2Q & 1H 2020 Earnings Conference Call August 6, 2020

Safe Harbor Regarding Forward-Looking Statements Forward-Looking Statements This presentation contains certain estimates and forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and may be identified by their use of words like “plans,” “expects,” “will,” “anticipates,” “believes,” “intends,” “projects,” “estimates”, “guidance”, or other words of similar meaning. All statements that address expectations or projections about the future, including statements about Corteva’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures, and financial results, as well as expected benefits from, the separation of Corteva from DuPont, are forward-looking statements. Forward-looking statements are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond Corteva's control. While the list of factors presented below is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Corteva's business, results of operations and financial condition. Some of the important factors that could cause Corteva's actual results to differ materially from those projected in any such forward-looking statements include: (i) failure to successfully develop and commercialize Corteva's pipeline; (ii) effect of competition and consolidation in Corteva's industry; (iii) failure to obtain or maintain the necessary regulatory approvals for some Corteva's products; (iv) failure to enforce Corteva's intellectual property rights or defend against intellectual property claims asserted by others; (v) effect of competition from manufacturers of generic products; (vi) impact of Corteva's dependence on third parties with respect to certain of its raw materials or licenses and commercialization; (vii) costs of complying with evolving regulatory requirements and the effect of actual or alleged violations of environmental laws or permit requirements; (viii) effect of the degree of public understanding and acceptance or perceived public acceptance of Corteva's biotechnology and other agricultural products; (ix) effect of changes in agricultural and related policies of governments and international organizations; (x) effect of industrial espionage and other disruptions to Corteva's supply chain, information technology or network systems; (xi) competitor's establishment of an intermediary platform for distribution of Corteva's products; (xii) effect of volatility in Corteva's input costs; (xiii) failure to raise capital through the capital markets or short-term borrowings on terms acceptable to Corteva; (xiv) failure of Corteva's customers to pay their debts to Corteva, including customer financing programs; (xv) failure to realize the anticipated benefits of the internal reorganizations taken by DowDuPont in connection with the spin-off of Corteva, including failure to benefit from significant cost synergies; (xvi) risks related to the indemnification obligations of legacy EID liabilities in connection with the separation of Corteva; (xvii) increases in pension and other post-employment benefit plan funding obligations; (xviii) effect of compliance with environmental laws and requirements and adverse judgments on litigation; (xix) risks related to Corteva's global operations; (xx) effect of climate change and unpredictable seasonal and weather factors; (xxi) effect of counterfeit products; (xxii) failure to effectively manage acquisitions, divestitures, alliances and other portfolio actions; (xxiii) risks related to non-cash charges from impairment of goodwill or intangibles assets; (xxiv) risks related to COVID-19; (xxv) risks related to oil and commodity markets, and (xxvi) other risks related to Corteva’s Separation from DowDuPont. Additionally, there may be other risks and uncertainties that Corteva is unable to currently identify or that Corteva does not currently expect to have a material impact on its business. Where, in any forward-looking statement or other estimate, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Corteva’s management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Corteva disclaims and does not undertake any obligation to update or revise any forward-looking statement or other estimate, except as required by applicable law. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements or other estimates is included in the “Risk Factors” section of Corteva’s Annual Report on Form 10-K, as modified by subsequent Quarterly Reports on Forms 10-Q and Current Reports on Form 8-K. 2

A Reminder About Non-GAAP Financial Measures and Pro Forma Financial Information Corteva Unaudited Pro Forma Financial Information In order to provide the most meaningful comparison of results of operations, supplemental unaudited pro forma financial information for the first quarter of 2019 has been included in this presentation. This presentation presents the pro forma results of Corteva, after giving effect to events that are (1) directly attributable to the merger of DuPont and Dow, debt retirement transactions related to paying off or retiring portions of Historical DuPont’s existing debt liabilities, and the separation and distribution to DowDuPont stockholders of all the outstanding shares of Corteva common stock; (2) factually supportable and (3) with respect to the pro forma statements of income, expected to have a continuing impact on the consolidated results. Refer to Corteva’s Form 10 registration statement filed on May 6, 2019, which can be found on the investors section of the Corteva website, for further details on the above transactions. The pro forma financial statements were prepared in accordance with Article 11 of Regulation S-X, and are presented for informational purposes only, and do not purport to represent what the results of operations would have been had the above actually occurred on the dates indicated, nor do they purport to project the results of operations for any future period or as of any future date. Regulation G (Non-GAAP Financial Measures) This is earnings release includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures may include organic sales, organic growth (including by segment and region), operating EBITDA, pro forma operating EBITDA, operating EBITDA margin, pro forma operating EBITDA margin, operating earnings per share, pro forma operating earnings per share, base tax rate and pro forma base tax rate. Management uses these measures internally for planning and forecasting, including allocating resources and evaluating incentive compensation. Management believes that these non-GAAP measures reflect the ongoing performance of the Company during the periods presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful comparison of year over year results. These non-GAAP measures supplement the Company's U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Reconciliations for these non-GAAP measures to U.S. GAAP are provided in the Selected Financial Information and Non-GAAP Measures starting on page A-6 of the Financial Statement Schedules. For first quarter 2019, these non-GAAP measures are being reconciled to a pro forma GAAP financial measure prepared and presented in accordance with Article 11 of Regulation S-X. Reconciliations for these non-GAAP measures to their most directly attributable U.S. GAAP measure are provided on slides 26 - 32 of this presentation. Corteva is not able to reconcile its forward-looking non-GAAP financial measures to their most comparable U.S. GAAP financial measures, as it is unable to predict with reasonable certainty items outside of the company’s control, such as Significant Items, without unreasonable effort. For Significant Items reported in the periods presented, refer to page A-9 of the Financial Statement Schedules. Beginning January 1, 2020, the company presents accelerated prepaid royalty amortization expense as a significant item. Accelerated prepaid royalty amortization represents the noncash charge associated with the recognition of upfront payments made to Monsanto in connection with the Company’s non-exclusive license in the United States and Canada for Monsanto's Genuity® Roundup Ready 2 Yield® Roundup Ready 2 Xtend® herbicide tolerance traits. During the five-year ramp-up period of Enlist E3TM, Corteva is expected to significantly reduce the volume of products with the Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits beginning in 2021, with expected minimal use of the trait platform after the completion of the ramp-up. Organic sales is defined as price and volume and excludes currency and portfolio impacts. Operating EBITDA is defined as earnings (i.e., income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits, net and foreign exchange gains (losses), excluding the impact of significant items (including goodwill impairment charges). Non-operating benefits, net consists of non-operating pension and other post-employment benefit (OPEB) credits, tax indemnification adjustments, environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense. Operating EBITDA margin is defined as Operating EBITDA as a percentage of net sales. Operating earnings per share are defined as "Earnings per common share from continuing operations - diluted" excluding the after-tax impact of significant items (including goodwill impairment charges), the after-tax impact of non-operating benefits, net, and the after-tax impact of amortization expense associated with intangible assets existing as of the Separation from DowDuPont. Although amortization of the Company's intangible assets is excluded from these non-GAAP measures, management believes it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in amortization of additional intangible assets. Base tax rate is defined as the effective tax rate excluding the impacts of foreign exchange gains (losses), non-operating benefits, net, amortization of intangibles as of the Separation from DowDuPont, and significant items (including goodwill impairment charges). The first half of 2019 is on a pro forma basis as discussed above in the paragraph ‘Corteva Unaudited Pro Forma Financial Information’. 3

Keeping our organization resilient through crisis Employee Safety & Customer Support & Government & Community Diversity, Equity & Security Supply Resilience Outreach Inclusion Ensuring the health Keeping our supply Doing our part in the Challenging our and safety or our chain open and communities where organization to model global workforce supporting our we operate the highest standard customers remotely of respect for people Picture Delivering on our purpose with operational agility and cultural integrity 4

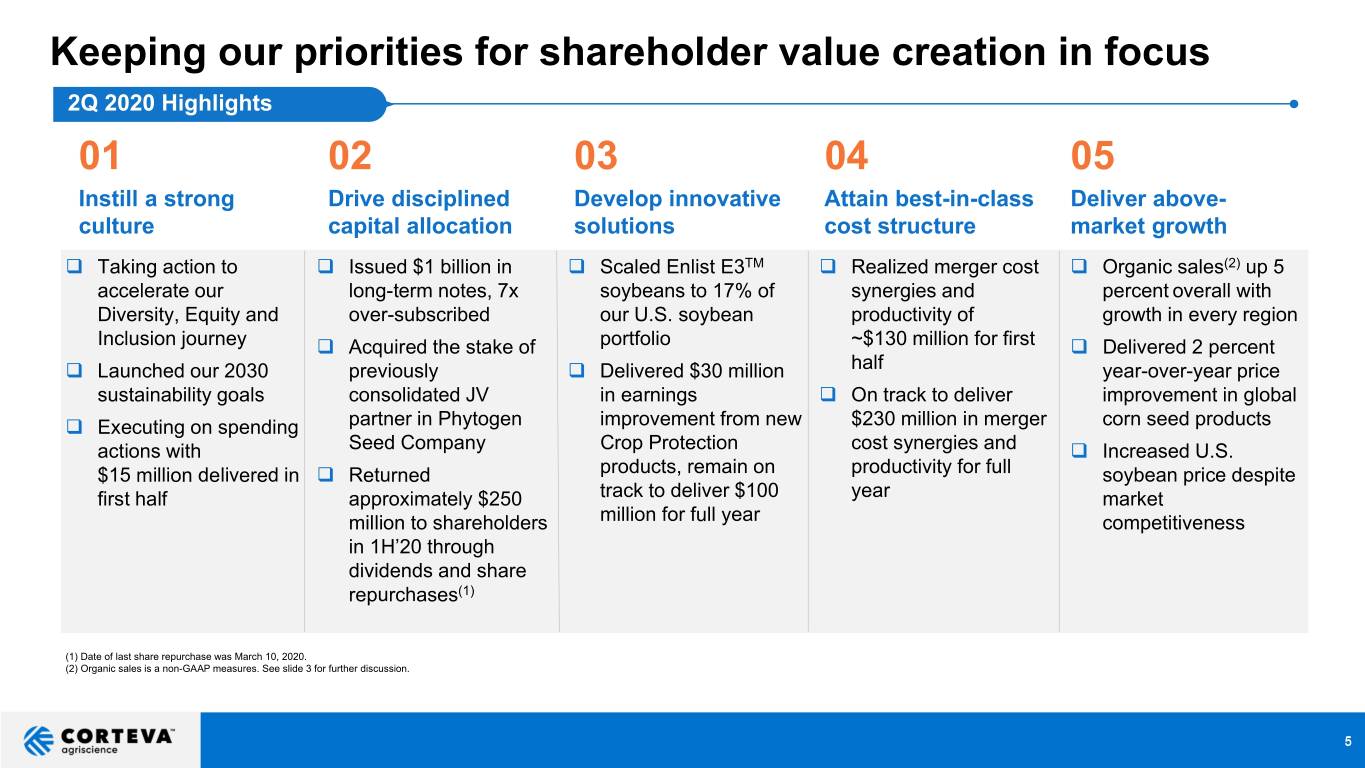

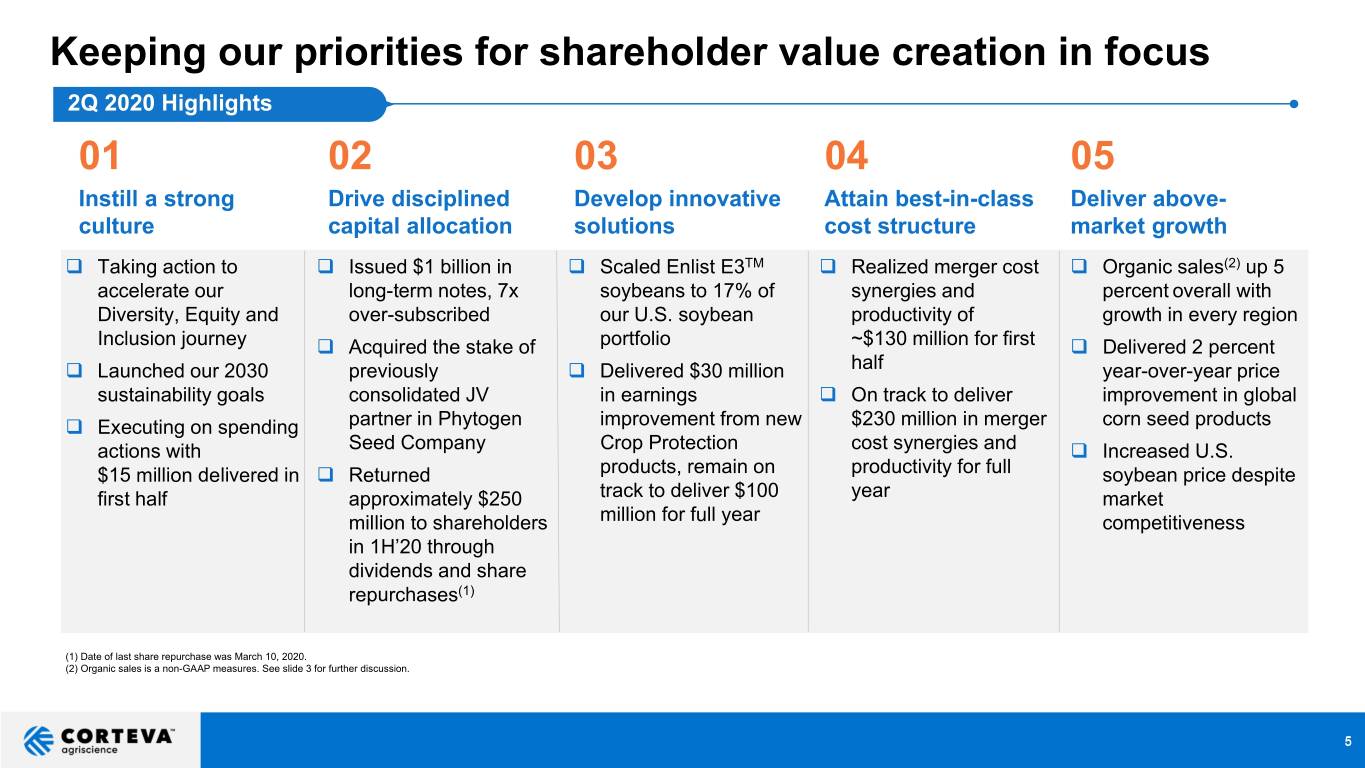

Keeping our priorities for shareholder value creation in focus 2Q 2020 Highlights 01 02 03 04 05 Instill a strong Drive disciplined Develop innovative Attain best-in-class Deliver above- culture capital allocation solutions cost structure market growth Taking action to Issued $1 billion in Scaled Enlist E3TM Realized merger cost Organic sales(2) up 5 accelerate our long-term notes, 7x soybeans to 17% of synergies and percent overall with Diversity, Equity and over-subscribed our U.S. soybean productivity of growth in every region Inclusion journey Acquired the stake of portfolio ~$130 million for first Delivered 2 percent Launched our 2030 previously Delivered $30 million half year-over-year price sustainability goals consolidated JV in earnings On track to deliver improvement in global Executing on spending partner in Phytogen improvement from new $230 million in merger corn seed products actions with Seed Company Crop Protection cost synergies and Increased U.S. $15 million delivered in Returned products, remain on productivity for full soybean price despite first half approximately $250 track to deliver $100 year market million to shareholders million for full year competitiveness in 1H’20 through dividends and share repurchases(1) (1) Date of last share repurchase was March 10, 2020. (2) Organic sales is a non-GAAP measures. See slide 3 for further discussion. 5

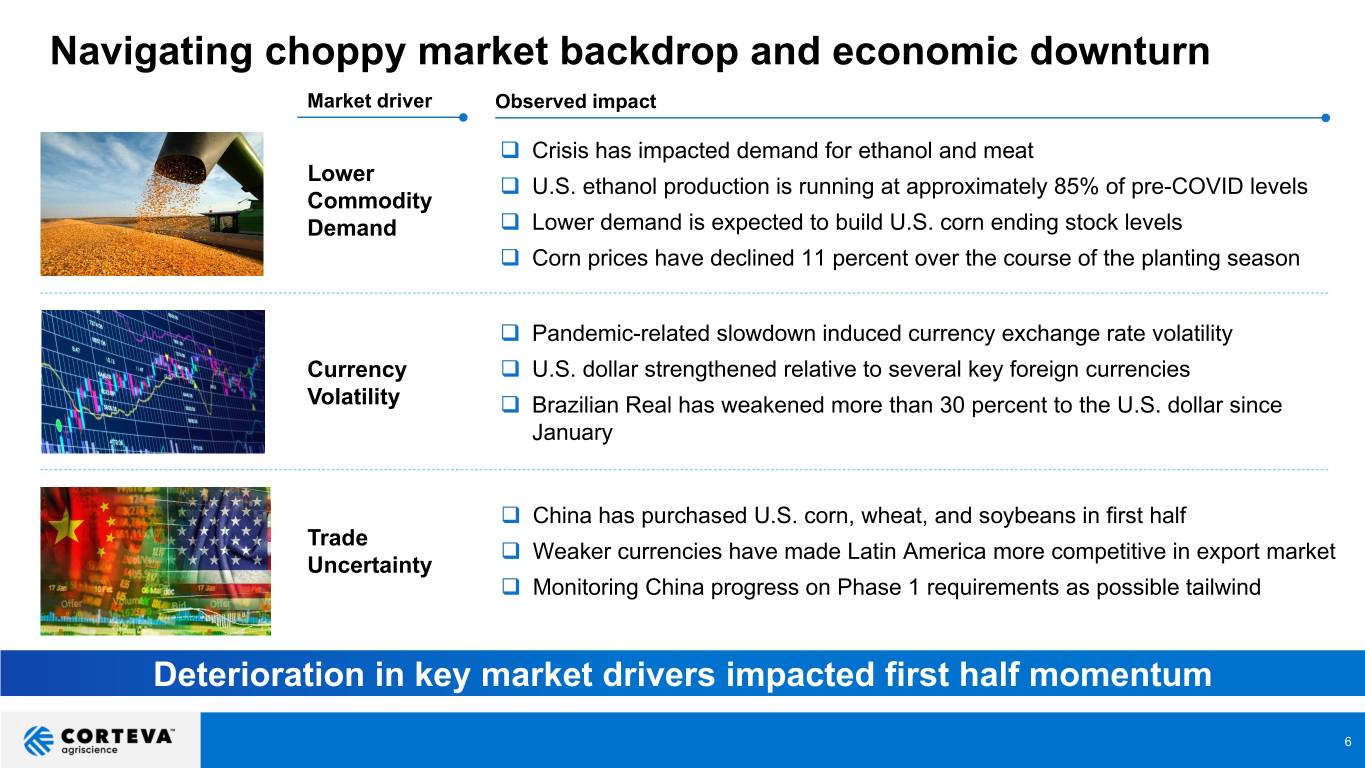

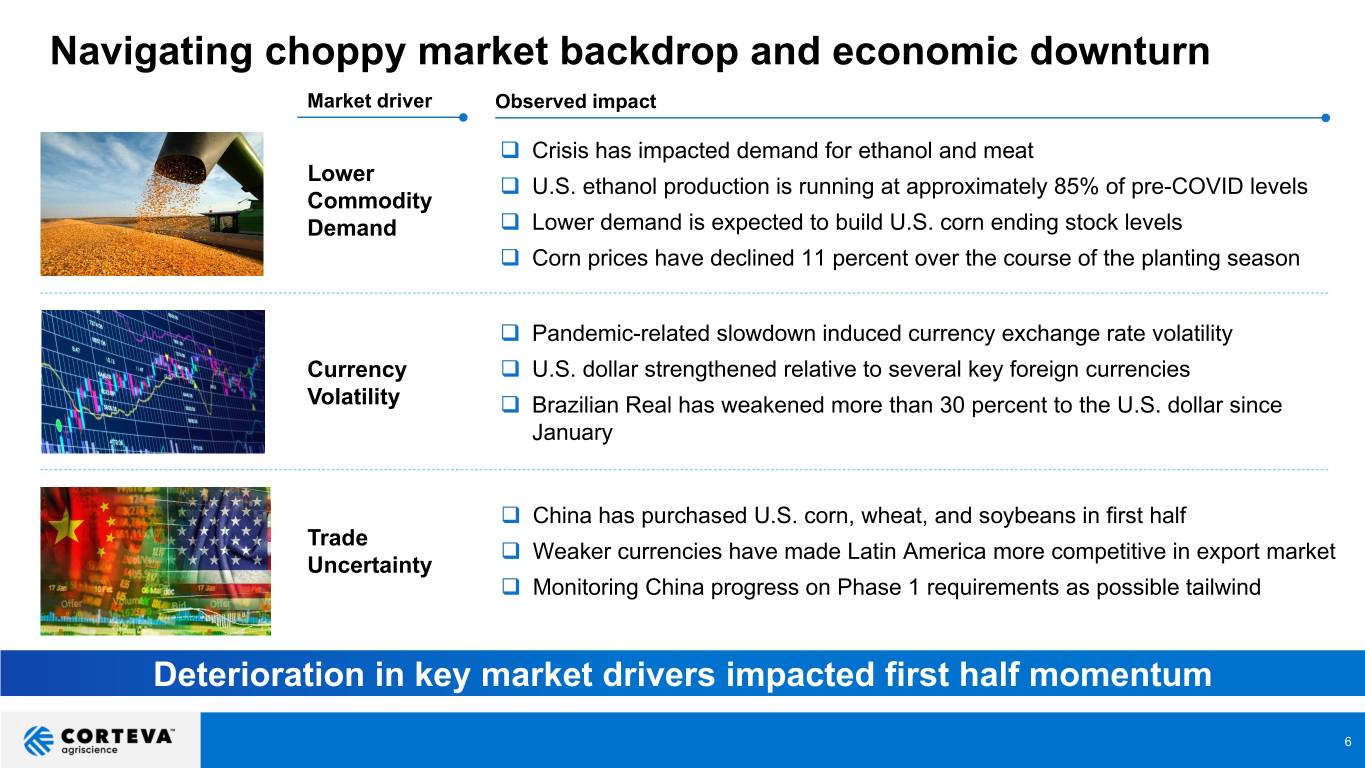

Navigating choppy market backdrop and economic downturn Market driver Observed impact Crisis has impacted demand for ethanol and meat Lower U.S. ethanol production is running at approximately 85% of pre-COVID levels Commodity Demand Lower demand is expected to build U.S. corn ending stock levels Corn prices have declined 11 percent over the course of the planting season Pandemic-related slowdown induced currency exchange rate volatility Currency U.S. dollar strengthened relative to several key foreign currencies Volatility Brazilian Real has weakened more than 30 percent to the U.S. dollar since January China has purchased U.S. corn, wheat, and soybeans in first half Trade Weaker currencies have made Latin America more competitive in export market Uncertainty Monitoring China progress on Phase 1 requirements as possible tailwind Deterioration in key market drivers impacted first half momentum 6

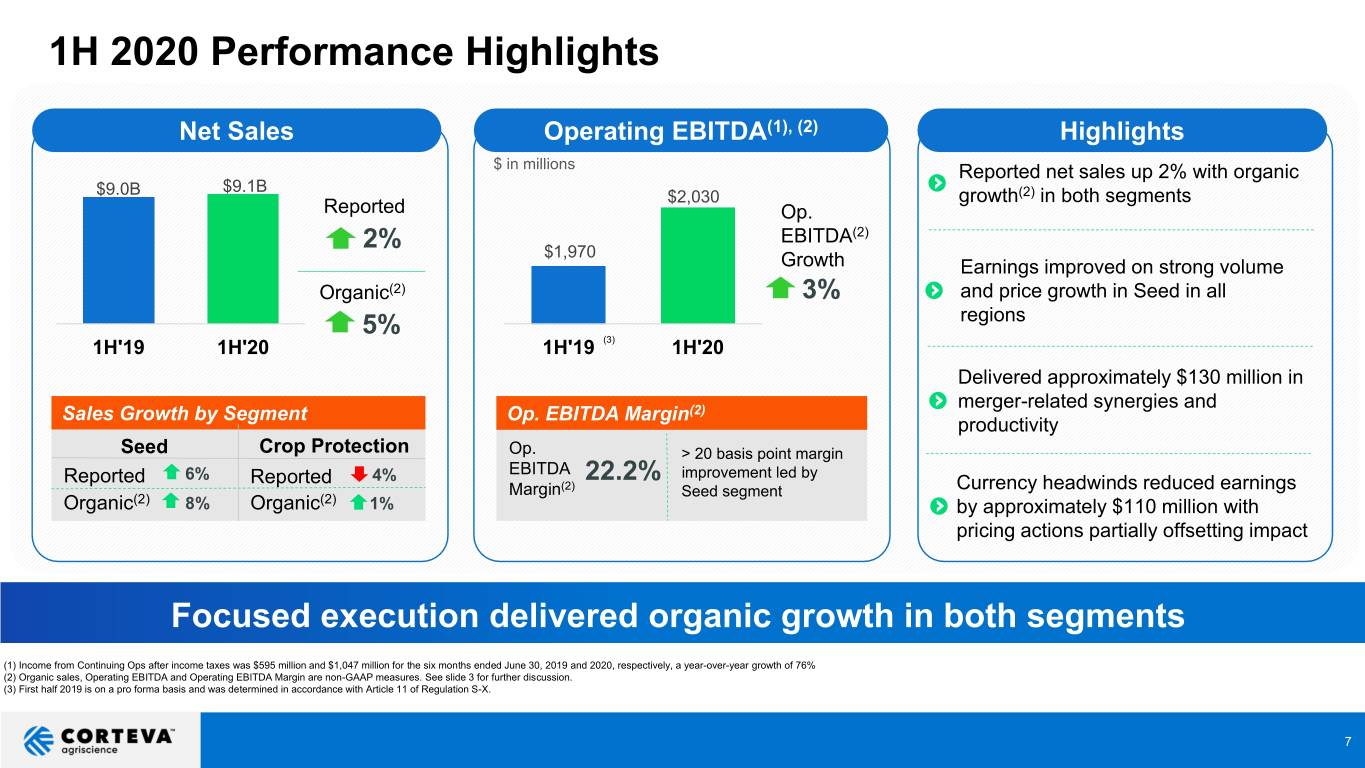

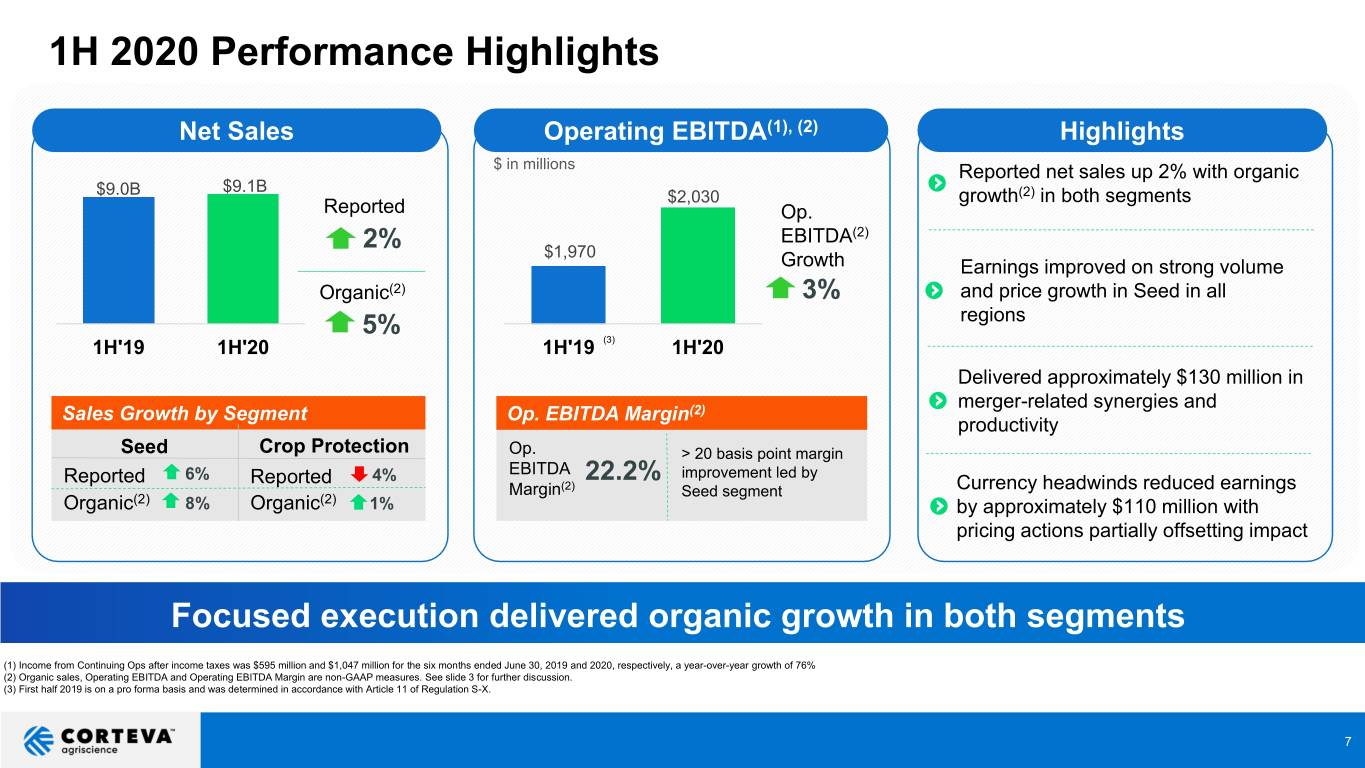

1H 2020 Performance Highlights Net Sales Operating EBITDA(1), (2) Highlights $ in millions Reported net sales up 2% with organic $9.1B $9.0B $2,030 growth(2) in both segments Reported Op. EBITDA(2) 2% $1,970 Growth Earnings improved on strong volume Organic(2) 3% and price growth in Seed in all regions 5% (3) 1H'19 1H'20 1H'19 1H'20 Delivered approximately $130 million in merger-related synergies and Sales Growth by Segment Op. EBITDA Margin(2) productivity Seed Crop Protection Op. > 20 basis point margin Reported 6% Reported 4% EBITDA 22.2% improvement led by Margin(2) Seed segment Currency headwinds reduced earnings Organic(2) 8% Organic(2) 1% by approximately $110 million with pricing actions partially offsetting impact Focused execution delivered organic growth in both segments (1) Income from Continuing Ops after income taxes was $595 million and $1,047 million for the six months ended June 30, 2019 and 2020, respectively, a year-over-year growth of 76% (2) Organic sales, Operating EBITDA and Operating EBITDA Margin are non-GAAP measures. See slide 3 for further discussion. (3) First half 2019 is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X. 7

Perspectives on First Half Performance Momentum Challenges Global corn seed portfolio and new corn seed Currency devaluation, primarily in Europe technology launches, like Qrome® and Brazil Disciplined execution in U.S. soybean seed Lower corn planted acreage increase in North leading to price gains America than originally expected New Crop Protection product growth, Vessarya fungicide formulation challenge particularly Arylex and Rinskor herbicides requiring returns to rework volume Pricing actions in Latin America to partially Herbicide volume declines in North America offset currency devaluation and Latin America in 2Q’20 Cost synergy and productivity savings offset Traction on spending actions to offset continued cost of goods sold headwinds investment in growth Used positive momentum to overcome market and competitive challenges 8

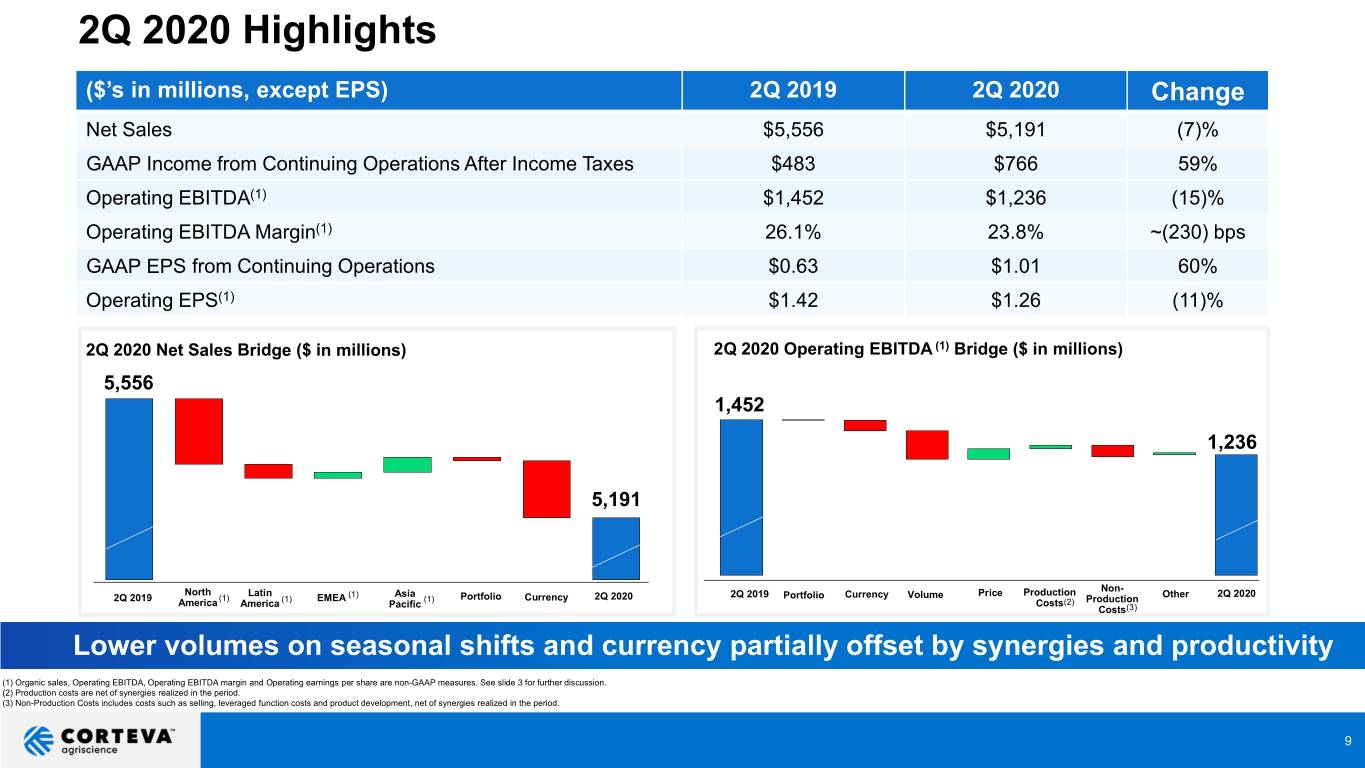

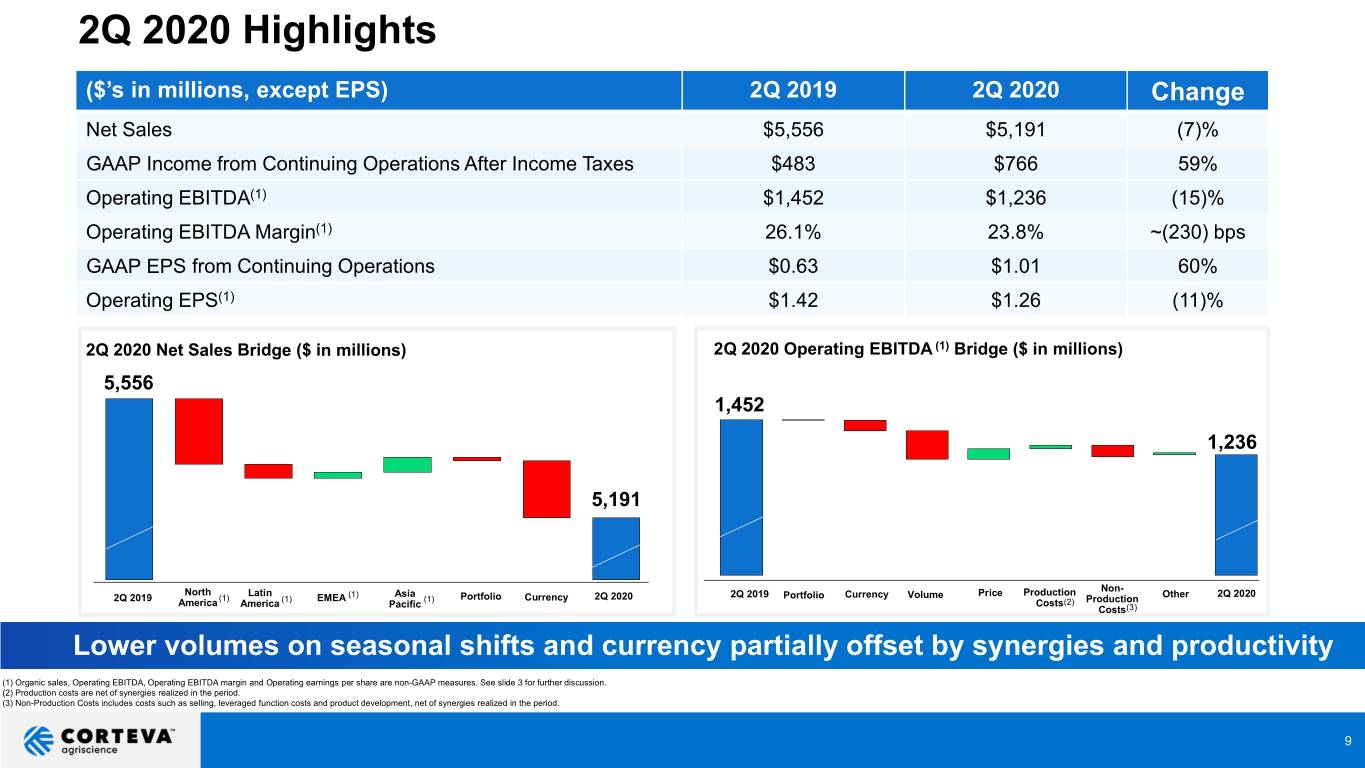

2Q 2020 Highlights ($’s in millions, except EPS) 2Q 2019 2Q 2020 Change Net Sales $5,556 $5,191 (7)% GAAP Income from Continuing Operations After Income Taxes $483 $766 59% Operating EBITDA(1) $1,452 $1,236 (15)% Operating EBITDA Margin(1) 26.1% 23.8% ~(230) bps GAAP EPS from Continuing Operations $0.63 $1.01 60% Operating EPS(1) $1.42 $1.26 (11)% 2Q 2020 Net Sales Bridge ($ in millions) 2Q 2020 Operating EBITDA (1) Bridge ($ in millions) 5,556 1,452 1,236 5,191 Non- North Latin (1) Asia 2Q 2019 Price Production Other 2Q 2020 2Q 2019 (1) (1) EMEA (1) Portfolio Currency 2Q 2020 Portfolio Currency Volume Production America America Pacific Costs(2) Costs(3) Lower volumes on seasonal shifts and currency partially offset by synergies and productivity (1) Organic sales, Operating EBITDA, Operating EBITDA margin and Operating earnings per share are non-GAAP measures. See slide 3 for further discussion. (2) Production costs are net of synergies realized in the period. (3) Non-Production Costs includes costs such as selling, leveraged function costs and product development, net of synergies realized in the period. 9

Updated Full Year 2020 Guidance(1) Net Sales Operating EBITDA(1) Operating EPS(2),(4) $ in billions $ in millions $1.43 ~$13.9 - $14.1B $13.8B $1.25 – 1.45 $1,987 $1,900 - $2,000 FY'19 FY'20E (3) (3) FY'19 FY'20E FY'19 FY'20E Sales Growth Op. EBITDA(2) vPY Operating EPS(2) vPY ~$400 million in currency (2) headwinds for FY20E, FY19 Reported Organic Mid-point Mid-point ~1-2% ~5-6% ~2% includes ~$70 million in gains from ~6% divestitures Updating full year guidance to reflect focused 2H execution (1) Guidance does not contemplate any further operational disruptions, significant changes in customers’ demand or ability to pay, or further acceleration of currency impacts resulting from the COVID-19 pandemic. (2) Organic Sales, Operating EBITDA and Operating EPS are non-GAAP measures. See slide 3 for further discussion. (3) Full year 2019 information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X. (4) See appendix charts for detailed Operating EPS modeling assumptions 10

Second Half 2020 Key Assumptions 2H’20 Growth Cost Management Other Financial Organic Growth(1) 6 - 7% Synergies / Productivity Gains on Divestitures . Growth largely due to Latin America . 2H’20 synergies and productivity . ~$70 million headwind on gains Crop Protection volume and pricing actions ~$100 million – FY2020 from divestitures in 4Q’19 not . ~$80 million favorable shift in sales target of $230 million on track expected to recur for 3Q’20 compared to prior year . Headwind on North America 4Q Costs of Goods / SARD Cash Flow seed deliveries given 2021 market . ~$50 million of remaining COGS . Focus on working capital uncertainty headwinds expected to be incurred improvements . Crop Protection new product sales in 2H’20 - $150 million for FY20 on . Capital expenditures ~$300 million (1) growth ~$150 million ex-currency track for 2H’20 – FY2020 target of – on track for $250 million for . SG&A and R&D expected to be up ~$500 million on track FY2020 ~$20 million over prior year due to new product launch costs Currency . Driving spending reduction actions . ~$300 million EBITDA headwind, net of hedging . Partial offset from pricing in Latin America (1) Organic sales is a non-GAAP measures. See slide 3 for further discussion. 11

Net Sales Progression and Critical Second Half Actions Net Sales by Region in Second Half(1) Asia Pacific Latin America 2H captures conclusion of the summer Execution on high-demand products, season in Brazil and start of safrinha like Spinosyns insecticide and ~10% RinskorTM herbicide Leverage advantaged portfolio in Brazil corn to execute on Safrinha season Seasonal shift in seed sales in India due to early monsoon season VessaryaTM fungicide rework, restocking in ~40% the channel and growth ~15% ~40% of 2H(1) Sales are concentrated in North America(2) Europe, Middle East and Latin America Africa 4Q captures start of the 2021 season Continue to penetrate European Secure orders and position product in markets with new Crop Protection North America to prepare for start of 2021 technology, particularly ArylexTM season herbicide and IsoclastTM insecticide ~35% Continue scaling of EnlistTM E3 soybean TM Improve corn seed market share in technology and Enlist herbicides South Africa (1) Second half sales split by region based on 2019 actuals. (2) North America is defined as United States and Canada. 12

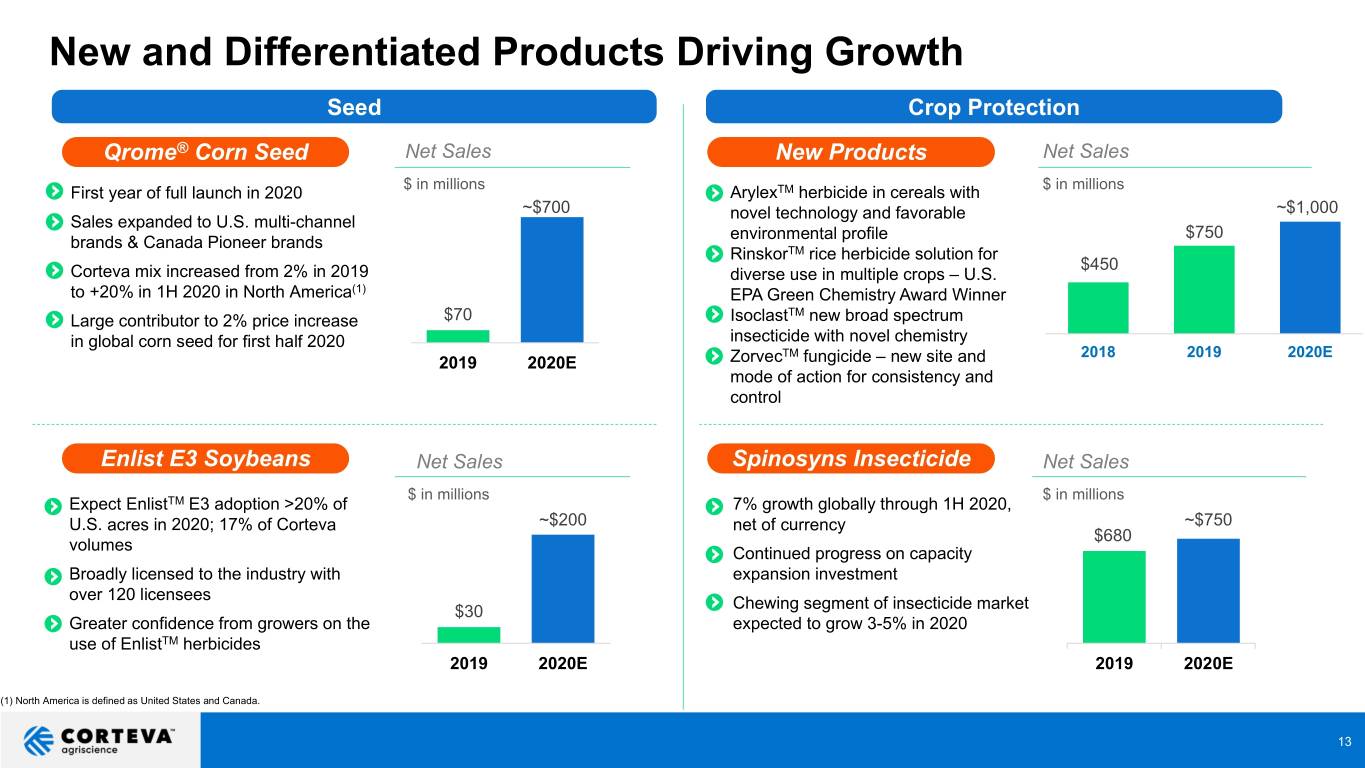

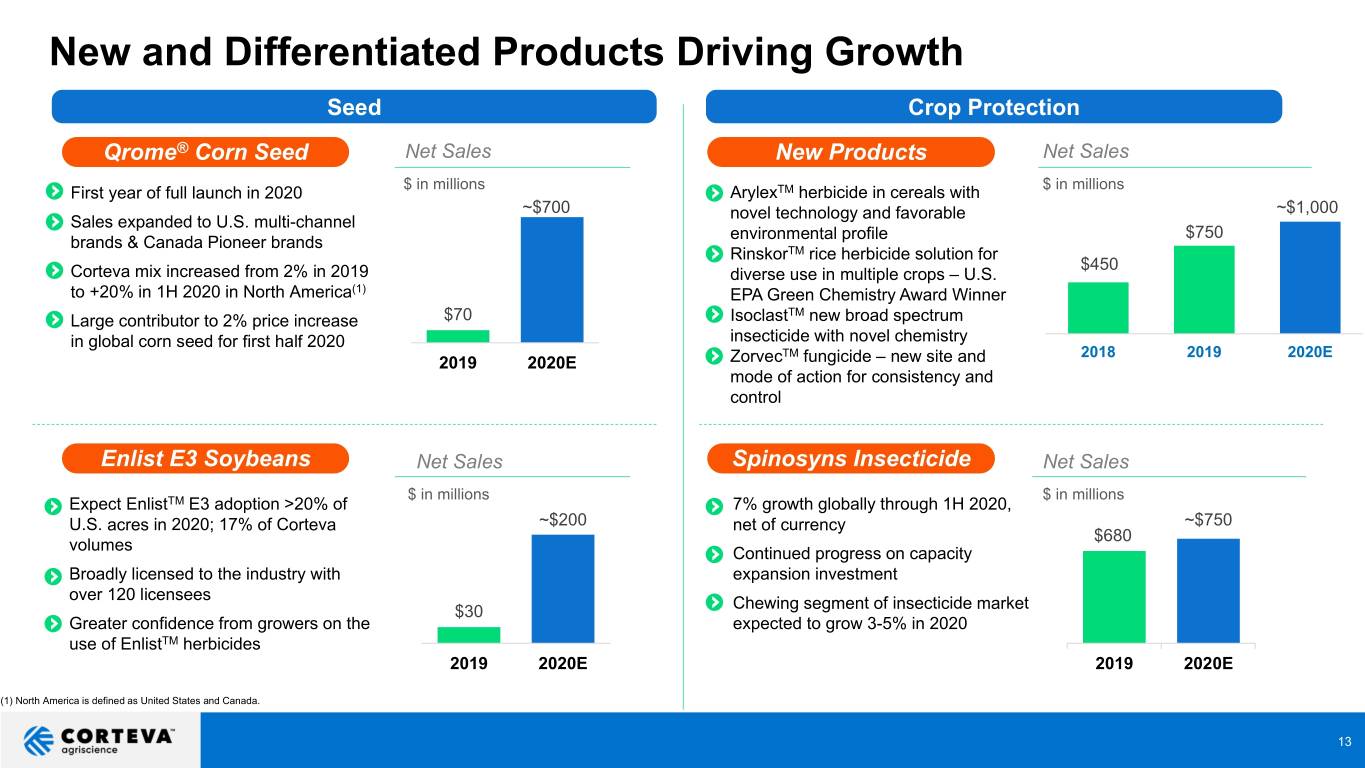

New and Differentiated Products Driving Growth Seed Crop Protection Qrome® Corn Seed Net Sales New Products Net Sales $ in millions $ in millions . First year of full launch in 2020 • ArylexTM herbicide in cereals with ~$700 novel technology and favorable ~$1,000 . Sales expanded to U.S. multi-channel environmental profile $750 brands & Canada Pioneer brands • RinskorTM rice herbicide solution for $450 . Corteva mix increased from 2% in 2019 diverse use in multiple crops – U.S. to +20% in 1H 2020 in North America(1) EPA Green Chemistry Award Winner TM . Large contributor to 2% price increase $70 • Isoclast new broad spectrum in global corn seed for first half 2020 insecticide with novel chemistry TM 2018 2019 2020E 2019 2020E • Zorvec fungicide – new site and mode of action for consistency and control Enlist E3 Soybeans Net Sales Spinosyns Insecticide Net Sales $ in millions $ in millions . Expect EnlistTM E3 adoption >20% of . 7% growth globally through 1H 2020, U.S. acres in 2020; 17% of Corteva ~$200 net of currency ~$750 $680 volumes . Continued progress on capacity . Broadly licensed to the industry with expansion investment over 120 licensees . $30 Chewing segment of insecticide market . Greater confidence from growers on the expected to grow 3-5% in 2020 use of EnlistTM herbicides 2019 2020E 2019 2020E (1) North America is defined as United States and Canada. 13

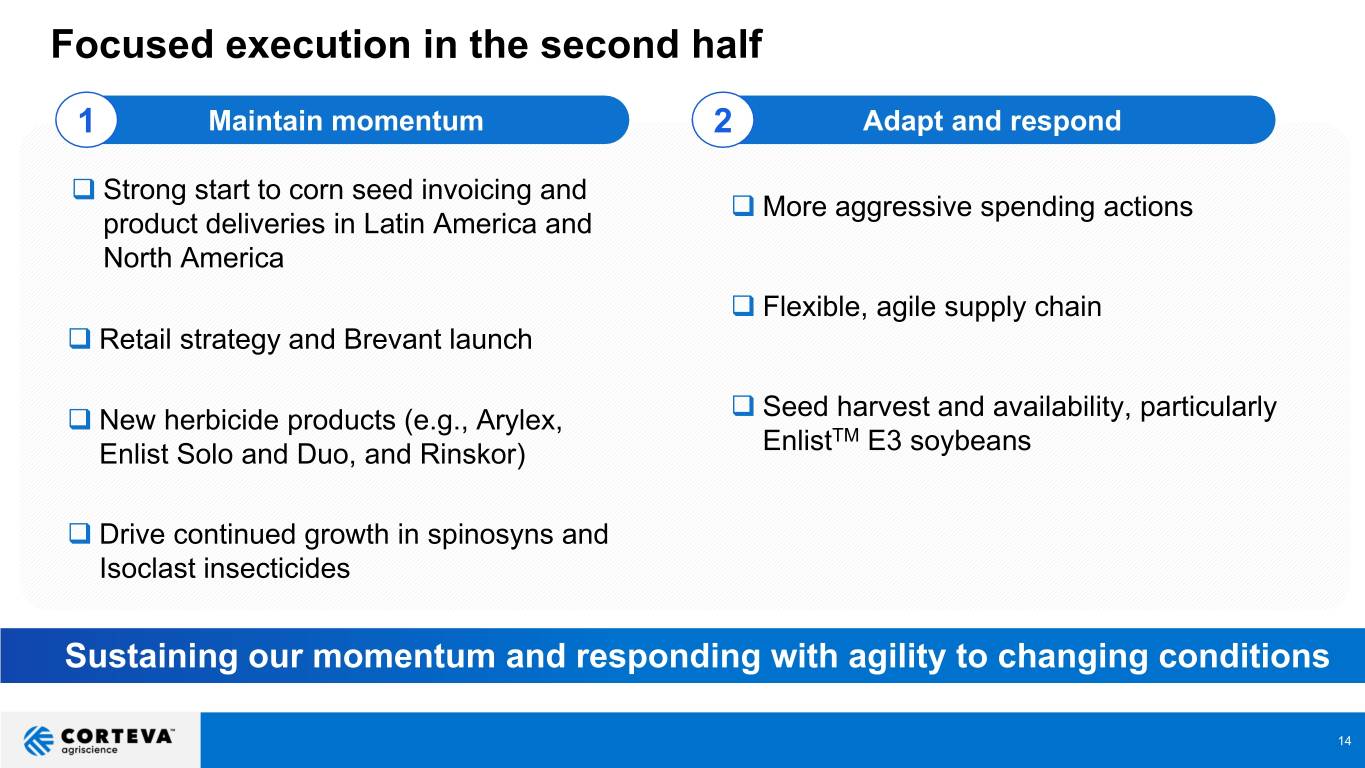

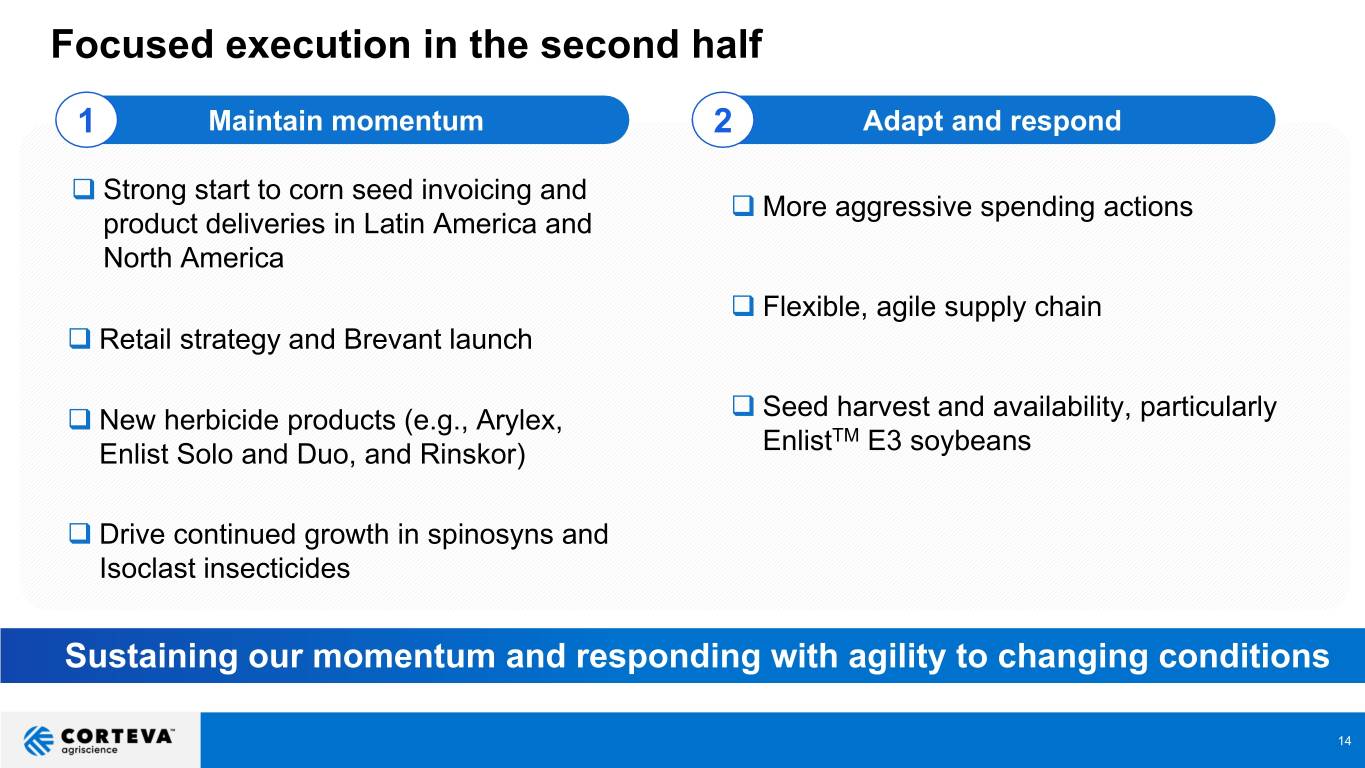

Focused execution in the second half 1 Maintain momentum 2 Adapt and respond Strong start to corn seed invoicing and More aggressive spending actions product deliveries in Latin America and North America Flexible, agile supply chain Retail strategy and Brevant launch Seed harvest and availability, particularly New herbicide products (e.g., Arylex, TM Enlist Solo and Duo, and Rinskor) Enlist E3 soybeans Drive continued growth in spinosyns and Isoclast insecticides Sustaining our momentum and responding with agility to changing conditions 14

2Q 2020 Regional Net Sales Highlights – Crop Protection (1) (1) Global Net Sales North Reported Organic Latin Reported Organic America(2) 3% 2% America 34% 20% Q2 2019 Q2 2020 Q2 2019 Q2 2020 $1.9B Net Sales ($MM) $686 $663 Net Sales ($MM) $466 $309 Volume Price Currency Portfolio Volume Price Currency Portfolio $1.7B (3)% 1% - % (1)% (25)% 5% (14)% - % Reported Volume declines driven by competitive Lower volumes on VessaryaTM rework due soybean herbicide market to formulation issue and normalized start to 11% season in Brazil in herbicides Pricing gains reflect timing of grower Organic(1) incentive discounts Currency impact from Brazilian Real partially offset by pricing 5% Reported Organic(1) Asia Reported Organic(1) EMEA(3) 4% 1% Pacific 3% 3% Q2'19 Q2'20 Q2 2019 Q2 2020 Q2 2019 Q2 2020 Net Sales ($MM) $393 $379 Net Sales ($MM) $312 $302 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio (7)% 2% (5)% (1)% - % 1% (4)% (1)% 4% (1)% (5)% (1)% Continued penetration of new products, Volume growth due to strong start to including RinskorTM herbicide, largely monsoon season in India offset by strong early demand in Q1 Ramp-up of new technology, including (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. Spinetoram and PyraxaltTM insecticides and (2) North America is defined as U.S. and Canada. Unfavorable currency impact (3) EMEA Is defined as Europe, Middle East and Africa. RinskorTM herbicide 16

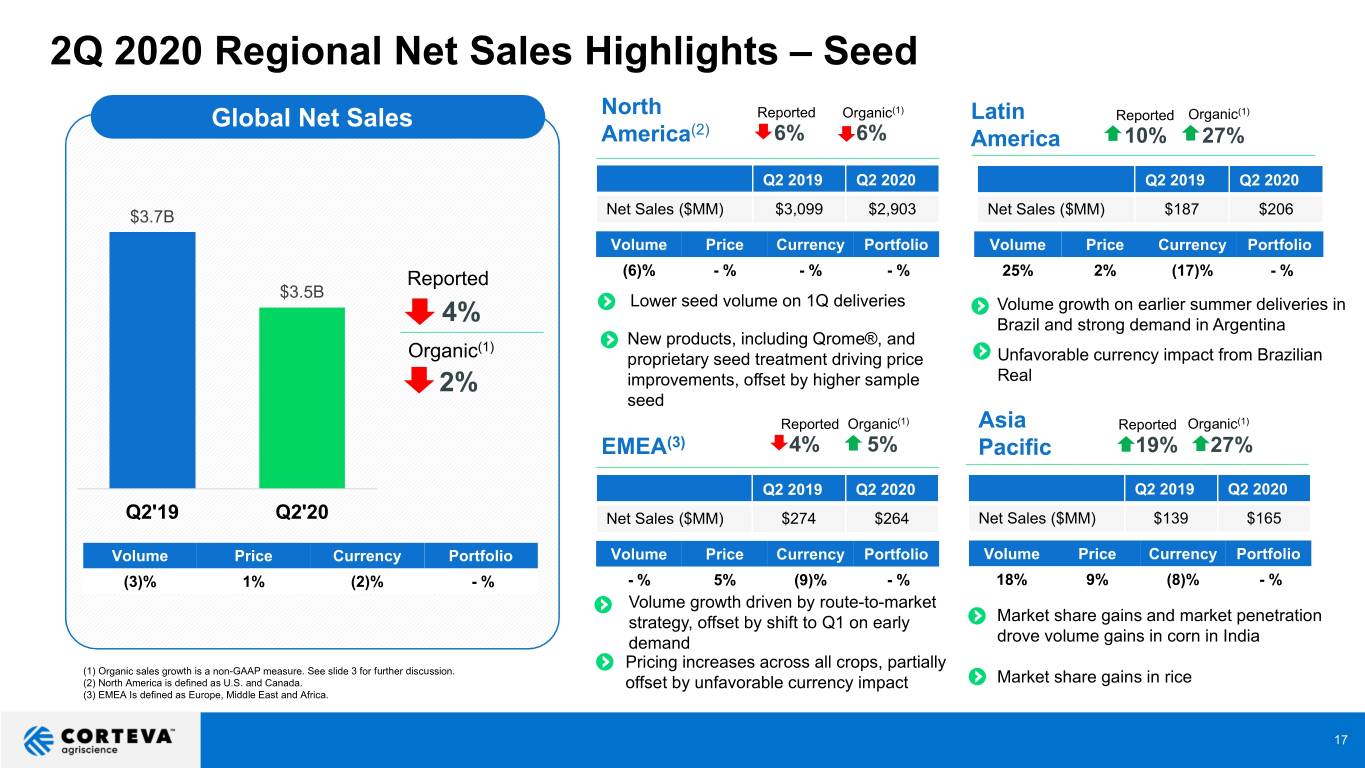

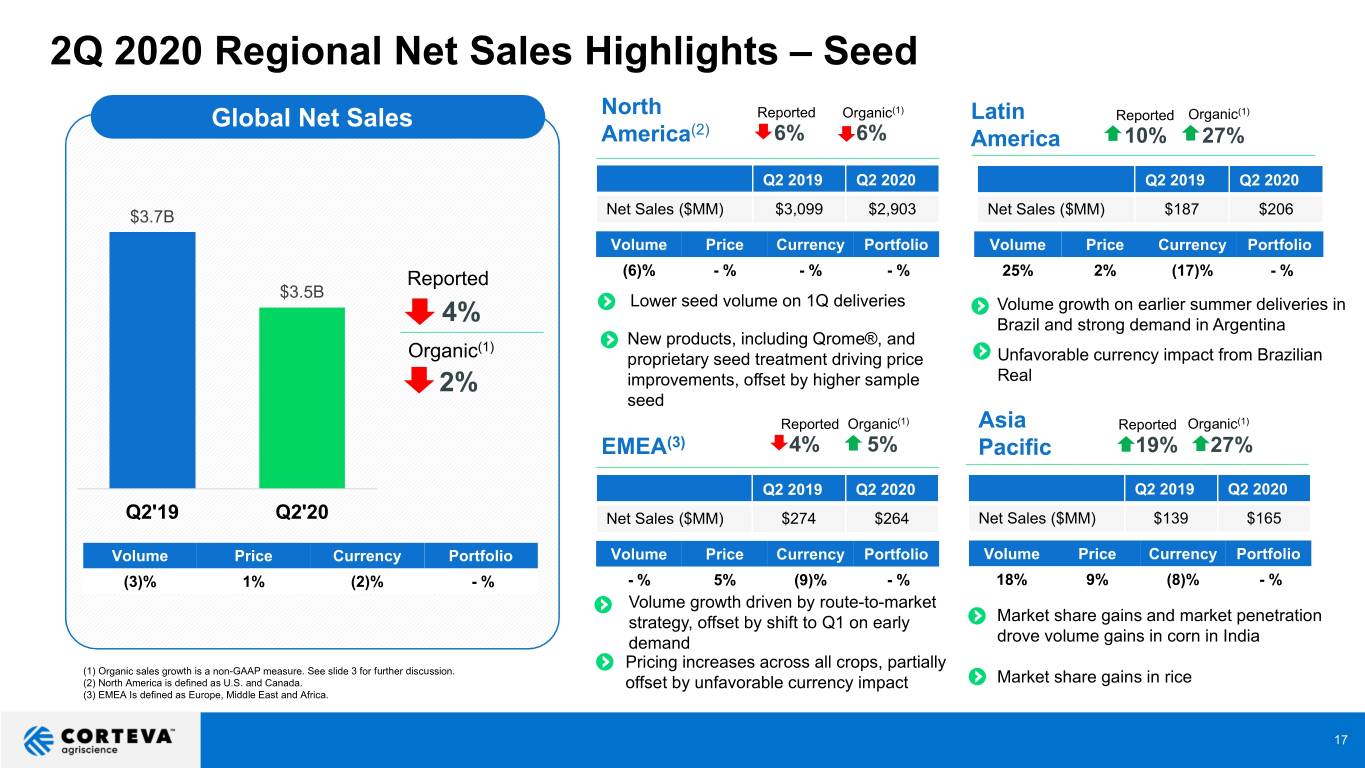

2Q 2020 Regional Net Sales Highlights – Seed North Reported Organic(1) Latin Reported Organic(1) Global Net Sales (2) America 6% 6% America 10% 27% Q2 2019 Q2 2020 Q2 2019 Q2 2020 $3.7B Net Sales ($MM) $3,099 $2,903 Net Sales ($MM) $187 $206 Volume Price Currency Portfolio Volume Price Currency Portfolio Reported (6)% - % - % - % 25% 2% (17)% - % $3.5B Lower seed volume on 1Q deliveries Volume growth on earlier summer deliveries in 4% Brazil and strong demand in Argentina (1) New products, including Qrome®, and Organic proprietary seed treatment driving price Unfavorable currency impact from Brazilian 2% improvements, offset by higher sample Real seed Reported Organic(1) Asia Reported Organic(1) EMEA(3) 4% 5% Pacific 19% 27% Q2 2019 Q2 2020 Q2 2019 Q2 2020 Q2'19 Q2'20 Net Sales ($MM) $274 $264 Net Sales ($MM) $139 $165 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio (3)% 1% (2)% - % - % 5% (9)% - % 18% 9% (8)% - % Volume growth driven by route-to-market strategy, offset by shift to Q1 on early Market share gains and market penetration demand drove volume gains in corn in India (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. Pricing increases across all crops, partially (2) North America is defined as U.S. and Canada. offset by unfavorable currency impact Market share gains in rice (3) EMEA Is defined as Europe, Middle East and Africa. 17

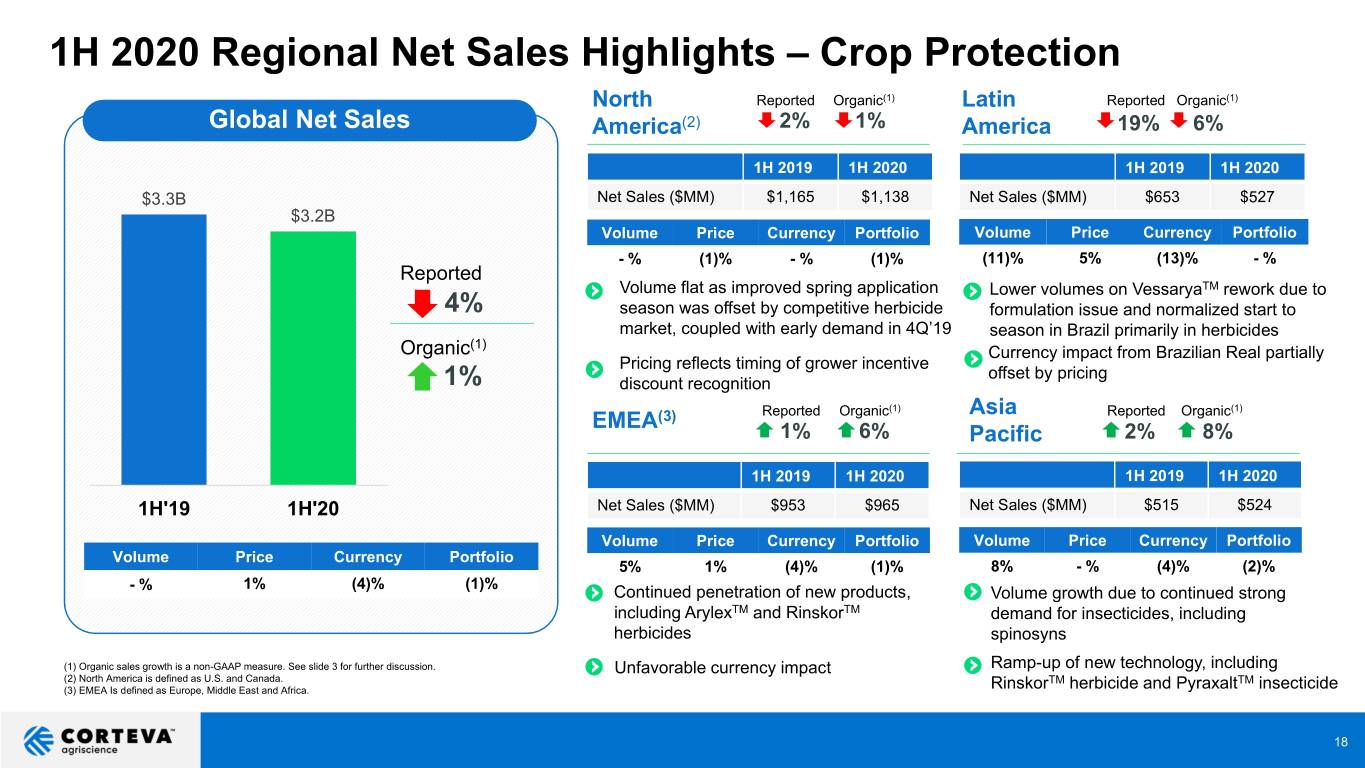

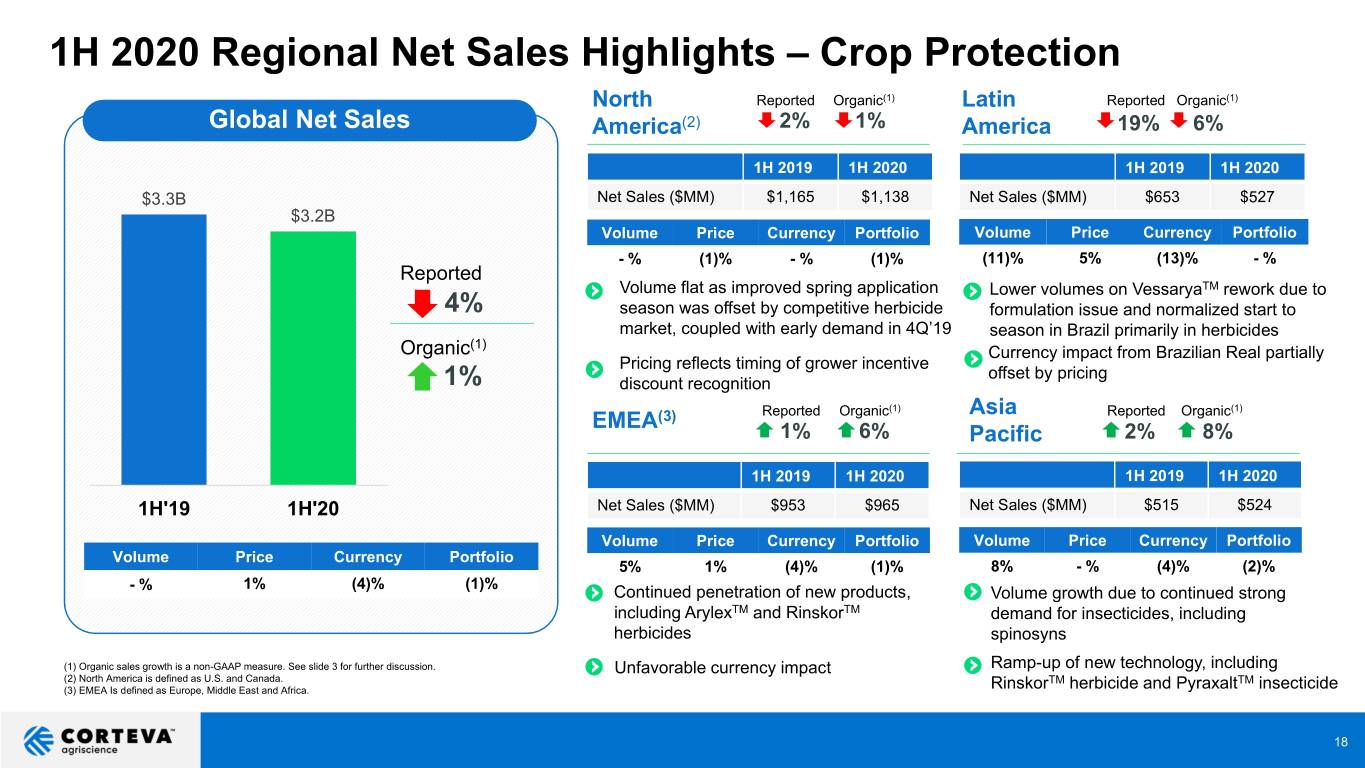

1H 2020 Regional Net Sales Highlights – Crop Protection North Reported Organic(1) Latin Reported Organic(1) Global Net Sales America(2) 2% 1% America 19% 6% 1H 2019 1H 2020 1H 2019 1H 2020 $3.3B Net Sales ($MM) $1,165 $1,138 Net Sales ($MM) $653 $527 $3.2B Volume Price Currency Portfolio Volume Price Currency Portfolio - % (1)% - % (1)% (11)% 5% (13)% - % Reported Volume flat as improved spring application Lower volumes on VessaryaTM rework due to 4% season was offset by competitive herbicide formulation issue and normalized start to market, coupled with early demand in 4Q’19 season in Brazil primarily in herbicides (1) Organic Currency impact from Brazilian Real partially Pricing reflects timing of grower incentive offset by pricing 1% discount recognition Reported Organic(1) Asia Reported Organic(1) EMEA(3) 1% 6% Pacific 2% 8% 1H 2019 1H 2020 1H 2019 1H 2020 1H'19 1H'20 Net Sales ($MM) $953 $965 Net Sales ($MM) $515 $524 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio 5% 1% (4)% (1)% 8% - % (4)% (2)% 1% (4)% (1)% - % Continued penetration of new products, Volume growth due to continued strong including ArylexTM and RinskorTM demand for insecticides, including herbicides spinosyns (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. Unfavorable currency impact Ramp-up of new technology, including (2) North America is defined as U.S. and Canada. TM TM (3) EMEA Is defined as Europe, Middle East and Africa. Rinskor herbicide and Pyraxalt insecticide 18

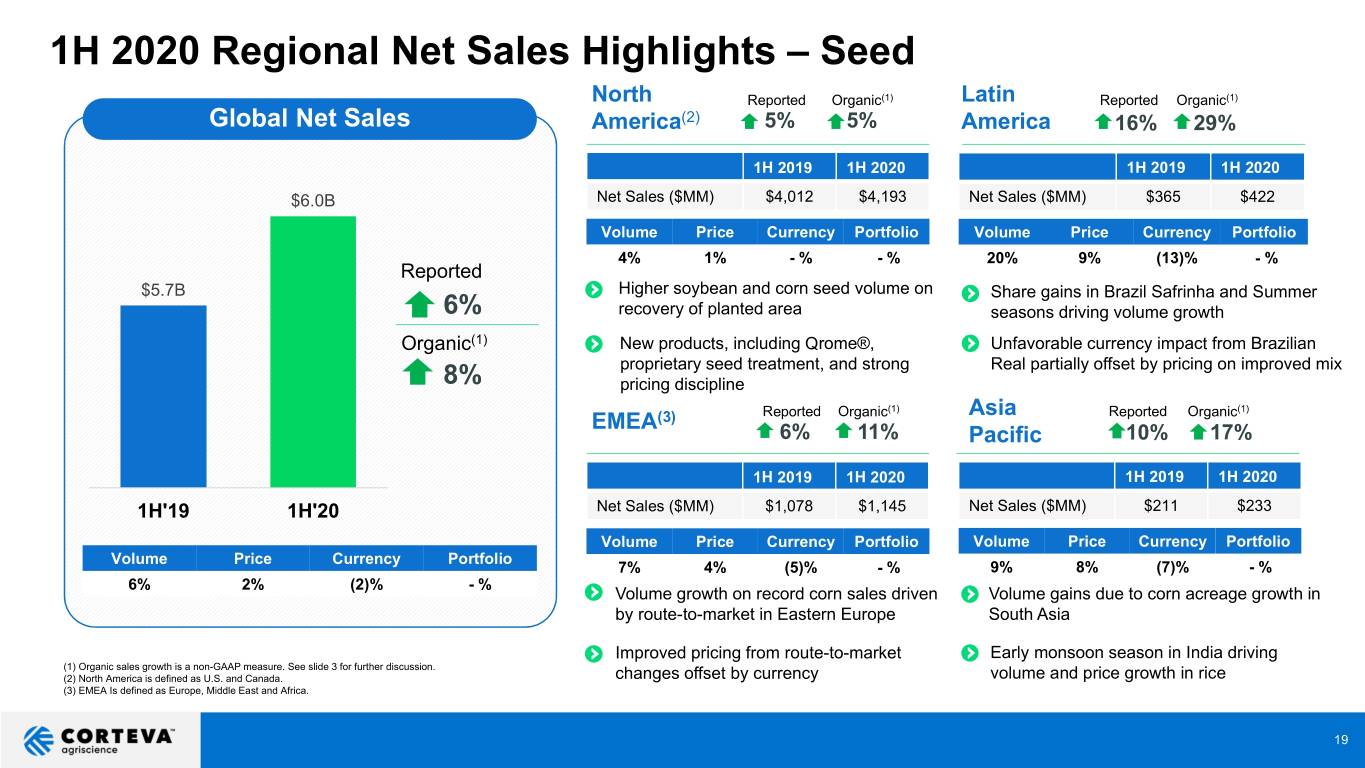

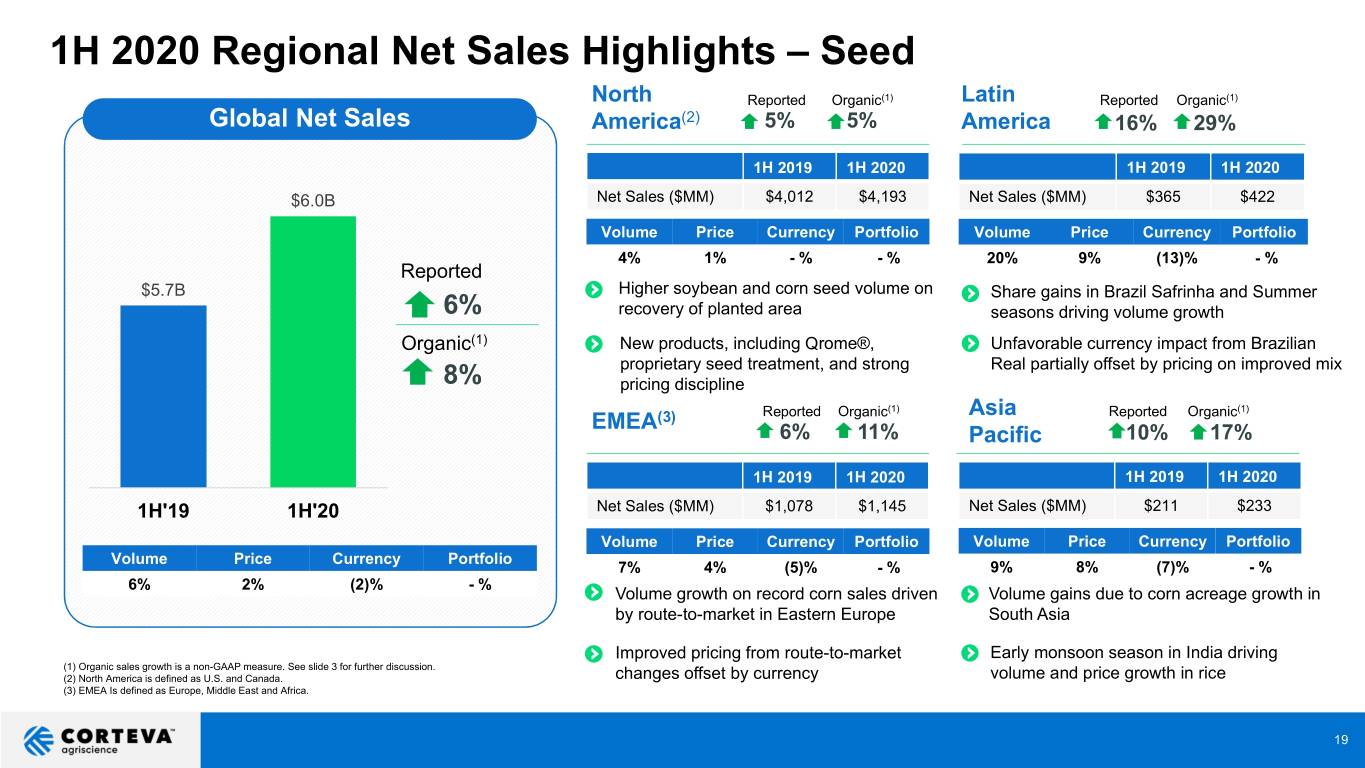

1H 2020 Regional Net Sales Highlights – Seed North Reported Organic(1) Latin Reported Organic(1) Global Net Sales America(2) 5% 5% America 16% 29% 1H 2019 1H 2020 1H 2019 1H 2020 $6.0B Net Sales ($MM) $4,012 $4,193 Net Sales ($MM) $365 $422 Volume Price Currency Portfolio Volume Price Currency Portfolio 4% 1% - % - % 20% 9% (13)% - % Reported $5.7B Higher soybean and corn seed volume on Share gains in Brazil Safrinha and Summer 6% recovery of planted area seasons driving volume growth Organic(1) New products, including Qrome®, Unfavorable currency impact from Brazilian proprietary seed treatment, and strong Real partially offset by pricing on improved mix 8% pricing discipline Reported Organic(1) Asia Reported Organic(1) EMEA(3) 6% 11% Pacific 10% 17% 1H 2019 1H 2020 1H 2019 1H 2020 1H'19 1H'20 Net Sales ($MM) $1,078 $1,145 Net Sales ($MM) $211 $233 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio 7% 4% (5)% - % 9% 8% (7)% - % 6% 2% (2)% - % Volume growth on record corn sales driven Volume gains due to corn acreage growth in by route-to-market in Eastern Europe South Asia Improved pricing from route-to-market Early monsoon season in India driving (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. (2) North America is defined as U.S. and Canada. changes offset by currency volume and price growth in rice (3) EMEA Is defined as Europe, Middle East and Africa. 19

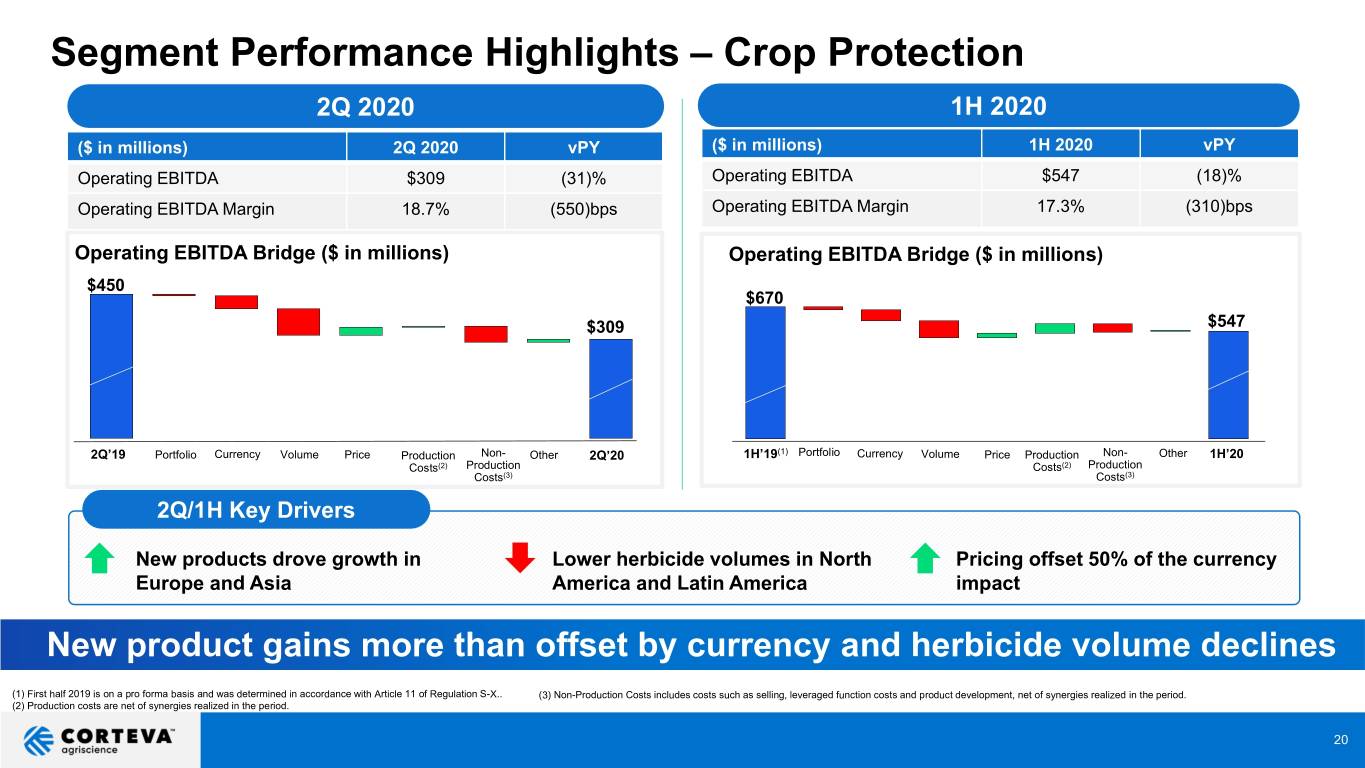

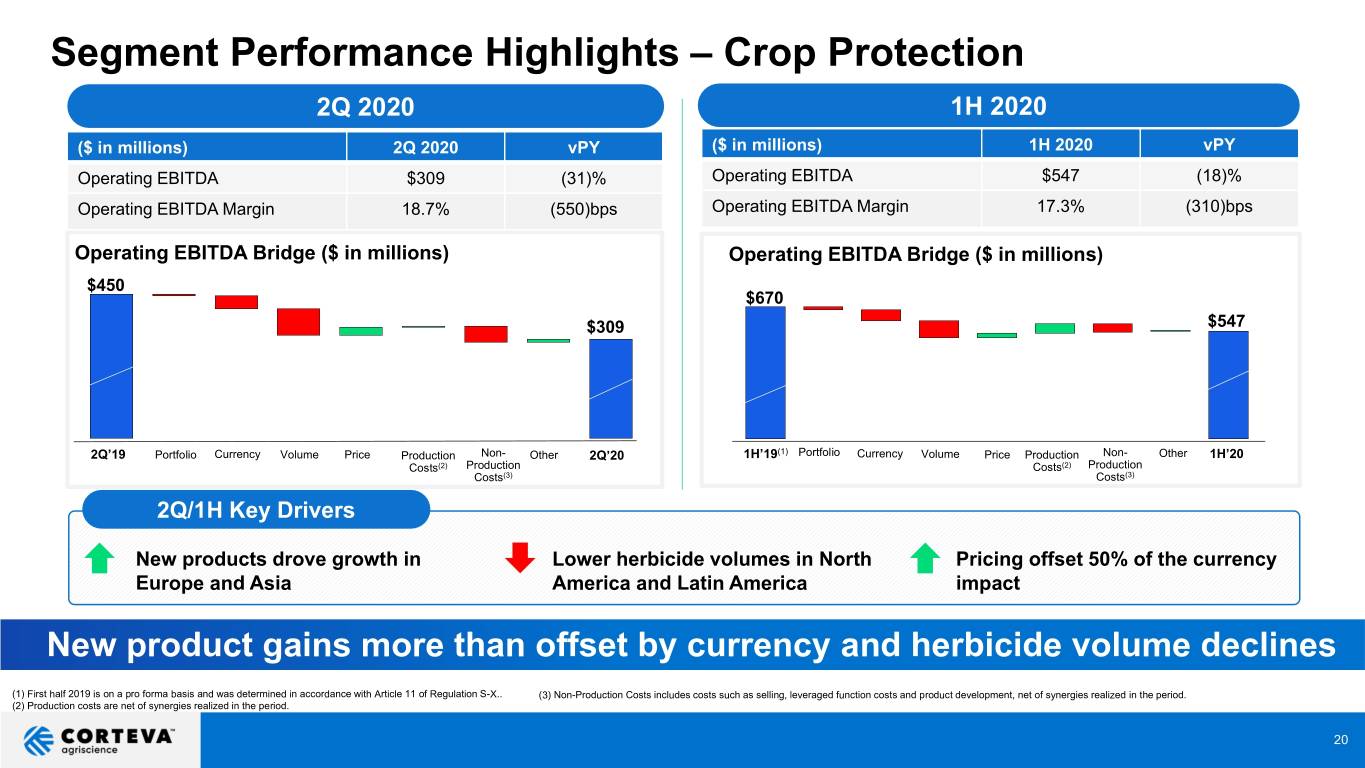

Segment Performance Highlights – Crop Protection 2Q 2020 1H 2020 ($ in millions) 2Q 2020 vPY ($ in millions) 1H 2020 vPY Operating EBITDA $309 (31)% Operating EBITDA $547 (18)% Operating EBITDA Margin 18.7% (550)bps Operating EBITDA Margin 17.3% (310)bps Operating EBITDA Bridge ($ in millions) Operating EBITDA Bridge ($ in millions) $450 $670 $309 $547 2Q’19 Portfolio Currency Volume Price Production Non- Other 2Q’20 1H’19(1) Portfolio Currency Volume Price Production Non- Other 1H’20 Costs(2) Production Costs(2) Production Costs(3) Costs(3) 2Q/1H Key Drivers New products drove growth in Lower herbicide volumes in North Pricing offset 50% of the currency Europe and Asia America and Latin America impact New product gains more than offset by currency and herbicide volume declines (1) First half 2019 is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.. (3) Non-Production Costs includes costs such as selling, leveraged function costs and product development, net of synergies realized in the period. (2) Production costs are net of synergies realized in the period. 20

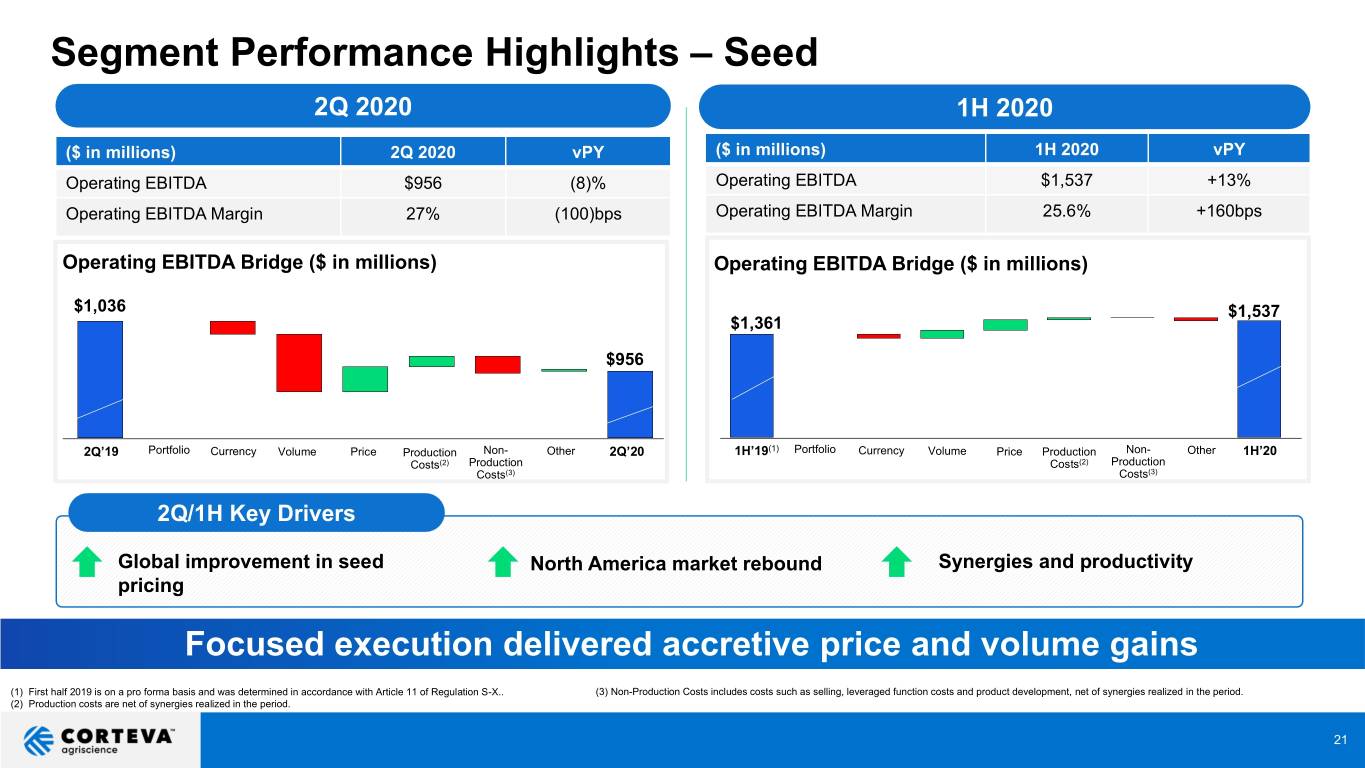

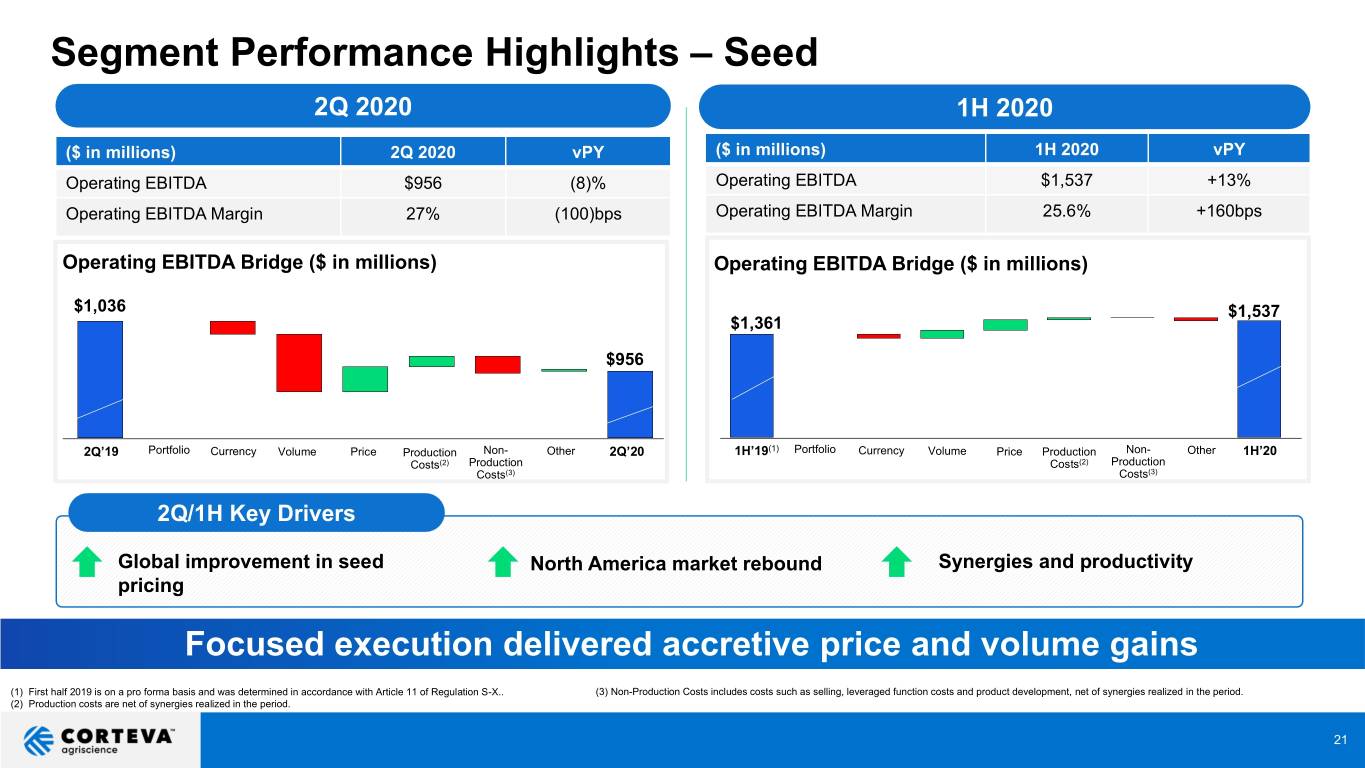

Segment Performance Highlights – Seed 2Q 2020 1H 2020 ($ in millions) 2Q 2020 vPY ($ in millions) 1H 2020 vPY Operating EBITDA $956 (8)% Operating EBITDA $1,537 +13% Operating EBITDA Margin 27% (100)bps Operating EBITDA Margin 25.6% +160bps Operating EBITDA Bridge ($ in millions) Operating EBITDA Bridge ($ in millions) $1,036 $1,537 $1,361 $956 2Q’19 Portfolio Currency Volume Price Production Non- Other 2Q’20 1H’19(1) Portfolio Currency Volume Price Production Non- Other 1H’20 Costs(2) Production Costs(2) Production Costs(3) Costs(3) 2Q/1H Key Drivers Global improvement in seed North America market rebound Synergies and productivity pricing Focused execution delivered accretive price and volume gains (1) First half 2019 is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X.. (3) Non-Production Costs includes costs such as selling, leveraged function costs and product development, net of synergies realized in the period. (2) Production costs are net of synergies realized in the period. 21

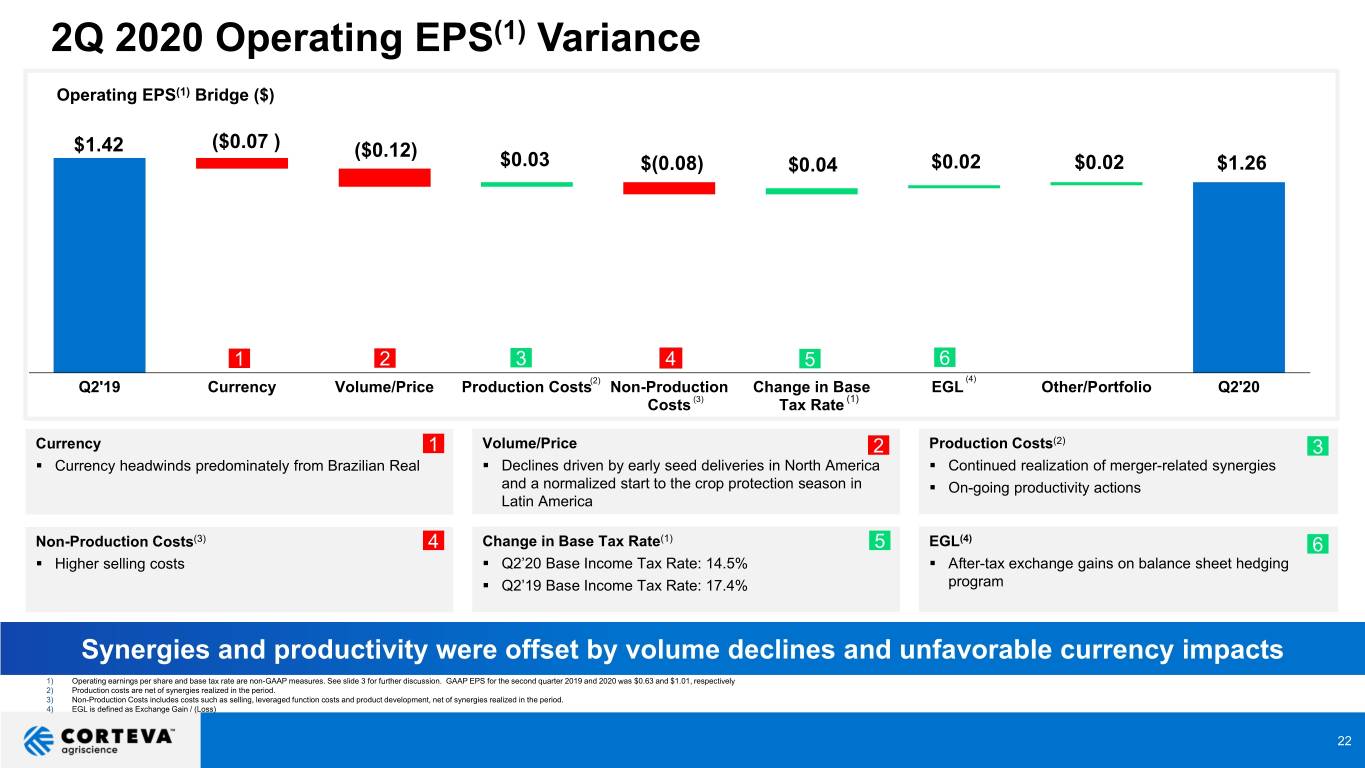

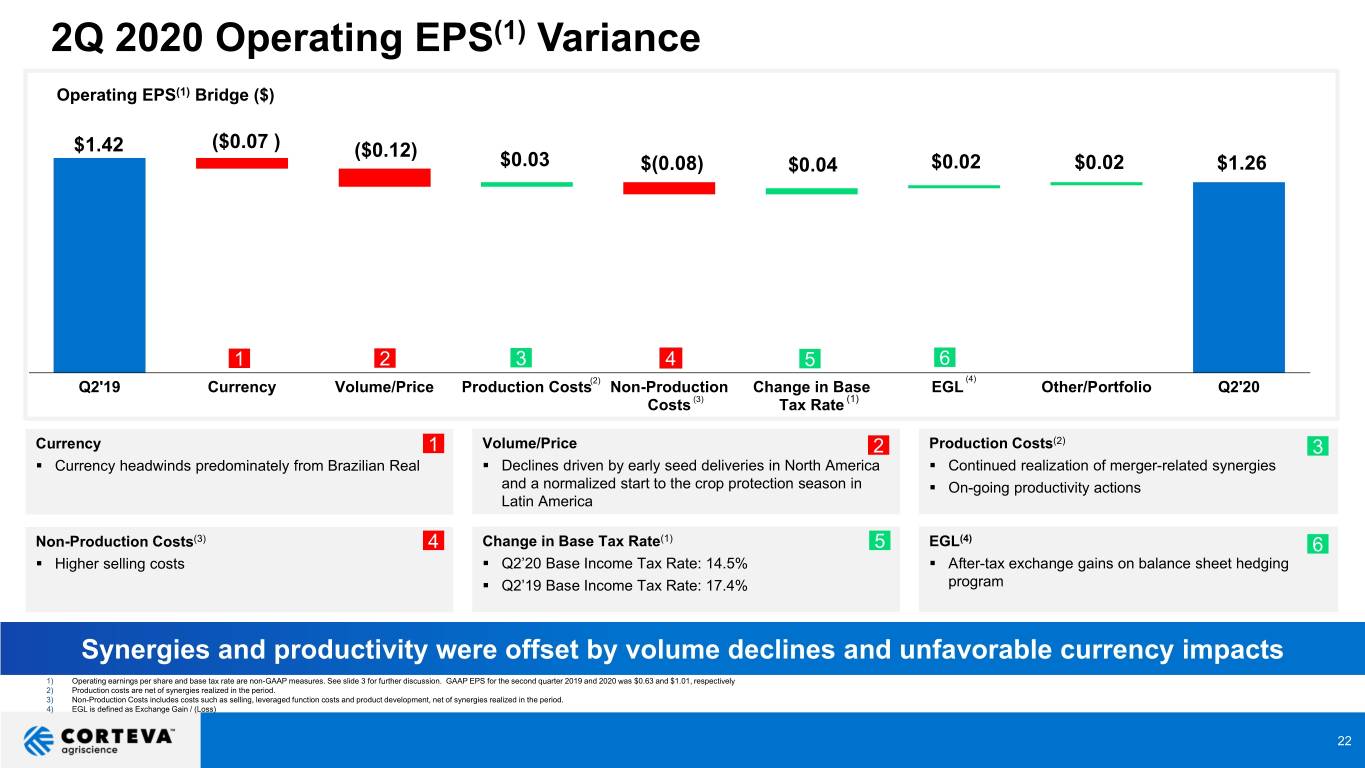

2Q 2020 Operating EPS(1) Variance Operating EPS(1) Bridge ($) $1.42 ($0.07 ) ($0.12) $0.03 $(0.08) $0.04 $0.02 $0.02 $1.26 1 2 3 4 5 6 (2) (4) Q2'19 Currency Volume/Price Production Costs Non-Production Change in Base EGL Other/Portfolio Q2'20 (3) (1) Costs Tax Rate Currency 1 Volume/Price 2 Production Costs(2) 3 . Currency headwinds predominately from Brazilian Real . Declines driven by early seed deliveries in North America . Continued realization of merger-related synergies and a normalized start to the crop protection season in . On-going productivity actions Latin America Non-Production Costs(3) 4 Change in Base Tax Rate(1) 5 EGL(4) 6 . Higher selling costs . Q2’20 Base Income Tax Rate: 14.5% . After-tax exchange gains on balance sheet hedging . Q2’19 Base Income Tax Rate: 17.4% program Synergies and productivity were offset by volume declines and unfavorable currency impacts 1) Operating earnings per share and base tax rate are non-GAAP measures. See slide 3 for further discussion. GAAP EPS for the second quarter 2019 and 2020 was $0.63 and $1.01, respectively 2) Production costs are net of synergies realized in the period. 3) Non-Production Costs includes costs such as selling, leveraged function costs and product development, net of synergies realized in the period. 4) EGL is defined as Exchange Gain / (Loss) 22

1H 2020 Regional Net Sales Highlights North America(1) Europe, Middle Latin America Asia Pacific East, Africa Net Sales $5.33B $5.18B $2.11B Reported Reported $1.02B Reported Reported 3% 4% 7% $0.73B $0.76B 4% $2.03B Organic(2) Organic (2) $0.95B Organic (2) Organic (2) 3% 8% 7% 10% 1H'19 1H'20 1H'19 1H'20 1H'19 1H'20 1H'19 1H'20 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio 3% - % - % - % 6% 2% (4)% - % - % 7% (14)% - % 8% 2% (5)% (1)% Regional Highlights Seed growth Above market growth Currency volatility New product demand Favorable pricing in corn and soybeans New route to market in Russia and Share gains in Brazil safrinha and Double digit organic growth on on improved mix led by Qrome® corn Ukraine drove volume and price summer seasons driving seed volume volume and price improvements seed growth in Seed growth Pricing improvement from seed Strong demand for corn in South Asia Recovery in corn and soybean planted Strong demand for new products and rice in Philippines area with strong early start such as ArylexTM herbicide technology mix offset by unfavorable currency impact from Brazilian Real Insecticide growth led by Competitive pressures in herbicides Spinosyns and PyraxaltTM pressured Crop Protection volume Headwinds as a result of impact Prior year seasonal shift from 3Q’19 to and price from phase out of regulatory 2Q’19 impacting 1H’19 sales by challenged products suppressing $80 million coupled with higher product 1) North America is defined as U.S. and Canada. 2) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. growth returns 23

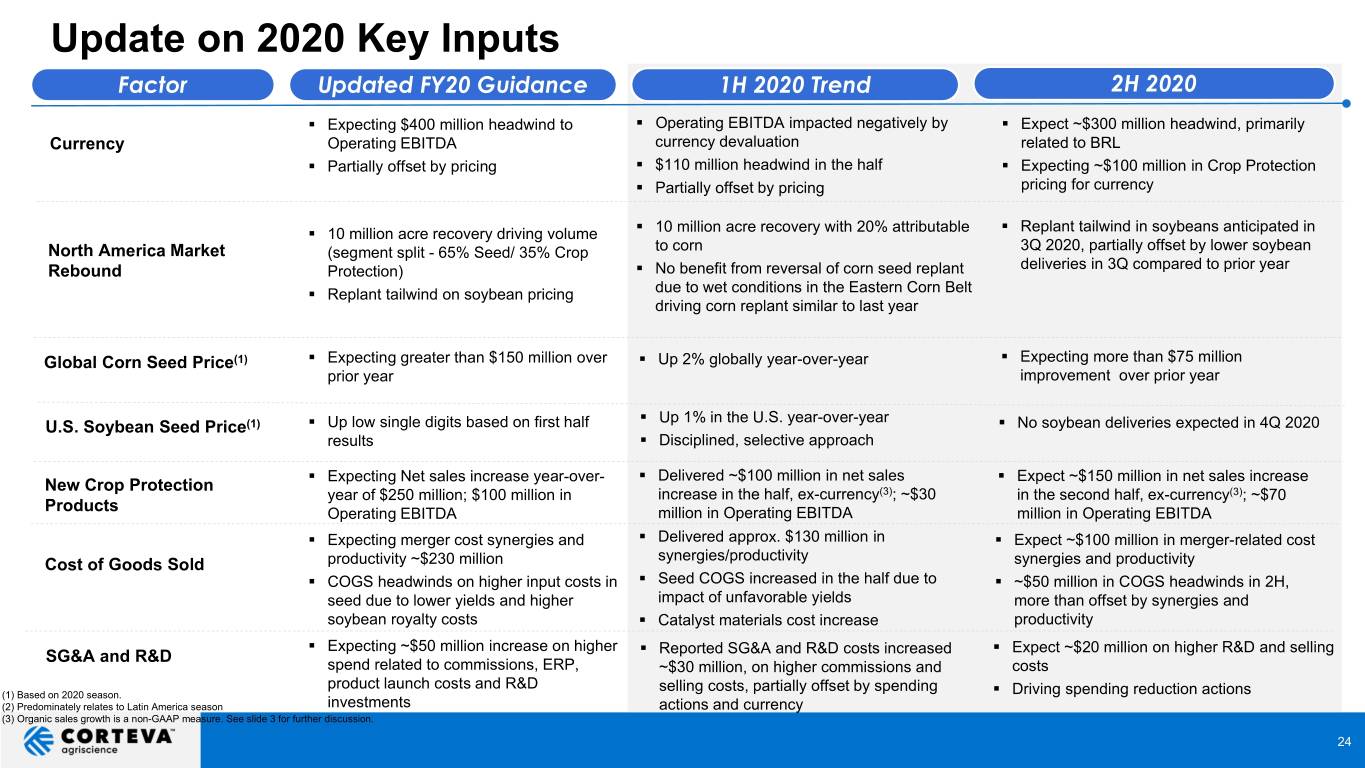

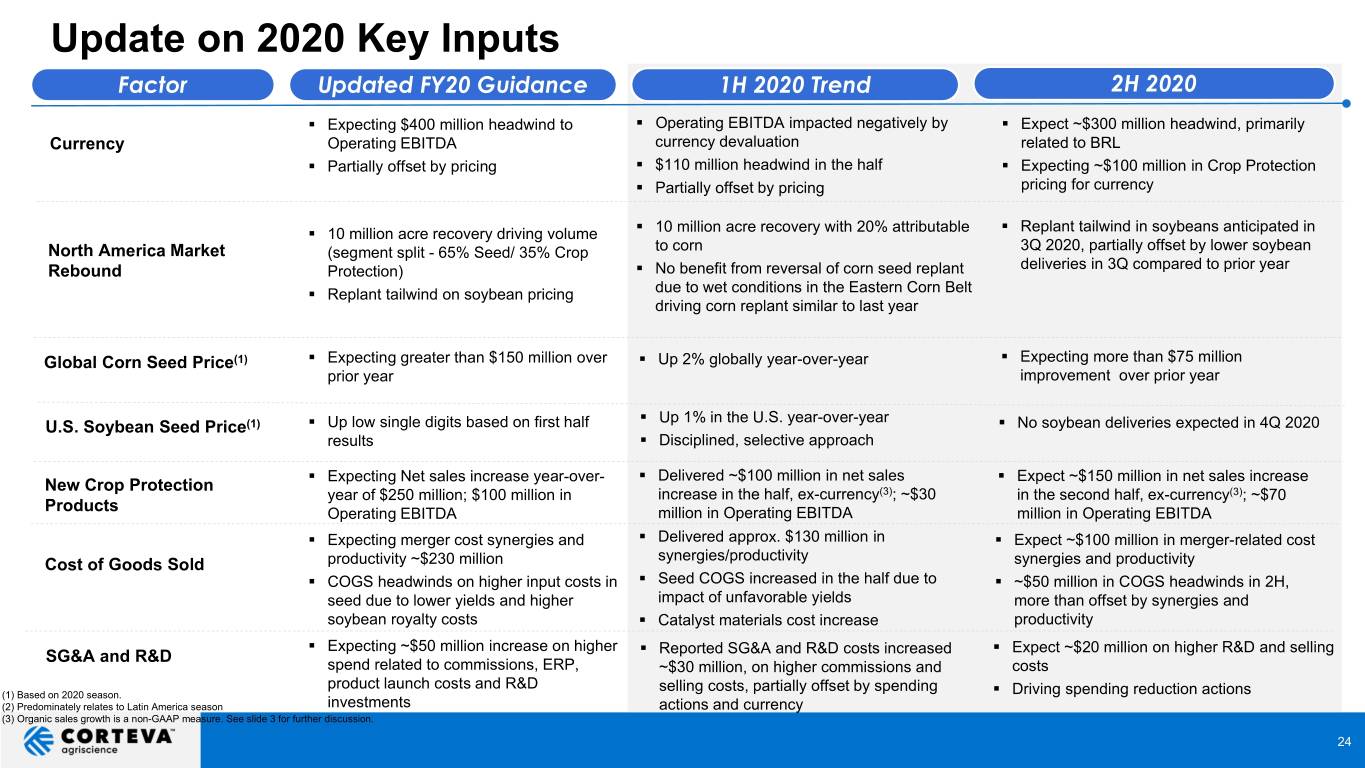

Update on 2020 Key Inputs Factor Updated FY20 Guidance 1H 2020 Trend 2H 2020 . Expecting $400 million headwind to . Operating EBITDA impacted negatively by . Expect ~$300 million headwind, primarily Currency Operating EBITDA currency devaluation related to BRL . Partially offset by pricing . $110 million headwind in the half . Expecting ~$100 million in Crop Protection . Partially offset by pricing pricing for currency . . . 10 million acre recovery driving volume 10 million acre recovery with 20% attributable Replant tailwind in soybeans anticipated in North America Market (segment split - 65% Seed/ 35% Crop to corn 3Q 2020, partially offset by lower soybean Rebound Protection) . No benefit from reversal of corn seed replant deliveries in 3Q compared to prior year . Replant tailwind on soybean pricing due to wet conditions in the Eastern Corn Belt driving corn replant similar to last year . Global Corn Seed Price(1) . Expecting greater than $150 million over . Up 2% globally year-over-year Expecting more than $75 million prior year improvement over prior year . Up 1% in the U.S. year-over-year U.S. Soybean Seed Price(1) . Up low single digits based on first half . No soybean deliveries expected in 4Q 2020 results . Disciplined, selective approach . Expecting Net sales increase year-over- . Delivered ~$100 million in net sales . Expect ~$150 million in net sales increase New Crop Protection year of $250 million; $100 million in increase in the half, ex-currency(3); ~$30 in the second half, ex-currency(3); ~$70 Products Operating EBITDA million in Operating EBITDA million in Operating EBITDA . Expecting merger cost synergies and . Delivered approx. $130 million in . Expect ~$100 million in merger-related cost synergies/productivity Cost of Goods Sold productivity ~$230 million synergies and productivity . COGS headwinds on higher input costs in . Seed COGS increased in the half due to . ~$50 million in COGS headwinds in 2H, seed due to lower yields and higher impact of unfavorable yields more than offset by synergies and soybean royalty costs . Catalyst materials cost increase productivity . Expecting ~$50 million increase on higher . Reported SG&A and R&D costs increased . Expect ~$20 million on higher R&D and selling SG&A and R&D spend related to commissions, ERP, ~$30 million, on higher commissions and costs product launch costs and R&D selling costs, partially offset by spending (1) Based on 2020 season. . Driving spending reduction actions (2) Predominately relates to Latin America season investments actions and currency (3) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. 24

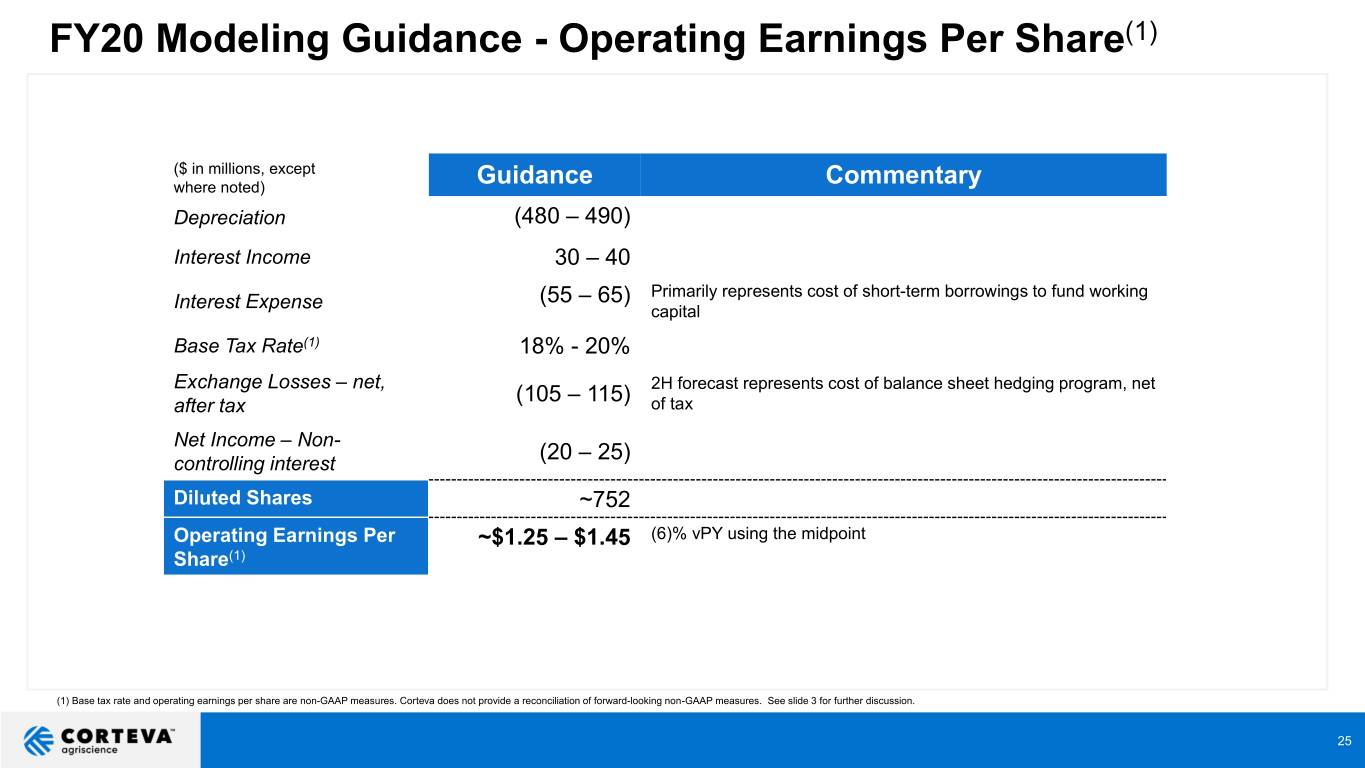

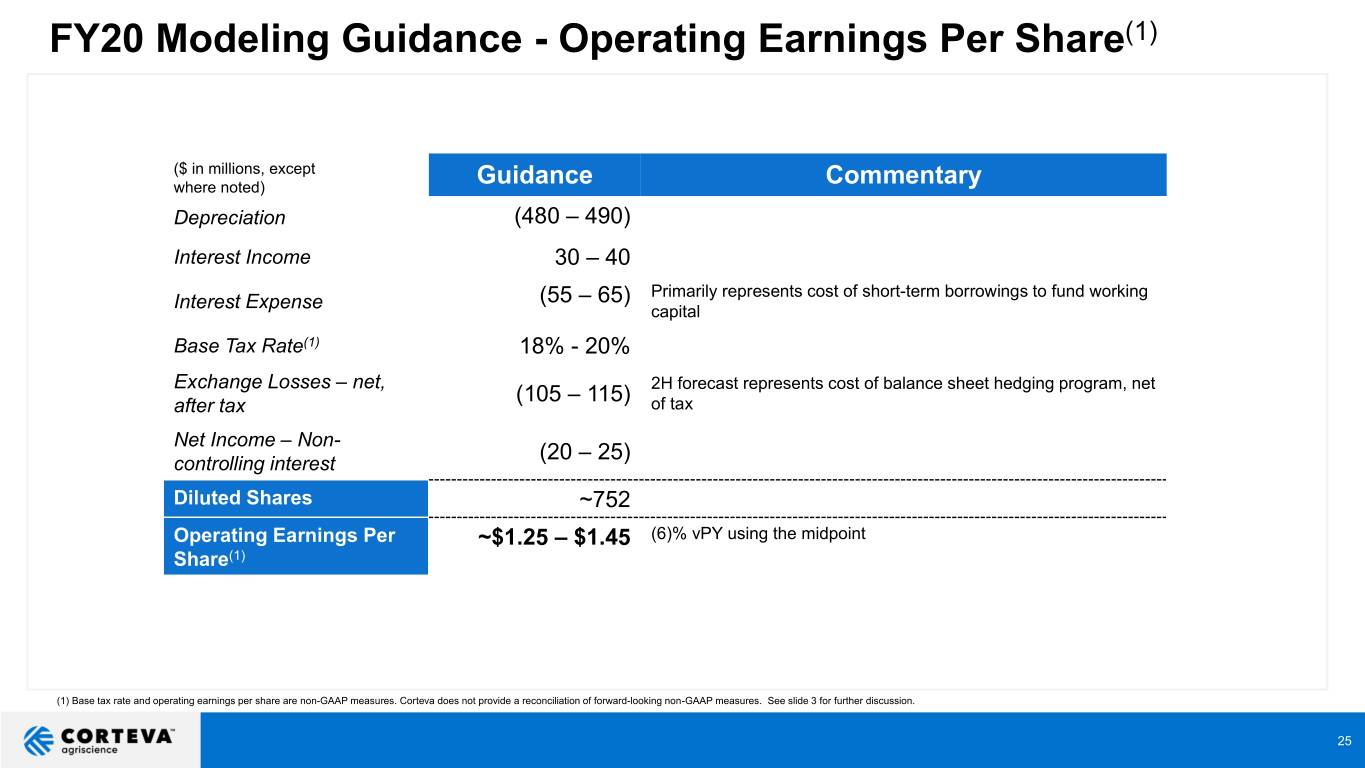

FY20 Modeling Guidance - Operating Earnings Per Share(1) ($ in millions, except where noted) Guidance Commentary Depreciation (480 – 490) Interest Income 30 – 40 (55 – 65) Primarily represents cost of short-term borrowings to fund working Interest Expense capital Base Tax Rate(1) 18% - 20% Exchange Losses – net, 2H forecast represents cost of balance sheet hedging program, net (105 – 115) after tax of tax Net Income – Non- (20 – 25) controlling interest Diluted Shares ~752 Operating Earnings Per ~$1.25 – $1.45 (6)% vPY using the midpoint Share(1) (1) Base tax rate and operating earnings per share are non-GAAP measures. Corteva does not provide a reconciliation of forward-looking non-GAAP measures. See slide 3 for further discussion. 25

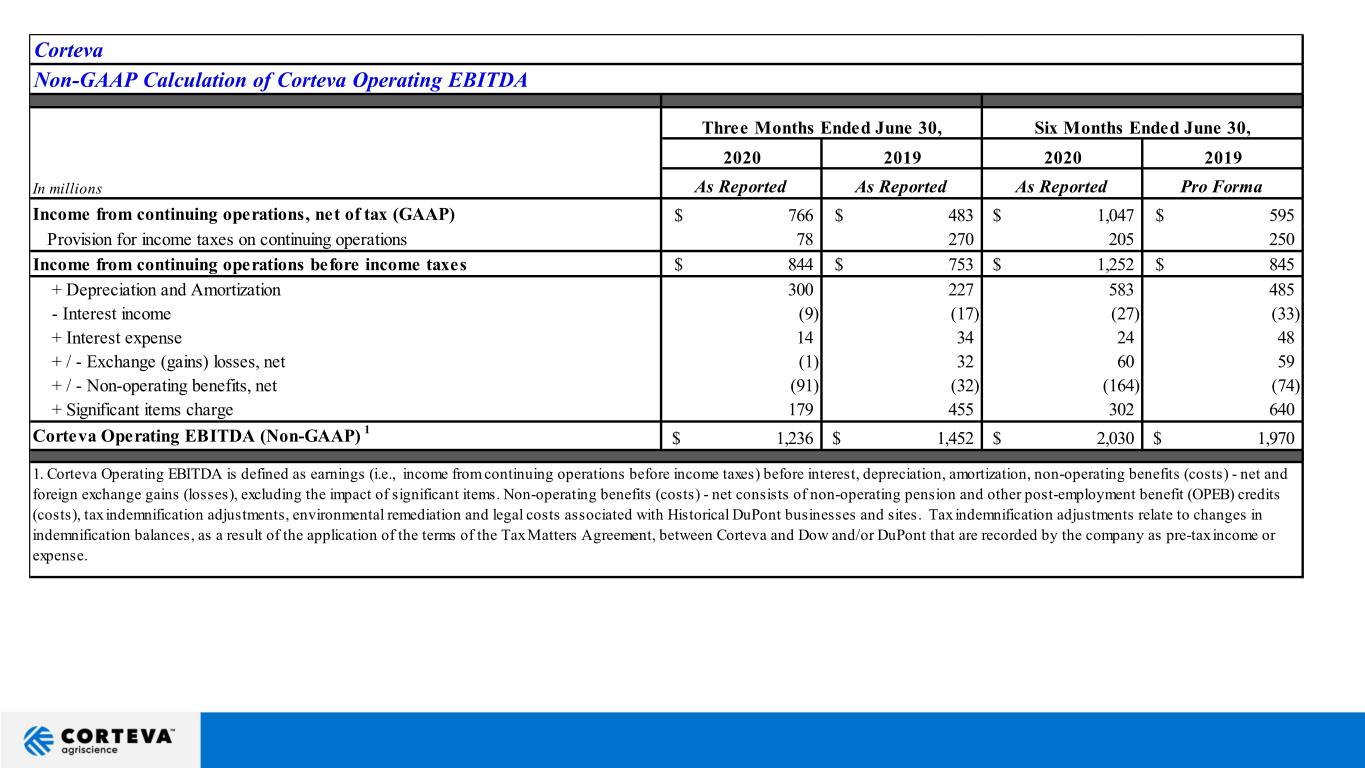

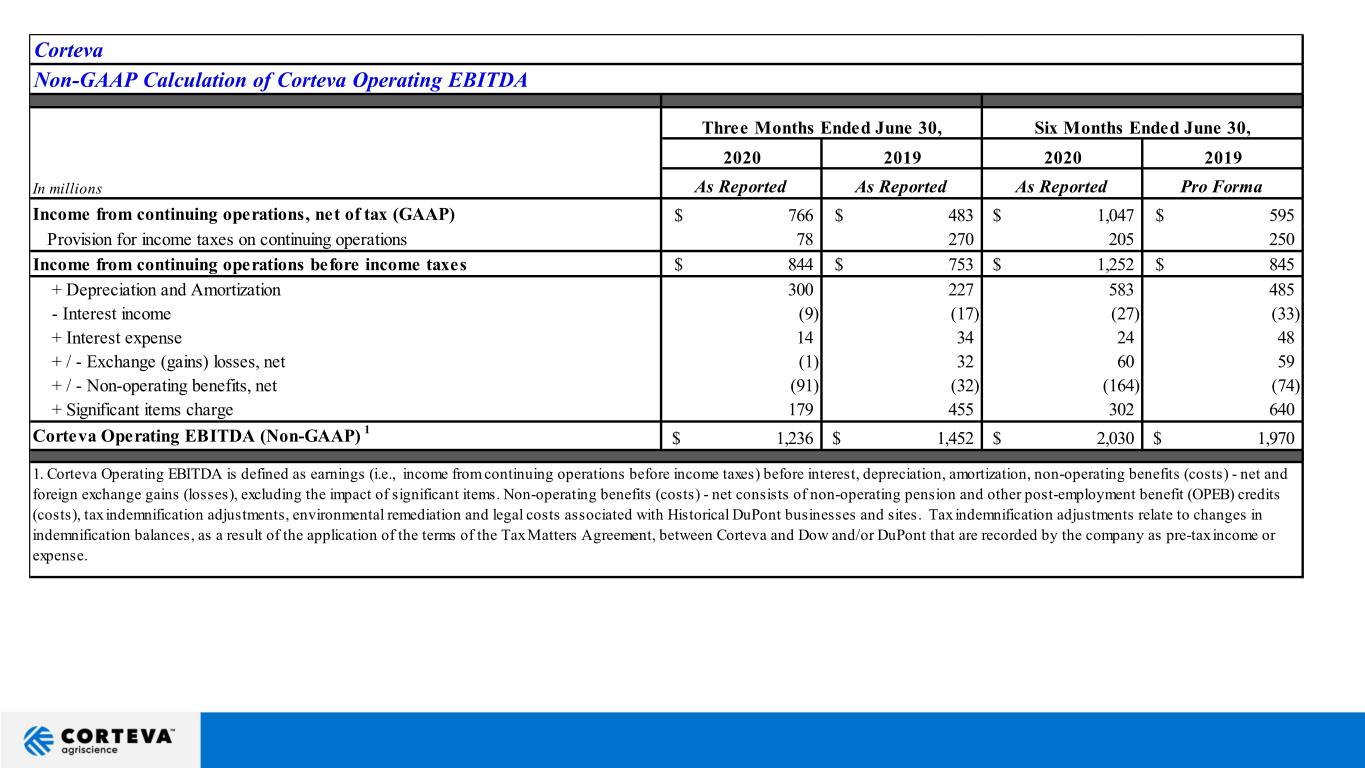

Corteva Non-GAAP Calculation of Corteva Operating EBITDA Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 In millions As Reported As Reported As Reported Pro Forma Income from continuing operations, net of tax (GAAP) $ 766 $ 483 $ 1,047 $ 595 Provision for income taxes on continuing operations 78 270 205 250 Income from continuing operations before income taxes $ 844 $ 753 $ 1,252 $ 845 + Depreciation and Amortization 300 227 583 485 - Interest income (9) (17) (27) (33) + Interest expense 14 34 24 48 + / - Exchange (gains) losses, net (1) 32 60 59 + / - Non-operating benefits, net (91) (32) (164) (74) + Significant items charge 179 455 302 640 1 Corteva Operating EBITDA (Non-GAAP) $ 1,236 $ 1,452 $ 2,030 $ 1,970 1. Corteva Operating EBITDA is defined as earnings (i.e., income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits (costs) - net and foreign exchange gains (losses), excluding the impact of significant items. Non-operating benefits (costs) - net consists of non-operating pension and other post-employment benefit (OPEB) credits (costs), tax indemnification adjustments, environmental remediation and legal costs associated with Historical DuPont businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense.

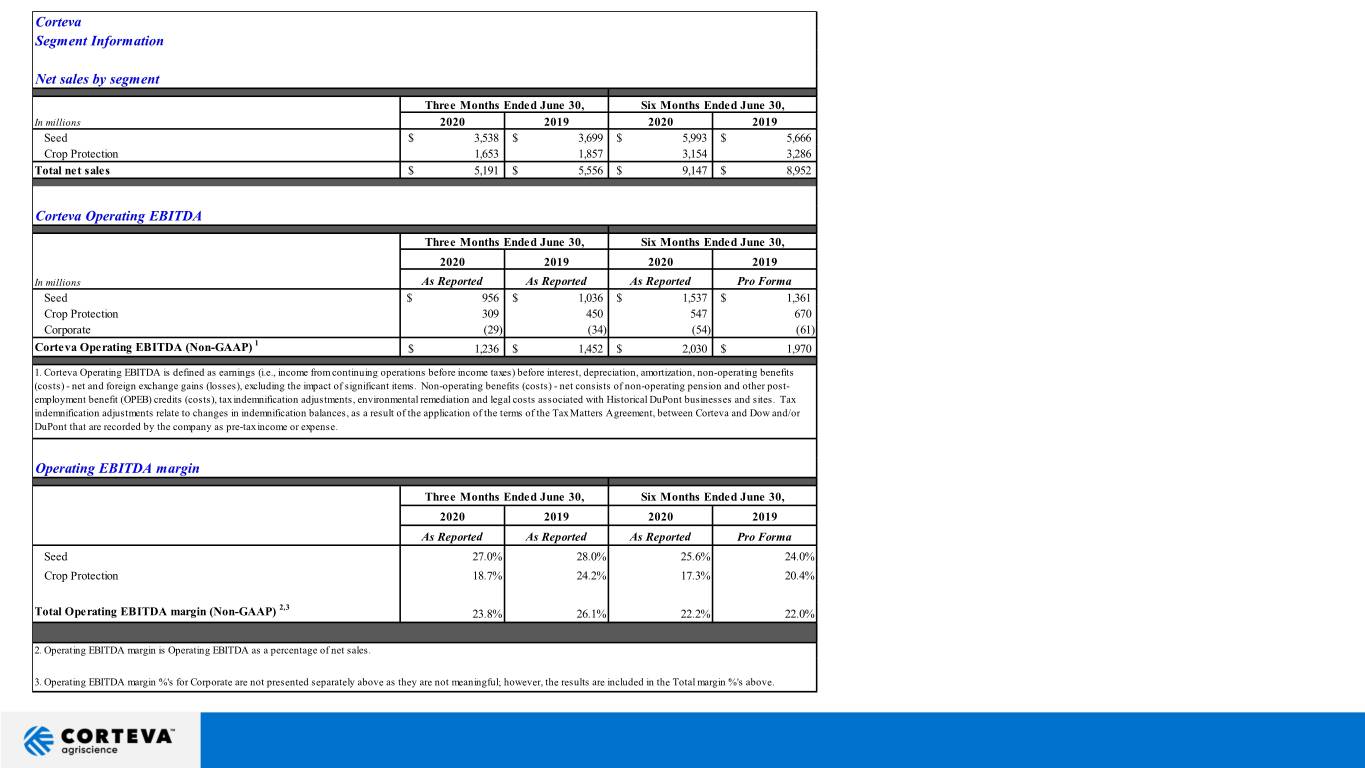

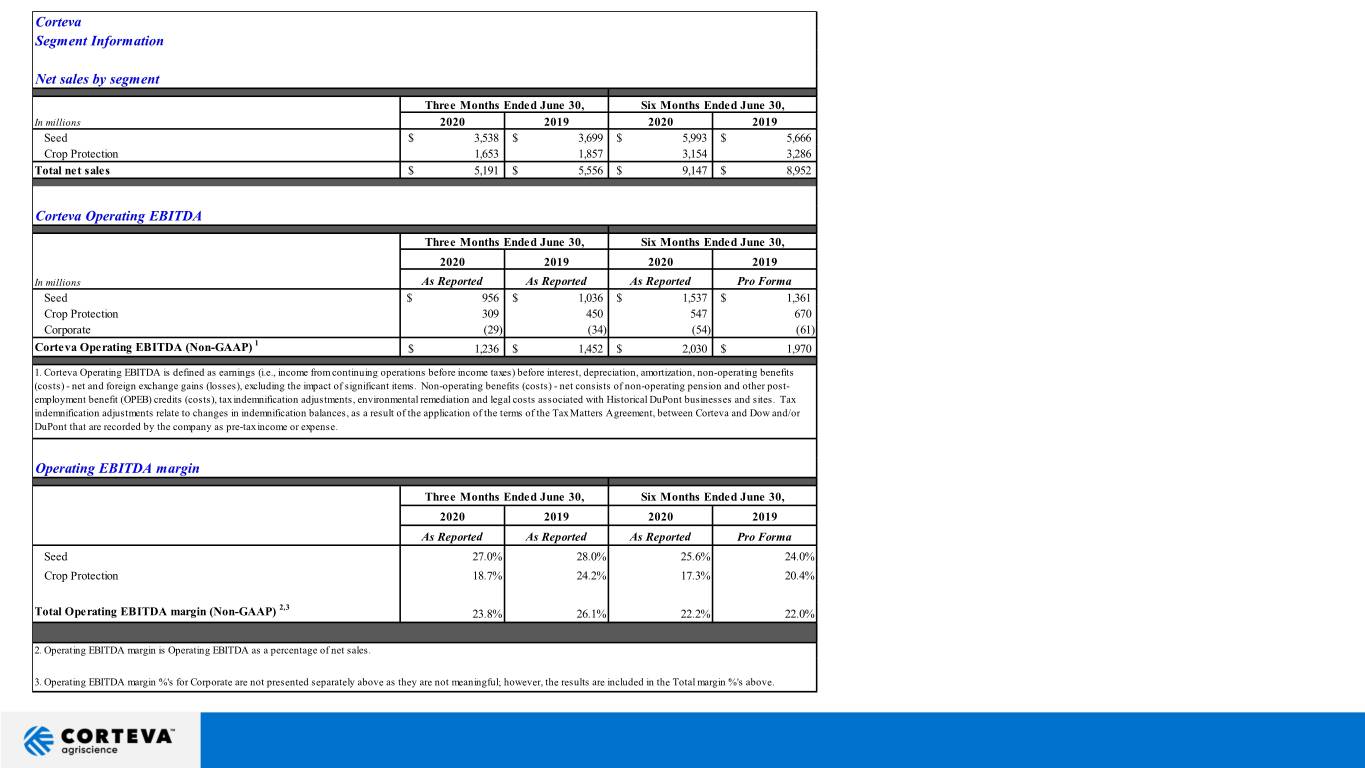

Corteva Segment Information Net sales by segment Three Months Ended June 30, Six Months Ended June 30, In millions 2020 2019 2020 2019 Seed $ 3,538 $ 3,699 $ 5,993 $ 5,666 Crop Protection 1,653 1,857 3,154 3,286 Total net sales $ 5,191 $ 5,556 $ 9,147 $ 8,952 Corteva Operating EBITDA Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 In millions As Reported As Reported As Reported Pro Forma Seed $ 956 $ 1,036 $ 1,537 $ 1,361 Crop Protection 309 450 547 670 Corporate (29) (34) (54) (61) 1 Corteva Operating EBITDA (Non-GAAP) $ 1,236 $ 1,452 $ 2,030 $ 1,970 1. Corteva Operating EBITDA is defined as earnings (i.e., income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits (costs) - net and foreign exchange gains (losses), excluding the impact of significant items. Non-operating benefits (costs) - net consists of non-operating pension and other post- employment benefit (OPEB) credits (costs), tax indemnification adjustments, environmental remediation and legal costs associated with Historical DuPont businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense. Operating EBITDA margin Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 As Reported As Reported As Reported Pro Forma Seed 27.0% 28.0% 25.6% 24.0% Crop Protection 18.7% 24.2% 17.3% 20.4% 2,3 Total Operating EBITDA margin (Non-GAAP) 23.8% 26.1% 22.2% 22.0% 2. Operating EBITDA margin is Operating EBITDA as a percentage of net sales. 3. Operating EBITDA margin %'s for Corporate are not presented separately above as they are not meaningful; however, the results are included in the Total margin %'s above.

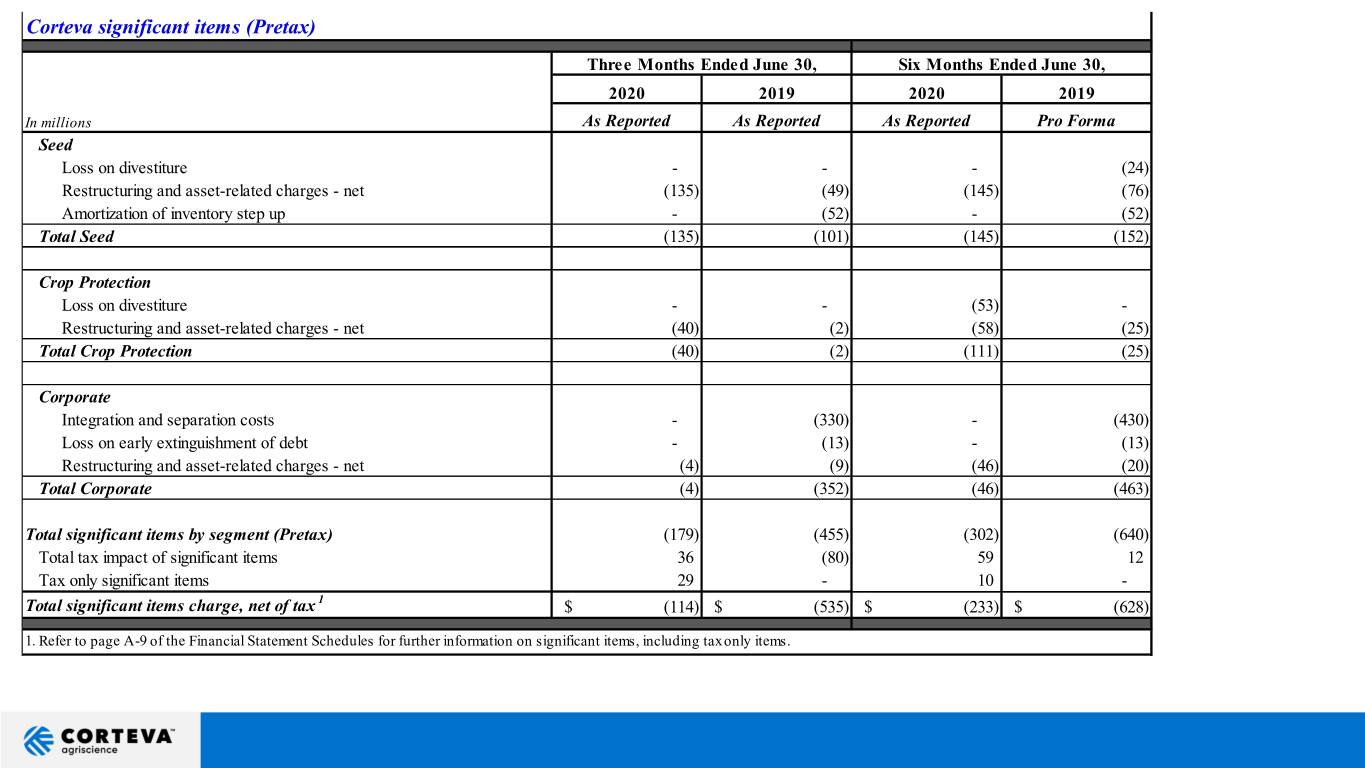

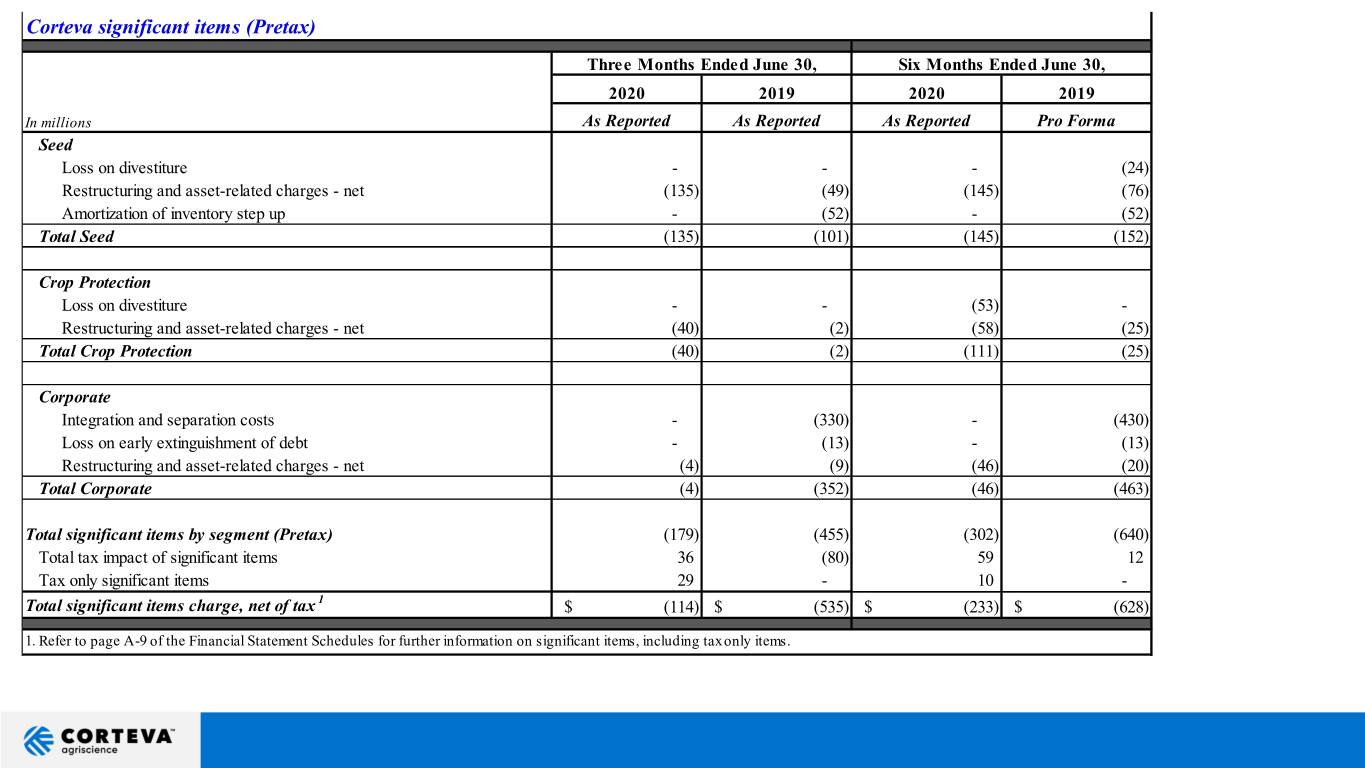

Corteva significant items (Pretax) Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 In millions As Reported As Reported As Reported Pro Forma Seed Loss on divestiture - - - (24) Restructuring and asset-related charges - net (135) (49) (145) (76) Amortization of inventory step up - (52) - (52) Total Seed (135) (101) (145) (152) Crop Protection Loss on divestiture - - (53) - Restructuring and asset-related charges - net (40) (2) (58) (25) Total Crop Protection (40) (2) (111) (25) Corporate Integration and separation costs - (330) - (430) Loss on early extinguishment of debt - (13) - (13) Restructuring and asset-related charges - net (4) (9) (46) (20) Total Corporate (4) (352) (46) (463) Total significant items by segment (Pretax) (179) (455) (302) (640) Total tax impact of significant items 36 (80) 59 12 Tax only significant items 29 - 10 - Total significant items charge, net of tax 1 $ (114) $ (535) $ (233) $ (628) 1. Refer to page A-9 of the Financial Statement Schedules for further information on significant items, including tax only items.

Corteva Segment Information - Price, Volume Currency Analysis Region Q2 2020 vs. Q2 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Curre ncy Portfolio / Other North Ame rica1 $ (219) -6% $ (201) -5% 0% -5% -1% 0% EMEA1 (24) -4% 19 3% 3% 0% -7% 0% Latin America (138) -21% (44) -7% 4% -11% -14% 0% Asia Pacific 16 4% 46 10% 2% 8% -5% -1% Rest of World (146) -8% 21 1% 3% -2% -9% 0% Total $ (365) -7% $ (180) -3% 1% -4% -3% -1% Seed Q2 2020 vs. Q2 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Curre ncy Portfolio / Other North Ame rica1 $ (196) -6% $ (185) -6% 0% -6% 0% 0% EMEA1 (10) -4% 14 5% 5% 0% -9% 0% Latin America 19 10% 51 27% 2% 25% -17% 0% Asia Pacific 26 19% 37 27% 9% 18% -8% 0% Rest of World 35 6% 102 17% 5% 12% -11% 0% Total $ (161) -4% $ (83) -2% 1% -3% -2% 0% Crop Protection Q2 2020 vs. Q2 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Curre ncy Portfolio / Other North Ame rica1 $ (23) -3% $ (16) -2% 1% -3% 0% -1% EMEA1 (14) -4% 5 1% 1% 0% -4% -1% Latin America (157) -34% (95) -20% 5% -25% -14% 0% Asia Pacific (10) -3% 9 3% -1% 4% -5% -1% Rest of World (181) -16% (81) -7% 2% -9% -8% -1% Total $ (204) -11% $ (97) -5% 2% -7% -5% -1%

Corteva Segment Information - Price, Volume Currency Analysis Region Six Months Ended June 30, 2020 vs. Six Months Ended June 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Curre ncy Portfolio / Other North Ame rica1 $ 154 3% $ 179 3% 0% 3% 0% 0% EMEA1 79 4% 173 8% 2% 6% -4% 0% Latin America (69) -7% 66 7% 7% 0% -14% 0% Asia Pacific 31 4% 75 10% 2% 8% -5% -1% Rest of World 41 1% 314 8% 3% 5% -7% 0% Total $ 195 2% $ 493 5% 1% 4% -3% 0% Seed Six Months Ended June 30, 2020 vs. Six Months Ended June 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Curre ncy Portfolio / Other North Ame rica1 $ 181 5% $ 190 5% 1% 4% 0% 0% EMEA1 67 6% 119 11% 4% 7% -5% 0% Latin America 57 16% 105 29% 9% 20% -13% 0% Asia Pacific 22 10% 36 17% 8% 9% -7% 0% Rest of World 146 9% 260 16% 6% 10% -7% 0% Total $ 327 6% $ 450 8% 2% 6% -2% 0% Crop Protection Six Months Ended June 30, 2020 vs. Six Months Ended June 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Curre ncy Portfolio / Other North Ame rica1 $ (27) -2% $ (11) -1% -1% 0% 0% -1% EMEA1 12 1% 54 6% 1% 5% -4% -1% Latin America (126) -19% (39) -6% 5% -11% -13% 0% Asia Pacific 9 2% 39 8% 0% 8% -4% -2% Rest of World (105) -5% 54 3% 2% 1% -7% -1% Total $ (132) -4% $ 43 1% 1% 0% -4% -1% 1. North America is defined as U.S. and Canada. EMEA is defined as Europe, Middle East and Africa. 2. Organic sales is defined as price and volume and excludes currency and portfolio impacts.

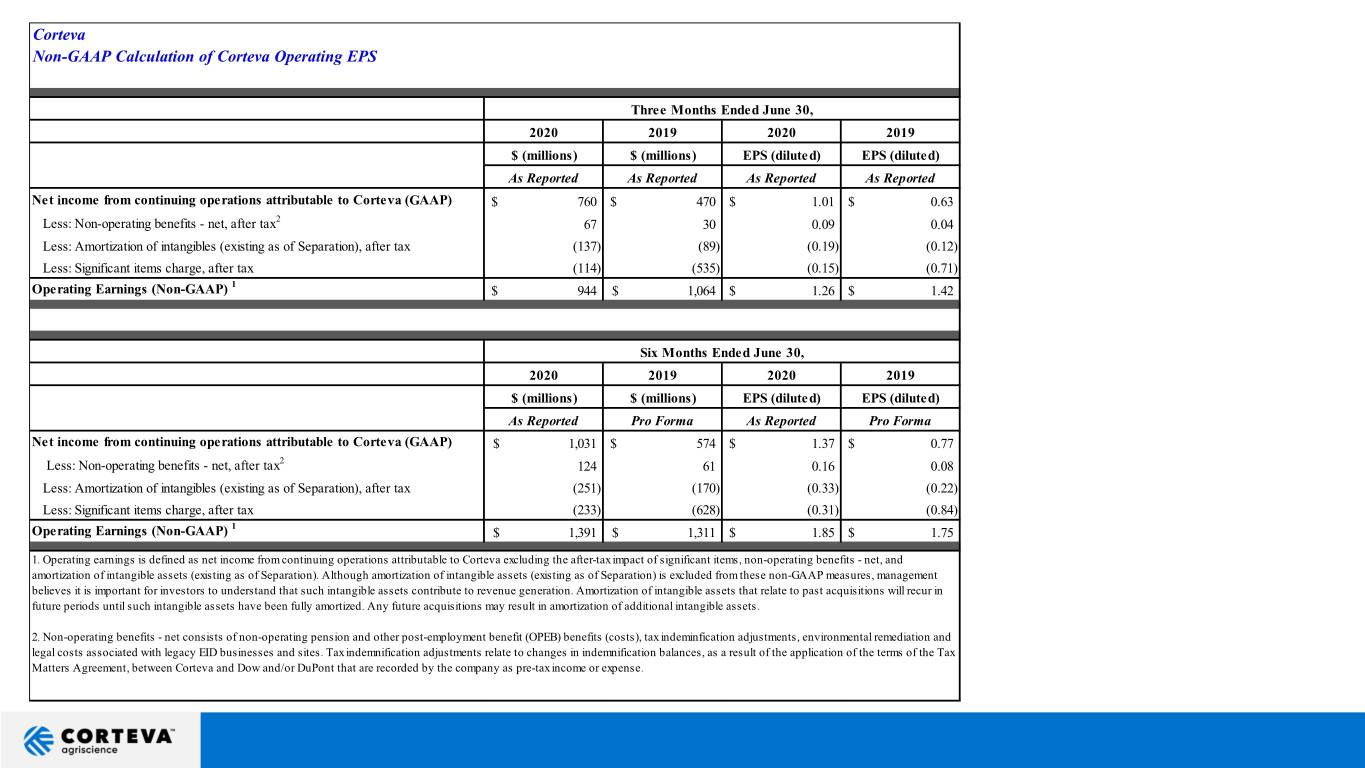

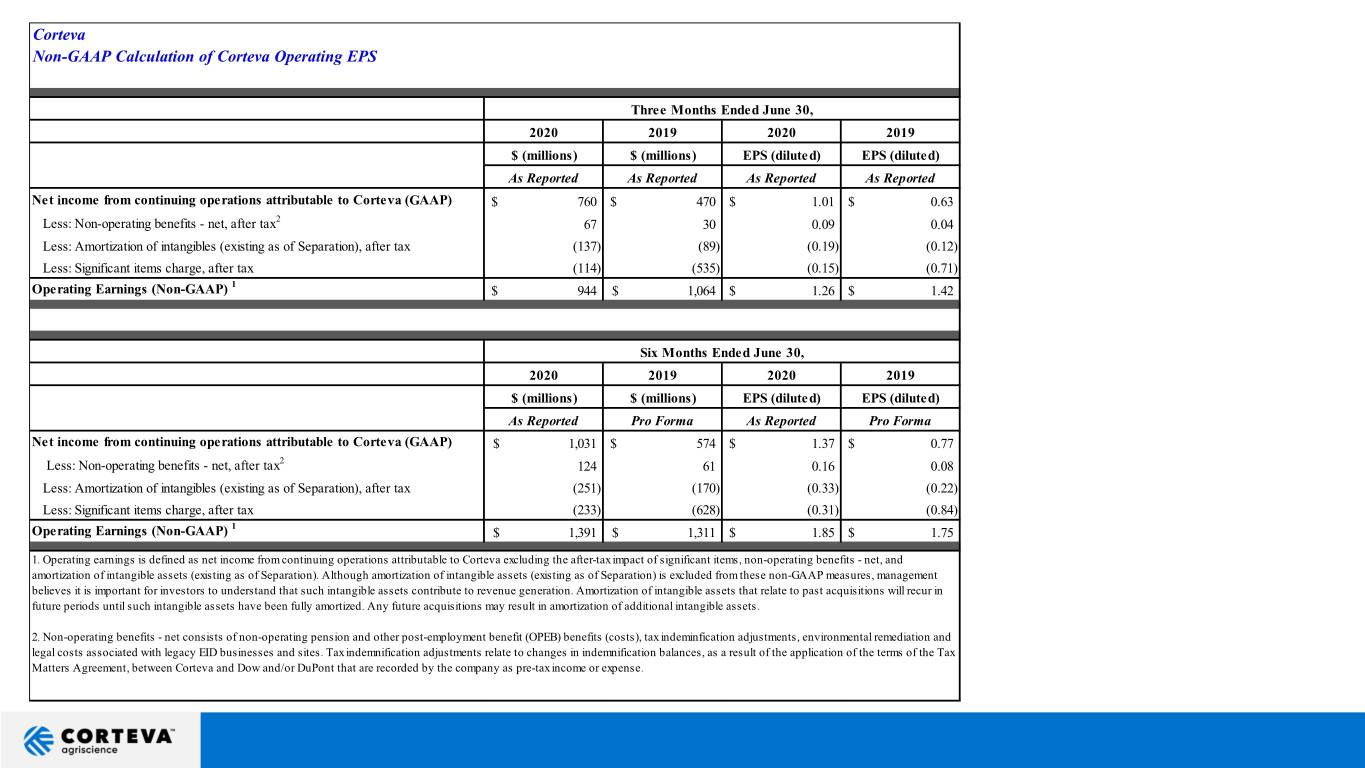

Corteva Non-GAAP Calculation of Corteva Operating EPS Three Months Ended June 30, 2020 2019 2020 2019 $ (millions) $ (millions) EPS (diluted) EPS (diluted) As Reported As Reported As Reported As Reported Net income from continuing operations attributable to Corteva (GAAP) $ 760 $ 470 $ 1.01 $ 0.63 Less: Non-operating benefits - net, after tax2 67 30 0.09 0.04 Less: Amortization of intangibles (existing as of Separation), after tax (137) (89) (0.19) (0.12) Less: Significant items charge, after tax (114) (535) (0.15) (0.71) 1 Operating Earnings (Non-GAAP) $ 944 $ 1,064 $ 1.26 $ 1.42 Six Months Ended June 30, 2020 2019 2020 2019 $ (millions) $ (millions) EPS (diluted) EPS (diluted) As Reported Pro Forma As Reported Pro Forma Net income from continuing operations attributable to Corteva (GAAP) $ 1,031 $ 574 $ 1.37 $ 0.77 Less: Non-operating benefits - net, after tax2 124 61 0.16 0.08 Less: Amortization of intangibles (existing as of Separation), after tax (251) (170) (0.33) (0.22) Less: Significant items charge, after tax (233) (628) (0.31) (0.84) 1 Operating Earnings (Non-GAAP) $ 1,391 $ 1,311 $ 1.85 $ 1.75 1. Operating earnings is defined as net income from continuing operations attributable to Corteva excluding the after-tax impact of significant items, non-operating benefits - net, and amortization of intangible assets (existing as of Separation). Although amortization of intangible assets (existing as of Separation) is excluded from these non-GAAP measures, management believes it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in amortization of additional intangible assets. 2. Non-operating benefits - net consists of non-operating pension and other post-employment benefit (OPEB) benefits (costs), tax indeminfication adjustments, environmental remediation and legal costs associated with legacy EID businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense.

Corteva Non-GAAP Calculation of Corteva Base Tax Rate Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 As Reported As Reported As Reported Pro Forma Income from continuing operations before income taxes (GAAP) $ 844 $ 753 $ 1,252 $ 845 Add: Significant items - charge 179 455 302 640 Non-operating benefits - net (91) (32) (164) (74) Amortization of intangibles (existing as of Separation) 176 113 339 214 2 Less: Exchange gains (losses), net 1 (32) (60) (59) Income from continuing operations before income taxes, significant items, non-operating benefits - net, amortization of intangibles (existing as of Separation), and exchange gains (losses), net (Non- GAAP) $ 1,107 $ 1,321 $ 1,789 $ 1,684 Provision for income taxes on continuing operations (GAAP) $ 78 $ 270 $ 205 $ 250 Add: Tax benefits (expenses) on significant items charge 65 (80) 69 12 Tax expenses on non-operating benefits - net (24) (2) (40) (13) Tax benefits on amortization of intangibles (existing as of Separation) 39 24 88 44 Tax benefits (expenses) on exchange gains (losses), net 2 18 (15) 12 Provision for income taxes on continuing operations before significant items, non-operating benefits - net, amortization of intangibles (existing as of Separation), and exchange gains (losses), net (Non- GAAP) $ 160 $ 230 $ 307 $ 305 Effective income tax rate (GAAP) 9.2% 35.9% 16.4% 29.6% Significant items, non-operating benefits, and amortization of intangibles (existing as of Separation) effect 5.1% -19.4% 2.2% -11.6% Tax rate from continuing operations before significant items, non-operating benefits - net, and amortization of intangibles (existing as of Separation) 14.3% 16.5% 18.6% 18.0% Exchange gains (losses), net effect 0.2% 0.9% -1.4% 0.1% Base income tax rate from continuing operations (Non-GAAP)1 14.5% 17.4% 17.2% 18.1% 1. Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), significant items, amortization of intangibles (existing as of Separation), and non-operating benefits - net. 2. Refer to page A-14 of the Financial Statement Schedules for further information on exchange gains (losses).