Non-GAAP Financial Metrics

To supplement our financial information presented in accordance with generally accepted accounting principles in the United States (“GAAP”), this shareholder letter includes certain financial measures that are not prepared in accordance with GAAP, including Adjusted EBITDA, Segment Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP costs and expenses, and certain measures adjusted for publisher bonuses. A reconciliation of each such non-GAAP financial measure to the most directly comparable GAAP measure can be found below.

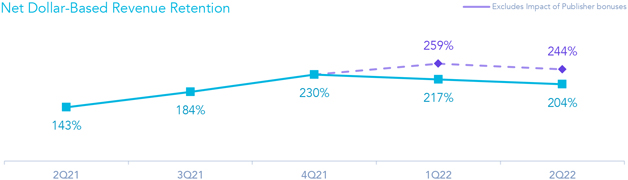

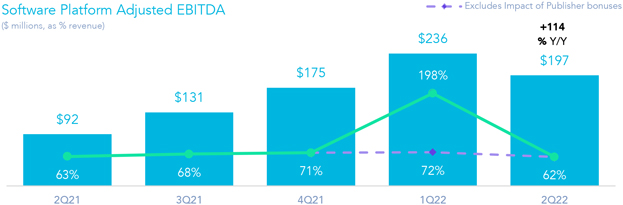

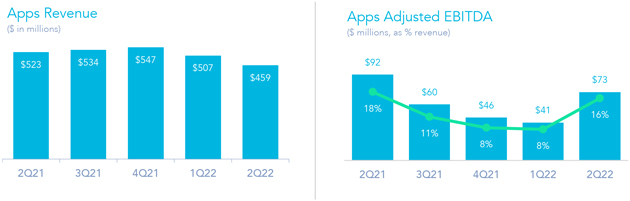

We define Adjusted EBITDA for a particular period as net income (loss) before interest expense and loss on settlement of debt, other (income) expense, net (excluding certain recurring items), provision for (benefit from) income taxes, amortization, depreciation and write-offs and as further adjusted for non-operating foreign exchange (gains) losses, stock-based compensation expense, acquisition-related expense and transaction bonuses, publisher bonuses, MoPub acquisition transition services, restructuring costs, loss (gain) on extinguishments of acquisition-related contingent consideration, lease modification and abandonment of leasehold improvements, and change in the fair value of contingent consideration. We define Adjusted EBITDA margin as Adjusted EBITDA divided by revenue for the same period. We define non-GAAP costs and expenses as total costs and expenses adjusted to exclude stock-based compensation expense, amortization expense related to acquired intangibles and acquisition-related expense and transaction bonuses. Segment Adjusted EBITDA is calculated using the same methodology, but using the revenue and costs attributable to either the Software or the Apps business, respectively.

We believe that the presentation of these non-GAAP financial measures provides useful information to investors regarding our results of operations and operating performance, as they are similar to measures reported by our public competitors and are regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects.

Adjusted EBITDA, Segment Adjusted EBITDA, Adjusted EBITDA margin, and non-GAAP costs and expenses are key measures we use to assess our financial performance and are also used for internal planning and forecasting purposes. We believe Adjusted EBITDA, Segment Adjusted EBITDA, Adjusted EBITDA margin, and non-GAAP costs and expenses are helpful to investors, analysts, and other interested parties because they can assist in providing a more consistent and comparable overview of our operations across our historical financial periods. In addition, these measures are frequently used by analysts, investors, and other interested parties to evaluate and assess performance. We use Adjusted EBITDA, Segment Adjusted EBITDA, Adjusted EBITDA margin, and non-GAAP costs and expenses in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies, and to communicate with our board of directors concerning our financial performance. We believe that the presentation of certain measures adjusted for publisher bonuses are useful in understanding the ongoing results of our operations and for comparability to prior periods. These measures have certain limitations in that they do not include the impact of certain expenses that are reflected in our consolidated statement of operations that are necessary to run our business. Our definitions may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may not publish these or similar metrics. Thus, our non-GAAP financial measures should be considered in addition to, not as substitutes for, or in isolation from, measures prepared in accordance with GAAP.

| | |

| AppLovin Corporation / 2Q 2022 Shareholder Letter | | 9 |