Exhibit 99.1 Relief you can rely on Investor Presentation | June 2021Exhibit 99.1 Relief you can rely on Investor Presentation | June 2021

Forward Looking Statements and Industry and Market Data Unless the context otherwise requires, the terms “Trulieve,” “we,” “us” and “our” in this prospectus refer to Trulieve Cannabis Corp. and its subsidiaries. Certain statements in this presentation constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation (collectively herein referred to as “forward-looking statements”), which can often be identified by words such as “will”, “may”, “estimate”, “expect”, “plan”, “project”, “intend”, “anticipate” and other words indicating that the statements are forward-looking. Such forward-looking statements are expectations only and are subject to known and unknown risks, uncertainties and other important factors, including, but not limited to, risk factors included in this presentation, that could cause the Company’s actual results, performance or achievements or industry results to differ materially from any future results, performance or achievements implied by such forward-looking statements. Such risks and uncertainties include, among others, dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing state, local or other licenses; engaging in activities which currently are illegal under United States federal law and the uncertainty of existing protection from United States federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including United States state-law legalization, particularly in Florida, due to inconsistent public opinion, perception of the medical-use and adult-use cannabis industry, bureaucratic delays or inefficiencies or any other reasons; any other factors or developments which may hinder market growth; reliance on management; and the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Although it may voluntarily do so from time to time, the Company undertakes no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Unless otherwise noted, the forecasted industry and market data contained herein are based upon management estimates and industry and market publications and surveys. The information from industry and market publications has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. The Company has not independently verified any of the data from third-party sources, nor has the Company ascertained the underlying economic assumptions relied upon therein. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. PLEASE NOTE THAT MARIJUANA IS ILLEGAL UNDER U.S. FEDERAL LAW, INCLUDING ITS CONSUMPTION, POSSESSION, CULTIVATION, DISTRIBUTION, MANUFACTURING, DISPENSING, AND POSSESSION WITH INTENT TO DISTRIBUTE. Forward-looking statements made in this document are made only as of the date of their initial publication, and the Company undertakes no obligation to publicly update any of these forward-looking statements as actual events unfold. 2 │ © 2021 Trulieve. All Rights Reserved.Forward Looking Statements and Industry and Market Data Unless the context otherwise requires, the terms “Trulieve,” “we,” “us” and “our” in this prospectus refer to Trulieve Cannabis Corp. and its subsidiaries. Certain statements in this presentation constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation (collectively herein referred to as “forward-looking statements”), which can often be identified by words such as “will”, “may”, “estimate”, “expect”, “plan”, “project”, “intend”, “anticipate” and other words indicating that the statements are forward-looking. Such forward-looking statements are expectations only and are subject to known and unknown risks, uncertainties and other important factors, including, but not limited to, risk factors included in this presentation, that could cause the Company’s actual results, performance or achievements or industry results to differ materially from any future results, performance or achievements implied by such forward-looking statements. Such risks and uncertainties include, among others, dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing state, local or other licenses; engaging in activities which currently are illegal under United States federal law and the uncertainty of existing protection from United States federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including United States state-law legalization, particularly in Florida, due to inconsistent public opinion, perception of the medical-use and adult-use cannabis industry, bureaucratic delays or inefficiencies or any other reasons; any other factors or developments which may hinder market growth; reliance on management; and the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Although it may voluntarily do so from time to time, the Company undertakes no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Unless otherwise noted, the forecasted industry and market data contained herein are based upon management estimates and industry and market publications and surveys. The information from industry and market publications has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. The Company has not independently verified any of the data from third-party sources, nor has the Company ascertained the underlying economic assumptions relied upon therein. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. PLEASE NOTE THAT MARIJUANA IS ILLEGAL UNDER U.S. FEDERAL LAW, INCLUDING ITS CONSUMPTION, POSSESSION, CULTIVATION, DISTRIBUTION, MANUFACTURING, DISPENSING, AND POSSESSION WITH INTENT TO DISTRIBUTE. Forward-looking statements made in this document are made only as of the date of their initial publication, and the Company undertakes no obligation to publicly update any of these forward-looking statements as actual events unfold. 2 │ © 2021 Trulieve. All Rights Reserved.

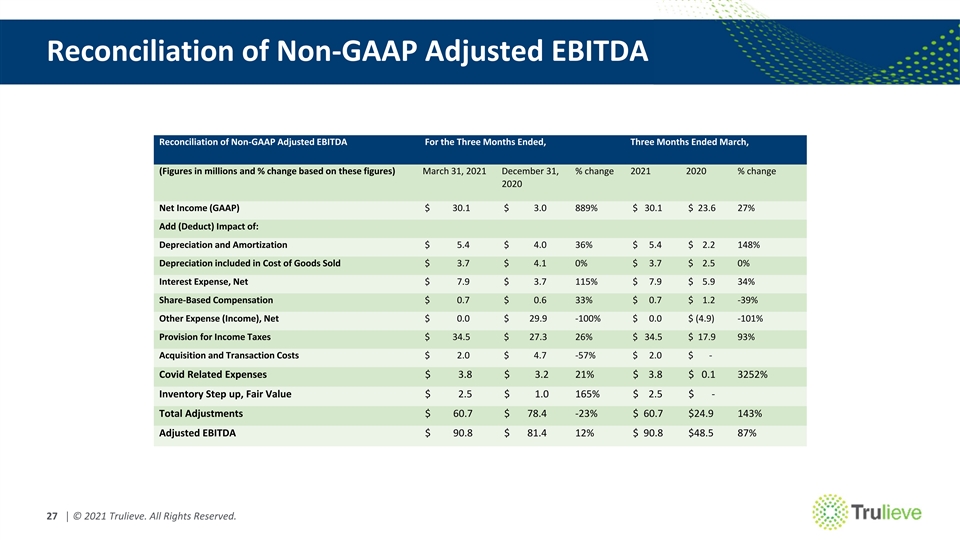

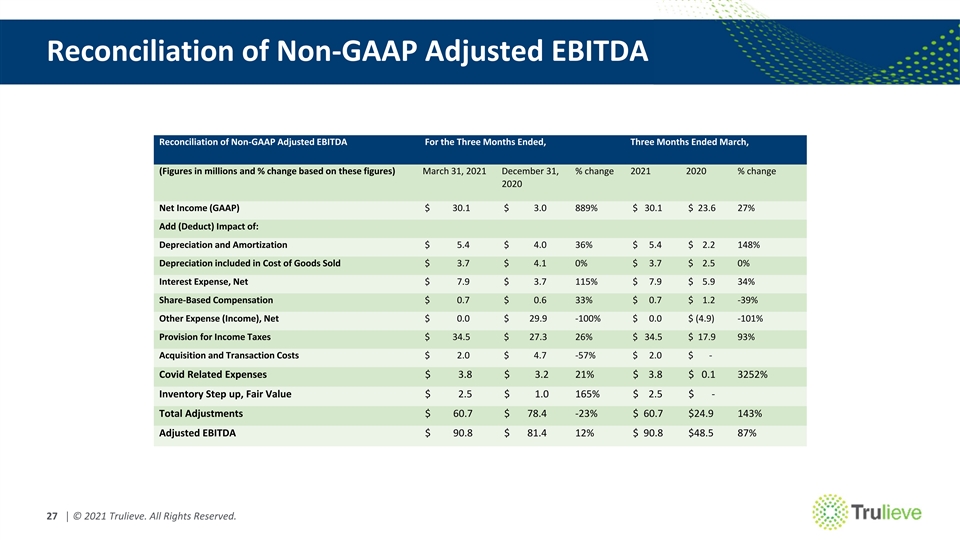

Management’s Use of Non-GAAP Financial Measures Our management uses financial measures that are not in accordance with generally accepted accounting principles in the United States, or GAAP, in addition to financial measures in accordance with GAAP to evaluate our operating results. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP. Adjusted EBITDA is a financial measure that is not defined under GAAP. Our management uses this non-GAAP financial measure and believes it enhances an investor’s understanding of our financial and operating performance from period to period because it excludes certain material non-cash items and certain other adjustments management believes are not reflective of our ongoing operations and performance. Adjusted EBITDA excludes from net income as reported interest, share-based compensation, tax, depreciation, acquisition and transaction costs, fair value step-up of inventory from acquisitions, non-cash expenses and other income. The financial measures noted above are metrics that have been adjusted from the GAAP net income measure in an effort to provide readers with a normalized metric in making comparisons more meaningful across the cannabis industry, as well as to remove non- recurring, irregular and one-time items that may otherwise distort the GAAP net income measure. As noted above, our Adjusted EBITDA is not prepared in accordance with GAAP, and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income, which is the most directly comparable financial measure calculated and presented in accordance with GAAP. Because of these limitations, we consider, and you should consider, Adjusted EBITDA together with other operating and financial performance measures presented in accordance with GAAP. A reconciliation of Adjusted EBITDA from net income, the most directly comparable financial measure calculated in accordance with GAAP, has been included at the end of this presentation. 3 │ © 2021 Trulieve. All Rights Reserved.Management’s Use of Non-GAAP Financial Measures Our management uses financial measures that are not in accordance with generally accepted accounting principles in the United States, or GAAP, in addition to financial measures in accordance with GAAP to evaluate our operating results. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP. Adjusted EBITDA is a financial measure that is not defined under GAAP. Our management uses this non-GAAP financial measure and believes it enhances an investor’s understanding of our financial and operating performance from period to period because it excludes certain material non-cash items and certain other adjustments management believes are not reflective of our ongoing operations and performance. Adjusted EBITDA excludes from net income as reported interest, share-based compensation, tax, depreciation, acquisition and transaction costs, fair value step-up of inventory from acquisitions, non-cash expenses and other income. The financial measures noted above are metrics that have been adjusted from the GAAP net income measure in an effort to provide readers with a normalized metric in making comparisons more meaningful across the cannabis industry, as well as to remove non- recurring, irregular and one-time items that may otherwise distort the GAAP net income measure. As noted above, our Adjusted EBITDA is not prepared in accordance with GAAP, and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income, which is the most directly comparable financial measure calculated and presented in accordance with GAAP. Because of these limitations, we consider, and you should consider, Adjusted EBITDA together with other operating and financial performance measures presented in accordance with GAAP. A reconciliation of Adjusted EBITDA from net income, the most directly comparable financial measure calculated in accordance with GAAP, has been included at the end of this presentation. 3 │ © 2021 Trulieve. All Rights Reserved.

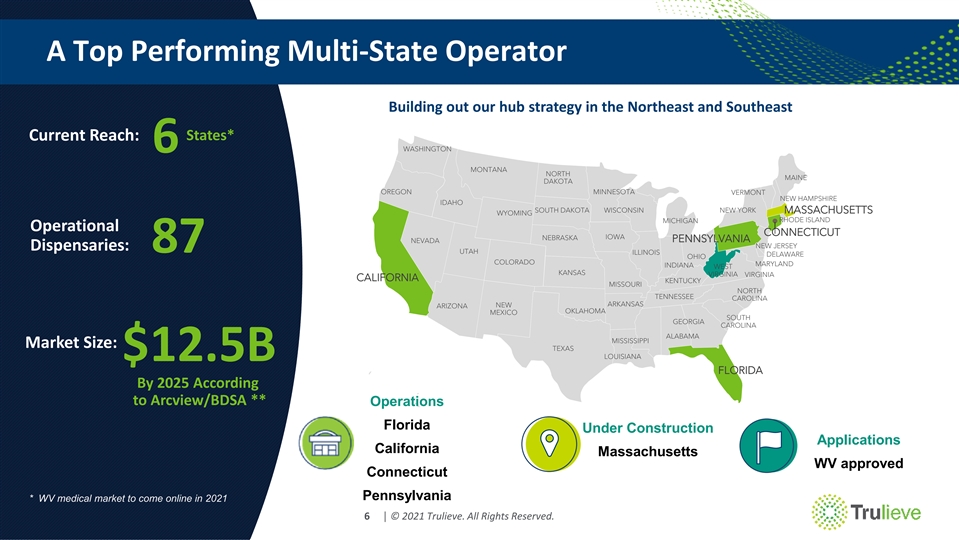

Company Overview Founded in 2015 MISSION and VISION Nearly 5,000 employees as of Dec. 31, 2021 Our mission is to provide the 6 states (FL, CA, MA, CT, PA, WV) highest level of cannabis products and customer experiences *87 stores (FL, CA, CT, PA) through authentic and reciprocal relationships. Approximately 2.2M sq. ft. cultivation Profitable since 2018 4 │ © 2021 Trulieve. All Rights Reserved. 4 │ © 2021 Trulieve. All Rights Reserved. *As of May 15, 2021Company Overview Founded in 2015 MISSION and VISION Nearly 5,000 employees as of Dec. 31, 2021 Our mission is to provide the 6 states (FL, CA, MA, CT, PA, WV) highest level of cannabis products and customer experiences *87 stores (FL, CA, CT, PA) through authentic and reciprocal relationships. Approximately 2.2M sq. ft. cultivation Profitable since 2018 4 │ © 2021 Trulieve. All Rights Reserved. 4 │ © 2021 Trulieve. All Rights Reserved. *As of May 15, 2021

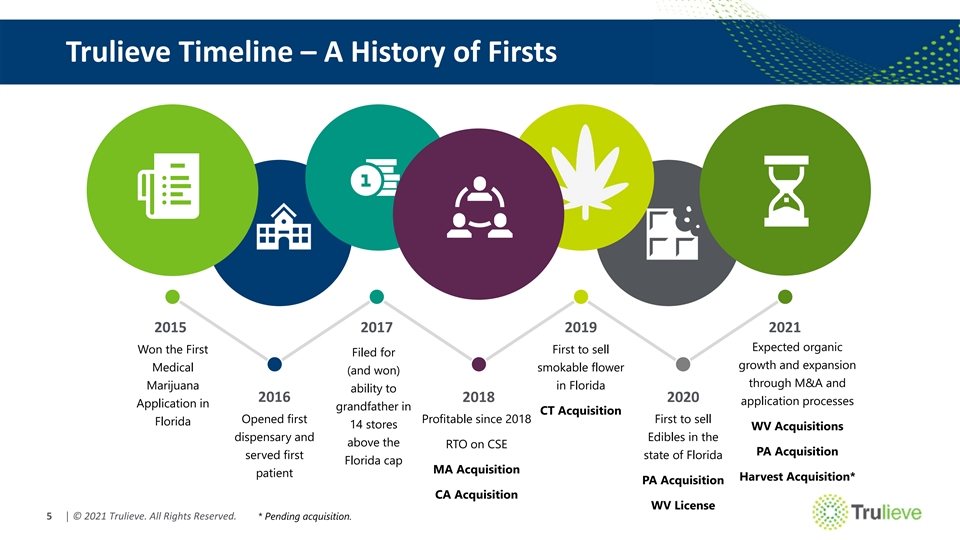

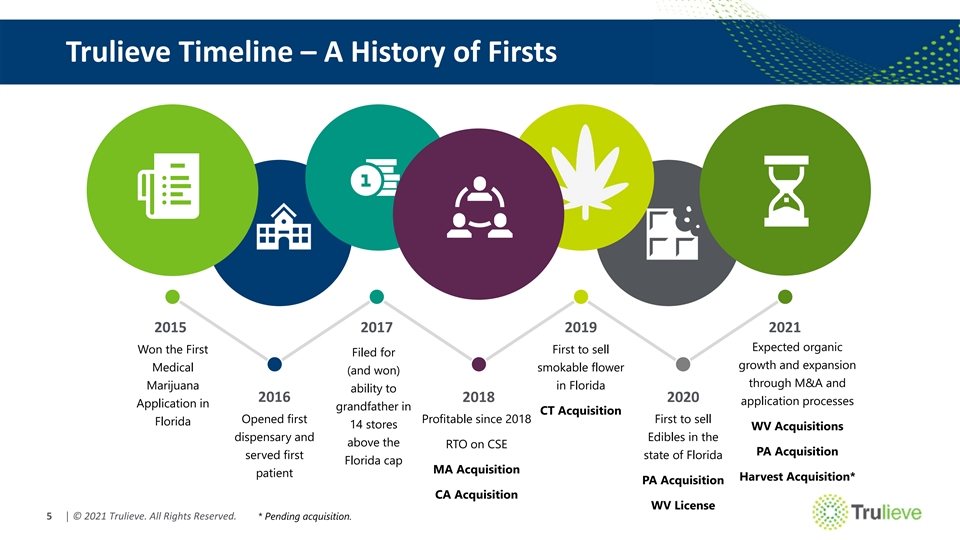

Trulieve Timeline – A History of Firsts 2015 2017 2019 2021 Expected organic Won the First First to sell Filed for growth and expansion Medical smokable flower (and won) through M&A and Marijuana in Florida ability to 2016 2018 2020 application processes Application in grandfather in CT Acquisition Opened first Profitable since 2018 First to sell Florida 14 stores WV Acquisitions dispensary and Edibles in the above the RTO on CSE PA Acquisition served first state of Florida Florida cap MA Acquisition patient Harvest Acquisition* PA Acquisition CA Acquisition WV License 5 │ © 2021 Trulieve. All Rights Reserved. * Pending acquisition. Trulieve Timeline – A History of Firsts 2015 2017 2019 2021 Expected organic Won the First First to sell Filed for growth and expansion Medical smokable flower (and won) through M&A and Marijuana in Florida ability to 2016 2018 2020 application processes Application in grandfather in CT Acquisition Opened first Profitable since 2018 First to sell Florida 14 stores WV Acquisitions dispensary and Edibles in the above the RTO on CSE PA Acquisition served first state of Florida Florida cap MA Acquisition patient Harvest Acquisition* PA Acquisition CA Acquisition WV License 5 │ © 2021 Trulieve. All Rights Reserved. * Pending acquisition.

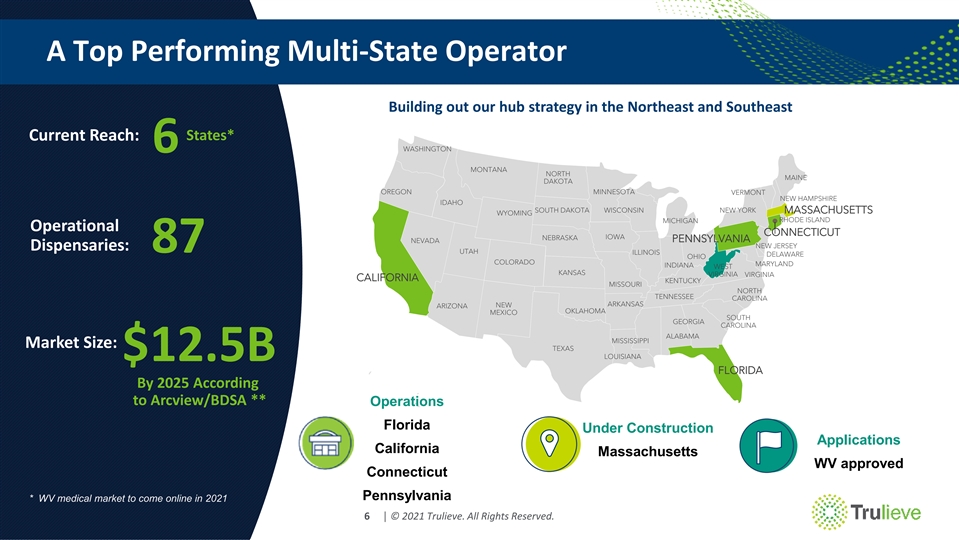

A Top Performing Multi-State Operator Building out our hub strategy in the Northeast and Southeast States* Current Reach: WASHINGTON 6 MONTANA NORTH MAINE DAKOTA OREGON MINNESOTA VERMONT NEW HAMPSHIRE IDAHO SOUTH DAKOTA WISCONSIN NEW YORK MASSACHUSETTS WYOMING RHODE ISLAND MICHIGAN Operational CONNECTICUT IOWA NEBRASKA PENNSYLVANIA NEVADA NEW JERSEY Dispensaries: 87 UTAH ILLINOIS DELAWARE OHIO COLORADO MARYLAND INDIANA WEST KANSAS VIRGINIA VIRGINIA CALIFORNIA KENTUCKY MISSOURI NORTH TENNESSEE CAROLINA ARKANSAS NEW ARIZONA OKLAHOMA MEXICO SOUTH GEORGIA CAROLINA ALABAMA MISSISSIPPI Market Size: TEXAS LOUISIANA $12.5B FLORIDA By 2025 According to Arcview/BDSA ** Operations Florida Under Construction Applications California Massachusetts WV approved Connecticut Pennsylvania * WV medical market to come online in 2021 6 │ © 2021 Trulieve. All Rights Reserved. 6 │ © 2021 Trulieve. All Rights Reserved.A Top Performing Multi-State Operator Building out our hub strategy in the Northeast and Southeast States* Current Reach: WASHINGTON 6 MONTANA NORTH MAINE DAKOTA OREGON MINNESOTA VERMONT NEW HAMPSHIRE IDAHO SOUTH DAKOTA WISCONSIN NEW YORK MASSACHUSETTS WYOMING RHODE ISLAND MICHIGAN Operational CONNECTICUT IOWA NEBRASKA PENNSYLVANIA NEVADA NEW JERSEY Dispensaries: 87 UTAH ILLINOIS DELAWARE OHIO COLORADO MARYLAND INDIANA WEST KANSAS VIRGINIA VIRGINIA CALIFORNIA KENTUCKY MISSOURI NORTH TENNESSEE CAROLINA ARKANSAS NEW ARIZONA OKLAHOMA MEXICO SOUTH GEORGIA CAROLINA ALABAMA MISSISSIPPI Market Size: TEXAS LOUISIANA $12.5B FLORIDA By 2025 According to Arcview/BDSA ** Operations Florida Under Construction Applications California Massachusetts WV approved Connecticut Pennsylvania * WV medical market to come online in 2021 6 │ © 2021 Trulieve. All Rights Reserved. 6 │ © 2021 Trulieve. All Rights Reserved.

Go-to-Market Strategy Providing the highest quality products, premier national brands, cherished local brands and the best consumer experience Large & growing product line 600+ SKUs with multiple concentration ratios and strains Powerful brand name partnerships Helping our market grow faster with national brand names Building trust with local brands Local brands build community support Wholesale distribution Extend our Trulieve brand in approved states. PA wholesales to 100% of market. MA wholesale Massachusetts Pennsylvania launch in 2021. 7 │ © 2021 Trulieve. All Rights Reserved.Go-to-Market Strategy Providing the highest quality products, premier national brands, cherished local brands and the best consumer experience Large & growing product line 600+ SKUs with multiple concentration ratios and strains Powerful brand name partnerships Helping our market grow faster with national brand names Building trust with local brands Local brands build community support Wholesale distribution Extend our Trulieve brand in approved states. PA wholesales to 100% of market. MA wholesale Massachusetts Pennsylvania launch in 2021. 7 │ © 2021 Trulieve. All Rights Reserved.

Announced Definitive Agreement on May 10, 2021 to Acquire Harvest Health & Recreation - Creating the Most Profitable MSO The Trulieve and Harvest combination expands the most profitable MSO. Our regional hub strategy provides leading market positions in the most attractive markets. This combination allows us to accelerate our national expansion strategy and go deeper in the markets we operate in to support our mutual vision of increasing access to cannabis through industry-leading retail stores, innovative high-quality products and brands and delivering optimal customer experiences. 8 │ © 2021 Trulieve. All Rights Reserved. 8 │ © 2021 Trulieve. All Rights Reserved.Announced Definitive Agreement on May 10, 2021 to Acquire Harvest Health & Recreation - Creating the Most Profitable MSO The Trulieve and Harvest combination expands the most profitable MSO. Our regional hub strategy provides leading market positions in the most attractive markets. This combination allows us to accelerate our national expansion strategy and go deeper in the markets we operate in to support our mutual vision of increasing access to cannabis through industry-leading retail stores, innovative high-quality products and brands and delivering optimal customer experiences. 8 │ © 2021 Trulieve. All Rights Reserved. 8 │ © 2021 Trulieve. All Rights Reserved.

Combined Trulieve + Harvest Footprint MA CT NORTHEAST HUB ⚫16 dispensaries ⚫282K sq. ft. of MA cultivation & CT production PA PA WV NV CA AZ SOUTHWEST UT CO CA MD WV HUB MD ⚫20 dispensaries ⚫380K sq. ft. of AZ AZ cultivation & production CO NV FL SOUTHEAST FL HUB ⚫90 dispensaries UT ⚫2.430 M sq. ft. of cultivation & production + 9 │ © 2021 Trulieve. All Rights Reserved. 9 │ © 2021 Trulieve. All Rights Reserved.Combined Trulieve + Harvest Footprint MA CT NORTHEAST HUB ⚫16 dispensaries ⚫282K sq. ft. of MA cultivation & CT production PA PA WV NV CA AZ SOUTHWEST UT CO CA MD WV HUB MD ⚫20 dispensaries ⚫380K sq. ft. of AZ AZ cultivation & production CO NV FL SOUTHEAST FL HUB ⚫90 dispensaries UT ⚫2.430 M sq. ft. of cultivation & production + 9 │ © 2021 Trulieve. All Rights Reserved. 9 │ © 2021 Trulieve. All Rights Reserved.

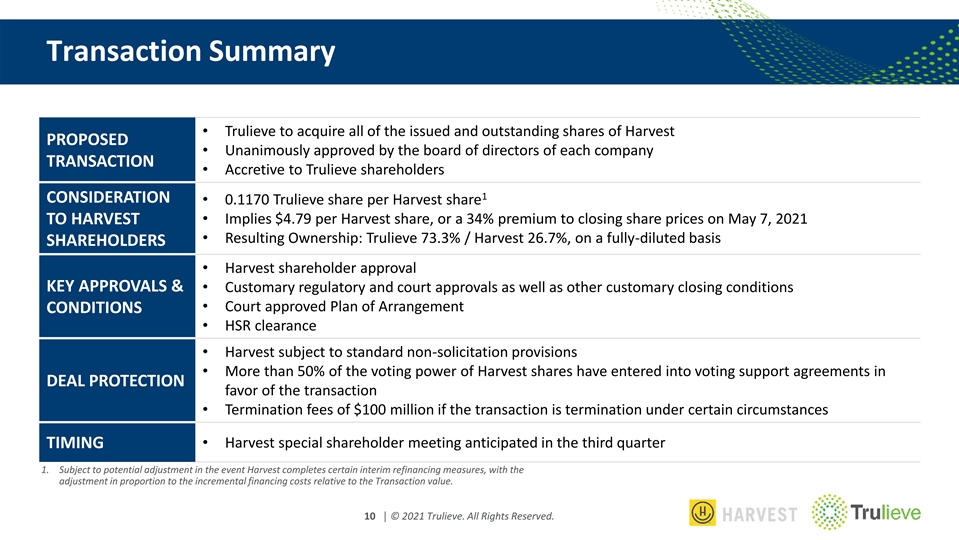

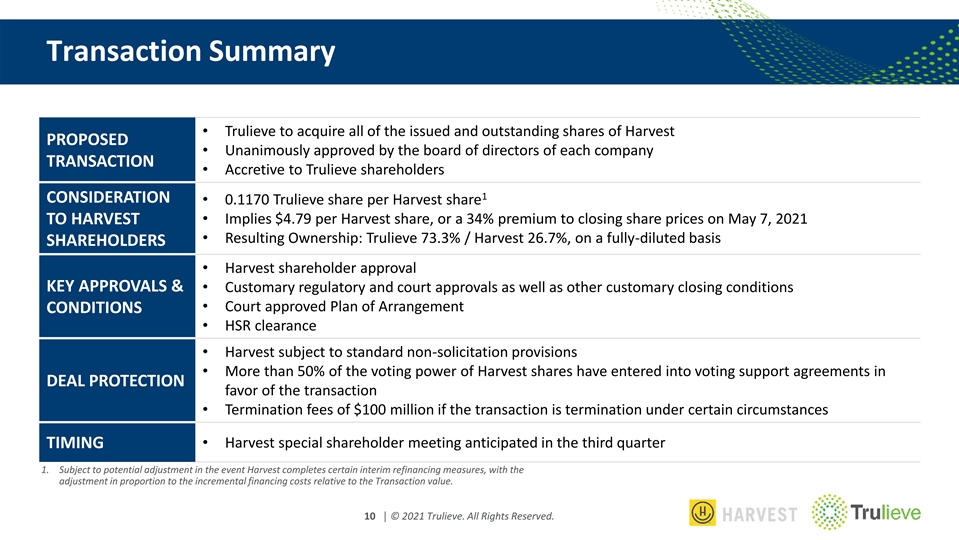

Transaction Summary • Trulieve to acquire all of the issued and outstanding shares of Harvest PROPOSED • Unanimously approved by the board of directors of each company TRANSACTION • Accretive to Trulieve shareholders 1 CONSIDERATION • 0.1170 Trulieve share per Harvest share TO HARVEST • Implies $4.79 per Harvest share, or a 34% premium to closing share prices on May 7, 2021 • Resulting Ownership: Trulieve 73.3% / Harvest 26.7%, on a fully-diluted basis SHAREHOLDERS • Harvest shareholder approval KEY APPROVALS & • Customary regulatory and court approvals as well as other customary closing conditions • Court approved Plan of Arrangement CONDITIONS • HSR clearance • Harvest subject to standard non-solicitation provisions • More than 50% of the voting power of Harvest shares have entered into voting support agreements in DEAL PROTECTION favor of the transaction • Termination fees of $100 million if the transaction is termination under certain circumstances TIMING• Harvest special shareholder meeting anticipated in the third quarter 1. Subject to potential adjustment in the event Harvest completes certain interim refinancing measures, with the adjustment in proportion to the incremental financing costs relative to the Transaction value. 10 │ © 2021 Trulieve. All Rights Reserved. 10 │ © 2021 Trulieve. All Rights Reserved.Transaction Summary • Trulieve to acquire all of the issued and outstanding shares of Harvest PROPOSED • Unanimously approved by the board of directors of each company TRANSACTION • Accretive to Trulieve shareholders 1 CONSIDERATION • 0.1170 Trulieve share per Harvest share TO HARVEST • Implies $4.79 per Harvest share, or a 34% premium to closing share prices on May 7, 2021 • Resulting Ownership: Trulieve 73.3% / Harvest 26.7%, on a fully-diluted basis SHAREHOLDERS • Harvest shareholder approval KEY APPROVALS & • Customary regulatory and court approvals as well as other customary closing conditions • Court approved Plan of Arrangement CONDITIONS • HSR clearance • Harvest subject to standard non-solicitation provisions • More than 50% of the voting power of Harvest shares have entered into voting support agreements in DEAL PROTECTION favor of the transaction • Termination fees of $100 million if the transaction is termination under certain circumstances TIMING• Harvest special shareholder meeting anticipated in the third quarter 1. Subject to potential adjustment in the event Harvest completes certain interim refinancing measures, with the adjustment in proportion to the incremental financing costs relative to the Transaction value. 10 │ © 2021 Trulieve. All Rights Reserved. 10 │ © 2021 Trulieve. All Rights Reserved.

Going Deep in Florida Provides Scale in Operations One of the Largest US Cultivation Footprints – approaching 2.2M sq. ft. – Approximately 2.1M sq. ft. of cultivation capacity in FL (as of 6/1/21) • Indoor Cultivation – approximate turns of 5 • Greenhouse – approximate turns of 2 – Building out to 90K sq ft in PA, and 78K sq ft of canopy/production in MA High-End Extraction & Branded Product Development – Private label, medical grade cannabis consumer products – Super-critical ethanol and CO2 extraction and distillation processes to produce concentrates – Infrastructure ready to support BHO extraction methods Dispensary Market Leader – 82 Florida retail locations plus a statewide delivery program (as of 5/16/21) – Continuing to grow in 2021 to maintain lead in Florida – > 250,000 sq. ft. retail space (as of 6/1/21) 11 │ © 2021 Trulieve. All Rights Reserved. 11 │ © 2021 Trulieve. All Rights Reserved.Going Deep in Florida Provides Scale in Operations One of the Largest US Cultivation Footprints – approaching 2.2M sq. ft. – Approximately 2.1M sq. ft. of cultivation capacity in FL (as of 6/1/21) • Indoor Cultivation – approximate turns of 5 • Greenhouse – approximate turns of 2 – Building out to 90K sq ft in PA, and 78K sq ft of canopy/production in MA High-End Extraction & Branded Product Development – Private label, medical grade cannabis consumer products – Super-critical ethanol and CO2 extraction and distillation processes to produce concentrates – Infrastructure ready to support BHO extraction methods Dispensary Market Leader – 82 Florida retail locations plus a statewide delivery program (as of 5/16/21) – Continuing to grow in 2021 to maintain lead in Florida – > 250,000 sq. ft. retail space (as of 6/1/21) 11 │ © 2021 Trulieve. All Rights Reserved. 11 │ © 2021 Trulieve. All Rights Reserved.

Bringing New Innovations to Florida • Edibles – DOH approval August 2020, launched September 2020 – Trulieve Branded edibles: TruGels, TruChocolates, and TruNanoGels, TruGel Puckers – Partner Brands: Love’s Oven -- cookies, brownies Binske -- Peruvian chocolates • R&D team delivering new offerings – TruPowder, TruTincture Drops, TruWax, TruKief, CBN, TruSpectrum, Bellos • Expanded flower offerings – Ground flower and minis added to expand value product lineup • Partner brands with continuous launches throughout the year – Blue River, Binske, Slang releases in Florida – Local partners – Sunshine Cannabis, Bellamy Brothers and Black Tuna • Ready for hydrocarbon extraction in Florida when DOH approves – Ability to produce live resin from freshly harvested/flash frozen material – High quality concentrates products – for dabbing or vaporization 12 │ © 2021 Trulieve. All Rights Reserved. 12 │ © 2021 Trulieve. All Rights Reserved.Bringing New Innovations to Florida • Edibles – DOH approval August 2020, launched September 2020 – Trulieve Branded edibles: TruGels, TruChocolates, and TruNanoGels, TruGel Puckers – Partner Brands: Love’s Oven -- cookies, brownies Binske -- Peruvian chocolates • R&D team delivering new offerings – TruPowder, TruTincture Drops, TruWax, TruKief, CBN, TruSpectrum, Bellos • Expanded flower offerings – Ground flower and minis added to expand value product lineup • Partner brands with continuous launches throughout the year – Blue River, Binske, Slang releases in Florida – Local partners – Sunshine Cannabis, Bellamy Brothers and Black Tuna • Ready for hydrocarbon extraction in Florida when DOH approves – Ability to produce live resin from freshly harvested/flash frozen material – High quality concentrates products – for dabbing or vaporization 12 │ © 2021 Trulieve. All Rights Reserved. 12 │ © 2021 Trulieve. All Rights Reserved.

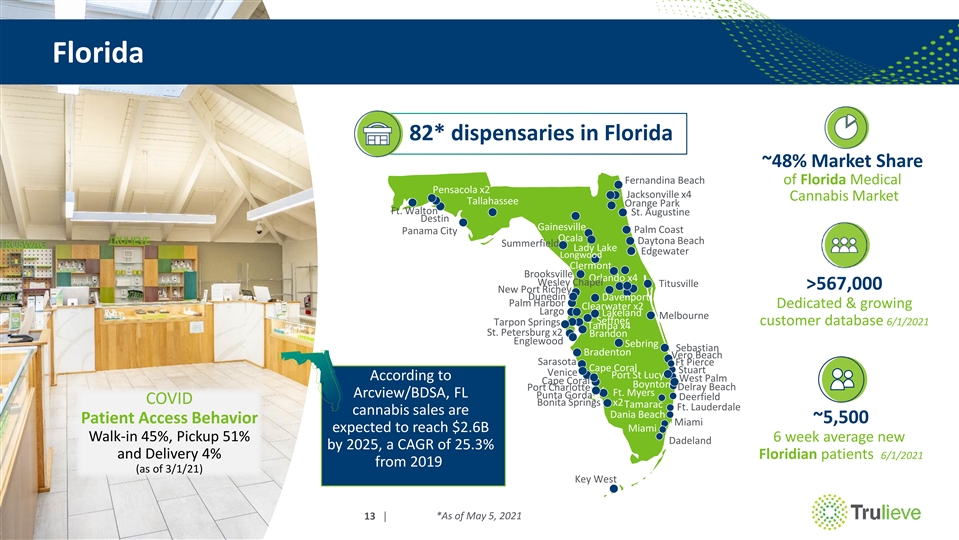

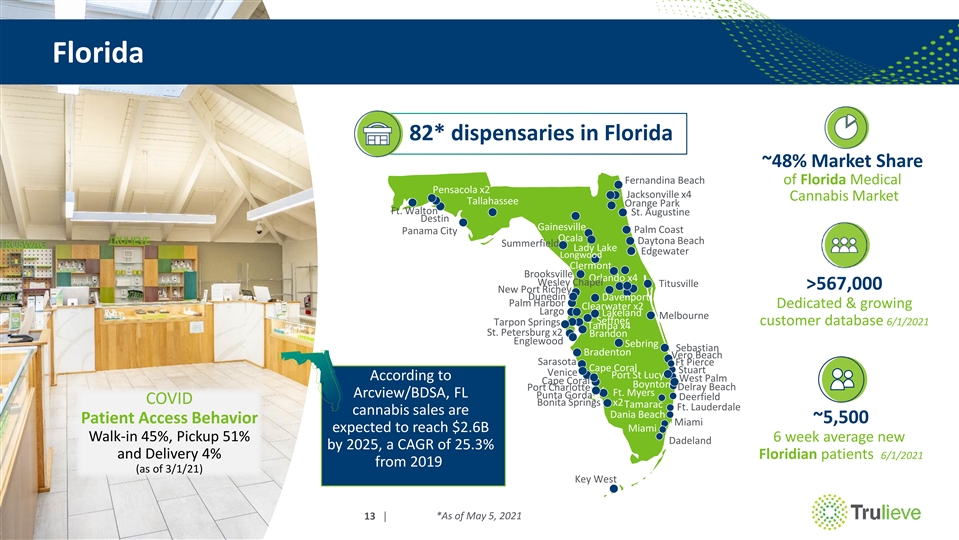

Florida Florida 82* dispensaries in Florida ~48% Market Share Fernandina Beach of Florida Medical Pensacola x2 Jacksonville x4 Cannabis Market Tallahassee Orange Park Ft. Walton St. Augustine Destin Gainesville Palm Coast Panama City Ocala Daytona Beach Summerfield Lady Lake Edgewater Longwood Clermont Brooksville Orlando x4 Wesley Chapel Titusville >567,000 New Port Richey Seffner Dunedin Davenport Palm Harbor Dedicated & growing Clearwater x2 Largo Lakeland Melbourne Seffner customer database 6/1/2021 Tarpon Springs Tampa x4 St. Petersburg x2 Brandon Englewood Sebring Sebastian Bradenton Vero Beach Sarasota Ft Pierce Cape Coral Stuart Venice Port St Lucy According to West Palm Cape Coral Boynton Delray Beach Port Charlotte Ft. Myers Arcview/BDSA, FL Punta Gorda Deerfield COVID Bonita Springs x2 Tamarac Ft. Lauderdale cannabis sales are Dania Beach Patient Access Behavior ~5,500 Miami expected to reach $2.6B Miami Walk-in 45%, Pickup 51% 6 week average new Dadeland by 2025, a CAGR of 25.3% and Delivery 4% Floridian patients 6/1/2021 from 2019 (as of 3/1/21) Key West *As of May 5, 2021 13 │ © 2021 Trulieve. All Rights Reserved. 13 │ © 2021 Trulieve. All Rights Reserved.Florida Florida 82* dispensaries in Florida ~48% Market Share Fernandina Beach of Florida Medical Pensacola x2 Jacksonville x4 Cannabis Market Tallahassee Orange Park Ft. Walton St. Augustine Destin Gainesville Palm Coast Panama City Ocala Daytona Beach Summerfield Lady Lake Edgewater Longwood Clermont Brooksville Orlando x4 Wesley Chapel Titusville >567,000 New Port Richey Seffner Dunedin Davenport Palm Harbor Dedicated & growing Clearwater x2 Largo Lakeland Melbourne Seffner customer database 6/1/2021 Tarpon Springs Tampa x4 St. Petersburg x2 Brandon Englewood Sebring Sebastian Bradenton Vero Beach Sarasota Ft Pierce Cape Coral Stuart Venice Port St Lucy According to West Palm Cape Coral Boynton Delray Beach Port Charlotte Ft. Myers Arcview/BDSA, FL Punta Gorda Deerfield COVID Bonita Springs x2 Tamarac Ft. Lauderdale cannabis sales are Dania Beach Patient Access Behavior ~5,500 Miami expected to reach $2.6B Miami Walk-in 45%, Pickup 51% 6 week average new Dadeland by 2025, a CAGR of 25.3% and Delivery 4% Floridian patients 6/1/2021 from 2019 (as of 3/1/21) Key West *As of May 5, 2021 13 │ © 2021 Trulieve. All Rights Reserved. 13 │ © 2021 Trulieve. All Rights Reserved.

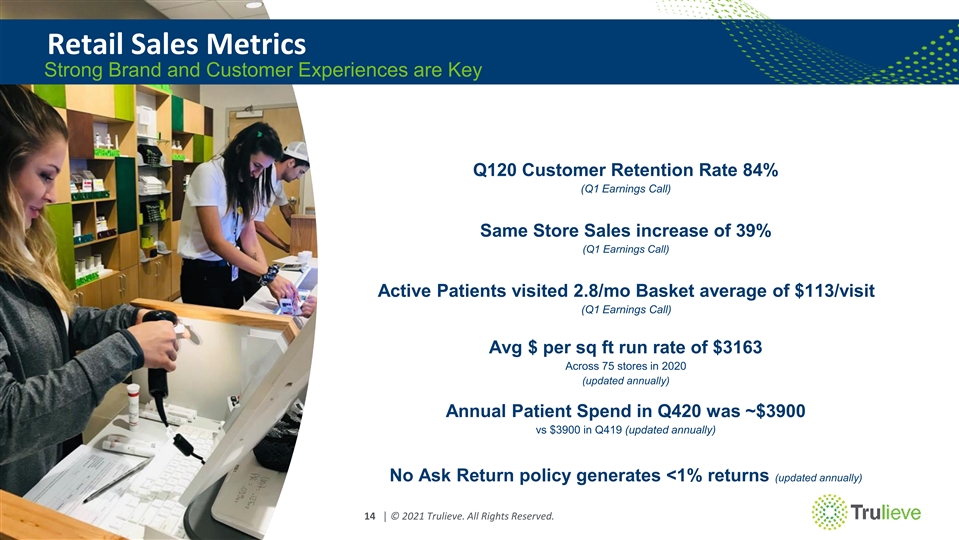

Retail Sales Metrics Strong Brand and Customer Experiences are Key Q120 Customer Retention Rate 84% (Q1 Earnings Call) Same Store Sales increase of 39% (Q1 Earnings Call) Active Patients visited 2.8/mo Basket average of $113/visit (Q1 Earnings Call) Avg $ per sq ft run rate of $3163 Across 75 stores in 2020 (updated annually) Annual Patient Spend in Q420 was ~$3900 vs $3900 in Q419 (updated annually) No Ask Return policy generates <1% returns (updated annually) 14 │ © 2021 Trulieve. All Rights Reserved. 14 │ © 2021 Trulieve. All Rights Reserved.Retail Sales Metrics Strong Brand and Customer Experiences are Key Q120 Customer Retention Rate 84% (Q1 Earnings Call) Same Store Sales increase of 39% (Q1 Earnings Call) Active Patients visited 2.8/mo Basket average of $113/visit (Q1 Earnings Call) Avg $ per sq ft run rate of $3163 Across 75 stores in 2020 (updated annually) Annual Patient Spend in Q420 was ~$3900 vs $3900 in Q419 (updated annually) No Ask Return policy generates <1% returns (updated annually) 14 │ © 2021 Trulieve. All Rights Reserved. 14 │ © 2021 Trulieve. All Rights Reserved.

Jefferson County, FL • 84.97 acres of land purchased in 2019 in Jefferson County Future • Plans for ~ 1M sq ft 337K sq ft of state-of-the-art Construction indoor growing building facilities. • 24K sq ft buildings operational • 337,000 sq ft building will come online in 2021 24K sq ft buildings 15 │ © 2021 Trulieve. All Rights Reserved. 15 │ © 2021 Trulieve. All Rights Reserved.Jefferson County, FL • 84.97 acres of land purchased in 2019 in Jefferson County Future • Plans for ~ 1M sq ft 337K sq ft of state-of-the-art Construction indoor growing building facilities. • 24K sq ft buildings operational • 337,000 sq ft building will come online in 2021 24K sq ft buildings 15 │ © 2021 Trulieve. All Rights Reserved. 15 │ © 2021 Trulieve. All Rights Reserved.

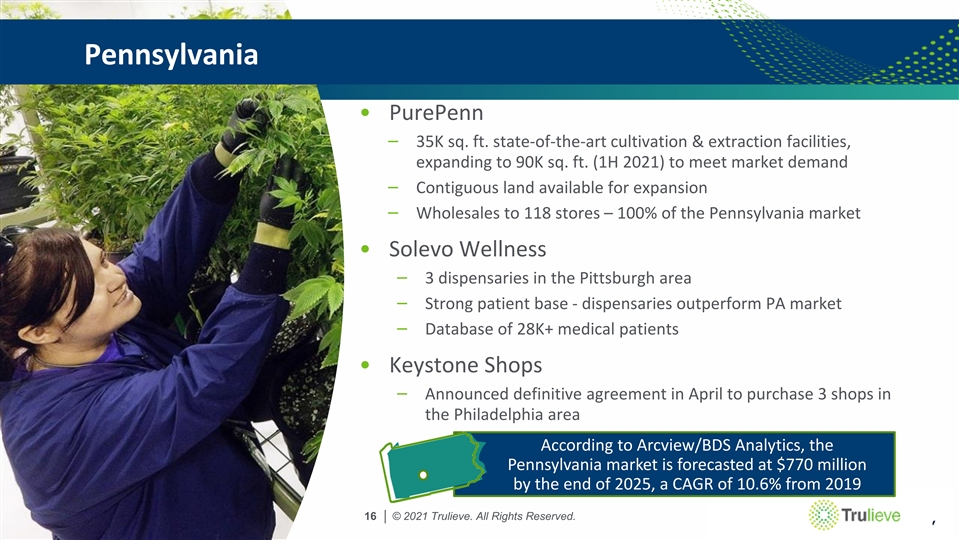

Pennsylvania • PurePenn – 35K sq. ft. state-of-the-art cultivation & extraction facilities, expanding to 90K sq. ft. (1H 2021) to meet market demand – Contiguous land available for expansion – Wholesales to 118 stores – 100% of the Pennsylvania market • Solevo Wellness – 3 dispensaries in the Pittsburgh area – Strong patient base - dispensaries outperform PA market – Database of 28K+ medical patients • Keystone Shops – Announced definitive agreement in April to purchase 3 shops in the Philadelphia area According to Arcview/BDS Analytics, the Pennsylvania market is forecasted at $770 million by the end of 2025, a CAGR of 10.6% from 2019 + 16 │ © 2020 Trulieve. All Rights Reserved. 16 │ © 2021 Trulieve. All Rights Reserved.Pennsylvania • PurePenn – 35K sq. ft. state-of-the-art cultivation & extraction facilities, expanding to 90K sq. ft. (1H 2021) to meet market demand – Contiguous land available for expansion – Wholesales to 118 stores – 100% of the Pennsylvania market • Solevo Wellness – 3 dispensaries in the Pittsburgh area – Strong patient base - dispensaries outperform PA market – Database of 28K+ medical patients • Keystone Shops – Announced definitive agreement in April to purchase 3 shops in the Philadelphia area According to Arcview/BDS Analytics, the Pennsylvania market is forecasted at $770 million by the end of 2025, a CAGR of 10.6% from 2019 + 16 │ © 2020 Trulieve. All Rights Reserved. 16 │ © 2021 Trulieve. All Rights Reserved.

Massachusetts • In MA, Trulieve operates as Life Essence, Inc DBA Trulieve • Trulieve holds final licenses for both adult use retail and a vertically integrated medical license, and provisional licenses for adult use cultivation and product manufacturing facilities. • Planting started March 2021 • First store opens June 3, 2021, wholesale to start in 2H21 • Over 140,000 sq ft facility in Holyoke, MA will support: – Over 60,000 square feet of canopy, as defined by Massachusetts regulations, and 18,000 square feet of production – 3 medical/3 recreational marijuana dispensaries – or 3 co-located stores According to Arcview/BDS Analytics, the Massachusetts market will reach $1.46 Billion in 2025, a CAGR of 16.4% from 2019. Holyoke, MA + 17 │ © 2020 Trulieve. All Rights Reserved. 17 │ © 2021 Trulieve. All Rights Reserved. Cultivation & ProcessingMassachusetts • In MA, Trulieve operates as Life Essence, Inc DBA Trulieve • Trulieve holds final licenses for both adult use retail and a vertically integrated medical license, and provisional licenses for adult use cultivation and product manufacturing facilities. • Planting started March 2021 • First store opens June 3, 2021, wholesale to start in 2H21 • Over 140,000 sq ft facility in Holyoke, MA will support: – Over 60,000 square feet of canopy, as defined by Massachusetts regulations, and 18,000 square feet of production – 3 medical/3 recreational marijuana dispensaries – or 3 co-located stores According to Arcview/BDS Analytics, the Massachusetts market will reach $1.46 Billion in 2025, a CAGR of 16.4% from 2019. Holyoke, MA + 17 │ © 2020 Trulieve. All Rights Reserved. 17 │ © 2021 Trulieve. All Rights Reserved. Cultivation & Processing

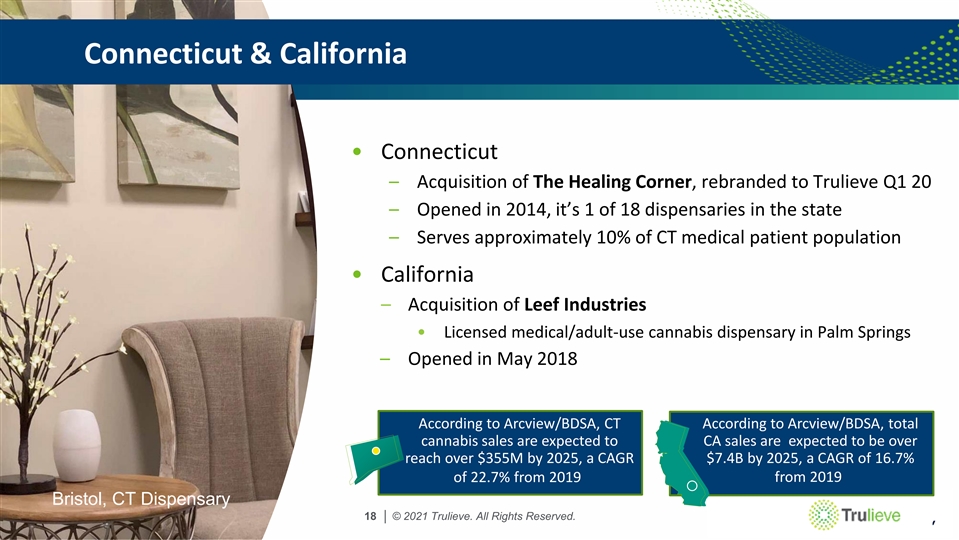

Connecticut & California • Connecticut – Acquisition of The Healing Corner, rebranded to Trulieve Q1 20 – Opened in 2014, it’s 1 of 18 dispensaries in the state – Serves approximately 10% of CT medical patient population • California – Acquisition of Leef Industries • Licensed medical/adult-use cannabis dispensary in Palm Springs – Opened in May 2018 According to Arcview/BDSA, CT According to Arcview/BDSA, total cannabis sales are expected to CA sales are expected to be over reach over $355M by 2025, a CAGR $7.4B by 2025, a CAGR of 16.7% of 22.7% from 2019 from 2019 Bristol, CT Dispensary + 18 │ © 2020 Trulieve. All Rights Reserved. 18 │ © 2021 Trulieve. All Rights Reserved.Connecticut & California • Connecticut – Acquisition of The Healing Corner, rebranded to Trulieve Q1 20 – Opened in 2014, it’s 1 of 18 dispensaries in the state – Serves approximately 10% of CT medical patient population • California – Acquisition of Leef Industries • Licensed medical/adult-use cannabis dispensary in Palm Springs – Opened in May 2018 According to Arcview/BDSA, CT According to Arcview/BDSA, total cannabis sales are expected to CA sales are expected to be over reach over $355M by 2025, a CAGR $7.4B by 2025, a CAGR of 16.7% of 22.7% from 2019 from 2019 Bristol, CT Dispensary + 18 │ © 2020 Trulieve. All Rights Reserved. 18 │ © 2021 Trulieve. All Rights Reserved.

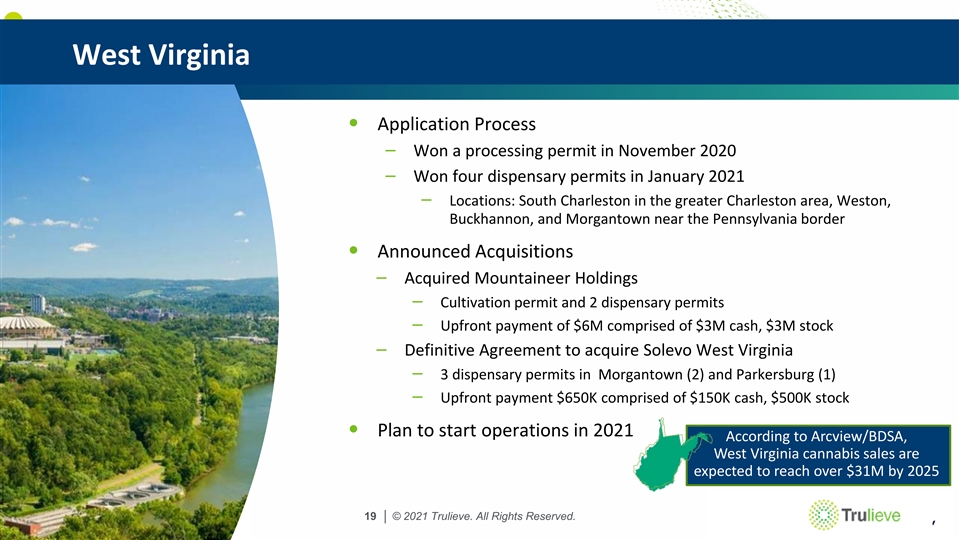

West Virginia • Application Process – Won a processing permit in November 2020 – Won four dispensary permits in January 2021 – Locations: South Charleston in the greater Charleston area, Weston, Buckhannon, and Morgantown near the Pennsylvania border • Announced Acquisitions – Acquired Mountaineer Holdings – Cultivation permit and 2 dispensary permits – Upfront payment of $6M comprised of $3M cash, $3M stock – Definitive Agreement to acquire Solevo West Virginia – 3 dispensary permits in Morgantown (2) and Parkersburg (1) – Upfront payment $650K comprised of $150K cash, $500K stock • Plan to start operations in 2021 According to Arcview/BDSA, West Virginia cannabis sales are expected to reach over $31M by 2025 + 19 │ © 2020 Trulieve. All Rights Reserved. 19 │ © 2021 Trulieve. All Rights Reserved.West Virginia • Application Process – Won a processing permit in November 2020 – Won four dispensary permits in January 2021 – Locations: South Charleston in the greater Charleston area, Weston, Buckhannon, and Morgantown near the Pennsylvania border • Announced Acquisitions – Acquired Mountaineer Holdings – Cultivation permit and 2 dispensary permits – Upfront payment of $6M comprised of $3M cash, $3M stock – Definitive Agreement to acquire Solevo West Virginia – 3 dispensary permits in Morgantown (2) and Parkersburg (1) – Upfront payment $650K comprised of $150K cash, $500K stock • Plan to start operations in 2021 According to Arcview/BDSA, West Virginia cannabis sales are expected to reach over $31M by 2025 + 19 │ © 2020 Trulieve. All Rights Reserved. 19 │ © 2021 Trulieve. All Rights Reserved.

Financial Highlights 20 │ © 2021 Trulieve. All Rights Reserved.Financial Highlights 20 │ © 2021 Trulieve. All Rights Reserved.

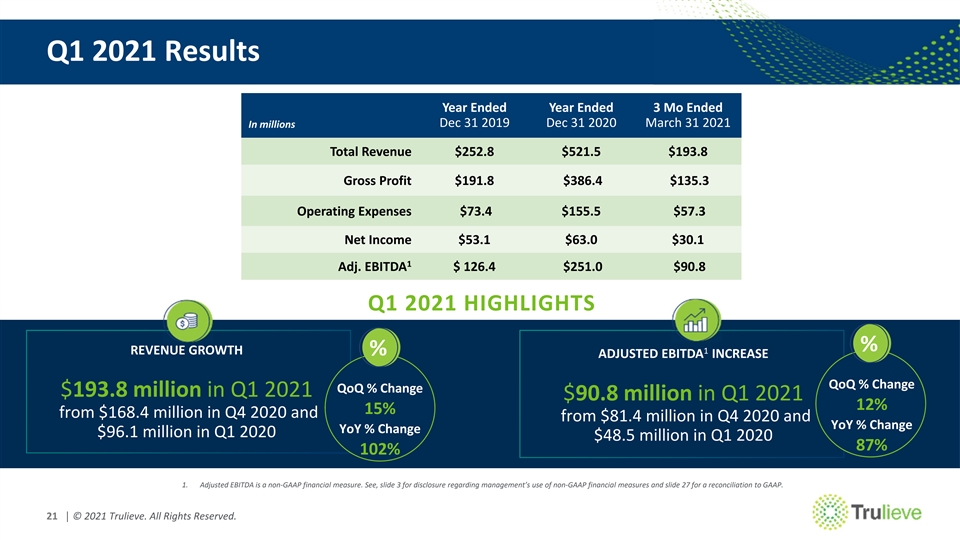

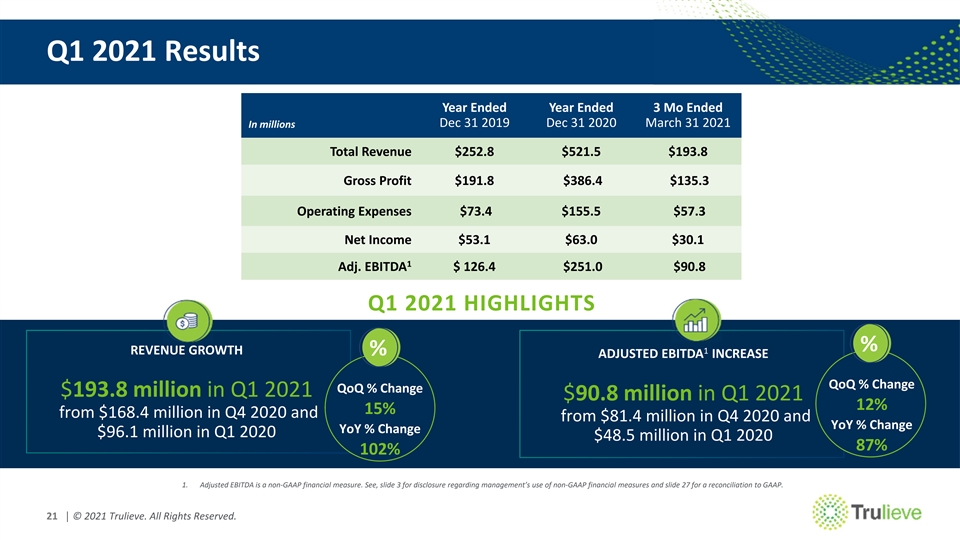

Q1 2021 Results Year Ended Year Ended 3 Mo Ended Dec 31 2019 Dec 31 2020 March 31 2021 In millions Total Revenue $252.8 $521.5 $193.8 Gross Profit $191.8 $386.4 $135.3 Operating Expenses $73.4 $155.5 $57.3 Net Income $53.1 $63.0 $30.1 1 Adj. EBITDA $ 126.4 $251.0 $90.8 Q1 2021 HIGHLIGHTS % 1 REVENUE GROWTH % ADJUSTED EBITDA INCREASE QoQ % Change QoQ % Change $193.8 million in Q1 2021 $90.8 million in Q1 2021 12% 15% from $168.4 million in Q4 2020 and from $81.4 million in Q4 2020 and YoY % Change YoY % Change $96.1 million in Q1 2020 $48.5 million in Q1 2020 87% 102% 1. Adjusted EBITDA is a non‐GAAP financial measure. See, slide 3 for disclosure regarding management’s use of non‐GAAP financial measures and slide 27 for a reconciliation to GAAP. 21 21 │ © 2021 Trulieve. All Rights Reserved.Q1 2021 Results Year Ended Year Ended 3 Mo Ended Dec 31 2019 Dec 31 2020 March 31 2021 In millions Total Revenue $252.8 $521.5 $193.8 Gross Profit $191.8 $386.4 $135.3 Operating Expenses $73.4 $155.5 $57.3 Net Income $53.1 $63.0 $30.1 1 Adj. EBITDA $ 126.4 $251.0 $90.8 Q1 2021 HIGHLIGHTS % 1 REVENUE GROWTH % ADJUSTED EBITDA INCREASE QoQ % Change QoQ % Change $193.8 million in Q1 2021 $90.8 million in Q1 2021 12% 15% from $168.4 million in Q4 2020 and from $81.4 million in Q4 2020 and YoY % Change YoY % Change $96.1 million in Q1 2020 $48.5 million in Q1 2020 87% 102% 1. Adjusted EBITDA is a non‐GAAP financial measure. See, slide 3 for disclosure regarding management’s use of non‐GAAP financial measures and slide 27 for a reconciliation to GAAP. 21 21 │ © 2021 Trulieve. All Rights Reserved.

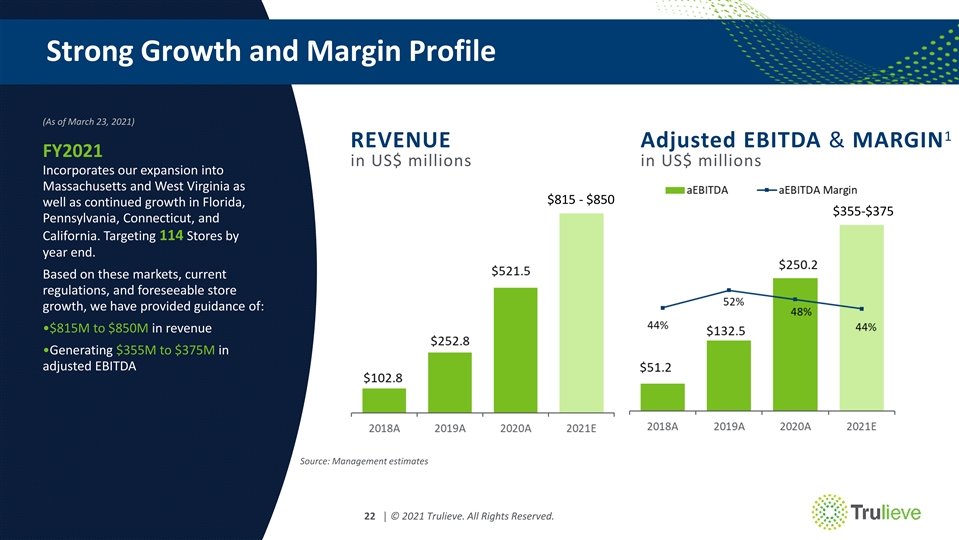

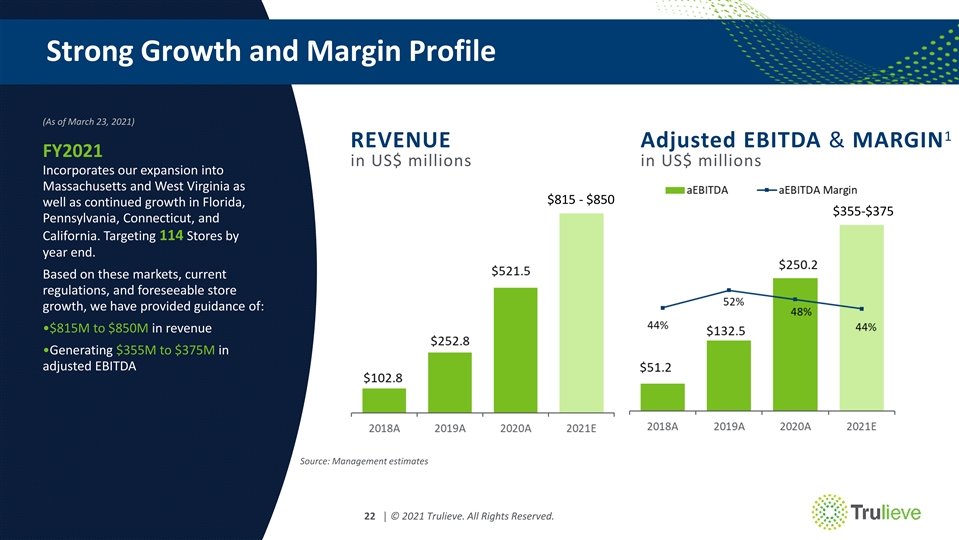

Strong Growth and Margin Profile (As of March 23, 2021) 1 REVENUE Adjusted EBITDA & MARGIN FY2021 in US$ millions in US$ millions Incorporates our expansion into Massachusetts and West Virginia as $815 - $850 well as continued growth in Florida, $355-$375 Pennsylvania, Connecticut, and California. Targeting 114 Stores by year end. Based on these markets, current regulations, and foreseeable store growth, we have provided guidance of: •$815M to $850M in revenue •Generating $355M to $375M in adjusted EBITDA Source: Management estimates 22 │ © 2021 Trulieve. All Rights Reserved. 22 │ © 2021 Trulieve. All Rights Reserved.Strong Growth and Margin Profile (As of March 23, 2021) 1 REVENUE Adjusted EBITDA & MARGIN FY2021 in US$ millions in US$ millions Incorporates our expansion into Massachusetts and West Virginia as $815 - $850 well as continued growth in Florida, $355-$375 Pennsylvania, Connecticut, and California. Targeting 114 Stores by year end. Based on these markets, current regulations, and foreseeable store growth, we have provided guidance of: •$815M to $850M in revenue •Generating $355M to $375M in adjusted EBITDA Source: Management estimates 22 │ © 2021 Trulieve. All Rights Reserved. 22 │ © 2021 Trulieve. All Rights Reserved.

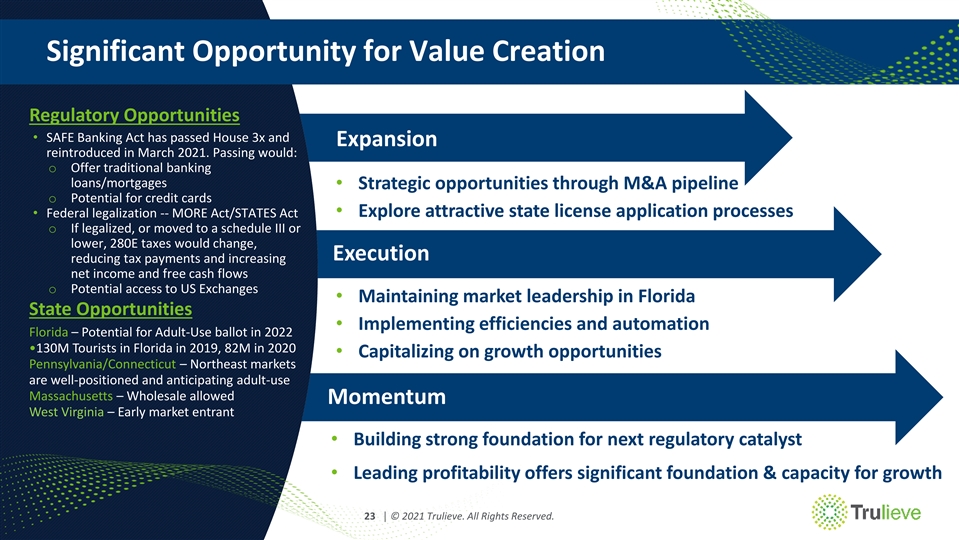

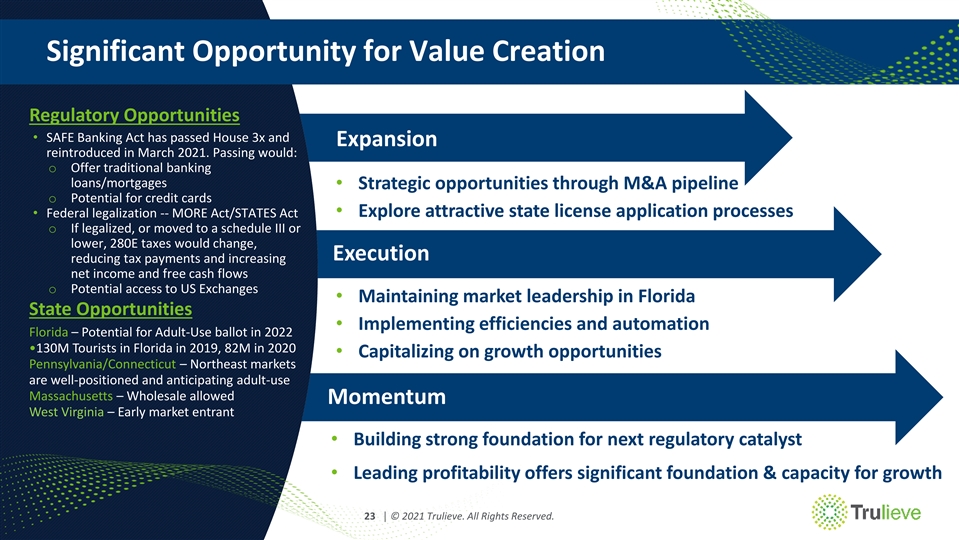

Significant Opportunity for Value Creation Regulatory Opportunities • SAFE Banking Act has passed House 3x and Expansion reintroduced in March 2021. Passing would: o Offer traditional banking loans/mortgages • Strategic opportunities through M&A pipeline o Potential for credit cards • Explore attractive state license application processes • Federal legalization -- MORE Act/STATES Act o If legalized, or moved to a schedule III or lower, 280E taxes would change, Execution reducing tax payments and increasing net income and free cash flows o Potential access to US Exchanges • Maintaining market leadership in Florida State Opportunities • Implementing efficiencies and automation Florida – Potential for Adult-Use ballot in 2022 •130M Tourists in Florida in 2019, 82M in 2020 • Capitalizing on growth opportunities Pennsylvania/Connecticut – Northeast markets are well-positioned and anticipating adult-use Massachusetts – Wholesale allowed Momentum West Virginia – Early market entrant • Building strong foundation for next regulatory catalyst • Leading profitability offers significant foundation & capacity for growth 23 │ © 2021 Trulieve. All Rights Reserved. 23 │ © 2021 Trulieve. All Rights Reserved.Significant Opportunity for Value Creation Regulatory Opportunities • SAFE Banking Act has passed House 3x and Expansion reintroduced in March 2021. Passing would: o Offer traditional banking loans/mortgages • Strategic opportunities through M&A pipeline o Potential for credit cards • Explore attractive state license application processes • Federal legalization -- MORE Act/STATES Act o If legalized, or moved to a schedule III or lower, 280E taxes would change, Execution reducing tax payments and increasing net income and free cash flows o Potential access to US Exchanges • Maintaining market leadership in Florida State Opportunities • Implementing efficiencies and automation Florida – Potential for Adult-Use ballot in 2022 •130M Tourists in Florida in 2019, 82M in 2020 • Capitalizing on growth opportunities Pennsylvania/Connecticut – Northeast markets are well-positioned and anticipating adult-use Massachusetts – Wholesale allowed Momentum West Virginia – Early market entrant • Building strong foundation for next regulatory catalyst • Leading profitability offers significant foundation & capacity for growth 23 │ © 2021 Trulieve. All Rights Reserved. 23 │ © 2021 Trulieve. All Rights Reserved.

Appendix 24 │ © 2020 Trulieve. All Rights Reserved.Appendix 24 │ © 2020 Trulieve. All Rights Reserved.

Executive Management Team ALEX D’AMICO KYLE LANDRUM KIM RIVERS Chief Financial Officer Chief Production Officer Chief Executive 20 years of accounting 10 years of multi-site Officer and finance experience operations management in technology, and successfully led healthcare large teams to achieve entertainment and company goals. advertising. . TIM MOREY ERIC POWERS 15 years of experience running successful Chief Sales Officer Chief Legal Officer businesses from real estate to finance. Legal background in M&A and securities law. Rivers 20 years of of retail 25 years of broad legal serves as second vice chair for the National leadership and experience with a Cannabis Roundtable. She received her Bachelor’s operations background in degree in Multinational Business and Political experience corporate and tax law, Science from Florida State University, and her Juris both in-house and Doctorate from the University of Florida. private practice. 25 │ © 2021 Trulieve. All Rights Reserved.Executive Management Team ALEX D’AMICO KYLE LANDRUM KIM RIVERS Chief Financial Officer Chief Production Officer Chief Executive 20 years of accounting 10 years of multi-site Officer and finance experience operations management in technology, and successfully led healthcare large teams to achieve entertainment and company goals. advertising. . TIM MOREY ERIC POWERS 15 years of experience running successful Chief Sales Officer Chief Legal Officer businesses from real estate to finance. Legal background in M&A and securities law. Rivers 20 years of of retail 25 years of broad legal serves as second vice chair for the National leadership and experience with a Cannabis Roundtable. She received her Bachelor’s operations background in degree in Multinational Business and Political experience corporate and tax law, Science from Florida State University, and her Juris both in-house and Doctorate from the University of Florida. private practice. 25 │ © 2021 Trulieve. All Rights Reserved.

Board of Directors THAD BESHEARS, Director KIM RIVERS, Chief Executive Officer Co-Owner/President of Simpson Nurseries of FL and TN where he develops and implements 12 years of experience running successful businesses. Several years in private practice as a strategic vision while monitoring the market for opportunities for growth and expansion. lawyer specializing in mergers, acquisitions, and securities for multi-million dollar companies. Responsible for all sales operations, production, and inventory tracking. Under his guidance and Bachelor’s in Multinational Business and Political Science, Juris Doctorate from the University oversight, the company has more than doubled their annual sales. of Florida. THOMAS MILLNER, Director MICHAEL J. O’DONNELL SR., Director Strong combination of executive leadership, merchandising and multichannel operational skills, Former Executive Director of the Office of Innovation and Entrepreneurship at the University of and a philanthropic background. Central Florida. Served as CEO of Cabela's, a direct marketer and specialty retailer of outdoor recreation Principal in MOD Ventures, which invests in new ventures in various sectors. Co-founder of several merchandise, for nearly a decade. Prior to Cabela's, Milner spent 14 years as president and cannabis companies, including Trulieve, SACS, and 3Jays. Master of Science in Management from CEO of North Carolina's Remington Arms Company. the University of Central Florida. SUSAN THRONSON, Director RICHARD MAY, Director Experienced independent director with global digital, ecommerce and loyalty marketing President and Co-Owner of May Nursery, Inc. where he has 18 years of growing and managing experience experience. Thronson was Senior Vice President of Global Marketing for Marriott International, leading He has served on several agricultural and civic boards including the Southern Nursery Association Marriott's worldwide integrated marketing strategy and execution for its 15 hotel brands. and the Gadsden County Chamber of Commerce. May is a founding member of Trulieve. PETER T. HEALY , Director GEORGE HACKNEY, Director Attorney with a focus on capital markets, M&A, & private equity transactions. Clients have President and Owner of Hackney Nursery Company in Quincy, FL. Has presided over all aspects of included corporate issuers, Wall Street underwriters, and private equity firms. the operations of the company. Substantial experience representing issuers and underwriters in public offerings and private Served on several agricultural industry associations’ boards and earned many honors for his placements, private equity firms and sovereign wealth funds in their investment activities, commitment to the industry. Hackney Is a founding member of Trulieve and has also served on and corporate boards in governance matters and strategic transactions. many community boards. 26 │ © 2021 Trulieve. All Rights Reserved.Board of Directors THAD BESHEARS, Director KIM RIVERS, Chief Executive Officer Co-Owner/President of Simpson Nurseries of FL and TN where he develops and implements 12 years of experience running successful businesses. Several years in private practice as a strategic vision while monitoring the market for opportunities for growth and expansion. lawyer specializing in mergers, acquisitions, and securities for multi-million dollar companies. Responsible for all sales operations, production, and inventory tracking. Under his guidance and Bachelor’s in Multinational Business and Political Science, Juris Doctorate from the University oversight, the company has more than doubled their annual sales. of Florida. THOMAS MILLNER, Director MICHAEL J. O’DONNELL SR., Director Strong combination of executive leadership, merchandising and multichannel operational skills, Former Executive Director of the Office of Innovation and Entrepreneurship at the University of and a philanthropic background. Central Florida. Served as CEO of Cabela's, a direct marketer and specialty retailer of outdoor recreation Principal in MOD Ventures, which invests in new ventures in various sectors. Co-founder of several merchandise, for nearly a decade. Prior to Cabela's, Milner spent 14 years as president and cannabis companies, including Trulieve, SACS, and 3Jays. Master of Science in Management from CEO of North Carolina's Remington Arms Company. the University of Central Florida. SUSAN THRONSON, Director RICHARD MAY, Director Experienced independent director with global digital, ecommerce and loyalty marketing President and Co-Owner of May Nursery, Inc. where he has 18 years of growing and managing experience experience. Thronson was Senior Vice President of Global Marketing for Marriott International, leading He has served on several agricultural and civic boards including the Southern Nursery Association Marriott's worldwide integrated marketing strategy and execution for its 15 hotel brands. and the Gadsden County Chamber of Commerce. May is a founding member of Trulieve. PETER T. HEALY , Director GEORGE HACKNEY, Director Attorney with a focus on capital markets, M&A, & private equity transactions. Clients have President and Owner of Hackney Nursery Company in Quincy, FL. Has presided over all aspects of included corporate issuers, Wall Street underwriters, and private equity firms. the operations of the company. Substantial experience representing issuers and underwriters in public offerings and private Served on several agricultural industry associations’ boards and earned many honors for his placements, private equity firms and sovereign wealth funds in their investment activities, commitment to the industry. Hackney Is a founding member of Trulieve and has also served on and corporate boards in governance matters and strategic transactions. many community boards. 26 │ © 2021 Trulieve. All Rights Reserved.

Reconciliation of Non‐GAAP Adjusted EBITDA Reconciliation of Non‐GAAP Adjusted EBITDA For the Three Months Ended, Three Months Ended March, (Figures in millions and % change based on these figures) March 31, 2021 December 31, % change 2021 2020 % change 2020 Net Income (GAAP) $ 30.1 $ 3.0 889% $ 30.1 $ 23.6 27% Add (Deduct) Impact of: Depreciation and Amortization $ 5.4 $ 4.0 36% $ 5.4 $ 2.2 148% Depreciation included in Cost of Goods Sold $ 3.7 $ 4.1 0% $ 3.7 $ 2.5 0% Interest Expense, Net $ 7.9 $ 3.7 115% $ 7.9 $ 5.9 34% Share‐Based Compensation $ 0.7 $ 0.6 33% $ 0.7 $ 1.2 ‐39% Other Expense (Income), Net $ 0.0 $ 29.9 ‐100% $ 0.0 $ (4.9) ‐101% Provision for Income Taxes $ 34.5 $ 27.3 26% $ 34.5 $ 17.9 93% Acquisition and Transaction Costs $ 2.0 $ 4.7 ‐57% $ 2.0 $ ‐ Covid Related Expenses $ 3.8 $ 3.2 21% $ 3.8 $ 0.1 3252% Inventory Step up, Fair Value $ 2.5 $ 1.0 165% $ 2.5 $ ‐ Total Adjustments $ 60.7 $ 78.4 ‐23% $ 60.7 $24.9 143% Adjusted EBITDA $ 90.8 $ 81.4 12% $ 90.8 $48.5 87% 27 │ © 2021 Trulieve. All Rights Reserved.Reconciliation of Non‐GAAP Adjusted EBITDA Reconciliation of Non‐GAAP Adjusted EBITDA For the Three Months Ended, Three Months Ended March, (Figures in millions and % change based on these figures) March 31, 2021 December 31, % change 2021 2020 % change 2020 Net Income (GAAP) $ 30.1 $ 3.0 889% $ 30.1 $ 23.6 27% Add (Deduct) Impact of: Depreciation and Amortization $ 5.4 $ 4.0 36% $ 5.4 $ 2.2 148% Depreciation included in Cost of Goods Sold $ 3.7 $ 4.1 0% $ 3.7 $ 2.5 0% Interest Expense, Net $ 7.9 $ 3.7 115% $ 7.9 $ 5.9 34% Share‐Based Compensation $ 0.7 $ 0.6 33% $ 0.7 $ 1.2 ‐39% Other Expense (Income), Net $ 0.0 $ 29.9 ‐100% $ 0.0 $ (4.9) ‐101% Provision for Income Taxes $ 34.5 $ 27.3 26% $ 34.5 $ 17.9 93% Acquisition and Transaction Costs $ 2.0 $ 4.7 ‐57% $ 2.0 $ ‐ Covid Related Expenses $ 3.8 $ 3.2 21% $ 3.8 $ 0.1 3252% Inventory Step up, Fair Value $ 2.5 $ 1.0 165% $ 2.5 $ ‐ Total Adjustments $ 60.7 $ 78.4 ‐23% $ 60.7 $24.9 143% Adjusted EBITDA $ 90.8 $ 81.4 12% $ 90.8 $48.5 87% 27 │ © 2021 Trulieve. All Rights Reserved.

Questions? 28 │ © 2020 Trulieve. All Rights Reserved.Questions? 28 │ © 2020 Trulieve. All Rights Reserved.