UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number 333-229748

M2I GLOBAL, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 37-1904036 |

State or other jurisdiction of incorporation or organization | | (I.R.S. Employer Identification No.) |

| 885 Tahoe Blvd., Incline Village, NV | | 89451 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s Telephone number, including area code: (775) 909-6000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| None | | None | | None |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal year: $111,459,905.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 612,654,525 common shares issued and outstanding as of February 24, 2025.

TABLE OF CONTENTS

PART I

Item 1. Business

Unless otherwise stated or the context requires otherwise, references in this annual report on Form 10-K to “we,” “us,” “our,” the “Company,” “M2i,” and “our Company” refer to M2i Global, Inc., a Nevada corporation, and its subsidiaries.

OUR BUSINESS

Our Vision

Our vision is to secure reliable access to critical minerals and metals for the U.S., its allies, and partners. We expect to accomplish this by developing a world-class portfolio of critical minerals and materials projects. The diversity of our portfolio will provide an integrated solution to the challenges facing the critical minerals and materials industry in the U.S.

Critical Minerals Underpin U.S. Economic Security and National Defense

The U.S. relies on critical minerals flow for its National Defense and Economic Security. The defense of our nation is contingent on the ability to manufacture the elements that collectively represent our national military power. Equally important is the critical mineral flow that fuels our nation’s economy, providing the elementary materials that support all technology innovation, manufacturing, and energy sectors, to name only a few.

The U.S. is dependent on foreign sources for almost all of the critical minerals that serve as the foundational building blocks for the industries that underpin our nation’s defense as well as those that are serving as the primary engine for our economic strength and growth.

These sectors are rapidly exposing vulnerabilities in the current supply chain. Our strategic focus is on securing a reliable supply of critical minerals essential for national defense, economic stability, advanced manufacturing, and energy infrastructure. Recent examples of these vulnerabilities are China’s announcements to ban export of important, dual use minerals, such as the announcement in December 2024 banning antimony, tungsten, and tantalum, as well as additional bans affecting tungsten and indium in February of 2025.

In the U.S., the Secretary of Interior pursuant to authority under the Energy Act of 2020, acting through the director of the U.S. Geological Survey, determines the list of critical minerals and materials. The final 2022 list of critical minerals includes the following 50 minerals: Aluminum, antimony, arsenic, barite, beryllium, bismuth, cerium, cesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium, palladium, platinum, praseodymium, rhodium, rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, vanadium, ytterbium, yttrium, zinc, and zirconium.

The Energy Act of 2020 also requires the Secretary of Energy, acting through the Undersecretary for Science and Innovation, in conjunction with other departments, to determine the Critical Materials List. The Final 2023 Critical Materials list has 18, of which only four do not appear on the Critical Minerals List. The full list of critical materials includes aluminum, cobalt, copper*, dysprosium, electrical steel* (grain-oriented electrical steel, non-grain-oriented electrical steel, and amorphous steel), fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, terbium, silicon*, and silicon carbide* (asterisked materials are unique to the critical materials list).

The vital market for critical minerals and metals is the enabling component of the vital transition of the energy market. The infrastructure requirement for clean energy is dependent on the availability of the raw materials that these minerals represent.

The ability to generate, transmit, distribute, and store energy is at the center of all U.S. industrial capacity. Key examples that highlight the growing importance that critical minerals play in the increasing demand for energy are renewable energy generation, electric vehicle (EV) market growth, Artificial Intelligence (AI), data center expansion, cryptocurrency mining, among many other existing and developing industries.

Nickel, lithium, cobalt, and graphite are used in batteries. Rare-earth minerals such as neodymium and samarium are essential to the magnets of wind turbines and electric motors. supported by copper, nickel, and rare earths are also required for the robust energy infrastructure, power distribution, and thermal management demanded by the increasing demand for energy. Additional essential minerals like aluminum and neodymium are critical for transmission lines, transformers, and high-efficiency motors. An unstable supply of these minerals threatens the ability to meet the continued growth of demand for energy.

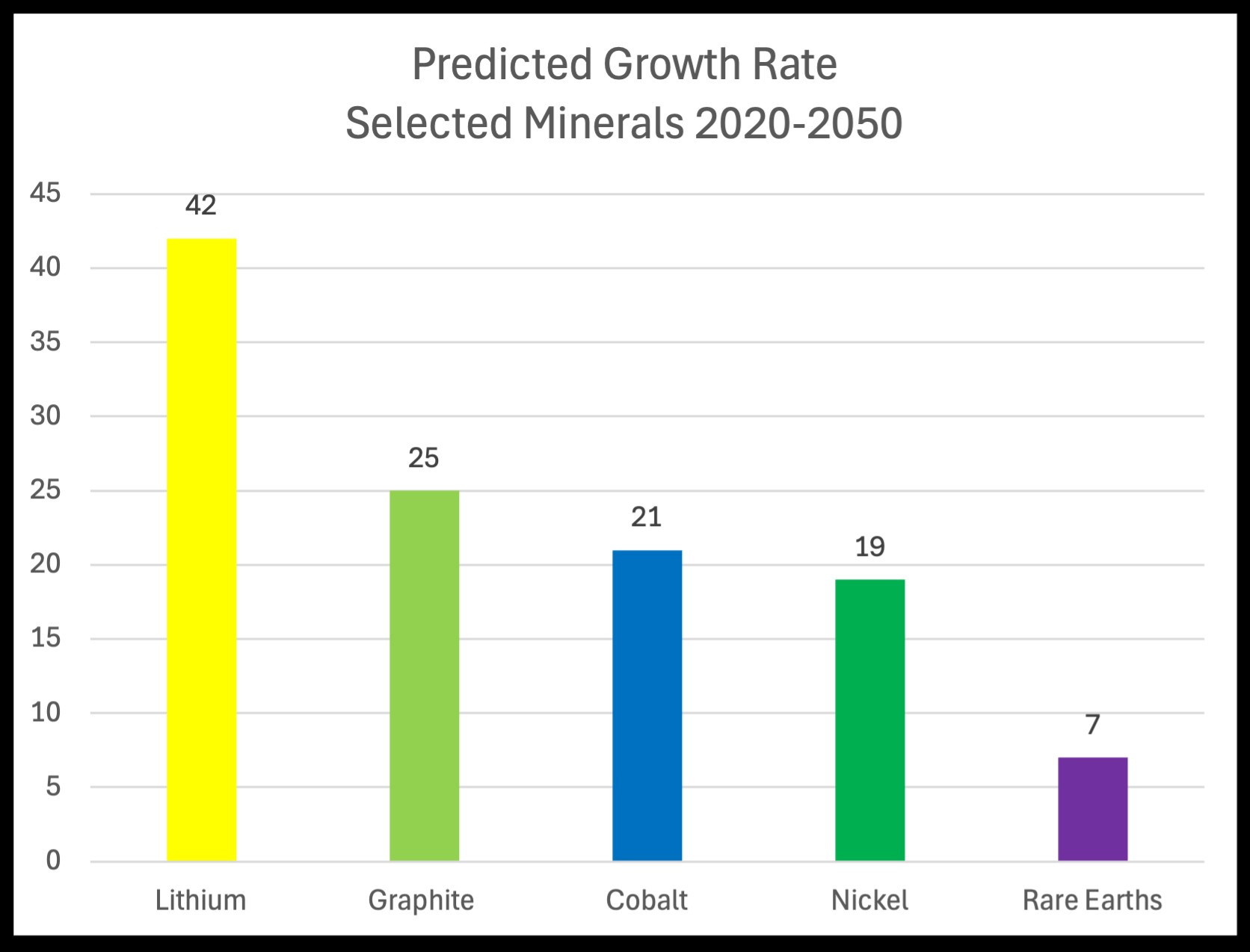

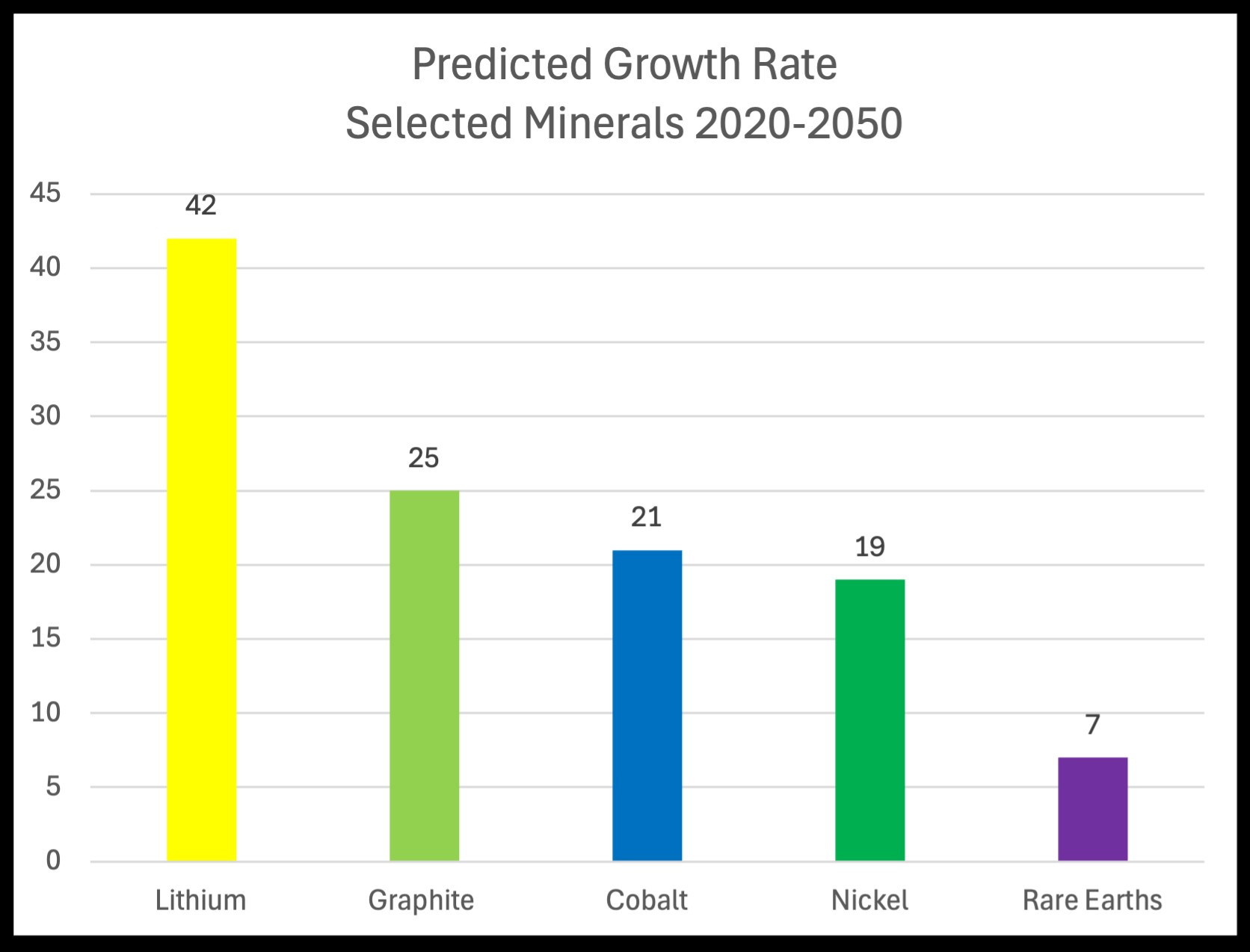

The chart in figure 1 depicts the projected growth of the demand for specific minerals that provide the base material for the manufacturing of electrical vehicle and energy storage batteries. The growth rate for projected demand in 2050 is presented using 2020 as the base of comparison (Source: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions; The Role of Critical Minerals in Clean Energy Transitions”).

Figure 1: Energy Storage Minerals

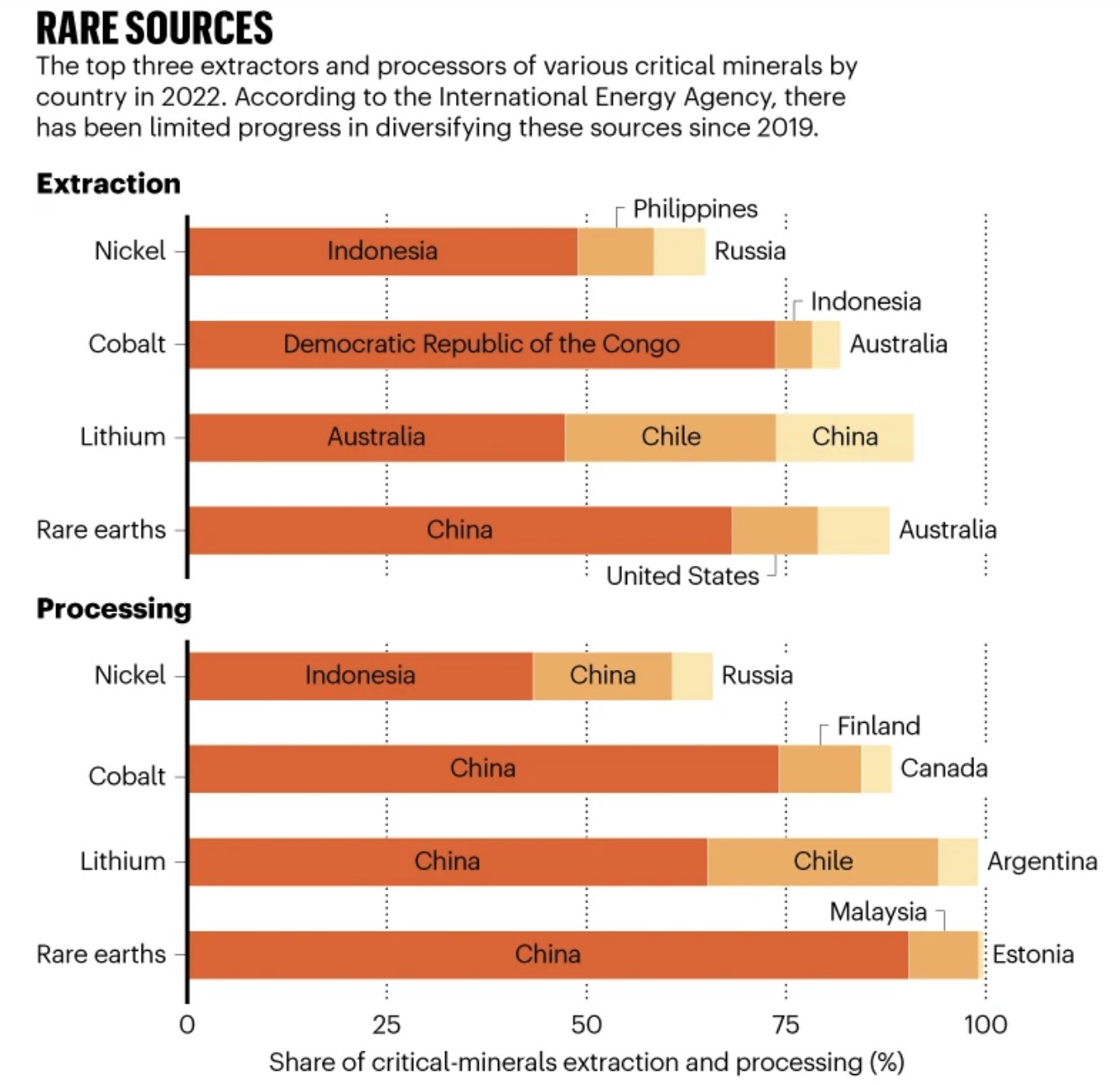

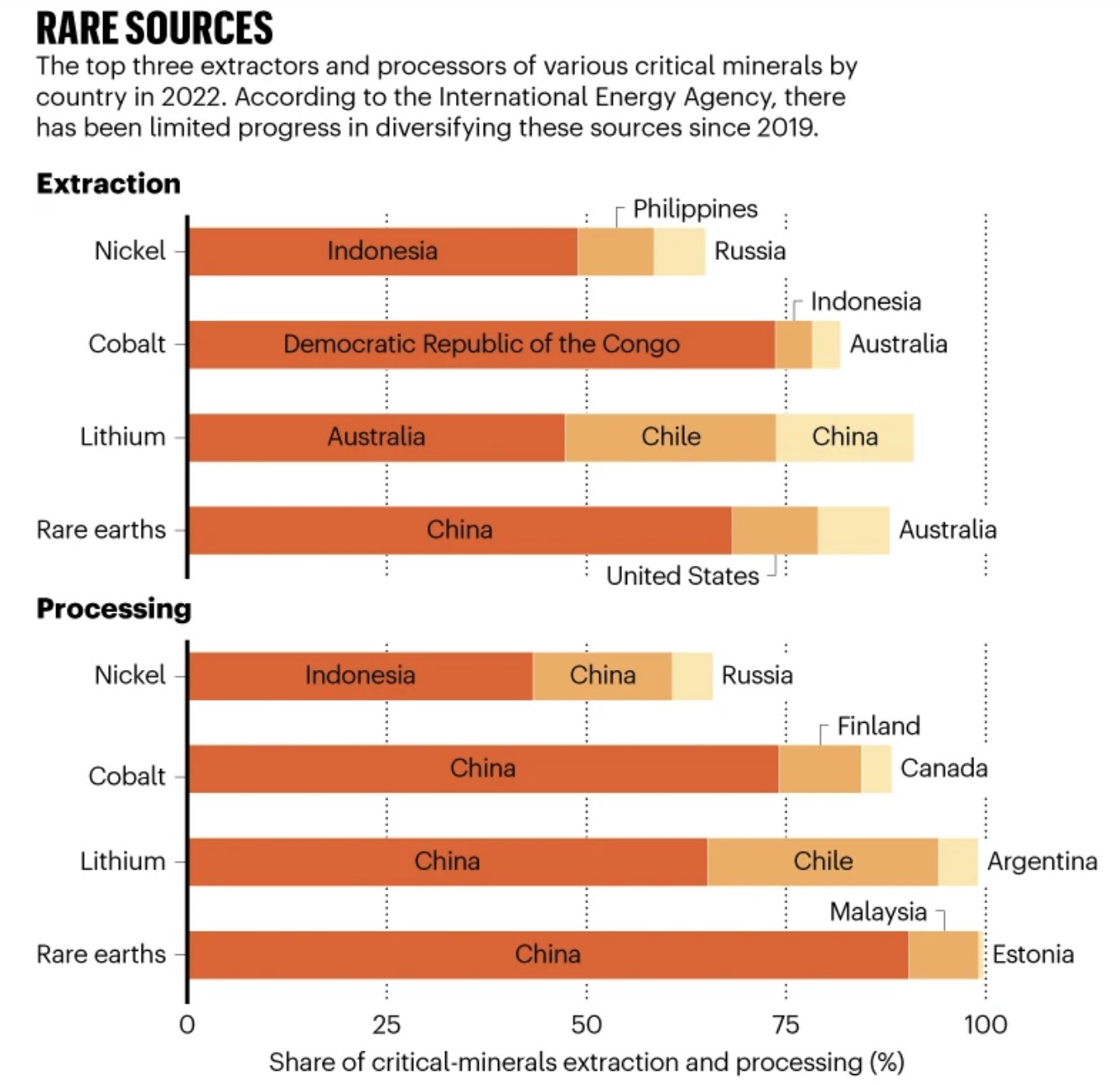

Many of these critical minerals are mined and processed in a small number of countries, as illustrated in the chart in Figure 2 (Source: “The global fight for critical minerals is costly and damaging,” Nature, July 19, 2023).

Figure 2: Sources of Minerals

The current dependence on foreign sources for critical materials supply flow and minerals processing must be addressed in the short and mid-term to create a stable supply chain of these materials to support both the national and economic security of the U.S. The table (Figure 3) depicts the current level of foreign sources for critical minerals by industry (Source: U.S. Department of the Interior U.S. Geological Survey, MINERAL COMMODITY SUMMARIES 2023).

Figure 3: Critical Minerals List Associated with Key Industries

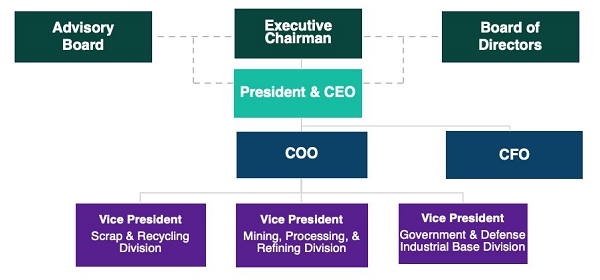

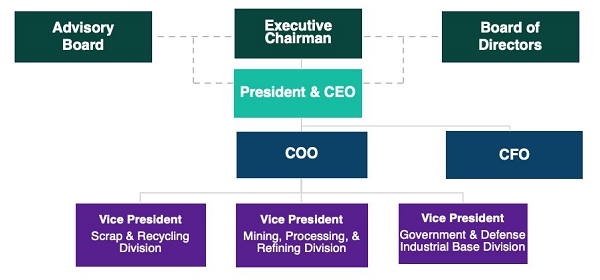

Our Organizational Chart

M2i’s structure will be built upon three separate business units with standalone P&Ls to carry on the Company’s objectives. Each P&L, led by a vice president, will work with a management team focused on implementing and building each business line and contribute respectively to the overall organization. The vice presidents will report to the president/chief executive officer of the Company. M2i will establish a finance department, staffed by a Director of Finance and Controller to ensure the effective and efficient management of funds, and to implement appropriate accounting controls.

M2i Mining, Processing, & Refining

The primary business purpose of M2i MPR is to develop and supply the U.S. sanctioned value chain of critical metals needed by the U.S. and its free trade partners. M2i MPR will supply the 50 critical minerals, including the rare earth elements (“REE”) as defined by the U.S. Geologic Survey in 2022, as well as the 18 critical materials defined by the U.S. Department of Energy in 2023. These minerals will be sourced globally from mines adhering to ethical and sustainable extraction principles and guidelines.

Strategic Alliances

The Company’s focus is to enter strategic alliances (“SAs”) to further its business objectives; namely through multiple mechanisms including asset acquisition and independent supply contracts. The SAs will likely be with companies that can expand our capability to extract minerals from existing mines, assist in implementing new mining projects, and develop and place into production new technologies and processes in extracting and processing minerals. Our efforts, and particularly our SAs will be focused on delivering guaranteed access to critical minerals and metals for national defense and economic security.

Currently, we have entered into a strategic alliance (SA) with Reforme Group (“Reforme”), an Australian mining and recycling company (the “SA Agreement”) wherein Reforme and M2i will create an Australian proprietary limited company (“M2iAust”) to source and trade critical metals and strategic minerals. It is currently anticipated that M2i and Reforme Group will each be equal shareholders in M2iAust. It is currently anticipated that the SA Agreement will enable us to capitalize on Reforme’s expertise in critical minerals. Reforme is an innovative Australian mining services, infrastructure, recycling, and renewables company with specialized expertise in the development of green and brown field mining projects with the demonstrated capability in end-to-end management of mine operations, processing, logistics and off-take negotiations.

The SA will play a pivotal role in advancing the critical minerals supply chain and contributing to the global energy transformation. We expect that the SA will extract critical minerals from existing brownfield mines’ tailings utilizing a novel extraction technology and process developed by Reforme. Reforme’s technology includes mine remediation methods to return the site to a state that would satisfy government and community concerns. It is anticipated that Reforme will grant M2iAust a right of first refusal to enter into offtake agreements with Reforme or its related corporate bodies for any critical metals and strategic minerals extracted from mining tenements owned or controlled by Reforme. M2i will support the development of strategic resources by Reforme. Together, the companies will refer any third party off take opportunities in the Asia Pacific region for strategic resources to M2iAust. M2iAust will negotiate offtake agreements to secure offtake from Reforme and third parties for offtake which will be sold to M2i in subsequent offtake agreements. The SA has a term of 5 years unless agreed otherwise. By leveraging their combined expertise and resources, the partners intend to establish a more sustainable and efficient critical minerals ecosystem that fully aligns with the objectives outlined in the United States-Australian Climate, Critical Minerals, and Clean Energy Transformation Compact.

The Company’s subsidiary, U.S. Minerals and Metals Corp.,(“USMM”) has assigned its two contracts with Lyons Capital, LLC to the parent Company, M2i Global, Inc. On February 23, 2023, USMM, and Lyons Capital, LLC (“Lyons”) entered into a business development agreement wherein Lyons agreed to act as Senior Strategic and Business Development Advisor to USMM for a term of 10 years (the “BDA”). Lyons received, on January 2, 2024, and on the first business day of each year thereafter 10,000,000 shares of USMM’s common stock in exchange for a purchase price of $1,000 per year. The BDA may be terminated by either party for any reason effective upon the first business day of the calendar year following the termination notice provided at least 30 days in advance.

Lyons and USMM also entered into the Wall Street Conference Business Development Agreement on February 23, 2023 (the “WSCA”), which was also assigned to the parent Company, M2i Global, Inc. In the WSCA, Lyons agreed, for a term of 5 years, to provide USMM with a yearly event sponsorship, including a speaking slot at the Wall Street Conference organized by Lyons, and introductions to, among others, personnel for business development opportunities. In exchange, Lyons will receive $2,000,000 per year in either cash or shares of USMM.’s common stock (if elected, the issuance of shares will be issued at a purchase price of $200 per year).

Pursuant to the Agreement and Plan of Merger, dated as of May 12, 2023, and entered into by and among Inky, Inc. and U.S. M and M Acquisition Corp. and U.S. Minerals and Metals Corp., which is annexed hereto as exhibit 2.01 below, at the time of consummation of the merger, all shares of USMM were simultaneously converted into shares of M2i Global, Inc.’s common stock, and thus, any shares issued by USMM pursuant to the BDA or WSCA, as referenced above are now issued from M2i Global, Inc.

M2i Scrap & Recycling

M2i has identified an opportunity to establish a source of critical minerals from scrap and recycling of metals currently reaching their end of life in their current use. Small and medium sized scrap metal recycling yards present an opportunity as many are family owned, with a good solid business, but are reaching the end of their succession plan and will need to close or sell. The scrap and recycling businesses we are considering provide low risk with good cash flow. The S&R Division acquisitions are an early emphasis for M2i and will generate steady revenue and profit.

Critical metals are of vital importance for the defense sector across the air, sea, and land domains. For instance, tantalum is needed in warheads, and high-performing alloys used in fuselages of combat aircraft require niobium, vanadium, and molybdenum.

We see an opportunity to establish a closed-loop, transparent program for capturing and returning critical metals and minerals in the defense industrial supply chain. This program would encompass both new production and end-of-life systems, ensuring that these valuable resources are reused domestically rather than relying on foreign sources.

The defense supply chain presents a significant volume of critical metals that can be effectively recycled and reused. By tapping into this resource and establishing M2i as an efficient supplier of this service, we can capture a considerable market share. This opportunity arises from the fact that no recycling company, to our knowledge, has successfully accomplished this on a large scale thus far.

M2i Government and Defense Industrial Base

M2i Government and Defense Industrial Base (“DIB”) is the business unit established with the goals of aligning U.S. policy in terms of industry requirements and national interests. The cornerstone of the value proposition of M2i DIB is the creation and management of the Strategic Minerals Reserve (“SMR”) in collaboration with the federal government to enable an uninterrupted supply of the most critical minerals and metals to mitigate the current and future vulnerabilities of this vital supply chain. We expect the SMR to augment or enhance the National Defense Stockpile.

M2i DIB will focus on two key efforts, the implementation of the SMR and the ongoing liaison with the government at the federal, state, and local levels. Critical to the success of the SMR will be the continuing dialogue with key congressional members. We have established congressional support in Nevada and are working to receive both an authorization in the annual National Defense Authorization Act as well as an appropriation of funding to enable the implementation of the M2i. DIB also aims to establish a collaboration with Hawthorne Army Depot, located in Hawthorne, Nevada, to obtain storage and administrative space to conduct a pilot demonstration.

The ongoing liaison with selected members of the congressional contingent from Nevada will act to ensure that the SMR pilot retains the focus of each respective office. We expect that the conclusion of a successful pilot will lead to the establishment of the second phase of the SMR, which is to build out the SMR to multiple locations, and to stockpile critical minerals that would extend supply beyond the DOD industry to private sector industry organizations in the event of a disruption to the flow of critical minerals.

Human Capital

Recruiting the right people will be critical to our success. We believe that the team of officers, directors and advisors that we have already assembled will provide a strong foundation for developing our business.

Financing Sources

We estimate that our first two years of operation will require $20-30 million. Our aim is to augment the capital raised with obtaining government funding to meet this need.

Competition

The Company, upon achieving its business objectives, believes it will be one of the only companies that operates across the full spectrum of the mineral and metals industry.

The rare earths mining and processing markets are capital intensive and competitive. Outside of the six (6) major rare earth producers in China, and those consolidated under their production quotas-there are only two other producers operating at scale, MP Materials and Lynas, which processes its rare earth materials in Malaysia. The Company’s competitors may have greater financial resources, as well as other strategic advantages to maintain, improve and possibly expand their facilities.

It is possible that when the Company achieves its anticipated production rates and other planned products, the increased competition could lead competitors to engage in predatory pricing behavior. Any increase in the amount of rare earth products exported from other nations, and increased competition, whether legal or illegal, may result in price reductions, reduced margins and loss of potential market share, any of which could materially and adversely affect our profitability.

Additionally, our potential Chinese competitors have historically been able to produce at relatively low costs due to domestic economic and regulatory factors, including less stringent environmental regulations. If we are not able to achieve the projected costs of production, then any strategic advantages that our competitors may have over us, such as lower labor and production costs, could have a material adverse effect on our business. As a result of these factors, we may not be able to compete effectively against current and future competitors.

Many of the Company’s competitors, as well as potential competitors, possess substantially greater financial, marketing, personnel and other resources than the Company. The Company’s competitors and potential competitors include far larger, more established companies that have access to capital markets, and to other funding sources that may be unavailable to the Company. There can be no guarantee that the Company will be able to compete successfully against current or future competitors or that competitive pressures faced by the Company will not materially adversely affect its business, operating results, and financial condition.

Compliance with Government Regulation

Mining operations and exploration activities are subject to various national, state, and local laws and regulations in United States, as well as other jurisdictions, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters.

We believe that we are and will continue to be compliant in all material respects with applicable statutes and the regulations passed in the United States. There are no current orders or directions relating to our Company with respect to the foregoing laws and regulations.

Item 1A. Risk Factors

Not required for smaller reporting companies.

Item 1B. Unresolved Staff Comments

Not required for smaller reporting companies.

Item 1C. Cybersecurity

Risk Management and Strategy

We recognize the critical importance of developing, implementing, and maintaining robust cybersecurity measures to safeguard our information systems and protect the confidentiality, integrity, and availability of our data.

Managing Material Risks & Integrated Overall Risk Management

We have strategically integrated cybersecurity risk management into our broader risk management framework to promote a company-wide culture of cybersecurity risk management. This integration ensures that cybersecurity considerations are an integral part of our decision-making processes at every level. Our management team continuously evaluates and addresses cybersecurity risks in alignment with our business objectives and operational needs.

Oversee Third-party Risk

Because we are aware of the risks associated with third-party service providers, we have implemented stringent processes to oversee and manage these risks. We conduct thorough security assessments of all third-party providers before engagement and maintain ongoing monitoring to ensure compliance with our cybersecurity standards. The monitoring includes annual assessments of the SOC reports of our providers and implementing complementary controls. This approach is designed to mitigate risks related to data breaches or other security incidents originating from third parties.

Risks from Cybersecurity Threats

We have not encountered cybersecurity challenges that have materially impaired our operations or financial standing.

Item 2. Properties

Our principal executive offices are located at 885 Tahoe Blvd. Incline Village, NV 89451. The Company does not own any property or hold any leases.

Item 3. Legal Proceedings

We know of no legal proceedings to which we are a party or to which any of our property is the subject which are pending, threatened, or contemplated or any unsatisfied judgments against us.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

MARKET INFORMATION

Our Common Stock began trading on the OTC Pink Market under the symbol “INKI.” On June 8, 2023, our stock symbol changed to “MTWO”. You should be aware that over-the-counter market quotations may reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions.

HOLDERS

As of February 24, 2025, there were approximately 160 stockholders of record holding 612,654,525 shares of our Common Stock. This number does not include an indeterminate number of stockholders whose shares are held by brokers in street name. The holders of our Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of our Common Stock have no preemptive rights and no right to convert their Common Stock into any other securities. Additionally, there are no redemption or sinking fund provisions applicable to our Common Stock.

DIVIDEND POLICY

We have never paid any cash dividends on our Common Stock and do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. We presently intend to retain all earnings to implement our business plan. Any future determination to pay cash dividends will be at the discretion of our Board and will be dependent upon our financial condition, results of operations, capital requirements and such other factors as our Board deems relevant. Our ability to pay cash dividends is subject to limitations imposed by state law.

RECENT SALES OF UNREGISTERED SECURITIES

None.

Issuer Purchases of Equity Securities

In August of 2023, the Company repurchased 6,013,334 shares of the Company’s common stock from Ioanna Kallidou for $435,000 (the “Treasury Stock Repurchase”).

In December of 2023, the Company repurchased 50,000,000 shares of the Company’s common stock from a shareholder for $5,000.

In August of 2024, the Company repurchased 11,500,000 shares of the Company’s common stock from two former consultants for $1,150.

Item 6. [Reserved]

Not required for smaller reporting companies.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The information and financial data discussed below is derived from our financial statements for the fiscal years ended November 30, 2024, and 2023. The financial statements of the Company were prepared and presented in accordance with generally accepted accounting principles in the United States. The information and financial data discussed below is only a summary and was prepared to provide a historical and narrative discussion of our financial condition and results of operations through the eyes of management and should be read in conjunction with the historical financial statements and related notes of the Company contained elsewhere in this Form 10-K. The financial statements contained elsewhere in this Form 10-K fully represent the Company’s financial condition and operations; however, they are not indicative of the Company’s future performance. This discussion contains forward-looking statements based upon current plans, expectations and beliefs that involve risks and uncertainties. Our actual results and the timing of certain events could differ materially from those anticipated in or implied by these forward-looking statements because of several factors, including those discussed in the section captioned “Risk Factors” included under Part I, Item 1A and elsewhere in this Form 10-K.

Results of Operations for the fiscal years ended November 30, 2024 and 2023:

Revenue

During the fiscal years ended November 30, 2024 and 2023 we generated total revenue of $0 and $3,400, respectively.

Operating expenses

For the fiscal year ended November 30, 2024, operating expenses were $3,795,121, compared to $1,982,836 for the fiscal year ended November 30, 2023. Operating expenses consist primarily of general and administrative expenses and legal and professional fees incurred in connection with the operation of our business. The net increase of $1,812,285 in operating expenses was primarily a result of an increase in professional fees to implement the change in business as noted in Part I, Item 1 earlier in this document, an increase in marketing and investor relations expenses.

Net Loss

Our net loss for the fiscal years ended November 30, 2024 and 2023 was $3,887,261 and $1,990,162, respectively. The increase in net loss is because of the increase in operating expenses, discussed above, and an increase in interest expense.

Liquidity and Capital Resources and Cash Requirements

As of the fiscal year ended November 30, 2024, the Company had cash of $80,281 and $48,197 as of the fiscal year ended November 30, 2023. Furthermore, the Company had a working capital deficit of $2,532,472 and $1,038,946 as of the fiscal years ended November 30, 2024 and 2023, respectively. The increase in the working deficit is because of an increase in unpaid accounts payable and accounts payable-related party.

During the fiscal year ended November 30, 2024, the Company used $2,098,661 of cash in operating activities compared to $1,611,258 of cash in operating activities during the fiscal year ended November 30, 2023. The increase in cash used in operating activities was the result of an increase in net loss, offset by an increase in accounts payable and accounts payable-related party.

During the fiscal years ended November 30, 2024 and 2023, the Company had no cash flows from investing activities

During the fiscal year ended November 30, 2024, the Company generated $2,130,745 cash in financing activities which came from a net decrease in the related-party loan of $563,950 and proceeds from sale of common stock of $2,396,735 offset by repurchase of common stock of $5,000 and a promissory note for $302,960. During the fiscal year ended November 30, 2023, the Company generated $1,659,341 of cash in financing activities which came from a related-party loan of $608,319, a convertible note for $250,000 and proceeds from sale of common stock of $1,236,022 offset by repurchase of common stock of $435,000.

OFF BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements, including arrangements that would affect our liquidity, capital resources, market risk support and credit risk support or other benefits.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Not required for smaller reporting companies.

Item 8. Financial Statements and Supplementary Data

The full text of our audited consolidated financial statements begins on page F-1 of this annual report

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

On February 8, 2024, the Company dismissed Heaton & Company, PLLC dba Pinnacle Accountancy Group of Utah (“Pinnacle”) as the Company’s independent registered public accounting firm. During the engagement period from December 6, 2019 to February 8, 2024, there were no disagreements between the Company and Pinnacle on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of Pinnacle, would have caused Pinnacle to make reference to the matter in a report on the Company’s financial statements. The decision to replace Pinnacle was approved by the Board of Directors of the Company.

Effective February 8, 2024, the Company appointed Turner, Stone & Company, LLP (“Turner Stone”) as the independent registered public accounting firm to audit the consolidated financial statements of the Company, and the related consolidated statements of operations, changes in stockholders’ deficit, and cash flows of the Company and the related notes to consolidated financial statements.

On June 6, 2024, the Company dismissed Turner, Stone & Company, LLP (“Turner Stone”) (“Turner Stone”) as the Company’s independent registered public accounting firm. During the engagement period from January 29, 2024, to June 4, 2024, there were no disagreements between the Company and Turner Stone on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of Turner Stone, would have caused Turner Stone to make reference to the matter in a report on the Company’s financial statements. The decision to replace Turner Stone was approved by the Board of Directors of the Company.

Effective June 5, 2024, the Company appointed TAAD LLP (“TAAD”) as the independent registered public accounting firm to audit the consolidated financial statements of the Company, and the related consolidated statements of operations, changes in stockholders’ deficit, and cash flows of the Company and the related notes to consolidated financial statements.

Item 9A. Controls and Procedures

The Company is responsible for establishing and maintaining a system of disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act) that is designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive officer or officers and principal financial officer or officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

An assessment was conducted with the participation of our principal executive and principal financial officer of the effectiveness of the design and operation of our disclosure controls and procedures as of November 30, 2024. Based on that evaluation, our management concluded that our disclosure controls and procedures were not effective as of such date to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms.

Changes in Internal Controls over Financial Reporting

There have been no changes in our internal controls over financial reporting that occurred during the fiscal year ended November 30, 2024, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

In our annual report for the fiscal year ended November 30, 2023, we identified the following material weaknesses which are still applicable:

| | ● | We do not have an audit committee |

| | ● | We did not implement appropriate information technology controls |

Management plans to address these material weaknesses in the coming quarters.

In our annual report for the fiscal year ended November 30, 2023, we identified the following material weakness which is no longer applicable:

| | ● | We did not maintain appropriate cash controls – the handling of cash and accounting functions have been segregated and bills require management approval prior to payment |

Item 9B. Other Information.

Rule 10b5-1 Trading Arrangement

During the fiscal year ended November 30, 2024, no director or officer of the Company adopted or terminated a “Rule 10b5-1 trading arrangement” or “non-Rule 10b5-1 trading arrangement,” as each term is defined in Item 408(a) of Regulation S-K.

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections

Not applicable.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Our executive officers and directors and their respective ages are as follows:

| Name | | Age | | Positions |

| Douglas Cole | | 69 | | Executive Chairman, Chief Financial Officer |

| Alberto Rosende | | 62 | | President, Chief Executive Officer and Director |

| Douglas MacLellan | | 69 | | Director |

| Anthony Short | | 65 | | Director |

| Michael Sander | | 61 | | Director |

Set forth below is a brief description of the background and business experience of our executive officers and directors for the past five years.

Douglas Cole

Douglas Cole, age 69, is Executive Chairman and Chief Financial Officer of M2i Global, Inc. Mr. Cole brings over 39 years of experience in sales, marketing, and leadership roles, having run over 8 companies, both public and private. He has focused all his time on global development of startup companies and turnarounds. He has been involved with raising millions of dollars for his companies and numerous M&A work. As a private and public chairman, CEO, and board member, he has expanded every company he has been involved with, leveraging relationships globally. He has spoken at many major industry conferences throughout his career.

Prior to M2i, Mr. Cole was Chairman and CEO of American Battery Metals Corporation (ABML) from 2017 to 2021, where he orchestrated a successful turnaround that resulted in a high of a $2 billion market capitalization. Mr. Cole led the transition from a lithium exploration and development company to a lithium asset and lithium-ion battery metal recycling company and left the company in August of 2021. He was a Partner overseeing all ongoing deal activities with Objective Equity LLC from 2005 through 2016, a boutique investment bank focused on the high technology, data analytics and the mining sector.

Since 1977, Mr. Cole has held various executive roles, including Chairman, Executive Vice Chairman, Chief Executive Officer and President of multiple public corporations. From May 2000 to September 2005, he was also the Director of Lair of the Bear, The University of California Family Camp located in Pinecrest, California. During the period between 1991 and 1996 he was the CEO of HealthSoft and he also founded and operated Great Bear Technology, which acquired Sony Image Soft and Starpress, then went public and eventually sold to Graphix Zone. In 1995, Mr. Cole was honored by New Enterprise Associates, a leading venture capital firm, as CEO of the year.

Since 1982 he has been very active with the University of California, Berkeley where he mentors early-stage technology companies. Mr. Cole has extensive experience in global M&A and global distributions. He obtained his BA in Social Sciences from UC Berkeley in 1978.

Alberto Rosende

Major General (Ret) Alberto “Al” Rosende, age 62, is President & CEO of M2i Global Inc. Mr. Rosende has over 37 years of command and operational experience in the Army. In his private sector career, Al spent 28 years in the global payments industry, where he worked for two of the largest global payment brands in a variety of responsibilities, providing operational and risk management consulting services to client banks and payment processors operating in the Latin America and Caribbean Region.

Mr. Rosende joined M2i in March of 2023 where he previously led M2i’s business operations and integration efforts, focused on ensuring efficient operations across M2i’s business units, as well as driving the effective and timely integration of new entities and technologies, focusing on realizing planned revenue and operational contributions to M2i, in order to optimize M2i’s growing economies of scale. A major component of Mr. Rosende’s previous responsibilities was leading the Government & Defense Industrial Base effort, where he endeavored to strengthen our relationships with federal, state, and local governmental entities, agencies and departments to develop Public Private Partnerships (P3). Special focus continues to be the creation of a national Strategic Mineral Reserve similar in scope and operation to the federal government’s Strategic Petroleum Reserve.

Mr. Rosende retired from the U.S. Army in December of 2021 with over 37 years of service, after spending the last four plus years serving in a full-time capacity. After transitioning from the Army, he returned to work in the payments industry as a consultant, serving as President of Emerg-Int Group, which he founded in 2016. He served as Head of Cards & Payments for Hi Americas during the period of March to July 2022, an early wage access start-up firm and subsidiary of Hi-UK. Al also provided consulting services to Axyde Analytics, responsible for customer support for key clients during the period of August 2022 thru February 2023. Since January 2023, Al has served as a Senior Instructor for the Next Leadership Academy (since January 2023).

Mr. Rosende holds a BS in Business Administration from Nova Southeastern University, an MS in National Resource Strategy from the Eisenhower School of National Security and Resource Strategy of the National Defense University, and an MA from The George Washington University in Education and Human Development.

Douglas MacLellan

Douglas MacLellan, age 69, has provided management advice and counsel on: strategic planning, operational activities, corporate finance, economic policy, asset allocation and mergers & acquisitions throughout his professional career as a senior international business executive and as a member of the board of directors of numerous companies. He has helped raise over US$1 billion for development stage, start-up and mid-cap companies. In regard to U.S. publicly listed companies experience, Mr. MacLellan has over 25 years of public company board experience and 17 years of active audit committee chair experience that includes managing through difficult investigative matters. Mr. MacLellan is also a regular speaker at industry conferences and has been interviewed on various syndicated radio and television news programs in regard to his insights related to China business, selected industries and economic forecasts. MacLellan is also a co-founder of a NASDAQ listed green battery metals miner and recycler company.

Mr. MacLellan holds over 30 years of senior level international executive business experience primarily in the natural resources, pharmaceuticals, telecoms, software, consumer products and IT industries as well as in capital formation and capital markets for new and emerging technologies and companies. MacLellan has been a catalyst for the development and financing of global businesses in the United States and in the countries of: Bulgaria, Cambodia, Canada, Chile, China, Hungary, India, Korea, Madagascar, Vietnam and Russia. MacLellan’s career has had a contemporary focus on the mining, recycling and securitization of strategic materials and critical elements.

Mr. MacLellan’s board experience includes serving as an independent director and Chairman of the Compensation Committee of American Battery Technology Company (NASDAQ: ABAT) from October 2017 to February 2022. MacLellan also served as an independent director and Chairman of the Audit Committee of ChinaNet Online Holdings, Inc. (NASDAQ: CNET) a media development, advertising and communications company from November 2009 to December 2017. Mr. MacLellan also held various Board positions and was Chairman and chief executive officer at Radient Pharmaceuticals Corporation (OTCQB: RXPC), a vertically integrated specialty pharmaceutical company from September 1992 through April 2014.

Mr. MacLellan served as President and Chief Executive Officer for the MacLellan Group, an international financial advisory firm from March 1992 through January 2016. From August 2005 to May 2009, MacLellan was a co-founder and vice chairman at Ocean Smart, Inc., a Canadian based aquaculture company. From February 2002 to September 2006, Mr. MacLellan served as chairman and cofounder at Broadband Access MarketSpace, Ltd., a China based IT advisory firm, and was also a co-founder at Datalex Corp., a software and IT company specializing in mainframe applications, from February 1997 to May 2002. Mr. MacLellan was educated at the University of Southern California with a degree in economics and international relations.

Anthony Short

Anthony Short, 65, is an experienced public company director with over 30 years in the hard rock mining and oil and gas sectors, both internationally and within Australia. Mr. Short has a demonstrated history of working in the venture capital and private equity industries and has sound experience in corporate governance in both the public and private sectors. Mr. Short is skilled in investor relations, analytical skills, asset management, management, and corporate development. Additionally, Mr. Short is a strong business development professional and a proven business innovator, with commercial delivery of cutting-edge propriety mining technology developed in conjunction with AusIndustry and the University of Adelaide, South Australia.

Mr. Short has been the Chairman of Reforme Group since 2018 and the company now successfully operates the Frances Creek iron ore mine in the Northern Territory. Reforme, in conjunction with AusIndustry and the University of Adelaide, South Australia, has developed a ‘World-First’ ore sorting technology that allows low grade iron ore to be beneficiated to Direct Shipping Ore (DSO). Reforme holds the propriety technology rights for this beneficiation process and are now in talks with other industry groups who are interested in using this advanced technology to beneficiate their lower grade ore, making it amenable to offshore shipping. Reforme successfully entered into a working partnership with Anglo America in early 2020 which saw the first trial shipment of beneficiated ore leave Darwin Port in June 2021. Reforme, through their partnership with AusIndustry and the University of Adelaide, are commencing works on their second research and development project which is based on multiple commodity extraction from epithermal polymetallic Au, Ag, Co, Cu deposits. Reforme is a privately owned Australian company which is 30% owned by the Traditional Landowners. The company provides employment and upskilling opportunities to the local Northern Territory communities.

Additionally, Mr. Short is chairman and founder of the Nova Terra Institute. The Nova Terra Institute (“Nova Terra”) is an Australian research and development institute with a mission to address real-world problems by facilitating a synergistic collaboration between industry, academia, and other likeminded research organizations. By linking advanced science with practical applications, the not-for-profit aims to facilitate the creation of commercially viable solutions that address critical environmental concerns for the betterment of society and the protection of our planet. We foster collaboration and support the innovation efforts of Australian businesses and thought leaders, driving improvements in critical mineral recovery, mine waste rehabilitation, recycling, and renewable energy supplies.

Mr. Short is Chairman of Komodo Capital which is an Australian based, internationally focused corporate finance advisory firm which specializes in mergers and acquisitions. Komodo currently holds mandates with the Company to facilitate transactions in Australia.

Mr. Short holds a Bachelor of Physical Education and a Bachelor in Commerce from the University of Western Australia, a Graduate Diploma of Finance from Curtin University Western Australia, and is a member of the Australian Institute of Company Directors.

Michael Sander

Michael Sander, 61, has over thirty years of invaluable experience to the intersecting fields of technology, finance and real estate. As a seasoned strategist and investment professional, Mr. Sander has consistently demonstrated his ability to identify and capitalize on high-potential opportunities.

Throughout his career, Mr. Sander has played a pivotal role in closing numerous complex transactions, showcasing his talent for transforming promising ventures into tangible, value-added assets. His expertise spans multiple industries, encompassing various investment and ownership positions. Mr. Sander’s strength lies in his comprehensive understanding of the technology sector, coupled with his extensive experience in investment strategies, mergers and acquisitions, and sophisticated capital markets deal structuring. This unique combination of skills allows him to approach challenges with a multifaceted perspective, often uncovering innovative solutions where others see obstacles.

Mr. Sander acted as the Senior Managing Director at Sortis Capital from 2010 to 2016, where he focused on strategic planning and investor relations. Mr. Sander was then promoted to Managing Partner at Sortis Capital in 2022. Mr. Sander is currently a board advisor for Papaya Development, a real estate development and consulting company, and is also a current board member of TRILITY, a pharmaceutical manufacturing company.

Family Relationships

There are no family relationships among our executive officers and directors.

Election of Directors and Officers

All directors will hold office until the next annual meeting of the stockholders or until their successors have been elected and qualified. The officers of our Company are appointed by our Board and hold office until their death, resignation or removal from office.

Involvement in Certain Legal Proceedings

During the past ten years, except as set forth above, none of our directors, executive officers, promoters, control persons, or nominees have been:

| | ● | the subject of any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| | | |

| | ● | convicted in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| | ● | subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or any Federal or State authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; |

| | | |

| | ● | found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law; |

| | | |

| | ● | the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of (a) any Federal or State securities or commodities law or regulation; (b) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (c) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| | | |

| | ● | the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Committees of the Board

Due to the small size of the Company and its Board of Directors, we currently have no audit committee, compensation committee or nominations and governance committee of our board of directors. We do not have an audit committee financial expert.

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct (“Code of Ethics”) that applies to all of its directors, officers and employees. Any waiver of the provisions of the Code of Ethics for executive officers and directors may be made only by the Board of Directors. Any such waivers will be promptly disclosed to the Company’s shareholders. A copy of our Code of Ethics is attached as an exhibit to this Form 10-K and will be provided to any person requesting same without charge. To request a copy of our Code of Ethics please make written request to our Chief Executive Officer c/o M2i Global, Inc. at 885 Tahoe Blvd., Incline Village, NV 89451.

Changes in Nominating Procedures

None.

Item 11. Executive Compensation

EXECUTIVE COMPENSATION SUMMARY COMPENSATION TABLE

The Summary Compensation Table shows certain compensation information for services rendered in all capacities for the fiscal years ended November 30, 2024 and 2023. Other than as set forth herein, no executive officer’s salary and bonus exceeded $100,000 in any of the applicable years. The following information includes the dollar value of base salaries, bonus awards, the number of stock options granted and certain other compensation, if any, whether paid or deferred.

Summary Compensation

The particulars of compensation paid to the following persons:

| | (a) | our principal executive officers; and |

| | (b) | each of our two most highly compensated executive officers who were serving as executive officers at the end of the fiscal years ended November 30, 2024 and 2023; |

| Name and Principal Position | | Year | | | Stock

Awards

($) | | | Option

Awards

($) | | | All Other

Compensation

($) | | | Total

($) | |

| Douglas Cole | | | 2023 | | | | - | | | | - | | | | 496,833 | | | | 496,833 | |

| Executive Chairman, Chief Financial Officer, Former President and Chief Executive Officer(1) | | | 2024 | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Jeffrey W. Talley | | | 2023 | | | | - | | | | - | | | | 437,333 | | | | 437,333 | |

| Former President and Chief Executive Officer of U.S. Minerals and Metals, Corporation(2) | | | 2024 | | | | - | | | | - | | | | 131,000 | | | | 131,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| Alberto Rosende | | | 2023 | | | | - | | | | - | | | | 200,999 | | | | 200,999 | |

| President and Chief Executive Officer(3) | | | 2024 | | | | - | | | | - | | | | 268,000 | | | | 268,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ioanna Kallidou | | | 2023 | | | | - | | | | - | | | | 16,500 | | | | 16,500 | ) |

| Former President(4) | | | 2024 | | | | - | | | | - | | | | - | | | | - | |

(1) On December 11, 2023, Mr. Doug Cole resigned from the President and Chief Executive Officer roles of the Company but still maintains his roles as Executive Chairman and Chief Financial Officer.

(2) On December 11, 2023, Mr. Talley, was appointed as President and Chief Executive Officer of the Company. On August 23, 2024, the Company accepted Mr. Talley’s resignation as President and Executive Officer.

(3) On August 16, 2024, the Company appointed Mr. Alberto Rosende as Chief Executive Officer of the Company.

(4) Consists of a $35,000 salary and $14,000 bonus.

Agreements with Named Executive Officers

M2i and its subsidiaries entered into new agreements or amended existing agreements with its named executive officers. A summary of the compensation provided under such agreements is as follows:

| | 1. | On December 1, 2022, Jeffrey W. Talley and U.S. Minerals & Metals Corporation entered into a consulting agreement where Mr. Talley agreed to serve as president and chief executive officer of U.S. Minerals & Metals Corporation until the agreement is terminated. Mr. Talley is entitled to a consulting payment of $41,666.67 per month. His additional bonuses are determined by the Board of Directors. Mr. Talley resigned his positions as president and chief executive officer on August 23, 2024. |

| | 2. | On December 1, 2022, Douglas Cole and U.S. Minerals & Metals Corporation entered into a consulting agreement where Mr. Cole agreed to serve as executive chairman of U.S. Minerals Corporation until the agreement is terminated. Mr. Cole is entitled to a consulting payment of $41,666.67 per month. His additional bonuses are determined by the Board of Directors. On January 23, 2023, Douglas Cole and U.S. Minerals and Metals Corporation entered into a business development agreement where Mr. Cole agreed to serve as a Senior Strategic and Business Development Advisor for a term of 10 years to U.S. Minerals & Metals Corporation. For his services, Mr. Cole will receive, on January 2, 2024, and on the first business day of each year thereafter until and including the first business day of January 2033, 10,000,000 shares of the U.S. Minerals & Metals Corporation’s common stock, par value $.0001, as they may be adjusted from time to time on account of splits, consolidations, dividends and similar changes in exchange for a purchase price of $1,000. |

| | | |

| | 3. | On March 1, 2023, Alberto Rosende and U.S. Minerals & Metals Corporation entered into a consulting agreement where Mr. Rosende agreed to serve Vice President of Operations of U.S. Minerals & Metals Corporation until the agreement is terminated. Mr. Rosende is entitled to a consulting payment of $20,333.33 per month. His additional bonuses are determined by the Board of Directors. On August 16, 2024, Mr. Rosende entered into a consulting agreement where Mr. Rosende agreed to serve as president and chief executive officer of M2i Global, Inc. until the agreement is terminated. Mr. Rosende is entitled to a consulting payment of $41,666.67 per month. |

| | | |

| | 4. | Pursuant to the Agreement and Plan of Merger, dated as of May 12, 2023, and entered into by and among Inky, Inc. and U.S. M and M Acquisition Corp. and U.S. Minerals and Metals Corp., which is annexed hereto as exhibit 2.01 below, at the time of consummation of the merger, all shares of USMM were simultaneously converted into shares of M2i Global, Inc.’s common stock, and thus, any shares issued by USMM pursuant to the BDA or WSCA, as referenced above are now issued from M2i Global, Inc. |

There are no arrangements or plans in which we provide pension, retirement or similar benefits for our executive officers, except that our executive officers may receive stock options at the discretion of our board of directors.

Grants of Plan-Based Awards Table

We did not grant any awards to our named executive officers during our fiscal year ended November 30, 2024.

Compensation Plans

As of November 30, 2024, we did not have an equity compensation plan in place.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth for each named executive officer certain information concerning the outstanding equity awards as of November 30, 2024:

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| | | OPTION AWARDS | | | STOCK AWARDS | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#)

Un-exercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) | |

| Doug Cole | | | | | | | - | | | | - | | | $ | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Albert Rosende | | | | | | | - | | | | - | | | $ | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Compensation of Directors

The following compensation was provided to the directors of M2i who are not also named executive officers during the fiscal year ended November 30, 2024:

| Name | | Fees earned

or paid

in cash

($) | | | Stock Awards

($) | | | Option

Awards

($)(1) | | | Non-

Equity

Incentive

Plan

Compensation

($) | | | Nonqualified Deferred Compensation Earnings

($) | | | All Other Compensation($) Total

($) | |

| Douglas MacLellan | | | 50,000 | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Anthony Short | | | 40,000 | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Michael Sanders | | | 20,000 | | | | - | | | | - | | | | - | | | | - | | | | - | |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth information as of November 30, 2024 regarding the beneficial ownership of our Common Stock by (i) those persons who are known to us to be the beneficial owner(s) of more than 5% of our Common Stock, (ii) each of our directors and named executive officers, and (iii) all of our directors and executive officers as a group and of our preferred stock. Except as otherwise indicated, the beneficial owners listed in the tables below possess the sole voting and dispositive power in regard to such shares and have an address of c/o M2i Global, Inc. 885 Tahoe Blvd. Incline Village, NV 89451. As of November 30, 2024 there were 581,704,525 shares of our Common Stock outstanding. As of November 30, 2024 there were 100,000 shares of preferred stock issued and outstanding.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of our Common Stock subject to options, warrants, notes or other conversion privileges currently exercisable or convertible, or exercisable within 60 days of the date of this table, are deemed outstanding for computing the percentage of the person holding such option, warrant, note, or other convertible instrument but are not deemed outstanding for computing the percentage of any other person. Where more than one person has a beneficial ownership interest in the same shares, the sharing of beneficial ownership of these shares is designated in the footnotes to this table.

Beneficial Ownership of Common Stock

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | | Percent of Class | |

| Doug Cole, Executive Chairman and Chief Financial Officer* | | | 16,013,334 | (1) | | | 3 | % |

| Jeffrey W. Talley, President & Chief Executive Officer, resigned on August 30, 2024* | | | 0 | (2) | | | * | % |

| Alberto Rosende, President & Chief Executive Officer, appointed on August 30, 2024* | | | 0 | (3) | | | * | % |

| Douglas MacLellan, Director | | | 5,366,667 | | | | * | % |

| Anthony Short, Director | | | 0 | (4) | | | * | % |

| Michael Sander, Director | | | 3,025,000 | | | | * | % |

| Lyons Capital LLC | | | 61,999,000 | | | | 11 | % |

| Directors, Executive Officers and 5% or more of Common Stock as a Group (7 persons) | | | 86,404,0015 | | | | 15 | % |

| * | Represents ownership of less than 1% |

| (1) | This does not include 70,000,000 shares of Common Stock beneficially owned by The Cole Family Revocable Trust; and 10,000,000 shares of Common Stock beneficially owned by the Cole Family Trust of 2014 or Mr. Cole’s 100,000 shares of preferred stock. Mr. Cole does not have any control over the trust, including no voting power and no power to dispose of the shares. |

| (2) | This does not include 50,000,000 shares of Common Stock beneficially owned by The Talley Family Revocable Trust. Mr. Talley does not have any control over the trust, including no voting power and no power to dispose of the shares. |

| (3) | This does not include 18,000,000 shares of Common Stock beneficially owned by Rosende Quattro LLC of which Mr. Rosende is the managing member. |

(4) | This does not include 25,000,000 shares of Common Stock beneficially owned by Reforme Group Investments PTYLTD, beneficially owned by Anthony Short |

Beneficial Ownership of Preferred Stock

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership of Preferred Stock | | | Percent of Class | |

| Doug Cole, Executive Chairman and Chief Financial Officer | | | 100,000 | (1) | | | 100 | % |

| Directors and Executive Officers as a Group (1 person) | | | 100,000 | | | | 100 | % |

| (1) | Mr. Cole holds 100,000 shares of preferred stock. This does not include 70,000,000 shares of Common Stock beneficially owned by The Cole Family Revocable Trust; and 10,000,000 shares of Common Stock beneficially owned by the Cole Family Trust of 2014. Mr. Cole does not have any control over the trust, including no voting power and no power to dispose of the shares. |

Item 13. Certain Relationships and Related Transactions and Director Independence

Certain Relationships and Related Transactions

During May 2023, the Company’s former CEO, Ioanna Kallidou, forgave liabilities totaling $146,593 consisting of accrued payroll and a related party loan. As a result of the forgiveness, a contribution was recorded to additional paid in capital during May 2023. As of the fiscal year ended November 30, 2024, no balances were due to Ioanna Kallidou.

During the fiscal year ended November 30, 2023, the Company’s former CEO loaned the Company $8,319. The balance was unsecured, non-interest bearing, and did not have a maturity date. During May 2023, the loans, totaling $81,093, were forgiven.

Under the terms of a consulting agreement with the Company’s Executive Chairman and CFO, the Company is obligated to compensate him $43,667 per month, consisting of $41,667 in consulting fees and a $2,000 monthly allowance. During the fiscal year ended November 30, 2024, the Company incurred $524,000 in expenses related to the consulting agreement, of which $203,667 was repaid by the Company. At the fiscal year ended November 30, 2024, $393,000 remained unpaid under the agreement.

Under the terms of a consulting agreement with the Company’s President and Chief Executive Officer, the Company is obligated to compensate him $43,667 per month, consisting of $41,667 in consulting fees and a $2,000 monthly allowance. This agreement replaced a former agreement wherein the consultant agreed to serve as Vice President-Operations for $22,333.33 per month, consisting of $20,833.33 in consulting fees and a $1,500 monthly allowance. During the fiscal year ended November 30, 2024, the Company incurred $353,333 in expenses related to the consulting agreement, of which $268,000 was repaid by the Company. At the fiscal year ended November 30, 2024, $85,833 remained unpaid under the agreement.

During the fiscal year ended November 30, 2023, the Company entered into a loan agreement with the Company’s Executive Chairman. The loan, which bears interest at 7%, is due on demand. During the fiscal years ended November 30, 2024 and 2023, the Executive Chairman loaned the Company $127,500 and $600,000, respectively. During the fiscal year ended November 30, 2024, the Company repaid $691,500 to the CFO. At the fiscal years ended November 30, 2024 and 2023, the amount due to the Executive Chairman was $36,050 and $600,000, respectively. This loan is recorded as a related party loan on the balance sheet. During the fiscal years ended November 30, 2024 and 2023, the Company recorded accrued interest of $31,761 and $6,781, respectively. During the fiscal year ended November 30, 2024, the Company repaid $17,352 interest. At the fiscal year ended November 30, 2024, accrued interest payable due to the loans from the Executive Chairman totaled $21,190.

Director Independence

We currently do not have any directors who are “independent” as defined under the NASDAQ Marketplace Rules.

Item 14. Principal Accountant Fees and Services

TAAD, LLP (“TAAD”) served as the independent registered public accounting firm to audit our books and accounts for the fiscal year ending November 30, 2024.

Turner, Stone & Company, LLP (“Turner Stone”) served as the independent registered public accounting firm to audit our books and accounts for the fiscal year ending November 30, 2023.

The table below presents the aggregate fees billed for professional services rendered by Turner Stone and TAAD, LLP for the fiscal years ended November 30, 2024 and 2023.

| Fees | | | 2024 | (1)* | | | 2023 | (2) |

| Audit Fees | | $ | [ ] | | | $ | 70,500 | |

| Audit Related Fees | | | [ ] | | | | - | |

| Tax Fees | | | - | | | | - | |

| Other Fees | | | - | | | | - | |

| Total Fees | | $ | [ ] | | | $ | 70,500 | |

*At the time of the filing of this annual report on Form 10-K, the total fees billed for professional services by TAAD, LLP have not yet been determined.

| | (1) | Represents aggregate fees charged by TAAD, LLP for audit of the Company’s financial statements for the fiscal year ended November 30, 2024. |

| | (2) | Represents aggregate fees charged by Turner Stone for audit of the Company’s financial statements for the fiscal year ended November 30, 2023 and for subsequent reviews of the Company’s financial statements for the quarters ending February 29, 2024, May 31, 2024, and August 31, 2024.. |

In the above table, “audit fees” are fees billed for services provided related to the audit of our annual financial statements, quarterly reviews of our interim financial statements, and services normally provided by the independent accountant in connection with regulatory filings or engagements for those fiscal periods. “Audit-related fees” are fees not included in audit fees that are billed by the independent accountant for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements. These audit-related fees also consist of the review of our registration statements filed with the SEC and related services normally provided in connection with regulatory filings or engagements. “All other fees” are fees billed by the independent accountant for products and services not included in the foregoing categories.

PART IV

Item 15. Exhibits and Financial Statement Schedules

| 1) | The consolidated financial statements contained herein are as listed on the “Index to Consolidated Financial Statements” on page F-1 of this report. |

| 2) | The consolidated financial statement schedule contained herein is as listed on the “Index to Consolidated Financial Statements” on page F-1 of this report. All other schedules have been omitted because they are not applicable, not required, or the information is included in the consolidated financial statements or notes thereto. |

| Exhibit Number | | Description |

| 2.01 | | Agreement and Plan of Merger, dated as of May 12, 2023 and entered into by and among Inky, Inc. and U.S. M and M Acquisition Corp. and U.S. Minerals and Metals Corp. (incorporated by reference to Exhibit 2.01 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.1 | | Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.2 | | Certificate of Amendment to the Certificate of Incorporation of Inky Inc. dated May 8, 2023 (incorporated by reference to Exhibit 3.2 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.3 | | Articles of Merger dated as of May 18, 2023 (incorporated by reference to Exhibit 3.3 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.4 | | Certificate of Amendment to Articles of Incorporation dated June 8, 2023- Name Change (incorporated by reference to Exhibit 3.4 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.5 | | Certificate of Designation of Series A Super-Voting Preferred Stock (incorporated by reference to Exhibit 3.5 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 3.6 | | Bylaws (incorporated by reference to Exhibit 3.6 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.1 | | Consulting Agreement with Jeffrey Talley (incorporated by reference to Exhibit 10.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.2 | | Business Development Agreement with Lyons Capital LLC dated February 23, 2023 (incorporated by reference to Exhibit 10.2 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.3 | | Wall Street Conference Business Development Agreement with Lyons Capital LLC dated February 23, 2023 (incorporated by reference to Exhibit 10.3 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 10.4 | | Business Development Agreement with Doug Cole dated January 23, 2023 (incorporated by reference to Exhibit 10.4 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 14.1 | | Code of Business Conduct and Ethics (incorporated by reference to Exhibit 14.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 21.1 | | List of Subsidiaries (incorporated by reference to Exhibit 21.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on December 7, 2023) |

| 31.1* | | Certification of Principal Executive Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act, as amended. |

| 31.2* | | Certification of Principal Financial Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act, as amended. |

| 32.1** | | Certification of Principal Executive Officer and Principal Financial Officer pursuant to Rules 13a-14(b) or 15d-14(b) of the Securities Exchange Act, as amended, and 18 U.S.C. Section 1350. |

| 101.INS | | Inline XBRL Instance Document. |

| 101.SCH | | Inline XBRL Taxonomy Extension Schema Document. |

| 101.CAL | | Inline XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document. |

| 101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

| * | Filed herewith. |

| | |

| ** | Furnished herewith. |

Item 16. Form 10-K Summary

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| M2I GLOBAL, INC. | | |

| | | |

| Date: February 27, 2025 | By: | /s/ Alberto Rosende |

| | | Alberto Rosende Chief Executive Officer |

| | | (Principal Executive Officer) |

In accordance with the Exchange Act, this Report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Signature | | Title | | Date |

| | | | | |

| /s/ Doug Cole | | Chief Financial Officer and Executive Chairman | | February 27, 2025 |

| Doug Cole | | (Principal Financial Officer) | | |

| Signature | | Title | | Date |

| | | | | |

| /s/ Alberto Rosende | | Chief Executive Officer | | February 27, 2025 |

| Alberto Rosende | | (Principal Executive Officer) | | |

M2i GLOBAL, INC.

FINANCIAL STATEMENTS

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Stockholders

M2i Global, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheet of M2i Global, Inc. (the “Company”) as of November 30, 2024, and the related consolidated statements of operations, changes in stockholders’ (deficit) equity and cash flows for the year in the period ended November 30, 2024, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of November 30, 2024, and the results of its operations and its cash flows for the year in the period ended November 30, 2024, in conformity with accounting principles generally accepted in the United States of America.

Going Concern