UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23385

Axonic Alternative Income Fund

(exact name of registrant as specified in charter)

520 Madison Avenue, 42nd Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Clayton DeGiacinto, President

c/o Axonic Capital LLC

520 Madison Avenue, 42nd Floor

New York, NY 10022

(Name and Address of Agent for Service)

Copies of information to:

Jeffrey Skinner

Kilpatrick Townsend & Stockton LLP

1001 West Fourth Street

Winston-Salem, NC 27101

Registrant’s telephone number, including area code: (212) 259-0430

Date of fiscal year end: October 31

Date of reporting period: November 1, 2019 – April 30, 2020

Item 1. Report to Stockholders.

AXONIC ALTERNATIVE INCOME FUND

SEMI-ANNUAL REPORT

April 30, 2020

TABLE OF CONTENTS

| Portfolio Update | 1 |

| Schedule of Investments | 3 |

| Statement of Assets and Liabilities | 5 |

| Statement of Operations | 6 |

| Statement of Changes in Net Assets | 7 |

| Financial Highlights | 8 |

| Notes to Financial Statements | 9 |

| Additional Information | 15 |

| Trustees and Officers | 16 |

| Privacy Policy | 18 |

Electronic Report Disclosure Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website www.axonicfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by calling the Fund at (833) 429-6642, or submit a signed letter of instruction requesting paperless reports to PO Box 219445, Kansas City, MO 64121. If you own these shares through a financial intermediary, you may contact your financial intermediary to request your shareholder reports electronically.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling the Fund at (833) 429-6642, or by submitting a signed letter of instruction requesting paper reports to PO Box 219445, Kansas City, MO 64121. If you own these shares through a financial intermediary, contact the financial intermediary to request paper copies. Your election to receive reports in paper will apply to all funds held with the fund complex or your financial intermediary.

| Axonic Alternative Income Fund | Portfolio Update |

April 30, 2020 (Unaudited)

Average Annual Total Returns (as of April 30, 2020)

| | 1 Month | Quarter | 6 Month | YTD | 1 Year | Since Inception* |

| Axonic Alternative Income Fund - NAV | -3.18% | -20.08% | -18.76% | -20.05% | -16.76% | -10.88% |

| Bloomberg Barclays US Aggregate Bond Index(a) | 1.78% | 3.00% | 4.86% | 4.98% | 10.84% | 10.60% |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling (833) 429-6642 or by visiting www.axonicfunds.com.

| * | Fund’s inception date is December 28, 2018. |

| (a) | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark. |

Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes.

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, if repurchased, may be worth more or less than their original cost. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions. For the most current month-end performance please call 1-833-429-6642 (833-4Axonic) or download one at www.axonicfunds.com.

The Axonic Alternative Income Fund (the “Fund”) is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund. The Fund is suitable only for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment. The Fund’s shares have no history of public trading, nor is it intended that our shares will be listed on a national securities exchange at this time, if ever. Investing in the Fund’s shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risk, including the risk that shareholders may receive little or no return on their investment or that shareholders may lose part or all of their investment.

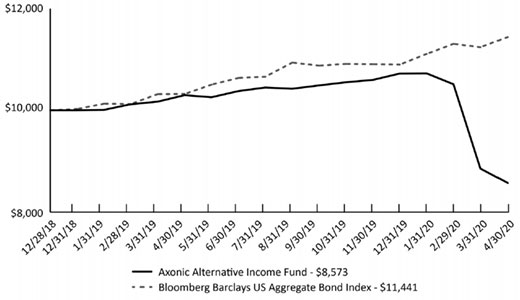

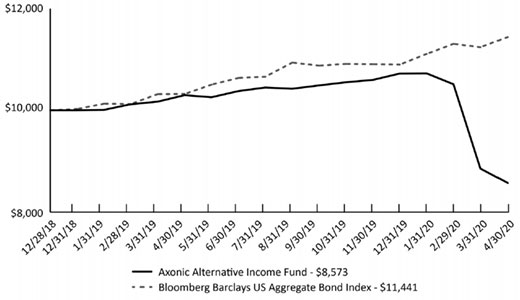

Performance of $10,000 Initial Investment (as of April 30, 2020)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares.

| Semi-Annual Report | April 30, 2020 | 1 |

| Axonic Alternative Income Fund | Portfolio Update |

April 30, 2020 (Unaudited)

| Top Ten Holdings (as a % of Net Assets)* | |

| | |

Lehman Mortgage Trust, Series 2007-5, Class 4A2 | 12.94% |

| Saxon Asset Securities Trust, Series 2004-2, Class MF4 | 8.48% |

| Merrill Lynch Mortgage Investors Trust, Series 2006-RM2, Class A1B | 6.50% |

| Residential Asset Mortgage Products, Inc. Trust, Series 2006-RS2, Class M1 | 4.93% |

| Oaktree Specialty Lending Corp. | 4.93% |

| Nexpoint Real Estate Finance, Inc. | 3.95% |

| Countrywide Alternative Loan Trust, Series 2006-21CB, Class A7 | 3.55% |

| Residential Accredit Loans, Inc. Trust, Series 2006-QS5, Class A7 | 3.27% |

| Countrywide Home Loans Mortgage Pass-Through Trust, Series 2006-21, Class A6 | 2.95% |

| Countrywide Alternative Loan Trust, Series 2006-24CB, Class A19 | 2.72% |

| Top Ten Holdings | 54.22% |

| | |

| Portfolio Composition (as a % of Net Assets)* | |

| | |

Residential Mortgage-Backed Securities | 49.93% |

| Common Stocks - Financials | 17.79% |

| Common Stocks - Consumer Discretionary | 1.08% |

| Cash Equivalents & Other Net Assets | 31.20% |

| | 100.00% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. Tables present indicative values only. |

| Axonic Alternative Income Fund | Schedule of Investments |

April 30, 2020 (Unaudited)

| Description | | Shares | | | Value | |

| COMMON STOCKS (18.87%) | | | | | | | | |

| Financials (17.79%) | | | | | | | | |

| Ambac Financial Group, Inc.(a) | | | 1,000 | | | $ | 17,200 | |

| Arbor Realty Trust, Inc. REIT | | | 1,060 | | | | 7,303 | |

| FS KKR Capital Corp. | | | 290 | | | | 998 | |

| Hudson Pacific Properties, Inc. REIT | | | 1,510 | | | | 37,116 | |

| JBG SMITH Properties REIT | | | 400 | | | | 13,580 | |

| KKR Real Estate Finance Trust, Inc. REIT | | | 1,800 | | | | 28,405 | |

| MFA Financial, Inc. REIT | | | 2,931 | | | | 5,129 | |

| New Residential Investment Corp. REIT | | | 3,235 | | | | 19,701 | |

| Nexpoint Real Estate Finance, Inc. REIT | | | 5,000 | | | | 57,300 | |

| Oaktree Specialty Lending Corp. | | | 17,854 | | | | 71,594 | |

| | | | | | | | 258,326 | |

| Consumer Discretionary (1.08%) | | | | | | | | |

| Extended Stay America, Inc. | | | 1,440 | | | | 15,653 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $413,431) | | | | | | | 273,979 | |

| | | Rate | | Maturity Date | | Principal Amount | | | Value | |

| RESIDENTIAL MORTGAGE-BACKED SECURITIES (49.93%) | | | | | | | | | | | | |

| Countrywide Alternative Loan Trust, Series 2006-20CB, Class A6(b) | | 1M US L + 0.50% | | 07/25/36 | | $ | 114,048 | | | $ | 30,887 | |

| Countrywide Alternative Loan Trust, Series 2006-24CB, Class A19(b) | | 1M US L + 0.50% | | 08/25/36 | | | 93,688 | | | | 39,450 | |

| Countrywide Alternative Loan Trust, Series 2006-21CB, Class A7(b) | | 1M US L + 0.70% | | 07/25/36 | | | 109,633 | | | | 51,486 | |

| Countrywide Home Loans Mortgage Pass-Through Trust, Series 2006-21, Class A6(b) | | 1M US L + 0.37% | | 02/25/37 | | | 108,613 | | | | 42,864 | |

| Lehman Mortgage Trust, Series 2007-5, Class 4A2(b) | | 1M US L + 0.32% | | 08/25/36 | | | 297,052 | | | | 187,921 | |

| MASTR Asset Securitization Trust, Series 2006-1, Class 2A1(b) | | 1M US L + 0.45% | | 05/25/36 | | | 154,838 | | | | 35,833 | |

| Merrill Lynch Mortgage Investors Trust, Series 2006-RM2, Class A1B(b) | | 1M US L + 0.47% | | 05/25/37 | | | 1,429,735 | | | | 94,432 | |

| Residential Accredit Loans, Inc. Trust, Series 2006-QS5, Class A7(b) | | 1M US L + 0.30% | | 05/25/36 | | | 70,529 | | | | 47,520 | |

| Residential Asset Mortgage Products, Inc. Trust, Series 2006-RS2, Class M1(b) | | 1M US L + 0.39% | | 03/25/36 | | | 100,000 | | | | 71,622 | |

| Saxon Asset Securities Trust, Series 2004-2, Class MF4 | | 3.83% | | 08/25/35 | | | 147,556 | | | | 123,078 | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES | | | | | | | | | | | | |

| (Cost $941,464) | | | | | | | | | | | 725,093 | |

| | | 7-Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS - COMMON SHARES (28.09%) | | | | | | | | | | | |

| JPMorgan US Treasury Plus Money Market Fund | | | 0.19 | % | | 407,877 | | | $ | 407,877 | |

| | | | | | | | | | | | |

TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | |

| (Cost $407,877) | | | | | | | | | | 407,877 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTS (96.89%) | | | | | | | | | | | |

| (Cost $1,762,772) | | | | | | | | | $ | 1,406,949 | |

| | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (3.11%) | | | | | | | | | | 45,168 | |

| NET ASSETS (100.00%) | | | | | | | | | $ | 1,452,117 | |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2020 | 3 |

| Axonic Alternative Income Fund | Schedule of Investments |

April 30, 2020 (Unaudited)

| (a) | Non-income producing security. |

| (b) | Floating or variable rate security. The Reference Rate is described below. The Interest Rate in effect as of April 30, 2020 is based on the Reference Rate plus the displayed spread as of the security’s last reset date. |

Investment Abbreviations:

REIT - Real Estate Investment Trust

LIBOR - London Interbank Offered Rate

Libor Rates:

1M US L - 1 Month LIBOR as of April 30, 2020 was 0.33%

See Notes to Financial Statements.

| Axonic Alternative Income Fund | Statement of Assets and Liabilities |

April 30, 2020 (Unaudited)

| ASSETS: | | | |

| Investments, at fair value (Cost $1,762,772) | | $ | 1,406,949 | |

| Receivable for investment securities sold | | | 2,708 | |

| Dividend receivable | | | 246 | |

| Interest receivable | | | 834 | |

| Receivable due from Adviser (Note 3) | | | 85,966 | |

| Prepaid expenses and other assets | | | 49,501 | |

| Total Assets | | | 1,546,204 | |

| | | | | |

| LIABILITIES: | | | | |

| Accrued legal and audit fees payable | | | 31,309 | |

| Accrued fund accounting and administration fees payable | | | 39,536 | |

| Accrued Chief Compliance Officer fee payable | | | 89 | |

| Accrued Trustees’ fees payable | | | 76 | |

| Other payables and accrued expenses | | | 23,077 | |

| Total Liabilities | | | 94,087 | |

| Net Assets | | $ | 1,452,117 | |

| | | | | |

| COMPOSITION OF NET ASSETS: | | | | |

| Paid-in capital | | $ | 1,831,602 | |

| Total distributable earnings | | | (379,485 | ) |

| Net Assets | | $ | 1,452,117 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 1,452,117 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common share authorized) | | | 73,154 | |

| Net Asset Value and redemption price per share | | $ | 19.85 | |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2020 | 5 |

| Axonic Alternative Income Fund | Statement of Operations |

For the Six Months Ended April 30, 2020 (Unaudited)

| INVESTMENT INCOME: | | | |

| Dividends | | $ | 17,392 | |

| Interest | | | 30,886 | |

| Total Investment Income | | | 48,278 | |

| | | | | |

| EXPENSES: | | | | |

| Offering costs (Note 2) | | | 38,694 | |

| Fund accounting and administration fees (Note 3) | | | 78,965 | |

| Legal fees | | | 129,310 | |

| Audit and tax fees | | | 20,906 | |

| Insurance expenses | | | 29,297 | |

| Transfer agent fees (Note 3) | | | 27,709 | |

| Advisory fees (Note 3) | | | 10,652 | |

| Custodian fees | | | 8,726 | |

| Trustees’ fees and expenses (Note 3) | | | 48,167 | |

| Printing expenses | | | 4,785 | |

| Chief Compliance Officer fee (Note 3) | | | 12,173 | |

| Other expenses | | | 10,595 | |

| Total expenses before waiver/reimbursement (Note 3) | | | 419,979 | |

| Expense waiver/reimbursement (Note 3) | | | (402,958 | ) |

| Net expenses | | | 17,021 | |

| Net Investment Income | | | 31,257 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain on investments | | | (20,753 | ) |

| Net change in unrealized (depreciation) on investments | | | (345,793 | ) |

| Net Realized and Unrealized Loss on Investments | | | (366,546 | ) |

| | | | | |

| Net Decrease in Net Assets from Operations | | $ | (335,289 | ) |

See Notes to Financial Statements.

| Axonic Alternative Income Fund | Statement of Changes in Net Assets |

| | | For the Six

Months Ended

April 30, 2020

(Unaudited) | | | For the Period

December 31, 2018

(Commencement of

Operations) to

October 31, 2019 | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 31,257 | | | $ | 46,222 | |

| Net realized gain/(loss) on investments | | | (20,753 | ) | | | 50,848 | |

| Net realized gain distributions from other investment companies | | | – | | | | 366 | |

| Net change in unrealized (depreciation) on investments | | | (345,793 | ) | | | (10,030 | ) |

| Net Increase/(Decrease) in Net Assets from Operations | | | (335,289 | ) | | | 87,406 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From distributable earnings | | | (85,835 | ) | | | (46,516 | ) |

| Net Decrease in Net Assets from Distributions to Shareholders | | | (85,835 | ) | | | (46,516 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from sale of shares of beneficial interest | | | – | | | | 1,600,000 | |

| Shares issued in reinvestment of distributions | | | 85,835 | | | | 46,516 | |

| Net Increase from Capital Share Transactions | | | 85,835 | | | | 1,646,516 | |

| Net Increase/(Decrease) in Net Assets | | | (335,289 | ) | | | 1,687,406 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 1,787,406 | | | | 100,000 | |

| End of period | | $ | 1,452,117 | | | $ | 1,787,406 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Beginning shares | | | 69,574 | | | | 4,000 | |

| Issued | | | – | | | | 63,751 | |

| Distributions reinvested | | | 3,580 | | | | 1,823 | |

| Net increase in capital shares | | | 3,580 | | | | 69,574 | |

| Ending shares | | | 73,154 | | | | 69,574 | |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2020 | 7 |

| Axonic Alternative Income Fund | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Six

Months Ended

April 30, 2020

(Unaudited) | | | For the Period

December 31, 2018

(Commencement of

Operations) to

October 31, 2019 | |

| OPERATING PERFORMANCE: | | | | | | | | |

| Net asset value - beginning of period | | $ | 25.69 | | | $ | 25.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income(a) | | | 0.44 | | | | 0.74 | |

| Net realized and unrealized gain on investments | | | (5.06 | ) | | | 0.63 | |

| Total Income/(Loss) from Investment Operations | | | (4.62 | ) | | | 1.37 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From net investment income | | | (0.58 | ) | | | (0.68 | ) |

| From net realized gains | | | (0.64 | ) | | | – | |

| Total Distributions to Shareholders | | | (1.22 | ) | | | (0.68 | ) |

| | | | | | | | | |

| Net asset value - end of period | | $ | 19.85 | | | $ | 25.69 | |

| | | | | | | | | |

| Total Investment Return - Net Asset Value(b) | | | (18.76 | %)(c) | | | 5.52 | %(c) |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

| Net assets end of period (000s) | | $ | 1,452 | | | $ | 1,787 | |

| Ratio of expenses to average net assets excluding reimbursement(d) | | | 49.33 | %(e) | | | 60.30 | %(e) |

| Ratio of expenses to average net assets including reimbursement(d) | | | 2.00 | %(e) | | | 2.00 | %(e) |

| Ratio of net investment income to average net assets(d) | | | 3.67 | %(e) | | | 3.49 | %(e) |

| Portfolio turnover rate | | | 11 | %(c) | | | 48 | %(c) |

| (a) | Calculated using average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been reimbursed during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude applicable sales charges. |

| (d) | Expenses and net investment income/(loss) amounts used to calculate the ratios above include amounts allocated to investors. An individual investor’s results may vary based on a variety of factors and the timing of capital transactions. |

See Notes to Financial Statements.

| Axonic Alternative Income Fund | Notes to Financial Statements |

April 30, 2020 (Unaudited)

1. ORGANIZATION

Axonic Alternative Income Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a non-diversified, closed-end management investment company. The Fund was organized as a Delaware statutory trust on September 26, 2018 pursuant to a Declaration of Trust governed by the laws of the State of Delaware. The Fund engages in a continuous offering of shares and operates as an interval fund and makes quarterly offers to repurchase its shares at their net asset value (the “NAV”) in accordance with Rule 23c-3 under the 1940 Act. Axonic Capital LLC (the “Adviser”) acts as the Fund’s investment adviser. The Adviser is a registered investment adviser and is responsible for making the investment decisions for the Fund’s portfolio. The Fund’s investment objective is to seek total return. The Fund’s portfolio will be deemed to be non-diversified under the 1940 Act, meaning it may invest a greater percentage of its assets in a single or limited number of issuers than a diversified fund. Under normal circumstances, the Fund will concentrate its investments (i.e., invest 25% or more of its total assets (measured at the time of purchase)) in mortgage-related assets issued by government agencies or other governmental entities or by private originators or issuers.

The Fund currently offers a single class of common shares of beneficial interest (“Shares”), which commenced operations on December 31, 2018. Shares are offered at NAV per share and are not subject to sales charges, though the Fund may, in the future, impose sales charges. The Fund may offer additional classes of shares in the future. The Fund has received exemptive relief from the Securities and Exchange Commission (“SEC”) that permits the Fund to issue multiple classes of shares. However, until the Fund registers a new share class, the Fund will only offer one class of shares.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is considered an investment company for financial reporting purposes under GAAP. The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standard Update (“ASU”) 2013-08. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Securities Valuation – The Fund’s Board of Trustees (the “Board”) has approved pricing policies and procedures and fair valuation policies and procedures pursuant to which the Fund will value its investments. The Adviser has appointed an independent Administrator of the Fund, pursuant to the administration agreement, under which the Administrator independently calculates the daily Net Asset Value per share (“NAV”) of the Fund. In doing so, the Administrator, on a daily basis, in compliance with the policies and procedures described above, independently values the investment positions within the Fund’s portfolio. The Administrator at its discretion may notify the Fund or the Board of any valuation conflicts and/or non-compliance with the policies and procedures. The Administrator and the Adviser will include in quarterly written reports to the Board, confirmation that the policies and procedures provide fair and accurate prices. Securities listed on an exchange, including common stocks, are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined. Investments in shares of funds, including money market funds, that are not traded on an exchange, are valued at the end of day net asset value (“NAV”) per share of such fund.

Structured credit and other similar debt securities including, but not limited to, asset-backed securities, collateralized debt obligations, collateralized loan obligations, collateralized mortgage obligations, mortgage-backed securities, commercial mortgage-backed security, and other securitized investments backed by certain debt or other receivables (collectively, “Structured Credit Securities”), are valued on the basis of valuations provided by independent pricing services and /or dealers in those instruments recommended by the Adviser and approved by the Board. In determining fair value, pricing services and dealers will generally use information with respect to transactions in the securities being valued, quotations from other dealers, market transactions in comparable securities, analyses and evaluations of various relationships between securities, and yield to maturity information. The Adviser will, based on its reasonable judgment, select the pricing services or dealer quotations that most accurately reflect the fair market value of the Structured Credit Security while taking into account the information utilized by the pricing services or dealers to formulate the quotation in addition to any other relevant factors.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at “fair value” as determined in good faith by the Adviser’s Valuation Committee using the fair valuation policies and procedures adopted by, and under the supervision of, the Board. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV.

The fair valuation policies and procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by an independent pricing service and broker-dealer is inaccurate.

| Semi-Annual Report | April 30, 2020 | 9 |

| Axonic Alternative Income Fund | Notes to Financial Statements |

April 30, 2020 (Unaudited)

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level and supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; and (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

Fair Value Measurements – A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 | – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 | – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| Level 3 | – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. To the extent practicable, the Adviser generally endeavors to maximize the use of observable inputs and minimize the use of unobservable inputs by requiring that the most observable inputs are to be used when available.

| Axonic Alternative Income Fund | Notes to Financial Statements |

April 30, 2020 (Unaudited)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund’s investments as of April 30, 2020:

| Investments in Securities at Value(a) | | Level 1 -

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Total | |

| Common Stocks | | $ | 273,979 | | | $ | – | | | $ | – | | | $ | 273,979 | |

| Residential Mortgage-Backed Securities | | | – | | | | 725,093 | | | | – | | | | 725,093 | |

| Short Term Investments | | | 407,877 | | | | – | | | | – | | | | 407,877 | |

| Total | | $ | 681,856 | | | $ | 725,093 | | | $ | – | | | $ | 1,406,949 | |

| (a) | For detailed descriptions of industries, see the accompanying Schedule of Investments. |

Securities Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities using the effective interest method and is included in the interest income. Dividend income from REITs is recognized on the ex-dividend date. It is common for distributions from REITs to exceed taxable earnings and profits, resulting in the excess portion of such dividends being designated as a return of capital. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investment in REITs are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported to the Fund after the end of the calendar year. Estimates are based on the most recent REIT distribution information available.

Premium and Discount Amortization/Paydown Gains and Losses – All premiums and discounts on fixed-income securities are amortized/accreted over the estimated lives of such securities for financial statement purposes using the effective interest method. Gains and losses realized on principal payments of mortgage-backed securities (paydown gains and losses) are classified as part of investment income.

Concentration of Credit Risk – The Fund places its cash with one banking institution, which is insured by Federal Deposit Insurance Corporation (“FDIC”). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

Federal and Other Taxes – No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax provisions to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

As of and during the period ended April 30, 2020, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders – Distributions from the Fund’s net investment income are accrued daily and typically paid quarterly. However, there can be no assurances that the Fund will achieve any level of distribution to its Shareholders. The Fund intends to make sufficient distributions of its ordinary taxable income and capital gain net income prior to the end of each calendar year to avoid liability for the excise tax. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

| Semi-Annual Report | April 30, 2020 | 11 |

| Axonic Alternative Income Fund | Notes to Financial Statements |

April 30, 2020 (Unaudited)

Offering Costs – Offering costs incurred by the Fund were treated as deferred charges until operations commenced and are being amortized over a 12-month period using the straight line method. As of April 30, 2020, $38,694 in offering costs have been amortized. Unamortized amounts are included in prepaid offering costs in the Statement of Operations.

Indemnification – The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

3. ADVISORY FEES AND OTHER TRANSACTIONS WITH SERVICE PROVIDERS

Advisory Fees – Pursuant to the investment advisory agreement by and between the Fund and the Adviser (the “Investment Advisory Agreement”), and in consideration of the advisory services provided by the Adviser to the Fund, the Adviser is entitled to a management fee equal to 1.25% of the Fund’s average daily net assets. For the period ended April 30, 2020, the Fund incurred $10,652 in Advisory Fees.

The Adviser has contractually agreed to waive its fees and/or reimburse certain expenses (inclusive of organizational and offering costs, but exclusive of any taxes, interest on borrowings, dividends on securities sold short, brokerage commissions, 12b-1 fees, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization and extraordinary expenses) to limit the Fund’s Total Annual Fund Operating Expenses after Fee Waiver/Expense Reimbursement to 2.00% of the Fund’s average daily net assets (the “Expense Limit”) through February 28, 2021. The Expense Limit excludes certain expenses and, consequently, the Fund’s Total Annual Fund Operating Expenses after Fee Waiver/Expense Reimbursement may be higher than the Expense Limit. The contractual waiver and expense reimbursement may be changed or eliminated at any time by the Board of Trustees, on behalf of the Fund, upon 60 days’ written notice to the Adviser. The contractual fee waiver and expense reimbursement may not be terminated by the Adviser without the consent of the Board of Trustees. The Adviser may recoup from the Fund any waived amount or reimbursed expenses pursuant to this agreement if such recoupment does not cause the Fund to exceed the current Expense Limit or the Expense Limit in place at the time of the waiver or reimbursement (whichever is lower) and the recoupment is made within three years after the end of the month in which the Adviser incurred the expense. During the period ended April 30, 2020, the Adviser reimbursed expenses of $402,958.

As of April 30, 2020, the following amounts were available for recoupment by the Advisor based upon their potential expiration dates:

| Fund | | Expires

2022 | | | Expires

2023 | |

| Axonic Alternative Income Fund | | $ | 842,237 | | | $ | 402,958 | |

CCO/Compliance Services – Effective December 19, 2019, ALPS no longer provides Chief Compliance Officer Services to the Fund. Prior to December 19, 2019, ALPS provided Chief Compliance Officer Services to the Fund. Additionally, ALPS provided services in monitoring and testing the policies and procedures of the Fund in conjunction with requirements under Rule 38a-1 under the 1940 Act. ALPS was compensated under the Chief Compliance Officer Services Agreement.

Fund Accounting and Administration Fees and Expenses – ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s administrator and accounting agent (the “Administrator”) and receives customary fees from the Fund for such services.

Transfer Agent – DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Fund (“Transfer Agent”).

Distributor – The Fund has entered into a distribution agreement with ALPS Distributors, Inc. (the “Distributor”) to provide distribution services to the Fund. There are no fees paid to the Distributor pursuant to the distribution agreement.

The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of ALPS. During the period ended April 30, 2020, no fees were retained by the Distributor.

| Axonic Alternative Income Fund | Notes to Financial Statements |

April 30, 2020 (Unaudited)

Trustees – Officers of the Fund and Trustees who are “interested persons” of the Fund or the Adviser will receive no salary or fees from the Fund. The Independent Trustees also serve as independent trustees on the Board of Trustees of the Axonic Funds, an open-end investment company for which Axonic Capital LLC also serves as the investment adviser. Effective April 15, 2020, for their service on the Board and the Board of Trustees of Axonic Funds, the Independent Trustees receive the following fees, which are split between the Fund and the Axonic Funds pro rata based on assets under management: an annual retainer of $4,000 and a fee of $2,000 for each Board meeting attended in person and $1,000 for each Board meeting attended by telephone. Prior to April 15, 2020, each Trustee who is not an “interested person” received an annual retainer of $17,500, as well as a fee of $2,500 for each regularly scheduled Board meeting attended in person and $500 for each Board meeting attended by telephone. The Fund reimburses each Trustee and officer for his or her travel and other expenses relating to attendance at Board or Committee meetings.

4. INVESTMENT TRANSACTIONS

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the period ended April 30, 2020, amounted to $138,524 and $210,973, respectively.

5. TAX BASIS INFORMATION

Distributions are determined in accordance with federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end. Accordingly, tax basis balances have not been determined as of the date of the semi-annual report.

As of April 30, 2020, net unrealized appreciation/(depreciation) of investments based on the federal tax cost was a follows:

| Cost of investments for income tax purposes | | $ | 1,762,875 | |

| Gross appreciation (excess of value over tax cost) | | $ | 19,096 | |

| Gross depreciation (excess of tax cost over value) | | | (375,022 | ) |

| Net unrealized depreciation | | $ | (355,926 | ) |

6. REPURCHASE OFFERS

Pursuant to Rule 23c-3 under the 1940 Act, the Fund offers shareholders on a quarterly basis the option of redeeming shares, at NAV, of no less than 5% and no more than 25% of its issued and outstanding shares as of the close of regular business hours on the New York Stock Exchange on the Repurchase Pricing Date. If shareholders tender for repurchase more than the Repurchase Offer Amount for a given repurchase offer, the Fund may, but is not required to, repurchase an additional amount of Shares not to exceed 2.00% of the outstanding shares on the Repurchase Request Deadline. If the Fund determines not to repurchase more than the Repurchase Offer Amount, or if Shareholders tender Shares in an amount exceeding the Repurchase Offer Amount plus 2.00% of the outstanding Shares on the Repurchase Request Deadline, the Fund will repurchase Shares on a pro rata basis. However, the Fund may accept all Shares tendered for repurchase by Shareholders who own less than one hundred Shares and who tender all of their Shares, before prorating other amounts tendered. There can be no assurance that the Fund will be able to repurchase all shares that each shareholder has tendered, even if all of the shares in a shareholder’s account are tendered. In the event of an oversubscribed offer, you may not be able to tender all shares that you wish to tender and you may have to wait until the next quarterly repurchase offer to tender the remaining shares, subject to any proration. Subsequent repurchase requests will not be given priority over other shareholder requests.

The Fund completed quarterly repurchase offers on December 20, 2019 and March 20, 2020 which resulted in no shares of the Fund being repurchased.

| Semi-Annual Report | April 30, 2020 | 13 |

| Axonic Alternative Income Fund | Notes to Financial Statements |

April 30, 2020 (Unaudited)

7. SIGNIFICANT SHAREHOLDERS

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates a presumption of control of the Fund under Section 2(a)(9) of the 1940 Act. As of April 30, 2020, the following entities owned beneficially more than 25% of each Fund’s outstanding shares. The shares may be held under omnibus accounts (whereby the transactions of two or more shareholders are combined and carried in the name of the originating broker rather than designated separately). Any transaction by these investors could have a material impact on the share class.

| Name | | Percentage |

| Clayton H DeGiacinto* | | 29.53% |

| Peter B Schendel* | | 29.52% |

| * | Shareholder is an affiliate of the Adviser. |

8. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

The Fund completed a quarterly repurchase offer on June 19, 2020, which resulted in 20,639 shares of the Fund being repurchased for $420,622.

Management has determined that there were no other subsequent events to report through the issuance of these financial statements.

| Axonic Alternative Income Fund | Additional Information |

April 30, 2020 (Unaudited)

PROXY VOTING POLICIES AND VOTING RECORD

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 888-926-2688, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to its portfolio securities during the most recent 12-month period ended June 30th is available without charge upon request by calling toll-free 833-429-6642, or on the SEC’s website at http://www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT; the Fund’s Form N-PORT reports are available on the SEC’s Website at http://www.sec.gov. Prior to the SEC’s adoption of Form N-PORT and rescission of Form N-Q, the Fund filed its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov.

| Semi-Annual Report | April 30, 2020 | 15 |

| Axonic Alternative Income Fund | Trustees and Officers |

April 30, 2020 (Unaudited)

The shareholders of the Fund, pursuant to a written consent to action, elected Mr. Joshua M. Barlow, Mr. Charles D. Mires and Mr. Thomas S. Vales to the Board of Trustees of the Trust effective April 15, 2020. The Board is responsible for the oversight of the management of the Fund, including general supervision and review of the service providers that perform the investment activities of the Fund. The Board, in turn, elects the officers of the Fund, who are responsible for administering the day-to-day operations of the Fund. Unless otherwise indicated in the table below, the address of each Trustee and officer of the Fund is c/o Axonic Capital LLC, 520 Madison Avenue, 42nd Floor, New York, New York 10022. Additional information about the Trustees and officers of the Fund is provided in the table below.

Name and

Year of Birth | Position with

the Fund | Term of Office

and Length of

Time Served | Principal Occupation(s)

During Past 5 Years | Number of

Portfolios in

Fund

Complex*

Overseen by

Trustee | Other Directorships

Held During the Past 5 Years |

| INDEPENDENT TRUSTEES OF THE FUND(1) |

Joshua M. Barlow

1978 | Independent

Trustee | Indefinite Term;

Since April 15,

2020 | Managing Director, Valhalla Fiduciary (June 2018 – present); Head of Operational Due Diligence and Accounting and other positions, PAAMCO (Pacific Alternative Asset Management Company, LLC) (March 2006 – June 2018). | 2 | Axonic Funds |

Charles D. Mires

1960 | Independent

Trustee | Indefinite Term;

Since April 15,

2020 | Director CIB Marine Bancshares, Inc. (2010 – present); Retired from full time employment December, 2015; Director of Fixed Income, Alternative Strategies, and Third Party Mandates, Franklin Street Partners (2011-2015). | 2 | Axonic Funds; CIB Marine

Bancshares, Inc. |

Thomas S. Vales

1964 | Independent

Trustee | Indefinite Term;

Since April 15,

2020 | Chief Executive Officer, TMC Bonds LLC (an alternative trading system for fixed income) (2000 – 2019); Member, FINRA Fixed Income Advisory Committee (2016-2018). | 2 | Axonic Funds |

| INTERESTED TRUSTEE OF THE FUND** |

Clayton DeGiacinto**

1972 | Trustee,

President

(Principal

Executive

Officer) | Indefinite Term;

Since Inception | Managing Member and Chief Investment Officer, Axonic Capital LLC (2010 – present). | 2 | Axonic Funds |

| Axonic Alternative Income Fund | Trustees and Officers |

April 30, 2020 (Unaudited)

Name and

Year of Birth | Position with

the Fund | Term of Office and

Length of Time Served | Principal Occupation(s) During Past 5 Years |

| OFFICERS OF THE FUND |

John Kelly

1978 | Treasurer (Principal Financial Officer) | Indefinite Term; Since

Inception | Chief Financial Officer, Axonic Capital LLC (2017 – present); Controller, J. Goldman & Co. LP (June 2015- 2017); Manager of Financial Reporting, Moore Capital Management LP (2003 – 2015). |

Joseph Grogan

1980 | Secretary; Chief Compliance Officer | Indefinite Term; Since

Inception | Chief Compliance Officer, Axonic Capital LLC (February 2018 – present); Chief Compliance Officer, Claren Road Asset Management, LLC (January 2015 – February 2018); Director of Compliance, Claren Road Asset Management, LLC (July 2011 – January 2015). |

| * | The Fund Complex consists of the Fund and the Axonic Strategic Income Fund, the sole series of the Axonic Funds, a registered open-end investment company for which Axonic Capital LLC also serves as the investment adviser. |

| ** | The Interested Trustee is an Interested Trustee because he is the Managing Member and Chief Investment Officer of the Axonic Capital LLC. |

| Semi-Annual Report | April 30, 2020 | 17 |

| Axonic Alternative Income Fund | Privacy Policy |

April 30, 2020 (Unaudited)

DATA PRIVACY POLICY AND PROCEDURE

Policy Statement:

Axonic Alternative Income Fund (the “Fund”) has in effect the following policy (the “Data Privacy Policy”) with respect to nonpublic personal information about its customers.

The Fund collects nonpublic personal information about its customers1 from the following sources:

| ● | account applications and other forms, which may include a customer’s name, address, social security number, and information about a customer’s investment goals and risk tolerance; |

| ● | account history, including information about the transactions and balances in a customer’s account; and |

| ● | correspondence, written, or telephonic, between a customer and the Fund or service providers to the Fund. In addition, the Fund may obtain consumer information about its customers from consumer reports. |

The Fund will not release nonpublic personal or consumer information about its customers or their accounts unless one of the following conditions is met:

| ● | Prior written consent is received. |

| ● | The Fund believes the recipient to be the customer of the Fund or such Fund customer’s authorized representative. |

| ● | The Fund is required by law to release information to the recipient. |

The Fund does not give or sell nonpublic personal or consumer information about its customers or their fund accounts to any other company, individual, or group.

The Fund will only use nonpublic personal or consumer information about its customers and their accounts to attempt to better serve their investment needs or to suggest services or educational materials that may be of interest to them.

The Fund restricts access to nonpublic personal and consumer information about customers to those employees who need to know that information in order to provide products or services. The Fund may also share personal information with companies that it hires to provide support services. When the Fund or its Transfer Agent shares nonpublic personal or consumer information with other service providers, it protects that information with a strict confidentiality agreement. The Fund also maintains reasonable physical, electronic and procedural safeguards that comply with federal standards to protect against unauthorized access to and properly dispose of customers’ nonpublic personal and consumer information.

The Fund will adhere to the policies and practices described in this notice for current and former shareholders of the Fund.

II. Physical, Electronic and Procedural Safeguards

The following includes a list of the primary physical, electronic and procedural safeguards employed by the Transfer Agent to ensure against unauthorized access and proper disposal of customers’ nonpublic personal and consumer information.

| ● | The Fund shall distribute this Data Privacy Policy annually to shareholders through the Fund’s annual report to shareholders to ensure compliance with shareholder notification requirements mandated by Regulation S-P. |

| ● | Should a change in this Data Privacy Policy occur during the year that requires a change to this Data Privacy Policy, the Principal Underwriter or Transfer Agent will provide existing customers of the Fund with an updated Data Privacy Policy. |

| ● | The Transfer Agent shall maintain a third-party list that identifies any non-affiliated third-parties that do business with the Transfer Agent, the type(s) of service(s) provided, whether there is an exchange of non-public personal information, and whether these relationships fall outside of any exceptions and/or exemptions to the opt-out requirements afforded under Regulation S-P. Appropriate confidentiality language must exist in the contractual arrangements with each of these relations. |

| 1 | For purposes of this Data Privacy Policy, the terms “customer” or “customers” includes both shareholders of the Fund and individuals who provide nonpublic personal information to the Fund, but do not invest in Fund shares. |

| Axonic Alternative Income Fund | Privacy Policy |

April 30, 2020 (Unaudited)

| ● | The Transfer Agent, the Administrator, the Fund Accounting Agent, the Principal Underwriter, and Investment Adviser shall maintain procedures related to the security of nonpublic personal information and consumer information (including physical, electronic and procedural safeguards) and properly disposal of such information. |

| ● | Any data privacy related questions, concerns or breaches will be brought to the attention of the Fund’s CCO. |

Procedures:

| 1. | The Fund’s CCO will determine that the policies and procedures of the Transfer Agent, Principal Underwriter and the Fund’s other service providers are reasonably designed to safeguard customer information and require only appropriate and authorized access to, and use of, customer information through the application of appropriate administrative, technical, physical, and procedural safeguards that comply with applicable federal standards and regulations. |

| 2. | The Fund’s CCO will continually monitor applicable regulations that may cause policies of the Fund and/or its service providers subject to the requirements of Regulation S-P to change. |

| 3. | Annually, the Fund’s CCO will review any independent reviews applicable to data security at its service providers who have access to or otherwise obtain nonpublic personal information in fulfilling their obligations to the Fund. |

| 4. | Annually, the Fund’s CCO will inquire and review, where applicable, any related data privacy issues reported by the Fund’s service providers who have access to or otherwise obtain nonpublic personal information in fulfilling their obligations to the Fund. |

Adopted: December 19, 2018

| Semi-Annual Report | April 30, 2020 | 19 |

AXONIC ALTERNATIVE INCOME FUND

SEMI-ANNUAL REPORT

April 30, 2020

Not applicable to semi-annual report.

| Item 3. | Audit Committee Financial Expert. |

Not applicable to semi-annual report.

| Item 4. | Principal Accountant Fees and Services. |

Not applicable to semi-annual report.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to the Registrant.

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the Report to Stockholders filed under Item 1 of this Form N-CSR. |

| (b) | Not applicable to the Registrant. |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable to semi-annual report.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable to semi-annual report.

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

None.

| Item 10. | Submission of Matters to a Vote of Security Holders. |

The Nominating and Governance Committee, comprised of all the Independent Trustees, is responsible for seeking and reviewing candidates for consideration as nominees for Trustees. The Committee has a policy in place for considering Trustee candidates recommended by shareholders. Nomination submissions must be accompanied by all information relating to the recommended nominee that is required to be disclosed in solicitations or proxy statements for the election of Trustees, as well as information sufficient to evaluate the individual’s qualifications. Nomination submissions must be accompanied by all information relating to the recommended nominee that is required to be disclosed in solicitations or proxy statements for the election of Trustees, as well as information sufficient to evaluate the individual’s qualifications. Nomination submissions should be sent to:

Secretary, Axonic Alternative Income Fund

c/o Axonic Capital LLC

520 Madison Avenue, 42nd Floor

New York, NY 10022

| Item 11. | Controls and Procedures. |

| (a) | The Registrant’s principal executive officer and principal financial officer have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) are effective as of a date within 90 days of the filing date of this report. |

| (b) | There was no change in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940, as amended) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

| Item 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. |

Not applicable to semi-annual report.

| (a)(3) | Not applicable to the Registrant. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Axonic Alternative Income Fund

| By: | /s/ Clayton DeGiacinto | |

| | Clayton DeGiacinto (Principal Executive Officer) | |

| | Chief Executive Officer and President | |

| | | |

| Date: | July 8, 2020 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

Axonic Alternative Income Fund

| By: | /s/ Clayton DeGiacinto | |

| | Clayton DeGiacinto (Principal Executive Officer) | |

| | Chief Executive Officer and President | |

| | | |

| Date: | July 8, 2020 | |

| | | |

| By: | /s/ John R. Kelly | |

| | John R. Kelly (Principal Financial Officer) | |

| | Treasurer and Chief Financial Officer | |

| | | |

| Date: | July 8, 2020 | |