Raleigh MSA

The Raleigh metropolitan statistical area is home to a population of 1.36 million as of 2018, which represents a population growth of 20.5% since 2010 compared to 6.0% nationally over the same time period. As of December 2019, Raleigh is the tenth fastest growing metro in the U.S. The Raleigh MSA has witnessed expansion in recent years and its fundamentals continue to indicate room for further growth in the years to come.

The metro’s educated talent-base, where nearly half the population holds a 4-year degree, and relative affordability compared to other cities has led to and increasing number of companies to relocate to or expand within the metro. These companies continue to provide sizable investments in job creation and the development of infrastructure in Raleigh. Since 2011, Raleigh’s employment growth has consistently outpaced the national average by approximately 1-2% per year. Specifically, tech-based companies have provided the largest gain in the MSAs job growth, contributing 27.4% of total employment growth from 2016 to 2018.

Charleston MSA

The Charleston metropolitan statistical area has a population of 787,600 as of 2018, which has grown 18.5% since 2010 or more than three times the national growth over the same time period. The population is the third youngest in the southeast, where the millennial generation comprises of 26.5% of its inhabitants. This has contributed to strong multi-family absorption that continues to outpace net completions.

As of 2018, Charleston’s unemployment rate was just 3.0% and the number of jobs has increased by 23.1% over the last 8 years. The Port of Charleston drives many manufacturing, logistics, and industrial users to make significant investments in the market. The Port is currently undergoing a $2.4 billion capital improvement and expansion that will increase capacity and support further investment in the market. Several such companies are capitalizing on this by building multi-billion dollar facilities that are slated to add 4,000 high-wage jobs to the metro.

Potential Investments

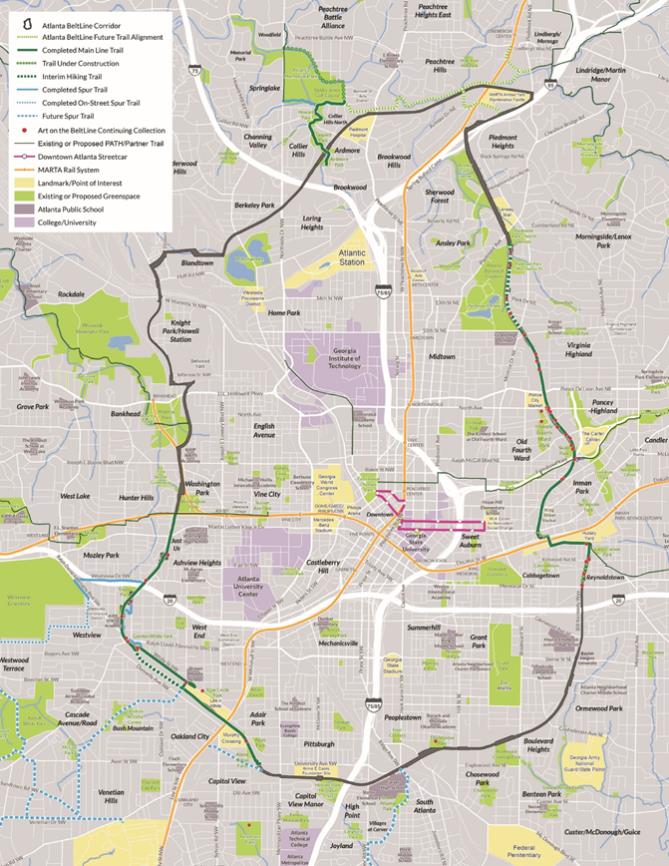

We have identified a potential target acquisition (“Southern Dairies”). Southern Dairies is a 79,960 square foot, five-building creative office campus in Atlanta, Georgia with current occupancy of 93%. Southern Dairies is located on North Avenue in Atlanta’s Old Fourth Ward submarket, across the street from Ponce City Market and the BeltLine Eastside Trail and near Atlanta landmarks such as Piedmont Park and, Inman Park. Southern Dairies is positioned in a location with more than 2,800 Class A multifamily units within 13 communities immediately surrounding the campus.

The property’s place in history: Southern Dairies was originally constructed as a dairy distribution plant and linen manufacturing facility in the 1920s and was converted to creative office in 1998. It is listed on the National Register of Historic Places.

Occupancy details: The campus is leased to 11 tenants offering a diversified rent roll, including architectural firms, psychologists, advertising agencies and real estate firms as of August 2019. The property has averaged a 97% occupancy over the past 10 years, outperforming the broader Midtown Atlanta office market.

Notes on architecture: The property features high exposed ceilings, historic finishes and distinctive architectural details from its Art Deco beginnings, and drawing from its roots as manufacturing space, the buildings offer dynamic floor plates with an abundance of natural light. As such, the property caters to boutique office tenants looking for non-traditional and inspired space that distinguishes itself from surrounding office options and provides key amenities including the BeltLine and neighborhood retail offerings.

We identified Southern Dairies as a target investment for several reasons, including its location, size, property type, and value creation potential. We believe that Jamestown’s history of managing adaptive reuse projects makes it uniquely qualified to drive revenue through upgrades in landscaping, wayfinding, rebranding, and leasing initiatives. The business plan may include renovating suites that become available and re-leasing at market rents, in addition to actively managing the property to maintain market tenancy and boutique feel. We may also explore development opportunities at the site to create further value.

We have further identified four other target acquisitions, 1357 Collier Road, 1483 Chattahoochee Avenue, 1401 Hills Place and 1435 Hills Place (collectively, the “Upper Westside Portfolio”). Consistent with our investment strategy, the Upper Westside Portfolio properties are (i) retail and warehouse/flex, aggregating 223,531 square feet, (ii) located in a submarket of Atlanta, Georgia in the path of anticipated growth, and (iii) within our target purchase price range in aggregate. Atlanta’s Upper Westside submarket has experienced an influx of creative users in recent years, many relocating to the submarket for quality showroom space at a relative value compared to similar space in nearby Buckhead and Peachtree Hills, while remaining proximate to customers and interstate access. The Upper Westside Portfolio is currently 60% occupied. Components of our business plan may be to implement capital improvements and build upon the Upper Westside district brand to attract a diverse set of users to support leasing of the vacancies. We may also evaluate the opportunity to create restaurant space and convert industrial space to creative office.

Southern Dairies and the Upper Westside Portfolio (together, the “Properties”) are presented for information purposes only to demonstrate the types of investments that we will seek to make. The Properties are not current investments of ours and it should not be assumed that we will invest in the Properties, or that we will have the same or similar investment opportunities in the future. There can be no assurance that we will be able to implement our investment strategy or to achieve our investment objectives.

Target Returns

Our investment strategy is focused on equity investments with potential value creation. We anticipate acquisition targets will be smaller than $40,000,000 in gross purchase price, but could be larger or smaller based on investor subscriptions and actual opportunities in the market. We may selectively employ leverage to enhance total returns to our shareholders through a combination of senior financing and other financing transactions. We may enter into joint ventures, including with Jamestown, where venture partners provide additional capital to acquire larger assets.

Our investments are underwritten with the objective of providing over our term a return of 1.4x – 1.6x on our invested capital, after reduction for fees payable to our Manager or its affiliates and taking into account an anticipated 3% - 5% annual stabilized distribution yield. There can be no assurance that such objectives can or will be achieved.

Statements regarding target returns, forecasts and projections that are not historical facts are based on our current expectations, estimates, projections, opinions and beliefs. Such statements involve a number of known and unknown risks, uncertainties and other factors, and rely on a number of economic and financial variables and are inherently speculative. There is no assurance that we will be able to meet these objectives or make annual distributions in any amount or that shareholders will receive a return of their capital. Accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements included herein. Target returns are based on a number of assumptions related to the market factors relevant to the proposed investment strategy, including, but not limited to, interest rates, capitalization rates, supply and demand trends, acquisition and/or disposition activity and the terms and costs of debt financing. While Jamestown believes these assumptions to be reasonable, there can be no guarantee that any of these assumptions will prove to be correct, that we will be successful in implementing our investment strategy, that target returns or annual distribution yields will be realized, or that investors will receive a return of their capital. Investing in our common shares is speculative and involves substantial risks. Important risk factors are set forth in the section entitled “Risk Factors” and should be considered carefully by prospective investors.

Jamestown’s Value Creation Process

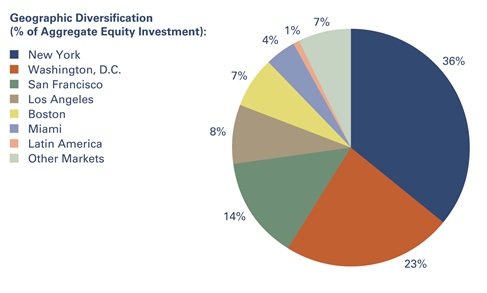

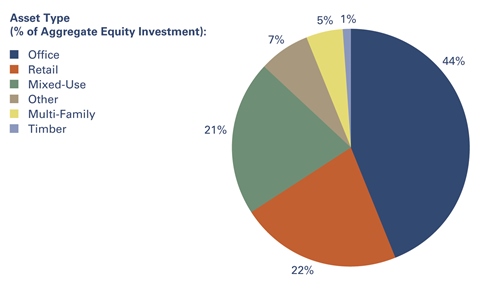

Jamestown strategically focuses on markets that Jamestown believes show strong demographic and economic growth bolstered by the presence of emerging industries such as technology and new media. Each year, the acquisition professionals at Jamestown consider hundreds of investments, ultimately closing on less than 1%. Jamestown’s highly-disciplined, analytical approach to investing has contributed to its strong track record over the company’s35-year history.

The company intends to take advantage of its integrated platform on each acquisition by engaging all company departments in the evaluation of new opportunities. Early in the acquisitions phase, the Asset Management, Retail Leasing, Development & Construction, Sustainability and Creative & Marketing departments will be included in order to fully understand the characteristics of a potential acquisition, exploring site activations and opportunities for property improvements. Jamestown’s capital markets professionals evaluate the existing and proposed capital structure of each investment and work with the Fund Management team to recommend the appropriate capital structure for an investment, taking into account the business plan for each asset. The Capital Markets department maintains international lending relationships to provide access to favorable loan pricing and terms.

Jamestown actively manages its portfolioin-house. The Asset Management department maintains a robust team that stays highly involved with the real estate. Jamestown believes thishands-on management provides many benefits, such as cultivating close tenant relationships and providing tenants with access to expansion or relocation space in multiple markets. For retail assets, these relationships start with the Leasing department, which works to develop a unique sense of place by carefully curating the selection of retailers. Leasing is responsible for creating merchandising plans that maximize each asset’s retail positioning from both landlord and tenant perspectives.

In the effort to capture substantial quality and value in Jamestown’s retail assets through leasing, the Retail Leasing department conducts retail market analysis, advises on leasing economics, and commissions consumer research. The Creative & Marketing department approaches assets from a brand perspective by developing and implementing distinctive property positioning, designing and producing compelling collateral, activating properties through innovative event programming, reconfiguring community spaces, and collaborating with public entities including business improvement districts and neighborhood-focused partnerships. Jamestown believes the end result of this creative and collaborative process is a distinctive and compelling brand for each asset—one that is activated through exceptional programming, while also creating value for each individual property.

Finally, Jamestown manages development and constructionin-house led by development professionals supported by a dedicated team of architects. Jamestown believes this vertical integration ensures that construction is cost-effective and consistent with the property aesthetic and brand. Jamestown believes that Jamestown’s ownership, constant collaboration among the Manager and its affiliate’s Asset Management, Leasing, Creative & Marketing, and Development & Construction departments drives value creation at the property.

Dispositions

Acquisitions are expected to have a five to seven year hold period to allow for investment decisions that lead to long-term NOI growth. However, Jamestown continually evaluates and monitors potential exit opportunities to ensure value optimization and conducts hold/sell analyses based on rigorousre-underwriting, considering the risks and benefits of continued ownership. Strategic asset reviews are supplemented by market intelligence of sales and leasing activity and the depth of buyers to reconcile prevailing market pricing with the fund strategy.

For more information on Jamestown’s track record, please see the “Prior Performance” section.

61