united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number: | 811-23373 |

| Exchange Place Advisors Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 |

| Cincinnati, OH 45246 |

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Stacy H. Louizos, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, NY 10020

(212) 885-5147

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | May 31 | |

| Date of reporting period: | November 30, 2024 | |

Item 1. Reports to Stockholders.

North Square Core Plus Bond Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Core Plus Bond Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521. This report describes changes to the Fund that occurred during the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $56 | 1.08% |

|---|

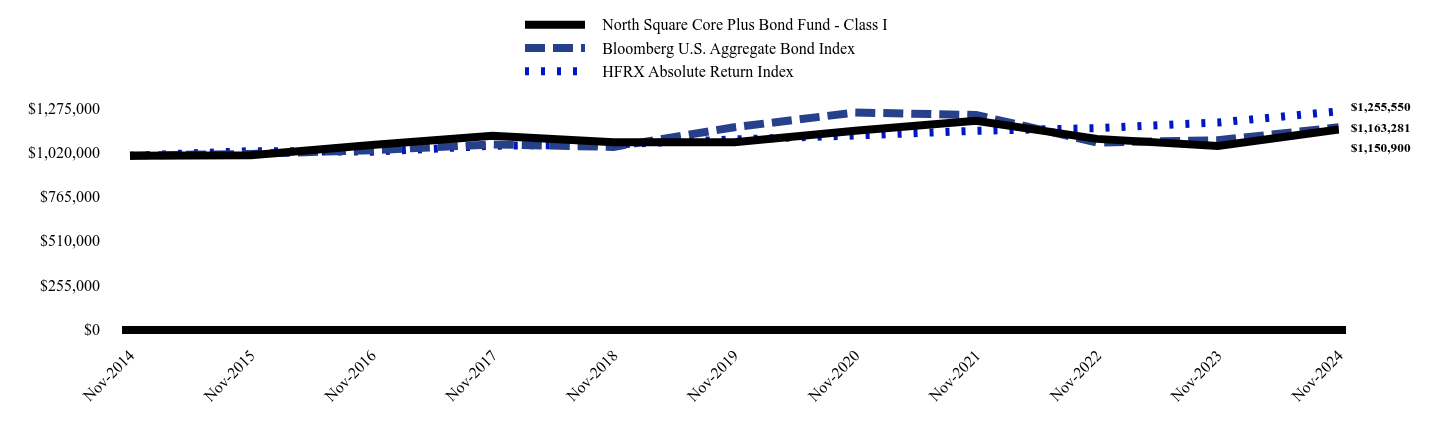

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| North Square Core Plus Bond Fund - Class I | Bloomberg U.S. Aggregate Bond Index | HFRX Absolute Return Index |

|---|

| Nov-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| Nov-2015 | $1,002,695 | $1,009,702 | $1,026,234 |

|---|

| Nov-2016 | $1,061,978 | $1,031,630 | $1,023,014 |

|---|

| Nov-2017 | $1,114,936 | $1,064,786 | $1,056,813 |

|---|

| Nov-2018 | $1,077,415 | $1,050,494 | $1,064,867 |

|---|

| Nov-2019 | $1,077,503 | $1,163,856 | $1,093,682 |

|---|

| Nov-2020 | $1,143,531 | $1,248,630 | $1,116,068 |

|---|

| Nov-2021 | $1,200,703 | $1,234,230 | $1,143,488 |

|---|

| Nov-2022 | $1,096,644 | $1,075,757 | $1,158,479 |

|---|

| Nov-2023 | $1,055,787 | $1,088,449 | $1,190,972 |

|---|

| Nov-2024 | $1,150,900 | $1,163,281 | $1,255,550 |

|---|

- Net Assets$18,171,455

- Number of Portfolio Holdings211

- Advisory Fee (net of waivers)$16,478

- Portfolio Turnover242%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Core Plus Bond Fund - Class I | 9.01% | 1.33% | 1.42% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 6.88% | -0.01% | 1.52% |

|---|

| HFRX Absolute Return Index | 5.42% | 2.80% | 2.30% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to September 23, 2024 represent the performance of the Trilogy Alternative Return Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The fund's performance has not been restated to reflect any differences paid by the Predecessor Fund and those paid by the fund.

Effective September 27, 2024, the Fund made changes to its principal investment strategies. Accordingly, the performance shown for periods prior to September 27, 2024, is based on the Fund's prior principal investment strategies and may not be representative of the Fund's performance under its current principal investment strategies. In connection with changes to the Fund’s investment objectives and principal investment strategies, the Fund’s primary benchmark index changed from the HFRX Absolute Return Index to the Bloomberg U.S. Aggregate Bond Index. The Adviser believes this benchmark index more closely aligns with the investment objectives and principal investment strategies of the Fund. Investors cannot invest directly in an index or benchmark.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

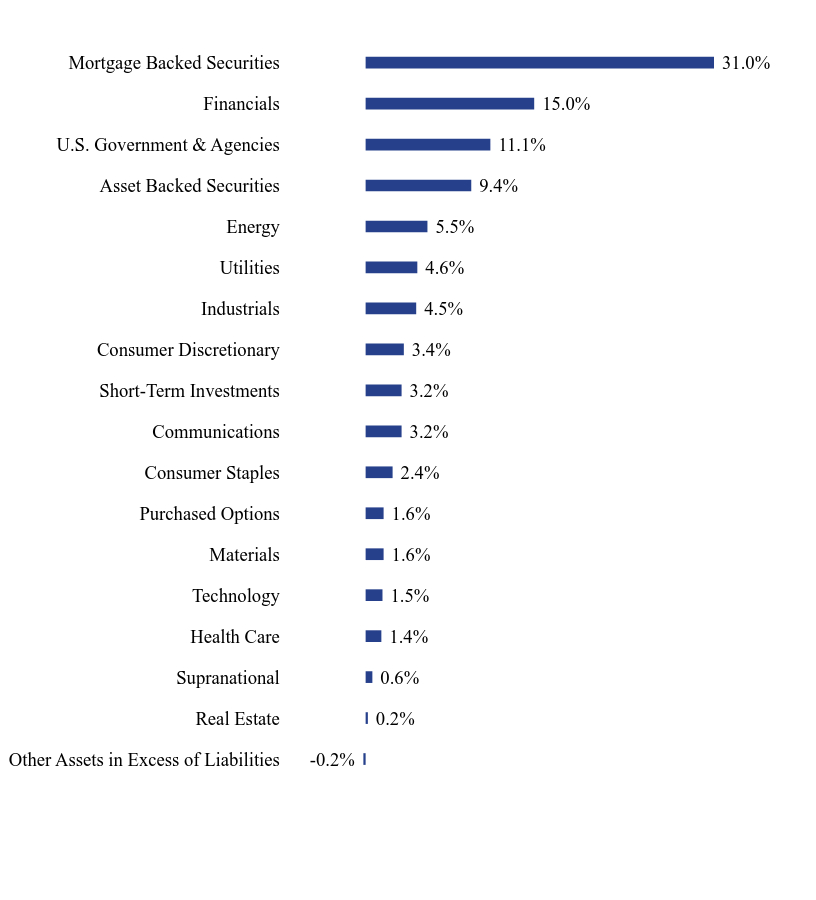

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | -0.2% |

| Real Estate | 0.2% |

| Supranational | 0.6% |

| Health Care | 1.4% |

| Technology | 1.5% |

| Materials | 1.6% |

| Purchased Options | 1.6% |

| Consumer Staples | 2.4% |

| Communications | 3.2% |

| Short-Term Investments | 3.2% |

| Consumer Discretionary | 3.4% |

| Industrials | 4.5% |

| Utilities | 4.6% |

| Energy | 5.5% |

| Asset Backed Securities | 9.4% |

| U.S. Government & Agencies | 11.1% |

| Financials | 15.0% |

| Mortgage Backed Securities | 31.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 3.2% |

| United States Treasury Note/Bond | 2.4% |

| Federal National Mortgage Association | 2.3% |

| Federal Home Loan Banks | 1.6% |

| E-mini S&P 500 Index | 1.6% |

| Freddie Mac Pool | 1.4% |

| United States Treasury Note/Bond | 1.3% |

| United States Treasury Note/Bond | 1.3% |

| United States Treasury Note/Bond | 1.3% |

| Federal Home Loan Banks | 1.3% |

This is a summary of certain changes to the Fund since September 27, 2024. For more complete information you may review the Fund’s prospectus, which is available upon request at 1-855-551-5521 or on the Fund's website at https://northsquareinvest.com/fund-reports-holdings/

On September 27, 2024, the Fund changed its name from the North Square Trilogy Alternative Return Fund to the North Square Core Plus Bond Fund. In conjunction with the change of the Fund's name, the Fund changed: its investment objective to seek high current income and long-term capital appreciation; its principal investment strategies and principal risks to reflect the Fund's principal investments in fixed income investments; and its sub-advisers to CSM Advisors, LLC and Red Cedar Investment Management, LLC. For more information on these changes, please review Fund's Prospectus dated September 27, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Core Plus Bond Fund - Class I (STTIX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Dynamic Small Cap Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Dynamic Small Cap Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $67 | 1.24% |

|---|

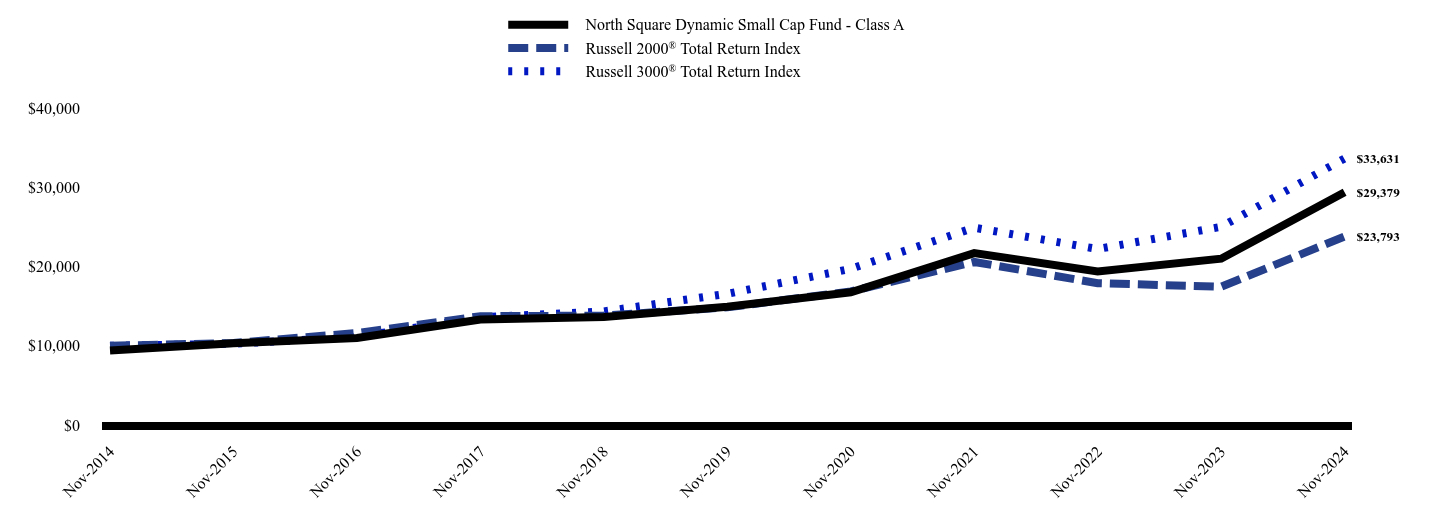

How has the Fund performed over the last 10 years?

Total Return Based on $10,000 Investment

| North Square Dynamic Small Cap Fund - Class A | Russell 2000® Total Return Index | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $9,413 | $10,000 | $10,000 |

|---|

| Nov-2015 | $10,325 | $10,351 | $10,258 |

|---|

| Nov-2016 | $10,990 | $11,601 | $11,111 |

|---|

| Nov-2017 | $13,323 | $13,728 | $13,585 |

|---|

| Nov-2018 | $13,635 | $13,807 | $14,336 |

|---|

| Nov-2019 | $14,934 | $14,844 | $16,557 |

|---|

| Nov-2020 | $16,740 | $16,862 | $19,706 |

|---|

| Nov-2021 | $21,690 | $20,576 | $24,897 |

|---|

| Nov-2022 | $19,363 | $17,898 | $22,207 |

|---|

| Nov-2023 | $20,983 | $17,439 | $25,007 |

|---|

| Nov-2024 | $29,379 | $23,793 | $33,631 |

|---|

- Net Assets$425,278,772

- Number of Portfolio Holdings243

- Advisory Fee (net of waivers)$1,255,188

- Portfolio Turnover87%

Average Annual Total Returns

| 1 Year | 5 Years | 10 years |

|---|

| North Square Dynamic Small Cap Fund - Class A | | | |

|---|

| Without Load | 40.01% | 14.49% | 12.05% |

|---|

| With Load | 31.99% | 13.15% | 11.38% |

|---|

Russell 2000® Total Return Index | 36.43% | 9.90% | 9.05% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to May 10, 2019 represent the performance of the Oak Ridge Multi Strategy Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

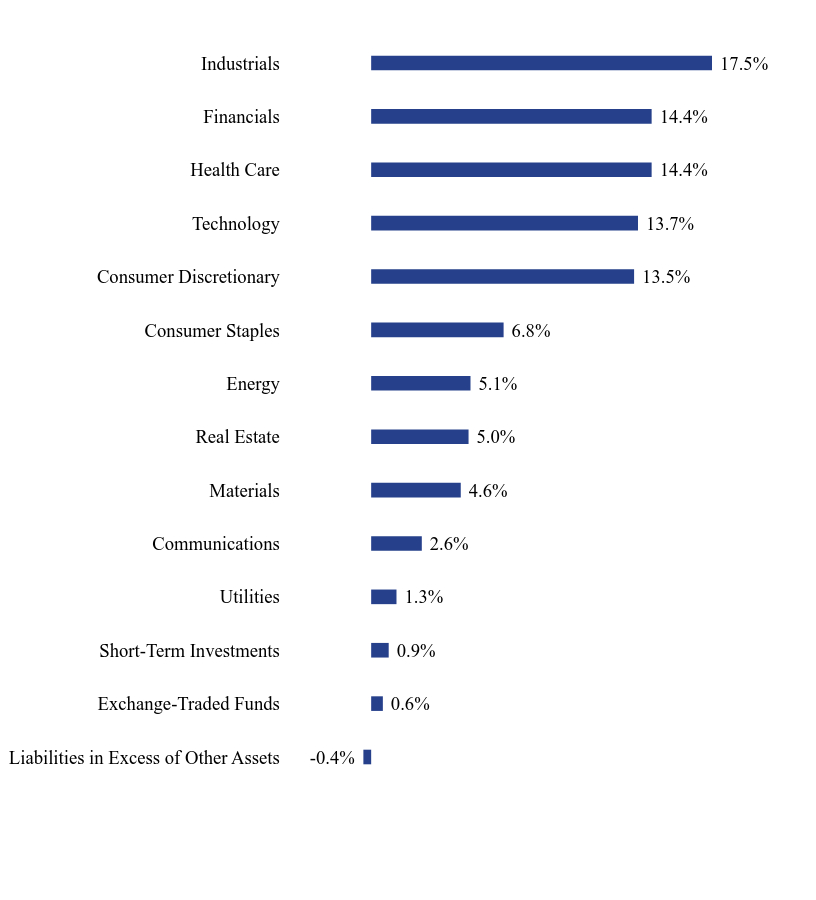

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.4% |

| Exchange-Traded Funds | 0.6% |

| Short-Term Investments | 0.9% |

| Utilities | 1.3% |

| Communications | 2.6% |

| Materials | 4.6% |

| Real Estate | 5.0% |

| Energy | 5.1% |

| Consumer Staples | 6.8% |

| Consumer Discretionary | 13.5% |

| Technology | 13.7% |

| Health Care | 14.4% |

| Financials | 14.4% |

| Industrials | 17.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Itron, Inc. | 1.5% |

| BellRing Brands, Inc. | 1.5% |

| Axos Financial, Inc. | 1.5% |

| Mueller Industries, Inc. | 1.5% |

| Louisiana-Pacific Corp. | 1.5% |

| Frontdoor, Inc. | 1.4% |

| Atkore, Inc. | 1.4% |

| Coca-Cola Consolidated, Inc. | 1.3% |

| Affiliated Managers Group, Inc. | 1.2% |

| RingCentral, Inc., Class A | 1.2% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Dynamic Small Cap Fund - Class A (ORSAX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Dynamic Small Cap Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Dynamic Small Cap Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $54 | 0.99% |

|---|

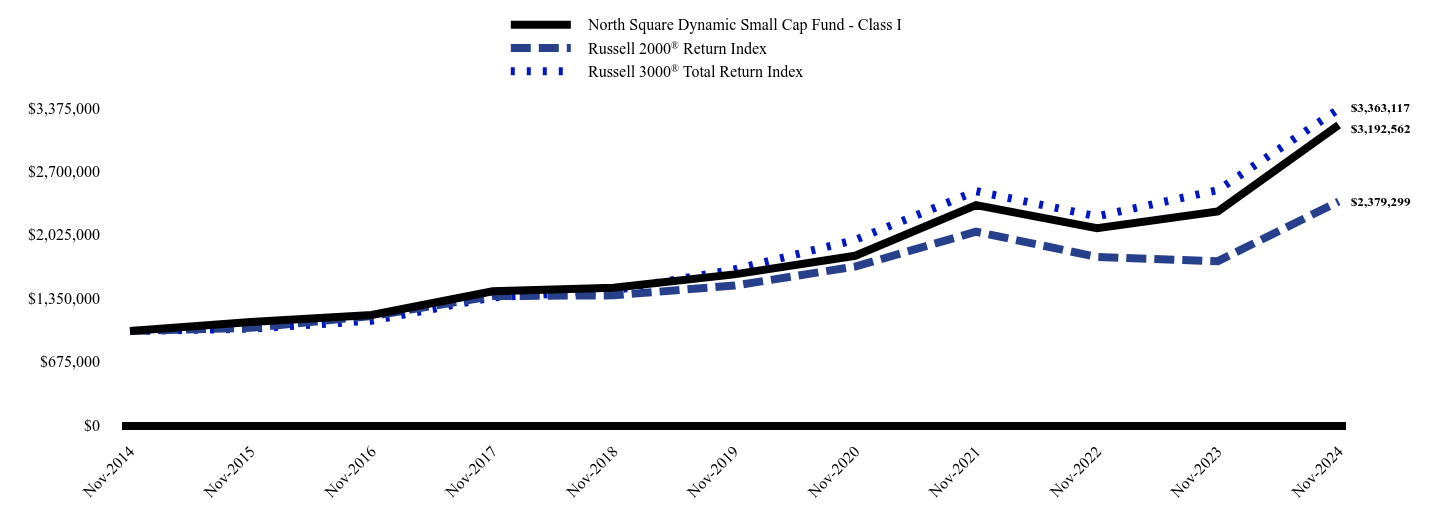

How has the Fund performed over the last 10 years?

Total Return Based on $1,000,000 Investment

| North Square Dynamic Small Cap Fund - Class I | Russell 2000® Return Index | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $999,997 | $1,000,000 | $1,000,000 |

|---|

| Nov-2015 | $1,097,628 | $1,035,071 | $1,025,831 |

|---|

| Nov-2016 | $1,171,153 | $1,160,075 | $1,111,055 |

|---|

| Nov-2017 | $1,423,364 | $1,372,801 | $1,358,510 |

|---|

| Nov-2018 | $1,460,367 | $1,380,676 | $1,433,590 |

|---|

| Nov-2019 | $1,603,461 | $1,484,422 | $1,655,661 |

|---|

| Nov-2020 | $1,801,897 | $1,686,212 | $1,970,628 |

|---|

| Nov-2021 | $2,340,506 | $2,057,601 | $2,489,677 |

|---|

| Nov-2022 | $2,094,715 | $1,789,835 | $2,220,728 |

|---|

| Nov-2023 | $2,274,157 | $1,743,926 | $2,500,731 |

|---|

| Nov-2024 | $3,192,562 | $2,379,299 | $3,363,117 |

|---|

- Net Assets$425,278,772

- Number of Portfolio Holdings243

- Advisory Fee (net of waivers)$1,255,188

- Portfolio Turnover87%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Dynamic Small Cap Fund - Class I | 40.38% | 14.77% | 12.30% |

|---|

Russell 2000® Return Index | 36.43% | 9.90% | 9.05% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to May 10, 2019 represent the performance of the Oak Ridge Multi Strategy Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

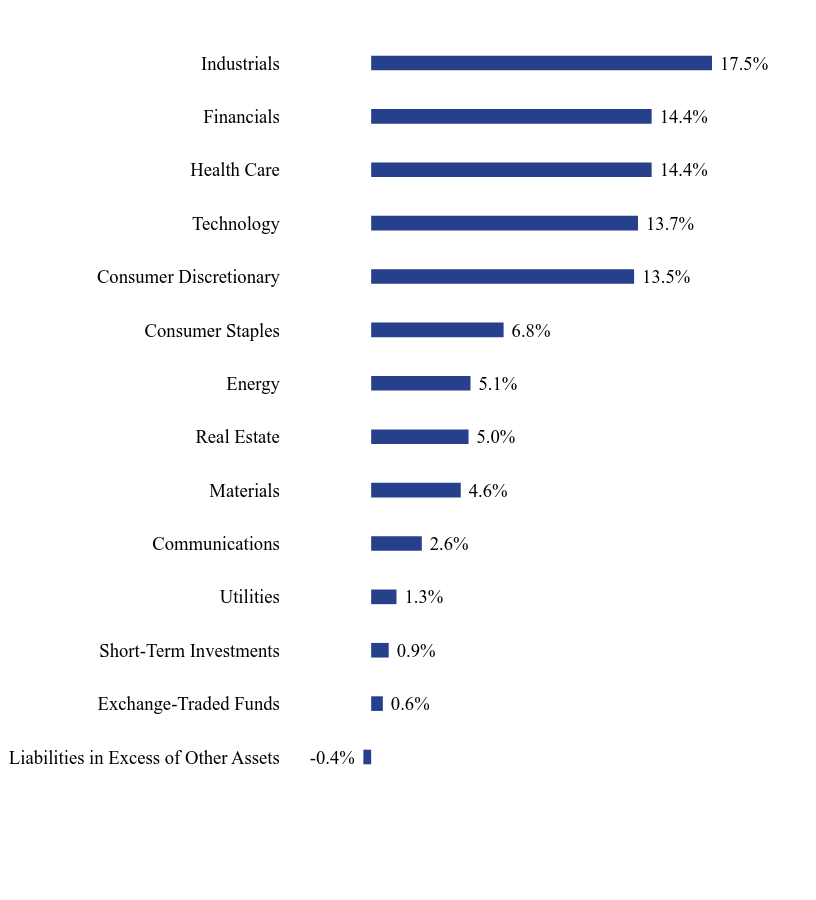

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.4% |

| Exchange-Traded Funds | 0.6% |

| Short-Term Investments | 0.9% |

| Utilities | 1.3% |

| Communications | 2.6% |

| Materials | 4.6% |

| Real Estate | 5.0% |

| Energy | 5.1% |

| Consumer Staples | 6.8% |

| Consumer Discretionary | 13.5% |

| Technology | 13.7% |

| Health Care | 14.4% |

| Financials | 14.4% |

| Industrials | 17.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Itron, Inc. | 1.5% |

| BellRing Brands, Inc. | 1.5% |

| Axos Financial, Inc. | 1.5% |

| Mueller Industries, Inc. | 1.5% |

| Louisiana-Pacific Corp. | 1.5% |

| Frontdoor, Inc. | 1.4% |

| Atkore, Inc. | 1.4% |

| Coca-Cola Consolidated, Inc. | 1.3% |

| Affiliated Managers Group, Inc. | 1.2% |

| RingCentral, Inc., Class A | 1.2% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Dynamic Small Cap Fund - Class I (ORSIX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Kennedy MicroCap Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Kennedy MicroCap Fund (the "Fund") for the period of June 10, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the reporting period?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $72 | 1.47% |

|---|

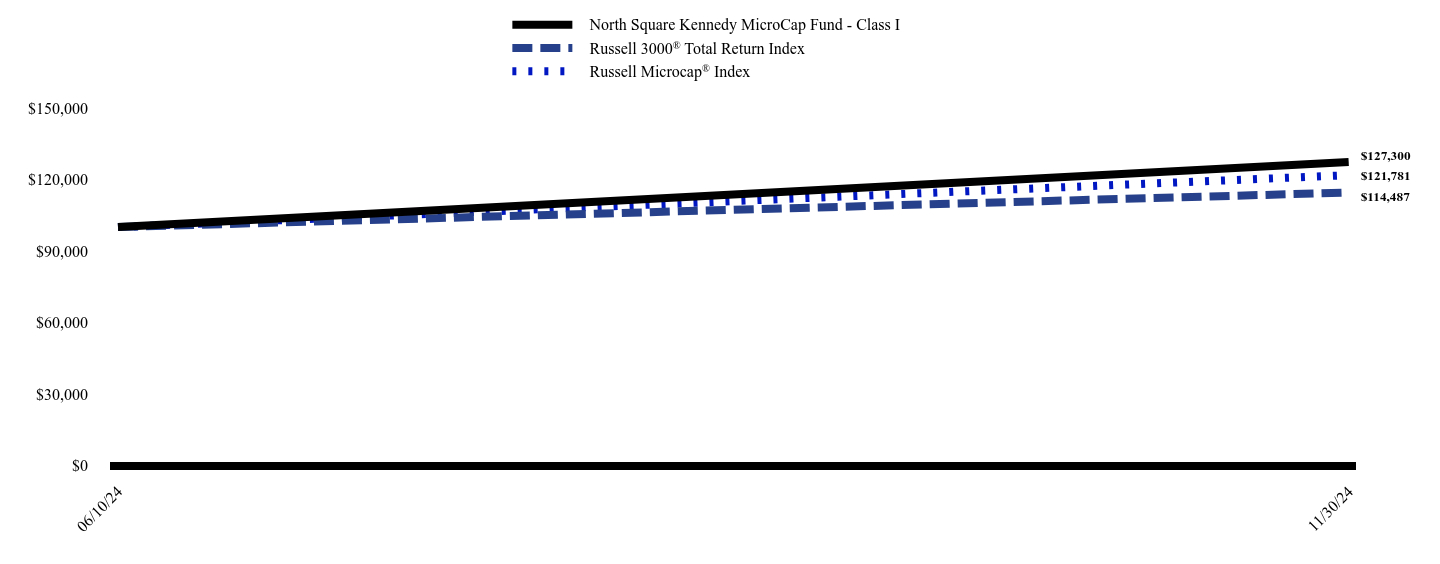

How has the Fund performed since inception?

Total Return Based on $100,000 Investment

| North Square Kennedy MicroCap Fund - Class I | Russell 3000® Total Return Index | Russell Microcap® Index |

|---|

| 06/10/24 | $100,000 | $100,000 | $100,001 |

|---|

| 11/30/24 | $127,300 | $114,487 | $121,781 |

|---|

- Net Assets$12,463,230

- Number of Portfolio Holdings122

- Advisory Fee (net of waivers)$0

- Portfolio Turnover46%

Average Annual Total Returns

| Since Inception (June 10, 2024) |

|---|

| North Square Kennedy MicroCap Fund - Class I | 27.30% |

|---|

Russell 3000® Total Return Index | 14.49% |

|---|

Russell Microcap® Index | 21.80% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

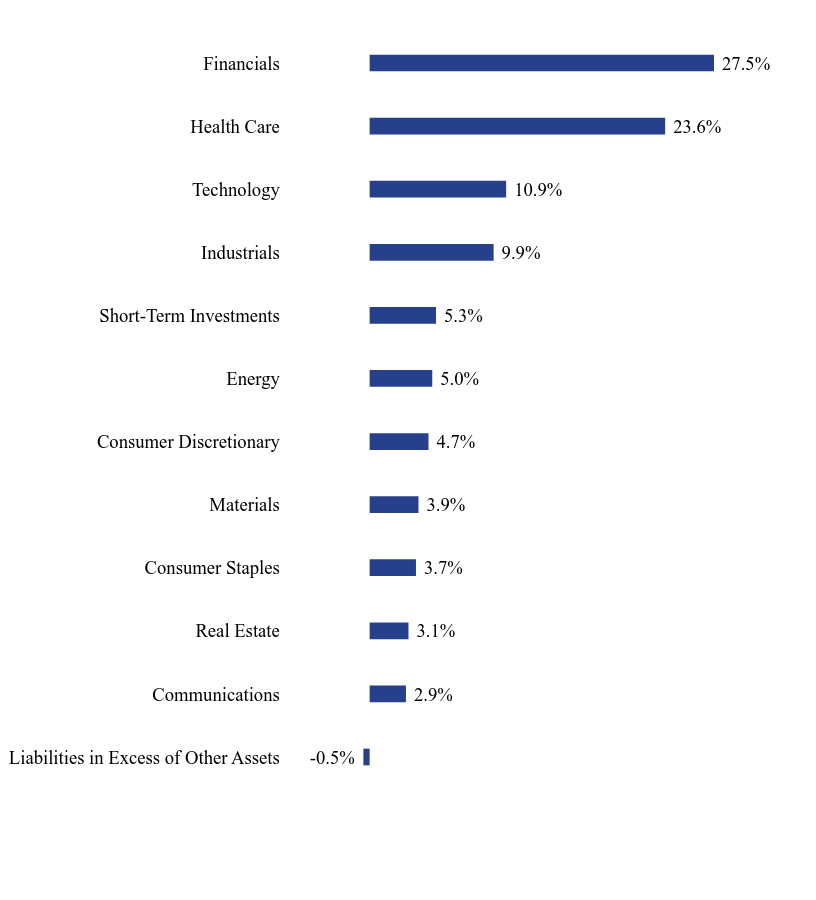

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.5% |

| Communications | 2.9% |

| Real Estate | 3.1% |

| Consumer Staples | 3.7% |

| Materials | 3.9% |

| Consumer Discretionary | 4.7% |

| Energy | 5.0% |

| Short-Term Investments | 5.3% |

| Industrials | 9.9% |

| Technology | 10.9% |

| Health Care | 23.6% |

| Financials | 27.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 5.3% |

| Southern States Bancshares, Inc. | 2.8% |

| Northeast Bank | 2.4% |

| Universal Technical Institute, Inc. | 2.3% |

| Third Coast Bancshares, Inc. | 2.0% |

| Riley Exploration Permian, Inc. | 2.0% |

| Oportun Financial Corp. | 1.7% |

| SunOpta, Inc. | 1.5% |

| Capital Bancorp, Inc. | 1.5% |

| Powerfleet, Inc. | 1.5% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Kennedy MicroCap Fund - Class I (NKMCX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Multi Strategy Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Multi Strategy Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $51 | 0.96% |

|---|

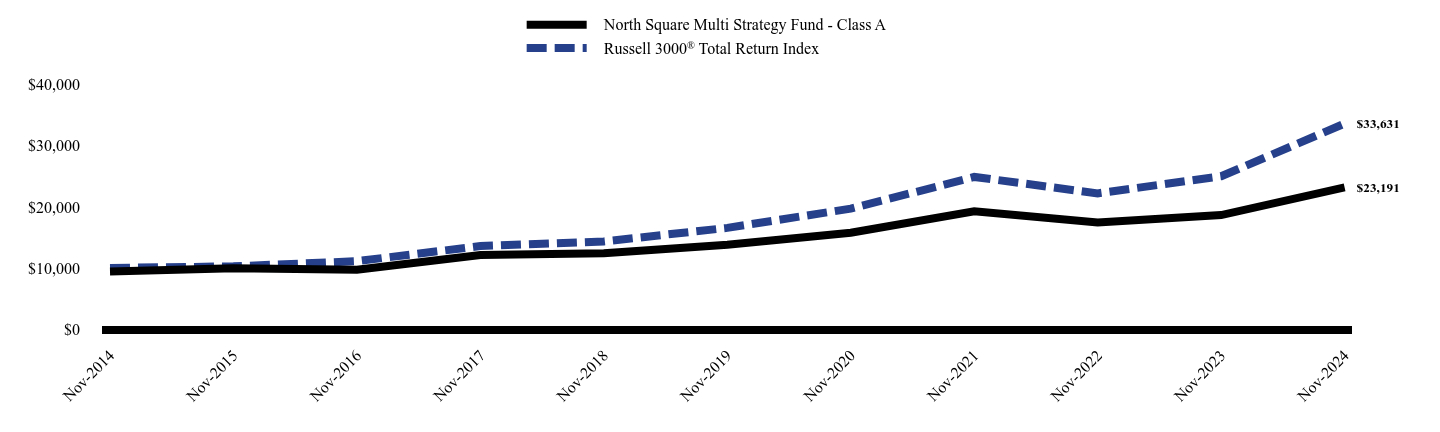

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Square Multi Strategy Fund - Class A | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $9,426 | $10,000 |

|---|

| Nov-2015 | $9,937 | $10,258 |

|---|

| Nov-2016 | $9,720 | $11,111 |

|---|

| Nov-2017 | $12,122 | $13,585 |

|---|

| Nov-2018 | $12,420 | $14,336 |

|---|

| Nov-2019 | $13,814 | $16,557 |

|---|

| Nov-2020 | $15,775 | $19,706 |

|---|

| Nov-2021 | $19,270 | $24,897 |

|---|

| Nov-2022 | $17,427 | $22,207 |

|---|

| Nov-2023 | $18,658 | $25,007 |

|---|

| Nov-2024 | $23,191 | $33,631 |

|---|

- Net Assets$42,323,927

- Number of Portfolio Holdings12

- Advisory Fee (net of waivers)$38,045

- Portfolio Turnover5%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Multi Strategy Fund - Class A | | | |

|---|

| Without Load | 24.30% | 10.92% | 9.42% |

|---|

| With Load | 17.15% | 9.62% | 8.78% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to May 10, 2019 represent the performance of the Oak Ridge Multi Strategy Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

Effective July 18, 2017, the Predecessor Fund made certain changes to its principal investment strategies. Accordingly, the Predecessor Fund's performance for the periods prior to July 18, 2017, is based on the Predecessor Fund's prior principal investment strategies and may not be representative of the Predecessor Fund's performance with its amended investment strategies, which are substantially identical to that of the Fund.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

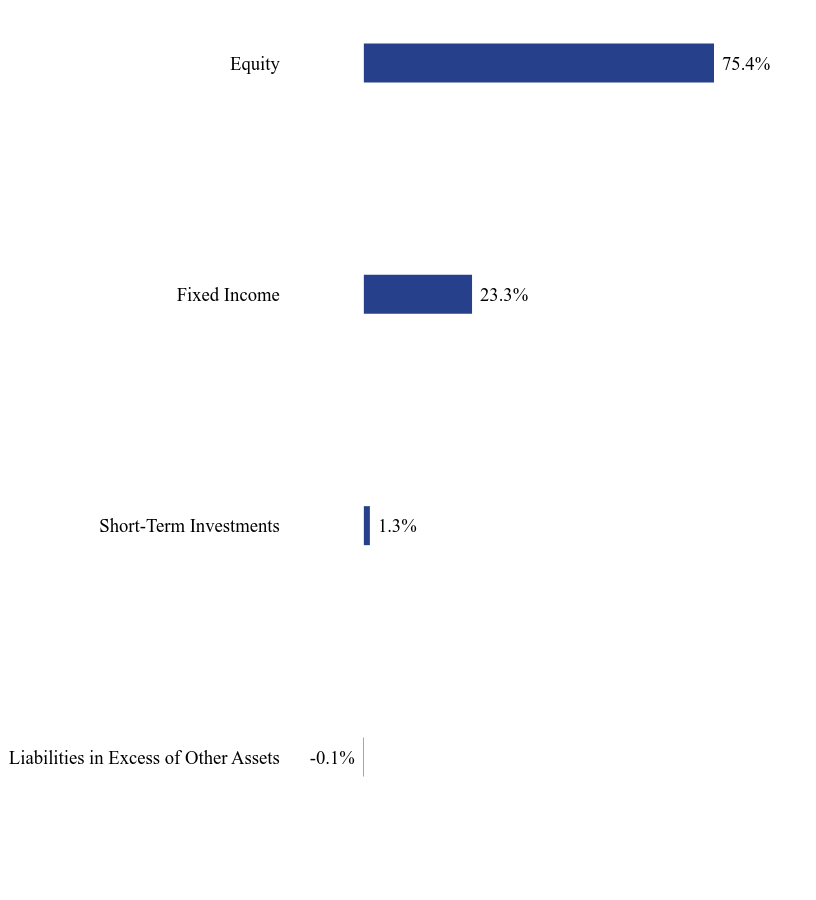

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Short-Term Investments | 1.3% |

| Fixed Income | 23.3% |

| Equity | 75.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| North Square Dynamic Small Cap Fund, Class I | 17.5% |

| North Square Altrinsic International Equity Fund, Class I | 13.6% |

| North Square Preferred and Income Securities Fund, Class I | 12.3% |

| North Square McKee Bond Fund, Class I | 11.0% |

Vanguard® Dividend Appreciation ETF | 10.6% |

Vanguard® Value ETF | 7.5% |

| North Square Advisory Research Small Value Fund, Class I | 6.8% |

Invesco® S&P 500® GARP ETF | 6.3% |

Vanguard® Growth ETF | 5.7% |

iShares® Core S&P 500® ETF | 5.0% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Multi Strategy Fund - Class A (ORILX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Multi Strategy Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Multi Strategy Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $37 | 0.70% |

|---|

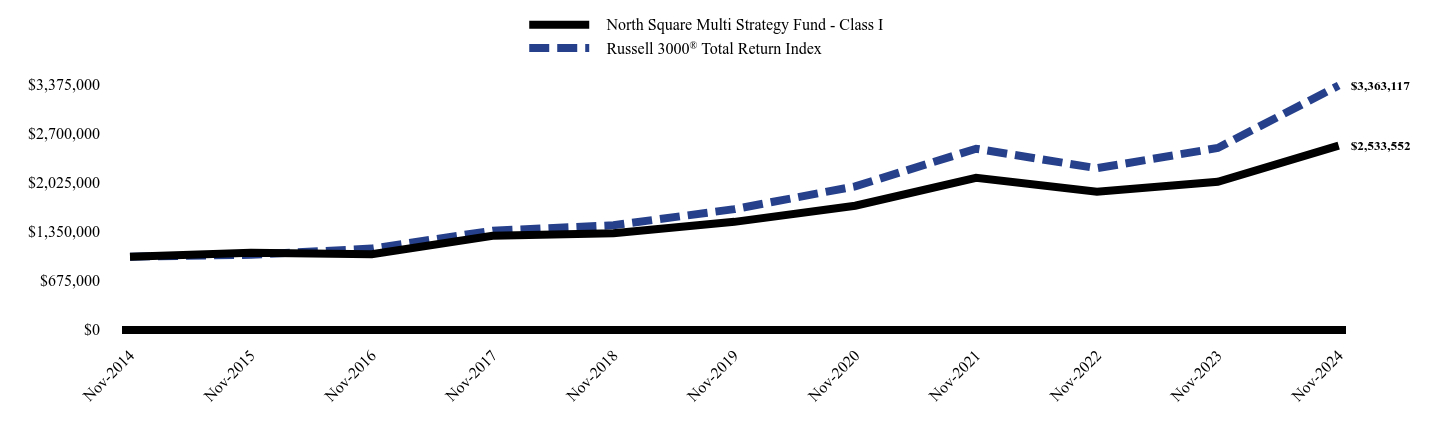

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| North Square Multi Strategy Fund - Class I | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $1,000,000 | $1,000,000 |

|---|

| Nov-2015 | $1,054,774 | $1,025,831 |

|---|

| Nov-2016 | $1,032,161 | $1,111,055 |

|---|

| Nov-2017 | $1,287,437 | $1,358,510 |

|---|

| Nov-2018 | $1,323,116 | $1,433,590 |

|---|

| Nov-2019 | $1,480,415 | $1,655,661 |

|---|

| Nov-2020 | $1,703,050 | $1,970,628 |

|---|

| Nov-2021 | $2,089,161 | $2,489,677 |

|---|

| Nov-2022 | $1,894,977 | $2,220,728 |

|---|

| Nov-2023 | $2,032,715 | $2,500,731 |

|---|

| Nov-2024 | $2,533,552 | $3,363,117 |

|---|

- Net Assets$42,323,927

- Number of Portfolio Holdings12

- Advisory Fee (net of waivers)$38,045

- Portfolio Turnover5%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Multi Strategy Fund - Class I | 24.64% | 11.34% | 9.74% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to May 10, 2019 represent the performance of the Oak Ridge Multi Strategy Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

Effective July 18, 2017, the Predecessor Fund made certain changes to its principal investment strategies. Accordingly, the Predecessor Fund's performance for the periods prior to July 18, 2017, is based on the Predecessor Fund's prior principal investment strategies and may not be representative of the Predecessor Fund's performance with its amended investment strategies, which are substantially identical to that of the Fund.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

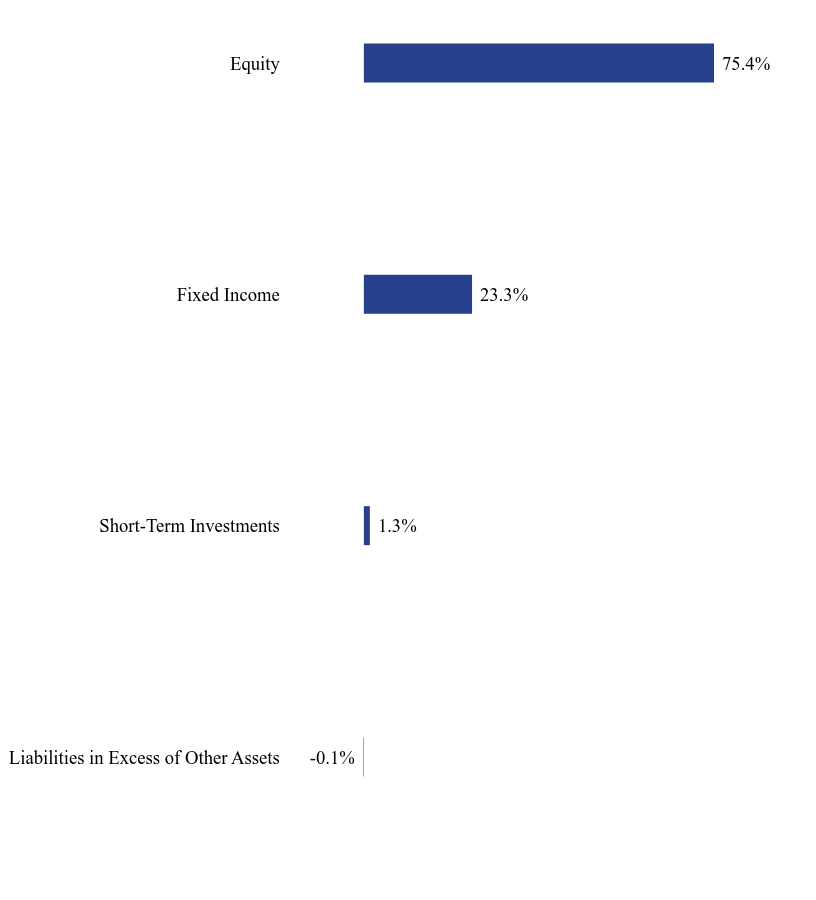

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Short-Term Investments | 1.3% |

| Fixed Income | 23.3% |

| Equity | 75.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| North Square Dynamic Small Cap Fund, Class I | 17.5% |

| North Square Altrinsic International Equity Fund, Class I | 13.6% |

| North Square Preferred and Income Securities Fund, Class I | 12.3% |

| North Square McKee Bond Fund, Class I | 11.0% |

Vanguard® Dividend Appreciation ETF | 10.6% |

Vanguard® Value ETF | 7.5% |

| North Square Advisory Research Small Value Fund, Class I | 6.8% |

Invesco® S&P 500® GARP ETF | 6.3% |

Vanguard® Growth ETF | 5.7% |

iShares® Core S&P 500® ETF | 5.0% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Multi Strategy Fund - Class I (PORYX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Preferred and Income Securities Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Preferred and Income Securities Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $50 | 0.96% |

|---|

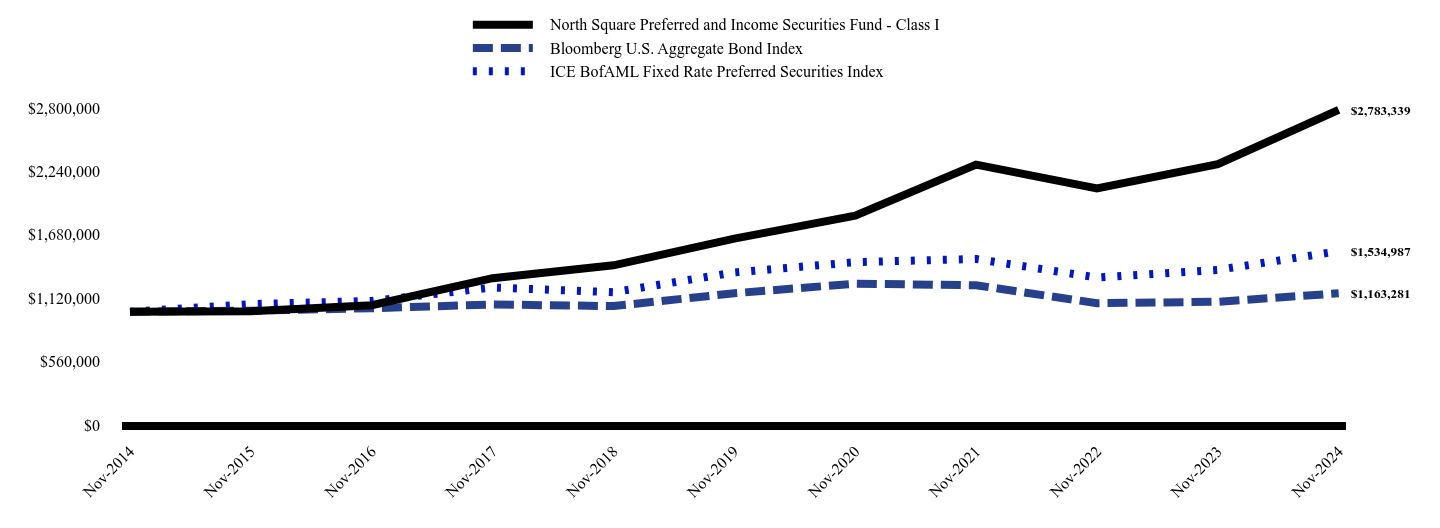

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| North Square Preferred and Income Securities Fund - Class I | Bloomberg U.S. Aggregate Bond Index | ICE BofAML Fixed Rate Preferred Securities Index |

|---|

| Nov-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| Nov-2015 | $1,004,700 | $1,009,702 | $1,067,866 |

|---|

| Nov-2016 | $1,058,114 | $1,031,630 | $1,096,103 |

|---|

| Nov-2017 | $1,297,133 | $1,064,786 | $1,214,181 |

|---|

| Nov-2018 | $1,410,680 | $1,050,494 | $1,173,065 |

|---|

| Nov-2019 | $1,645,827 | $1,163,856 | $1,347,576 |

|---|

| Nov-2020 | $1,848,972 | $1,248,630 | $1,438,222 |

|---|

| Nov-2021 | $2,299,148 | $1,234,230 | $1,466,708 |

|---|

| Nov-2022 | $2,089,309 | $1,075,757 | $1,302,512 |

|---|

| Nov-2023 | $2,304,377 | $1,088,449 | $1,370,005 |

|---|

| Nov-2024 | $2,783,339 | $1,163,281 | $1,534,987 |

|---|

- Net Assets$253,815,416

- Number of Portfolio Holdings78

- Advisory Fee (net of waivers)$796,379

- Portfolio Turnover44%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Preferred and Income Securities Fund - Class I | 20.78% | 11.08% | 10.78% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 6.88% | -0.01% | 1.52% |

|---|

| ICE BofAML Fixed Rate Preferred Securities Index | 12.04% | 2.64% | 4.38% |

|---|

The Fund adopted the historical performance of the Oak Ridge Dividend Growth Fund (the “Predecessor Fund”), which was reorganized into the Fund on May 10, 2019. Fund performance results above for the period prior to that date represent the performance of the Predecessor Fund. Effective January 11, 2022, the Fund made changes to its investment objective and principal investment strategies. Accordingly, the performance prior to January 11, 2022, is based on the Fund's prior investment objective and principal investment strategies and may not be representative of the Fund's performance under its current principal investment strategies.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

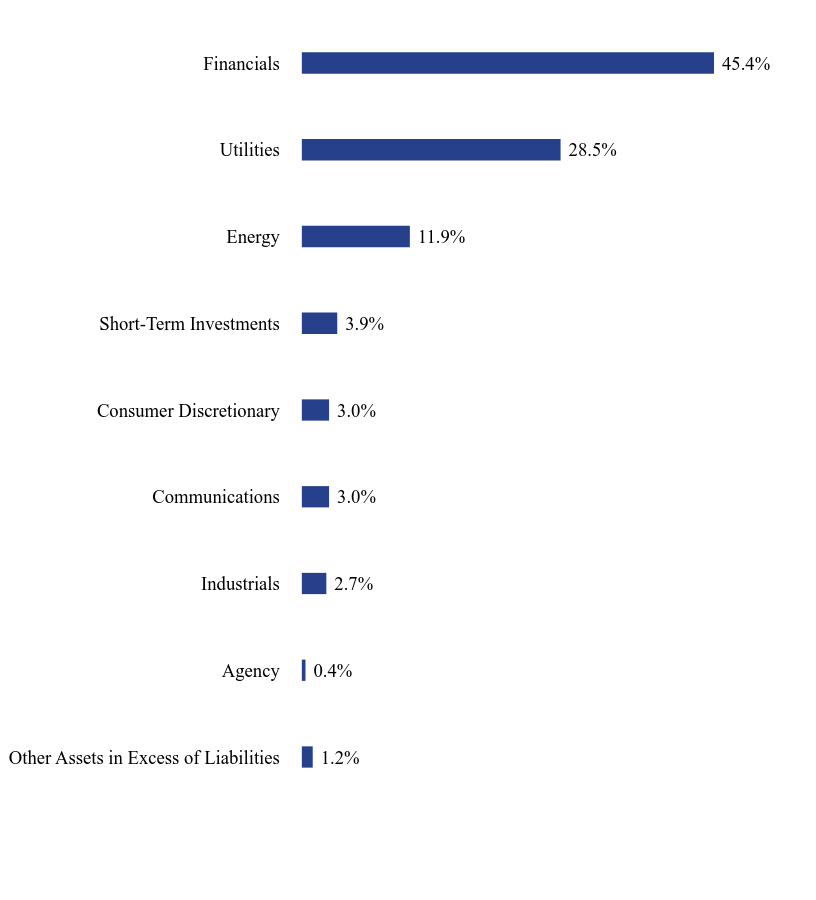

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.2% |

| Agency | 0.4% |

| Industrials | 2.7% |

| Communications | 3.0% |

| Consumer Discretionary | 3.0% |

| Short-Term Investments | 3.9% |

| Energy | 11.9% |

| Utilities | 28.5% |

| Financials | 45.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Vistra Corp., 8.875%, 12/31/49 | 3.3% |

| Energy Transfer LP, 6.625%, Perpetual | 3.2% |

| KeyCorp, 5.000%, Perpetual | 2.9% |

| AltaGas Ltd., 7.200%, 10/15/54 | 2.8% |

| Stanley Black & Decker, Inc., 4.000%, 03/15/60 | 2.7% |

| Deutsche Bank AG, 4.789%, 12/31/49 | 2.7% |

| Algonquin Power & Utilities Corp., 4.750%, 01/18/82 | 2.6% |

| South Bow Canadian Infrastructure Holdings Ltd., 7.500%, 03/1/55 | 2.6% |

| Ally Financial, Inc., 4.700%, Perpetual | 2.5% |

| CenterPoint Energy, Inc., 6.850%, 02/15/55 | 2.4% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Preferred and Income Securities Fund - Class I (ORDNX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Spectrum Alpha Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Spectrum Alpha Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $71 | 1.30% |

|---|

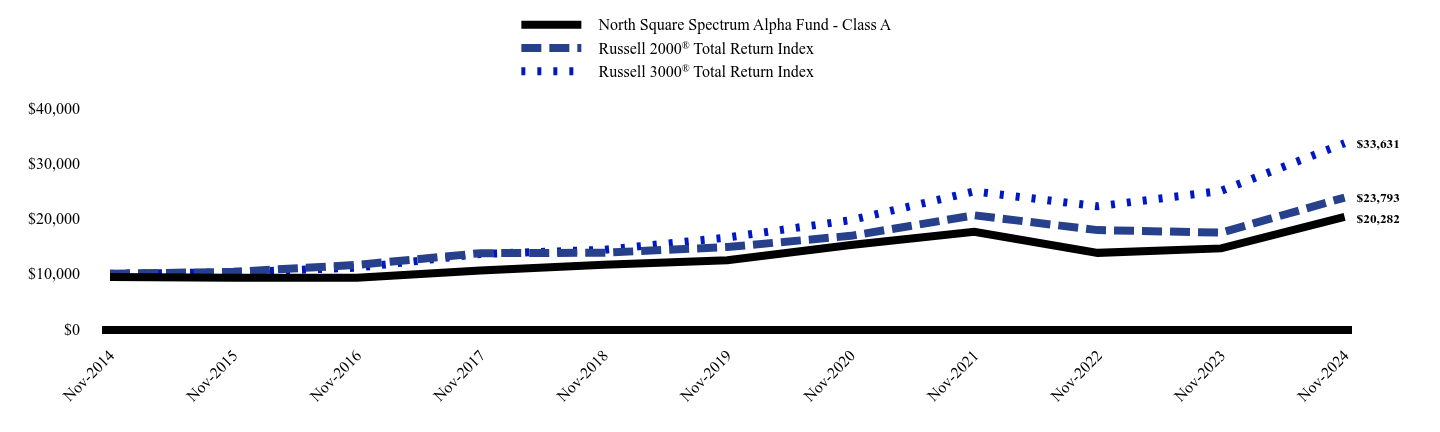

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Square Spectrum Alpha Fund - Class A | Russell 2000® Total Return Index | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $9,425 | $10,000 | $10,000 |

|---|

| Nov-2015 | $9,270 | $10,351 | $10,258 |

|---|

| Nov-2016 | $9,292 | $11,601 | $11,111 |

|---|

| Nov-2017 | $10,601 | $13,728 | $13,585 |

|---|

| Nov-2018 | $11,641 | $13,807 | $14,336 |

|---|

| Nov-2019 | $12,443 | $14,844 | $16,557 |

|---|

| Nov-2020 | $15,219 | $16,862 | $19,706 |

|---|

| Nov-2021 | $17,579 | $20,576 | $24,897 |

|---|

| Nov-2022 | $13,783 | $17,898 | $22,207 |

|---|

| Nov-2023 | $14,594 | $17,439 | $25,007 |

|---|

| Nov-2024 | $20,282 | $23,793 | $33,631 |

|---|

- Net Assets (In Millions)$86,997

- Number of Holdings5

- Advisory Fee$80,976

- Portfolio turnover14%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Spectrum Alpha Fund - Class A | | | |

|---|

| Without Load | 38.98% | 10.27% | 7.97% |

|---|

| With Load | 31.04% | 8.97% | 7.33% |

|---|

Russell 2000® Total Return Index | 36.43% | 9.90% | 9.05% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to May 10, 2019 represent the performance of the Oak Ridge Small Cap Growth Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

Effective January 11, 2022, the Fund made certain changes to its principal investment strategies. Accordingly, the Fund's performance for the periods prior to January 11, 2022, is based on the prior principal investment strategies and may not be representative of the Fund's performance under its current principal investment strategies.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

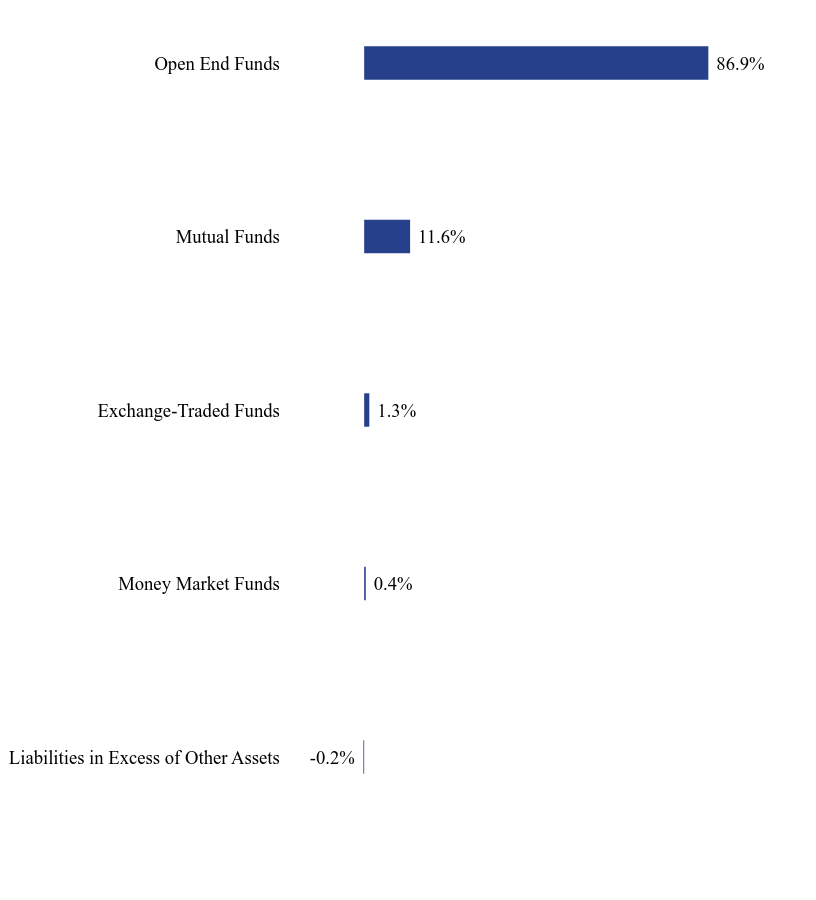

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| Money Market Funds | 0.4% |

| Exchange-Traded Funds | 1.3% |

| Mutual Funds | 11.6% |

| Open End Funds | 86.9% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

| North Square Dynamic Small Cap Fund, Class I | 60.9% |

| North Square Advisory Research Small Value Fund, Class I | 26.0% |

| North Square Kennedy MicroCap Fund, Class I | 11.6% |

iShares® Russell 2000 ETF | 1.3% |

| First American Treasury Obligations Fund, Class X | 0.4% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Spectrum Alpha Fund - Class A (ORIGX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Spectrum Alpha Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Spectrum Alpha Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $58 | 1.05% |

|---|

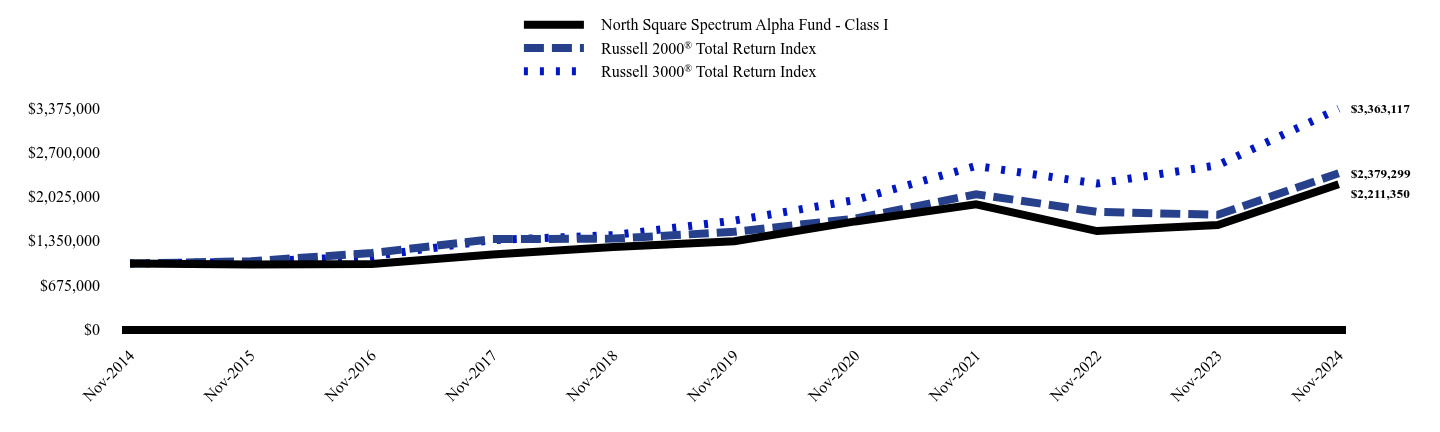

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| North Square Spectrum Alpha Fund - Class I | Russell 2000® Total Return Index | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| Nov-2015 | $986,688 | $1,035,071 | $1,025,831 |

|---|

| Nov-2016 | $992,843 | $1,160,075 | $1,111,055 |

|---|

| Nov-2017 | $1,136,410 | $1,372,801 | $1,358,510 |

|---|

| Nov-2018 | $1,250,959 | $1,380,676 | $1,433,590 |

|---|

| Nov-2019 | $1,340,446 | $1,484,422 | $1,655,661 |

|---|

| Nov-2020 | $1,643,005 | $1,686,212 | $1,970,628 |

|---|

| Nov-2021 | $1,903,196 | $2,057,601 | $2,489,677 |

|---|

| Nov-2022 | $1,496,070 | $1,789,835 | $2,220,728 |

|---|

| Nov-2023 | $1,587,878 | $1,743,926 | $2,500,731 |

|---|

| Nov-2024 | $2,211,350 | $2,379,299 | $3,363,117 |

|---|

- Net Assets (In Millions)$86,997

- Number of Holdings5

- Advisory Fee$80,976

- Portfolio turnover14%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Spectrum Alpha Fund - Class I | 39.26% | 10.53% | 8.26% |

|---|

Russell 2000® Total Return Index | 36.43% | 9.90% | 9.05% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to May 10, 2019 represent the performance of the Oak Ridge Small Cap Growth Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

Effective January 11, 2022, the Fund made certain changes to its principal investment strategies. Accordingly, the Fund's performance for the periods prior to January 11, 2022, is based on the prior principal investment strategies and may not be representative of the Fund's performance under its current principal investment strategies.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

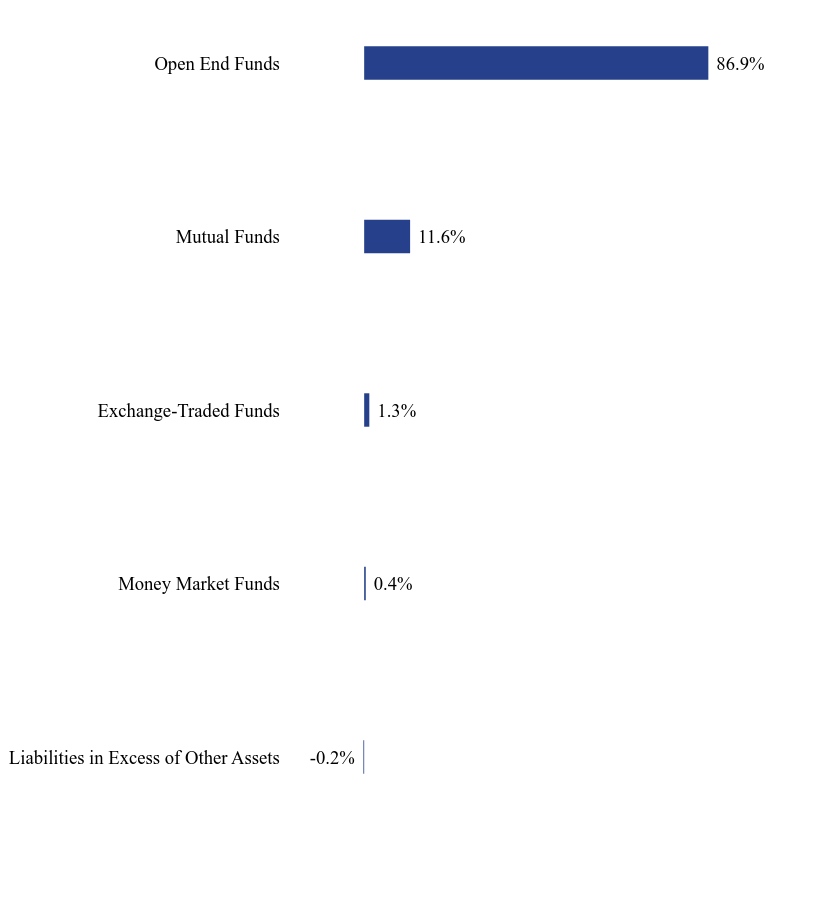

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| Money Market Funds | 0.4% |

| Exchange-Traded Funds | 1.3% |

| Mutual Funds | 11.6% |

| Open End Funds | 86.9% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

| North Square Dynamic Small Cap Fund, Class I | 60.9% |

| North Square Advisory Research Small Value Fund, Class I | 26.0% |

| North Square Kennedy MicroCap Fund, Class I | 11.6% |

iShares® Russell 2000 ETF | 1.3% |

| First American Treasury Obligations Fund, Class X | 0.4% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Spectrum Alpha Fund - Class I (ORIYX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Tactical Defensive Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Tactical Defensive Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $100 | 1.95% |

|---|

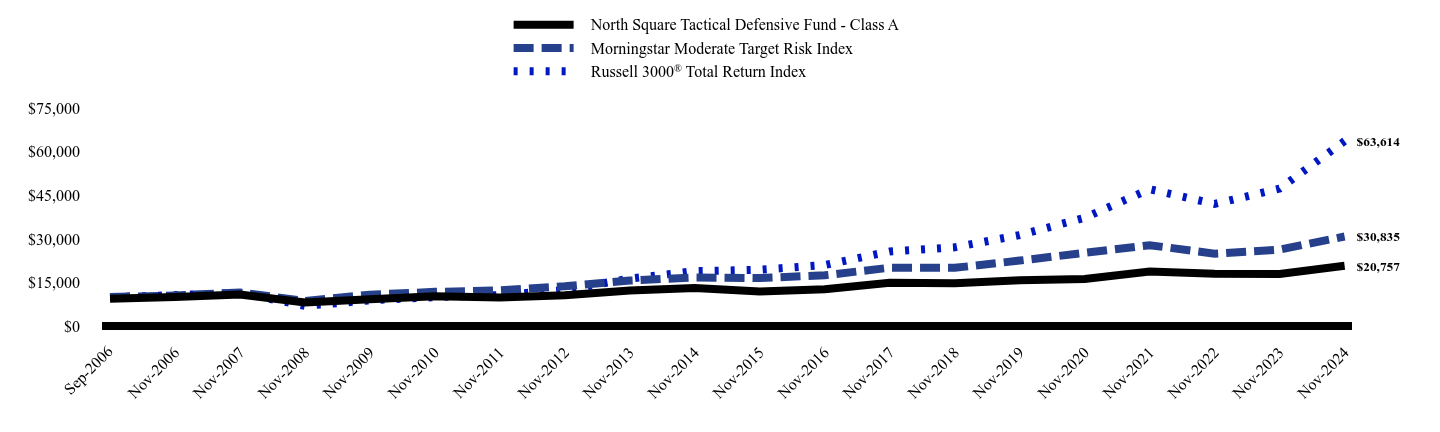

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Square Tactical Defensive Fund - Class A | Morningstar Moderate Target Risk Index | Russell 3000® Total Return Index |

|---|

| Sep-2006 | $9,428 | $10,000 | $10,000 |

|---|

| Nov-2006 | $10,027 | $10,572 | $10,688 |

|---|

| Nov-2007 | $10,890 | $11,594 | $11,441 |

|---|

| Nov-2008 | $8,158 | $8,701 | $6,996 |

|---|

| Nov-2009 | $9,296 | $10,842 | $8,896 |

|---|

| Nov-2010 | $10,333 | $11,805 | $10,020 |

|---|

| Nov-2011 | $9,861 | $12,315 | $10,721 |

|---|

| Nov-2012 | $10,661 | $13,704 | $12,431 |

|---|

| Nov-2013 | $12,292 | $15,690 | $16,373 |

|---|

| Nov-2014 | $13,147 | $16,765 | $18,915 |

|---|

| Nov-2015 | $11,971 | $16,551 | $19,404 |

|---|

| Nov-2016 | $12,682 | $17,491 | $21,016 |

|---|

| Nov-2017 | $14,896 | $20,099 | $25,697 |

|---|

| Nov-2018 | $14,768 | $20,063 | $27,117 |

|---|

| Nov-2019 | $15,826 | $22,559 | $31,317 |

|---|

| Nov-2020 | $16,264 | $25,215 | $37,275 |

|---|

| Nov-2021 | $18,836 | $27,853 | $47,093 |

|---|

| Nov-2022 | $18,039 | $24,935 | $42,006 |

|---|

| Nov-2023 | $17,949 | $26,321 | $47,302 |

|---|

| Nov-2024 | $20,757 | $30,835 | $63,614 |

|---|

- Net Assets$57,564,623

- Number of Portfolio Holdings7

- Advisory Fee (net of waivers)$334,622

- Portfolio Turnover93%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Tactical Defensive Fund - Class A | | | |

|---|

| Without Load | 15.64% | 5.57% | 4.67% |

|---|

| With Load | 9.03% | 4.33% | 4.05% |

|---|

| Morningstar Moderate Target Risk Index | 17.15% | 6.45% | 6.28% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to June 11, 2021 represent the performance of the Stadion Tactical Defensive Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Morningstar Moderate Target Risk Index is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

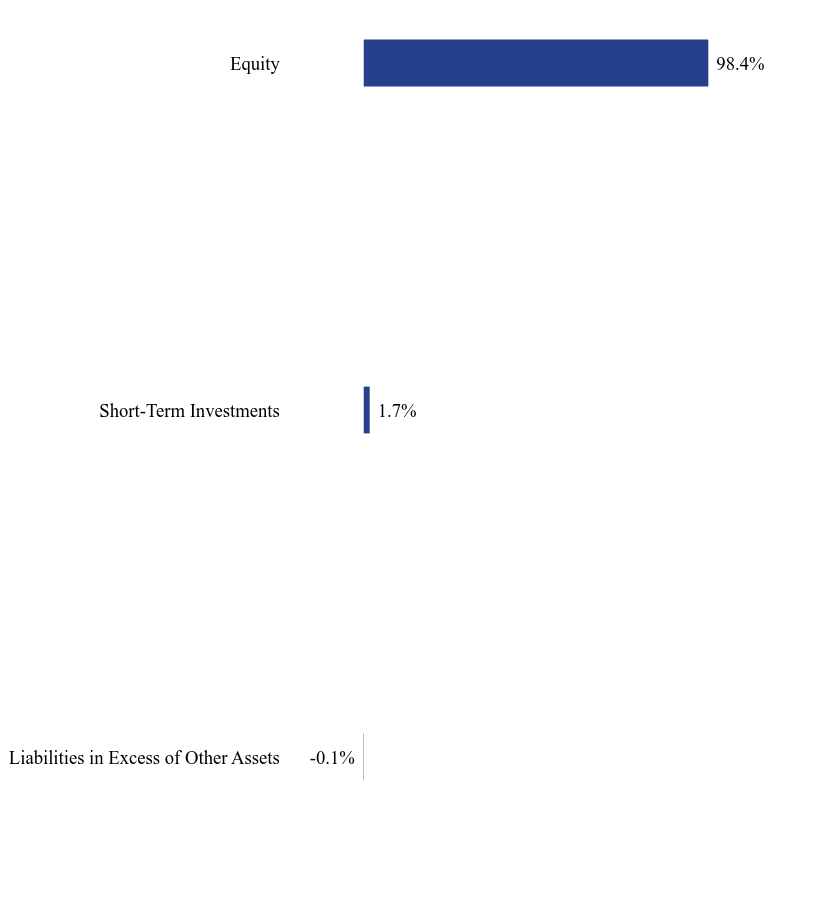

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Short-Term Investments | 1.7% |

| Equity | 98.4% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

SPDR® Portfolio S&P 500® ETF | 27.2% |

SPDR® Dow Jones Industrial Average ETF Trust | 23.8% |

iShares® Core S&P 500® ETF | 23.7% |

SPDR® Portfolio Developed World ex-US ETF | 14.9% |

SPDR® Portfolio Emerging Markets ETF | 5.4% |

SPDR® Portfolio S&P 600® Small Cap ETF | 3.4% |

This report describes changes to the Fund that occurred during the reporting period.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Tactical Defensive Fund - Class A (ETFRX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Tactical Defensive Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Tactical Defensive Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $69 | 1.35% |

|---|

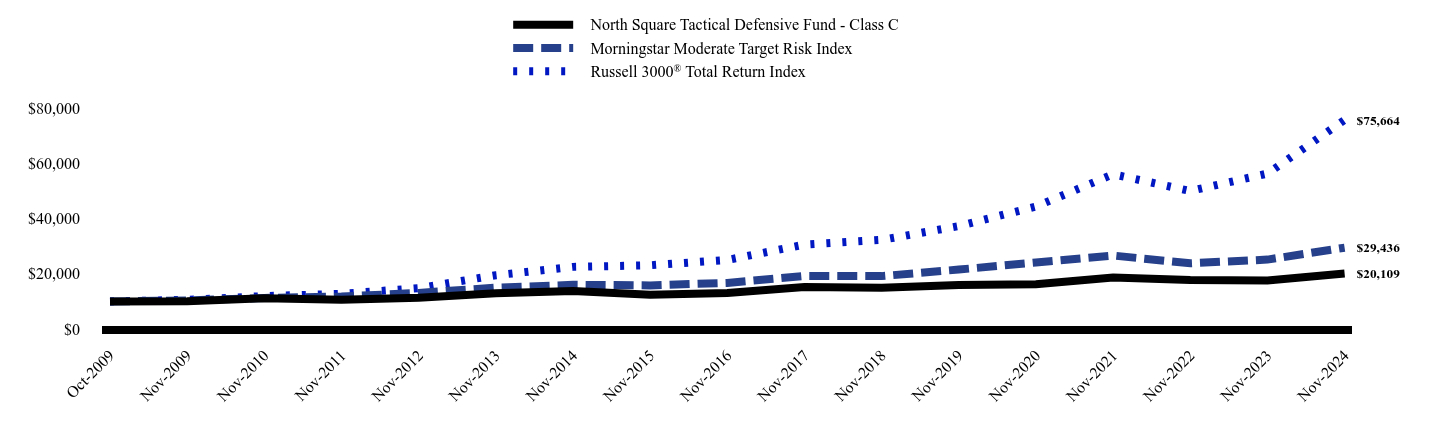

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Square Tactical Defensive Fund - Class C | Morningstar Moderate Target Risk Index | Russell 3000® Total Return Index |

|---|

| Oct-2009 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2009 | $10,103 | $10,350 | $10,582 |

|---|

| Nov-2010 | $11,149 | $11,270 | $11,918 |

|---|

| Nov-2011 | $10,564 | $11,756 | $12,751 |

|---|

| Nov-2012 | $11,327 | $13,082 | $14,785 |

|---|

| Nov-2013 | $12,943 | $14,978 | $19,474 |

|---|

| Nov-2014 | $13,747 | $16,004 | $22,498 |

|---|

| Nov-2015 | $12,418 | $15,800 | $23,079 |

|---|

| Nov-2016 | $13,064 | $16,697 | $24,997 |

|---|

| Nov-2017 | $15,215 | $19,187 | $30,564 |

|---|

| Nov-2018 | $14,977 | $19,153 | $32,253 |

|---|

| Nov-2019 | $15,928 | $21,535 | $37,250 |

|---|

| Nov-2020 | $16,246 | $24,071 | $44,336 |

|---|

| Nov-2021 | $18,674 | $26,590 | $56,013 |

|---|

| Nov-2022 | $17,742 | $23,804 | $49,963 |

|---|

| Nov-2023 | $17,534 | $25,127 | $56,262 |

|---|

| Nov-2024 | $20,109 | $29,436 | $75,664 |

|---|

- Net Assets$57,564,623

- Number of Portfolio Holdings7

- Advisory Fee (net of waivers)$334,622

- Portfolio Turnover93%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Tactical Defensive Fund - Class C | | | |

|---|

| Without Load | 14.69% | 4.77% | 3.88% |

|---|

| With Load | 13.69% | 4.77% | 3.88% |

|---|

| Morningstar Moderate Target Risk Index | 17.15% | 6.45% | 6.28% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to June 11, 2021 represent the performance of the Stadion Tactical Defensive Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Morningstar Moderate Target Risk Index is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

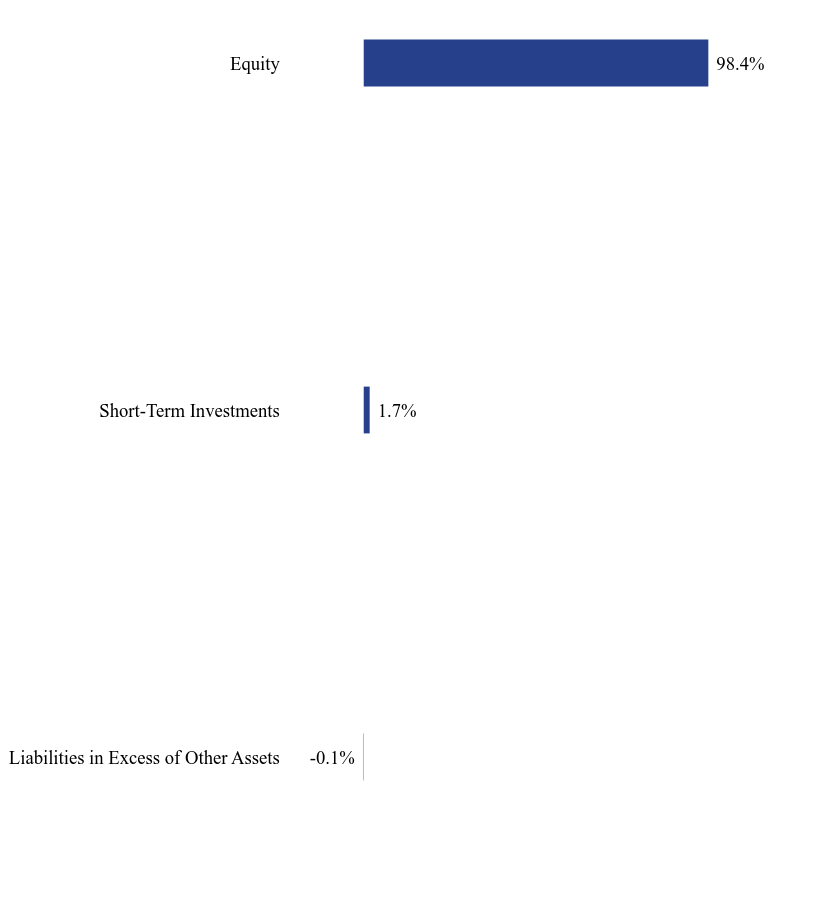

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Short-Term Investments | 1.7% |

| Equity | 98.4% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

SPDR® Portfolio S&P 500® ETF | 27.2% |

SPDR® Dow Jones Industrial Average ETF Trust | 23.8% |

iShares® Core S&P 500® ETF | 23.7% |

SPDR® Portfolio Developed World ex-US ETF | 14.9% |

SPDR® Portfolio Emerging Markets ETF | 5.4% |

SPDR® Portfolio S&P 600® Small Cap ETF | 3.4% |

This report describes changes to the Fund that occurred during the reporting period.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Tactical Defensive Fund - Class C (ETFZX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Tactical Defensive Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Tactical Defensive Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $87 | 1.70% |

|---|

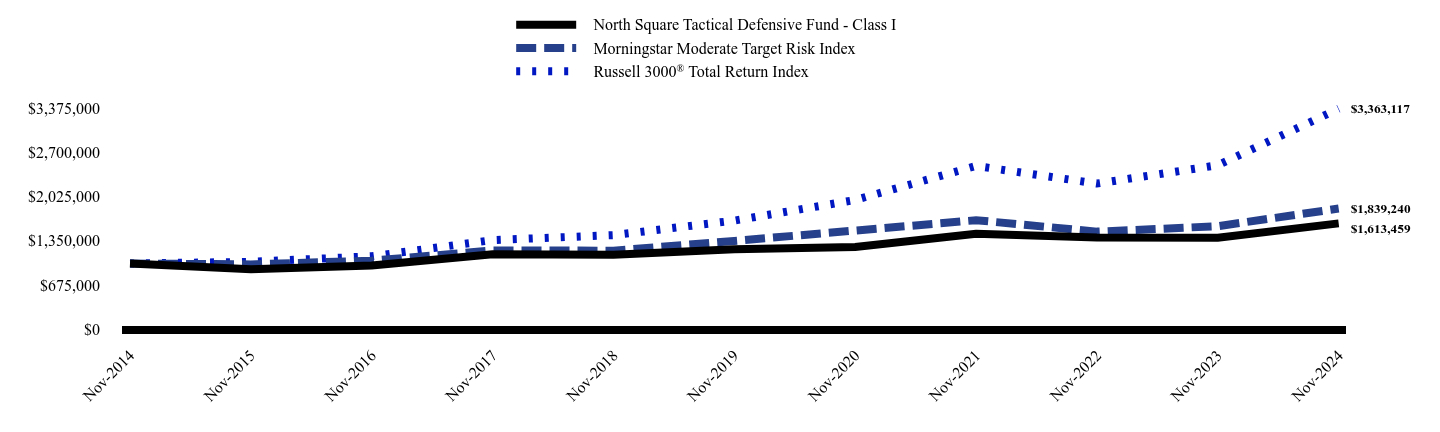

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| North Square Tactical Defensive Fund - Class I | Morningstar Moderate Target Risk Index | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| Nov-2015 | $912,221 | $987,210 | $1,025,831 |

|---|

| Nov-2016 | $969,874 | $1,043,307 | $1,111,055 |

|---|

| Nov-2017 | $1,140,566 | $1,198,892 | $1,358,510 |

|---|

| Nov-2018 | $1,134,276 | $1,196,711 | $1,433,590 |

|---|

| Nov-2019 | $1,216,651 | $1,345,588 | $1,655,661 |

|---|

| Nov-2020 | $1,253,032 | $1,504,027 | $1,970,628 |

|---|

| Nov-2021 | $1,454,397 | $1,661,405 | $2,489,677 |

|---|

| Nov-2022 | $1,396,019 | $1,487,340 | $2,220,728 |

|---|

| Nov-2023 | $1,392,634 | $1,570,001 | $2,500,731 |

|---|

| Nov-2024 | $1,613,459 | $1,839,240 | $3,363,117 |

|---|

- Net Assets$57,564,623

- Number of Portfolio Holdings7

- Advisory Fee (net of waivers)$334,622

- Portfolio Turnover93%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Tactical Defensive Fund - Class I | 15.86% | 5.81% | 4.90% |

|---|

| Morningstar Moderate Target Risk Index | 17.15% | 6.45% | 6.28% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to June 11, 2021 represent the performance of the Stadion Tactical Defensive Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Morningstar Moderate Target Risk Index is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

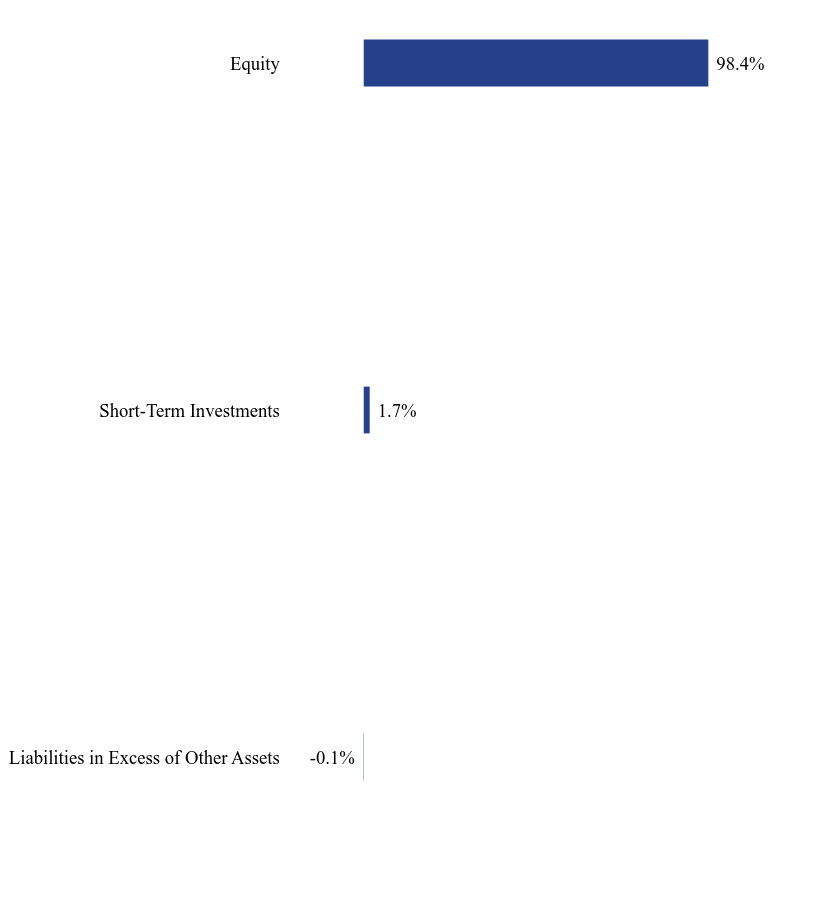

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Short-Term Investments | 1.7% |

| Equity | 98.4% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

SPDR® Portfolio S&P 500® ETF | 27.2% |

SPDR® Dow Jones Industrial Average ETF Trust | 23.8% |

iShares® Core S&P 500® ETF | 23.7% |

SPDR® Portfolio Developed World ex-US ETF | 14.9% |

SPDR® Portfolio Emerging Markets ETF | 5.4% |

SPDR® Portfolio S&P 600® Small Cap ETF | 3.4% |

This report describes changes to the Fund that occurred during the reporting period.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Tactical Defensive Fund - Class I (ETFWX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Tactical Growth Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Tactical Growth Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $82 | 1.55% |

|---|

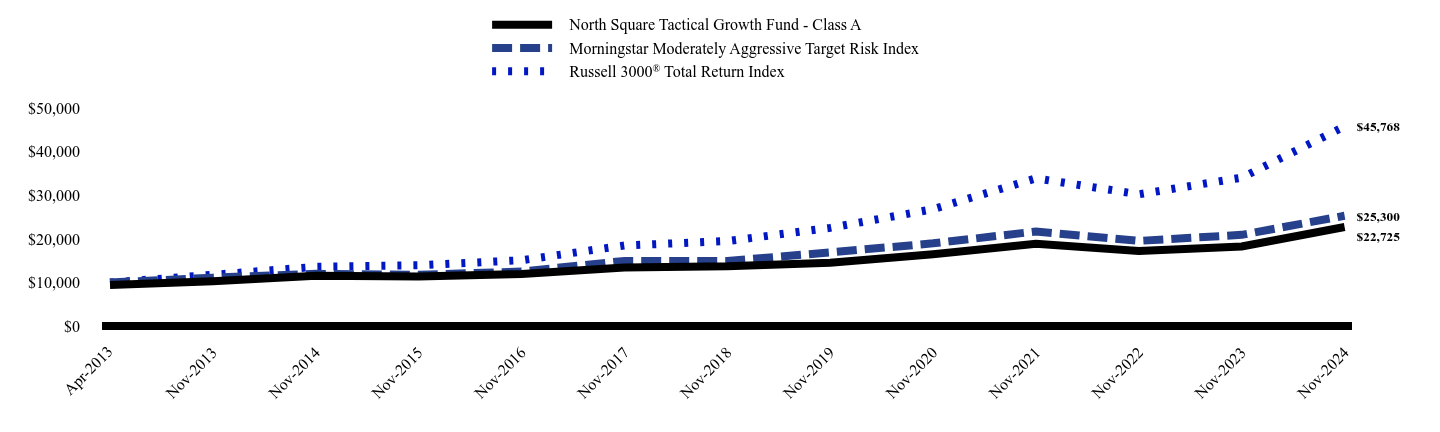

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Square Tactical Growth Fund - Class A | Morningstar Moderately Aggressive Target Risk Index | Russell 3000® Total Return Index |

|---|

| Apr-2013 | $9,422 | $10,000 | $10,000 |

|---|

| Nov-2013 | $10,296 | $11,131 | $11,780 |

|---|

| Nov-2014 | $11,548 | $11,992 | $13,609 |

|---|

| Nov-2015 | $11,378 | $11,786 | $13,960 |

|---|

| Nov-2016 | $11,938 | $12,537 | $15,120 |

|---|

| Nov-2017 | $13,476 | $14,959 | $18,488 |

|---|

| Nov-2018 | $13,725 | $14,944 | $19,510 |

|---|

| Nov-2019 | $14,553 | $16,918 | $22,532 |

|---|

| Nov-2020 | $16,490 | $18,986 | $26,818 |

|---|

| Nov-2021 | $18,863 | $21,700 | $33,882 |

|---|

| Nov-2022 | $17,220 | $19,549 | $30,222 |

|---|

| Nov-2023 | $18,257 | $20,932 | $34,032 |

|---|

| Nov-2024 | $22,725 | $25,300 | $45,768 |

|---|

- Net Assets$557,556,772

- Number of Portfolio Holdings11

- Advisory Fee (net of waivers)$2,745,825

- Portfolio Turnover13%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Tactical Growth Fund - Class A | | | |

|---|

| Without Load | 24.47% | 9.32% | 7.00% |

|---|

| With Load | 17.31% | 8.04% | 6.37% |

|---|

| Morningstar Moderately Aggressive Target Risk Index | 20.87% | 8.38% | 7.75% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to June 11, 2021 represent the performance of the Stadion Tactical Growth Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Morningstar Moderately Target Risk Index is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

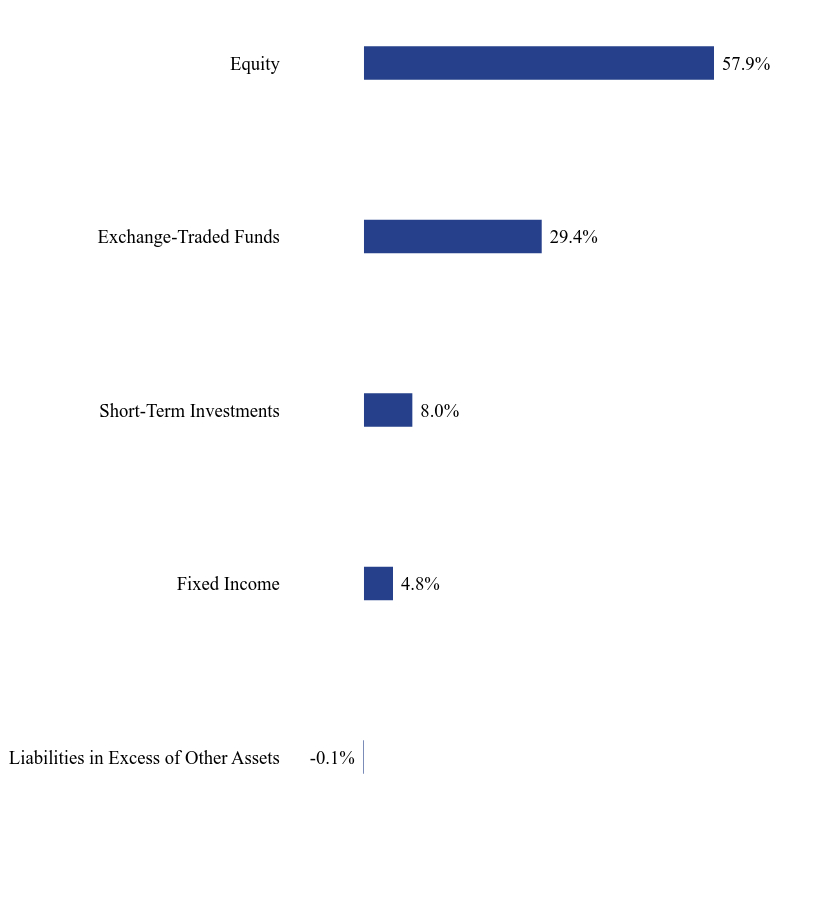

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Fixed Income | 4.8% |

| Short-Term Investments | 8.0% |

| Exchange-Traded Funds | 29.4% |

| Equity | 57.9% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco QQQ Trust, Series 1 | 15.4% |

| Vanguard Growth ETF | 15.2% |

SPDR® S&P 500® ETF Trust | 14.0% |

| Vanguard Value ETF | 11.6% |

iShares® Russell 2000 ETF | 9.5% |

Financial Select Sector SPDR® Fund | 6.3% |

iShares® Russell 3000 ETF | 5.8% |

iShares® Core High Dividend ETF | 5.0% |

iShares® 3-7 Year Treasury Bond ETF | 4.8% |

iShares® MSCI Eurozone ETF | 4.6% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Tactical Growth Fund - Class A (ETFAX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Tactical Growth Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Tactical Growth Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $61 | 1.15% |

|---|

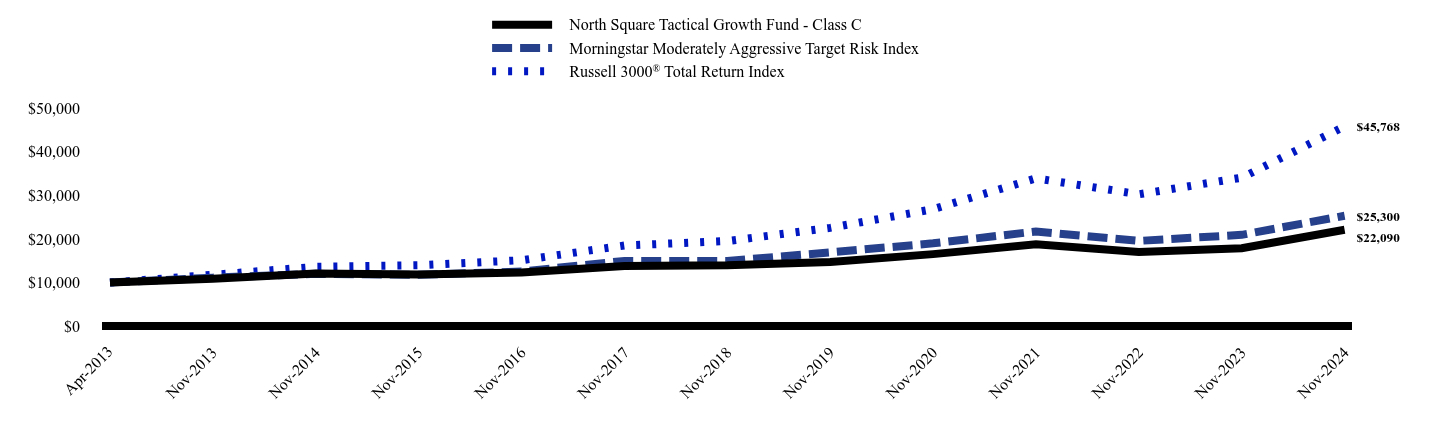

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| North Square Tactical Growth Fund - Class C | Morningstar Moderately Aggressive Target Risk Index | Russell 3000® Total Return Index |

|---|

| Apr-2013 | $10,000 | $10,000 | $10,000 |

|---|

| Nov-2013 | $10,871 | $11,131 | $11,780 |

|---|

| Nov-2014 | $12,103 | $11,992 | $13,609 |

|---|

| Nov-2015 | $11,840 | $11,786 | $13,960 |

|---|

| Nov-2016 | $12,321 | $12,537 | $15,120 |

|---|

| Nov-2017 | $13,802 | $14,959 | $18,488 |

|---|

| Nov-2018 | $13,957 | $14,944 | $19,510 |

|---|

| Nov-2019 | $14,688 | $16,918 | $22,532 |

|---|

| Nov-2020 | $16,515 | $18,986 | $26,818 |

|---|

| Nov-2021 | $18,753 | $21,700 | $33,882 |

|---|

| Nov-2022 | $16,985 | $19,549 | $30,222 |

|---|

| Nov-2023 | $17,871 | $20,932 | $34,032 |

|---|

| Nov-2024 | $22,090 | $25,300 | $45,768 |

|---|

- Net Assets$557,556,772

- Number of Portfolio Holdings11

- Advisory Fee (net of waivers)$2,745,825

- Portfolio Turnover13%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Tactical Growth Fund - Class C | | | |

|---|

| Without Load | 23.61% | 8.50% | 6.20% |

|---|

| With Load | 22.61% | 8.50% | 6.20% |

|---|

| Morningstar Moderately Aggressive Target Risk Index | 20.87% | 8.38% | 7.75% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to June 11, 2021 represent the performance of the Stadion Tactical Growth Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Morningstar Moderately Target Risk Index is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

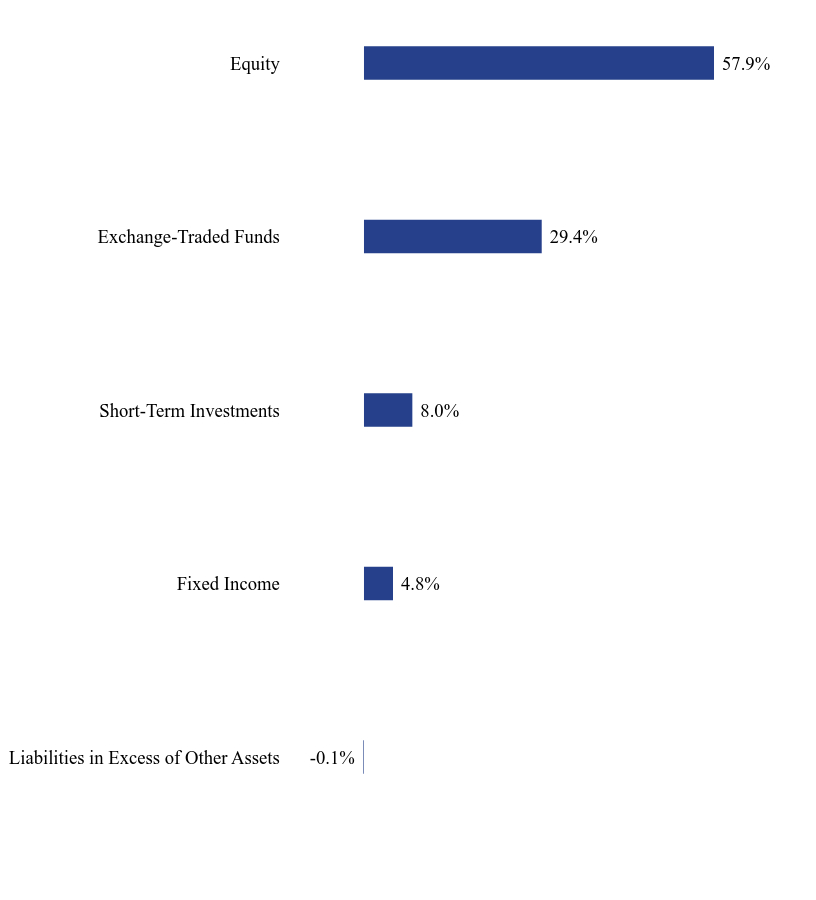

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Fixed Income | 4.8% |

| Short-Term Investments | 8.0% |

| Exchange-Traded Funds | 29.4% |

| Equity | 57.9% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco QQQ Trust, Series 1 | 15.4% |

| Vanguard Growth ETF | 15.2% |

SPDR® S&P 500® ETF Trust | 14.0% |

| Vanguard Value ETF | 11.6% |

iShares® Russell 2000 ETF | 9.5% |

Financial Select Sector SPDR® Fund | 6.3% |

iShares® Russell 3000 ETF | 5.8% |

iShares® Core High Dividend ETF | 5.0% |

iShares® 3-7 Year Treasury Bond ETF | 4.8% |

iShares® MSCI Eurozone ETF | 4.6% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Tactical Growth Fund - Class C (ETFCX)

Semi-Annual Shareholder Report - November 30, 2024

North Square Tactical Growth Fund

Semi-Annual Shareholder Report - November 30, 2024

This semi-annual shareholder report contains important information about North Square Tactical Growth Fund (the "Fund") for the period of June 1, 2024, to November 30, 2024. You can find additional information about the Fund at https://northsquareinvest.com/fund-reports-holdings/. You can also request this information by contacting us at 1-855-551-5521.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $70 | 1.30% |

|---|

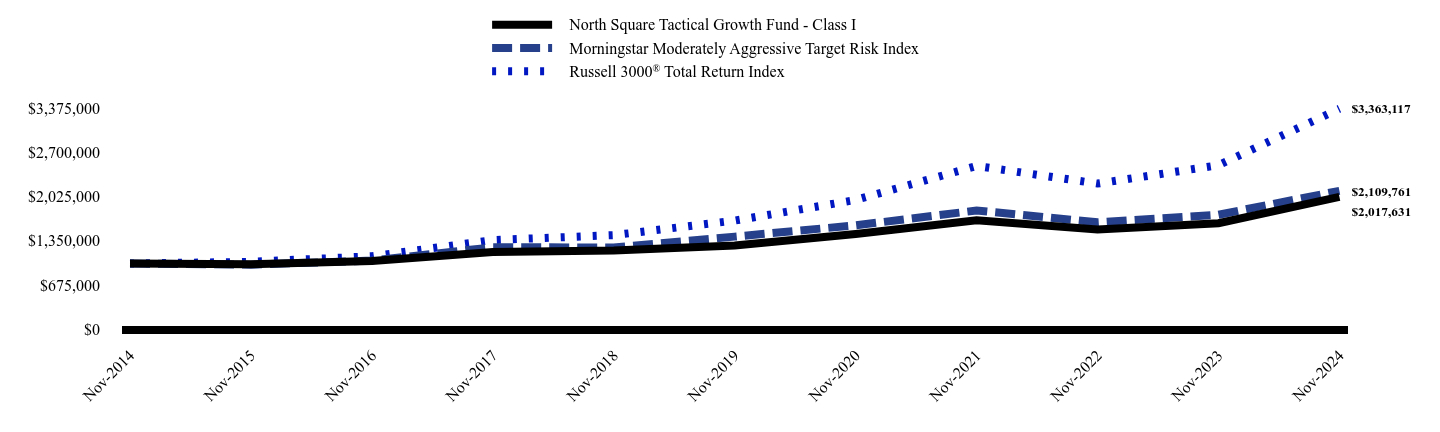

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| North Square Tactical Growth Fund - Class I | Morningstar Moderately Aggressive Target Risk Index | Russell 3000® Total Return Index |

|---|

| Nov-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| Nov-2015 | $988,362 | $982,789 | $1,025,831 |

|---|

| Nov-2016 | $1,038,767 | $1,045,453 | $1,111,055 |

|---|

| Nov-2017 | $1,175,949 | $1,247,466 | $1,358,510 |

|---|

| Nov-2018 | $1,200,387 | $1,246,166 | $1,433,590 |

|---|

| Nov-2019 | $1,275,163 | $1,410,823 | $1,655,661 |

|---|

| Nov-2020 | $1,449,724 | $1,583,202 | $1,970,628 |

|---|

| Nov-2021 | $1,661,532 | $1,809,560 | $2,489,677 |

|---|

| Nov-2022 | $1,520,706 | $1,630,182 | $2,220,728 |

|---|

| Nov-2023 | $1,616,391 | $1,745,521 | $2,500,731 |

|---|

| Nov-2024 | $2,017,631 | $2,109,761 | $3,363,117 |

|---|

- Net Assets$557,556,772

- Number of Portfolio Holdings11

- Advisory Fee (net of waivers)$2,745,825

- Portfolio Turnover13%

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| North Square Tactical Growth Fund - Class I | 24.82% | 9.61% | 7.27% |

|---|

| Morningstar Moderately Aggressive Target Risk Index | 20.87% | 8.38% | 7.75% |

|---|

Russell 3000® Total Return Index | 34.49% | 15.23% | 12.89% |

|---|

The performance results shown above in the line chart and the average annual total returns table for periods prior to June 11, 2021 represent the performance of the Stadion Tactical Growth Fund (the "Predecessor Fund") which converted into the Fund and is attributable to the Fund moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Morningstar Moderately Target Risk Index is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

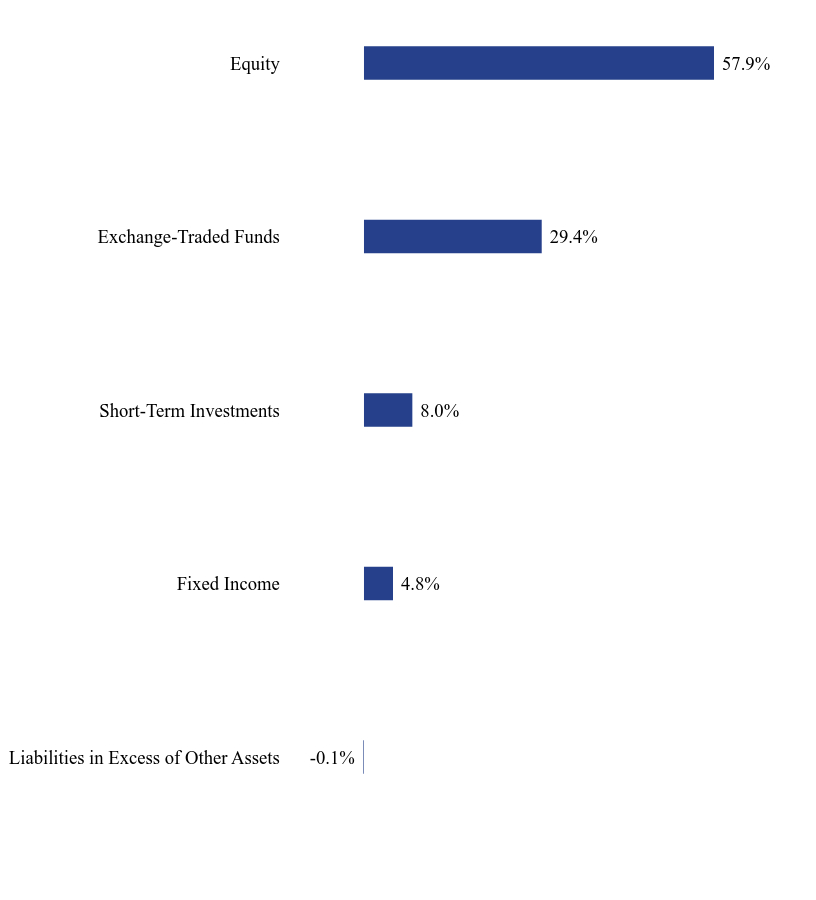

What did the Fund invest in?

Composition of Net Assets (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Fixed Income | 4.8% |

| Short-Term Investments | 8.0% |

| Exchange-Traded Funds | 29.4% |

| Equity | 57.9% |

Top Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco QQQ Trust, Series 1 | 15.4% |

| Vanguard Growth ETF | 15.2% |

SPDR® S&P 500® ETF Trust | 14.0% |

| Vanguard Value ETF | 11.6% |

iShares® Russell 2000 ETF | 9.5% |

Financial Select Sector SPDR® Fund | 6.3% |

iShares® Russell 3000 ETF | 5.8% |

iShares® Core High Dividend ETF | 5.0% |

iShares® 3-7 Year Treasury Bond ETF | 4.8% |

iShares® MSCI Eurozone ETF | 4.6% |

No material changes occurred during the period ended November 30, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://northsquareinvest.com/fund-reports-holdings/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

North Square Tactical Growth Fund - Class I (ETFOX)

Semi-Annual Shareholder Report - November 30, 2024

Item 2. Code of Ethics.

Not applicable – disclosed with annual report

Item 3. Audit Committee Financial Expert.

Not applicable – disclosed with annual report

Item 5. Audit Committee of Listed Registrants.

Not applicable – disclosed with annual report

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

SEMI-ANNUAL FINANCIAL STATEMENTS NORTH SQUARE SPECTRUM ALPHA FUND NORTH SQUARE DYNAMIC SMALL CAP FUND NORTH SQUARE MULTI STRATEGY FUND NORTH SQUARE PREFERRED AND INCOME SECURITIES FUND NORTH SQUARE TACTICAL GROWTH FUND NORTH SQUARE TACTICAL DEFENSIVE FUND NORTH SQUARE CORE PLUS BOND FUND NORTH SQUARE KENNEDY MICROCAP FUND NOVEMBER 30, 2024 |

North Square Investments | www.northsquareinvest.com

North Square Investments | www.northsquareinvest.com

North Square Funds

Table of Contents

| | |

Schedules of Investments | 1 |

Statements of Assets and Liabilities | 34 |

Statements of Operations | 37 |

Statements of Changes in Net Assets | 39 |

Financial Highlights | 46 |

Notes to Financial Statements | 61 |

Supplemental Information | 80 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the North Square Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.northsquareinvest.com

North Square Spectrum Alpha Fund

Schedule of Investments (Unaudited)

November 30, 2024

| | Shares | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 1.3% | | | | |

| | | 4,600 | | iShares® Russell 2000 ETF | | $ | 1,112,602 | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $1,021,339) | | | 1,112,602 | |

| | | | | | | | | |

| | | | | MUTUAL FUNDS — 98.5% | | | | |

| | | 1,576,800 | | North Square Advisory Research Small Value Fund, Class I(b) | | | 22,642,848 | |

| | | 3,059,062 | | North Square Dynamic Small Cap Fund, Class I(a)(c) | | | 52,952,366 | |

| | | 795,232 | | North Square Kennedy MicroCap Fund, Class I(a) | | | 10,123,300 | |

| | | | | TOTAL MUTUAL FUNDS (Cost $65,287,546) | | | 85,718,514 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 0.4% | | | | |

| | | 343,424 | | First American Treasury Obligations Fund, Class X, 4.55%(d) | | | 343,424 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $343,424) | | | 343,424 | |

| | | | | TOTAL INVESTMENTS — 100.2% (Cost $66,652,309) | | $ | 87,174,540 | |

| | | | | Liabilities in Excess of Other Assets— (0.2)% | | | (177,441 | ) |

| | | | | NET ASSETS — 100.0% | | $ | 86,997,099 | |

(a) | Affiliated Company. See Note 11. |

(b) | Represents an investment greater than 25% of the Fund’s net assets. Performance of the Fund may be adversely impacted by concentrated investments in securities. As of November 30, 2024, the percentage of net assets invested in North Square Advisory Research Small Value Fund, Class I was 26.0 % of the Fund. |

(c) | Represents an investment greater than 25% of the Fund’s net assets. Performance of the Fund may be adversely impacted by concentrated investments in securities. As of November 30, 2024, the percentage of net assets invested in North Square Dynamic Small Cap Fund, Class I was 60.9% of the Fund. |

(d) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

ETF - Exchange-Traded Fund

See accompanying Notes to Financial Statements.

1

North Square Dynamic Small Cap Fund

Schedule of Investments (Unaudited)

November 30, 2024

| | Shares | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.9% | | | | |

| | | | | COMMUNICATIONS — 2.6% | | | | |

| | | | | INTERNET MEDIA & SERVICES — 0.8% | | | | |

| | | 208,180 | | Eventbrite, Inc., Class A(a) | | $ | 732,794 | |

| | | 25,890 | | MediaAlpha, Inc.(a) | | | 326,991 | |

| | | 60,960 | | Yelp, Inc.(a) | | | 2,329,891 | |

| | | | | | | | 3,389,676 | |

| | | | | PUBLISHING & BROADCASTING — 0.1% | | | | |

| | | 59,430 | | Gray Television, Inc. | | | 253,766 | |

| | | | | | | | | |

| | | | | TELECOMMUNICATIONS — 1.7% | | | | |

| | | 12,870 | | IDT Corp., Class B(a) | | | 664,607 | |

| | | 41,280 | | Iridium Communications, Inc.(a) | | | 1,226,842 | |

| | | 130,790 | | Telephone and Data Systems, Inc. | | | 4,470,401 | |

| | | 18,370 | | United States Cellular Corp.(a) | | | 1,165,760 | |

| | | | | | | | 7,527,610 | |

| | | | | TOTAL COMMUNICATIONS | | | 11,171,052 | |

| | | | | | | | | |

| | | | | CONSUMER DISCRETIONARY — 13.5% | | | | |

| | | | | AUTOMOTIVE — 0.8% | | | | |

| | | 147,193 | | American Axle & Manufacturing Holdings, Inc.(a) | | | 972,946 | |

| | | 204,160 | | Dana, Inc. | | | 2,041,599 | |

| | | 3,270 | | Dorman Products, Inc.(a) | | | 457,735 | |

| | | | | | | | 3,472,280 | |

| | | | | CONSUMER SERVICES — 2.1% | | | | |

| | | 21,410 | | Adtalem Global Education, Inc.(a) | | | 1,957,088 | |

| | | 51,390 | | Coursera, Inc.(a) | | | 408,551 | |

| | | 19,800 | | Grand Canyon Education, Inc.(a) | | | 3,258,882 | |

| | | 10,040 | | Stride, Inc.(a) | | | 1,072,975 | |

| | | 62,790 | | Upbound Group, Inc. | | | 2,159,348 | |

| | | | | | | | 8,856,844 | |

| | | | | E-COMMERCE DISCRETIONARY — 1.1% | | | | |

| | | 56,380 | | Chewy, Inc.(a) | | | 1,883,656 | |

| | | 80,970 | | Revolve Group, Inc.(a) | | | 2,921,397 | |

| | | | | | | | 4,805,053 | |

| | | | | HOME CONSTRUCTION — 3.5% | | | | |

| | | 31,520 | | Century Communities, Inc. | | | 2,848,147 | |

| | | 21,126 | | Forestar Group, Inc.(a) | | | 630,611 | |

| | | 34,105 | | Griffon Corp. | | | 2,875,052 | |

| | | 34,211 | | Interface, Inc. | | | 908,302 | |

| | | 25,500 | | M/I Homes, Inc.(a) | | | 4,208,264 | |

| | | 4,430 | | Taylor Morrison Home Corp.(a) | | | 327,244 | |

| | | 73,030 | | TRI Pointe Homes, Inc.(a) | | | 3,178,996 | |

| | | | | | | | 14,976,616 | |

| | | | | | | | | |

See accompanying Notes to Financial Statements.

2

North Square Dynamic Small Cap Fund

Schedule of Investments (Unaudited) – Continued

November 30, 2024

| | Shares | | | | Fair Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | CONSUMER DISCRETIONARY (Continued) | | | | |

| | | | | LEISURE FACILITIES & SERVICES — 3.3% | | | | |

| | | 124,720 | | Life Time Group Holdings, Inc.(a) | | $ | 3,026,954 | |

| | | 59,350 | | OneSpaWorld Holdings Ltd. | | | 1,127,057 | |

| | | 254,040 | | Rush Street Interactive, Inc.(a) | | | 3,663,257 | |

| | | 21,340 | | St. Joe Company (The) | | | 1,090,047 | |

| | | 90,140 | | Travel + Leisure Co.(a) | | | 5,036,122 | |

| | | | | | | | 13,943,437 | |

| | | | | RETAIL - DISCRETIONARY — 2.6% | | | | |

| | | 4,850 | | Abercrombie & Fitch Co., Class A(a) | | | 725,997 | |

| | | 146,850 | | Aspen Aerogels, Inc.(a) | | | 2,173,380 | |

| | | 36,620 | | Beacon Roofing Supply, Inc.(a) | | | 4,138,791 | |

| | | 9,915 | | BlueLinx Holdings, Inc.(a) | | | 1,246,316 | |

| | | 1,470 | | Freshpet, Inc.(a) | | | 224,984 | |

| | | 29,390 | | MarineMax, Inc.(a) | | | 1,008,665 | |

| | | 58,290 | | Mister Car Wash Inc.(a) | | | 466,320 | |

| | | 18,302 | | Rush Enterprises, Inc., Class A | | | 1,133,809 | |

| | | | | | | | 11,118,262 | |

| | | | | WHOLESALE - DISCRETIONARY — 0.1% | | | | |

| | | 4,671 | | Eplus, Inc.(a) | | | 377,697 | |

| | | | | TOTAL CONSUMER DISCRETIONARY | | | 57,550,189 | |

| | | | | | | | | |

| | | | | CONSUMER STAPLES — 6.8% | | | | |

| | | | | BEVERAGES — 1.6% | | | | |

| | | 4,200 | | Coca-Cola Consolidated, Inc. | | | 5,478,018 | |

| | | 23,240 | | National Beverage Corp. | | | 1,147,824 | |

| | | | | | | | 6,625,842 | |

| | | | | FOOD — 2.5% | | | | |

| | | 81,420 | | BellRing Brands, Inc.(a) | | | 6,388,213 | |

| | | 26,010 | | Cal-Maine Foods, Inc. | | | 2,538,836 | |

| | | 51,380 | | Vital Farms, Inc.(a) | | | 1,705,816 | |

| | | | | | | | 10,632,865 | |

| | | | | HOUSEHOLD PRODUCTS — 1.6% | | | | |

| | | 132,210 | | Honest Co., Inc. (The)(a) | | | 1,096,021 | |

| | | 10,940 | | Inter Parfums, Inc. | | | 1,506,000 | |

| | | 44,560 | | Spectrum Brands Holdings, Inc. | | | 4,097,292 | |

| | | | | | | | 6,699,313 | |

| | | | | RETAIL - CONSUMER STAPLES — 0.5% | | | | |

| | | 21,811 | | PriceSmart, Inc. | | | 1,957,320 | |

| | | 2,430 | | Sprouts Farmers Market, Inc.(a) | | | 375,386 | |

| | | | | | | | 2,332,706 | |

| | | | | TOBACCO & CANNABIS — 0.2% | | | | |