Filed pursuant to Rule 424(b)(3)

1933 Act File No. 333-272168

PROSPECTUS SUPPLEMENT dated May 23, 2024

(to Prospectus dated June 29, 2023, as supplemented from time to time)

EAGLE POINT INCOME COMPANY INC.

$157,000,000 of Common Stock

Up to 615,000 Shares of 7.75% Series B Term Preferred Stock due 2028

Liquidation Preference $25 per share

Up to 400,000 Shares of 8.00% Series C Term Preferred Stock due 2029

Liquidation Preference $25 per share

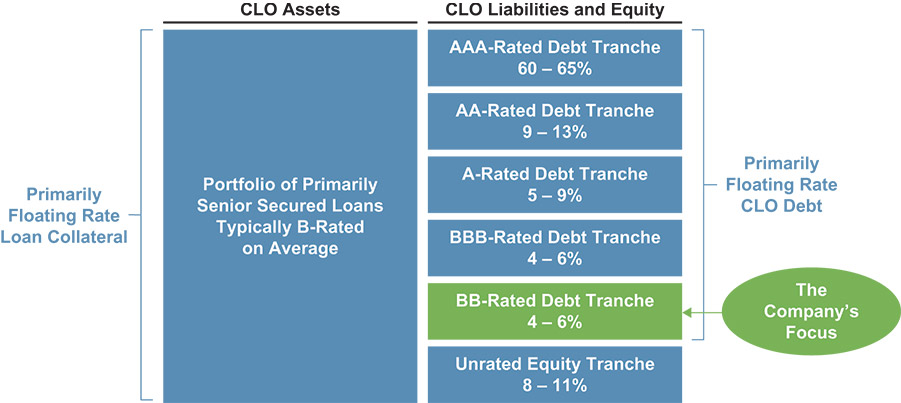

We are an externally managed, diversified closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, as amended, or the “1940 Act.” Our primary investment objective is to generate high current income, with a secondary objective to generate capital appreciation. We seek to achieve our investment objectives by investing primarily in junior debt tranches of collateralized loan obligations, or “CLOs,” that are collateralized by a portfolio consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. We focus on CLO debt tranches rated “BB” (e.g., BB+, BB or BB-, or their equivalent) by Moody’s Investors Service, Inc., or “Moody’s,” S&P Global Ratings, or “S&P,” or Fitch Ratings, Inc., or “Fitch,” and/or other applicable nationally recognized statistical rating organizations. We refer to such debt tranches in this prospectus supplement as “BB-Rated CLO Debt.” We may also invest in other junior debt tranches of CLOs, senior debt tranches of CLOs, loan accumulation facilities, or “LAFs,” and other related securities and instruments, including synthetic investments, such as significant risk transfer securities and credit risk transfer securities issued by banks or other financial institutions. In addition, we may invest up to 35% of our total assets (at the time of investment) in CLO equity securities. We expect our investments in CLO equity securities to primarily reflect minority ownership positions. CLO junior debt and equity securities are highly leveraged, and therefore the CLO securities in which we intend to invest are subject to a higher degree of loss since the use of leverage magnifies losses. See “Risk Factors — Risks Related to Our Investments — We may leverage our portfolio, which would magnify the potential for gain or loss on amounts invested and will increase the risk of investing in us” in the accompanying prospectus. We may also invest in other securities and instruments that our investment adviser believes are consistent with our investment objectives. The CLO securities in which we primarily seek to invest are rated below investment grade or, in the case of CLO equity securities, are unrated and are considered speculative with respect to timely payment of interest and repayment of principal. Below investment grade and unrated securities are also sometimes referred to as “junk” securities.

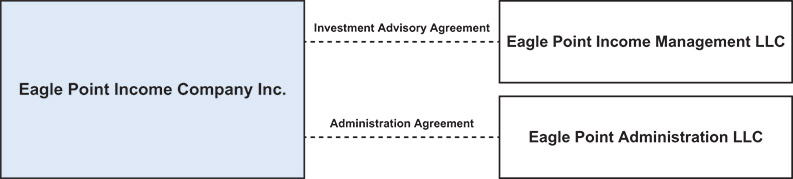

Eagle Point Income Management LLC, or “Eagle Point Income Management” or the “Adviser,” our investment adviser, manages our investments subject to the supervision of our board of directors. An affiliate of the Adviser, Eagle Point Credit Management LLC, or “Eagle Point Credit Management,” provides investment professionals and other resources to the Adviser as the Adviser may determine to be reasonably necessary to conduct its operations. As of March 31, 2024, the Adviser, collectively with certain affiliates of the Adviser, had approximately $9.6 billion in total assets under management, including capital commitments that were undrawn as of such date. Eagle Point Administration LLC, an affiliate of the Adviser, or the “Administrator,” serves as our administrator.

We are offering up to $157,000,000 aggregate offering price of our common stock, up to 615,000 shares of our 7.75% Series B Term Preferred Stock due 2028, or the “Series B Term Preferred Stock,” with an aggregate liquidation preference of $25,000,000, and up to 400,000 shares of our 8.00% Series C Term Preferred Stock due 2029, or the “Series C Term Preferred Stock,” and, together with the Series A Term Preferred Stock (as defined below), the Series B Term Preferred Stock, and any additional shares of preferred stock we may issue from time to time, the “Preferred Stock,” with an aggregate liquidation preference of $25,000,000 pursuant to this prospectus supplement and the accompanying prospectus. We have entered into the Fourth Amended and Restated At Market Issuance Sales Agreement, dated May 23, 2024, or the “Sales Agreement,” with B. Riley Securities, Inc. (“B. Riley”), which we refer to as the placement agent, relating to the sale of shares of common stock and Preferred Stock offered by this prospectus supplement and the accompanying prospectus.

The Sales Agreement provides that we may offer and sell shares of our common stock and Preferred Stock from time to time through the placement agent, as placement agent or principal. Sales of our common stock and Preferred Stock, if any, under this prospectus supplement and the accompanying prospectus may be made by any method that is deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We are required to redeem all outstanding shares of the Series B Term Preferred Stock on July 31, 2028, at a redemption price of $25 per share, or the “Series B Liquidation Preference,” plus accumulated but unpaid dividends, if any, to, but excluding, the Series B Mandatory Redemption Date (as defined below). At any time on or after July 31, 2025, we may, at our sole option, redeem the outstanding shares of the Series B Term Preferred Stock at a redemption price per share equal to the Series B Liquidation Preference plus accumulated but unpaid dividends, if any, to, but excluding, the Series B Redemption Date (as defined below).

We are required to redeem all outstanding shares of the Series C Term Preferred Stock on April 30, 2029, at a redemption price of $25 per share, or the “Series C Liquidation Preference,” plus accumulated but unpaid dividends, if any, to, but excluding, the Series C Mandatory Redemption Date (as defined below). At any time on or after April 3, 2026, we may, at our sole option, redeem the outstanding shares of the Series C Term Preferred Stock at a redemption price per share equal to the Series C Liquidation Preference plus accumulated but unpaid dividends, if any, to, but excluding, the Series C Redemption Date (as defined below).

In addition, if we fail to maintain asset coverage (as defined in Section 18(h) of the 1940 Act) of at least 200%, we will be required to redeem the number of shares of our preferred stock (which at our discretion may include any number or portion of the Preferred Stock, including any particular series) that, when combined with any debt securities redeemed for failure to maintain the asset coverage required by the indenture governing such securities (if applicable), (1) results in us having asset coverage of at least 200%, or (2) if fewer, the maximum number of shares of Preferred Stock that can be redeemed out of funds legally available for such redemption. In connection with any redemption for failure to maintain such asset coverage, we may, in our sole option, redeem such additional number of shares of Preferred Stock that will result in asset coverage up to and including 285%. The Preferred Stock ranks senior in right of payment to our common stock, ranks equally in right of payment with any shares of Preferred Stock we have issued or may issue in the future. Each holder of the Preferred Stock is entitled to one vote on each matter submitted to a vote of our stockholders, and the holders of all of our outstanding Preferred Stock and common stock generally vote together as a single class. The holders of shares of the Preferred Stock (together with any additional series of preferred stock we may issue in the future) are entitled as a class to elect two of our directors and, if dividends on any outstanding shares of our Preferred Stock are in arrears by two years or more, to elect a majority of our directors (and to continue to be so represented until all dividends in arrears have been paid or otherwise provided for).

The placement agent will receive a commission from us equal to up to 2.0% of the gross sales price of any shares of our common stock or Preferred Stock sold through it under the Sales Agreement. The placement agent is not required to sell any specific number or dollar amount of common stock or Preferred Stock but will use its commercially reasonable efforts consistent with its sales and trading practices to sell the shares of our common stock and Preferred Stock offered by this prospectus supplement and the accompanying prospectus. For all fees and expenses paid to the placement agent, see “Plan of Distribution” beginning on page S-37 of this prospectus supplement. The sales price per share of our common stock offered by this prospectus supplement and the accompanying prospectus, less commissions payable under the Sales Agreement and discounts, if any, will not be less than the net asset value, or, “NAV,” per share of our common stock at the time of such sale. Our common stock, 5.00% Series A Term Preferred Stock due 2026, or the “Series A Term Preferred Stock,” Series B Term Preferred Stock and Series C Term Preferred Stock trade on the New York Stock Exchange under the symbols “EIC,” “EICA,” “EICB,” and “EICC,” respectively. The last reported closing sales price for our common stock on May 21, 2024 was $16.25 per share. We determine the NAV per share of our common stock on a quarterly basis. As of March 31, 2024, the NAV per share of our common stock was $15.12 (the last date prior to the date of this prospectus supplement as of which we determined our NAV). Management’s unaudited estimate of the range of our NAV per share of our common stock as of April 30, 2024 was between $15.16 and $15.26.

Even though shares of the common stock and Preferred Stock are listed on an exchange, such shares may be thinly traded and you may face a greater risk of loss if you sell on the secondary market under these conditions. Investors who purchase shares of the common stock at a premium may also be subject to a heighted risk of loss under certain circumstances. Shares of common stock of closed-end management investment companies that are listed on an exchange frequently trade at a discount to their NAV per share. If our shares of common stock trade at a discount to our NAV per share, it will likely increase the risk of loss for purchasers of our securities.

We generally borrow funds to make investments. As a result, we are exposed to the risk of borrowing (also known as leverage) which may be considered a speculative investment technique. Leverage increases the volatility of investments and magnifies the potential for loss on amounts invested thereby increasing the risk associated with investing in our common stock or Preferred Stock.

Investing in our securities involves a high degree of risk, including the risk of a substantial loss of investment. Before purchasing any shares of our common stock or Preferred Stock, you should read the discussion of the principal risks of investing in our securities, which are summarized in “Risk Factors” beginning on page S-15 of this prospectus supplement and on page 13 of the accompanying prospectus. This prospectus supplement, the accompanying prospectus, any free writing prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus contain important information you should know before investing in our securities. Please read these documents before you invest and retain them for future reference. We file annual and semi-annual stockholder reports, proxy statements and other information with the U.S. Securities and Exchange Commission, or the “SEC.” To obtain this information free of charge or make other inquiries pertaining to us, please visit our website (www.eaglepointincome.com) or call (844) 810-6501 (toll-free). Information on our website is not incorporated by reference into or a part of this prospectus supplement or the accompanying prospectus. See “Additional Information” on page S-39 of this prospectus supplement. You may also obtain a copy of any information regarding us filed with the SEC from the SEC’s website (www.sec.gov). Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined that this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

B. Riley Securities

The date of this prospectus supplement is May 23, 2024.