Exhibit 99.1 Investor Presentation April 2021

Disclaimer This presentation contains highly confidential and proprietary information regarding StoneMor, Inc. (“StoneMor” or the “Company”) and its subsidiaries and affiliates and their strategy and organization. This confidential presentation is provided to you on the condition that you agree that you will hold it in strict confidence and not reproduce, disclose, forward or distribute it to any third party in whole or in part without StoneMor’s prior written consent. This presentation contains forward-looking statements that are based on StoneMor’s current expectations or forecasts of future events as well as a number of assumptions, estimates and projections concerning future events. These statements can be identified by the use of forward-looking words, including “may,” “expect,” “anticipate,” “potential,” “forecast,” “likely,” “could,” “plan,” “project,” “believe,” “estimate,” “intend,” “will,” “should” or other similar words. Forward-looking statements are prepared in good faith based upon assumptions that are believed by management to be reasonable at the time such forward-looking statements are prepared, it being understood and agreed that forward-looking statements are not a guarantee of future performance and actual results may differ from the results discussed in or implied by the forward-looking statements and such differences may be material. These forward-looking statements involve risks, uncertainties, changes in circumstances, assumptions and other important factors, many of which are beyond management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Given these risks, uncertainties and other factors, you should not place undue reliance on the forward-looking statements. Forward-looking statements speak only as of the date the statements are made. StoneMor assumes no obligation and expressly disclaims any obligation to update or revise forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except as required by applicable law. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. In addition, this presentation includes certain non-GAAP financial measures. Non-GAAP financial measures are not measures of financial performance in accordance with U.S. generally accepted accounting principles (“GAAP”) and may exclude items that are significant in understanding and assessing the Company’s financial results. Because not all companies calculate non-GAAP financial measures identically (or at all), the information presented herein may not be comparable to other similarly titled measures used by other companies. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation, or as a substitute for our results as reported under GAAP. A reconciliation of non-GAAP financial measures to the nearest comparable GAAP amounts have been provided in the appendix. Statements contained herein describing documents and agreements are summaries only and such summaries are qualified in their entirety by reference to such documents and agreements. You acknowledge that neither the Company nor any of its subsidiaries or affiliates, or any of its or their stockholders, subsidiaries, affiliates or associates, or any of their respective directors, officers, partners, employees, representatives, financing sources and advisors (the “Relevant Parties”) shall have any liability to you or any other person for furnishing the information contained herein or for any action taken or decision made by you in purported reliance on such information. No Relevant Party is making any representation or warranty as to the accuracy or completeness of the information contained in this document, and no Relevant Party shall have any liability to you or any other person for failing to furnish any other information now or in the future known to or in possession of any Relevant Party or have any obligation to update or supplement any information previously provided to you with any additional information. The furnishing of the information contained in this document shall not, under any circumstances, create any implication that there has been no change in the information set forth herein or in the affairs of the Company and its subsidiaries and affiliates since the date of such information or the date it was furnished. The presentation does not constitute or form part of, and should not be construed as an offer or the solicitation of an offer to subscribe for or purchase the securities referenced herein (the “Securities”), and nothing contained therein shall form the basis of or be relied on in connection with any contract or commitment whatsoever, nor does it constitute a recommendation regarding the Securities. Any decision to purchase the Securities should be made solely on the basis of the information that may be contained in an offering memorandum produced in connection with the offering of the Securities. Prospective investors are required to make their own independent investigations and appraisals of the business and financial condition of StoneMor and the nature of the Securities before taking any investment decision with respect thereto. The offering memorandum may contain information different from the information contained herein. The offer and sale of Securities has not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and the Securities may not be offered or sold in the United States or to U.S. persons unless so registered, or an exemption from the registration requirements of the Securities Act is available. 2

Today’s Presenters ◼ Joe Redling was named President and Chief Executive Officer and appointed to the Board of Directors in July 2018 ◼ Previously served as the Chief Operating Officer of Vonage Joe Redling Holdings. Inc. and Chief Executive Officer at Nutrisystem President & Chief Executive Officer along with various senior management at Time Warner and AOL ◼ B.S. in Business Management from St. Peter's University ◼ Joined StoneMor as the Company’s CAO in 2018 and became CFO in September 2019 ◼ Previously a Managing Director for a leading accounting and Jeff DiGiovanni transaction advisory firm in the Northeast from 2012 to Senior Vice President and Chief 2017 Financial Officer ◼ B.S. in Accounting and a Master of Science in Financial Services From Saint Joseph’s University ◼ Certified Public Accountant ◼ Keith joined StoneMor as a consultant in June 2019, becoming the Company’s VP of Financial Planning and Analysis in October 2019 Keith Trost ◼ Previously held senior roles in financial analysis and accounting at various real estate companies and developers Vice President of Corporate Development & Investor Relations◼ Started career as a Senior Accountant at Deloitte ◼ B.B.A. in Accounting from Notre Dame and M.B.A From Villanova 3

Table of Contents 5 1 Transaction Overview 9 2 Business Summary & Company Overview 19 3 Key Investment Highlights 32 4 Historical Financial Overview 36 5 Appendix 4

1 Transaction Summary

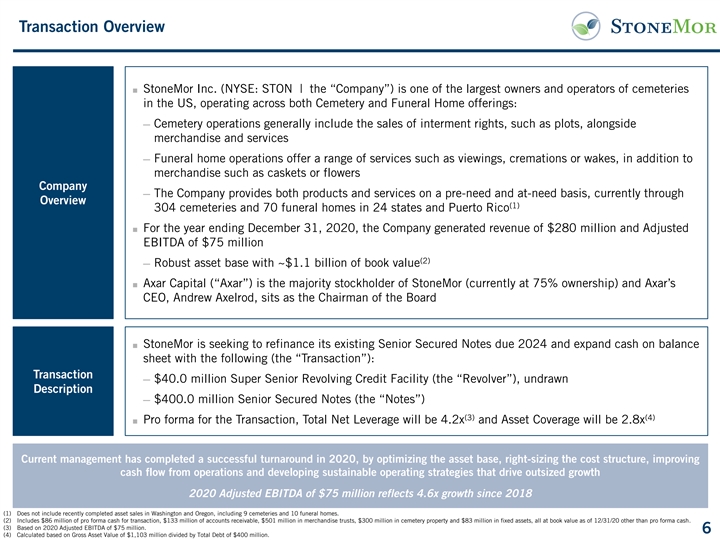

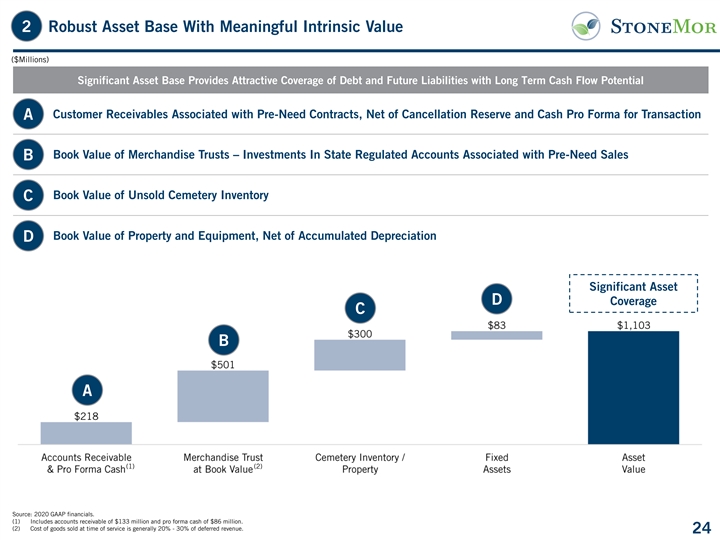

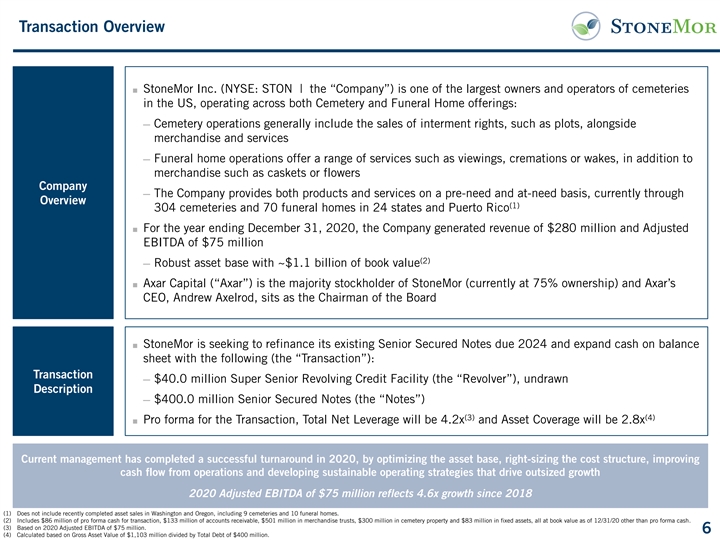

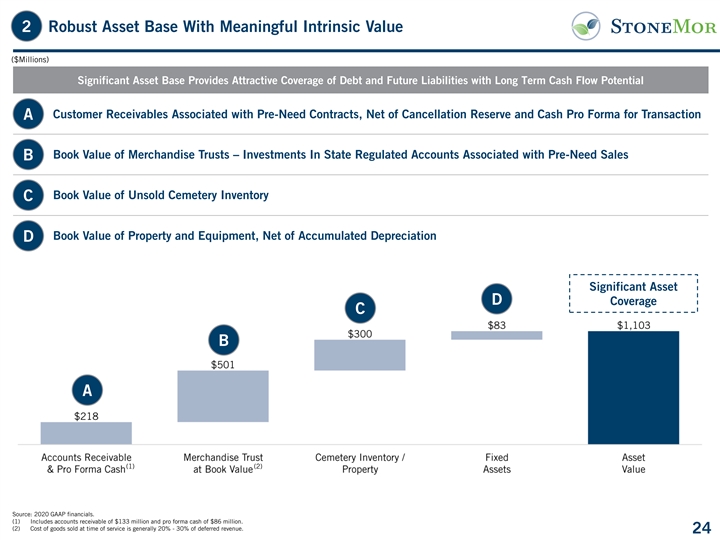

Transaction Overview ◼ StoneMor Inc. (NYSE: STON | the “Company”) is one of the largest owners and operators of cemeteries in the US, operating across both Cemetery and Funeral Home offerings: ─ Cemetery operations generally include the sales of interment rights, such as plots, alongside merchandise and services Funeral home operations offer a range of services such as viewings, cremations or wakes, in addition to ─ merchandise such as caskets or flowers Company The Company provides both products and services on a pre-need and at-need basis, currently through ─ Overview (1) 304 cemeteries and 70 funeral homes in 24 states and Puerto Rico For the year ending December 31, 2020, the Company generated revenue of $280 million and Adjusted ◼ EBITDA of $75 million (2) ─ Robust asset base with ~$1.1 billion of book value Axar Capital (“Axar”) is the majority stockholder of StoneMor (currently at 75% ownership) and Axar’s ◼ CEO, Andrew Axelrod, sits as the Chairman of the Board StoneMor is seeking to refinance its existing Senior Secured Notes due 2024 and expand cash on balance ◼ sheet with the following (the “Transaction”): Transaction ─ $40.0 million Super Senior Revolving Credit Facility (the “Revolver”), undrawn Description ─ $400.0 million Senior Secured Notes (the “Notes”) (3) (4) ◼ Pro forma for the Transaction, Total Net Leverage will be 4.2x and Asset Coverage will be 2.8x Current management has completed a successful turnaround in 2020, by optimizing the asset base, right-sizing the cost structure, improving cash flow from operations and developing sustainable operating strategies that drive outsized growth 2020 Adjusted EBITDA of $75 million reflects 4.6x growth since 2018 (1) Does not include recently completed asset sales in Washington and Oregon, including 9 cemeteries and 10 funeral homes. (2) Includes $86 million of pro forma cash for transaction, $133 million of accounts receivable, $501 million in merchandise trusts, $300 million in cemetery property and $83 million in fixed assets, all at book value as of 12/31/20 other than pro forma cash. (3) Based on 2020 Adjusted EBITDA of $75 million. 6 (4) Calculated based on Gross Asset Value of $1,103 million divided by Total Debt of $400 million.

Sources, Uses & Pro Forma Capitalization ($Millions, except as noted) Sources of Funds Uses of Funds New Super Senior Revolver ($40.0 million) $ - Repay Senior Secured Notes $ 345 New Senior Secured Notes 400 Prepayment Penalty 20 (1) Release of Restricted Cash 21 Cash to Balance Sheet 46 Financing Fees & Expenses 10 Total Sources $ 421 Total Uses $ 421 Capitalization Credit Statistics As of 12/31/2020 As of 12/31/2020 Actual Pro Forma Actual Pro Forma (2) Cash & Cash Equivalents $ 39 $ 86 2020 Adjusted EBITDA $ 75 $ 75 (4) New Super Senior Revolver ($40.0 million) - - Gross Asset Value $ 1,057 $ 1,103 New Senior Secured Notes - 400 Total Leverage 4.6x 5.3x ` Senior Secured Notes 345 - Total Net Leverage 4.1x 4.2x Total Debt $ 345 $ 400 Asset Coverage 3.1x 2.8x (3) Market Capitalization 261 261 Equity / Total Capitalization 43.0% 39.4% Total Capitalization $ 605 $ 661 (1) Contingent upon final terms of Super Senior Revolving Credit Facility. (2) Current Cash & Cash Equivalents excludes $20.8 million of restricted cash that is expected to be released in the future once a Revolver with LC facility is put in place. Pro Forma Cash & Cash Equivalents includes release of currently restricted cash. Does not reflect the $6.7 million repayment of existing notes from the Clearstone sale. (3) Based on stock price of $2.21 as of 4/19/21. (4) For actual, includes $39 million of cash, $133 million of accounts receivable, $501 million in merchandise trusts, $300 million in cemetery property and $83 million in fixed assets, all at book value as of 12/31/20. For pro forma, includes $86 million of pro forma cash for transaction, $133 million of accounts receivable, $501 million in merchandise trusts, $300 million in cemetery property and $83 million in fixed assets, all at book value as of 12/31/20. 7

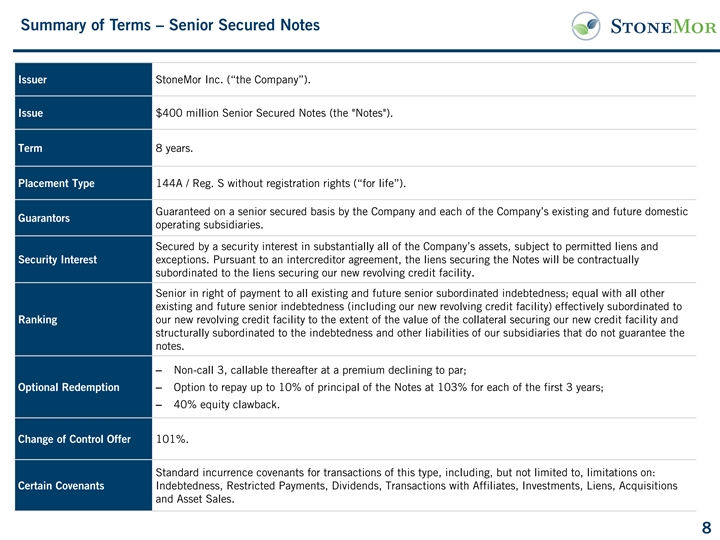

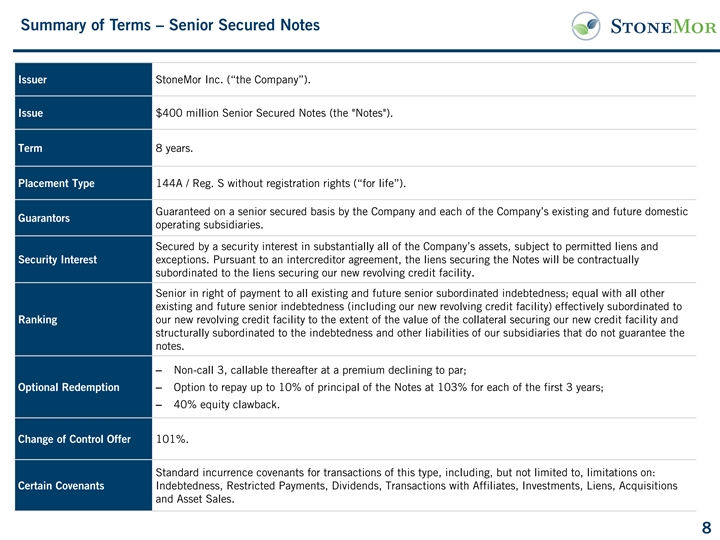

Summary of Terms – Senior Secured Notes Issuer StoneMor Inc. (“the Company”). Issue $400 million Senior Secured Notes (the Notes ). Term 8 years. Placement Type 144A / Reg. S without registration rights (“for life”). Guaranteed on a senior secured basis by the Company and each of the Company’s existing and future domestic Guarantors operating subsidiaries. Secured by a security interest in substantially all of the Company’s assets, subject to permitted liens and Security Interest exceptions. Pursuant to an intercreditor agreement, the liens securing the Notes will be contractually subordinated to the liens securing our new revolving credit facility. Senior in right of payment to all existing and future senior subordinated indebtedness; equal with all other existing and future senior indebtedness (including our new revolving credit facility) effectively subordinated to Ranking our new revolving credit facility to the extent of the value of the collateral securing our new credit facility and structurally subordinated to the indebtedness and other liabilities of our subsidiaries that do not guarantee the notes. – Non-call 3, callable thereafter at a premium declining to par; Optional Redemption– Option to repay up to 10% of principal of the Notes at 103% for each of the first 3 years; – 40% equity clawback. Change of Control Offer 101%. Standard incurrence covenants for transactions of this type, including, but not limited to, limitations on: Certain Covenants Indebtedness, Restricted Payments, Dividends, Transactions with Affiliates, Investments, Liens, Acquisitions and Asset Sales. 8 8

2 Business Summary & Company Overview

StoneMor Company Overview Geographically Diversified ◼ StoneMor is one of the largest owners and operators of cemeteries in the US, operating both cemeteries and funeral homes in the deathcare industry Northeast 121 Cemeteries ─ Founded in 1999 and headquartered in Bensalem, PA 11 Funeral Homes ─ Publicly traded on the New York Stock Exchange Central & South under ticker “STON” 171 Cemeteries 54 Funeral Homes ◼ The Company operates through two primary segments, Cemetery (85% of 2020 revenue) and Funeral Homes (15% of 2020 revenue) (2) West 12 Cemeteries ◼ The Company sells cemetery and funeral home goods 5 Funeral Homes and services both at the time of death (“at-need”) and before death (“pre-need”) (2) Total 304 Cemeteries ◼ StoneMor has created a robust backlog of future cash 70 Funeral Homes flows with $635 million of merchandise trust assets and Not Pictured: Puerto Rico accounts receivable along with additional investment income created by $312 million in perpetual care (1) trusts 2020 Revenue By Segment 2020 Revenue Mix ─ A portion of pre-need sales are placed into merchandise trusts to cover future costs to service Funeral Home Funeral Home Funeral Services contracts with the funds returned to the Company Merchandise Home 7% Interments after service is completed 8% 15% / Property 24% ─ The perpetual care trust is funded by sales of interments and lots, generating investment income for Investment StoneMor into perpetuity & Other 16% ◼ Strong existing sponsorship from Axar Capital who has assisted in executing the Company’s turnaround strategy while providing access various equity capital infusions Cemetery Merchandise Cemetery 22% Cemetery Services 85% 23% (1) Represents book value of Merchandise Trusts, Accounts Receivable and Perpetual Care Trusts. (2) Does not include recently completed asset sales in Washington and Oregon, including 9 cemeteries and 10 funeral homes. 10

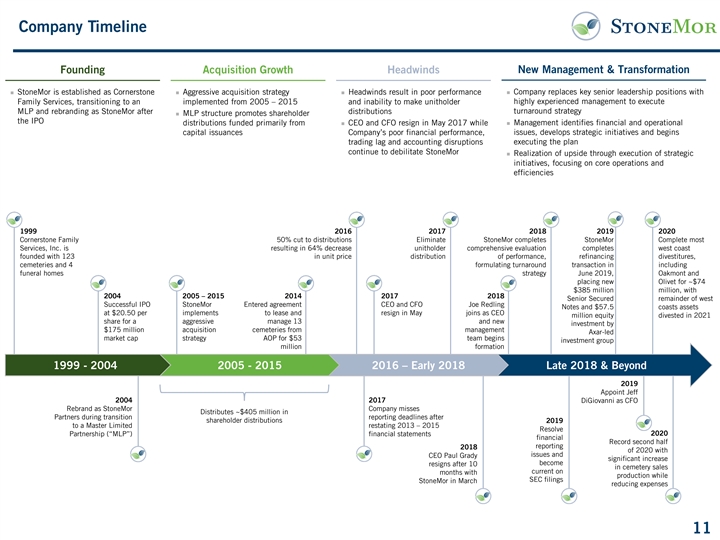

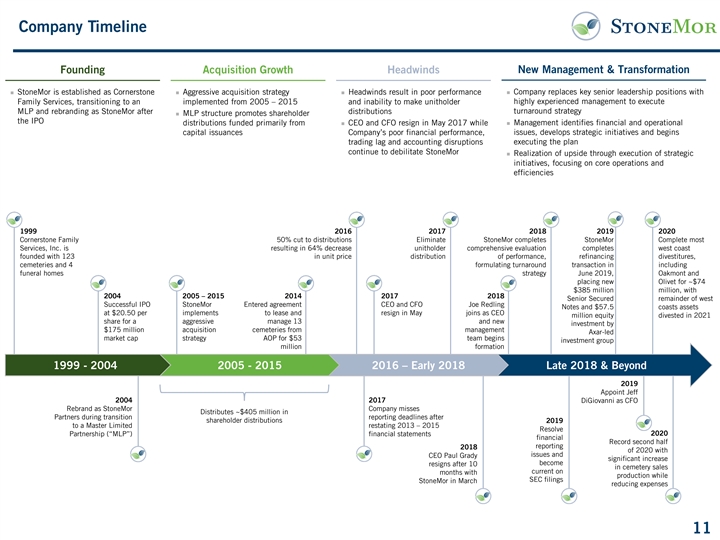

Company Timeline New Management & Transformation Founding Acquisition Growth Headwinds ◼ StoneMor is established as Cornerstone ◼ Aggressive acquisition strategy ◼ Headwinds result in poor performance ◼ Company replaces key senior leadership positions with Family Services, transitioning to an implemented from 2005 – 2015 and inability to make unitholder highly experienced management to execute MLP and rebranding as StoneMor after distributions turnaround strategy ◼ MLP structure promotes shareholder the IPO ◼ Management identifies financial and operational distributions funded primarily from ◼ CEO and CFO resign in May 2017 while capital issuances Company’s poor financial performance, issues, develops strategic initiatives and begins executing the plan trading lag and accounting disruptions continue to debilitate StoneMor ◼ Realization of upside through execution of strategic initiatives, focusing on core operations and efficiencies 1999 2016 2017 2018 2019 2020 Cornerstone Family 50% cut to distributions Eliminate StoneMor completes StoneMor Complete most Services, Inc. is resulting in 64% decrease unitholder comprehensive evaluation completes west coast founded with 123 in unit price distribution of performance, refinancing divestitures, cemeteries and 4 formulating turnaround transaction in including funeral homes strategy June 2019, Oakmont and placing new Olivet for ~$74 $385 million million, with 2004 2005 – 2015 2014 2017 2018 Senior Secured remainder of west Successful IPO StoneMor Entered agreement CEO and CFO Joe Redling Notes and $57.5 coasts assets at $20.50 per implements to lease and resign in May joins as CEO million equity divested in 2021 share for a aggressive manage 13 and new investment by $175 million acquisition cemeteries from management Axar-led market cap strategy AOP for $53 team begins investment group million formation 1999 - 2004 2005 - 2015 2016 – Early 2018 Late 2018 & Beyond 2019 Appoint Jeff 2004 2017 DiGiovanni as CFO Rebrand as StoneMor Company misses Distributes ~$405 million in Partners during transition reporting deadlines after shareholder distributions 2019 to a Master Limited restating 2013 – 2015 Resolve Partnership (“MLP”) financial statements 2020 financial Record second half reporting 2018 of 2020 with issues and CEO Paul Grady significant increase become resigns after 10 in cemetery sales current on months with production while SEC filings StoneMor in March reducing expenses 11

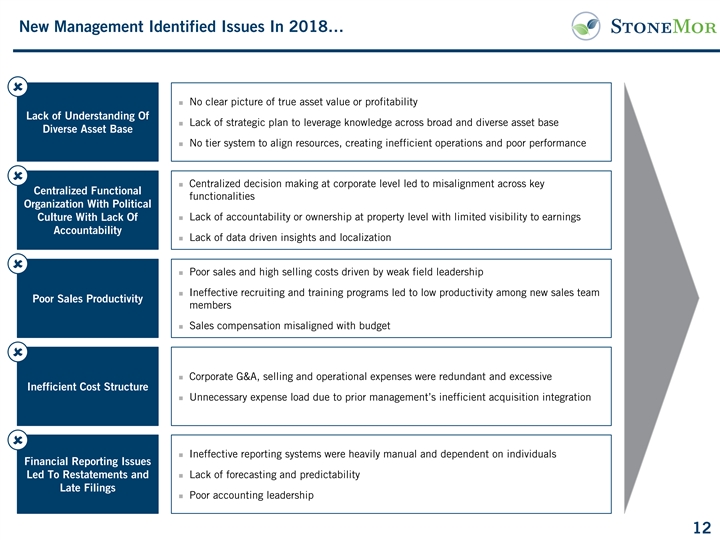

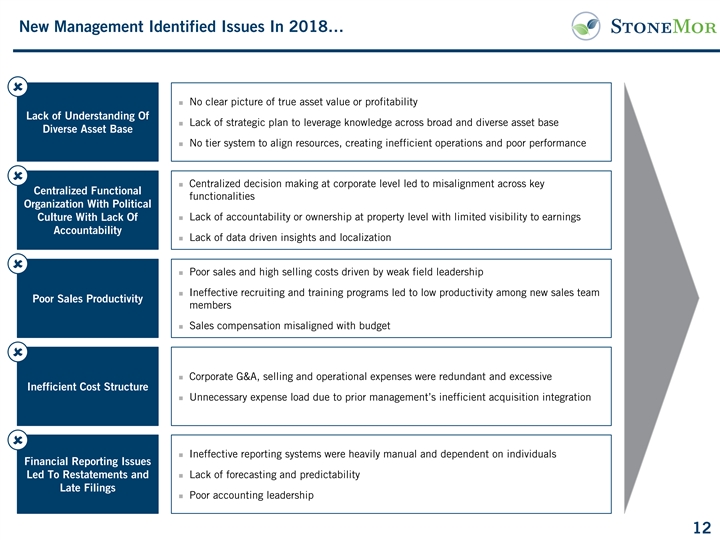

New Management Identified Issues In 2018… û ◼ No clear picture of true asset value or profitability Lack of Understanding Of ◼ Lack of strategic plan to leverage knowledge across broad and diverse asset base Diverse Asset Base ◼ No tier system to align resources, creating inefficient operations and poor performance û ◼ Centralized decision making at corporate level led to misalignment across key Centralized Functional functionalities Organization With Political ◼ Lack of accountability or ownership at property level with limited visibility to earnings Culture With Lack Of Accountability ◼ Lack of data driven insights and localization û ◼ Poor sales and high selling costs driven by weak field leadership ◼ Ineffective recruiting and training programs led to low productivity among new sales team Poor Sales Productivity members ◼ Sales compensation misaligned with budget û ◼ Corporate G&A, selling and operational expenses were redundant and excessive Inefficient Cost Structure ◼ Unnecessary expense load due to prior management’s inefficient acquisition integration û ◼ Ineffective reporting systems were heavily manual and dependent on individuals Financial Reporting Issues Led To Restatements and ◼ Lack of forecasting and predictability Late Filings ◼ Poor accounting leadership 12

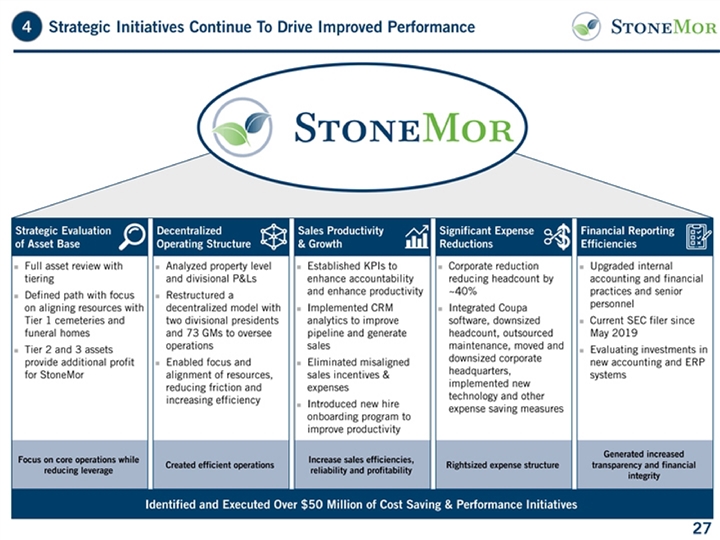

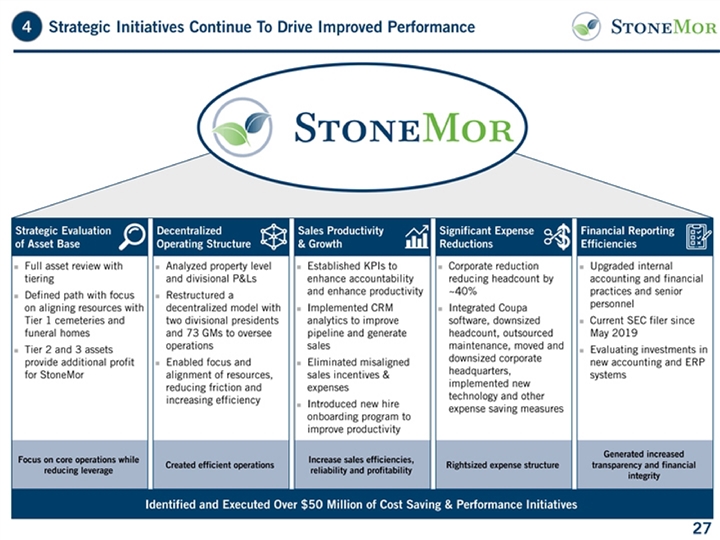

…And Successfully Executed On Turnaround Strategy Identified and Executed Over $50 Million of Cost Saving & Performance Initiatives ✓ ◼ Full asset review was undertaken to create three property tiers for asset quality Focus on core Realign Focus On Top Tier operations while ◼ Successfully divested non-core assets outside of key markets, Assets & Strategy reducing leverage primarily on the west coast, allowing management to take advantage of scale ✓ ◼ Completed restructuring of decentralized model, creating two divisional presidents and 73 general managers in charge of regional Reorganize Field and Created efficient operations Corporate Operations To operations Increase Accountability ◼ Undertook review of property-level P&Ls to restructure and identify inefficiencies ✓ ◼ Performed extensive review of sales productivity by each sales cohort Increase sales Generate Greater Sales by tenure to identify top tier management teams efficiencies, Productivity With reliability and ◼ Created more efficient sales team and introduced new sales training, Sustainable Pipeline profitability generating stronger production using a smaller more efficient team ✓ ◼ Implemented various cost and expense reduction programs at both Eliminate Redundant the asset and corporate level Rightsized expense Expenses & Implement structure ◼ Reduced corporate overhead through staffing reductions and Tighter Management implementation of expense management systems ✓ Renewed Focus On ◼ Hired new accounting and financial teams to execute appropriate Generated increased reporting policies, resulting in a return to consistent reporting and transparency and Accounting & Financial financial integrity forecasting insights Segments 13

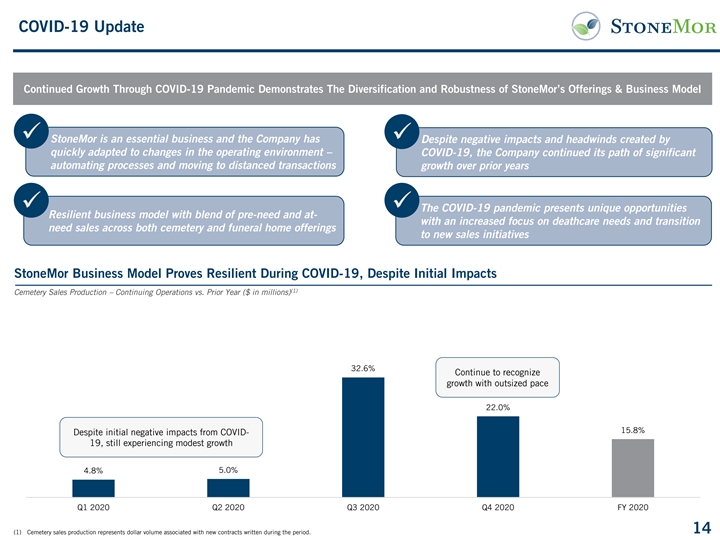

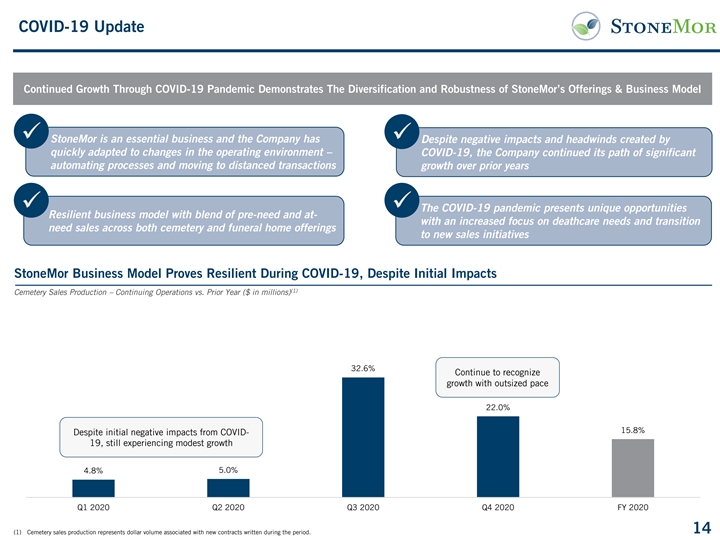

COVID-19 Update Continued Growth Through COVID-19 Pandemic Demonstrates The Diversification and Robustness of StoneMor’s Offerings & Business Model ✓✓ StoneMor is an essential business and the Company has Despite negative impacts and headwinds created by quickly adapted to changes in the operating environment – COVID-19, the Company continued its path of significant automating processes and moving to distanced transactions growth over prior years ✓✓ The COVID-19 pandemic presents unique opportunities Resilient business model with blend of pre-need and at- with an increased focus on deathcare needs and transition need sales across both cemetery and funeral home offerings to new sales initiatives StoneMor Business Model Proves Resilient During COVID-19, Despite Initial Impacts (1) Cemetery Sales Production – Continuing Operations vs. Prior Year ($ in millions) 32.6% Continue to recognize growth with outsized pace 22.0% 15.8% Despite initial negative impacts from COVID- 19, still experiencing modest growth 5.0% 4.8% Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 (1) Cemetery sales production represents dollar volume associated with new contracts written during the period. 14

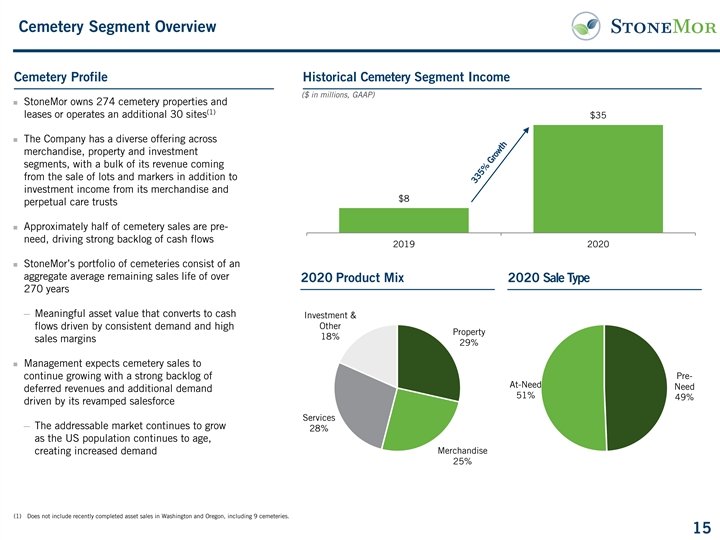

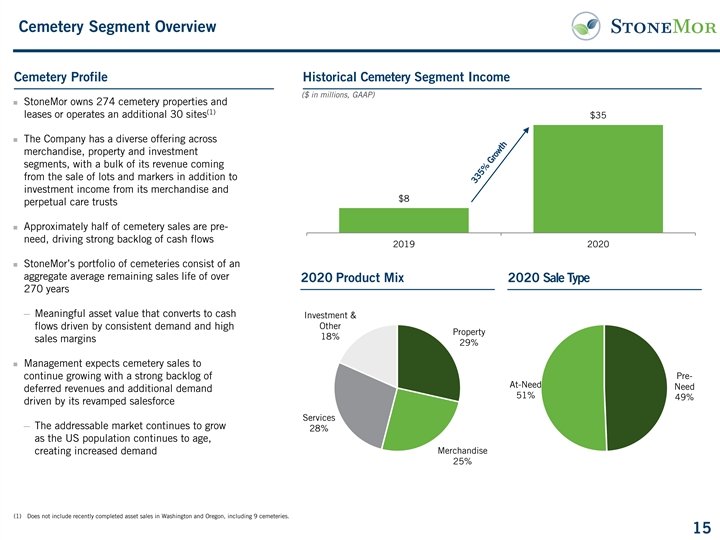

Cemetery Segment Overview Cemetery Profile Historical Cemetery Segment Income ($ in millions, GAAP) ◼ StoneMor owns 274 cemetery properties and $40 (1) leases or operates an additional 30 sites $35 ◼ The Company has a diverse offering across $30 merchandise, property and investment segments, with a bulk of its revenue coming $20 from the sale of lots and markers in addition to investment income from its merchandise and $8 perpetual care trusts $10 ◼ Approximately half of cemetery sales are pre- $0 need, driving strong backlog of cash flows 2019 2020 ◼ StoneMor’s portfolio of cemeteries consist of an aggregate average remaining sales life of over 2020 Product Mix 2020 Sale Type 270 years ─ Meaningful asset value that converts to cash Investment & Other flows driven by consistent demand and high Property 18% sales margins 29% ◼ Management expects cemetery sales to continue growing with a strong backlog of Pre- At-Need Need deferred revenues and additional demand 51% 49% driven by its revamped salesforce Services ─ The addressable market continues to grow 28% as the US population continues to age, creating increased demand Merchandise 25% (1) Does not include recently completed asset sales in Washington and Oregon, including 9 cemeteries. 15

Cemetery Segment Overview (Cont’d.) Cemeteries Sell Interment Rights, Including Perpetual Care and Maintenance of the Site, Along With Related Merchandise and Services Merchandise (25% of Cemetery Revenue) Property (29% of Cemetery Revenue) Services (28% of Cem. Rev.) Markers Bases Vaults Burial Lots Mausoleums Openings and Closings ◼ Digging and refilling of burial ◼ Memorial that shows ◼ Base supports upright ◼ Rectangular container ◼ Parcel of property that ◼ Above ground structure spaces to install the vault and who is remembered, markers (used only in that sits in the burial holds interred human that may be designed place the casket into the vault the dates of birth and conjunction with lot and in which the remains for a particular customer death and other markers) casket is placed (private) or for multiple pertinent information customers (community) Urns Caskets Crypts Niches Installations ◼ Installation of cemetery ◼ Receptacle for holding ◼ A box for holding a ◼ Series of closely ◼ Spaces in which the merchandise cremated remains body, made of wood, spaced enclosures for ashes remaining after metal or concrete caskets in a community cremation are stored mausoleum ◼ Often part of a community mausoleum Note: Reflects examples of merchandise and services sold. Not reflective of comprehensive list. 16

Funeral Home Segment Overview Funeral Home Profile Historical Funeral Home Segment Income ($ in millions, GAAP) ◼ StoneMor operates 70 funeral homes in the US $10 (1) and Puerto Rico ◼ Funeral homes generally sell packages of funeral services (“calls”), which include consultation, $5 preparation of remains, transportation and the $4 use of facilities for ceremonies, in addition to merchandise sold at the homes ◼ A majority of StoneMor’s funeral homes are $0 located within similar geographical areas, 2019 2020 allowing for shared resources such as limos, hearses, embalmers and marketing 2020 Product Mix 2020 Sale Type ─ Generates synergies across clusters to create additional economies of scale Pre- Need Merchandise 22% 52% ◼ Pre-need funeral home revenues create a backlog of cash flows and margin for the future ◼ Funeral homes are generally more focused on at- need business, creating recurring cash flow streams received at the time of sale Services 48% At- Need 78% (1) Does not include recently completed asset sales in Washington and Oregon, including 10 funeral homes. 17

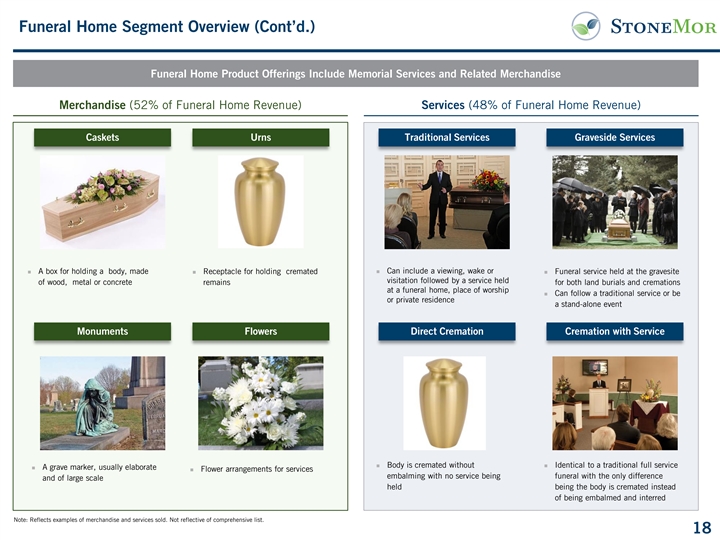

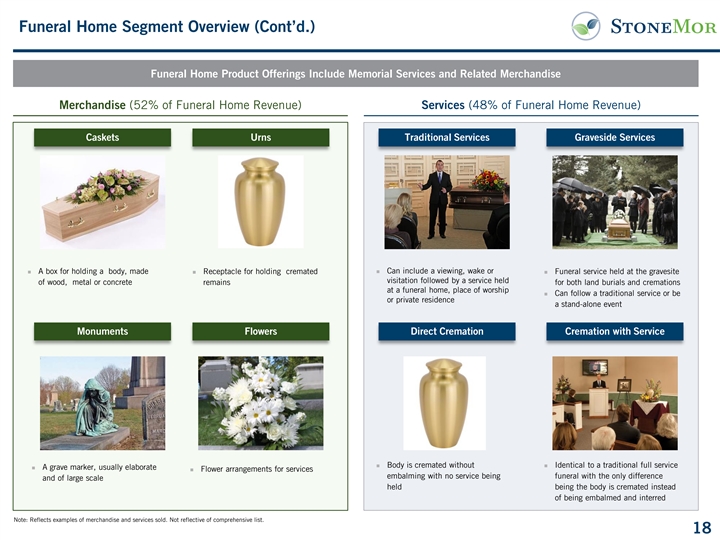

Funeral Home Segment Overview (Cont’d.) Funeral Home Product Offerings Include Memorial Services and Related Merchandise Merchandise (52% of Funeral Home Revenue) Services (48% of Funeral Home Revenue) Caskets Urns Traditional Services Graveside Services ◼ A box for holding a body, made ◼ Receptacle for holding cremated ◼ Can include a viewing, wake or ◼ Funeral service held at the gravesite visitation followed by a service held of wood, metal or concrete remains for both land burials and cremations at a funeral home, place of worship ◼ Can follow a traditional service or be or private residence a stand-alone event Monuments Flowers Direct Cremation Cremation with Service ◼ Body is cremated without ◼ Identical to a traditional full service ◼ A grave marker, usually elaborate ◼ Flower arrangements for services embalming with no service being funeral with the only difference and of large scale held being the body is cremated instead of being embalmed and interred Note: Reflects examples of merchandise and services sold. Not reflective of comprehensive list. 18

3 Key Investment Highlights

Key Investment Highlights Highly Fragmented Industry With Secular Tailwinds 1 Robust Asset Base With Meaningful Intrinsic Value 2 Significant Backlog Supports Future Cash Flow 3 Strategic Initiatives Continue To Drive 4 Improved Performance Platform Poised For Growth 5 Experienced Management Team Successfully Executing Strategy 6 20

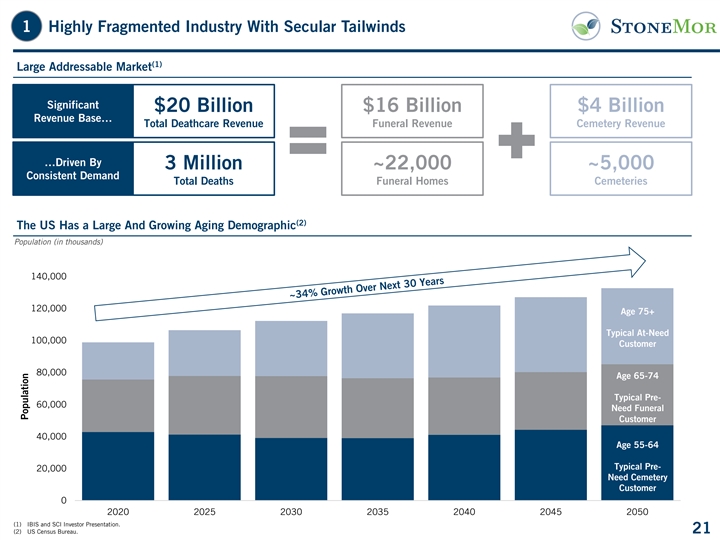

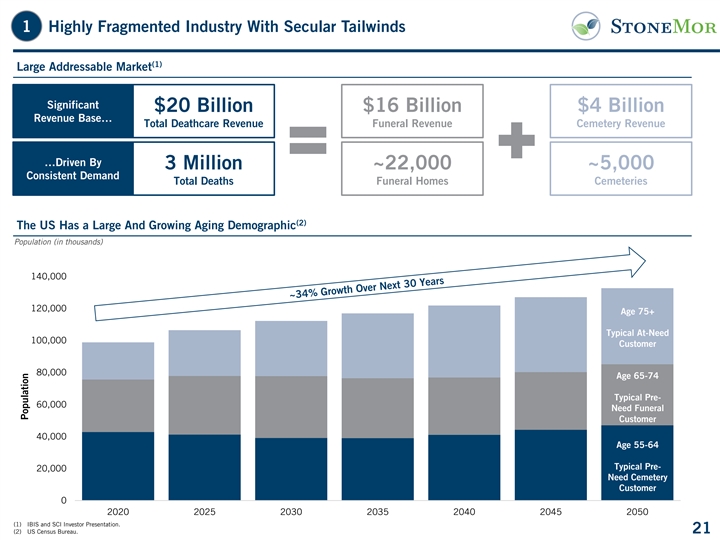

1 Highly Fragmented Industry With Secular Tailwinds (1) Large Addressable Market Significant $20 Billion $16 Billion $4 Billion Revenue Base… Total Deathcare Revenue Funeral Revenue Cemetery Revenue …Driven By 3 Million ~22,000 ~5,000 Consistent Demand Total Deaths Funeral Homes Cemeteries (2) The US Has a Large And Growing Aging Demographic Population (in thousands) 140,000 120,000 Age 75+ Typical At-Need 100,000 Customer 80,000 Age 65-74 Typical Pre- 60,000 Need Funeral Customer 40,000 Age 55-64 Typical Pre- 20,000 Need Cemetery Customer 0 2020 2025 2030 2035 2040 2045 2050 (1) IBIS and SCI Investor Presentation. (2) US Census Bureau. 21 Population

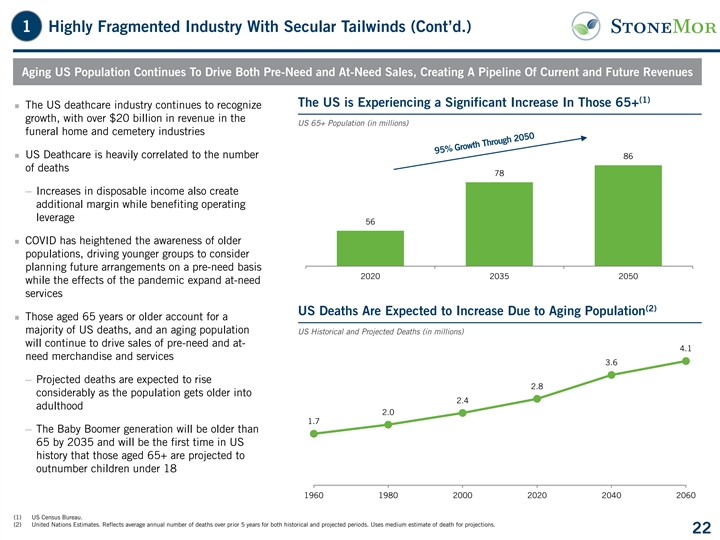

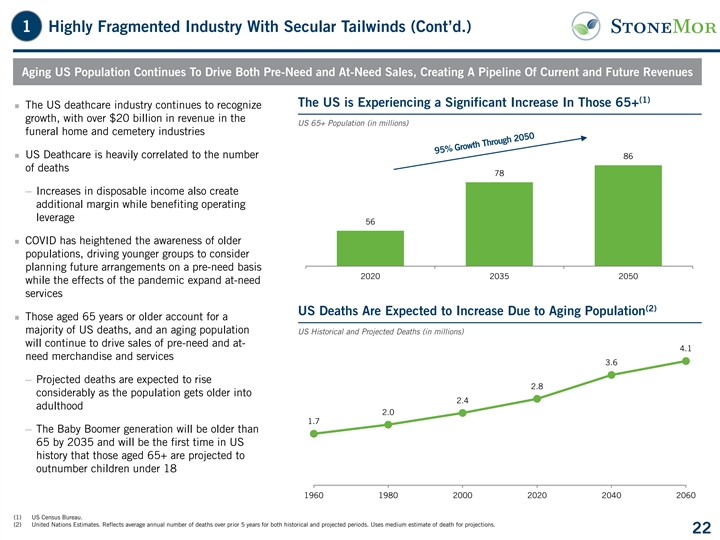

1 Highly Fragmented Industry With Secular Tailwinds (Cont’d.) Aging US Population Continues To Drive Both Pre-Need and At-Need Sales, Creating A Pipeline Of Current and Future Revenues (1) The US is Experiencing a Significant Increase In Those 65+ ◼ The US deathcare industry continues to recognize growth, with over $20 billion in revenue in the US 65+ Population (in millions) funeral home and cemetery industries ◼ US Deathcare is heavily correlated to the number 86 of deaths 78 ─ Increases in disposable income also create additional margin while benefiting operating leverage 56 ◼ COVID has heightened the awareness of older populations, driving younger groups to consider planning future arrangements on a pre-need basis 2020 2035 2050 while the effects of the pandemic expand at-need services (2) US Deaths Are Expected to Increase Due to Aging Population ◼ Those aged 65 years or older account for a majority of US deaths, and an aging population US Historical and Projected Deaths (in millions) will continue to drive sales of pre-need and at- 4.1 need merchandise and services 3.6 ─ Projected deaths are expected to rise 2.8 considerably as the population gets older into 2.4 adulthood 2.0 1.7 ─ The Baby Boomer generation will be older than 65 by 2035 and will be the first time in US history that those aged 65+ are projected to outnumber children under 18 1960 1980 2000 2020 2040 2060 (1) US Census Bureau. (2) United Nations Estimates. Reflects average annual number of deaths over prior 5 years for both historical and projected periods. Uses medium estimate of death for projections. 22

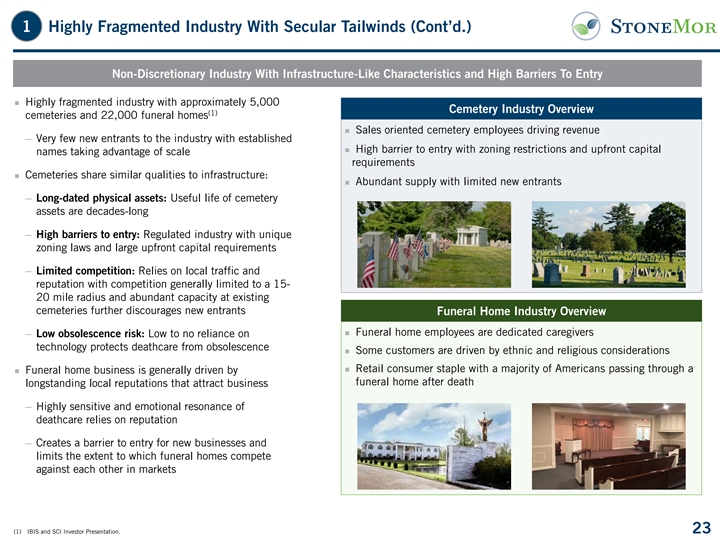

1 Highly Fragmented Industry With Secular Tailwinds (Cont’d.) Non-Discretionary Industry With Infrastructure-Like Characteristics and High Barriers To Entry ◼ Highly fragmented industry with approximately 5,000 Cemetery Industry Overview (1) cemeteries and 22,000 funeral homes ◼ Sales oriented cemetery employees driving revenue ─ Very few new entrants to the industry with established ◼ High barrier to entry with zoning restrictions and upfront capital names taking advantage of scale requirements ◼ Cemeteries share similar qualities to infrastructure: ◼ Abundant supply with limited new entrants ─ Long‐dated physical assets: Useful life of cemetery assets are decades-long ─ High barriers to entry: Regulated industry with unique zoning laws and large upfront capital requirements ─ Limited competition: Relies on local traffic and reputation with competition generally limited to a 15- 20 mile radius and abundant capacity at existing cemeteries further discourages new entrants Funeral Home Industry Overview ◼ Funeral home employees are dedicated caregivers ─ Low obsolescence risk: Low to no reliance on technology protects deathcare from obsolescence ◼ Some customers are driven by ethnic and religious considerations ◼ Retail consumer staple with a majority of Americans passing through a ◼ Funeral home business is generally driven by funeral home after death longstanding local reputations that attract business ─ Highly sensitive and emotional resonance of deathcare relies on reputation ─ Creates a barrier to entry for new businesses and limits the extent to which funeral homes compete against each other in markets (1) IBIS and SCI Investor Presentation. 23

2 Robust Asset Base With Meaningful Intrinsic Value ($Millions) Significant Asset Base Provides Attractive Coverage of Debt and Future Liabilities with Long Term Cash Flow Potential Customer Receivables Associated with Pre-Need Contracts, Net of Cancellation Reserve and Cash Pro Forma for Transaction A Book Value of Merchandise Trusts – Investments In State Regulated Accounts Associated with Pre-Need Sales B Book Value of Unsold Cemetery Inventory C Book Value of Property and Equipment, Net of Accumulated Depreciation D Significant Asset D Coverage C B A (1) (2) Source: 2020 GAAP financials. (1) Includes accounts receivable of $133 million and pro forma cash of $86 million. (2) Cost of goods sold at time of service is generally 20% - 30% of deferred revenue. 24

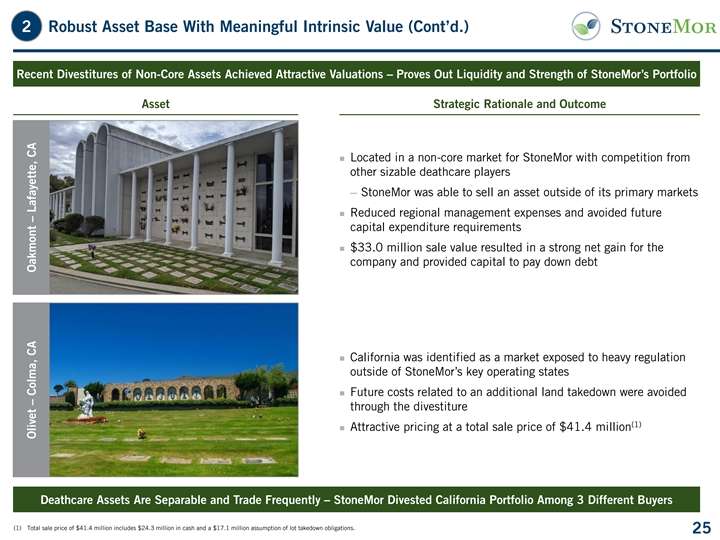

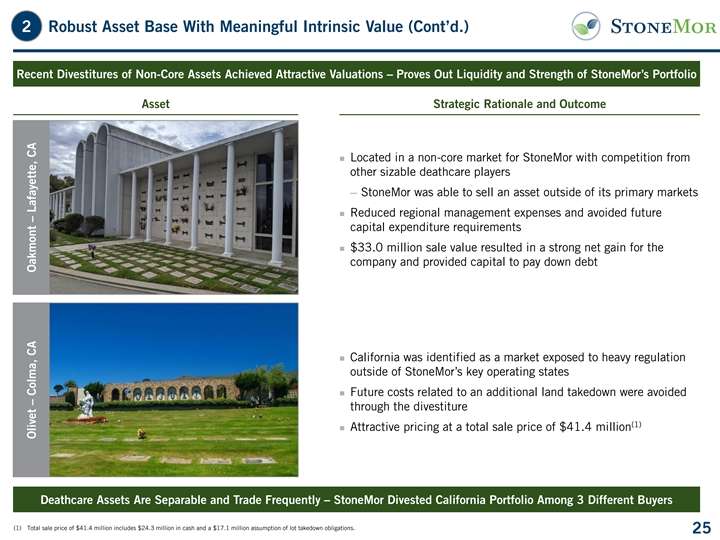

2 Robust Asset Base With Meaningful Intrinsic Value (Cont’d.) Recent Divestitures of Non-Core Assets Achieved Attractive Valuations – Proves Out Liquidity and Strength of StoneMor’s Portfolio Asset Strategic Rationale and Outcome ◼ Located in a non-core market for StoneMor with competition from other sizable deathcare players ─ StoneMor was able to sell an asset outside of its primary markets ◼ Reduced regional management expenses and avoided future capital expenditure requirements ◼ $33.0 million sale value resulted in a strong net gain for the company and provided capital to pay down debt ◼ California was identified as a market exposed to heavy regulation outside of StoneMor’s key operating states ◼ Future costs related to an additional land takedown were avoided through the divestiture (1) ◼ Attractive pricing at a total sale price of $41.4 million Deathcare Assets Are Separable and Trade Frequently – StoneMor Divested California Portfolio Among 3 Different Buyers (1) Total sale price of $41.4 million includes $24.3 million in cash and a $17.1 million assumption of lot takedown obligations. 25 Olivet – Colma, CA Oakmont – Lafayette, CA

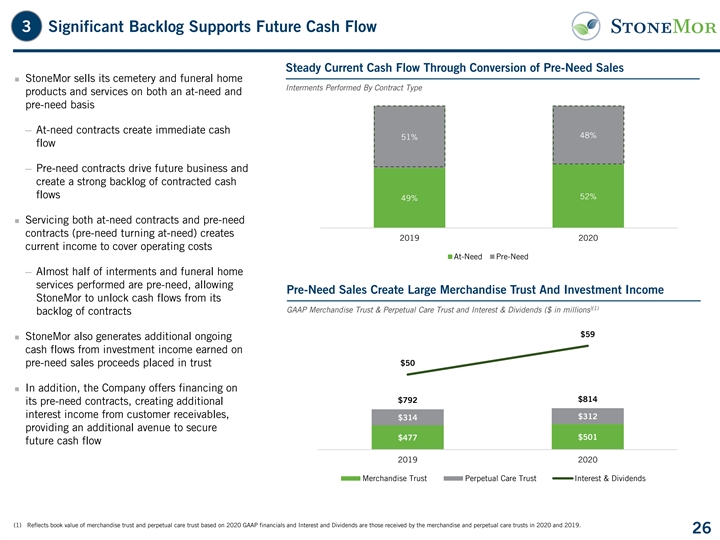

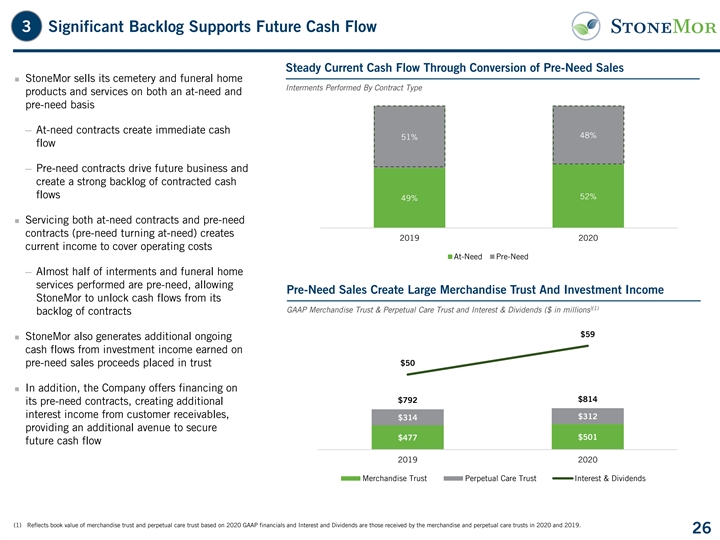

3 Significant Backlog Supports Future Cash Flow Steady Current Cash Flow Through Conversion of Pre-Need Sales ◼ StoneMor sells its cemetery and funeral home Interments Performed By Contract Type products and services on both an at-need and pre-need basis 100% 90% 80% ─ At-need contracts create immediate cash 48% 51% 70% flow 60% 50% ─ Pre-need contracts drive future business and 40% create a strong backlog of contracted cash 30% flows 52% 49% 20% 10% ◼ Servicing both at-need contracts and pre-need 0% contracts (pre-need turning at-need) creates 2019 2020 current income to cover operating costs At-Need Pre-Need ─ Almost half of interments and funeral home services performed are pre-need, allowing Pre-Need Sales Create Large Merchandise Trust And Investment Income StoneMor to unlock cash flows from its )(1) GAAP Merchandise Trust & Perpetual Care Trust and Interest & Dividends ($ in millions backlog of contracts $65 $59 ◼ StoneMor also generates additional ongoing $60 $2,000 cash flows from investment income earned on $55 pre-need sales proceeds placed in trust $50 $1,500 $50 $45 ◼ In addition, the Company offers financing on $1,000 $814 $792 its pre-need contracts, creating additional $40 interest income from customer receivables, $312 $314 $35 $500 providing an additional avenue to secure $30 $501 $477 future cash flow $0 $25 2019 2020 Merchandise Trust Perpetual Care Trust Interest & Dividends (1) Reflects book value of merchandise trust and perpetual care trust based on 2020 GAAP financials and Interest and Dividends are those received by the merchandise and perpetual care trusts in 2020 and 2019. 26

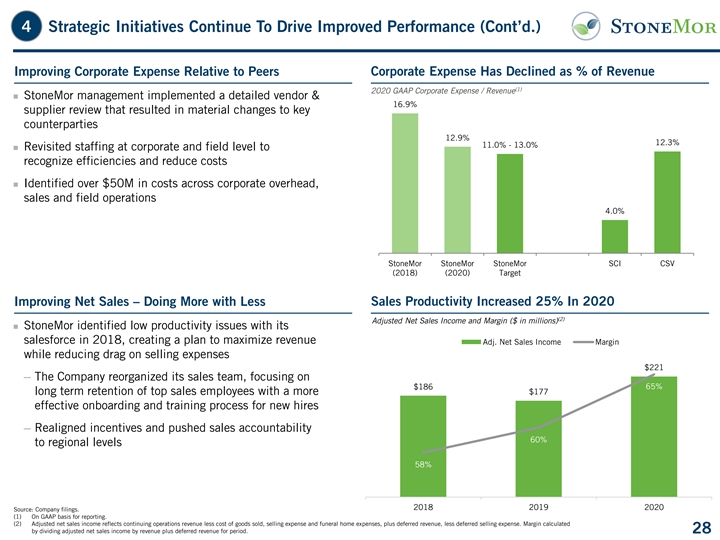

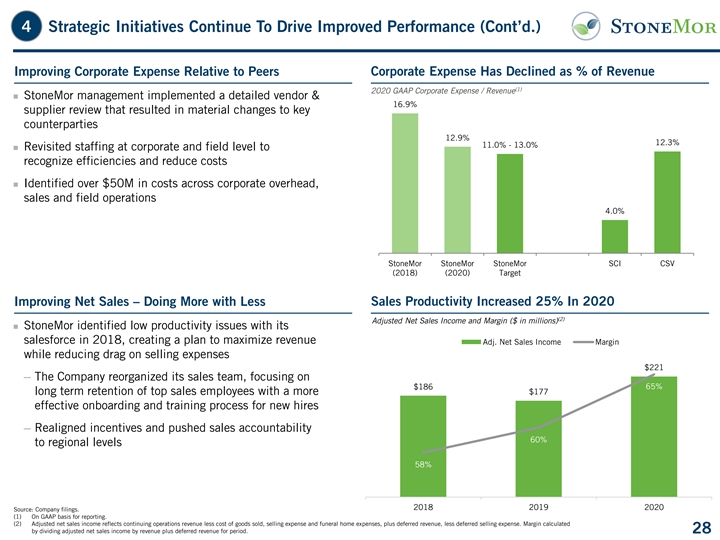

4 Strategic Initiatives Continue To Drive Improved Performance (Cont’d.) Improving Corporate Expense Relative to Peers Corporate Expense Has Declined as % of Revenue (1) 2020 GAAP Corporate Expense / Revenue ◼ StoneMor management implemented a detailed vendor & 16.9% supplier review that resulted in material changes to key counterparties 12.9% 12.3% 11.0% - 13.0% ◼ Revisited staffing at corporate and field level to recognize efficiencies and reduce costs ◼ Identified over $50M in costs across corporate overhead, sales and field operations 4.0% StoneMor StoneMor StoneMor SCI CSV (2018) (2020) Target Improving Net Sales – Doing More with Less Sales Productivity Increased 25% In 2020 (2) Adjusted Net Sales Income and Margin ($ in millions) ◼ StoneMor identified low productivity issues with its salesforce in 2018, creating a plan to maximize revenue Adj. Net Sales Income Margin while reducing drag on selling expenses $221 ─ The Company reorganized its sales team, focusing on 65% $186 long term retention of top sales employees with a more $177 effective onboarding and training process for new hires ─ Realigned incentives and pushed sales accountability 60% to regional levels 58% 2018 2019 2020 Source: Company filings. (1) On GAAP basis for reporting. (2) Adjusted net sales income reflects continuing operations revenue less cost of goods sold, selling expense and funeral home expenses, plus deferred revenue, less deferred selling expense. Margin calculated by dividing adjusted net sales income by revenue plus deferred revenue for period. 28

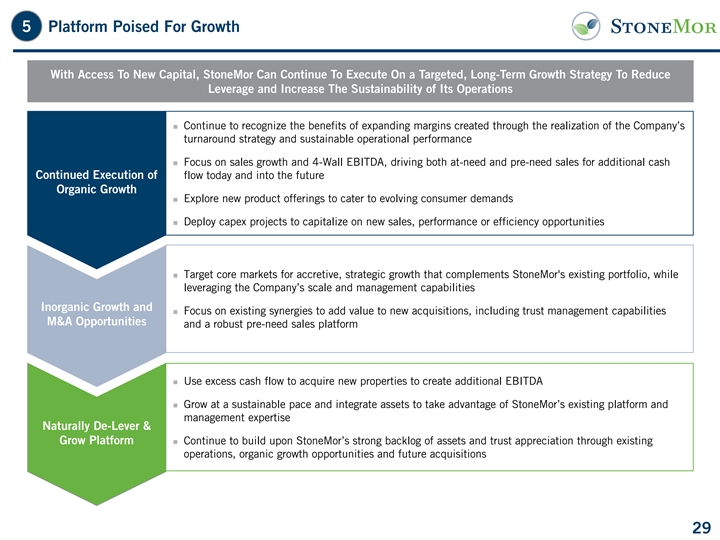

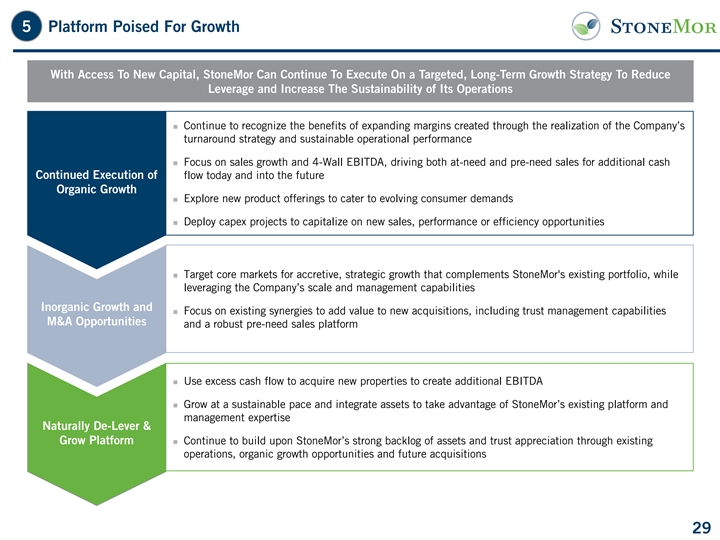

5 Platform Poised For Growth With Access To New Capital, StoneMor Can Continue To Execute On a Targeted, Long-Term Growth Strategy To Reduce Leverage and Increase The Sustainability of Its Operations ◼ Continue to recognize the benefits of expanding margins created through the realization of the Company’s turnaround strategy and sustainable operational performance ◼ Focus on sales growth and 4-Wall EBITDA, driving both at-need and pre-need sales for additional cash Continued Execution of flow today and into the future Develop A Sustainable, Organic Growth Long ◼ Explore new product offerings to cater to evolving consumer demands Term Strategy ◼ Deploy capex projects to capitalize on new sales, performance or efficiency opportunities ◼ Target core markets for accretive, strategic growth that complements StoneMor's existing portfolio, while leveraging the Company’s scale and management capabilities Inorganic Growth and ◼ Focus on existing synergies to add value to new acquisitions, including trust management capabilities M&A Opportunities and a robust pre-need sales platform ◼ Use excess cash flow to acquire new properties to create additional EBITDA ◼ Grow at a sustainable pace and integrate assets to take advantage of StoneMor’s existing platform and management expertise Naturally De-Lever & Evaluation of Grow Platform◼ Continue to build upon StoneMor’s strong backlog of assets and trust appreciation through existing Opportunities operations, organic growth opportunities and future acquisitions 29

6 Experienced Management Team Successfully Executing Strategy Joe Redling Jeff DiGiovanni Austin So President & CEO SVP & CFO SVP & CLO ◼ Named President and Chief Executive ◼ Joined as CAO in 2018 and became ◼ Joined as Chief Legal Officer in 2016 Officer and appointed to the Board of CFO in September 2019 ◼ Previously the Division General Directors in July 2018 ◼ Previously a Managing Director for a Counsel and Secretary of Heraeus, a ◼ Previously served as the Chief leading accounting and transaction Fortune Global 500 manufacturing Operating Officer of Vonage Holdings. advisory firm in the Northeast from conglomerate Inc. and Chief Executive Officer at 2012 to 2017 ◼ A.B. from Harvard University and J.D. Nutrisystem along with various senior ◼ B.S. in Accounting and a Master of from the University of Pennsylvania management at Time Warner and Science in Financial Services From School of Law AOL Saint Joseph’s University ◼ B.S. in Business Management from ◼ Certified Public Accountant St. Peter's University Tom Connolly Lindsay Granson Robert Page SVP of Business Planning & Ops SVP of Sales & Marketing SVP of Funeral Homes & Projects ◼ Joined in 2019 initially as a ◼ Joined in 2017 and named SVP of ◼ Joined in 2018 as President of the consultant before being named to Sales & Marketing in 2021 Western Division before becoming SVP of Business Planning & SVP of Funeral Homes & Special ◼ Previously held various leadership Operations in late 2019 Projects in 2021 roles in the Senior Living sector ◼ Previously served as VP of Business ◼ Previously worked for several public ◼ B.A. in Elementary Education from Operations for Brookstone and private deathcare consolidators Wright State University in various acquisitions, finance, tech ◼ B.A. in Political Science from and operations roles Haverford Keith Trost Jack Omer Marc Bing-Zaremba VP of Corporate Development & IR Divisional President, South & Midwest Divisional President, Northeast ◼ Joined in 2019 as the VP of FP&A◼ Joined in 2017 as Regional Vice ◼ Joined in 2015 before being named President of Sales before being President of the Northeast Division in ◼ Previously held various senior roles in appointed to Division President in 2019 financial analysis and accounting at 2018 real estate developers and Deloitte◼ Previously held senior leadership ◼ Previously worked in leadership at positions in real estate and a US ◼ B.B.A in Accounting from Notre Brookdale Senior Living Army Veteran Dame and M.B.A From Villanova ◼ Oversees operations and sales in the South, Midwest, and Puerto Rico 30

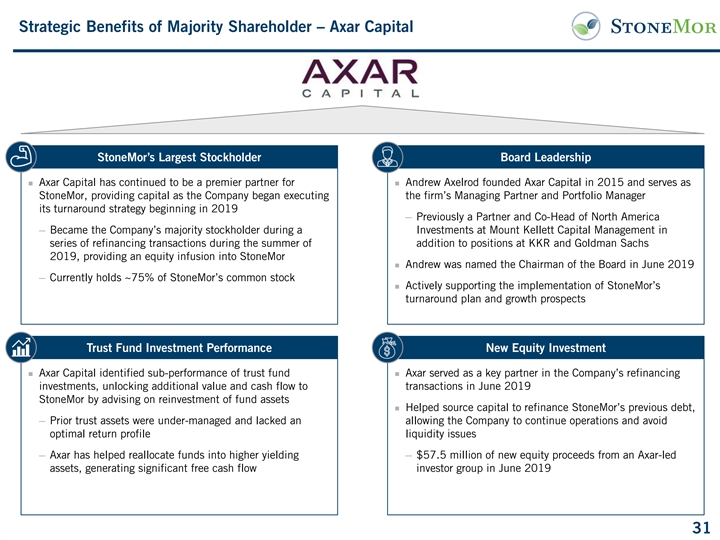

Strategic Benefits of Majority Shareholder – Axar Capital StoneMor’s Largest Stockholder Board Leadership ◼ Axar Capital has continued to be a premier partner for ◼ Andrew Axelrod founded Axar Capital in 2015 and serves as StoneMor, providing capital as the Company began executing the firm’s Managing Partner and Portfolio Manager its turnaround strategy beginning in 2019 ─ Previously a Partner and Co-Head of North America ─ Became the Company’s majority stockholder during a Investments at Mount Kellett Capital Management in series of refinancing transactions during the summer of addition to positions at KKR and Goldman Sachs 2019, providing an equity infusion into StoneMor ◼ Andrew was named the Chairman of the Board in June 2019 ─ Currently holds ~75% of StoneMor’s common stock ◼ Actively supporting the implementation of StoneMor’s turnaround plan and growth prospects Trust Fund Investment Performance New Equity Investment ◼ Axar Capital identified sub-performance of trust fund ◼ Axar served as a key partner in the Company’s refinancing investments, unlocking additional value and cash flow to transactions in June 2019 StoneMor by advising on reinvestment of fund assets ◼ Helped source capital to refinance StoneMor’s previous debt, ─ Prior trust assets were under-managed and lacked an allowing the Company to continue operations and avoid optimal return profile liquidity issues ─ Axar has helped reallocate funds into higher yielding ─ $57.5 million of new equity proceeds from an Axar-led assets, generating significant free cash flow investor group in June 2019 31

4 Historical Financial Overview

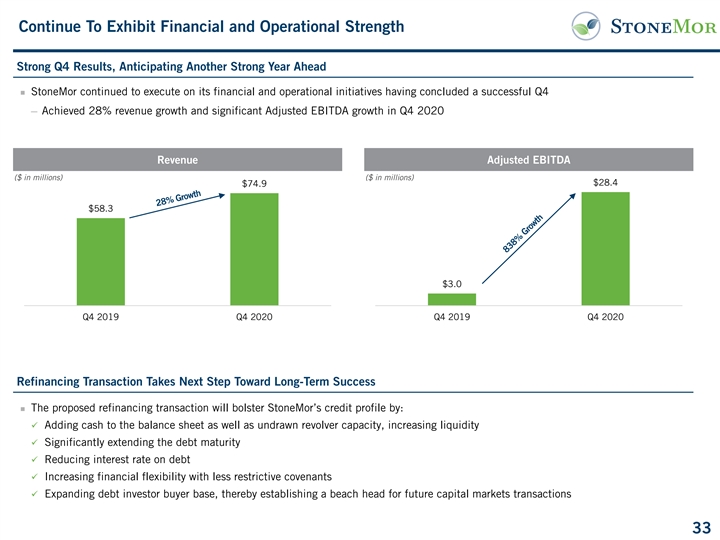

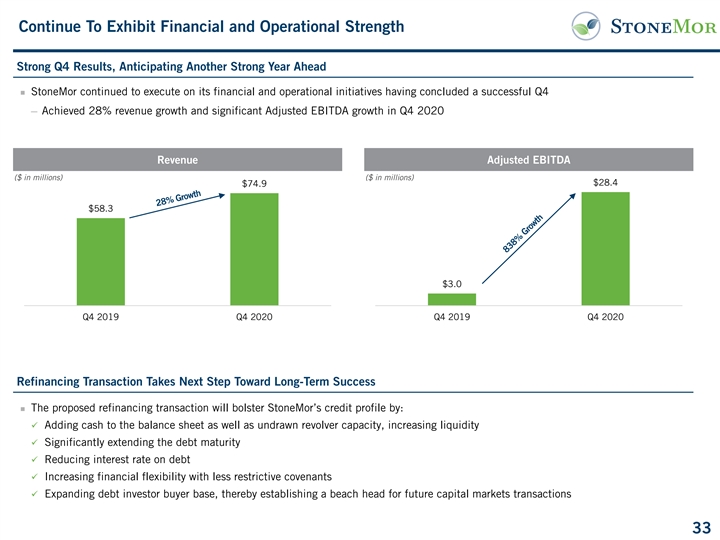

Continue To Exhibit Financial and Operational Strength Strong Q4 Results, Anticipating Another Strong Year Ahead ◼ StoneMor continued to execute on its financial and operational initiatives having concluded a successful Q4 ─ Achieved 28% revenue growth and significant Adjusted EBITDA growth in Q4 2020 Revenue Adjusted EBITDA ($ in millions) ($ in millions) $28.4 $74.9 $58.3 $3.0 Q4 2019 Q4 2020 Q4 2019 Q4 2020 Refinancing Transaction Takes Next Step Toward Long-Term Success ◼ The proposed refinancing transaction will bolster StoneMor’s credit profile by: ✓ Adding cash to the balance sheet as well as undrawn revolver capacity, increasing liquidity ✓ Significantly extending the debt maturity ✓ Reducing interest rate on debt ✓ Increasing financial flexibility with less restrictive covenants ✓ Expanding debt investor buyer base, thereby establishing a beach head for future capital markets transactions 33

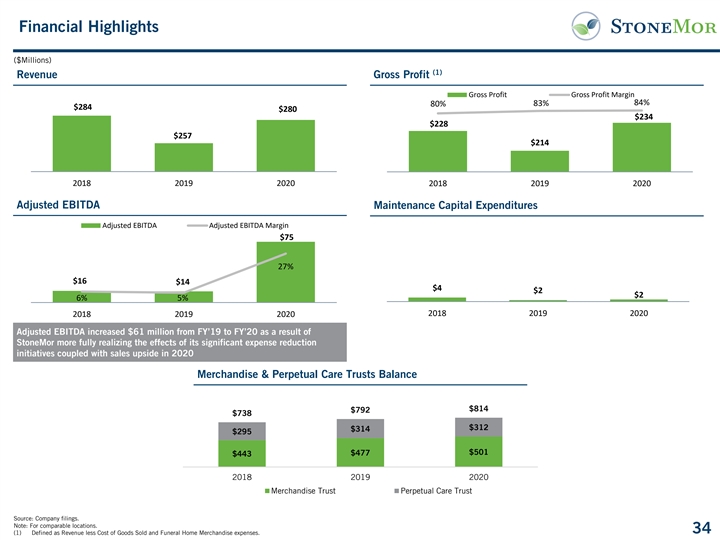

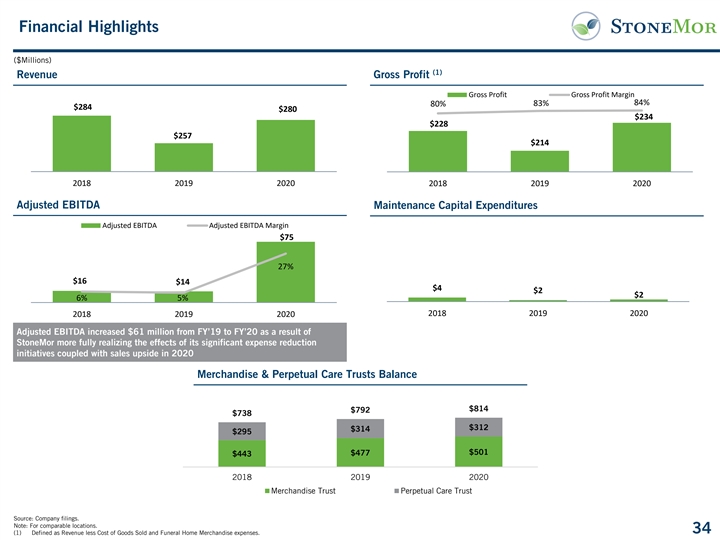

Financial Highlights ($Millions) (1) Revenue Gross Profit Gross Profit Gross Profit Margin 84% 83% 80% $284 $280 $234 $228 $257 $214 2018 2019 2020 2018 2019 2020 Adjusted EBITDA Maintenance Capital Expenditures Adjusted EBITDA Adjusted EBITDA Margin $75 27% $16 $14 $4 $2 $2 6% 5% 2018 2019 2020 2018 2019 2020 Adjusted EBITDA increased $61 million from FY’19 to FY’20 as a result of StoneMor more fully realizing the effects of its significant expense reduction initiatives coupled with sales upside in 2020 Merchandise & Perpetual Care Trusts Balance $814 $792 $738 $312 $314 $295 $501 $477 $443 2018 2019 2020 Merchandise Trust Perpetual Care Trust Source: Company filings. Note: For comparable locations. 34 (1) Defined as Revenue less Cost of Goods Sold and Funeral Home Merchandise expenses.

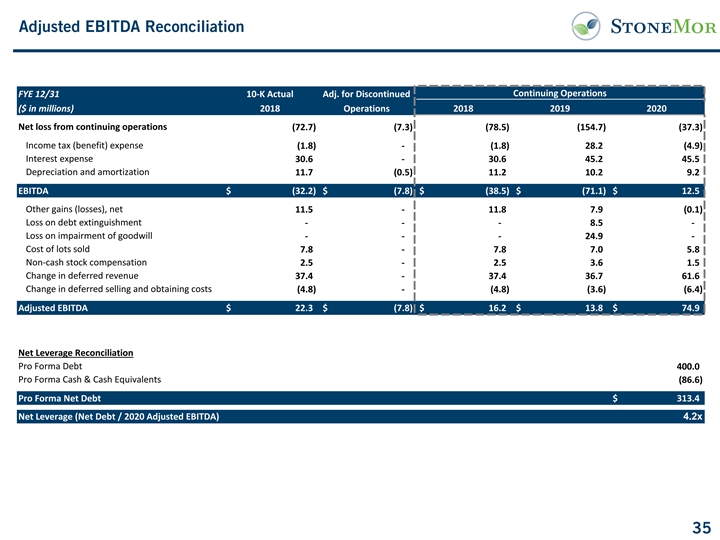

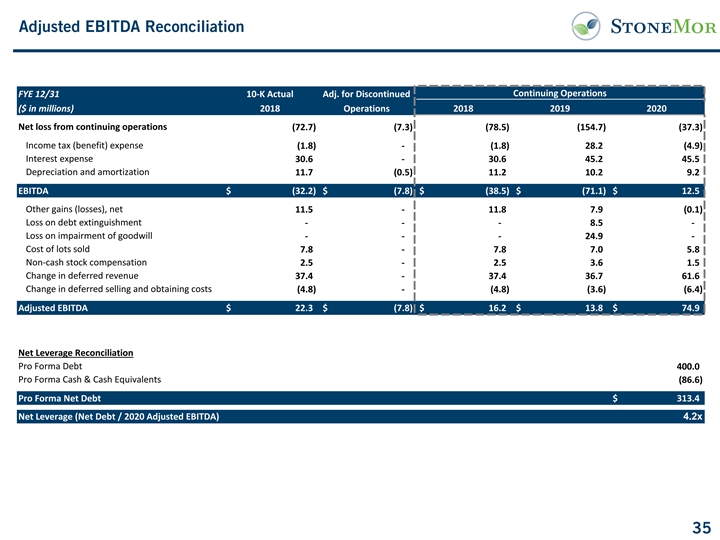

Adjusted EBITDA Reconciliation Continuing Operations FYE 12/31 10-K Actual Adj. for Discontinued ($ in millions) 2018 Operations 2018 2019 2020 Net loss from continuing operations (72.7) (7.3) (78.5) (154. 7) (37.3) Income tax (benefit) expense (1.8) - (1.8) 28.2 (4.9) Interest expense 30.6 - 30.6 45.2 45.5 Depreciation and amortization 11.7 (0.5) 11.2 10.2 9.2 EBITDA $ (32.2 ) $ (7.8) $ ( 38.5) $ (71.1 ) $ 12.5 Other gains (losses), net 11.5 - 11.8 7.9 (0.1) Loss on debt extinguishment - - - 8.5 - Loss on impairment of goodwill - - - 24.9 - Cost of lots sold 7.8 - 7.8 7.0 5.8 Non-cash stock compensation 2.5 - 2.5 3.6 1.5 Change in deferred revenue 37.4 - 37.4 36.7 61.6 Change in deferred selling and obtaining costs (4.8) - (4.8) (3.6) (6.4) Adjusted EBITDA $ 22.3 $ (7.8) $ 16.2 $ 13.8 $ 74.9 Net Leverage Reconciliation Pro Forma Debt 400.0 Pro Forma Cash & Cash Equivalents (86.6) Pro Forma Net Debt $ 313.4 Net Leverage (Net Debt / 2020 Adjusted EBITDA) 4.2x 35

5 Appendix

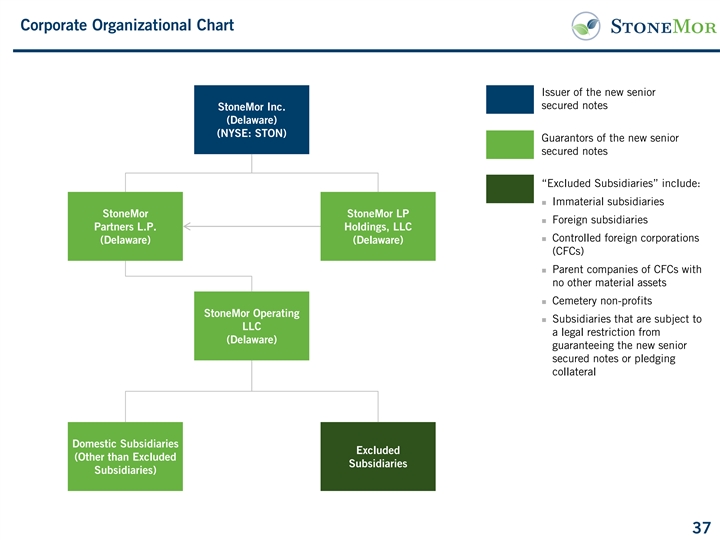

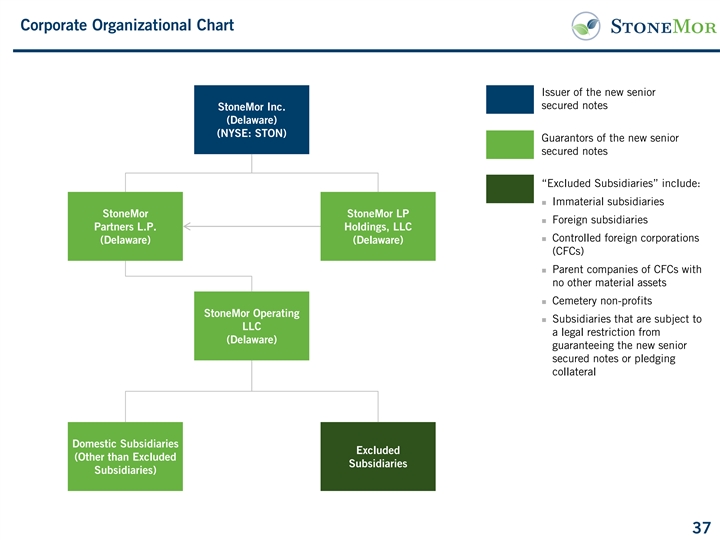

Corporate Organizational Chart Issuer of the new senior secured notes StoneMor Inc. (Delaware) (NYSE: STON) Guarantors of the new senior secured notes “Excluded Subsidiaries” include: ◼ Immaterial subsidiaries StoneMor StoneMor LP ◼ Foreign subsidiaries Partners L.P. Holdings, LLC ◼ Controlled foreign corporations (Delaware) (Delaware) (CFCs) ◼ Parent companies of CFCs with no other material assets ◼ Cemetery non-profits StoneMor Operating ◼ Subsidiaries that are subject to LLC a legal restriction from (Delaware) guaranteeing the new senior secured notes or pledging collateral Domestic Subsidiaries Excluded (Other than Excluded Subsidiaries Subsidiaries) 37