Offering Circular

FIRST JERSEY CANNABIS CORPORATION

Wyoming Corporation

$2,250,000 Offering Amount for 1,000,000 Shares of Common Stock

$2.25 per Common Stock

This is the initial public offering of securities of First Jersey Cannabis Corporation, a Wyoming corporation. The Company are offering 1,000,000 of our Common Stock, par value $0.01 (“Common Stock”). at the initial public offering price of $2.25 per share (the “Offered Shares”). If we have not received and accepted subscriptions for the Offered Shares at the end of the one hundred fiftieth (150) day following qualification of the offering statement of which this offering circular is a part, subject to the Company’s ability to extend the offering for an additional thirty (30) days (the “Extension Period”), this offering will terminate. If the Company has received and accepted subscriptions for the number of Offered Shares on or before the end of the one hundred fiftieth (150) day following qualification, or the end of the Extension Period, if exercised, then the Company will close on this offering.

For this Closing, proceeds for such closing will be kept in a separate bank account, as agent or trustee for the persons who have the beneficial interests therein, pursuant to Section 15c2-4. If the offering does not close for any reason, the proceeds for the offering will be promptly returned to investors, without deduction and generally without interest. The minimum purchase requirement per investor is 150 Offered Shares ($337.50); however, the Company can waive the minimum purchase requirement on a case-by-case basis in our sole discretion.

| Number of Shares | Price to Public | Underwriting Discounts(1) and Commissions | Proceeds to Issuer(2) |

Per Share | 1,000,000 | $ 2.25 | $ 0.00 | $ 2,250,000 |

(1) We do not intend to use commissioned sales agents or underwriters.

(2) Does not include expenses of the offering, including, but not limited to, legal, accounting, printing, marketing, blue sky compliance, transfer agent, and escrow fees. Such expenses are estimated at $110,000.

FIRST JERSEY CANNABIS CORPORATION

Wyoming Corporation

The date of this Offering Circular is September 28, 2018

1

TABLE OF CONTENTS

Page(s)

3ADVISORY STATEMENT

3OPENING STATEMENT

4CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

4PLAN OF DISTRIBUTION

5SUMMARY

6OUR BUSINESS

8THE OFFERING

8USE OF PROCEEDS

10MILESTONES

11SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

11DESCRIPTION OF SECURITIES

12DILUTION

13SUMMARY TABLE

13DESCRIPTION OF PROPERTY

14EMPLOYEES

15CONSOLIDATED FINANCIAL STATEMENTS AND NOTES AND PROFORMA

19OTHER DISCLOSURES

21DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, AND CONTROL PERSONS

21EXECUTIVE COMPENSATION

22FAMILY RELATIONSHIP

23CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

23SELLING SHAREHOLDERS

23LEGAL PROCEEDINGS

23RETAINING ATTTORNEY(s)

24INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

25MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL2

29HIGH RISK DECLARATION

37INDUSTRY RISKS AND REWARDS

38INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

39BOARD COMPOSITION

39DIRECTOR INDEPENDENCE

39BOARD COMMITTEES

40AUDIT COMMITTEE

40COMPENSATION COMMITTEE

41NOMINATING COMMITTEE

41BOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

41CODE OF BUSINESS CONDUCT AND ETHICS

41COMMISSION’S POSITION ON INDEMNIFICATION FOR SECURITES LIABILITIES

41INDUSTRY REGULATIONS AND OUR CLIENTS

42MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

43REGISTRAR AND TRANSFER AGENT

43ESCROW AGENT

2

ADVISORY STATEMENT

For general information on investing, the Company encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR APPLICABLE STATE SECURITIES LAWS, AND THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION. HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

OPENING STATEMENT - FIRST JERSEY CANNABIS CORPORATION

The Company is offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. The Company has not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

Unless otherwise indicated, data contained in this Offering Circular concerning the business of the Company are based on information from various public sources. Although the Company believes that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

3

In this Offering Circular, unless the context indicates otherwise, references to “First Jersey Cannabis Corporation,” “we,” “Company,” “our” and “us” refer to the activities of and the assets and liabilities of the business and operations of “FJCC”.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Our Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

Our ability to effectively execute our business plan;

Our ability to manage our expansion, growth and operating expenses;

Our ability to retain and grow our customer base;

Our ability to enter into, sustain and renew customer arrangements on favorable terms;

Our ability to evaluate and measure our business, prospects and performance metrics;

Our ability to compete and succeed in a highly competitive and evolving industry;

Our ability to respond and adapt to changes in technology and customer behavior; and

Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand.

Unanticipated but potential changes in government laws, rules and regulations, the replacement of which is being considered by Congress.

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, considering all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as maybe be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

PLAN OF DISTRIBUTION

We are not selling the shares through commissioned sales agents or underwriters. We will use our existing website https://www.fjcannabis.com. Persons who desire information will be

4

directed to https://www.fjcannabis.com/offering. This Offering Circular will be furnished to prospective investors via download 24 hours per day, 7 days per week on the

https://www.fjcannabis.com/offering website.

The website will not be the exclusive means by which prospective investors may subscribe in this offering. Upon qualification by the Securities & Exchange Commission, potential investors will be able to go on the website and a button will appear that simply states “Invest” in First Jersey Cannabis Corporation. Once the “Invest” button is clicked, potential investors will again be given a comprehensive overview of the process and procedures, which will require an e-signature. Potential investors will then begin a user-friendly process of establishing their personal and financial identity, selecting the number of shares to be purchased and how payment will be made, and executing subscription agreements. Once complete all purchasers will be emailed a confirmation.

If the minimum contingency for this offering is not satisfied or the offering is otherwise terminated, investor funds will be promptly refunded in accordance with Securities Exchange Act Rule 10b-9. In order to subscribe to purchase the shares, a prospective investor must complete a subscription agreement and send payment by wire transfer, check, or PayPal. Investors must answer certain questions to determine compliance with the investment limitation set forth in Regulation A Rule 251(d)(2)(i)(C) under the Securities Act of 1933, which states that in offerings such as this one, where the securities will not be listed on a registered national securities exchange upon qualification, the aggregate purchase price to be paid by the investor for the securities cannot exceed 10% of the greater of the investor’s annual income or net worth. In the case of an investor who is not a natural person, revenues or net assets for the investor’s most recently completed fiscal year are used instead.

The investment limitation does not apply to accredited investors, as that term is defined in Regulation D Rule 501 under the Securities Act of 1933. An individual is an accredited investor if he/she meets one of the following criteria: An entity other than a natural person is an accredited investor if it falls within any one of the following categories: The Company plans to engage its own facilities to confirm investor accreditation. It is estimated such cost are within the budget of $50,000 allocated for the cost of our Regulation A offering. The Company will engage Equity Stock Transfer as escrow agent for the offering.

First Jersey Cannabis Corporation, reserves the right to develop programming to be used for the actual investment process. They may also have direct telephone, email exchanges or other contacts with persons interested in purchasing the Offered Shares.

SUMMARY

This summary highlights selected information contained elsewhere in this Offering Circular.

This summary is not complete and does not contain all the information that you should consider

before deciding whether to invest in our Common Stock. You should carefully read the entire

Offering Circular, including the risks associated with an investment in the company discussed in

the “Risk Factors” section of this Offering Circular, before making an investment decision.

5

Some of the statements in this Offering Circular are forward-looking statements. See the section

entitled “Cautionary Statement Regarding Forward-Looking Statements.”

OUR BUSINESS

The Company is engaged as a transitional enterprise by agreeing to purchase certain assets of Mr. James Guercioni, consisting of 9,200 square feet of greenhouses, approximately 4,000 square feet of offices, warehouse and processing, and four acres of land available for marijuana cultivation. The cost of such assets is $920,000 and be funded from the proceeds of this Stock Offering. The objective is to redirect and modify these assets and evolve the Company into a cannabis-based entity.

During this phase of our development strategy, which is projected to last 18 months, the Company intends to (1) apply for a license with the Department of Health in New Jersey to become an Alternative Treatment Center (ATC), (2) apply for a license with the state of New Jersey to become an adult recreational cannabis grower and distributor, (3) launch the Cannabis Fusion Club™ to offer local marijuana enthusiast a venue to recognize the benefits of mutual association, and (4) establish a new business to cultivate, buy and sell non-cannabis plants and flowers under the trade name – captivatingflowers.com™.

The Company’s headquarters are at 1030 West White Horse Pike, Egg Harbor City, New Jersey, from which it can reach the Northeast cannabis markets of Pennsylvania, Maine, Massachusetts, and other states, including Canada in which some form of marijuana usage is allowed; and use the same geographical territory to grow and market non-cannabis plants and flowers. An exploratory location was established at 175 Robert Street, Suite 1024, Vancouver BC V6G 387, Canada, to investigate business alliances with cannabis producers and marketers. Canada is scheduled to launch its adult-use marijuana market on October 17, 2018.

At present, the Department of Health (the “Department”) is not accepting applications to open additional ATCs. An ATC facility is a medicinal marijuana dispensary. If additional ATC facilities are permitted, the Department will announce and publish the criteria and process to submit applications according to the procedure outlined in its regulations. The Department cannot consider applications until a notice of request for applications is published. Long-term, the Company proposes to apply for a recreational marijuana license, when and if such application is made available by the state of New Jersey. At present no permits have been issued in the state of New Jersey to grow, and distribute recreational marijuana.

As part of our development strategy, the Company evaluated the impact of Section 280E of the Internal Revenue Service Code on our near and long-term efforts, and to best design programs and services in compliance to the current and evolving rules and regulation concerning the cannabis industry. Until 280E is appealed or modified, our transition to a traditional business will prevent us from being a direct marijuana grower, cannabis product manufacturer or distributor on a national basis. The Company is in full compliance with Section 280E. SeeRisk Factors and Statement concerning Section 280E of the Internal Revenue Service Code.

6

If the Company is unable to obtain the license for a medicinal marijuana dispensary, it intends to conduct derivative and reality research and development without actually growing marijuana plants in New Jersey, while operating the assets acquired ascativatingflowers.com. The Company plans to maintain the blueprint aa a non-cannabis plant and flower grower, wholesale and retail establishment. Moreover, the Company intends to design proprietary E-commerce applications, including Internet sites and support services, and to offer such activities to cannabis producers, product manufacturers, product distributors and marketers within the state of New Jersey, and other locations outside the state where marijuana is legally sanctioned.

As indicated herein, The Company does not plan to focus its primary attention cultivating, developing and marketing non-cannabis plants and flowers. However, if circumstances beyond our control and influence, whether politically, statutorily or otherwise, or the cannabis industry fails to materialize as a viable commercial investment, the Company will use its best efforts to be successful in the floral trade. Floriculture represents a $40 billion a year industry in the U.S. Based on the Florist – U. S Market Report published in June 2018,https://www.ibisworld.com/industry-trends/market-research-reports/retail-trade/miscellaneous-store-retailers/florists.html, 32,425 businesses employ 77,951 individuals. There is no assurance that the Company will be successful in the floral trade.

7

THE OFFERING

Issuer:First Jersey Cannabis Corporation

Securities offered:1,000,000 shares of our common stock, par value $0.01

(“Common Stock”) At an offering price of $2.25 per share

(the “Offering Shares”).

Number of shares of Common2,020,000

Stocks to be outstanding before

the offering:

Number of shares of Common3,020,000

Stocks to be outstanding after

the offering:

Price per share:$2.25

Offering amount at $2.25:$2,250,000

Proposed Listing:We plan to apply to list our Common Stock on the NASDAQ

Capital Market, and we expect trading to commence

following theQualification of this offering, assuming we

have sold the Offered Shares and our filing on Form 8-A in

order to register our shares under Section 12(b) under the

Exchange Act has become effective. We anticipate that this

filing will not be made until we have in hand the required

certification from NASDAQ before we file.

USE OF PROCEEDS:

| SHARES SOLD AT $2.25 PER SHARE |

NUMBER OF SHARES SOLD | | | 1,000,000 | | |

VALUE OF SHAES SOLD | | | | | $ 2,250,000 |

| | | | | |

(1) | | | | | $ 110,000 |

(2)(5) | | | | | $ 1,093,000 |

(3) | | | | | $ 125,000 |

(4)(6)(7)(8) | | | | | $ 137,000 |

(9) | | | | | $ 130,000 |

(10) | | | | | $ 655,000 |

GROSS PROCEEEDS | | | | | $ 2,250,000 |

8

Notes to the Use of Proceed:

(1)Upon closing of the common stock offering, 5% of the net proceeds of

$110,000 are allocated for costs and related expenses of the Offering.

(2)Upon closing of the common stock offering, 41% of the net proceeds

representing $920,000 are allocated to purchase assts from Mr. Guercioni

.(3)Upon closing the common stock offering, 6% of the net proceeds

of $125,000 allocated to the state of New Jersey licensing costs and

business structure to conform with issuance of a medical cannabis

license.

(4)Upon closing the common stock offering, 3% of the net proceeds of

$70,000 allocated for training and engagement of an administrator to

operate cativatingflowers.comfor 12 months.

(5)Upon closing the common stock offering, 8% of the net proceeds of

$173,000 for acquisition enhancement relating to approval of a cannabis

medical license.

(6)Upon closing the common stock offering, 2% of the net proceeds of

$45,000 for staff training and expansion.

(7)Upon closing the common stock offering, .007% of the net proceeds of

$15,000 for enhancement to platform and support of ecommerce app and

support.

(8)Upon closing the common stock offering, .003% of the net proceeds of

$7,000 for enhancement to platform ecommerce app and

support.

(9)Upon closing the common stock offering, 6% of the net proceeds of

$130,000 as general and administrative expenses.

(10)Upon closing the common stock offering, 29% of the net proceeds of

$655,000 represents working capital. As part of the available working capital,

the Company plans to allocate $15,000 to establish Cannabis Fusion Club ™.

and $3,500 will be allocated to investigate business alliances with Canadian

cannabis producers and marketers.

The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors.

The following table sets forth a breakdown of our estimated use of our net proceeds as “MILESTONES” we currently expect to use them.

Price per Share | Offering Proceeds | Approximate Offering Cost | Total Net Proceeds |

$ 2.25 | $ 2,250,000 | $ 110,000 | $ 2,140,000 |

9

MILESTONES:

Set forth below is our plan of operation for the twelve-month period following the closing of this offering assuming net proceeds of the Offering are received.

Milestones: | Closing at $2.25 share with gross proceeds of$2,250,000 |

(1) purchase JFI/ enhancements (2) transition cannabis-based activities (3) build staff (4) license application/other costs | Continued development as a primary research facility. Create prototype model of manufacturing unit, while establishing business plan | Q1 Offering Cost Q1/2/3 Property Acquisition/ Enhancements | $1,080,000 | $1,370,000 |

Q1/Q2: Engage Administrator | 70,000 |

Q2:IT Platforms & Support | 15,000 |

Q2: E Commerce App.& Support | 70,000 |

Q2/Q3Business Development | 90,000 |

Q2/Q3: Staff Expansion: | 45,000 |

Subtotal |

(5) IT infrastructure and proprietary software platform, produce research & development, E-commerce applications and support. | Development of integrated systems for distribution. License for intrastate product and marketing. | Q3/Q4: Establish Research Facility | $ 40,000 | $ 190,000 |

Q3: Licensing | 115,000 |

Q3: Addition of substantial IT processing components to the platform. | 20,000 |

Q4: marketing/trademarks | 15,000 |

Subtotal |

Additional expansion of intrastate model / Business development | Q4: Allocate reserves for additional asset management | $ 20,000 | $ 20,000 |

Subtotal |

Staff Enhancement | Q4 Staff | $ 15,000 | $ 15,000 |

Subtotal |

Working Capital - adjust for 12-month fiscal cycle period. | | $655,000 | $655,000 |

| |

TOTAL PROCEEDS | $2,140,000 |

During the time period before this Offering closes, and thereafter, if the offering does not close for any reason, the entire business plan will be abandoned.

10

None of the proceeds from the offering will be used to compensate or otherwise make payments to our officers/directors, provided, however, our officers/directors will be paid in the ordinary course of business, in accordance with our agreements, consistent with industry standards, and consistent with such constraints as the Compensation Committee may impose.

The expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve and change. The amounts and timing of our actual expenditures, specifically with respect to working capital, may vary significantly depending on numerous factors. The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering.

We may seek additional forms of financing to enable us to accomplish the business objectives associated with this offering. If we secure additional equity funding, investors in this offering would be diluted. No plans for additional financing are currently being contemplated by the Company, and in all events, there can be no assurance that additional financing would be available to us when wanted or needed and, if available, on terms acceptable to us.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to us regarding beneficial ownership of our capital stock as of August 31, 2018, for (i) all executive officers and directors as a group and (ii) each person, or group of affiliated persons, known by us to be the beneficial owner of more than ten percent (10%) of our capital stock. The percentage of beneficial ownership in the table below is based on 2,020,000 shares of common stock deemed to be outstanding as of August 31, 2018.

Christopher Netelkos 99%2,000,000 common stock.

DESCRIPTION OF SECURITIES

Securities Being Offered

The following is a summary of the rights of our capital stock as provided in our articles of incorporation and bylaws. For more detailed information, please see our articles of incorporation and bylaws, which have been filed as exhibits to the offering statement of which this offering circular is a part.

11

Authorized Capital

One classes of common shares:

The Company has authorized capital stock consists of 10,000,000 shares of common stock, par value $0.01 par value share of which 2,020,000 shares of common stock are issued and outstanding as of August 31, 2018.

Under Wyoming law and generally under state corporation laws, the holders of our common will have limited liability pursuant to which their liability is limited to the amount of their investment in us.

Common Stock

Voting Rights. The holders of the common stock are entitled to one vote for each share held of record on all matters submitted to a vote as shareholders.

Wyoming law provides for cumulative voting for the election of directors. As a result, any shareholder may cumulate his or her votes by casting them all for any one director nominee or by distributing them among two or more nominees. This may make it easier for minority shareholders to elect a director.

Dividends. Holders of all common stock are entitled to receive ratably such dividends as may be declared by the board of directors out of funds legally available therefor as well as any distributions to the shareholders. The payment of dividends on both classes of common stock will be a business decision to be made by our board of directors from time to time based upon results of our operations and our financial condition and any other factors that our board of directors considers relevant. Payment of dividends on the common stock may be restricted by loan agreements, indentures and other transactions entered into by us from time to time.

Liquidation Rights. In the event of our liquidation, dissolution or winding up, holders of common stock are entitled to share ratably in all of our assets remaining after payment of liabilities and the liquidation preference of any then outstanding preferred stock.

Absence of Other Rights or Assessments. Holders of common stock have no preferential, preemptive, conversion or exchange rights. There is no redemption or sinking fund provisions applicable to the common stock. When issued in accordance with our articles of incorporation and law, shares of our common stock are fully paid and not liable to further calls or assessment by us.

DILUTION

Our historical net tangible book value as of August 31, 2018, was $100,000 or $0.05 per share of common stock on 2,020,000 shares outstanding. Historical net tangible book value per share represents our total tangible assets fewer total liabilities divided by the number of shares of our common stock outstanding. Proforma as adjusted net tangible book value per share gives further

12

effect to the issuance of 1,000,000 shares of common stock at an assumed initial public offering price of $2.25 per share and after deducting an estimated $110,000 of offering expenses. The Company’s proforma, as adjusted net tangible book value of $2,422,980 on 3,020,000 shares or $0.80 per share. This represents an immediate increase in proforma net tangible book value of $0.75 per share to existing stockholders and an immediate dilution in proforma net tangible book value of $1.45 per share to investors purchasing common stock in this offering. The following table shows the resulting dilution, assuming an initial public offering price of $2.25 per share.

Historical net tangible book value as of August 31, 2018 $ 100,000 $ 0.05

Price to the public charged for each share in this offering $ 2,250,000 $ 2.25

Expenses relating to Offering:$ 110,000 $ 0.06

Net tangible value as of August 31, 2018$ 2,422,980 $ 0.80

Increase in net tangible book value per share attributable$ 2,322,980 $ 0.77

to new investors in this offering

Proforma, as adjusted net tangible book value per share, $ 2,422,980 $ 0.80

after this offering

Dilution per share to new investors $1.45

SUMMARY TABLE – Average Price Per Share

The following table summarizes on an as adjusted basis as of August 31, 2018, the difference between the number of shares of common stock purchased from us, the total consideration paid and the average price per share paid by existing stockholders and by new investors, assuming an initial public offering price of $2.25 per share and after deducting estimated underwriting discounts and commissions and excluding estimated offering expenses separately payable by us:

| SHARES PURCHASED | TOTAL CONSIDERATION | AVERAGE PRICE PER SHARE |

| NUMBER | PERCENTAGE | AMOUNT | PERCENTAGE |

Assuming sold: | | | | | |

Existing stockholders | 2,020,000 | 66% | $ 100,000 | 00.04% | $ 0.05 |

New Investors | 1,000,000 | 34% | $ 2,250,000 | 99.06% | 2.25 |

TOTAL | 3,020,000 | 100% | $ 2,350,000 | 100% | $ 1.15 |

DESCRIPTION OF PROPERTY

The Company maintains office space at 1030 White Horse Pike, Egg Harbor, New Jersey 08215. Our landlord James Guercioni has waived rental costs or other charges since the property will be an asset purchased by the Company at time of the closing of the Stock Offering. The space available to the Company is 3,000 square feet, notwithstanding the use of greenhouses and

13

warehousing spaces. We consider that this spaces and arrangements are sufficient for our current needs, although we plan to expand existing operations or open other offices in other cities.

EMPLOYEES

We currently have the following employees in our business office:

Operational Staff:

Clerical/administrative -

Executive Officer Management - 2

Non-Executive Officer Operational Management - 2

Sales - 0

All executive officer duties are currently performed by Christopher Netelkos.

14

CONSOLIDATED FINANCIAL STATEMENTS AND NOTES AND PROFORMA

FIRST JERSEY CANNABIS CORPORATION(7)

Consolidated Balance Sheet (1)

August 31, 2018

(Unaudited)

Actual $ *Proforma $

Assets

Current Assets

Cash and Cash Equivalent(2) 51.500.00 1,454,480.00

Accounts Receivable

Prepaid Expense 1,050.00 1,050.00

Total Current Assets 52,550.00 1,455,530.00

Property and Equipment(3) 9,300.00 928,300.00

Intangible Assets(4) 85,000.00 85,000.00

Other Assets 3,500.00 3,500.00

97,800.00 1,016,800.00

Total Assets 150,350.00 2,472,330.00

Liabilities and Stockholders’ Equity

Current Liabilities

Accounts Payable 240.00 240.00

Accrued and Other Current Liabilities 110.00 110.00

Total Current Liabilities 350.00 350.00

Other Long-Term Liability (5) 50,000.00 50,000.00

Total Liabilities 50,350.00 50,350.00

Stockholders’ Equity

Common Stock(6)

par value $0.01-

10,000,000 authorized,

3,020,000 issued and

outstanding. 2,020.00 3.020.00

Additional Paid-In Capital 97,980.00 2,419,960.00

100,000.00 2,422,980.00

Total Stockholders’ Equity 150,350.00 2,473,330.00

*Proforma represents gross proceeds of $2,250,000 for the Offered Shares.

See notes to Financial Statements

15

Statement of Comprehensive Income, Cash Flow, and Changes in Stockholders’ Equity

No material Statement of Comprehensive Income, Cash Flow, and Changes in Stockholders’ Equity is necessary under the circumstances as stated herein:

First Jersey Cannabis Corporation was incorporated on August 31, 2018 as a new business enterprise without prior sales or income. Upon incorporation the Company has (1) issued founder’s common stock, (2) purchase assets for common stock, (3) executed assets purchase agreement option, (3) executed employment and management agreements, all to deferred, until the Offered Shares are sold, (4) structure the company to perform as planned by the Board of Directors, and (4) position the Company to effectively file a registration statement with the SEC, including all the underlying chargers for such an endeavor. In the opinion of the Board of Directors, all such efforts did not materially disturb cash flow, did not generate a profit or loss, or effected Stockholders’ Equity.

Notes to Financial Statements

The financial statements are prepared in accordance with generally accepted accounting principles in the United States (US GAAP). Upon a successful Offering, the Company will engage an independent certified public accountant.

Since First Jersey Cannabis Corporation has been incorporated on August 31, 2018, and the Proforma Statement represented the acquisition of assets and the public sale as declared under the Offering, the newness of the Company and subsequent transaction did not present sufficient accounting periods to present a Condensed Statement of Operations, Statement of Comprehensive Income, Cash Flows and Changes in Stockholders’ Equity, Interim Financial Statements, Financial Statements of Other Entitles and no other financial reporting documents other tan what has been stated in this Offering.

Note 1: Balance Sheet: Financial Statement includes the Company’s wholly owned subsidiary, First Jersey Capital Corporation.

Note 2: Cash and Cash Equivalent:Represents on hand and available, including proceeds (proforma) from the Offering.See Note 5.

Note 3: Property and Equipment: Except for $9,300 represents the assets purchased from Mr. Gurcioni, which includes 9,200 sq. ft of greenhouses, 3,000 sq. ft of storage, real property of four acres and 3-story house, and related business assets.

Note 4: Intangible Assets. Calculated as(a) Intellectual properties -Non-exclusive transfer by Christopher Netelkos, related software, designs and intellectual properties. The stated value was arbitrarily determined at $15,000. (b)Proprietary technology-Non-Exclusive transfer by Christopher Netelkos of proprietary technology known as “Method to Cut, Set and Configure Dried Marijuana” for the manufacturing of marijuana cigarettes. The stated value was arbitrarily determined at $10,000. This proprietary technology carries with it a nondisclosure stipulation to

16

any third-party without exception. (c)Exclusive transfer by Christopher Netelkos to First Jersey Cannabis Corporation of tradenames and package designs. The stated value was arbitrarily determined at $60,000: [cigarette brand names] RX ™, REEFER 101™, NONSTOP™, RED DOT™, ELIMINATOR™ ,FLASHLIGHT GOLD™, HAPPY ™, SPARROW LITE , KANGAROO SILVER™, WESTBROOK CLASSIC™, GREEN LEAF™, KAMARA ™, KING CALIFORNIA STRONG ™, DR. GOOD ™, MISS JONES ™, NORTHERN CLASSIC ™, 609-99 ROYAL FLUSH ™, FIVE DIAMONDS ™, DEUCES WILD ™, BLACK SMOKE 109 ™, ROWBOAT ™, AIRSTRIKE ™ , LUCKY 13™, SEVEN DIALS™, 9-DOWN™, NORTHGATE™, NEEKO™,EDENWILLOW™, NICKSTER™, TOPHER™, LONG BOAT™, TURTLE ™, BLUE™, THREE KINGS™. ROSE BUD™; [cigar brand names],GANGSTER JACK ™ , PIRATE STICK ™, NIGHTWALKER ™, PENGUIN ™ , BLACKLEG™, BLUEBOY™, GREYBEARD™, PENDRAGON™, VIKING HARD™, COWBOY RIGHT™, ENDZONE™ [cannabis chewing gum] RX SELECT™, SARLAT-LA-CANEDA ™, ZHONGDA ™, TIBET ™, TIANJIN ™, MAR del PLATA ™, SAO PAULO ™, HUMBOLDT ™, PORT HENRY ™, EL CAMPO ™, BOSTON EASY ™, NEW ORLEANS STATION ™, TALLADEGA SLEEK ™, NEW YORK SILK ™, BLISS BLUE™.

Note 5: Long Term Debt: Note carried as open advance with no interest and available as required by the Company.

Note 6: Common Stock: Common Stock, par value $0.01- 10,000,000 authorized with 2,020,000 issued and outstanding as of August 31, 2018, and as presented the in forma 3,020,000 issued and outstanding.

Note 7: Summary of significant accounting policies

Basis of Presentation

The accompanying unaudited financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and the rules of the Securities and Exchange Commission (“SEC”) applicable to interim reports of companies filing as a smaller reporting company. In the opinion of management, the accompanying interim financial statements include all adjustments necessary in order to make the financial statements not misleading. The accompanying balance sheet at August 31, 2018, has been derived from the Company’s minutes and transactions to date.

Principles of Consolidation

At present the Company does not have subsidiaries and when it does will have been consolidated in the accompanying consolidated financial statements. All intercompany balances have been eliminated.

17

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

The Company has not revenue and when it does the following procedures will be followed

Prepaid expenses and other current assets

Prepaid expenses and other current assets as of August 31, 2018 include development costs that the Company had paid in excess of work estimated to have been performed.

Earnings (Loss) Per Share

The Company plans to utilizes Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 260, “Earnings per Share.” Basic earnings (loss) per share is computed by dividing earnings (loss) attributable to common stockholders by the weighted-average number of common shares outstanding during the reporting period. Diluted earnings (loss) per share is computed similar to basic earnings (loss) per share except that the denominator is increased to include additional common share equivalents available upon exercise of stock options and warrants using the treasury stock method. Dilutive common share equivalents include the dilutive effect of in-the-money share equivalents, which are calculated based on the average share price for each period using the treasury stock method, excluding any common share equivalents if their effect would be anti-dilutive.

Liquidity and Capital Resources

The Company was formed on August 31, 2018, and accordingly, has not incurred losses from operations, negative cash flows from operations and has limited working capital. Since inception, the Company’s principal source of financing has come through the sale of its common stock for cash and assets. The Company will have sufficient cash to fund operations through at least the next twelve months. Even if the Company is unable to raise additional funds, management believes existing business plan will support its current operating platform. The Company believes that additional funds will allow the Company to quickly scale its operations and fulfill its expectations.

During the time period before this Offering closes, and thereafter, if the offering does not close for any reason, including failure to receive the Offering Proceeds, we will finance the above activities from internal cash flow and private offerings. Therefore, we cannot currently predict when each of the above activities will occur if the offering does not close, but the actions, timing and cost will in general follow the Offering Proceeds table above.

18

Liquidity and Capital Resources

The Company has not incurred losses from operations, negative cash flows from operations and has limited working capital.

Since inception, the Company’s principal source of financing and business development has come through the sale of its common stock. The Company believes that its operating results as well as cash received from subsequent financing activities that the Company will have sufficient cash to fund operations through at least the next twelve months.

OTHER DISCLOSURES

Business Plan Targets

If we are unable to generate significant revenue or secure additional financing, we may be unable to implement our business plan, grow our business and meet our target objectives in our business plan. Accordingly, no investor should rely on any assumption that the Company will meet its business plan targets in making an investment decision concerning the Shares in this Offering.

Credit Facilities

We do not have any credit facilities or other access to bank credit.

Capital Expenditures

We do not have any contractual obligations for ongoing capital expenditures at this time. We do, however, may purchase equipment and software necessary to conduct our operations on an as needed basis.

Contractual Obligations, Commitments and Contingencies

We do not have any ongoing material contracts that extend beyond a one-year period or which are not cancellable sooner.

Off-Balance Sheet Arrangements

We did not have during the periods presented, and we do not currently have, any off-balance sheet arrangements.

19

Quantitative and Qualitative Disclosures about Market Risk

In the ordinary course of our business, we are not exposed to market risk of the sort that may arise from changes in interest rates or foreign currency exchange rates, or that may otherwise arise from transactions in derivatives.

The preparation of financial statements in conformity with GAAP requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s significant estimates and assumptions include the fair value of the Company’s common stock, stock-based compensation, the recoverability and useful lives of long-lived assets, and the valuation allowance relating to the Company’s deferred tax assets.

Contingencies

We do not have any contingencies or any conditions that may exist as of the date the financial statements.

Relaxed Ongoing Reporting Requirements

Upon the completion of this offering, we expect to elect to become a public reporting company under the Exchange Act. If we elect to do so, we will be required to publicly report on an ongoing basis as an “emerging growth company” (as defined in the Jumpstart Our Business Startups Act of 2012, which we refer to as the JOBS Act) under the reporting rules set forth under the Exchange Act. For so long as we remain an “emerging growth company”, we may take advantage of certain exemptions from various reporting requirements that are applicable to other Exchange Act reporting companies that are not “emerging growth companies”, including but not limited to: (1) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; (2) taking advantage of extensions of time to comply with certain new or revised financial accounting standards; (3) taking advantage of extensions of time to comply with certain new or revised financial accounting standards; (4) being permitted to comply with reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and (5) being exempt from the requirement to hold a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We expect to take advantage of these reporting exemptions until we are no longer an emerging growth company. We would remain an “emerging growth company” for up to five years, although if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time, we would cease to be an “emerging growth company” as of the following December 31.

If we elect not to become a public reporting company under the Exchange Act, we will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A

20

for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year.

In either case, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies”, and our stockholders could receive less information than they might expect to receive from more mature public companies.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, AND CONTROL PERSONS

The board of directors elects our executive officer annually. A majority vote of the directors who are in office is required to fill vacancies. Each director shall be elected for the term of one year, and until his successor is elected and qualified, or until his earlier resignation or removal.

The table below sets forth our directors and executive officers of as of the date of this Annual Report.

NamePositionAge Term of Office

Christopher NetelkosDirector, President, Chief Executive51 Inception to Present

COO, and Secretary.

Eden Willow NetelkosDirector, Vice President23 Inception to Present

James GuercioniOperation Project Manager76 Inception to Present

Deborah K. WilliamsTechnical Applications Manager55 Inception to Present

EXECUTIVE COMPENSATION

Christopher Netelkos:

The Company entered into an employment agreement with Christopher Netelkos to serve as its Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, President and Secretary. Mr. Netelkos currently provides all of the labor necessary to support our operation. Under the terms of the agreement, Mr. Netelkos does not currently receive a salary, and has decided to forego salary until the Company successfully completes the offering. Upon the completion of the Offering, Mr. Netelkos shall receive a salary of $90,000 per annum. Mr. Netelkos is a Director and Office of the Company.

21

Christopher Netelkos has over 30 years of experience in the construction industry. Complete understanding of accounting and business management skills; able to read and understand detailed financial statements, blueprints and engineering plans; Capable of administering complete contraction projects the complete from estimating, contract negotiations, along with the permitting and inspections process; Topline understanding of the construction industry, along with national building codes and OSHA requirement skills. Able to manage large scale building projects while effectively completing them on time and within budget.

Eden Willow Netelkos

The Company entered into an employment agreement with Ms. Netelkos to serve as Vice President and Director Ms. Netelkos is currently providing all of the labor necessary to support our operation. Under the terms of the agreement, Ms. Netelkos does not receive a salary, and has decided to forego salary until the Company successfully completes the offering. Upon the completion of the Offering, Ms. Netelkos shall receive a salary of $25,000 per annum until such time that the Company obtained a commercial cannabis license in the state of New Jersey. At such time Ms. Netelkos salary shall increase to $115,000 per annum and entitled to a two-year stock option for 100,000 shares calculated at the weighted average of the price of the common stock over the prior 12 months. Ms. Netelkos is a Director and Officer of the Company.

Eden Willow Netelkos has over two years’ experience as a Telemetry nurse with BLS, ACLS and NIH certified. Currently employed with HealthTrust Staffing. She performs special staff needs in PCU, MERD/SURG, Telemetry trauma.

James Guercioni:

The Company entered into an employment agreement with Mr. Guercino at $52,000 for one year, payable in weekly installments and a two-year, a 4,000-share stock option with an exercise price of $2.25 The agreement is effective on the date of the Stock Offerings closing. Mr. Guercioni has thirty years’ experience in all phases related to the floral industry. Mr. Guercino is not a Director or Officer of the Company.

Deborah K. Williams:

The Company entered into an employment agreement with Ms. Williams at $30,000 for one year, payable in weekly installments. As part of the employment agreement, she received 10,000 share, $0.01 par value common stock. The employment portion of the agreement is effective on the date of the Stock Offerings closing. Ms. Williams has extensive experience in technical applications and related disciplines. Ms. Williams is not a Director or Officer of the Company.

FAMILY RELATIONSHIP

There is a family relationship between any of our officers and directors.

22

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Christopher Netelkos: Upon formation, the Company exchanged 2,000,000 common stock, $0.01 par value for intangible assets and cash of $100,000, and executed the following transactions with Mr. Netelkos: (1) Non- Exclusive transfer website, related software, designs and intellectual properties. The stated value was arbitrarily determined at $15,000. (2) Exclusive transfer of tradenames and package designs. The stated value was arbitrarily determined at $60,000: (3) Non-Exclusive transfer of proprietary technology known as “Method to Cut, Set and Configure Dried Marijuana” for the manufacturing of marijuana cigarettes. The stated value was arbitrarily determined at $10,000.

Eden Netelkos: Upon formation, the Company issued 10,000 common stock, $0.01 par value for no consider beyond par value. As part of her Employment Agreement, Company granted a two-year stock option to purchase 100,000 shares common stock for a price calculated at the weighted average of the price of common stock over a prior 12 month upon the effective data of a license being granted by the state of New Jersey to the Company to handle cannabis in any legal capacity.

Deborah K. Williams: Upon formation, the Company issued 10,000 common stock, $0.01 par value for no consideration beyond par value as part of her Employment Agreement.

James Guercioni: Upon formation, the Company issued a two-year common stock option to purchase 4,000 shares at $2.25 per share as part of his Employment Agreement.

SELLING SHAREHOLDERS

Not applicable

LEGAL PROCEEDINGS

There is currently no pending or threatened lawsuits against us that are not covered by applicable insurance or that would, if decided against us, have a material, negative impact on us.

RETAINING ATTORNEY(s)

Upon the closing of the Stock Offering, the Company shall appointa securities lawyer that specializes in the complex and changing laws and regulations that apply to a public company. Additionally, the Company plans to engage general counsel for corporate matters, and special counsel to handle cannabis licensing and related matters.

23

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

None of the following events have occurred during the past five years and which are material to an evaluation of the ability or integrity of any director or executive officer: (1) A petition under the federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing; or (2) Such person was convicted in a criminal proceeding (excluding traffic violations and other minor offenses)

24

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of our operations together with our consolidated financial statements and the notes thereto appearing elsewhere in this Offering Circular. This discussion contains forward-looking statements reflecting our current expectations, whose actual outcomes involve risks and uncertainties. Actual results and the timing of events may differ materially from those stated in or implied by these forward-looking statements due to a number of factors, including those discussed in the sections entitled “Risk Factors”, “Cautionary Statement regarding Forward-Looking Statements” and elsewhere in this Offering Circular. Please see the notes to our Financial Statements for information about our Critical Accounting Policies and Recently Issued Accounting Pronouncements.

MANAGEMENT’S ASSESSMENT:

The recreational and medical marijuana "revolution" is well underway, and we believe that First Jersey Cannabis Corporation is the best structured vehicle to take full advantage of the near-term uncertainties in the Cannabis industry, while creating a business platform for sustained growth in the future.

Cannabis growers will transform an exotic commodity and reduce marijuana to an everyday staple, as what happened to tobacco. 1604 England sold tobacco for today’s equivalent of $2,500 an ounce, now it’s worth $1.25 per ounce. Marijuana’s trajectory will follow the same path, but at an accelerated pace. Grows will be catchup in a zero-sum game with substantial risks. We believe the sectors of long term sustained growth are in product manufacturing, warehousing, distribution and brand marketing. These four areas are the “heart” of our program.

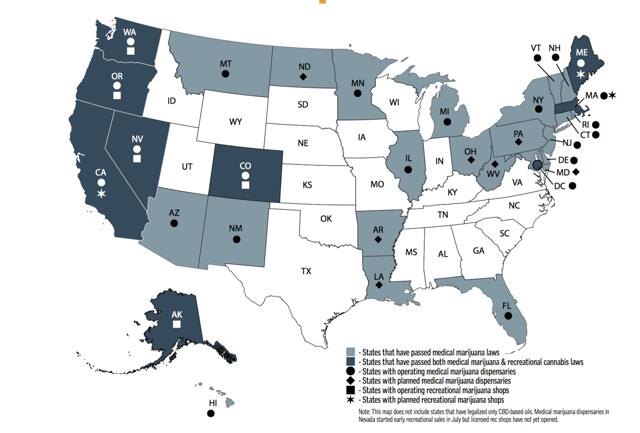

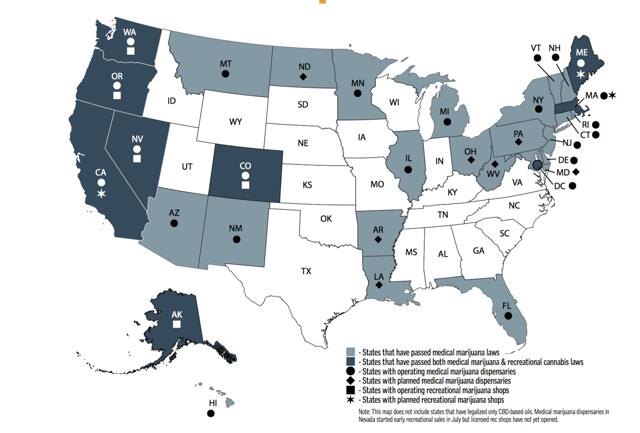

We are currently witnessing the emergence of a major new industry, with significant opportunities for investors. 29 states and the District of Columbia have now legalized cannabis for medical and/or recreational purposes and public acceptance of cannabis continues to increase at a rapid pace. Cannabis has also shown encouraging signs as a treatment for various medical conditions and ailments, which should make the space of interest to investors in biotech and healthcare.

While cannabis remains federally illegal in the United States and publicly-traded cannabis companies are located overseas, we believe that investors should pay close attention to this emerging industry and First Jersey Cannabis Corporation

25

OVERVIEW OF THE CANNABIS INDUSTY

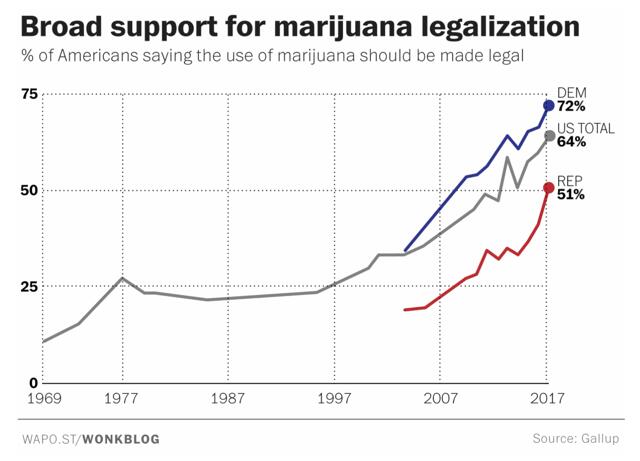

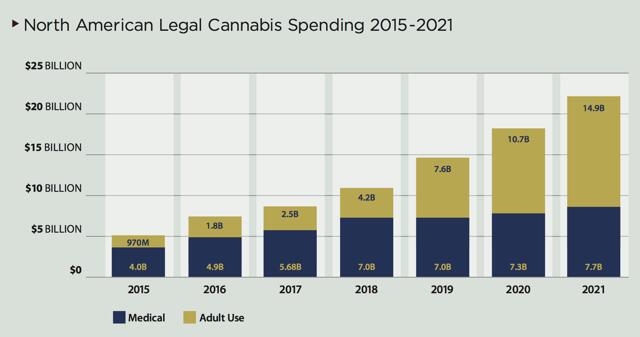

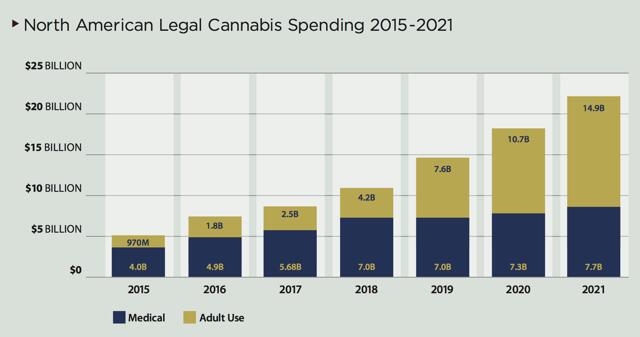

The cannabis industry continues to expand at a rapid pace. Americans spent $6.7 billion on recreational and medical cannabis in 2017, a surprisingly large number given that marijuana is illegal in wide swaths of the United States. Sales have continued to grow steadily, as per the below graph:

The United States is sharply divided when it comes to the legal status of cannabis. The west coast is the most liberal when it comes to cannabis, whereas areas of the Midwest appear less so. The below chart provides a handy reference of marijuana's legal status in various states:

26

(Source: Marijuana Business Daily)

(Source: Marijuana Business Daily)

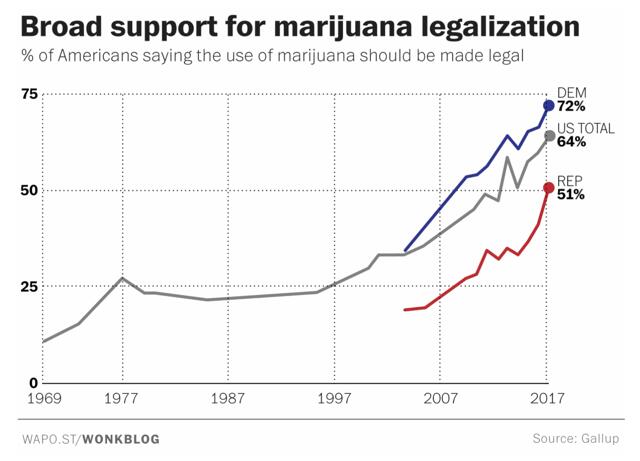

There are also partisan divides: 72 percent of Democrats believe cannabis should be legalized, whereas just 51 percent of Republicans believe the same. However, it is interesting to note that support for legalization has gradually increased over the past several decades, and 64 percent of American as a whole now support legalization:

27

Cannabis will be legalized nationally in Canada in October 2018, with widespread support from Canadian citizens and Prime Minister Justin Trudeau This means that the future of cannabis in the US is likely contingent on the effects of legalization in Canada, as Canada will likely be used as a barometer by our politicians to assess the effects of recreational marijuana.

Despite the sharp divides in support for cannabis legalization, a few things are clear: public support for marijuana legalization continues to increase, the industry is already a multibillion-dollar juggernaut that looks primed for continued expansion, and there are clear potential medical benefits of cannabis.

28

HIGH RISK DECLARATION

RISK FACTORS SUMMARY

An investment in our Common Stock involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this Offering Circular, before purchasing our Common Stock. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

GENERAL RISK FACTORS

Providing specialized services and management products and services is an emerging and limited cannabis business, and many would be competitors have greater resources that may enable them to compete more effectively.

We will compete in the same markets with many companies that offer similar products and services. Price competition in the industry, particularly from larger, more untraditional industry model competitors, is intense, and pricing pressures from competitors and clients are increasing. New competitors entering our markets may further increase pricing pressures.

Many of our competitors have greater resources than we do, which may enable them to compete more effectively in this market. Our competitors may devote their resources to developing and marketing products and services that will directly compete with our product lines, and new, more efficient competitors may enter the market. If we are unable to successfully compete with existing companies and new entrants to the market this will have a negative impact on our business and financial condition.

Our success depends on adoption of our products and services by customers, and if these potential customers do not accept and acquire our products and services then our revenue will be severely limited.

The recreational cannabis market is still in the early stages of further experimentation and growth. Products and services considered by our potential clients may not be accepted and new ideas, avenues and other methods must be tried to gain client access. The same factors are true for all competitors in the field. While we will use our “best efforts” to create, deliver and offer the right products and service, there is no assure we will be successful.

If we are unable to protect our proprietary and technology rights our operations will be adversely affected.

Our success will depend in part on our ability to protect our proprietary rights and technologies, including those related to our products and services. We have not applied for any formal patent, or similar protection. Our failure to adequately protect our proprietary rights may adversely affect our operations. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our services or to obtain and use trade secrets or other information that we regard as proprietary. Based on the nature of our business, we may or may not be able to adequately protect our rights through patent. Our means of protecting our proprietary rights in the United States or abroad may not be adequate, and competitors may independently develop similar technologies. However, we do intend to trademark the key trade names, both in States, Federal government and International jurisdictions. At this stage we do not know the key trade names to protect. In addition, litigation may be necessary in the future to:

Any such litigation could result in substantial costs if we are held to have willfully infringed or to expend significant resources to develop non-infringing technology and would divert the attention of management from the implementation of our business strategy. Furthermore, the outcome of litigation is inherently difficult to predict and we may not prevail in any litigation in which we become involved.

29

Failure to comply with, or changes in, laws and regulations applicable to our business, particularly potential changes to theSection 280E of the Internal Revenue Service Code could have a materially adverse effect on our marketing plan, results of operations or financial condition, or have other adverse consequences.

Our business is subject to a wide range of complex laws and regulations. There can be no assurance that either First Jersey Cannabis Corporation will be successful in either securing or maintaining a license or licenses in compliance with a particular state’s and federal laws and regulations. Cannabis as viable commerce product cannot transition to a mainstream sector until existing Federal tax laws are changed. The issue: federal tax law deals with businesses that are associated with “trafficking” substances as Schedule I and Schedule II of the Controlled Substance Act violations. Since cannabis remains listed as a Schedule I substance at the federal level, the IRS applies Section 280E to most state-legal cannabis companies, preventing them from deducting normal business expenses from their total income. The IRS has determined Section 280E applies to licensed, regulated cannabis businesses acting in full compliance with state marihuana laws and federal guidelines.

Failure to comply with such laws and regulations could result in the suspension or revocation of licenses or registrations, the limitation, suspension or termination of services, and the imposition of consent orders or civil and criminal penalties, including fines, that could damage our reputation and have a materially adverse effect on our results of operation or financial condition.

Political and economic factors, whether federal or states, may adversely affect our business and financial results.

Monetary and fiscal policies and political and economic conditions may substantially change.

If we are unable to effectively manage growth and maintain low operating costs, our results of operations and financial condition may be adversely affected.

If we are unable to manage our growth effectively, including having geographically dispersed offices and employees or to anticipate and manage our future growth accurately, our business may be adversely affected. If we are unable to manage our expansion and growth effectively, we may be unable to keep our operating costs low or effectively meet the requirements of an ever-growing, geographically dispersed client base. In addition, our growth may place significant demands on our management, and our overall operational and financial resources. A failure on our part to meet any of the foregoing challenges inherent in our growth strategy may have an adverse effect on our results of operations and financial condition

We operate in an immature and rapidly evolving industry and have a relatively new business model, which makes it difficult to evaluate our business and prospects.

The industry in which we operate is characterized by rapidly changing regulatory requirements, evolving industry standards and shifting user and client demands. Our business model is also evolving and is different from models used by other companies in our industry. As a result of these factors, the success and future revenue and income potential of our business is uncertain. Any evaluation of our business and our prospects must be considered in light of these risks and uncertainties, some of which relate to our ability to: (1) Expand our credibility within the cannabis industry; (2) Develop relationships with third-party vendors and manufactures; (3) Expand operations and implement and improve our operational, financial and management controls; (4) Raise capital at attractive costs, or at all; (5) Attract and retain qualified management, employees and independent service providers; (6) Successfully introduce new processes, technologies products and services and upgrade our existing processes, technologies, products and services; (7) Protect our proprietary processes and technologies and our intellectual property rights; and (8) Respond to government regulations, product and software technologies, cyber security and other regulated aspects of our business.

If we are unable to successfully address the challenges posed by operating in an immature and rapidly evolving industry and having a relatively new business model, our business could suffer.

We have not engaged an independent registered public accountant, and therefore unable to provide an attestation report as to our internal control over financial reporting for the foreseeable future.

30

We are currently review adequate candidates to be our independent registered public accounting firm and provide such firm access to assess the effectiveness of our internal control over financial reporting and establish an effective, if necessary, internal control over financial reporting. As an issuer of securities under Regulation A, we do not expect to be required to assess the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act, unless and until we become a reporting company under the Exchange Act and, thereafter, no longer qualify as an emerging growth company or are no longer a non-accelerated filer, as defined in Rule 12b-2 under the Exchange Act, whichever is later. Currently, we would expect to be an emerging growth company for up to five years after we become a reporting company under the Exchange Act. As a result of the foregoing, for the foreseeable future, you may not receive any attestation concerning our internal control over financial reporting from us or our independent registered public accountants.Upon the closing of the Stock Offering, the Company plans to engage an independent public accountant.

RISKS RELATING TO OUR BUSINESS

We have limited operating history, which makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We are a development stage company and are in the process of developing our products and services. The founder of the Company, Christopher Netelkos has been monitoring the cannabis industry since 2007. Although that fact does not warrant future success, it is still difficult, if not impossible, to forecast our future results based upon our limited operational history. Because of the related uncertainties, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, revenues or expenses. If we make poor budgetary decisions as a result of unreliable data, our net revenues in the future may decline, which may result in a decline in our stock price once we start trading.

The Company’s success and survival is contingent upon its ability to achieve profitable operations and the Company’s ability to raise additional capital as required.

There is uncertainty regarding our ability to implement our business plan and to grow our business to a greater extent than we can with our existing financial resources without additional financing. Except from the proceeds of this offering, we have no binding agreements, commitments or understandings to secure additional financing at this time. We have no binding agreements, commitments or understandings to acquire any other businesses or assets. Our long-term future growth and success is dependent upon our ability to generate cash from operating activities and obtain additional financing, potentially beyond the proceeds of this offering. There is no assurance that we will be able to generate sufficient cash from operations, sell shares of common stock in addition to this Offering or borrow additional funds. Our inability to obtain additional cash could have a material adverse effect on our ability to fully implement our business plan as described herein and grow our business, including our three-year target objectives, to a greater extent than we can with our existing financial resources.

Management currently believes that the Company can fully implement its current business plan. A major assumption underlying management’s belief is that this Offering is successful. However, there is a risk that this Offering, although on different terms, since the Company may not be able to sell all the shares offered and settle for a lesser amount. There is no assurance that this Offering will be successful or that the Company will be able to implement its current business plan and achieve profitable operations for the reasons set forth herein and elsewhere in “Risk Factors.”

Because the financial statements (Consolidated Balance Sheet) for August 31, 2018 have not been reviewed by our auditors, there is no assurance that, when the auditors do review our financial statements there will not be changes in the reviewed financial statements from the non-reviewed financial statements in this Offering Circular.

The requirements for interim financial statements in a Regulation A offering are different from those required under the Securities Act of 1933, as amended. A Regulation A filer like us can submit financial statements that are not reviewed by an auditor. Because the financial statements (Balance Sheet) have not been reviewed by an auditor, there is no assurance that when it does happen there will not be changes in the reviewed financial statements from the non-

31

reviewed financial statements in this Offering Circular. Moreover, the Company intends to engage a certified public accounting firm sanctioned by the Securities and Exchange Commission upon successful conclusion of this Offering

RISKS RELATED TO MANAGEMENT AND PERSONNEL

Mr. Christopher Netelkos is the Company’s CEO, CFO, President, Secretary and Director.

Ms. Eden Willow Netelkos is the Company’s Vice President and Director.

Mr. James Guercioni is the Company’s Operations Manager for cativatingflowers.com.

Ms. Deborah K. Williamsis the Company’s Technical Applications Manager.

We depend heavily on Mr. Christopher Netelkos.The loss of his services could harm our business.Our future business and results of operations depend in significant part upon the continued contributions of Mr. Christopher Netelkos, CEO and Director. If we lose his services or if he fails to perform in his current position, or if we are not able to attract and retain skilled employees in addition to Mr. Christopher Netelkos, CEO and Director, this could adversely affect the development of our business plan and harm our business.

Mr. Netelkos has limited experience managing a public company, which may inhibit our ability to implement successfully our business plan.

Mr. Netelkos never operated as a public company, which required that he establish and maintain disclosure controls and procedures and internal control over financial reporting. As a result, he may not be able to operate successfully as a public company, even if our operations are successful. He plans to comply with all of the various rules and regulations, which are required for a public company that is reporting company with the Securities and Exchange Commission. However, if we cannot operate successfully as a public company, your investment may be materially adversely affected.

The same risks factors are evident for the other personnel. Additionally, Mr. Guercioni and Ms. Williams are not officers or directors of the Company, and therefore have no authority to vote on Company issues.

.

RISKS RELATING TO OFFERING

There has been no public market for our Common Stock prior to this offering, and an active market in which investors can resell their shares may not develop.

Prior to this offering, there has been no public market for our Common Stock. We cannot predict the extent to which an active market for our Common Stock will develop or be sustained after this offering, or how the development of such a market might affect the market price of our Common Stock. The initial offering price of our Common Stock in this offering will be agreed between us and the Underwriter based on a number of factors, including market conditions in effect at the time of the offering, and it may not be in any way indicative of the price at which our shares will trade following the completion of this offering. Investors may not be able to resell their shares at or above the initial offering price.

Investors in this offering will experience immediate and substantial dilution.

Upon the sale of 1,000,000 common share, investors in this offering will own approximately 33% of the then outstanding shares of common stocks, but will have paid over 95% of the total consideration for our outstanding shares. See “Dilution.”

The market price of our Common Stock may fluctuate, and you could lose all or part of your investment.

The offering price for our Common Stock was based on a number of factors, and may not be indicative of prices that will prevail on NASDAQ or elsewhere following this offering. The price of our Common Stock may decline following this offering. The stock market in general, and the market price of our Common Stock will likely be subject to fluctuation, whether due to, or irrespective of, our operating results, financial condition and prospects.

32

Our financial performance, our industry’s overall performance, changing consumer preferences, technologies and advertiser requirements, government regulatory action, tax laws and market conditions in general could have a significant impact on the future market price of our Common Stock. Some of the other factors that could negatively affect our share price or result in fluctuations in our share price include: (1) actual or anticipated variations in our periodic operating results;(2) increases in market interest rates that lead purchasers of our Common Stock to demand a higher yield; (3) changes in earnings estimates; (4) changes in market valuations of similar companies; (5) actions or announcements by our competitors; (6) adverse market reaction to any increased indebtedness we may incur in the future; (7) additions or departures of key personnel; (8) actions by stockholders; (9) speculation in the press or investment community; and (10) our intentions and ability to list our Common Stock on a national securities exchange and our subsequent ability to maintain such listing.

NASDAQ may delist our Common Stock from trading on its exchange, which could limit stockholders’ ability to trade our Common Stock.

In the event we are able to list our Common Stock on the NASDAQ Capital Market, NASDAQ will require us to meet certain financial, public float, bid price and liquidity standards on an ongoing basis in order to continue the listing of our Common Stock. If we fail to meet these continued listing requirements, our Common Stock may be subject to delisting. If our Common Stock is delisted and we are not able to list our Common Stock on another national securities exchange, we expect our securities would be quoted on an over-the-counter market. If this were to occur, our shareholders could face significant material adverse consequences, including limited availability of market quotations for our Common Stock and reduced liquidity for the trading of our securities. In addition, we could experience a decreased ability to issue additional securities and obtain additional financing in the future.

We do not expect to declare or pay dividends in the foreseeable future.

We do not expect to declare or pay dividends in the foreseeable future, as we anticipate that we will invest future earnings in the development and growth of our business. Therefore, holders of our Common Stock will not receive any return on their investment unless they sell their securities, and holders may be unable to sell their securities on favorable terms or at all.

Sales of our common stock under Rule 144 could reduce the price of our stock.

Rule 144 of the Securities Act of 1933 defines as restricted securities that can only be resold if the conditions of Rule 144 are met. In general, persons holding restricted securities, including affiliates, must hold their shares for a period of at least six months, may not sell more than one percent of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. The availability for sale of substantial amounts of common stock under Rule 144 could reduce prevailing market prices for our securities.

Because we don’t have an audit committee, we are subject to increased risk related to financial statement disclosures.

While we endeavor to create an Audit Committee after the successful conclusion of this common stock offering, we are subject to increased risk related to financial statement disclosures until that event.

Certain of our stockholders hold a significant percentage of our outstanding securities, which could reduce the ability of minority shareholders to effect certain corporate actions.