As filed with the Securities and Exchange Commission on January 22, 2019.

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

POSITIVE PHYSICIANS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Pennsylvania | 6331 | 83-0824448 |

(State or other jurisdiction of

incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

100 Berwyn Park, 850 Cassatt Road, Suite 220

Berwyn, PA 19312

(888) 335-5335

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lewis S. Sharps, M.D.

Chief Executive Officer

Positive Physicians Holdings, Inc.

100 Berwyn Park, 850 Cassatt Road, Suite 220

Berwyn, PA 19312

(888) 335-5335

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

| |

Wesley R. Kelso, Esquire Stevens & Lee, P.C. 111 North 6th Street Reading, PA 19603 (610) 478-2242 | James M. Connolly, Esquire Griffin Financial Group, LLC 100 Lennox Lane, Suite 200 Lawrenceville, NJ 08648 (973) 610-2010 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 of the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

| | | Emerging growth company | x |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to section 7 (a) (2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

| | | | |

| |

Table of each class of securities to be registered | Amount

to be

registered | Proposed Maximum offering price per share | Proposed Maximum Aggregate offering price (2) | Amount of registration fee |

| Common Stock, no par value per share, to be offered by the issuer | 4,830,000 shares | $10.00(1) | 48,300,000 (2) | $5,854 |

| |

| |

| (1) | Shares to be sold in the stock offering by the issuer have an offering price of $10.00. |

| |

| (2) | Estimated solely for the purpose of calculating the registration fee. |

This registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

POSITIVE PHYSICIANS HOLDINGS, INC.

Up to 4,830,000 Shares of Common Stock

This is the initial public offering of Positive Physicians Holdings, Inc. (“the Company”). We are offering up to 4,830,000 shares of our common stock for sale at a price of $10.00 per share in connection with the conversion of each of Positive Physicians Insurance Exchange, or PPIX, Professional Casualty Association, or PCA, and Physicians’ Insurance Program Exchange, or PIPE, from a reciprocal insurance exchange to the stock form of organization. In connection with the conversions of PPIX, PCA and PIPE, we will acquire all of the shares of capital stock of these new insurance companies, and immediately thereafter, they will be merged together to form a single insurance company called Positive Physicians Insurance Company. PPIX, PCA, and PIPE caused the Company to be formed in order to facilitate the conversions.

We are offering shares of our common stock in two phases: a subscription offering phase and a community offering phase. The minimum number of shares that must be sold, the maximum number of shares that can be sold and the limit on the number of shares that any person may purchase apply to both phases of the offering taken together.

We are offering shares in the subscription offering phase to the policyholders of PPIX, PCA, and PIPE as of June 1, 2018. First priority to purchase shares is being granted to such policyholders of PPIX, PCA, and PIPE as required by the Pennsylvania Medical Professional Liability Reciprocal Exchange-to-Stock Conversion Act.

The subscription offering phase will end at noon, Eastern Time, on [.], 2019. Any shares of our common stock not sold in the subscription offering may be sold in the community offering phase, which will commence simultaneously with and end concurrently with the subscription offering phase unless extended by us. The community offering will end no later than [.], 2019. Certain stockholders of Diversus, Inc., or Diversus, which manages the three reciprocals through its subsidiaries, will have the right to purchase shares in the community offering. The total number of shares purchased by such Diversus stockholders (excluding Enstar Holdings (US) LLC) cannot exceed 5% of the total number of shares remaining to be sold in the community offering after satisfaction of all subscription offering orders.

Our ability to complete this offering is subject to certain conditions, including the sale of at least 3,570,000 shares of common stock in the offering, the approval of the plans of conversion by the policyholders of PPIX, PCA and PIPE, respectively, and receipt of all required approvals from the Pennsylvania Insurance Commissioner. See “The Conversions and The Offering - Conditions to Closing” herein. Until such time as these conditions are satisfied, all funds submitted to purchase shares will be held in escrow with Computershare Trust Company, N.A., as escrow agent. Purchasers of shares of common stock in this offering will not receive any interest with respect to any of the funds that are held in escrow.

We have entered into a standby stock purchase agreement with Insurance Capital Group, LLC, or ICG, whereby it has agreed to purchase such number of shares as will cause the minimum number of shares, which is 3,570,000, to be sold in the offering. We refer to Insurance Capital Group, LLC herein as the “standby purchaser.” Accordingly, the number of shares purchased by eligible subscribers of PPIX, PCA, and PIPE will not impact the condition to closing that at least 3,570,000 shares must be sold in the offering. If all of the conditions to ICG’s obligation to purchase sales in the offering are satisfied, the sale of the minimum number of shares is guaranteed. Accordingly, the sale of sufficient shares to meet the offering minimum of 3,570,000 shares does not indicate that sales have been made to investors who have no financial or other interest in the offering, and the sale of 3,570,000 shares in the offering should not be viewed as an indication of the merits of the offering.

ICG has agreed to permit Enstar Holdings (US) LLC, or “Enstar”, to purchase 30% of the shares that ICG would otherwise purchase in the offering. Because we are unable to predict with any certainty the number of shares that may be sold in the subscription offering, the percentage of shares owned by ICG and by Enstar after the offering may range from 0% to 66.5% and from 0% to 28.5%, respectively. We anticipate that ICG will own a majority of our outstanding shares of stock after completion of the conversions and the offerings and will obtain control of the Company. ICG and Enstar have entered into a governance agreement, and assuming that after the offering they collectively own a majority of our outstanding shares, they will be able to control the election of our board of directors. See “Risk Factors - The standby purchaser may obtain control over us and may not always exercise its control in a way that benefits our public shareholders.” As a result of the governance agreement between ICG and Enstar, and because it is likely that ICG and Enstar will collectively own a majority of our outstanding shares after completion of the offering, it is unlikely that we will undertake any significant corporate actions without the support of both ICG and Enstar.

The minimum number of shares that a person may subscribe to purchase is 50 shares. Except for purchases by Diversus stockholders, ICG, and Enstar, the maximum number of shares that a person may purchase in the offering is 5,000 shares.

Griffin Financial Group, LLC, which we refer to as Griffin Financial, will act as our placement agent and will use its best efforts to assist us in selling our common stock in the offering, but is not obligated to purchase any shares of stock that are being offered for sale. Any commissions paid in connection with the purchase of shares of common stock in this offering will be paid by us from the gross proceeds of the offering.

There is currently no public market for our common stock. We have applied for the quotation of our common stock on the Nasdaq Capital Market under the symbol “PPHI.” Our management and ICG are likely to seek to delist our shares from trading on the NASDAQ Stock Market in the future and end our public reporting obligations. This would greatly reduce the market for our common stock. See “Risk Factors - Our management and ICG are likely to seek to delist our shares from trading on the NASDAQ Stock Market and end our reporting obligations under the Securities Exchange Act of 1934.”

We intend to use $10,000,000 of the offering proceeds to make a payment to Diversus in exchange for Diversus agreeing to reduce the management fees paid by PPIX, PCA, and PIPE to Diversus Management, Inc. See “Description of Our Business - Management of Positive Insurance After the Conversions.” In addition, up to $6,000,000 of the offering proceeds may be used to make loans to Diversus. See “Use of Proceeds.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. This investment involves risk. For a discussion of the material risks that you should consider, see “Risk Factors” beginning on page 17 of this prospectus.

OFFERING SUMMARY

Price: $10.00 per share

|

| | | | | | | | | | | |

| | Minimum | | Midpoint | | Maximum |

| Number of shares offered | 3,570,000 |

| | 4,200,000 |

| | 4,830,000 |

|

| Gross offering proceeds | $ | 35,700,000 |

| | $ | 42,000,000 |

| | $ | 48,300,000 |

|

| Estimated offering expenses | $ | 1,000,000 |

| | $ | 1,000,000 |

| | $ | 1,000,000 |

|

| Estimated selling agent fees and expenses (1)(2) | $ | 1,995,250 |

| | $ | 2,357,500 |

| | $ | 2,719,750 |

|

| Estimated net proceeds | $ | 32,704,750 |

| | $ | 38,642,500 |

| | $ | 44,580,250 |

|

| Estimated net proceeds per share | $ | 9.16 |

| | $ | 9.20 |

| | $ | 9.23 |

|

__________________

| |

| (1) | Represents the total of (i) the fees to be paid to Griffin Financial, which is equal to 3.5% of the gross proceeds from shares sold in the subscription offering and the community offering, and 5.75% of the gross proceeds from shares purchased by ICG and Enstar, and (ii) an estimate of the reimbursable expenses expected to be incurred by Griffin Financial in connection with the offering. See “The Conversions and The Offering - Marketing and Underwriting Arrangements.” |

| |

| (2) | Assumes that 300,000 shares are sold to purchasers other than ICG and Enstar and that 3,270,000, 3,900,000 and 4,530,000 shares are sold to ICG and Enstar at the minimum, midpoint, and maximum of the offering range, respectively. See “The Conversions and The Offering - Marketing and Underwriting Arrangements.” |

Neither the Securities and Exchange Commission, the Pennsylvania Insurance Department nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

For assistance, please call the Stock Information Center at (610) 205-6003.

Griffin Financial Group, LLC

The date of this prospectus is [.], 2019

TABLE OF CONTENTS

CERTAIN IMPORTANT INFORMATION

You should rely only on the information contained in this prospectus. We have not, and Griffin Financial has not, authorized any other person to provide information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We and Griffin Financial are offering to sell and seeking offers to buy our common stock only in jurisdictions where such offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. Information contained on our web site is not part of this prospectus.

Unless the context otherwise requires, as used in this prospectus:

| |

| • | “the Company,” “we,” “us” and “our” refer to the registrant, Positive Physicians Holdings, Inc. prior to completion of the conversions, and after completion of the conversions refer to Positive Physicians Holdings, Inc. and all of its subsidiaries; |

| |

| • | the “conversions” refers to the transactions by which PPIX, PCA and PIPE will each convert from a reciprocal insurance exchange to a stock insurance company by merging with and into PPIX Conversion Corp., PCA Conversion Corp., and PIPE Conversion Corp., respectively, which will become wholly owned subsidiaries of the Company; |

| |

| • | “eligible policyholder” or “eligible subscriber” refers to a policyholder of PPIX, PCA, or PIPE as of June 1, 2018; |

| |

| • | “Enstar” means Enstar Holdings (US) LLC; |

| |

| • | “exchange” means PPIX, PCA, or PIPE, and “exchanges” means PPIX, PCA, and PIPE collectively; |

| |

| • | “Diversus Management” refers to Diversus Management, Inc., a wholly owned subsidiary of Diversus, Inc. which will be the surviving entity upon the merger of the attorneys-in-fact of PPIX, PIPE, and PCA with and into Diversus Management; |

| |

| • | the “offering” and the “conversion offering” refer to the offering of up to 4,830,000 shares of our common stock to eligible policyholders of PPIX, PCA and PIPE in a subscription offering under their respective plans of conversion and to certain stockholders of Diversus and to ICG and Enstar in a community offering. We expect to conduct the subscription offering and the community offering simultaneously; |

| |

| • | “PCA” refers to Professional Casualty Association, which as part of the conversions will merge with and into PCA Conversion Corp.; |

| |

| • | “PIPE” refers to Physicians’ Insurance Program Exchange, which as part of the conversions will merge with and into PIPE Conversion Corp.; |

| |

| • | “PPIX” refers to Positive Physicians Insurance Exchange, which as part of the conversions will merge with and into PPIX Conversion Corp.; |

| |

| • | “Positive Insurance” refers to Positive Physicians Insurance Company, the stock insurance company that will be the surviving entity after the merger of PCA Conversion Corp. and PIPE Conversion Corp. with and into PPIX Conversion Corp., which will then change its name to Positive Physicians Insurance Company; |

| |

| • | “standby purchaser” or “ICG” refers to Insurance Capital Group, LLC; and |

| |

| • | “subscribers” refers to the policyholders of PPIX, PCA or PIPE, who are the named insureds under insurance policies issued by PPIX, PCA or PIPE, respectively. |

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you. To understand the offering fully, you should read this entire prospectus carefully, including the financial statements and the notes to the financial statements included in this prospectus.

Overview of PPIX

PPIX is a reciprocal insurance exchange domiciled in Pennsylvania. PPIX writes medical professional liability insurance primarily for physicians, physician groups and allied healthcare providers such as physician assistants and certified registered nurse practitioners who are licensed to practice in Pennsylvania, Delaware, Maryland, New Jersey, and Ohio. At December 31, 2017, PPIX had a surplus of $17.5 million, and for the year ended December 31, 2017, PPIX had $15.3 million in direct written premiums and a net loss of $22,000. At September 30, 2018, PPIX had a surplus of $17.1 million, and for the nine months ended September 30, 2018, PPIX had $10.3 million in direct written premiums and net income of $194,000.

PPIX primarily markets its products through a network of over 45 independent producers in Pennsylvania, Delaware, Maryland, New Jersey, and Ohio. PPIX has not been assigned a rating by A.M. Best Company, Inc. (“A. M. Best”), but has been assigned an “A” rating by Demotech, Inc. (“Demotech”), a provider of financial stability ratings of insurance companies.

PPIX is managed by Specialty Insurance Services, LLC (“SIS”), the attorney-in-fact for PPIX. SIS, as the attorney-in-fact, has the power to direct the activities of PPIX that most significantly impact PPIX’s economic performance. SIS is owned by Diversus.

Overview of PCA

PCA is a reciprocal insurance exchange domiciled in Pennsylvania. PCA writes medical professional liability insurance primarily for physicians, physician groups and allied healthcare providers such as physician assistants and certified registered nurse practitioners who are licensed to practice in Pennsylvania and Michigan. At December 31, 2017, PCA had a surplus of $13.9 million, and for the year ended December 31, 2017, PCA had $7.7 million in direct written premiums and net income of $311,000. At September 30, 2018, PCA had a surplus of $11.4 million, and for the nine months ended September 30, 2018, PCA had direct written premiums of $4.2 million and a net loss of $2.1 million.

PCA primarily markets its products through a network of over 40 independent producers in Pennsylvania and Michigan. PCA has not been assigned a rating by A.M. Best, but has been assigned an “A” rating by Demotech.

PCA is managed by Professional Third Party, L.P. (“PTP”), the attorney-in-fact for PCA. PTP, as the attorney-in-fact, has the power to direct the activities of PCA that most significantly impact PCA’s economic performance. PTP, is owned by Diversus.

Overview of PIPE

PIPE is a reciprocal insurance exchange domiciled in Pennsylvania. PIPE writes medical professional liability insurance primarily for physicians, physician groups and allied healthcare providers such as physician assistants and certified registered nurse practitioners who are licensed to practice in Pennsylvania and South Carolina. At December 31, 2017, PIPE had a surplus of $12.3 million, and for the year ended December 31, 2017, PIPE had $3.6 million in direct written premiums and a net loss of $60,000. At September 30, 2018, PIPE had a surplus of $11.9 million, and for the nine months ended September 30, 2018, PIPE had direct written premiums of $3.0 million and net income of $85,000.

PIPE primarily markets its products through a network of over 20 independent producers in Pennsylvania and South Carolina. PIPE has not been assigned a rating by A.M. Best, but has been assigned an “A” rating by Demotech.

PIPE is managed by Physicians’ Insurance Program Management Company (“PIPE Management”), the attorney-in-fact for PIPE. PIPE Management, as the attorney-in-fact, has the power to direct the activities of PIPE that most significantly impact PIPE’s economic performance. PIPE Management is owned by Diversus.

Overview of Positive Physicians Holdings, Inc.

Positive Physician Holdings, Inc. is a newly created Pennsylvania corporation organized to be the stock holding company for Positive Insurance following the conversions of PPIX, PCA, and PIPE from reciprocal insurance exchanges to stock insurance companies. Positive Physician Holdings, Inc., which was incorporated on May 1, 2018, is not an operating company and has not engaged in any business to date. Our executive offices are located at 100 Berwyn Park, 850 Cassatt Road, Suite 220, Berwyn, PA 19312, and our phone number is 888-335-5335. Our web site address is www.positivephysicians.com. Information contained on our website is not incorporated by reference into this prospectus, and such information should not be considered to be part of this prospectus.

Positive Physicians Holdings, Inc. has no full time employees, and upon completion of the conversions and the offerings the day-to-day operations of the Company will be managed by Diversus Management pursuant to a management services agreement. See “Management - Executive Management.”

PPIX, PCA, and PIPE are subject to examination and comprehensive regulation by the Pennsylvania Insurance Department (the “Department”). As an insurance holding company, Positive Physician Holdings, Inc. will also be subject to examination and comprehensive regulation by the Department. See “Description of Our Business - Regulation.”

The Standby Stock Purchase Agreement

On June 8, 2018, the Company entered into the standby stock purchase agreement with ICG. Subject to the terms and conditions of the standby stock purchase agreement, ICG has agreed to purchase from the Company at a price of $10.00 per share such number of shares as is necessary for the minimum of 3,570,000 shares to be sold as required under the plan of conversion. ICG, however, has the right to purchase additional shares from the Company up the offering maximum of 4,830,000 shares. Accordingly, if all of the conditions to ICG’s obligation to purchase shares in the offering are satisfied, the sale of the minimum number of shares is guaranteed. ICG, as the standby purchaser, has agreed to permit Enstar Holdings (US) LLC to purchase 30% of the shares that ICG would otherwise purchase in the offering pursuant to a governance agreement entered into between ICG and Enstar. In connection with that governance agreement, Enstar agreed to dismiss litigation brought by Enstar against Diversus and its directors which sought to enjoin Diversus from entering into the transaction contemplated by the standby stock purchase agreement. We anticipate that ICG will own approximately 66% and Enstar will own approximately 28% of our outstanding shares after completion of the offering.

ICG has agreed to loan up to $750,000 to us to fund expenses we incur in connection with the conversion and the offerings. We have issued an exchangeable note to ICG in connection with such credit facility. The outstanding principal balance of the exchangeable note will automatically convert into shares of our common stock at a price of $10.00 per share upon completion of the offerings. The shares issued upon the conversion of the exchangeable note will count towards the minimum number of shares that must be sold in the offerings. See “The Conversion and Offering ‑ Description of Standby Stock Purchase Agreement.” Enstar has agreed with ICG that Enstar will fund 30% of the advances made under the exchangeable note. On December 15, 2018, there was no outstanding principal balance under the exchangeable note. Accordingly, currently we do not anticipate issuing any shares upon the conversion of the exchangeable note upon completion of the offerings. See “The Conversions and the Offering - Standby Stock Purchase Agreement.”

In connection with closing under the standby stock purchase agreement, we will appoint Matthew T. Popoli and Craig A. Huff, the Managing Partners of ICG, to the Company’s board of directors. So long as ICG beneficially owns more than 50% of the outstanding shares of our common stock, ICG has the right to nominate and appoint a majority of the members of the board of directors of the Company and Positive Insurance.

ICG will be entitled to preemptive rights that would allow it to maintain its percentage ownership in certain subsequent offerings of our common stock or securities convertible into our common stock. This right will not apply to, and will terminate upon the earlier of (a) the first date upon which ICG no longer beneficially owns more than twenty percent (20%) of the outstanding shares of our common stock or (b) the date of any breach by ICG of any obligation under the standby stock purchase agreement that remains uncured after 30 days’ notice thereof.

For more information regarding the provisions of the standby stock purchase agreement, see “The Conversions and the Offering - Description of Standby Stock Purchase Agreement” and “Risk Factors - Risks Relating to Ownership of Our Common Stock - There will not be an active, liquid trading market for our common stock.”

Conflicts of interest may arise between ICG and the Company, and ICG and its representatives on our board of directors may at times take actions that are not in the best interests of our other shareholders. See “Risk Factors - Risks Relating to Ownership of Our Common Stock - The standby purchaser may obtain control over us and may not always exercise its control in a way that benefits our public shareholders.”

Insurance Capital Group LLC

ICG is a holding company that was organized on January 8, 2018, for the purpose of acquiring and making investments in insurance businesses across targeted sectors, with a focus on sponsored insurance company demutualizations and other complex conversion transactions. ICG currently owns interests in Capitol Insurance Company, a Pennsylvania non-standard auto insurance company that ICG acquired in the second quarter of 2018, and Federal Life Insurance Company, an Illinois life insurance company that ICG acquired in the fourth quarter of 2018.

ICG is controlled by its Chief Executive Officer, Matthew Popoli, and Managing Partner, Craig Huff. ICG’s board of directors has extensive experience investing in and operating insurance businesses, including two directors who were formerly Commissioners of Insurance in Illinois, Connecticut and Texas.

During the fourth quarter of 2018, ICG entered into certain financing transactions with affiliates of Bain Capital, LP providing financing to ICG as it completed previously announced transactions as well as the transactions contemplated by the standby purchase agreement described in the Positive Physicians Holdings, Inc. Registration Statement on Form S-1, filed as of January 22, 2019. As a result, of these financing transactions, Bain Capital or one of its affiliates may ultimately acquire, with any such acquisition(s) being subject to prior regulatory approval, common equity interests in ICG. Following the consummation of the Conversion and Offering, the board of directors of Positive Physicians Holdings, Inc. may elect to consider having the company enter into an investment advisory agreement with an affiliate or affiliates of Bain Capital.

ICG has advised us that it has sufficient funds to complete the offering.

Diversus, Inc.

Diversus, Inc. (“Diversus”) is the owner of the attorneys-in-fact of PPIX, PCA, and PIPE. Such attorneys-in-fact have the power to direct the activities that most significantly impact the economic performance of PPIX, PCA, and PIPE, respectively. Diversus is also the owner of Diversus Management, Inc., Gateway Risk Services, Inc. and Andrews Outsource Solutions, each of which provides services to PPIX, PCA, and PIPE. After completion of the conversions and the offerings, Diversus Management, Inc., a wholly-owned subsidiary of Diversus, will manage the day-to-day operations of Positive Insurance, which will be the successor to PPIX, PCA, and PIPE. Enstar is the largest stockholder of Diversus. Dr. Lewis Sharps is a director and the Chief Executive Officer of both Diversus and the Company. In addition, James Zech and Scott Penwell are currently directors of both Diversus and the Company, and after completion of the conversions and the offerings, Matthew Popoli, Paul Brockman, and Duncan McLaughlin will also be directors of both Diversus and the Company. Except for the agreements described in “The Conversions and the Offering - Transactions Related to the Conversions”, Diversus has no relationship to ICG.

Our Business Strategies and Offering Rationale

Market Overview and Strategy

Many medical professional liability insurance (“MPLI”) focused risk retention groups (“RRGs”) and reciprocal insurance exchanges were formed in the late 1990s and early 2000s primarily because of capacity constraints in the MPLI market that were then prevalent. The MPLI market is currently experiencing over-capacity due to the excess capital held by MPLI insurers. As a result, competition for business among MPLI carriers has led to a significant decrease in the rates charged for MPLI coverage over the last 10 years. In addition, the creation of very large physician practice groups and the acquisition of physician practices by hospitals, which are often self-insured, have reduced the number of available independent healthcare professionals requiring insurance. In addition, physician groups and

hospitals are increasingly utilizing physician assistants and other allied healthcare providers to reduce costs in response to changes in payments from health insurers designed to reduce the insurers’ costs. These factors have led to MPLI premium volume shrinking on a national basis and consolidation of medical professional liability (“MPL”) insurers. This declining premium volume, however, has been accompanied by reduced claim frequency, which has permitted MPLI carriers to generally remain quite profitable. The challenge for larger MPLI carriers is to seek new sources of premium growth, and increasingly they seek this growth through acquisition.

The Company believes these changes in the healthcare industry and the MPLI market will create consolidation opportunities for the Company, which, in turn, may become a target for larger MPLI insurers seeking premium growth. See “Description of Our Business - Operating Strategy.”

The conversion offering and the merger of PPIX, PCA, and PIPE and the consolidation of the three exchanges to form Positive Insurance will create a company with sufficient statutory surplus to enable growth and will create a stable insurance platform that will permit the Company to execute its business plan.

Based on current over-capacity and the soft market conditions in the MPLI market, the Company believes there is a significant opportunity to acquire risk-bearing entities focused on the MPLI market, including small RRGs, stock and mutual insurance companies, and reciprocal insurance exchanges and to enter into reinsurance transactions and loss portfolio transfers with such entities. Many of these entities are experiencing shrinking premium volume and declining profitability. The Company believes it can act as a consolidator of these smaller entities. RRGs are alternative market vehicles organized under the Federal Liability Risk Retention Act of 1986 (the “Federal Risk Retention Act”), which allows physicians to form insurance companies to insure their own medical malpractice risk. Over 250 RRGs have been formed since the introduction of the Federal Risk Retention Act, many of which are focused on the MPLI market. Reciprocal insurance exchanges are created under state law and are essentially contractual inter-indemnity agreements among policyholders, which are sometimes called subscribers. Another feature of a reciprocal insurance exchange is that it is managed by a separate company called an attorney-in-fact. SIS, PTP and PIPE Management are the attorneys-in-fact with respect to PPIX, PCA, and PIPE, respectively.

The completion of this offering will supply additional capital needed to support substantially increased premium volume that we expect to result from the implementation of our growth strategy.

Exit Strategy

Although we expect that our shares will initially be listed for trading on the Nasdaq Stock Market, we are aware that there will be limited liquidity for our stock. This is because the majority of our common stock will most likely be held by the standby purchaser. The Company is focused on creating shareholder value for our shareholders through a future liquidity event. The three principal methods we expect to consider to create future liquidity are:

| |

| • | A follow on offering of our common stock or the issuance of our stock in connection with acquisitions; or |

| |

| • | A sale of the Company to a larger participant in the MPLI market or the insurance industry generally. |

We may engage in repurchases of our shares as a way to create liquidity for our shareholders or in connection with any effort we may take to delist our stock from NASDAQ in the future. See “Risk Factors - Our management and the standby purchaser are likely to seek to delist our shares from trading on the NASDAQ Stock Market and end our reporting obligations under the Securities Exchange Act of 1934.”

The Conversion Act provides that we cannot repurchase any shares for three years after the completion of the conversions and the offerings without the prior approval of the Pennsylvania Insurance Commissioner. Accordingly, no assurance can be given that we will engage in any share repurchases or that we will repurchase a significant number of shares. There is no limitation under the Conversion Act on ICG purchasing shares of our stock on the NASDAQ Stock Market or in privately negotiated transactions. Existing SEC regulations impose disclosure requirements with respect to actions that our management and ICG can take that would result in the Company going private and our common stock being delisted from trading on the NASDAQ Stock Market.

We will consider a follow on offering of our common stock to fund organic growth or acquisitions in furtherance of our growth strategy. We may also issue stock to shareholders of a company in connection with our acquisition of that company. A follow on offering or the issuance of stock in an acquisition would increase the number of outstanding shares not held by the standby purchaser. This could result in a broader market for our common stock that has more depth and liquidity, which would afford existing shareholders an opportunity to sell their shares in the market if they so choose.

We are also aware that there is excess capacity in the MPLI market, and, as a result, larger participants in the market are seeking premium growth through acquisitions. If we are successful in aggregating premium through the acquisition of small RRGs, stock and mutual insurance companies, and reciprocal insurance exchanges, we may become an attractive acquisition candidate for larger MPLI carriers. Moreover, larger companies typically trade at higher multiples in the market or upon sale than do smaller companies. A key element of our strategy is to buy small companies at a reasonable price, thereby aggregating premium, and achieve a higher multiple in the market or upon a sale of the Company. Although the Company is not actively seeking a buyer at this time and it does not expect to do so in the near term, our board of directors will continually evaluate its strategic options, including sale, with a view to maximizing shareholder value.

The Company’s ability to create a liquidity event will be based, in part, on the Company’s performance and economic and market conditions at that time. No assurance can be given that the Company will be able to achieve a liquidity event at a price or time that investors will view favorably.

The Conversion of PPIX, PCA, and PIPE from Reciprocal Insurance Exchanges to Stock Form

PPIX, PCA, and PIPE are reciprocal insurance exchanges. As such, they have no shareholders, but do have subscribers or members. The subscribers of PPIX, PCA, and PIPE are their policyholders. Unlike shareholders, the subscribers have no voting rights with respect to the governance of their respective exchange. All of the decision making authority relating to the operations and governance of a reciprocal insurance exchange resides in the attorney-in-fact, which under the organizational documents of PPIX, PCA, and PIPE, can only be terminated with the mutual agreement of the attorney-in-fact and the exchange. The subscribers only have such voting rights as are required by Pennsylvania law, including the right to vote to approve the conversion from reciprocal insurance exchange to stock form. In addition, unlike shares held by shareholders, the memberships in PPIX, PCA, and PIPE are not transferable and do not exist separate from the related insurance policy issued by the exchange. Therefore, these membership rights are extinguished when a policyholder cancels or does not renew its policy or the policy is otherwise terminated.

On June 1, 2018, PPIX’s attorney-in-fact adopted a plan of conversion by which PPIX will convert from a reciprocal insurance exchange to a stock insurance company by merging with and into PPIX Conversion Corp. Following the conversion, PPIX Conversion Corp. will become a wholly owned subsidiary of the Company. The affirmative vote of at least two-thirds of the votes cast by subscribers of PPIX as of June 1, 2018, is necessary to approve the plan of conversion at a special meeting of the subscribers to be held on [.], 2019.

On June 1, 2018, PCA’s attorney-in-fact adopted a plan of conversion by which PCA will convert from a reciprocal insurance exchange to a stock insurance company by merging with and into PCA Conversion Corp. Following the conversion, PCA Conversion Corp. will become a wholly owned subsidiary of the Company. The affirmative vote of at least two-thirds of the votes cast by subscribers of PCA as of June 1, 2018, is necessary to approve the plan of conversion at a special meeting of the subscribers to be held on [.], 2019.

On June 1, 2018, PIPE’s attorney-in-fact adopted a plan of conversion by which PIPE will convert from a reciprocal insurance exchange to a stock insurance company by merging with and into PIPE Conversion Corp. Following the conversion, PIPE Conversion Corp. will become a wholly owned subsidiary of the Company. The affirmative vote of at least two-thirds of the votes cast by subscribers of PIPE as of June 1, 2018, is necessary to approve the plan of conversion at a special meeting of the subscribers to be held on [.], 2019.

Immediately after the conversions, PIPE Conversion Corp. and PCA Conversion Corp. will merge into PPIX Conversion Corp. to form Positive Insurance, a single stock insurance subsidiary of the Company.

Pennsylvania Conversion Statute

PPIX, PCA, and PIPE are converting from reciprocal insurance exchanges to stock insurance companies under the Pennsylvania Medical Professional Liability Reciprocal Exchange‑to‑Stock Conversion Act (the “Conversion Act”). The Conversion Act requires the reciprocal insurance exchange to adopt a plan of conversion that grants each eligible subscriber nontransferable subscription rights to purchase a portion of the capital stock of the converted stock company. Such rights, in the aggregate, must give the eligible subscribers the right, prior to the right of any other person, to purchase 100% of the capital stock of the converted stock company. The Act defines “eligible subscriber” as a subscriber whose policy is in force on the date the plan of conversion is adopted (or the record date for voting on the plan of conversion if different than the adoption date). Therefore, policyholders of the converting company on the date the plan is adopted must have the first right to purchase shares in the offering, and collectively they must have the right to purchase all of the shares being offered.

The Conversion Act also requires that the plan of conversion provide that if the eligible subscribers do not purchase all of the shares being offered, the remaining shares must be sold in a public offering or a private placement with the approval of the Department. The Act states that the aggregate dollar value of the stock offered for sale in the offering must be equal to the estimated pro forma market value of the converted stock company, as successor to the reciprocal insurance exchange, based upon an independent valuation by a qualified expert. The pro forma market value may be the value that is estimated to be necessary to attract full subscription for the shares, as indicated by the independent valuations and may be stated as a range. Traditionally, as in mutual to stock conversions for both mutual insurance companies and mutual savings banks, the independent valuation expert selects a midpoint valuation and then sets the offering range, with the minimum being 15% below the midpoint valuation and the maximum being 15% above the midpoint. This results in a minimum dollar amount and a maximum dollar amount for the offering.

The Subscription and Community Offerings

As part of the conversions of PPIX, PCA, and PIPE, we are offering between 3,570,000 shares and 4,830,000 shares of our common stock for sale to the policyholders of PPIX, PCA, and PIPE as of June 1, 2018, which we refer to as the “eligible policyholders” or the “eligible subscribers”.

The eligible policyholders of PPIX, PCA, and PIPE have the right to purchase shares of common stock in the offering subject to the limitation that no eligible policyholder can, together with its affiliates, purchase more than 5,000 shares in the offering and to the allocation of shares in the event of an oversubscription as described herein. We call the offering of the common stock to these constituents the “subscription offering.”

In the community offering phase, shares of common stock are being offered primarily to certain stockholders of Diversus and to ICG and Enstar. Unlike the subscription offering, except for ICG, Enstar, and certain stockholders of Diversus, purchasers in the community offering do not have any right to purchase shares in the offering, and their orders are subordinate to the rights of the purchasers in the subscription offering. The stockholders of Diversus (excluding Enstar) collectively cannot purchase more than five percent of the total number of shares available after giving effect to the shares sold in the subscription offering.

ICG has agreed to purchase in the community offering such number of shares as will cause at least 3,570,000 shares to be sold in the offering. The standby purchaser’s right to purchase shares in the offering is subject to the rights of eligible policyholders to purchase in the subscription offering. Accordingly, if purchasers in the subscription offering phase subscribe to purchase all of the 4,830,000 shares offered hereby, ICG, Enstar, and Diversus stockholders will be unable to purchase shares in the offering. Moreover, if purchasers in the subscription offering subscribe to purchase 2,415,000 shares or more, ICG will not be able to purchase a majority of the number of shares sold in the offering. Accordingly, ICG’s percentage ownership of the Company’s outstanding common stock after the offering could range from 0% to 66.5%.

Any of the 4,830,000 offered shares of common stock not subscribed for in the subscription offering may be sold in the community offering. However, except for any order submitted by stockholders of Diversus, or ICG and Enstar, to whom we are contractually committed to sell shares, we reserve the absolute right to accept or reject any orders in the community offering, in whole or in part. None of ICG, Enstar, or stockholders of Diversus has priority over the others with respect to its right to purchase shares in the community offering.

ICG and Enstar have each agreed not to transfer any shares that it purchases in the offering for at least six months after completion of the offering. ICG and Enstar are purchasing such shares for investment rather than resale.

The following table shows those persons that are eligible to purchase shares in the various phases of the offering and the shares available for purchase in each phase of the offering. We expect to conduct the subscription offering and the community offering simultaneously.

|

| | | | |

Offering | | Eligible Purchasers | | Shares Available

for Purchase |

| Subscription Offering | | Eligible policyholders of PPIX, PCA, and PIPE; | | 4,830,000 shares |

| | | | | |

| Community Offering | | Eligible stockholders of Diversus | | 4,830,000 shares, less shares subscribed for in the Subscription Offering. These persons and their affiliates may not purchase more than 5% of shares available after the Subscription Offering |

| | | | | |

| | | ICG and Enstar

| | 4,830,000 shares, less shares subscribed for in the Subscription Offering (subject to the right of Diversus eligible stockholders to purchase up to 5% of any shares available after the Subscription Offering) |

If the gross proceeds from the orders for shares in the offering do not fall within the valuation range determined from the combined valuations of PPIX, PCA, and PIPE performed by Feldman Financial, a firm engaged by us to provide valuation services, we may cancel the offering, or establish a new valuation range and hold a new offering. In either event, the funds of any person who submitted a subscription or order will be returned to such person promptly, without interest. If we proceed with a new offering using updated valuations, people who submitted subscriptions or orders will be promptly notified by mail of the updated valuations and revised offering range. In that case, people will be given an opportunity to place new subscriptions and orders. See “The Conversions and the Offering - Resolicitation.” Subscriptions and orders may not be withdrawn for any reason if the gross proceeds from orders for shares in the offering fall within the estimated valuation range. Feldman Financial will not update its valuations of PPIX, PCA, and PIPE prior to the completion of the offering.

Our Structure Prior to the Conversions

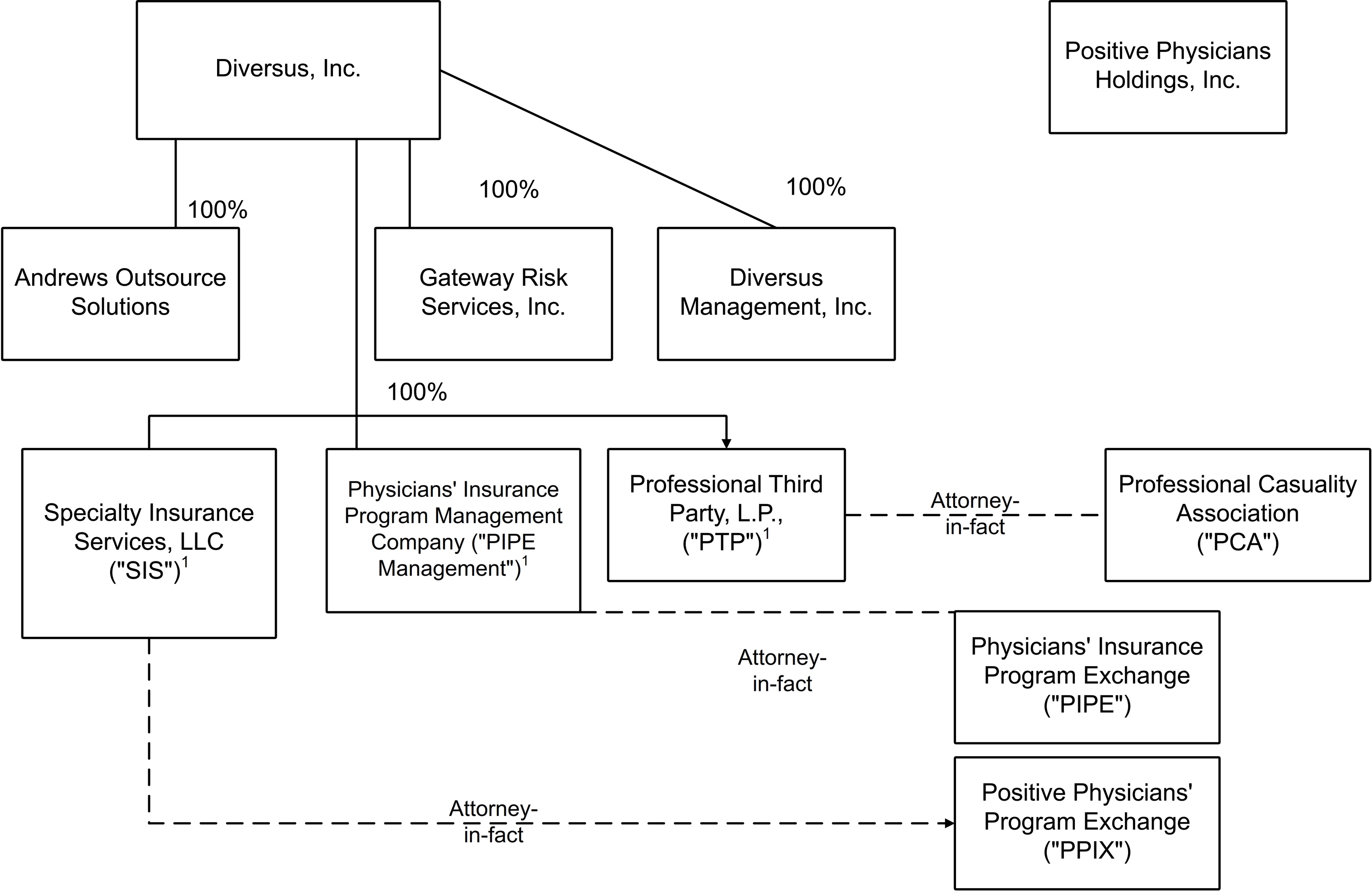

The current corporate structures of PPIX, PCA, and PIPE and the Company are shown in the following chart.

__________________

| |

| (1) | Manages the reciprocal insurance exchange pursuant to an attorney-in-fact agreement. |

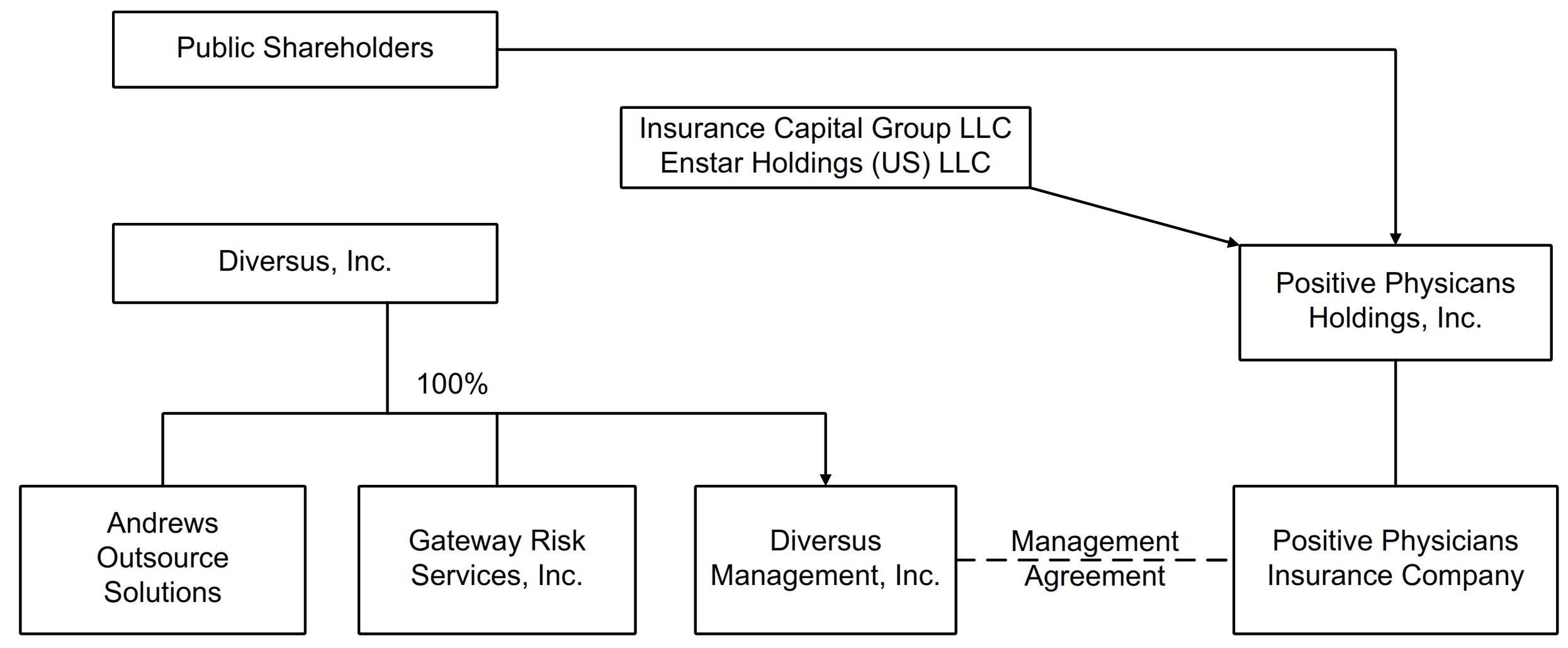

Our Structure Following the Conversions

The following chart shows our corporate structure following completion of the conversions.

__________________

| |

| (1) | ICG has agreed to purchase in the community offering such number of shares as will cause at least 3,570,000 shares to be sold in the offering. ICG has agreed to permit Enstar to purchase 30% of the shares that ICG would otherwise purchase in the offering. However, if the eligible |

policyholders of PPIX, PCA and PIPE subscribe to purchase all of the shares being offered by the Company, ICG and Enstar may be unable to purchase any shares in the offering. Accordingly, the percentage ownership of the Company’s outstanding common stock after the offering by ICG and Enstar could range from 0% to 95%. We anticipate that ICG will own a majority of our outstanding shares after completion of the conversions and the offering and will have the right to appoint at least a majority of our directors.

Use of Proceeds

We expect the net proceeds of the offering to between $32.7 million and $44.6 million, after the payment of conversion and offering expenses. We intend to use the net proceeds from the offering as follows:

|

| | | | | | | |

| Net Proceeds | | | |

| Gross proceeds | $ | 35,700,000 |

| | $ | 48,300,000 |

|

| Conversion and offering expenses | 1,000,000 |

| | 1,000,000 |

|

| Estimated selling agent fees and expenses | 1,995,250 |

| | 2,719,750 |

|

| Net proceeds | $ | 32,704,750 |

| | $ | 44,580,250 |

|

| | | | |

| Use of Net Proceeds | | | |

| Payment to Diversus | $ | 10,000,000 |

| | $ | 10,000,000 |

|

| General corporate purposes | 15,504,750 |

| | 27,380,250 |

|

| Capital contribution to Positive Insurance | 1,200,000 |

| | 1,200,000 |

|

| Line of credit to Diversus | 6,000,000 |

| | 6,000,000 |

|

| Total | $ | 32,704,750 |

| | $ | 44,580,250 |

|

Upon completion of the offering, we will make a payment of $10,000,000 to Diversus in consideration for Diversus Management agreeing to enter into a new management agreement with Positive Insurance that provides for lower management fees. In addition, we will provide a credit facility of up to $6,000,000 to Diversus to provide Diversus with working capital in the event that Diversus experiences working capital shortfalls as a result of such reduction in the management fees. See “Description of Our Business - Transactions Related to the Conversions.” We have no other current specific plans for the use of a significant portion of the proceeds. Any remaining net proceeds retained by us will be used for general corporate purposes, including to fund possible future acquisitions of risk-based businesses in the MPLI industry and possibly to make stock repurchases and to pay cash dividends. Any proceeds retained at the holding company will be invested primarily in U.S. government securities, other federal agency securities, and other securities consistent with our investment policy until utilized. See “Use of Proceeds.”

How Do I Buy Stock in the Offering?

To buy common stock in the offering, sign and complete the stock order form that accompanies this prospectus and send it to us with your payment in the envelope provided so that it is received no later than noon, Eastern Time on [.], 2019. Payment may be made by personal check, cashier’s check or money order payable to “Computershare Trust Company, N.A. on behalf of Positive Physicians Holdings, Inc.” After you send in your payment, you have no right to modify your investment or withdraw your funds without our consent, unless we extend the offering to a date later than [.], 2019. See “The Conversions and The Offering - If Subscriptions Received in all of the Offerings Combined Do Not Meet the Required Minimum” and “The Conversions and The Offering - Resolicitation.” We may or may not consent to any modification or withdrawal request in our sole discretion. We may reject a stock order form if it is incomplete or not timely received. Except for any order received from ICG and Enstar, we may also reject any order received in the community offering, in whole or in part, for any or no reason.

Limits on Your Purchase of Common Stock

The minimum number of shares a person or entity may subscribe for in the offering is 50 shares ($500). The maximum number of shares that an eligible policyholder, together with his or her affiliates and associates as a group, may purchase in the subscription offering is 5,000 shares. Except for ICG and Enstar, which have received approval from the Department to acquire more than 5% of the total shares sold in the offering, the maximum number of shares

that a person or entity, together with any affiliate, associate or any person or entity with whom he or she is acting in concert, may purchase in the offering without the prior approval of the Department is 5% of the number of shares sold in the offering. For this purpose, an associate of a person or entity includes:

| |

| • | relatives of such person or such person’s spouse living in the same house; |

| |

| • | companies, trusts or other entities in which such person or entity holds 10% or more of the equity securities (excluding the Company); |

| |

| • | a trust or estate in which such person or entity holds a substantial beneficial interest or serves in a fiduciary capacity; or |

| |

| • | any person acting in concert with any of the persons or entities listed above. |

Only those Diversus stockholders who had paid or provided other consideration for their shares of Diversus stock are eligible to purchase shares in the offering. Each holder of Diversus common stock will be permitted to purchase shares with an aggregate purchase price up to 33% of the purchase price such stockholder paid for such stockholder’s shares of Diversus common stock. Holders of Diversus preferred stock will be permitted to purchase shares with an aggregate purchase price up to 10% of the purchase price such stockholder paid for such stockholder’s shares of Diversus preferred stock, provided that if such stockholder voluntarily converts all of such stockholder’s shares of preferred stock to Diversus common stock prior to closing of the offerings, such stockholder will be permitted to purchase shares with an aggregate purchase price up to 33% of the purchase price such stockholder paid for such stockholder’s shares of Diversus preferred stock. Enstar and its affiliates will not be permitted to purchase shares in the offerings in its capacity as a stockholder of Diversus because it will purchase shares as a result ICG’s agreement with Enstar to permit Enstar to purchase 30% of the shares that ICG would otherwise purchase in the community offering. An eligible stockholder of Diversus, together with any associate of such stockholder, cannot purchase in excess of 25,000 shares in the offerings.

Oversubscription

If you are an eligible policyholder of PPIX, PCA or PIPE, and we receive subscriptions in the subscription offering for more than 4,830,000 shares, which is the maximum number of shares being offered, your subscription may be reduced. In that event, no shares will be sold in the community offering, and the shares of common stock will be allocated among the eligible policyholders of PPIX, PCA and PIPE.

The shares of common stock will be allocated so as to permit each eligible policyholder to purchase up to the lesser of their subscription or 1,000 shares (unless the magnitude of subscriptions does not permit such an allocation). Any remaining shares will be allocated among eligible policyholders with unfulfilled subscriptions in proportion to the respective amounts of unfilled subscriptions. For a more complete description of the allocation procedures in the event of an oversubscription, see “The Conversions and The Offering - Subscription Offering and Subscription Rights.”

If eligible policyholders of PPIX, PCA and PIPE subscribe for less than 4,830,000 shares, each eligible policyholder will be allowed to purchase the full amount of shares for which he or she subscribed; provided that no eligible policyholder, together with his or her associates and affiliates, may purchase more than 5,000 shares.

If we receive in the subscription offering subscriptions for less than 4,830,000 shares of common stock, but in the subscription and community offerings together we receive subscriptions and orders for more than 3,570,000 shares, we will sell to participants in the subscription offering the number of shares sufficient to satisfy their subscriptions in full, and then may accept orders in the community offering provided that the total number of shares sold in both offerings does not exceed 4,380,000 shares.

Undersubscription

If the number of shares purchased in the subscription and community offerings are collectively less than 3,570,000, then we will return all funds received in the offerings promptly to purchasers, without interest. In that event, we may

cause new valuations of PPIX, PCA and PIPE to be performed, and based on this valuation amend the registration statement of which this prospectus is a part and commence a new offering of the common stock. In that event, people who submitted subscriptions or orders will be permitted to submit new subscriptions or orders. See “The Conversions and The Offering - Resolicitation.” Because ICG has agreed to purchase sufficient shares to cause at least the minimum number of shares to be sold, if all of the conditions to ICG’s obligation to purchase shares in the offering are satisfied, the sale of the minimum number of shares is guaranteed.

Market for Common Stock

We have applied for listing on the Nasdaq Capital Market under the symbol “PPHI”, but development of an active trading market for our stock is unlikely. Griffin Financial intends to become a market maker in our common stock following the offering, but is under no obligation to do so. Neither we nor any market maker has any control over the development of an active public market. See “Market for Our Common Stock.” Our management and ICG are likely to seek to delist our shares from trading on the NASDAQ Stock Market in the future and end our public reporting obligations. This would greatly reduce the market for our common stock. See “Risk Factors - Our management and the standby purchaser are likely to seek to delist our shares from trading on the NASDAQ Stock Market and end our reporting obligations under the Securities Exchange Act of 1934.”

Management Purchases of Stock

Only those directors and executive officers of the attorneys-in-fact of PPIX, PCA and PIPE who are eligible subscribers or who are stockholders of Diversus will be permitted to purchase shares of common stock in the offering. Accordingly, it is unlikely that such directors and officers will purchase a significant number of shares in the offerings. The total shares purchased by all of the stockholders of Diversus as a group may not exceed 5% of the shares remaining to be sold in the offering after satisfaction of all orders in the subscription offering. See “The Conversions and The Offering - Proposed Management Purchases.”

Deadlines for Purchasing Stock

If you wish to purchase shares of our common stock in the offering, a properly completed and signed original stock order form, together with full payment for the shares, must be received (not postmarked) at the Stock Information Center no later than 12:00 noon, Eastern Time, on [.], 2019. You may submit your order form in one of three ways: by mail using the order reply envelope provided, by overnight courier to the address indicated on the stock order form, or by bringing the stock order form and payment to the Stock Information Center, which is located at 111 North 6th Street, Reading, PA 19601. The Stock Information Center is open weekdays, except bank holidays, from 10:00 a.m. to 4:00 p.m., Eastern Time. Once submitted, your order is irrevocable unless the offering is terminated or extended. We may extend the [.], 2019 expiration date, without notice to you. If we extend the subscription offering to a date later than [.], 2019, the stock orders will be canceled and all funds received will be returned promptly without interest. The subscription offering may not be extended to a date later than [.], 2019. The community offering may terminate at any time without notice, but no later than 45 days after the termination of the subscription offering. Although, we have provided a self-addressed envelope for the return of stock order forms, we are not responsible for slow or delayed delivery of first class mail by the United States Postal Service. In order to maximize the likelihood of timely delivery of any stock order form, people wishing to purchase stock in the offering should consider the use of an overnight delivery service.

Conditions That Must Be Satisfied Before We Can Complete the Offering and Issue the Stock

Before we can complete the offering and issue our stock, the eligible policyholders of PPIX must approve the PPIX plan of conversion, the eligible policyholders of PCA must approve the PCA plan of conversion, and the eligible policyholders of PIPE must approve the PIPE plan of conversion, and we must sell at least the minimum number of shares offered. In addition, completion of the conversions and the offering is subject to approval by the Department of ICG acquiring more than 10% of our outstanding common stock, which approval was received on [.], 2019.

No funds will be released from the escrow account until the offering has been completed and all of these conditions have been satisfied. If all of these conditions are not satisfied by March 31, 2019, the offering will be terminated and all funds will be returned promptly without interest.

Termination of the Offering

We have the right to cancel the offering at any time. If we cancel the offering, your money will be promptly refunded, without interest.

Dividend Policy

We currently do not have any plans to pay dividends to our shareholders. In addition, as a holding company, our ability to pay dividends will be dependent upon any proceeds from the offering retained at the holding company and the declaration and payment of dividends to us by Positive Insurance and any future subsidiaries. The payment of dividends by Positive Insurance may require the prior approval of the Department. For additional information regarding restrictions on our ability to pay dividends, see “Dividend Policy.”

Share Repurchases

We may engage in repurchases of our shares as a way to create liquidity for our shareholders or in connection with any effort we may take to delist our stock from NASDAQ in the future. See “Risk Factors - Our management and the standby purchaser are likely to seek to delist our shares from trading on the NASDAQ Stock Market and end our reporting obligations under the Securities Exchange Act of 1934.” The Conversion Act provides that we cannot repurchase any shares for three years after the completion of the conversions and the offerings without the prior approval of the Pennsylvania Insurance Commissioner. Accordingly, no assurance can be given that we will engage in any share repurchases or that we will repurchase a significant number of shares. There is no limitation under the Conversion Act on ICG purchasing shares of our stock on the NASDAQ Stock Market or in privately negotiated transactions. Existing SEC regulations impose disclosure requirements with respect to actions that our management and ICG can take that would result in the Company going private and our common stock being delisted from trading on the NASDAQ Stock Market. See “Market for Our Common Stock.”

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, commonly known as the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and reduction of other obligations that are otherwise applicable generally to public companies. These provisions include:

| |

| • | a requirement to include in this prospectus only two years of audited financial statements, two years of selected financial information, and two years of related Management Discussion & Analysis; |

| |

| • | exemption from the auditor attestation requirement on the effectiveness of our internal control over financial reporting; |

| |

| • | reduced disclosure about our executive compensation arrangements; and |

| |

| • | no stockholder non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions until the earlier of five years or such time as we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced compliance obligations.

Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We intend to take advantage of the extended transition period.

Delivery of Prospectus

To ensure that each person receives a prospectus at least 48 hours before the offering deadline, we will not mail prospectuses any later than five days before such date or hand-deliver prospectuses later than two days before that date.

Stock order forms may only be delivered if accompanied or preceded by a prospectus. We are not obligated to deliver a prospectus or order form by means other than U.S. mail.

We will make reasonable attempts to provide a prospectus and offering materials to holders of subscription rights. The subscription offering and all subscription rights will expire at 12:00 noon, Eastern Time, on [.], 2019 whether or not we have been able to locate each person entitled to subscription rights.

Delivery of Shares of Common Stock

All shares of common stock of the Company sold in the subscription offering and community offering will be issued in book entry form and held electronically on the books of our transfer agent. Stock certificates will not be issued. A statement reflecting ownership of shares of common stock sold in the offering will be mailed by our transfer agent to the persons entitled thereto at the address noted by them on their stock order form as soon as practicable following consummation of the conversions. We expect trading in the stock to begin on the business day of or on the business day immediately following the completion of the conversions and stock offering. It is possible that until a statement reflecting ownership of shares of common stock is available and delivered to purchasers, purchasers might not be able to sell the shares of common stock that they ordered, even though the common stock will have begun trading. Your ability to sell the shares of common stock before receiving your statement will depend on arrangements you may make with a brokerage firm.

How You May Obtain Additional Information Regarding the Offering

If you have any questions regarding the stock offering, please call the Stock Information Center at 1-610-205-6003, Monday through Friday between 10:00 a.m. and 4:00 p.m., Eastern Time or write to us at Positive Physicians Holdings, Inc., 100 Berwyn Park, Suite 220, 850 Cassatt Road, Berwyn, PA 19312. Our Stock Information Center is located at 111 North 6th Street, Reading, PA 19601. Additional copies of the materials will be available at the Stock Information Center. The Stock Information Center will be closed on weekends and bank holidays.

Transactions Related to the Conversions

Management of Positive Insurance

Currently, each of the exchanges pays a management fee equal to 25% of its gross written premiums to its respective attorney-in-fact. The Company and Positive Insurance will enter into a management agreement with Diversus Management, Inc. that will be effective upon completion of the conversion and the offering. Pursuant to the management agreement, officers of Diversus Management will be responsible for the day to day management of the insurance operations of Positive Insurance. Under the management agreement, Diversus Management will provide solicitation and underwriting of applications for insurance, claims management, accounting, and other services to Positive Insurance. The agreement has a term of seven years and will automatically be renewed for one year at each anniversary date of the agreement so that the remaining term is always between six and seven years; however, each of Positive Insurance and Diversus Management can terminate the agreement under certain circumstances. The management agreement is subject to review and approval of the Department.

Under the management agreement, Positive Insurance will pay a base management fee based upon a percentage of Positive Insurance’s gross written premiums, less return premiums. In 2018, the percentage will be 25% of gross written premiums, less return premiums, and thereafter will decline to 12% in 2019, 11% in 2020, and 10% in 2021. At January 1, 2022, the percentage will thereafter be set at 9% of gross written premiums, less return premiums. If by December 31, 2019, the Company has not acquired one or more additional insurance entities with additional annual gross written premiums of at least $10,000,000 and that become subject to the management agreement, the reduction in fees scheduled to occur on January 1, 2020 will be deferred for one year. The agreement also provides for a performance management fee reflecting the profitability of Positive Insurance based upon the ratio of Positive Insurance’s losses and loss adjustment expenses and other underwriting expenses to net earned premiums. The quarterly performance management fee will be equal to the product of (x) 100 minus the combined ratio of Positive Insurance, (y) 0.0825, and (z) net earned premiums calculated on a rolling 12-month basis. The management agreement will apply to any insurance company, risk retention group, reciprocal exchange, or other risk bearing entity acquired or formed by the Company. See “Description of Our Business - Management of Positive Insurance After the Conversions.”

As consideration for Diversus agreeing to enter into the new management agreement at a materially reduced rate of compensation, upon completion of the conversions and the offerings, the Company will pay a one-time fee of $10,000,000 to Diversus.

Loan to Diversus

The Company has agreed to provide a $6,000,000 credit facility to Diversus to provide working capital. Diversus may borrow up to $500,000 at anytime under such credit facility and may borrow additional amounts at any time after completion of the conversions and the offering. The loan will provide for monthly payments of interest at an annual rate of 8%, and the outstanding principal balance of the loan may be converted at the Company’s option into shares of Diversus common stock at a price of $1.00 per share. The Company and Diversus agreed upon the $1.00 price per share based upon their projection of the fair market value of Diversus common stock at the time that the loan is converted into Diversus common stock, which is anticipated to be the effective date of any merger of Diversus with a subsidiary of the Company. See “---- Option Agreement” and “The Conversions and the Offering - Transactions Related to the Conversions.”

Option Agreement

The Company and Diversus will enter into an option agreement whereby the Company and Diversus will each have the option to cause Diversus to merge with a wholly owned subsidiary of the Company. Under the terms of the agreement, the option may be exercised by either Diversus or the Company at any time (a) during the period beginning two years after completion of the conversions of PPIX, PCA, and PIPE and ending 54 months after completion of the conversions, or (b) if earlier than two years after completion of the conversions, such date on which the standby purchaser no longer has the right to appoint a majority of the members of the board of directors of the Company. In connection with any merger, the shareholders of Diversus will receive either cash, shares of common stock of the Company, or some combination thereof for their shares of Diversus stock. In connection with the merger, shares of Diversus preferred stock will be converted into such amount of cash or such number of shares of the Company’s common stock as if such shares of Diversus preferred stock had been converted into shares of Diversus common stock immediately prior to the effective date of the merger. The amount of cash or number of shares of common stock of the Company to be received for each share of Diversus capital stock will be determined by negotiation, or if the parties cannot agree upon the amount of cash or number of shares, by an appraisal process pursuant to the terms of the option agreement. Any such merger will be subject to approval by the stockholders of Diversus, but it is unlikely that any such merger would be subject to approval by the shareholders of the Company. See “The Conversions and the Offering - Transactions Related to the Conversions.”

Exchangeable Note

ICG has agreed to provide a $750,000 loan to the Company for the purpose of providing funding for the expenses incurred by the Company in connection with the conversions and the offerings. The loan is evidenced by an exchangeable note of the Company that will be due and payable on the first anniversary of the date of the note, and will bear interest at an annual rate of 8%. Upon completion of the conversions and the offerings, the unpaid principal balance of the exchangeable note will automatically be converted into shares of common stock of the Company at a price of $10.00 per share. Shares issued upon the conversion of the exchangeable note will count towards the minimum number of shares that must be sold in the offerings. Enstar has agreed with ICG that Enstar will fund 30% of all advances made under the exchangeable note. At November 15, 2018, there were no outstanding borrowings under the exchangeable note.

Agreement between ICG and Enstar

Insurance Capital Group LLC, as the standby purchaser, and Enstar Holdings (US) LLC have entered into an agreement pursuant to which ICG has agreed to permit Enstar to purchase 30% of the shares of the Company’s common stock that ICG would otherwise purchase in the community offering. It is likely that after completion of the offerings ICG and Enstar will collectively own at least a majority of the Company’s outstanding common stock. ICG and Enstar have agreed upon the number of directors that will constitute the Company’s board of directors and the number of such directors that will be designated by ICG and the number that will be designated by Enstar. They have also agreed that the Company will not take certain actions without the written approval of both Enstar and ICG. See “Management -

Board Governance.” The interests of ICG and Enstar may from time to time conflict with the interests of the Company, and the requirement that Enstar and ICG must agree upon certain actions to be taken by the Company may prevent the Company from taking advantage of opportunities that may be in the best interest of the Company. See “Risk Factors - ICG and Enstar can prevent the Company from taking actions that may be in the Company’s best interest.”

Risk Factors

The Company and its businesses are subject to numerous risks as more fully described in the section of this prospectus titled “Risk Factors.” As part of your evaluation of our business and a possible investment in our common stock, you should consider the challenges and risks we face in implementing our business strategies, including the following:

| |

| • | The Company may not be able to grow its premiums either organically or through acquisitions of other business. The Company may be unable to identify and complete acquisitions on terms favorable to the Company, and integration of such businesses will entail various risks and may distract the Company’s management from the day to day operations of its businesses; |

| |

| • | Changes in the healthcare industry and overcapacity in the MPLI market may impair the Company’s insurance company subsidiaries’ ability to increase premium revenues; |

| |

| • | A significant percentage of the Company’s written premiums are concentrated geographically in Pennsylvania and New Jersey. Changes in the legal or regulatory environment in Pennsylvania or New Jersey would have a material adverse effect on the results of our MPLI insurance subsidiaries; |

| |

| • | Because ICG and Enstar will likely own a majority of the Company’s outstanding shares after the offering, there will be little liquidity in the Company’s stock and they will control the Company; |

| |

| • | It is likely that ICG will cause the Company to delist from the NASDAQ Stock Market, which will have a material and adverse effect on the liquidity of the Company’s stock, and to deregister its shares of common stock under the Securities Exchange Act of 1934, thereby terminating its public reporting obligations; and |

| |

| • | The option agreement provides Diversus with the option of requiring the Company to acquire Diversus. |

An investment in our common stock involves numerous additional risks. See “Risk Factors.”

RISK FACTORS

In addition to all other information contained in this prospectus, you should carefully consider the following risk factors in deciding whether to purchase our common stock. If any of these risks actually occur, our business, financial condition and results of operations could be materially adversely affected and the price of our common stock and the value of your investment in our common stock could decline substantially.

Risks Related to Our Industry