- APP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

AppLovin (APP) S-1IPO registration

Filed: 24 Nov 21, 9:34pm

Delaware | 7370 | 45-3264542 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Rezwan D. Pavri Lisa L. Stimmell Andrew T. Hill Lang Liu Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 | Victoria Valenzuela Lonnie Huang AppLovin Corporation 1100 Page Mill Road Palo Alto, California 94304 (800) 839-9646 | Michael T. Esquivel Ran D. Ben-Tzur James D. Evans Jennifer J. Hitchcock Fenwick & West LLP 801 California Street Mountain View, California 94041 (650) 988-8500 |

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

Emerging growth company | ☐ |

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1)(2) | Amount of Registration Fee | ||

Class A common stock, par value $0.00003 per share | $100,000,000 | $9,270 | ||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase. |

Price to Public | Underwriting Discounts and Commissions (1) | Proceeds to Selling Stockholders | ||||||||||

Per Share | $ | $ | $ | |||||||||

Total | $ | $ | $ |

J.P. Morgan | BofA Securities | Citigroup |

| 1 | ||||

| 17 | ||||

| 62 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 69 | ||||

| 72 | ||||

| 113 | ||||

| 130 | ||||

| 139 | ||||

| 164 |

| 170 | ||||

| 174 | ||||

| 182 | ||||

| 187 | ||||

| 189 | ||||

| 194 | ||||

| 208 | ||||

| 208 | ||||

| 208 | ||||

| F-1 |

| • | The mobile app ecosystem is growing rapidly and is increasingly defining how we interact with the world. |

| • | The proliferation of accessible and affordable advanced development tools has led to lower cost and shorter development times for new apps |

| • | Mobile gaming has become one of the largest and fastest-growing sectors within the mobile app ecosystem. |

| • | The abundance of apps today creates a discovery and marketing challenge for mobile app developers. |

| • | Many developers lack access to marketing and monetization tools required to build a successful business in the mobile app ecosystem. in-game advertising and in-app purchases (IAPs) for monetization. To be successful, a developer’s app must not just be discovered but also generate user engagement to effectively sell ad inventory or create compelling content for IAPs. |

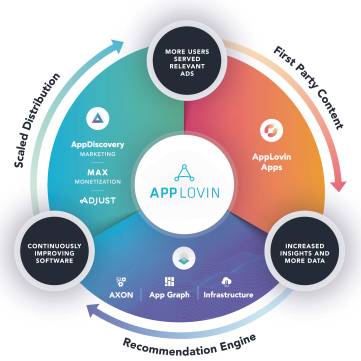

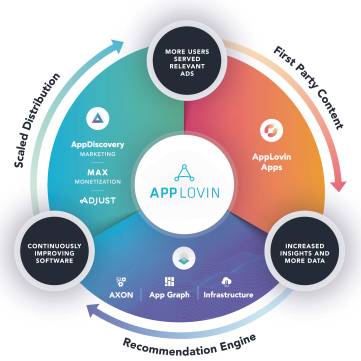

| • | AppLovin Core Technologies |

recommendation engine, our App Graph data management layer, and our elastic cloud infrastructure. Our Core Technologies are robust, having processed 5.9 petabytes of data per day on average, as many as 4 trillion predictions per day, and up to 29.6 trillion events per day in September 2021, while remaining flexible enough to rapidly adjust to our customers’ evolving needs. Our App Graph stores and manages anonymized data from hundreds of millions of mobile devices we reach every day, which our AXON engine then leverages to better predict and match each user to relevant advertising content. |

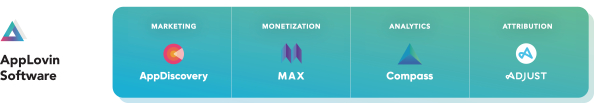

| • | AppLovin Software Platform 1 Our Software Platform is comprised of four solutions: |

| • | AppDiscovery |

| • | Adjust |

| • | MAX in-app bidding software thatoptimizes the value of an app’s advertising inventory by running a real-time competitive auction, driving more competition and higher returns for publishers. |

| • | Compass |

| 1 | See the section titled “Business” for information on how we calculate this figure. |

| • | Reach and attract users at scale. |

| • | Maximize monetization of engagement. |

tools operate at nearly instantaneous speeds and at vast scale to enhance monetization for developers while preserving the end user experience. |

| • | Leverage proprietary data and insights. Developers benefit from accessing comprehensive real-time insights through our customized user dashboards, helping them optimize campaigns, improve user engagement, and manage their return on investment. |

| • | Automate time consuming and manual processes. Our Software Platform automates marketing and monetization, allowing developers to focus on improving their apps rather than managing complex go-to-market |

| • | Seamlessly adapt to industry innovation. |

| • | Unique and improving strategic position. |

| • | Proven and optimized mobile app discovery and monetization technologies. |

| • | An advantaged approach to the mobile apps market. |

| • | Highly accretive approach to strategic acquisitions and partnerships. |

| • | Strong business model to drive rapid growth and cash flow. |

| • | Founder-led business, with a proven and experienced team to execute.co-founder, CEO, and Chairperson, Adam Foroughi, leads a tenured management team with significant experience in the mobile app industry and scaling successful businesses. |

| • | Existing market expansion |

| • | Enhance and extend machine-learning platform technologies. |

| • | Expand distribution reach and software capabilities. |

| • | Grow AppLovin Apps. |

| • | New market extensions . |

| • | Expand into other mobile app segments and industries. |

| • | Geographic expansion and industry partnerships. |

| • | Other performance marketing and yield marketing categories. |

| • | Pursue accretive strategic acquisitions and partnerships. |

| • | We have a limited operating history, especially with respect to our Apps, which makes it difficult to evaluate our current business and future performance and the risks we may encounter. |

| • | Our results of operations are likely to fluctuate from period-to-period, |

| • | The mobile app ecosystem is intensely competitive. If business clients or users prefer our competitors’ products or services over our own, our business, financial condition, and results of operations could be adversely affected. |

| • | The mobile app ecosystem is subject to rapid technological change, and if we do not adapt to, and appropriately allocate our resources among, emerging technologies and business models, our business, financial condition, and results of operations could be adversely affected. |

| • | The failure to attract new business clients, the loss of clients, or a reduction in spending by these clients could adversely affect our business, financial condition, and results of operations. |

| • | If we are unable to launch or acquire new Apps and successfully monetize them, or continue to improve the experience and monetization of our existing Apps, our business, financial condition, and results of operations could be adversely affected. |

| • | If we fail to retain existing users or add new users cost-effectively, or if our users decrease their level of engagement with Apps, our business, financial condition, and results of operations could be adversely affected. |

| • | We have experienced significant growth through strategic acquisitions and partnerships, and we face risks related to the integration of such acquisitions and the management of such growth. |

| • | We plan to continue to expand and diversify our operations through strategic acquisitions and partnerships. We face a number of risks related to these transactions. |

| • | We rely on third-party platforms to distribute our Apps and collect revenue, and if our ability to do so is harmed, or such third-party platforms change their policies in such a way that restricts our business, increases our expenses, or limits the information we derive from our Apps, our business, financial condition, and results of operations could be adversely affected. |

| • | The multi-class structure of our common stock and the Voting Agreement among the Class B Stockholders have the effect of concentrating voting power with the Class B Stockholders. This will limit your ability to influence the outcome of matters submitted to our stockholders for approval, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction. |

| • | We are considered a “controlled company” within the meaning of the Nasdaq corporate governance requirements, and, as a result, we qualify for, and currently rely on, exemptions from certain corporate governance requirements. |

Class A common stock offered by the selling stockholders | shares | |

Class A common stock to be outstanding after this offering and related transactions | shares | |

Class B common stock to be outstanding after this offering and related transactions | shares | |

Class C common stock to be outstanding after this offering and related transactions | None | |

Class A, Class B, and Class C common stock to be outstanding after this offering and related transactions | shares | |

Option to purchase additional shares | The selling stockholders have granted the underwriters an option to purchase an additional shares of Class A common stock. Any shares of Class A common stock purchased by the underwriters from the selling stockholders pursuant to this option shall reduce the number of shares of Class B common stock and increase the number of shares of Class A common stock outstanding after this offering. | |

Use of proceeds | The selling stockholders will receive all net proceeds from the sale of shares of Class A common stock in this offering and we will not receive any proceeds from this offering. We will, however, bear the costs associated with the sale of shares by the selling stockholders, other than underwriting discounts and commissions. | |

See the sections titled “Use of Proceeds,” “Principal and Selling Stockholders,” and “Underwriters” for additional information. | ||

Voting rights | Shares of our Class A common stock are entitled to one vote per share. | |

Shares of our Class B common stock are entitled to 20 votes per share. | ||

Shares of our Class C common stock have no voting rights, except as otherwise required by law. | ||

Holders of our Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by law or our amended and restated certificate of incorporation. Upon the closing of this offering and related transactions, the Class B Stockholders will collectively hold approximately % of the voting power of our outstanding capital stock in the aggregate. The Class B Stockholders have entered into the Voting Agreement whereby all Class B | ||

common stock held by the Class B Stockholders and their respective permitted entities and permitted transferees will be voted as determined by two of Mr. Foroughi, Mr. Chen, and KKR Denali (one of which must be Mr. Foroughi). As a result, the Class B Stockholders will collectively be able to determine or significantly influence any action requiring the approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction. See the sections titled “Principal and Selling Stockholders” and “Description of Capital Stock” for additional information. | ||

Controlled company | We are considered a “controlled company” within the meaning of the Nasdaq corporate governance requirements. See the sections titled “Management—Director Independence and Controlled Company Exemption” and “Principal and Selling Stockholders” for additional information. | |

Nasdaq trading symbol | “APP” | |

| • | 16,689,042 shares of our Class A common stock issuable upon the exercise of options to purchase shares of our Class A common stock outstanding as of September 30, 2021, with a weighted-average exercise price of $6.55 per share; |

| • | 195,000 shares of our Class A common stock issuable upon the exercise of a warrant to purchase Class A common stock outstanding as of September 30, 2021, with an exercise price of $26.67 per share; |

| • | 7,222,536 of our Class A common stock issuable upon the vesting and settlement of restricted stock units (RSUs) outstanding as of September 30, 2021; |

| • | 324,156 shares of our Class A common stock issued upon conversion of a convertible security in October 2021; and |

| • | 44,994,361 shares of our Class A common stock reserved for future issuance under our equity compensation plans as of September 30, 2021, consisting of: |

| • | 37,163,984 shares of our Class A common stock reserved for future issuance under our 2021 Equity Incentive Plan (our 2021 Plan); |

| • | 30,377 shares of our Class A common stock reserved for future issuance under our 2021 Partner Studio Incentive Plan (our 2021 Partner Plan); and |

| • | 7,800,000 shares of our Class A common stock reserved for future issuance under our 2021 Employee Stock Purchase Plan (our ESPP). |

| • | gives effect to a 1-to-3 forward stock split, which occurred on May 20, 2020 (the Forward Stock Split) as if it had occurred on the date of such information; |

| • | assumes no exercise of outstanding stock options and warrants, vesting and settlement of RSUs, conversion of convertible securities, or forfeiture of outstanding restricted stock subsequent to September 30, 2021; and |

| • | assumes no exercise by the underwriters of their option to purchase additional shares. |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except for share and per share amounts) | ||||||||||||||||||||

Revenue | $ | 483,363 | $ | 994,104 | $ | 1,451,086 | $ | 941,249 | $ | 1,999,634 | ||||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of revenue (1)(2) | 53,758 | 241,274 | 555,578 | 357,564 | 722,966 | |||||||||||||||

Sales and marketing (1)(2) | 166,799 | 481,781 | 627,796 | 417,000 | 816,200 | |||||||||||||||

Research and development (1) | 16,270 | 44,966 | 180,652 | 99,950 | 246,861 | |||||||||||||||

General and administrative (1) | 14,854 | 31,712 | 66,431 | 41,256 | 122,116 | |||||||||||||||

Lease modification and abandonment of leasehold improvements | — | — | 7,851 | 7,851 | — | |||||||||||||||

Extinguishments of acquisition-related contingent consideration | (10,763 | ) | — | 74,820 | 74,712 | — | ||||||||||||||

Total cost and expenses | 240,918 | 799,733 | 1,513,128 | 998,333 | 1,908,143 | |||||||||||||||

Income (loss) from operations | 242,445 | 194,371 | (62,042 | ) | (57,084 | ) | 91,491 | |||||||||||||

Other income (expense): | ||||||||||||||||||||

Interest expense and loss on settlement of debt | (484,644 | ) | (73,955 | ) | (77,873 | ) | (57,548 | ) | (72,796 | ) | ||||||||||

Other income (expense), net | 1,940 | 5,818 | 4,209 | 5,347 | (997 | ) | ||||||||||||||

Total other expense | (482,704 | ) | (68,137 | ) | (73,664 | ) | (52,201 | ) | (73,793 | ) | ||||||||||

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except for share and per share amounts) | ||||||||||||||||||||

Income (loss) before income taxes | (240,259 | ) | 126,234 | (135,706 | ) | (109,285 | ) | 17,698 | ||||||||||||

Provision for (benefit from) income taxes | 19,736 | 7,194 | (9,772 | ) | (2,324 | ) | 13,767 | |||||||||||||

Net income (loss) | (259,995 | ) | 119,040 | (125,934 | ) | (106,961 | ) | 3,931 | ||||||||||||

Add: Net loss attributable to noncontrolling interest | — | — | 747 | 546 | 149 | |||||||||||||||

Net income (loss) attributable to AppLovin shareholders | $ | (259,995 | ) | $ | 119,040 | $ | (125,187 | ) | $ | (106,415 | ) | $ | 4,080 | |||||||

Less: Income attributable to participating securities | — | (42,664 | ) | — | — | (568 | ) | |||||||||||||

Net income (loss) attributable to common stock—Basic | $ | (259,995 | ) | $ | 76,376 | $ | (125,187 | ) | $ | (106,415 | ) | $ | 3,512 | |||||||

Net income (loss) attributable to common stock—Diluted | $ | (259,995 | ) | $ | 76,561 | $ | (125,187 | ) | $ | (106,415 | ) | $ | 3,539 | |||||||

Net income (loss) per share attributable to common stockholders: (3) | ||||||||||||||||||||

Basic | $ | (1.37 | ) | $ | 0.36 | $ | (0.58 | ) | $ | (0.50 | ) | $ | 0.01 | |||||||

Diluted | $ | (1.37 | ) | $ | 0.36 | $ | (0.58 | ) | $ | (0.50 | ) | $ | 0.01 | |||||||

Weighted average common shares used to compute net income (loss) per share attributable to common stockholders: (3) | ||||||||||||||||||||

Basic | 189,533,630 | 210,937,147 | 214,936,545 | 212,998,263 | 309,353,304 | |||||||||||||||

Diluted | 189,533,630 | 212,365,429 | 214,936,545 | 212,998,263 | 327,426,792 | |||||||||||||||

| (1) | Includes stock-based compensation expense as follows: |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Cost of revenue | $ | 517 | $ | 124 | $ | 982 | $ | 204 | $ | 1,504 | ||||||||||

Sales and marketing | 2,582 | 1,922 | 10,668 | 2,812 | 8,814 | |||||||||||||||

Research and development | 1,009 | 5,009 | 36,852 | 10,692 | 40,148 | |||||||||||||||

General and administrative | 1,357 | 3,167 | 13,885 | 5,654 | 41,362 | |||||||||||||||

Total stock-based compensation | $ | 5,465 | $ | 10,222 | $ | 62,387 | $ | 19,362 | $ | 91,828 | ||||||||||

| (2) | Includes amortization expense related to acquired intangibles as follows: |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Cost of revenue | $ | 7,932 | $ | 74,787 | $ | 228,339 | $ | 137,673 | $ | 273,444 | ||||||||||

Sales and marketing | 495 | 7,641 | 11,587 | 8,470 | 16,008 | |||||||||||||||

Total amortization expense related to acquired intangibles | $ | 8,427 | $ | 82,428 | $ | 239,926 | $ | 146,143 | $ | 289,452 | ||||||||||

| (3) | See Note 2 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to compute the historical net income (loss) per share and the number of shares used in the computation of the per share amounts. |

As of September 30, 2021 (1) | ||||

| (in thousands) | ||||

Cash and cash equivalents | $ | 1,049,617 | ||

Working capital (2) | 1,056,597 | |||

Total assets | 4,567,760 | |||

Total debt | 1,749,330 | |||

Accumulated deficit | (1,008,320 | ) | ||

Total stockholders’ equity | 2,049,059 | |||

| (1) | Subsequent to September 30, 2021, we issued incremental loans in an aggregate amount of $1.5 billion. See the section titled “Description of Certain Indebtedness” for additional information. |

| (2) | Working capital is defined as current assets less current liabilities. |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

Net income (loss) | $ | (259,995 | ) | $ | 119,040 | $ | (125,934 | ) | $ | (106,961 | ) | $ | 3,931 | |||||||

Adjusted EBITDA | $ | 255,618 | $ | 301,197 | $ | 345,495 | $ | 207,594 | $ | 505,490 | ||||||||||

Net income (loss) margin | (53.8 | )% | 12.0 | % | (8.7 | )% | (11.4 | )% | 0.2 | % | ||||||||||

Adjusted EBITDA margin | 52.9 | % | 30.3 | % | 23.8 | % | 22.1 | % | 25.3 | % | ||||||||||

| • | accurately forecast our revenue and plan our operating expenses; |

| • | attract new and retain existing business clients using AppLovin Software Platform and users of our Apps; |

| • | successfully compete with current and future competitors, some of whom are also our clients; |

| • | successfully expand our business in existing markets and enter new markets and geographies; |

| • | successfully execute strategic acquisitions and partnerships; |

| • | develop a scalable, high-performance technology infrastructure that can efficiently and reliably handle increased usage, as well as the deployment of new features and services; |

| • | comply with existing and new laws and regulations applicable to our business; |

| • | anticipate and respond to macroeconomic changes and changes in the markets in which we operate; |

| • | establish and maintain our brand and reputation; |

| • | adapt to rapidly evolving trends in the ways businesses and consumers interact with technology; |

| • | effectively manage our rapid growth; |

| • | avoid interruptions or disruptions in our AppLovin Core Technologies, Software Platform, or Apps; and |

| • | hire, integrate, and retain key personnel. |

| • | our ability to maintain and grow our business client and user bases; |

| • | changes to our Core Technologies, Software Platform, Apps, or other offerings, or the development and introduction of new software or development of new mobile apps by our studios or our competitors; |

| • | changes to the policies or practices of companies or governmental agencies that determine access to third-party platforms, such as the Apple App Store and the Google Play Store, or to our Software Platform, Apps, website, or the internet generally; |

| • | changes to the policies or practices of third-party platforms, such as the Apple App Store and the Google Play Store, including with respect to Apple’s Identifier for Advertisers (IDFA), which helps advertisers assess the effectiveness of their advertising efforts, and with respect to transparency regarding data processing; |

| • | the diversification and growth of revenue sources beyond our current Software Platform and Apps; |

| • | the actions of our competitors, both with respect to their own offerings and, to the extent such competitors are also our clients, with respect to their use of our Software Platform; |

| • | costs and expenses related to the strategic acquisitions and partnerships, including costs related to integrating mobile gaming studios or other companies that we acquire, as well as costs and expenses related to the development of our Core Technologies, Software Platform, or Apps; |

| • | our ability to achieve or maintain profitability; |

| • | increases in and timing of operating expenses that we may incur to grow and expand our operations and to remain competitive; |

| • | system failures or outages, or actual or perceived breaches of security or privacy, and the costs associated with preventing, responding to, or remediating any such outages or breaches; |

| • | changes in the legislative or regulatory environment, including with respect to privacy and data protection, or actions by governments or regulators, including fines, orders, or consent decrees; |

| • | charges associated with impairment of any assets on our balance sheet or changes in our expected estimated useful life of property and equipment and intangible assets; |

| • | adverse litigation judgments, settlements, or other litigation-related costs and the fees associated with investigating and defending claims; |

| • | changes in the legislative or regulatory environment, such as with respect to privacy and data protection; |

| • | the overall tax rate for our business, which may be affected by the mix of income we earn in the United States and in jurisdictions with comparatively lower tax rates; |

| • | the impact of changes in tax laws or judicial or regulatory interpretations of tax laws, which are recorded in the period such laws are enacted or interpretations are issued and may significantly affect the effective tax rate of that period; |

| • | the application of new or changing financial accounting standards or practices; and |

| • | changes in regional or global business or macroeconomic conditions, including as a result of the COVID-19 pandemic, which may impact the other factors described above. |

| • | our ability to attract and retain business clients; |

| • | our ability to improve the effectiveness and predictability of our advertising and matching algorithms; |

| • | our ability to maintain or increase advertiser demand and third-party publisher supply, the quantity, or quality of advertisements shown to users, or our pricing of advertisements; |

| • | our ability to continue to increase user access to and engagement with our Apps; |

| • | mobile app changes or inventory management decisions we may make that change the size, format, frequency, or relative prominence of advertisements displayed on our Apps; |

| • | our ability to recruit, train, and retain personnel to support continued growth of our Software Platform; |

| • | our ability to establish and maintain our brand and reputation; |

| • | loss of market share to our competitors, including if competitors offer lower priced, more integrated, or otherwise more effective products; |

| • | the development and success of technologies designed to block the display of advertisements or block our ad measurement tools, which have in the past impacted and may in the future impact our business, or technologies that make it easier for users to opt out of behavioral targeting; |

| • | the availability, accuracy, utility, and security of analytics and measurement solutions offered by us or third parties that demonstrate the value of our Software Platform to advertisers, developers and publishers, or our ability to further improve such tools; |

| • | government actions or legislative, regulatory, or other legal developments relating to advertising, including developments that may impact our ability to deliver, target, or measure the effectiveness of advertising; |

| • | changes that limit our ability to deliver, target, or measure the effectiveness of advertising, including changes to policies by mobile operating system and third-party platform providers, and the degree to which users opt out of certain types of ad targeting as a result of changes and controls implemented in connection with such policy changes and with the E.U. General Data Protection Regulation (the GDPR), ePrivacy Directive, the California Consumer Privacy Act (the CCPA), and the Children’s Online Privacy Protection Act (the COPPA); |

| • | decisions by business clients to reduce their advertising due to concerns about legal liability or uncertainty regarding their own legal and compliance obligations, or due to negative publicity, regardless of its accuracy, involving us, our user data practices, advertising metrics or tools, our Software Platform or Apps, or other companies in our industry; and |

| • | the impact of macroeconomic conditions, including the impact of the COVID-19 pandemic and responses thereto, and seasonality, whether in the advertising industry in general, or among specific types of advertisers or within particular geographies. |

| • | effectively market our Apps to existing and new users; |

| • | achieve a positive return on investment from our marketing and user acquisition costs or achieve organic user growth; |

| • | adapt to changing trends, user preferences, new technologies, and new feature sets for mobile and other devices, including determining whether to invest in development for any new technologies, and achieve a positive return on the costs associated with such adaptation; |

| • | continue to adapt mobile app feature sets for an increasingly diverse set of mobile devices, including various operating systems and specifications, limited bandwidth, and varying processing power and screen sizes; |

| • | achieve and maintain successful user engagement and effectively monetize our Apps; |

| • | develop mobile games that can build upon or become franchise games and expand and enhance our mobile games after their initial releases; |

| • | develop Apps other than mobile games; |

| • | identify and execute strategic acquisitions and partnerships; |

| • | attract advertisers to advertise on our Apps; |

| • | partner with third-party platforms and obtain featuring opportunities; |

| • | compete successfully against a large and growing number of competitors; |

| • | accurately forecast the timing and expense of our operations, including mobile app and feature development, marketing, and user acquisition; |

| • | minimize and quickly resolve bugs or outages; |

| • | acquire, or invest in, and successfully integrate high quality mobile app companies or technologies; and |

| • | retain and motivate talented and experienced developers and other key personnel from such acquisitions and investments. |

| • | users increasingly engage with mobile apps offered by competitors or mobile apps in categories other than those of our Apps; |

| • | we fail to introduce new Apps or features that users find engaging or that achieve a high level of market acceptance or we introduce new Apps, or make changes to existing Apps that are not favorably received; |

| • | users feel that their experience is diminished as a result of the decisions we make with respect to the frequency, prominence, format, size, and quality of advertisements that we display; |

| • | users have difficulty installing, updating, or otherwise accessing our Apps as a result of actions by us or third parties; |

| • | we are unable to continue to develop Apps that work with a variety of mobile operating systems and networks; and |

| • | questions about the quality of our Apps, our data practices or concerns related to privacy and sharing of personal information and other user data, safety, security, or other factors. |

| • | diversion of our management’s attention in the acquisition and integration process, including oversight over acquired businesses which continue their operations under contingent consideration provisions in acquisition agreements; |

| • | declining employee morale and retention issues resulting from changes in compensation, or changes in management, reporting relationships, or future performance; |

| • | the need to integrate the operations, systems, technologies, products, and personnel of each acquired company, the inefficiencies and lack of control that may result if such integration is delayed or not implemented, and unforeseen difficulties and expenditures that may arise in connection with integration; |

| • | the need to implement internal controls, procedures, and policies appropriate for a larger, U.S.-based public company at companies that prior to acquisition may not have as robust controls, procedures, and policies, in particular, with respect to the effectiveness of internal controls, cyber and information security practices and incident response plans, compliance with privacy and other regulations protecting the rights of clients and users, and compliance with U.S.-based economic policies and sanctions which may not have previously been applicable to the acquired company’s operations; |

| • | the difficulty in accurately forecasting and accounting for the financial impact of an acquisition transaction, including accounting charges, write-offs of deferred revenue under purchase accounting, and integrating and reporting results for acquired companies that have not historically followed generally accepted accounting principles in the United States (GAAP); |

| • | the implementation of restructuring actions and cost reduction initiatives to streamline operations and improve cost efficiencies; |

| • | the fact that we may be required to pay contingent consideration in excess of the initial fair value, and contingent consideration may become payable at a time when we do not have sufficient cash available to pay such consideration; |

| • | in the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political, and regulatory risks associated with specific countries as well as tax risks that may arise from the acquisition; |

| • | increasing legal, regulatory, and compliance exposure, and the additional costs related to mitigate each of those, as a result of adding new offices, employees and other service providers, benefit plans, equity, job types, and lines of business globally; and |

| • | liability for activities of the acquired company before the acquisition, including intellectual property, commercial, and other litigation claims or disputes, cyber and information security vulnerabilities, violations of laws, rules and regulations, including with respect to employee classification, tax liabilities, and other known and unknown liabilities. |

| • | recruiting and retaining talented and capable management and employees in foreign countries; |

| • | the diversion of senior management attention; |

| • | challenges caused by distance, language, and cultural differences; |

| • | developing and customizing Software Platform and Apps that appeal to the tastes and preferences of users in international markets; |

| • | the inability to offer certain Software Platform or Apps in certain foreign countries; |

| • | competition from local mobile app developers with intellectual property rights and significant market share in those markets and with a better understanding of user preferences; |

| • | utilizing, protecting, defending, and enforcing our intellectual property rights; |

| • | negotiating agreements with local distribution platforms that are sufficiently economically beneficial to us and protective of our rights; |

| • | the inability to extend proprietary rights in our brand, content, or technology into new jurisdictions; |

| • | implementing alternative payment methods for features and virtual goods in a manner that complies with local laws and practices and protects us from fraud; |

| • | compliance with applicable foreign laws and regulations, including anti-bribery laws, privacy laws, and laws relating to content and consumer protection (for example, the United Kingdom’s Office of Fair Trading’s 2014 principles relating to IAPs in free-to-play |

| • | credit risk and higher levels of payment fraud; |

| • | currency exchange rate fluctuations; |

| • | protectionist laws and business practices that favor local businesses in certain countries; |

| • | double taxation of our international earnings and potentially adverse tax consequences due to changes in the tax laws in the United States or the foreign jurisdictions in which we operate; |

| • | political, economic, and social instability; |

| • | public health crises, such as the COVID-19 pandemic, which can result in varying impacts to our employees, clients, users, advertisers, app developers, and business partners internationally; |

| • | higher costs associated with doing business internationally, including costs related to local advisors; |

| • | export or import regulations; and |

| • | trade and tariff restrictions. |

| • | make it difficult for us to pay other obligations; |

| • | increase our cost of borrowing; |

| • | make it difficult to obtain favorable terms for any necessary future financing for working capital, capital expenditures, strategic acquisitions and partnerships, debt service requirements, or other purposes; |

| • | restrict us from making strategic acquisitions and partnerships or cause us to make divestitures or similar transactions; |

| • | adversely affect our liquidity and result in a material adverse effect on our financial condition upon repayment of the indebtedness; |

| • | require us to dedicate a substantial portion of our cash flow from operations to service and repay the indebtedness, reducing the amount of cash flow available for other purposes; |

| • | increase our vulnerability to adverse and economic conditions; |

| • | increase our exposure to interest rate risk from variable rate indebtedness; |

| • | place us at a competitive disadvantage compared to our less leveraged competitors; and |

| • | limit our flexibility in planning for and reacting to changes in our business. |

| • | the requirement that a majority of its board of directors consist of independent directors; |

| • | the requirement that we have a nominating/corporate governance committee that is comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | the requirement that we have a compensation committee that is comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | the requirement for an annual performance evaluation of the nominating and corporate governance and compensation committees. |

| • | price and volume fluctuations in the overall stock market from time to time, including fluctuations due to general economic uncertainty or negative market sentiment, in particular related to the COVID-19 pandemic; |

| • | volatility in the market and trading volumes of technology stocks; |

| • | changes in operating performance and stock market valuations of other technology companies generally, or those in our industry in particular; |

| • | sales of shares of our Class A common stock by us or our stockholders; |

| • | rumors and market speculation involving us or other companies in our industry; |

| • | failure of securities analysts to maintain coverage of us, changes in financial estimates by securities analysts who follow our company, or our failure to meet these estimates or the expectations of investors; |

| • | actual or perceived significant data breaches involving our Software Platform or Apps; |

| • | the financial or non-financial metric projections we may provide to the public, any changes in those projections or our failure to meet those projections; |

| • | third-party data published about us or other mobile gaming companies, whether or not such data accurately reflects actual levels of usage; |

| • | announcements by us or our competitors of new products or services; |

| • | the public’s reaction to our press releases, other public announcements, and filings with the SEC; |

| • | fluctuations in the trading volume of shares of our Class A common stock or the size of our public float; |

| • | short selling of our Class A common stock or related derivative securities; |

| • | actual or anticipated changes or fluctuations in our results of operations; |

| • | actual or anticipated developments in our business, our competitors’ businesses, or the competitive landscape generally; |

| • | our issuance of shares of our Class A common stock; |

| • | litigation or regulatory action involving us, our industry or both, or investigations by regulators into our operations or those of our competitors; |

| • | developments or disputes concerning our intellectual property or other proprietary rights; |

| • | announced or completed acquisitions of businesses or technologies by us or our competitors; |

| • | new laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

| • | changes in accounting standards, policies, guidelines, interpretations, or principles; |

| • | major catastrophic events in our domestic and foreign markets; |

| • | any significant change in our management; and |

| • | general economic conditions and slow or negative growth of our markets. |

| • | our multi-class common stock structure and the Voting Agreement, which provide the Class B Stockholders with the ability to determine or significantly influence the outcome of matters requiring stockholder approval, even if they own significantly less than a majority of the shares of our outstanding common stock; |

| • | vacancies on our board of directors may be filled only by our board of directors and not by stockholders; |

| • | a special meeting of our stockholders may only be called by a majority of our board of directors, the chairperson of our board of directors, our Chief Executive Officer, or our President; |

| • | advance notice procedures apply for stockholders to nominate candidates for election as directors or to bring matters before an annual meeting of stockholders; |

| • | our amended and restated certificate of incorporation does not provide for cumulative voting; |

| • | our amended and restated certificate of incorporation authorizes undesignated preferred stock, the terms of which may be established and shares of which may be issued by our board of directors, without further action by our stockholders; |

| • | after the first date on which the outstanding shares of our Class B common stock represent less than a majority of the total combined voting power of our Class A common stock and our Class B common stock (the Voting Threshold Date), our stockholders will only be able to take action at a meeting of stockholders and will not be able to take action by written consent for any matter; and |

| • | certain litigation against us may only be brought in Delaware. |

| • | our future financial performance, including our expectations regarding our revenue, cost of revenue, and operating expenses, and our ability to achieve or maintain future profitability; |

| • | the sufficiency of our cash and cash equivalents to meet our liquidity needs; |

| • | the demand for our Software Platform and Apps; |

| • | our ability to attract and retain business clients and users; |

| • | our ability to develop new products, features, and enhancements for our Core Technologies and Software Platform and to launch or acquire new Apps and successfully monetize them; |

| • | our ability to compete with existing and new competitors in existing and new markets and offerings; |

| • | our ability to successfully acquire and integrate companies and assets and to expand and diversify our operations through strategic acquisitions and partnerships; |

| • | our ability to maintain the security and availability of our Core Technologies, Software Platform, and Apps; |

| • | our expectations regarding the effects of existing and developing laws and regulations, including with respect to taxation and privacy and data protection; |

| • | our ability to manage risk associated with our business; |

| • | our expectations regarding new and evolving markets; |

| • | our ability to develop and protect our brand; |

| • | our expectations and management of future growth; |

| • | our expectations concerning relationships with third parties; |

| • | our ability to attract and retain employees and key personnel; |

| • | our integration plans and expected timing for the closing of the MoPub transaction; |

| • | our ability to maintain, protect and enhance our intellectual property; and |

| • | the increased expenses associated with being a public company. |

| • | App Annie, The State of Mobile 2019; |

| • | App Annie, The State of Mobile 2020; |

| • | eMarketer, Average US Time Spent with Mobile in 2019 Has Increased, June 2019; |

| • | International Data Corporation, Worldwide Mobile In-Game Advertising Forecast, 2020-2024, December 2020; |

| • | International Data Corporation, Worldwide Mobile and Handheld Gaming Forecast, 2020–2024, March 2020; |

| • | Sensor Tower, The Top 1% of App Publishers Generate 80% of All New App Installs, November 2019; |

| • | Statista, Number of apps available in leading app stores as of 3rd quarter 2020; and |

| • | Statista, Number of available apps in the Apple App Store from 2008 to 2020. |

As of September 30, 2021 | ||||

| (in thousands, except for share and per share data) | ||||

Cash and cash equivalents | $ | 1,049,617 | ||

Long-term debt | $ | 1,749,330 | ||

Stockholders’ equity (deficit): | ||||

Preferred stock, par value $0.00003 per share: 100,000,000 shares authorized, no shares issued and outstanding | — | |||

| Class A common stock, par value $0.00003 per share: 1,500,000,000 shares authorized, 225,833,513 shares issued and outstanding | 7 | |||

Class B common stock, par value $0.00003 per share: 200,000,000 shares authorized, 147,807,622 shares issued and outstanding | 4 | |||

Class C common stock, par value $0.00003 per share: 150,000,000 shares authorized, no shares issued and outstanding | — | |||

Additional paid-in capital | 3,084,928 | |||

Accumulated other comprehensive loss | (27,560 | ) | ||

Accumulated deficit | (1,008,320 | ) | ||

Total stockholders’ equity (deficit) | 2,049,059 | |||

Total capitalization | $ | 3,798,389 | ||

| • | 16,689,042 shares of our Class A common stock issuable upon the exercise of options to purchase shares of our Class A common stock outstanding as of September 30, 2021, with a weighted-average exercise price of $6.55 per share; |

| • | 195,000 shares of our Class A common stock issuable upon the exercise of a warrant to purchase Class A common stock outstanding as of September 30, 2021, with an exercise price of $26.67 per share; |

| • | 7,222,536 shares of our Class A common stock issuable upon the vesting and settlement of RSUs outstanding as of September 30, 2021; |

| • | 324,156 shares of our Class A common stock issued upon conversion of a convertible security in October 2021; and |

| • | 44,994,361 shares of our Class A common stock reserved for future issuance under our equity compensation plans as of September 30, 2021, consisting of: |

| • | 37,163,984 shares of our Class A common stock reserved for future issuance under our 2021 Plan; |

| • | 30,377 shares of our Class A common stock reserved for future issuance under our 2021 Partner Plan; and |

| • | 7,800,000 shares of our Class A common stock reserved for future issuance under our ESPP. |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except for share and per share amounts) | ||||||||||||||||||||

Revenue | $ | 483,363 | $ | 994,104 | $ | 1,451,086 | $ | 941,249 | $ | 1,999,634 | ||||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of revenue (1)(2) | 53,758 | 241,274 | 555,578 | 357,564 | 722,966 | |||||||||||||||

Sales and marketing (1)(2) | 166,799 | 481,781 | 627,796 | 417,000 | 816,200 | |||||||||||||||

Research and development (1) | 16,270 | 44,966 | 180,652 | 99,950 | 246,861 | |||||||||||||||

General and administrative (1) | 14,854 | 31,712 | 66,431 | 41,256 | 122,116 | |||||||||||||||

Lease modification and abandonment of leasehold improvements | — | — | 7,851 | 7,851 | — | |||||||||||||||

Extinguishments of acquisition-related contingent consideration | (10,763 | ) | — | 74,820 | 74,712 | — | ||||||||||||||

Total cost and expenses | 240,918 | 799,733 | 1,513,128 | 998,333 | 1,908,143 | |||||||||||||||

Income (loss) from operations | 242,445 | 194,371 | (62,042 | ) | (57,084 | ) | 91,491 | |||||||||||||

Other income (expense): | ||||||||||||||||||||

Interest expense and loss on settlement of debt | (484,644 | ) | (73,955 | ) | (77,873 | ) | (57,548 | ) | (72,796 | ) | ||||||||||

Other income (expense), net | 1,940 | 5,818 | 4,209 | 5,347 | (997 | ) | ||||||||||||||

Total other expense | (482,704 | ) | (68,137 | ) | (73,664 | ) | (52,201 | ) | (73,793 | ) | ||||||||||

Income (loss) before income taxes | (240,259 | ) | 126,234 | (135,706 | ) | (109,285 | ) | 17,698 | ||||||||||||

Provision for (benefit from) for income taxes | 19,736 | 7,194 | (9,772 | ) | (2,324 | ) | 13,767 | |||||||||||||

Net income (loss) | (259,995 | ) | 119,040 | (125,934 | ) | (106,961 | ) | 3,931 | ||||||||||||

Net loss attributable to noncontrolling interest | — | — | 747 | 546 | 149 | |||||||||||||||

Net income (loss) attributable to AppLovin shareholders | $ | (259,995 | ) | $ | 119,040 | $ | (125,187 | ) | $ | (106,415 | ) | $ | 4,080 | |||||||

Less: Income attributable to participating securities | — | (42,664 | ) | — | — | (568 | ) | |||||||||||||

Net income (loss) attributable to common stock—Basic | $ | (259,995 | ) | $ | 76,376 | $ | (125,187 | ) | $ | (106,415 | ) | $ | 3,512 | |||||||

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except for share and per share amounts) | ||||||||||||||||||||

Net income (loss) attributable to common stock—Diluted | $ | (259,995 | ) | $ | 76,561 | $ | (125,187 | ) | $ | (106,415) | $ | 3,539 | ||||||||

Net income (loss) per share attributable to common stockholders: (3) | ||||||||||||||||||||

Basic | $ | (1.37 | ) | $ | 0.36 | $ | (0.58 | ) | $ | (0.50) | $ | 0.01 | ||||||||

Diluted | $ | (1.37 | ) | $ | 0.36 | $ | (0.58 | ) | $ | (0.50) | $ | 0.01 | ||||||||

Weighted average common shares used to compute net income (loss) per share attributable to common stockholders: (3) | ||||||||||||||||||||

Basic | 189,533,630 | 210,937,147 | 214,936,545 | 212,998,263 | 309,353,304 | |||||||||||||||

Diluted | 189,533,630 | 212,365,429 | 214,936,545 | 212,998,263 | 327,426,792 | |||||||||||||||

| (1) | Includes stock-based compensation expense as follows: |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Cost of revenue | $ | 517 | $ | 124 | $ | 982 | $ | 204 | $ | 1,504 | ||||||||||

Sales and marketing | 2,582 | 1,922 | 10,668 | 2,812 | 8,814 | |||||||||||||||

Research and development | 1,009 | 5,009 | 36,852 | 10,692 | 40,148 | |||||||||||||||

General and administrative | 1,357 | 3,167 | 13,885 | 5,654 | 41,362 | |||||||||||||||

Total stock-based compensation | $ | 5,465 | $ | 10,222 | $ | 62,387 | $ | 19,362 | $ | 91,828 | ||||||||||

| (2) | Includes amortization expense related to acquired intangibles as follows: |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Cost of revenue | $ | 7,932 | $ | 74,787 | $ | 228,339 | $ | 137,673 | $ | 273,444 | ||||||||||

Sales and marketing | 495 | 7,641 | 11,587 | 8,470 | 16,008 | |||||||||||||||

Total amortization expense related to acquired intangibles | $ | 8,427 | $ | 82,428 | $ | 239,926 | $ | 146,143 | $ | 289,452 | ||||||||||

| (3) | See Note 2 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to compute the historical net income (loss) per share and the number of shares used in the computation of the per share amounts. |

December 31, | September 30, | |||||||||||

2019 | 2020 | 2021 | ||||||||||

| (in thousands) | ||||||||||||

Cash and cash equivalents | $ | 396,247 | $ | 317,235 | $ | 1,049,617 | ||||||

Working capital (1) | 347,346 | 64,942 | 1,056,597 | |||||||||

Total assets | 1,202,485 | 2,154,593 | 4,567,760 | |||||||||

Total debt | 1,180,584 | 1,599,200 | 1,749,330 | |||||||||

Convertible preferred stock | 399,589 | 399,589 | — | |||||||||

Accumulated deficit | (887,213 | ) | (1,012,400 | ) | (1,008,320 | ) | ||||||

Total stockholders’ equity (deficit) | (256,567 | ) | (158,545 | ) | 2,049,059 | |||||||

| (1) | Working capital is defined as current assets less current liabilities. |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

Net income (loss) | $ | (259,995 | ) | $ | 119,040 | $ | (125,934 | ) | $ | (106,961 | ) | $ | 3,931 | |||||||

Adjusted EBITDA | $ | 255,618 | $ | 301,197 | $ | 345,495 | 207,594 | 505,490 | ||||||||||||

Net income (loss) margin | (53.8 | )% | 12.0 | % | (8.7 | )% | (11.4 | )% | 0.2 | % | ||||||||||

Adjusted EBITDA margin | 52.9 | % | 30.3 | % | 23.8 | % | 22.1 | % | 25.3 | % | ||||||||||

| • | 2011: |

| • | 2012: |

| • | 2014: |

| • | 2017: |

| • | 2018: |

| • | 2018: in-app bidding platform, which improves monetization on apps. |

| • | 2019: |

| • | 2020: mid-core genre through the acquisition of Machine Zone. |

| • | 2020: |

| • | 2021: |

| • | 2021: |

| 2 | We measure Net Dollar-Based Retention Rate for the twelve months ended September 30, 2021 for our Enterprise Clients as current period revenue divided by prior period revenue. Prior period revenue is measured as revenue for the twelve months ended September 30, 2020 from our Enterprise Clients as of September 30, 2020. Current period revenue is revenue for the twelve months ended September 30, 2021 from our Enterprise Clients as of September 30, 2021, and excludes revenue from any new Enterprise Clients during the twelve months ended September 30, 2021. |

| 3 | We measure Net Dollar-Based Retention Rate for the three months ended September 30, 2021 for our Software Platform Enterprise Clients as current period revenue divided by prior period revenue. Prior period revenue is measured as revenue for the three months ended September 30, 2020 from our Software Platform Enterprise Clients as of September 30, 2020. Current period revenue is revenue for the three months ended September 30, 2021 from Software Platform Enterprise Clients as of September 30, 2020. |

Year Ended December 31, | Twelve Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

Enterprise Clients | 192 | 167 | 172 | 156 | 325 | |||||||||||||||

Revenue Per Enterprise Client (in thousands) | $ | 2,184 | $ | 3,515 | $ | 4,081 | $ | 3,931 | $ | 3,435 | ||||||||||

Three Months Ended | ||||||||||||||||||||

December 31, | September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

SPEC | 152 | 133 | 158 | 111 | 449 | |||||||||||||||

Revenue per SPEC (in thousands) | $ | 431 | $ | 338 | $ | 500 | $ | 360 | $ | 398 | ||||||||||

Year Ended December 31, | Three Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

Total Software Transaction Value | $ | 283,423 | $ | 281,079 | $ | 295,697 | $ | 62,283 | $ | 275,619 | ||||||||||

Year Ended December 31, | Three Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

Monthly Active Payers (millions) | 0.3 | 1.0 | 1.5 | 1.5 | 2.9 | |||||||||||||||

Average Revenue Per Monthly Active Payer | $ | 11 | $ | 32 | $ | 41 | $ | 46 | $ | 44 | ||||||||||

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

Net income (loss) | $ | (259,995 | ) | $ | 119,040 | $ | (125,934 | ) | $ | (106,961 | ) | $ | 3,931 | |||||||

Adjusted as follows: | ||||||||||||||||||||

Interest expense and loss on settlement of debt | 484,644 | 73,955 | 77,873 | 57,548 | 72,796 | |||||||||||||||

Other (income) expense, net (1) | (1,940 | ) | (5,818 | ) | (6,183 | ) | (6,181 | ) | (6,852 | ) | ||||||||||

Provision for (benefit from) income taxes | 19,736 | 7,194 | (9,772 | ) | (2,324 | ) | 13,767 | |||||||||||||

Amortization, depreciation and write-offs | 16,061 | 92,806 | 254,951 | 157,223 | 315,409 | |||||||||||||||

Non-operating foreign exchange (gains) losses | — | — | 1,210 | 731 | (1,510 | ) | ||||||||||||||

| (1) | The nine months ended September 30, 2021 excludes recurring operational foreign exchange gains and losses and write-off of an investment that is included in amortization, depreciation and write-offs line item above. |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

Stock-based compensation (2) | 5,465 | 10,222 | 62,387 | 19,362 | 94,119 | |||||||||||||||

Acquisition-related expense and transaction bonus | 2,410 | 3,798 | 7,850 | 5,633 | 14,060 | |||||||||||||||

Loss (gain) on extinguishments of acquisition related contingent consideration | (10,763 | ) | — | 74,820 | 74,712 | — | ||||||||||||||

Change in the fair value of contingent consideration | — | — | 442 | — | (230 | ) | ||||||||||||||

Lease modification and abandonment of leasehold improvements | — | — | 7,851 | 7,851 | — | |||||||||||||||

Adjusted EBITDA | $ | 255,618 | $ | 301,197 | $ | 345,495 | $ | 207,594 | $ | 505,490 | ||||||||||

Net income (loss) margin | (53.8 | )% | 12.0 | % | (8.7 | )% | (11.4 | )% | 0.2 | % | ||||||||||

Adjusted EBITDA margin | 52.9 | % | 30.3 | % | 23.8 | % | 22.1 | % | 25.3 | % | ||||||||||

| (2) | The nine months ended September 30, 2021 includes $2.3 million of bonus compensation settled in stock outside of the scope of ASC 718. |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Revenue | $ | 483,363 | $ | 994,104 | $ | 1,451,086 | $ | 941,249 | $ | 1,999,634 | ||||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of revenue (1)(2) | 53,758 | 241,274 | 555,578 | 357,564 | 722,966 | |||||||||||||||

Sales and marketing (1)(2) | 166,799 | 481,781 | 627,796 | 417,000 | 816,200 | |||||||||||||||

Research and development (1) | 16,270 | 44,966 | 180,652 | 99,950 | 246,861 | |||||||||||||||

General and administrative (1) | 14,854 | 31,712 | 66,431 | 41,256 | 122,116 | |||||||||||||||

Extinguishments of acquisition-related contingent consideration | (10,763 | ) | — | 74,820 | 74,713 | — | ||||||||||||||

Lease modification and abandonment of leasehold improvements | 0 | 0 | 7,851 | 7,851 | — | |||||||||||||||

Total costs and expenses | 240,918 | 799,733 | 1,513,128 | 998,333 | 1,908,143 | |||||||||||||||

Income (loss) from operations | 242,445 | 194,371 | (62,042 | ) | (57,084 | ) | 91,491 | |||||||||||||

Other income (expense): | ||||||||||||||||||||

Interest expense and loss on settlement of debt | (484,644 | ) | (73,955 | ) | (77,873 | ) | (57,548 | ) | (72,796 | ) | ||||||||||

Other income (expense), net | 1,940 | 5,818 | 4,209 | 5,347 | (997 | ) | ||||||||||||||

Total other expense | (482,704 | ) | (68,137 | ) | (73,664 | ) | (52,201 | ) | (73,793 | ) | ||||||||||

Income (loss) before income taxes | (240,259 | ) | 126,234 | (135,706 | ) | (109,285 | ) | 17,698 | ||||||||||||

Provision for (benefit from) income taxes | 19,736 | 7,194 | (9,772 | ) | (2,324 | ) | 13,767 | |||||||||||||

Net income (loss) | $ | (259,995 | ) | $ | 119,040 | $ | (125,934 | ) | $ | (106,961 | ) | $ | 3,931 | |||||||

| (1) | Includes stock-based compensation expense as follows: |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Cost of revenue | $ | 517 | $ | 124 | $ | 982 | $ | 204 | $ | 1,504 | ||||||||||

Sales and marketing | 2,582 | 1,922 | 10,668 | 2,812 | 8,814 | |||||||||||||||

Research and development | 1,009 | 5,009 | 36,852 | 10,692 | 40,148 | |||||||||||||||

General and administrative | 1,357 | 3,167 | 13,885 | 5,654 | 41,362 | |||||||||||||||

Total stock-based compensation | $ | 5,465 | $ | 10,222 | $ | 62,387 | $ | 19,362 | $ | 91,828 | ||||||||||

| (2) | Includes amortization expense related to acquired intangibles as follows: |

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Cost of revenue | $ | 7,932 | $ | 74,787 | $ | 228,339 | $ | 137,673 | $ | 273,444 | ||||||||||

Sales and marketing | 495 | 7,641 | 11,587 | 8,470 | 16,008 | |||||||||||||||

Total amortization expense related to acquired intangibles | $ | 8,427 | $ | 82,428 | $ | 239,926 | $ | 146,143 | $ | 289,452 | ||||||||||

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | ||||||||||||||||

Revenue | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of revenue | 11 | % | 24 | % | 38 | % | 38 | % | 36 | % | ||||||||||

Sales and marketing | 35 | % | 48 | % | 43 | % | 44 | % | 41 | % | ||||||||||

Research and development | 3 | % | 5 | % | 12 | % | 11 | % | 12 | % | ||||||||||

General and administrative | 3 | % | 3 | % | 5 | % | 4 | % | 6 | % | ||||||||||

Extinguishments of acquisition-related contingent consideration | (2 | )% | — | % | 5 | % | 8 | % | — | % | ||||||||||

Lease modification and abandonment of leasehold improvements | — | % | — | % | 1 | % | 1 | % | — | % | ||||||||||

Total costs and expenses | 50 | % | 80 | % | 104 | % | 106 | % | 95 | % | ||||||||||

Income (loss) from operations | 50 | % | 20 | % | (4 | )% | (6 | )% | 5 | % | ||||||||||

Other income (expense): | ||||||||||||||||||||

Interest expense and loss on settlement of debt | (100 | )% | (7 | )% | (5 | )% | (6 | )% | (4 | )% | ||||||||||

Other income (expense), net | 0 | % | 1 | % | 0 | % | 1 | % | — | % | ||||||||||

Total other expense | (100 | )% | (7 | )% | (5 | )% | (6 | )% | (4 | )% | ||||||||||

Income (loss) before income taxes | (50 | )% | 13 | % | (9 | )% | (12 | )% | 1 | % | ||||||||||

Provision for (benefit from) income taxes | 4 | % | 1 | % | (1 | )% | 0 | % | 1 | % | ||||||||||

Net income (loss) | (54 | )% | 12 | % | (9 | )% | (11 | )% | 0 | % | ||||||||||

| (1) | Totals of percentages of revenue may not foot due to rounding. |

Nine Months Ended September 30, | 2020 to 2021 % change | |||||||||||

2020 | 2021 | |||||||||||

Business Revenue—Apps | $ | 327,915 | $ | 475,394 | 45 | % | ||||||

Business Revenue—Software Platform | 127,262 | 427,390 | 236 | % | ||||||||

Total Business Revenue | 455,177 | 902,784 | 98 | % | ||||||||

Consumer Revenue | 486,072 | 1,096,850 | 126 | % | ||||||||

Total Revenue | $ | 941,249 | $ | 1,999,634 | 112 | % | ||||||

Nine Months Ended September 30, | 2020 to 2021 % Change | |||||||||||

2020 | 2021 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Cost of revenue | $ | 357,564 | $ | 722,966 | 102 | % | ||||||

Percentage of revenue | 38 | % | 36 | % | ||||||||

Nine Months Ended September 30, | 2020 to 2021 % Change | |||||||||||

2020 | 2021 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Sales and marketing | $ | 417,000 | $ | 816,200 | 96 | % | ||||||

Percentage of revenue | 44 | % | 41 | % | ||||||||

Nine Months Ended September 30, | 2020 to 2021 % Change | |||||||||||

2020 | 2021 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Research and development | $ | 99,950 | $ | 246,861 | 147 | % | ||||||

Percentage of revenue | 11 | % | 12 | % | ||||||||

Nine Months Ended September 30, | 2020 to 2021 % Change | |||||||||||

2020 | 2021 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

General and administrative | $ | 41,256 | $ | 122,116 | 196 | % | ||||||

Percentage of revenue | 4 | % | 6 | % | ||||||||

Nine Months Ended September 30, | 2020 to 2021 % Change | |||||||||||

2020 | 2021 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Interest expense and loss on settlement of debt | $ | (57,548 | ) | $ | (72,796 | ) | 26 | % | ||||

Percentage of revenue | (6 | )% | (4 | )% | ||||||||

Nine Months Ended September 30, | 2020 to 2021 % Change | |||||||||||

2020 | 2021 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Other income (expense), net | $ | 5,347 | $ | (997 | ) | (119 | )% | |||||

Percentage of revenue | 1 | % | (0 | )% | ||||||||

Nine Months Ended September 30, | 2020 to 2021 % Change | |||||||||||

2020 | 2021 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Provision for (benefit from) income taxes | $ | (2,324 | ) | $ | 13,767 | (692 | )% | |||||

Percentage of revenue | (0 | )% | 1 | % | ||||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Business Revenue—Apps | $ | 397,643 | $ | 503,867 | 27 | % | ||||||

Business Revenue—Software Platform | 198,305 | 207,285 | 5 | % | ||||||||

Total Business Revenue | $ | 595,948 | $ | 711,152 | 19 | % | ||||||

Consumer Revenue | 398,156 | 739,934 | 86 | % | ||||||||

Total Revenue | $ | 994,104 | $ | 1,451,086 | 46 | % | ||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Cost of revenue | $ | 241,274 | $ | 555,578 | 130 | % | ||||||

Percentage of revenue | 24 | % | 38 | % | ||||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Sales and marketing | $ | 481,781 | $ | 627,796 | 30 | % | ||||||

Percentage of revenue | 48 | % | 43 | % | ||||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Research and development | $ | 44,966 | $ | 180,652 | 302 | % | ||||||

Percentage of revenue | 5 | % | 12 | % | ||||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

General and administrative | $ | 31,712 | $ | 66,431 | 109 | % | ||||||

Percentage of revenue | 3 | % | 5 | % | ||||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Interest expense | $ | (73,955 | ) | $ | (77,873 | ) | 5 | % | ||||

Percentage of revenue | (7 | )% | (5 | )% | ||||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Other income (expense), net | $ | 5,818 | $ | 4,209 | (28 | )% | ||||||

Percentage of revenue | 1 | % | 0 | % | ||||||||

Year Ended December 31, | 2019 to 2020 % Change | |||||||||||

2019 | 2020 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Provision for (benefit from) income taxes | $ | 7,194 | $ | (9,772 | ) | (236 | )% | |||||

Percentage of revenue | 1 | % | (1 | )% | ||||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Business Revenue—Apps | $ | 166,259 | $ | 397,643 | 139 | % | ||||||

Business Revenue—Software Platform | 262,997 | 198,305 | (25 | )% | ||||||||

Total Business Revenue | 429,256 | 595,948 | 39 | % | ||||||||

Consumer Revenue | 54,107 | 398,156 | 636 | % | ||||||||

Total Revenue | $ | 483,363 | $ | 994,104 | 106 | % | ||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Cost of revenue | $ | 53,758 | $ | 241,274 | 349 | % | ||||||

Percentage of revenue | 11 | % | 24 | % | ||||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Sales and marketing | $ | 166,799 | $ | 481,781 | 189 | % | ||||||

Percentage of revenue | 35 | % | 48 | % | ||||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Research and development | $ | 16,270 | $ | 44,966 | 176 | % | ||||||

Percentage of revenue | 3 | % | 5 | % | ||||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

General and administrative | $ | 14,854 | $ | 31,712 | 113 | % | ||||||

Percentage of revenue | 3 | % | 3 | % | ||||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Interest expense and loss on settlement of debt | $ | (484,644 | ) | $ | (73,955 | ) | (85 | )% | ||||

Percentage of revenue | (100 | )% | (7 | )% | ||||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Other income (expense), net | $ | 1,940 | $ | 5,818 | 200 | % | ||||||

Percentage of revenue | 0 | % | 1 | % | ||||||||

Year Ended December 31, | 2018 to 2019 % Change | |||||||||||

2018 | 2019 | |||||||||||

| (in thousands, except percentages) | ||||||||||||

Provision for income taxes | $ | 19,736 | $ | 7,194 | (64 | )% | ||||||

Percentage of revenue | 4 | % | 1 | % | ||||||||

Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

March 31, 2019 | June 30, 2019 | Sept. 30, 2019 | Dec. 31, 2019 | March 31, 2020 | June 30, 2020 | Sept. 30, 2020 | Dec. 31, 2020 | Mar. 31, 2021 | June 30, 2021 | Sept. 30, 2021 | ||||||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||||||||

Revenue | $ | 206,241 | $ | 248,452 | $ | 260,597 | $ | 278,814 | $ | 260,178 | $ | 299,331 | $ | 381,740 | $ | 509,837 | $ | 603,877 | $ | 668,806 | $ | 726,951 | ||||||||||||||||||||||

Costs and expenses: | ||||||||||||||||||||||||||||||||||||||||||||

Cost of revenue (1)(2) | 46,063 | 55,613 | 66,661 | 72,937 | 76,453 | 118,051 | 163,060 | 198,014 | 223,061 | 245,853 | 254,052 | |||||||||||||||||||||||||||||||||

Sales and marketing (1)(2) | 105,330 | 114,282 | 127,869 | 134,300 | 128,667 | 135,319 | 153,014 | 210,796 | 265,513 | 265,463 | 285,224 | |||||||||||||||||||||||||||||||||

Research and development (1) | 6,845 | 10,522 | 12,243 | 15,356 | 19,112 | 29,702 | 51,136 | 80,702 | 60,876 | 77,462 | 108,523 | |||||||||||||||||||||||||||||||||

General and administrative (1) | 7,337 | 6,637 | 6,446 | 11,292 | 10,810 | 15,170 | 15,276 | 25,175 | 42,962 | 45,050 | 34,104 | |||||||||||||||||||||||||||||||||

Lease modification and abandonment of leasehold improvements | — | — | — | — | — | 7,851 | — | — | — | — | — | |||||||||||||||||||||||||||||||||

Extinguishments of acquisition-related contingent consideration | — | — | — | — | — | — | 74,712 | 108 | — | — | — | |||||||||||||||||||||||||||||||||

Total costs and expenses | 165,575 | 187,054 | 213,219 | 233,885 | 235,042 | 306,093 | 457,198 | 514,795 | 592,412 | 633,828 | 681,903 | |||||||||||||||||||||||||||||||||

Income (loss) from operations | 40,666 | 61,398 | 47,378 | 44,929 | 25,136 | (6,762 | ) | (75,458 | ) | (4,958 | ) | 11,465 | 34,978 | 45,048 | ||||||||||||||||||||||||||||||

Other income (expense): | ||||||||||||||||||||||||||||||||||||||||||||

Interest expense and loss on settlement of debt | (14,421 | ) | (19,245 | ) | (20,929 | ) | (19,360 | ) | (18,629 | ) | (18,809 | ) | (20,110 | ) | (20,325 | ) | (35,010 | ) | (19,030 | ) | (18,756 | ) | ||||||||||||||||||||||

Other income (expense), net | 367 | 1,929 | 2,112 | 1,410 | 1,021 | 3,157 | 1,169 | (1,138 | ) | 9,790 | (1,570 | ) | (9,217 | ) | ||||||||||||||||||||||||||||||

Total other expense | (14,054 | ) | (17,316 | ) | (18,817 | ) | (17,950 | ) | (17,608 | ) | (15,652 | ) | (18,941 | ) | (21,463 | ) | (25,220 | ) | (20,600 | ) | (27,973 | ) | ||||||||||||||||||||||

Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

March 31, 2019 | June 30, 2019 | Sept. 30, 2019 | Dec. 31, 2019 | March 31, 2020 | June 30, 2020 | Sept. 30, 2020 | Dec. 31, 2020 | Mar. 31, 2021 | June 30, 2021 | Sept. 30, 2021 | ||||||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||||||||

Income (loss) before income taxes | 26,612 | 44,082 | 28,561 | 26,979 | 7,528 | (22,414 | ) | (94,399 | ) | (26,421 | ) | (13,755 | ) | 14,378 | 17,075 | |||||||||||||||||||||||||||||

Provision for (benefit from) income taxes | 5,092 | 8,602 | 5,553 | (12,053 | ) | 2,864 | (703 | ) | (4,485 | ) | (7,448 | ) | (3,180 | ) | 14 | 16,933 | ||||||||||||||||||||||||||||

Net income (loss) | $ | 21,520 | $ | 35,480 | $ | 23,008 | $ | 39,032 | $ | 4,664 | $ | (21,711 | ) | $ | (89,914 | ) | $ | (18,973 | ) | $ | (10,575 | ) | $ | 14,364 | $ | 142 | ||||||||||||||||||

| (1) | Includes stock-based compensation expense as follows: |

Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

March 31, 2019 | June 30, 2019 | Sept. 30, 2019 | Dec. 31, 2019 | March 31, 2020 | June 30, 2020 | Sept. 30, 2020 | Dec. 31, 2020 | March 31, 2021 | June 30, 2021 | Sept. 30, 2021 | ||||||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||||||||

Cost of revenue | $ | 30 | $ | 30 | $ | 31 | $ | 33 | $ | 29 | $ | 49 | $ | 126 | $ | 778 | $ | 109 | $ | 473 | $ | 922 | ||||||||||||||||||||||

Sales and marketing | 489 | 524 | 533 | 376 | 452 | 789 | 1,571 | 7,856 | 1,819 | 2,221 | 4,774 | |||||||||||||||||||||||||||||||||

Research and development | 1,197 | 1,245 | 1,261 | 1,306 | 1,527 | 2,342 | 6,823 | 26,160 | 6,465 | 13,573 | 20,110 | |||||||||||||||||||||||||||||||||

General and administrative | 832 | 683 | 534 | 1,118 | 1,454 | 1,852 | 2,348 | 8,231 | 21,566 | 10,877 | 8,919 | |||||||||||||||||||||||||||||||||

Total stock-based compensation | $ | 2,548 | $ | 2,482 | $ | 2,359 | $ | 2,833 | $ | 3,462 | $ | 5,032 | $ | 10,868 | $ | 43,025 | $ | 29,959 | $ | 27,144 | $ | 34,725 | ||||||||||||||||||||||

| (2) | Includes amortization expense related to acquired intangibles as follows: |

Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

March 31, 2019 | June 30, 2019 | Sept. 30, 2019 | Dec. 31, 2019 | March 31, 2020 | June 30, 2020 | Sept. 30, 2020 | Dec. 31, 2020 | Mar. 31, 2021 | June 30, 2021 | Sept. 30, 2021 | ||||||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||||||||||

Cost of revenue | $ | 11,573 | $ | 15,495 | $ | 21,538 | $ | 26,181 | $ | 27,576 | $ | 44,562 | $ | 65,535 | $ | 90,666 | $ | 82,185 | $ | 95,200 | $ | 96,059 | ||||||||||||||||||||||

Sales and marketing | — | 2,438 | 2,438 | 2,765 | 2,694 | 2,726 | 3,050 | 3,117 | 3,209 | 6,034 | 6,765 | |||||||||||||||||||||||||||||||||

Total amortization expense related to acquired intangibles | $ | 11,573 | $ | 17,933 | $ | 23,976 | $ | 28,946 | $ | 30,270 | $ | 47,288 | $ | 68,585 | $ | 93,783 | $ | 85,394 | $ | 101,234 | $ | 102,824 | ||||||||||||||||||||||

Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

March 31, 2019 | June 30, 2019 | Sept. 30, 2019 | Dec. 31, 2019 | March 31, 2020 | June 30, 2020 | Sept. 30, 2020 | Dec. 31, 2020 | Mar. 31, 2021 | June 30, 2021 | Sept. 30, 2021 | ||||||||||||||||||||||||||||||||||

Revenue | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||||||||

Costs and expenses: | ||||||||||||||||||||||||||||||||||||||||||||

Cost of revenue | 22 | % | 22 | % | 26 | % | 26 | % | 29 | % | 39 | % | 43 | % | 39 | % | 37 | % | 37 | % | 35 | % | ||||||||||||||||||||||

Sales and marketing | 51 | % | 46 | % | 49 | % | 48 | % | 49 | % | 45 | % | 40 | % | 41 | % | 44 | % | 40 | % | 39 | % | ||||||||||||||||||||||

Research and development | 3 | % | 4 | % | 5 | % | 6 | % | 7 | % | 10 | % | 13 | % | 16 | % | 10 | % | 12 | % | 15 | % | ||||||||||||||||||||||

General and administrative | 4 | % | 3 | % | 2 | % | 4 | % | 4 | % | 5 | % | 4 | % | 5 | % | 7 | % | 7 | % | 5 | % | ||||||||||||||||||||||

Lease modification and abandonment of leasehold improvements | — | % | — | % | — | % | — | % | — | % | 3 | % | — | % | — | % | — | % | — | % | — | % | ||||||||||||||||||||||

Extinguishments of acquisition-related contingent consideration | — | % | — | % | — | % | — | % | — | % | — | % | 20 | % | — | % | — | % | — | % | — | % | ||||||||||||||||||||||

Total costs and expenses | 80 | % | 75 | % | 82 | % | 84 | % | 90 | % | 102 | % | 120 | % | 101 | % | 98 | % | 95 | % | 94 | % | ||||||||||||||||||||||

Income (loss) from operations | 20 | % | 25 | % | 18 | % | 16 | % | 10 | % | (2 | )% | (20 | )% | (1 | )% | 2 | % | 5 | % | 6 | % | ||||||||||||||||||||||

Other income (expense): | ||||||||||||||||||||||||||||||||||||||||||||