Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to _____________

Commission File No. 000-56590

TANCHENG GROUP CO., LTD.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | | 38-4086827 |

| (State or Other Jurisdiction of | | (I.R.S. Employer |

| Incorporation or Organization) | | Identification No.) |

No. 32 Hexizhuang Village, Huili Township, Jiaocheng County

Lvliang City, Shanxi Province, P.R. China 030500

(Address of Principal Executive Offices)

(+86) 139-1097-2765

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☒

As of June 30, 2023, the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of $0.46 per share) was approximately $50,600. Shares of the registrant’s common stock held by each executive officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There was a total of 4,381,550 shares of the registrant’s common stock outstanding as of March 29, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TANCHENG GROUP CO., LTD.

TABLE OF CONTENTS

INTRODUCTORY NOTE

Special Note Regarding Forward Looking Statements

Statements made in this Form 10-K that are not historical or current facts are “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 (the “Act”) and Section 21E of the Securities Exchange Act of 1934. These statements often can be identified by the use of terms such as “may”, “will”, “expect”, “believe”, “anticipate”, “estimate”, “approximate” or “continue”, or the negative thereof. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management's best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Financial information contained in this report and in our financial statements is stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Use of Certain Defined Terms

In addition, unless the context otherwise requires and for the purposes of this report only, references to:

| | • | “we,” “us,” “our,” “the Company” or “our company,” are to the combined business of Tancheng Group Co., Ltd., a Nevada corporation, and its subsidiaries; |

| | | |

| | • | “Tancheng Group” are to Tancheng Group Co., Ltd., a Nevada corporation; |

| | | |

| | • | “Qiansui International” are to Qiansui International Group Limited, a Cayman Islands exempted company and wholly-owned subsidiary of Tancheng Group Co., Ltd.; |

| | | |

| | • | “Qiansui HK” are to Qiansui (Hong Kong) Holdings Limited, a Hong Kong company and wholly-owned subsidiary of Qiansui International Group Limited; |

| | | |

| | • | “Qiansui Consulting” are to Shanxi Qiansui Tancheng Culture Consulting Co., Ltd., a PRC company and wholly-owned subsidiary of Qiansui (Hong Kong) Holdings Limited; |

| | | |

| | • | “Qiansui Media” are to Shanxi Qiansui Tancheng Culture Media Co., Ltd., a PRC company and wholly-owned subsidiary of Shanxi Qiansui Tancheng Culture Consulting Co., Ltd.; |

| | | |

| | • | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| | | |

| | • | “China” and “PRC” refer to the People’s Republic of China; |

| | | |

| | • | “Renminbi” and “RMB” refer to the legal currency of China; |

| | | |

| | • | “U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States; |

| | • | “SEC” are to the U.S. Securities and Exchange Commission; |

| | | |

| | • | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; and |

| | | |

| | • | “Securities Act” are to the Securities Act of 1933, as amended. |

Disclosures Related to Our China-Based Operations

Tancheng Group Co., Ltd. is a Nevada holding company which conducts its operations in China through its PRC subsidiaries (our corporate group does not include any variable interest entities). The Company faces various legal and operational risks and uncertainties as a company with substantial operations in China. The PRC government has significant authority to exert influence on the ability of a company with substantial operations in China, like us, to conduct its business, accept foreign investments or be traded on the U.S. OTC markets. For example, we face risks associated with PRC regulatory approvals of offshore offerings, anti-monopoly regulatory actions, cybersecurity, data privacy and from U.S. regulators if there is a lack of inspection from the U.S. Public Company Accounting Oversight Board, or PCAOB, on our auditors, and in various risk factors in this section. The PRC government may also intervene with or influence our operations as the government deems appropriate to further regulatory, political and societal goals. The PRC government publishes from time to time new policies that can significantly affect our industry in which we operate and we cannot rule out the possibility that it will in the future further release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Any such action, once taken by the PRC government, could cause the value of our common stock to significantly decline or in extreme cases, become worthless.

Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCAA if the SEC determines that an issuer has filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit its shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. Neither our current auditor, Onestop Assurance PAC, headquartered in Singapore, or our former auditor, Mac Accounting Group, LLP, was on the list. Further, we have never been listed as a Commission-Identified Issuer under the HFCAA following the filing of our annual report on Form 10-K for the fiscal year ended July 31, 2022, because our former auditor, Mac Accounting Group, LLP, who audited our financial statements included in such annual report, is headquartered in Utah, the United States. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. We do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this Annual Report on Form 10-K. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. Notwithstanding, as our current auditor, Onestop Assurance PAC, is headquartered in Singapore, we expect that it will remain subject to complete inspection and investigation by PCAOB in the foreseeable future, and thus, that the risk of our shares being prohibited from trading pursuant to the HFCAA is low. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 10-K for the relevant fiscal year. In accordance with the HFCAA, as amended, our securities would be prohibited from being traded on a national securities exchange or in the over-the-counter trading market in the United States if we are identified as a Commission-Identified Issuer for two consecutive years in the future. A prohibition of being able to trade in the United States would substantially impair your ability to sell or purchase our common stock when you wish to do so, and the risk and uncertainty associated with delisting would have a negative impact on the price of our common stock. Also, such a prohibition would significantly affect our ability to raise capital on terms acceptable to us, or at all, which would have a material adverse impact on our business, financial condition, and prospects.

Permissions, Approvals, Licenses and Permits Required from the PRC Authorities for Our Operations and for the Offering of Our Securities to Foreign Investors

We conduct our business primarily through our subsidiary, Qiansui Media, in China. Our operations in China are governed by PRC laws and regulations. As of the date of this Annual Report, Qiansui Media has obtained the requisite permissions, approvals, licenses and permits from the PRC government authorities that are material for its business operations, including:

| License/Permit/Approval/Permission | Business License |

| Issuing Authority | Jiaocheng County Market Supervision Administration |

| Issuance Date | February 28, 2022 |

| Operational Term | June 14, 2017 through June 13, 2037 |

| Scope of Operation | LICENSED PROJECT: Residential interior decoration. (Projects subject to approval can only be carried out after being approved by relevant governmental agencies. Specifically approved business projects are governed by the approval documents or specific licenses of relevant agencies). GENERAL PROJECTS: organizing cultural and artistic exchange activities; internet sales (except for sale of products that require approvals); corporate image planning; graphic design and production; advertisement production; advertising design, agency; advertising release (radio station, TV station, newspaper publishers); technical service, technical development, technical consultation, technical exchange, technology transfer, technology promotion; professional design service; planning and consulting of tourism development projects; management of scenic spots; manufacturing of arts and crafts and etiquette items (except ivory and its products); sales of arts and crafts and etiquette items (except ivory and its products); catering management. (Except for projects subject to approval, the company can independently carry out business activities according to law with a business license) |

No such material permission or approval has been denied.

Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional requisite permissions, approvals, licenses, permits and filings for the operation of our business in the future.

Furthermore, under currently effective PRC laws, regulations and regulatory rules, as of the date of this report, we are not currently required to obtain permissions from the China Securities Regulatory Commission (the “CSRC”), and we have not received any formal notice from any PRC authority indicating that we should apply for or are otherwise subject to cybersecurity review or security assessment. In addition, we have not been asked to obtain such permissions by any PRC authority or received any denial to do so. However, the PRC government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. The CSRC published the Trial Measures and Listing Guidelines on February 17, 2023, designed to regulate overseas securities offerings by PRC domestic companies. On February 24, 2023, the CSRC, together with the Ministry of Finance, National Administration of State Secrets Protection and National Archives Administration of China, revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing, which were issued by the CSRC and National Administration of State Secrets Protection and National Archives Administration of China in 2009, or the “Provisions.” The revised Provisions were issued under the title the “Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies,” and came into effect on March 31, 2023 together with the Trial Measures.

Given the recent nature of the introduction of the above Trial Measures, Listing Guidelines, and revised Provisions, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. Notwithstanding the foregoing, as of the date of this report, we are not aware of any PRC laws or regulations in effect requiring that we obtain permission from any PRC authorities to issue securities to foreign investors, and we have not received any inquiry, notice, warning, or sanction from the CSRC, the CAC, or any other PRC authorities that have jurisdiction over our operations.

Cash Flows Through Our Organization

Tancheng Group Co., Ltd. is a Nevada incorporated holding company with no material operations of its own. We conduct our operations primarily in China through our PRC subsidiary Qiansui Media. Tancheng Group indirectly owns all of the equity interests of Qiansui Media, through offshore intermediate holding companies (namely Cayman-incorporated Qiansui International, and Hong Kong-incorporated Qiansui HK).

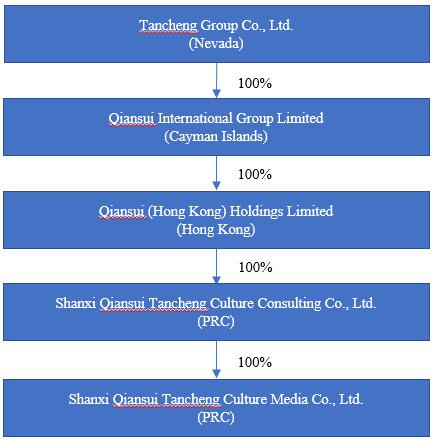

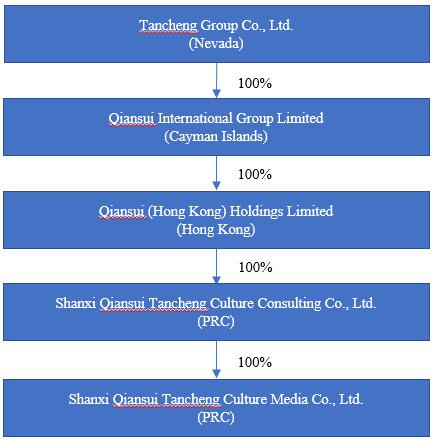

The chart below presents our corporate structure as of the date of this report:

Cash may be transferred among Tancheng Group and its subsidiaries in the following manners: (1) funds may be transferred to Qiansui Consulting (“the WFOE”) from Tancheng Group as needed through our subsidiaries in the Cayman Islands and/or Hong Kong in the form of capital contribution or shareholder loan, as the case may be; (2) dividends or other distributions may be paid by the WFOE to Tancheng Group through our subsidiaries in Hong Kong and the Cayman Islands; and (3) our PRC subsidiaries may lend to and borrow from each other from time to time for business operation purposes. Tancheng Group, our subsidiaries in Cayman Islands and Hong Kong are permitted under PRC laws and regulations to provide funding to our PRC subsidiaries in the form of loans or capital contributions, provided that the applicable governmental registration and approval requirements are satisfied. In the future, cash proceeds raised from financings conducted outside of China may be transferred by Tancheng Group to our PRC subsidiaries via capital contribution or shareholder loans, as the case may be. As a holding company, Tancheng Group may rely on dividends and other distributions on equity paid by our PRC operating subsidiaries for its cash and financing requirements. Current PRC regulations permit Chinese companies to distribute dividends only out of their accumulated profits, and additionally, PRC companies are required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of the company’s registered capital. Funds under such reserve are not distributable as cash dividends. The articles of association of each of our PRC subsidiaries contain provisions that incorporate the foregoing legal restrictions on distribution of dividends under PRC regulations. In addition, if any of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends. None of our subsidiaries has made any dividends or other distributions to Tancheng Group as of the date of this report. As of the date of this report, neither Tancheng Group nor its subsidiaries have made any dividend or distribution to U.S. investors. Tancheng Group and its subsidiaries currently do not have plans to distribute earnings in the foreseeable future.

As of the date of this report, there were no cash flows among Tancheng Group, our Nevada holding company, and its subsidiaries. The PRC regulations allow using cash generated from one PRC subsidiary to fund another PRC subsidiary’s operations. Currently, other than complying with the applicable PRC laws and regulations, we do not have our own cash management policy and procedures that dictate how funds are transferred. While there are currently no restrictions on foreign exchange and our ability to transfer cash or assets among Tancheng Group, the Cayman subsidiary and the Hong Kong subsidiary, if certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future were to become applicable to our Hong Kong subsidiary in the future, and to the extent our cash or assets are in Hong Kong or the Hong Kong Subsidiary, such funds or assets may not be available due to interventions in or the imposition of restrictions and limitations on our ability to transfer funds or assets by the PRC government. Furthermore, we cannot assure you that the PRC government will not intervene or impose restrictions on Tancheng Group and its subsidiaries to transfer or distribute cash within the organization, which could result in an inability of or prohibition on making transfers or distributions to entities outside of mainland China and Hong Kong, which may adversely affect our business, financial condition and results of operations.

Summary of Risk Factors

| | • | Because all of the Company’s operations are in China, the Company’s business is subject to the complex and rapidly evolving laws and regulations there. The Chinese government may exercise significant oversight and discretion over the conduct of the Company’s business and may intervene in or influence the Company’s operations at any time, which could result in a material change in the Company’s operations and/or the value of the Common stock. |

| | | |

| | • | The PRC government has increasingly strengthened oversight in offerings conducted overseas or on foreign investment in China-based issuers, which could result in a material change in our operations and our common stock could decline in value or become worthless. |

| | | |

| | • | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on the Company’s business and operations. |

| | • | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against the Company or its management based on foreign laws. |

| | | |

| | • | The recent joint statement by the SEC, and an act passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to U.S.-listed companies with significant operations in China. These developments could add uncertainties to our continued trading on the OTC markets, future offerings, business operations, share price and reputation. |

| | | |

| | • | U.S. regulatory bodies may be limited in their ability to conduct investigations or inspections of the Company’s operations in China. |

| | | |

| | • | Failure to effectively expand our sales and marketing capabilities could harm our ability to increase our customer base and achieve broader market acceptance of our products. |

| | | |

| | • | The recreational and tourism projects operate in a competitive industry and their revenues, profits or market share could be harmed if they are unable to compete effectively. |

| | | |

| | • | Our common stock is quoted on the OTC market, which may have an unfavorable impact on our stock price and liquidity. |

| | | |

| | • | We are subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock. |

| | | |

| | • | We do not intend to pay dividends for the foreseeable future. |

| | | |

| | • | Our largest stockholder holds a significant percentage of our outstanding voting securities and may be able to control our management and affairs. |

PART I

ITEM 1. BUSINESS.

Tancheng Group Co., Ltd. (formerly Bigeon), or Tancheng Group, was incorporated under the laws of Nevada on June 19, 2018. It remained a shell company until the completion of acquiring Qiansui International Group Limited, a Cayman Islands exempted company (“Qiansui International”), and Qiansui International’s subsidiaries on March 20, 2023, pursuant to a contribution agreement (the “Contribution Agreement”) entered into by and among Tancheng Group, and holders of 100% of the outstanding ordinary shares of Qiansui International who also held 79.9% of Tancheng Group’s outstanding common stock then (the “Contributors”). In accordance with the Contribution Agreement, the Contributors contributed all of their interests in Qiansui International to Tancheng Group (the “Contribution”).

Qiansui International was incorporated in the Cayman Islands on June 7, 2022. Qiansui (Hong Kong) Holdings Limited (“Qiansui HK”) was incorporated on July 21, 2022 in the Hong Kong SAR. Qiansui HK wholly owns Shanxi Qiansui Tancheng Culture Consulting Co., Ltd. (“Qiansui Consulting”) which was established on December 12, 2022 in the PRC. Qiansui Consulting is a wholly owned foreign entity, or WFOE, under PRC law. Qiansui Consulting wholly owns Shanxi Qiansui Tancheng Culture Media Co., Ltd. (“Qiansui Media”), which was established on June 14, 2017 in the PRC. Qiansui Consulting acquired Qiansui Media on December 28, 2022. Qiansui HK and Qiansui Consulting are intermediary holding companies. Qiansui International conducts its operations through Qiansui Media.

Following the consummation of the Contribution, our company, through its wholly owned PRC subsidiary Qiansui Media, has been engaged in the business of selling ornament and adornment products related to “Jue Cheng” culture and creating cultural tourism programs. Located in close proximity to PangQuanGou National Nature Reserve in Jiaocheng County, Shanxi Province, China, Qiansui Media has leveraged the rich heritage of “Jue Cheng” culture to develop innovative peripheral cultural products and large-scale recreational tourism projects.

On April 11, 2023, the holder of Tancheng Group, representing approximately 97% voting power of the total issued and outstanding capital stock of Tancheng Group, acting by written consent, approved a Certificate of Amendment to Articles of Incorporation (the “Certificate of Amendment”) to increase the number of shares of common stock that Tancheng Group is authorized to issue from 75,000,000 shares to 1,000,000,000 shares. The Company filed the Certificate of Amendment with the Secretary of State of the State of Nevada on April 11, 2023.

Our revenues were $1,969,094 and $590,306 for the years ended December 31, 2023 and 2022, respectively. Our net loss was $289,666 and $1,010,923 for the respective periods. These conditions raise substantial doubt about our ability to continue as a going concern.

Products and Services

The Company’s primary source of revenue in the fiscal years ended December 31, 2023 and 2022 was the sale of self-designed ornament and adornment products through its online store.

Currently, the Company’s ornament and adornment products for sale mainly include:

1. Silver-Plated Platinum Jewelry Pendant

Material: Silver, platinum, inlaid with natural jade.

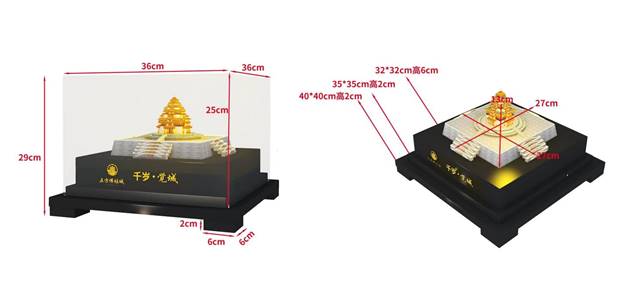

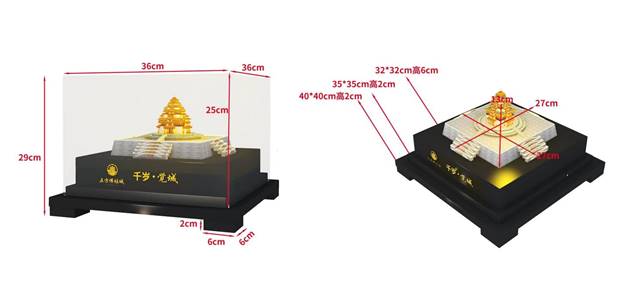

2. “Jue Cheng” Ornament

Material: Copper, gold and polymer nanomaterials

3. Chinese Twelve Zodiac Pendants

Material: Rhodium, gold, silver, copper, zinc, nickel and natural gemstones

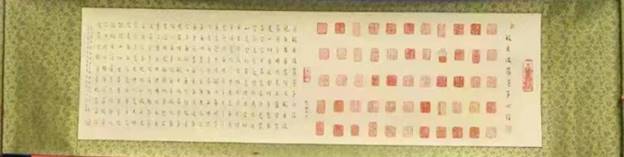

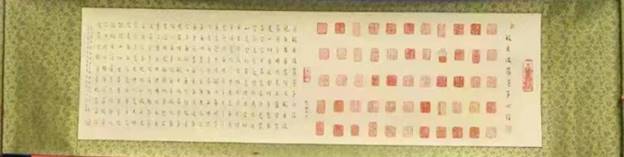

4. Master Hongyi’s Heart Sutra

Certifications

(1) Environmental management system certification

On May 26, 2022, Qiansui Media obtained the “Environmental Management System Certification” issued by Shanxi Lingtuo Certification Co., Ltd. The license number is LTC001-2022E0273, valid until May 25, 2025. The scope of business covered includes sales of arts and crafts (except ivory and its products) and related environmental management activities.

(2) China Occupational Health and Safety Management System Certification

On May 26, 2022, Qiansui Media obtained the “China Occupational Health and Safety Management System Certification” issued by Shanxi Lingtuo Certification Co., Ltd. The license number is LTC001-2022S0265, valid until May 25, 2025. The scope of business covered includes sales of arts and crafts (except ivory and its products) and related occupational health and safety management activities.

(3) Quality management system certification (ISO9001)

On May 26, 2022, Qiansui Media obtained the “Quality Management System Certification (ISO9001)” issued by Shanxi Lingtuo Certification Co., Ltd. The license number is LTC001-2022Q0395, valid until May 25, 2025. The scope of business covered includes sales of arts and crafts (except ivory and its products).

Growth Strategies

We intend to pursue the following growth strategies:

| | · | Explore and develop “Jue Cheng” culture. The Company plans to invest in research and development to better understand the “Jue Cheng” culture, including its history, traditions, and symbolism. This could involve collaborating with experts in the field to gain insights into “Jue Cheng” culture’s rich heritage. The Company could then use this knowledge to create authentic cultural experiences that resonate with visitors and consumers. |

| | | |

| | · | Develop high-quality innovative peripheral cultural products. The Company plans to focus on developing a wide range of cultural products that appeal to different tastes and preferences. These could include arts and crafts, food and beverages, clothing and accessories, and other merchandise that incorporate “Jue Cheng” culture. |

| | | |

| | · | Develop large-scale recreational tourism projects. The Company intends to partner with local governments and other entities to develop large-scale recreational tourism projects that showcase the beauty and charm of “Jue Cheng” culture. This could include a variety of cultural performances, celebrations and other events that immerse visitors in “Jue Cheng” culture. The Company plans to hold traditional dance performances, music concerts, festivals, exhibitions, Buddhism mediation courses, Chinese studies, Chinese medicine health programs and other cultural activities to offer a unique cultural experience. |

| | | |

| | · | Construct and manage “Qiansui Jue Cheng” health resort town. The Company intends to build a health resort town that offers visitors a holistic and rejuvenating experience based on “Jue Cheng” culture. The town could feature state-of-the-art wellness facilities, such as meditation or short-term retreat centers and other wellness amenities, as well as upscale accommodations, dining options, and recreational activities that highlight the local culture and natural beauty of the region. |

Competitive Strengths

| | · | Strategic location near a natural reserve. The Company's location near PangQuanGou National Nature Reserve in Jiaocheng County, Shanxi Province, China, provides a unique competitive advantage. The beautiful natural environment surrounding the reserve makes it an attractive destination for tourists seeking to escape the hustle and bustle of city life. The Company aims to capitalize on this advantage by developing sustainable tourism initiatives that showcase the natural beauty of the region and promote eco-friendly practices. |

| | | |

| | · | Rich cultural heritage and tourism resources. The region surrounding the Company’s location is steeped in rich historical and cultural heritage, offering a wealth of tourism resources that the Company could leverage to develop cultural products, organize cultural events and create tourism packages that highlight the unique traditions and customs of the area. |

| | | |

| | · | Innovative and entrepreneurial management. The Company’s management team is highly innovative and entrepreneurial, constantly seeking new opportunities and ways to grow the business. This is essential for the Company to maintain its competitive edge. The Company’s management strives to stay at the forefront of the health and tourism sectors by prioritizing customer-centricity and investing in and creating new products and services that meet customers’ evolving needs. |

Customers

Currently, the Company's customer base primarily consists of individual consumers who make small, individual purchases.

Once the Company’s tourism projects are in place, it plans to welcome a diverse range of visitors from all walks of life, including school students, adventurous adults, health-conscious seniors, families, couples and businesspeople. The Company's focus on cultural heritage and natural beauty will make it an attractive destination for those seeking an educational and enriching experience, as well as those who simply want to relax and unwind. In addition, the Company’s location near Taiyuan City, a major transportation hub, will make it an ideal stopover for travelers passing through the area.

Suppliers

Qiansui Media relied heavily on its largest suppliers, which are jewelry design and manufacturing firms, for the majority of its purchase costs in the fiscal years ended December 31, 2023 and 2022. Specifically, in 2023, approximately 99.57% of Qiansui Media’s total purchase costs were attributed to one supplier, while in 2022, approximately 77% of Qiansui Media’s total purchase costs were attributed to one supplier.

Sales and Marketing

The Company plans to engage in the following marketing tactics and strategies to increase its brand awareness and appeal to a broad audience:

| | · | Direct marketing by in-house marketing team. The Company plans to establish a dedicated marketing team responsible for project promotion, sales, and other marketing initiatives. To increase customer awareness, the team will adopt a multi-channel approach that includes print and digital advertising in strategic tourist centers and other densely-populated areas, conducting telemarketing campaigns and low-price promotions. The Company also plans to set up reception service points in Taiyuan Wusu International Airport, Taiyuan Railway Station, Lvliang Railway Station and other nearby transportation hubs and provide ticket purchase services to travelers. These strategies are designed to generate interest and awareness among potential customers, and to build momentum for the Company’s tourism projects. |

| | | |

| | · | Company website. To optimize the Company website’s impact, the Company plans to assign dedicated personnel to manage website maintenance and updates in real-time. In addition, the Company intends to work closely with key tourism bureaus such as Shanxi Provincial Tourism Bureau, Lvliang Tourism Bureau and Jiaocheng County Tourism Bureau, as well as online travel platforms like China Tourism Network, Sina Travel Network, Sohu Travel Network, NetEase Travel Network, Ctrip.com and eLong.com to increase the Company’s visibility and drive traffic to the Company website. Additionally, the Company aims to improve the user experience by enhancing website accessibility and functionality, and by providing online services such as booking and sales. The Company also intends to implement a comprehensive SEO strategy that helps the Company improve its search engine ranking and attract more visitors to the website. |

| | · | Smart tourism and mobile technology. The Company plans to take advantage of the growing trend of smart tourism and mobile technology by offering direct sales through a range of mobile channels, including WeChat, Sina Weibo, and QR codes. To build excitement and engagement during the tourist peak season, the Company plans to send targeted SMS messages to consumers with event notices and direct offers for discounted electronic tickets or scenic spot coupons. To ensure that customers stay informed of the latest promotions and developments, the Company intends to maintain an active presence on social media platforms such as Weibo and WeChat and offer regular updates and special offers. |

| | | |

| | · | Exhibitions. The Company plans to attend travel fairs, expositions, and other industry events to reach potential customers. These events will provide an ideal platform to showcase the Company’s tourism projects through interactive presentations, marketing videos and photos, and other creative activities. To generate interest and drive sales, the Company intends to offer special discounts and incentives, as well as distribute travel brochures and postcards to potential customers. For example, Qiansui Media attended the “12th Expo Central China” and its “Qiansui Jue Cheng Health, Culture and Tourism Comprehensive Resort Town Project” was showcased in this expo. |

Partnerships

The Company is dedicated to making a positive impact in the local community and has partnered with Taiyuan University of Science and Technology to establish the “Qiansui Scholarship” program. This program provides financial support to qualified students, helping to promote education and create opportunities for success.

Research and Development

In addition to its existing products, the Company continues to develop new products and offerings to fulfill the evolving customer needs. The Company’s research and development efforts are an essential part of its operations and the core competitive strength. Based on the “Zhan Jue Cheng” theme, Qiansui Media has developed a series of periphery products in recent years.

Intellectual Property

The Company relies on a combination of trade secrets, know-how, trademarks and other contractual rights to establish and protect its proprietary rights in its intellectual property. As of the date of this Annual Report, Qiansui Media has thirty-three (33) registered trademarks for “千岁觉城” under different categories.

Competition

China’s tourism industry is highly fragmented with a large number of industry players. Competitors in this sector compete on a variety of factors, including:

| · | price; |

| | | |

| · | quality and visitor experience; |

| | | |

| · | reputation; |

| | | |

| · | technology (companies that offer a seamless and convenient booking experience are often able to gain a competitive advantage over their rivals); and |

| | | |

| · | Sales and marketing effectiveness. |

Employees

As of December 31, 2023, we had approximately 17 full-time employees. The following table illustrates the allocation of these employees among the various job functions conducted at our company.

| Function: | | | |

| | | Number | | | % of total | |

| | | | | | | |

| Management | | | 1 | | | | 6% | |

| Human Resources | | | 2 | | | | 12% | |

| Finance | | | 3 | | | | 18% | |

| Administration | | | 5 | | | | 29% | |

| Logistics | | | 2 | | | | 12% | |

| Products | | | 4 | | | | 24% | |

| | | | | | | | | |

| Total | | | 17 | | | | 100.0% | |

We believe that our relationship with our employees is good. Our Chinese subsidiaries have trade unions which protect employees’ rights, aim to assist in the fulfillment of our economic objectives, encourage employee participation in management decisions and assist in mediating disputes between us and union members. We have not experienced any significant problems or disruption to our operations due to labor disputes, nor have we experienced any difficulties in recruitment and retention of experienced staff. The remuneration payable to employees includes basic salaries and allowances. We also provide training for our staff from time to time to enhance their technical knowledge.

As required by applicable Chinese law, we have entered into employment contracts with all of our officers, managers and employees.

Under the Social Insurance Law of the PRC, all employees are required to participate in basic pension insurance, basic medical insurance schemes and unemployment insurance, which must be contributed by both the employers and the employees. All employees are required to participate in work-related injury insurance and maternity insurance schemes, which must be contributed by the employers. Employers are required to complete registrations with local social insurance authorities. Moreover, the employers must timely make all social insurance contributions. 13 of Qiansui Media’s 17 employees participate in the basic pension insurance, basic medical insurance, unemployment insurance, work-related injury insurance and maternity insurance schemes.

Pursuant to PRC regulations on the Housing Provident Fund, enterprises are required to register with the competent administrative centers of housing provident fund and open bank accounts for housing provident funds for their employees. Employers are also required to timely pay all housing fund contributions for their employees. Qiansui Media has not made any housing fund contributions for any of the 17 employees.

Available Information

The SEC maintains a website that contains our reports and other SEC filings. The address of the SEC’s website is www.sec.gov.

ITEM 1A. RISK FACTORS.

Risks Related to Doing Business in China

Because all of the Company’s operations are in China, the Company’s business is subject to the complex and rapidly evolving laws and regulations there. The Chinese government may exercise significant oversight and discretion over the conduct of the Company’s business and may intervene in or influence the Company’s operations at any time, which could result in a material change in the Company’s operations and/or the value of the Common stock.

As a business operating in China, the Company is subject to the laws and regulations of the PRC, which can be complex and evolve rapidly. The PRC government has the power to exercise significant oversight and discretion over the conduct of the Company’s business, and the regulations to which we are subject may change rapidly and with little notice to us or the Company’s shareholders. As a result, the application, interpretation, and enforcement of new and existing laws and regulations in the PRC are often uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies or authorities. New laws, regulations, and other government directives in the PRC may also be costly to comply with, and such compliance or any associated inquiries or investigations or any other government actions may:

| | · | Delay or impede the Company’s development, |

| | · | Require significant management time and attention, and |

| | · | Subject the Company to remedies, administrative penalties and even criminal liabilities that may harm the Company’s business, including fines assessed for the Company’s current or historical operations, or demands or orders that the Company modify or even cease its business practices. |

The promulgation of new laws or regulations, or the new interpretation of existing laws and regulations, in each case that restrict or otherwise unfavorably impact the ability or manner in which we conduct our business and could require us to change certain aspects of our business to ensure compliance, which could decrease demand for our products, reduce revenues, increase costs, require us to obtain more licenses, permits, approvals or certificates, or subject us to additional liabilities. To the extent any new or more stringent measures are required to be implemented, our business, financial condition and results of operations could be adversely affected as well as materially decrease the value of the Common stock.

If the Chinese government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, such action could significantly limit or completely hinder Tancheng Group’s ability to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China based issuers. PRC has recently promulgated new rules that require companies collecting or holding large amounts of data to undergo a cybersecurity review prior to listing in foreign countries, a move that will significantly tighten oversight over China-based internet giants. The Cybersecurity Review Measures (2021 version) was promulgated on December 28, 2021 and became effective on February 15, 2022. These measures specify that any “online platform operators” controlling the personal information of more than one million users which seek to list on a foreign stock exchange are subject to prior cybersecurity review.

We believe that our 100% owned PRC subsidiary Qiansui Media, which operates our business of selling ornament and adornment products, is not subject to the review or prior approval of the CAC or the CSRC in connection with the Contribution transaction.

If the Chinese government were to impose new requirements for approval from the PRC authorities to issue the Common stock to investors outside of China or list on a foreign exchange, such action could significantly limit or completely hinder Tancheng Group’s ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

To date, Tancheng Group and its PRC subsidiaries, (1) are not required to obtain permissions from any PRC authorities to operate or issue the Common stock to investors outside of China, (2) are not subject to permission requirements from the CSRC, CAC or any other entity that is required to approve of the Company’s PRC subsidiaries’ operations, and (3) have not received or were denied such permissions by any PRC authorities. Nevertheless, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Strictly Cracking Down on Illegal Securities Activities According to Law,” or the Opinions, which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Given the current PRC regulatory environment, it is uncertain when and whether we or our PRC subsidiaries, will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and even when such permission is obtained, whether it will be denied or rescinded. We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC or other PRC governmental authorities required for overseas listings, including the Contribution transaction. As of today, we have not received any inquiry, notice, warning, sanctions or regulatory objection to the Contribution transaction from the CSRC or other PRC governmental authorities. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. If it is determined in the future that the approval of the CSRC or any other regulatory authority is required for the Contribution transaction, we may face sanctions by the CSRC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on the Company’s operations in China, limit the Company’s ability to pay dividends outside of China, limit the Company’s operations in China, or take other actions that could have a material adverse effect on the Company’s business, financial condition, results of operations and prospects, as well as the trading price of the Company’s securities. In addition, if the CSRC or other regulatory PRC agencies later promulgate new rules requiring that we obtain their approvals for the Contribution transaction, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding such an approval requirement could have a material adverse effect on the trading price of the Common stock.

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on the Company’s business and operations.

Substantially all of the Company’s assets and operations are located in the PRC. Accordingly, the Company’s business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in the PRC generally. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, development, growth rate, control of foreign exchange and allocation of resources. Although the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in the PRC is still owned by the government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over the PRC’s economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced significant growth over past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes in economic conditions in the PRC, in the policies of the Chinese government or in the laws and regulations in the PRC could have a material adverse effect on the overall economic growth of the PRC. Such developments could adversely affect the Company’s business and operating results, lead to a reduction in demand for the Company’s services and adversely affect the Company’s competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us. For example, the Company’s financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past the Chinese government has implemented certain measures, including interest rate adjustment, to control the pace of economic growth. These measures may cause decreased economic activity in the PRC, which may adversely affect the Company’s business and operating results.

The PRC government has implemented various measures to encourage foreign investment and sustainable economic growth and to guide the allocation of financial and other resources. However, we cannot assure you that the PRC government will not repeal or alter these measures or introduce new measures that will have a negative effect on the Company. China’s social and political conditions may change and become unstable. Any sudden changes to China’s political system or the occurrence of widespread social unrest could have a material adverse effect on the Company’s business and results of operations.

Uncertainties with respect to the PRC legal system could adversely affect us.

The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference but have limited precedential value.

In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters generally. The overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investments in the PRC. However, the PRC has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in the PRC. In particular, the interpretation and enforcement of these laws and regulations involve uncertainties. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings. These uncertainties may affect the Company’s judgment on the relevance of legal requirements and the Company’s ability to enforce the Company’s contractual rights or tort claims. In addition, these regulatory uncertainties may be exploited through unmerited or frivolous legal actions or threats in attempts to extract payments or benefits from us.

Furthermore, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all and may have a retroactive effect. As a result, the Company may not be aware of the Company’s violation of any of these policies and rules until sometime after the violation. In addition, any administrative and court proceedings in the PRC may be protracted, resulting in substantial costs and diversion of resources and management attention.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against the Company or its management based on foreign laws.

The Company conducts substantially all of its operations in China, and substantially all of the Company’s assets are located in China. In addition, the Company’s current officer resides within China and is a PRC national. As a result, it may be difficult for you to effect service of process upon the Company or those persons inside the PRC. In addition, the PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with many other countries and regions. Therefore, recognition and enforcement in China of judgments of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult or impossible.

The PRC government has increasingly strengthened oversight in offerings conducted overseas or on foreign investment in China-based issuers, which could result in a material change in our operations and our common stock could decline in value or become worthless.

The PRC government has recently indicated an intent to take actions to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. For example, on July 6, 2021, the relevant PRC government authorities made public the Opinions on Strictly Scrutinizing Illegal Securities Activities in Accordance with the Law, or the Opinions. These Opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision of overseas listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies.

On December 24, 2021, the CSRC issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments), collectively the Draft Overseas Listing Regulations, for public comment until January 23, 2022.

Following issuance of the Draft Overseas Listing Regulations, on February 17, 2023, the CSRC issued the Notice on Filing Arrangements for Overseas Securities Offering and Listing by Domestic Companies (the “CSRC Filing Notice”), stating that the CSRC has published the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines (the “Listing Guidelines”), collectively the Trial Measures and Listing Guidelines. Among others, the Trial Measures and Listing Guidelines provide that overseas offerings and listings by PRC domestic companies shall:

| | (i) | require submission of relevant materials that contain a filing report and a legal opinion, providing truthful, accurate and complete information on matters including but not limited to the shareholders of the issuer. Where the filing documents are complete and in compliance with stipulated requirements, the CSRC shall, within 20 working days after receipt of filing documents, conclude the filing procedure and publish filing results on the CSRC website. Where filing documents are incomplete or do not conform to stipulated requirements, the CSRC shall request supplementation and amendment thereto within five working days after receipt of the filing documents. The issuer should then complete supplementation and amendment within 30 working days; |

| | (ii) | abide by laws, administrative regulations and relevant state rules concerning foreign investment in China, state-owned asset administration, industry regulation and outbound investment, and shall not disrupt the PRC domestic market order, harm state or public interests or undermine the lawful rights and interests of PRC domestic investors; |

| | (iii) | abide by national secrecy laws and relevant provisions. Necessary measures shall be taken to fulfill confidentiality obligations. Divulgence of state secrets or working secrets of government agencies is strictly prohibited. Provision of personal information and important data, etc., to overseas parties in relation to overseas offering and listing of PRC domestic companies shall be in compliance with applicable laws, administrative regulations and relevant state rules; and |

| | (iv) | be made in strict compliance with relevant laws, administrative regulations and rules concerning national security in the spheres of foreign investment, cybersecurity, data security, etc., and issuers shall duly fulfill their obligations to protect national security. If the intended overseas offering and listing necessitates a national security review, relevant security review procedures shall be completed according to the law before the application for such offering and listing is submitted to any overseas parties such as securities regulatory agencies and trading venues; |

The Trial Measures came into effect on March 31, 2023. PRC domestic companies seeking to offer and list securities (which, for the purposes of the Trial Measures, are defined thereunder as equity shares, depository receipts, corporate bonds convertible to equity shares, and other equity securities that are offered and listed overseas, either directly or indirectly, by PRC domestic companies) in overseas markets, either via direct or indirect means, must file with the CSRC within three working days after their application for an overseas listing is submitted.

The Trial Measures provide that where a PRC domestic company seeks to indirectly offer and list securities in overseas markets, the issuer shall designate a major domestic operating entity, which shall, as the domestic entity responsible, file with the CSRC. The Trial Measures stipulate that an overseas listing will be determined as “indirect” if the issuer meets both of the following conditions: (1) 50% or more of any of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year are accounted for by PRC domestic companies (“Condition I”), and (2) the main parts of the issuer’s business activities are conducted in the PRC, or its main places of business are located in the PRC, or the senior managers in charge of its business operations and management are mostly Chinese citizens or domiciled in the PRC (“Condition II”); whether Chinese citizens from Taiwan, Hong Kong, and Macau are included in the foregoing specification is not specified. The determination as to whether or not an overseas offering and listing by PRC domestic companies is indirect shall be made on a ‘substance over form’ basis; the Listing Guidelines further stipulate that if an issuer not satisfying Condition I submits an application for issuance and listing in overseas markets in accordance with relevant non-PRC issuance regulations requiring such issuer to disclose risk factors mainly related to the PRC, the securities firm(s) and the issuer’s PRC counsel should follow the principle of ‘substance over form’ in order to identify and argue whether the issuer should complete a filing under the Trial Measures. Subsequent securities offerings of an issuer in (i) the same overseas market where it has previously offered and listed securities, and (ii) an overseas market other than one where the issuer has previously offered and listed securities shall be filed with the CSRC within three working days after offerings are completed. Additionally, the Trial Measures stipulate that after an issuer has offered and listed securities in an overseas market, the issuer shall submit a report to the CSRC within three working days after the occurrence and public disclosure of (i) a change of control thereof, (ii) investigations of or sanctions imposed on the issuer by overseas securities regulators or relevant competent authorities, (iii) changes of listing status or transfers of listing segment, and (iv) a voluntary or mandatory delisting.

The CSRC Filing Notice states that, beginning from March 31, 2023, PRC domestic enterprises which have already issued and listed securities overseas and fall within the scope of filing under the Trial Measures shall be considered “existing enterprises” (“Existing Listed Enterprises”). Existing Listed Enterprises are not required to complete filings immediately; rather, Existing Listed Enterprises should complete filings if they are subsequently involved in matters require filings, such as follow-on financing activities, in accordance with the Trial Measures.

There is a possibility that we may be deemed as an Existing Listed Enterprise as defined under the CSRC Filing Notice, and that future offerings of listed securities or listings outside China by us may be subject to CSRC filing requirements in accordance with the Trial Measures.

On February 24, 2023, the CSRC, together with the Ministry of Finance, National Administration of State Secrets Protection and National Archives Administration of China, revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing, which were issued by the CSRC and National Administration of State Secrets Protection and National Archives Administration of China in 2009, or the “Provisions.” The revised Provisions were issued under the title the “Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies,” and came into effect on March 31, 2023 together with the Trial Measures. One of the major revisions to the revised Provisions is expanding their application to cover indirect overseas offering and listing, as is consistent with the Trial Measures. The revised Provisions require that, among other things, (a) a domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals or entities, including securities companies, securities service providers, and overseas regulators, any documents and materials that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level; and (b) a domestic company that plans to, either directly or indirectly through its overseas listed entity, publicly disclose or provide to relevant individuals and entities, including securities companies, securities service providers, and overseas regulators, any other documents and materials that, if leaked, will be detrimental to national security or public interest, shall strictly fulfill relevant procedures stipulated by applicable national regulations. Any failure or perceived failure by our Company, or our PRC subsidiaries to comply with the above confidentiality and archives administration requirements under the revised Provisions and other PRC laws and regulations may result in the relevant entities being held legally liable by competent authorities, and referred to the judicial organ to be investigated for criminal liability if suspected of committing a crime.

Given that the Trial Measures, Listing Guidelines and revised Provisions have been introduced recently, and that there remain substantial uncertainties surrounding the enforcement thereof, we cannot assure you that, if required, we would be able to complete the filings and fully comply with the relevant new rules on a timely basis, if at all. Further, as of the date of this report, the aforementioned Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) issued on December 24, 2021, although effectively replaced by the Trial Measures and its supporting guidelines, remain in draft form. The final and effective versions are yet to be published.

Tancheng Group may rely on dividends and other distributions on equity from our PRC subsidiaries for its cash requirements.

Our Nevada holding company, Tancheng Group, has no material assets other than ownership of equity interests in its subsidiaries. As a result, it has no independent means of generating revenue and may rely on dividends and other distributions on equity from our PRC operating subsidiaries for its cash requirements. Our PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries, as a Foreign Invested Enterprise, or FIE, is required to draw 10% of its after-tax profits each year, if any, to fund a common reserve, which may stop drawing its after-tax profits if the aggregate balance of the common reserve has already accounted for over 50 percent of its registered capital. These reserves are not distributable as cash dividends. If our PRC subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us. Any limitation on the ability of our PRC subsidiaries to distribute dividends or other payments to their respective shareholders could materially and adversely limit the Company’s ability to grow, make investments or acquisitions that could be beneficial to the Company’s business, pay dividends or otherwise fund and conduct the Company’s business.

In addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax rate of up to 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless otherwise exempted or reduced according to treaties or arrangements between the PRC central government and governments of other countries or regions where the non-PRC resident enterprises are incorporated.

Non-compliance with labor-related laws and regulations of the PRC could have an adverse impact on the Company’s financial condition and results of operation.

Our PRC subsidiaries have been subject to stricter regulatory requirements in terms of entering into labor contracts with their employees and paying various statutory employee benefits, including pensions, housing fund, medical insurance, work-related injury insurance, unemployment insurance and childbearing insurance to designated government agencies for the benefit of their employees. Pursuant to the PRC Labor Contract Law, or the Labor Contract Law, that became effective in January 2008 and its implementing rules that became effective in September 2008 and was amended in July 2013, employers are subject to stricter requirements in terms of signing labor contracts, minimum wages, paying remuneration, determining the term of employees’ probation and unilaterally terminating labor contracts.

Under the Social Insurance Law of the PRC, all employees are required to participate in basic pension insurance, basic medical insurance schemes and unemployment insurance, which must be contributed by both the employers and the employees. All employees are required to participate in work-related injury insurance and maternity insurance schemes, which must be contributed by the employers. Employers are required to complete registrations with local social insurance authorities. Moreover, the employers must timely make all social insurance contributions. Only 13 of Qiansui Media’s 17 employees participate in the basic pension insurance, basic medical insurance, unemployment insurance, work-related injury insurance and maternity insurance schemes.

Pursuant to PRC regulations on the Housing Provident Fund, enterprises are required to register with the competent administrative centers of housing provident fund and open bank accounts for housing provident funds for their employees. Employers are also required to timely pay all housing fund contributions for their employees. Qiansui Media has not made any housing fund contributions for any of the 17 employees.

As of the date of this report, we are not aware of any action, claim, investigation or penalties being conducted or threatened by any government authorities. However, if Qiansui Media is fined or otherwise penalized by government authorities due to its failure to adequately pay social insurance and housing provident fund contributions for its employees, its financial condition may be negatively impacted.

The recent joint statement by the SEC, and an act passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to U.S.-listed companies with significant operations in China. These developments could add uncertainties to our continued trading on the OTC markets, future offerings, business operations, share price and reputation.

U.S. public companies that have substantially all of their operations in China have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered on financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud.

On December 7, 2018, the SEC and the PCAOB issued a joint statement highlighting the continued challenges faced by the U.S. regulators in their oversight of financial statement audits of U.S.-listed companies with significant operations in HK SAR. On April 21, 2020, SEC Chairman Jay Clayton and PCAOB Chairman William D. Duhnke III, along with other senior SEC staff, released a joint statement highlighting the risks associated with investing in companies based in or have substantial operations in emerging markets including China, reiterating past SEC and PCAOB statements on matters including the difficulty associated with inspecting accounting firms and audit work papers in China and higher risks of fraud in emerging markets and the difficulty of bringing and enforcing SEC, Department of Justice and other U.S. regulatory actions, including in instances of fraud, in emerging markets generally.

On May 20, 2020, the U.S. Senate passed the HFCA Act requiring a foreign company to certify it is not owned or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. In addition, if the PCAOB is unable to inspect the company’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a national exchange. On December 2, 2020, the U.S. House of Representatives approved the HFCA Act and it was signed into law on December 18, 2020.

On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCA Act”), which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its audit work cannot be inspected when its auditor is subject to PCAOB inspections for two consecutive years instead of three and, thus, would reduce the time before the Common stock may be prohibited from trading or delisted.

On September 22, 2021, the PCAOB adopted a final rule implementing the HFCA Act, which provides a framework for the PCAOB to use when determining, as contemplated under the HFCA Act, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction.

On December 2, 2021, the SEC adopted amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate (“Commission-Identified Issuers”). The final amendments require Commission-Identified Issuers to submit documentation to the SEC establishing that, if true, it is not owned or controlled by a governmental entity in the public accounting firm’s foreign jurisdiction. The amendments also require that a Commission-Identified Issuer that is a “foreign issuer,” as defined in Exchange Act Rule 3b-4, provide certain additional disclosures in its annual report for itself and any of its consolidated foreign operating entities. A Commission-Identified Issuer will be required to comply with the submission and disclosure requirements in the annual report for each year in which it was identified. Accordingly, if we are determined by the SEC to be a Commission-Identified Issuer, we will incur additional costs in complying with the submission and disclosure requirements in the annual report for each year in which we are identified. In the event that we are deemed to have had three consecutive “non-inspection” years by the SEC, our securities will be prohibited from trading on any national securities exchange or over-the-counter markets in the United States. Moreover, if the AHFCA Act is enacted into law, it would reduce the time before our securities may be prohibited from trading or delisted from three years to two years.

On December 16, 2021, pursuant to the HFCA Act, the PCAOB issued a Determination Report which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in the PRC and Hong Kong, because of a position taken by one or more authorities in such jurisdictions. In addition, the PCAOB’s report identified specific registered public accounting firms which are subject to these determinations. Either our current or former registered public accounting firm is not headquartered in the PRC or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination. Our current auditor is a Singapore-based accounting firm that is registered with the PCAOB and can be inspected by the PCAOB. We have no current intention of engaging any auditor based in the mainland China or Hong Kong and not subject to regular inspection by the PCAOB. Furthermore, the PCAOB is able to inspect the audit workpapers of our PRC subsidiaries, as such workpapers are electronic files possessed by our registered public accounting firms. However, if the PCAOB determines in the future after the offering that it cannot inspect or fully investigate our auditor at such future time, trading in our securities would be prohibited under the HFCA Act.