- DOW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Dow (DOW) DEF 14ADefinitive proxy

Filed: 1 Mar 24, 4:02pm

| ☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☐ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of Annual Meeting of Stockholders

Dear Dow Stockholder,

You are invited to attend the 2024 Annual Meeting of Stockholders of Dow Inc. (the “2024 Meeting”) online at www.virtualshareholdermeeting.com/DOW2024.

At the 2024 Meeting, stockholders will vote on the following matters either by proxy or in person at the virtual meeting:

| Election of the Directors named in the Proxy Statement |

| Advisory Resolution to Approve Executive Compensation |

| Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2024 |

| Stockholder Proposals, if properly presented |

| Transaction of any other business as may properly be brought before the 2024 Meeting |

Meeting Date | Record Date | Meeting Time | ||||||||||||||||||||

| Thursday, April 11, 2024 |

| Thursday, February 15, 2024 |

| 8:00 AM Eastern Time |

| ||||||||||||||||

|

|

Virtual Meeting

www.virtualshareholdermeeting.com/DOW2024 | ||||||||||||||||||||

HOW TO VOTE IN ADVANCE OF THE 2024 MEETING

Your vote is important. We encourage you to vote in advance, even if you plan to attend the 2024 Meeting online. To vote online or by phone, you will need to use your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form. The independent tabulator must receive any proxy that will not be delivered electronically at the 2024 Meeting by 11:59 PM Eastern Time on April 10, 2024.

|

|

www.proxyvote.com

| ||||||

|

1-800-690-6903 or the number provided on your voting instructions

| |||||||

| Use the postage-paid envelope provided if you received printed proxy materials | |||||||

The Board of Directors of Dow Inc. (the “Board”) has set the close of business on February 15, 2024, as the record date for determining stockholders who are entitled to receive notice of and to vote at the 2024 Meeting and any adjournment or postponement thereof.

As permitted by the SEC rules, proxy materials were made available via the internet. Notice regarding availability of proxy materials and instructions on how to access those materials were mailed to certain stockholders of record on or about March 1, 2024 (the “Notice of Internet Availability of Proxy Materials”). The Notice of Internet Availability of Proxy Materials included instructions on how to vote and how to request a paper copy of the proxy materials. This method of notice and access gives the Company a low-cost way to furnish stockholders with their proxy materials. If you previously chose to receive proxy materials electronically, you will continue to receive access to these materials via email unless you elect otherwise.

| 2024 | Dow Proxy Statement | i |

HOW TO ATTEND THE 2024 MEETING

You are invited to attend the 2024 Meeting online at www.virtualshareholdermeeting.com/DOW2024.

Dow is pleased to use the virtual meeting format to facilitate stockholder attendance, voting and questions by leveraging technology to communicate more effectively and efficiently with our stockholders. This format allows stockholders to participate fully from any location, without the cost of travel.

To participate in the 2024 Meeting, you must be a stockholder of record and log in with your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form. Whether or not you participate in the 2024 Meeting online, it is important that your shares are included in the voting process.

If you are a beneficial stockholder, please follow the instructions on the voting instruction form provided by your bank or broker or other nominee in order to participate in the 2024 Meeting. Please contact your bank or broker if you have questions about how to obtain your control number.

Interested persons who are not stockholders may also access the 2024 Meeting as guests, but will not be able to vote or ask questions during the 2024 Meeting.

HOW TO ASK QUESTIONS

Stockholders may submit questions during the 2024 Meeting using the “Ask a Question” field on the virtual meeting website.

You will need to log in with your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form to submit a question.

Time has been allocated on the agenda to respond to questions submitted during the 2024 Meeting. Questions we do not answer during the 2024 Meeting will be answered in writing and posted on the Company’s website at www.dow.com/investors.

For more information, see the section titled “Voting and Attendance Procedures” on page vi. Please refer to the 2024 Meeting Rules of Conduct and Procedures for more information on how to vote, how to ask questions and other procedures for the 2024 Meeting. The Rules of Conduct and Procedures are available at www.proxyvote.com and during the 2024 Meeting at www.virtualshareholdermeeting.com/DOW2024.

A replay of the 2024 Meeting will be made available promptly at www.dow.com/investors and it will remain available for at least one year.

We encourage you to join the 2024 Meeting early. Online access will begin approximately 15 minutes before the start at 8:00 AM Eastern Time. If you encounter technical difficulties during the check-in or while attending the meeting, we have technicians available to help you. The technical support contact information will be posted on the 2024 Meeting login page. In the event of any technical malfunction, we expect to make an announcement on the 2024 Meeting login page. Any updated information regarding the 2024 Meeting will be posted at www.dow.com/investors.

Thank you for your continued support and interest in Dow.

Amy E. Wilson

General Counsel and Corporate Secretary

March 1, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS MEETING TO BE HELD ON APRIL 11, 2024

The Notice of Internet Availability of Proxy Materials, Proxy Statement and Annual Report are available at www.proxyvote.com. | ||||

| ii | 2024 | Dow Proxy Statement |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Proxy Statement are “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements often address expected future business and financial performance, financial condition, and other matters, and often contain words or phrases such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “opportunity,” “outlook,” “plan,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “will be,” “will continue,” “will likely result,” “would” and similar expressions, and variations or negatives of these words or phrases.

Forward-looking statements are based on current assumptions and expectations of future events that are subject to risks, uncertainties and other factors that are beyond Dow’s control, which may cause actual results to differ materially from those projected, anticipated or implied in the forward-looking statements and speak only as of the date the statements were made. These factors include, but are not limited to: sales of Dow’s products; Dow’s expenses, future revenues and profitability; any global and regional economic impacts of a pandemic or other public health-related risks and events on Dow’s business; any sanctions, export restrictions, supply chain disruptions or increased economic uncertainty related to the ongoing conflicts between Russia and Ukraine and in the Middle East; capital requirements and need for and availability of financing; unexpected barriers in the development of technology, including with respect to Dow’s contemplated capital and operating projects; Dow’s ability to realize its commitment to carbon neutrality on the contemplated timeframe, including the completion and success of its integrated ethylene cracker and derivatives facility in Alberta, Canada; size of the markets for Dow’s products and services and ability to compete in such markets; failure to develop and market new products and optimally manage product life cycles; the rate and degree of market acceptance of Dow’s products; significant litigation and environmental matters and related contingencies and unexpected expenses; the success of competing technologies that are or may become available; the ability to protect Dow’s intellectual property in the United States and abroad; developments related to contemplated restructuring activities and proposed divestitures or acquisitions such as workforce reduction, manufacturing facility and/or asset closure and related exit and disposal activities, and the benefits and costs associated with each of the foregoing; fluctuations in energy and raw material prices; management of process safety and product stewardship; changes in relationships with Dow’s significant customers and suppliers; changes in public sentiment and political leadership; increased concerns about plastics in the environment and lack of a circular economy for plastics at scale; changes in consumer preferences and demand; changes in laws and regulations, political conditions or industry development; global economic and capital markets conditions, such as inflation, market uncertainty, interest and currency exchange rates, and equity and commodity prices; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, including the ongoing conflicts between Russia and Ukraine and in the Middle East; weather events and natural disasters; disruptions in Dow’s information technology networks and systems, including the impact of cyberattacks; and risks related to Dow’s separation from DowDuPont Inc. such as Dow’s obligation to indemnify DuPont de Nemours, Inc. and/or Corteva, Inc. for certain liabilities.

Where, in any forward-looking statement, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. A detailed discussion of principal risks and uncertainties which may cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and the Company’s subsequent Quarterly Reports on Form 10-Q. These are not the only risks and uncertainties that Dow faces. There may be other risks and uncertainties that Dow is unable to identify at this time or that Dow does not currently expect to have a material impact on its business. If any of those risks or uncertainties develops into an actual event, it could have a material adverse effect on Dow’s business. Dow Inc. and The Dow Chemical Company (“TDCC”) assume no obligation to update or revise publicly any forward-looking statements whether because of new information, future events, or otherwise, except as required by securities and other applicable laws.

The Company’s website, reports and social media feeds are not part of or incorporated by reference into this Proxy Statement.

| 2024 | Dow Proxy Statement | iii |

Table of Contents

| iv | 2024 | Dow Proxy Statement |

DEFINED TERMS

Capitalized terms, not otherwise defined in this Proxy Statement, have the meaning ascribed below:

2024 Meeting | 2024 Annual Meeting of Stockholders of Dow Inc. | |

Board | Board of Directors of Dow Inc. | |

Carbon Emissions | GHG emissions in CO2 equivalent | |

CD&A | Compensation Discussion & Analysis | |

CEO | Chief Executive Officer | |

CFO | Chief Financial Officer | |

Committee | In the CD&A section, Compensation and Leadership Development Committee | |

Company | Dow Inc. and its consolidated subsidiaries | |

Compensation Peer Group | Peer group utilized for market comparisons, benchmarking and setting executive and non-employee Director compensation | |

Cumulative Cash from Operations | Cash provided by operating activities—continuing operations | |

DEPP | Dow Employees’ Pension Plan | |

Dow | Dow Inc. and its consolidated subsidiaries; all references to “we,” “us,” and “our” refer to the Company | |

EBIT | Earnings before interest and taxes | |

EDP | The Dow Chemical Company Elective Deferral Plan Post 2004, a non-qualified deferred compensation plan | |

ERG | Employee Resource Group—voluntary employee-led groups open to all Dow employees that foster inclusion at Dow and in the community | |

ESG | Environmental, social and governance | |

ESPP | Dow Inc. 2021 Employee Stock Purchase Plan | |

ESRP | Executives’ Supplemental Retirement Plan—Supplemental Benefits | |

Free Cash Flow | “Cash provided by operating activities—continuing operations,” less capital expenditures (non-GAAP) | |

GAAP | U.S. Generally Accepted Accounting Principles | |

GHG | Greenhouse gas | |

GRI | Global Reporting Initiative | |

ID&E | Inclusion, diversity and equity | |

LTI | Long-term incentive | |

NEO | Named Executive Officer | |

Net-zero carbon | Scope 1 and 2 carbon emissions, including reductions from technology advancements | |

NYSE | New York Stock Exchange | |

Operating EBIT | Earnings (i.e., “Income before income taxes”) before interest, excluding the impact of significant items (non-GAAP) | |

Operating ROC | Net operating profit after tax (excluding significant items) divided by total average capital (non-GAAP) | |

Performance Award | Annual cash incentive program | |

PPA | Personal Pension Account | |

PSU | Performance stock unit | |

Relative TSR | Percentile ranking against the Relative TSR Peer Group of stock price appreciation plus dividends paid | |

Relative TSR Peer Group | Peer group utilized to measure Relative TSR performance within the performance share programs | |

ROC | Return on capital | |

RSU | Restricted stock unit | |

SASB | Sustainability Accounting Standards Board | |

Savings Plan | The Dow Chemical Company Employees’ Savings Plan, a tax-qualified 401(k) plan | |

SEC | U.S. Securities and Exchange Commission | |

SIP | Dow Inc. 2019 Stock Incentive Plan | |

TCFD | Task Force on Climate-related Financial Disclosures | |

TDCC | The Dow Chemical Company | |

TSR | Total shareholder return | |

Voice | Annual employee survey that measures employee experience and satisfaction as well as leader effectiveness | |

WEF | World Economic Forum | |

Zero-carbon emissions | Scope 1+2+3 carbon emissions, including product benefits and reductions from technology advancements; Dow’s 2050 carbon neutrality target refers to Dow’s intention to achieve zero-carbon emissions by 2050 | |

| 2024 | Dow Proxy Statement | v |

Voting and Attendance Procedures

In this Proxy Statement, you will find information on the nominees for election to the Board and other items to be voted upon at the 2024 Meeting and any adjournment or postponement of the 2024 Meeting. The background information in this Proxy Statement has been supplied to you at the request of the Board to help you decide how to vote and to provide information on the Company’s corporate governance and compensation practices. This Proxy Statement is first being distributed to stockholders on or about March 1, 2024.

VOTE YOUR SHARES

You are entitled to vote at the 2024 Meeting if you were a stockholder as of the close of business on the record date, February 15, 2024, or hold a valid proxy for the 2024 Meeting.

To vote online or by phone, you will need to use your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form to log in to www.proxyvote.com. You may also vote your shares online by using your 16-digit control number to log in to www.virtualshareholdermeeting.com/DOW2024 during the 2024 Meeting.

If you received printed proxy materials, you may also vote by mail. Your shares will be voted only if the proxy card or voting instruction form is properly signed and received by the Inspector of Election prior to the 2024 Meeting.

Except as provided below with respect to shares held in The Dow Chemical Company Employees’ Savings Plan, if you submit your proxy and if no specific instructions are given by you, your shares will be voted as recommended by the Board.

You may revoke or change your proxy or voting instructions before the polls close at the 2024 Meeting by sending a written revocation to the Office of the Corporate Secretary at 2211 H.H. Dow Way, Midland, Michigan 48674, by submitting another proxy card or voting instruction form, or by submitting your vote online or by phone. The independent tabulator must receive any proxy that will not be delivered electronically at the 2024 Meeting by 11:59 PM Eastern Time on April 10, 2024.

If you are a beneficial stockholder, please follow the instructions on the voting instruction card provided by your bank or broker or other nominee to vote your shares. Please contact your bank or broker if you have questions about how to obtain your control number.

We encourage you to vote in advance, even if you plan to attend the 2024 Meeting online. Be sure to submit votes for each separate account in which you hold Dow common stock.

CONFIDENTIAL VOTING

The Company maintains vote confidentiality. Proxies and ballots of all stockholders are kept confidential from the Company’s management and Board unless disclosure is required by law and in certain other limited circumstances.

This practice further provides that employees may confidentially vote their shares of Company stock held by The Dow Chemical Company Employees’ Savings Plan and requires the appointment of an independent tabulator and Inspector of Election for the 2024 Meeting.

PLAN SHARES

If you are enrolled in the direct stock purchase and dividend reinvestment plan administered by Computershare Trust Company, N.A. (the “Computershare CIP”), the shares of Dow common stock owned on the record date by

| vi | 2024 | Dow Proxy Statement |

you directly in registered form, plus all shares of Dow common stock held for you in the Computershare CIP, will appear together on a single proxy voting form. If no instructions are provided by you on an executed proxy voting form, your Computershare CIP shares will be voted as recommended by the Board.

Participants in The Dow Chemical Company Employees’ Savings Plan (the “Savings Plan”) will receive a voting instruction form. Your form will provide voting instructions to Fidelity Management Trust Company (the “Savings Plan Trustee”). If no instructions are provided to the Savings Plan Trustee, the Savings Plan Trustee and/or administrators of the Savings Plan will vote the shares held pursuant to the Savings Plan according to the provisions of the Savings Plan. In order to have your Savings Plan shares voted in accordance with your voting instructions, your voting instructions must be received by 11:59 PM Eastern Time on April 8, 2024.

DOW SHARES OUTSTANDING AND QUORUM

At the close of business on the record date, February 15, 2024, there were 703,268,115 shares of Dow common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote. The holders of at least 50 percent of the issued and outstanding shares of common stock entitled to vote that are present in person or represented by proxy constitute a quorum for the transaction of business at the 2024 Meeting.

Agenda Item | ||

1: | Election of Directors | |

Each nominee must receive more FOR votes than AGAINST votes in order to be elected. | ||

2: | Advisory Resolution to Approve Executive Compensation | |

Agenda Item 2 must receive more FOR votes than AGAINST votes in order to be approved. | ||

3: | Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2024 | |

Agenda Item 3 must receive more FOR votes than AGAINST votes in order to be approved. | ||

4: | Stockholder Proposal—Shareholder Right to Act by Written Consent | |

Agenda Item 4 must receive more FOR votes than AGAINST votes in order to be approved. | ||

5: | Stockholder Proposal—Single-Use Plastics Report | |

Agenda Item 5 must receive more FOR votes than AGAINST votes in order to be approved. | ||

Abstentions and broker non-votes will be included in determining the presence of a quorum at the 2024 Meeting, but will not be counted or have an effect on the outcome of any matter except as specified below with respect to Agenda Item 3.

Broker non-votes occur when a person holding shares through a bank or broker, meaning that their shares are held in a nominee name or beneficially through such bank or broker, does not provide instructions as to how to vote their shares and the bank or broker is not permitted to exercise voting discretion. Under NYSE rules, even though your bank or broker is not permitted to exercise voting discretion, it may vote shares held in beneficial name only on Agenda Item 3: Ratification of the Appointment of the Independent Registered Public Accounting Firm, without instruction from you, but may not vote on any other matter to be voted on at the 2024 Meeting.

A list of stockholders of record entitled to vote shall be available to any stockholder for any purpose relevant to the 2024 Meeting for 10 days prior to the 2024 Meeting upon request to the Office of the Corporate Secretary. Please send the request to the Office of the Corporate Secretary at 2211 H.H. Dow Way, Midland, Michigan 48674, with a copy to corporatesecretary@dow.com.

| 2024 | Dow Proxy Statement | vii |

PROXY SOLICITATION ON BEHALF OF THE BOARD

The Board is soliciting proxies to provide an opportunity for all stockholders to vote, whether or not the stockholders are able to attend the 2024 Meeting, or an adjournment or postponement thereof. Dow Directors, officers and employees may solicit proxies on behalf of the Board by mail, by telephone or by electronic communication. The proxy representatives of the Board will not be specially compensated for their services in this regard.

Dow has retained D. F. King & Co., Inc., to aid in the solicitation of stockholders for an estimated fee of $17,500, plus reasonable expenses. Arrangements have been made with brokerage houses, nominees and other custodians and fiduciaries to send materials to their principals, and their reasonable expenses will be reimbursed by Dow upon request. The cost of solicitation will be borne by the Company.

ATTENDING THE 2024 MEETING

The 2024 Meeting will be conducted in an online, virtual format. Dow is pleased to use the virtual meeting format to facilitate stockholder attendance, voting and questions by leveraging technology to communicate more effectively and efficiently with our stockholders. This format allows stockholders to participate fully from any location, without the cost of travel. We have designed the virtual format to protect stockholder rights. For example: we have allocated time on the agenda to respond to questions submitted by stockholders, questions not answered during the 2024 Meeting will be answered in writing and posted on the Company’s website at www.dow.com/investors, and we will make available a replay of the 2024 Meeting promptly at www.dow.com/investors and it will remain available for at least one year.

You are entitled to attend, vote and ask questions in the virtual 2024 Meeting if you were a stockholder as of the close of business on the record date, February 15, 2024, or hold a valid proxy for the 2024 Meeting.

To attend, vote and ask questions online during the 2024 Meeting, you will need to use your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form to log in to www.virtualshareholdermeeting.com/DOW2024. Whether or not you participate in the 2024 Meeting online, it is important that your shares are included in the voting process.

If you are a beneficial stockholder, please follow the instructions on the voting instruction form provided by your bank or broker or other nominee in order to participate in the 2024 Meeting. Please contact your bank or broker if you have any questions about how to access the 2024 Meeting or to obtain your control number.

Interested persons who are not stockholders may also access the 2024 Meeting as guests, but will not be able to vote or ask questions during the 2024 Meeting.

We encourage you to join the 2024 Meeting early. Online access will begin approximately 15 minutes before the 8:00 AM Eastern start time. If you encounter technical difficulties during the check-in or while attending the meeting, we have technicians available to help you. The technical support contact information will be posted on the 2024 Meeting login page. In the event of any technical malfunction, we expect to make an announcement on the 2024 Meeting login page. Any updated information regarding the 2024 Meeting will be posted at www.dow.com/investors.

HOW TO ASK QUESTIONS

Stockholders may submit questions during the 2024 Meeting using the “Ask a Question” field on the virtual meeting website.

You will need to log in with your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form to submit a question. Time has been allocated on the agenda to respond to questions submitted during the 2024 Meeting. Questions we do not answer during the 2024 Meeting will be answered in writing and posted on the Company’s website at www.dow.com/investors.

| viii | 2024 | Dow Proxy Statement |

OTHER MATTERS

The proxy or voting instruction form confers upon the designated persons the discretion to vote the shares represented in accordance with their best judgment. Such discretionary authority extends to any other properly presented matter. The Board does not intend to present any business at the 2024 Meeting that is not described in this Proxy Statement. The Board is not aware of any other matter that may properly be presented for action at the 2024 Meeting.

RULES OF CONDUCT AND PROCEDURES

Please refer to the 2024 Meeting Rules of Conduct and Procedures for more information on attending the 2024 Meeting, how to ask questions and other procedural rules. The Rules of Conduct and Procedures are available at www.proxyvote.com and during the 2024 Meeting at www.virtualshareholdermeeting.com/DOW2024.

| 2024 | Dow Proxy Statement | ix |

Additional Information

FUTURE STOCKHOLDER PROPOSALS

If you satisfy the requirements of the rules and regulations of the SEC and wish to submit a proposal to be considered for inclusion in the Company’s proxy materials for the 2025 Annual Meeting of Stockholders of Dow Inc. (“2025 Meeting”), pursuant to Rule 14a-8 of the Exchange Act, please send it to the Office of the Corporate Secretary at 2211 H.H. Dow Way, Midland, Michigan 48674, with a copy to corporatesecretary@dow.com. Under Rule 14a-8, these proposals must be received no later than 5:00 PM Eastern Time on November 1, 2024.

FUTURE ANNUAL MEETING BUSINESS

Under the Company’s Bylaws, if you wish to raise items of proper business at an annual meeting, other than shareholder proposals complying with Rule 14a-8 (which are subject to separate requirements provided above), including director nominations other than nominations pursuant to Dow’s proxy access provision (which are subject to separate requirements provided in the Bylaws), you must give advance written notice to the Office of the Corporate Secretary at 2211 H.H. Dow Way, Midland, Michigan 48674, with a copy to corporatesecretary@dow.com between 8:00 AM Eastern Time on November 1, 2024, and 5:00 PM Eastern Time on December 1, 2024 for the 2025 Meeting.

Further, if you intend to nominate a director outside of the proxy access process and solicit proxies in support of such director nominee(s) (other than the Company’s nominees) at the 2025 Meeting in reliance on Rule 14a-19, in addition to the requirements set forth in the Company’s Bylaws, you must comply with the additional requirements of Rule 14a-19.

Different deadlines may apply if the 2025 Meeting is called for a date that is not within 30 days (before or after) the anniversary of the 2024 Meeting. In such case, such written advance notice of your intention to raise items of proper business at an annual meeting must be received by the Office of the Corporate Secretary (a) no earlier than the close of business on the 120th day prior to the 2025 Meeting date and (b) no later than the close of business on the later of (A) the 90th day prior to the 2025 Meeting date or (B) the 10th day following the date on which public disclosure of the date of such meeting is first made by the Company.

If notice of a matter or nomination is not received within the applicable deadlines or it does not comply with the procedural and content requirements of the Bylaws for such notices, Rule 14a-4 or Rule 14a-19, as applicable, any officer or director acting as chair of the annual meeting may refuse to introduce such matter. The Bylaws may be amended from time to time and, to the extent any such amendment conflicts with any of the requirements herein, the terms of the amended Bylaws will apply. The full text of the Bylaws is available on the Company’s website at www.dow.com/investors.

FUTURE DIRECTOR NOMINEES THROUGH PROXY ACCESS

Under the Company’s Bylaws, if you wish to nominate a director through proxy access, you must give advance written notification to the Office of the Corporate Secretary at 2211 H.H. Dow Way, Midland, Michigan 48674, with a copy to corporatesecretary@dow.com. For the 2025 Meeting, written notice must be received by the Office of the Corporate Secretary between 8:00 AM Eastern Time on October 2, 2024, and 5:00 PM Eastern Time on November 1, 2024. Such notices must comply with the procedural and content requirements of the Bylaws. The full text of the Bylaws is available on the Company’s website at www.dow.com/investors.

| x | 2024 | Dow Proxy Statement |

MULTIPLE STOCKHOLDERS WITH THE SAME ADDRESS

In accordance with a notice sent previously to stockholders with the same surname who share a single address, only one notice or set of proxy materials will be sent to an address unless contrary instructions were received from any stockholder at that address. This practice, known as “householding,” is designed to reduce printing and postage costs. If you did not respond that you did not want to participate in householding, you were deemed to have consented to the practice. If you are a registered stockholder, you may revoke your consent by sending your name and your holder identification number to the Office of the Corporate Secretary at corporatesecretary@dow.com or 2211 H.H. Dow Way, Midland, Michigan 48674. If you hold your stock with a bank or broker, you may revoke your consent to householding by contacting Broadridge Financial Solutions Inc., 51 Mercedes Way, Edgewood, New York 11717, or by calling 1-866-540-7095. If you are a registered stockholder receiving multiple copies at the same address or if you have a number of accounts at a single brokerage firm, you may submit a request to receive a single copy in the future by contacting the Office of the Corporate Secretary at corporatesecretary@dow.com. If you hold your stock with a bank or broker, contact Broadridge Financial Solutions Inc. at the address and telephone number provided above. The Company will promptly deliver to a stockholder who received one copy of proxy materials as the result of householding, a copy of the materials upon the stockholder’s written request to the Office of the Corporate Secretary at corporatesecretary@dow.com.

ELECTRONIC DELIVERY OF PROXY MATERIALS

Stockholders may request proxy materials be delivered to them electronically by enrolling at www.proxyvote.com or https://enroll.icsdelivery.com/dow. This results in faster, online delivery of the Proxy Statement, Annual Report and related materials. Going paperless is not only convenient for stockholders, but it also saves resources and reduces Dow’s impact on the environment.

COPIES OF PROXY MATERIALS AND ANNUAL REPORT

The Notice of Internet Availability of Proxy Materials and Proxy Statement and Annual Report are posted on the Company’s website at www.dow.com/investors and at www.proxyvote.com.

COPIES OF CORPORATE GOVERNANCE DOCUMENTS

The Certificate of Incorporation, Bylaws, Corporate Governance Guidelines, Code of Conduct, Code of Financial Ethics, Board Committee Charters and other governance documents are posted on the Company’s website at www.dow.com/investors. Stockholders may request printed copies of each of these documents at no charge by contacting the Office of the Corporate Secretary at corporatesecretary@dow.com.

| 2024 | Dow Proxy Statement | xi |

A Message from our

Independent Lead Director

RICHARD K. DAVIS

Independent Lead Director since 2021

✓ Strong familiarity with the Dow Board and Committee structure and rapport with the other independent Directors

✓ Global leadership experience as a former Chairman and Chief Executive Officer of a public company

✓ Vast knowledge in industries subject to extensive regulation, including risk management

✓ Extensive expertise in international business operations, financial services, and capital allocation

✓ Broad public company board experience across the financial services and medical industries

✓ Deep knowledge of corporate governance and compensation matters

|

Dear Fellow Stockholders,

On behalf of Dow’s independent Directors and Jim Fitterling, Chair and Chief Executive Officer, I am pleased to invite you to our virtual 2024 Annual Meeting of Stockholders. As your Independent Lead Director, I’m proud to provide insights into the advancement of Dow’s strategic priorities and corporate governance during 2023.

Dow is committed to maintaining strong financial and operational discipline while progressing our climate, circularity and societal actions and continuing to drive long-term stockholder value. Achieving these priorities begins with our experienced, diverse, and independent Board of Directors and our continued commitment to best-in-class governance and accountability.

Our Board is responsible for robust oversight of the Company’s strategy, enterprise risk management, stakeholder engagement and governance practices. We remained sharply focused on executing these responsibilities in 2023, as noted by the following examples:

• Delivered solid financial performance amid challenging and dynamic macroeconomic conditions.

• Advanced our long-term strategy to Decarbonize & Grow by approving final investment decision for our Path2Zero project in Fort Saskatchewan, Alberta, Canada.

• Progressed our Transform the Waste strategy through strategic partnerships and offtake agreements.

• Continued to strengthen our governance practices by implementing enhanced disclosures for Board member qualification, enterprise risk management, and leadership succession planning.

• Expanded disclosure of our enterprise risk management approach and process.

• Continued emphasis on Board oversight and responsibility for environmental, social and governance performance.

• Increased the percentage of leadership team members who are women or U.S. ethnic minorities to 83%, outpacing our peers.

• Named a Great Place To Work® and FORTUNE 100 Best Companies to Work For® for the third consecutive year and recognized by Great Place To Work® and FORTUNE as one of the World’s Best Workplaces™ for the first time — a recognition provided to only 25 companies in the world.

In addition to our strategic and operational advances, the Company returned $2.6 billion to shareholders through share repurchases and dividends while generating $5.2 billion in cash flow from operations. I encourage you to read the Proxy Statement, Annual Report, and INtersections Report for further insights and details on additional actions and accomplishments.

On behalf of Dow’s Board and management team, thank you for investing in our Company. We understand this is an active choice and are deeply grateful for your trust and engagement as we continue to grow the Company, deliver innovative solutions to address the world’s greatest challenges, and create long-term and sustainable value for all of our stakeholders.

Richard K. Davis | |||

| xii | 2024 | Dow Proxy Statement |

Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting.

2024 ANNUAL MEETING OF STOCKHOLDERS OF DOW INC.

| Meeting Date | Record Date | Meeting Time | ||||||||||||

| Thursday, April 11, 2024 | Thursday, February 15, 2024 | 8:00 AM Eastern Time |

| |||||||||||

| Vote Your Shares in Advance |

Attend the 2024 Meeting |

| |||||

| Your vote is important. We encourage you to vote in advance, even if you plan to attend the 2024 Meeting.

| You are invited to attend the 2024 Meeting online at www.virtualshareholdermeeting.com/DOW2024.

To vote and ask questions during the 2024 Meeting, you must be a stockholder of record and log in with your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form.

Interested persons who are not stockholders may also access the 2024 Meeting as guests, but will not be able to vote or ask questions during the 2024 Meeting.

We encourage you to join the 2024 Meeting early. Online access will begin approximately 15 minutes before the start at 8:00 AM Eastern Time. If you encounter technical difficulties during the check-in or while attending the meeting, please call technical support. The technical support contact information will be posted on the 2024 Meeting login page.

In the event of any technical malfunction, we expect to make an announcement on the virtual meeting login page. Any updated information regarding the 2024 Meeting will be posted at www.dow.com/investors.

A replay of the 2024 Meeting will be made available promptly at www.dow.com/investors and it will remain available for at least one year.

For more information, see the section titled “Voting and Attendance Procedures” on page vi. |

| |||||

| www.proxyvote.com | |||||||

|

1-800-690-6903 or the number provided on your voting instructions | |||||||

|

Use the postage-paid envelope provided if you received printed proxy materials | |||||||

You may also vote online during the 2024 Meeting at www.virtualshareholdermeeting.com/DOW2024.

To vote online or by phone, you will need your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form. The independent tabulator must receive any proxy that will not be delivered electronically at the 2024 Meeting by 11:59 PM Eastern Time on April 10, 2024.

| ||||||||

|

Ask Questions | |||||||

You may submit questions during the 2024 Meeting at www.virtualshareholdermeeting.com/DOW2024.

To ask a question, you will need to log in with your 16-digit control number found on the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form.

| ||||||||

AGENDA AND VOTING RECOMMENDATIONS

The Notice of Internet Availability of Proxy Materials, Proxy Statement and Annual Report are available at www.proxyvote.com.

Agenda Item | Board Vote Recommendation | Page Reference | ||||

1: | Election of Directors | FOR | 33 | |||

2: | Advisory Resolution to Approve Executive Compensation | FOR | 101 | |||

3: | Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2024 | FOR

| 102 | |||

4: | Stockholder Proposal—Shareholder Right to Act by Written Consent | AGAINST | 106 | |||

5: | Stockholder Proposal—Single-Use Plastics Report | AGAINST | 110 | |||

| 2024 | Dow Proxy Statement | 1 |

ABOUT DOW

Dow (NYSE: DOW) is one of the world’s leading materials science companies, serving customers in high-growth markets such as packaging, infrastructure, mobility and consumer applications. Our global breadth, asset integration and scale, focused innovation, leading business positions and commitment to sustainability enable us to achieve profitable growth and help deliver a sustainable future. Learn more about us and our ambition to be the most innovative, customer-centric, inclusive and sustainable materials science company in the world by visiting www.dow.com. The Company’s website, reports and social media feeds are not part of or incorporated by reference into this Proxy Statement.

|  |

|  | |||||||||||||

2023 NET SALES

| EMPLOYEES

| MANUFACTURING SITES

| GLOBAL REACH

|

| ||||||||||||

| ~$45B | ~35,900 | 98 sites | 31 countries | |||||||||||||

|

|

|

|

| ||||||||||||

| in which Dow manufactures products | ||||||||||||||||

Note: All data as of December 31, 2023

Delivering Performance and Progress

For more than 125 years, Dow has been pursuing solutions for the world’s toughest challenges by asking the right questions. Together, our purpose and ambition drive us to improve the sustainability and circularity of the markets we serve, positively contribute to the development and wellness of our communities, and embrace and cultivate an inclusive, diverse, equitable and accountable culture.

We believe materials science drives innovation, and Dow’s innovation is built on creativity and collaboration – enabling us to create solutions that transform our world and deliver a more sustainable future.

| 2 | 2024 | Dow Proxy Statement |

2023 Highlights

Net sales of $44.6B |

Delivered net income of $660M |

Delivered operating EBIT1 of $2.8B |

Generated $5.2B in cash flow from operations |

Returned $2.6B to shareholders through dividends and share buybacks | ||||||||||||||||||||||||

|

Achieved highest Customer Experience (CX) satisfaction score since inception of our annual CX survey in 2018 |

|

|

Started operation of our UNIFINITYTM FCDh technology in Louisiana to produce propylene with ~20% lower emissions vs. conventional PDH technology |

|

|

Expanded access to renewable power to >1,000 megawatts, exceeding our goal of 750 megawatts by 2025 |

| ||||||||||||

|

Announced collaboration with New Energy Blue to transform agricultural residue in the form of corn stover into bio-based ethylene used to make plastics |

|

|

|

Launched reduced-carbon, bio-based and circular Propylene Glycol DEC, REN and CIR with ISCC PLUS certification in Europe |

|

|

|

Launched SURLYNTM REN and CIR lonomers, produced using bio and circular feedstocks at U.S. Gulf Coast assets |

| ||||||||||

|

$335MM in global certified diverse ($253MM) and small business ($82MM) spend in 17 countries and 5 continents |

|

|

|

75% of Dow employees volunteered at least once in the past year in the communities where they live and work |

|

|

|

Enhanced diversity self-identification capabilities to improve the employee experience |

| ||||||||||

|

Invested $34.1MM in corporate + foundation + in-kind contributions

|

|

|

|

Redefined best-in-class Employee Resource Group participation with ~61% Team Dow participation |

|

|

|

Improved global representation of women to 29.8% and U.S. ethnic minority representation to 28.1% |

| ||||||||||

|

|

Percentage of U.S. ethnic minority Board and executive team members continues to outpace industry peers2

|

|

|

|

Enhanced disclosures for Board of Directors qualifications, enterprise risk management and leadership succession planning |

|

|

|

Recognized by Great Place To Work® and FORTUNE as one of the 25 World’s Best WorkplacesTM |

| ||||||||||

| 1 | Non-GAAP measure. See the Appendix for definitions and a reconciliation to the most directly comparable GAAP measure. |

| 2 | For a detailed list of our industry peers, see the Appendix. |

| 2024 | Dow Proxy Statement | 3 |

OUR ENVIRONMENTAL, SOCIAL AND GOVERNANCE PRIORITIES

Dow focuses on four strategic areas of action—Environmental Performance; Inclusion, Diversity and Equity; Community; and Corporate Governance—to deliver solutions to global challenges and create lasting value for our customers, communities, employees, businesses and stockholders. How we drive accountability for these strategic areas of action can be found in more detail beginning on page 5.

|

|

|

| |||||||||

ENVIRONMENTAL PERFORMANCE

|

INCLUSION, DIVERSITY & EQUITY

|

COMMUNITY |

CORPORATE GOVERNANCE

| |||||||||

| Our strategy for building a more sustainable world focuses on three priority areas: circular economy, climate protection and safer materials. These areas address some of the most pressing challenges facing our planet and offer the most opportunity for Dow to use our science and global scale to make a positive impact. | Realizing our purpose and ambition as a company requires an inclusive and equitable culture that enables our people to develop, advance, be heard and contribute their greatest value. It requires a diverse workforce that brings wide-ranging, fresh perspectives on how to tackle global challenges and innovate for our customers. | We believe in sustainable business growth that creates positive social change. The global citizenship strategy is a road map for how we connect our core strengths—our science and technology expertise, and global reach and resources—to enhance the lives of people in our communities and help make our planet more sustainable. | Best-in-class governance strengthens accountability and protects the long-term interests of all of Dow’s stakeholders. Our leadership starts with the diverse and highly skilled Board and well-defined Committee structure. The Board actively engages with management in oversight and stewardship of the Company’s strategy, risk management and overall performance.

| |||||||||

|

|

|

| |||||||||

A PROACTIVE APPROACH TO REPORTING AND DISCLOSURE

Dow has been a leader in sustainability reporting since our first report in 2003. Our sustainability reporting objective is to provide transparency on how we are advancing our sustainability strategy and how we are contributing to sustainable development. With that objective we continue to deliver high-quality and comprehensive environmental, social, and governance reporting on Dow’s material topics for our customers, stockholders, employees, and community members. The 2022 INtersections Report includes disclosures prepared in accordance with the GRI and GHG Protocol. The report also includes disclosures aligned with the TCFD, SASB, and WEF Stakeholder Capitalism Metrics. We continue to monitor the evolution of frameworks and standard setters, such as the International Sustainability Standards Board. Dow engaged Deloitte & Touche, LLP to perform a review engagement to obtain limited assurance on management’s assertion related to disclosures presented in accordance with the 2021 GRI Sustainability Reporting Standards as of, and for the year ended, December 31, 2022, and related to Scopes 1+2+3 carbon emissions presented in accordance with the GHG Protocol Corporate Accounting and Reporting Standards under its Corporate Standards for the year ended December 31, 2022.

| 4 | 2024 | Dow Proxy Statement |

Dow’s comprehensive annual disclosure of environmental, social and governance performance can be found on our website at www.dow.com/esg. Dow’s public policies on topics such as Chemical Management, Responsible Care, Energy and Climate Change, Sustainability, and Environment, Health & Safety can be found on our website at www.dow.com/about. Additional resources can be found here: https://investors.dow.com/en/esg-resources/default.aspx. These reports, disclosures, policies and additional resources are not part of or incorporated by reference into this Proxy Statement.

STAKEHOLDER ENGAGEMENT ON STRATEGIC PRIORITIES

We regularly engage stakeholders and establish collaborative partnerships as we continue progress on our environmental, social and governance priorities and build a clearer understanding of the complex global challenges and local conditions in the countries where we do business. Stakeholders include customers, suppliers, current and prospective employees, community advisory panels, societal organizations, regulators, shareholders and investors. We also bring in diverse perspectives and guidance through our Sustainability External Advisory Council (SEAC) and Science and Technology Advisory Council (STAC).

| ENVIRONMENTAL PERFORMANCE |

We’re working to deliver a sustainable future by collaborating and innovating to help make a positive impact on society and the planet. As a leading materials science company, we have the responsibility and opportunity to act and lead the industry in areas where our science and innovation can make a difference. This means we are reducing our environmental footprint, developing and implementing circular economy solutions, and creating new materials that are more sustainable.

We continue to make significant progress on our 2025 Sustainability Goals using our expertise, products, technologies, and partnerships to meet the evolving demands of customers while leading the transition to a more sustainable, inclusive future. Additional information on our 2025 Sustainability Goals can be found here: https://corporate.dow.com/en-us/science-and-sustainability/2025-goals.html.

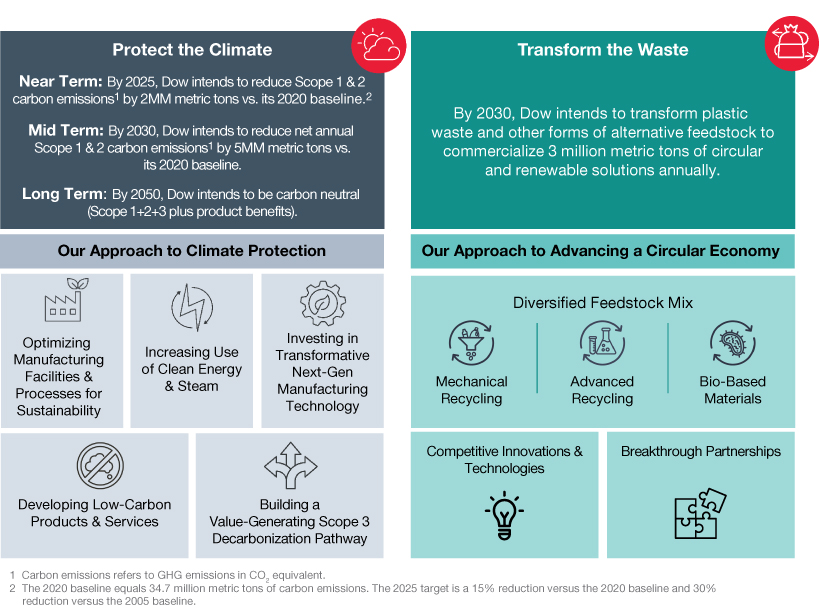

In 2019, we identified three focus areas where we believe we can make the biggest difference and drive industry-wide change: Climate Protection, Circular Economy, and Safer Materials. These global priorities represent areas where we are using our science, scale and global relationships across our value chains to seek and create shared opportunity for Dow and society. In 2020, we introduced new targets aimed at reducing carbon emissions and plastic waste.

Since that time, we have continued to advance toward zero-carbon emissions and plastics circularity. We have a clear plan to achieve our 2030 carbon emissions reduction target and will continue to build on our detailed roadmap to reach zero-carbon emissions by 2050.

In 2023, we started operation of our UNIFINITYTM fluidized catalytic dehydrogenation (FCDh) unit in Plaquemine, Louisiana. Leveraging breakthrough technology, the unit expands our capacity at lower capital and cost intensity while reducing energy usage and carbon emissions relative to conventional propane dehydrogenation (PDH) units. We also achieved the start-up of a new methylene diphenyl diisocyanate (MDI) distillation and pre-polymers facility at our manufacturing site in Freeport, Texas. The new facility replaces our existing capacity in La Porte, Texas, and expands supply by an additional 30% at the site to support high-value demand growth in polyurethane systems while also reducing our carbon emissions by more than 45% compared to the La Porte asset.

In November 2023, we announced the Board approved a final investment decision on our Fort Saskatchewan Path2Zero investment to build the world’s first net-zero Scope 1 and 2 carbon emissions integrated ethylene cracker and derivatives facility in Alberta, Canada.

| 2024 | Dow Proxy Statement | 5 |

Dow and its plastics value chain are making significant investments to help create a circular economy. Moving toward a more circular world for the products we consume every day is important not only to stop increasing environmental pollution but also to address climate change. Plastics are an essential part of the world’s journey toward a lower carbon emissions future. Our comprehensive approach to reducing our carbon emissions footprint and increasing circularity is grounded in our purpose: to deliver a sustainable future for the world through our materials science expertise and collaboration with our partners.

Alignment to the Paris Agreement

Climate change has serious consequences for the global economy and human progress, and Dow embraces our responsibility to accelerate work to reduce global carbon emissions. We support the Paris Agreement and are committed to achieving its goal of keeping global temperature rise below 2°C, and to pursue efforts to limit the increase to 1.5°C.

| 6 | 2024 | Dow Proxy Statement |

| INCLUSION, DIVERSITY AND EQUITY | |

At Dow, we are committed to advancing ID&E for all. Our long-term business growth and success is only achievable with a diverse team and an inclusive culture where everyone can grow and thrive. Our ID&E strategy focuses on leading with inclusion, elevating our focus on diversity and embedding equity into our practices, policies and processes to deliver breakthrough results by 2025.

In 2023, Dow advanced to #7 on the DiversityInc Top 50 Companies for Diversity list and was recognized by Great Place to Work® and FORTUNE as one of the 25 World’s Best WorkplacesTM. These are significant accomplishments that represent only two of the many awards the Company received related to its efforts in ID&E.

Accountability at Every Level Drives Progress and Results

Our strategy is built on seven global foundational pillars that focus on our employees and our suppliers, customers and communities where we operate, and is implemented in our geographic regions at a local level.

| Top-Down Commitment |

q Board and Leadership Team Oversight

q Chief Inclusion Officer

q Inclusion Councils: President’s Inclusion Council, Senior Leaders’ Inclusion Council, Joint Inclusion Council

q The Environmental, Social and Governance Network

q Dow Company Foundation Board |

| Bottom-Up Alignment and Action |

p Inclusion metrics embedded in the Annual Performance Award program for approximately 3,000 people leaders and senior leaders

p Annual employee survey includes ID&E questions to track and drive progress

p Volunteer-based ERGs

p Team Dow engaged and empowered to advance inclusion around the Dow world |

| 2024 | Dow Proxy Statement | 7 |

Advancing our Culture through Employee Resource Groups

Dow’s ten ERGs are representative of the Company’s diverse workforce and help foster an inclusive workplace. Our ERGs continue to be a valuable resource for employees and the Company by cultivating positive employee experiences and providing a platform for business growth. ERGs are open to the total workforce with strong allyship representation.

Advancing ID&E in Our Communities

We are championing a more inclusive society in the communities where we live and work and are committed to addressing systemic discrimination and inequities. Launched in 2020, Dow ACTs is our strategic framework designed to address systemic racism and inequality, backed by a $21 million pledge through 2028 to help accelerate change. ACT is an acronym for three areas of focus: Advocacy, Community engagement and our own Talent pipeline.

| 8 | 2024 | Dow Proxy Statement |

Supplier Diversity: Delivering Impact to Communities and Our Bottom Line

Dow is committed to promoting diversity and inclusion across its supply chain. We believe that a diverse and inclusive supplier base not only benefits our business, but also the communities where we operate. We offer supplier training and development programs, mentorship opportunities, and events and networking opportunities for diverse suppliers. Dow’s goal is to exceed $500 million in global diverse supplier spend by 2025.

Human Capital

Dow’s ambition—to be the most innovative, customer-centric, inclusive and sustainable materials science company in the world—starts with people. Dow employees create innovative and sustainable materials science solutions to advance the world. Every answer starts with asking the right questions. This is why the diverse, dedicated Dow team collaborates with customers and other stakeholders to find solutions to the world’s toughest challenges. The Company’s values of Integrity, Respect for People, and Protecting Our Planet are fundamental beliefs that are ingrained in each action taken, can never be compromised and are the foundation of the Company’s Code of Conduct.

The Company is dedicated to employee health and safety and is invested in fostering a culture of inclusion and continuous learning while supporting its employees through its Total Rewards plans and programs to ensure all Dow employees are respected, valued and encouraged to make their fullest contribution.

The Compensation and Leadership Development Committee and the Environment, Health, Safety & Technology Committee regularly review our approach to human capital management as it aligns to their respective areas of responsibility.

Additional information regarding Dow’s human capital measures can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, the Company’s annual INtersections report, as well as Dow’s U.S. Equal Employment Opportunity Report (EEO-1), accessible through the Inclusion and Diversity website at www.dow.com/diversity.

| 2024 | Dow Proxy Statement | 9 |

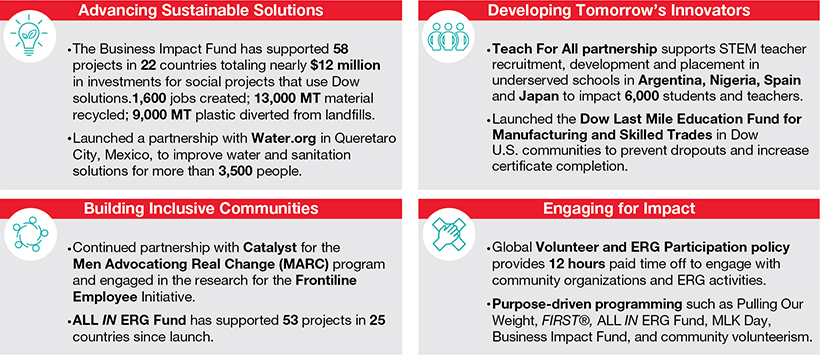

| COMMUNITY |

The communities where we do business are also the places our people call home. We are a stronger, more competitive company when our communities are strong and resilient. Across the globe, we are leveraging our people and partnerships to advance community-driven solutions through five strategic priority areas:

| • | Advancing Sustainable Solutions: Collaborating to address circularity, climate protection and resiliency. |

| • | Building Inclusive Communities: Inspiring ERGs to tackle ID&E needs and partnering to address systemic discrimination. |

| • | Developing Tomorrow’s Innovators: Equipping a diverse science, technology, engineering and math (STEM) pipeline for the jobs of tomorrow. |

| • | Collaborating with Communities: Taking action to help meet the needs of our communities. |

| • | Engaging Employees for Impact: Promoting a positive employee experience and creating meaningful impact through service and volunteerism. |

Highlighted Programs

Making an Impact

|

|

| ||

$34.1 million Corporate + Foundation + In-kind invested

| 75% of Dow employees volunteered at least once in the past year in the communities where they live and work1 | The Civic 50 Award – named by Points of Light for three consecutive years as one of the most community-minded companies in the U.S.

| ||

| 1 | Represents percentage of 2023 Voice respondents |

| 10 | 2024 | Dow Proxy Statement |

Collaborating with Communities

| • | Partnered with nearly 650 non-profits, educational institutions and other community organizations to accelerate social change and create a more sustainable and equitable future. |

| • | Continued to evaluate Community Opinion and Needs Assessments survey results to inform community investment at strategic Dow locations (defined as cities near large Dow manufacturing facilities). |

| • | All large Dow U.S. manufacturing sites have Community Advisory Panels (CAPs) or participate in a multi-company Community Advisory Council with local industry peers. Outside of the U.S., similar committees also meet to understand needs. Through strong and dedicated community engagement to effect real change, we share information on environmental performance, safety and emergency preparedness and collaborate on a variety of topics such as economic development, health and wellness, infrastructure, poverty, housing and food security. |

| CORPORATE GOVERNANCE

|

Our values of Integrity, Respect for People, and Protecting Our Planet are fundamental to how we work and all that we do. Adhering to these values helps us create and maintain a culture that supports sustainable business growth and serves as the foundation of our corporate governance.

We believe that strong corporate governance creates long-term value for shareholders by strengthening accountability and transparency, building trust in our Company and promoting good decision-making.

Accountability in Action

| 2024 | Dow Proxy Statement | 11 |

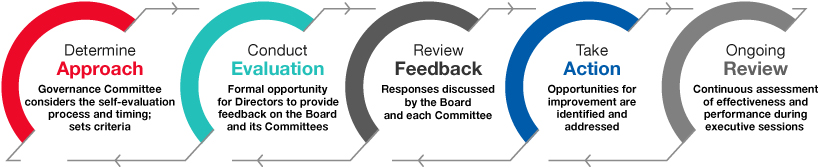

2023 Governance Highlights

The Corporate Governance Committee, the Board and management regularly review Dow’s corporate governance practices, considering evolving corporate governance principles and stockholder engagement. In 2023, we took the following actions:

| • | Enhanced director qualifications disclosure with focus on self-identified skills, professional experience, and diversity of backgrounds. |

| • | Expanded disclosure of our enterprise risk management approach and process; continued emphasis on Board oversight and responsibility for environmental, social and governance performance. |

| • | Improved leadership succession planning disclosure regarding our assessment and development of senior leadership talent and the succession plans of all key management positions. |

| • | Refreshed the Code of Conduct for alignment with industry best practices; formalized the role of Chief Compliance Officer as a corporate officer. |

| • | Continued to outpace industry peers with Dow’s best-in-class board and executive U.S. ethnic minority diversity; see the Appendix for a list of industry peers. |

Governance Best Practices

As part of Dow’s commitment to high ethical standards, the Board follows sound governance practices. Dow’s corporate governance practices are described in more detail beginning on page 17. The Corporate Governance Guidelines and Board Committee Charters are available on the Company’s website at www.dow.com/investors.

Board Independence |

Director Elections |

Board Practices |

Stock Ownership Requirements |

Stockholder Rights |

|

Comprehensive Accountability |

| |||||||||||||||||||||||||||||

11 of 12 Directors are independent

All Board Committees comprised of independent Directors

Strong Independent Lead Director with clearly identified role and responsibilities | Annual election by majority of votes cast; resignation policy if not elected

Demonstrated Board refreshment emphasizing diverse thought and experience

Director orientation and education programs | Independent Directors regularly hold executive sessions

Annual Board and Committee evaluations

Annual review of Board leadership structure and election of Independent Lead Director | Directors subject to stock ownership guidelines

Directors required to hold Company- granted equity awards, which settle upon retirement

Hedging or pledging Company stock is prohibited | Stockholder right to call special meetings with 25% ownership

No supermajority voting requirements

Eligible stockholders able to nominate directors through proxy access

Active stockholder outreach and engagement | Active Board and Committee oversight of priorities, risk management and performance

Industry leading reporting transparency

Diverse and inclusive senior leadership | |||||||||||||||||||||||||||||||

| 12 | 2024 | Dow Proxy Statement |

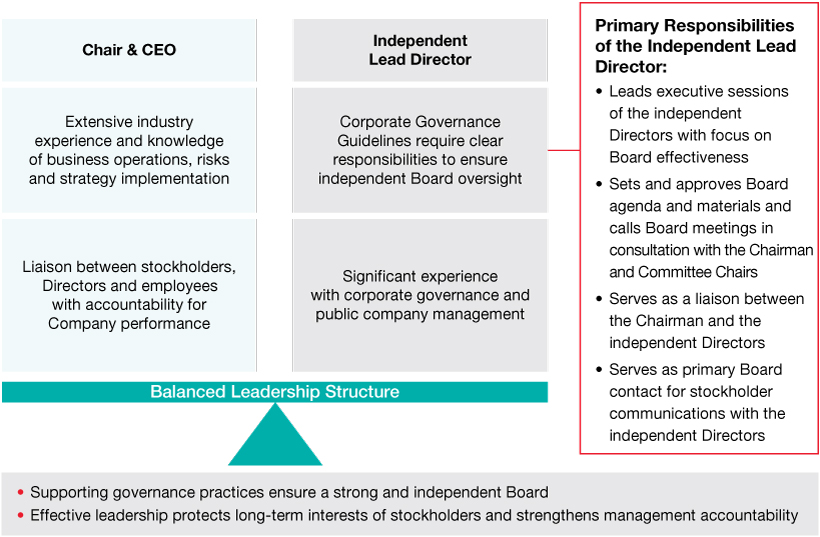

Balanced, Effective Board Leadership

The Board’s leadership structure is regularly reviewed, and it is recognized that the combination or separation of the CEO and Chair roles are driven by the needs of the Company at a particular time. Currently, the roles are combined with Jim Fitterling serving as Chair and CEO and Richard K. Davis serving as the Independent Lead Director. For more information, see the section titled “Board Leadership Structure” on page 18.

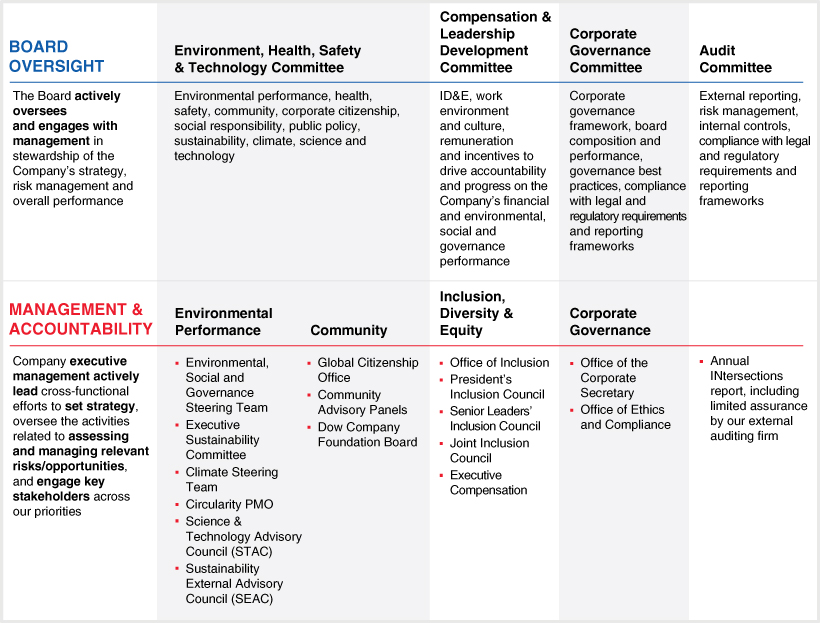

Clear Oversight Responsibilities

The Board actively engages with management in oversight and stewardship of the Company’s strategy; environmental, social and governance priorities; risk management; and overall performance. Committees comprised of independent Directors assist the Board in carrying out its responsibilities. Committees operate pursuant to written charters with clearly defined areas of responsibility and risk oversight. Each Committee reports on the topics discussed and actions taken at each Committee meeting for consideration by the full Board. For more information, see the section titled “Board’s Role in the Oversight of Strategy and Priorities” and “Board’s Role in the Oversight of Risk Management” beginning on page 24.

| 2024 | Dow Proxy Statement | 13 |

Driving Performance with Leadership Engagement

The responsibilities of the Board and its Committees are aligned with leadership accountability across environmental, social and governance priorities, which are summarized below.

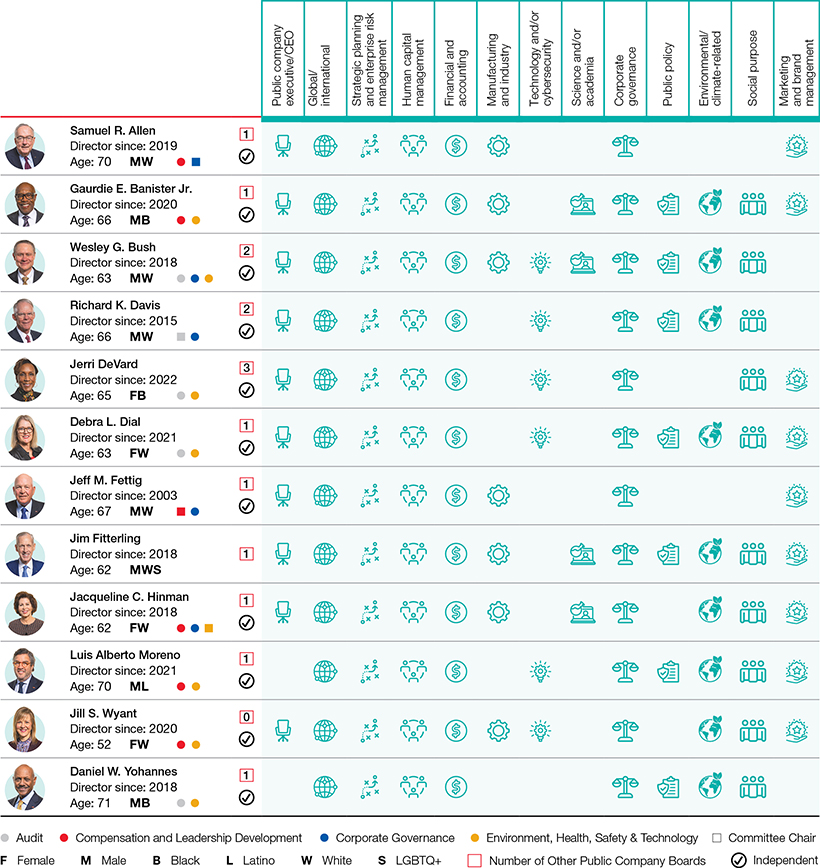

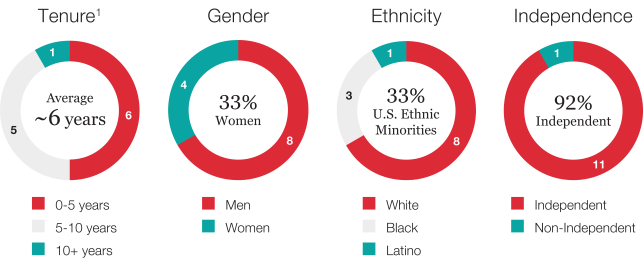

Meet our Board

We are committed to maintaining a Board that is best equipped to be a responsible steward of Dow’s strategy, performance and risk management. In addition to gender and ethnic diversity, our Board brings relevant skills, including capital allocation; financial acumen; technology expertise; operational experience; and environmental, social and governance expertise to help our Company compete, innovate and deliver. To learn more about the twelve individuals nominated for election at the 2024 Meeting, see the section titled “Election of Directors” beginning on page 33.

| 14 | 2024 | Dow Proxy Statement |

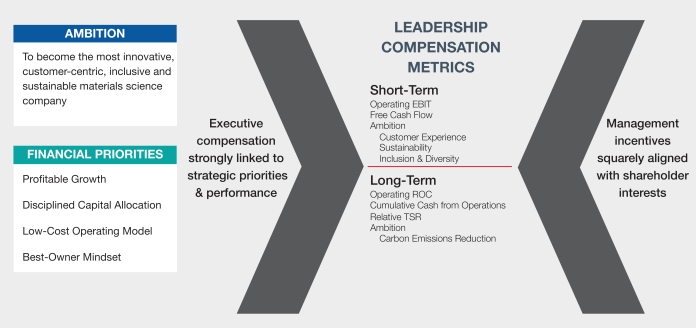

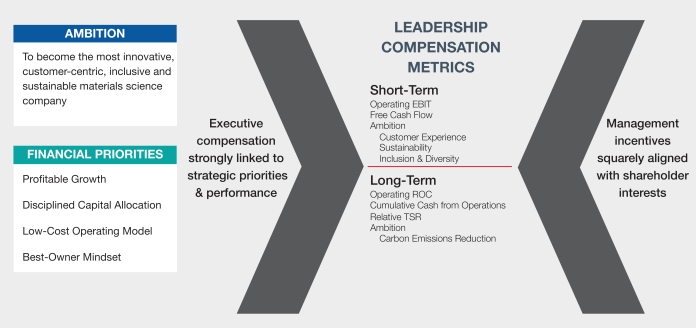

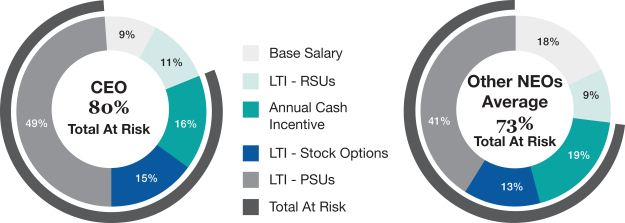

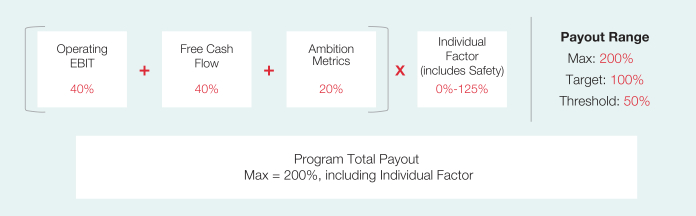

Executive Compensation

The objectives of Dow’s compensation program are set by the Compensation and Leadership Development Committee and designed to motivate and reward employees for achieving Dow’s most critical financial and operational goals as well as those aligned to our Company ambition. While the compensation discussion included in this Proxy Statement focuses on the administration of pay for the Company’s NEOs, the philosophies and programs apply broadly across the Company’s employee population. Dow’s pay for performance programs and offerings—including Base Pay, the Annual Performance Award and LTI programs—are designed to be equitable and fair, and to incentivize performance.

KEY EXECUTIVE COMPENSATION PRACTICES

The compensation programs are described in more detail in the CD&A section beginning on page 55. The following table summarizes the Company’s key executive compensation practices:

✓ Strong pay for performance alignment among executive compensation outcomes, individual performance and Company financial, strategic and operational performance

|

✓ Stockholder engagement and feedback considered in executive compensation design

|

✓ Compensation program structure designed to discourage excessive risk taking

|

✓ No change-in-control agreements |

✓ No excise tax gross-ups |

✓ Limited perquisites |

✓ Carefully considered Compensation Peer Group with regular Compensation and Leadership Development Committee review

|

✓ Each component of target pay benchmarked to median of the Compensation Peer Group

|

✓ Stock ownership requirements of six times base salary for the CEO and four times base salary for the other NEOs

|

✓ Compensation Clawback Policy |

✓ Anti-hedging/anti-pledging policies applicable to Directors and executive officers

|

✓ Stock incentive plans prohibit option repricing, reloads, exchanges and options granted below market value without stockholder approval

|

✓ 100% independent Compensation and Leadership Development Committee

|

✓ Independent Compensation Consultant reporting to the Compensation and Leadership Development Committee

|

✓ Regular review of the Compensation and Leadership Development Committee Charter to ensure best practices and priorities

|

| 2024 | Dow Proxy Statement | 15 |

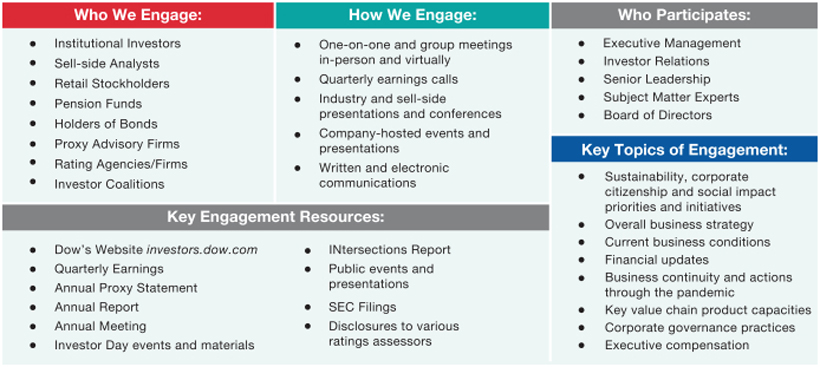

Stockholder Engagement

Throughout the year, members of the management team, and select members of the Board, continued extensive outreach to stockholders, engaging with investors who collectively held more than 55 percent of outstanding shares of common stock of the Company held by institutional stockholders. During this outreach, the management team and Board updated investors on a range of topics, and gained an understanding of the perspectives and concerns of investors. The management team and Board carefully consider the feedback from these meetings, as well as stockholder support for our most recent advisory vote on executive compensation, when reviewing the business, corporate governance and executive compensation profiles.

The Company continually evaluates enhancements to our environmental, social, governance and executive compensation practices, and appreciates engaging key stakeholders, including our stockholders, in the evaluation of these enhancements. For example, the following actions are being implemented:

| • | Reinforced our commitment to our long-term Decarbonize & Grow strategy by announcing final investment decision for the Fort Saskatchewan Path2Zero project in November 2023. |

| • | Further progressed on our Transform the Waste strategy with two of our recycling partners, Valoregen and Mura. Dow will continue partnering with key players through off-take agreements and co-investments, thus minimizing near-term capital outlay while diversifying our feedstock mix and leveraging our existing assets. |

| • | Maintained our focus on our low-cost-to-serve model and cash flow generation by delivering on our $1 billion of targeted cost savings in 2023. |

| • | Solidified our financial position by pursuing additional de-risking opportunities for our pension plans, including annuitization and risk transfer of $1.7 billion in pension liabilities resulting in a one-time non-cash non-operating settlement charge of $642 million. |

| • | Continued our focus on executive leadership succession planning and refreshment, where gender and ethnic diversity significantly outpace our industry peers. |

| • | Accelerated the adoption of supplier diversity among industry and brand leaders and achieved $335 million in global certified diverse ($253 million) and small business ($82 million) spend in 17 countries and 5 continents. |

| • | Enhanced disclosures for Board of Directors qualifications, enterprise risk management and leadership succession planning. |

| • | Completed a racial equity assessment of our policies and programs to promote ID&E among our U.S. workforce and in the communities where we do business in the U.S., the results of which will be published on our Company website in 2024. |

| 16 | 2024 | Dow Proxy Statement |

Corporate Governance

Dow is committed to applying sound corporate governance and leadership principles and practices. The Board has adopted a number of policies to support the Company’s values and good corporate governance, which are important to the success of the Company’s business and in advancing stockholder interests.

CORPORATE GOVERNANCE GUIDELINES

The Board adopted corporate governance guidelines designed to assist Dow and the Board in implementing effective corporate governance practices. The governance guidelines are reviewed regularly by the Corporate Governance Committee in order to continue serving the best interests of Dow and its stockholders. Among other things, these guidelines delineate the Board’s responsibilities, independence, leadership structure, qualifications, election, annual self-evaluation, and access to management and advisors.

The Company’s corporate governance guidelines, practices and policies are available on the Company’s website at www.dow.com/investors, including:

✓ Corporate Governance Guidelines |

✓ Bylaws |

✓ Certificate of Incorporation |

✓ Director Independence Standards |

✓ Board Committee Charters and Membership |

✓ Code of Conduct |

✓ Code of Financial Ethics |

✓ Human Rights |

✓ Responsible Sourcing: Conflict Minerals |

✓ U.S. Public Policy and Political Engagement |

DIRECTOR INDEPENDENCE

The Board has assessed the independence of each non-employee Director in accordance with the standards of independence of the NYSE, SEC rules and as described in the Corporate Governance Guidelines. Based upon these standards, the Board has determined that each of the following Director nominees are independent: Samuel R. Allen, Gaurdie E. Banister Jr., Wesley G. Bush, Richard K. Davis, Jerri DeVard, Debra L. Dial, Jeff M. Fettig, Jacqueline C. Hinman, Luis Alberto Moreno, Jill S. Wyant and Daniel W. Yohannes. These independent Director nominees constitute a “substantial majority” of the Board, consistent with the Corporate Governance Guidelines. The Corporate Governance Committee, as well as the Board, will review relationships that Directors may have with the Company and members of management at least annually to make a determination as to whether there are any material relationships that would preclude a Director from being independent. Mr. Fitterling, our Chair and CEO, is not independent.

All members of the Audit, Compensation and Leadership Development, Corporate Governance, and Environment, Health, Safety & Technology Committees are independent Directors under the Corporate Governance Guidelines and applicable regulatory and listing standards.

| 2024 | Dow Proxy Statement | 17 |

BOARD LEADERSHIP STRUCTURE

The Board is responsible for broad corporate policy and overall performance of the Company through oversight of management and stewardship of the Company. Among other duties, the Board has responsibility for overseeing the strategy, environmental, social and governance priorities and risk management for the Company. The Board appoints the Company’s officers, assigns them responsibility for management of the Company’s operations, and reviews their performance.

The Board recognizes that the leadership structure and combination or separation of the Chair and CEO roles are driven by the needs of the Company. As a result, no policy exists requiring combination or separation of leadership roles. This determination is made on an annual basis by the Board, which allows the Board the flexibility to make changes to Board leadership that are in the best interests of the Company and its stockholders. As a part of that process, the Board reviews whether the existing leadership structure provides strong independent oversight while balancing the need for extensive knowledge of business operations, risks and strategy implementation and accountability for Company performance. Regardless of the specific Board leadership structure, the Company has always incorporated a strong defined leadership role for an independent Director, as described below.

Currently, the roles of Chair and CEO are combined with Jim Fitterling serving as Chair and CEO and Richard K. Davis serving as the Independent Lead Director. Mr. Fitterling’s 40-year tenure and multiple roles with the Company and in the industry makes him uniquely suited to facilitate the Board’s governance oversight of strategy and safe and effective business operations. Mr. Fitterling’s familiarity with and knowledge of our business are unmatched. Furthermore, he has a long history of leadership in reporting transparency and sustainability disclosures. Mr. Fitterling has also led the Company’s extensive sustainability strategy, which includes robust public policy development on a national and international level, such as launching the Company’s aggressive and ambitious targets to become carbon neutral by 2050 and to transform plastic waste. Mr. Davis, the Company’s Independent Lead Director, has significant experience in corporate governance and public company management as a current and former director on other public company boards and a former CEO of a large public company.

In accordance with best practices and the Company’s Corporate Governance Guidelines, the independent Directors elect a Lead Director from among their membership. In order to be selected to serve as the Independent Lead Director, an individual must have served at least one full year on the Board, effectively communicate and engage with the other independent Directors, and possess public company and corporate governance experience. The determination regarding who should serve as the Independent Lead Director is made annually. As part of the Company’s ongoing board refreshment activities, the Board announced its decision to elect Mr. Davis as its new Independent Lead Director following the 2021 Annual Meeting of Stockholders. Mr. Davis was reelected for a one-year term following each of the 2022 and 2023 Annual Meeting of Stockholders.

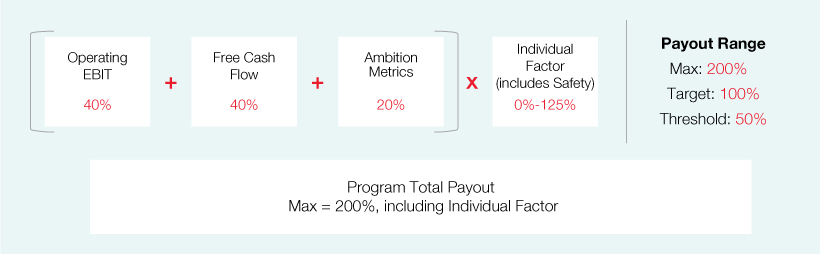

The Independent Lead Director has clearly defined leadership authority and responsibilities including: