As filed with the Securities and Exchange Commission on July 18, 2019

Registration No. 333- 232319

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________

AMENDMENT NO.2 TO

FORM F-10

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

__________________________________________________________

The Flowr Corporation

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Province or other jurisdiction of incorporation or organization)

2833

(Primary Standard Industrial Classification Code Number, if applicable)

N/A

(I.R.S. Employer Identification No., if applicable)

461 King Street W, Floor 2

Toronto, Ontario M5V 1K4

Canada

(905) 940-3993

(Address and telephone number of Registrant’s principal executive offices)

DL Services Inc.

Columbia Center

701 Fifth Avenue, Suite 6100

Seattle Washington 98104-7043

(206) 903-8800

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

| Copies to: | |

|

Alexander Dann

The Flowr Corporation

461 King Street W, Floor 2

Toronto, Ontario

Canada, M5V 1K4

Tel: (905) 940-3993

| |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

Province of Ontario, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

| | | | | | |

A. | | [X] | | upon filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

B. | | [ ] | | at some future date (check the appropriate box below): |

| | 1. | | [ ] | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

| | 2. | | [ ] | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| | 3. | | [ ] | | pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| | 4. | | [ ] | | after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. [ ]

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities

to be Registered | Proposed Maximum

Aggregate Offering

Price(1) | Amount of

Registration Fee(1) |

| | | |

Common Shares | $110,136,377.57 | $13,348.53 |

(1) Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Act”). There are being registered under this Registration Statement such number of common shares of the Registrant as shall have an aggregate offering price not to exceed US$110,136,377.57. Based on a proposed maximum aggregate offering price of CAD$125,000,000, and over-allotment amount of CAD$18,750,000. US dollar amounts are calculated based on the Bank of Canada daily average rate of US$1.00=CAD$1.3052 on July 16, 2019. The amount of registration fee includes $11,354.92 previously paid to the Commission.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Act or on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

SUBJECT TO COMPLETION, DATED JULY 18, 2019

I - 1

SHORT FORM BASE PREP PROSPECTUS

THE FLOWR CORPORATION

$125,000,000

[•] Common Shares

Price: $[•] per Offered Share |

This short form base PREP prospectus (the "Prospectus") of The Flowr Corporation ("Flowr", the "Corporation", "we", "us", "our" and similar terms) qualifies the distribution (the "Offering") of [•] common shares of the Corporation (the "Offered Shares") at a price of $[•] per Offered Share (the "Offering Price").

The Offered Shares will be issued pursuant to an underwriting agreement (the "Underwriting Agreement") dated [•], 2019, entered into among the Corporation and Barclays Capital Canada Inc., BMO Nesbitt Burns Inc. and Credit Suisse Securities (Canada), Inc. as representatives for the Underwriters (as defined below) (together, the "Representatives"), and AltaCorp Capital Inc., Clarus Securities Inc. and Sprott Capital Partners LP ( the "Canadian Underwriters" and Berenberg Capital Markets LLC, Oppenheimer & Co. Inc., Roth Capital Partners, LLC and MKM Partners, LLC (the "U.S. Underwriters, and collectively with the Representatives and the Canadian Underwriters, the "Underwriters"). The Representatives are acting as joint book-runners in connection with the Offering. See "Plan of Distribution".

Flowr operates in the cannabis industry and is focused on producing high-yield, premium cannabis for both medical and recreational markets throughout Canada, through its growing operations located in the Okanagan Valley of British Columbia, Canada.

Joint Book-Running Managers

| Barclays | BMO Capital Markets | Credit Suisse |

(continued on next page)

(continued from cover)

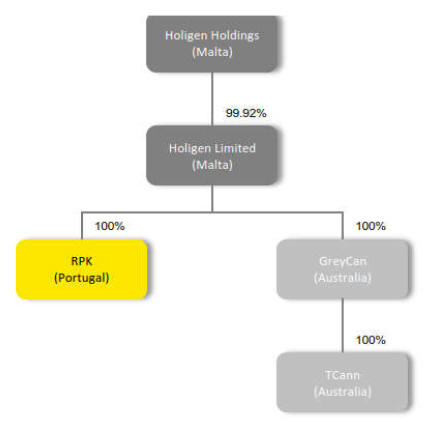

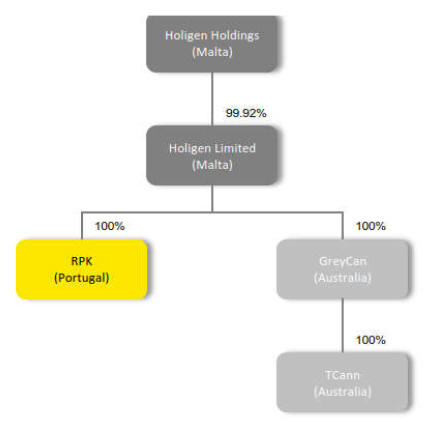

On June 24, 2019 the Corporation entered into a share purchase agreement which was amended on July 10, 2019 to extend the outside date to July 31, 2019 (the "Holigen Purchase Agreement") pursuant to which the Corporation has agreed to acquire (the "Acquisition") the remaining 80.2% of the outstanding equity interests in the capital of Holigen Holdings Limited ("Holigen") not already owned by the Corporation (the "Purchased Shares"). The consideration for the Purchased Shares (the "Purchase Price") is expected to be comprised of (i) share consideration; (ii) cash consideration; and (iii) the purchase of certain loans. See "Details of the Acquisition".

The share consideration for the Acquisition is expected to be satisfied by the issuance of an aggregate of 32,632,545 Series 1 Preferred Shares (as defined below) (the "Consideration Shares") at a deemed price per share of $7.15, being the volume weighted average trading price of the common shares of the Corporation (the "Common Shares") as traded on the facilities of the TSX Venture Exchange (the "TSX.V") for the five (5) trading days immediately preceding the date of the Holigen Purchase Agreement, as may be adjusted if required by the TSX.V (the "Issue Price"). Completion of the Acquisition is subject to certain closing conditions. A portion of the net proceeds of the Offering will be used to satisfy part of the Purchase Price. See "Details of the Acquisition" and "Use of Proceeds".

| | | Price to the Public | | | Underwriters’ Fee(1) | | | Net Proceeds to the

Corporation(2) | |

| Per Offered Share | $ | [•] | | $ | [•] | | $ | [•] | |

| Total(3) | $ | 125,000,000 | | $ | 7,500,000 | | $ | 117,500,000 | |

Notes:

(1) (1) In consideration for the services rendered by the Underwriters in connection with the Offering, the Underwriters will be paid a cash commission (the "Underwriters’ Fee") equal to 6% of the Offering Price for each Offered Share purchased on the Closing Date (as defined herein). See "Plan of Distribution" for additional information regarding the Underwriters’ compensation.

(2) (2) After deducting the Underwriters’ Fee, but before deducting expenses of the Offering, including expenses to prepare and file this Prospectus, which are estimated to be $2,100,000, and which will be paid from the net proceeds of the Offering.

(3) (3) The Corporation has granted the Underwriters an option (the "Underwriters’ Option"), exercisable in whole or in part, at any time and from time to time, in the sole discretion of the Underwriters, up to 30 days after and including the Closing Date (as defined below) to purchase up to an additional [•] Common Shares (the "Additional Offered Shares") at a price of $[•] per Additional Offered Share, to cover any over-allocation or for market stabilization purposes. If the Underwriters’ Option is exercised in full, the total price to the public, Underwriters’ Fee and net proceeds to the Corporation (before payment of the expenses of the Offering) will be $143,750,000, $8,625,000 and $135,125,000, respectively. This Prospectus qualifies the grant of the Underwriters’ Option and the issuance of the Additional Offered Shares on the exercise of the Underwriters’ Option. A purchaser who acquires Additional Offered Shares forming part of the Underwriters’ over-allocation position acquires those Additional Offered Shares under this Prospectus, regardless of whether the over-allocation position is ultimately filled through the exercise of the over-allocation option or secondary market purchases. Unless the context otherwise requires, references to "Offered Shares" in this Prospectus include the Additional Offered Shares. See "Plan of Distribution".

The following table sets out the number of Additional Offered Shares that may be issued by the Corporation to the Underwriters pursuant to the Underwriters’ Option:

Underwriters’ Position | Number of Securities

Available | Exercise Period | Exercise Price |

Underwriters’ Option | [•] Additional Offered Shares | Up to 30 days after the Closing Date | $[•] per Additional Offered Share |

The Common Shares are listed and posted for trading on the TSX.V under the symbol "FLWR". On June 21, 2019, the last trading day prior to the announcement of the Offering, the closing price of the Common Shares on the TSX.V was $7.26. On July 17, 2019, the last trading day prior to the date of this Prospectus the closing price of the Common Shares on the TSX.V was $4.76. The TSX.V has conditionally approved the listing of the Offered Shares and the Additional Offered Shares. Listing is subject to the Corporation fulfilling all of the listing requirements of the TSX.V on or before October 2, 2019. Concurrently with the pricing of the Offering, the Corporation intends to commence trading on the NASDAQ Capital Market (the "NASDAQ"). The Corporation has been approved for listing on the NASDAQ, subject to the effectiveness of the Corporation’s registration statement on Form 40-F filed with the SEC (as defined below) on February 5, 2019 as amended on May 28, 2019 and further amended on July 12, 2019. The Corporation intends to commence trading on NASDAQ one day after the pricing of the Offering.

The Offering is being made in each of the provinces of Canada except Quebec and the United States on an underwritten basis for 100% of the Offered Shares offered hereunder. The Underwriters, as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when issued by the Corporation and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under "Plan of Distribution", subject to the approval of certain Canadian legal matters on behalf of the Corporation by Fasken Martineau DuMoulin LLP and on behalf of the Underwriters by Borden Ladner Gervais LLP. The U.S. Underwriters are not registered as investment dealers in any Canadian jurisdiction and, accordingly, will only sell or solicit offers to sell the Offered Shares directly or indirectly, into the United States and will not, directly or indirectly, sell or solicit offers to sell the Offered Shares in Canada.

Subscriptions for the Offered Shares will be received subject to rejection or allotment, in whole or in part, and the Underwriters reserve the right to close the subscription books at any time without notice. Closing of the Offering is expected to take place on or about [•], 2019 or such other date as may be agreed upon by the Corporation and the Representatives, on behalf of the Underwriters, but in any event, not later than 42 days after the date of the receipt for the (final) short form base PREP prospectus (the "Closing Date"). In connection with the Offering, and subject to applicable laws, the Underwriters may over-allot or effect transactions that are intended to stabilize or maintain the market price of the Common Shares at levels other than that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time.

ii

After the Underwriters have made reasonable efforts to sell the Offered Shares at the Offering Price, the Underwriters may decrease the Offering Price for the Offered Shares and may further change the Offering Price from time to time to amounts no greater than the Offering Price. In the event the Offering Price is reduced, the compensation received by the Underwriters will be decreased by the amount that the aggregate price paid by the purchasers for the Offered Shares is less than the gross proceeds paid by the Underwriters for the Offered Shares. Any such reduction will not affect the proceeds received by the Corporation. See "Plan of Distribution".

Investing in the Offered Shares is speculative and involves a high degree of risk and should only be made by persons who can afford the total loss of their investment. A prospective purchaser should therefore review this Prospectus and the documents incorporated by reference herein in their entirety and carefully consider the risk factors described under the section "Risk Factors" in this Prospectus, prior to investing in the Offered Shares. See "Caution Regarding Forward-Looking Statements" and "Risk Factors".

Prospective purchasers are advised to consult their own tax advisors regarding the application of Canadian federal income tax laws to their particular circumstances, as well as any other provincial, foreign and other tax consequences of acquiring, holding or disposing of the Offered Shares.

It is anticipated that the Offered Shares will be delivered under the book-based system through CDS Clearing and Depository Services Inc. ("CDS") or its nominee and deposited in electronic form, or will otherwise be delivered to the Underwriters, registered as directed by the Underwriters, on the Closing Date. Except in limited circumstances, a purchaser of Offered Shares will receive only a customer confirmation from the registered dealer from or through which the Offered Shares are purchased and who is a CDS depository service participant. CDS will record the CDS participants who hold the Offered Shares on behalf of owners who have purchased the Offered Shares in accordance with the book-based system. No definitive certificates will be issued unless specifically requested or required. See "Plan of Distribution".

The Offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare this Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those applicable to issuers in the United States. Certain financial statements incorporated by reference in the Prospectus have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"), and may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the Offered Shares may have tax consequences both in the United States and in Canada. Such tax consequences for investors, including investors who are resident in or citizens of the United States, may not be described fully herein.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Corporation is amalgamated under the laws of the Province of Ontario, Canada, that most of its officers and Directors are residents of Canada, that some of the experts named in this Prospectus are residents of Canada, and that all or a substantial portion of the assets of the Corporation and said persons are located outside the United States. See "Enforceability of Civil Liabilities".

THE OFFERED SHARES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE "SEC") NOR ANY STATE SECURITIES COMMISSION AND NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSIONS HAVE PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Corporation does not have, and until federally legal does not intend to engage in, any direct, indirect or ancillary involvement in the United States cannabis industry (as described in CSA Staff Notice 51-352 (Revised) Issuers with U.S. Marijuana-Related Activities).

The registered and head office of the Corporation is located at 461 King Street West, Floor 2, Toronto, Ontario M5V 1K4.

iii

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Explanatory Notes

This Prospectus describes the specific terms of the Offering and also incorporates by reference certain documents herein. In this Prospectus, the Corporation and its subsidiaries, The Flowr Canada Holdings ULC and The Flowr Group (Okanagan) Inc. are collectively referred to as the "Corporation" or "Flowr", unless the context otherwise requires. Readers of this Prospectus should rely only on information contained in this Prospectus and contained in the documents incorporated by reference in this Prospectus. The Corporation and the Underwriters have not authorized anyone to provide the reader with different information and take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give readers of this Prospectus.

The Corporation and the Underwriters are not offering to sell the Offered Shares in any jurisdictions where the offer or sale of the Offered Shares is not permitted. The information contained in this Prospectus (including the documents incorporated by reference herein) is accurate only as of the date of this Prospectus (or the date of the document incorporated by reference herein, as applicable), regardless of the time of delivery of this Prospectus or any sale of the Offered Shares. The business, financial condition, results of operations and prospects of the Corporation may have changed since those dates. The Corporation does not undertake to update the information contained or incorporated by reference herein, except as required by applicable Canadian securities laws.

This Prospectus must not be used by anyone for any purpose other than in connection with the Offering. Information contained on, or otherwise accessed through, the Corporation’s website is not and shall not be deemed to be a part of this Prospectus and such information is not incorporated by reference, despite any references to such information in this Prospectus or the documents incorporated by reference herein, and prospective purchasers should not rely on such information when deciding whether or not to invest in the Offered Shares. The information on the Underwriters’ website and any information contained in any other website maintained by the Underwriters or their affiliates is not part of this Prospectus, has not been approved and/or endorsed by the Corporation or the Underwriters and should not be relied upon by prospective purchasers.

Capitalized terms not otherwise defined in the body of this Prospectus shall have the meanings ascribed to such terms in the Glossary of Terms attached as Appendix "A" to this Prospectus.

The documents incorporated or deemed to be incorporated by reference herein contain meaningful and material information relating to the Corporation and prospective purchasers should review all information contained in this Prospectus and the documents incorporated or deemed to be incorporated by reference herein.

Trademarks

This Prospectus and the documents incorporated by reference herein include references to trademarks which are protected under applicable intellectual property laws and are the property of the Corporation, Holigen, or their respective affiliates or licensors. Solely for convenience, the trademarks of the Corporation, Holigen, their respective affiliates and/or their respective licensors referred to in this Prospectus, or documents incorporated by reference herein, may appear with or without the ® or ™ symbol, but such references or the absence thereof are not intended to indicate, in any way, that the Corporation, Holigen, or their respective affiliates or licensors will not assert, to the fullest extent under applicable law, their respective rights to these trademarks. Any other trademarks used in this Prospectus, or the accompanying Prospectus or documents incorporated by reference herein, are the property of their respective owners.

Market Data

This Prospectus and the documents incorporated by reference herein, contain certain statistical data, market research and industry forecasts that were obtained, unless otherwise indicated, from independent industry and government publications and reports or based on estimates derived from such publications and reports and management’s knowledge of, and experience in, the markets in which the Corporation operates. Industry and government publications and reports generally indicate that they have obtained their information from sources believed to be reliable, but do not guarantee the accuracy and completeness of their information. While the Corporation believes this data to be reliable, market and industry data is subject to variation and cannot be verified due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. The Corporation has not independently verified the accuracy or completeness of such information contained in this Prospectus or incorporated by reference herein. In addition, projections, assumptions and estimates of the Corporation’s future performance and the future performance of the industry in which the Corporation operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the heading "Risk Factors" in this Prospectus.

Information Pertaining to Holigen

The information contained in this Prospectus with respect to Holigen and its business has been provided by management of Holigen. Management and the Directors of the Corporation have relied upon Holigen for the accuracy of the information provided by Holigen. See "Risk Factors - The Corporation Does Not Currently Control Holigen and No Assurance of Holigen’s Future Performance Can be Given".

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in this Prospectus or in documents incorporated by reference herein, constitute "forward-looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities laws ("forward-looking statements"), which are based upon the Corporation’s current internal expectations, estimates, projections, assumptions and beliefs. Statements concerning the Corporation’s objectives, goals, strategies, intentions, plans, beliefs, expectations and estimates, and the business, operations, future financial performance and condition of the Corporation and/or Holigen are forward-looking statements. The words "believe", "expect", "anticipate", "estimate", "intend", "may", "will", "would" and similar expressions, including the negative and grammatical variations of such expressions, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in the forward-looking statements. In addition, this Prospectus and/or the documents incorporated by reference herein, may contain forward-looking statements attributed to third-party industry sources.

By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts and projections that constitute forward-looking statements may not occur. Such forward-looking statements in this Prospectus or in documents incorporated by reference herein, speak only as of the date of such document. Forward-looking statements in this Prospectus or in documents incorporated by reference herein include, but are not limited to, statements with respect to:

• the completion and timing of the Offering;

• the use of net proceeds of the Offering;

• the Acquisition, including but not limited to:

• the completion and timing thereof;

• synergies and/or benefits resulting from the Acquisition; and

• the impact of the Acquisition on Flowr’s financial performance (including with respect to its growing capacity, revenues and margins);

• the performance of the Corporation’s and Holigen’s business and operations;

• the ability of the Corporation to integrate the business of Holigen with that of the Corporation;

• the retention of key personnel of the Corporation and Holigen;

• the Corporation’s capital expenditure programs;

• the future development of the Corporation, its growth strategy and the timing thereof;

• the construction, production capacity, expected completion, as well as expected receipt and timing of regulatory and GMP licensing, as applicable, of the K1 Facility, K2 Facility, Flowr Forest and R&D facility in Kelowna and Holigen’s facilities;

• the growth strategy of the Corporation;

• the estimated future contractual obligations of the Corporation;

• the Corporation’s future liquidity and financial capacity including its ability to satisfy financial obligations in future periods;

• the supply and demand for cannabis products and services similar to the Corporation’s and Holigen’s products and services;

• the ability to establish and market the Corporation’s brands within its targeted markets;

• cost and/or pricing of the Corporation’s and Holigen’s products;

• expectations regarding the Corporation’s ability to raise capital;

• the Corporation’s treatment under government regulatory and taxation regimes; and

• the Corporation’s and Holigen’s net sales of all or any one of their respective products.

With respect to the forward-looking statements contained in this Prospectus or in documents incorporated by reference herein, the Corporation has made assumptions regarding, among other things:

• the ability to develop and market future products;

• timing to launch new products;

• cost to develop and/or manufacture products;

• operating cost estimates and yield trends for the Corporation and/or Holigen;

• inventory levels;

• pricing for the Corporation’s and/or Holigen’s products;

• future market demand/trends;

• gross profitability for products;

• the ability of the Corporation to comply with its contractual obligations;

• the ability of the Corporation to complete the Acquisition and this Offering on the terms described in the Prospectus and the Underwriting Agreement;

• the successful sale of products to third parties on terms favorable to the Corporation;

• the ability of the Corporation to maintain key strategic alliances, and licensing and partnering arrangements, including in relation to the business of Holigen, now and in the future;

• the ability of the Corporation and/or Holigen to complete construction of their facilities and obtain licensing on time or at all;

• any delay in the construction and/or licensing of the facilities of the Corporation or Holigen not being material;

• the ability of the Corporation to maintain its and Holigen’s distribution networks and distribute its products effectively despite significant geographical expansion;

• the cannabis regulatory environment in which the Corporation and Holigen operate, including the areas of taxation, environmental protection, consumer safety and health regulation;

• the timely receipt of any required regulatory approvals;

• the general economic, financial, market and political conditions impacting the industry in which the Corporation and Holigen operate;

• the tax treatment of the Corporation, Holigen, and their subsidiaries and the materiality of legal proceedings;

• the ability of the Corporation to achieve or increase profitability, fund its operations with existing capital, and/or raise additional capital to fund future acquisitions and/or development, including construction and licensing of the facilities of the Corporation and Holigen;

• the ability of the Corporation to acquire any necessary technology, products or businesses and effectively integrate such acquisitions, including the Corporation’s ability to complete the Acquisition and integrate Holigen;

• reliance on third party suppliers to supply the Corporation and Holigen with products required for their respective businesses on favourable terms;

• the ability of the Corporation to generate sufficient cash flow from operations;

• the availability of raw materials and finished products necessary for the Corporation’s and Holigen’s products;

• the impact of increasing competition;

• the ability of the Corporation and Holigen to obtain and retain qualified staff, equipment and services in a timely and efficient manner;

• the ability of the Corporation and Holigen to maintain and enforce the protection afforded by trade secrets or other intellectual property rights;

• the ability of the Corporation and Holigen to conduct operations in a safe, efficient and effective manner;

• the results of continuing and future safety and efficacy studies by industry and government agencies related to the Corporation’s and Holigen’s products; and

• the ability of the Corporation to successfully market its products and services and the products and services of Holigen upon completion of the Acquisition.

Forward-looking statements contained in this Prospectus or in documents incorporated by reference herein, are based on the key assumptions described herein or therein. The reader is cautioned that such assumptions, although considered reasonable by the Corporation, may prove to be incorrect. Actual results achieved during the forecast period may vary from the information provided in this Prospectus or in documents incorporated by reference herein, as a result of numerous known and unknown risks and uncertainties. The Corporation cannot guarantee future results.

Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this Prospectus or in documents incorporated by reference herein, include, but are not limited to, the risk factors included under the heading "Risk Factors" in this Prospectus.

Forward-looking statements contained in this Prospectus or in documents incorporated by reference herein, are based on management’s current plans, expectations, estimates, projections, beliefs and opinions and the assumptions relating to those plans, expectations, estimates, projections, beliefs and opinions may change. Management of the Corporation has included the above summary of assumptions and risks related to forward-looking statements included in this Prospectus or in documents incorporated by reference herein, for the purpose of assisting the reader in understanding management’s current views regarding those future outcomes. Readers are cautioned that this information may not be appropriate for other purposes. Readers are cautioned that the lists of assumptions and risk factors contained herein are not exhaustive. Neither the Corporation nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements contained herein.

Such forward-looking statements are made as of the date of this Prospectus or any documents incorporated by reference herein, as of the dates of such documents, and the Corporation disclaims any intention or obligation to update publicly any such forward-looking statements, whether as a result of new information, future events or results or otherwise, other than as required by applicable Canadian securities laws.

All of the forward-looking statements made in this Prospectus or in documents incorporated by reference herein are expressly qualified by these cautionary statements and other cautionary statements or factors contained or incorporated by reference herein, and there can be no assurances that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Corporation. See "Risk Factors".

Actual results, performance or achievements could differ materially from those expressed in, or implied by, any forward-looking statement in this Prospectus, and, accordingly, investors should not place undue reliance on any such forward-looking statement. New factors emerge from time to time and the importance of current factors may change from time to time and it is not possible for the Corporation’s management to predict all of such factors, or changes in such factors, or to assess in advance the impact of each such factors on the business of the Corporation or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement contained in this Prospectus.

CAUTIONARY NOTE REGARDING FUTURE-ORIENTED FINANCIAL INFORMATION

To the extent any forward-looking statements in this Prospectus or in documents incorporated by reference herein, constitute "future-oriented financial information" or "financial outlooks" within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the potential benefits of the Acquisition and the Offering described herein and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information and financial outlooks. Future-oriented financial information and financial outlooks, as with forward-looking statements generally, are, without limitation, based on the reasonable assumptions of management of the Corporation and subject to the risks set out above under the heading "Cautionary Note Regarding Forward-Looking Information".

ENFORCEABILITY OF JUDGEMENT AGAINST FOREIGN PERSONS FOR CANADIAN INVESTORS

Steve Klein, Chief Strategy Officer and Director, David Miller, Director, Don Duet, Director and J. André De Barros Teixeira, Director, each reside outside of Canada and have each appointed the Corporation, 461 King Street West, Floor 2, Toronto, Ontario M5V 1K4, as their agent for service of process in Canada. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person that resides outside of Canada, even if the person has appointed an agent for service of process.

ENFORCEABILITY OF CIVIL LIABILITIES FOR UNITED STATES INVESTORS

Flowr is a corporation governed by the Business Corporations Act (Ontario). A number of the Corporation’s Directors and officers, and some of the experts named in this Prospectus, are residents of Canada or otherwise reside outside of the United States, and a substantial portion of their assets, and a substantial portion of the Corporation’s assets, are located outside the United States. The Corporation has appointed an agent for service of process in the United States, but it may be difficult for holders of securities who reside in the United States to effect service within the United States upon those Directors, officers and experts who are not residents of the United States. It may also be difficult for holders of securities who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon the Corporation’s civil liability and the civil liability of the Corporation’s Directors and officers and experts under the United States federal securities laws.

The Corporation filed with the SEC, concurrently with the Corporation’s registration statement on Form F-10 of which this Prospectus forms a part, an appointment of agent for service of process on Form F-X. Under the Form F-X, the Corporation appointed DL Services Inc. as its agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC and any civil suit or action brought against or involving the Corporation in a United States court arising out of or related to or concerning the Offering.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

All references to "$" in this Prospectus refer to Canadian dollars, all references to "US$" are to United States dollars, and all references to "€" or "EUR" are to European Union Euro, unless otherwise indicated. The following table reflects the high and low rates of exchange for one United States dollar, expressed in Canadian dollars, during the periods noted, the rates of exchange at the end of such periods, and the average rates of exchange during such periods, based on the Bank of Canada daily exchange rate.

| Three months ended

March 31, | Year ended December 31, |

| 2019 | 2018 | 2018 | 2017 |

High for the period……………………................. | 1.3600 | 1.3088 | 1.3642 | 1.3743 |

Low for the period…………………….................. | 1.3095 | 1.2288 | 1.2288 | 1.2128 |

Rate at the end of the period………….................. | 1.3363 | 1.2894 | 1.3642 | 1.2545 |

Average rate for the period…………..................... | 1.3295 | 1.2647 | 1.2957 | 1.2986 |

On July 17, 2019, the Bank of Canada rate of exchange for converting United States dollars into Canadian dollars was US$1.00 = $1.3053.

The following table reflects the high and low rates of exchange for one European Union Euro, expressed in Canadian dollars, during the periods noted, the rates of exchange at the end of such periods, and the average rates of exchange during such periods, based on the Bank of Canada daily exchange rate.

| Three months ended March 31, | Year ended December 31, |

| 2019 | 2018 | 2018 | 2017 |

High for the period……………………................. | 1.5441 | 1.6124 | 1.6124 | 1.5330 |

Low for the period…………………….................. | 1.4938 | 1.4853 | 1.4791 | 1.3832 |

Rate at the end of the period………….................. | 1.5002 | 1.5867 | 1.5613 | 1.5052 |

Average rate for the period…………..................... | 1.5098 | 1.5544 | 1.5302 | 1.4650 |

On July 17, 2019, the Bank of Canada rate of exchange for converting European Union Euros into Canadian dollars was €1.00 = $1.4649.

PRESENTATION OF FINANCIAL INFORMATION

The financial statements of the Corporation incorporated by reference in the Prospectus are reported in Canadian dollars and have been prepared in accordance with IFRS as issued by the IASB.

The financial statements of Holigen included in this Prospectus are reported in EUR and have been prepared in accordance with IFRS as issued by the IASB.

NON-IFRS MEASURES

This Prospectus contains references to certain measures that are not recognized under IFRS. These non-IFRS measures are set out in Management’s Discussion & Analysis for the three and twelve months ended December 31, 2018 and 2017 (the "YE 2018 MD&A") and Management’s Discussion & Analysis for the three months ended March 31, 2019 (the "Q1 2019 MD&A") and are used by the Corporation as indicators of financial performance and may differ from similar computations as reported by other similar entities and, accordingly, may not be comparable. The Corporation believes these measures provide useful supplemental information that may assist investors in assessing an investment in the Offered Shares.

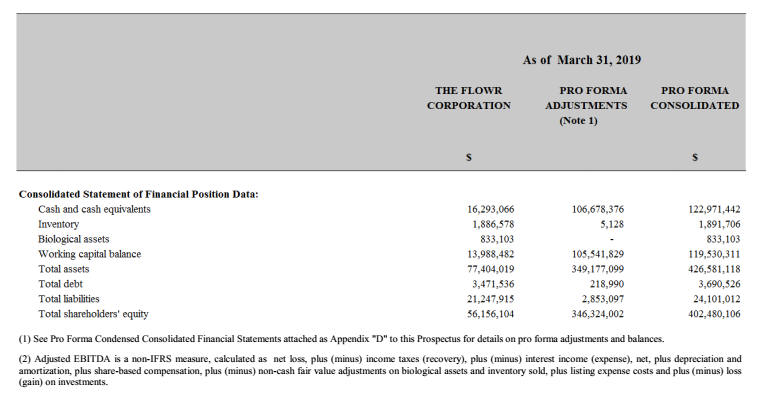

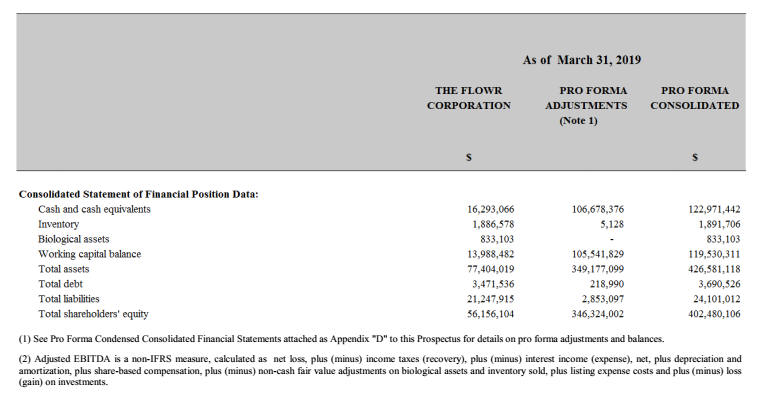

The non-IFRS measures used in relation to the Corporation in this Prospectus are Adjusted EBITDA and Price per Gram, which have the following meanings:

"Adjusted EBITDA" is defined as net loss, plus (minus) income taxes (recovery), plus (minus) interest income (expense), net, plus depreciation and amortization, plus share-based compensation, plus (minus) non-cash fair value adjustments on biological assets and inventory sold, plus listing expense costs and plus (minus) loss (gain) on investments.

"Price per Gram" is defined as the retail price of a gram of dried cannabis flower.

Investors are cautioned that this non-IFRS measure should not be considered an alternative to net earnings for the period (as determined in accordance with IFRS) as an indicator of the Corporation’s performance, or an alternative to cash flows from operating, financing and investing activities as a measure of liquidity. The Corporation’s method of calculating such non-IFRS measures may differ from the methods used by other issuers and, accordingly, non-IFRS measures used in relation to the Corporation may not be comparable to similar measures used by other issuers. Adjusted EBITDA has limitations as an analytical tool when compared to the use of net loss, as it excludes items which others may believe are normal for the operation of our business.

Please refer to the YE 2018 MD&A and the Q1 2019 MD&A for additional details regarding the non-IFRS measures used by the Corporation.

SUMMARY

The following is a summary of the principal features of the Offering and the Acquisition and should be read together with the more detailed information and financial data and statements contained elsewhere in this Prospectus.

Capitalized terms not otherwise defined in this Summary shall have the meanings ascribed to such terms in the Glossary of Terms attached as Appendix "A" to this Prospectus.

THE FLOWR CORPORATION

General Description of the Corporation

The Corporation was incorporated under the Business Corporations Act (Alberta) on June 1, 2016. On September 21, 2018, the Corporation completed a qualifying transaction under the TSX.V rules pursuant to a business combination agreement between Flowr Privateco, Needle and Needle Subco, which resulted in a reverse takeover of Needle by the shareholders of Flowr Privateco (the "Qualifying Transaction"). In connection with the completion of the Qualifying Transaction, on September 25, 2018, the Corporation continued from being governed under the Business Corporations Act (Alberta) to being governed under the Business Corporations Act (Ontario). On January 1, 2019, the Corporation and The Flowr Group Inc. amalgamated with the name of the amalgamated company being "The Flowr Corporation". The registered and head office of Flowr is located at 461 King Street West, Floor 2, Toronto, Ontario M5V 1K4.

The Corporation’s shares are listed on the TSX.V under the symbol "FLWR" and are approved for listing on the NASDAQ under the symbol "FLWR". The listing date will be confirmed prior to closing of the Offering. The Corporation intends to commence trading on NASDAQ one day after the pricing of the Offering.

The Corporation owns 100% of the issued and outstanding common shares of Flowr ULC and two U.S. shareholders own 100% of the issued and outstanding class A preferred shares in the capital of Flowr ULC (the "Flowr ULC Class A Shares"). See "Description of Capital Structure - Flowr ULC Shares" and "Material Contracts - Share Exchange Agreement" in the AIF.

The Corporation’s interest in Flowr Okanagan is held through Flowr ULC, which owns 100% of the issued and outstanding common shares of Flowr Okanagan.

Recent Developments

The Corporation is currently in negotiations to obtain committed financing from a syndicate of lenders led by ATB Financial ("ATB") in its capacity as lead arranger and administrative agent for up to approximately $50,000,000 of committed senior secured credit facilities (the "ATB Credit Facilities"). Pursuant to the ATB Credit Facilities, the Corporation will be permitted to use the recapitalization term facility and the revolving operating credit facility for general working capital purposes and the development facility for the development of the K1 Facility, the K2 Facility and the Flowr Forest. The ATB Credit Facilities will mature in three (3) years. Under the terms of the ATB Credit Facilities, the Corporation will be subject to certain financial, positive and negative covenants. In addition, the ATB Credit Facilities will provide for an accordion of up to $70,000,000. The ATB Credit Facilities are expected to be guaranteed by the Corporation's current and future direct and indirect material subsidiaries, except Holigen (together with the Corporation, the "Loan Parties") and expected to be secured by a general security agreement granting an interest over all the current and after acquired personal property and floating charge on all lands of the Loan Parties, as well as a collateral mortgage or debenture over the Corporation's freehold and leasehold interests in certain Kelowna facilities, non-disturbance agreement among ATB, the Corporation and the landlord of the Kelowna facilities, the Corporation's pledge in respect of its interests in the capital of its subsidiaries (other than Holigen) and certain other assets. The applicable margins for the ATB Credit Facilities will be based on certain performance-pricing grids, with availability in bank acceptance, letters of credit and prime loans. The ATB Credit Facilities are subject to negotiation and documentation and we cannot assure you that such facilities will be available to the Corporation on these or different terms. See "Risk Factors- The Corporation Expects to Enter Into the ATB Credit Facilities, but Such Facilities May Not Get Finalized or Be Available. In that Event, the Corporation Would Have to Find an Alternative Form of Financing. "

THE BUSINESS

Flowr is a rapidly growing cannabis company with the mission to provide consumers and medical patients unparalleled cannabis experiences through the production, marketing, distribution and sale of premium quality cannabis products.

Who is Flowr?

Flowr’s current operations are located in Canada. Flowr focuses on producing premium cannabis products for medical patients and recreational consumers throughout Canada, utilizing its purpose-built indoor and, upon licensing, outdoor cultivation and processing facilities located in the city of Kelowna in the Okanagan Valley Region of British Columbia, Canada (the "Kelowna Campus"). Flowr is currently focused on producing, marketing and distributing premium dried cannabis flower products (i.e. packaged dried cannabis flower and pre-rolls) and intends to strategically offer new product formats such as cannabis oils, vape technology, edibles, beverages and topical products, as demand patterns evolve and regulations permit the sale of such products. We believe demand for new product formats will consistently grow and that many of these products are best when infused with ingredients derived from greenhouse-grown cannabis. On February 12, 2019, Flowr purchased a parcel of land adjacent to its current operations in Kelowna, which it plans to use for greenhouse cultivation of cannabis for extraction and use in new product form factors upon such form factors being regulated for sale (the "Flowr Forest"). The Flowr Forest is intended to cultivate cannabis for extraction and use in new classes of cannabis upon regulation of the new classes of cannabis for commercial production and sale. Flowr believes that the demand for premium cannabis products in Canada will continue to grow, and we intend to continue to focus on providing customers with access to clean, consistent, terpene-rich products produced at the Kelowna Campus.

Where is Flowr Going?

On December 20, 2018, the Corporation announced it entered into a share purchase and subscription agreement to acquire a 19.8% equity interest in Holigen (the “SPSA”). The SPSA was amended and restated on May 8, 2019 (the “Amended and Restated SPSA”). On June 24, 2019, Flowr announced the entering into of the Holigen Purchase Agreement to acquire the remaining 80.2% of the issued and outstanding equity interests in Holigen that the Corporation does not already own. Holigen is a medical cannabis company with a facility in Australia and planned facilities in Portugal that are expected to provide finished medical cannabis products, pharmaceutical ingredients and plants and seeds to medical cannabis markets globally, where regulations permit. Holigen’s Australian facility is Good Manufacturing Process (“GMP”) licensed for certain activities, with full GMP licensing expected in 2020 upon finalization of construction. Holigen’s facilities in Portugal are expected to obtain GMP certification upon completion of construction in 2020. Holigen is in the final stages of obtaining a cultivation license for its outdoor and greenhouse facilities located on 65 hectares (approximately 7 million square feet) in Portugal and which is expected to have potential production capacity of approximately 500,000 kilograms of dried cannabis flower annually. The acquisition of Holigen will provide Flowr with a global platform to effectively serve growing demand for medical cannabis in European and Australian markets, where medical cannabis is regulated. See Details of the Acquisition.

Upon completion of the acquisition of Holigen and through the combined company platform, Flowr will operate a large scale, vertically integrated, licensed cannabis company with expertise in GMP-certified cultivation and manufacturing and will have a robust distribution platform for global markets.

Flowr’s focus in Europe and Australia will be the medical cannabis market. In Canada, Flowr intends to continue to expand its product offerings in recreational and medical markets with high-quality cannabis produced cost-effectively and at scale.

Industry-Leading Cultivation Expertise

We believe the foundation of our strategy is our team’s extensive indoor cannabis cultivation and production expertise. We believe that growing high quality cannabis economically at scale is challenging. It requires expertise in multiple areas, including plant genetic development, facility design and operations, cultivation operations and post-cultivation processes. This is particularly true in markets with stringent regulatory controls, such as those prescribed by Health Canada in Canada, which sets exacting standards for product cleanliness and quality. Our cultivation and operating team members are highly experienced in cultivating high quality cannabis at scale and have amassed significant experience in the design, construction and operation of numerous cannabis production facilities in Canada, which were built to comply with a variety of stringent regulatory predecessors to the Cannabis Act, including the MMAR, MMPR and the ACMPR. Our team includes experienced engineering and construction experts and a host of cannabis-focused research and development professionals.

We believe that our Canadian operating team’s expertise is highly transferable to other regulated cannabis markets and will provide a competitive advantage for successful entry into new markets. Our operating team’s experience to date has been focused on the design, construction and operation of indoor cannabis cultivation facilities and Flowr believes that this expertise can be transferred to greenhouse and outdoor cultivation facilities at both the Flowr Forest and Holigen’s operations in Portugal. However, there can be no guarantee that we will be able to translate the experience of our operating team with indoor growing facilities into successfully designing, constructing and operating outdoor and greenhouse cultivation facilities. See “Risk Factors - The Corporation May Not Be Able to Successfully Design, Construct or Operate Outdoor or Greenhouse Cultivation Facilities”.

Purpose-Built Facilities with Exacting Control of Cultivation Environments

Producing premium cannabis products requires an exacting level of control over every aspect of the cultivation, harvest, curing and post-harvest manufacturing processes. Upon completion of the Acquisition, Flowr is expected to have a global portfolio of purpose-built cultivation, production, processing and R&D assets, many of them being built or designed to GMP specifications and awaiting GMP licensing. We believe that this will position Flowr to produce high quality cannabis optimally suited for the markets and consumers it intends to serve. The following table describes our current and planned facilities:

| Facility | Location | Type | Expected Operational

Date(1) (2) | Estimated Initial

Capacity(2)(3) | Estimated Maximum

Capacity(2)(3) | Cost to Complete

(millions)(2)(4) |

| K1 Facility(5) | British Columbia, Canada | Indoor | Q3 2019 | 10,000kg | 10,000kg | $7.2 |

K2 Facility(6) | British Columbia, Canada | Indoor | H2 2021/2022 | 785kg(8) | 40,000kg(7) | $140.2 |

Hawthorne R&D Facility(5) | British Columbia, Canada | R&D | H2 2019 | N/A | N/A | $3.8 |

Flowr Forest(9) | British Columbia, Canada | Outdoor / greenhouse | H2 2019 (first phase) | 5,000kg(10) | 10,000kg | $2.4 |

| Aljustrel(11)(12) | Aljustrel, Portugal | Outdoor | H2 2019 | 1,500kg(14) | 500,000kg(13) | $67.0 |

Sintra(11)(12) | Sintra,

Portugal | Indoor + R&D | H2 2019 | 150kg(15) | 1,800kg | $10.5 |

| Sydney -

Phase 1(11)(16) | Sydney, Australia | Indoor | H1 2020 | 500kg(17) | 1,000kg | $10.5 |

Sydney -

Phase 2(11)(16) | Sydney, Australia | Indoor + R&D | To be determined | To be determined | To be determined (18) | To be determined |

(1) The Expected Operational Date reflects the anticipated time to reach the initial phase of commercialization for each facility, which, except for the K1 Facility, will be before construction is fully completed and prior to reaching estimated maximum capacity, as we construct in stages. Other than the K1 Facility (which is expected to be fully complete/built-out and operational upon receipt of an amendment to the Corporation's Health Canada licence for new phases by Q4 2019), Flowr expects that the construction and development of the facilities described in the table above will be completed over the course of the next two to three years. Such construction is expected to be completed in stages, with completed portions of the applicable facility becoming operational while other portions are under construction.

(2) Please see "Risk Factors" and "Forward-Looking Information".

(3) Subject to licensing, zoning and permitting. Estimated Initial Capacity reflects the facility's potential annual production capacity, as at the initial phase of commercialization and in many instances, prior to full completion. Estimated Maximum Capacity reflects the facility's potential production capacity, when fully complete/built-out and operational, based on targeted yields and maximum growing capacity, where applicable. Both Estimated Initial Capacity and Estimated Maximum Capacity include dried cannabis flower and dried cannabis flower equivalents. Except as otherwise described in the notes below, Flowr expects to be able to reach the capacities listed in the table above with (i) its available cash on hand, (ii) the net proceeds of the Offering and (iii) the cash expected to be generated from Flowr's and Holigen's operations, as such cash from operations becomes available. The anticipated timelines to scale each facility to its maximum production capacity (described below) are based on the time required to reach full build-out and operation and are not subject to additional funding (except as described in the notes below).

(4) The Cost to Complete represents the forecasted remaining costs associated with the construction and development of each of the facilities to reach full completion/operation. The total aggregate amount of funding currently forecasted to be required to complete the construction of the facilities in the table above is approximately $241,600,000.

(5) K1 Facility is fully funded. The first floor of the Hawthorne R&D facility is fully funded.

(6) Expected to be funded with the proceeds from the Offering and the ATB Credit Facilities if obtained.

(7) This estimate is based on the assumption that the ATB Credit Facilities will be available to Flowr. In the event that the ATB Credit Facilities are not available, Flowr would likely construct a facility that is approximately half the size of the planned K2 Facility, which would result in half of the expected capacity of the K2 Facility from the capacity disclosed in the table above (such amount being approximately 20,000 kg). See "Use of Proceeds - Business Objectives and Milestones".

(8) Assuming achievement of the estimated initial capacity on the anticipated timeline, the annual production is expected to increase to 29,400 kilograms in the year 2022 and is expected to reach estimated maximum capacity of 40,000 kilograms in 2023.

(9) The remaining costs associated with the construction and development of the Flowr Forest are expected to be funded with the ATB Credit Facilities if obtained.

(10) Assuming achievement of the estimated initial capacity on the anticipated timeline, the annual production is expected to increase to 10,000 kilograms, reaching estimated maximum capacity, in the year 2020.

(11) Subject to the closing of the Acquisition. See "Risk Factors".

(12) Expected to be funded with the proceeds of the Offering and existing or proposed debt facilities available to Holigen.

(13) This estimate is based on the following material factors and assumptions: (i) the Aljustrel site, when fully planted and operational, is expected to have approximately 5,060,000 square feet of grow space; (ii) the anticipated yield in the outer years is expected to reach 100 grams per square foot per year; and (iii) with approximately 5,060,000 square feet of canopy at a targeted yield of 100 grams per square foot per year, the anticipated output of cannabis at the Aljustrel site is expected to be approximately 500,000 kilograms (5,060,000 multiplied by 100 grams/sq.ft./year divided by 1,000).

(14) Assuming achievement of the estimated initial capacity on the anticipated timeline, the annual production is expected to increase to 30,000 kilograms in the year 2020 and can reach the estimated maximum capacity of 500,000 kilograms in 2021, as the Aljustrel site is a low cost outdoor growing operation. Flowr will assess whether it will produce the full estimated maximum capacity in 2021 based on demand for its products.

(15) Assuming achievement of the estimated initial capacity on the anticipated timeline, the annual production is expected to increase to 1,800 kilograms, reaching estimated maximum capacity, in the year 2020.

(16) Expected to be funded with the proceeds of the Offering.

(17) Assuming achievement of the estimated initial capacity on the anticipated timeline, the annual production is expected to increase to 1,000 kilograms, reaching estimated maximum capacity, in the year 2021.

(18) Flowr has the option to construct Sydney - Phase 2 facility based on Phase 1 specifications.

R&D Engine to Drive Leadership, Enhanced by Hawthorne Partnership

Building industry-leading R&D capabilities provides us with a competitive advantage by providing proprietary insights and an intimate understanding of the full genetic potential of the cannabis plant. We believe that these capabilities will allow us to maximize cultivation yields and support the economic production of high quality derivative products and the development of new product formats to bring to market.

We believe that our cultivation and production capabilities are industry leading. The caliber of Flowr’s R&D expertise was validated in January 2018 through Flowr’s strategic R&D alliance with Hawthorne Canada Limited ("Hawthorne"). Hawthorne is a subsidiary of The Scotts Miracle-Gro Company, a NYSE-listed supplier of lawn, garden and hydroponics products.

Hawthorne conducted a review of Canadian federal cannabis licence holders in search of a partner with cultivation expertise and the ability to conduct industry-leading R&D work. Hawthorne’s search was driven by a strategic imperative to engage a federal cannabis licence holder capable of producing industry-leading yields and quality, in order to create successful case studies highlighting the effectiveness of Hawthorne’s cultivation products. Flowr and Hawthorne ultimately entered into a strategic R&D alliance, and Flowr has commenced construction of an R&D facility in collaboration with Hawthorne, as further described below. We believe that the Hawthorne-related work at this R&D facility will support the development and refinement of Hawthorne’s existing products and new products, and provide Flowr with key insights into optimal growing conditions for its products.

Focus On Quality Across Geographies and Product Formats

We cultivate, produce and market premium cannabis products targeting discerning recreational consumers in Canada under the Flowr® brand. Medical patients in Canada are targeted under the FlowrRx® brand. Following the completion of the acquisition of Holigen, Flowr intends to engage in the production and distribution of medical cannabis products in Europe and Australia under the Holigen brand.

While certain industry participants may purchase cannabis products wholesale from third parties for distribution, we believe this practice can negatively impact product quality and consistency as well as experience. As part of our premium brand strategy, we intend to maintain product quality and consistency by only using cannabis cultivated by Flowr or Holigen in Flowr-branded products. We believe that both medical patients and recreational consumers in Canada prefer premium quality cannabis products and are willing to pay a premium for such products. We believe that premium product quality, as defined by a rich sensory experience, a consistent psychoactive effect, and robust terpene profiles, is essential to our target consumers’ purchasing decisions and will continue to command a sustainable price premium in the market.

In developing premium dried cannabis flower products, we strive to deliver against the three pillars of quality that govern our processes, from seed to sale:

1. Consistency

Delivering a consistent experience for every usage occasion is essential for recreational and medical consumers to develop a trusted relationship with our brand. Doing so requires an exacting level of control over every aspect of the cultivation, harvest, curing and extraction processes. Minute variations in the environmental conditions during cultivation and harvest can drive wide variations in the chemical composition of cannabis produced with identical starting genetics. Flowr’s meticulous analysis and control of every variable in the production process provides a high level of consistency in our products and in our customers’ experiences.

2. Full Spectrum

We cultivate, harvest and cure - and, where relevant, process into cannabis concentrates, other cannabis extracts and edible cannabis - with the goal of delivering the broadest possible spectrum expression of the terpene and cannabinoid profile that results from plant’s genotype and growing conditions. Across product formats, we endeavor to produce products that are "true to the plant". The result is cannabis flower with satisfying and redolent aromas and flavors, which also have an essential role in producing a richly textured psychoactive experience. For concentrates such as live resin packaged in cartridges or vape pens, once regulated for sale, Flowr expects to also focus on extraction and manufacturing processes that preserve the full spectrum of the plant’s terpene and cannabinoid profile.

3. Clean

Due to the role played by terpenes in delivering heightened sensory experiences, we believe that preserving the terpene profile of dried cannabis flower products and, where relevant, certain derivative products, is a critical differentiating factor in producing premium products. Terpenes are components of the plant which have been shown to contribute tastes and aromas.

To date, approximately half of the Corporation’s cannabis flower products produced at the K1 Facility, which is 40% operational, have been produced without the use of irradiation. Irradiation is a "kill step" used to eliminate microbial contamination that may develop in the cultivation or curing process. Flowr is focused on reducing and ultimately eliminating the need for irradiation due to its potential negative effect on terpene profiles.

Flowr believes that operating meticulously clean, rigorously-designed indoor facilities that limit the need for irradiation is a critical factor in producing a premium dried cannabis flower product. We do not believe that other federal cannabis licence holders share the same focus to eliminate irradiation and that our achievements in reducing irradiation to date, and our targeted goal of fully eliminating the step, enhances our product quality and is a significant competitive advantage that supports our premium brand strategy.

We believe that by consistently delivering premium dried cannabis flower products, we will develop a relationship of trust with our consumers and establish a premium brand position. This relationship and associated brand equity will then be leveraged, once regulations permit, and applied to premium new form factor derivative products, including vapes, infused beverages, capsules and edibles.

Based on data received from the OCS and Nova Scotia Liquor Corporation, Flowr’s products in these provinces’ recreational markets have achieved retail price points ranging from a 25% premium to prevailing average pricing to as high as a 55% premium with an average premium of 40% between October 17, 2018 to June 16, 2019. We expect to sustain significant premiums over the medium to long term.

Our industry-leading price points are reflected in recent Ontario and Nova Scotia recreational sales data from October 17, 2018 to June 16, 2019, as illustrated below:

Since comparable recreational sales data is not currently available from the other provinces in which Flowr’s products are sold (British Columbia, Manitoba and Saskatchewan), we cannot provide similar retail price point comparisons for these provinces at this time.

Product-First Marketing Strategy Leverages Our Enthusiast Consumers

Flowr has to date executed a "product first" marketing strategy for its recreational consumers in Canada which leverages the quality of Flowr's dried cannabis flower products to build brand awareness organically through budtenders (i.e. product information, education and recommendation specialists present at retail locations), influencers, and word of mouth. To support our marketing strategy, we have hired a marketing specialist that has extensive consumer packaged goods experience with companies such as British American Tobacco and Japan Tobacco International.

Flowr’s focus is on, and its target market is, what we define as the “Cannabis Connoisseur” segment. We believe these consumers are more knowledgeable and consider themselves to be a trusted source of information for friends and family on cannabis. According to the Colorado Department of Revenue, frequent users (who consume cannabis more than 20 days per month) comprise approximately 27% of cannabis consumers but consumed over 80% of the volume of cannabis products sold in 2017 in the state of Colorado, which is considered a mature recreational market.

Our target consumer represents a potential marketing asset as an ambassador for the Flowr brand and for the premiere quality level of our products. Because the Canadian regulatory environment currently restricts the ability to use conventional marketing and promotional tactics, we believe this approach will serve us well for the near to medium term. As the market evolves, we expect the least-frequent consumers to become more knowledgeable and thus more likely to follow the lead of the “Cannabis Connoisseur” in terms of product purchases. We believe that by positioning Flowr® as a trusted premium brand, we will see some increase in market share in the long-term as the knowledge of the less-frequent consumers increases. In parallel and as the market matures further, we expect to devote additional resources to in-store merchandising, event-based education, and consultative selling within retailers, using both dedicated in-house personnel and third party brokerage and service providers. In October 2018, we also entered into a strategic partnership with Ace Hill Beer Company, a craft beer brand in Canada, to create Ace Valley, a new brand of premium cannabis products for the Canadian recreational market. The collaboration gives us information about the recreational consumer’s preferences and has allowed us to capitalize on the Ace Hill team’s expertise in marketing and brand building in a highly regulated market.

World Class Facilities Expected to Drive Industry-Leading Yields and Profit Margins

Flowr believes that the profitability of its cultivation operations is driven by yield per square foot. We believe that our yields per square foot can be increased significantly from our already elevated levels - and ultimately, we believe we can continue to achieve yields per square foot that we believe exceed industry norms.

We believe that Flowr has been able to achieve higher pricing due to the premium nature of its product offerings. Combined with Flowr’s construction, design and cultivation expertise, focus on cost optimization through standardization of production capabilities and, upon consummation of the Acquisition, lower cost international production footprint, Flowr will be positioned to maximize its profitability.

Global Footprint to Capture Worldwide Opportunities

Following the Acquisition, Flowr will have a global footprint which will allow it to leverage its cultivation expertise to supply premium products, brands and intellectual property developed in Canada, across medical and recreational markets worldwide as regulations permit. We intend to tailor our market penetration strategies to each of our markets, production assets and target customer bases.

Upon closing of the Acquisition, we will operate a large scale, vertically integrated, licensed cannabis company with expertise in GMP-certified manufacturing. We will also have a distribution platform for global markets in Europe, Australia and surrounding countries, where sales of cannabis are permitted. Driven by our cultivation expertise, we will focus on targeting the medical cannabis markets across those geographies with high-quality cannabis produced cost-effectively for extraction into active pharmaceutical ingredients (“API”).

Holigen is currently developing production, extraction and manufacturing facilities in Portugal and Australia. Holigen’s Aljustrel project in Portugal has been designated a Project of National Interest (“PIN”) by the Portuguese government. This designation provides Holigen with the ability to quickly move this project through regulatory licensing processes and potential access to funding. In Aljustrel, Portugal, Holigen is expected to build and operate a cannabis cultivation site with a combined potential production, manufacturing and R&D area of more than 7,000,000 square feet and potential annual dried cannabis flower capacity of approximately 500,000 kilograms. The Aljustrel site’s processing and manufacturing facilities will be built to GMP specifications and the cultivation area will be strategically located in proximity to a nearby dam providing reliable access to water and power. It is expected that Holigen will cultivate the majority of its cannabis product at its Aljustrel site, and distribute medical products and APIs to markets in Europe, Australia and surrounding countries, where cannabis sales are permitted, under the Holigen brand. Holigen will have an indoor cultivation and manufacturing facility in Sintra, Portugal. Upon completion of construction, this facility will include smaller indoor growing areas for high quality indoor grown cannabis, and manufacturing and packaging areas to be used for extraction and packaging of cannabis grown in Portugal.

In Australia, Holigen is licensed to cultivate and manufacture medical cannabis products, subject to additional permitting which is in process. It was also granted GMP approval by the Therapeutic Goods Administration for labelling, secondary packaging and release for supply in November 2018. Its full manufacturing facility is expected to be fully constructed in the second half of 2019 and receive GMP approval in 2020. The manufacturing space is located in Sydney and is designed with excess manufacturing capacity to process not only cannabis cultivated in Australia, but also product imported from Holigen’s Portugal operations As part of its distribution strategy, Holigen will partner with Anspec Pty Limited. (“Anspec”) in Australia, a privately-owned specialty pharmaceutical and medical distributor and exporter in Australia and abroad. Upon successful integration with Holigen, we expect that this relationship will provide Flowr with access to export pathways to 37 countries globally. To the extent that the on-site processing and manufacturing facility is not constructed, the Corporation expects to export and sell dried or fresh cannabis in countries where importation and sales of such products are permitted, such as Germany. Peter Comerford, an executive officer of Holigen and a proposed executive officer of Flowr post acquisition of Holigen, is the Chief Executive Officer of Anspec and provides a continuity of this distribution relationship to the combined company. Mr. Comerford receives compensation from Anspec for his services as Chief Executive Officer of Anspec, and is entitled to certain payments on the sale of Anspec to a third party purchaser.

Holigen’s operations represent strategic production assets and geographically optimal gateways to distribute into current and future markets in Europe, Australia and surrounding countries, where sales of cannabis are permitted, particularly given the preference displayed in these markets for locally produced cannabis. Upon closing of the Acquisition, we believe the combined company’s proprietary cannabis cultivation know-how, regulatory familiarity, complex pharmaceutical and GMP construction expertise, and pharmaceutical distribution expertise, will give it the scalability and capability needed to service the global cannabis markets.

In addition to providing access to Australia and Europe, we expect that the assets in these geographies will serve as a platform for further global expansion. As a trusted trade partner of many Asian nations, we believe that Australia is well positioned to be a leading exporter of cannabis products to the Asia-Pacific region, and that the combined company will be able to capitalize on such opportunities to enter new markets in Asia if and when regulatory regimes in this region regulate cannabis products.

FLOWR’S STRENGTHS

Flowr’s strategy is focused on leveraging its following core strengths to exploit its competitive advantage:

Cultivation expertise affirmed through partnership with a hydroponic products industry leader.

Facilities designed to maximize yield and profitability.

Highest quality products and premium brands further drive profitability.

Expertise and infrastructure to capture global opportunities.

Highly seasoned management team with aligned interests.

Cultivation Expertise Affirmed Through Partnership with a Hydroponic Products Industry Leader

Our cultivation team members have extensive experience with the production of high quality indoor cannabis. They have designed, built and operated over 15 cannabis production facilities, in aggregate, across multiple teams and under a variety of stringent regulatory structures, including the MMAR, the MMPR and the ACMPR. We believe the team’s robust cultivation-related proprietary know-how and trade secrets create a long-term strategic advantage relative to competitors - particularly as awareness grows about the high degree of difficulty involved in the consistent production of high quality cannabis.