Information about each Director” below. Biographical information regarding each other member of the Adviser’s Board of Managers is summarized below:

James D. Carey. Mr. Carey is a Senior Principal of Stone Point and a member of the investment committees of the Trident V Funds. Mr. Carey is also a member of the Adviser’s Board of Managers, the Adviser’s investment committee, and Eagle Point Credit Management’s investment committee. Mr. Carey joined Stone Point in 1997 from Merrill Lynch & Co. Prior to joining Merrill Lynch & Co., Mr. Carey was a corporate attorney with Kelley Drye & Warren LLP. Mr. Carey is a director of a number of portfolio companies of the Trident V Funds managed by Stone Point, including Alliant Insurance Services, Inc., the holding company of Amherst Pierpont Securities LLC, Enstar Group Limited, Privilege Underwriters, Inc., HireRight and Sedgwick Claims Management Services, Inc.

Mr. Carey holds a B.S. from Boston College, a J.D. from Boston College Law School and an M.B.A. from the Duke University Fuqua School of Business.

Scott Bronner. Mr. Bronner is a Managing Director at Stone Point. Mr. Bronner is also a member of the Adviser’s Board of Managers, the Adviser’s investment committee, and Eagle Point Credit Management’s investment committee. Mr. Bronner joined Stone Point in 2009. He is a director of a number of portfolio companies of the Trident Funds managed by Stone Point. Prior to joining Stone Point, Mr. Bronner was an Analyst in the Private Equity Division at Lehman Brothers Inc.

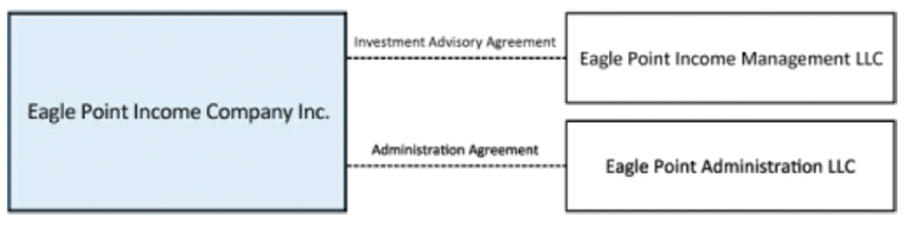

Investment Advisory Agreement

Services. Subject to the overall supervision of our board of directors, the Adviser manages the day-to-day operations of, and provides investment advisory and management services to, us. Under the terms of our Investment Advisory Agreement, the Adviser:

•

determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes;

•

identifies, evaluates and negotiates the structure of the investments we make (including performing due diligence on our prospective investments);

•

executes, closes, services and monitors the investments we make;

•

determines the securities and other assets that we purchase, retain or sell; and

•

provides us with such other investment advisory, research and related services as we may from time to time reasonably require for the investment of our funds.

The Adviser’s services under the Investment Advisory Agreement are not exclusive, and both it and its members, officers and employees are free to furnish similar services to other persons and entities so long as its services to us are not impaired.

The Investment Advisory Agreement was most recently approved by the board of directors in May 2022. A discussion regarding the basis for the board of directors’ most recent approval of the Investment Advisory Agreement is included in our semi-annual report for the period ended June 30, 2022.

Duration and Termination. Unless earlier terminated as described below, the Investment Advisory Agreement will remain in effect if approved annually by our board of directors or by the affirmative vote of the holders of a majority of our outstanding voting securities, including, in either case, approval by a majority of our directors who are not “interested persons” of any party to such agreement, as such term is defined in Section 2(a)(19) of the 1940 Act. The Investment Advisory Agreement will automatically terminate in the event of its assignment. The Investment Advisory Agreement may also be terminated by our board of directors or the affirmative vote of a majority of our outstanding voting securities (as defined in the 1940 Act) without penalty upon not less than 60 days’ written notice to the Adviser and by the Adviser upon not less than 90 days’ written notice to us.

Indemnification. The Investment Advisory Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, the Adviser and its officers, managers, partners, agents, employees, controlling persons,