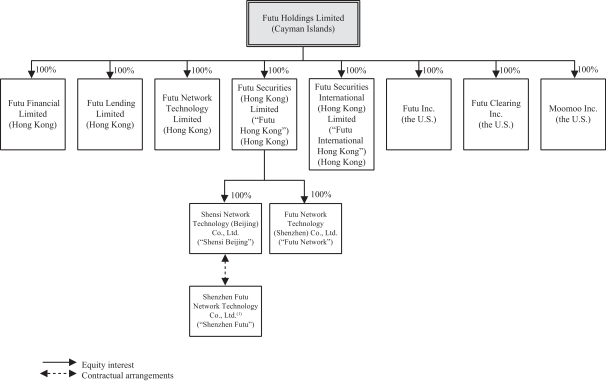

2012. In October 2012, Futu International Hong Kong became a securities dealer registered with the HK SFC by obtaining a Type 1 License for dealing in securities. Futu International Hong Kong obtained a Type 2 License for dealing in future contracts, a Type 4 License for advising on securities, a Type 9 License for asset management and a Type 5 License for advising on future contracts from the HK SFC subsequently in July 2013, June 2015, July 2015, and August 2018, respectively. In October 2014, Mr. Li transferred all of Futu International Hong Kong’s shares to Futu Holdings Limited, or Futu Holdings, our holding company. Futu International Hong Kong established two wholly-owned PRC subsidiaries, Shenzhen Shidai Futu Consulting Limited, or Shenzhen Shidai, and Shenzhen Qianhai Fuzhitu Investment Consulting Management Limited, or Shenzhen Qianhai, in May 2015 and August 2015, respectively. As of the date of this prospectus, we conduct most aspects of our operations through Futu International Hong Kong in Hong Kong.

In April 2014, Futu Holdings was incorporated under the laws of the Cayman Islands as our holding company. In May 2014, Futu Securities (Hong Kong) Limited, or Futu Hong Kong, was incorporated under the laws of Hong Kong as a wholly-owned subsidiary of Futu Holdings. As of the date of this prospectus, Futu Hong Kong has not engaged in any operating activities. Futu Hong Kong established three wholly-owned PRC subsidiaries, Shensi Network Technology (Beijing) Co., Ltd., or Shensi Beijing, Futu Network Technology (Shenzhen) Co., Ltd., or Futu Network and Futu Information Technology (Hainan) Co., Ltd., in September 2014, October 2015 and September 2018, respectively, which, together with Futu Business Information Consulting (Hainan) Co., Ltd., a wholly-owned subsidiary of Futu Network Technology Limited established in September 2018, Shenzhen Shidai and Shenzhen Qianhai, are referred to as our wholly-foreign-owned entities, or PRC WFOEs, in this prospectus.

Due to restrictions imposed by PRC laws and regulations on foreign ownership of companies that engage in internet and other related business, Shensi Beijing later entered into a series of contractual arrangements with Shenzhen Futu, which we refer to as our variable interest entity, or VIE, in this prospectus, and its shareholders. For more details, see “Corporate History and Structure—Contractual Arrangements with Our VIE and Its Shareholders.” As a result of our direct ownership in our PRC WFOEs and the variable interest entity contractual arrangements, we are regarded as the primary beneficiary of our VIE. We treated our VIE and its subsidiary as our consolidated affiliated entities under generally accepted accounting principles in the United States, or U.S. GAAP, and have consolidated the financial results of these entities in our consolidated financial statements in accordance with U.S. GAAP.

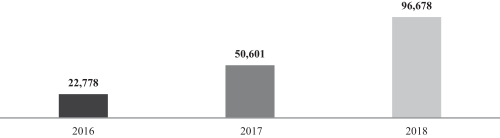

We operate our business mainly through Futu International Hong Kong, which is a HK SFC-regulated entity that holds the relevant licenses related to our securities brokerage business. In 2016, 2017 and 2018, we generated revenues of HK$83.2 million, HK$305.6 million and HK$795.0 million (US$101.5 million), accounting for 95.6%, 98.0% and 98.0% of our total revenues, respectively, from Futu International Hong Kong, whose assets amounted to HK$4,425.8 million, HK$10,748.7 million and HK$15,547.7 million (US$1,985.5 million), accounting for 98.0%, 98.4%, 96.8% of our total assets as of the end of the same years, respectively, taking intercompany transaction offset into consideration. We also conduct research and development activities in China through Futu Network and our VIE. In 2016, 2017 and 2018, we generated revenues of HK$2.5 million, HK$4.6 million and HK$3.2 million (US$0.4 million), accounting for 2.9%, 1.5% and 0.4% of our total revenues, respectively, from Futu Network and our VIE, whose assets amounted to HK$45.2 million, HK$73.8 million and HK$224.8 million (US$28.7 million), accounting for 1.0%, 0.7% and 1.4% of our total assets as of the end of the same years, respectively, taking intercompany transaction offset into consideration. As of the date of this prospectus, we have not engaged in any operating activities through our other subsidiaries in China.

We strategically established Futu Financial Limited, Futu Lending Limited and Futu Network Technology Limited, each a wholly-owned subsidiary of our company in Hong Kong, in April 2017, April 2017 and August 2015, respectively, for the purpose of our potential business expansion in the future. As of the date of this prospectus, these subsidiaries have not engaged in any active operating activities. In the past, compared to our total revenues and total assets, the revenues and assets of these subsidiaries were nominal.

), a subsidiary of Tencent. Pursuant to the strategic cooperation framework agreement, subject to further definitive agreements to be entered into between the parties and to the extent in compliance with applicable laws and regulations, Tencent agreed to cooperate with us in traffic, content and cloud areas through Tencent’s online platform. In addition, to the extent permitted by the applicable laws and regulations, we and Tencent agreed to further explore and pursue additional cooperation opportunities for potential cooperation in the area of fintech-related products and services to expand both parties’ international operations. Tencent also agreed to cooperate with us in the areas of ESOP services, administration, talent recruiting and training.

), a subsidiary of Tencent. Pursuant to the strategic cooperation framework agreement, subject to further definitive agreements to be entered into between the parties and to the extent in compliance with applicable laws and regulations, Tencent agreed to cooperate with us in traffic, content and cloud areas through Tencent’s online platform. In addition, to the extent permitted by the applicable laws and regulations, we and Tencent agreed to further explore and pursue additional cooperation opportunities for potential cooperation in the area of fintech-related products and services to expand both parties’ international operations. Tencent also agreed to cooperate with us in the areas of ESOP services, administration, talent recruiting and training.