PUNCHFLIX INC.

Corporate

11705 Willake St.

Santa Fe Springs CA 90670

909.486.4742

PunchFlix.com

ir@punchflix.com

Best Efforts Offering Offering Price Minimum Offering | : 5,000,000 Shares Common Stock : $10.00 (Ten Dollars US) Per Share : None |

| Maximum Offering | : $50,000,000 |

Underwriting

Discount or Proceeds to Proceeds to

Commission Issuer Other Person

| Per Share: | $10 | $0.00 $10.00 | N/A |

| Total: | $50,000,000 | $50,000,000 | N/A |

| Minimum Total:(1) | 0 | 0 | N/A |

| Maximum Total: | $50,000,000 | $50,000,000 | N/A |

1 There shall be no minimum amount invested before the Company shall have access to the proceeds.

The proposed sale will begin as soon as practicable after the Securities and Exchange Commission has qualified this Offering Circular.The Offering will close upon the earlier of (1) the sale of 5,000,000 shares of Common Stock, or (2) One Year from the date this Offering begins, or (3) a date prior to one year from the date this Offering begins that is so determined by the Company’s Management (the “Offering Period”).

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth.Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation

| A. | For general information on investing, we encourage you to refer towww.investor.gov. |

Dated: June 15, 2019

THERE IS AT THIS TIME, NO PUBLIC MARKET FOR THE SECURITIES

THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SECURITIES AND EXCHANGE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATIONTHATTHE SECURITIES BEING OFFERED ARE EXEMPT FROM REGISTRATION. THE SECURITIES AND EXCHANGE COMMISSION DOES NOTPASSUPON THE MERITS OF OR GIVE ITSAPPROVALTO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES ITPASSUPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE.

THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS, AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THESE LAWS. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE REGULATORY AUTHORITY NOR HAS THE COMMISSION OR ANY STATE REGULATORY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, THE COMPANY ENCOURAGES YOU TO REVIEW RULE 251 (d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, THE COMPANY ENCOURAGES YOU TO REFER TO WWW.INVESTOR.GOV

THE COMPANY IS FOLLOWING THE “OFFERING CIRCULAR” FORMAT OF DISCLOSURE UNDER REGULATION A

AN OFFERING CIRCULAR PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING CIRCULAR FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF A SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR SELLING LITERATURE. THESE SECURITIES ARE OFFERED UNDER AN EXEMPTION FROM REGISTRATION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THESE SECURITIES ARE EXEMPT FROM REGISTRATION.

INVESTMENT IN SMALL BUSINESSES INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSURER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE OFFER MADE BY THIS OFFERING CIRCULAR, NOR HAS ANY PERSON BEEN AUTHORIZED TO GIVE ANY INFORMATION OR MAKE ANYREPRESENTATIONOTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON. THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER TO SELL ORSOLICITATIONOF AN OFFER TO BUY IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICIATION WOULD BEUNLAWFULOR ANY PERSON TO WHO IT ISUNLAWFULTO MAKE SUCH OFFER OR SOLICIATION. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE MADE HEREUNDER SHALL, UNDER ANY CIRCUMSTANCES,CREATEAN IMPLICATIONTHATTHERE AS HAS BEEN NO CHANGE IN THEAFFAIRSOF OURCOMPANYSINCE THEDATEHEREOF.

THIS OFFERING CIRCULAR MAY NOT BE REPRODUCED IN WHOLE OR IN PART. THE USE OF THIS OFFERING CIRCULAR FOR ANY PURPOSE OHER THAN AN INVESTMENT IN SECURITIES DESCRIBED HEREIN IS NOT AUTHORIZED AND IS PROHIBITED. AN OFFERING CIRCULAR PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

INFORMATION CONTAINED IN THE PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED PRIOR TO THE TIME AN OFFERING CIRCULAR WHICH IS NOT DESIGNATED AS A PRELIMINARY OFFERING CIRCULAR IS DELIVERED AND THE OFFERING STATEMENT FILED WITH THE COMMISSION BECOMES QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AND OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR SHALL THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE.

THE OFFERING PRICE OF THE SECURITIES IN WHICH THIS OFFERING CIRCULARRELATESHAS BEEN DETERMINED BY THECOMPANY AND DOES NOT NECESSARILY BEAR ANY SPECIFIC RELATION TO THE ASSETS, BOOKVALUEOR POTENTIAL EARNINGS OF THECOMPANYOR ANY OTHER RECOGNIZED CRITERIA OFVALUE.

NASAA UNIFORM LEGEND:

IN MAKING AN INVESTMENT DECISION INVESTORS MUSTRELYON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKSINVOLVED.THESE SECURITIESHAVENOT BEEN RECOMMENDED BY THE FEDERAL ORSTATESECURITIES COMMISSION ORREGULATORYAUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIESHAVENOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANYREPRESENTATIONTO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE ANDMAYNOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND THE APPLICABLESTATESECURITIESLAWS,PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BEAWARETHATTHEY WILL BE REQUIRED TO BEAR THE FINANCAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

FOR ALL RESIDENTS OF ALL STATES:

THE SHARES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF CERTAIN STATES AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF SAID ACT AND SUCH LAWS. THE INTERESTS ARE SUBJECT IN VARIOUS STATES TO RESTRICTION ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER SAID ACT AND SUCH LAWS PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, ANY STATE SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY, NOR HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF THIS OFFERING OR THE ACCURACY OR ADEQUACY OF THE OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Table of Contents

| Item 3: Summary Offering and Risk Factors | 5 |

| Item 4: Dilution | 16 |

| Item 5: Plan of Distribution and Selling Shareholders | 17 |

| Item 7: Description of Business | 20 |

| Item 8: Description of Property | 22 |

| Item 9: Management’s Decision and Analysis of Financial Condition and Results of Operation | 22 |

| Item 10: Directors, Executive Officers and Significant Employees | 26 |

| Item 11: Compensation of Directors and Executive Officers | 27 |

| Item 12: Security Ownership of Management and Certain Beneficial Owner | 27 |

| Item 13: Interest of Management and Others in Certain Transactions | 28 |

| Item 14: Securities Being Offered | 29 |

| FINANCIAL STATEMENTS | 31 |

| PART III INDEX TO EXHIBITS | 38 |

Item 3: Summary Offering and Risk Factors

Summary of Offering

The following summary highlights selected information contained in this OfferingCircular.This summary does not contain all the information that may be important to you.Youshould read the more detailed information contained in this OfferingCircular,including, but not limited to, the risk factors beginning on page 5. References to “we,” “us,”“our,”or the “company” shall mean PunchFlix, Inc.

Our Company

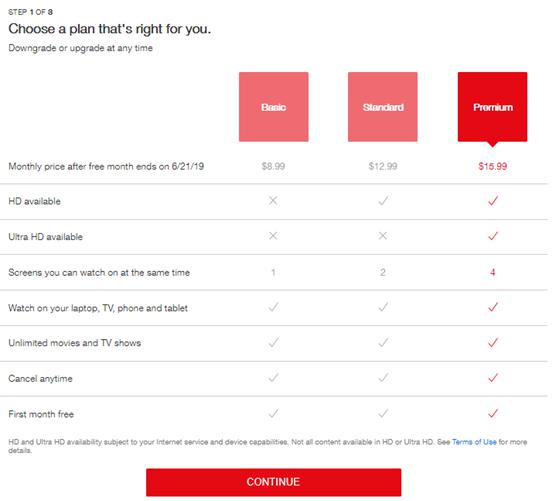

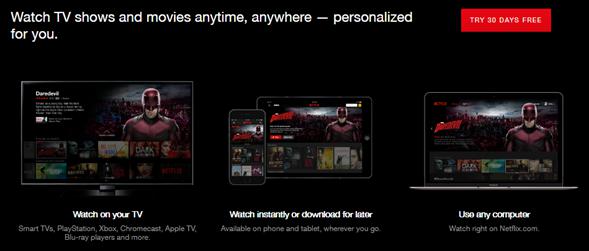

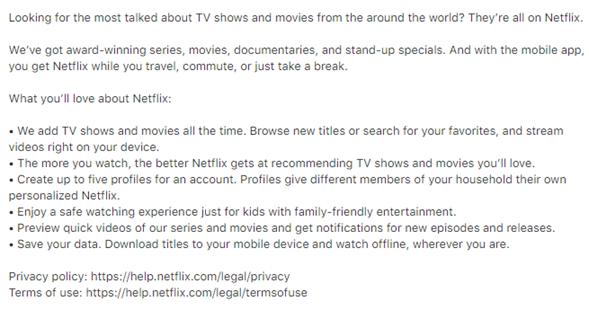

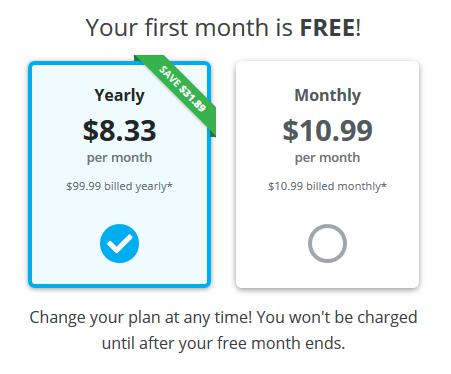

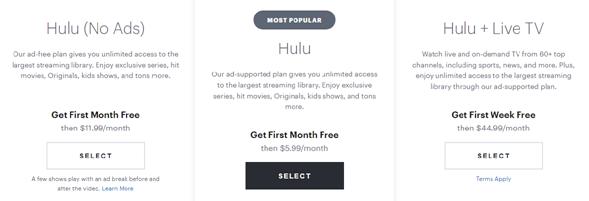

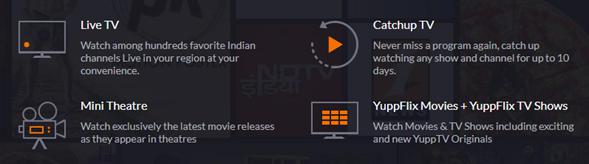

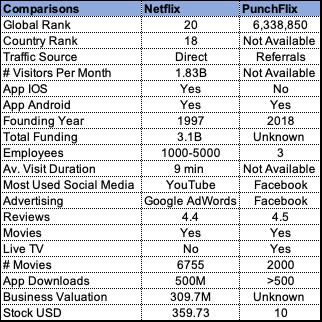

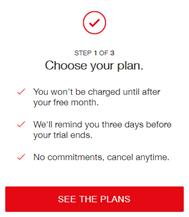

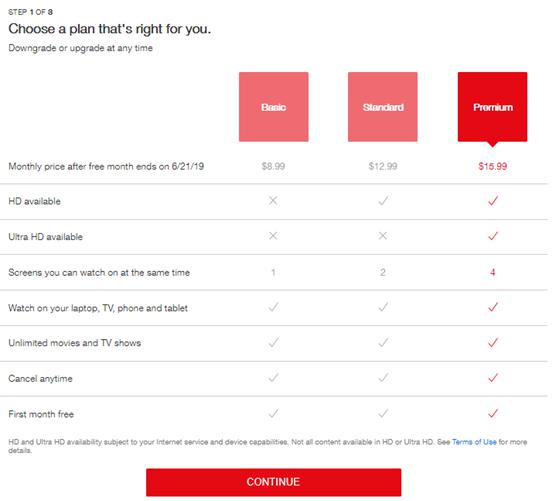

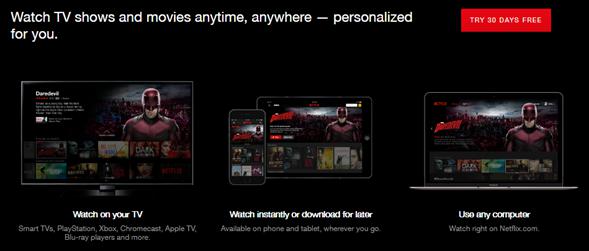

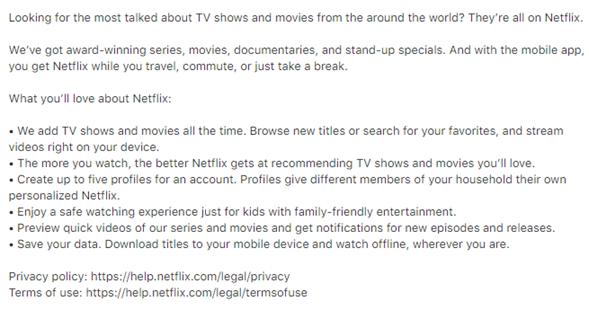

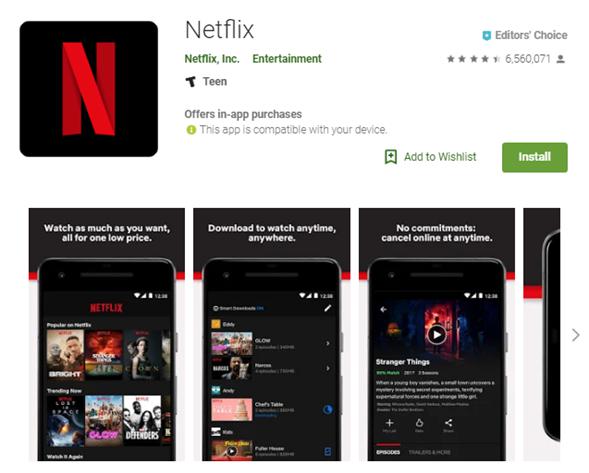

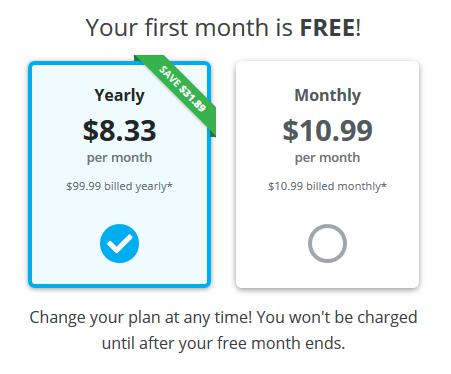

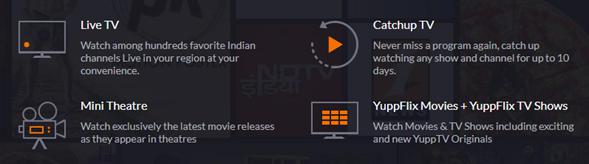

PunchFlix, Inc. is a digital internet entertainment streaming service. PunchFlix is a subscription-based service that offers video-on-demand movies and live streaming television around the globe for a monthly fee based on plan. The PunchFlix platform will provide plans with capabilities to enjoy TV series, documentaries and feature films across a wide variety of genres and languages on devices with both standard and high definition.

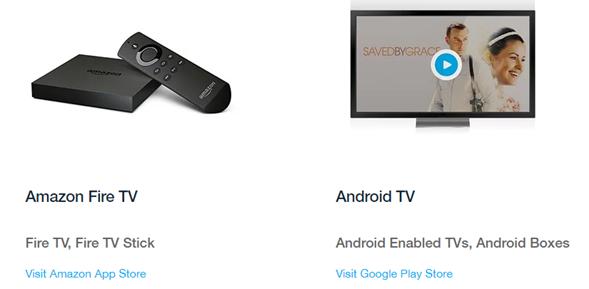

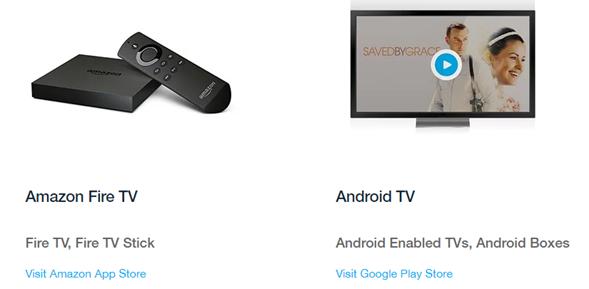

Subscribers will be able watch the unlimited based video-on-demand, anytime, anywhere, on any internet-connected device. Subscribers can play, pause, and resume watching movies, with or without commercials. Our platform will contain artificial intelligence that will make recommendations for subscribers to streamline their movie selection process.

PunchFlix is a company devoted to creating potential innovative plans, and solutions which offers a diverse range of choices to the digital subscriber. PunchFlix plan offerings will be affordable, unique, and engaging, with first class customer service. We believe digital media and the world is at its best when the subscriber is stimulated, enriched, enlighten, and encouraged through digital media. On November 1, 2018, PunchFlix launched streaming services with all operational Capabilities.

PunchFlix acquired certain assets from Punch TV Studios. Due to unforeseen challenges, Punch TV Studios was subject to a brief SEC suspension that led to a nine-month suspension under Regulation A. The United States Securities and Exchange Commission issued its Order Making Finding, Specifying Procedures, and Temporarily Suspending Exemption Pursuant to Section 3(b) of the Securities Act of 1922 and Regulation A Thereunder due to the filing of misrepresented and unaudited financial statements contained in the Offering Circular on Form 1-A pursuant to Regulation A, exemption commencing on January 10, 2018. This suspension has been lifted and there is no guarantee that we may or may not have challenges as such, in the future. This suspension ended October 4, 2018.

This Offering

All dollar amounts refer to US dollars unless otherwise indicated.

We have 80,700,000 (eighty million seven thousand) shares of common stock that will be issued and outstanding. Through this offering, we intend to register 5,000,000 (five million) shares for offering to the public, which represents additional common stock. We will endeavor to sell all 5,000,000 (five million) shares of common stock after this registration becomes effective. The price at which we offer these shares is fixed at $10.00 per share for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of the common stock.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as market makers for our common stock. We have not yet applied to have our securities registered in any state and will not do so until we receive expressions of interest from investors resident in specific states after they have viewed this Prospectus. We will initially focus our offering in the state of California and will rely on exemptions found under California Law. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

We endeavor to sell all 5,000,000 (five million) shares of common stock after this registration becomes effective. The price at which we offer these shares is fixed at $10.00 per share for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of the common stock.

Securities being offered by the Company: 5,000,000 (five million) shares of common stock, par value $.0001 offered by us in a direct offering.

Offering price per share: Weare offering the 5,000,000 (five million) shares of our common stock at $10.00 per share United States currency.

Number of shares outstanding before

the offering of common stock: 80,700,000 (eighty million seven hundred thousand) common shares are currently issued and outstanding.

Number of shares outstanding after the

offering of common shares: 85,700,000 (eighty-five million seven hundred thousand) common shares will be issued and outstanding if we sell all the shares we are offering.

The minimum number of shares to be

sold in this offering: 10

Market for the common shares

There is no public market for the common shares at the price of $10.00 (ten dollars US) per share. We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop.

The offering price for the shares will remain $10.00 (ten dollars US) per share for the duration of the offering.

Use of Proceeds

Wewill receive all proceeds from the sale of the common stock and intend to use the proceeds from this offering to accelerate the execution of all strategic business models to implement, initiate business designs with effective solutions, and plans. It will usher in an unprecedented use of technology to create values in PunchFlix’s business models, subscriber experiences, and the internal capabilities that will support the gut core of the ecosystem within PunchFlix.

Proceed from this offering may be used to create and develop strategic engaging marketing campaigns to stimulate the consumer to subscribe to PunchFlix and provide the sustainable revenue for the company through the lifecycle of PunchFlix. In order to become a cutting-edge company, some of these proceeds may be needed for gaining marketing intelligence, the right keenness for business acumen, and competitive information.

A portion of the proceeds may also be used to lease office space for PunchFlix. We intend to also purchase and/or lease production and editing equipment. We plan to attract and retain high-level management team, partner with developers of content and produce content that is relevant for the consumer marketplace.

Termination of the Offering

This offering will terminate upon the earlier to occur of (i) 360 days after this Offering Circular becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 5,000,000 shares registered hereunder for sale to the public have been sold. We may, at our discretion, extend the offering for an additional 180 days post the effective of the offering.

Termsof the Offering

Our sole officer and director will sell the common stock upon effectiveness of this Offering Circular on a BEST EFFORTS basis.

Risk Factors

An investment in our shares involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below, together with the cautionary statement that follows this section and the other information included in this Offering Circular, before purchasing our shares in this offering. If one or more of the possibilities described as risks below actually occur, our operating results and financial condition would likely suffer and the trading price, if any, of our shares could fall, causing you to lose some or all your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment in our securities.

Since our sole officer and director currently owns over 83% of the outstanding common stock, investors may find that his decisions are contrary to their interests. You should not purchase shares unless you are willing to entrust all aspects of management to our sole officer and director, or his successors.

Our sole officer and director, Mr. Joseph Collins, owns 71,200,000 (seventy-one million two hundred thousand) shares of common stock representing 83% of our outstanding stock, and 7.12% of our authorized stock. Mr. Collins will own 71,200,000 (seventy-one million two hundred thousand) shares of our common stock after this offering is completed representing approximately 83% of our outstanding shares, assuming all securities are sold. As a result, he will have control of the Company even if the full offering is subscribed. He will also have the ability to choose the Companies officers. His interests may differ from the ones of other stockholders. Factors that could cause his interests to differ from the other stockholders include the impact of corporate transactions on the timing of business operations and his ability to continue to manage the business given the amount of time he is able to devote to us.

Mr. Collins shall exclusively make all decisions regarding the management of our affairs. Purchasers of the offered shares may not participate in our management and, therefore, are dependent upon his management abilities. The only assurance that our shareholders, including purchasers of the offered shares have, our sole officer and director will not abuse his discretion in executing our business affairs, as his fiduciary obligation and business integrity. Such discretionary powers include, but are not limited to, decisions regarding all aspects of business operations, corporate transactions and financing.

Mr. Collins also has the ability to accomplish or ratify actions at the shareholder level, which would otherwise implicate his fiduciary duties if done as one of the members of our board of directors. Accordingly, no person should purchase the offered shares unless willing to entrust all aspects of management to the sole officer and director, or his successors. Potential purchasers of the offered shares must carefully evaluate the personal experience and business performance of our management.

Investing in the Company’s Securities is very risky. You should be able to bear a complete loss of your investment. You should carefully consider the following factors, including those listed in this Securities Offering.

Related to our Business

This offering is being conducted by our sole officer and director, Joseph Collins, without the benefit of an underwriter, who could have confirmed the accuracy of the disclosures in our prospectus.

We have self-underwritten our offering on a “best efforts” basis, which means: No underwriter has engaged in any due diligence activities to confirm the accuracy of the disclosure in the prospectus or to provide input as to the offering price; our officers and directors will attempt to sell the shares and there can be no assurance that all of the shares offered under the prospectus will be sold or that the proceeds raised from the offering, if any, will be sufficient to cover the costs of the offering; and there is no assurance that we can raise the intended offering amount.

We are not currently profitable and may not become profitable.

We have incurred substantial operating losses since our formation and expect to incur substantial losses in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. There is substantial doubt as to our ability to continue as an on-going concern without proper funding.

PunchFlix is launching revolutionary products which may change the way people watch digital television. With the release of this streaming platform, and it’s easy to use app should create profitability

As a result, we are planning to generate significant revenues in order to achieve and maintain profitability for the PunchFlix product portfolio.Wemay not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of ouroverarchingbusiness model ecosystem.

We are dependent upon the proceeds of this offering to fund our business. If we do not sell enough shares in this offering to continue operations, this could have an impact on the value of the common stock.

In order to continue operating through 2018-2020, and achieve the milestones that we anticipate, we must raise approximately $50,000,000 in gross proceeds from this offering.

We estimate, an initial fee of approximately $21,500.00 associated with the offering costs, all being paid for by our sole director, officer and majority shareholder Joseph Collins as additional paid-in capital, and we do not intend to reimburse Mr. Collins for these costs from the proceeds of this offering.

Unless we begin to generate enough revenues to finance our operations, we may experience liquidity and solvency problems. Such liquidity and solvency problems may force us to cease operations if additional financing is not available.

Also, as a public company, we will incur professional and other fees in connection with our quarterly, annual reports, and other periodic filings with the SEC. Such costs can be substantial, we must generate enough revenue or raise money from offerings of securities or loans in order to meet these costs, and our SEC filing requirements. We are offering our securities to the public; however, there is no guarantee that we will be able to sell the securities. And even if we sell the securities, there is no guarantee that the proceeds will be enough to fund our plans.

Our operating history gives no assurances that our future operations will result in profitable revenues, which could result in the suspension or end of our operations.

We incorporated on September 10, 2018, and we have no revenues at the close of the fiscal year. We have a limited operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve, maintain profitability, positive cash flow is dependent upon the completion of this offering, and our ability to generate revenues through sales of our intended service.

There is substantial doubt as to our ability to continue as a going concern. We have incurred significant operating losses since our formation and expect to incur significant losses in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability the PunchFlix product portfolio. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our business and may cause us to go out of business.

The PunchFlix business will be located at Mr. Joseph Collins’ current offices provided with free of charge. The facility located at 11705 Willake St. Santa Fe Springs, CA 90670 where we conduct most of our daily operations.

We are a new company with a limited operating history, and we face a high risk of business failure that could result in the loss of your investment.

We began creating PunchFlix in October 2017, and however we did not incorporate until September 10, 2018, in the State of Delaware as a for-profit company, and an established fiscal year of September 30. We have generated no revenues from business operations at the close of the fiscal year. We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings. To meet our need for cash we are attempting to raise money from this offering. Even if we can raise enough money through this offering to commence operations, we cannot guarantee that once operations begin, we will stay in business after doing so. If we are unable to successfully attract subscriber and viewers, we may quickly use up the proceeds from this offering.

From inception, our business operations have primarily been focused on evaluating content and producers of content, nurturing relationships, and developing our business plan. We anticipate the cost of approximately $21,500 in accounting and attorney fees on the costs of preparing and filing this Offering Circular.

The proceeds from this offering will satisfy our cash requirements for up to 12 months. If we are unable turn a profit by that time, we may be forced to raise additional capital. The expenses of this offering include the preparation of this prospectus, the filing of this Offering Circular and transfer agent fees and developing the business plan.

PunchFlix, Inc. is a digital internet entertainment streaming service. PunchFlix is a subscription-based service that offers video-on-demand movies and live streaming television around the globe for a monthly fee based on plan. The PunchFlix platform will provide plans with capabilities to enjoy TV series, documentaries and feature films across a wide variety of genres and languages on devices with both standard and high definition.

Subscribers will be able watch the unlimited based video-on-demand, anytime, anywhere, on any internet-connected device. Subscribers can play, pause, and resume watching movies, with or without commercials. Our platform will contain artificial intelligence that will make recommendations for subscribers to streamline their movie selection process.

PunchFlix is a company devoted to creating potential innovative plans, and solutions which offers a diverse range of choices to the digital subscriber. PunchFlix plan offerings will be affordable, unique, and engaging, with first class customer service. We believe digital media and the world is at its best when the subscriber is stimulated, enriched, enlighten, and encouraged through digital media.

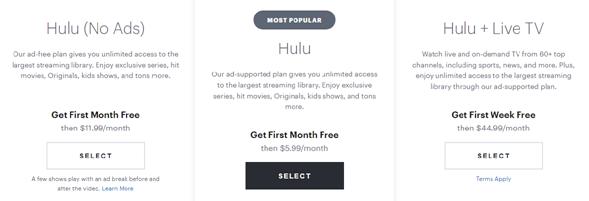

We will generate the majority of our revenues from subscription-based fees for the online viewing of our digital movies and streaming services. Our platform will launch with 10+ TV channels and more than 400 movies on-demand. Our strategy is to expand our content and services as a movie-oriented Web portal. However, we have limited experience with this business model and the transition may be difficult. We cannot assure you that we will be able to attract users and advertisers to our Web portal. We plan to introduce several new features to our Web portal in the future, such as streaming movie trailers, access to electronic theater ticketing, other products and services related to movies.

We may encounter new and additional risks as we introduce new services and product offerings.

Each of these new services, products and markets may entail unique risks which we have limited experience in managing. We cannot assure you that we will operate any of these new businesses profitably. If we fail to anticipate or address these risks successfully, our business may be harmed. For example, if we offer movie show time listings, we must gather and provide accurate information on a consistent basis. If we seek to offer electronic movie ticketing, we must establish relationships with movie theater chains and independent theaters. Offering streaming video content may require us to develop the capacity to deliver the content over a high bandwidth connection and license the content or enter into agreements with third parties who can do so. We also may face new competitors in each of these businesses.

We are depending on our subscription business for most of our revenues and cannot assure you that this business will be profitable.

The profitability of our streaming service depends on several factors, including but not limited to:

1. widespread acceptance of the internet as a means of entertainment

2. production cost

3. the number of new subscribers to our subscription service

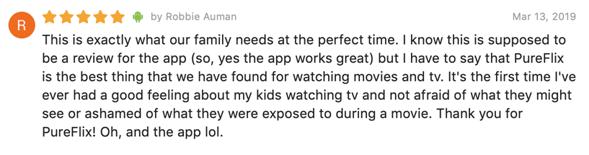

4. retention and customer satisfaction of existing subscribers

5. pricing of our product offerings and the sensitivity of our customers to pricing changes; and

6. fulfillment costs

If we are unable to manage successfully these risks, some of which are not under our control, we may not achieve profitability.

We may rely on promotional offers from movie and content distributors to maintain a favorable pricing for our new subscribers. If we fail to maintain our relationships with these distributors, our business and results of operations may be affected adversely.

Our future success is highly dependent on an increase in the number of subscribers to our subscription service. Most of our new subscribers will be obtained through promotional marketing campaigns with certain retailers under short-term promotional agreements. Our competitors may offer our promotional affiliates better terms or otherwise provide incentives to them to discontinue their participation in our marketing campaigns. If our promotional affiliates do not continue to participate in our marketing campaigns and promote our service in an effective manner, our subscriber retention and growth will be affected adversely. In addition, while our promotional affiliates are required to include our free trail offer, we cannot effectively control what portion the number of new subscribers. If we are not able to continue our current or similar promotional campaigns, our business, and results of operations could be harmed.

We have a limited operating history, and you should evaluate our prospects considering our early stage of development in a rapidly evolving market of digital streaming.

As of the end of our fiscal year, we have earned no revenues. Failure to generate revenue in the future may cause us to go out of business, which could result in the complete loss of your investment.

Adverse developments in the global economy restricting the credit markets may materially and negatively impact our business.

The recent downturn in the world’s major economies and the constraints in the credit markets have heightened or could continue to heighten several material risks to our business, cash flows, and financial condition, as well as our prospects. Continued issues involving liquidity and capital adequacy affecting lenders could affect our ability to access credit facilities or obtain debt financing and could affect the ability of lenders to meet their funding requirements when we need to borrow. Further, in the uncertain event that a public market for our stock develops, the volatility in the equity markets may make it difficult in the future for us to access the equity markets for additional capital at attractive prices, if at all. The current credit crisis in other countries, for example, and concerns over debt levels of certain other European Union member states, has increased volatility in global credit and equity markets. If we are unable to obtain credit or access capital markets, our business could be negatively impacted.

Our content as well as our production facility may not find acceptance with the public.

We are a new company with limited established visibility or recognition in the streaming video entertainment community. If we are not able to have our content and production facility accepted by the marketplace, we may not be able to generate revenues and our business plan may fail.

Our operating results may prove unpredictable, which could negatively affect our profit.

Our operating results are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control over. Factors that may cause our operating results to fluctuate significantly include: our inability to generate enough working capital from subscriptions fees, our inability to secure high-quality programs, projects, and content; the level of commercial acceptance of our content; fluctuations in the demand for our content; the amount, timing of operating costs, capital expenditures relating to expansion of our business, operations, infrastructure, and general economic conditions. If realized, any of these risks could have a material adverse effect on our business, financial condition, and operating results.

Key management personnel may leave the Company, which could adversely affect the ability of the Company to continue operations.

Because we are entirely dependent on the efforts of our sole officer and director, his departure or the loss of other key personnel in the future, could have a material adverse effect on the business. We believe that all commercially reasonable efforts have been made to minimize the risks attendant with the departure by key personnel from service.

However, there is no guarantee that replacement personnel, if any, will help the Company to operate profitably. We do not maintain key- person life insurance on our sole officer and director.

If our Company is dissolved, it is unlikely that there will be enough assets remaining to distribute to our shareholders.

In the event of the dissolution of our company, the proceeds realized from the liquidation of our assets, ifany,will be used primarily to pay the claims of our creditors, ifany,before there can be any distribution to the shareholders. In that case, the ability of purchasers of the offered shares to recover all or any portion of the purchase price for the offered shares will depend on the amount of funds realized and the claims to be satisfied there from.

If we are unable to gain any significant market acceptance for our service, or establish a significant market presence, we may be unable to generate enough revenue to continue our business.

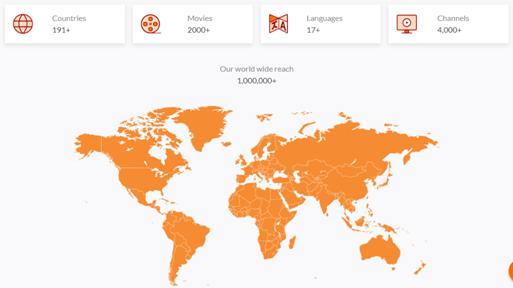

Our growth strategy is substantially dependent upon our ability to successfully market our digital streaming platform on a global level. However, our planned business model may not achieve significant acceptance. Such acceptance, if achieved, may not be sustained for any significant period. Failure of our digital streaming content to achieve or sustain market acceptance could have a material adverse effect on our business, financial conditions and the results of our operations.

Management’s ability to implement the business strategy may be slower than expected and we may be unable to generate a profit.

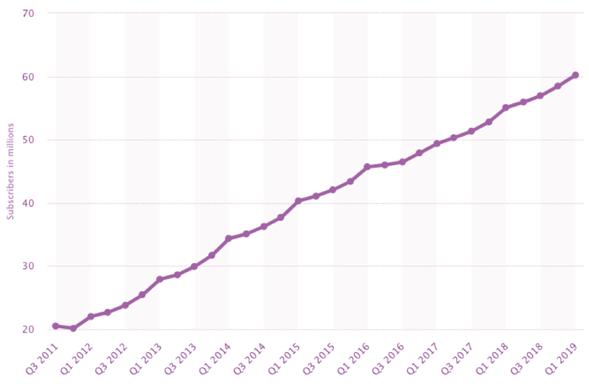

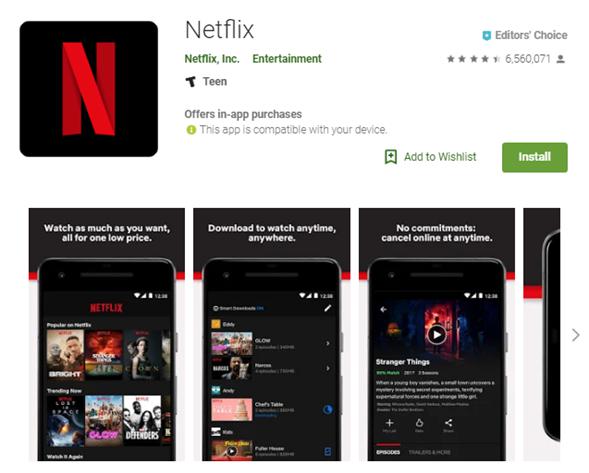

We anticipate that our business will grow rapidly, but we cannot assure you that our business will maintain an adequate growth rate. You should consider our business and prospects considering our limited operating history and the changes to our business that have occurred since we began operations. On November 1, 2018, PunchFlix launched streaming services with all operational capabilities. We have begun offering a Free Trial and subscriptions services on an individual basis. At the point of this filing, 270 consumers are streaming on the PunchFlix platform:

270 consumers have app downloads installed on their devices from Google Play Store.

270 consumers are undergoing a free trial period.

We expect to offer new movie-related services in the future as we continue our evolution to be among the top movies on-demand and television streaming services. Our business faces several risks and difficulties considering our early stage of operations, including the need for:

| | 1. | continued development of our Web portal business model; |

| | 2. | enough new and continued development of a Movie Finder service; |

| | 3. | accurate forecasting of the success of new service and product offerings; |

| | 4. | capital expenditures associated with our order-management systems, computer network and Web portal; and |

| | 5. | successful introduction of new technologies and movie delivery alternatives. |

Currently, we have a history of net losses, negative cash flow, and we anticipate that we will experience net losses and negative cash flow for the foreseeable future.

We will experience significant net losses and negative cash flow. We anticipate will incur significant losses for 2019 through 2021 fiscal years. We expect to continue to incur significant operating expenses and capital outlays for the foreseeable future in connection with our planned expansion, including expenditures for:

| | 1. | continued promotional offers to attract new subscribers; |

| | 2. | brand development, marketing and other promotional activities; |

| | 3. | the continued development of our computer network, Web portal, studio management and order fulfillment systems and delivery infrastructure; |

| | 4. | expand our operations into the development of original content; |

| | 5. | continued development of business alliances and partnerships; and |

| | 6. | responses to competitive developments. |

As a result, we expect to continue to have operating losses and negative cash flow on a quarterly and annual basis for the foreseeable future. To achieve and sustain profitability, we must accomplish numerous objectives, including but not limited to:

| | 1. | substantially increasing the number of new subscribers to our service; |

| | 2. | maintaining and increasing our subscription retention rates; |

| | 3. | maintaining and achieving more favorable gross and operating margins; and |

We cannot assure you that we will be able to achieve these objectives. In addition, because of the significant operating and capital expenditures associated with our expansion plan, our operating losses, negative cash flow are expected to increase significantly from current levels and to continue for the foreseeable future. If we do achieve profitability, we cannot be certain that we would be able to sustain or increase such profitability on a quarterly or annual basis in the future.

Our limited operating history makes financial forecasting difficult for us and for financial analysts that may publish estimates of our financial results.

As a result of our limited operating history, it is difficult to accurately forecast our revenues, gross, operating margins, number of trial subscribers converting to paid per day, other financial, and operating data. We have a limited amount of meaningful historical financial data. We base our current and forecasted expense levels on our operating plans and estimates of future revenues, which are dependent on the growth of our subscriber base. As a result, we may be unable to make accurate financial forecasts and to adjust our spending in a timely manner to compensate for any unexpected shortfalls in revenues. We believe, these difficulties in forecasting are even greater for financial analysts that may publish their own estimates of our financial results. The inability by us or the financial community to accurately forecast our operating results could cause our net losses in each quarter to be greater than expected.

Our quarterly operating results are expected to be volatile and difficult to predict based on a few factors that also will affect our long-term performance.

We expect our quarterly operating results to fluctuate significantly in the future based on a variety of factors, many of which are outside our control. These factors also are expected to affect our long-term performance. These factors include the following but not limited to:

| | 1. | our ability to maintain and increase subscriber retention rates, attract new subscribers at a steady rate, at a reasonable cost, and maintain new subscriber satisfaction; |

| | 2. | our ability to manage our fulfillment processes to handle significant increases in subscribers; |

| | 3. | our ability to improve or maintain gross margins in our existing business and in future product lines and markets; |

| | 4. | changes to our product and service offerings, including new features on our Web portal such as theater information, and content aggregation; |

| | 5. | changes to the product and service offerings of our competitors; |

| | 7. | our ability to maintain, upgrade, develop our Web portal, our internal computer systems and our fulfillment processes; |

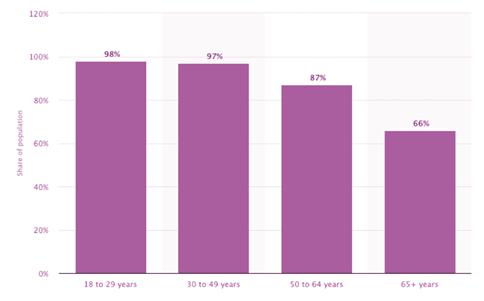

| | 8. | the level of use of the internet and increasing consumer acceptance of the internet for the purchase of consumer goods and services such as those offered by us; |

| | 9. | the level of traffic on our Web portal; |

| | 10. | technical difficulties, system downtime or internet brownouts; |

| | 11. | our ability to attract new, qualified personnel in a timely manner; |

| | 12. | the dollar and timing of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure; |

| | 13. | our ability to manage effectively the development of new business segments and markets; |

| | 14. | our ability to successfully manage the integration of operations and technology resulting from acquisitions; |

| | 15. | governmental regulation and taxation policies; and |

| | 16. | general economic conditions and economic conditions specific to the internet, online commerce and the movie industry. |

In addition to these factors, our quarterly operating results are expected to fluctuate based upon seasonal fluctuations in the use of internet based streaming services. Based on our limited operating history, we expect to experience stronger seasonal growth in the number of new subscribers during the late fall and early winter months, reflecting increased of new trial offers for our streaming service. Shifts in seasonal sales cycles may occur due to changes in the economy or other factors affecting the market for our services. Due to this wide variety of factors, we expect our operating results to be volatile and difficult to predict. As a result, quarter-to-quarter comparisons of our operating results may not be good indicators of our future performance.

If we are not able to manage our growth, our operating results and ability to sustain growth could be affected adversely.

Any future expansion, internally or through acquisitions, may place significant demands on our managerial, operational, administrative and financial resources. Effective November 1, 2018, PunchFlix launched streaming services with all operational capabilities with intent to expand rapidly by the end of 2019. We anticipate, further expansion of our operations will be required to address any significant growth in our subscriber base. Management will be engaged with the oversight of the expansion. We may choose to expand our operations by:

| | 1. | expanding the breath of product offerings and services offered; |

| | 2. | continuing promotional offers to attract subscribers; |

| | 3. | expanding our market presence through relationships with third parties; |

| | 4. | possibly expanding through the acquisition of other companies. |

Customers and viewers may not accept our content. Our growth strategy is subject to significant risks, which you should carefully consider before purchasing the shares we are offering.

Although, we plan on promoting our content carefully, it may be slow to achieve profitability, or may not become profitable at all, which will result in losses. There can be no assurance that we will succeed.

Our systems, procedures and controls may not be adequate to support the expansion of our business operations. Significant growth will place managerial demands on all aspects of our operations. Our future operating results will depend substantially upon our ability to manage changing business conditions, improve our creativity, technical, administrative, financial controls, and reporting systems.

If we are unable to manage our future growth, our business could be harmed, and we may not become profitable.

Significant growth may place a significant strain on management, financial, operating and technical resources. Failure to manage growth effectively could have a material adverse effect on the Company’s financial condition or the results of its operations.

Since inception to present, our sole officer, director, and majority shareholder Joseph Collins has paid all our start-up costs.

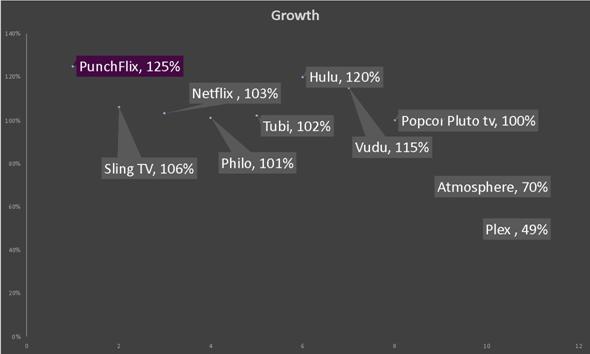

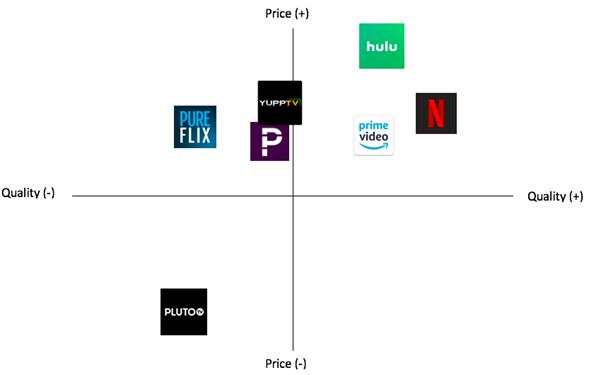

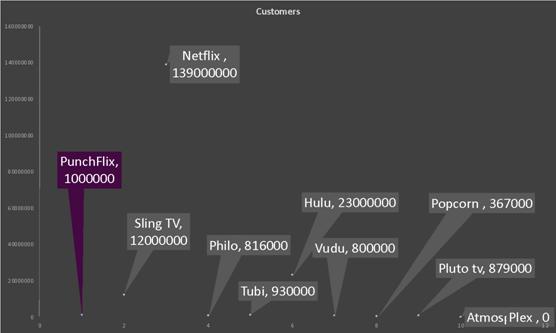

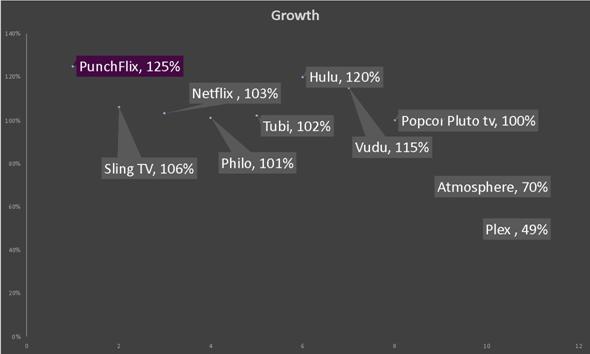

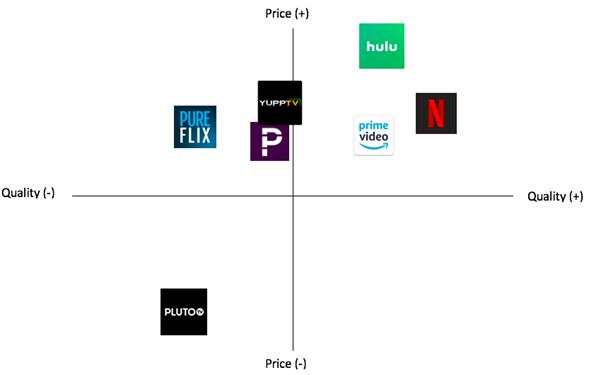

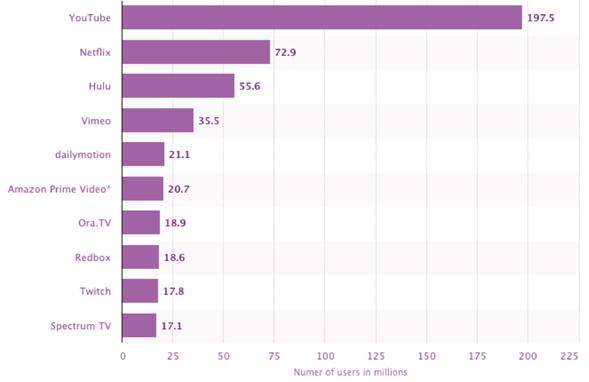

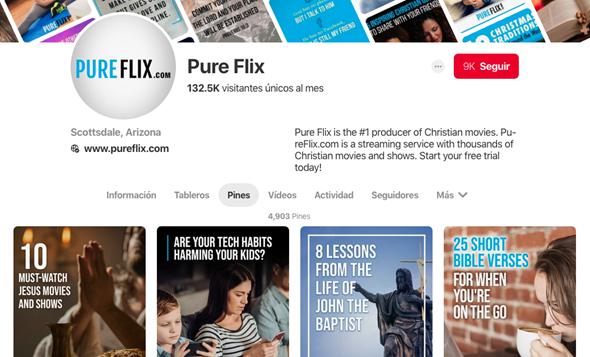

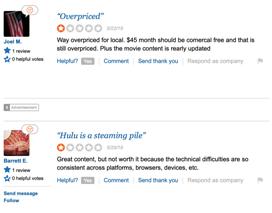

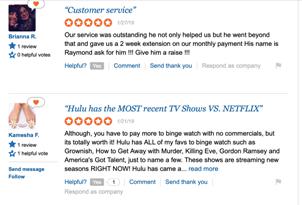

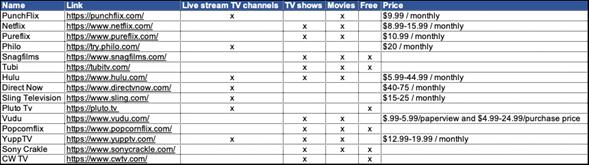

Competitors may enter this sector with superior infrastructure, content and backing, infringing on our customer or viewer base, and affecting our business adversely.

We have identified a market opportunity for our services. Competitors may enter this sector with a superior product. This would infringe on our customer base, having an adverse effect upon our business and the results of our operations.

Risks Related to Our Financial Condition

The enactment of the Sarbanes-Oxley Act makes it more difficult for us to retain or attract officers and directors, which could increase our operating costs or prevent us from becoming profitable.

The Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) was enacted in response to public concern regarding corporate accountability in the wake of several accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, provide enhanced penalties for accounting and auditing improprieties at publicly traded companies and protect investors by improving the accuracy and reliability of corporate disclosure pursuant to applicable securities laws. The Sarbanes-Oxley Act applies to all companies that file or are required to file periodic reports with the SEC under the Securities Exchange Act of 1934 (the “Exchange Act”).

We intend to register all shares sold through this offering. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act. Since the enactment of the Sarbanes-Oxley Act has resulted in the imposition of a series of rules and regulations by the SEC that increase the responsibilities and liabilities of directors and executive officer, the perceived increased personal risk associated with these changes may deter qualified individuals from accepting such roles. Consequently, it may be more difficult for us to attract and retain qualified persons to serve as our directors or executive officer, and we may need to incur additional operating costs. This could prevent us from becoming profitable.

Since we anticipate operating expenses will increase prior to earning revenue, we may never achieve profitability.

As a result of our limited operating history, it is difficult to accurately forecast our revenues, gross and operating margins, number of trial subscribers converting to paid per day and other financial and operating data. We have a limited amount of meaningful historical financial data upon which to base planned operating expenses. We base our current and forecasted expense levels on our operating plans and estimates of future revenues, which are dependent on the growth of our subscriber base. As a result, we may be unable to make accurate financial forecasts and to adjust our spending in a timely manner to compensate for any unexpected shortfalls in revenues. We believe that these difficulties in forecasting are even greater for financial analysts that may publish their own estimates of our financial results. The inability by us or the financial community to accurately forecast our operating results could cause our net losses in each quarter to be greater than expected.

If our Offering Circular is declared effective, we will be subject to the SEC’s reporting requirements and we currently do not have enough capital to maintain this reporting with the SEC.

We intend to register all shares sold though this offering. If our Offering Circular is declared effective, we will have a reporting obligation to the SEC. As of the date of this Offering Circular, the funds currently available to us will not be enough to meet our reporting obligations. If we fail to meet our reporting obligations, we will lose our reporting status with the SEC. Our management believes that if we cannot maintain our reporting status with the SEC, we will have to cease all efforts directed towards developing our company. In that event, any investment in the company could be lost in its entirety.

Risks Related to This Offering

Because there is no public trading market for our common stock, you may not be able to resell your shares.

If our common stock becomes listed and a market for the stock develops, the actual price of our shares will be determined by prevailing market prices at the time of the sale.

We cannot assure you that there will be a market in the future for our common stock. The trading of securities on the OTC or like service is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price of our common stock. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you may have difficulty reselling any shares you purchase from the selling security holders.

Investing in our company is highly speculative and could result in the entire loss of your investment.

Purchasing the offered shares is highly speculative and involves significant risk. The offered shares should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish our business objectives. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered shares and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all its exhibits carefully and consult with their attorney, business and/or investment advisor.

Investing in our company may result in an immediate loss because buyers will pay more for our common stock than what the pro rata portion of the assets are worth.

We have only been recently formed and have only a limited operating history with limited earnings; therefore, the price of the offered shares is not based on any data. The offering price, other terms and conditions regarding our shares have been arbitrarily determined and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. No investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

The arbitrary offering price of $10.00 per share as determined herein is substantially higher than the net tangible book value per share of our common stock. Our assets do not substantiate a share price of $10.00. This premium in share price applies to the terms of this offering. The offering price will not change for the duration of the offering even if we obtain a listing on any exchange or become quoted on the NASDAQ, OTC or like service.

We have 80,700,000 (eighty million seven hundred thousand) shares of common stock issued and outstanding. Through this offering, we intend to register 5,000,000 (five million) shares for offering to the public, which represents additional common stock. We will endeavor to sell all 5,000,000 (five million) shares of common stock after this registration becomes effective. The price at which we offer these shares is fixed at $10.00 per share for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of the common stock.

As we do not have an escrow or trust account with the subscriptions for investors, if we file for or are forced into bankruptcy protection, investors will lose their entire investment.

Invested funds for this offering will not be placed in an escrow or trust account and if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors.

We do not anticipate paying dividends in the foreseeable future, so there will be less ways in which you can make a gain on any investment with us.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will, therefore; be fewer ways in which you are able to make a gain on your investment.

In the event that our shares are traded, they may trade under $5.00 per share, and thus will be considered a penny stock. Trading penny stocks has many restrictions and these restrictions could severely affect the price and liquidity of our shares.

In the event that our shares are traded, and our stock trades below $5.00 per share, there is a possibility, our stock would be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be a “penny stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities and may negatively affect the ability of holders of shares of our common stock to resell the stock. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile, and you may not be able to buy or sell the stock when you want to.

Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may also limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

You may face significant restriction on the resale of your shares due to state “Blue Sky” laws.

Each state has its own securities laws, often called “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (2) govern the reporting requirements for broker- dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. The applicable broker-dealer must also be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as market makers for our common stock. We have not yet applied to have our securities registered in any state and will not do so until we receive expressions of interest from investors resident in specific states after they have viewed this Prospectus. We will initially focus our offering in the state of California and will rely on exemptions found under California Law. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

Item 4: Dilution

The price of the current offering is fixed at $10.00 per share.

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash from outside investors, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of the new investors stake is diluted because each share of the same type is worth the same amount, and the new investor has paid more for the shares than earlier investors did for theirs.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders.

| DILUTION TABLE |

| | | | | | | | | | | |

| Average Price Per Share |

| | | | | | | | | | | |

| | | Shares Issued | | Total Consideration | | Average Price per Share |

| | | Number of Shares | | Percent | | Amount | | Percent | |

| Founders | | 80,700,000 | | 94.17% | | $914,389 | | 1.80% | | 0.011 |

| New Investors | | 5,000,000 | | 5.83% | | $50,000,000 | | 98.20% | | 10.00 |

| TOTAL | | 85,700,000 | | 100.00% | | $50,914,389 | | 100.00% | | 0.59 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Dilution Per Share | | If 25% of | | If 50% of | | If 100% of | | | | |

| | | Shares Sold | | Shares Sold | | Shares Sold | | | | |

| Price Per Share of this Offering | | 10.00 | | 10.00 | | 10.00 | | | | |

| Book Value Per Share Before Offering | | 0.011 | | 0.011 | | 0.011 | | | | |

| Book Value Per Share After Offering | | 0.164 | | 0.312 | | 0.594 | | | | |

| Increase in Book Value Per Share | | 0.152 | | 0.300 | | 0.583 | | | | |

| Dilution Per Share to New Investors | | 9.836 | | 9.688 | | 9.406 | | | | |

| Dilution Per Share by Percentage | | 9.84% | | 9.69% | | 9.41% | | | | |

| | | | | | | | | | | |

| | | 25.00% | | 50.00% | | 100.00% | | | | |

Item 5: Plan of Distribution and Selling Shareholders

Plan of Distribution

We are offering the shares on a “self-underwritten” basis directly to shareholders through Joseph Collins, our Sole Officer and Director named herein. Mr. Collins will not receive any commissions or other remuneration of any kind in connection with his participation in this offering based either directly or indirectly on transactions in securities.

This offering is a self-underwritten offering, which means that it does not involve the participation of an underwriter to market, distribute or sell the shares offered under this prospectus. We will receive all the proceeds from such sales of securities and are bearing all expenses in connection with the registration of our shares. This offering will terminate upon the earlier to occur of (i) 360 days after this Offering Circular becomes effective with the Securities and Exchange Commission, (ii) the date on which all 5,000,000 shares offered to the public registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 180 days.

Mr. Joseph Collins will not register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker-dealer.

| | 1. | Mr.Collins is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of his participation. |

| | 2. 3. | Mr.Collins will not be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; Mr.Collins is not, nor will he be at the time of participation in the offering, an associated person of a broker-dealer; and |

| | |

| | 4. | Mr.Collins meets the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that he (A) primarily performs, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of our company, other than in connection with transactions in securities; and (B) is not a broker or dealer, or been an associated person of a broker or dealer, within the preceding twelve months; and (C) has not participated in selling and offering securities for any issuer more than once every twelve months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii). |

| | | | | | |

If applicable, the shares may not be offered or sold in certain jurisdictions unless they are registered or otherwise comply with the applicable securities laws of such jurisdictions by exemption, qualification or otherwise. We intend to sell the shares only in the states in which this offering has been qualified or an exemption from the registration requirements is available, and purchases of shares may be made only in those states.

Lock-Up Provision Investor acknowledges that the Shares are subject to a lock-up provision, and Investor is not permitted to sell, trade or otherwise dispose of the Shares for a period of 6 (six) months following the registration of the Shares with the SEC and/or FINRA.

In addition, and without limiting the foregoing, we will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the time when this Offering Circular is effective.

We will not use public solicitation and general advertising in connection with the offering until authorized to do so. The shares will be offered at a fixed price of $10.00 per share for the duration of the offering. There is no minimum number of shares required to be sold to close the offering.

Selling Shareholders

There shall be no selling shareholders in this offering

| | Item 6: Use of Proceeds | | | |

| Total Shares Offered | 5,000,000 | | | |

| Proceeds from Offering | $50,000,000 | | | |

| | | If 25% of Shares Sold | If 50% of Shares Sold | If 100% of Shares Sold | |

| Length of Operation | 18 months | 18 months | 18 months | |

| GROSS PROCEEDS | $12,500,000 | $25,000,000 | $50,000,000 | |

| OFFERING EXPENSES | | | | |

| Legal Fees | $180,000 | $260,000 | $420,000 | |

| Accounting & Auditing Fees | $64,000 | $189,000 | $96,000 | |

| Transfer Agent | $50,000 | $148,000 | $148,000 | |

| | | | | | |

| START UP EXPENSES | | | | |

| Production Equipment | $80,000 | $560,000 | $1,500,000 | |

| Information Technology | $180,000 | $860,000 | $1,860,000 | |

| IT Equipment | $572,000 | $740,000 | $1,480,000 | |

| Call Center | $48,000 | $196,000 | $250,000 | |

| Office Equipment | $20,000 | $40,000 | $600,000 | |

| Research and Development | $400,000 | $800,000 | $1,600,000 | |

| Training | | $6,000 | $58,000 | $200,000 | |

| Consulting | $2,000 | $500,000 | $700,000 | |

| Content Inventory | $3,000,000 | $4,400,000 | $14,000,000 | |

| | $250,000 | $250,000 | $500,000 | |

| Office Lease and Utilities | |

| Storage | | $500 | $2,400 | $12,000 | |

| Repairs/Maintenance | $30,000 | $123,000 | $225,000 | |

| Travel | | $2,500 | $3,600 | $60,000 | |

| SUB TOTAL | $4,885,000 | $9,130,000 | $23,651,000 | |

| OPERATING EXPENSES | | | | |

| General & Administrative | $1,600,000 | $1,600,000 | $1,200,000 | |

| Officer/Directors | $1,400,000 | $1,700,000 | $2,000,000 | |

| Staff Salaries | $580,000 | $700,000 | $1,120,000 | |

| Marketing | $2,600,000 | $4,200,000 | $6,709,000 | |

| Event Expenses | $80,000 | $160,000 | $320,000 | |

| Production | $1,355,000 | $7,510,000 | $15,000,000 | |

| | | | | | |

| SUB TOTAL | $7,615,000 | $15,870,000 | $26,349,000 | |

| TOTAL EXPENSES | $12,500,000 | $25,000,000 | $50,000,000 | |

| | | | | | | | | | |

The foregoing information is an estimate based on our current business plan. We may find it necessary or advisable to reallocate portions of the net proceeds reserved for one category to another, and we will have broad discretion in doing so. Pending these uses, we intend to invest the net proceeds of this offering in short-term, interest-bearing securities.

Item 7: Description of Business

We are a new company, we incorporated in the State of Delaware on September 10, 2018, as a for-profit company with a fiscal year end of September 30. Our business and registered office is located at 11705 Willake St. Santa Fe Springs, California 90670. Our telephone number is 323-489-8119. Our E-Mail address is IR@Punchflix.com.

PunchFlix, Inc. is a digital internet entertainment streaming service. PunchFlix is a subscription-based service that offers video-on-demand movies and live streaming television around the globe for a monthly fee based on plan. The PunchFlix platform will provide plans with capabilities to enjoy TV series, documentaries and feature films across a wide variety of genres and languages on devices with both standard and high definition.

Subscribers will be able watch the unlimited based video-on-demand, anytime, anywhere, on any internet-connected device. Subscribers can play, pause, and resume watching movies, with or without commercials. Our platform will contain artificial intelligence that will make recommendations for subscribers to streamline their movie selection process.

PunchFlix is a company devoted to creating potential innovative plans, and solutions which offers a diverse range of choices to the digital subscriber. PunchFlix plan offerings will be affordable, unique, and engaging, with first class customer service. We believe digital media, and the world is at its best when the subscriber is stimulated, enriched, enlighten, and encouraged through digital media.

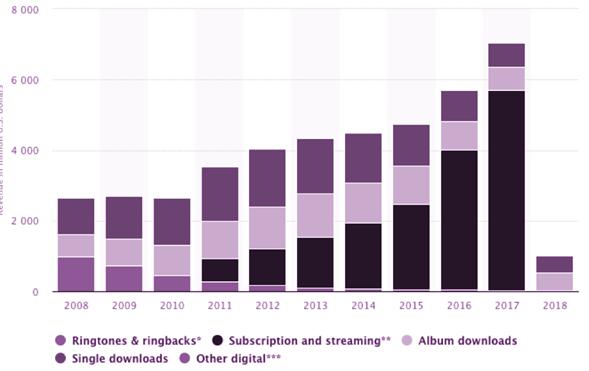

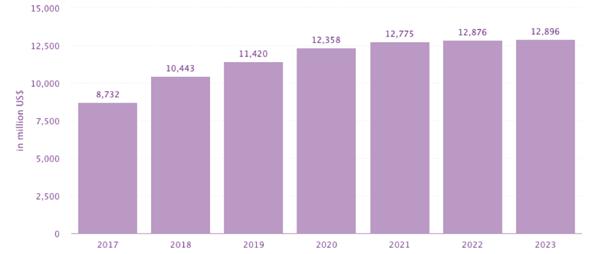

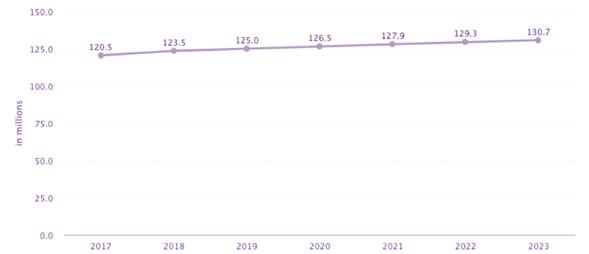

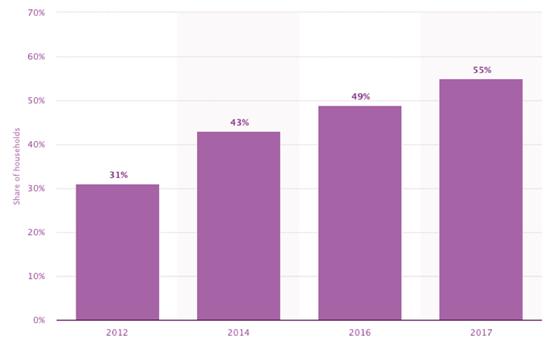

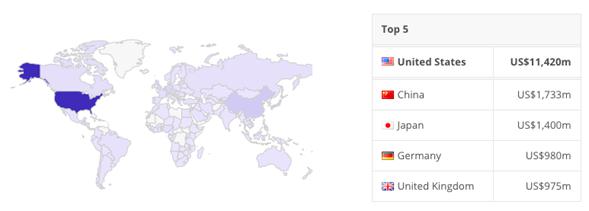

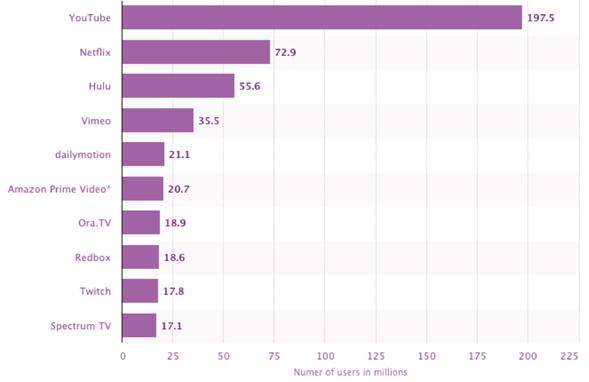

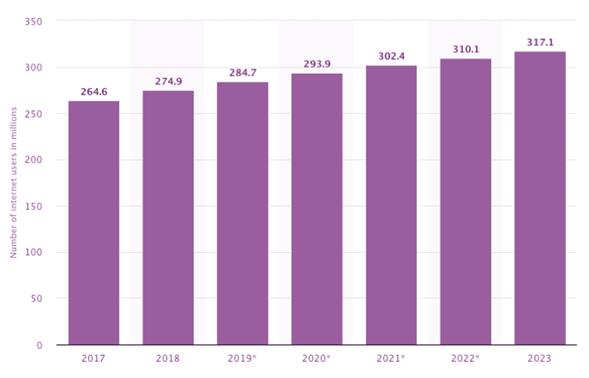

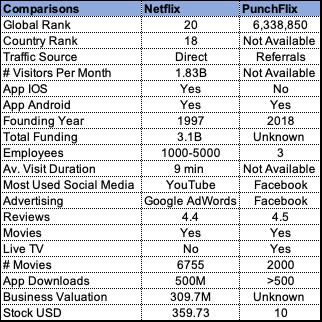

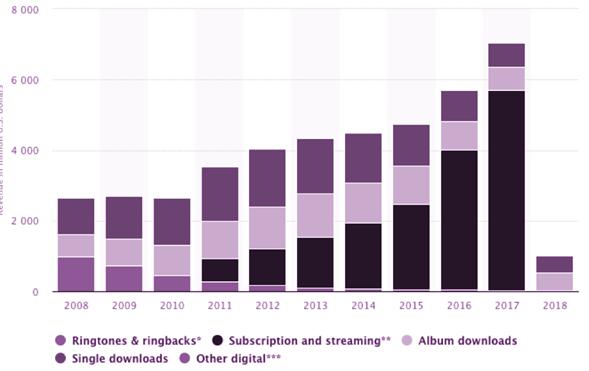

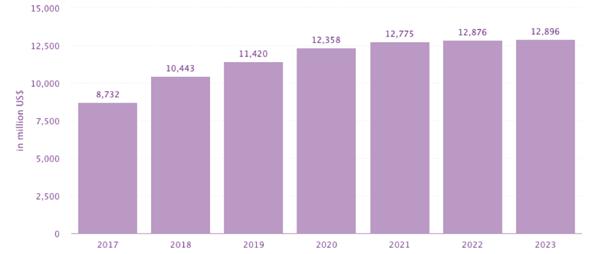

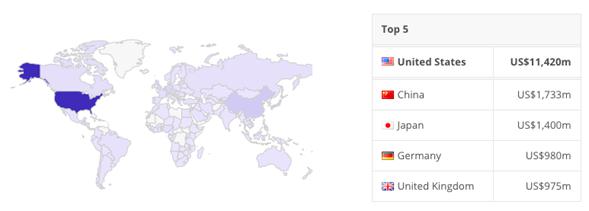

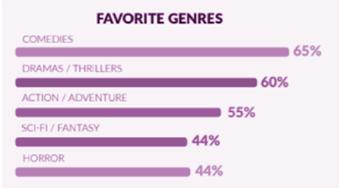

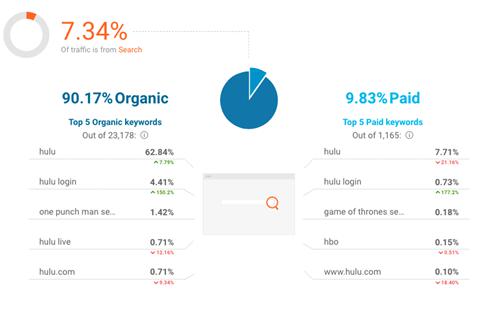

We operate in a large and growing market. Paul Kagan Associates, Inc. estimates that consumers in the United States spent $25.6 billion on home video and theatrical filmed entertainment in 1999 and forecasts this spending to grow to $35.0 billion in 2004.

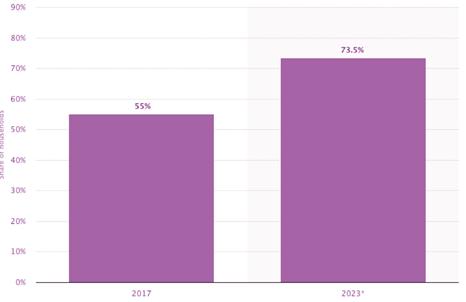

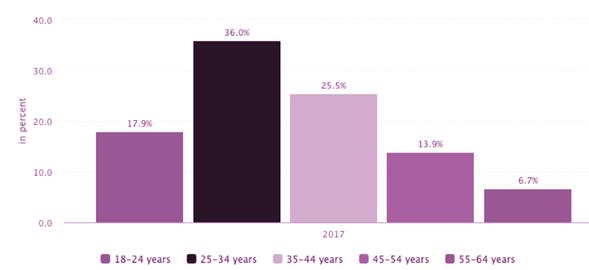

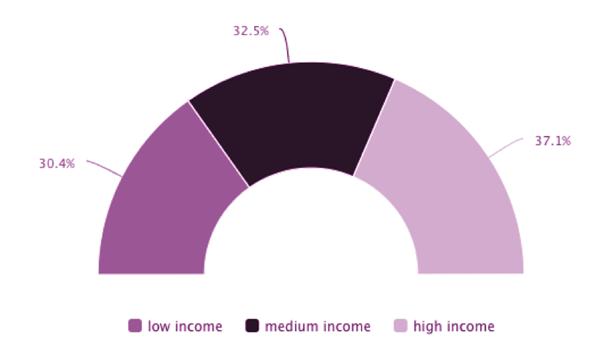

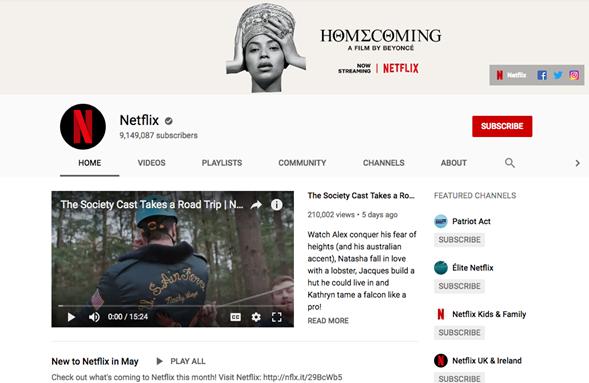

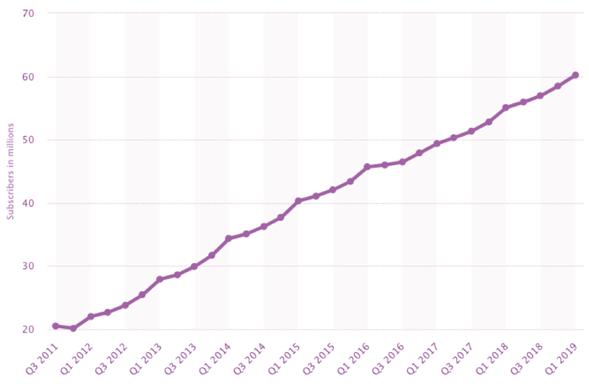

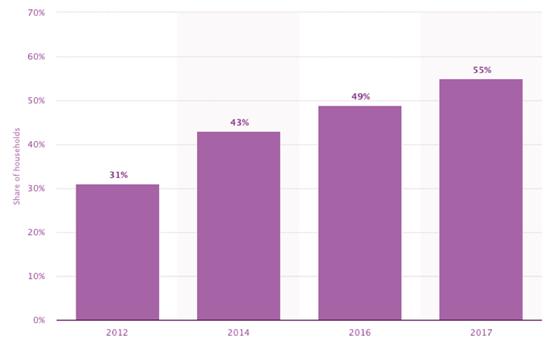

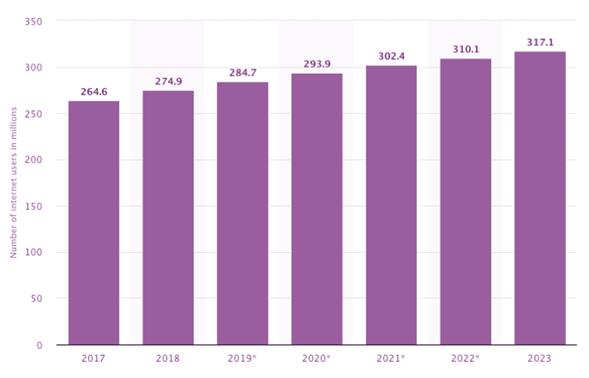

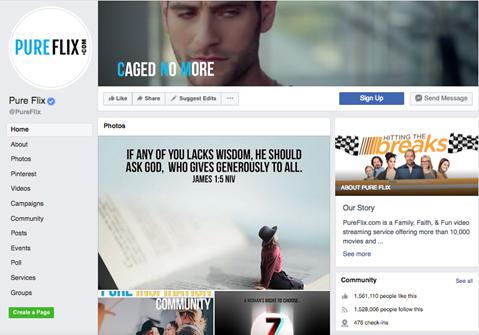

On April 14, 2017 Forbes reports “For the last 25 years, the internet has been challenging our assumptions about how entertainment and media work. Not that long ago, visiting movie rental chains on the Friday commute was a beloved American tradition. Today it strikes us like some quaint ritual out of the 1950s. One idea, represented by companies like Netflix, changed all of it. The idea? That movies, like television, should come to us. Now, logging into online entertainment is as much a part of Americans’ weekly routines as video rental stores once were. But could a similar idea be poised to transform sports broadcasting in 2017?

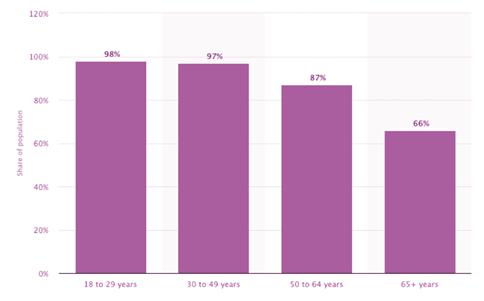

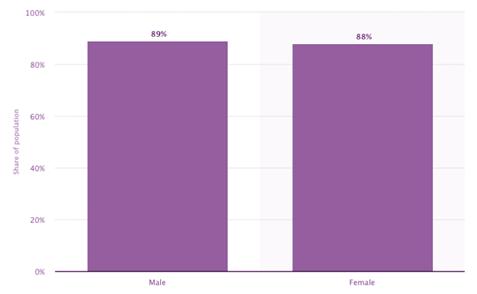

It’s a runaway train, and it’s only picking up speed. The typical American subscriber’s bill just hit a record $108 a month, prompting “end of cable” predictions. But financiers have foreseen the extinction of this outdated model for years. Writing at Bankrate in 2014, Stacy Jones consigned this “pricey, one-size-fits-all” approach to television to the dustbin of history. But what’s behind all this cable-cutting?

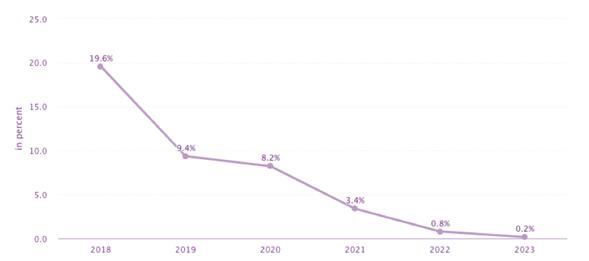

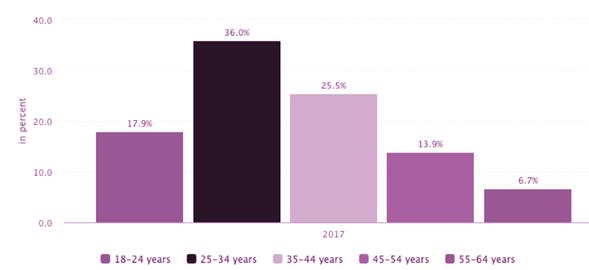

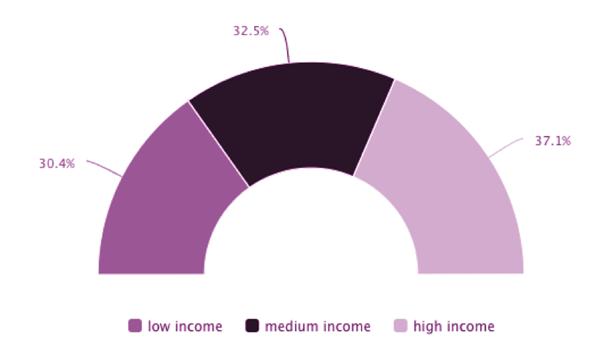

It’s more than just price, competition or programming. A generational shift is happening, and viewers are no longer interested in shelling out hundreds of dollars for channels they don’t watch. They also want access to their favorite programming on multiple devices, and the kind of “whenever you want, wherever you want” flexibility the internet has taught them to expect. Oh, and they hate contracts and termination fees, which (no surprise) have virtually disappeared already in the world of cellular phone carriers.” Despite that large amounts spent on marketing, the movie industry has lacked an effective means to market movies to a targeted audience on a personalized basis. In 2016 American consumers spent 235 billion dollars in movie entertainment including theatre sales by Statista.com and other sources say of that 9.6 billion is spent on streaming services.

Our first step will be to build the infrastructure necessary to support a video-on-demand service, and our live streaming television platform. Secondly, the intent is to add artificial intelligence to enhance the subscriber viewing on the Web portal. Our desire is to continue to expand upon available content which may increase our subscriber base over time.

We intend to hire and maintain a staff of seasoned marketing, promotional, sales and advertising professionals who will tap into and expand on new and existing resources to secure producers of content; sponsors for advertising and publicity for our content.

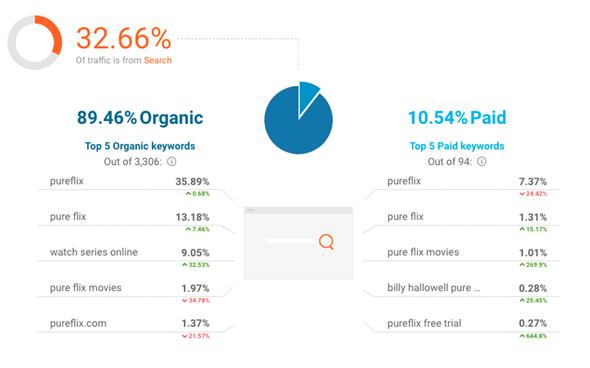

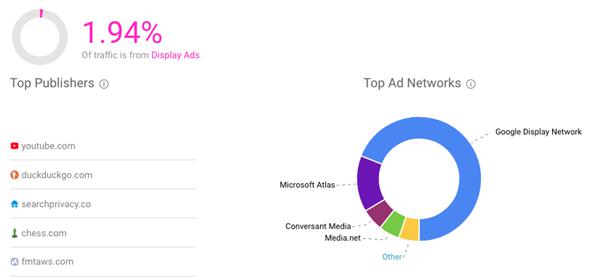

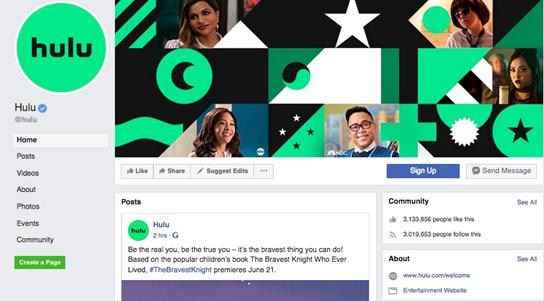

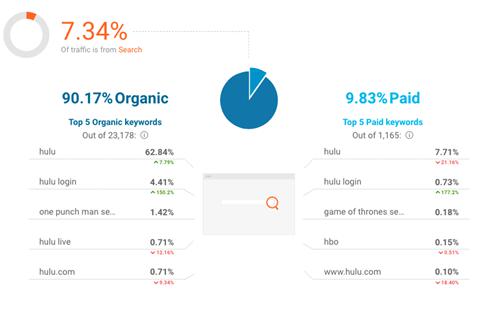

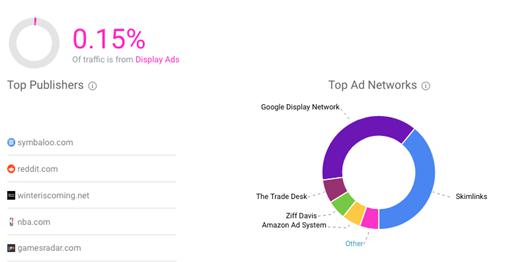

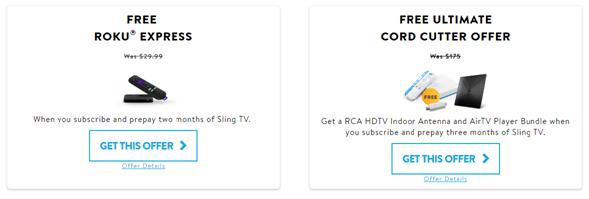

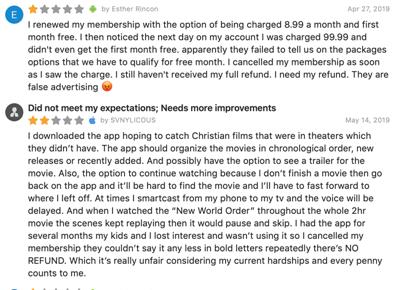

Marketing Strategy

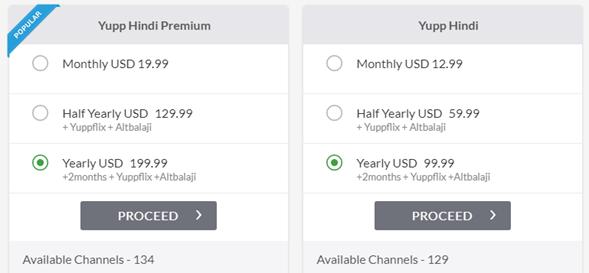

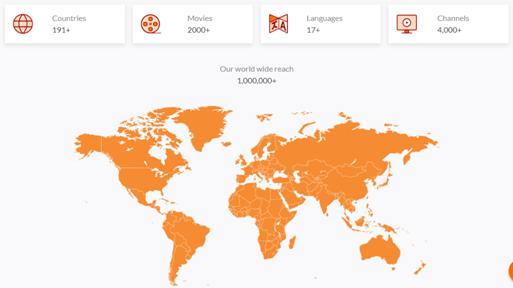

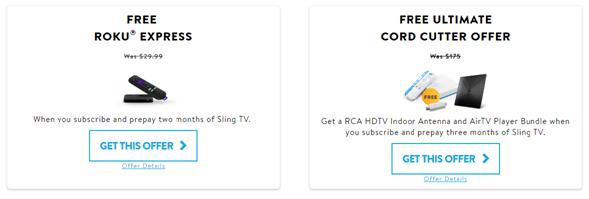

After we raise the 25% of the proceeds and proceeds thereafter; it is our intent to initiate a marketing strategy that will attract an initial one million subscribers. As part of the PunchFlix road map we will execute a phased approach for rolling out over 120 live streaming television channels over the next 12 months and more than 7,000 movie titles available in our video library.

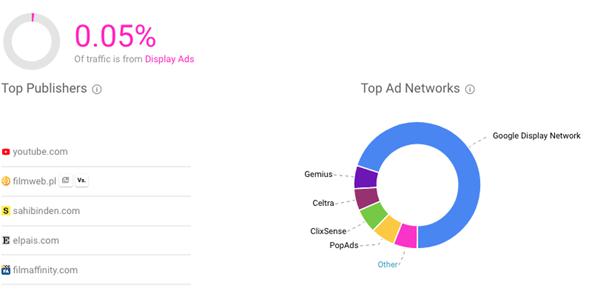

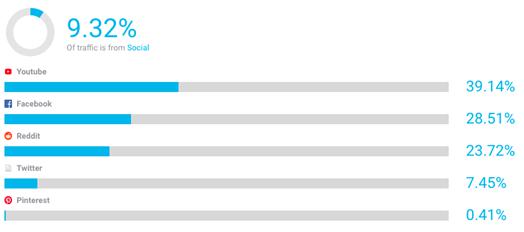

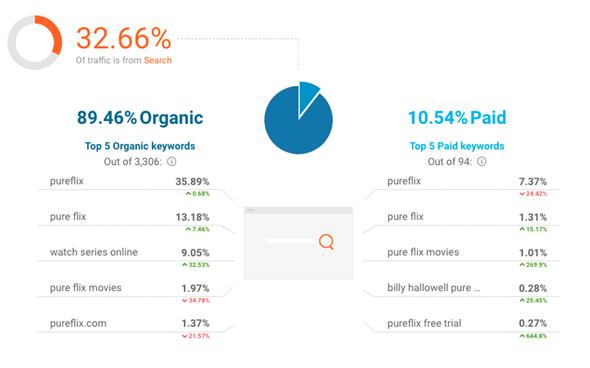

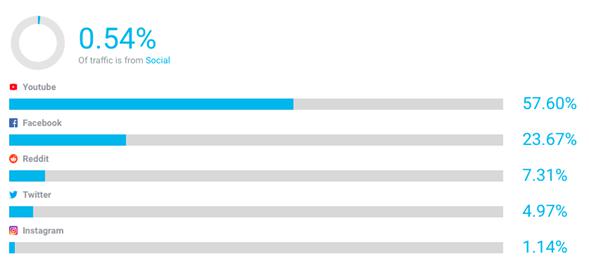

We believe the following strategies and tactics will support the on-boarding and retention of one million subscribers year over year. Our advertising program will generate approximately 90% of the subscriber base for PunchFlix. The marketing channels for these programs are stated below:

| | 1. | Market Channels Tactics |

We have multiple marketing channels through which we will attract subscribers to our service. We believe that our marketing efforts will be significantly enhanced by the benefits of word-of-mouth advertising, our subscriber referrals, and our active public relations program. We believe, the ongoing improvements we make to the subscriber experience will enhance our subscriber acquisition efforts over time.

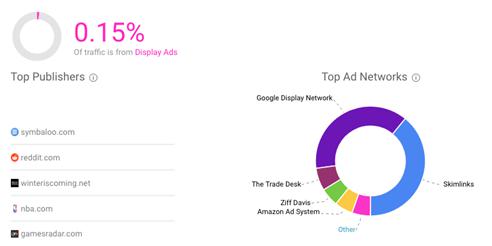

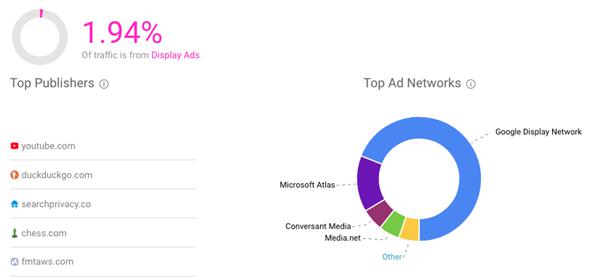

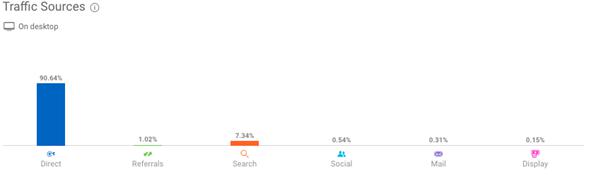

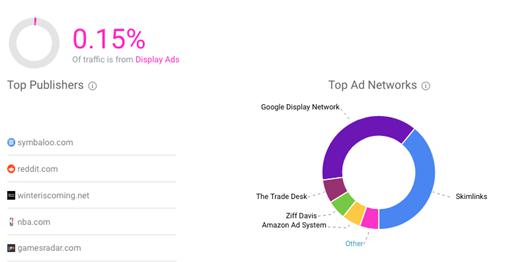

Online advertising will be a key tactic for us and will grow overtime. We plan to utilize a level-up model to build upon small marketing changes each week and measure the results. Each week we will focus on a level-up model to drive engagement to our web portal. The level-up models will consist of mass e-mail blasts, banner ads, pop-over advertisements, pop-under advertisements and on popular Web portals and other Web sites. In addition, we will have and will make Web-based banner ads and other advertisements accessible for self-use. We would like to see a 10% increment growth week-over-week, resulting in a 120% increase quarterly for online advertising.

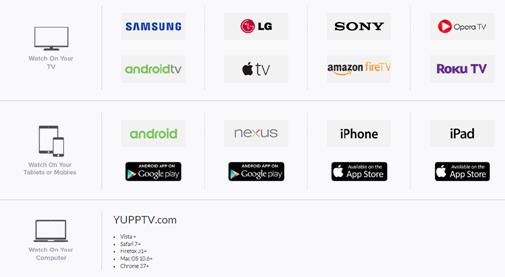

| | 3. | Television and handheld electronic companies |

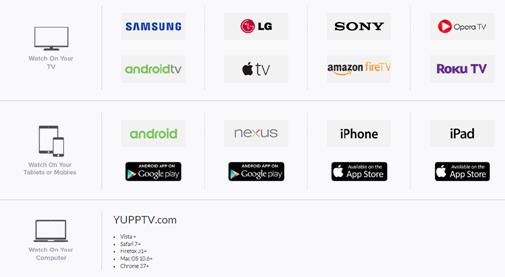

We plan to pave the way with establishing lifetime partnership agreements with electronic companies (TV, Tablet and other hand-held devices including cell phones) requiring them to place a PunchFlix link to our service on their dashboard or home screen and offer a free trial to lead to a subscription opportunity. These efforts will lead to developing relationships with Apex Digital, JVC Corporation of America, Panasonic Consumer Electronics Company, Philips Consumer Electronics, RCA, Samsung, Sanyo-Fisher, Sharp, Sony Electronics and Toshiba.

We will also work on other channels to increase our subscriber base such as, our web portal enters point that focus on traffic conversion, best content pieces on social media platforms and, trailer viewing capabilities at no cost to attract potential new subscribers.

Our marketing strategy will allow us to have a flavor to provide a seamless experience to our subscriber base. The Punchflix marketing experience will be convenient, engaging, and innovative to attract a global demographic. It will not be the landscape of our original content that will keep people at home binge watching, it will be the amazing digital marketing techniques used to acquire new customers. Anyone who has PunchFlix will experience their personalization artificial intelligence for suggested content. PunchFlix is an excellent choice, it easy, desirable and entertaining.

Employees and Employment Agreements

As of September 30, 2018, we had no employees other than Mr. Collins, our sole officer and director. Mr. Collins has the flexibility to work in our business as required to execute the strategic business plan. He is prepared to devote more time to our operations as may be required, and we have an employment agreement with him.

We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our sole director and officer.

During the initial implementation of our business plan, we intend to hire independent consultants to assist in the development of PunchFlix, Inc.

Government Regulations

We are unaware of and do not anticipate having to expend significant resources to comply with any local, state and governmental regulations. We are subject to the laws and regulations of those jurisdictions in which we plan to offer our programming, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and/or supervisory requirements.

Intellectual Property

We currently hold rights to intellectual property and have filed for copyright and trademark protection for our name, channel or intended website. We have trademarked the PunchFlix logo; and any other logo we create.

Research and Development

Since our inception to the date of this Offering Circular, we have not spent any money on research and development activities.

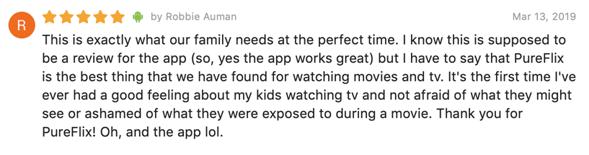

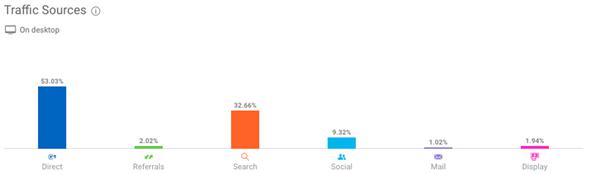

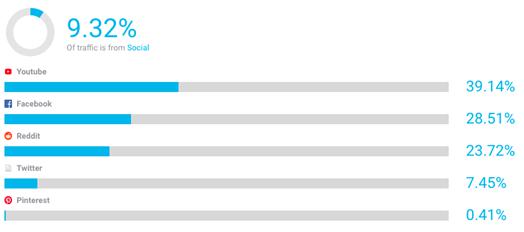

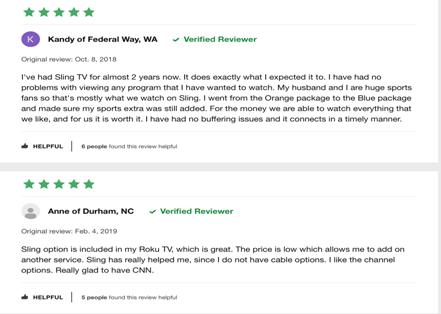

Reports to Security Holders