INVESTOR PRESENTATION Q1 2023 Steven E. Shelton CEO Thomas A. Sa President, CFO & COO Exhibit 99.2

FORWARD-LOOKING STATEMENTS During the course of the presentation and any transcript that may result, written or otherwise, California BanCorp (the “Company”) may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks. Although the Company may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized. The Company undertakes no obligation to release publicly the results of any revisions to the forward-looking statements included herein to reflect events or circumstances after today, or to reflect the occurrence of unanticipated events. The Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

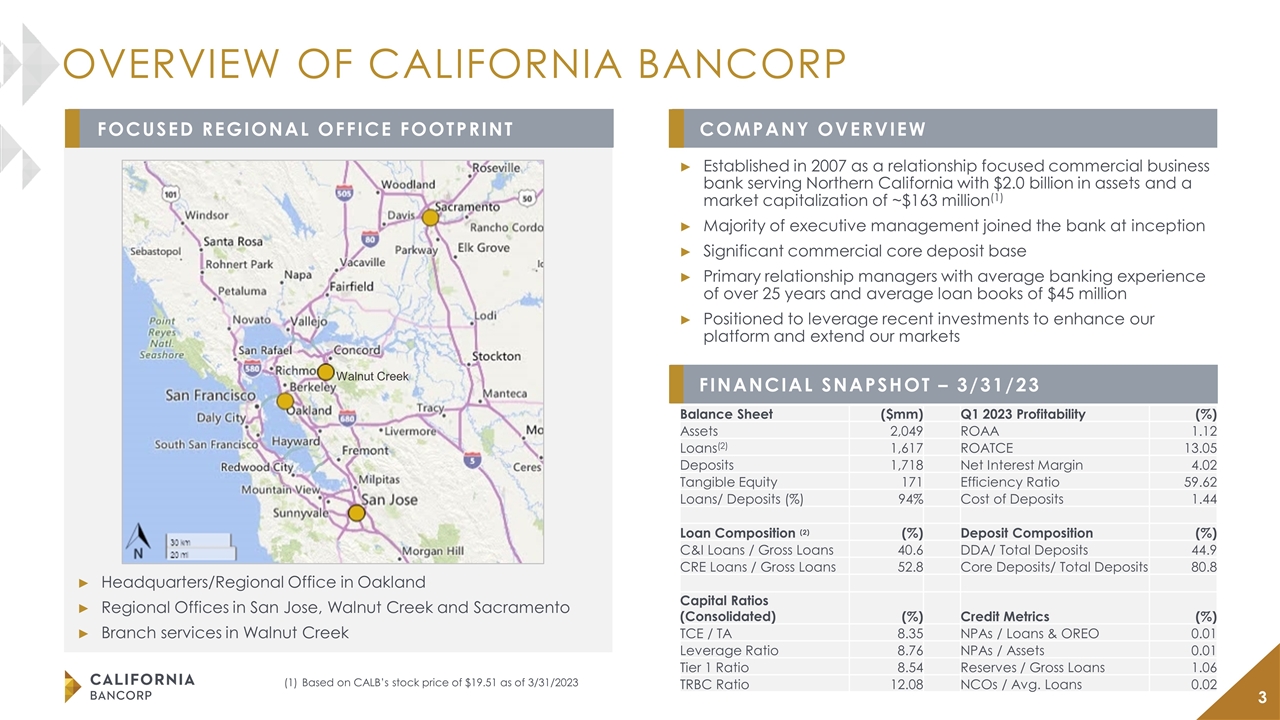

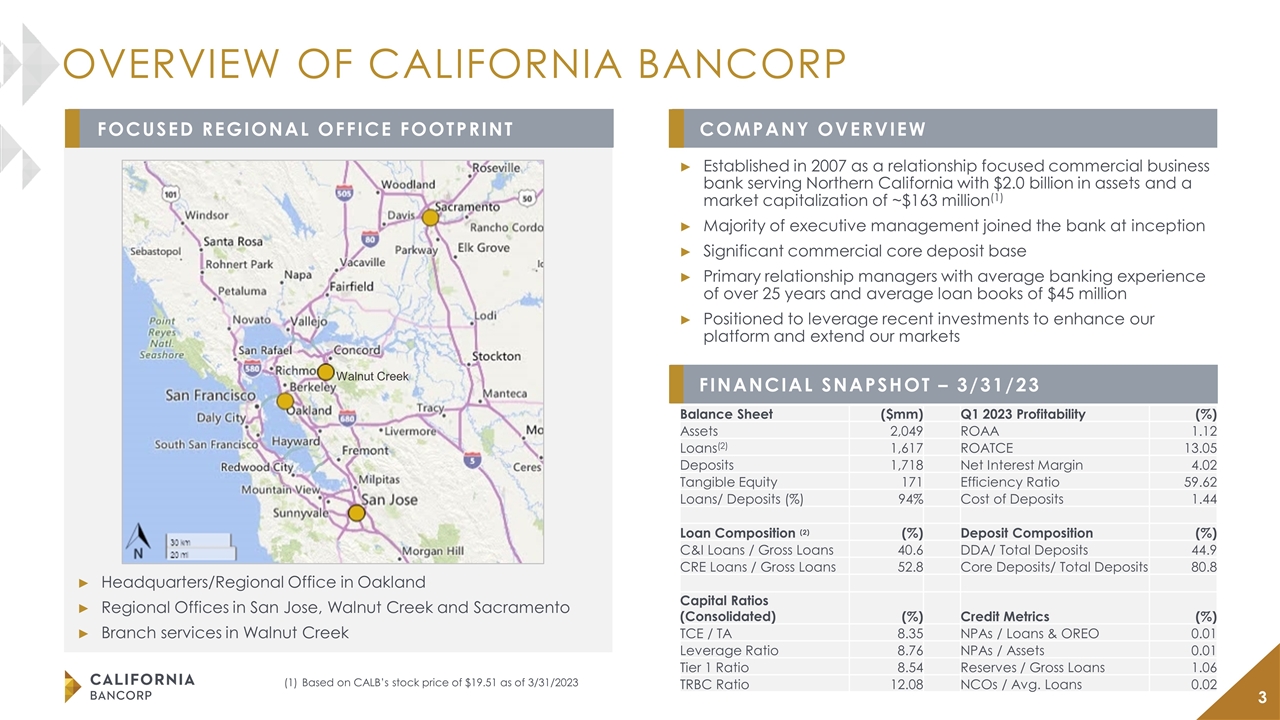

Based on CALB’s stock price of $19.51 as of 3/31/2023 Walnut Creek Headquarters/Regional Office in Oakland Regional Offices in San Jose, Walnut Creek and Sacramento Branch services in Walnut Creek OVERVIEW OF CALIFORNIA BANCORP Established in 2007 as a relationship focused commercial business bank serving Northern California with $2.0 billion in assets and a market capitalization of ~$163 million(1) Majority of executive management joined the bank at inception Significant commercial core deposit base Primary relationship managers with average banking experience of over 25 years and average loan books of $45 million Positioned to leverage recent investments to enhance our platform and extend our markets FOCUSED REGIONAL OFFICE FOOTPRINT COMPANY OVERVIEW FINANCIAL SNAPSHOT – 3/31/23 Balance Sheet ($mm) Q1 2023 Profitability (%) Assets 2,049 ROAA 1.12 Loans(2) 1,617 ROATCE 13.05 Deposits 1,718 Net Interest Margin 4.02 Tangible Equity 171 Efficiency Ratio 59.62 Loans/ Deposits (%) 94% Cost of Deposits 1.44 Loan Composition (2) (%) Deposit Composition (%) C&I Loans / Gross Loans 40.6 DDA/ Total Deposits 44.9 CRE Loans / Gross Loans 52.8 Core Deposits/ Total Deposits 80.8 Capital Ratios (Consolidated) (%) Credit Metrics (%) TCE / TA 8.35 NPAs / Loans & OREO 0.01 Leverage Ratio 8.76 NPAs / Assets 0.01 Tier 1 Ratio 8.54 Reserves / Gross Loans 1.06 TRBC Ratio 12.08 NCOs / Avg. Loans 0.02

Branch light, commercial focused business bank with strong middle market relationships throughout Northern California Strong earnings outlook as efficiencies from investments are realized Proven organic and acquisitive growth story Experienced management team and seasoned C&I relationship teams with strong ties to the local markets Quality core deposit franchise and commercial relationship strategy Disciplined underwriting standards with best-in-class asset quality metrics INVESTMENT HIGHLIGHTS 3

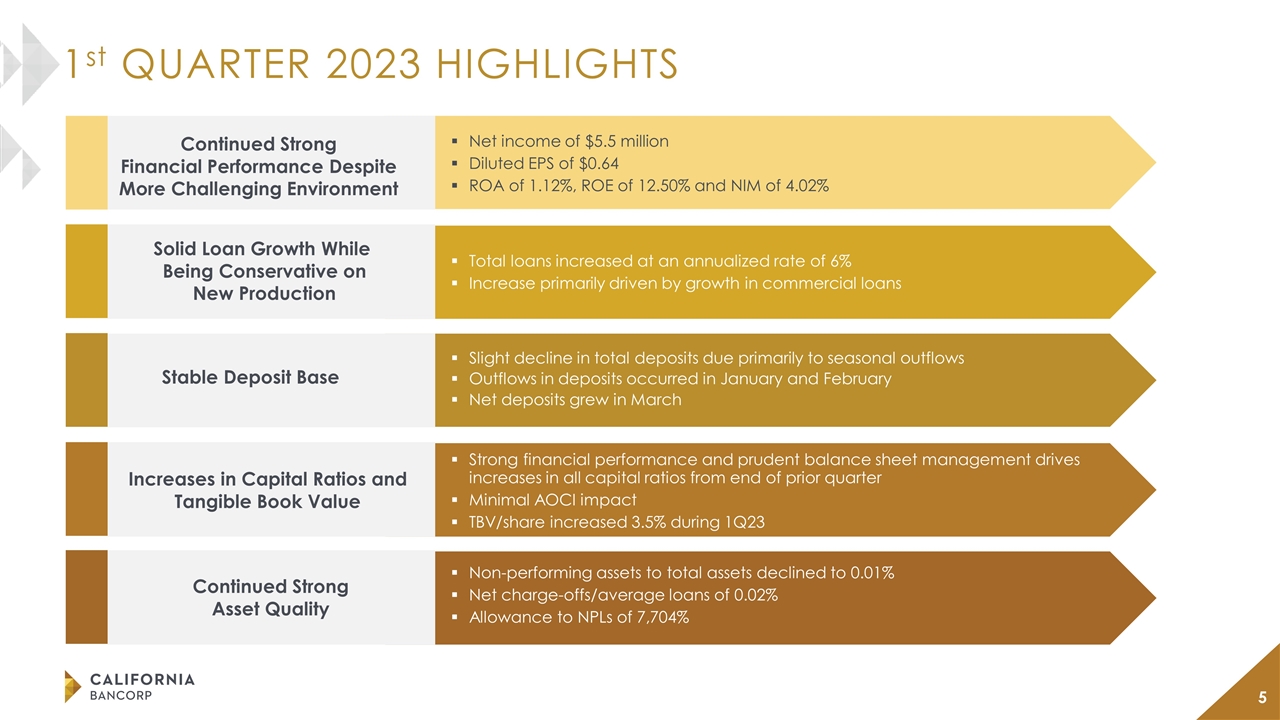

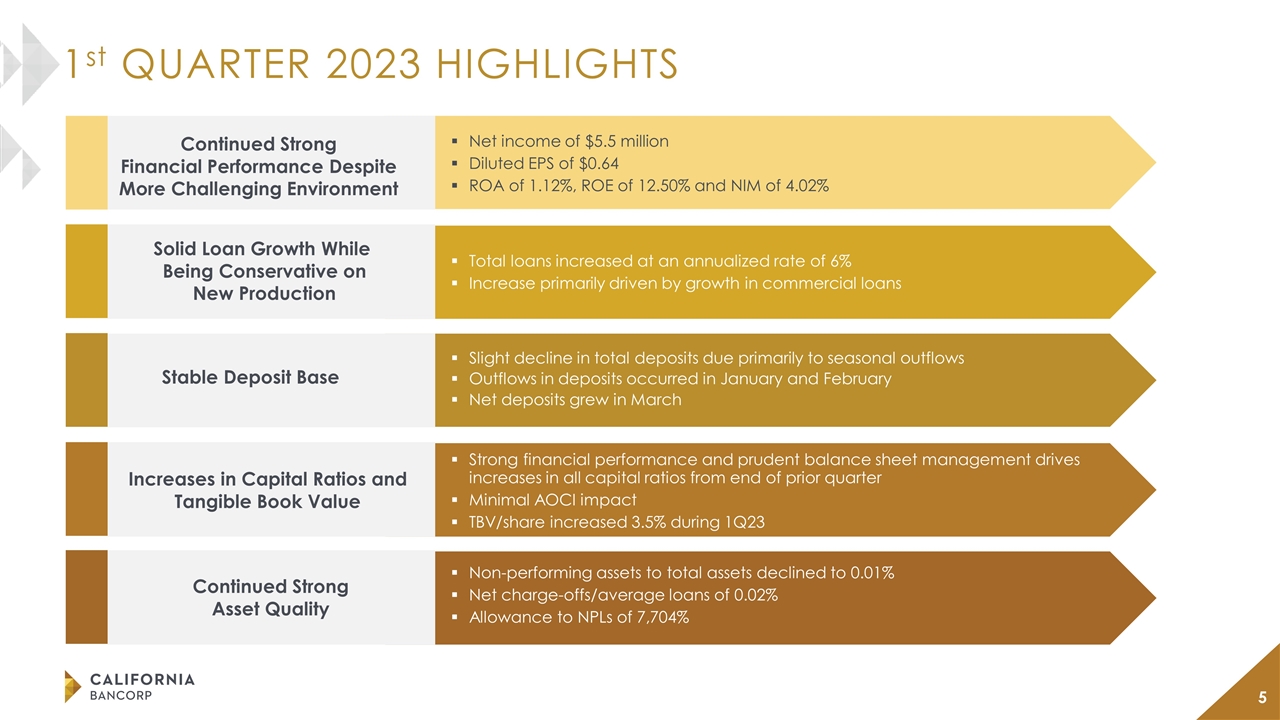

Continued Strong Financial Performance Despite More Challenging Environment Solid Loan Growth While Being Conservative on New Production 1st QUARTER 2023 HIGHLIGHTS Net income of $5.5 million Diluted EPS of $0.64 ROA of 1.12%, ROE of 12.50% and NIM of 4.02% Total loans increased at an annualized rate of 6% Increase primarily driven by growth in commercial loans Stable Deposit Base Slight decline in total deposits due primarily to seasonal outflows Outflows in deposits occurred in January and February Net deposits grew in March Increases in Capital Ratios and Tangible Book Value Strong financial performance and prudent balance sheet management drives increases in all capital ratios from end of prior quarter Minimal AOCI impact TBV/share increased 3.5% during 1Q23 Continued Strong Asset Quality Non-performing assets to total assets declined to 0.01% Net charge-offs/average loans of 0.02% Allowance to NPLs of 7,704%

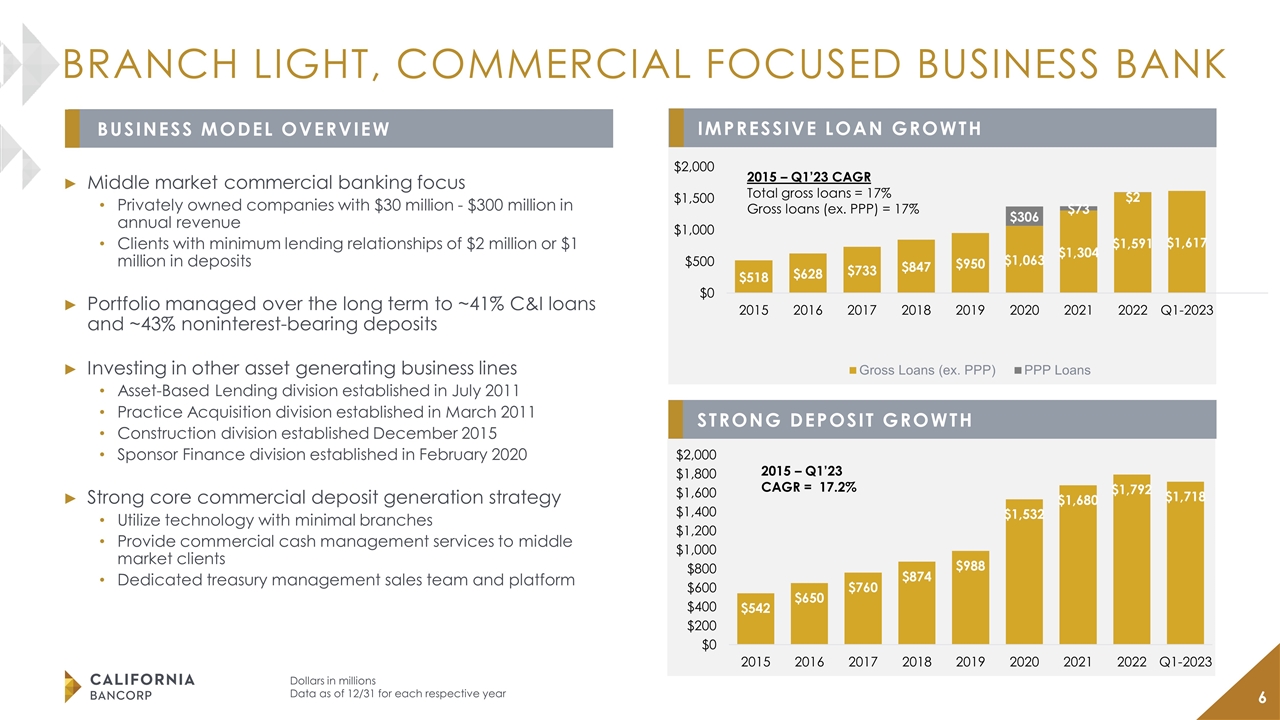

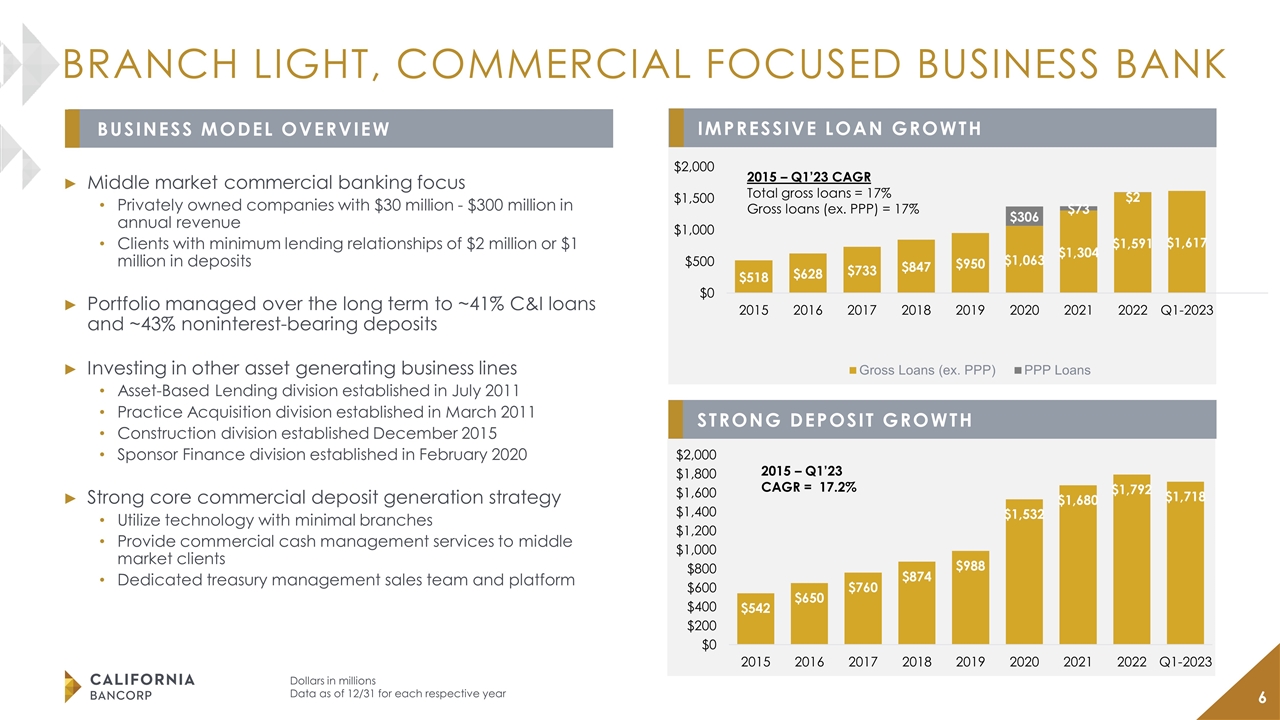

BRANCH LIGHT, COMMERCIAL FOCUSED BUSINESS BANK Middle market commercial banking focus Privately owned companies with $30 million - $300 million in annual revenue Clients with minimum lending relationships of $2 million or $1 million in deposits Portfolio managed over the long term to ~41% C&I loans and ~43% noninterest-bearing deposits Investing in other asset generating business lines Asset-Based Lending division established in July 2011 Practice Acquisition division established in March 2011 Construction division established December 2015 Sponsor Finance division established in February 2020 Strong core commercial deposit generation strategy Utilize technology with minimal branches Provide commercial cash management services to middle market clients Dedicated treasury management sales team and platform Dollars in millions Data as of 12/31 for each respective year 2015 – Q1’23 CAGR = 17.2% BUSINESS MODEL OVERVIEW IMPRESSIVE LOAN GROWTH STRONG DEPOSIT GROWTH 2015 – Q1’23 CAGR Total gross loans = 17% Gross loans (ex. PPP) = 17%

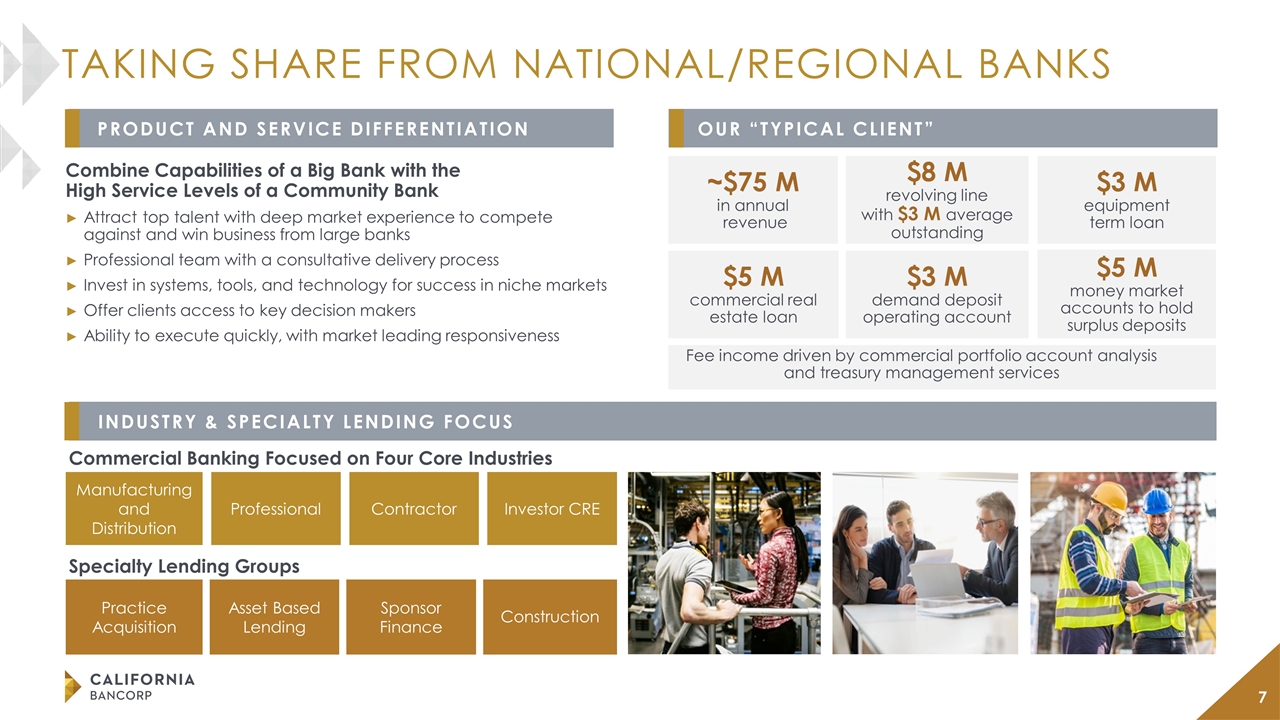

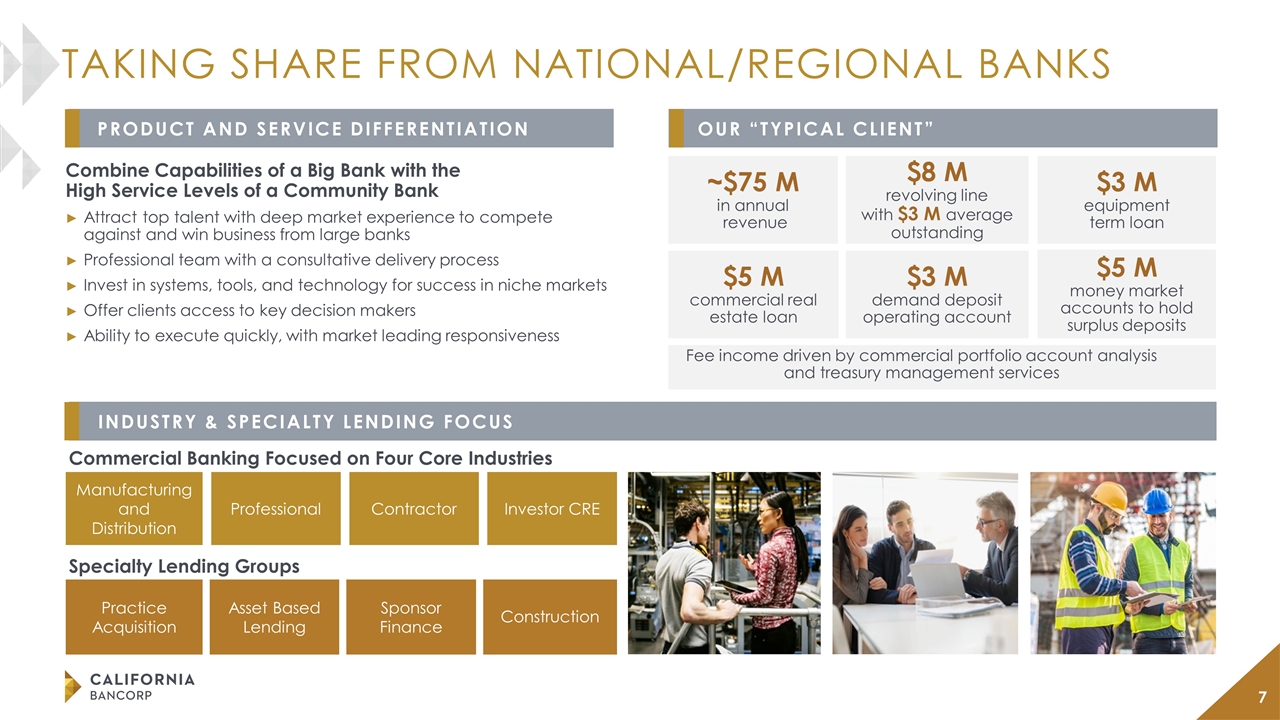

TAKING SHARE FROM NATIONAL/REGIONAL BANKS Combine Capabilities of a Big Bank with the High Service Levels of a Community Bank Attract top talent with deep market experience to compete against and win business from large banks Professional team with a consultative delivery process Invest in systems, tools, and technology for success in niche markets Offer clients access to key decision makers Ability to execute quickly, with market leading responsiveness PRODUCT AND SERVICE DIFFERENTIATION INDUSTRY & SPECIALTY LENDING FOCUS OUR “TYPICAL CLIENT” Commercial Banking Focused on Four Core Industries Manufacturing and Distribution Professional Contractor Investor CRE Practice Acquisition Asset Based Lending Sponsor Finance Construction Specialty Lending Groups ~$75 M in annual revenue $8 M revolving line with $3 M average outstanding $3 M equipment term loan $5 M commercial real estate loan $3 M demand deposit operating account $5 M money market accounts to hold surplus deposits Fee income driven by commercial portfolio account analysis and treasury management services

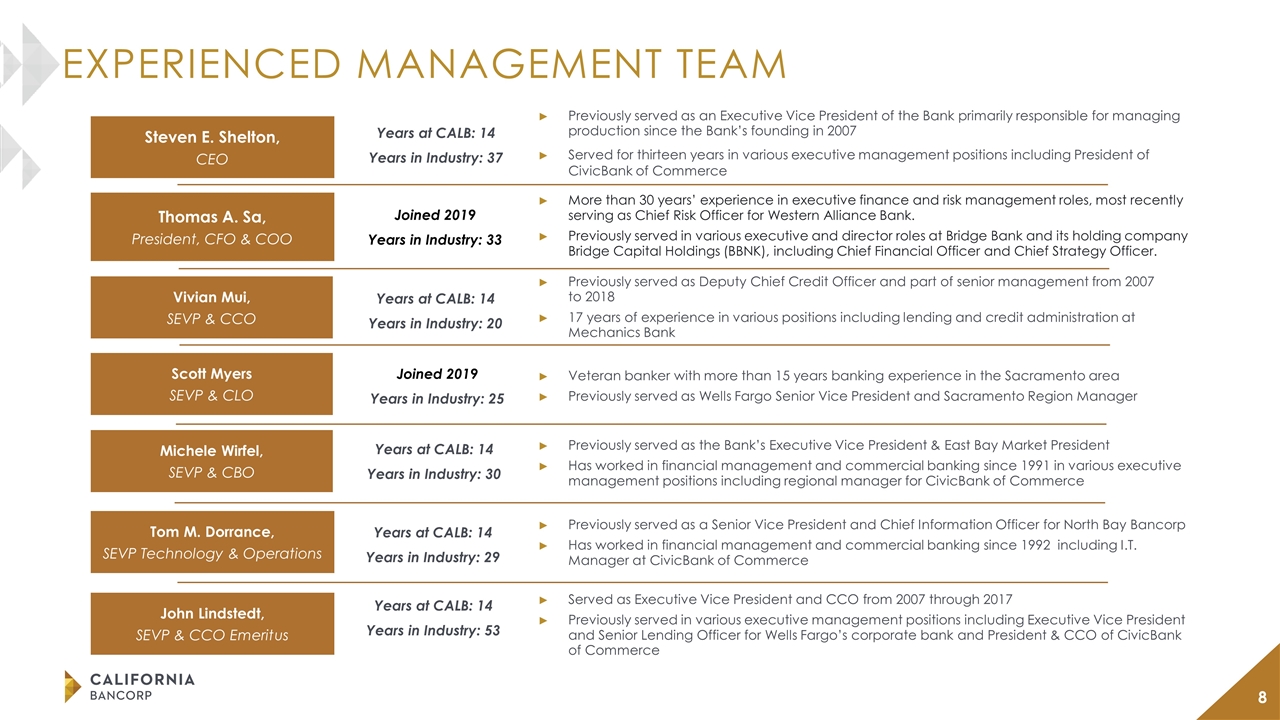

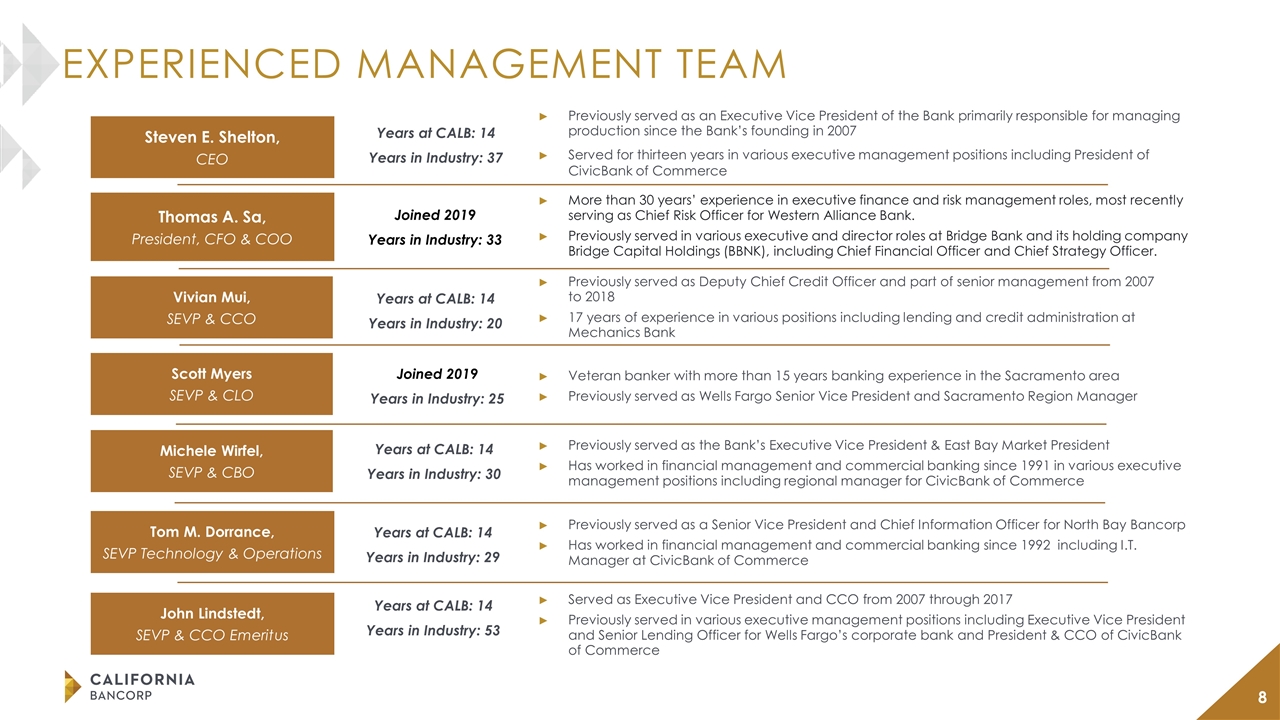

EXPERIENCED MANAGEMENT TEAM Served as Executive Vice President and CCO from 2007 through 2017 Previously served in various executive management positions including Executive Vice President and Senior Lending Officer for Wells Fargo’s corporate bank and President & CCO of CivicBank of Commerce John Lindstedt, SEVP & CCO Emeritus Tom M. Dorrance, SEVP Technology & Operations Previously served as a Senior Vice President and Chief Information Officer for North Bay Bancorp Has worked in financial management and commercial banking since 1992 including I.T. Manager at CivicBank of Commerce Michele Wirfel, SEVP & CBO Previously served as the Bank’s Executive Vice President & East Bay Market President Has worked in financial management and commercial banking since 1991 in various executive management positions including regional manager for CivicBank of Commerce Age: 84 Age: 57 Age: 51 Previously served as an Executive Vice President of the Bank primarily responsible for managing production since the Bank’s founding in 2007 Served for thirteen years in various executive management positions including President of CivicBank of Commerce Steven E. Shelton, CEO Age: 58 Years at CALB: 14 Years in Industry: 37 Years at CALB: 14 Years in Industry: 53 Years at CALB: 14 Years in Industry: 29 Years at CALB: 14 Years in Industry: 30 Veteran banker with more than 15 years banking experience in the Sacramento area Previously served as Wells Fargo Senior Vice President and Sacramento Region Manager Scott Myers SEVP & CLO Age: 49 Joined 2019 Years in Industry: 25 More than 30 years’ experience in executive finance and risk management roles, most recently serving as Chief Risk Officer for Western Alliance Bank. Previously served in various executive and director roles at Bridge Bank and its holding company Bridge Capital Holdings (BBNK), including Chief Financial Officer and Chief Strategy Officer. Thomas A. Sa, President, CFO & COO Age: 57 Joined 2019 Years in Industry: 33 Previously served as Deputy Chief Credit Officer and part of senior management from 2007 to 2018 17 years of experience in various positions including lending and credit administration at Mechanics Bank Vivian Mui, SEVP & CCO Age: 40 Years at CALB: 14 Years in Industry: 20

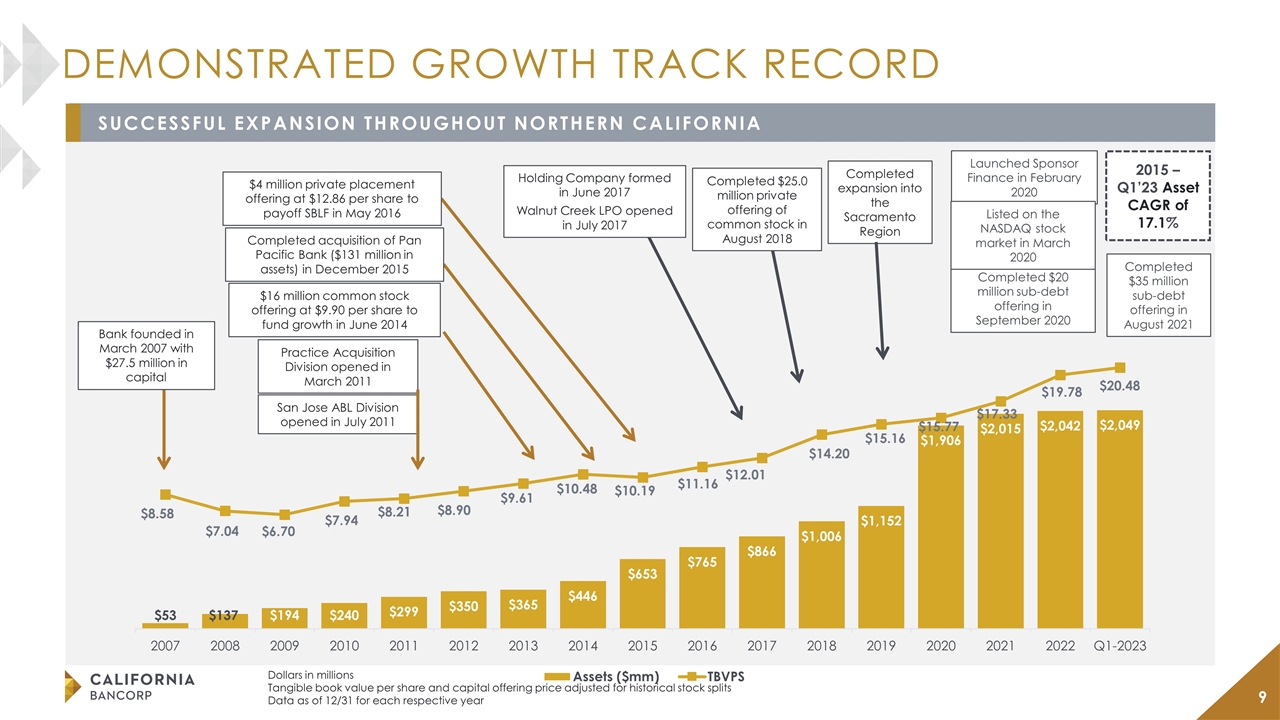

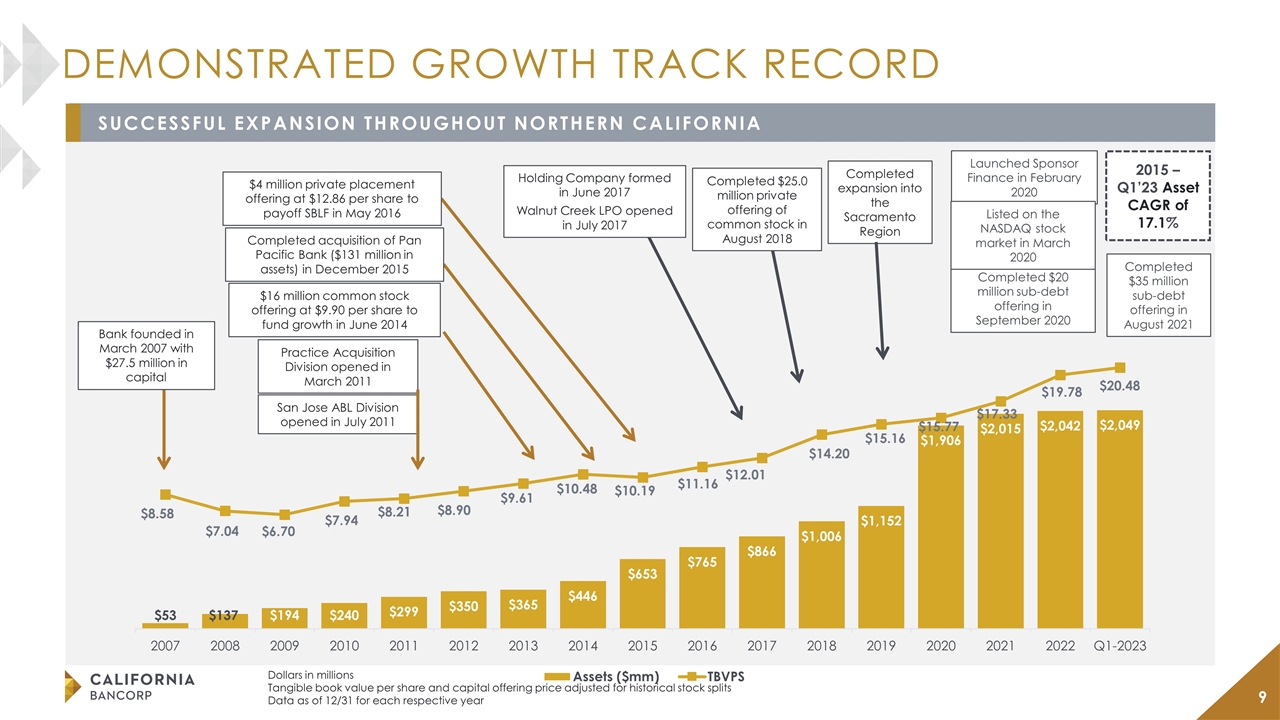

Dollars in millions Tangible book value per share and capital offering price adjusted for historical stock splits Data as of 12/31 for each respective year DEMONSTRATED GROWTH TRACK RECORD $16 million common stock offering at $9.90 per share to fund growth in June 2014 $4 million private placement offering at $12.86 per share to payoff SBLF in May 2016 Completed acquisition of Pan Pacific Bank ($131 million in assets) in December 2015 2015 – Q1’23 Asset CAGR of 17.1% Practice Acquisition Division opened in March 2011 Completed $25.0 million private offering of common stock in August 2018 Holding Company formed in June 2017 Walnut Creek LPO opened in July 2017 Bank founded in March 2007 with $27.5 million in capital Completed expansion into the Sacramento Region San Jose ABL Division opened in July 2011 Launched Sponsor Finance in February 2020 Completed $20 million sub-debt offering in September 2020 Listed on the NASDAQ stock market in March 2020 SUCCESSFUL EXPANSION THROUGHOUT NORTHERN CALIFORNIA Completed $35 million sub-debt offering in August 2021

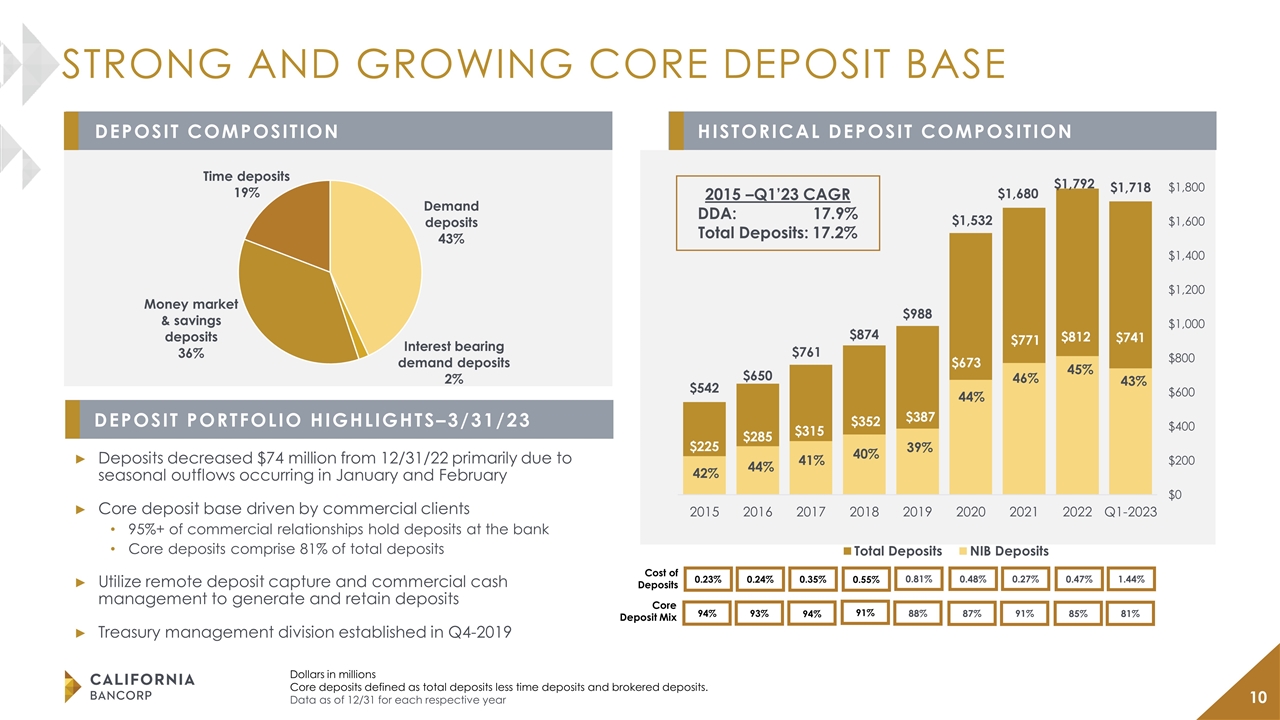

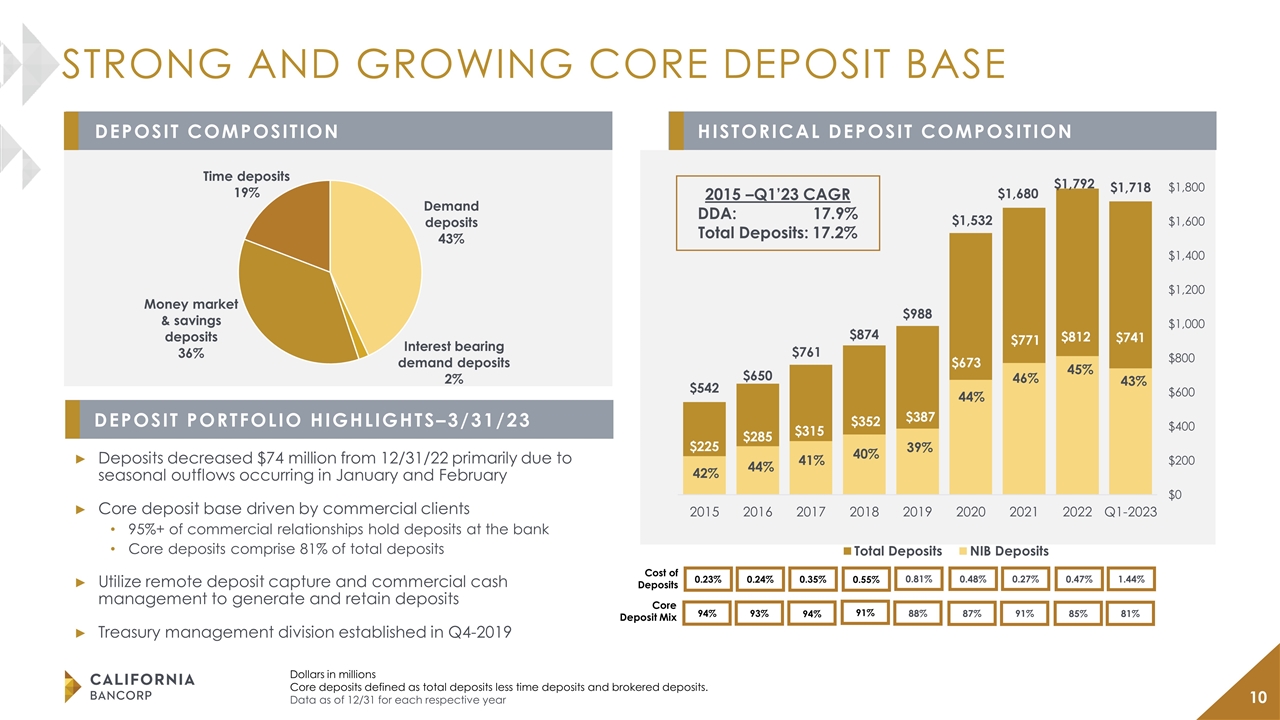

Dollars in millions Core deposits defined as total deposits less time deposits and brokered deposits. Data as of 12/31 for each respective year 2015 –Q1’23 CAGR DDA: 17.9% Total Deposits: 17.2% 0.23% 0.24% 0.35% Cost of Deposits 94% 93% 94% Core Deposit Mix 0.81% 88% 0.55% 91% 0.48% 87% 0.27% 91% 42% 44% 41% 39% 44% 46% 40% HISTORICAL DEPOSIT COMPOSITION DEPOSIT PORTFOLIO HIGHLIGHTS–3/31/23 STRONG AND GROWING CORE DEPOSIT BASE Deposits decreased $74 million from 12/31/22 primarily due to seasonal outflows occurring in January and February Core deposit base driven by commercial clients 95%+ of commercial relationships hold deposits at the bank Core deposits comprise 81% of total deposits Utilize remote deposit capture and commercial cash management to generate and retain deposits Treasury management division established in Q4-2019 DEPOSIT COMPOSITION 0.47% 85% 1.44% 81%

DEPOSIT BASE CHARACTERISTICS Granular, well diversified deposit base No meaningful industry concentrations No venture capital or crypto-related deposits High percentage of deposits related to operating accounts and credit facilities creates sticky deposit base Strong deposit pipeline centered in operating accounts Insured and Collateralized Deposits represent 53% of total deposits

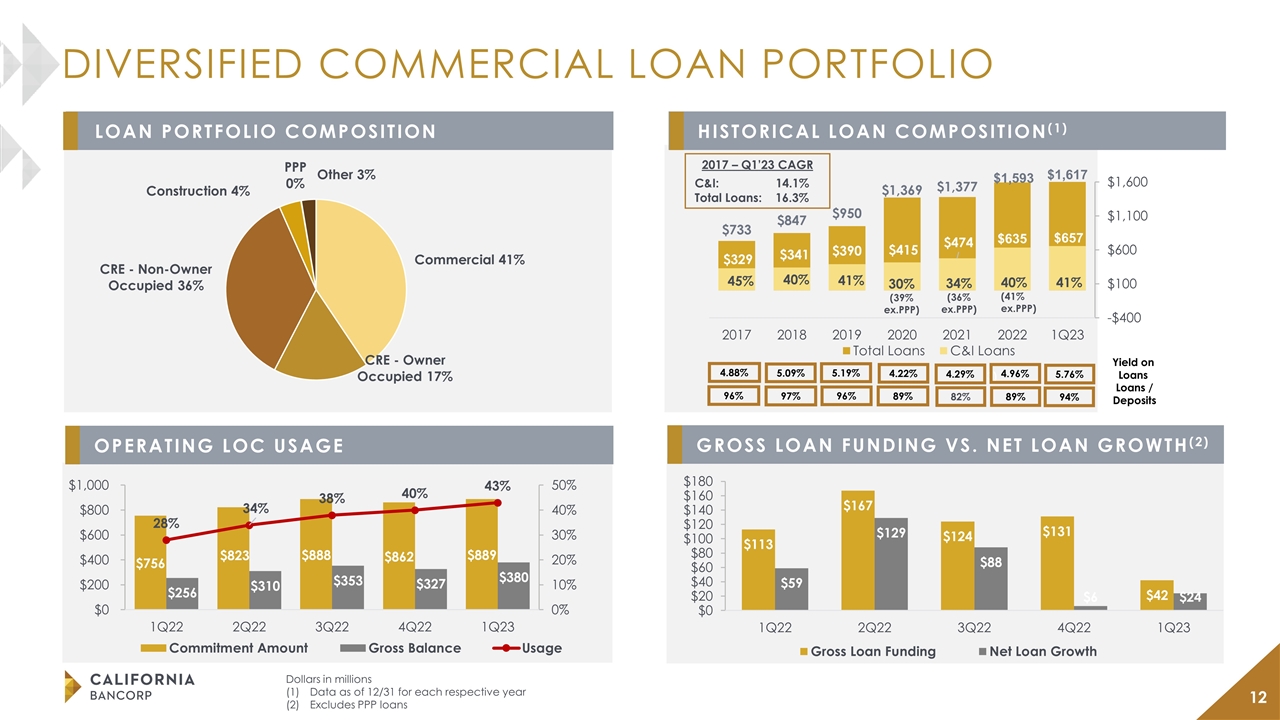

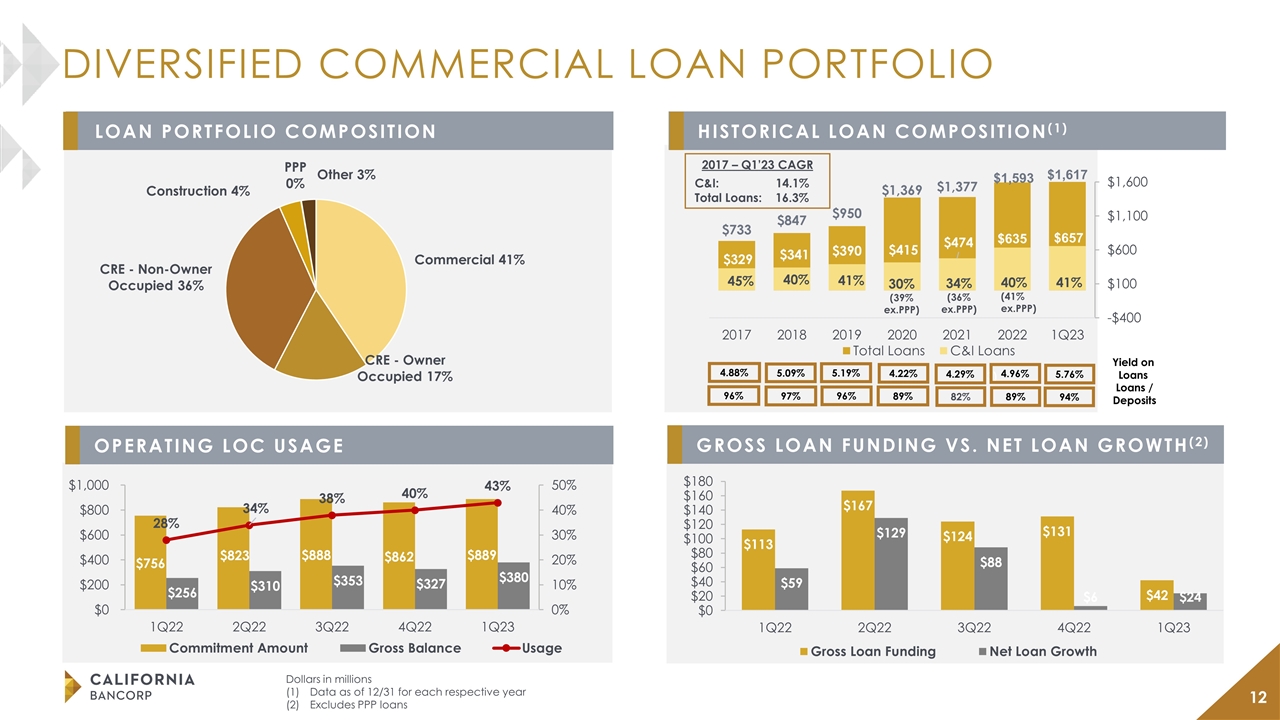

Dollars in millions Data as of 12/31 for each respective year Excludes PPP loans DIVERSIFIED COMMERCIAL LOAN PORTFOLIO HISTORICAL LOAN COMPOSITION(1) OPERATING LOC USAGE LOAN PORTFOLIO COMPOSITION GROSS LOAN FUNDING VS. NET LOAN GROWTH(2) (3) 2017 – Q1’23 CAGR C&I: 14.1% Total Loans: 16.3% 4.88% 96% 5.19% 96% 5.09% 97% 4.22% 89% Yield on Loans Loans / Deposits 4.29% 82% 45% 40% 41% 30% (39% ex.PPP) 4.96% 89% 40% (41% ex.PPP) 41% 5.76% 94%

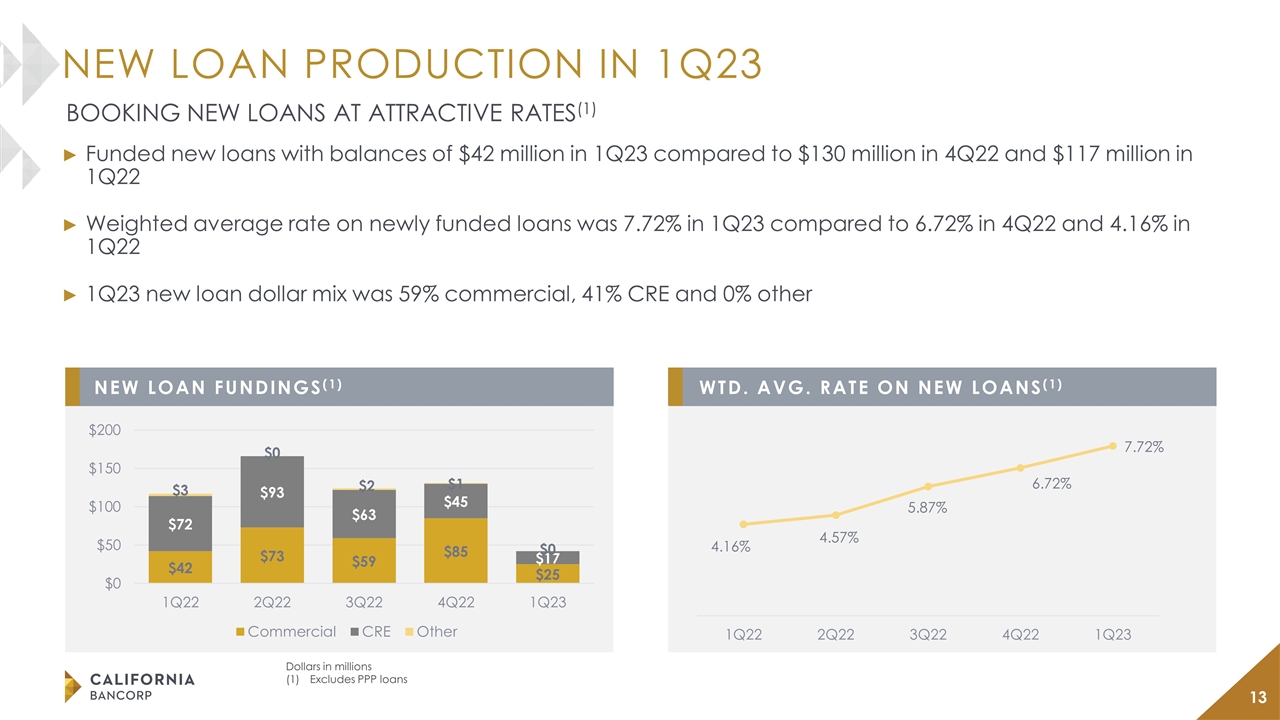

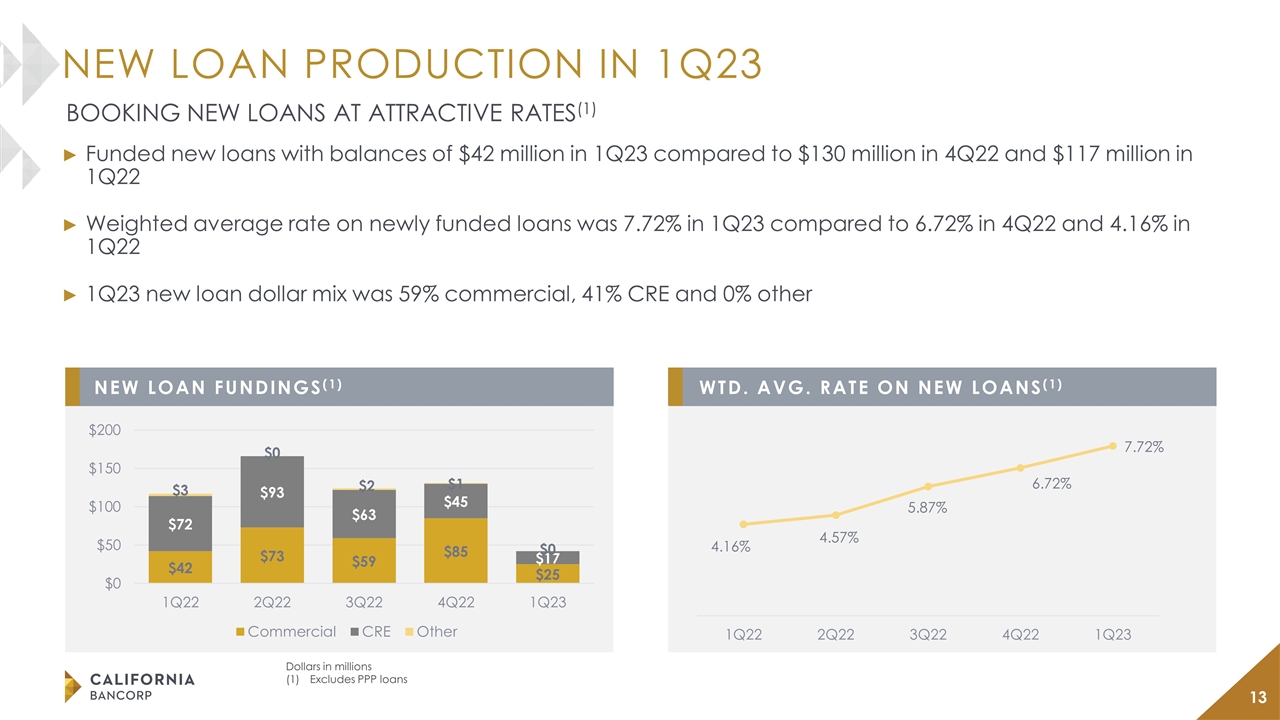

NEW LOAN PRODUCTION IN 1Q23 BOOKING NEW LOANS AT ATTRACTIVE RATES(1) NEW LOAN FUNDINGS(1) WTD. AVG. RATE ON NEW LOANS(1) Funded new loans with balances of $42 million in 1Q23 compared to $130 million in 4Q22 and $117 million in 1Q22 Weighted average rate on newly funded loans was 7.72% in 1Q23 compared to 6.72% in 4Q22 and 4.16% in 1Q22 1Q23 new loan dollar mix was 59% commercial, 41% CRE and 0% other Dollars in millions Excludes PPP loans

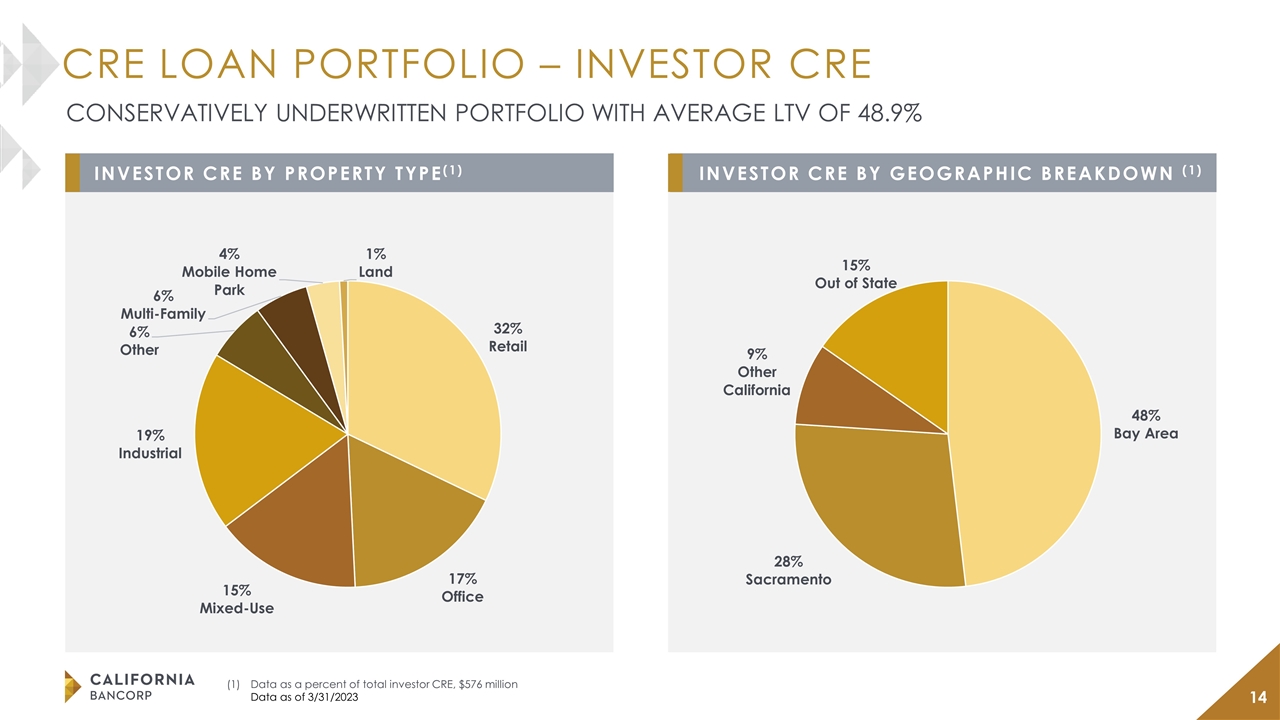

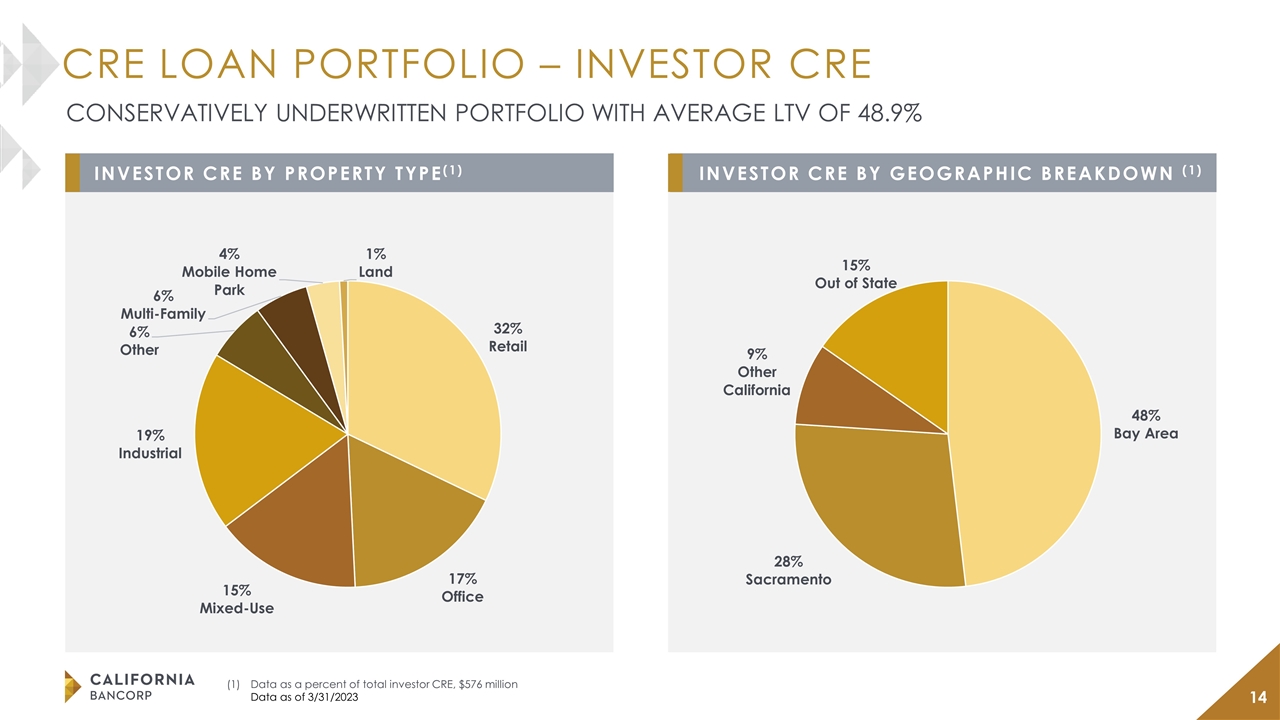

CRE LOAN PORTFOLIO – INVESTOR CRE CONSERVATIVELY UNDERWRITTEN PORTFOLIO WITH AVERAGE LTV OF 48.9% INVESTOR CRE BY PROPERTY TYPE(1) INVESTOR CRE BY GEOGRAPHIC BREAKDOWN (1) Data as a percent of total investor CRE, $576 million Data as of 3/31/2023

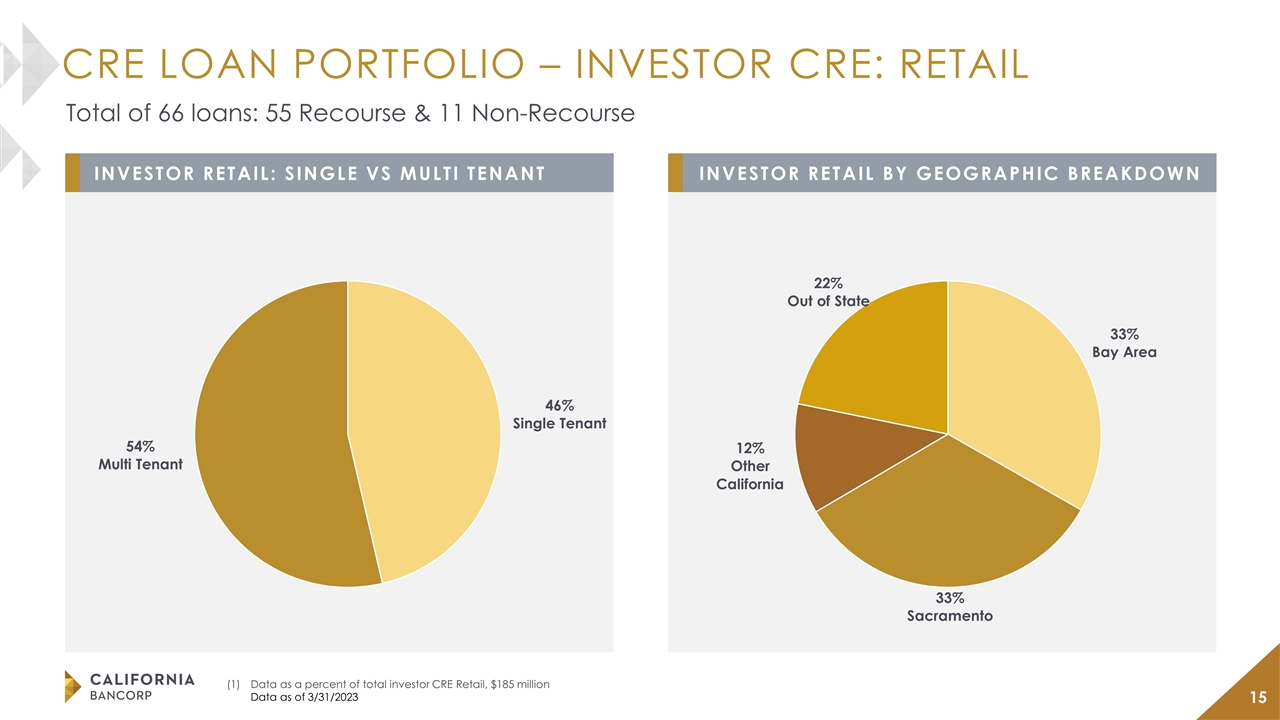

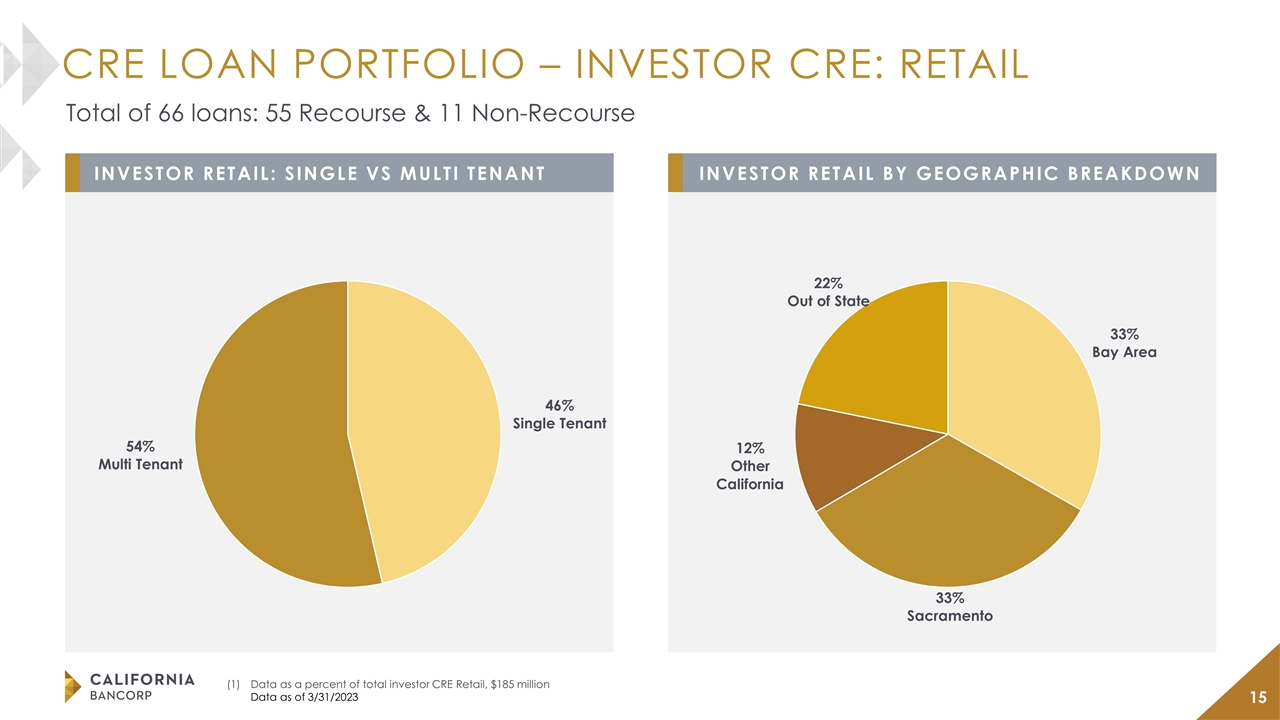

CRE LOAN PORTFOLIO – INVESTOR CRE: RETAIL Total of 66 loans: 55 Recourse & 11 Non-Recourse INVESTOR RETAIL: SINGLE VS MULTI TENANT INVESTOR RETAIL BY GEOGRAPHIC BREAKDOWN Data as a percent of total investor CRE Retail, $185 million Data as of 3/31/2023

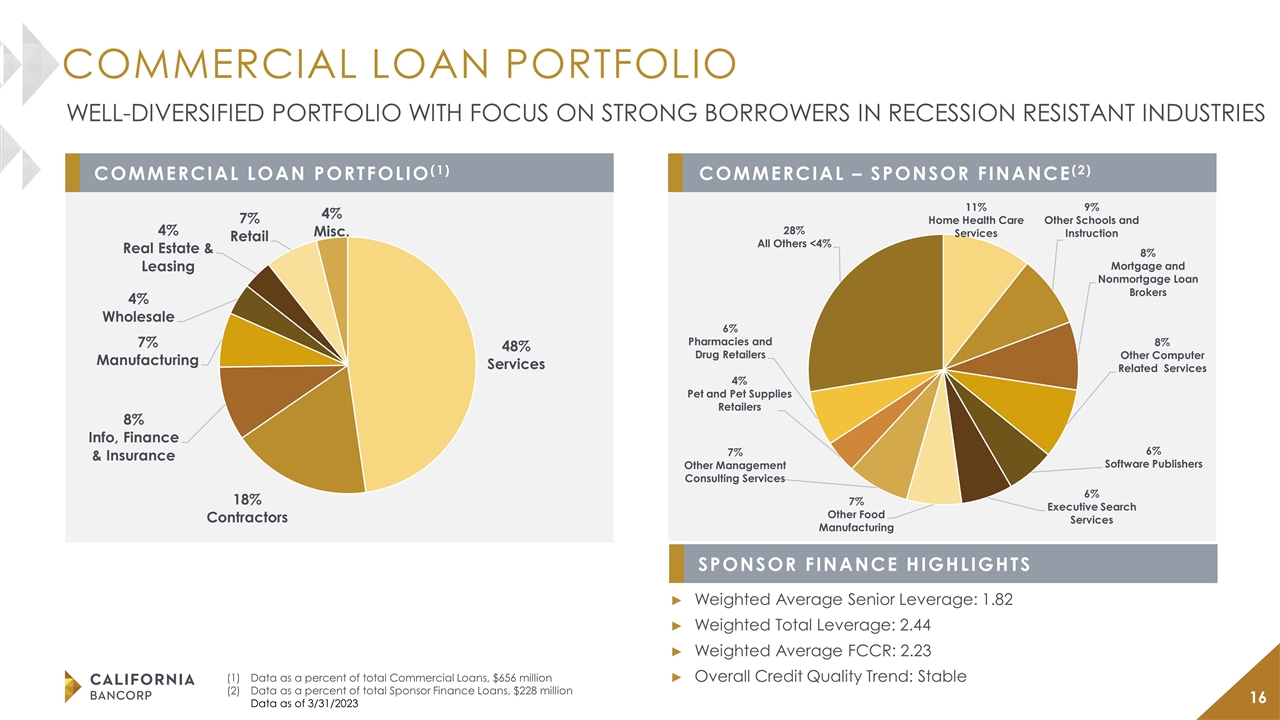

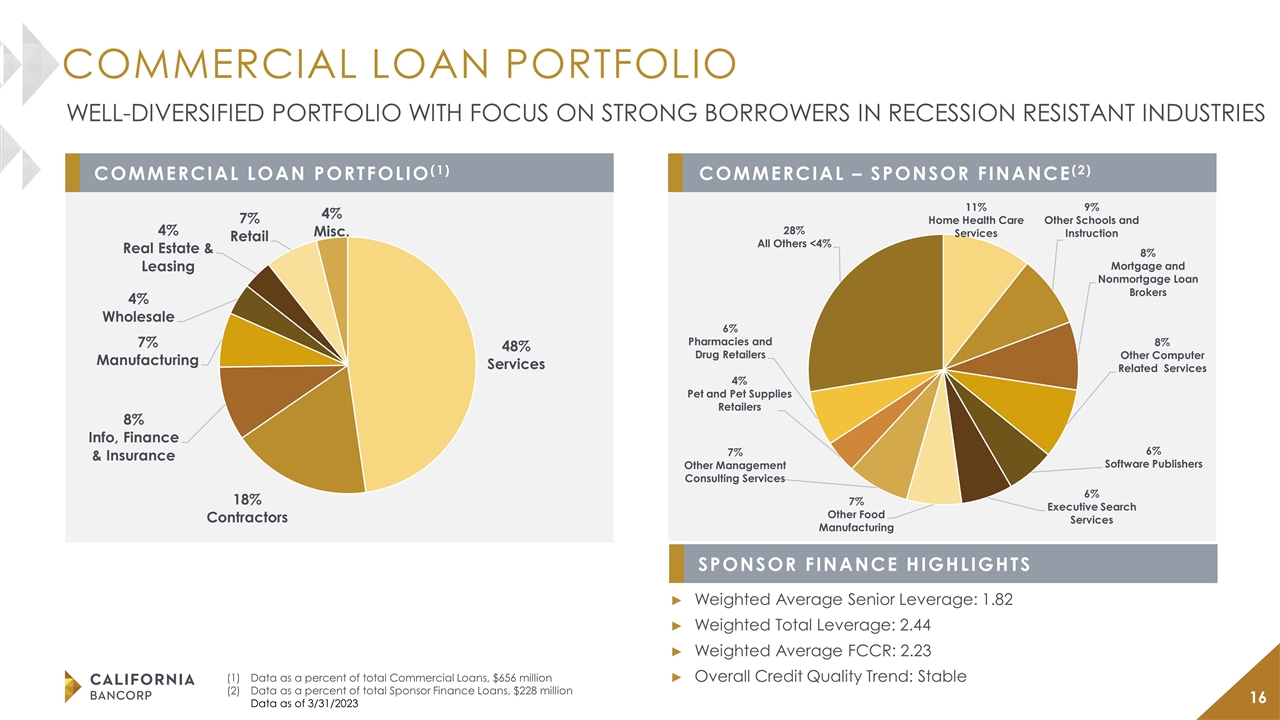

COMMERCIAL LOAN PORTFOLIO WELL-DIVERSIFIED PORTFOLIO WITH FOCUS ON STRONG BORROWERS IN RECESSION RESISTANT INDUSTRIES COMMERCIAL LOAN PORTFOLIO(1) COMMERCIAL – SPONSOR FINANCE(2) Data as a percent of total Commercial Loans, $656 million Data as a percent of total Sponsor Finance Loans, $228 million Data as of 3/31/2023 SPONSOR FINANCE HIGHLIGHTS Weighted Average Senior Leverage: 1.82 Weighted Total Leverage: 2.44 Weighted Average FCCR: 2.23 Overall Credit Quality Trend: Stable

LOAN PORTFOLIO CHARACTERISTICS Conservatively underwritten, well diversified loan portfolio with low LTVs and high DCRs Little to no exposure to areas most likely to be impacted by a recession No consumer loans Minimal SBA loans Office CRE represents just 10.6% of total loan portfolio No exposure to downtown San Francisco market Majority of credits are located in suburban markets with stable tenants like medical and dental practices During 4Q22, certain credits in the Sponsor Finance portfolio were refinanced with a portion of the loans being taken by other banks, which reduced the level of risk in this portfolio

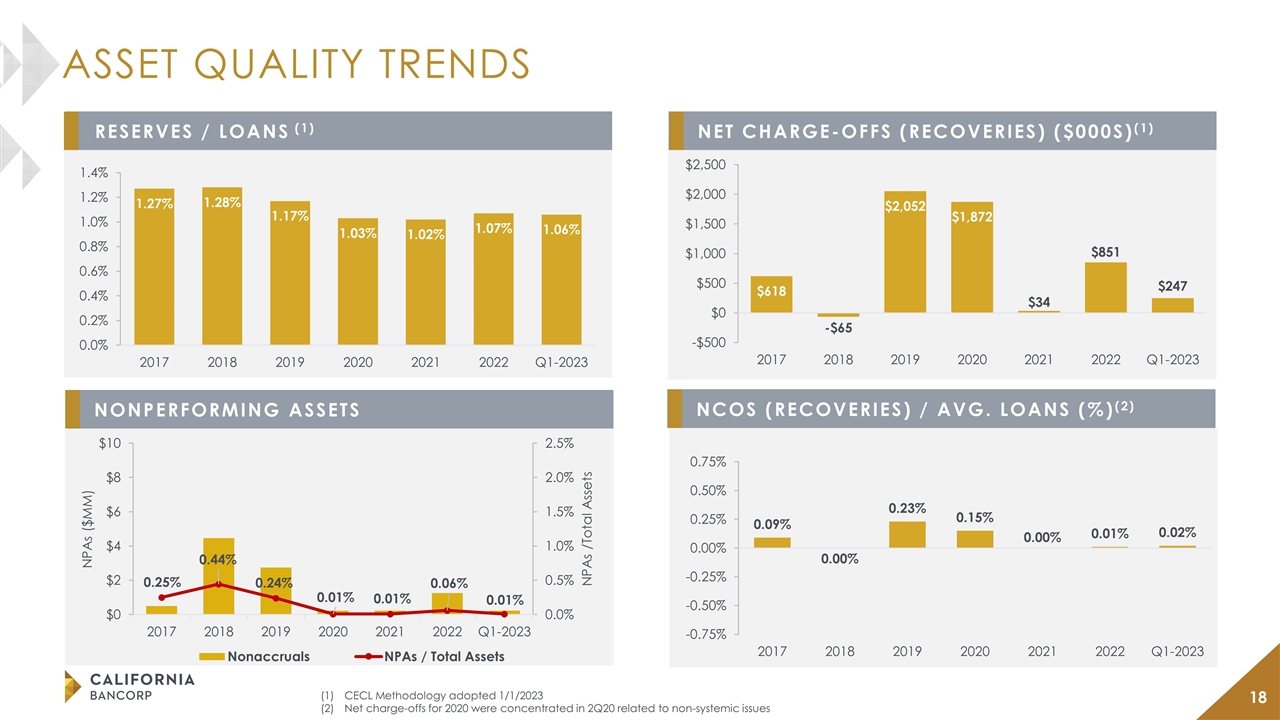

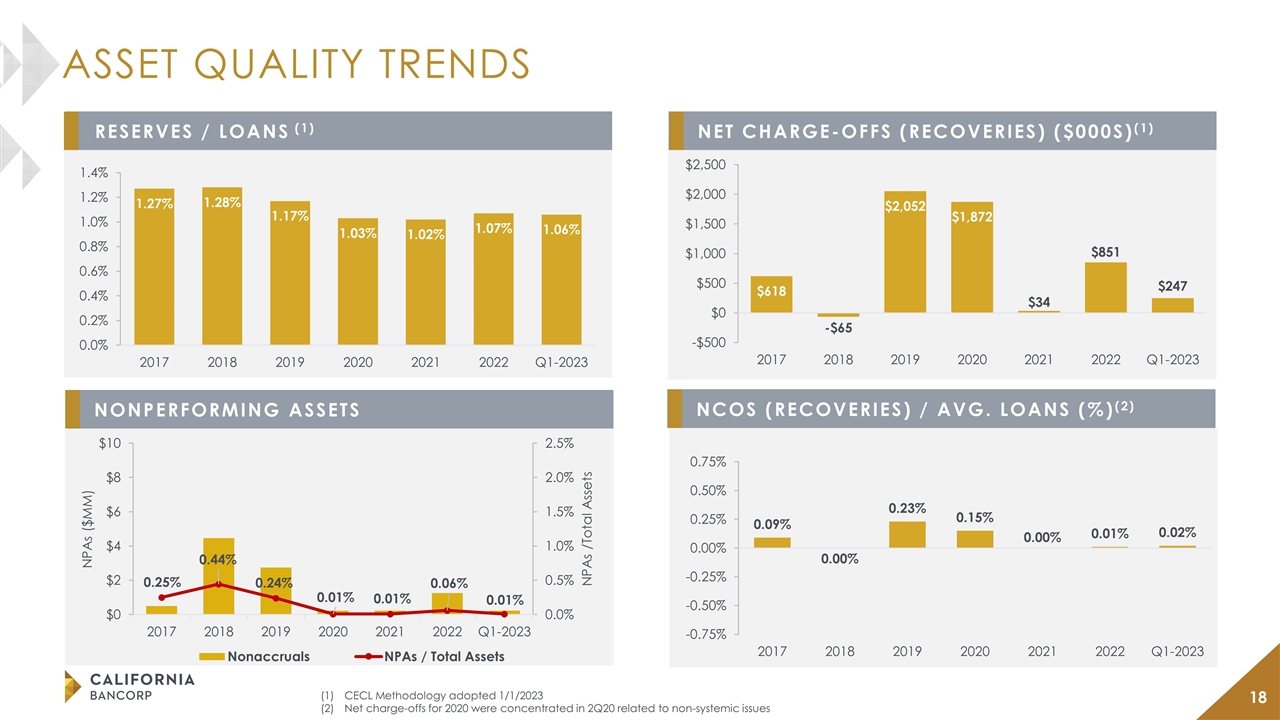

NET CHARGE-OFFS (RECOVERIES) ($000S)(1) NONPERFORMING ASSETS RESERVES / LOANS (1) NCOS (RECOVERIES) / AVG. LOANS (%)(2) CECL Methodology adopted 1/1/2023 Net charge-offs for 2020 were concentrated in 2Q20 related to non-systemic issues ASSET QUALITY TRENDS

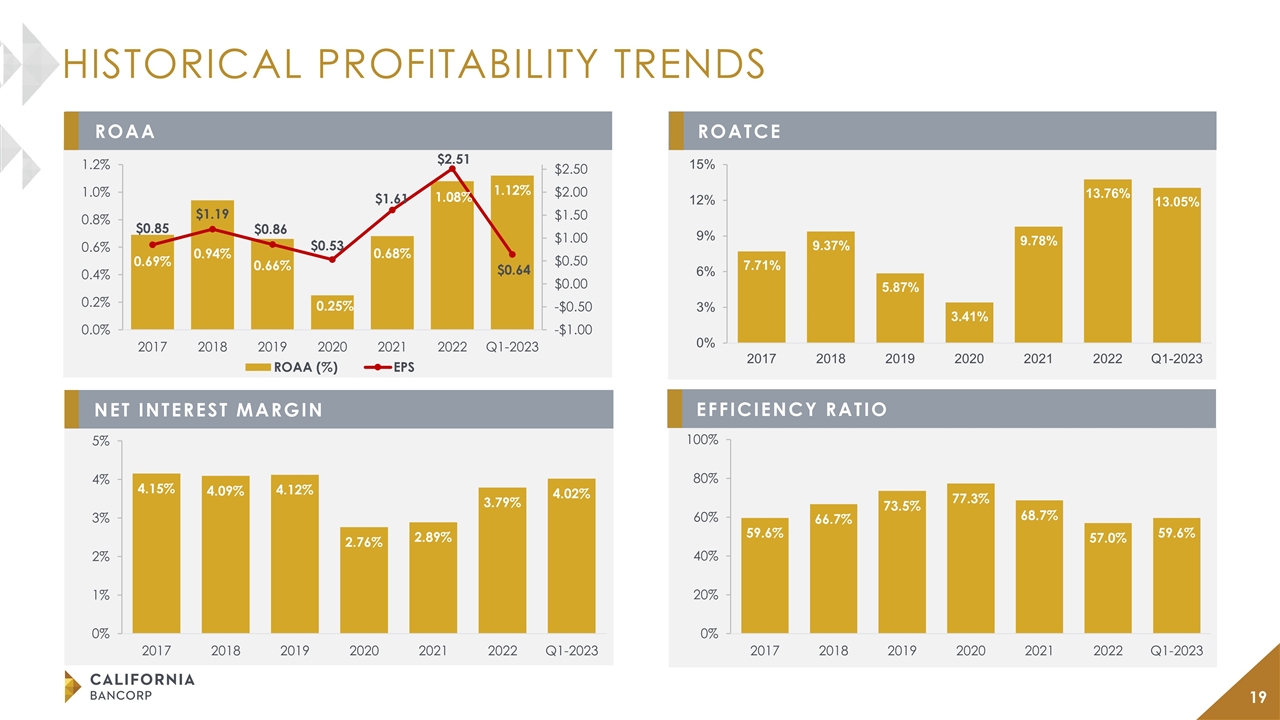

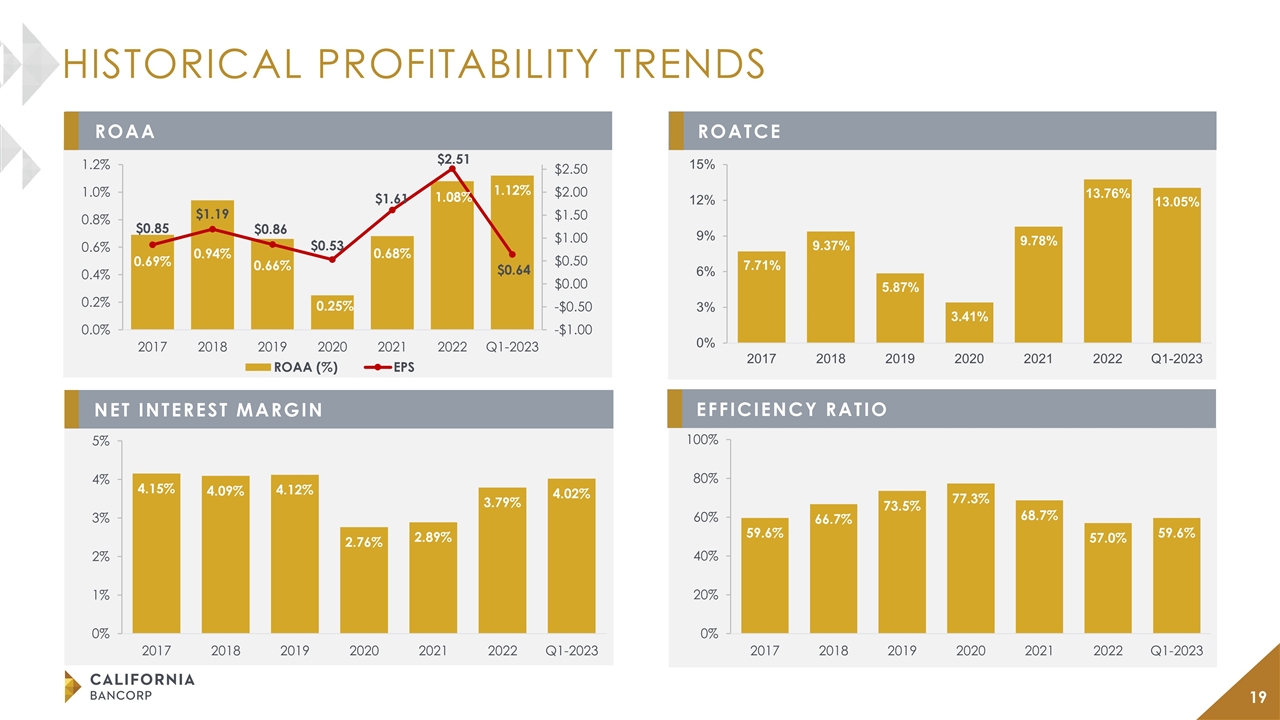

ROATCE NET INTEREST MARGIN ROAA EFFICIENCY RATIO HISTORICAL PROFITABILITY TRENDS

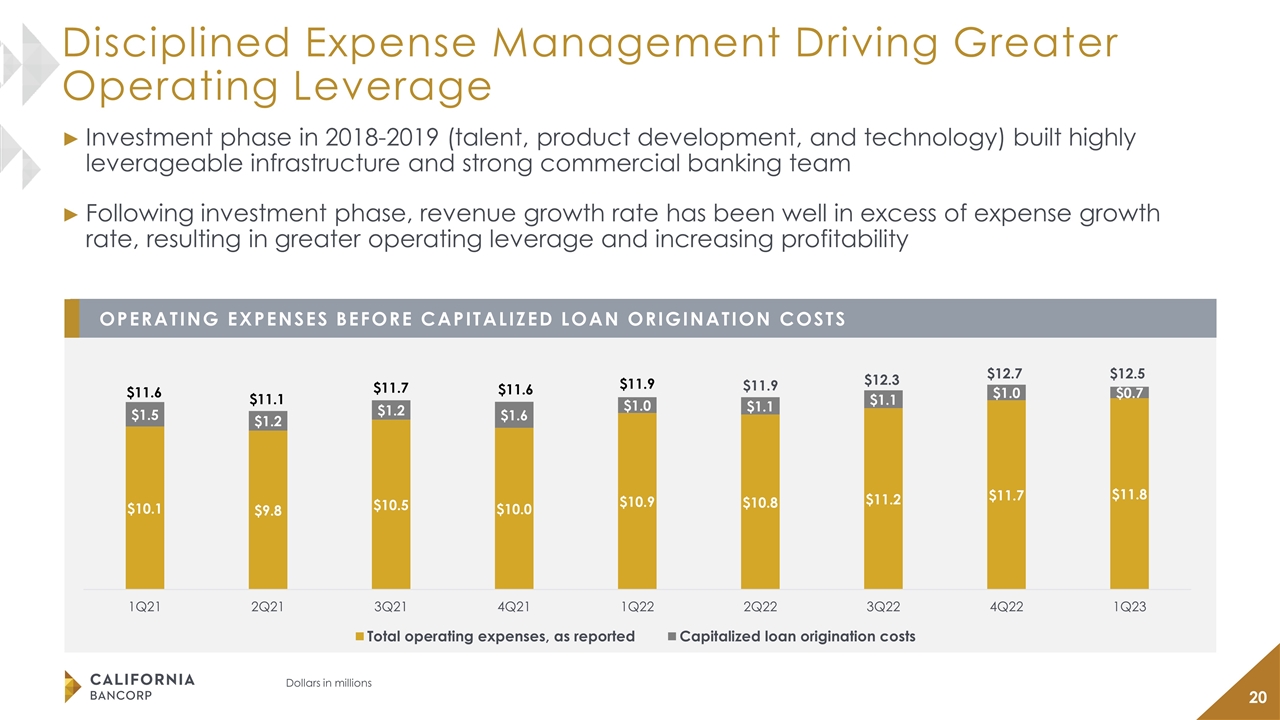

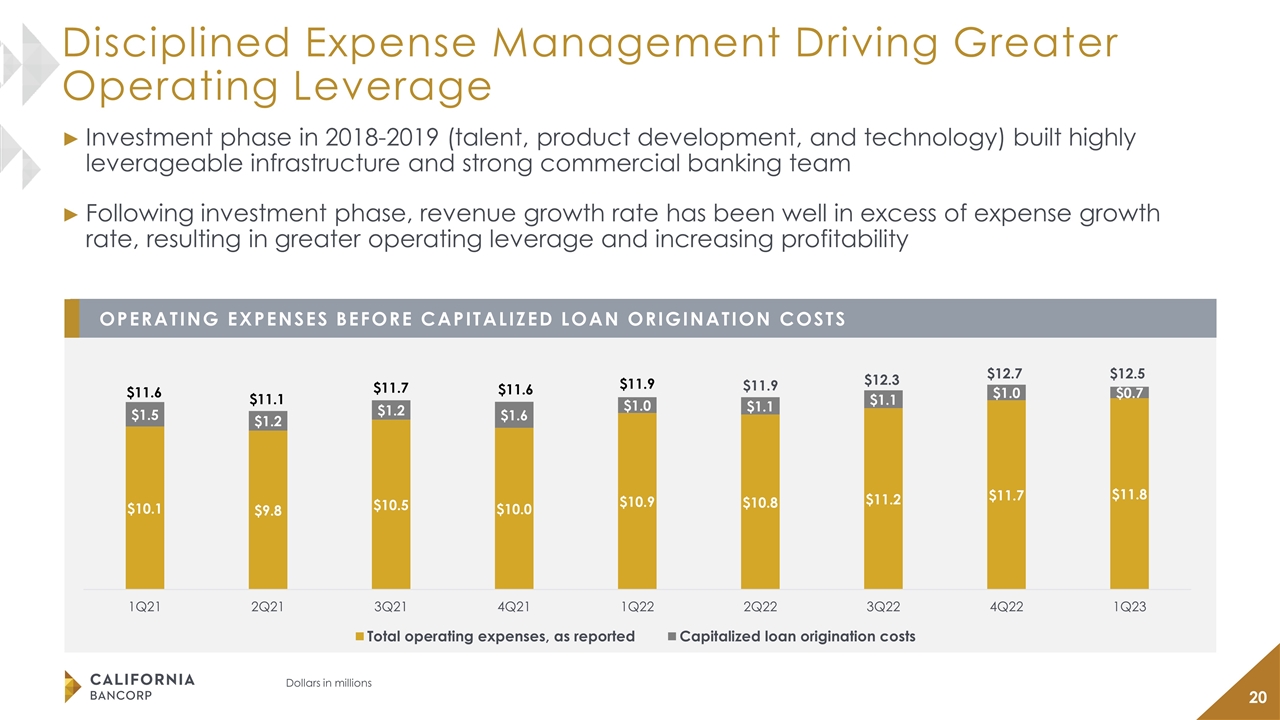

Disciplined Expense Management Driving Greater Operating Leverage Investment phase in 2018-2019 (talent, product development, and technology) built highly leverageable infrastructure and strong commercial banking team Following investment phase, revenue growth rate has been well in excess of expense growth rate, resulting in greater operating leverage and increasing profitability Dollars in millions OPERATING EXPENSES BEFORE CAPITALIZED LOAN ORIGINATION COSTS $11.9 $12.3 $12.7 $12.5

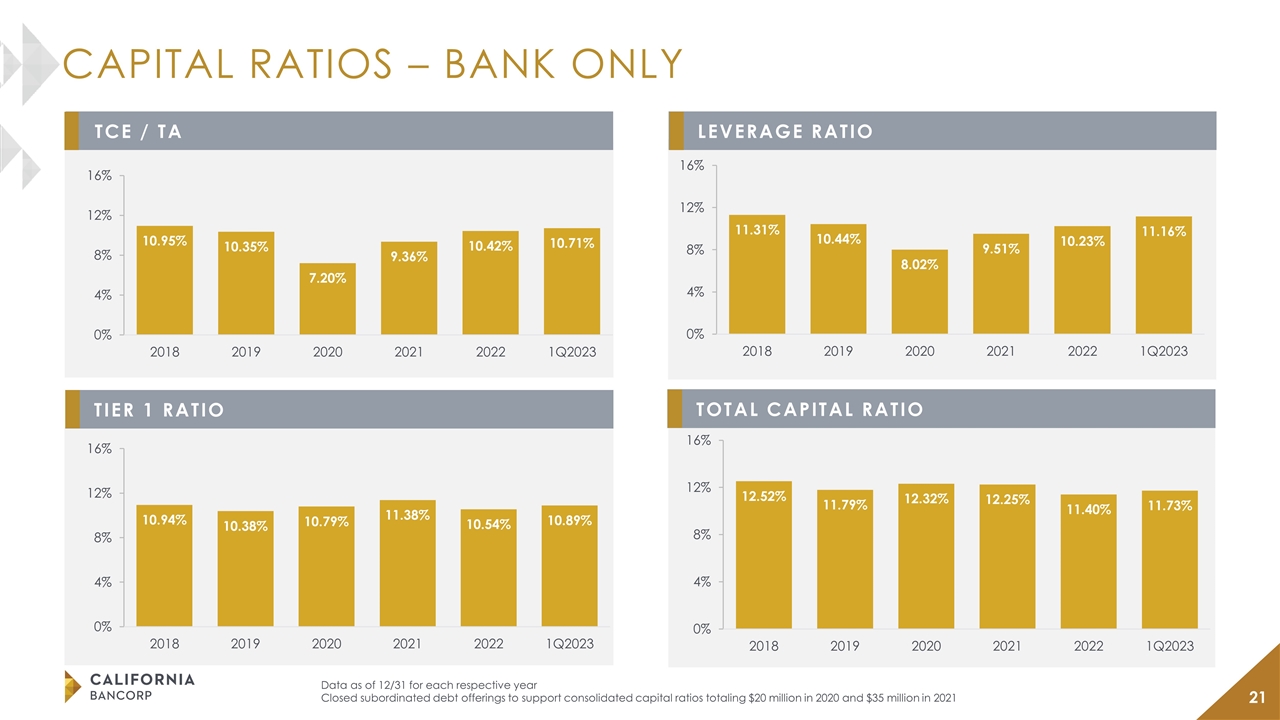

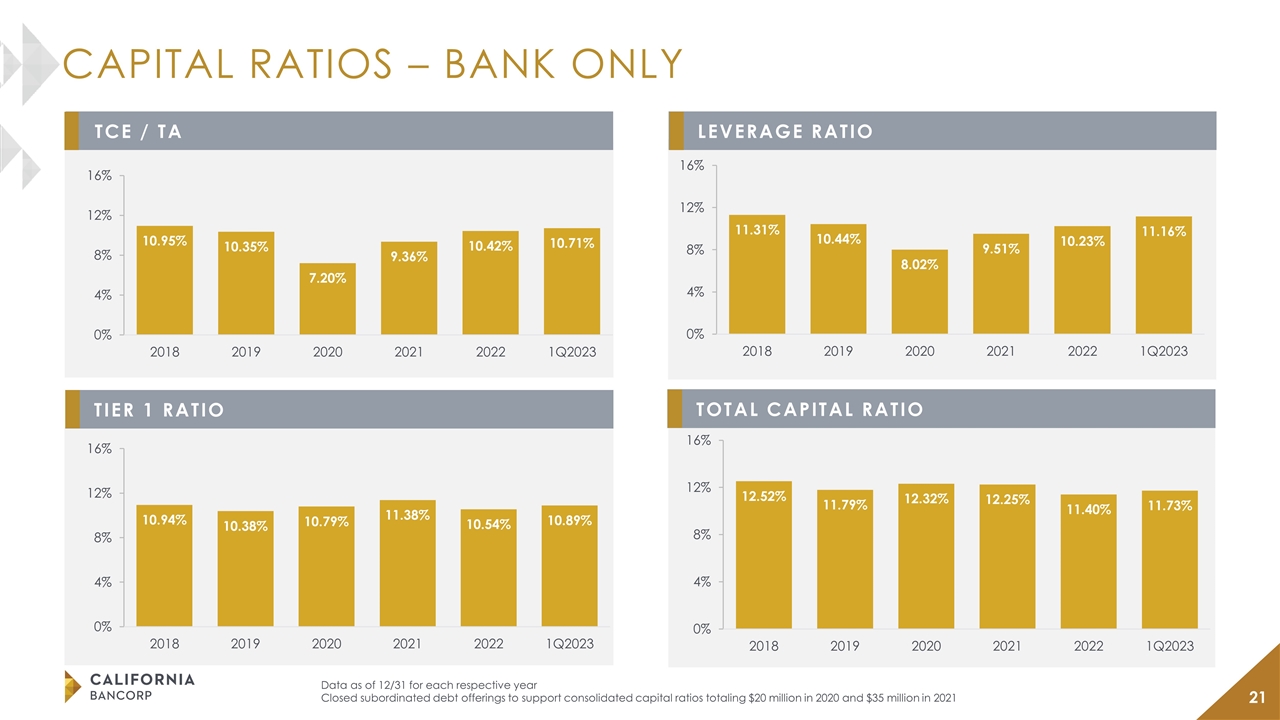

CAPITAL RATIOS – BANK ONLY Data as of 12/31 for each respective year Closed subordinated debt offerings to support consolidated capital ratios totaling $20 million in 2020 and $35 million in 2021 LEVERAGE RATIO TIER 1 RATIO TCE / TA TOTAL CAPITAL RATIO

2023 OUTLOOK AND PRIORITIES CONSERVATIVE LOAN PRODUCTION CONTINUE GROWING DEPOSIT MARKET SHARE Remain conservative in new loan production until economic conditions improve with near-term focus primarily on high quality C&I loans Capitalize on growing reputation and increased scale to continue adding new relationships with clients that provide lower-cost deposits EXPENSE MANAGEMENT Past investments in talent and technology enable us to tightly manage expenses and realize more operating leverage while continuing to add talent in areas that provide high value opportunities TREASURY MANAGEMENT Capitalize on improved treasury management platform to continue adding new commercial relationships that drive higher levels of fee income INTEREST RATE RISK MANAGEMENT Make adjustments in interest rate sensitivity as rate environment evolves to protect NIM when Fed starts to reduce interest rates PROFITABILITY Strength of franchise, with excellent asset quality, high level of reserves, and stable deposit base, positions the Company well to continue generating strong financial performance even in a more challenging environment

Northern California commercial business bank with a disciplined approach to credit underwriting Proven organic and acquisition growth capabilities Strong commercial loan portfolio with corresponding commercial relationship deposits Experienced management team and seasoned C&I relationship managers Keen focus on relationship core deposits in deposit rich industries SUMMARY 3

Please send questions to ir@bankcbc.com Or Call 510.457.3751 CaliforniaBankofCommerce.com