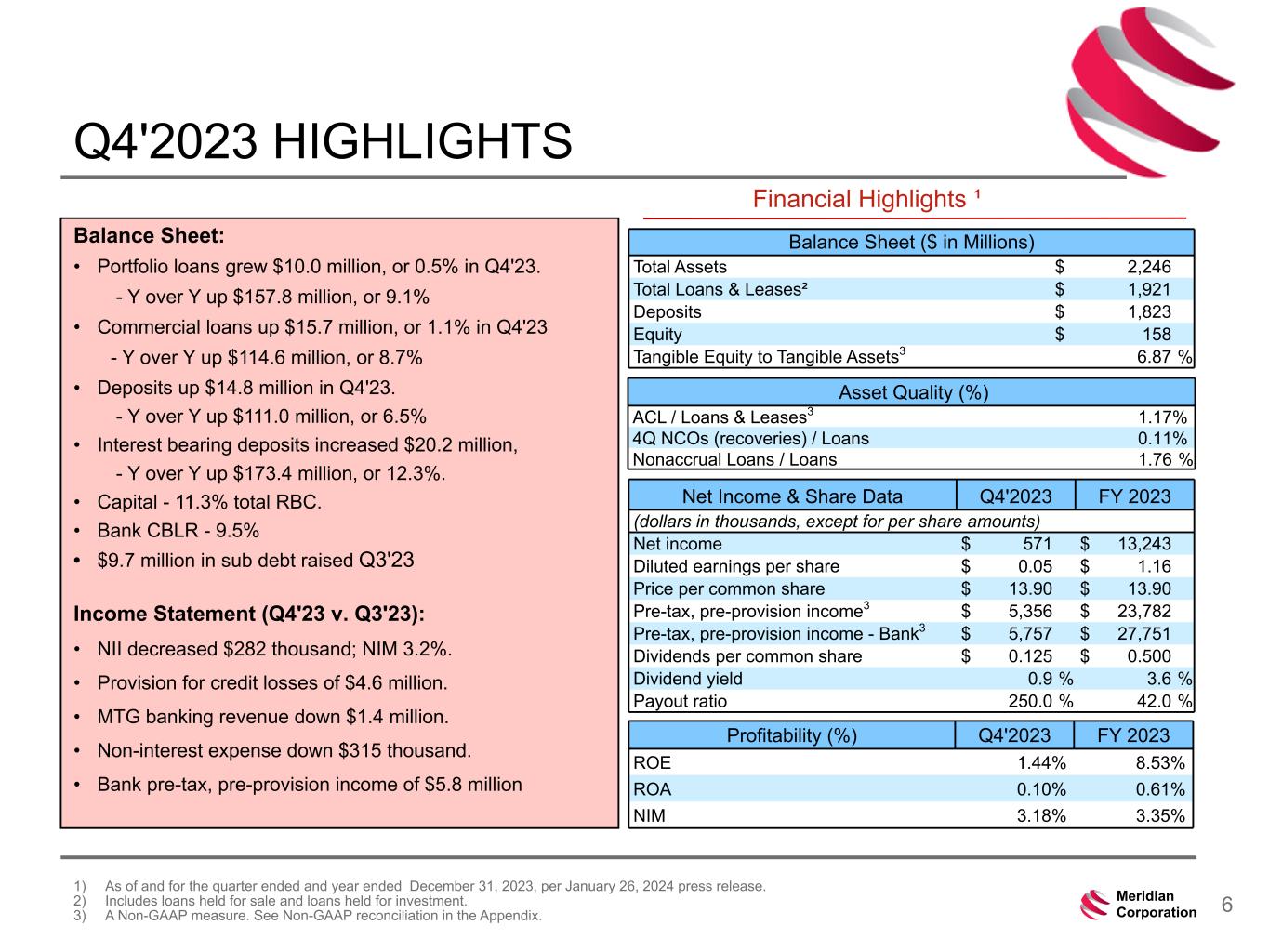

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 6Meridian Corporation Q4'2023 HIGHLIGHTS 1) As of and for the quarter ended and year ended December 31, 2023, per January 26, 2024 press release. 2) Includes loans held for sale and loans held for investment. 3) A Non-GAAP measure. See Non-GAAP reconciliation in the Appendix. Financial Highlights ¹ Balance Sheet: • Portfolio loans grew $10.0 million, or 0.5% in Q4'23. - Y over Y up $157.8 million, or 9.1% • Commercial loans up $15.7 million, or 1.1% in Q4'23 - Y over Y up $114.6 million, or 8.7% • Deposits up $14.8 million in Q4'23. - Y over Y up $111.0 million, or 6.5% • Interest bearing deposits increased $20.2 million, - Y over Y up $173.4 million, or 12.3%. • Capital - 11.3% total RBC. • Bank CBLR - 9.5% • $9.7 million in sub debt raised Q3'23 Income Statement (Q4'23 v. Q3'23): • NII decreased $282 thousand; NIM 3.2%. • Provision for credit losses of $4.6 million. • MTG banking revenue down $1.4 million. • Non-interest expense down $315 thousand. • Bank pre-tax, pre-provision income of $5.8 million Balance Sheet ($ in Millions) Total Assets $ 2,246 Total Loans & Leases² $ 1,921 Deposits $ 1,823 Equity $ 158 Tangible Equity to Tangible Assets3 6.87 % Profitability (%) Q4'2023 FY 2023 ROE 1.44% 8.53% ROA 0.10% 0.61% NIM 3.18% 3.35% Asset Quality (%) ACL / Loans & Leases3 1.17% 4Q NCOs (recoveries) / Loans 0.11% Nonaccrual Loans / Loans 1.76 % Net Income & Share Data Q4'2023 FY 2023 (dollars in thousands, except for per share amounts) Net income $ 571 $ 13,243 Diluted earnings per share $ 0.05 $ 1.16 Price per common share $ 13.90 $ 13.90 Pre-tax, pre-provision income3 $ 5,356 $ 23,782 Pre-tax, pre-provision income - Bank3 $ 5,757 $ 27,751 Dividends per common share $ 0.125 $ 0.500 Dividend yield 0.9 % 3.6 % Payout ratio 250.0 % 42.0 %

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 7Meridian Corporation PRE-TAX, PRE-PROVISION INCOME BY SEGMENT Pre-tax, Pre-provision Income by Segment Q4'2023 Q3'2023 YR 2023 YR 2022 Bank $ 5,757 $ 6,399 $ 27,751 $ 31,004 Wealth 267 417 1,240 2,030 Mortgage (668) (1,524) (5,209) (2,626) Total Pre-tax Income $ 5,356 $ 5,292 $ 23,782 $ 30,408 % of Pre-tax, Pre-provision Income by Segment (Q4) 107.5% 5.0% Bank Wealth Mortgage % of Pre-tax, Pre-provision Income by Segment (YTD) 116.7% 5.2% Bank Wealth Mortgage

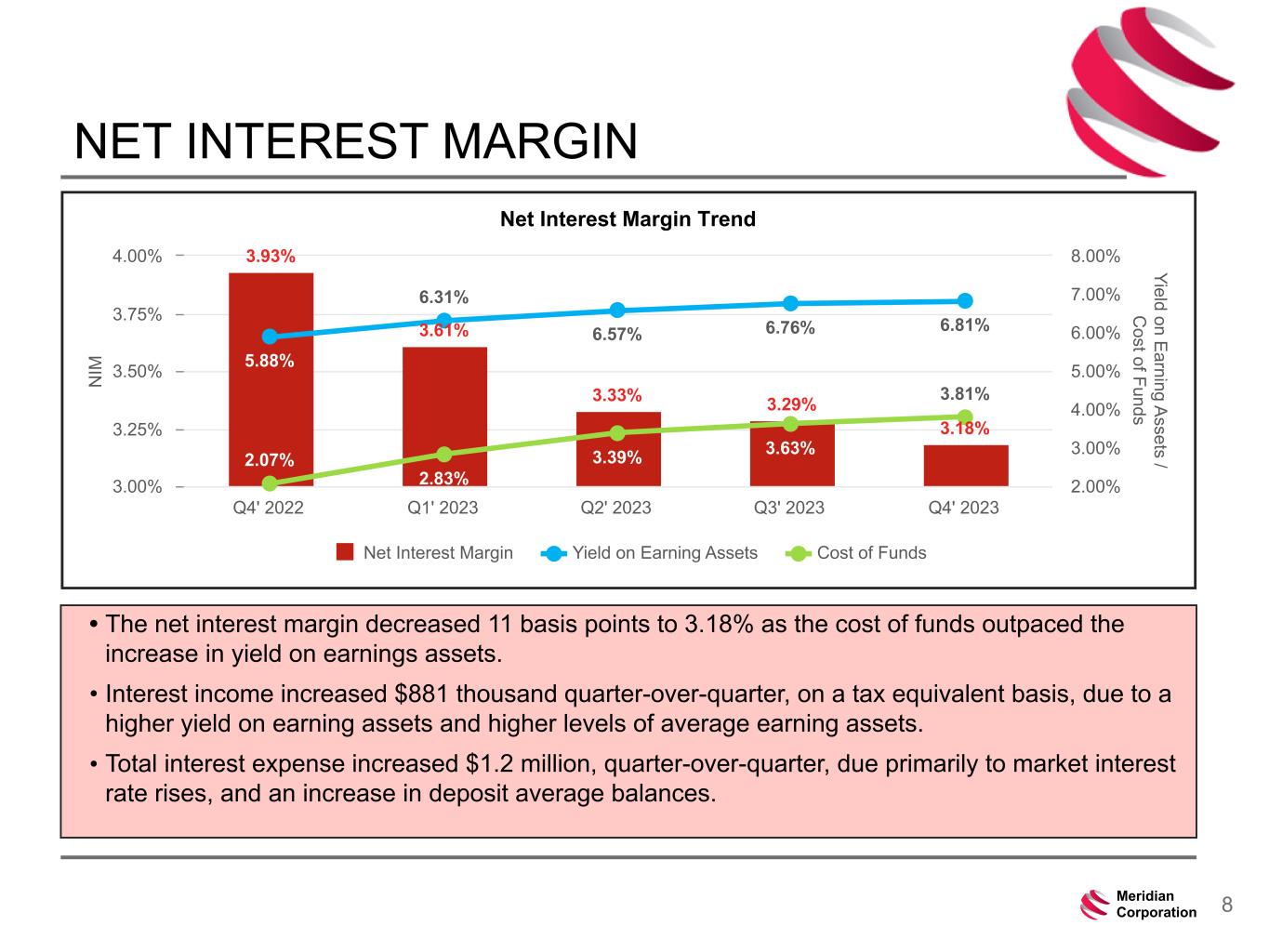

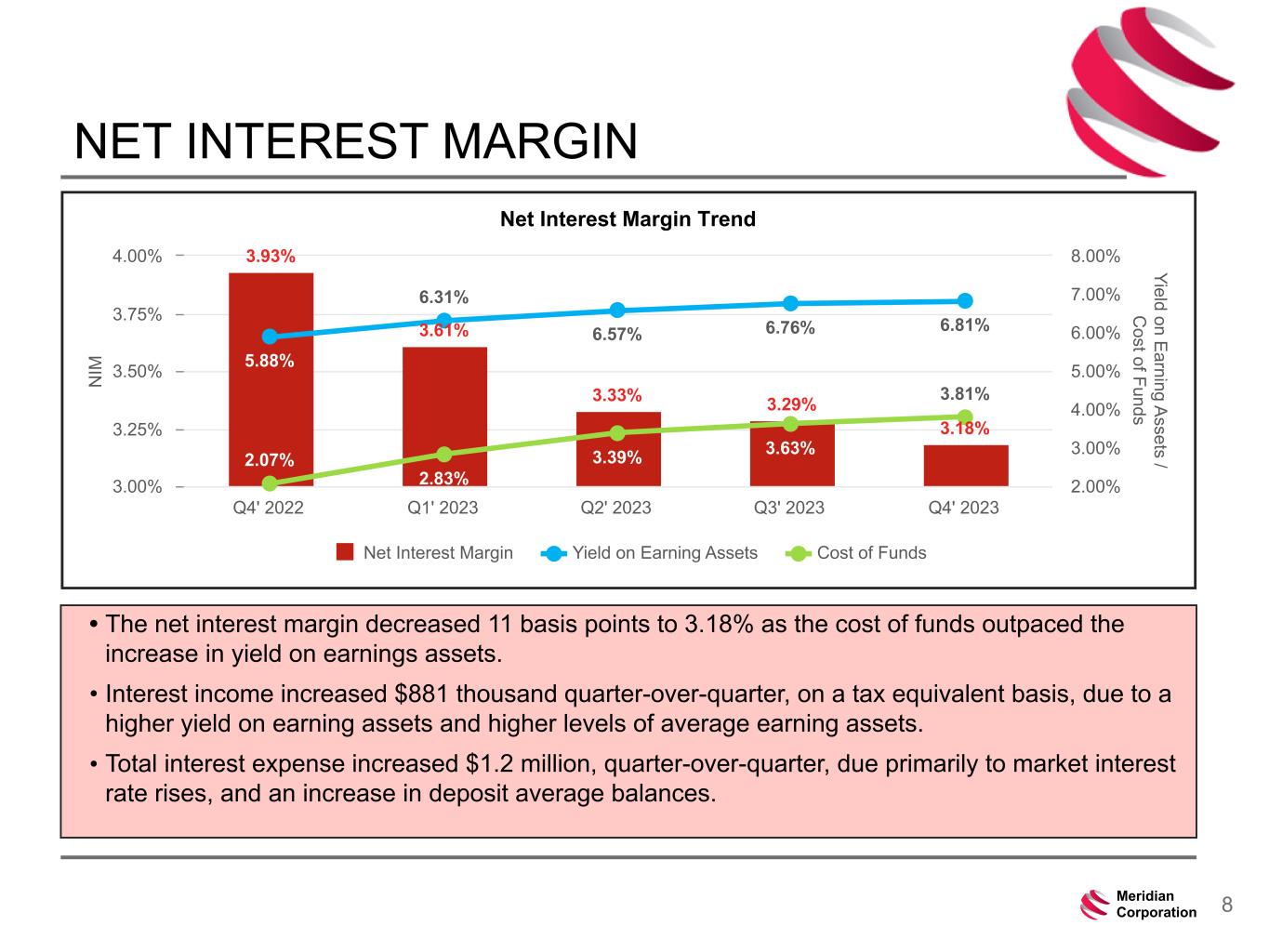

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 8Meridian Corporation NET INTEREST MARGIN • The net interest margin decreased 11 basis points to 3.18% as the cost of funds outpaced the increase in yield on earnings assets. • Interest income increased $881 thousand quarter-over-quarter, on a tax equivalent basis, due to a higher yield on earning assets and higher levels of average earning assets. • Total interest expense increased $1.2 million, quarter-over-quarter, due primarily to market interest rate rises, and an increase in deposit average balances. N IM Yield on E arning A ssets / C ost of Funds Net Interest Margin Trend 3.93% 3.61% 3.33% 3.29% 3.18% 5.88% 6.31% 6.57% 6.76% 6.81% 2.07% 2.83% 3.39% 3.63% 3.81% Net Interest Margin Yield on Earning Assets Cost of Funds Q4' 2022 Q1' 2023 Q2' 2023 Q3' 2023 Q4' 2023 3.00% 3.25% 3.50% 3.75% 4.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00%

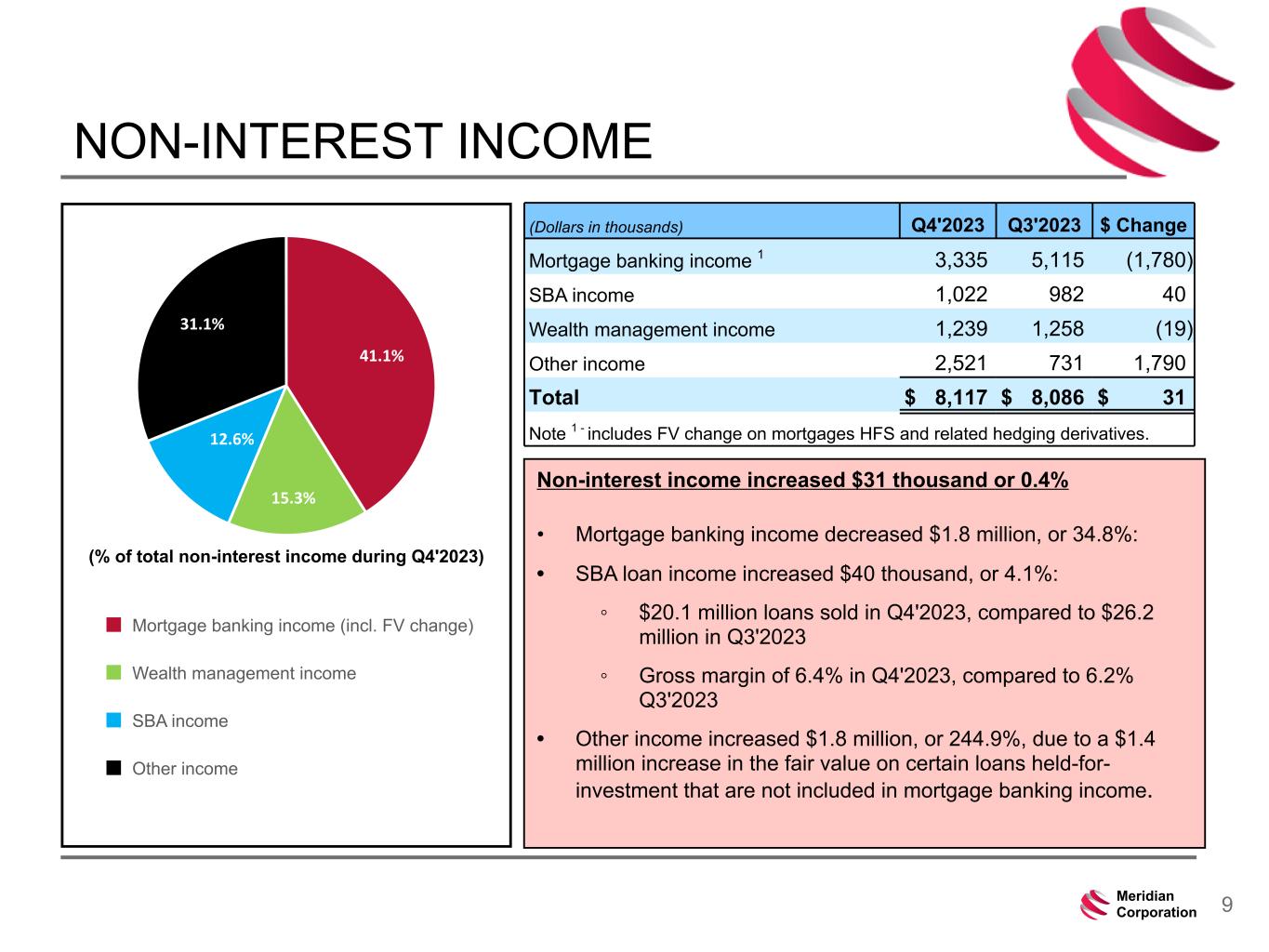

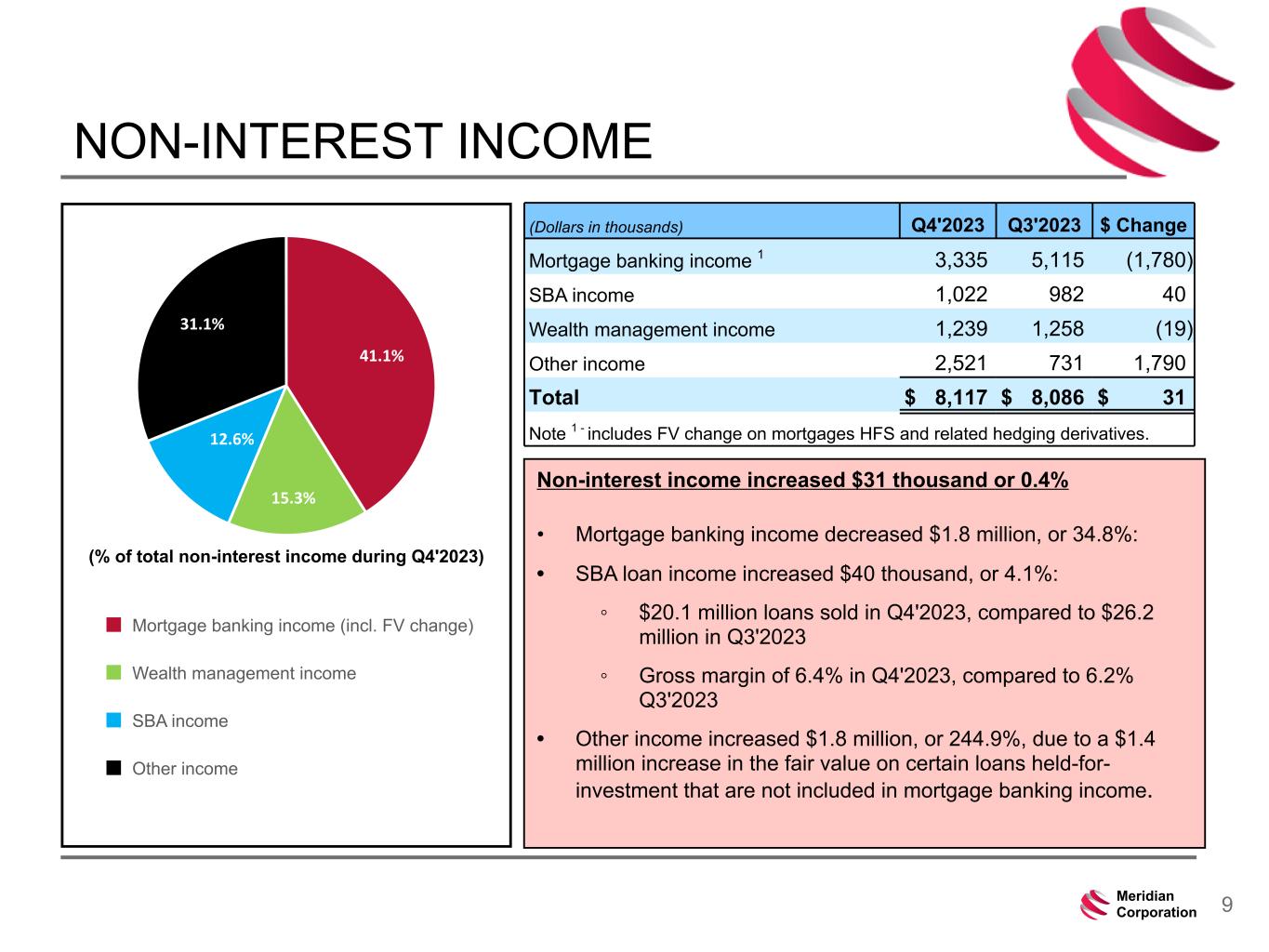

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 9Meridian Corporation NON-INTEREST INCOME Non-interest income increased $31 thousand or 0.4% • Mortgage banking income decreased $1.8 million, or 34.8%: • SBA loan income increased $40 thousand, or 4.1%: ◦ $20.1 million loans sold in Q4'2023, compared to $26.2 million in Q3'2023 ◦ Gross margin of 6.4% in Q4'2023, compared to 6.2% Q3'2023 • Other income increased $1.8 million, or 244.9%, due to a $1.4 million increase in the fair value on certain loans held-for- investment that are not included in mortgage banking income. (Dollars in thousands) Q4'2023 Q3'2023 $ Change Mortgage banking income 1 3,335 5,115 (1,780) SBA income 1,022 982 40 Wealth management income 1,239 1,258 (19) Other income 2,521 731 1,790 Total $ 8,117 $ 8,086 $ 31 Note 1 - includes FV change on mortgages HFS and related hedging derivatives. 41.1% 15.3% 12.6% 31.1% Mortgage banking income (incl. FV change) Wealth management income SBA income Other income (% of total non-interest income during Q4'2023)

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 10Meridian Corporation MORTGAGE PERFORMANCE • Fiscal year 2023 - unprecedented lack of homes for sale • Margin declined 44 basis points year over year • Mortgage loan origination volume down $445.3 million year over year Net Profit ($000s) $2,403 $20,899 $14,633 $(2,627) $(5,213) Revenue Expense Net profit 2019 2020 2021 2022 2023 $(25,000) $— $25,000 $50,000 $75,000 $100,000 Continued expense reductions: • Cumulative expense reduction of over $3.8 million. • Reducing FTEs, instituting pay cuts & other compensation changes, closing loan production offices. Cumulative Expense Reductions ($000s) $15 $336 $853 $1,593$1,636 $1,903 $2,673 $3,803 Cumulative expense reductions LTD Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 $— $1,000 $2,000 $3,000 $4,000

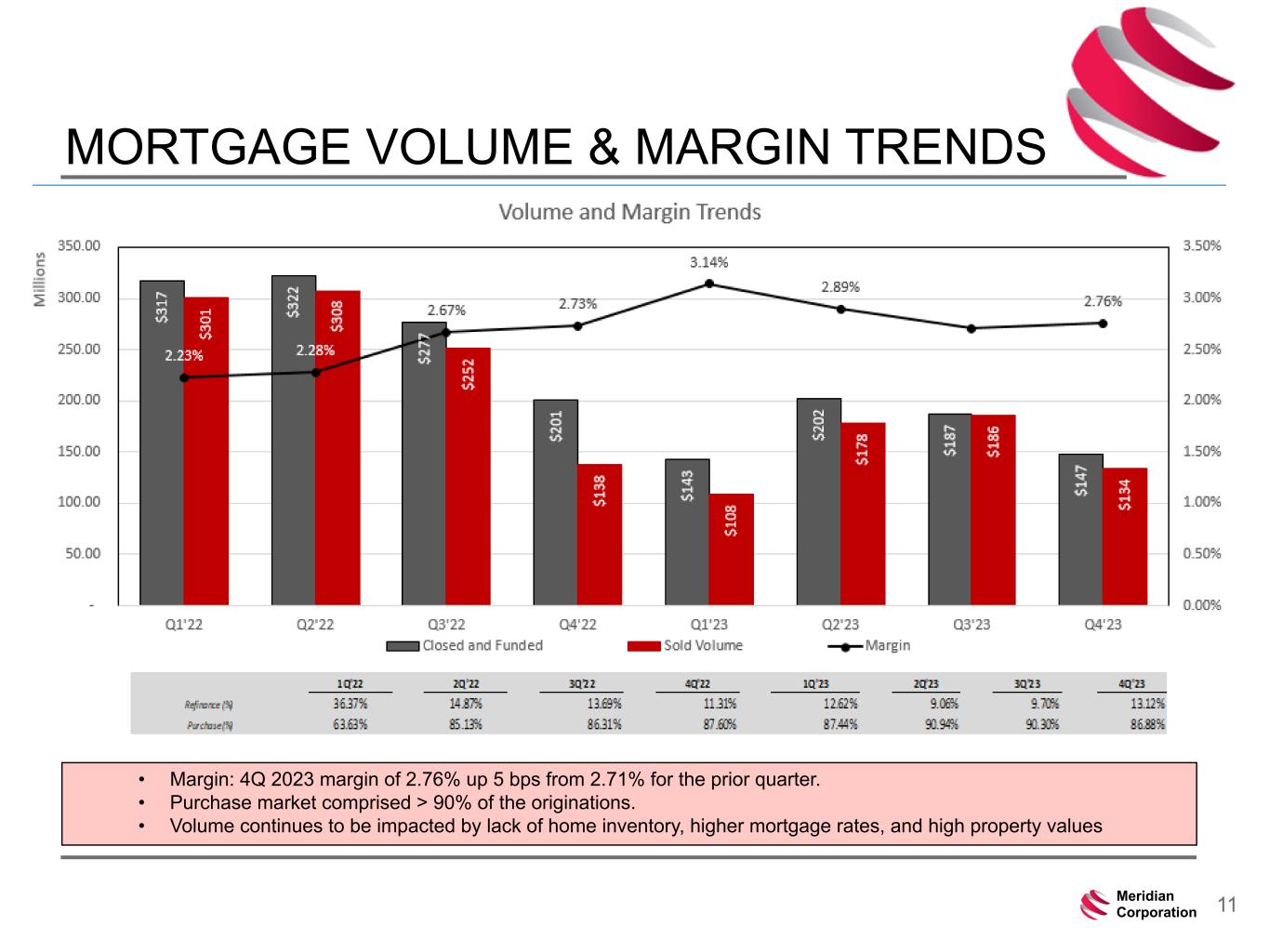

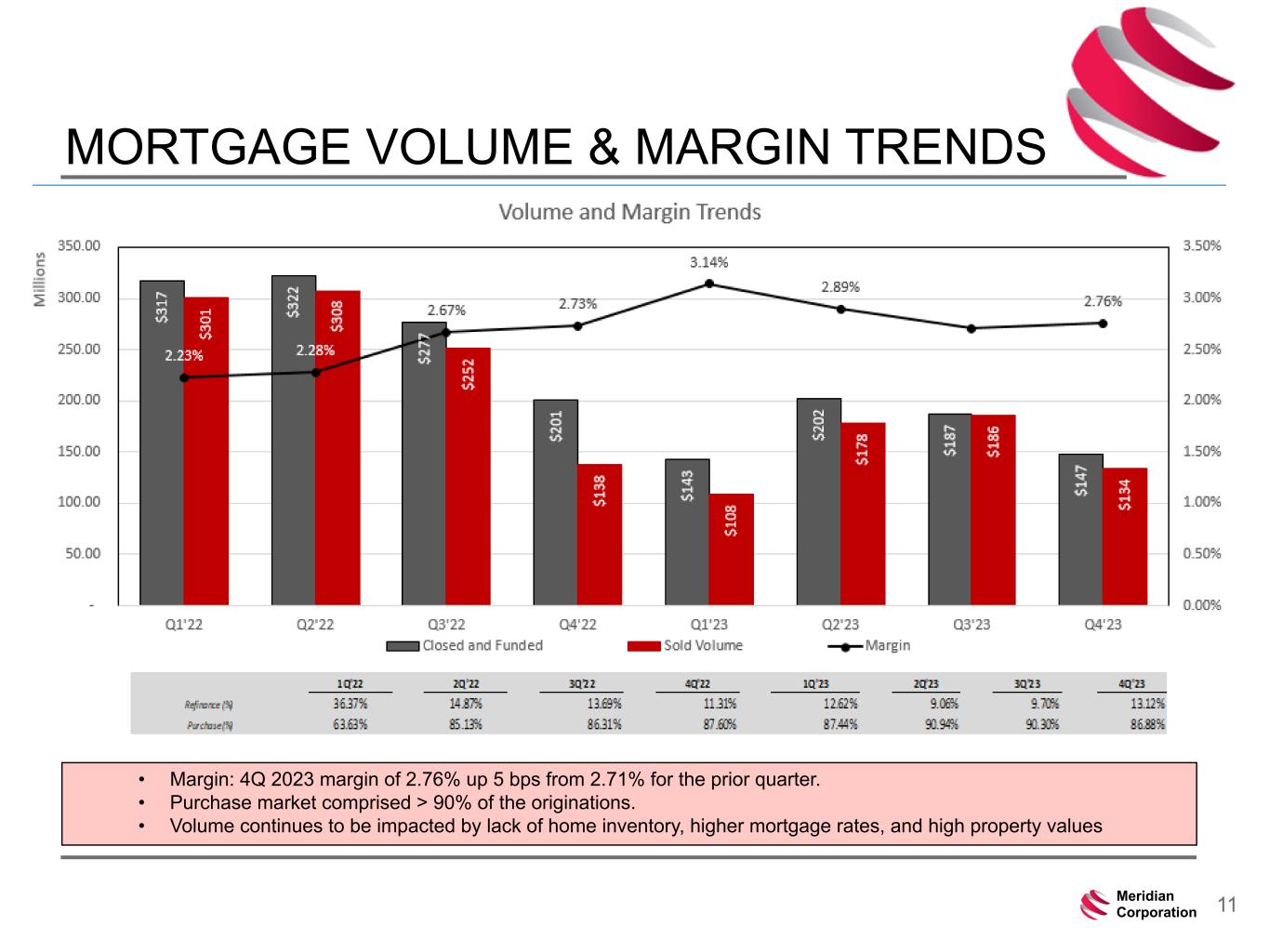

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 11Meridian Corporation MORTGAGE VOLUME & MARGIN TRENDS • Margin: 4Q 2023 margin of 2.76% up 5 bps from 2.71% for the prior quarter. • Purchase market comprised > 90% of the originations. • Volume continues to be impacted by lack of home inventory, higher mortgage rates, and high property values

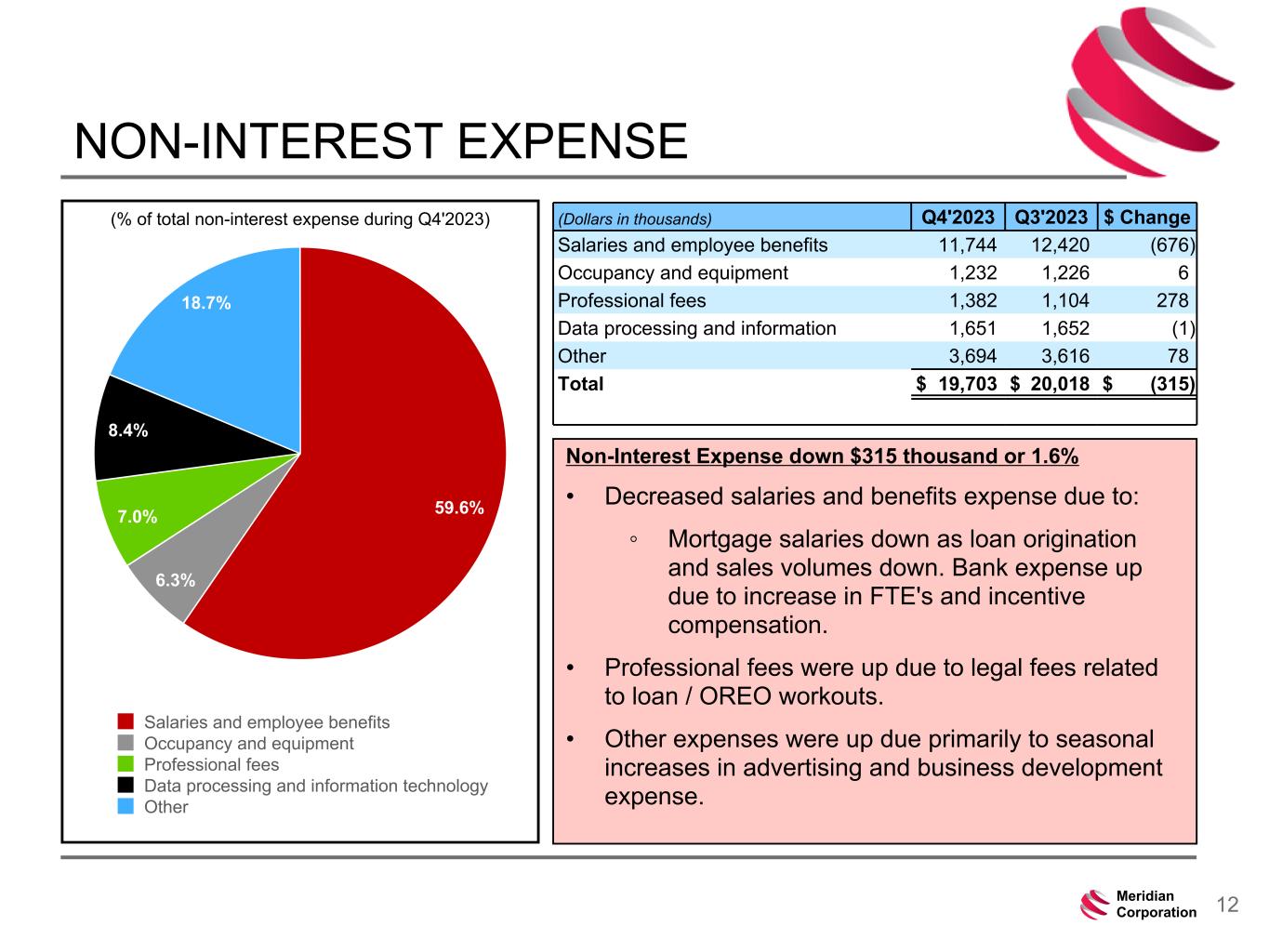

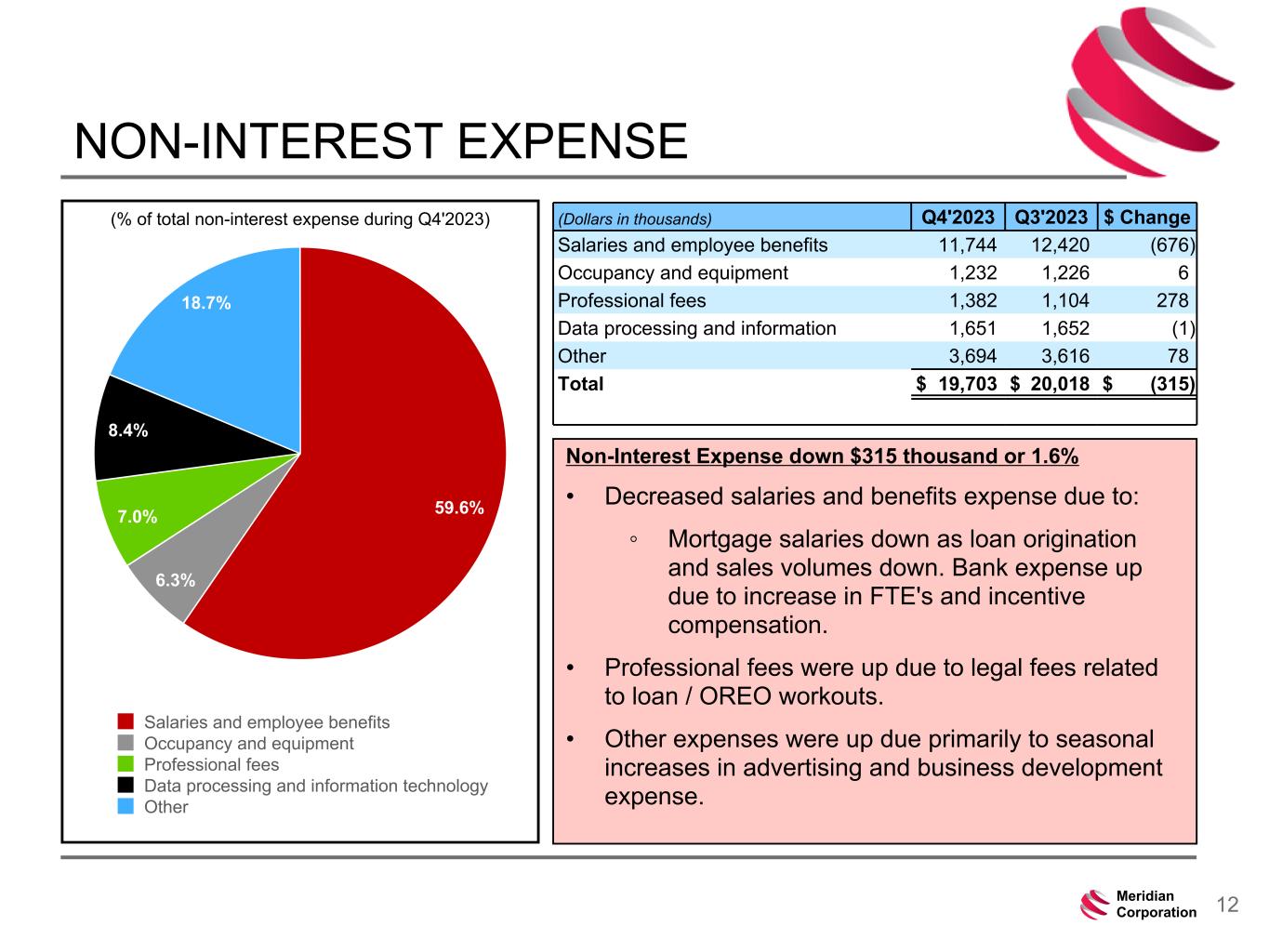

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 12Meridian Corporation NON-INTEREST EXPENSE Non-Interest Expense down $315 thousand or 1.6% • Decreased salaries and benefits expense due to: ◦ Mortgage salaries down as loan origination and sales volumes down. Bank expense up due to increase in FTE's and incentive compensation. • Professional fees were up due to legal fees related to loan / OREO workouts. • Other expenses were up due primarily to seasonal increases in advertising and business development expense. (% of total non-interest expense during Q4'2023) (Dollars in thousands) Q4'2023 Q3'2023 $ Change Salaries and employee benefits 11,744 12,420 (676) Occupancy and equipment 1,232 1,226 6 Professional fees 1,382 1,104 278 Data processing and information 1,651 1,652 (1) Other 3,694 3,616 78 Total $ 19,703 $ 20,018 $ (315) 59.6% 6.3% 7.0% 8.4% 18.7% Salaries and employee benefits Occupancy and equipment Professional fees Data processing and information technology Other

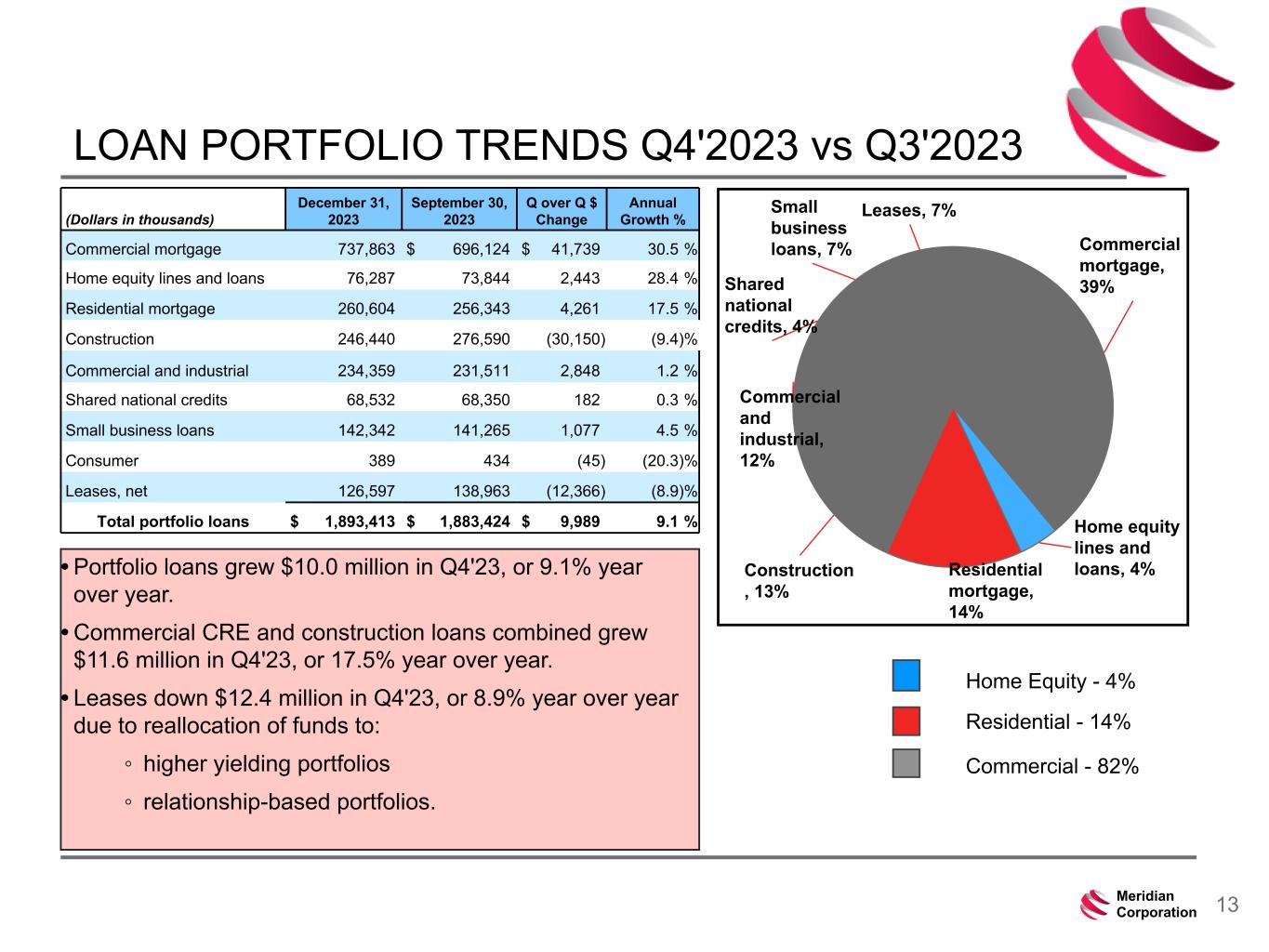

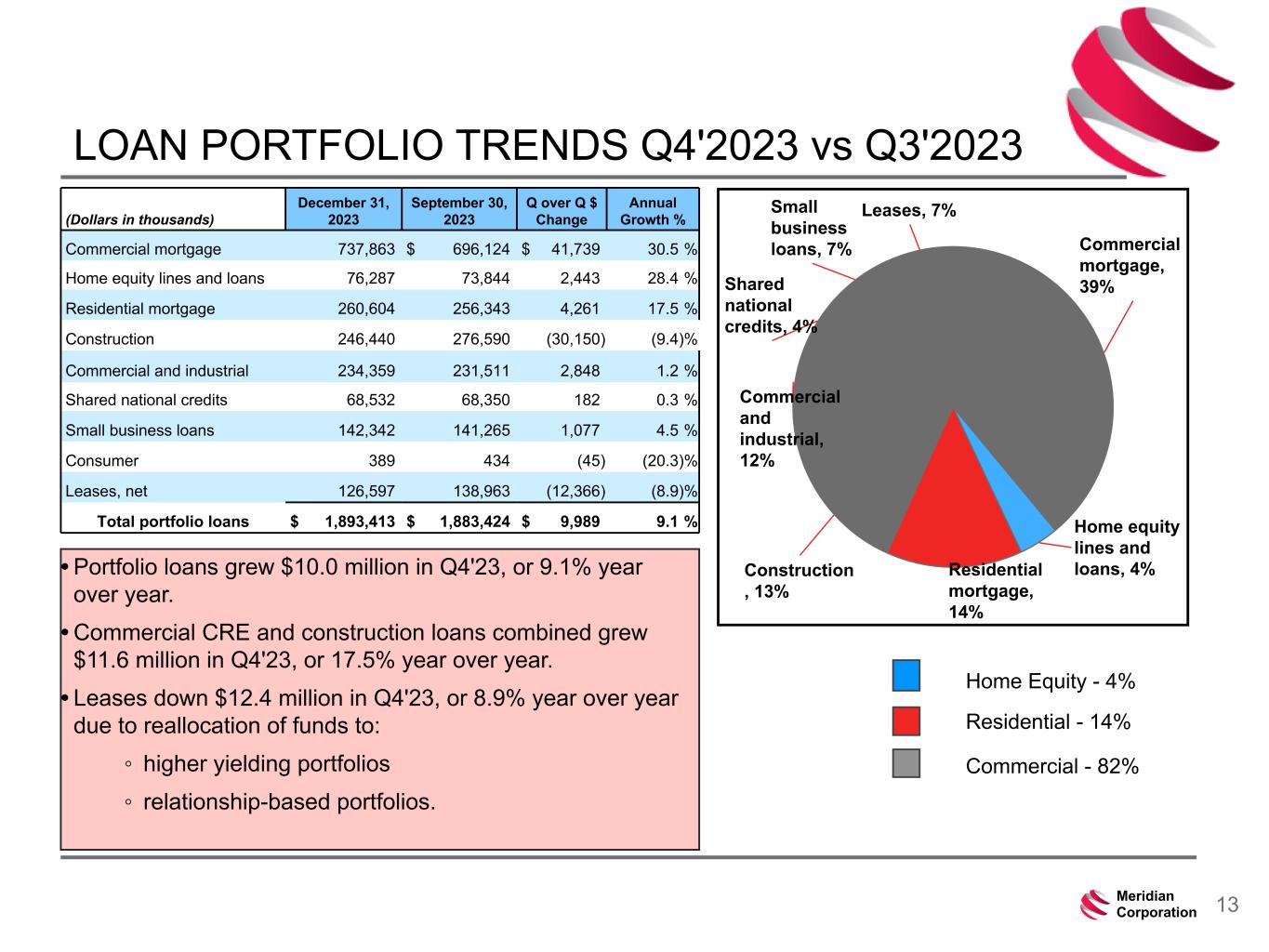

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 13Meridian Corporation LOAN PORTFOLIO TRENDS Q4'2023 vs Q3'2023 (Dollars in thousands) December 31, 2023 September 30, 2023 Q over Q $ Change Annual Growth % Commercial mortgage 737,863 $ 696,124 $ 41,739 30.5 % Home equity lines and loans 76,287 73,844 2,443 28.4 % Residential mortgage 260,604 256,343 4,261 17.5 % Construction 246,440 276,590 (30,150) (9.4) % Commercial and industrial 234,359 231,511 2,848 1.2 % Shared national credits 68,532 68,350 182 0.3 % Small business loans 142,342 141,265 1,077 4.5 % Consumer 389 434 (45) (20.3) % Leases, net 126,597 138,963 (12,366) (8.9) % Total portfolio loans $ 1,893,413 $ 1,883,424 $ 9,989 9.1 % Commercial mortgage, 39% Home equity lines and loans, 4%Residential mortgage, 14% Construction , 13% Commercial and industrial, 12% Shared national credits, 4% Small business loans, 7% Leases, 7% Commercial - 82% Residential - 14% Home Equity - 4% • Portfolio loans grew $10.0 million in Q4'23, or 9.1% year over year. • Commercial CRE and construction loans combined grew $11.6 million in Q4'23, or 17.5% year over year. • Leases down $12.4 million in Q4'23, or 8.9% year over year due to reallocation of funds to: ◦ higher yielding portfolios ◦ relationship-based portfolios.

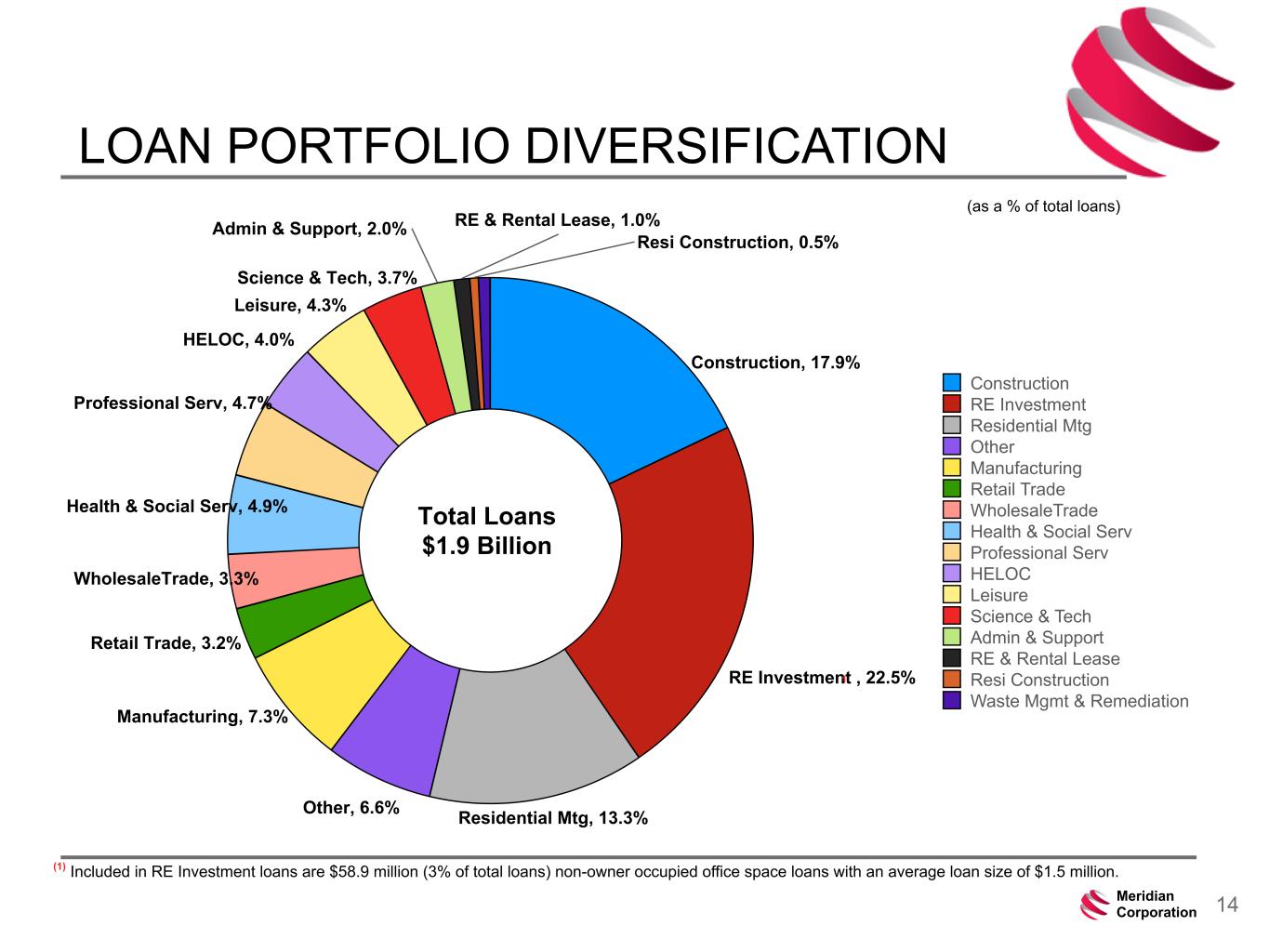

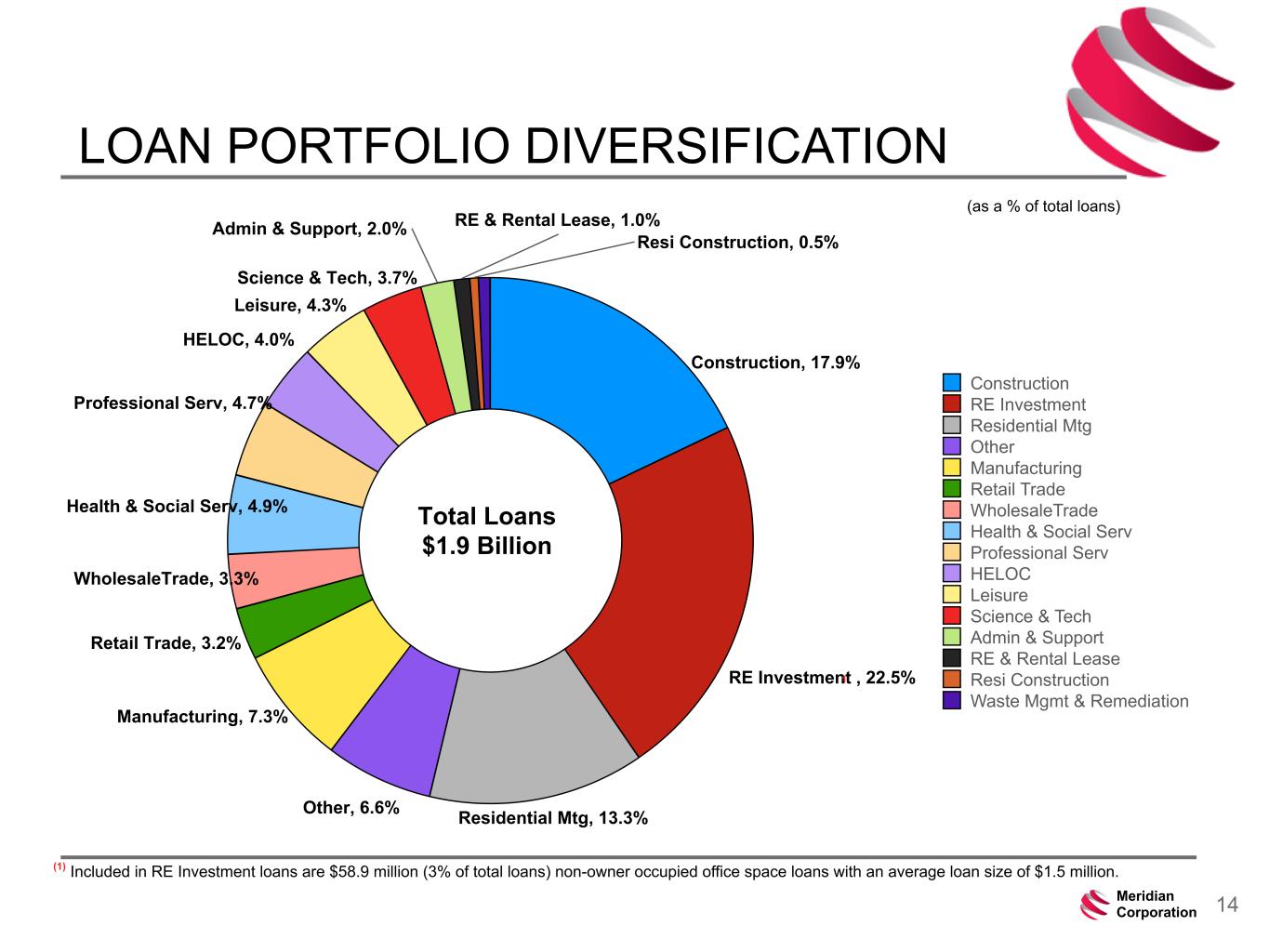

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 14Meridian Corporation Construction, 17.9% RE Investment , 22.5% Residential Mtg, 13.3%Other, 6.6% Manufacturing, 7.3% Retail Trade, 3.2% WholesaleTrade, 3.3% Health & Social Serv, 4.9% Professional Serv, 4.7% HELOC, 4.0% Leisure, 4.3% Science & Tech, 3.7% Admin & Support, 2.0% RE & Rental Lease, 1.0% Resi Construction, 0.5% Construction RE Investment Residential Mtg Other Manufacturing Retail Trade WholesaleTrade Health & Social Serv Professional Serv HELOC Leisure Science & Tech Admin & Support RE & Rental Lease Resi Construction Waste Mgmt & Remediation LOAN PORTFOLIO DIVERSIFICATION Total Loans $1.9 Billion 1 (as a % of total loans) (1) Included in RE Investment loans are $58.9 million (3% of total loans) non-owner occupied office space loans with an average loan size of $1.5 million.

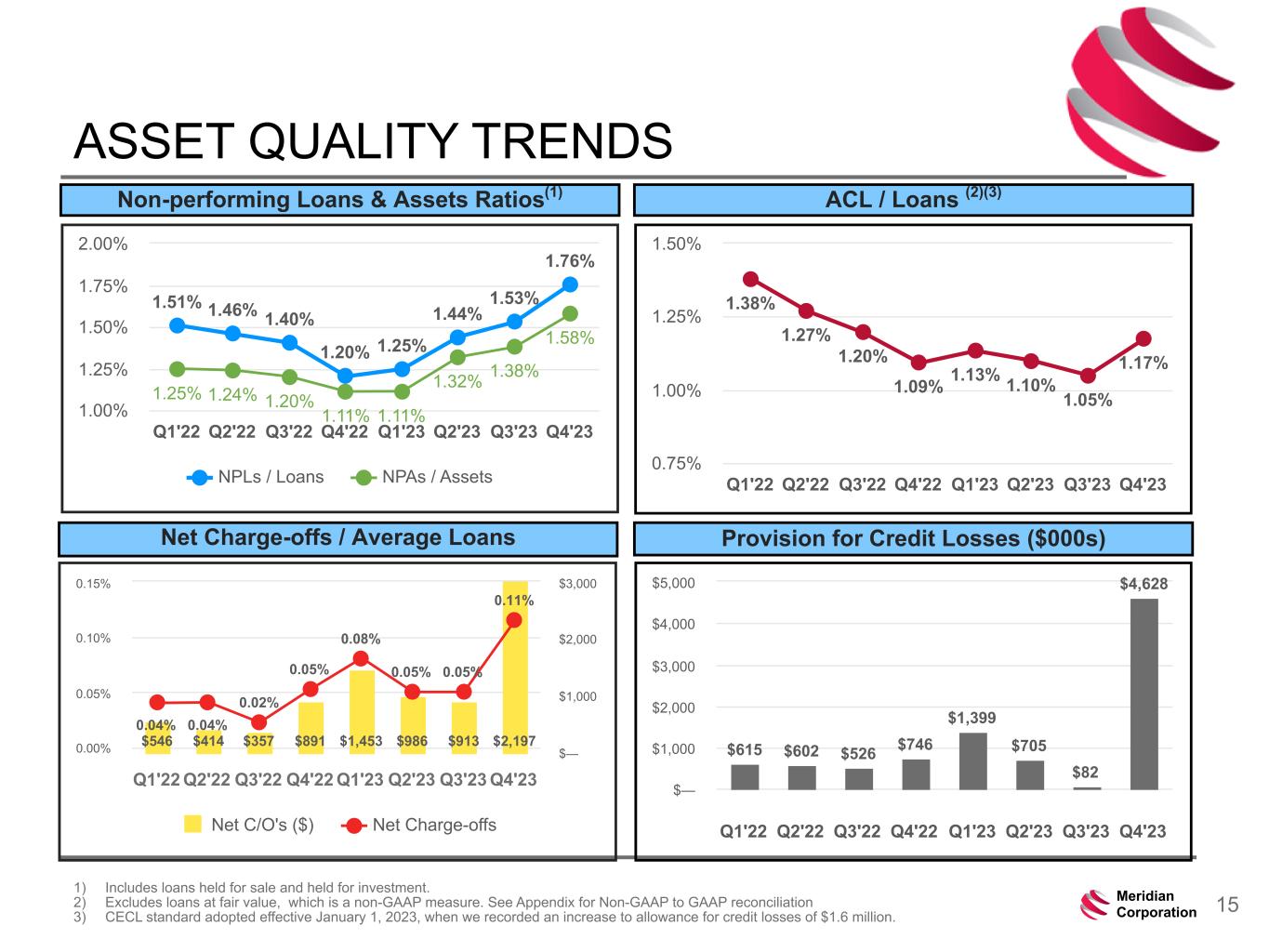

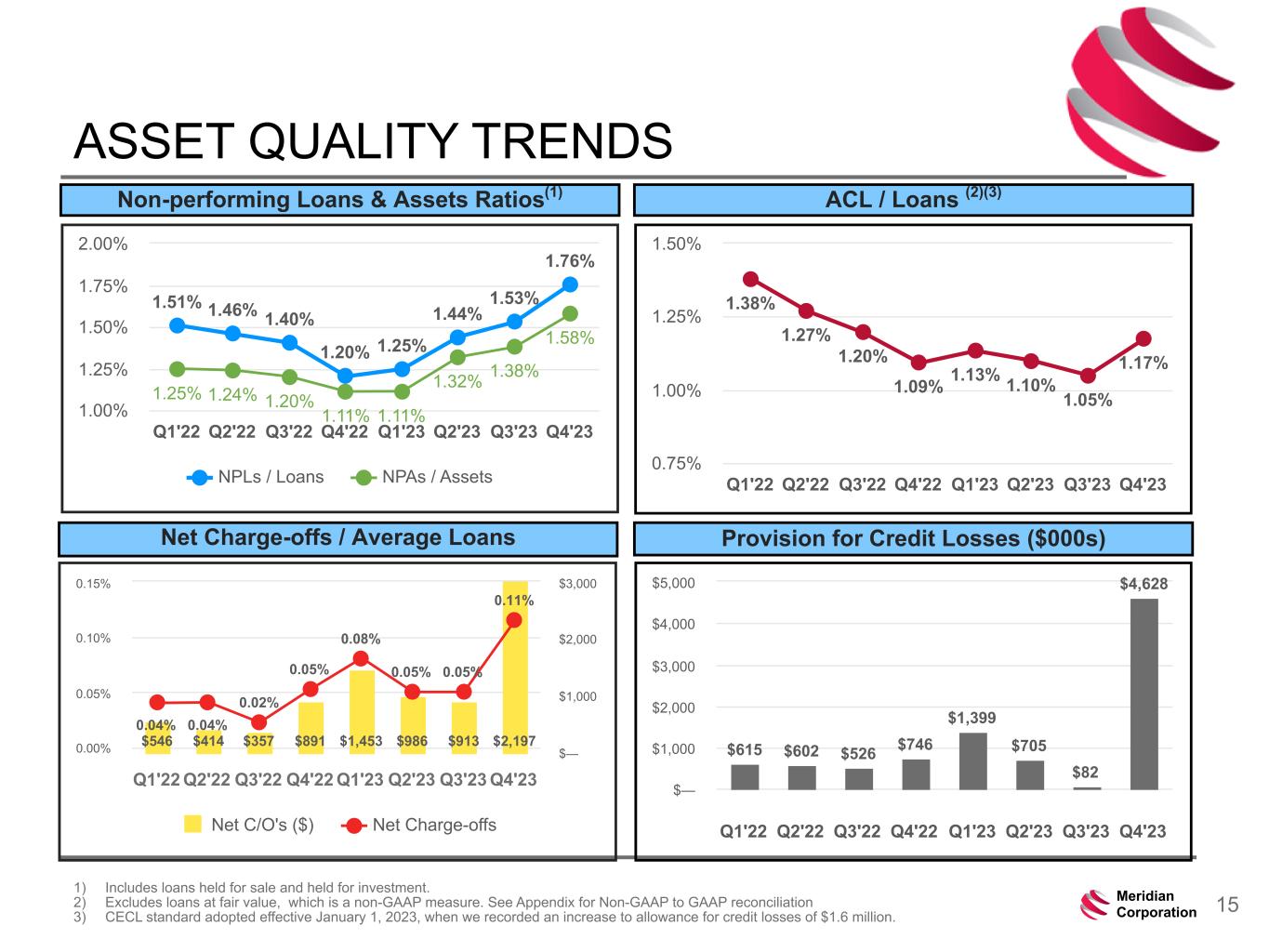

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 15Meridian Corporation 1.38% 1.27% 1.20% 1.09% 1.13% 1.10% 1.05% 1.17% Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 0.75% 1.00% 1.25% 1.50% ASSET QUALITY TRENDS 1) Includes loans held for sale and held for investment. 2) Excludes loans at fair value, which is a non-GAAP measure. See Appendix for Non-GAAP to GAAP reconciliation 3) CECL standard adopted effective January 1, 2023, when we recorded an increase to allowance for credit losses of $1.6 million. Non-performing Loans & Assets Ratios(1) Net Charge-offs / Average Loans ACL / Loans (2)(3) 1.51% 1.46% 1.40% 1.20% 1.25% 1.44% 1.53% 1.76% 1.25% 1.24% 1.20% 1.11% 1.11% 1.32% 1.38% 1.58% NPLs / Loans NPAs / Assets Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 1.00% 1.25% 1.50% 1.75% 2.00% $546 $414 $357 $891 $1,453 $986 $913 $2,197 0.04% 0.04% 0.02% 0.05% 0.08% 0.05% 0.05% 0.11% Net C/O's ($) Net Charge-offs Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 0.00% 0.05% 0.10% 0.15% $— $1,000 $2,000 $3,000 $615 $602 $526 $746 $1,399 $705 $82 $4,628 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 $— $1,000 $2,000 $3,000 $4,000 $5,000 Provision for Credit Losses ($000s)

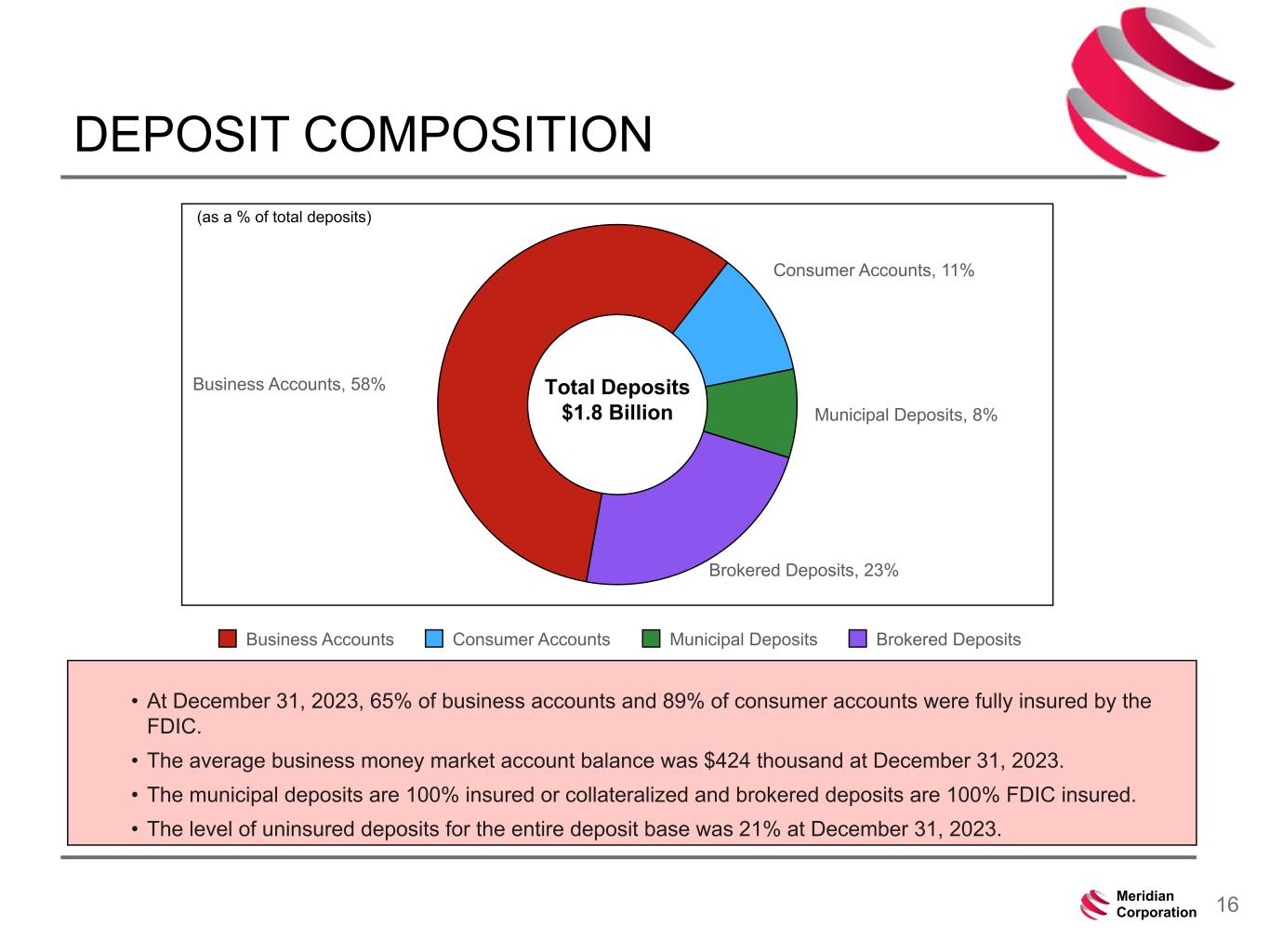

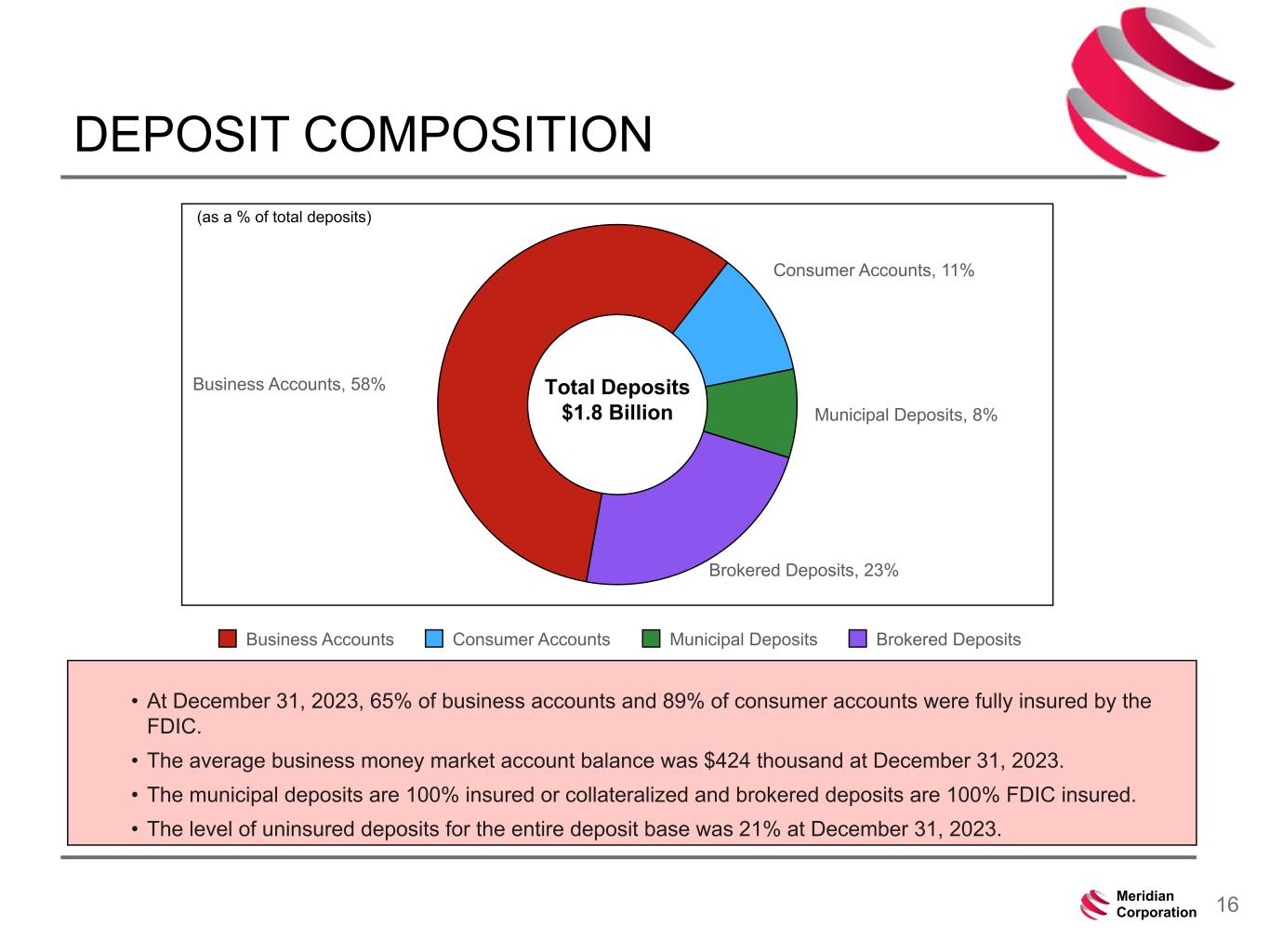

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 16Meridian Corporation DEPOSIT COMPOSITION Business Accounts, 58% Consumer Accounts, 11% Municipal Deposits, 8% Brokered Deposits, 23% Business Accounts Consumer Accounts Municipal Deposits Brokered Deposits Total Deposits $1.8 Billion • At December 31, 2023, 65% of business accounts and 89% of consumer accounts were fully insured by the FDIC. • The average business money market account balance was $424 thousand at December 31, 2023. • The municipal deposits are 100% insured or collateralized and brokered deposits are 100% FDIC insured. • The level of uninsured deposits for the entire deposit base was 21% at December 31, 2023. (as a % of total deposits)

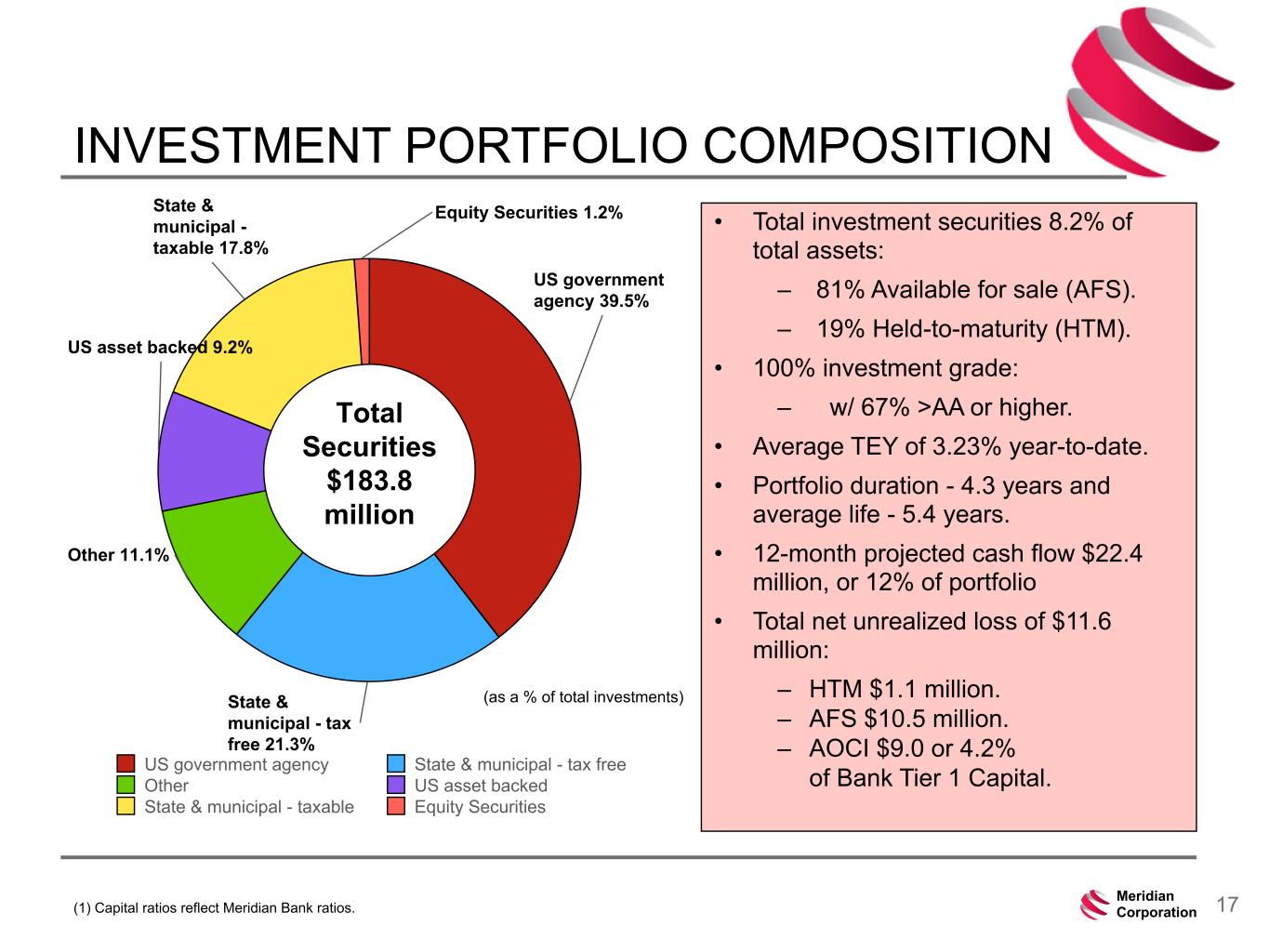

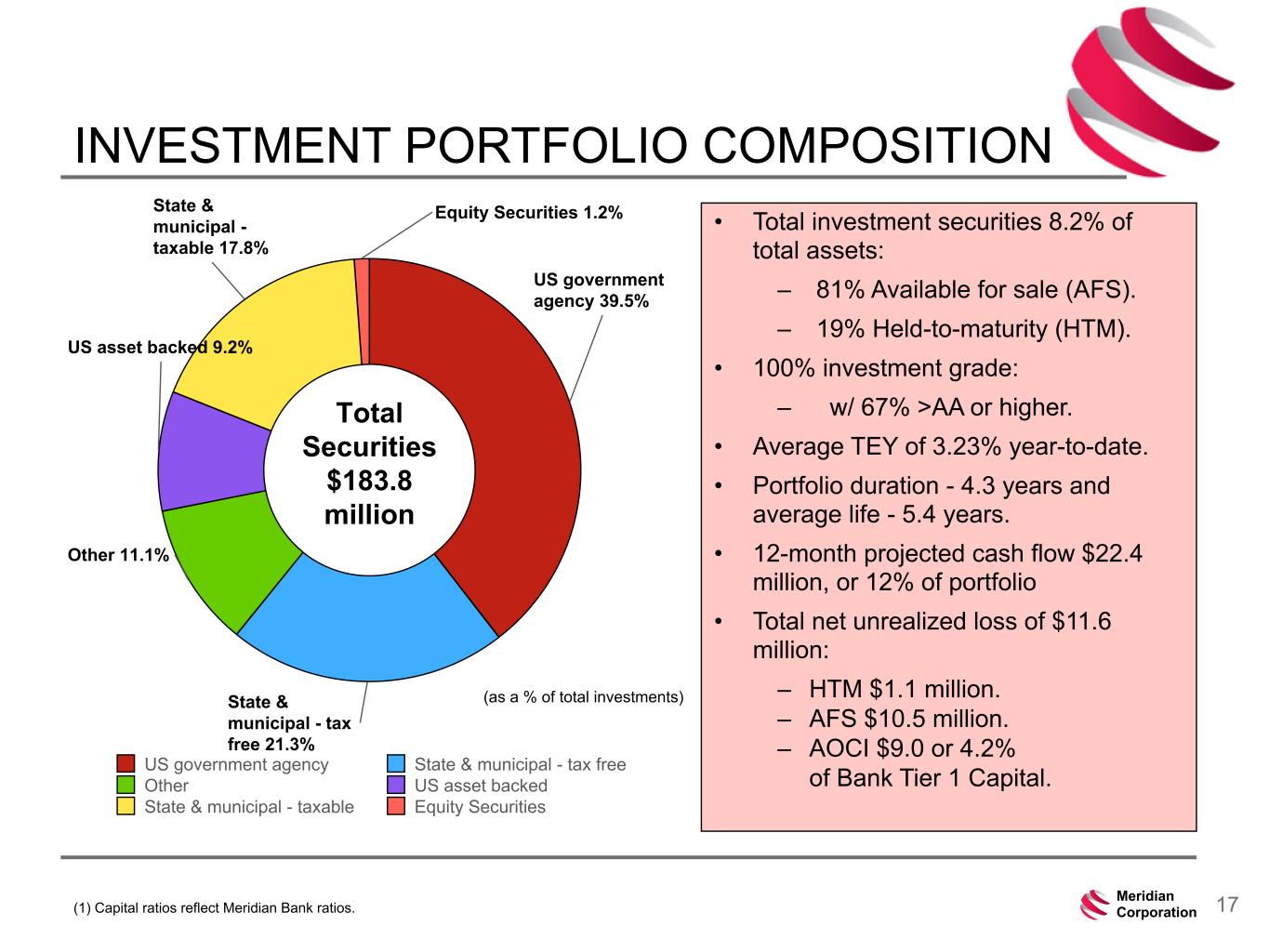

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 17Meridian Corporation INVESTMENT PORTFOLIO COMPOSITION • Total investment securities 8.2% of total assets: – 81% Available for sale (AFS). – 19% Held-to-maturity (HTM). • 100% investment grade: – w/ 67% >AA or higher. • Average TEY of 3.23% year-to-date. • Portfolio duration - 4.3 years and average life - 5.4 years. • 12-month projected cash flow $22.4 million, or 12% of portfolio • Total net unrealized loss of $11.6 million: – HTM $1.1 million. – AFS $10.5 million. – AOCI $9.0 or 4.2% of Bank Tier 1 Capital. (1) Capital ratios reflect Meridian Bank ratios. US government agency 39.5% State & municipal - tax free 21.3% Other 11.1% US asset backed 9.2% State & municipal - taxable 17.8% Equity Securities 1.2% US government agency State & municipal - tax free Other US asset backed State & municipal - taxable Equity Securities Total Securities $183.8 million (as a % of total investments)

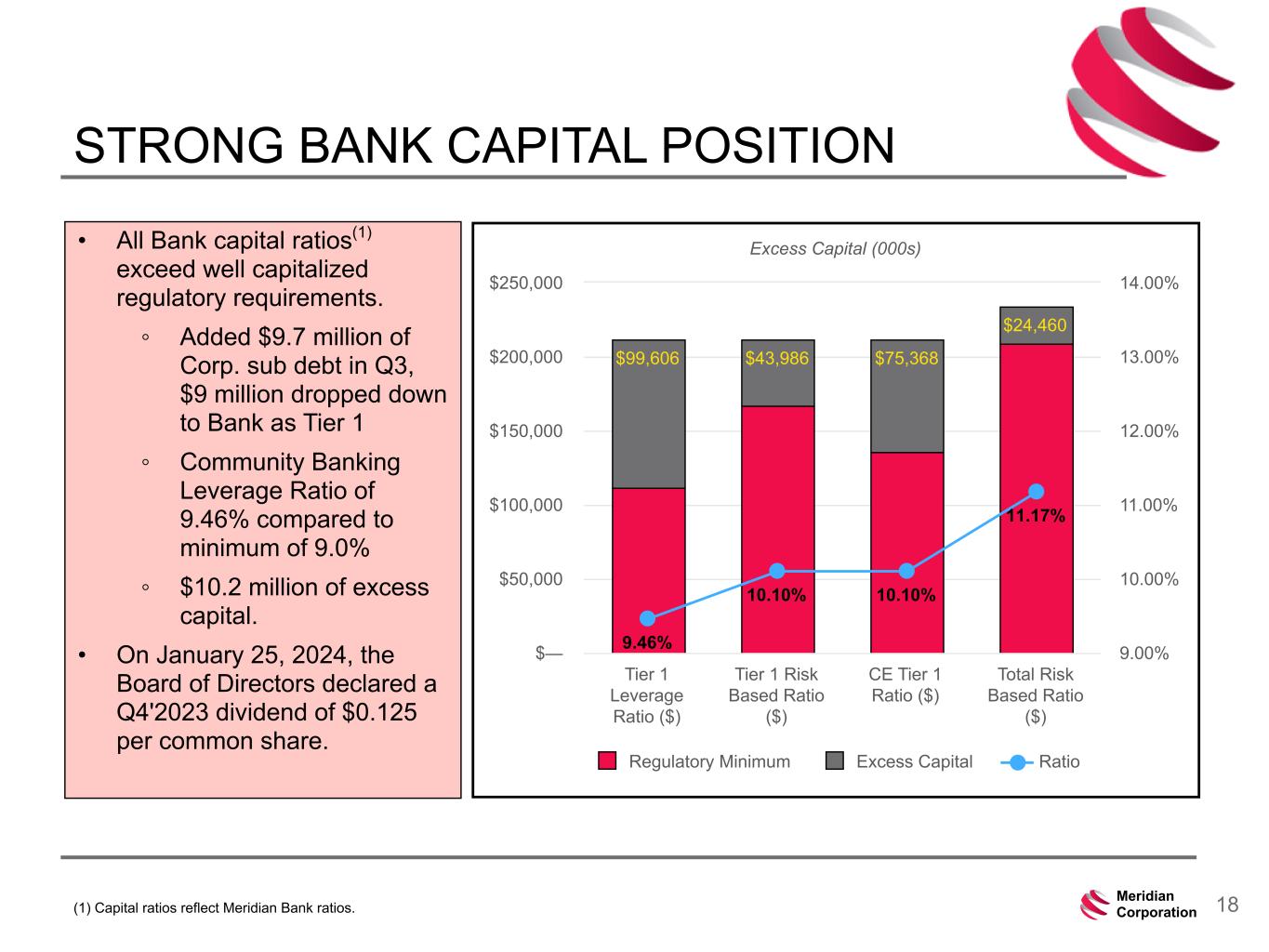

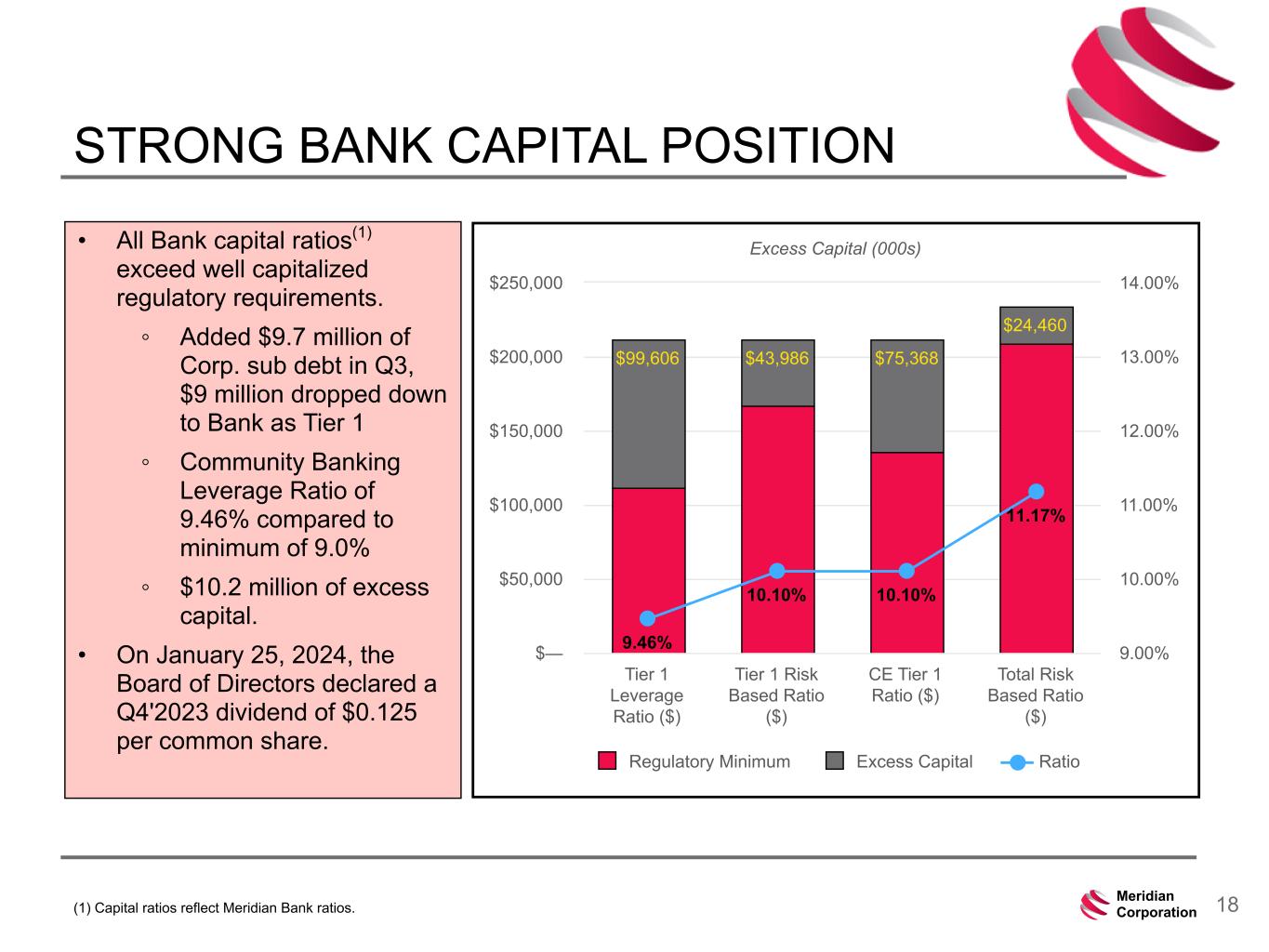

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 18Meridian Corporation STRONG BANK CAPITAL POSITION • All Bank capital ratios(1) exceed well capitalized regulatory requirements. ◦ Added $9.7 million of Corp. sub debt in Q3, $9 million dropped down to Bank as Tier 1 ◦ Community Banking Leverage Ratio of 9.46% compared to minimum of 9.0% ◦ $10.2 million of excess capital. • On January 25, 2024, the Board of Directors declared a Q4'2023 dividend of $0.125 per common share. Excess Capital (000s) $99,606 $43,986 $75,368 $24,460 9.46% 10.10% 10.10% 11.17% Regulatory Minimum Excess Capital Ratio Tier 1 Leverage Ratio ($) Tier 1 Risk Based Ratio ($) CE Tier 1 Ratio ($) Total Risk Based Ratio ($) $— $50,000 $100,000 $150,000 $200,000 $250,000 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% (1) Capital ratios reflect Meridian Bank ratios.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 19Meridian Corporation APPENDIX - HISTORICAL FINANCIAL HIGHLIGHTS AND RECONCILIATIONS OF NON-GAAP MEASURES

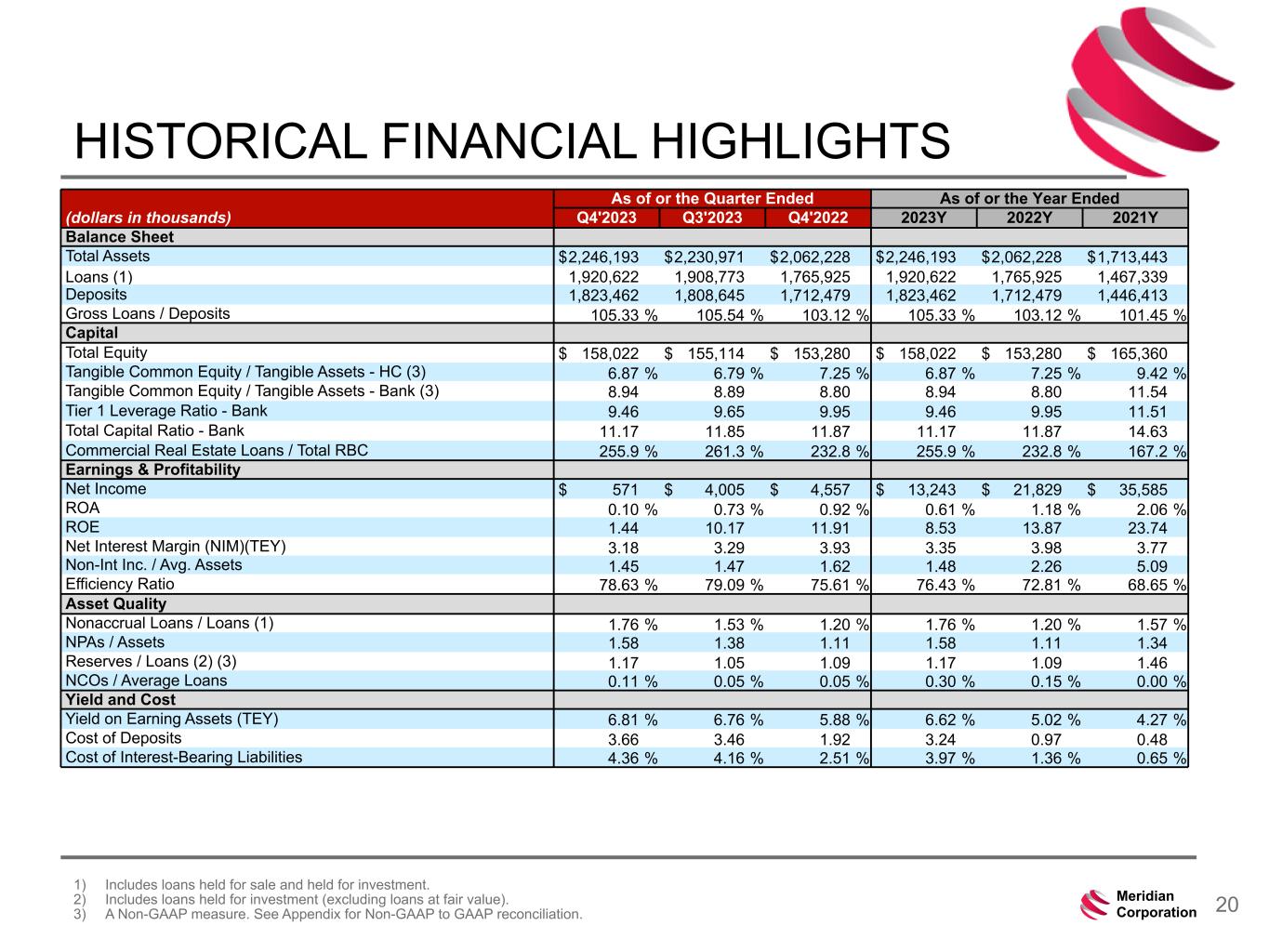

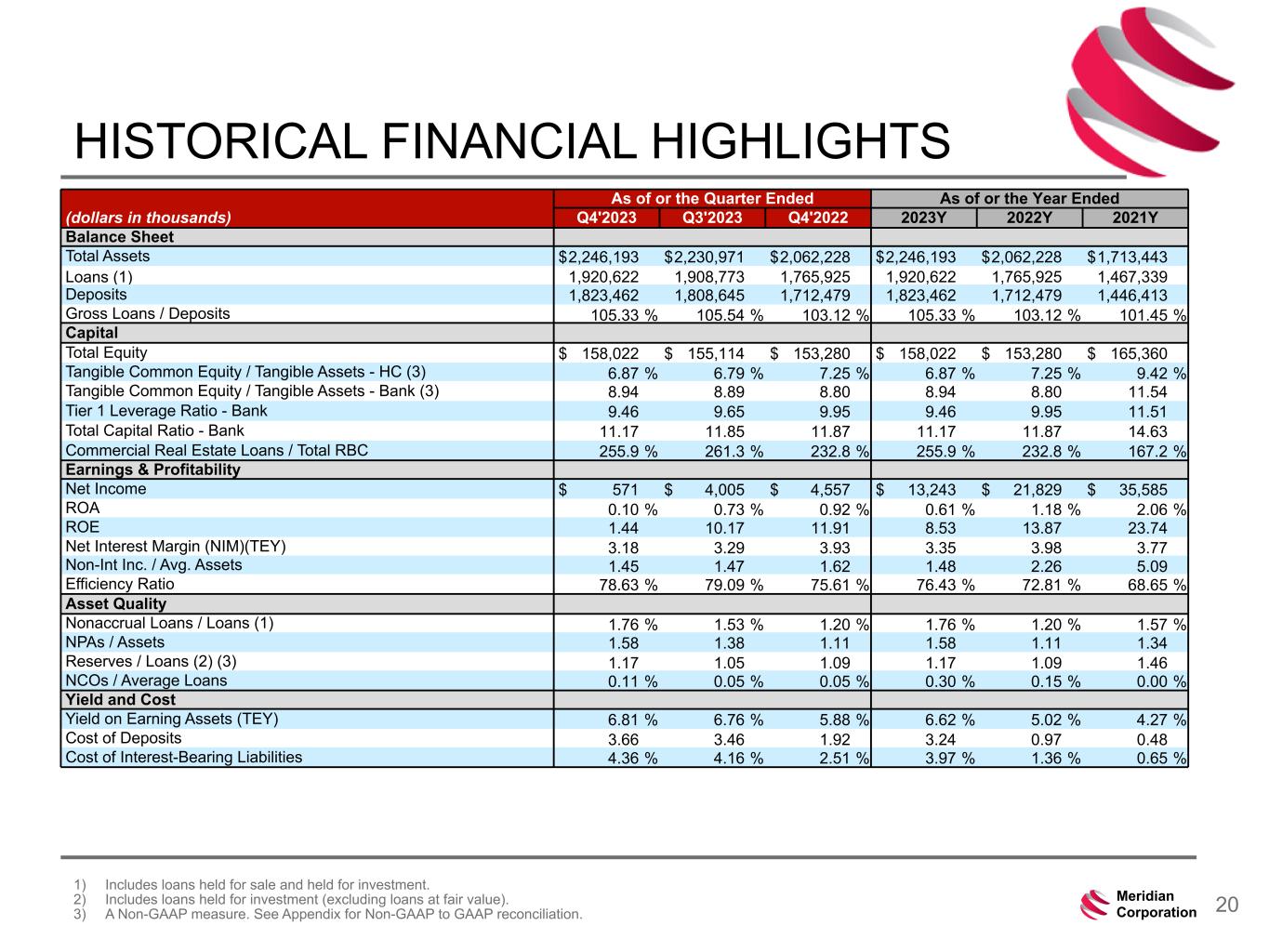

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 20Meridian Corporation HISTORICAL FINANCIAL HIGHLIGHTS 1) Includes loans held for sale and held for investment. 2) Includes loans held for investment (excluding loans at fair value). 3) A Non-GAAP measure. See Appendix for Non-GAAP to GAAP reconciliation. As of or the Quarter Ended As of or the Year Ended (dollars in thousands) Q4'2023 Q3'2023 Q4'2022 2023Y 2022Y 2021Y Balance Sheet Total Assets $ 2,246,193 $ 2,230,971 $ 2,062,228 $ 2,246,193 $ 2,062,228 $ 1,713,443 Loans (1) 1,920,622 1,908,773 1,765,925 1,920,622 1,765,925 1,467,339 Deposits 1,823,462 1,808,645 1,712,479 1,823,462 1,712,479 1,446,413 Gross Loans / Deposits 105.33 % 105.54 % 103.12 % 105.33 % 103.12 % 101.45 % Capital Total Equity $ 158,022 $ 155,114 $ 153,280 $ 158,022 $ 153,280 $ 165,360 Tangible Common Equity / Tangible Assets - HC (3) 6.87 % 6.79 % 7.25 % 6.87 % 7.25 % 9.42 % Tangible Common Equity / Tangible Assets - Bank (3) 8.94 8.89 8.80 8.94 8.80 11.54 Tier 1 Leverage Ratio - Bank 9.46 9.65 9.95 9.46 9.95 11.51 Total Capital Ratio - Bank 11.17 11.85 11.87 11.17 11.87 14.63 Commercial Real Estate Loans / Total RBC 255.9 % 261.3 % 232.8 % 255.9 % 232.8 % 167.2 % Earnings & Profitability Net Income $ 571 $ 4,005 $ 4,557 $ 13,243 $ 21,829 $ 35,585 ROA 0.10 % 0.73 % 0.92 % 0.61 % 1.18 % 2.06 % ROE 1.44 10.17 11.91 8.53 13.87 23.74 Net Interest Margin (NIM)(TEY) 3.18 3.29 3.93 3.35 3.98 3.77 Non-Int Inc. / Avg. Assets 1.45 1.47 1.62 1.48 2.26 5.09 Efficiency Ratio 78.63 % 79.09 % 75.61 % 76.43 % 72.81 % 68.65 % Asset Quality Nonaccrual Loans / Loans (1) 1.76 % 1.53 % 1.20 % 1.76 % 1.20 % 1.57 % NPAs / Assets 1.58 1.38 1.11 1.58 1.11 1.34 Reserves / Loans (2) (3) 1.17 1.05 1.09 1.17 1.09 1.46 NCOs / Average Loans 0.11 % 0.05 % 0.05 % 0.30 % 0.15 % 0.00 % Yield and Cost Yield on Earning Assets (TEY) 6.81 % 6.76 % 5.88 % 6.62 % 5.02 % 4.27 % Cost of Deposits 3.66 3.46 1.92 3.24 0.97 0.48 Cost of Interest-Bearing Liabilities 4.36 % 4.16 % 2.51 % 3.97 % 1.36 % 0.65 %

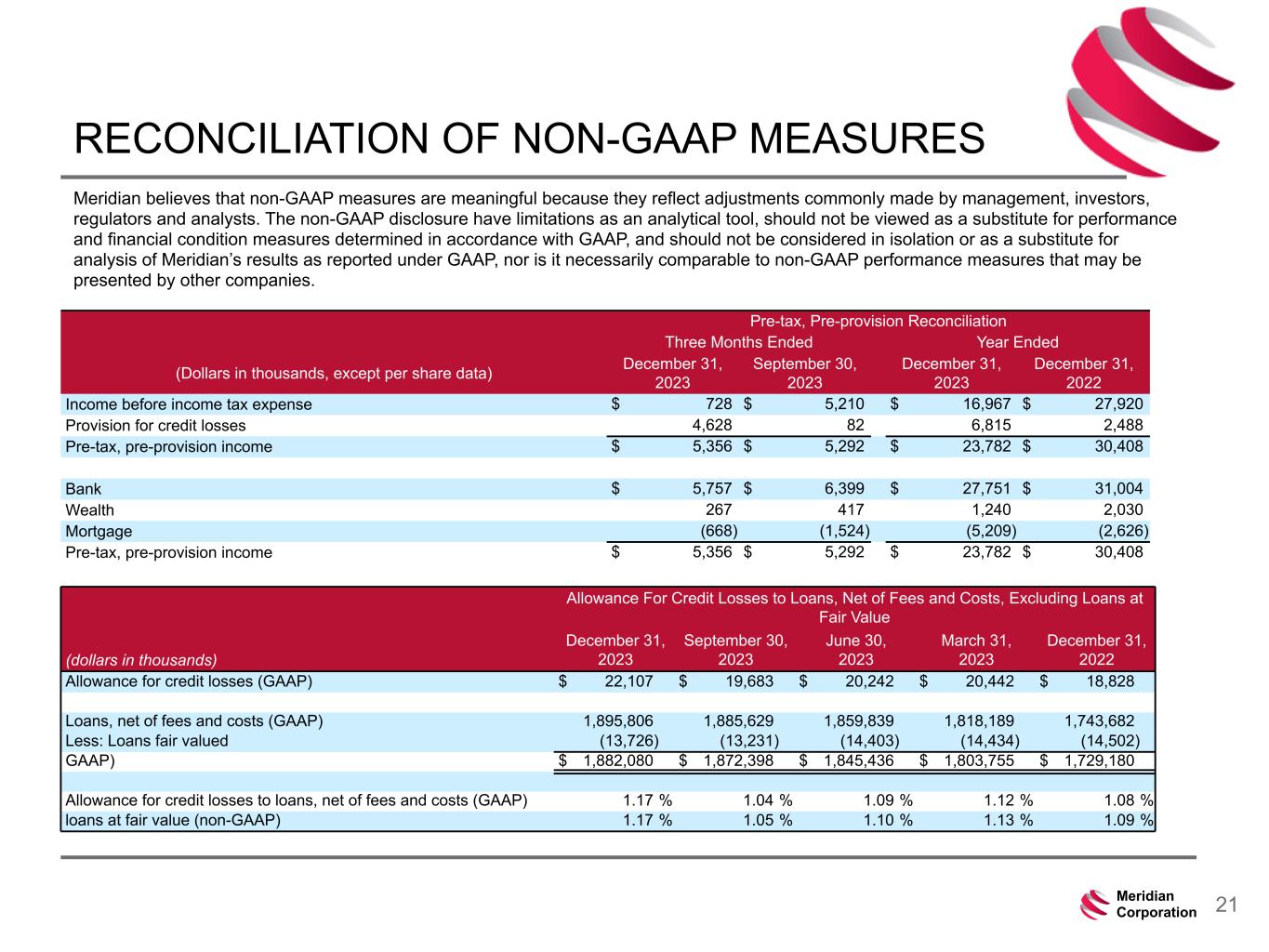

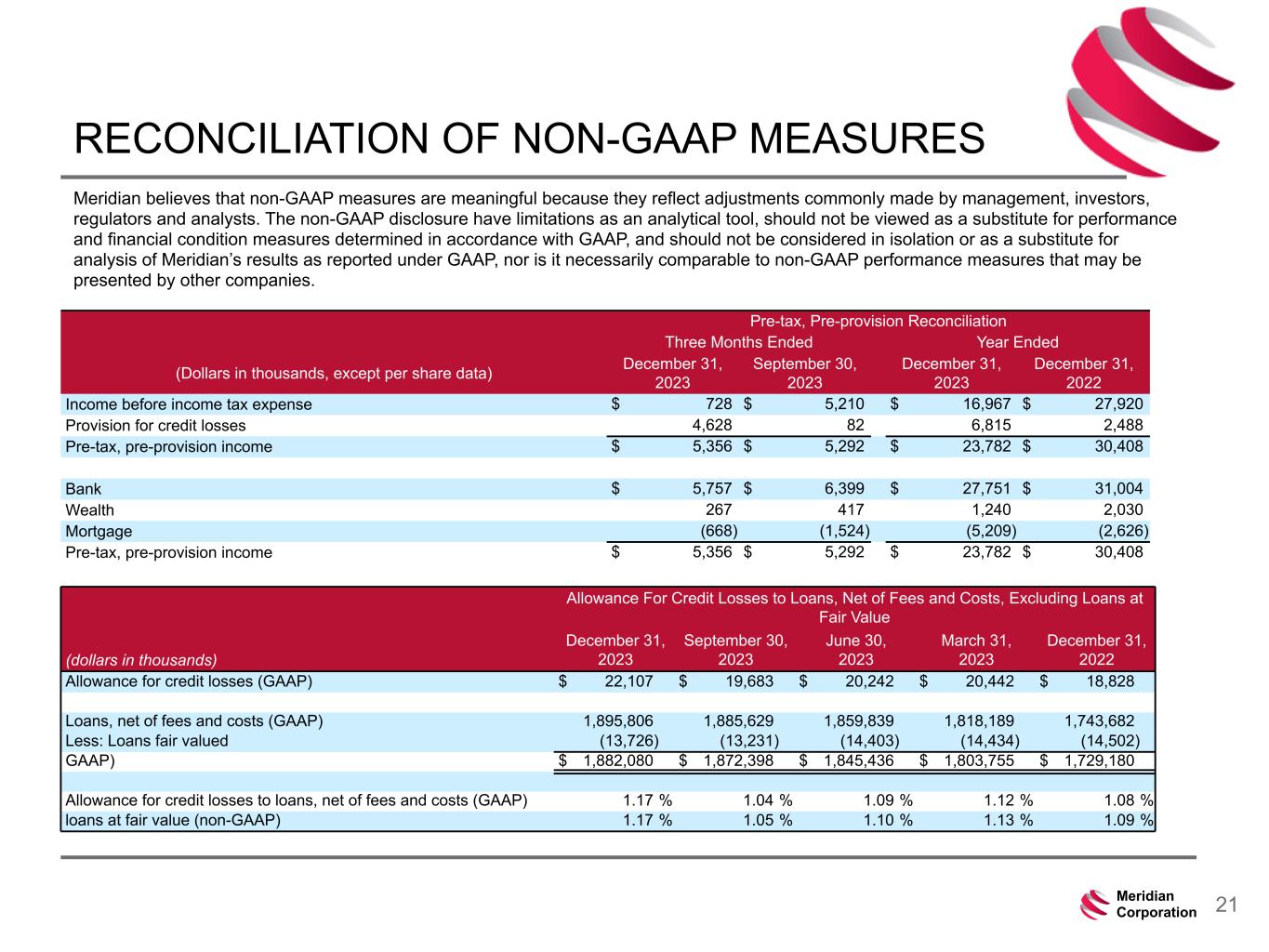

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 21Meridian Corporation Allowance For Credit Losses to Loans, Net of Fees and Costs, Excluding Loans at Fair Value (dollars in thousands) December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Allowance for credit losses (GAAP) $ 22,107 $ 19,683 $ 20,242 $ 20,442 $ 18,828 Loans, net of fees and costs (GAAP) 1,895,806 1,885,629 1,859,839 1,818,189 1,743,682 Less: Loans fair valued (13,726) (13,231) (14,403) (14,434) (14,502) GAAP) $ 1,882,080 $ 1,872,398 $ 1,845,436 $ 1,803,755 $ 1,729,180 Allowance for credit losses to loans, net of fees and costs (GAAP) 1.17 % 1.04 % 1.09 % 1.12 % 1.08 % loans at fair value (non-GAAP) 1.17 % 1.05 % 1.10 % 1.13 % 1.09 % RECONCILIATION OF NON-GAAP MEASURES Meridian believes that non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts. The non-GAAP disclosure have limitations as an analytical tool, should not be viewed as a substitute for performance and financial condition measures determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of Meridian’s results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies. Pre-tax, Pre-provision Reconciliation Three Months Ended Year Ended (Dollars in thousands, except per share data) December 31, 2023 September 30, 2023 December 31, 2023 December 31, 2022 Income before income tax expense $ 728 $ 5,210 $ 16,967 $ 27,920 Provision for credit losses 4,628 82 6,815 2,488 Pre-tax, pre-provision income $ 5,356 $ 5,292 $ 23,782 $ 30,408 Bank $ 5,757 $ 6,399 $ 27,751 $ 31,004 Wealth 267 417 1,240 2,030 Mortgage (668) (1,524) (5,209) (2,626) Pre-tax, pre-provision income $ 5,356 $ 5,292 $ 23,782 $ 30,408

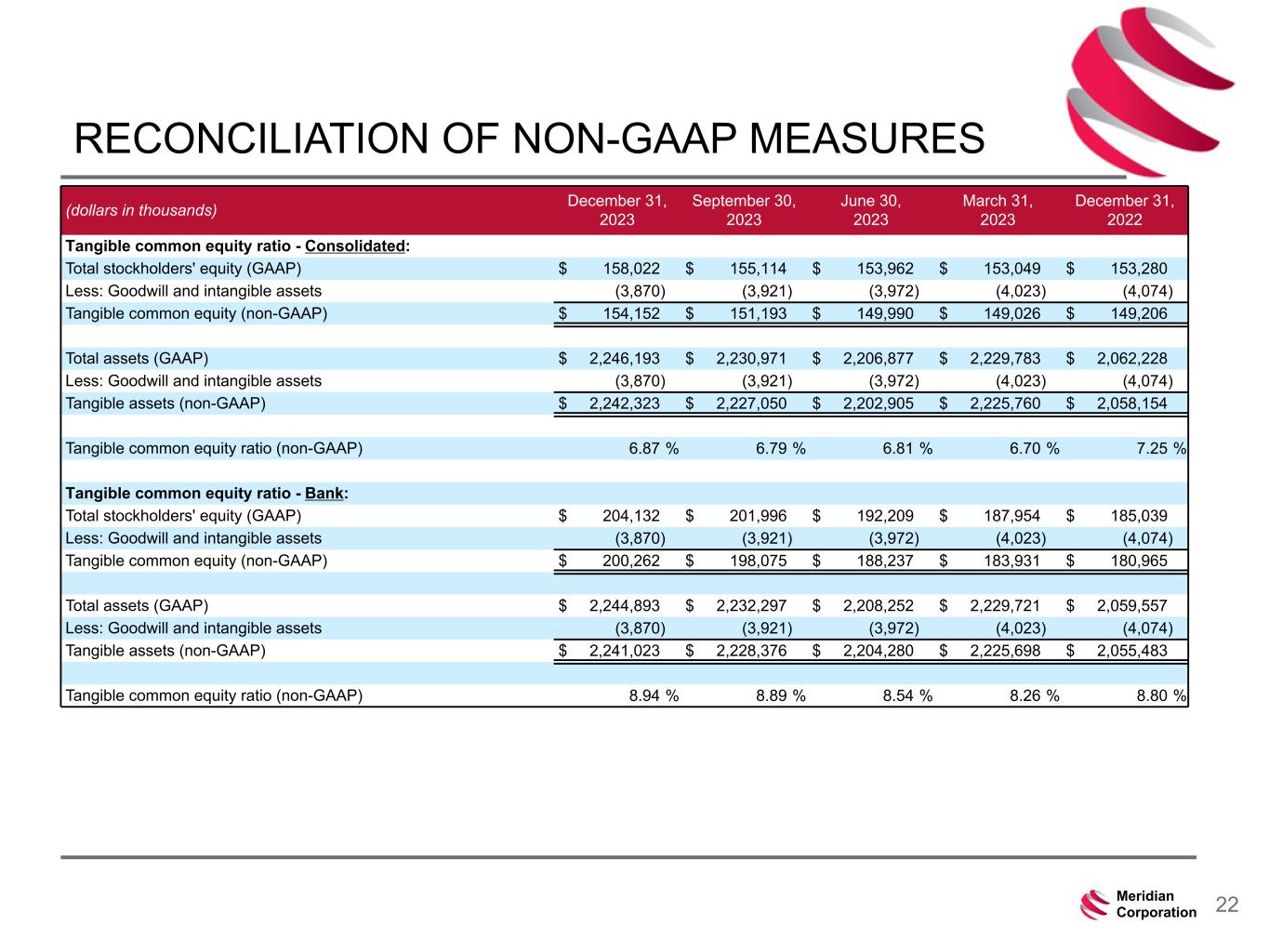

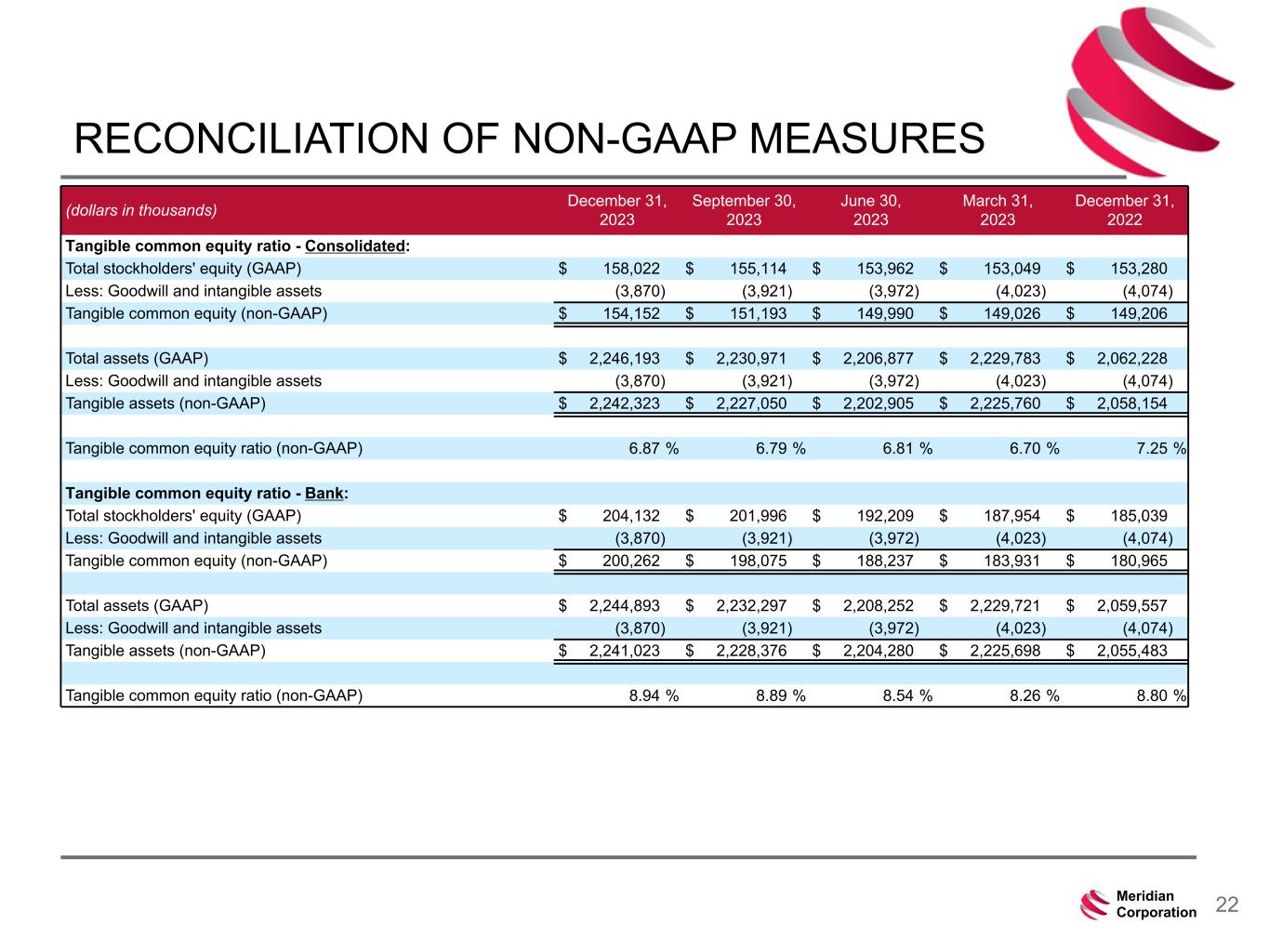

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 22Meridian Corporation (dollars in thousands) December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Tangible common equity ratio - Consolidated: Total stockholders' equity (GAAP) $ 158,022 $ 155,114 $ 153,962 $ 153,049 $ 153,280 Less: Goodwill and intangible assets (3,870) (3,921) (3,972) (4,023) (4,074) Tangible common equity (non-GAAP) $ 154,152 $ 151,193 $ 149,990 $ 149,026 $ 149,206 Total assets (GAAP) $ 2,246,193 $ 2,230,971 $ 2,206,877 $ 2,229,783 $ 2,062,228 Less: Goodwill and intangible assets (3,870) (3,921) (3,972) (4,023) (4,074) Tangible assets (non-GAAP) $ 2,242,323 $ 2,227,050 $ 2,202,905 $ 2,225,760 $ 2,058,154 Tangible common equity ratio (non-GAAP) 6.87 % 6.79 % 6.81 % 6.70 % 7.25 % Tangible common equity ratio - Bank: Total stockholders' equity (GAAP) $ 204,132 $ 201,996 $ 192,209 $ 187,954 $ 185,039 Less: Goodwill and intangible assets (3,870) (3,921) (3,972) (4,023) (4,074) Tangible common equity (non-GAAP) $ 200,262 $ 198,075 $ 188,237 $ 183,931 $ 180,965 Total assets (GAAP) $ 2,244,893 $ 2,232,297 $ 2,208,252 $ 2,229,721 $ 2,059,557 Less: Goodwill and intangible assets (3,870) (3,921) (3,972) (4,023) (4,074) Tangible assets (non-GAAP) $ 2,241,023 $ 2,228,376 $ 2,204,280 $ 2,225,698 $ 2,055,483 Tangible common equity ratio (non-GAAP) 8.94 % 8.89 % 8.54 % 8.26 % 8.80 % RECONCILIATION OF NON-GAAP MEASURES