INVESTOR PRESENTATION Q3 2021 Steven E. Shelton President & CEO Thomas A. Sa SEVP, CFO & COO Exhibit 99.1

FORWARD-LOOKING STATEMENTS During the course of the presentation and any transcript that may result, written or otherwise, California BanCorp (the “Company”) may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks. Although the Company may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized. The Company undertakes no obligation to release publicly the results of any revisions to the forward-looking statements included herein to reflect events or circumstances after today, or to reflect the occurrence of unanticipated events. The Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

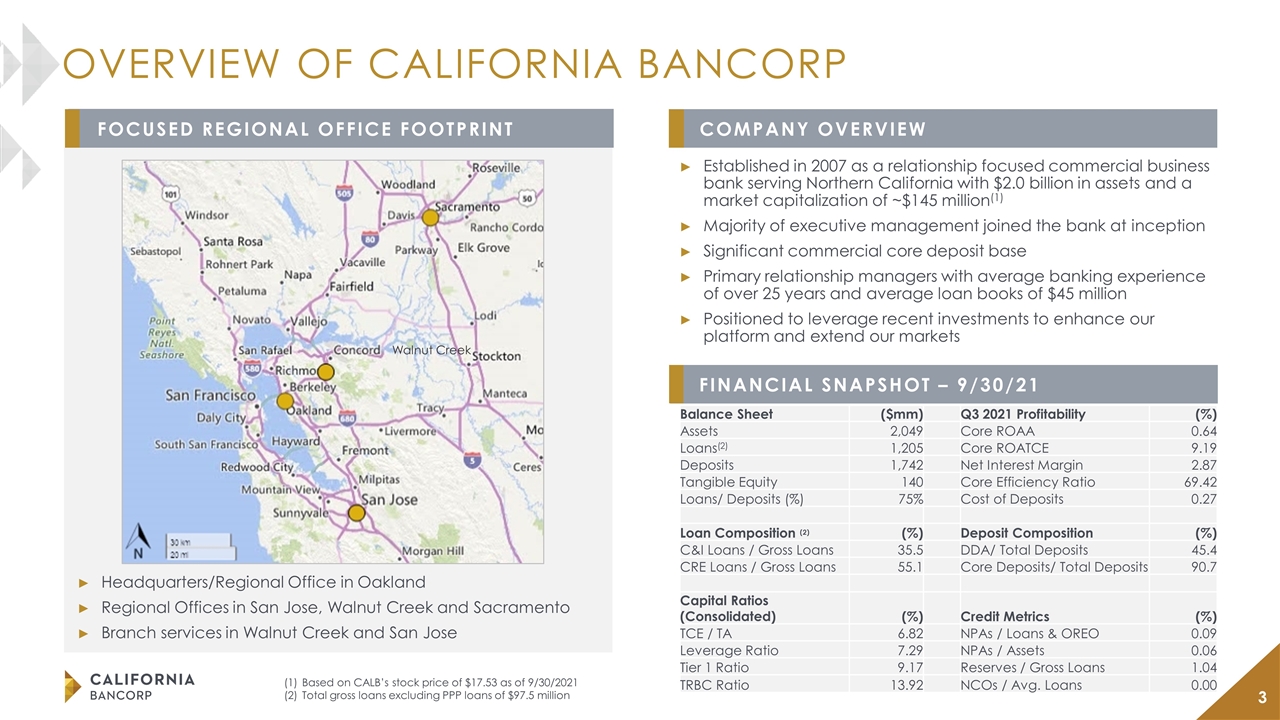

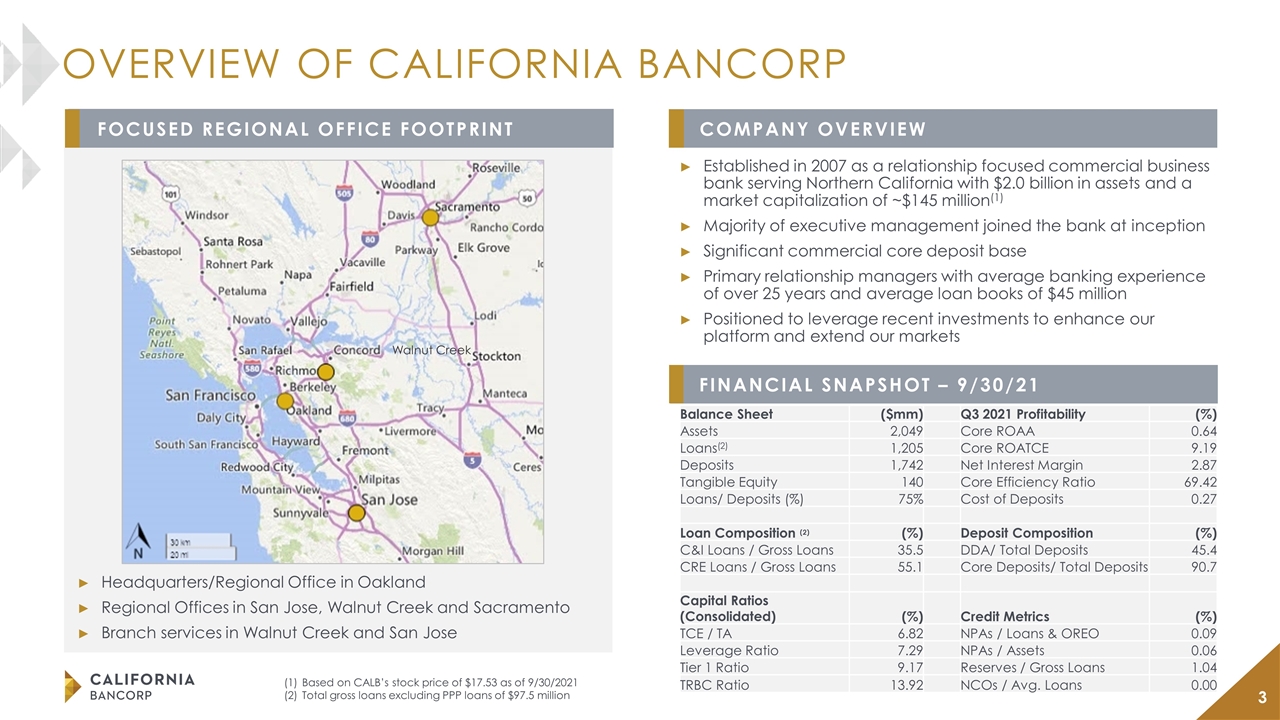

Based on CALB’s stock price of $17.53 as of 9/30/2021 Total gross loans excluding PPP loans of $97.5 million Walnut Creek Headquarters/Regional Office in Oakland Regional Offices in San Jose, Walnut Creek and Sacramento Branch services in Walnut Creek and San Jose OVERVIEW OF CALIFORNIA BANCORP Established in 2007 as a relationship focused commercial business bank serving Northern California with $2.0 billion in assets and a market capitalization of ~$145 million(1) Majority of executive management joined the bank at inception Significant commercial core deposit base Primary relationship managers with average banking experience of over 25 years and average loan books of $45 million Positioned to leverage recent investments to enhance our platform and extend our markets FOCUSED REGIONAL OFFICE FOOTPRINT COMPANY OVERVIEW FINANCIAL SNAPSHOT – 9/30/21 Balance Sheet ($mm) Q3 2021 Profitability (%) Assets 2,049 Core ROAA 0.64 Loans(2) 1,205 Core ROATCE 9.19 Deposits 1,742 Net Interest Margin 2.87 Tangible Equity 140 Core Efficiency Ratio 69.42 Loans/ Deposits (%) 75% Cost of Deposits 0.27 Loan Composition (2) (%) Deposit Composition (%) C&I Loans / Gross Loans 35.5 DDA/ Total Deposits 45.4 CRE Loans / Gross Loans 55.1 Core Deposits/ Total Deposits 90.7 Capital Ratios (Consolidated) (%) Credit Metrics (%) TCE / TA 6.82 NPAs / Loans & OREO 0.09 Leverage Ratio 7.29 NPAs / Assets 0.06 Tier 1 Ratio 9.17 Reserves / Gross Loans 1.04 TRBC Ratio 13.92 NCOs / Avg. Loans 0.00

Branch light, commercial focused business bank with strong middle market relationships throughout Northern California Strong earnings outlook as efficiencies from investments are realized Proven organic and acquisitive growth story Experienced management team and seasoned C&I relationship teams with strong ties to the local markets Quality core deposit franchise and commercial relationship strategy Disciplined underwriting standards with best-in-class asset quality metrics INVESTMENT HIGHLIGHTS 3

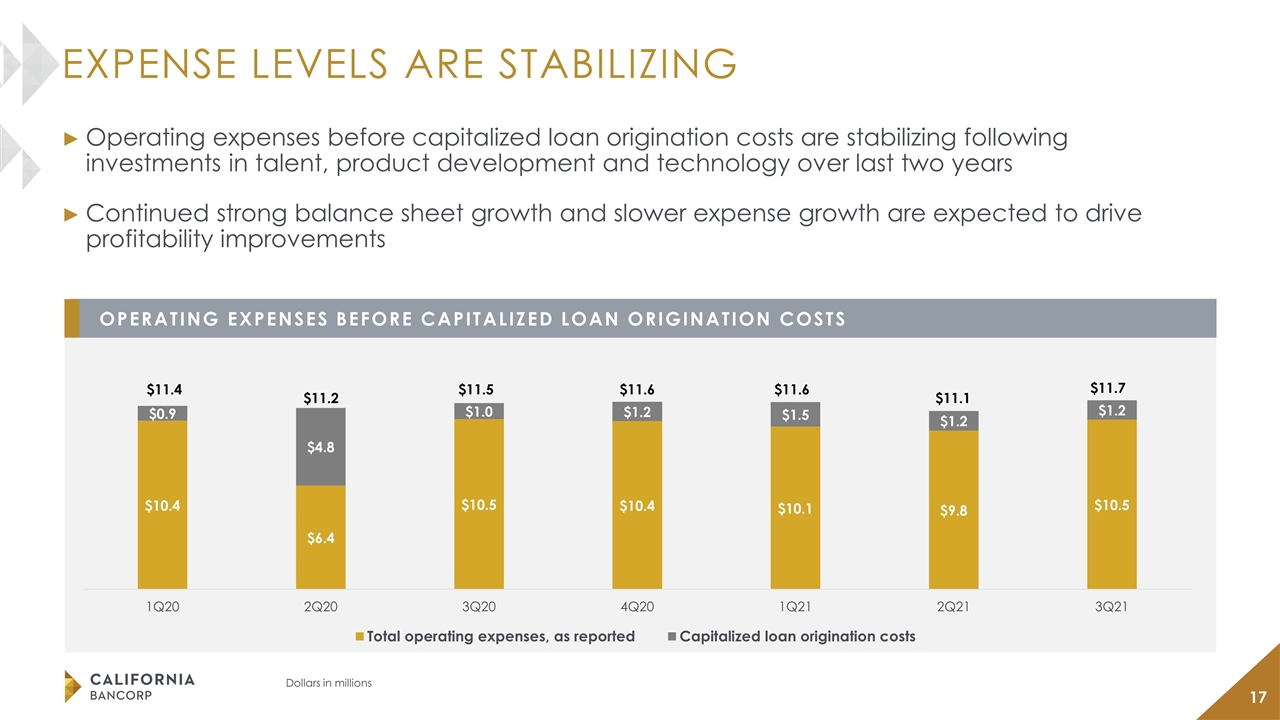

Balance Sheet Growth and Increasing Operating Leverage Driving Improved Profitability Strong Core Loan and Deposit Growth 3rd QUARTER 2021 HIGHLIGHTS Net income of $3.2 million, up from $0.5 million in Q3 2020 EPS of $0.39, up from $0.06 in Q3 2020 ROA of 0.64%, up from 0.10% in Q3 2020 Core loans (ex. PPP loans) increased $46 million, or 4%, from Q2 2021 to reach $1.20 billion; average core loans increased $65 million, or 6%, from prior quarter Total deposits increased $62 million, or 4%, from Q2 2021 to total $1.74 billion; average deposits increased $111 million, or 7%, from prior quarter Net Interest Income Increases Despite Modest Net Interest Margin Decline Net interest income of $13.8 million increased $0.3 million, or 2%, from Q2 2021 NIM declined to 2.87% from 2.98% in Q2 2021 due to excess liquidity and less PPP fees Average loan yield of 4.48% increased 31bps from Q2 2021 Cost of total deposits of 0.27% decreased 1bp from Q2 2021 Controlled Expenses Non-interest expense, excluding capitalized loan origination costs, of $11.7 million increased from $11.1 million in Q2 2021 due mostly to production-based incentives and the competitive labor market Efficiency ratio increased to 69.42% from 67.63% in Q2 2021 Continued Strong Asset Quality Non-performing assets to total assets of 0.06% Net recoveries of $31,000, or 0.00% of gross loans Provision for credit losses increased to $300,000 from ($1.1) million for Q2 2021

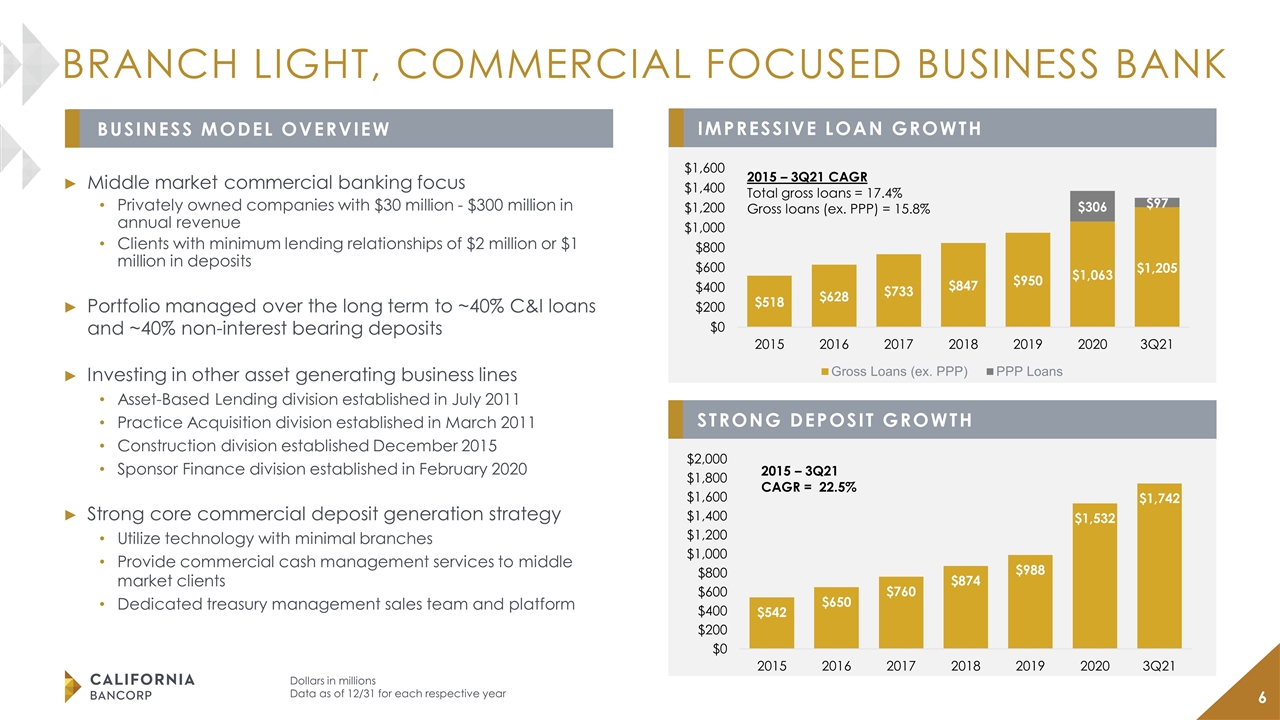

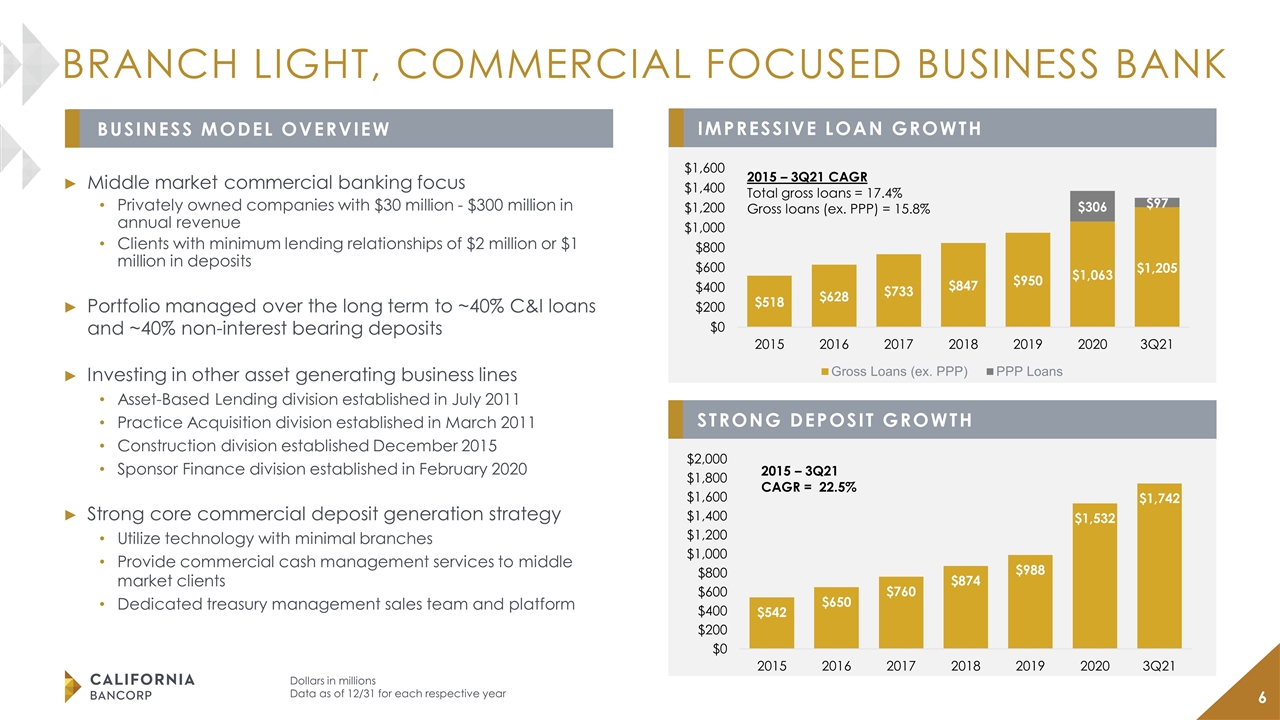

BRANCH LIGHT, COMMERCIAL FOCUSED BUSINESS BANK Middle market commercial banking focus Privately owned companies with $30 million - $300 million in annual revenue Clients with minimum lending relationships of $2 million or $1 million in deposits Portfolio managed over the long term to ~40% C&I loans and ~40% non-interest bearing deposits Investing in other asset generating business lines Asset-Based Lending division established in July 2011 Practice Acquisition division established in March 2011 Construction division established December 2015 Sponsor Finance division established in February 2020 Strong core commercial deposit generation strategy Utilize technology with minimal branches Provide commercial cash management services to middle market clients Dedicated treasury management sales team and platform Dollars in millions Data as of 12/31 for each respective year 2015 – 3Q21 CAGR = 22.5% BUSINESS MODEL OVERVIEW IMPRESSIVE LOAN GROWTH STRONG DEPOSIT GROWTH 2015 – 3Q21 CAGR Total gross loans = 17.4% Gross loans (ex. PPP) = 15.8%

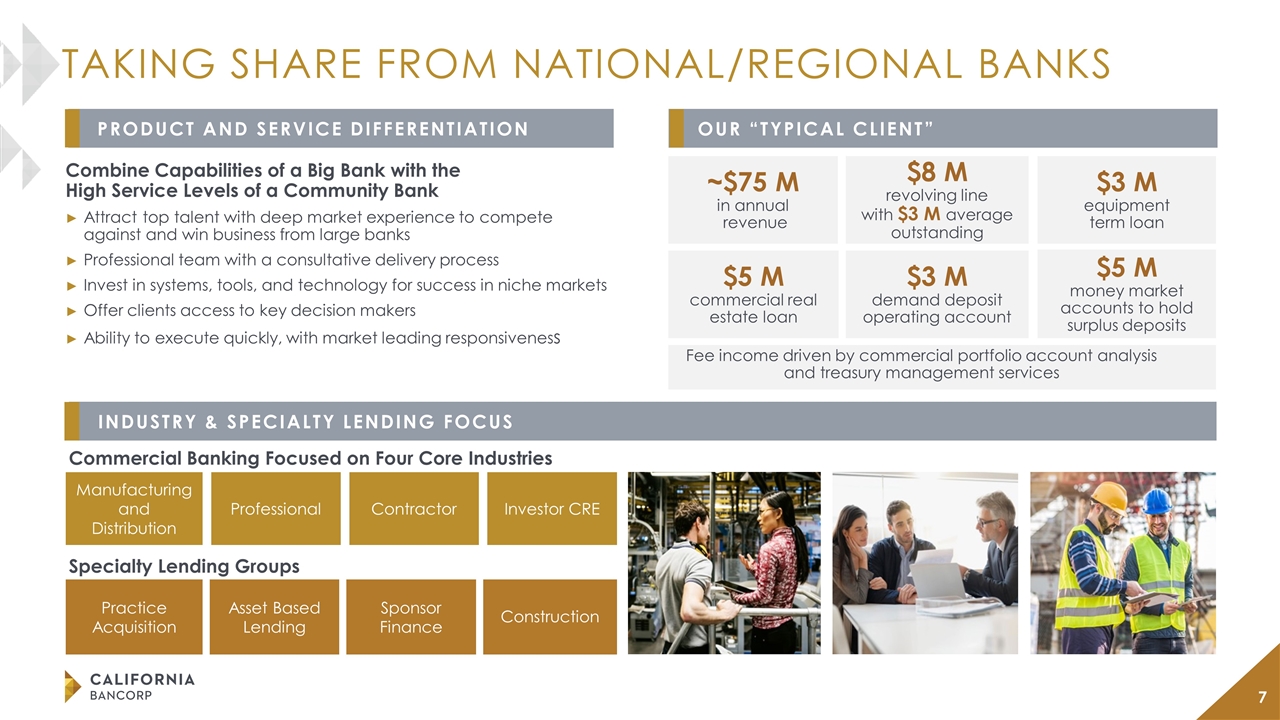

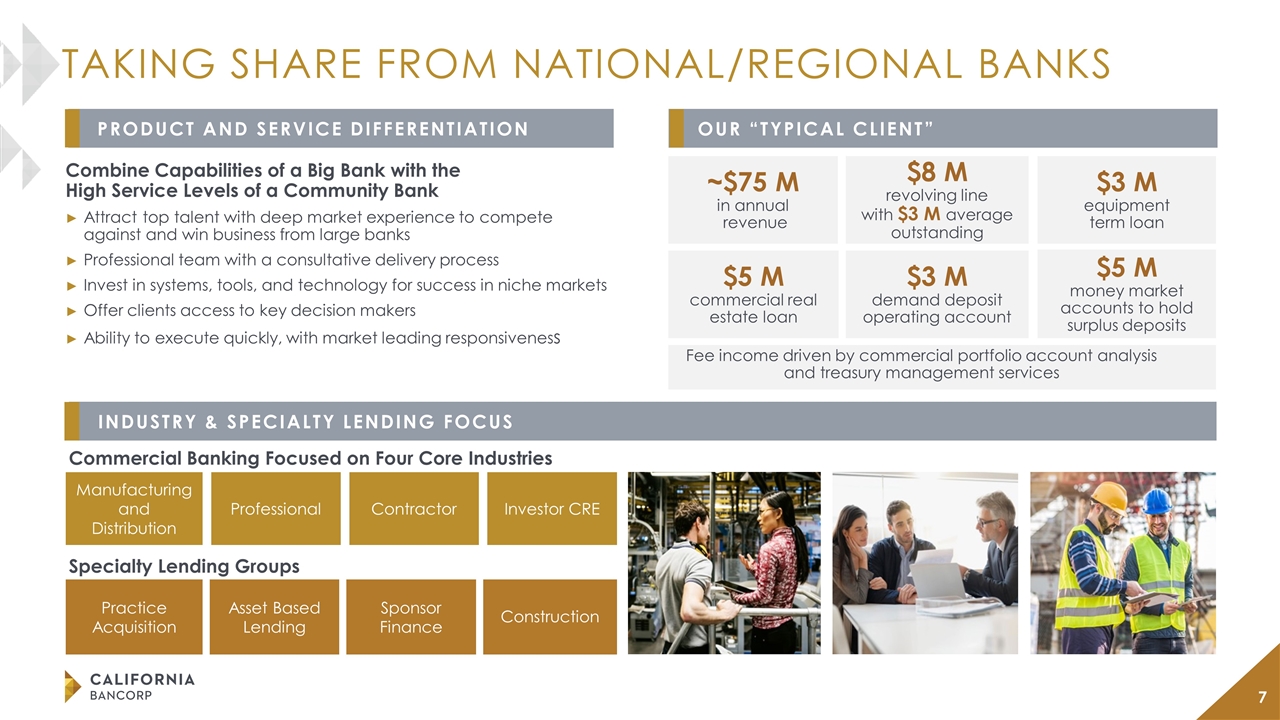

TAKING SHARE FROM NATIONAL/REGIONAL BANKS Combine Capabilities of a Big Bank with the High Service Levels of a Community Bank Attract top talent with deep market experience to compete against and win business from large banks Professional team with a consultative delivery process Invest in systems, tools, and technology for success in niche markets Offer clients access to key decision makers Ability to execute quickly, with market leading responsiveness PRODUCT AND SERVICE DIFFERENTIATION INDUSTRY & SPECIALTY LENDING FOCUS OUR “TYPICAL CLIENT” Commercial Banking Focused on Four Core Industries Manufacturing and Distribution Professional Contractor Investor CRE Practice Acquisition Asset Based Lending Sponsor Finance Construction Specialty Lending Groups ~$75 M in annual revenue $8 M revolving line with $3 M average outstanding $3 M equipment term loan $5 M commercial real estate loan $3 M demand deposit operating account $5 M money market accounts to hold surplus deposits Fee income driven by commercial portfolio account analysis and treasury management services

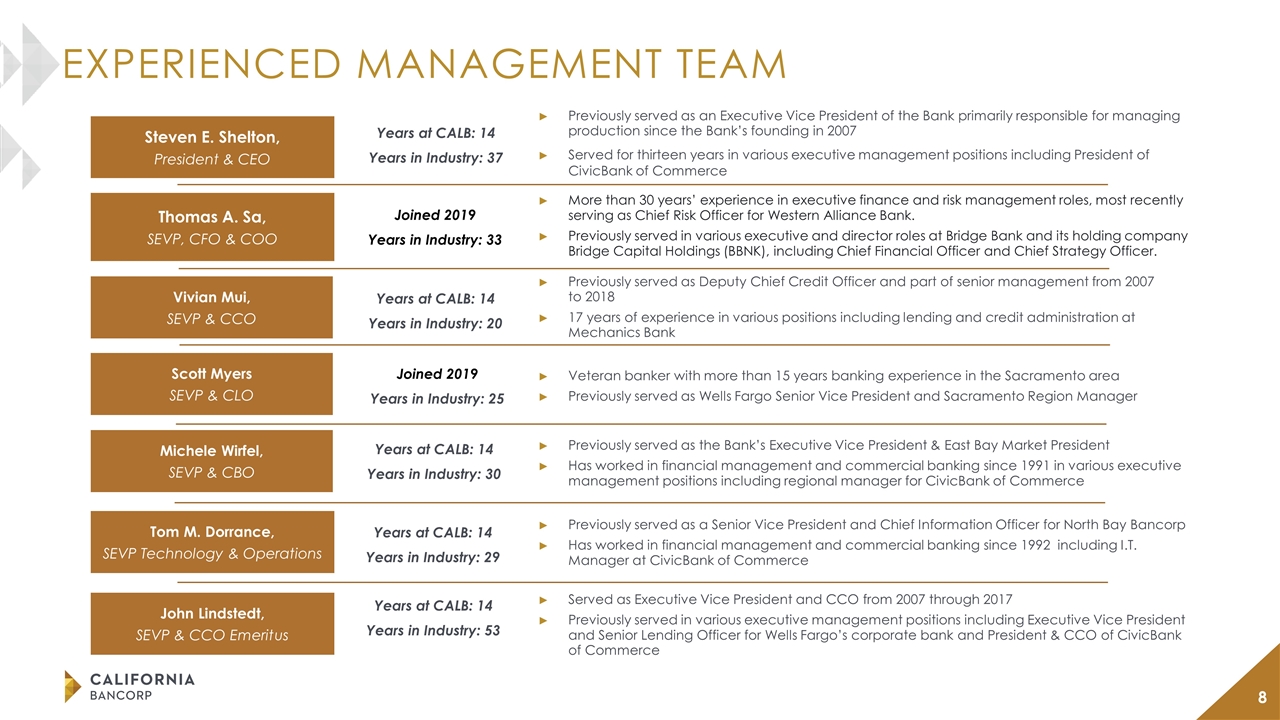

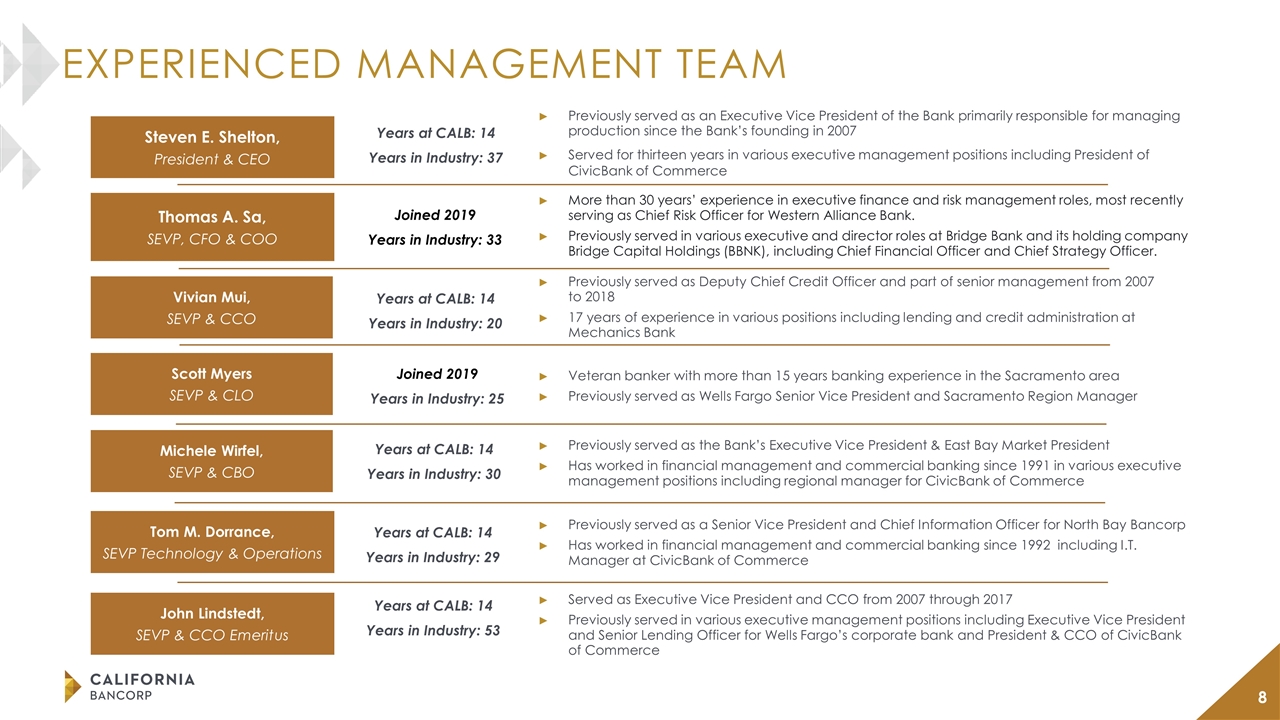

EXPERIENCED MANAGEMENT TEAM Served as Executive Vice President and CCO from 2007 through 2017 Previously served in various executive management positions including Executive Vice President and Senior Lending Officer for Wells Fargo’s corporate bank and President & CCO of CivicBank of Commerce John Lindstedt, SEVP & CCO Emeritus Tom M. Dorrance, SEVP Technology & Operations Previously served as a Senior Vice President and Chief Information Officer for North Bay Bancorp Has worked in financial management and commercial banking since 1992 including I.T. Manager at CivicBank of Commerce Michele Wirfel, SEVP & CBO Previously served as the Bank’s Executive Vice President & East Bay Market President Has worked in financial management and commercial banking since 1991 in various executive management positions including regional manager for CivicBank of Commerce Age: 84 Age: 57 Age: 51 Previously served as an Executive Vice President of the Bank primarily responsible for managing production since the Bank’s founding in 2007 Served for thirteen years in various executive management positions including President of CivicBank of Commerce Steven E. Shelton, President & CEO Age: 58 Years at CALB: 14 Years in Industry: 37 Years at CALB: 14 Years in Industry: 53 Years at CALB: 14 Years in Industry: 29 Years at CALB: 14 Years in Industry: 30 Veteran banker with more than 15 years banking experience in the Sacramento area Previously served as Wells Fargo Senior Vice President and Sacramento Region Manager Scott Myers SEVP & CLO Age: 49 Joined 2019 Years in Industry: 25 More than 30 years’ experience in executive finance and risk management roles, most recently serving as Chief Risk Officer for Western Alliance Bank. Previously served in various executive and director roles at Bridge Bank and its holding company Bridge Capital Holdings (BBNK), including Chief Financial Officer and Chief Strategy Officer. Thomas A. Sa, SEVP, CFO & COO Age: 57 Joined 2019 Years in Industry: 33 Previously served as Deputy Chief Credit Officer and part of senior management from 2007 to 2018 17 years of experience in various positions including lending and credit administration at Mechanics Bank Vivian Mui, SEVP & CCO Age: 40 Years at CALB: 14 Years in Industry: 20

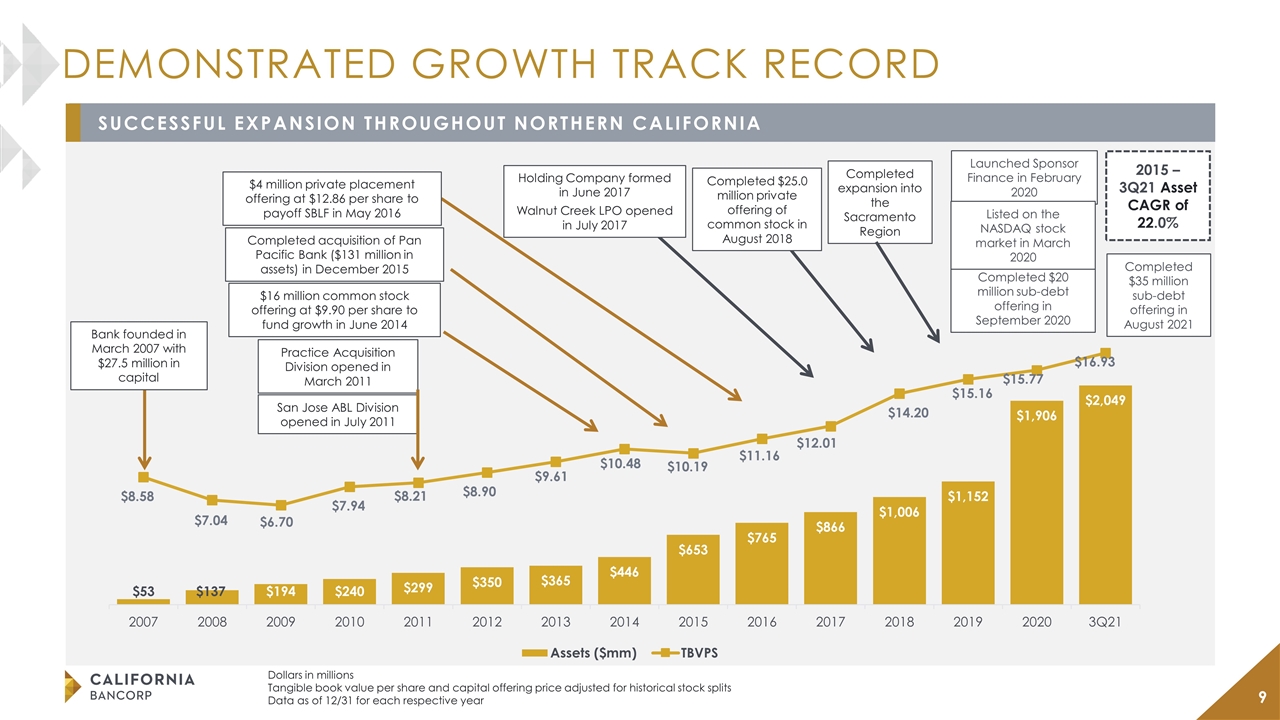

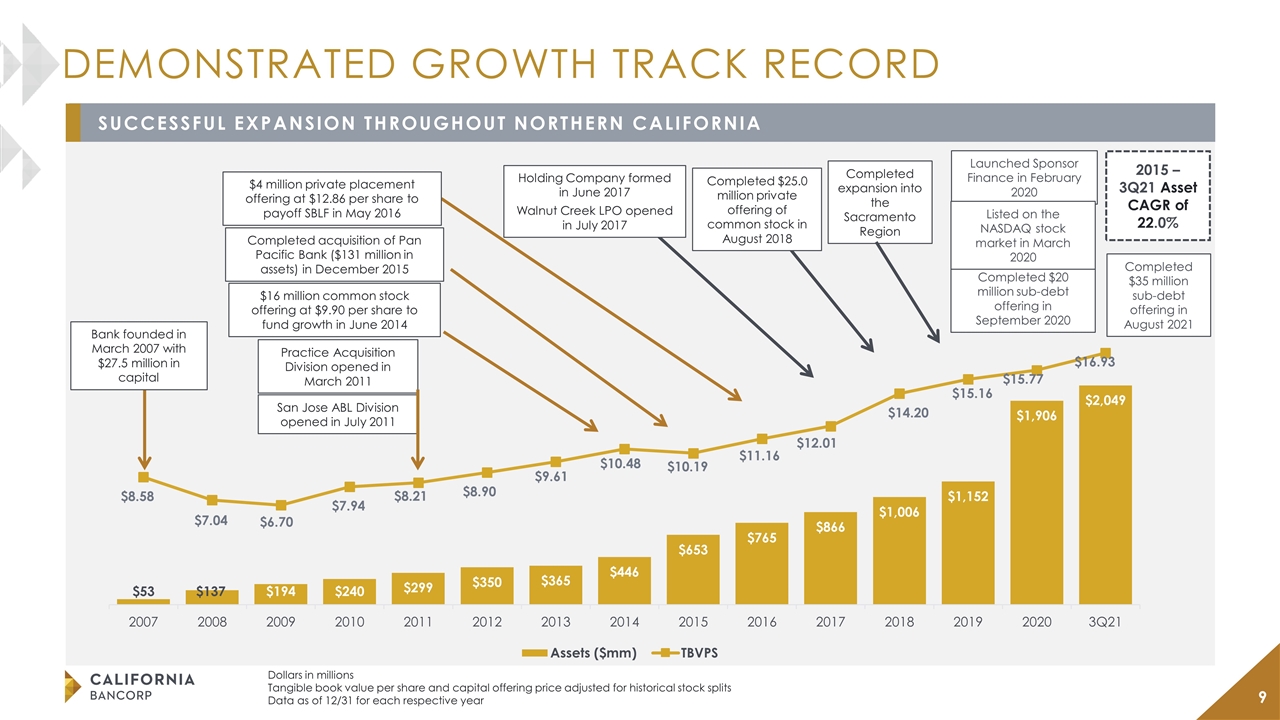

Dollars in millions Tangible book value per share and capital offering price adjusted for historical stock splits Data as of 12/31 for each respective year DEMONSTRATED GROWTH TRACK RECORD $16 million common stock offering at $9.90 per share to fund growth in June 2014 $4 million private placement offering at $12.86 per share to payoff SBLF in May 2016 Completed acquisition of Pan Pacific Bank ($131 million in assets) in December 2015 2015 – 3Q21 Asset CAGR of 22.0% Practice Acquisition Division opened in March 2011 Completed $25.0 million private offering of common stock in August 2018 Holding Company formed in June 2017 Walnut Creek LPO opened in July 2017 Bank founded in March 2007 with $27.5 million in capital Completed expansion into the Sacramento Region San Jose ABL Division opened in July 2011 Launched Sponsor Finance in February 2020 Completed $20 million sub-debt offering in September 2020 Listed on the NASDAQ stock market in March 2020 SUCCESSFUL EXPANSION THROUGHOUT NORTHERN CALIFORNIA Completed $35 million sub-debt offering in August 2021

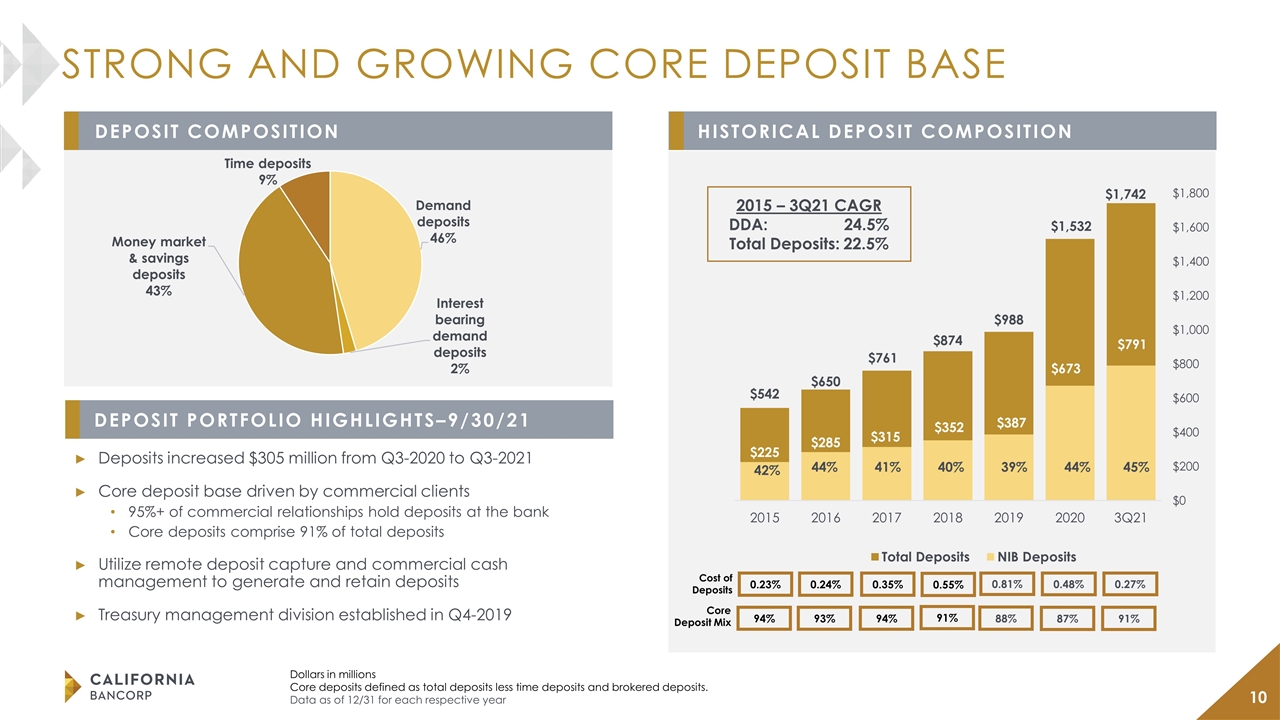

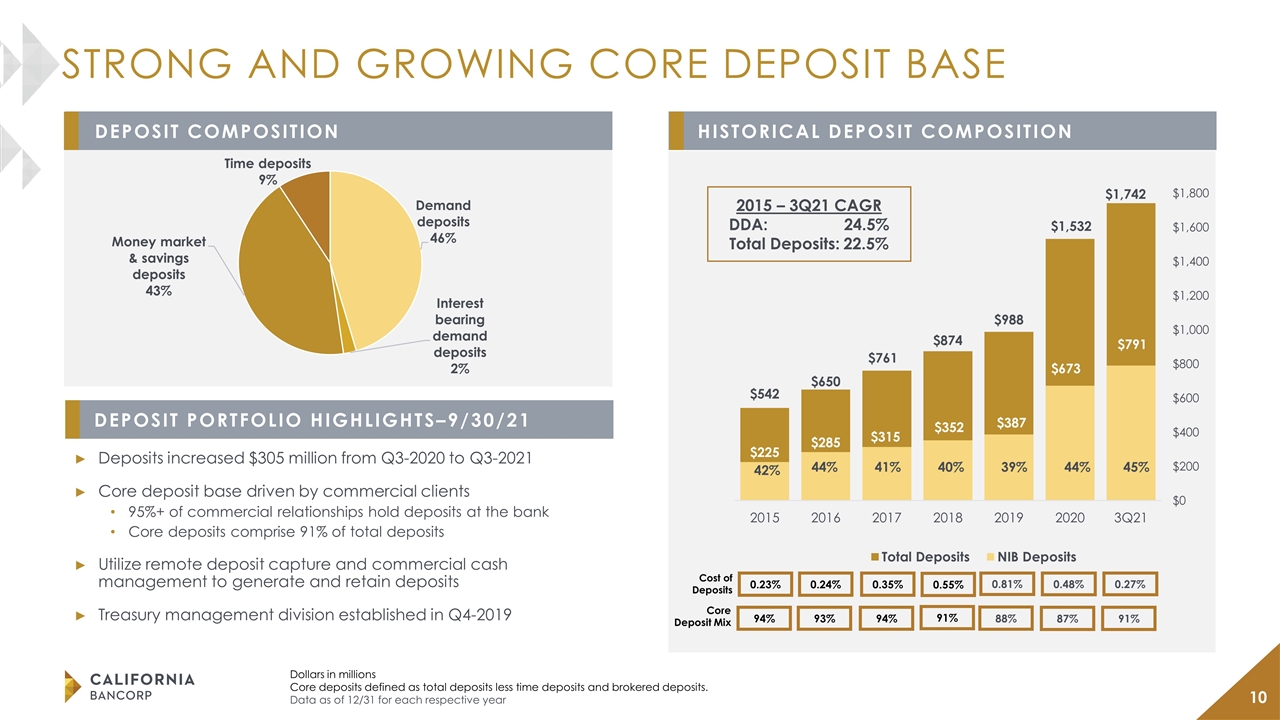

Dollars in millions Core deposits defined as total deposits less time deposits and brokered deposits. Data as of 12/31 for each respective year 2015 – 3Q21 CAGR DDA: 24.5% Total Deposits: 22.5% 0.23% 0.24% 0.35% Cost of Deposits 94% 93% 94% Core Deposit Mix 0.81% 88% 0.55% 91% 0.48% 87% 0.27% 91% 42% 44% 41% 39% 44% 45% 40% HISTORICAL DEPOSIT COMPOSITION DEPOSIT PORTFOLIO HIGHLIGHTS–9/30/21 STRONG AND GROWING CORE DEPOSIT BASE Deposits increased $305 million from Q3-2020 to Q3-2021 Core deposit base driven by commercial clients 95%+ of commercial relationships hold deposits at the bank Core deposits comprise 91% of total deposits Utilize remote deposit capture and commercial cash management to generate and retain deposits Treasury management division established in Q4-2019 DEPOSIT COMPOSITION

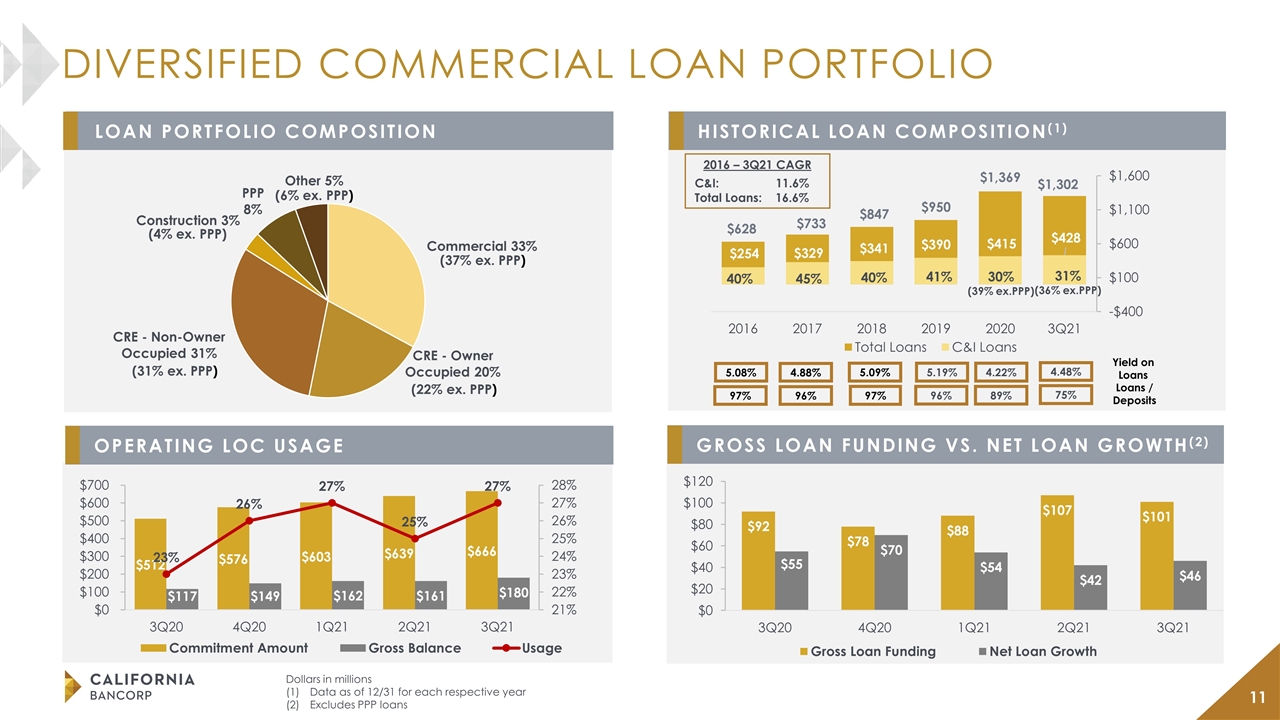

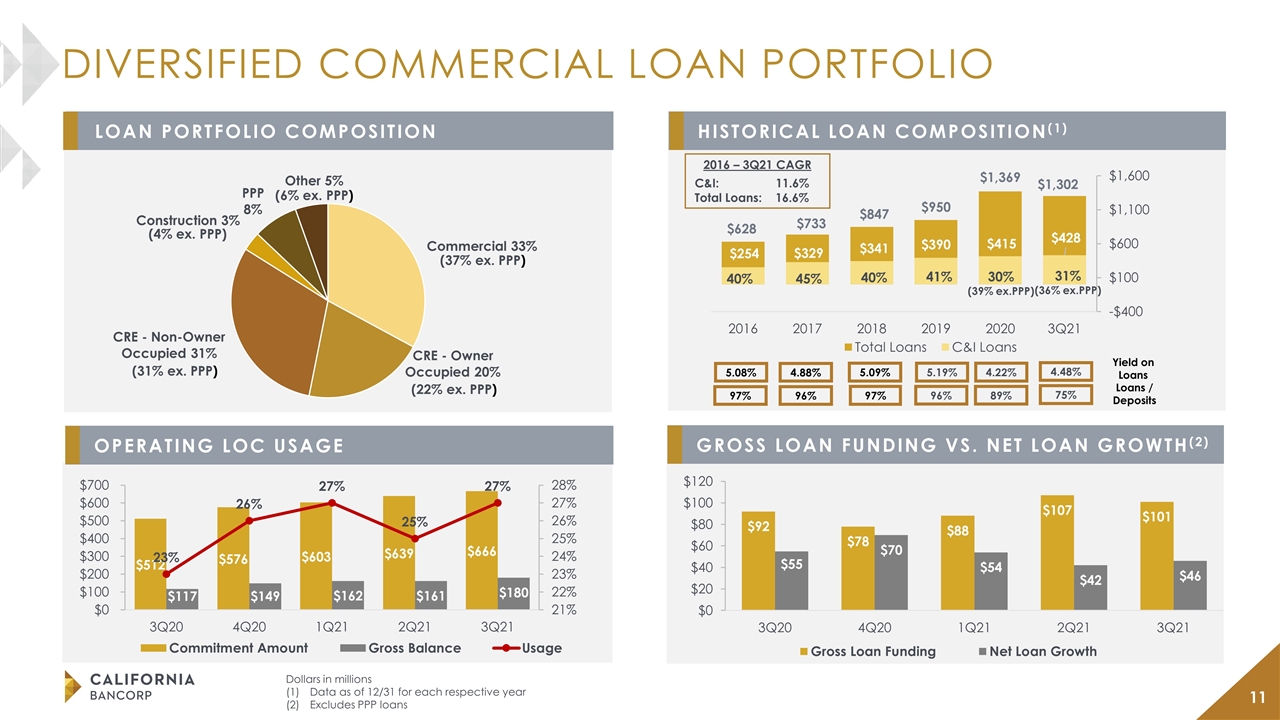

Dollars in millions Data as of 12/31 for each respective year Excludes PPP loans DIVERSIFIED COMMERCIAL LOAN PORTFOLIO HISTORICAL LOAN COMPOSITION(1) OPERATING LOC USAGE LOAN PORTFOLIO COMPOSITION GROSS LOAN FUNDING VS. NET LOAN GROWTH(2) (3) 2016 – 3Q21 CAGR C&I: 11.6% Total Loans: 16.6% 5.08% 4.88% 97% 96% 5.19% 96% 5.09% 97% 4.22% 89% Yield on Loans Loans / Deposits 4.48% 75% 40% 45% 40% 41% 30% (39% ex.PPP) (4% ex. PPP)

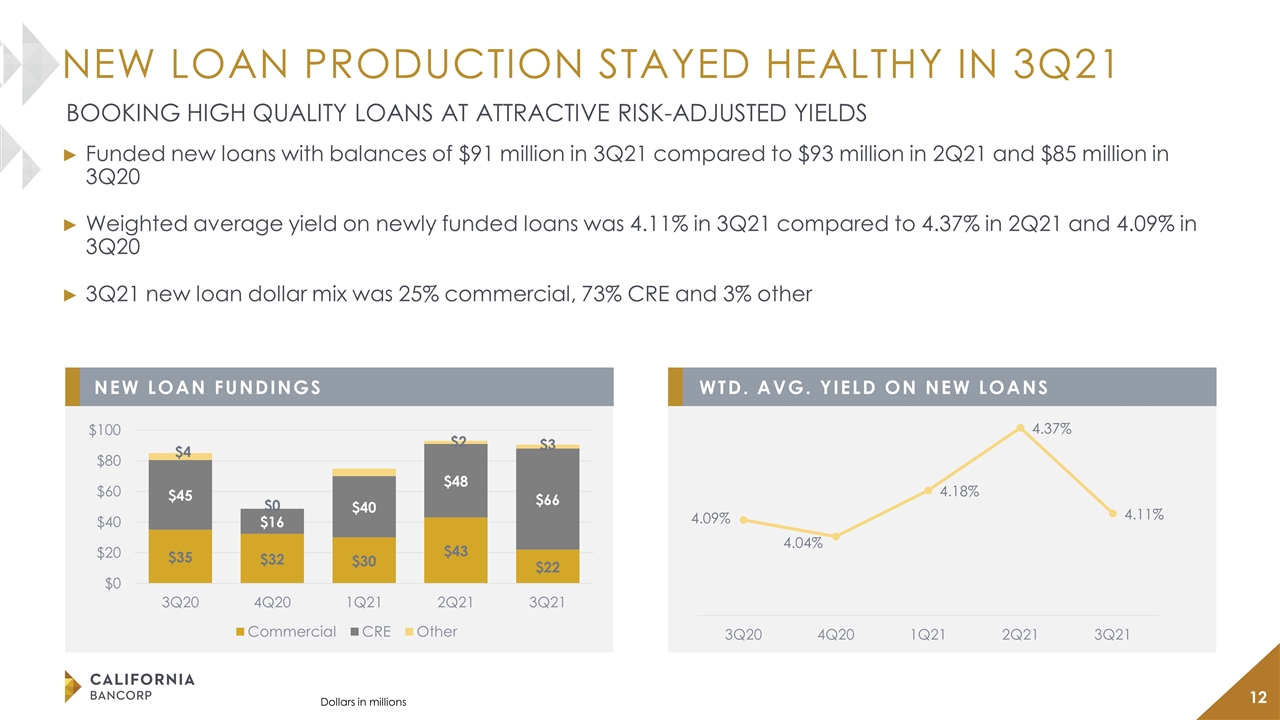

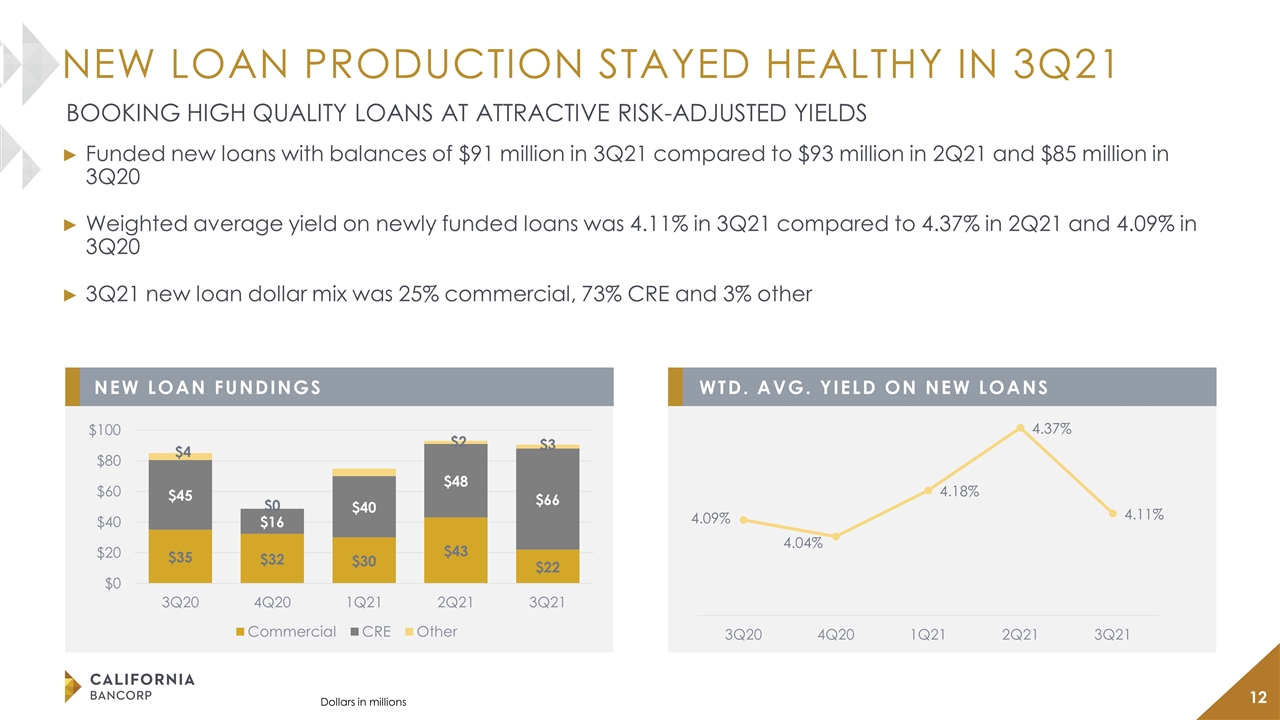

NEW LOAN PRODUCTION STAYED HEALTHY IN 3Q21 BOOKING HIGH QUALITY LOANS AT ATTRACTIVE RISK-ADJUSTED YIELDS NEW LOAN FUNDINGS WTD. AVG. YIELD ON NEW LOANS Dollars in millions Funded new loans with balances of $91 million in 3Q21 compared to $93 million in 2Q21 and $85 million in 3Q20 Weighted average yield on newly funded loans was 4.11% in 3Q21 compared to 4.37% in 2Q21 and 4.09% in 3Q20 3Q21 new loan dollar mix was 25% commercial, 73% CRE and 3% other

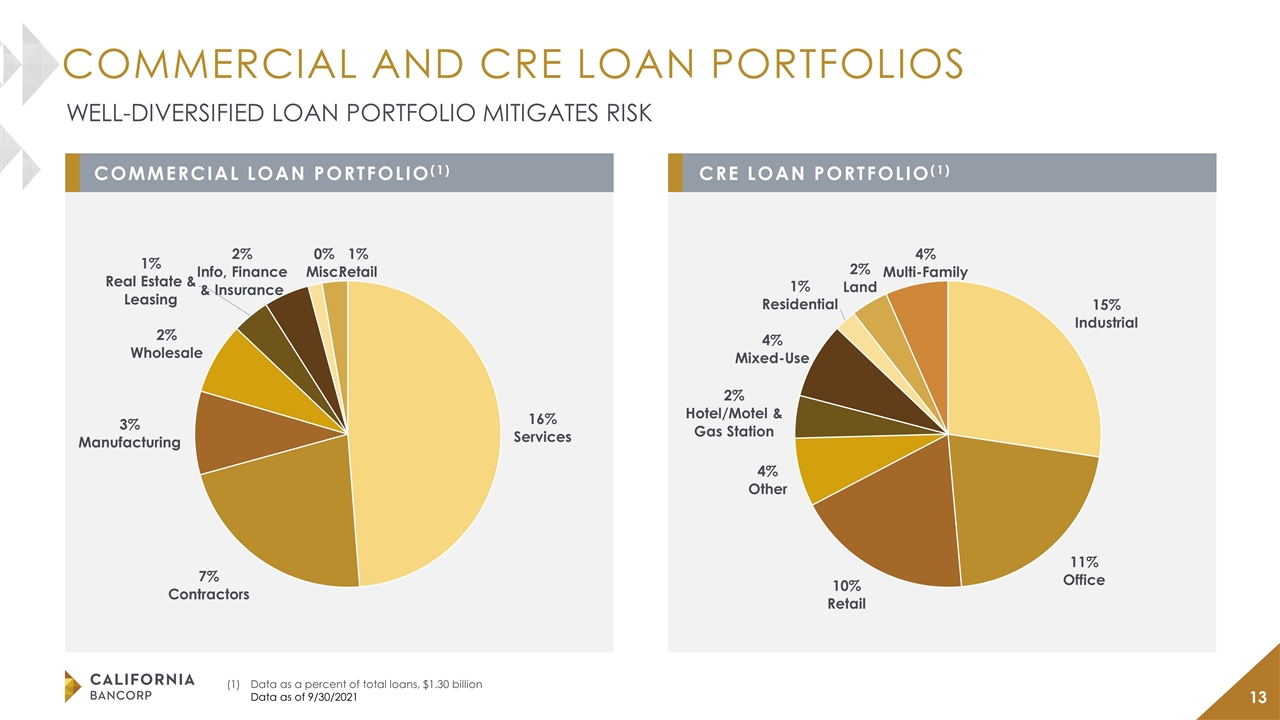

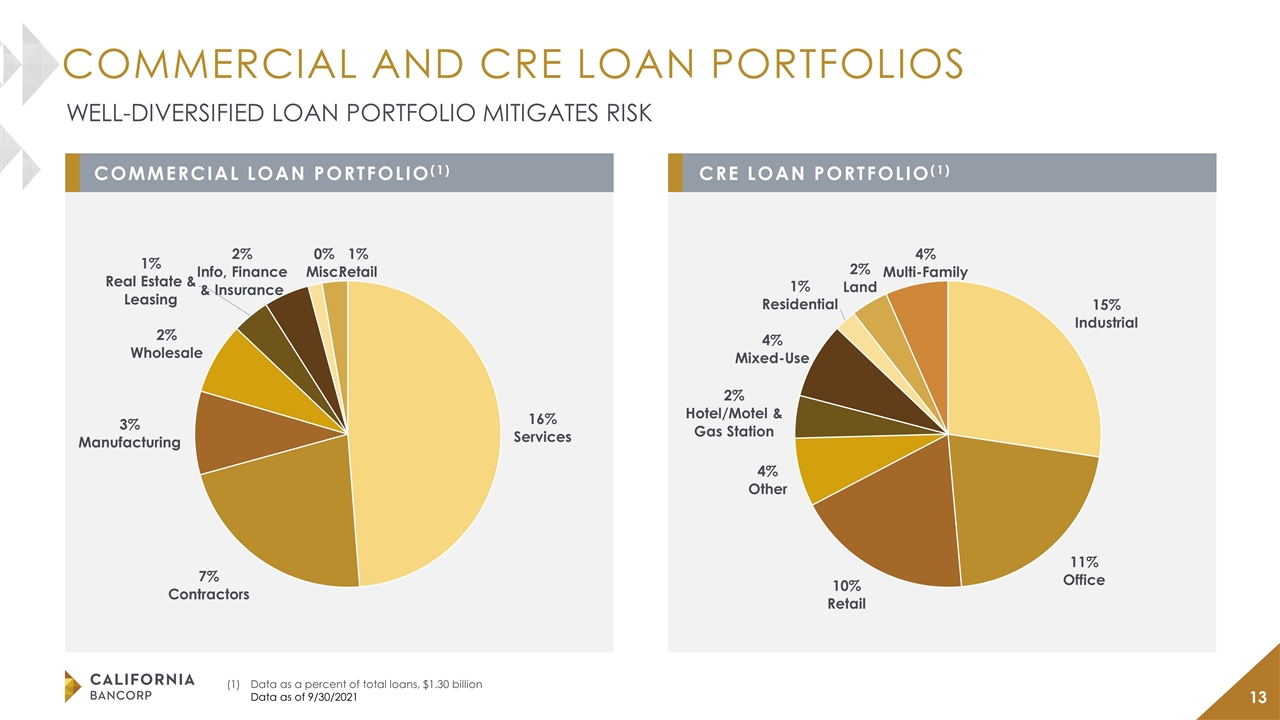

COMMERCIAL AND CRE LOAN PORTFOLIOS WELL-DIVERSIFIED LOAN PORTFOLIO MITIGATES RISK COMMERCIAL LOAN PORTFOLIO(1) CRE LOAN PORTFOLIO(1) Data as a percent of total loans, $1.30 billion Data as of 9/30/2021

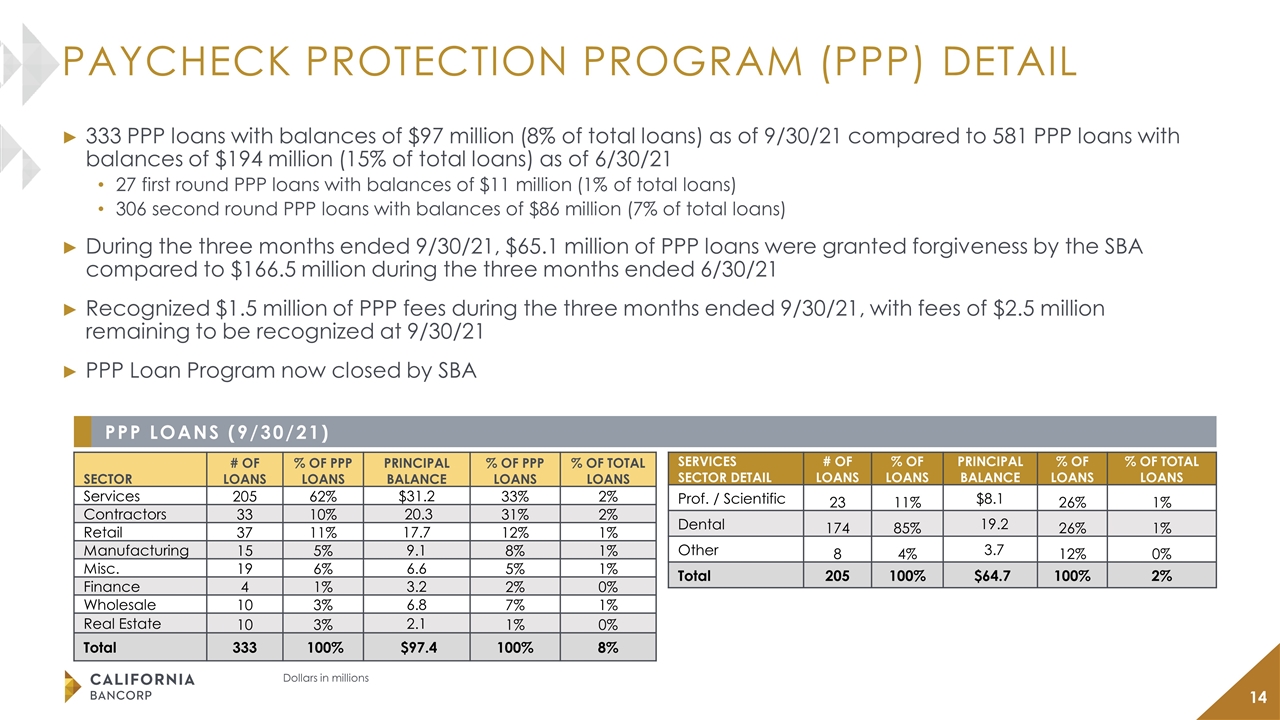

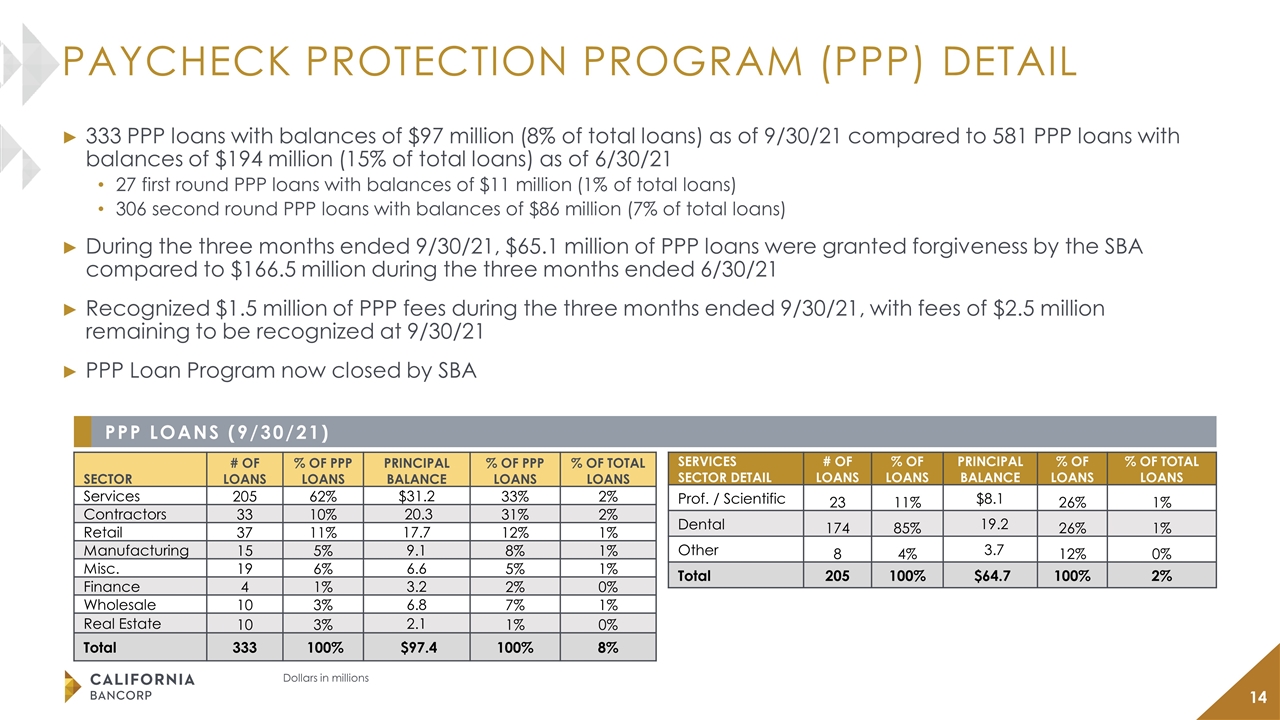

PAYCHECK PROTECTION PROGRAM (PPP) DETAIL 333 PPP loans with balances of $97 million (8% of total loans) as of 9/30/21 compared to 581 PPP loans with balances of $194 million (15% of total loans) as of 6/30/21 27 first round PPP loans with balances of $11 million (1% of total loans) 306 second round PPP loans with balances of $86 million (7% of total loans) During the three months ended 9/30/21, $65.1 million of PPP loans were granted forgiveness by the SBA compared to $166.5 million during the three months ended 6/30/21 Recognized $1.5 million of PPP fees during the three months ended 9/30/21, with fees of $2.5 million remaining to be recognized at 9/30/21 PPP Loan Program now closed by SBA SECTOR # OF LOANS % OF PPP LOANS PRINCIPAL BALANCE % OF PPP LOANS % OF TOTAL LOANS Services 205 62% $31.2 33% 2% Contractors 33 10% 20.3 31% 2% Retail 37 11% 17.7 12% 1% Manufacturing 15 5% 9.1 8% 1% Misc. 19 6% 6.6 5% 1% Finance 4 1% 3.2 2% 0% Wholesale 10 3% 6.8 7% 1% Real Estate 10 3% 2.1 1% 0% Total 333 100% $97.4 100% 8% Dollars in millions SERVICES SECTOR DETAIL # OF LOANS % OF LOANS PRINCIPAL BALANCE % OF LOANS % OF TOTAL LOANS Prof. / Scientific 23 11% $8.1 26% 1% Dental 174 85% 19.2 26% 1% Other 8 4% 3.7 12% 0% Total 205 100% $64.7 100% 2% PPP LOANS (9/30/21)

NET CHARGE-OFFS (RECOVERIES) ($000S)1 NONPERFORMING ASSETS RESERVES / LOANS NCOS (RECOVERIES) / AVG. LOANS (%)1 Net charge-offs for 2020 were concentrated in 2Q20 related to non-systemic issues 2021-YTD is through September 30, 2021 1.13% ex. PPP ASSET QUALITY TRENDS (2) (2)

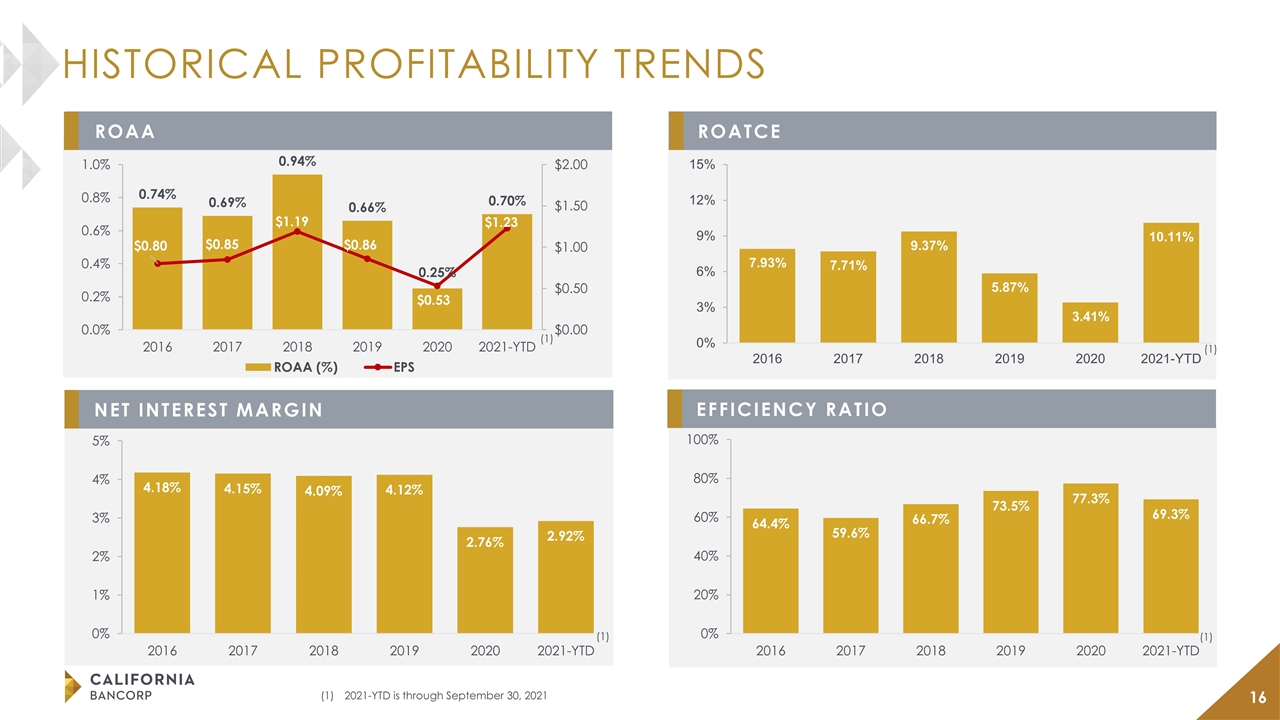

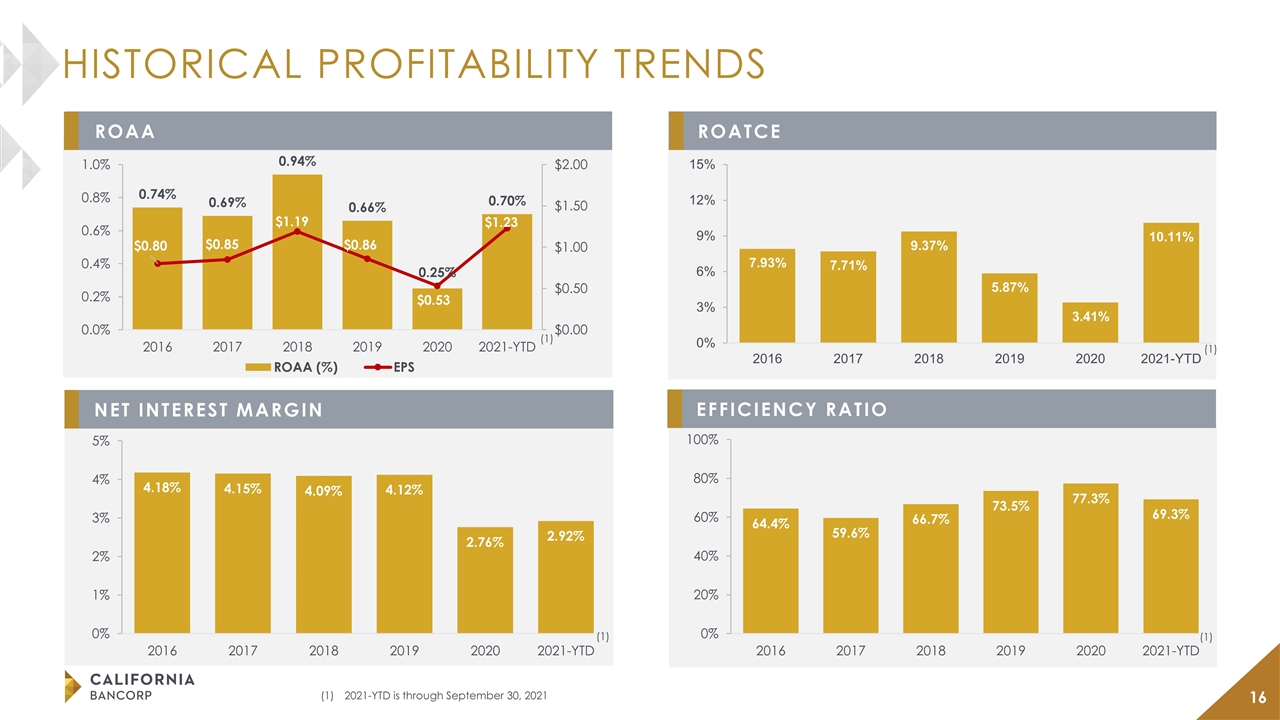

ROATCE NET INTEREST MARGIN ROAA EFFICIENCY RATIO HISTORICAL PROFITABILITY TRENDS (1) (1) (1) (1) 2021-YTD is through September 30, 2021

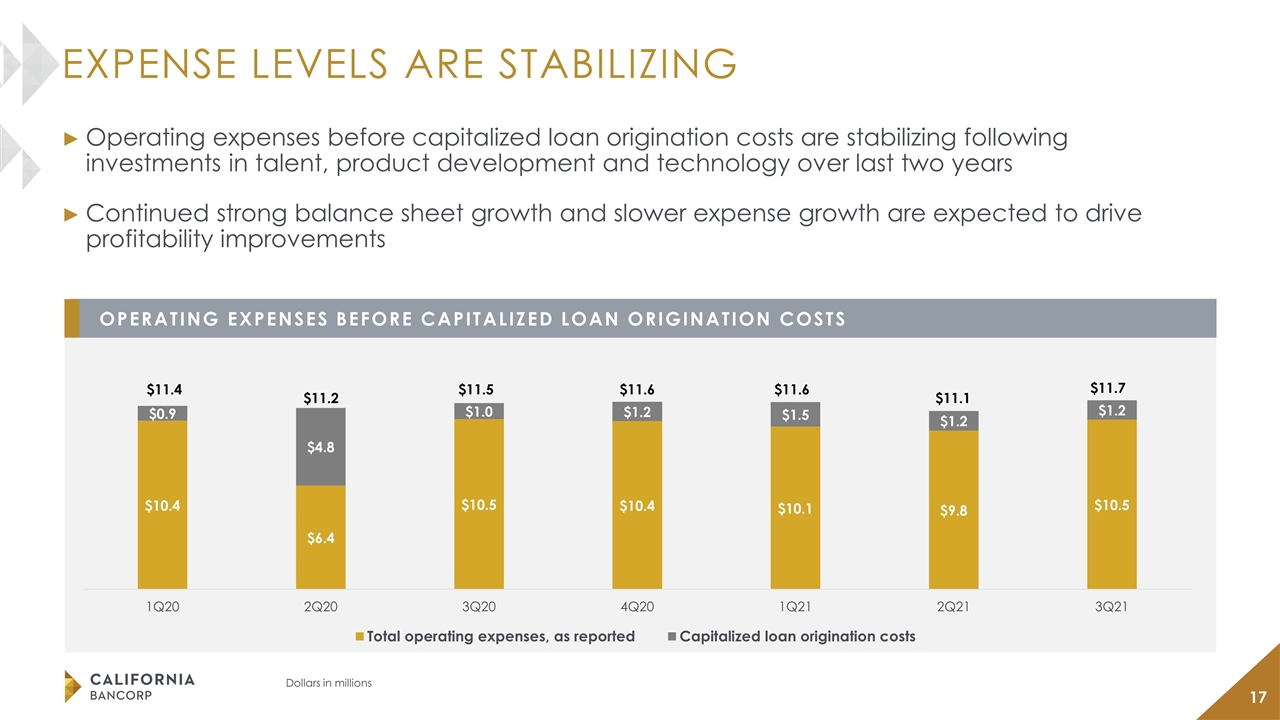

EXPENSE LEVELS ARE STABILIZING Operating expenses before capitalized loan origination costs are stabilizing following investments in talent, product development and technology over last two years Continued strong balance sheet growth and slower expense growth are expected to drive profitability improvements Dollars in millions OPERATING EXPENSES BEFORE CAPITALIZED LOAN ORIGINATION COSTS

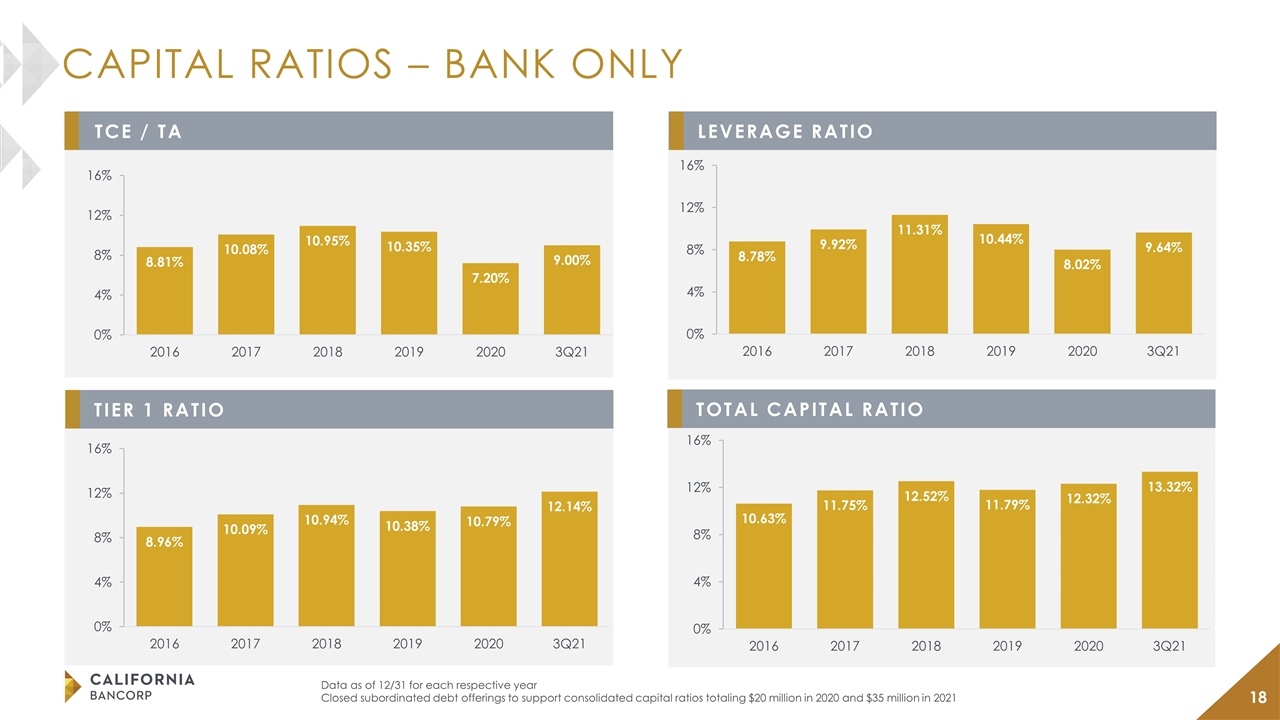

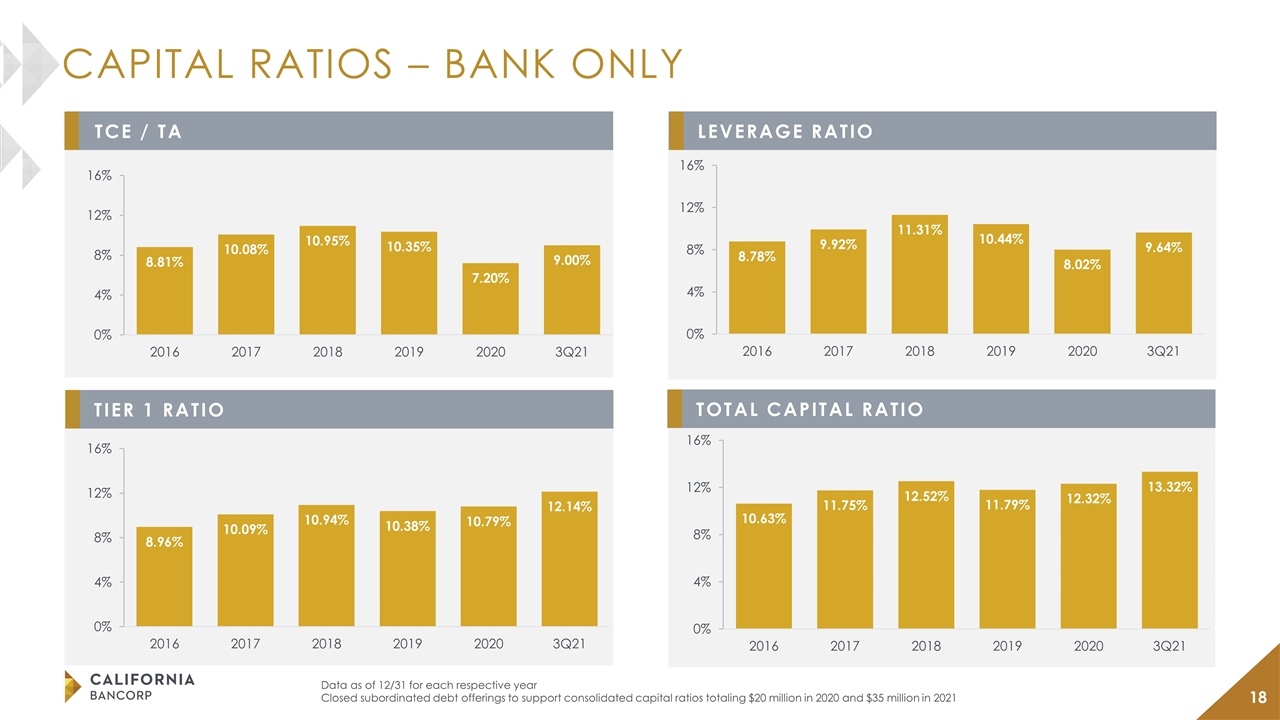

CAPITAL RATIOS – BANK ONLY Data as of 12/31 for each respective year Closed subordinated debt offerings to support consolidated capital ratios totaling $20 million in 2020 and $35 million in 2021 LEVERAGE RATIO TIER 1 RATIO TCE / TA TOTAL CAPITAL RATIO

2021 OUTLOOK AND PRIORITIES EFFICIENCY GROWTH Fully capitalize on the infrastructure put in place to generate additional balance sheet growth and realize increased operating leverage Continue growing loans and deposits as new banking talent added over past two years attracts new clients in our targeted markets, industries, and asset classes EXPENSE MANAGEMENT Tightly manage expense levels while continuing to opportunistically add banking talent in priority areas TREASURY MANAGEMENT Further enhance our treasury management platform to improve our ability to meet the needs of larger commercial clients with more complex cash management requirements ASSET QUALITY Maintain strong asset quality PROFITABILITY Continue executing well, deliver a strong year of balance sheet, revenue and earnings growth, and generate a higher level of returns

Northern California commercial business bank with a disciplined approach to credit underwriting Proven organic and acquisition growth capabilities Strong commercial loan portfolio with corresponding commercial relationship deposits Experienced management team and seasoned C&I relationship managers Keen focus on relationship core deposits in deposit rich industries SUMMARY 3

Please send questions to ir@bankcbc.com Or Call 510.457.3751 CaliforniaBankofCommerce.com