First Quarter 2022 Investor Presentation / May 2022 CSE: TRUL OTCQX: TCNNF Exhibit 99.2

Forward Looking Statements and Industry Data Unless the context otherwise requires, the terms “Trulieve,” “we,” “us” and “our” in this presentation refer to Trulieve Cannabis Corp. and its subsidiaries. Certain statements in this presentation constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation (collectively herein referred to as “forward-looking statements”), which can often be identified by words such as “will”, “may”, “estimate”, “expect”, “plan”, “project”, “intend”, “anticipate” and other words indicating that the statements are forward-looking. These forward looking statements relate to Trulieve’s expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding Trulieve’s expected revenue and adjusted EBITDA for fiscal 2022, its plans for expansion, potential acquisitions and expansion of the Company’s operations. Such forward-looking statements are expectations only and are subject to known and unknown risks, uncertainties and other important factors, including, but not limited to, risk factors included in this presentation, that could cause the Company’s actual results, performance or achievements or industry results to differ materially from any future results, performance or achievements implied by such forward-looking statements. Such risks and uncertainties include, among others, dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing state, local or other licenses; engaging in activities which currently are illegal under United States federal law and the uncertainty of existing protection from United States federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including United States state-law legalization, particularly in Florida, due to inconsistent public opinion, perception of the medical-use and adult-use cannabis industry, bureaucratic delays or inefficiencies or any other reasons; any other factors or developments which may hinder market growth; reliance on management; and the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Although it may voluntarily do so from time to time, the Company undertakes no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Unless otherwise noted, the forecasted industry and market data contained herein are based upon management estimates and industry and market publications and surveys. The information from industry and market publications has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. The Company has not independently verified any of the data from third-party sources, nor has the Company ascertained the underlying economic assumptions relied upon therein. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. Please note: MARIJUANA IS ILLEGAL UNDER U.S. FEDERAL LAW, including its consumption, possession, cultivation, distribution, manufacturing, dispensing, and possession with intent to distribute. Forward-looking statements made in this document are made only as of the date of their initial publication, and the Company undertakes no obligation to publicly update any of these forward-looking statements as actual events unfold.

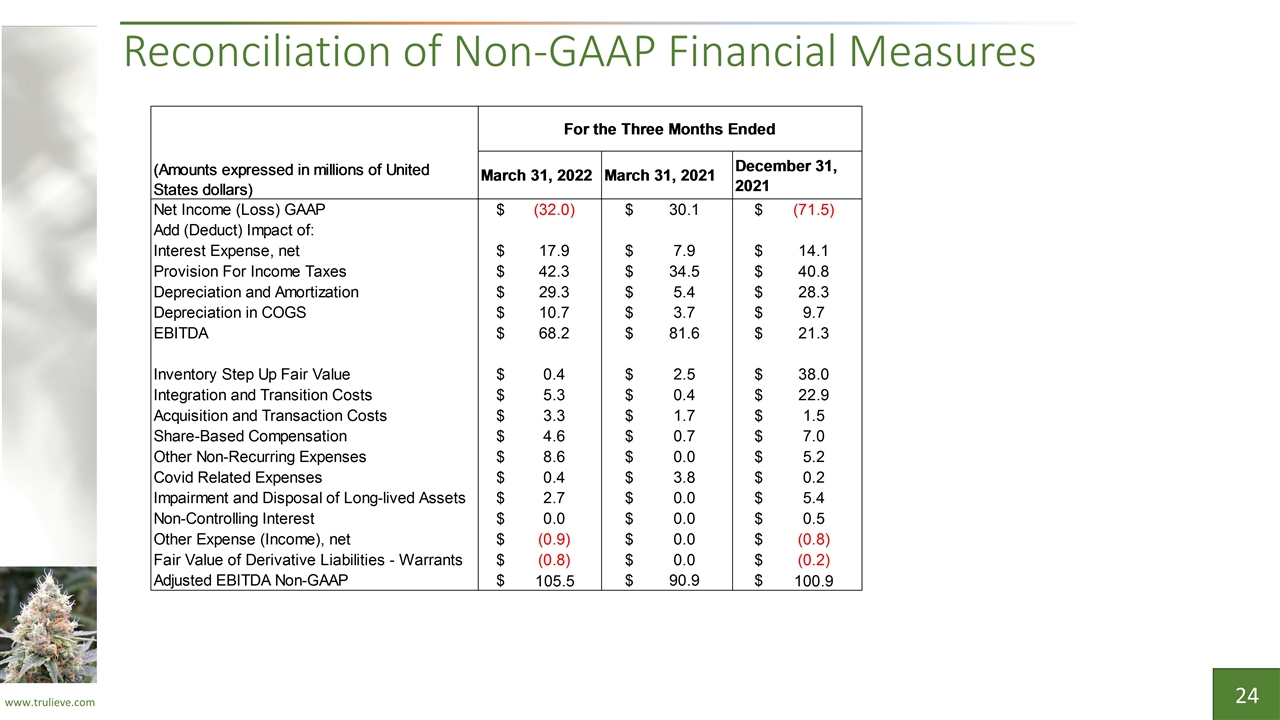

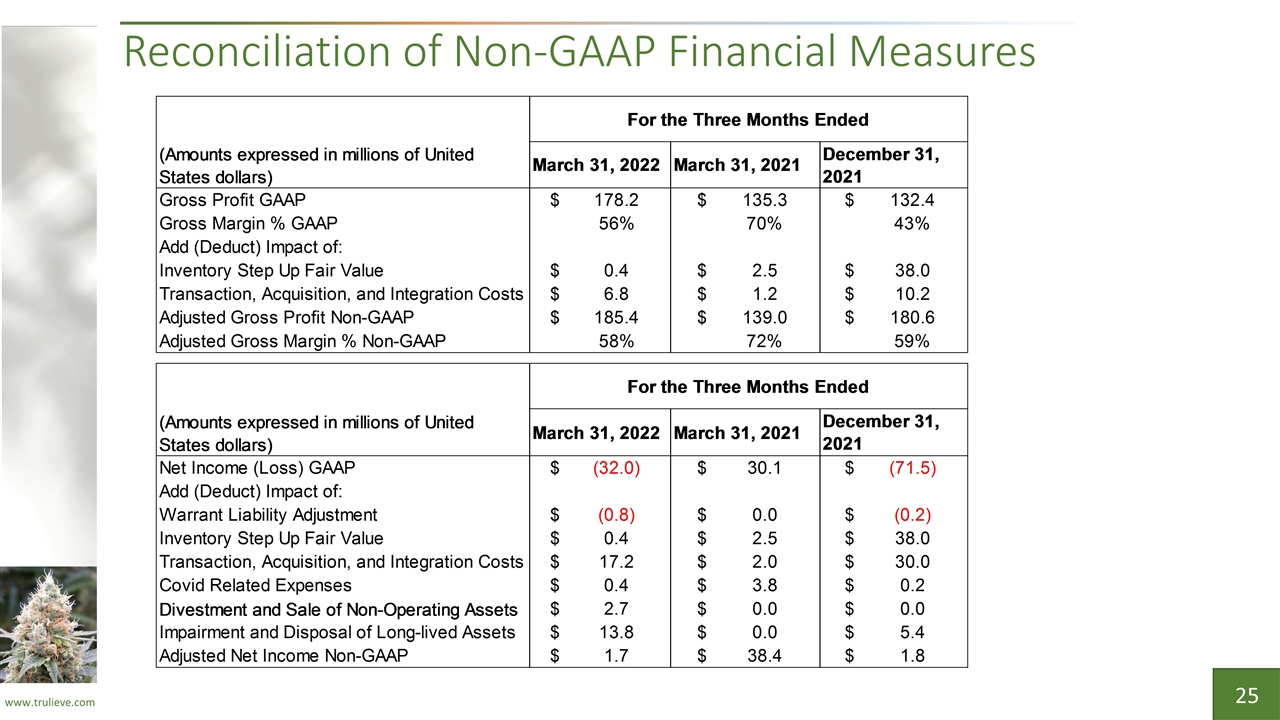

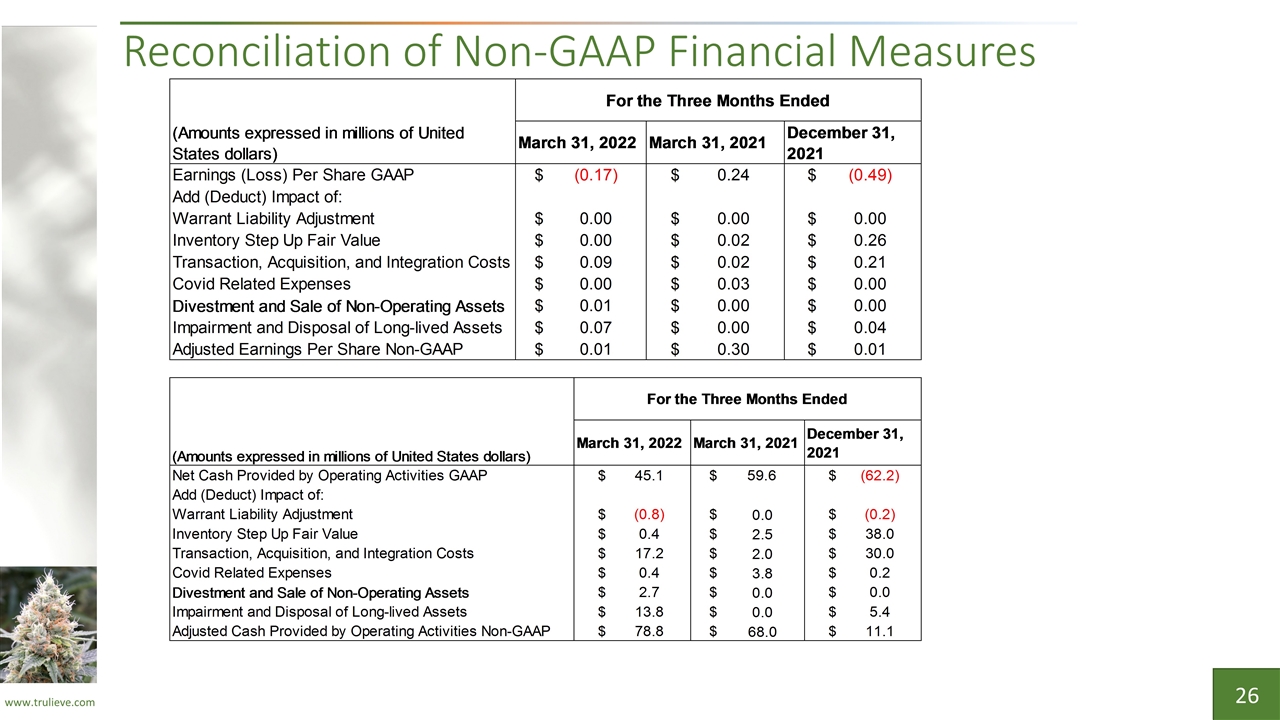

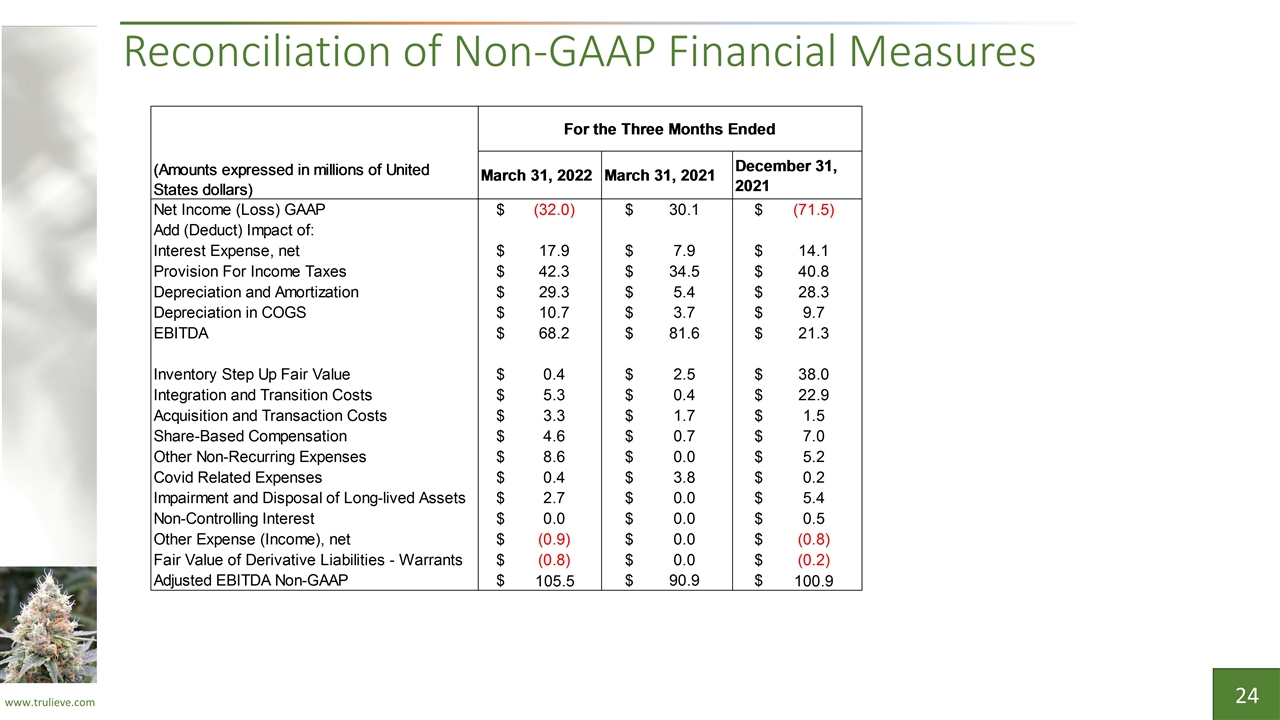

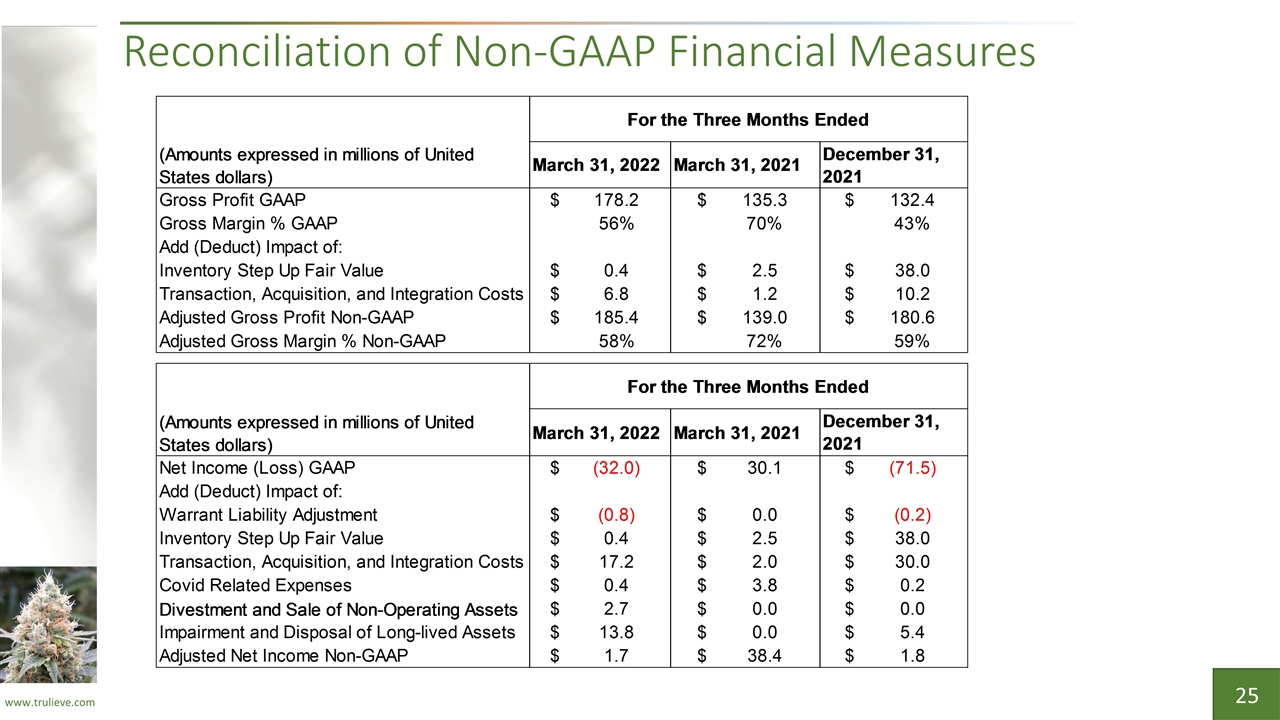

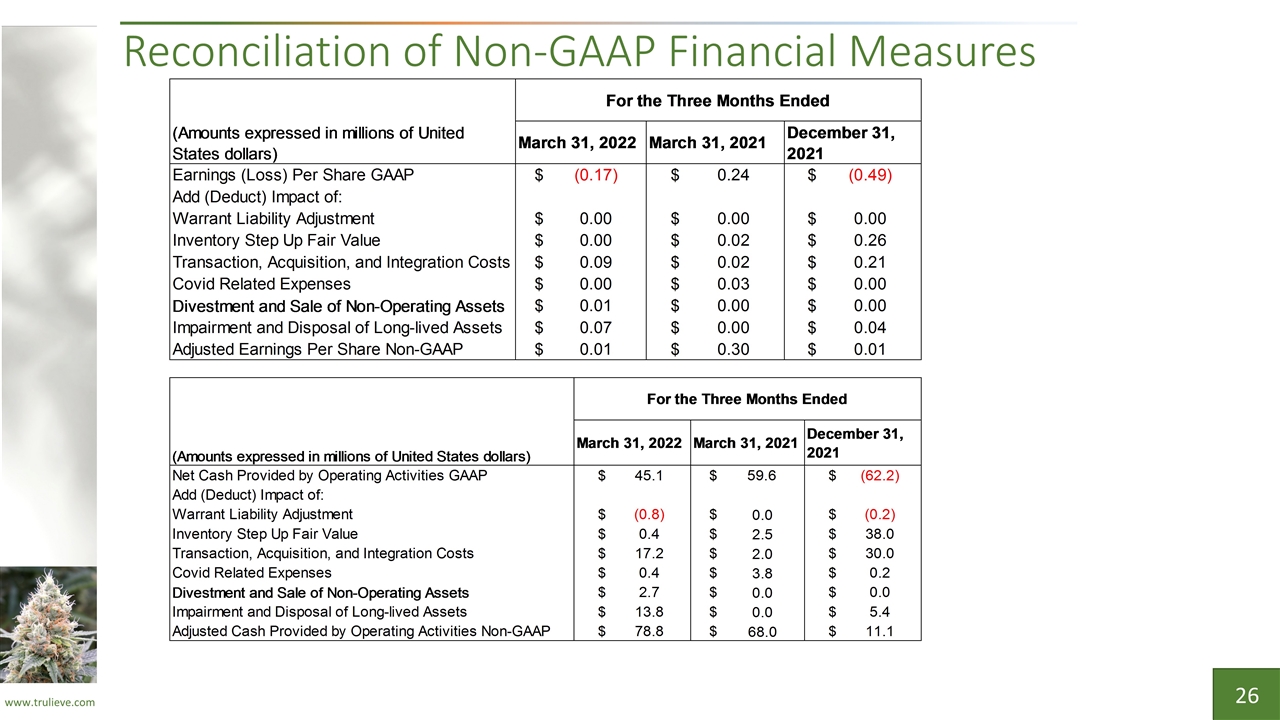

Management’s Use of Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we supplement our results with non-GAAP financial measures, including adjusted gross profit, adjusted net income, adjusted net income per diluted share, and adjusted cash flow from operations. Our management uses these non-GAAP financial measures in conjunction with GAAP financial measures to evaluate our operating results and financial performance. We believe these measures are useful to investors as they are widely used measures of performance and can facilitate comparison to other companies. These non-GAAP financial measures have limitations as analytical tools in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Because of these limitations, these non-GAAP financial measures should be considered along with GAAP financial performance measures. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measures to such GAAP measures can be found below. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP.

Agenda First Quarter 2022 Financial Highlights First Quarter 2022 Operational Highlights Financial Outlook Recent Developments Strategic Priorities Financial Results

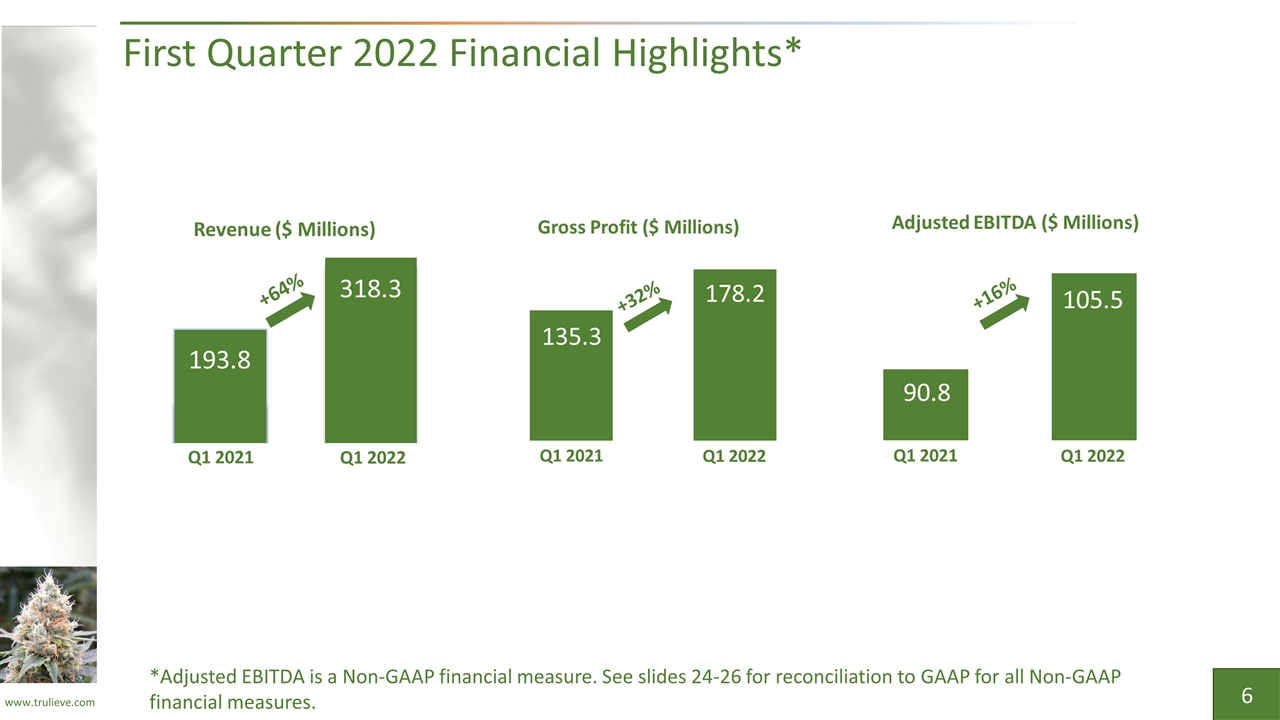

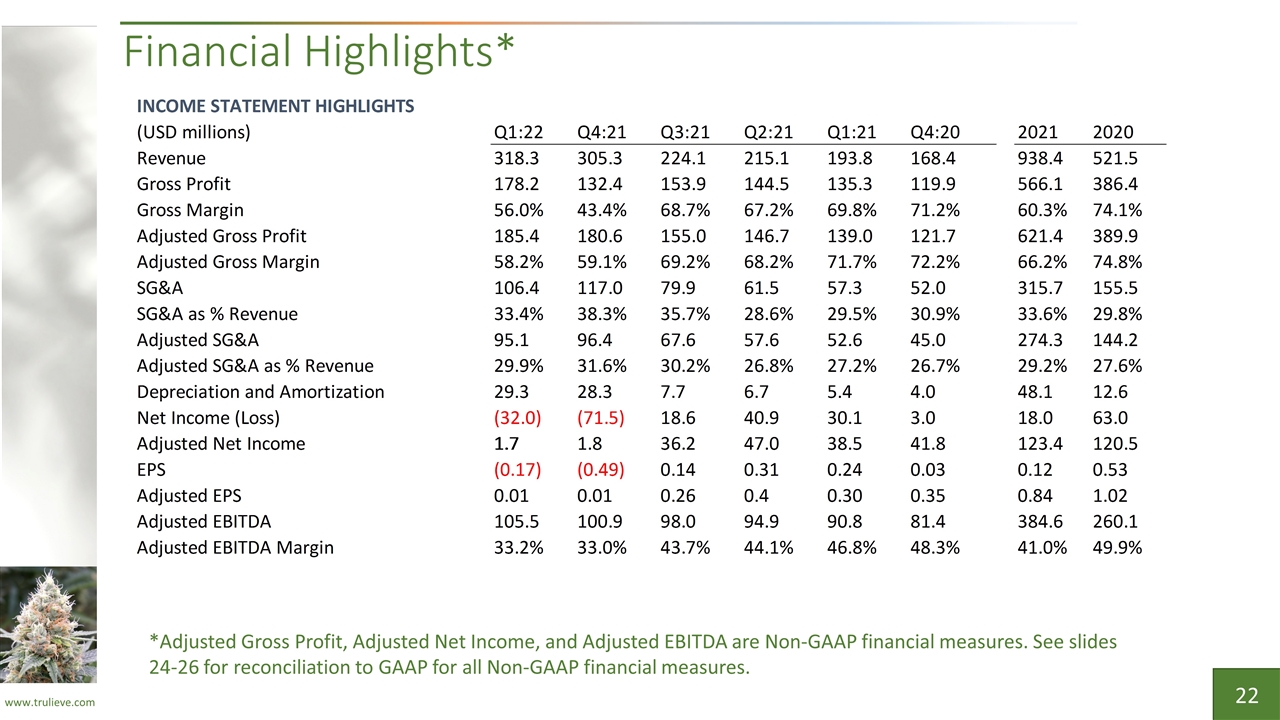

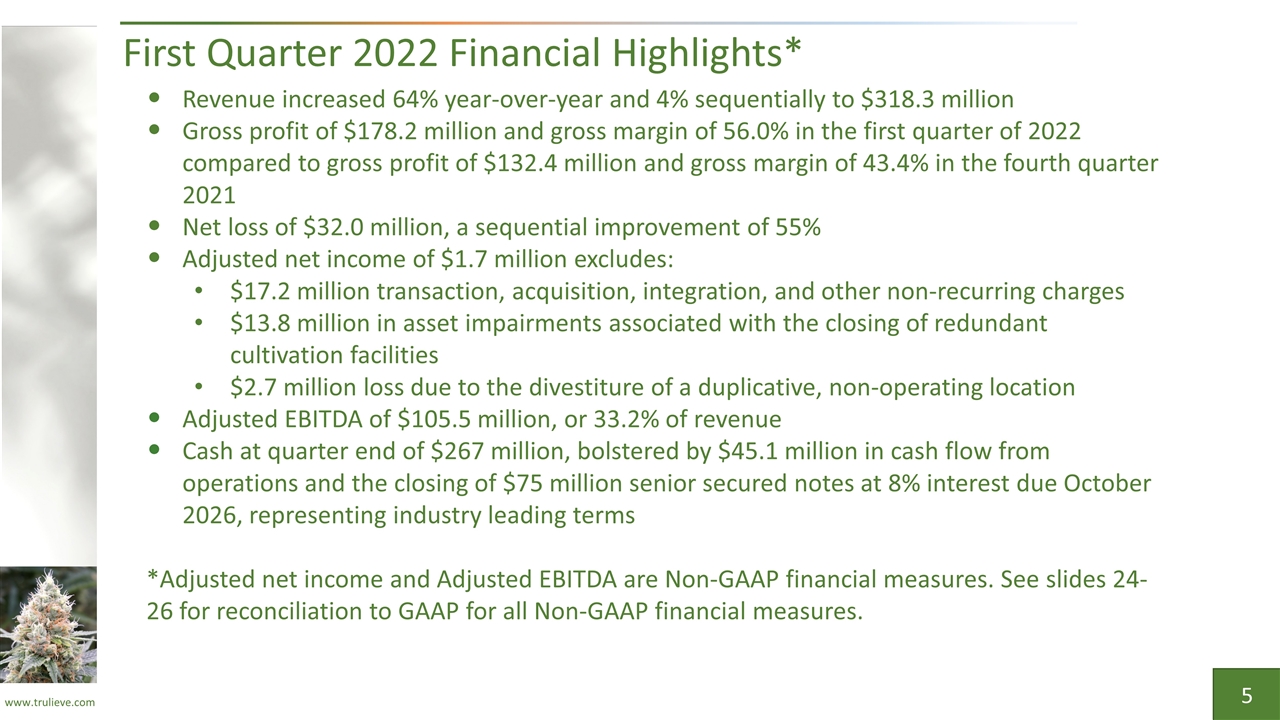

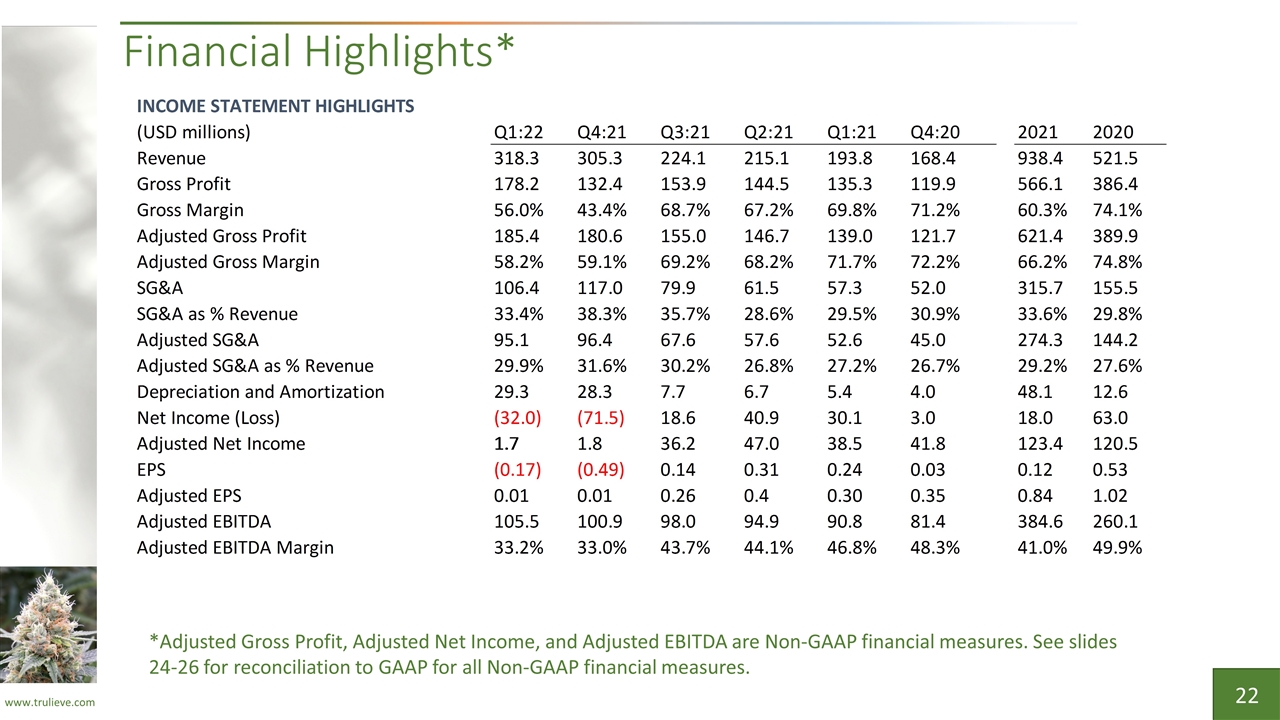

First Quarter 2022 Financial Highlights* Revenue increased 64% year-over-year and 4% sequentially to $318.3 million Gross profit of $178.2 million and gross margin of 56.0% in the first quarter of 2022 compared to gross profit of $132.4 million and gross margin of 43.4% in the fourth quarter 2021 Net loss of $32.0 million, a sequential improvement of 55% Adjusted net income of $1.7 million excludes: $17.2 million transaction, acquisition, integration, and other non-recurring charges $13.8 million in asset impairments associated with the closing of redundant cultivation facilities $2.7 million loss due to the divestiture of a duplicative, non-operating location Adjusted EBITDA of $105.5 million, or 33.2% of revenue Cash at quarter end of $267 million, bolstered by $45.1 million in cash flow from operations and the closing of $75 million senior secured notes at 8% interest due October 2026, representing industry leading terms *Adjusted net income and Adjusted EBITDA are Non-GAAP financial measures. See slides 24-26 for reconciliation to GAAP for all Non-GAAP financial measures.

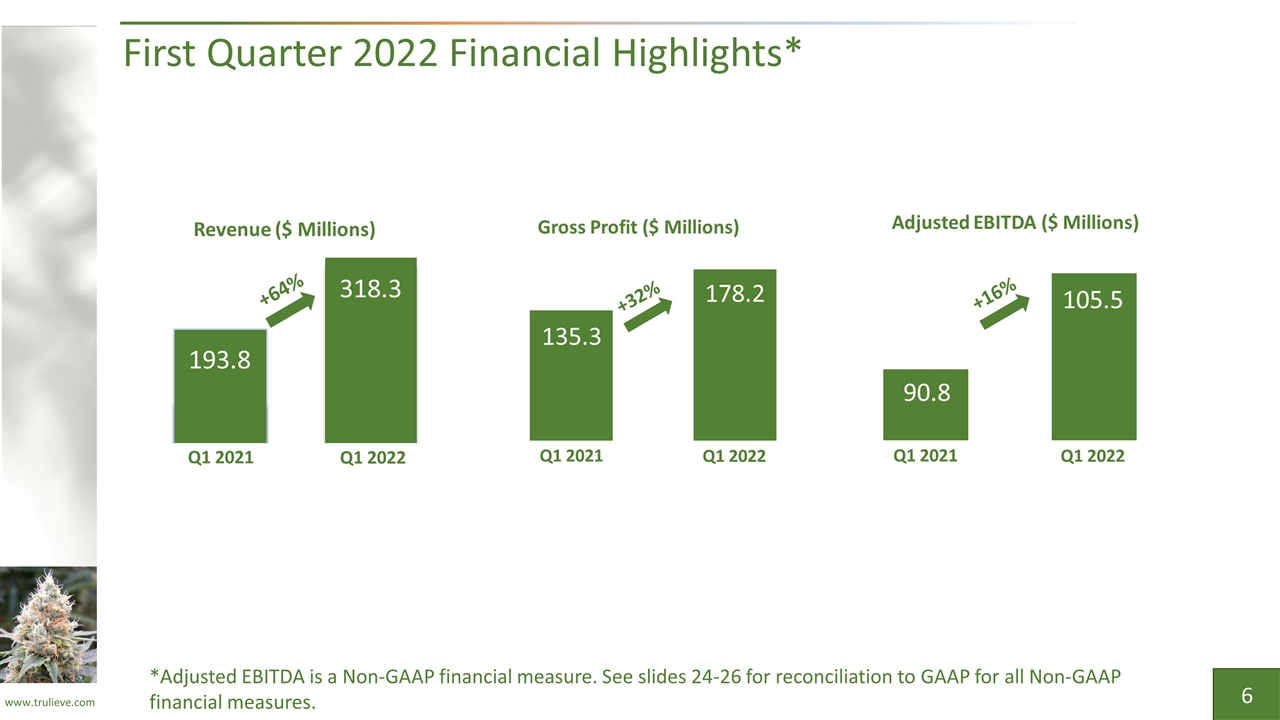

First Quarter 2022 Financial Highlights* *Adjusted EBITDA is a Non-GAAP financial measure. See slides 24-26 for reconciliation to GAAP for all Non-GAAP financial measures.

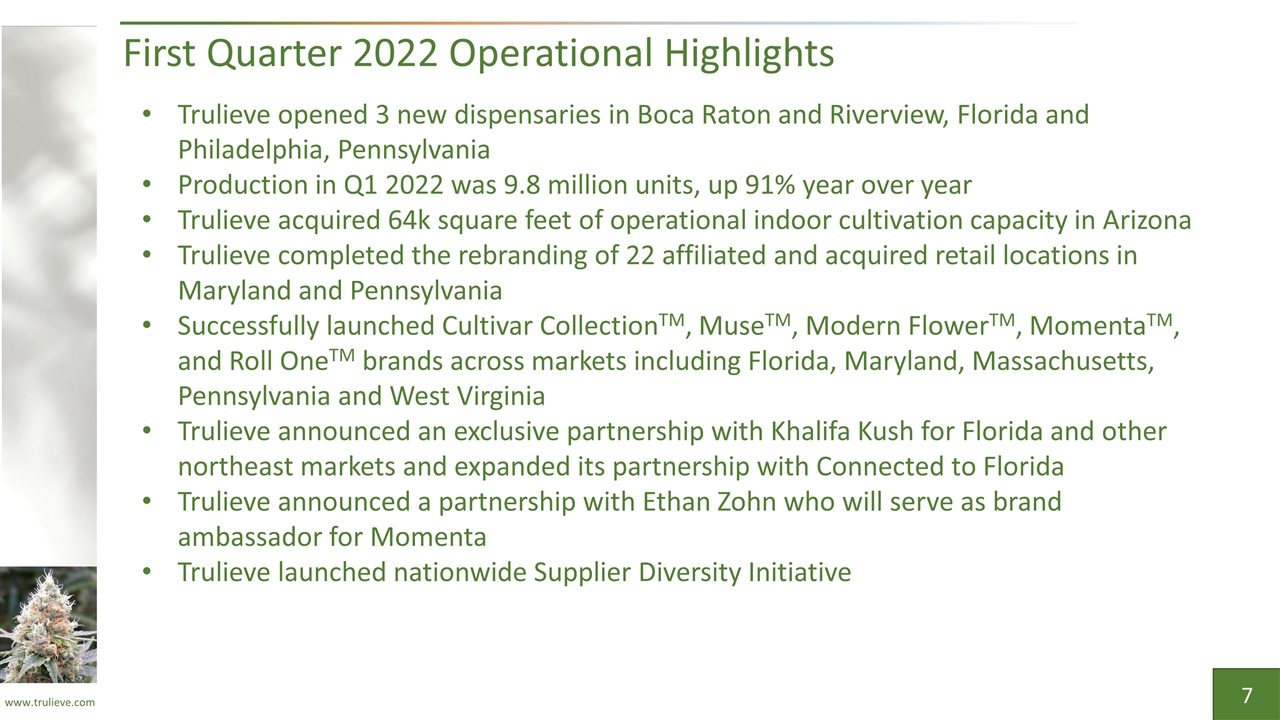

First Quarter 2022 Operational Highlights Trulieve opened 3 new dispensaries in Boca Raton and Riverview, Florida and Philadelphia, Pennsylvania Production in Q1 2022 was 9.8 million units, up 91% year over year Trulieve acquired 64k square feet of operational indoor cultivation capacity in Arizona Trulieve completed the rebranding of 22 affiliated and acquired retail locations in Maryland and Pennsylvania Successfully launched Cultivar CollectionTM, MuseTM, Modern FlowerTM, MomentaTM, and Roll OneTM brands across markets including Florida, Maryland, Massachusetts, Pennsylvania and West Virginia Trulieve announced an exclusive partnership with Khalifa Kush for Florida and other northeast markets and expanded its partnership with Connected to Florida Trulieve announced a partnership with Ethan Zohn who will serve as brand ambassador for Momenta Trulieve launched nationwide Supplier Diversity Initiative

Financial Outlook Reiterating Full Year 2022 Guidance Revenue of $1.3 billion to $1.4 billion Adjusted EBITDA of $450 million to $500 million Open 25-30 new dispensaries, relocate up to 6 dispensaries in Florida Anticipate 2H:22 results will reflect improved performance as strategic initiatives drive performance

Recent Developments Achieved record revenue, units sold, and number of customers served on 4/20 holiday Launched “4.20 For All” NFT collection Launched adult use sales at Napa, California dispensary Announced new brand partnership with DeLisioso Brands in Florida Expanded brand partnership with Khalifa Kush in Arizona Acquired West Virginia dispensary permit, expanding to 10 retail permits Trulieve opened 3 new dispensaries in Fort Myers and Zephyrhills, Florida and Framingham, Massachusetts Operate 165 retail dispensaries and >4.0 million square feet of cultivation and processing capacity as of May 12, 2022

Growth Initiatives

Strategic Priorities Deliver Exceptional Customer Experiences and Build Brand Loyalty Provide superb service, expedient transactions, and frictionless returns Innovate across product and consumer categories Expand through Hub Strategy Invest in cornerstone markets: Florida, Pennsylvania, and Arizona Expand in new and existing markets Pursue organic license awards and strategic M&A opportunities Distribute Branded Products through Branded Retail and Wholesale Channels Expand distribution of branded products through branded retail locations Convert acquired, affiliated and/or operated retail locations to Trulieve brand Develop and expand wholesale channels with initial emphasis on AZ, MA, MD, PA Focus on Profitable Growth and Create Shareholder Value

Customer Experience and Brand Loyalty Customer Experience Service, convenience, frictionless returns Customer loyalty rewards High quality products, broad selection New and innovative products Clones (MA only) Refined Crème, TruTonic powdered drink mix, and TruWax Live Budder, Live Diamonds, Live Meringue, Live Resin, Live Sauz carts, Live Suga Mini pre-rolls Ratio products, including CBG and CBN RSO tinctures Value sized edibles Primo buds

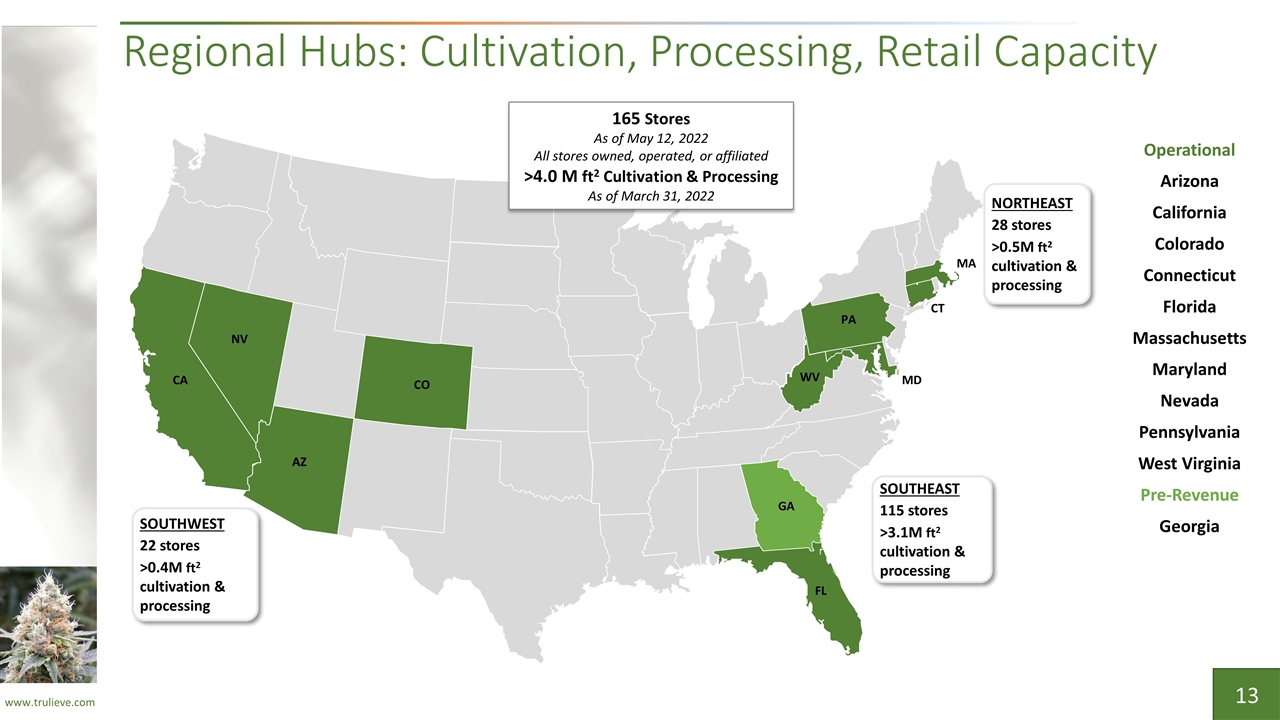

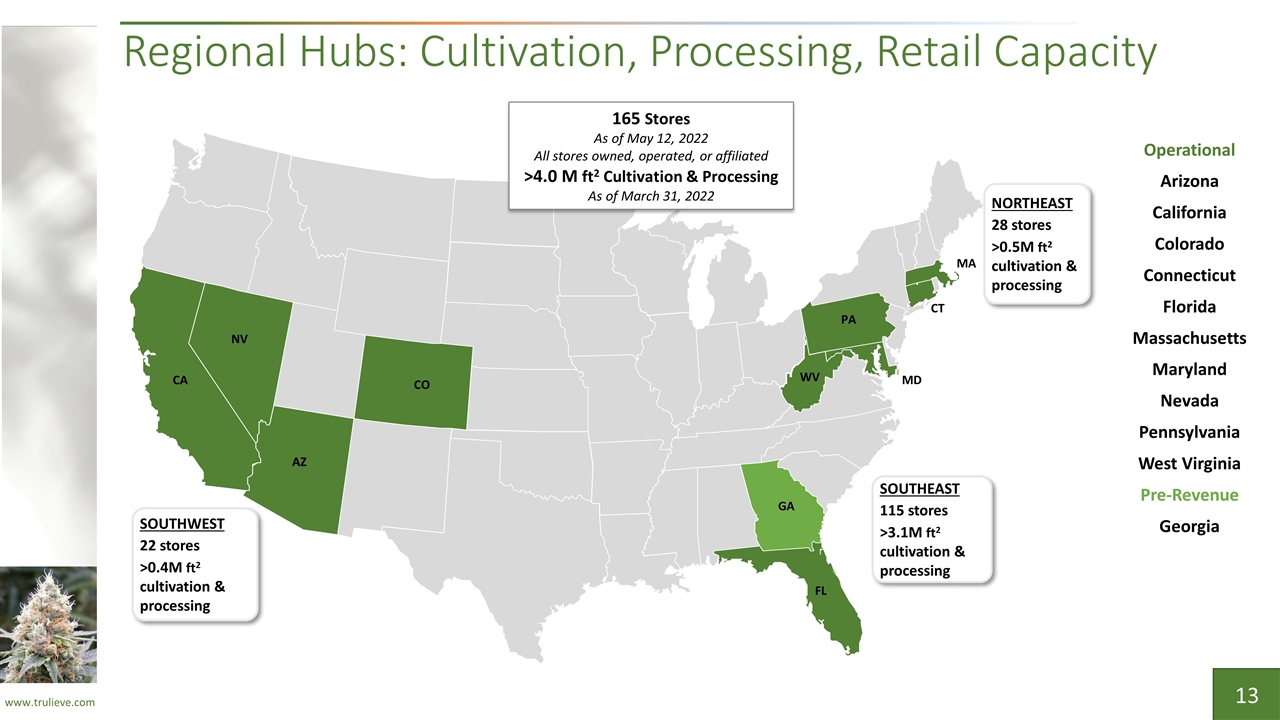

Regional Hubs: Cultivation, Processing, Retail Capacity FL CA MA PA AZ MD WV NV AZ CO CT GA 165 Stores As of May 12, 2022 All stores owned, operated, or affiliated >4.0 M ft2 Cultivation & Processing As of March 31, 2022 Operational Arizona California Colorado Connecticut Florida Massachusetts Maryland Nevada Pennsylvania West Virginia Pre-Revenue Georgia SOUTHWEST 22 stores >0.4M ft2 cultivation & processing NORTHEAST 28 stores >0.5M ft2 cultivation & processing SOUTHEAST 115 stores >3.1M ft2 cultivation & processing

Cornerstone Markets: Florida, Pennsylvania, Arizona Limited license markets Leading market presence in retail Cultivation, processing and manufacturing operations Potential for expansion and optimization Potential future catalysts with adult use expansion in Florida and Pennsylvania Fast and favorable returns on capital investments

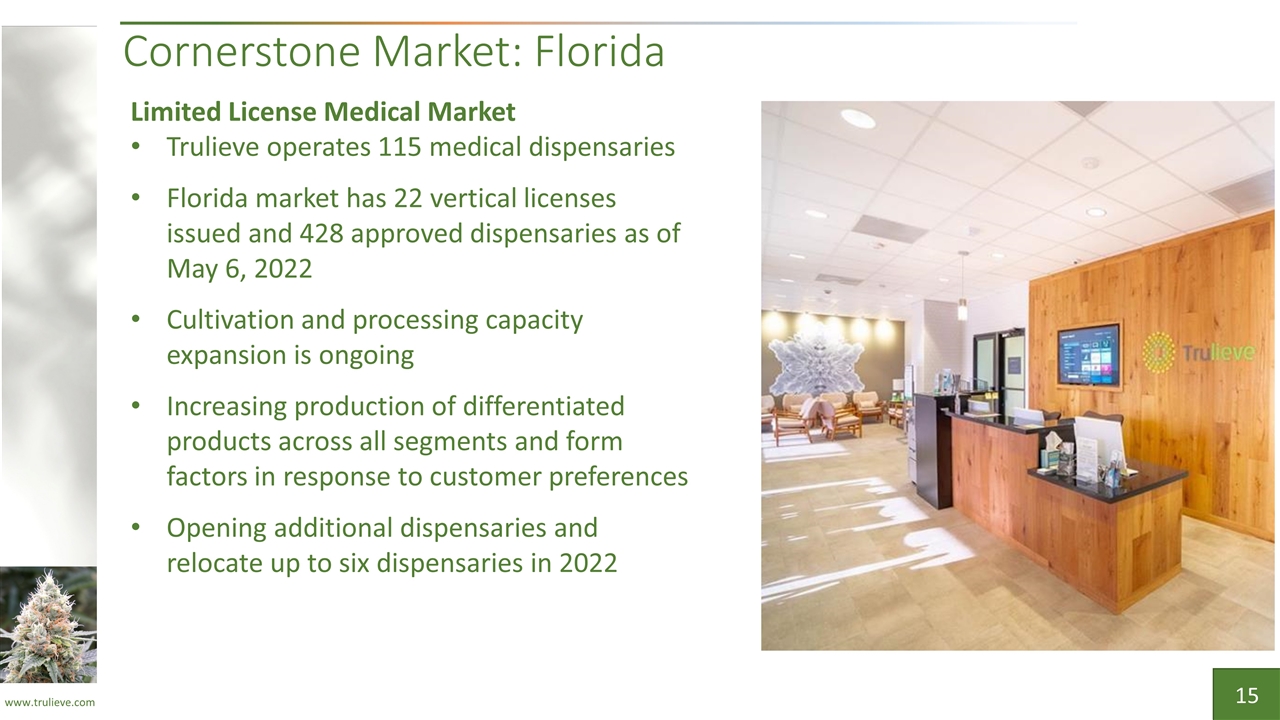

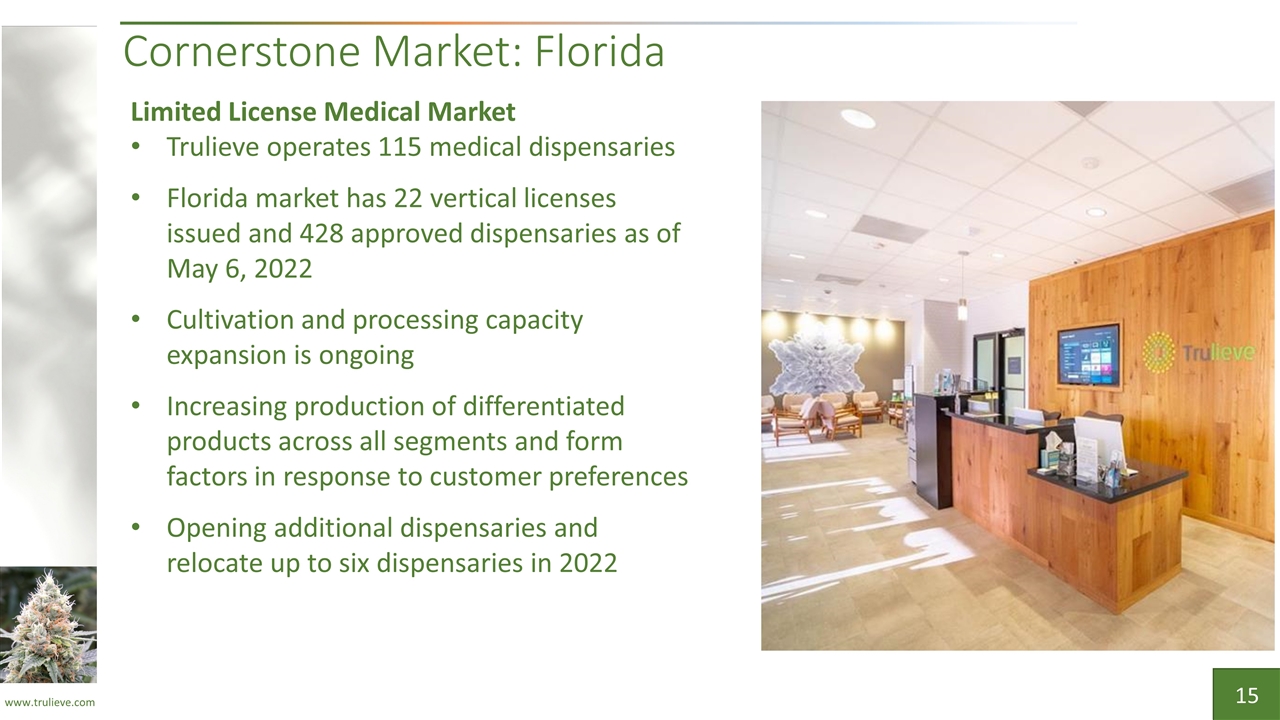

Cornerstone Market: Florida Limited License Medical Market Trulieve operates 115 medical dispensaries Florida market has 22 vertical licenses issued and 428 approved dispensaries as of May 6, 2022 Cultivation and processing capacity expansion is ongoing Increasing production of differentiated products across all segments and form factors in response to customer preferences Opening additional dispensaries and relocate up to six dispensaries in 2022

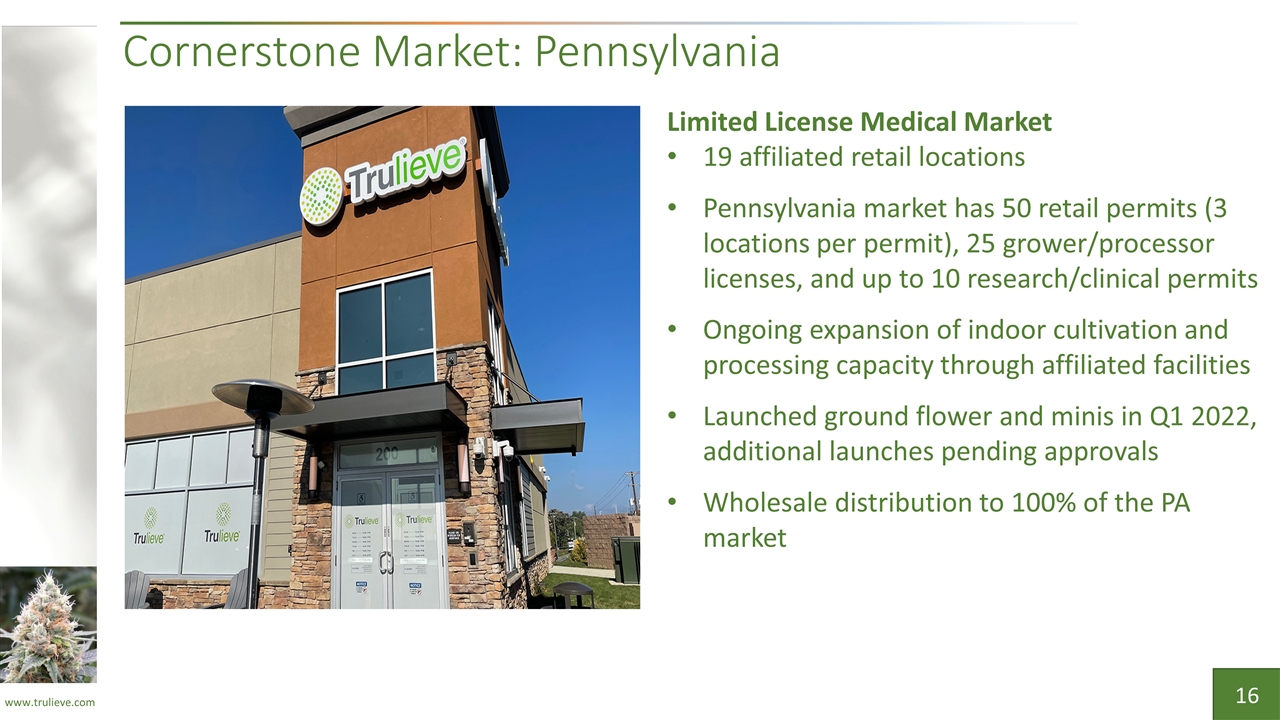

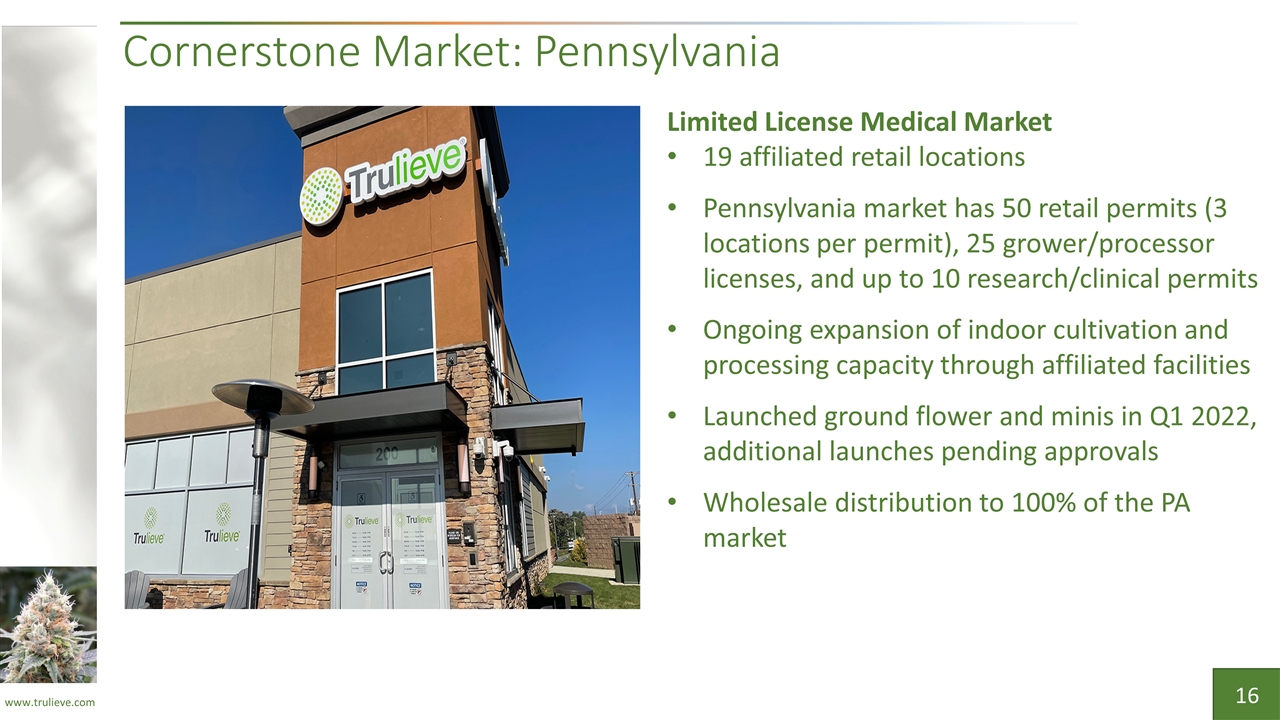

Cornerstone Market: Pennsylvania Limited License Medical Market 19 affiliated retail locations Pennsylvania market has 50 retail permits (3 locations per permit), 25 grower/processor licenses, and up to 10 research/clinical permits Ongoing expansion of indoor cultivation and processing capacity through affiliated facilities Launched ground flower and minis in Q1 2022, additional launches pending approvals Wholesale distribution to 100% of the PA market

Cornerstone Market: Arizona Limited License Adult Use and Medical Market Trulieve operates 17 retail dispensaries Arizona market has 131 core vertical licenses, 13 rural/underserved county licenses, and 26 future social equity licenses Expansion of cultivation and processing ongoing Plan to open two additional locations in 2022

Distribution of Branded Products through Branded Retail and Wholesale Channels Trulieve Brands VALUE MID PREMIUM

Distribution of Branded Products through Branded Retail and Wholesale Channels Partner Brands

Financials

Transaction Related and Non-Recurring Charges Transaction related charges $0.4 million fair value of inventory step up charge $17.2 million transaction, acquisition, integration, and other non-recurring charges $13.8 million in asset impairments associated with the closing of redundant cultivation facilities $2.7 million loss due to the divestiture of a duplicative, non-operating location Depreciation expense and amortization of intangibles expense increased by $20.4 million due to Harvest and will continue at higher expense level over useful life We expect reported results to improve in 2022 with greater improvements in 2H:22 as our strategic initiatives and optimization of assets drive performance

Financial Highlights* *Adjusted Gross Profit, Adjusted Net Income, and Adjusted EBITDA are Non-GAAP financial measures. See slides 24-26 for reconciliation to GAAP for all Non-GAAP financial measures.

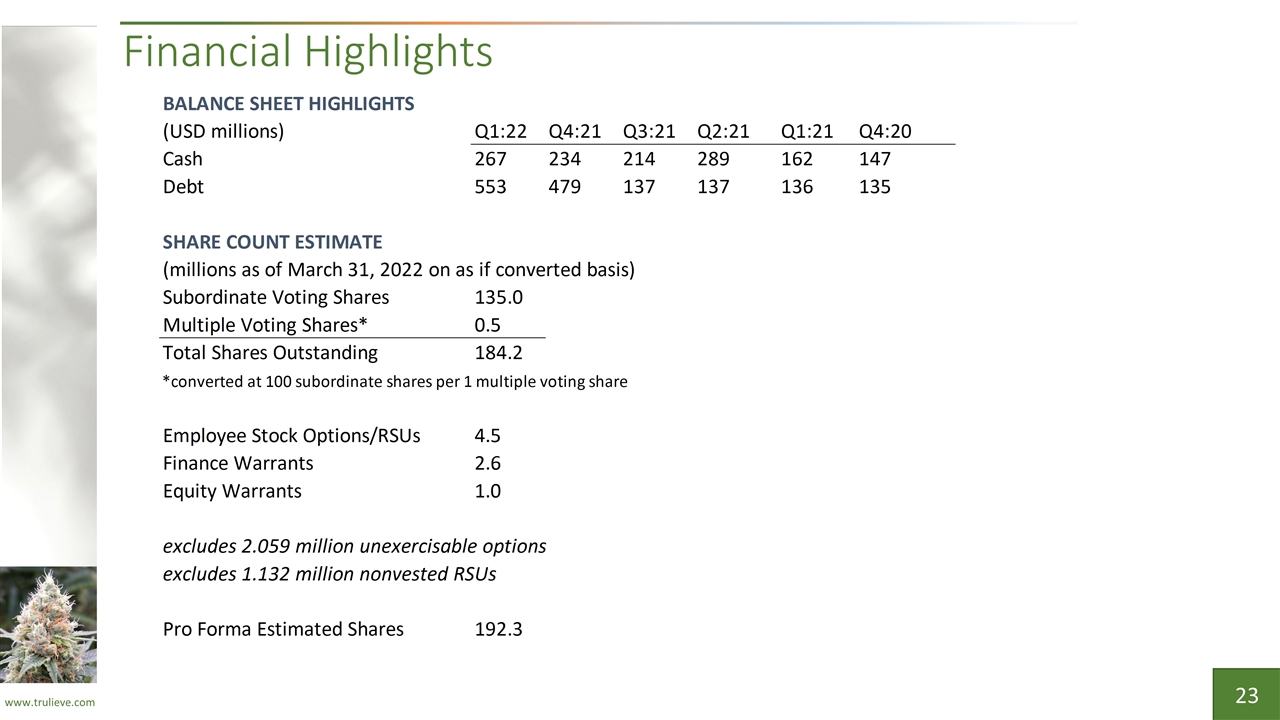

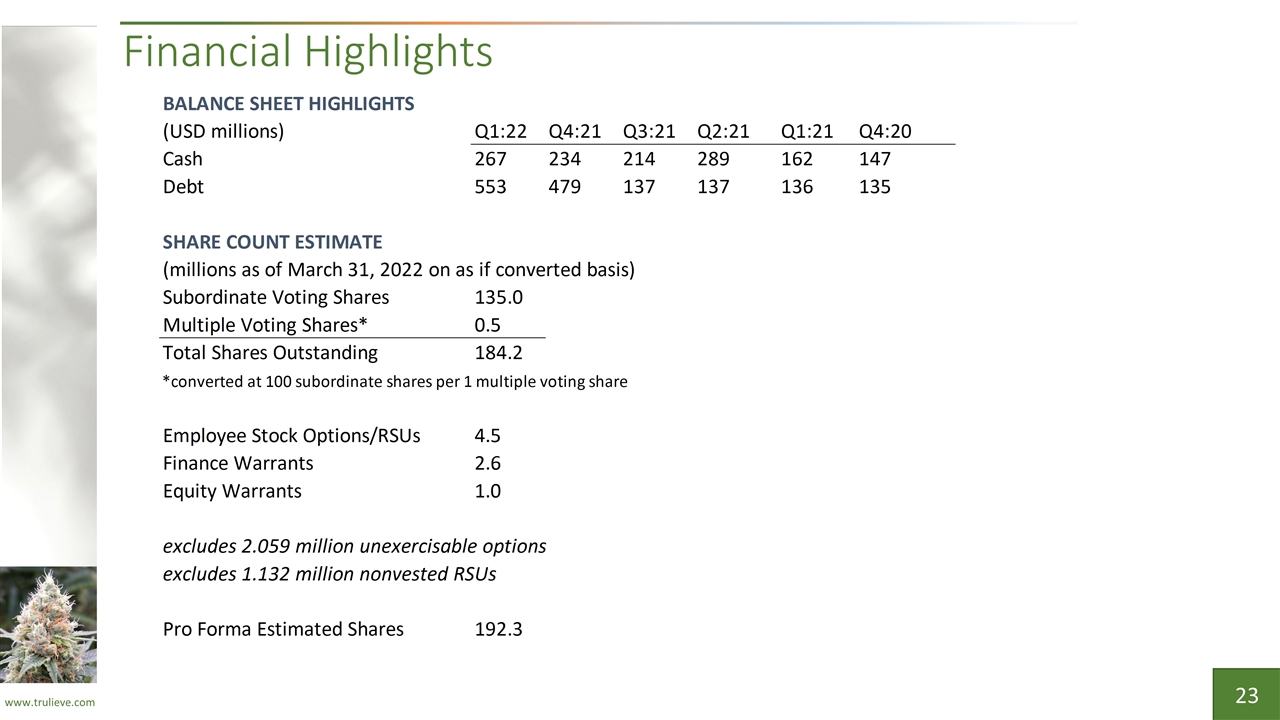

Financial Highlights

Reconciliation of Non-GAAP Financial Measures

Reconciliation of Non-GAAP Financial Measures

Reconciliation of Non-GAAP Financial Measures

Thank You CSE: TRUL OTCQX: TCNNF @Trulieve/@Trulieve_IR ir@trulieve.com