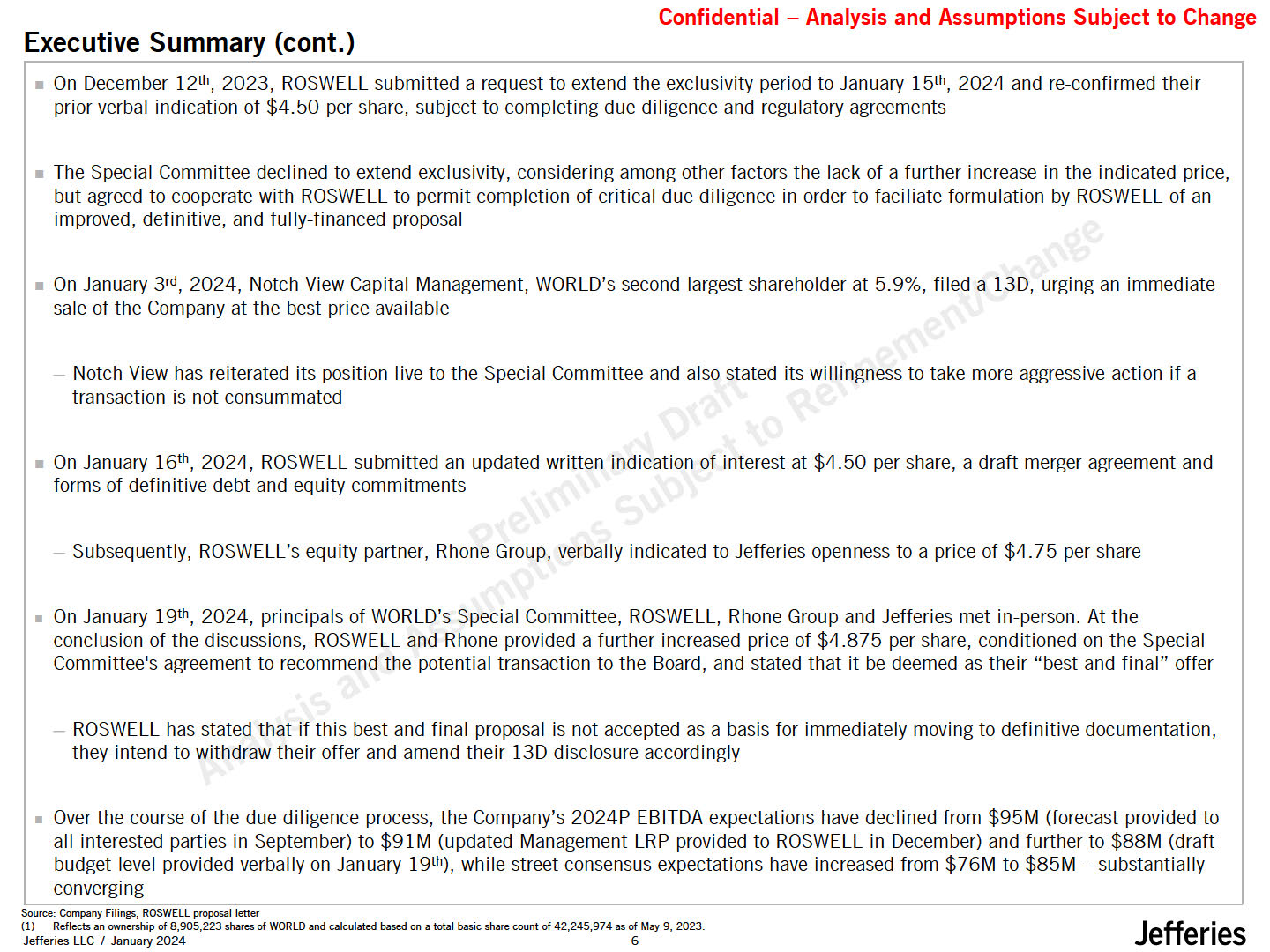

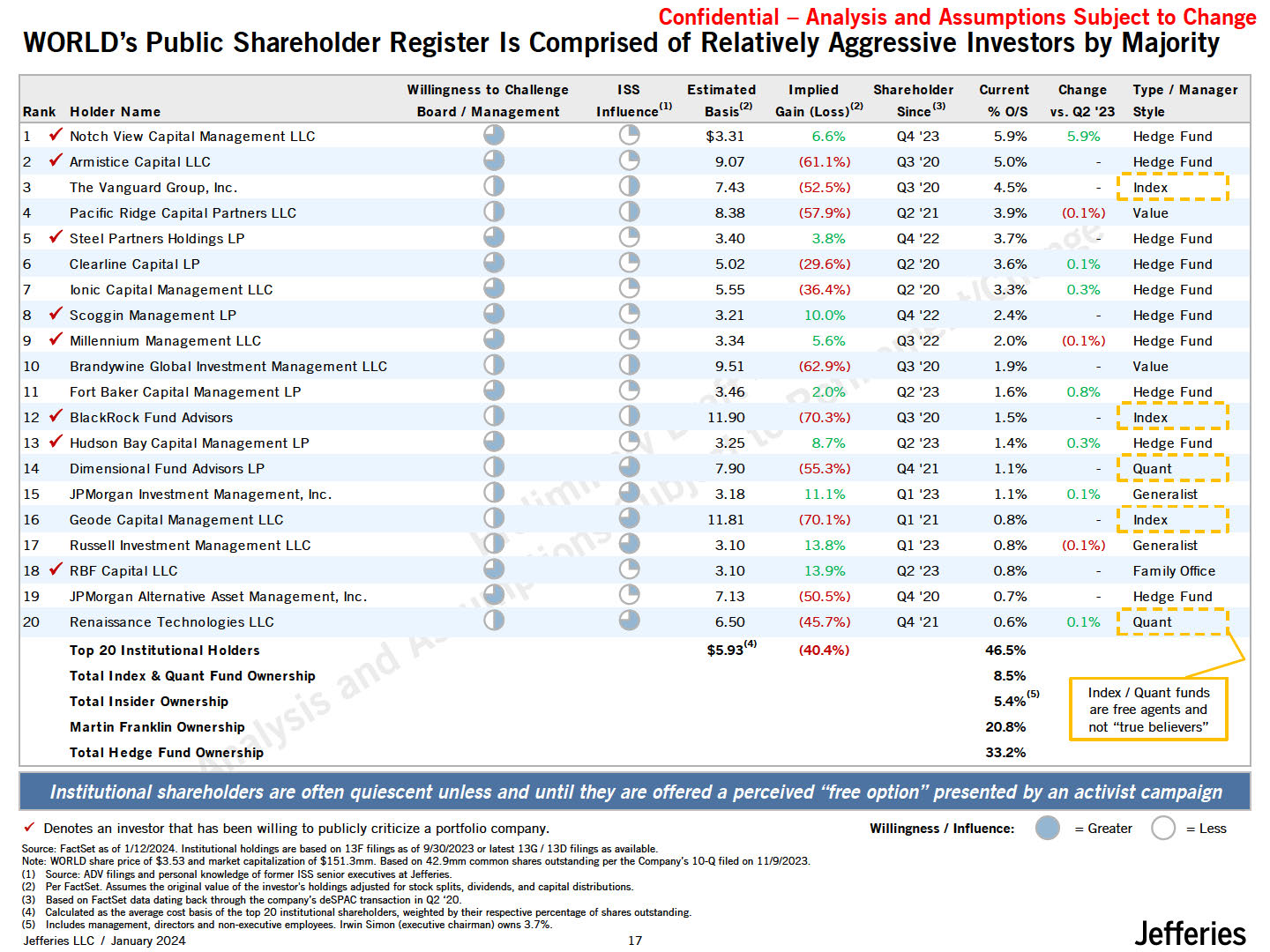

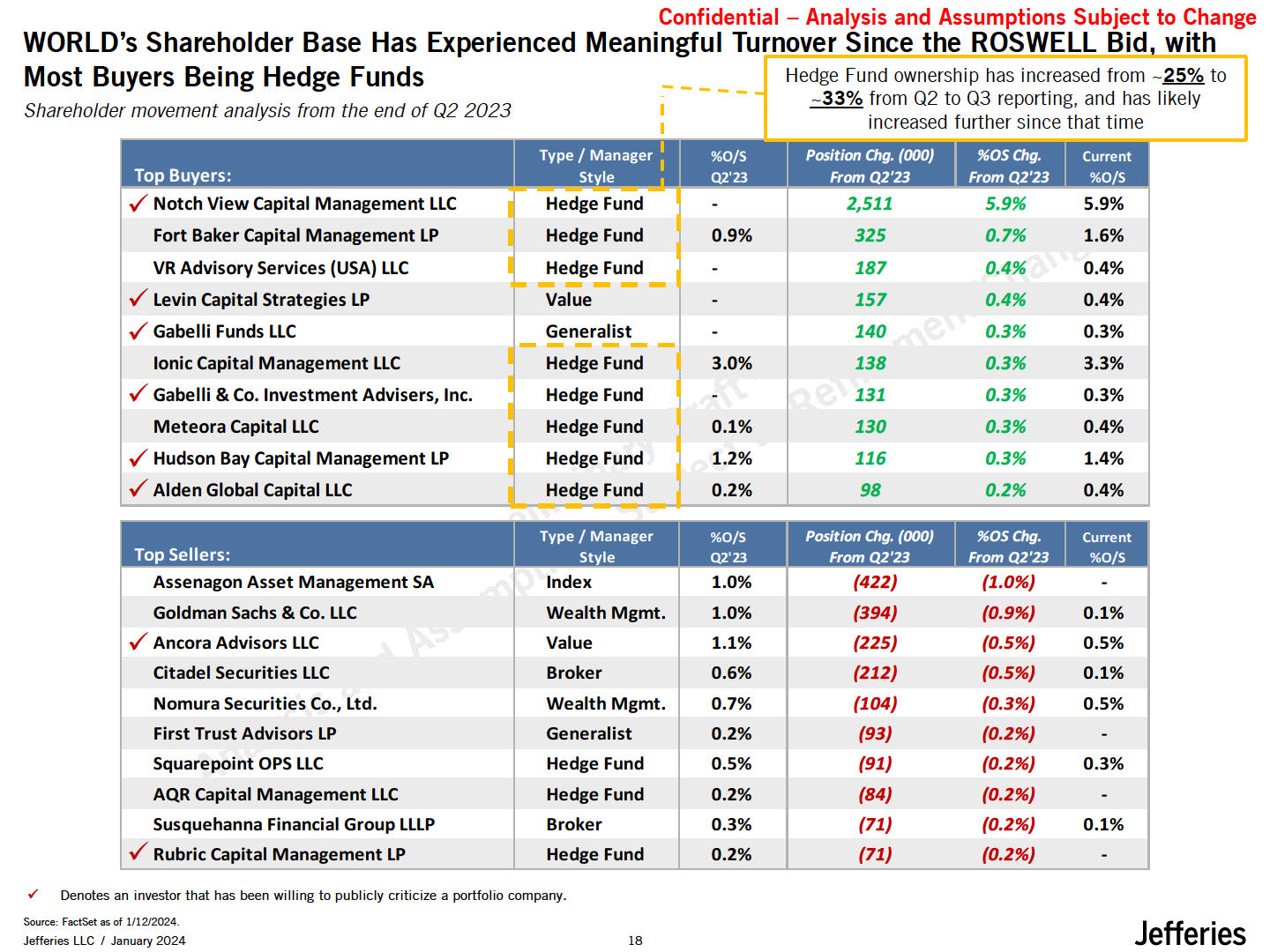

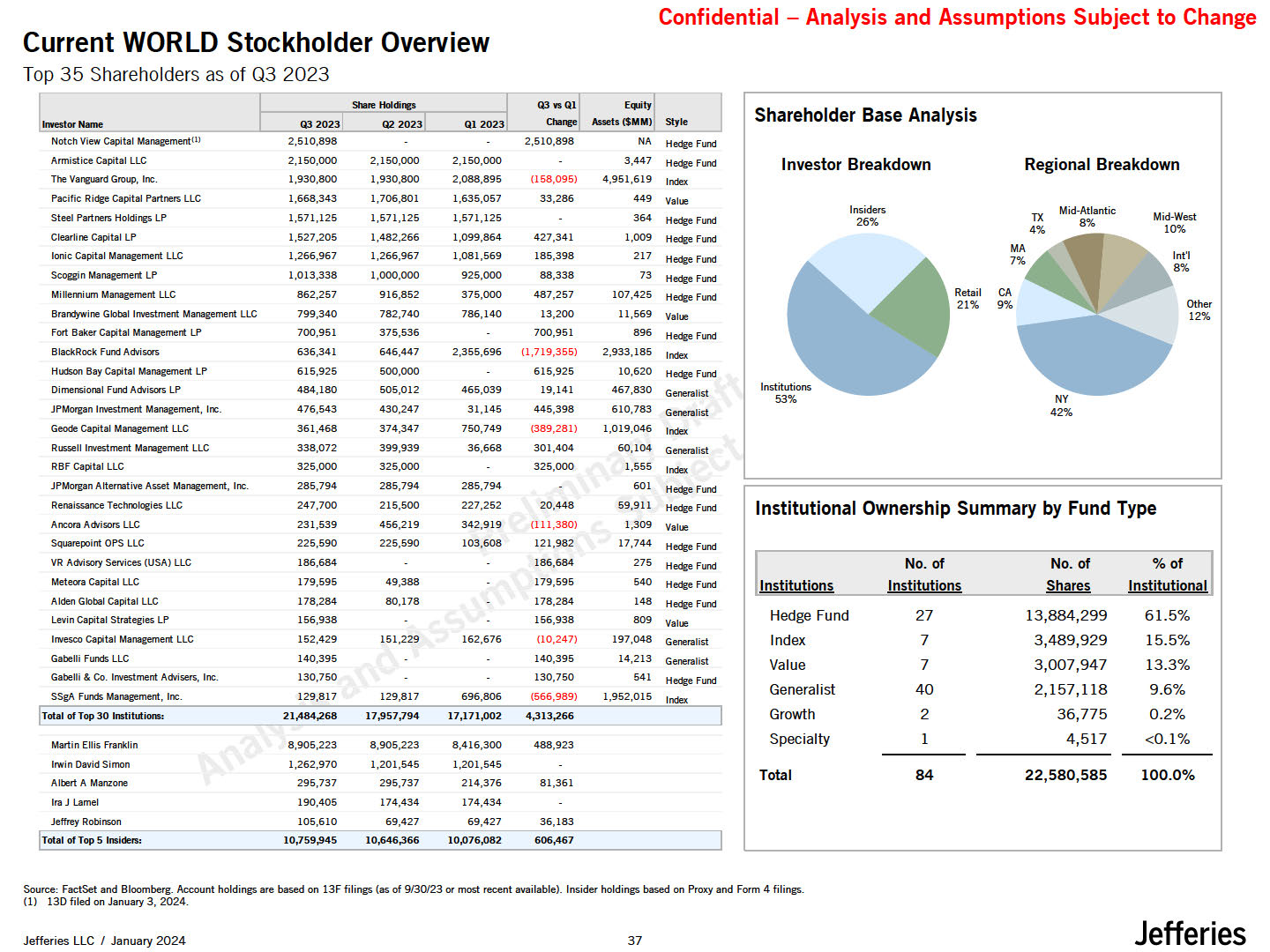

Share tto1dirvs Q3 vsQl E(Jlity lnw:stor Name Q3 2023 Q2 2023 Cha Auets ($MM) style Notch View Capital ManagementU> 2,510,898 2,510,898 NA Hedge Fund ArmisticeC..pital LLC 2,150,000 2,150,000 2,150,000 3,447 Hedge Fund The VanguardGroup, Inc. 1,930,800 1,930,800 2,088,895 (158,095) 4,951,619 lndeo< Pacific Ridge Capital Partners LLC 1,668,343 1,706,801 1,635,057 33,286 449 Value Steel Partners Holdings LP 1,571,125 1,571,125 1,571,125 364 Hedge Fund ClearlineCapital LP 1,527,205 1,482,266 1,099,864 427,341 1,009 Hedge Fund Ionic Capital Management LLC 1,266,967 1,266,967 1,081,569 185,398 217 Hedge Fund Scoggjn Management LP 1,013,338 1,000,000 925,000 88,338 73 Hedge Fund Millemium Management LLC 862,257 916,852 375,000 487,257 107,425 Hedge Fund BrarxtywineGlobal Investment Management LLC 799,340 782,740 786,140 13,200 11,569 Value Fort Baker Capital Management LP 700,951 375,536 700,951 896 Hedge Fund BlackRock FundAdvisors 636,341 646,447 2,355,696 (1,719,355) 2,933,185 lndeo< Hudson BayC..pital Management LP 615,925 500,000 615,925 10,620 Hedge Fund Dimensional FundAdvisorsLP 484,180 505,012 465,039 19,141 467,830 Generalist JPMorgan Investment Management, Ire. 476,543 430,247 31,145 445,398 610,783 Generalist Geode Capital Management LLC 361,468 374,347 750,749 (389,281) 1,019,046 lndeo< Russell Investment Management LLC 338,072 399,939 36,668 301,404 60,104 Generalist RBF Capital LLC 325,000 325,000 325,000 1,555 lndeo< JPMorgan Alternative Asset Management. loc. 285,794 285,794 285,794 601 Hedge Fund Renaissance Technologies LLC Ancora Advisors LLC 247,700 231,539 215,500 456,219 227,252 342,919 20,448 (111,380) 59,911 1,309 Hedge Fund Value Institutional Ownership Summary by Fund Type Squarepoint OPS LLC 225,590 225,590 103,608 121,982 17,744 Hedge Fund VR AdvisoryServices(USA) LLC 186,684 186,684 275 Hedge Fund Institutions No. of Institutions No. of Shares %of InstitutionaI Meteora Capital LLC 179,595 49,388 179,595 540 Hedge Fund AldenGlobal Capital LLC Levin Capital StrategiesLP 178,284 156,938 80,178 178,284 156,938 148 809 Hedge Fund Value Hedge Fund 27 13,884,299 61.5% InvescoCapital Managemert LLC 152,429 151,229 162,676 (10,247) 197,048 Generalist Index 7 3,489,929 15.5% Gabelli FundsLLC Gabelli & Co. Investment Advisers, Inc. SSgA FundsManagement, Inc. 140,395 130,750 129,817 129,817 696,806 140,395 130,750 (566,989) 14,213 541 1,952,015 Generalist Hedge Fund lndeo< Value Generalist 7 40 3,007,947 2,157,118 13.3% 9.6% Total ofTop30 lnstitutioos: 21,484,268 17,957,794 17,171,002 4,313,266 Growth 2 36,775 0.2% Martin Ellis Franklin 8,905,223 8,905,223 8,416,300 488,923 Specialty 1 4,517 <0.1% Irwin David Simon Albert A Manzone 1,262,970 295,737 1,201,545 295,737 1,201,545 214,376 81,361 Total 84 22,580,585 100.0% Ira J Lamel 190,405 174,434 174,434 Jeffrey Robinson 105,610 69,427 69,427 36,183 !Total of Top 5 Insiders: 10,759,945 10,646,366 10,076,082 606,467 Confidential - Analysis and Assumptions Subject to Change Jefferies Jefferies LLC / January 2024 35 Current WORLD Stockholder Overview Top 35 Shareholders as of Q3 2023 Shareholder Base Analysis Investor Breakdown Regional Breakdown Insiders 26% TX 4% Mid-Atlantic 8% Mid-West 10% lnt'I 8% Retail CA 21% 9% Other 12% NY 42% Source: FactSet and Bloomberg. Account holdings are based on 13F filings (as of 9/30/23 or most recent available). Insider holdings based on Proxy and Form 4 filings. (1) 13D filed on January 3, 2024.