239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 Fourth Quarter 2024 Earnings Supplement NASDAQ: MRBK

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 2Meridian Corporation FORWARD-LOOKING STATEMENTS Meridian Corporation (the “Corporation”) may from time to time make written or oral “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Meridian Corporation’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words "will", “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” "project", or similar expressions generally indicate a forward-looking statement. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: Local, regional, national and international economic conditions and the impact they may have on us and our customers and our assessment of that impact; Volatility and disruption in national and international financial markets; Adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity, and regulatory responses to these developments; Government intervention in the U.S. financial system; Changes in the mix of loan geographies, sectors and types or the level of non-performing assets and charge-offs; Our ability to manage our commercial real estate exposure; Changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; The effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board; Inflation, interest rate, securities market and monetary fluctuations; The effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities and insurance) with which we and our subsidiaries must comply; Impairment of our goodwill or other intangible assets; Acts of God or of war or terrorism; Changes in consumer spending, borrowings and savings habits; Changes in the financial performance and/or condition of our borrowers; Technological changes, including the rise of AI as a commonly used resource; The cost and effects of cyber incidents or other failures, interruption or security breaches of our systems or those of third-party providers; Acquisitions and integration of acquired businesses; Our ability to increase market share and control expenses; Our ability to attract and retain qualified employees; Changes in the competitive environment in our markets and among banking organizations and other financial service providers; The effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the PCAOB, the FASB and other accounting standard setters; Changes in the reliability of our vendors, internal control systems or information systems; Changes in our liquidity position; Changes in our organization, compensation and benefit plans; The costs and effects of legal and regulatory developments, the resolution of legal proceedings or regulatory or other governmental inquiries, the results of regulatory examinations or reviews and the ability to obtain required regulatory approvals; Greater than expected costs or difficulties related to the integration of new products and lines of business; Our success at managing the risks involved in the foregoing items. Meridian Corporation cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward-looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review the Corporation’s filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023 and subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. The Corporation does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by the Corporation or by or on behalf of Meridian Bank, except as may be required under applicable laws.

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 3Meridian Corporation MRBK INVESTMENT HIGHLIGHTS "Go to" bank in the Delaware Valley Valuable customer base trained to solely use electronic channel. Regional presence with a community touch. Focus on Commercial, CRE and SBA lending - 80% of loan book. Comfortably handle all but the largest companies. Skilled management team with extensive in-market experience. Demonstrated organic growth engine in diversified loan segments. Strong sales culture that capitalizes on market disruption.

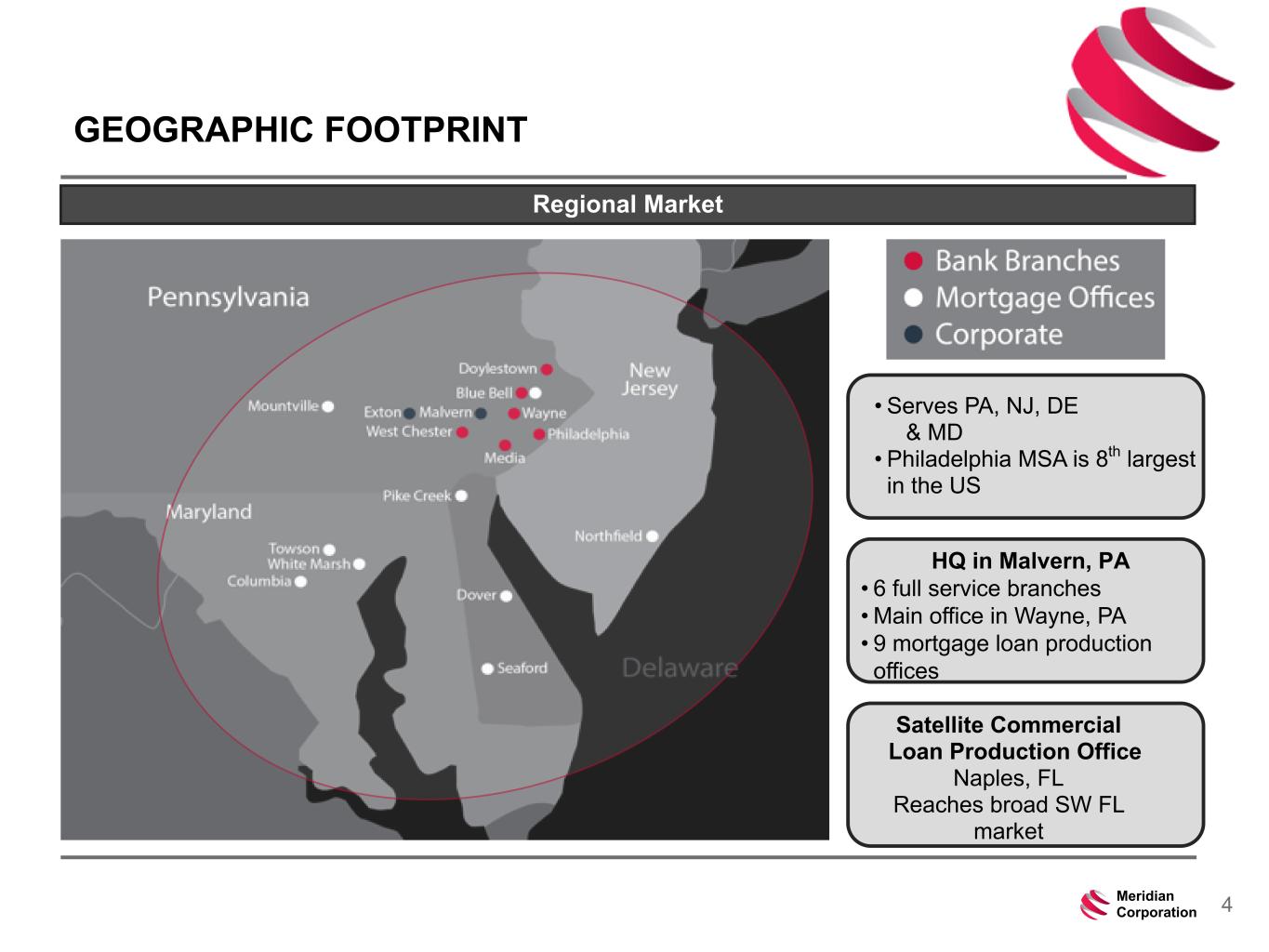

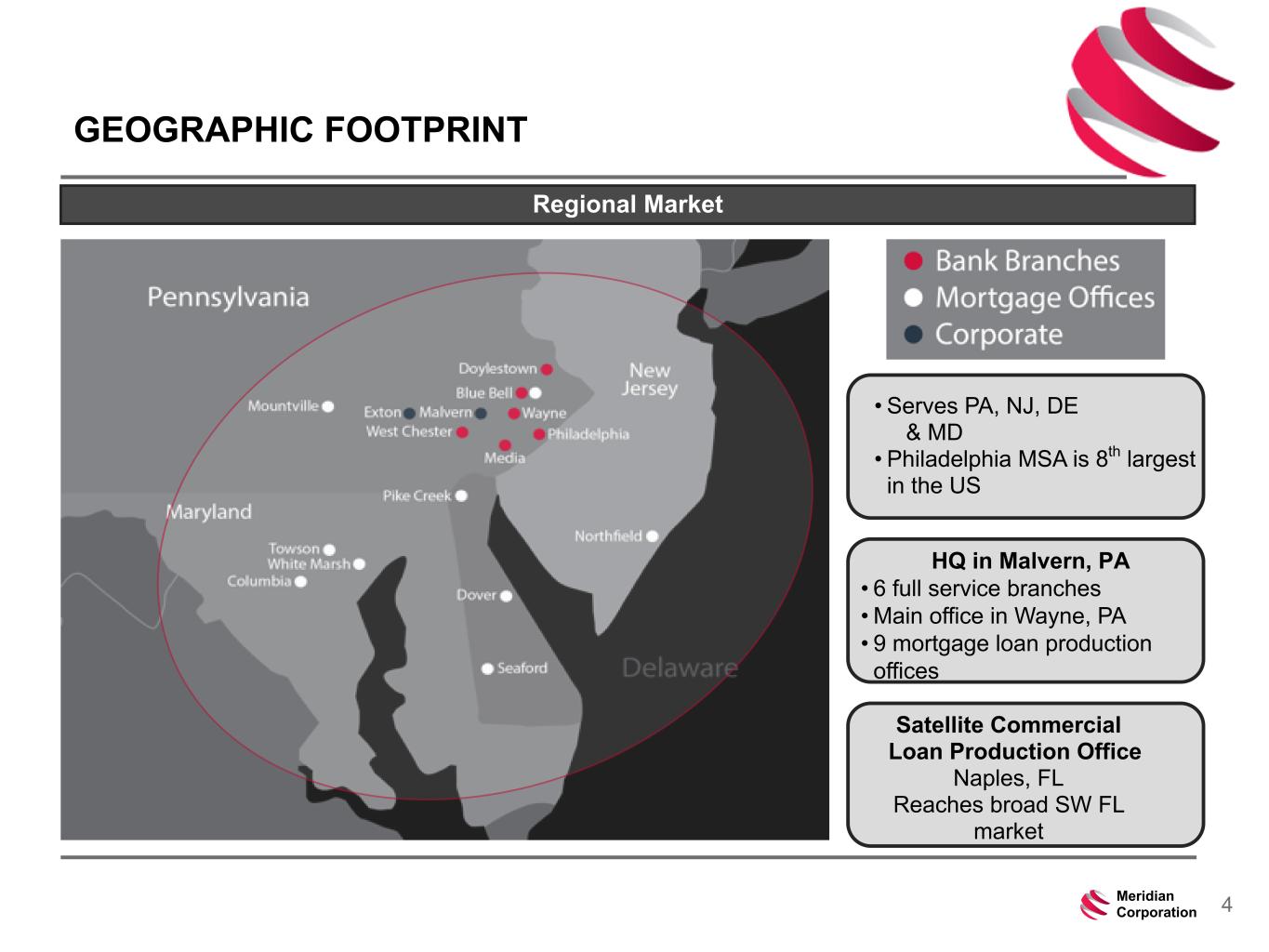

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 4Meridian Corporation GEOGRAPHIC FOOTPRINT Regional Market • Serves PA, NJ, DE & MD • Philadelphia MSA is 8th largest in the US Satellite Commercial Loan Production Office Naples, FL Reaches broad SW FL market HQ in Malvern, PA • 6 full service branches • Main office in Wayne, PA • 9 mortgage loan production offices

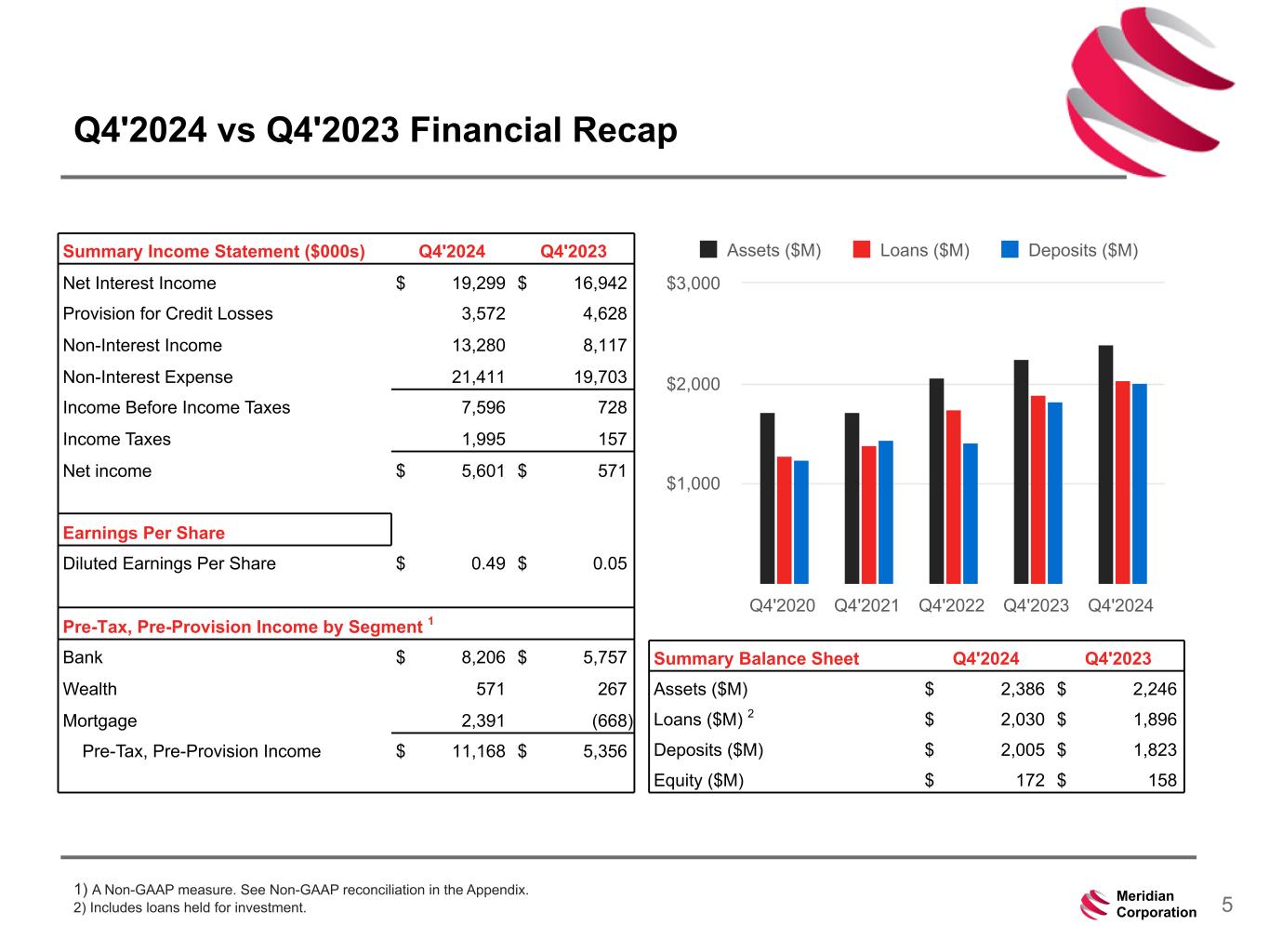

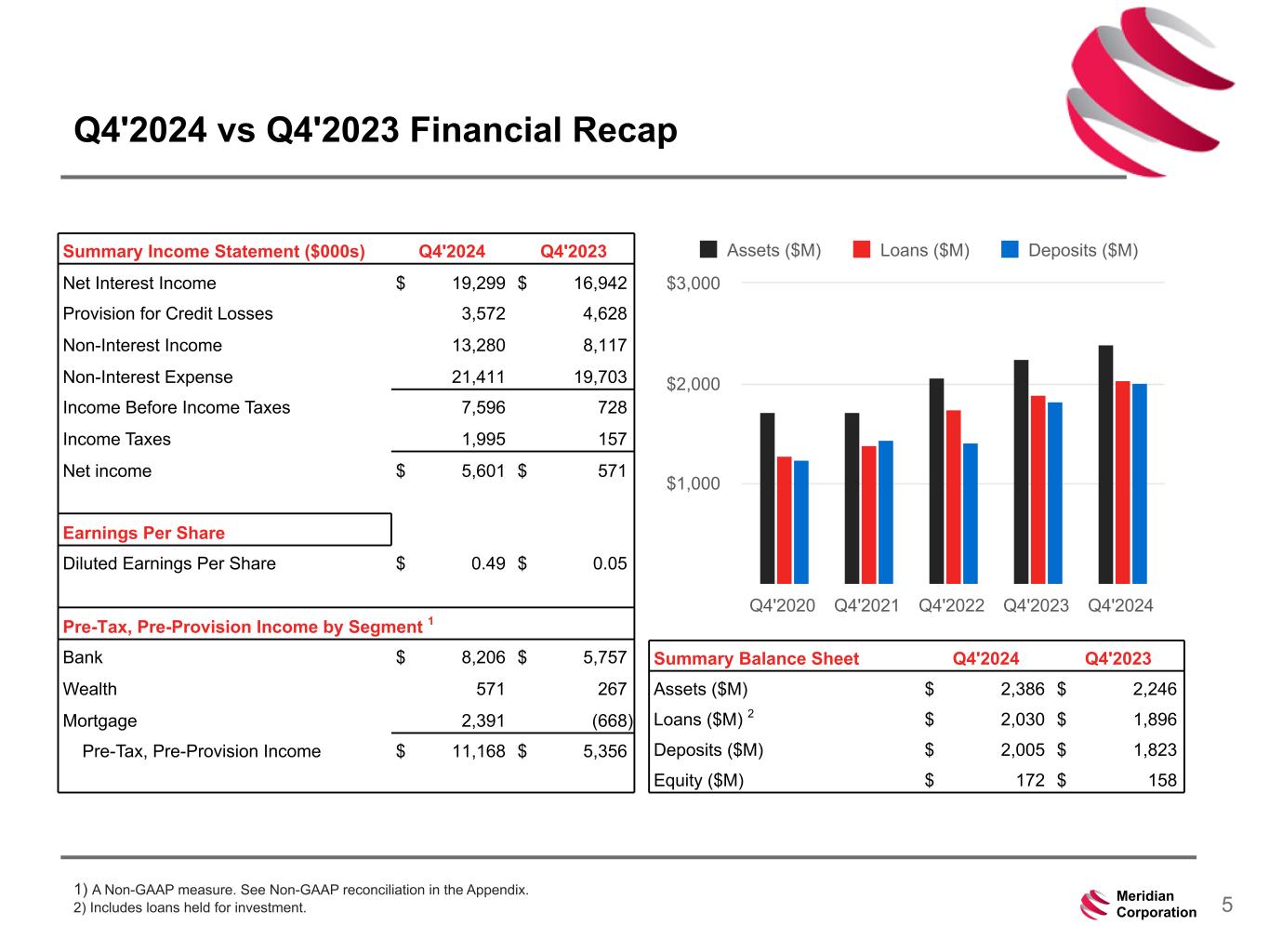

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 5Meridian Corporation Q4'2024 vs Q4'2023 Financial Recap 1) A Non-GAAP measure. See Non-GAAP reconciliation in the Appendix. 2) Includes loans held for investment. Summary Income Statement ($000s) Q4'2024 Q4'2023 Net Interest Income $ 19,299 $ 16,942 Provision for Credit Losses 3,572 4,628 Non-Interest Income 13,280 8,117 Non-Interest Expense 21,411 19,703 Income Before Income Taxes 7,596 728 Income Taxes 1,995 157 Net income $ 5,601 $ 571 Earnings Per Share Diluted Earnings Per Share $ 0.49 $ 0.05 Pre-Tax, Pre-Provision Income by Segment 1 Bank $ 8,206 $ 5,757 Wealth 571 267 Mortgage 2,391 (668) Pre-Tax, Pre-Provision Income $ 11,168 $ 5,356 Summary Balance Sheet Q4'2024 Q4'2023 Assets ($M) $ 2,386 $ 2,246 Loans ($M) 2 $ 2,030 $ 1,896 Deposits ($M) $ 2,005 $ 1,823 Equity ($M) $ 172 $ 158 Assets ($M) Loans ($M) Deposits ($M) Q4'2020 Q4'2021 Q4'2022 Q4'2023 Q4'2024 $1,000 $2,000 $3,000

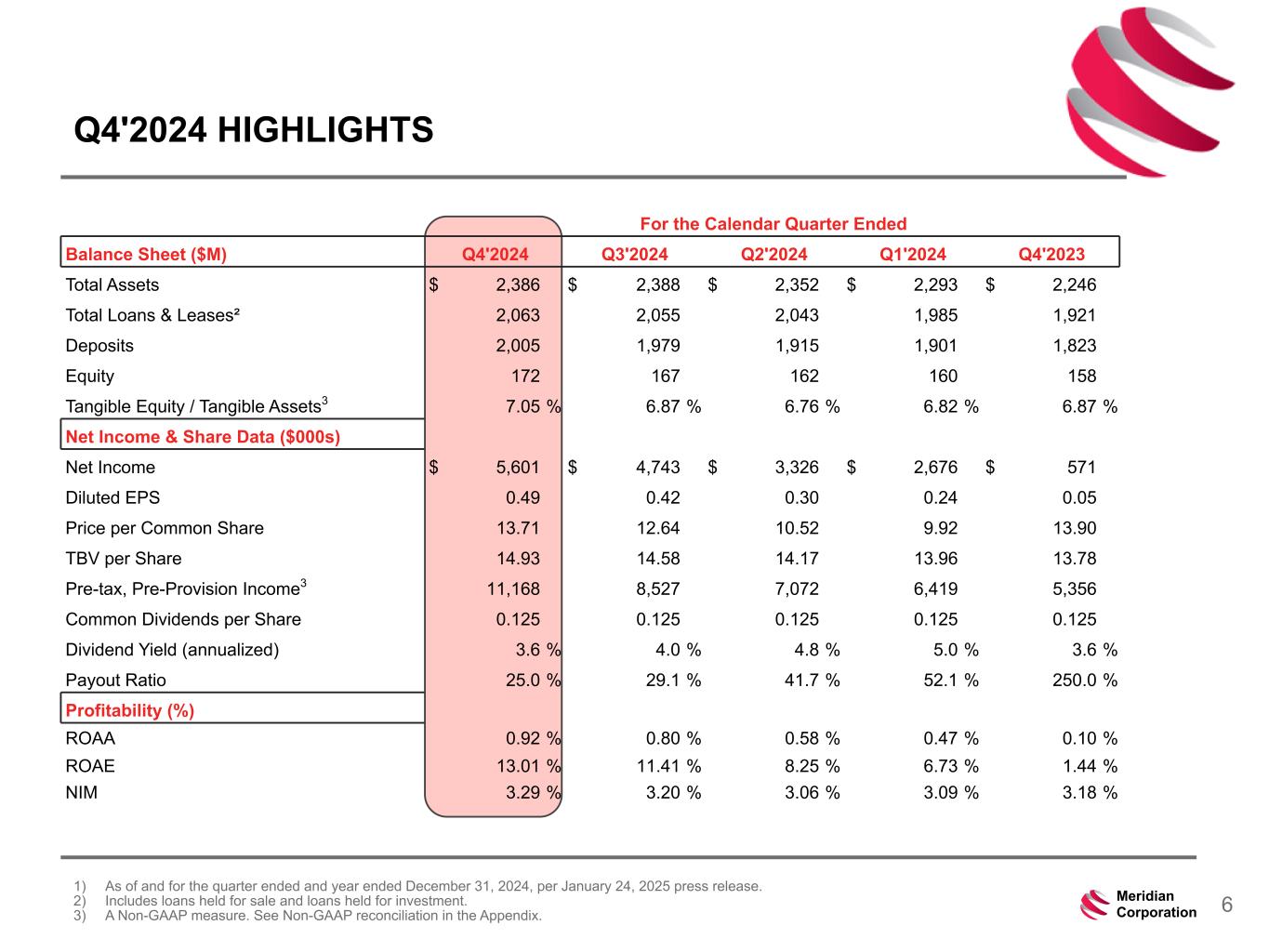

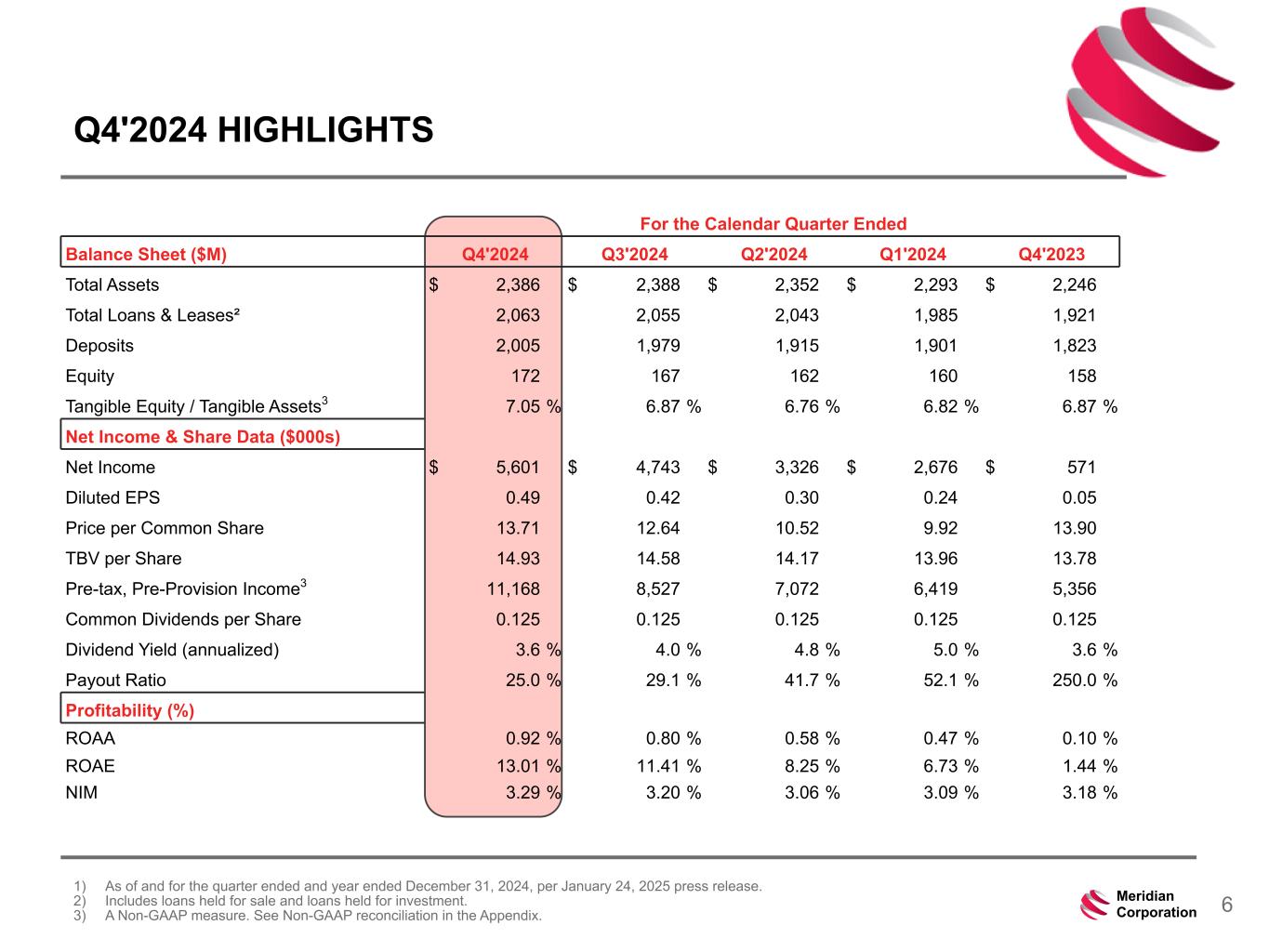

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 6Meridian Corporation Q4'2024 HIGHLIGHTS 1) As of and for the quarter ended and year ended December 31, 2024, per January 24, 2025 press release. 2) Includes loans held for sale and loans held for investment. 3) A Non-GAAP measure. See Non-GAAP reconciliation in the Appendix. For the Calendar Quarter Ended Balance Sheet ($M) Q4'2024 Q3'2024 Q2'2024 Q1'2024 Q4'2023 Total Assets $ 2,386 $ 2,388 $ 2,352 $ 2,293 $ 2,246 Total Loans & Leases² 2,063 2,055 2,043 1,985 1,921 Deposits 2,005 1,979 1,915 1,901 1,823 Equity 172 167 162 160 158 Tangible Equity / Tangible Assets3 7.05 % 6.87 % 6.76 % 6.82 % 6.87 % Net Income & Share Data ($000s) Net Income $ 5,601 $ 4,743 $ 3,326 $ 2,676 $ 571 Diluted EPS 0.49 0.42 0.30 0.24 0.05 Price per Common Share 13.71 12.64 10.52 9.92 13.90 TBV per Share 14.93 14.58 14.17 13.96 13.78 Pre-tax, Pre-Provision Income3 11,168 8,527 7,072 6,419 5,356 Common Dividends per Share 0.125 0.125 0.125 0.125 0.125 Dividend Yield (annualized) 3.6 % 4.0 % 4.8 % 5.0 % 3.6 % Payout Ratio 25.0 % 29.1 % 41.7 % 52.1 % 250.0 % Profitability (%) ROAA 0.92 % 0.80 % 0.58 % 0.47 % 0.10 % ROAE 13.01 % 11.41 % 8.25 % 6.73 % 1.44 % NIM 3.29 % 3.20 % 3.06 % 3.09 % 3.18 %

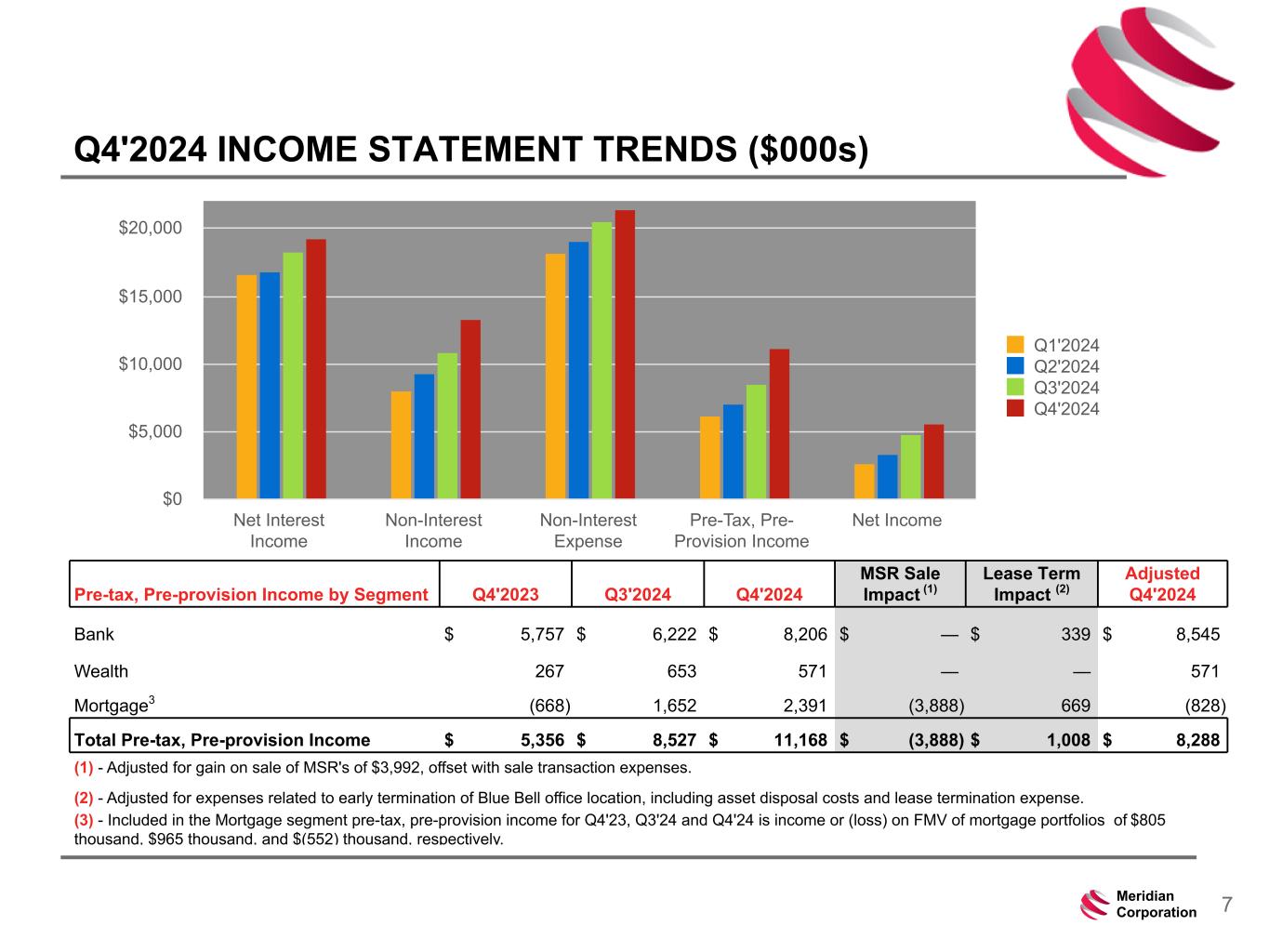

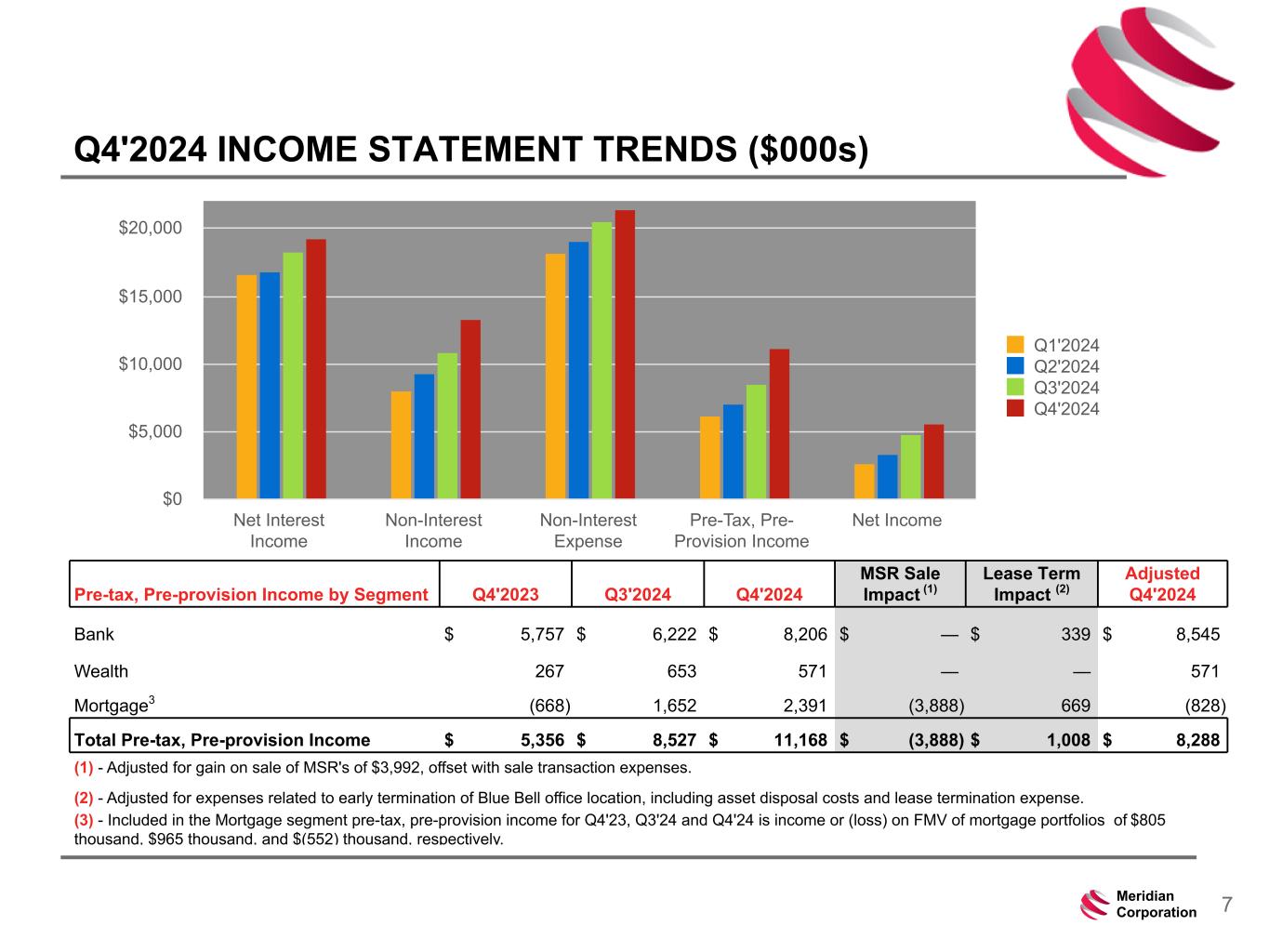

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 7Meridian Corporation Q4'2024 INCOME STATEMENT TRENDS ($000s) Pre-tax, Pre-provision Income by Segment Q4'2023 Q3'2024 Q4'2024 MSR Sale Impact (1) Lease Term Impact (2) Adjusted Q4'2024 Bank $ 5,757 $ 6,222 $ 8,206 $ — $ 339 $ 8,545 Wealth 267 653 571 — — 571 Mortgage3 (668) 1,652 2,391 (3,888) 669 (828) Total Pre-tax, Pre-provision Income $ 5,356 $ 8,527 $ 11,168 $ (3,888) $ 1,008 $ 8,288 (1) - Adjusted for gain on sale of MSR's of $3,992, offset with sale transaction expenses. (2) - Adjusted for expenses related to early termination of Blue Bell office location, including asset disposal costs and lease termination expense. (3) - Included in the Mortgage segment pre-tax, pre-provision income for Q4'23, Q3'24 and Q4'24 is income or (loss) on FMV of mortgage portfolios of $805 thousand, $965 thousand, and $(552) thousand, respectively. Q1'2024 Q2'2024 Q3'2024 Q4'2024 Net Interest Income Non-Interest Income Non-Interest Expense Pre-Tax, Pre- Provision Income Net Income $0 $5,000 $10,000 $15,000 $20,000

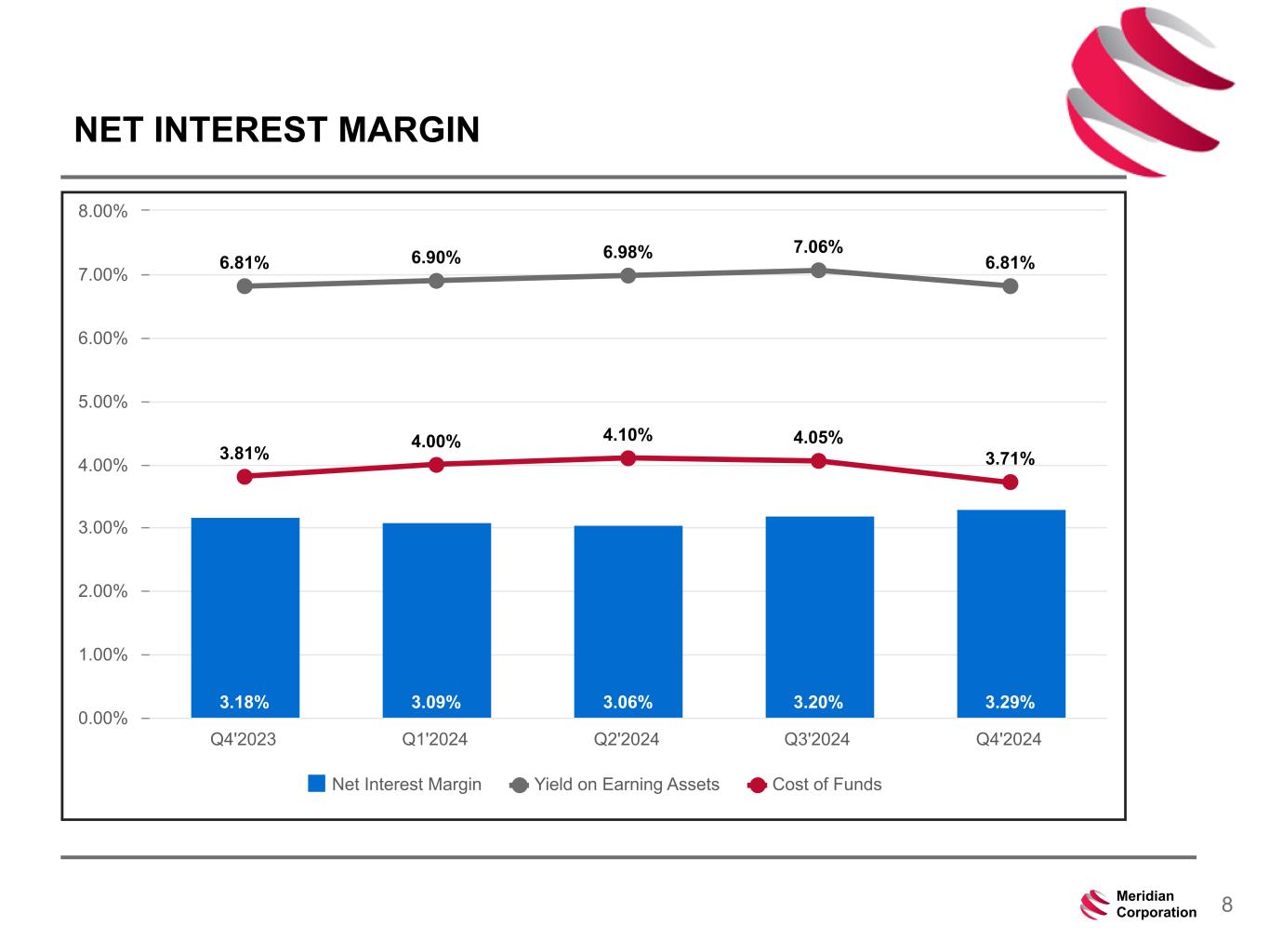

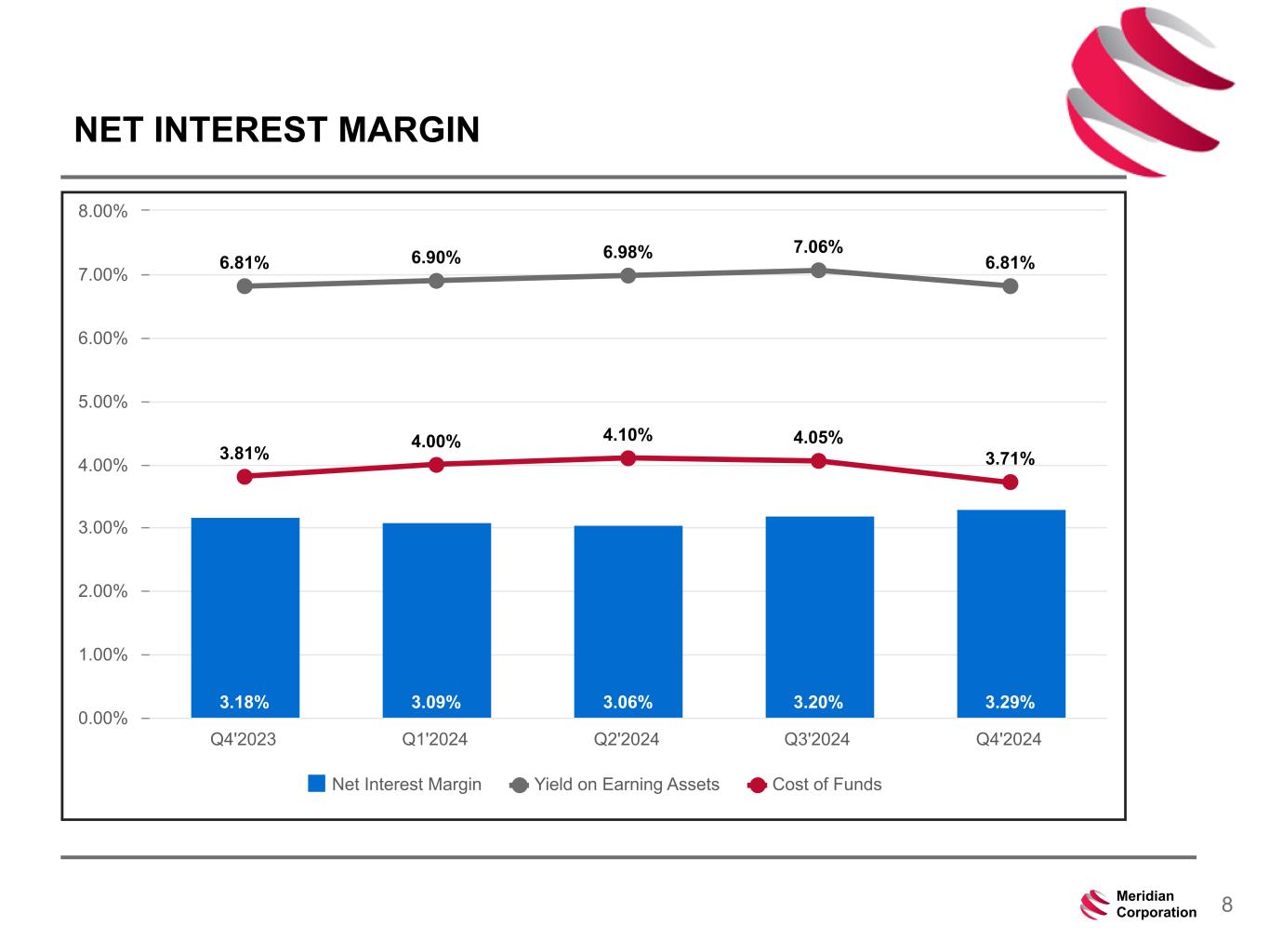

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 8Meridian Corporation NET INTEREST MARGIN 3.18% 3.09% 3.06% 3.20% 3.29% 6.81% 6.90% 6.98% 7.06% 6.81% 3.81% 4.00% 4.10% 4.05% 3.71% Net Interest Margin Yield on Earning Assets Cost of Funds Q4'2023 Q1'2024 Q2'2024 Q3'2024 Q4'2024 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00%

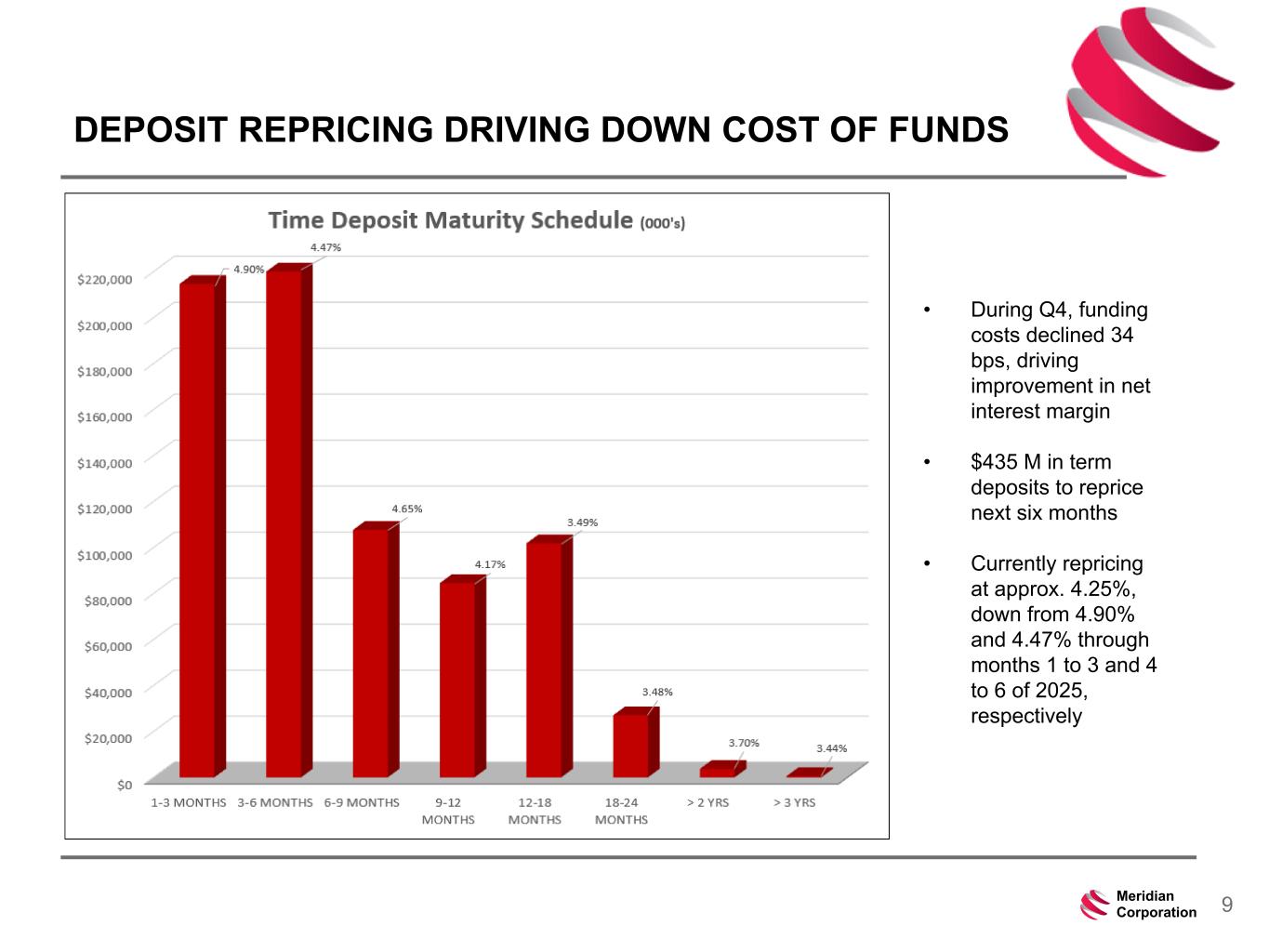

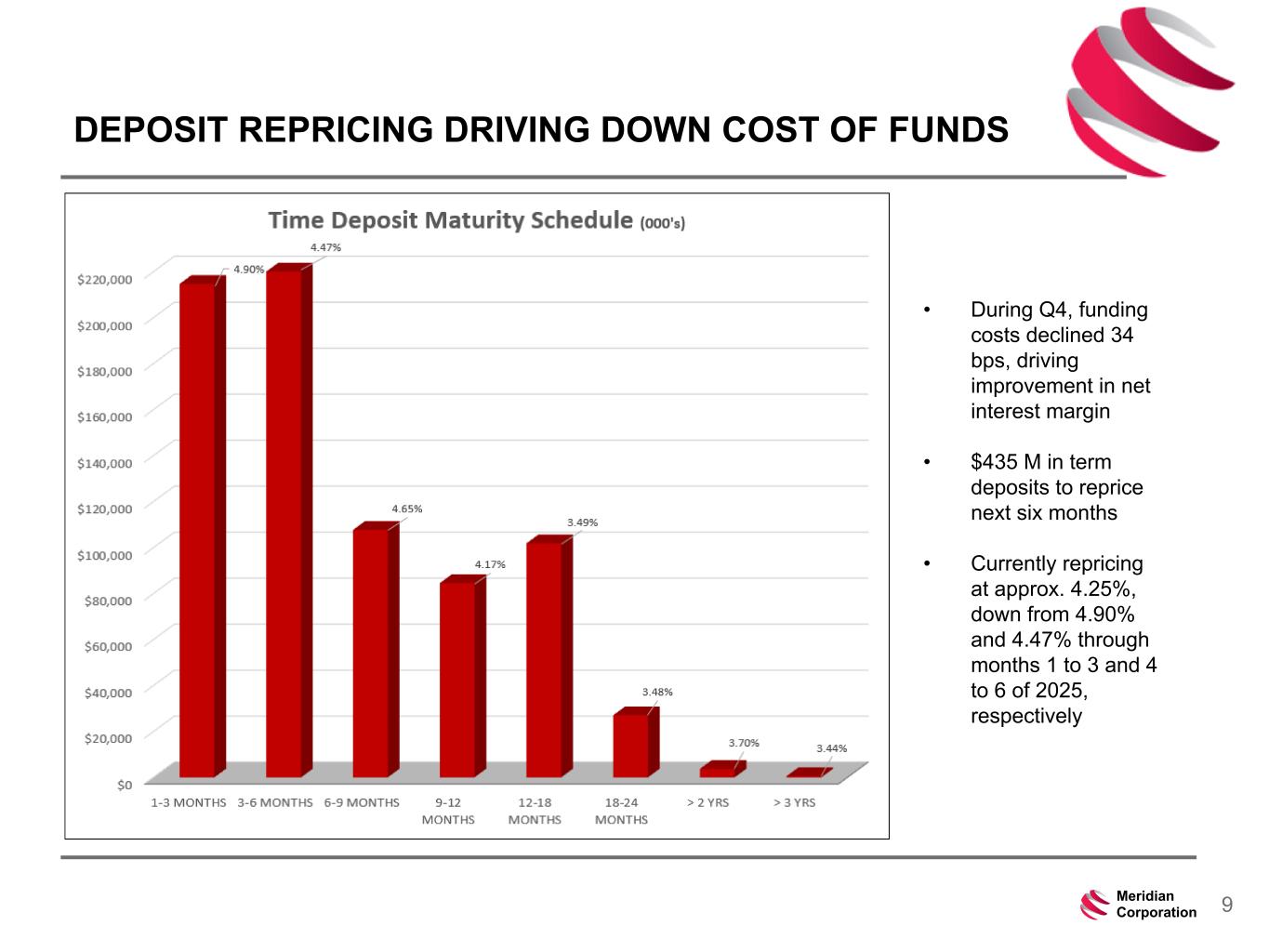

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 9Meridian Corporation DEPOSIT REPRICING DRIVING DOWN COST OF FUNDS • During Q4, funding costs declined 34 bps, driving improvement in net interest margin • $435 M in term deposits to reprice next six months • Currently repricing at approx. 4.25%, down from 4.90% and 4.47% through months 1 to 3 and 4 to 6 of 2025, respectively

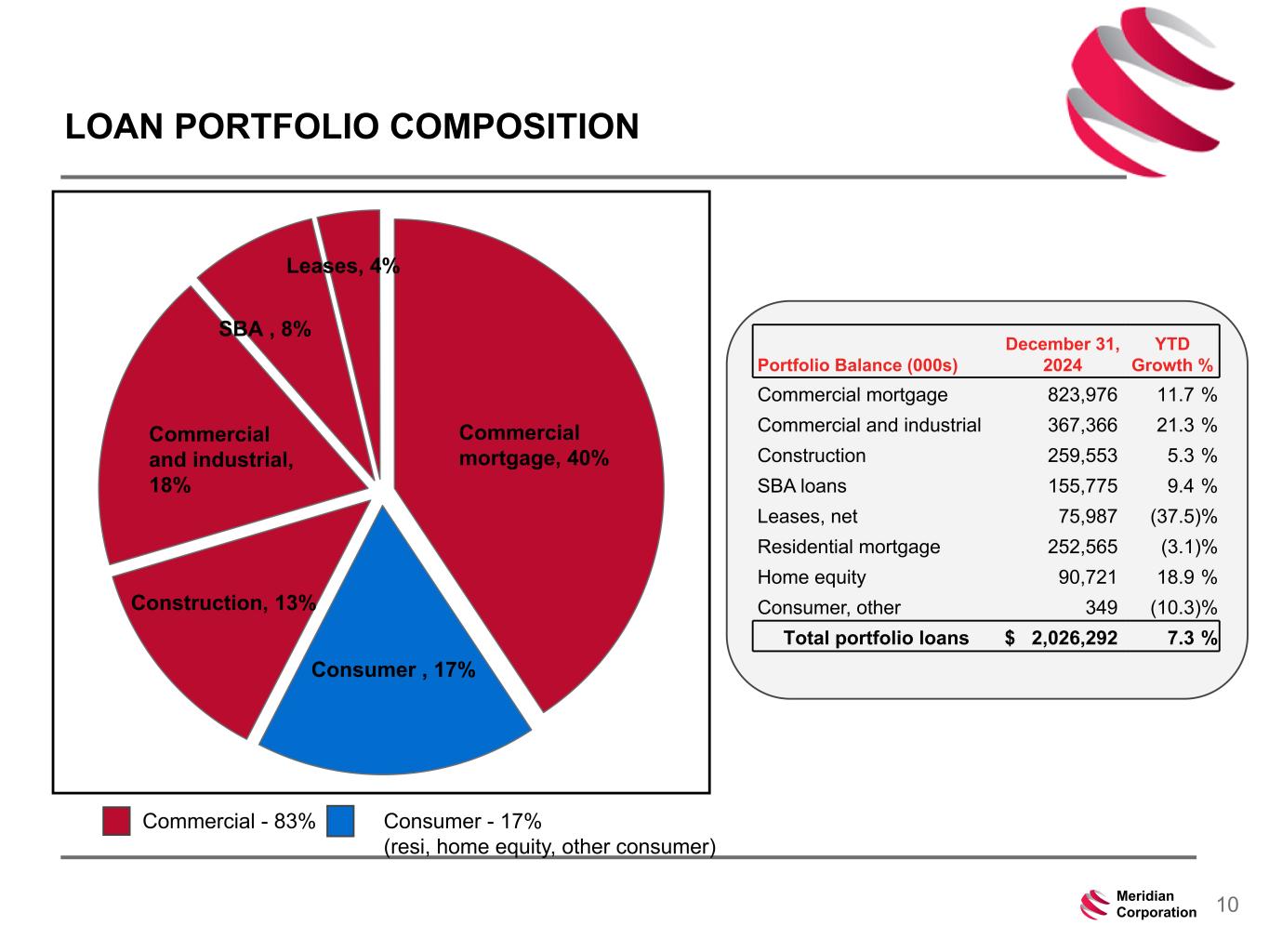

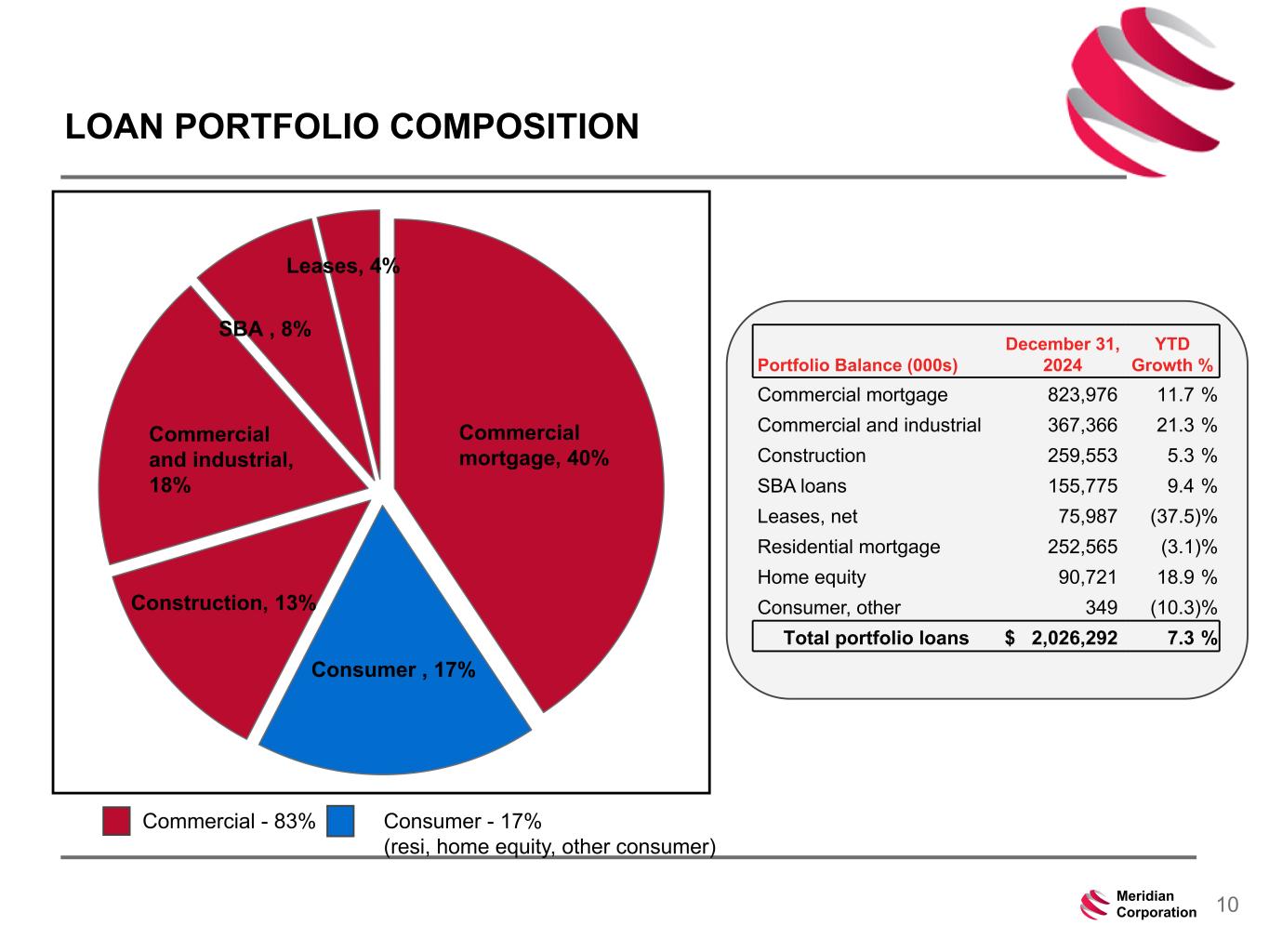

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 10Meridian Corporation LOAN PORTFOLIO COMPOSITION Portfolio Balance (000s) December 31, 2024 YTD Growth % Commercial mortgage 823,976 11.7 % Commercial and industrial 367,366 21.3 % Construction 259,553 5.3 % SBA loans 155,775 9.4 % Leases, net 75,987 (37.5) % Residential mortgage 252,565 (3.1) % Home equity 90,721 18.9 % Consumer, other 349 (10.3) % Total portfolio loans $ 2,026,292 7.3 % Commercial mortgage, 40% Consumer , 17% Construction, 13% Commercial and industrial, 18% SBA , 8% Leases, 4% Commercial - 83% Consumer - 17% (resi, home equity, other consumer)

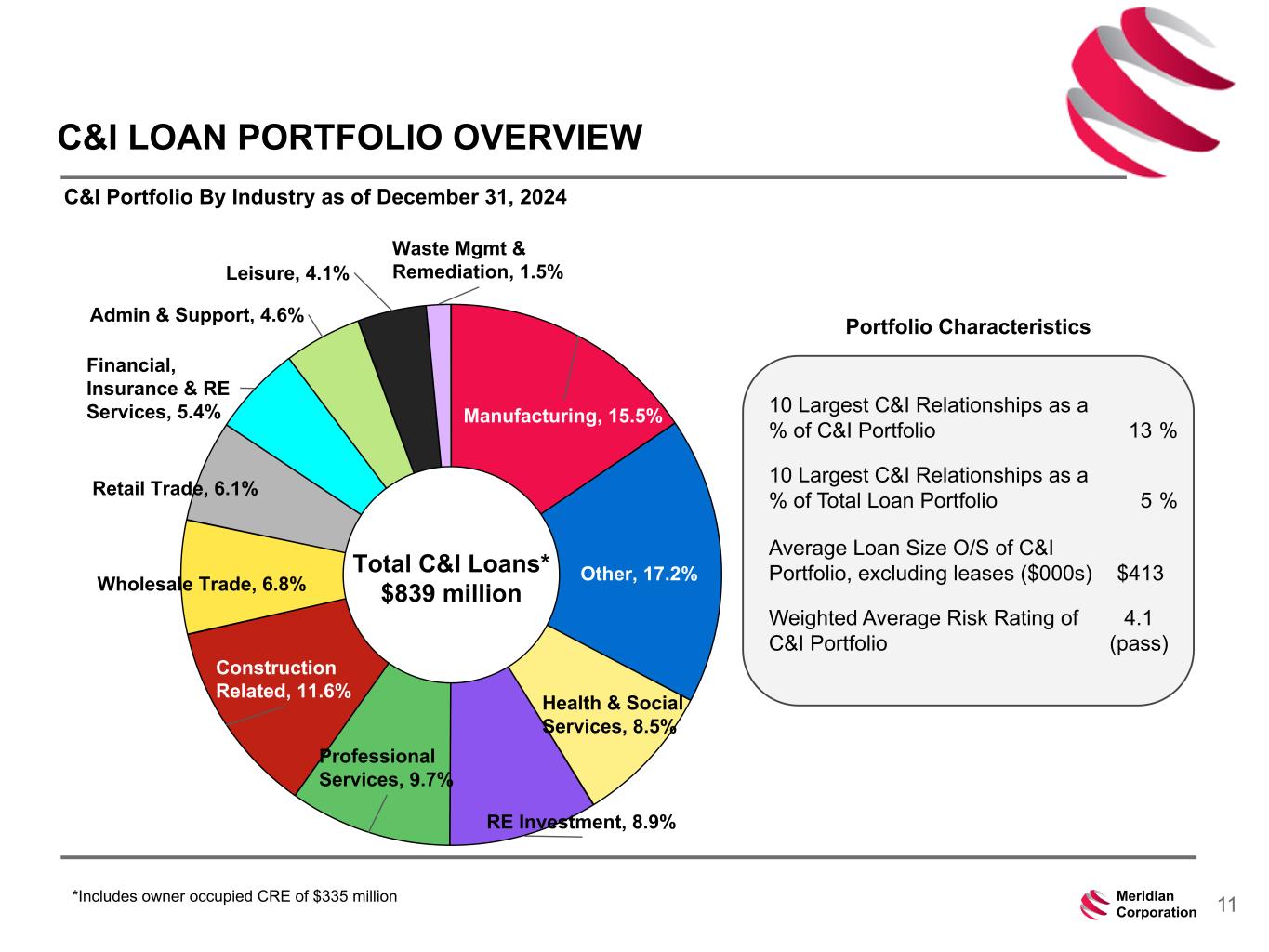

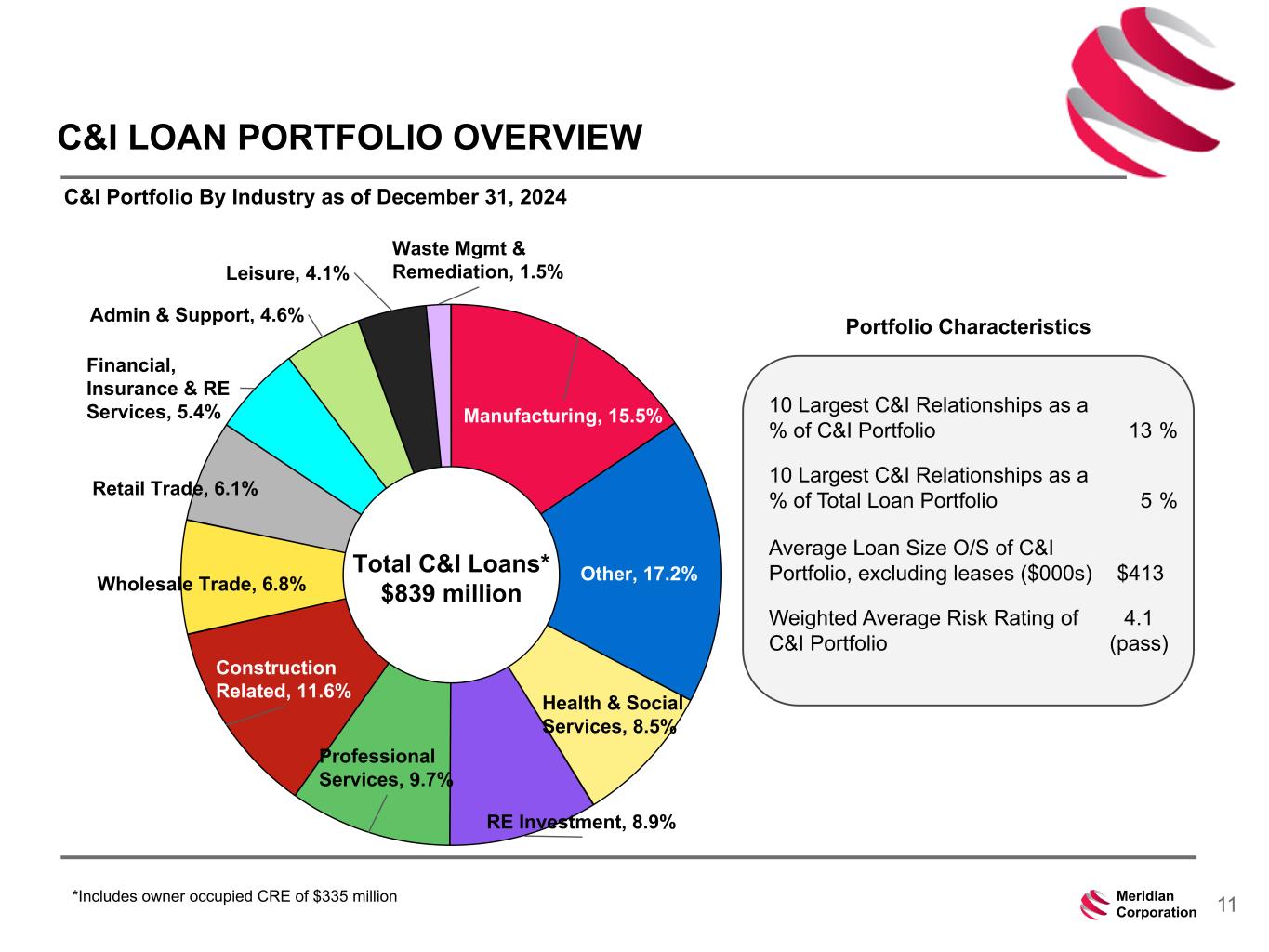

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 11Meridian Corporation C&I LOAN PORTFOLIO OVERVIEW C&I Portfolio By Industry as of December 31, 2024 10 Largest C&I Relationships as a % of C&I Portfolio 13 % 10 Largest C&I Relationships as a % of Total Loan Portfolio 5 % Average Loan Size O/S of C&I Portfolio, excluding leases ($000s) $413 Weighted Average Risk Rating of C&I Portfolio 4.1 (pass) Manufacturing, 15.5% Other, 17.2% Health & Social Services, 8.5% RE Investment, 8.9% Professional Services, 9.7% Construction Related, 11.6% Wholesale Trade, 6.8% Retail Trade, 6.1% Financial, Insurance & RE Services, 5.4% Admin & Support, 4.6% Leisure, 4.1% Waste Mgmt & Remediation, 1.5% Total C&I Loans* $839 million *Includes owner occupied CRE of $335 million Portfolio Characteristics

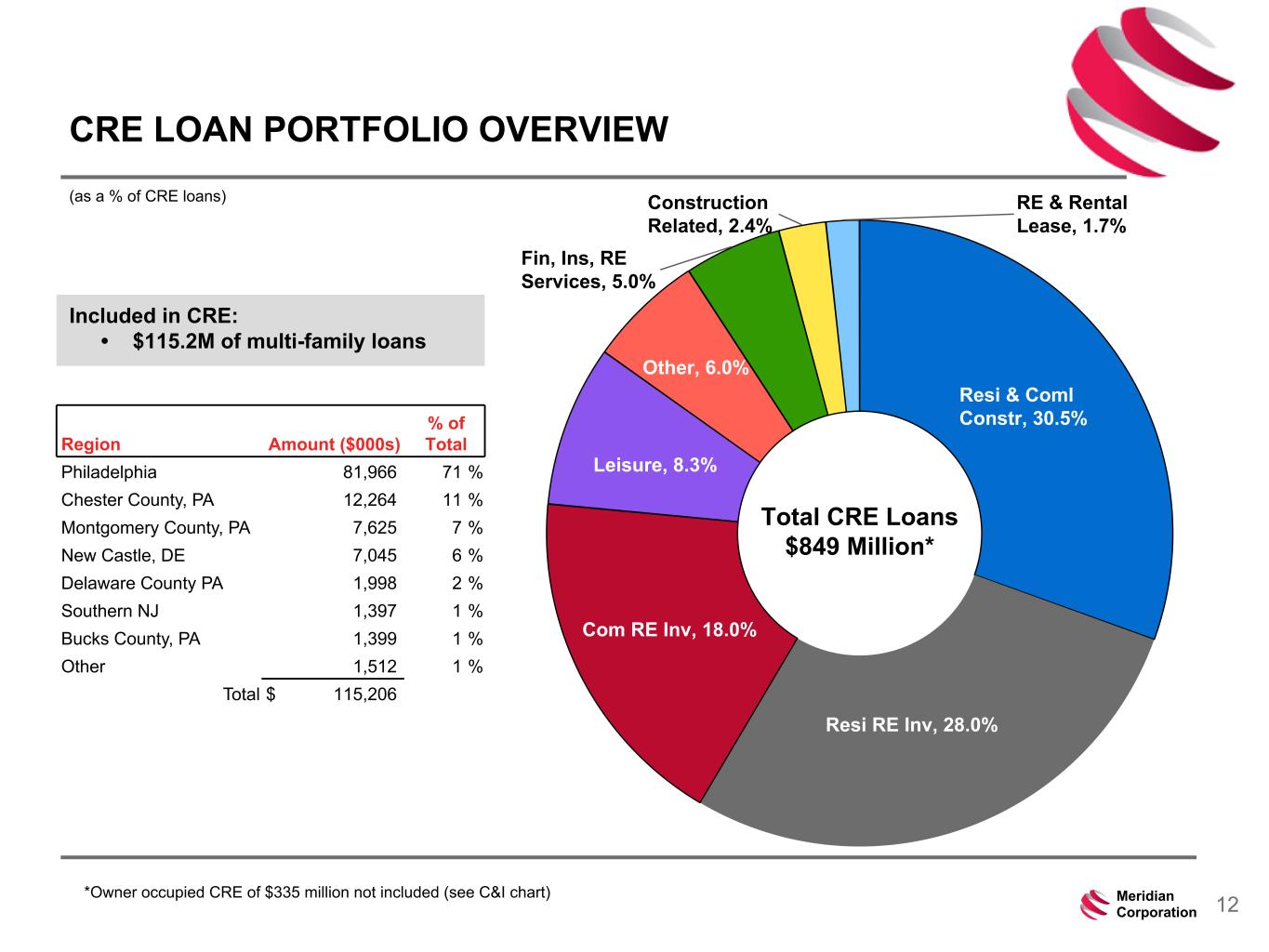

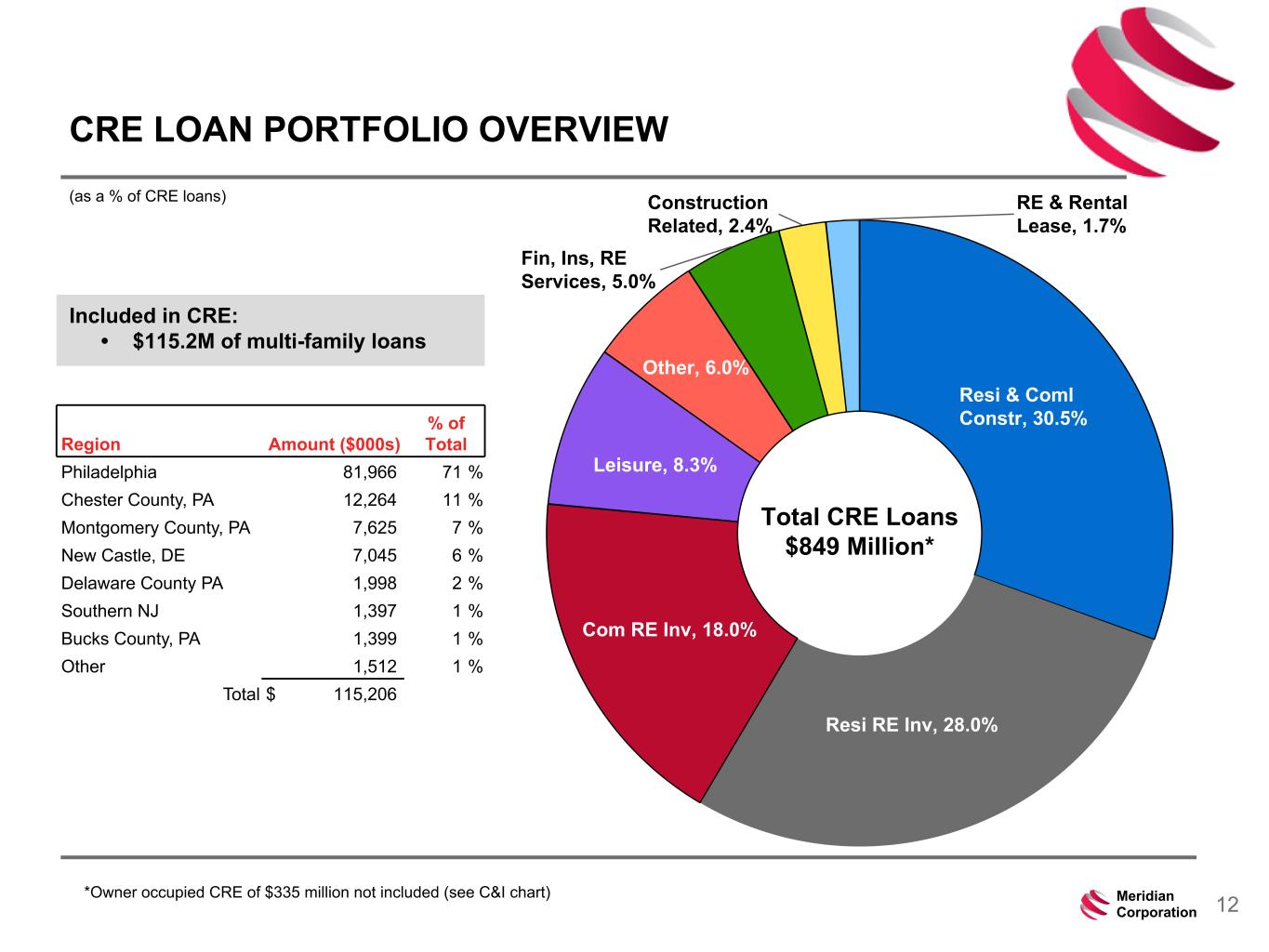

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 12Meridian Corporation Resi & Coml Constr, 30.5% Resi RE Inv, 28.0% Com RE Inv, 18.0% Leisure, 8.3% Other, 6.0% Fin, Ins, RE Services, 5.0% Construction Related, 2.4% RE & Rental Lease, 1.7% CRE LOAN PORTFOLIO OVERVIEW Total CRE Loans $849 Million* (as a % of CRE loans) *Owner occupied CRE of $335 million not included (see C&I chart) Included in CRE: • $115.2M of multi-family loans Region Amount ($000s) % of Total Philadelphia 81,966 71 % Chester County, PA 12,264 11 % Montgomery County, PA 7,625 7 % New Castle, DE 7,045 6 % Delaware County PA 1,998 2 % Southern NJ 1,397 1 % Bucks County, PA 1,399 1 % Other 1,512 1 % Total $ 115,206

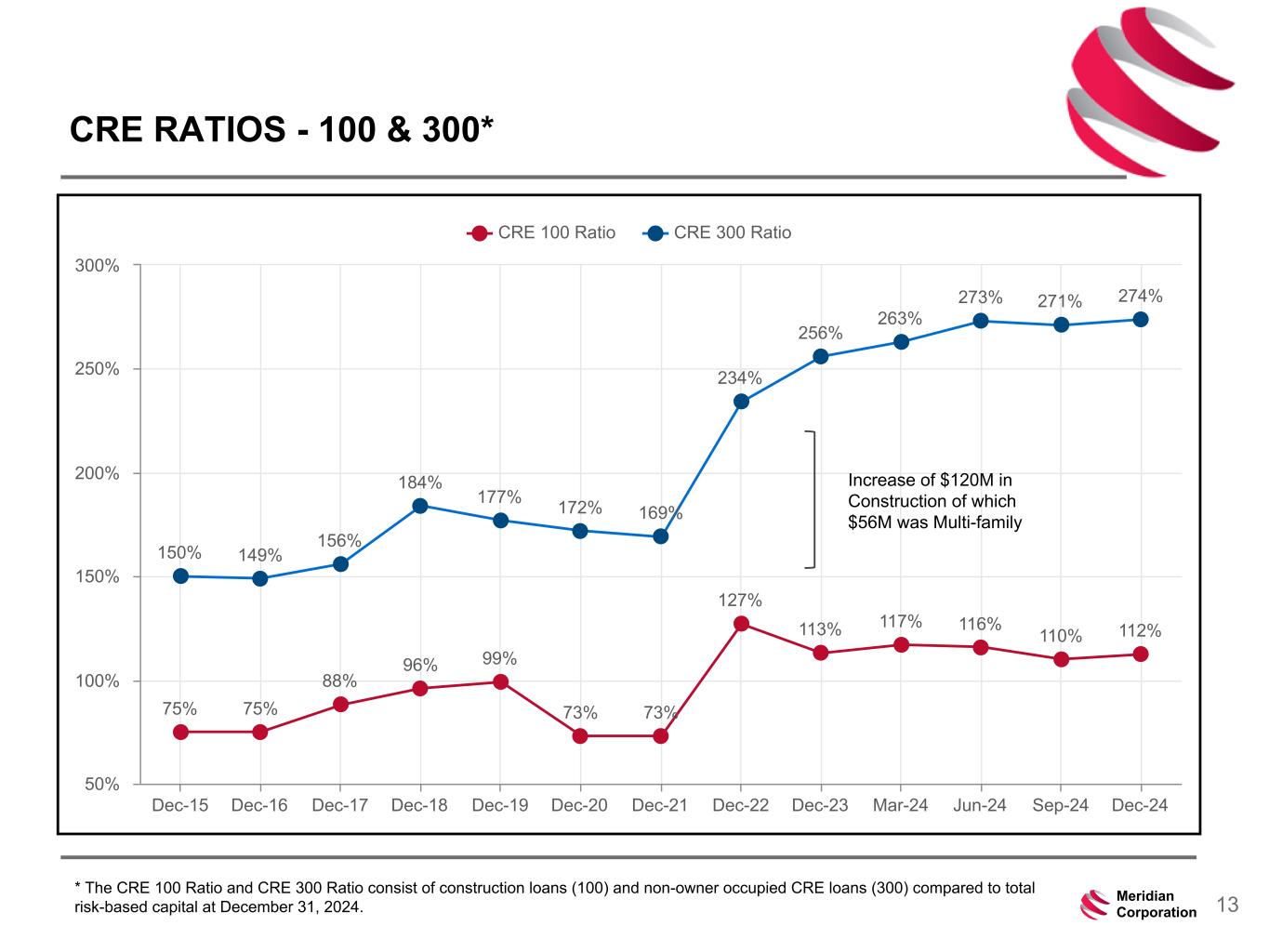

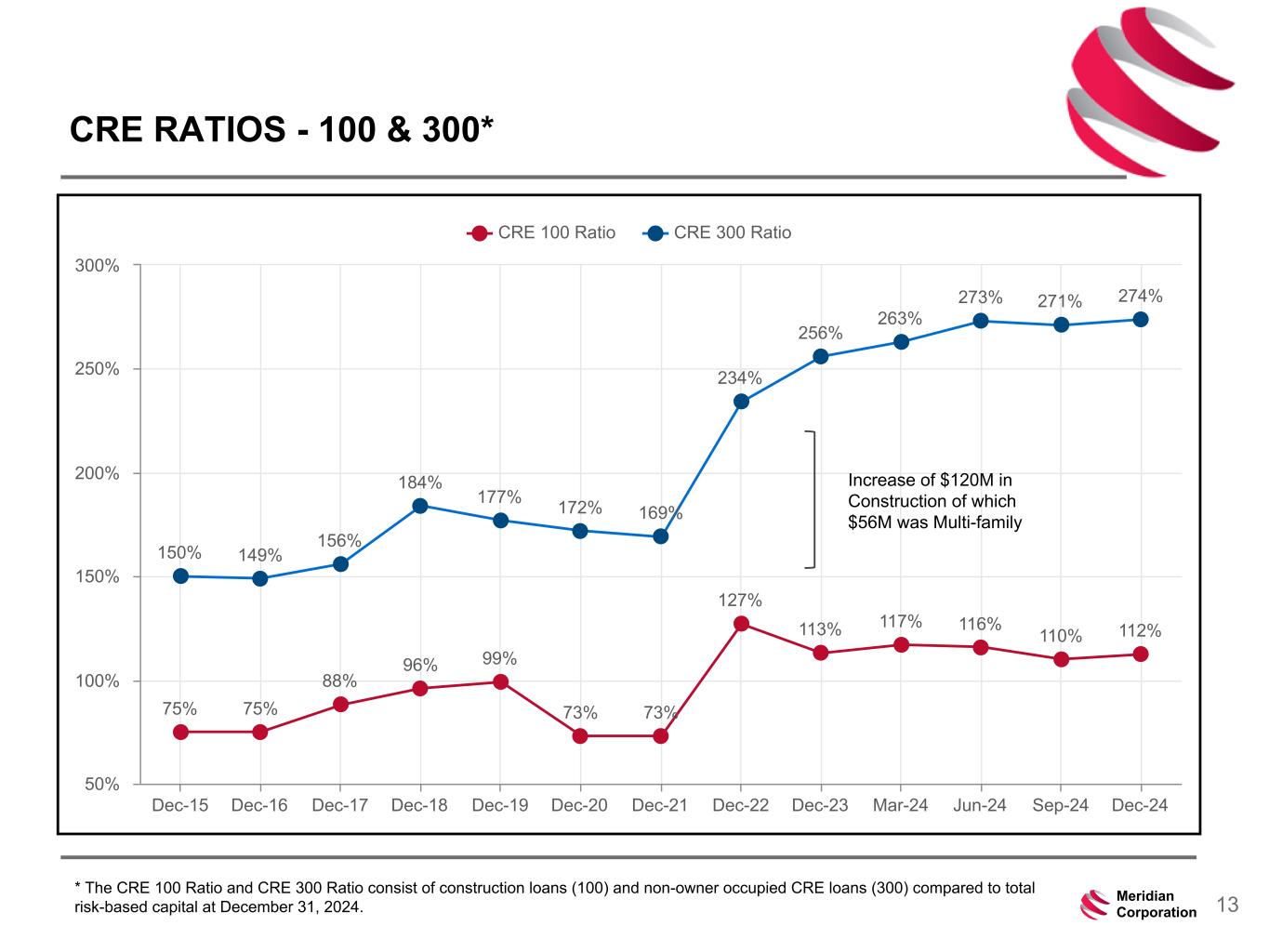

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 13Meridian Corporation CRE RATIOS - 100 & 300* 75% 75% 88% 96% 99% 73% 73% 127% 113% 117% 116% 110% 112% 150% 149% 156% 184% 177% 172% 169% 234% 256% 263% 273% 271% 274% CRE 100 Ratio CRE 300 Ratio Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21 Dec-22 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 50% 100% 150% 200% 250% 300% Increase of $120M in Construction of which $56M was Multi-family * The CRE 100 Ratio and CRE 300 Ratio consist of construction loans (100) and non-owner occupied CRE loans (300) compared to total risk-based capital at December 31, 2024.

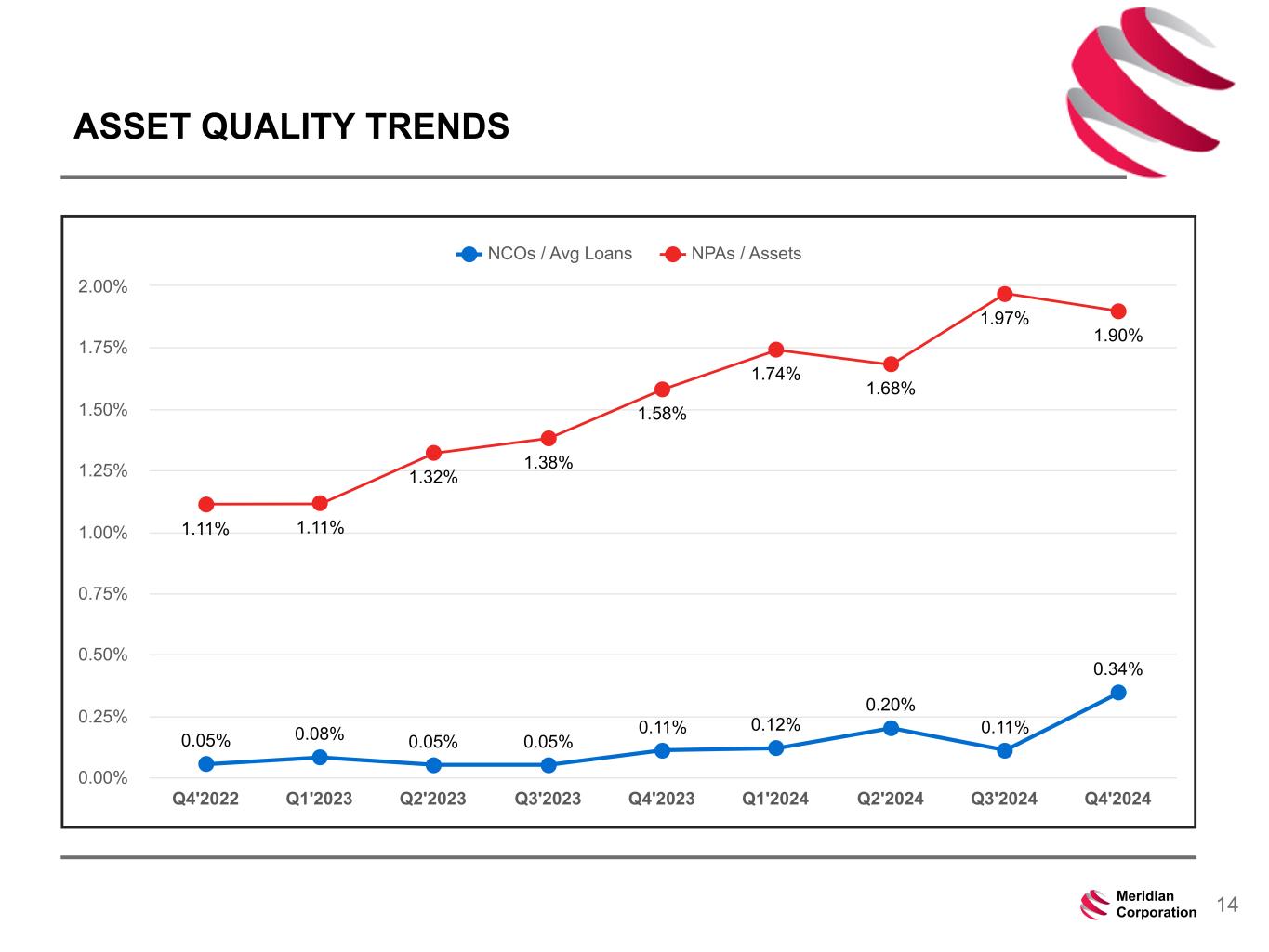

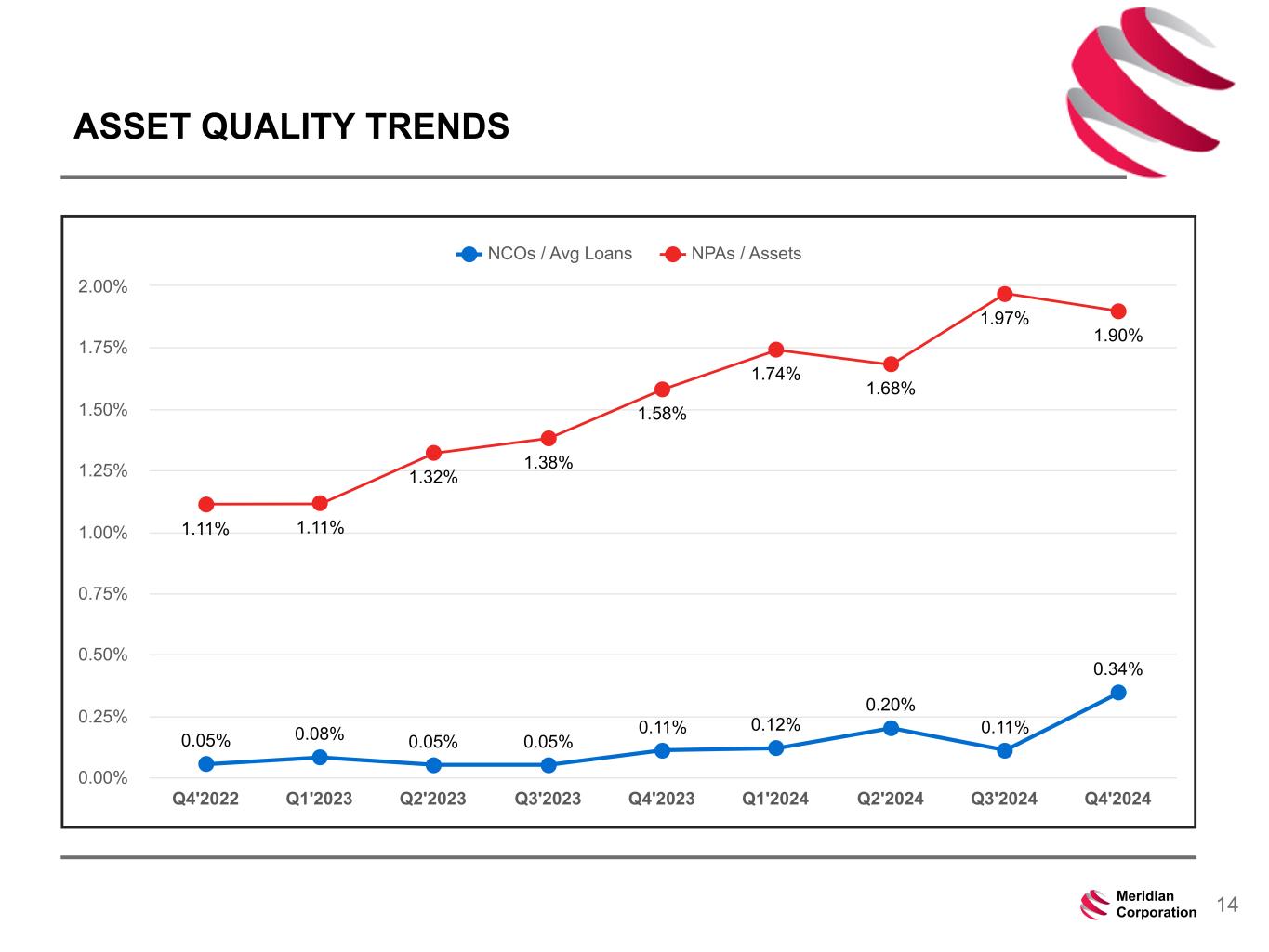

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 14Meridian Corporation ASSET QUALITY TRENDS 0.05% 0.08% 0.05% 0.05% 0.11% 0.12% 0.20% 0.11% 0.34% 1.11% 1.11% 1.32% 1.38% 1.58% 1.74% 1.68% 1.97% 1.90% NCOs / Avg Loans NPAs / Assets Q4'2022 Q1'2023 Q2'2023 Q3'2023 Q4'2023 Q1'2024 Q2'2024 Q3'2024 Q4'2024 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00%

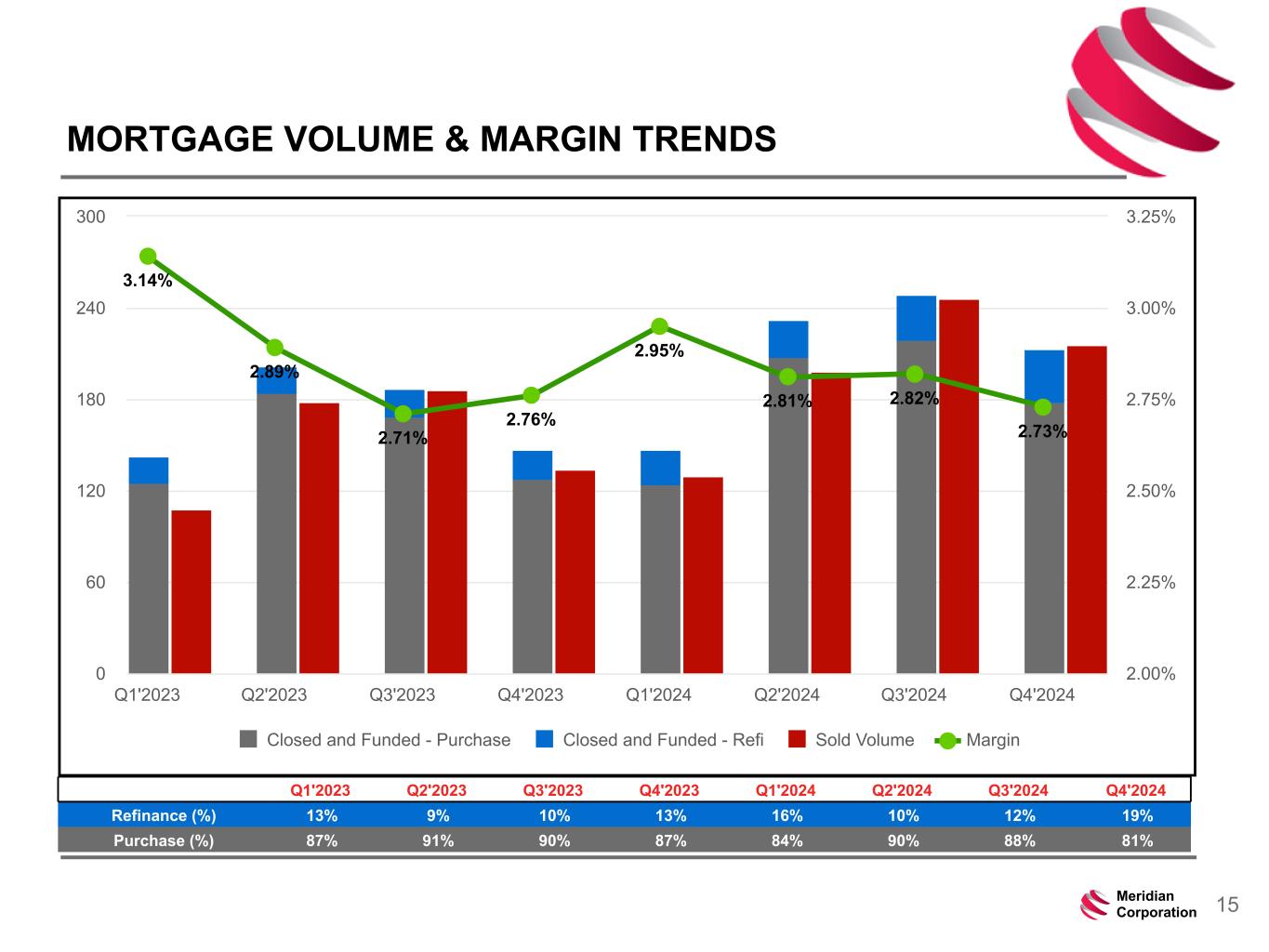

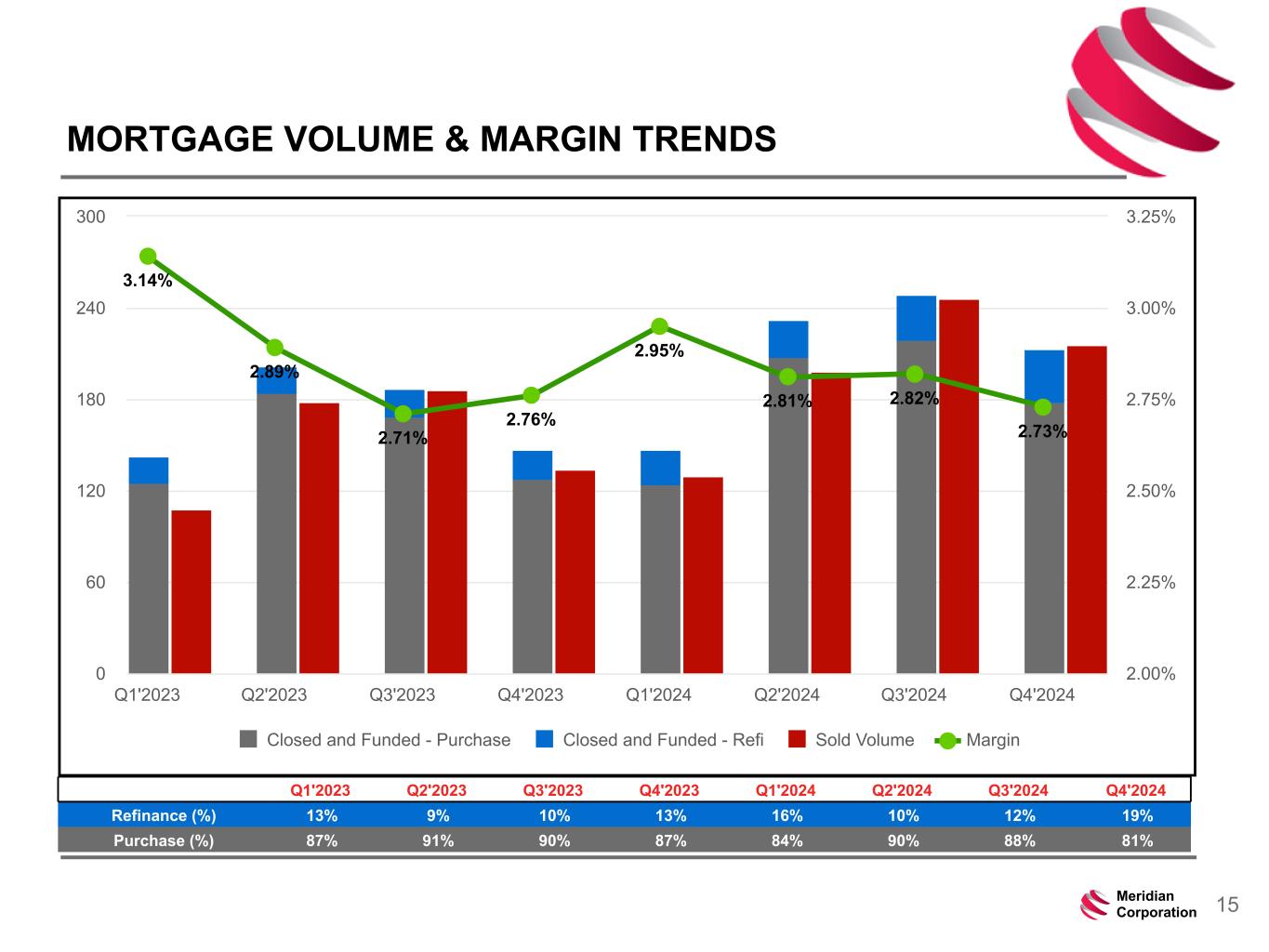

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 15Meridian Corporation MORTGAGE VOLUME & MARGIN TRENDS 3.14% 2.89% 2.71% 2.76% 2.95% 2.81% 2.82% 2.73% Closed and Funded - Purchase Closed and Funded - Refi Sold Volume Margin Q1'2023 Q2'2023 Q3'2023 Q4'2023 Q1'2024 Q2'2024 Q3'2024 Q4'2024 0 60 120 180 240 300 2.00% 2.25% 2.50% 2.75% 3.00% 3.25% Q1'2023 Q2'2023 Q3'2023 Q4'2023 Q1'2024 Q2'2024 Q3'2024 Q4'2024 Refinance (%) 13% 9% 10% 13% 16% 10% 12% 19% Purchase (%) 87% 91% 90% 87% 84% 90% 88% 81%

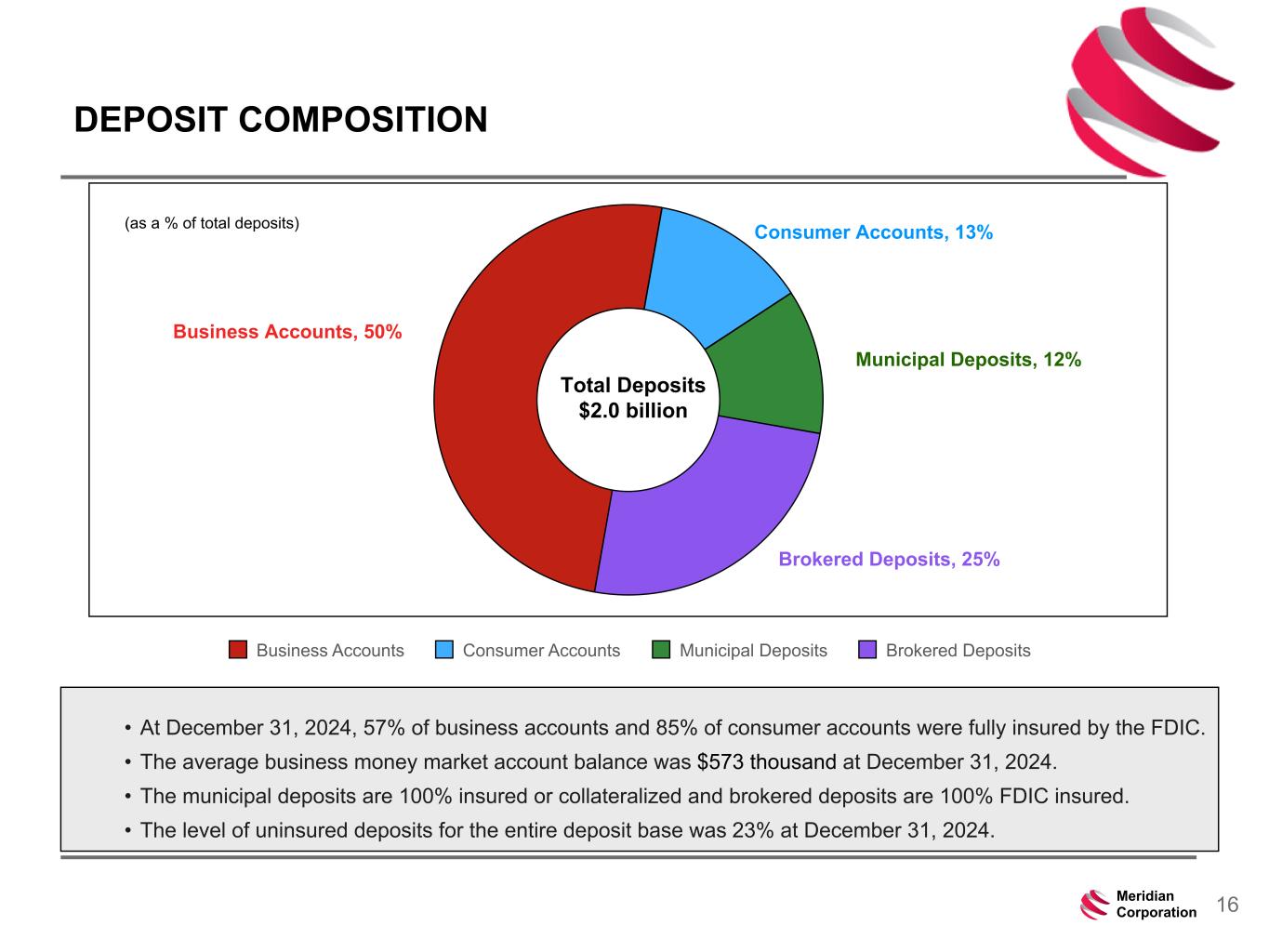

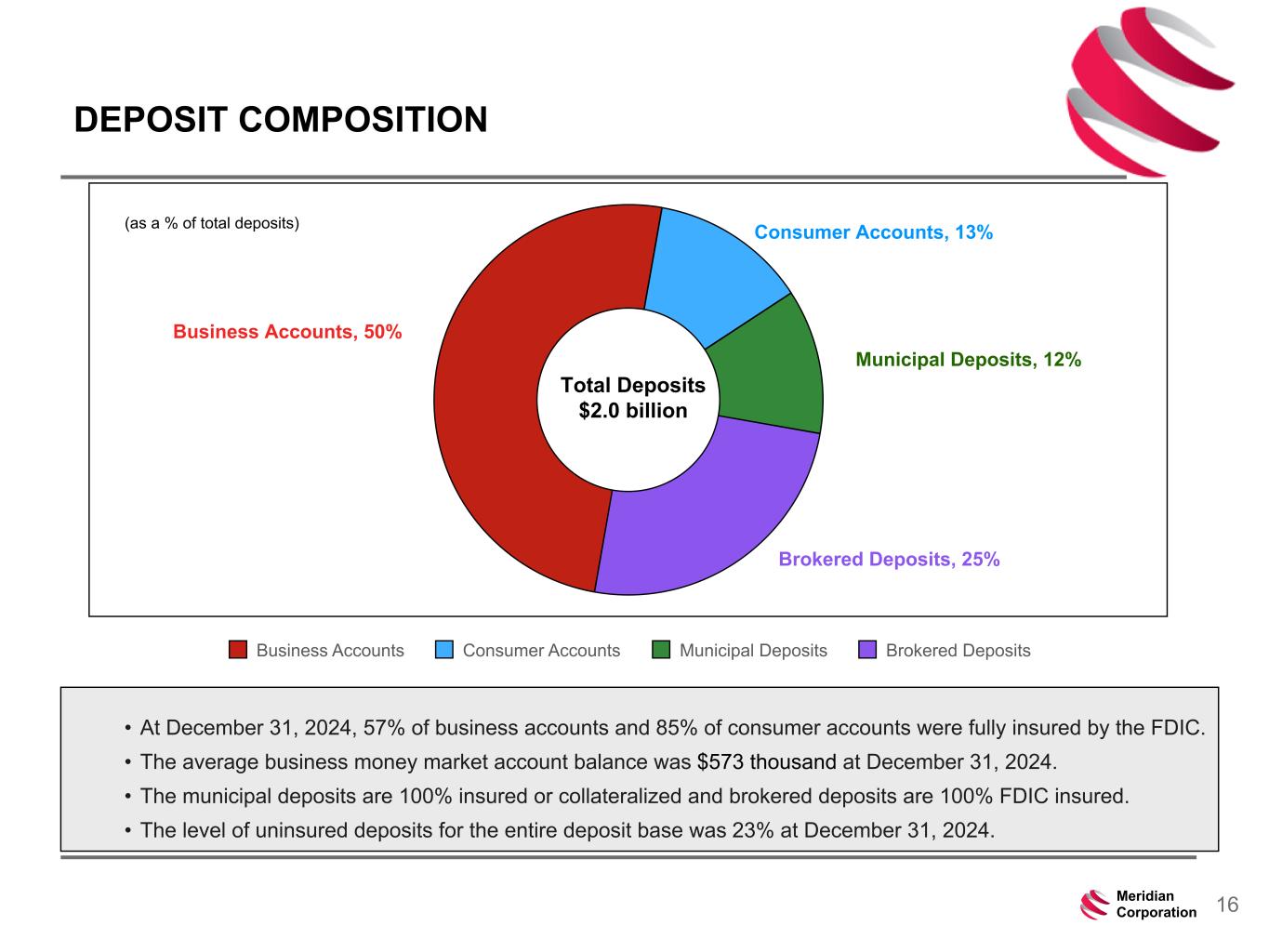

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 16Meridian Corporation DEPOSIT COMPOSITION Business Accounts, 50% Consumer Accounts, 13% Municipal Deposits, 12% Brokered Deposits, 25% Business Accounts Consumer Accounts Municipal Deposits Brokered Deposits Total Deposits $2.0 billion • At December 31, 2024, 57% of business accounts and 85% of consumer accounts were fully insured by the FDIC. • The average business money market account balance was $573 thousand at December 31, 2024. • The municipal deposits are 100% insured or collateralized and brokered deposits are 100% FDIC insured. • The level of uninsured deposits for the entire deposit base was 23% at December 31, 2024. (as a % of total deposits)

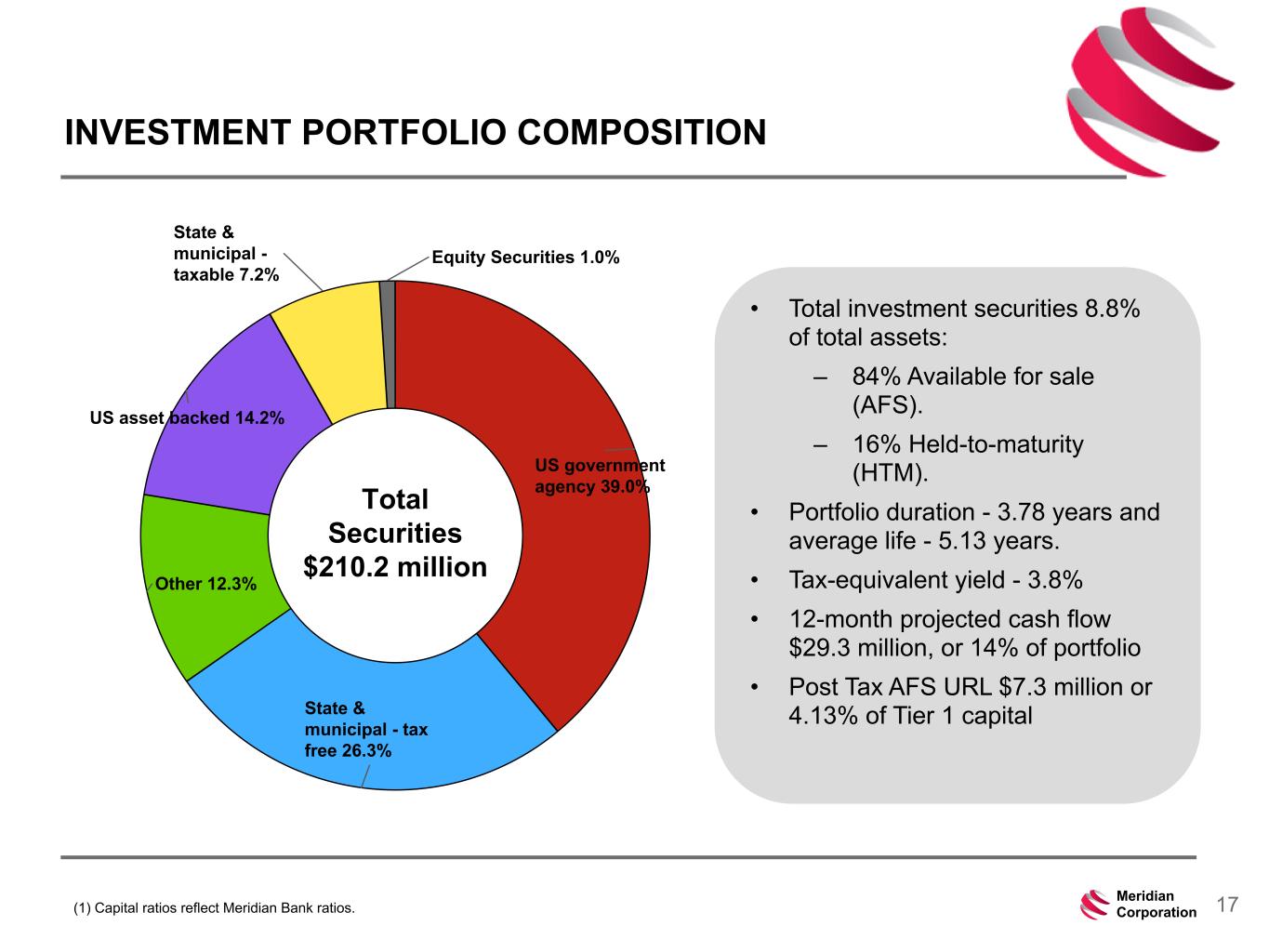

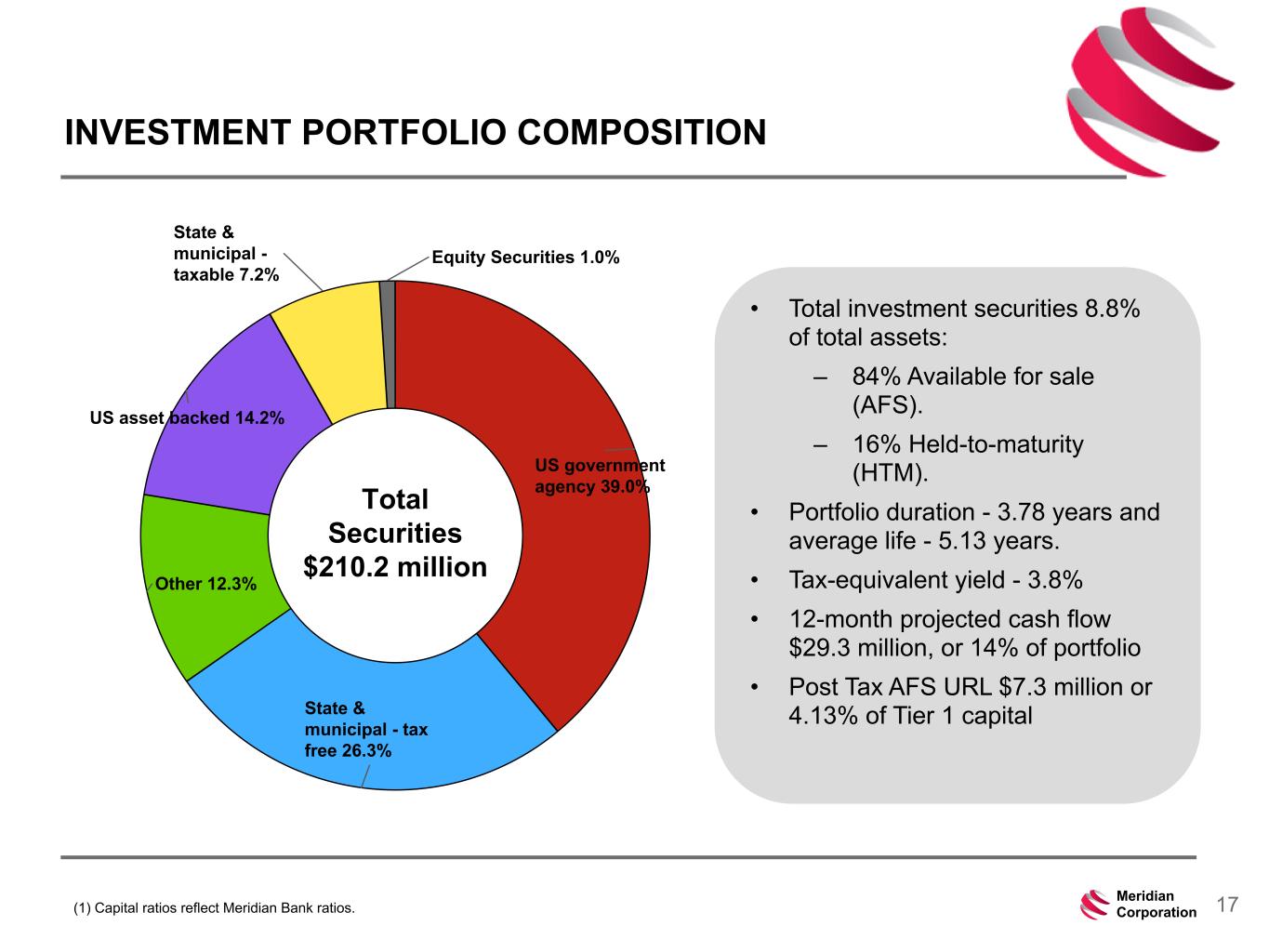

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 17Meridian Corporation INVESTMENT PORTFOLIO COMPOSITION • Total investment securities 8.8% of total assets: – 84% Available for sale (AFS). – 16% Held-to-maturity (HTM). • Portfolio duration - 3.78 years and average life - 5.13 years. • Tax-equivalent yield - 3.8% • 12-month projected cash flow $29.3 million, or 14% of portfolio • Post Tax AFS URL $7.3 million or 4.13% of Tier 1 capital (1) Capital ratios reflect Meridian Bank ratios. US government agency 39.0% State & municipal - tax free 26.3% Other 12.3% US asset backed 14.2% State & municipal - taxable 7.2% Equity Securities 1.0% Total Securities $210.2 million

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 18Meridian Corporation APPENDIX - HISTORICAL FINANCIAL HIGHLIGHTS AND RECONCILIATIONS OF NON-GAAP MEASURES

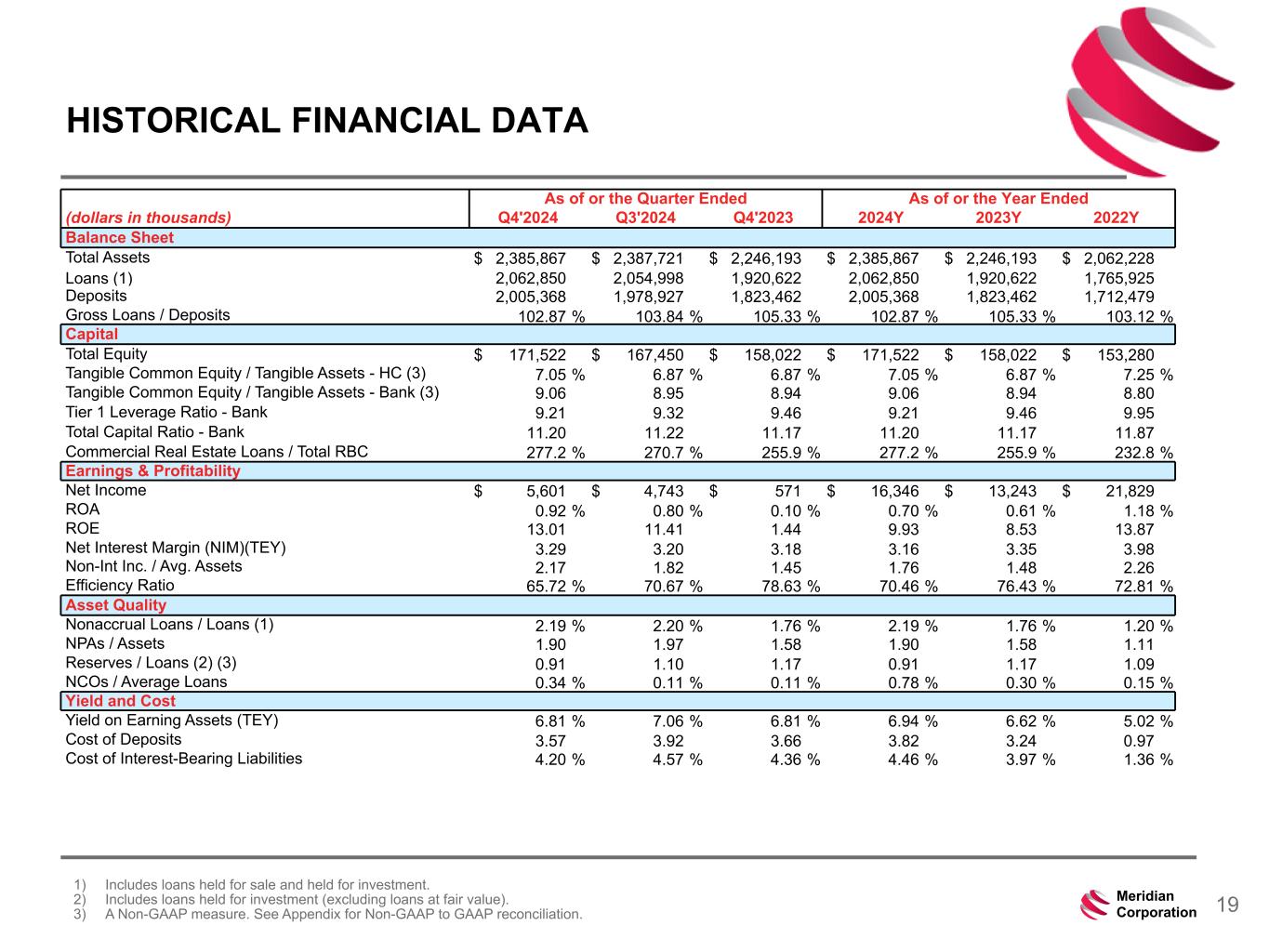

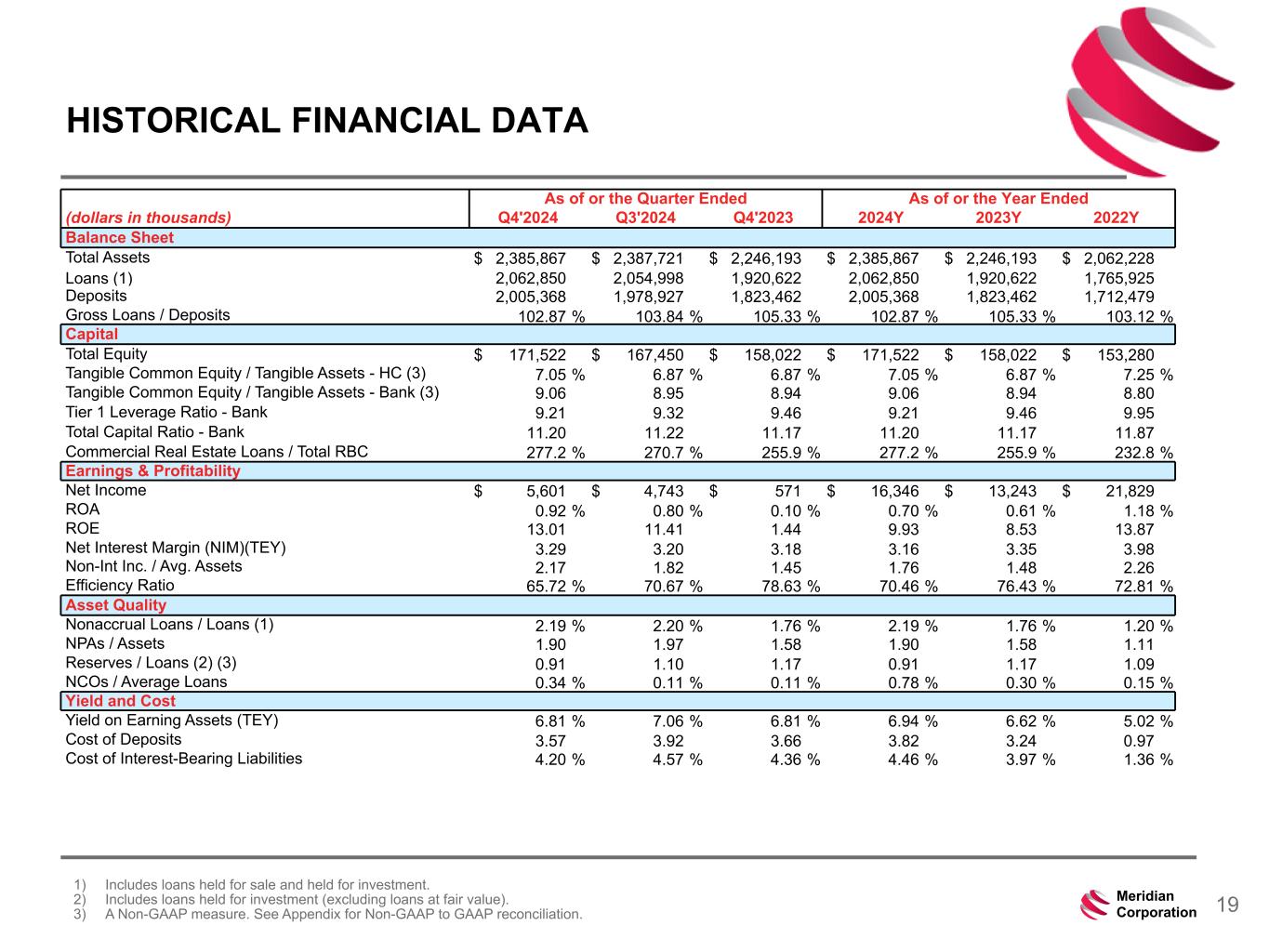

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 19Meridian Corporation HISTORICAL FINANCIAL DATA 1) Includes loans held for sale and held for investment. 2) Includes loans held for investment (excluding loans at fair value). 3) A Non-GAAP measure. See Appendix for Non-GAAP to GAAP reconciliation. As of or the Quarter Ended As of or the Year Ended (dollars in thousands) Q4'2024 Q3'2024 Q4'2023 2024Y 2023Y 2022Y Balance Sheet Total Assets $ 2,385,867 $ 2,387,721 $ 2,246,193 $ 2,385,867 $ 2,246,193 $ 2,062,228 Loans (1) 2,062,850 2,054,998 1,920,622 2,062,850 1,920,622 1,765,925 Deposits 2,005,368 1,978,927 1,823,462 2,005,368 1,823,462 1,712,479 Gross Loans / Deposits 102.87 % 103.84 % 105.33 % 102.87 % 105.33 % 103.12 % Capital Total Equity $ 171,522 $ 167,450 $ 158,022 $ 171,522 $ 158,022 $ 153,280 Tangible Common Equity / Tangible Assets - HC (3) 7.05 % 6.87 % 6.87 % 7.05 % 6.87 % 7.25 % Tangible Common Equity / Tangible Assets - Bank (3) 9.06 8.95 8.94 9.06 8.94 8.80 Tier 1 Leverage Ratio - Bank 9.21 9.32 9.46 9.21 9.46 9.95 Total Capital Ratio - Bank 11.20 11.22 11.17 11.20 11.17 11.87 Commercial Real Estate Loans / Total RBC 277.2 % 270.7 % 255.9 % 277.2 % 255.9 % 232.8 % Earnings & Profitability Net Income $ 5,601 $ 4,743 $ 571 $ 16,346 $ 13,243 $ 21,829 ROA 0.92 % 0.80 % 0.10 % 0.70 % 0.61 % 1.18 % ROE 13.01 11.41 1.44 9.93 8.53 13.87 Net Interest Margin (NIM)(TEY) 3.29 3.20 3.18 3.16 3.35 3.98 Non-Int Inc. / Avg. Assets 2.17 1.82 1.45 1.76 1.48 2.26 Efficiency Ratio 65.72 % 70.67 % 78.63 % 70.46 % 76.43 % 72.81 % Asset Quality Nonaccrual Loans / Loans (1) 2.19 % 2.20 % 1.76 % 2.19 % 1.76 % 1.20 % NPAs / Assets 1.90 1.97 1.58 1.90 1.58 1.11 Reserves / Loans (2) (3) 0.91 1.10 1.17 0.91 1.17 1.09 NCOs / Average Loans 0.34 % 0.11 % 0.11 % 0.78 % 0.30 % 0.15 % Yield and Cost Yield on Earning Assets (TEY) 6.81 % 7.06 % 6.81 % 6.94 % 6.62 % 5.02 % Cost of Deposits 3.57 3.92 3.66 3.82 3.24 0.97 Cost of Interest-Bearing Liabilities 4.20 % 4.57 % 4.36 % 4.46 % 3.97 % 1.36 %

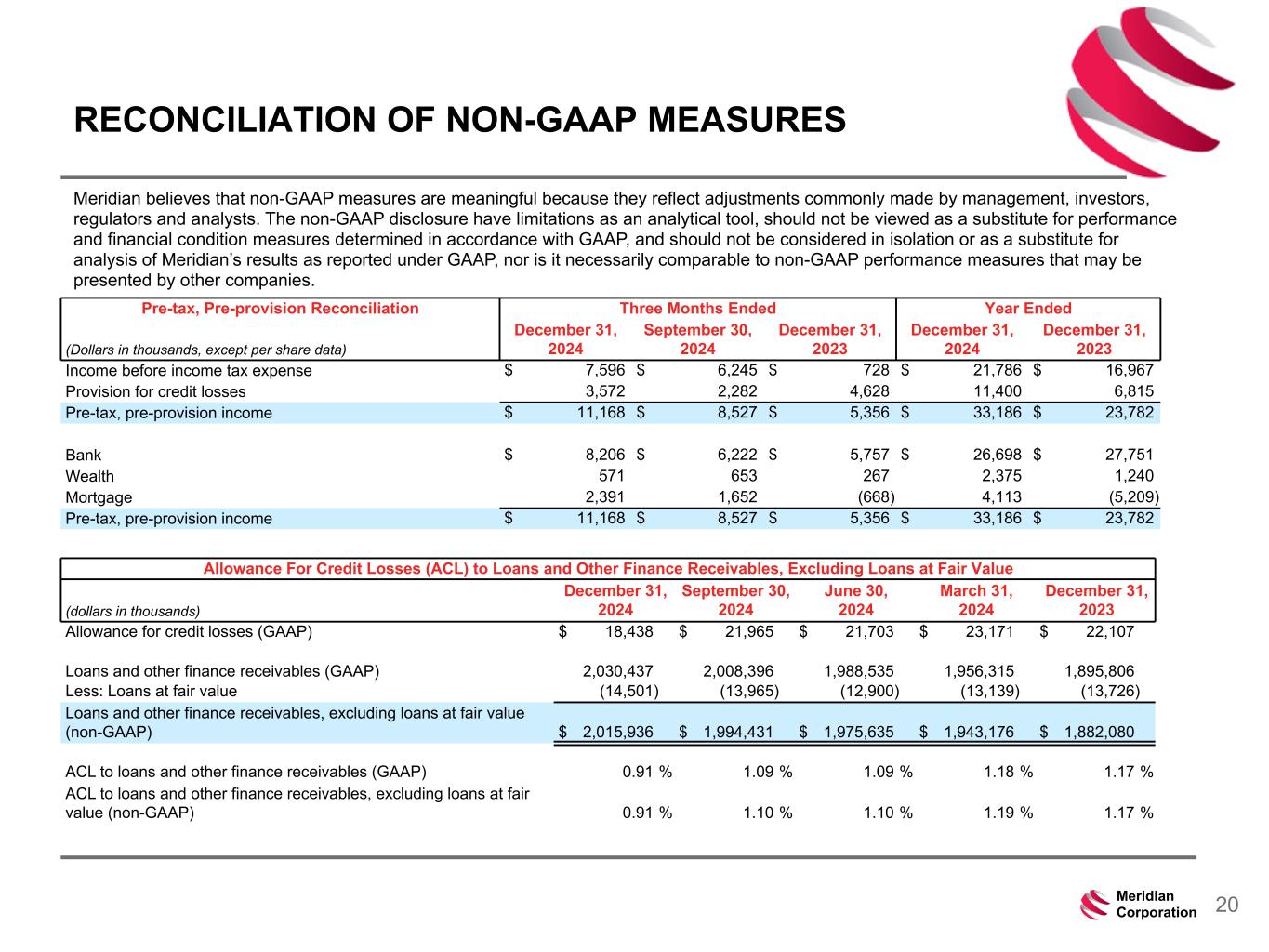

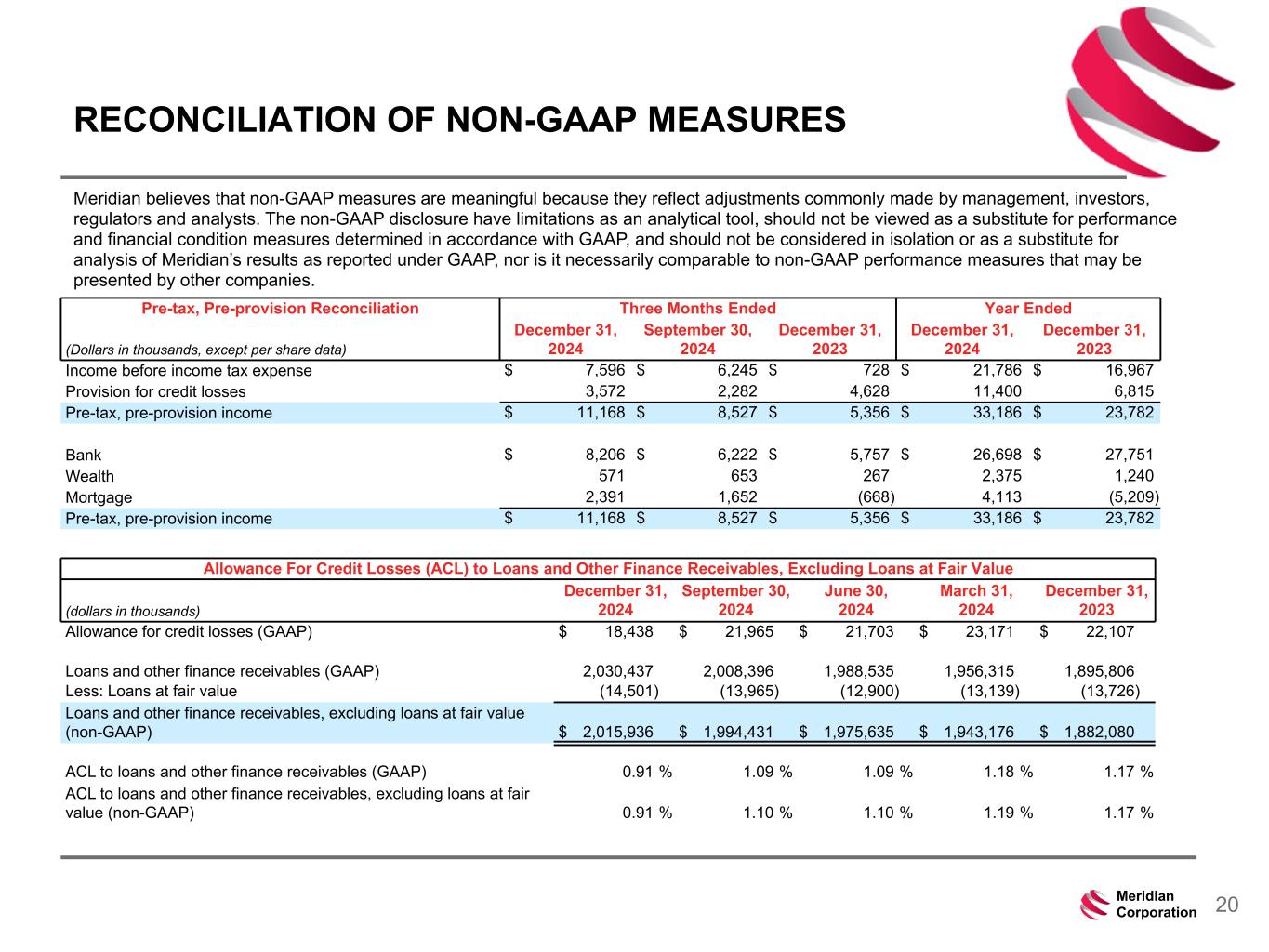

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 20Meridian Corporation Allowance For Credit Losses (ACL) to Loans and Other Finance Receivables, Excluding Loans at Fair Value (dollars in thousands) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Allowance for credit losses (GAAP) $ 18,438 $ 21,965 $ 21,703 $ 23,171 $ 22,107 Loans and other finance receivables (GAAP) 2,030,437 2,008,396 1,988,535 1,956,315 1,895,806 Less: Loans at fair value (14,501) (13,965) (12,900) (13,139) (13,726) Loans and other finance receivables, excluding loans at fair value (non-GAAP) $ 2,015,936 $ 1,994,431 $ 1,975,635 $ 1,943,176 $ 1,882,080 ACL to loans and other finance receivables (GAAP) 0.91 % 1.09 % 1.09 % 1.18 % 1.17 % ACL to loans and other finance receivables, excluding loans at fair value (non-GAAP) 0.91 % 1.10 % 1.10 % 1.19 % 1.17 % RECONCILIATION OF NON-GAAP MEASURES Meridian believes that non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts. The non-GAAP disclosure have limitations as an analytical tool, should not be viewed as a substitute for performance and financial condition measures determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of Meridian’s results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies. Pre-tax, Pre-provision Reconciliation Three Months Ended Year Ended (Dollars in thousands, except per share data) December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Income before income tax expense $ 7,596 $ 6,245 $ 728 $ 21,786 $ 16,967 Provision for credit losses 3,572 2,282 4,628 11,400 6,815 Pre-tax, pre-provision income $ 11,168 $ 8,527 $ 5,356 $ 33,186 $ 23,782 Bank $ 8,206 $ 6,222 $ 5,757 $ 26,698 $ 27,751 Wealth 571 653 267 2,375 1,240 Mortgage 2,391 1,652 (668) 4,113 (5,209) Pre-tax, pre-provision income $ 11,168 $ 8,527 $ 5,356 $ 33,186 $ 23,782

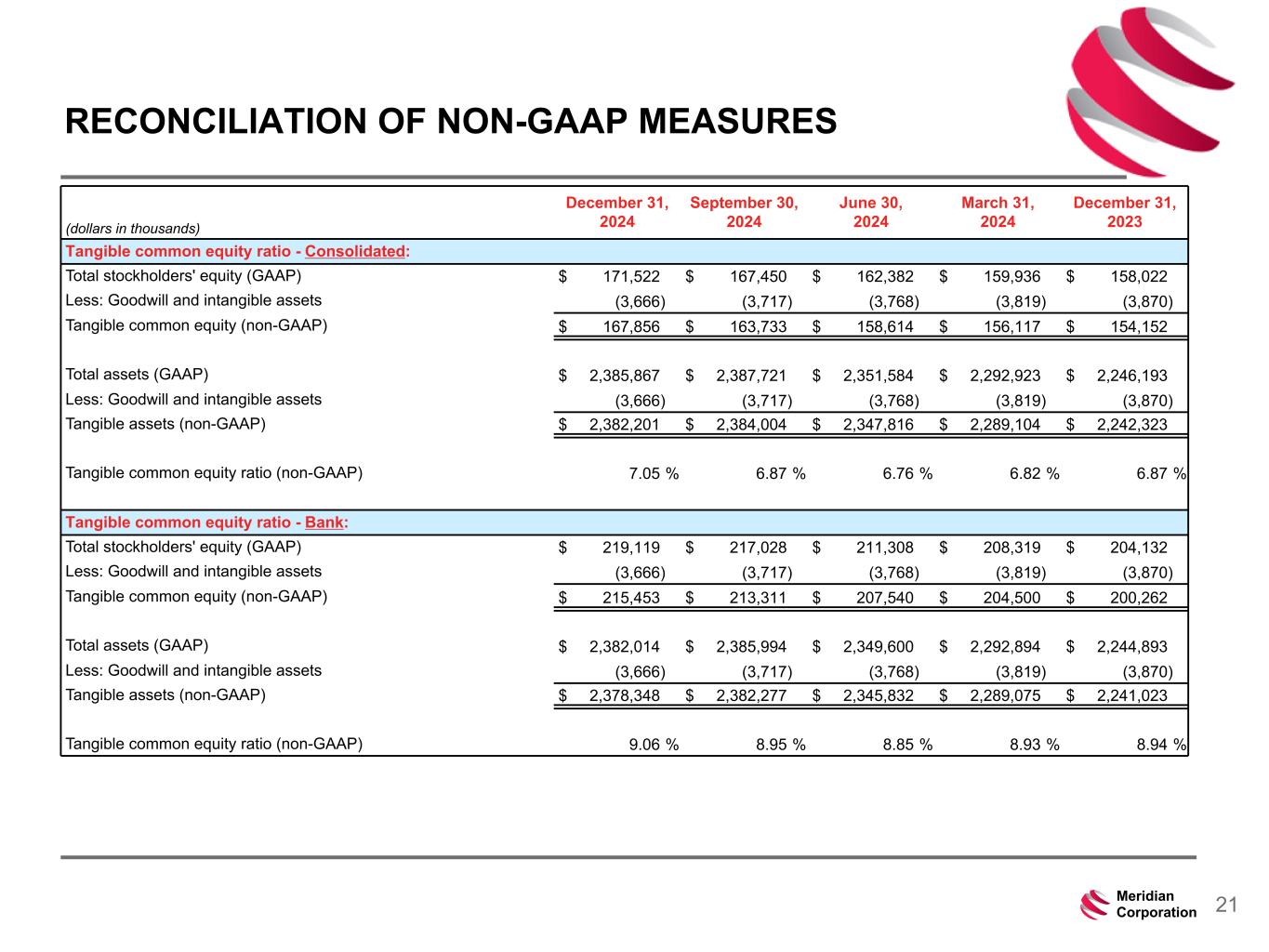

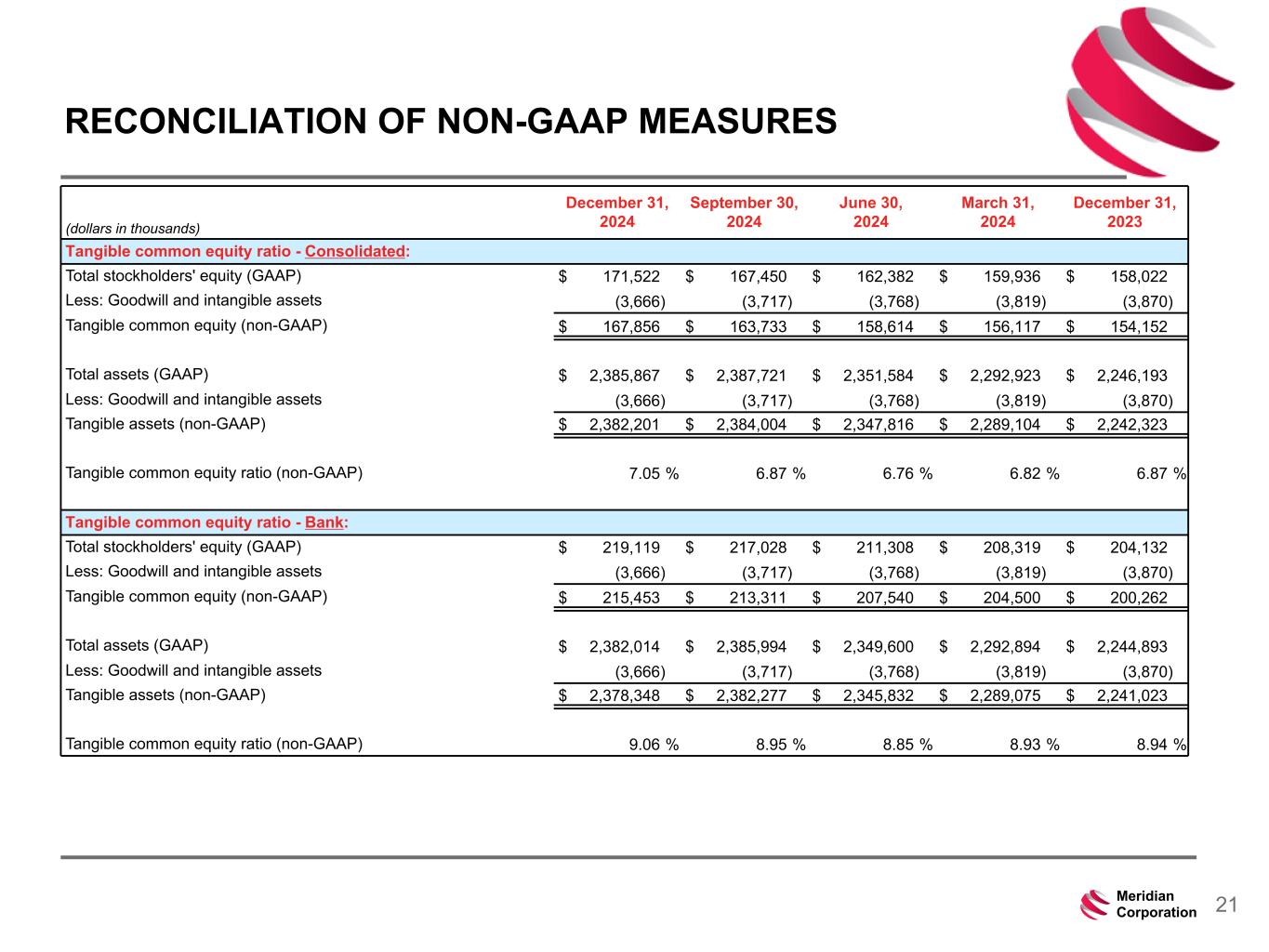

239 15 75 111 111 113 186 12 47 0 0 0 234 234 234 186 12 0 112 173 71 21Meridian Corporation (dollars in thousands) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Tangible common equity ratio - Consolidated: Total stockholders' equity (GAAP) $ 171,522 $ 167,450 $ 162,382 $ 159,936 $ 158,022 Less: Goodwill and intangible assets (3,666) (3,717) (3,768) (3,819) (3,870) Tangible common equity (non-GAAP) $ 167,856 $ 163,733 $ 158,614 $ 156,117 $ 154,152 Total assets (GAAP) $ 2,385,867 $ 2,387,721 $ 2,351,584 $ 2,292,923 $ 2,246,193 Less: Goodwill and intangible assets (3,666) (3,717) (3,768) (3,819) (3,870) Tangible assets (non-GAAP) $ 2,382,201 $ 2,384,004 $ 2,347,816 $ 2,289,104 $ 2,242,323 Tangible common equity ratio (non-GAAP) 7.05 % 6.87 % 6.76 % 6.82 % 6.87 % Tangible common equity ratio - Bank: Total stockholders' equity (GAAP) $ 219,119 $ 217,028 $ 211,308 $ 208,319 $ 204,132 Less: Goodwill and intangible assets (3,666) (3,717) (3,768) (3,819) (3,870) Tangible common equity (non-GAAP) $ 215,453 $ 213,311 $ 207,540 $ 204,500 $ 200,262 Total assets (GAAP) $ 2,382,014 $ 2,385,994 $ 2,349,600 $ 2,292,894 $ 2,244,893 Less: Goodwill and intangible assets (3,666) (3,717) (3,768) (3,819) (3,870) Tangible assets (non-GAAP) $ 2,378,348 $ 2,382,277 $ 2,345,832 $ 2,289,075 $ 2,241,023 Tangible common equity ratio (non-GAAP) 9.06 % 8.95 % 8.85 % 8.93 % 8.94 % RECONCILIATION OF NON-GAAP MEASURES