3Q 2020 Earnings Conference Call November 5, 2020

Safe Harbor Regarding Forward-Looking Statements Forward-Looking Statements This presentation contains certain estimates and forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and may be identified by their use of words like “plans,” “expects,” “will,” “anticipates,” “believes,” “intends,” “projects,” “estimates”, “guidance”, or other words of similar meaning. All statements that address expectations or projections about the future, including statements about Corteva’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures, and financial results, as well as expected benefits from, the separation of Corteva from DowDuPont, are forward-looking statements. Forward-looking statements are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond Corteva's control. While the list of factors presented below is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Corteva's business, results of operations and financial condition. Some of the important factors that could cause Corteva's actual results to differ materially from those projected in any such forward-looking statements include: (i) failure to successfully develop and commercialize Corteva's pipeline; (ii) effect of competition and consolidation in Corteva's industry; (iii) failure to obtain or maintain the necessary regulatory approvals for some Corteva's products; (iv) failure to enforce Corteva's intellectual property rights or defend against intellectual property claims asserted by others; (v) effect of competition from manufacturers of generic products; (vi) impact of Corteva's dependence on third parties with respect to certain of its raw materials or licenses and commercialization; (vii) costs of complying with evolving regulatory requirements and the effect of actual or alleged violations of environmental laws or permit requirements; (viii) effect of the degree of public understanding and acceptance or perceived public acceptance of Corteva's biotechnology and other agricultural products; (ix) effect of changes in agricultural and related policies of governments and international organizations; (x) effect of industrial espionage and other disruptions to Corteva's supply chain, information technology or network systems; (xi) competitor's establishment of an intermediary platform for distribution of Corteva's products; (xii) effect of volatility in Corteva's input costs; (xiii) failure to raise capital through the capital markets or short-term borrowings on terms acceptable to Corteva; (xiv) failure of Corteva's customers to pay their debts to Corteva, including customer financing programs; (xv) failure to realize the anticipated benefits of the internal reorganizations taken by DowDuPont in connection with the spin-off of Corteva, including failure to benefit from significant cost synergies; (xvi) risks related to the indemnification obligations of legacy EID liabilities in connection with the separation of Corteva; (xvii) increases in pension and other post-employment benefit plan funding obligations; (xviii) effect of compliance with environmental laws and requirements and adverse judgments on litigation; (xix) risks related to Corteva's global operations; (xx) effect of climate change and unpredictable seasonal and weather factors; (xxi) effect of counterfeit products; (xxii) failure to effectively manage acquisitions, divestitures, alliances and other portfolio actions; (xxiii) risks related to non-cash charges from impairment of goodwill or intangibles assets; (xxiv) risks related to COVID-19; (xxv) risks related to oil and commodity markets, and (xxvi) other risks related to Corteva’s Separation from DowDuPont. Additionally, there may be other risks and uncertainties that Corteva is unable to currently identify or that Corteva does not currently expect to have a material impact on its business. Where, in any forward-looking statement or other estimate, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Corteva’s management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Corteva disclaims and does not undertake any obligation to update or revise any forward-looking statement or other estimate, except as required by applicable law. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements or other estimates is included in the “Risk Factors” section of Corteva’s Annual Report on Form 10-K, as modified by subsequent Quarterly Reports on Forms 10-Q and Current Reports on Form 8-K. 2

A Reminder About Non-GAAP Financial Measures and Pro Forma Financial Information Corteva Unaudited Pro Forma Financial Information In order to provide the most meaningful comparison of results of operations, supplemental unaudited pro forma financial information for the first quarter of 2019 has been included in this presentation. This presentation presents the pro forma results of Corteva, after giving effect to events that are (1) directly attributable to the merger of DuPont and Dow, debt retirement transactions related to paying off or retiring portions of Historical DuPont’s existing debt liabilities, and the separation and distribution to DowDuPont stockholders of all the outstanding shares of Corteva common stock; (2) factually supportable and (3) with respect to the pro forma statements of income, expected to have a continuing impact on the consolidated results. Refer to Corteva’s Form 10 registration statement filed on May 6, 2019, which can be found on the investors section of the Corteva website, for further details on the above transactions. The pro forma financial statements were prepared in accordance with Article 11 of Regulation S-X, and are presented for informational purposes only, and do not purport to represent what the results of operations would have been had the above actually occurred on the dates indicated, nor do they purport to project the results of operations for any future period or as of any future date. Regulation G (Non-GAAP Financial Measures) This presentation includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures may include organic sales, organic growth (including by segment and region), operating EBITDA, pro forma operating EBITDA, operating EBITDA margin, pro forma operating EBITDA margin, operating earnings per share, pro forma operating earnings per share, base tax rate and pro forma base tax rate. Management uses these measures internally for planning and forecasting, including allocating resources and evaluating incentive compensation. Management believes that these non-GAAP measures reflect the ongoing performance of the Company during the periods presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful comparison of year over year results. These non-GAAP measures supplement the Company's U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. For first quarter 2019, these non-GAAP measures are being reconciled to a pro forma GAAP financial measure prepared and presented in accordance with Article 11 of Regulation S-X. Reconciliations for these non-GAAP measures to their most directly attributable U.S. GAAP measure are provided on slides 24 - 32 of this presentation. Corteva is not able to reconcile its forward-looking non-GAAP financial measures to their most comparable U.S. GAAP financial measures, as it is unable to predict with reasonable certainty items outside of the company’s control, such as Significant Items, without unreasonable effort. For Significant Items reported in the periods presented, refer to slide 26. Beginning January 1, 2020, the company presents accelerated prepaid royalty amortization expense as a significant item. Accelerated prepaid royalty amortization represents the noncash charge associated with the recognition of upfront payments made to Monsanto in connection with the Company’s non-exclusive license in the United States and Canada for Monsanto's Genuity® Roundup Ready 2 Yield® Roundup Ready 2 Xtend® herbicide tolerance traits. During the five-year ramp-up period of Enlist E3TM, Corteva is expected to significantly reduce the volume of products with the Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits beginning in 2021, with expected minimal use of the trait platform after the completion of the ramp-up. Organic sales is defined as price and volume and excludes currency and portfolio impacts. Operating EBITDA is defined as earnings (i.e., income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits, net and foreign exchange gains (losses), net, excluding the impact of significant items (including goodwill impairment charges). Non-operating benefits, net consists of non-operating pension and other post-employment benefit (OPEB) credits, tax indemnification adjustments, environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense. Operating EBITDA margin is defined as Operating EBITDA as a percentage of net sales. Operating earnings per share are defined as "Earnings per common share from continuing operations - diluted" excluding the after-tax impact of significant items (including goodwill impairment charges), the after-tax impact of non-operating benefits, net, and the after-tax impact of amortization expense associated with intangible assets existing as of the Separation from DowDuPont. Although amortization of the Company's intangible assets is excluded from these non-GAAP measures, management believes it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in amortization of additional intangible assets. Base tax rate is defined as the effective tax rate excluding the impacts of foreign exchange gains (losses), net, non-operating benefits, net, amortization of intangibles as of the Separation from DowDuPont, and significant items (including goodwill impairment charges). The first quarter of 2019 is on a pro forma basis as discussed above in the paragraph ‘Corteva Unaudited Pro Forma Financial Information’. 3

Next Stage on Our Journey to Drive Growth 1 2 3 4 Delivering Driving actions to Fortifying currency Accelerating return organic(1) expand margins in risk management of cash to sales growth both segments practices shareholders Expect to deliver earnings growth aligned with mid-term targets (1) Organic sales is a non-GAAP measures. See slide 3 for further discussion. 4

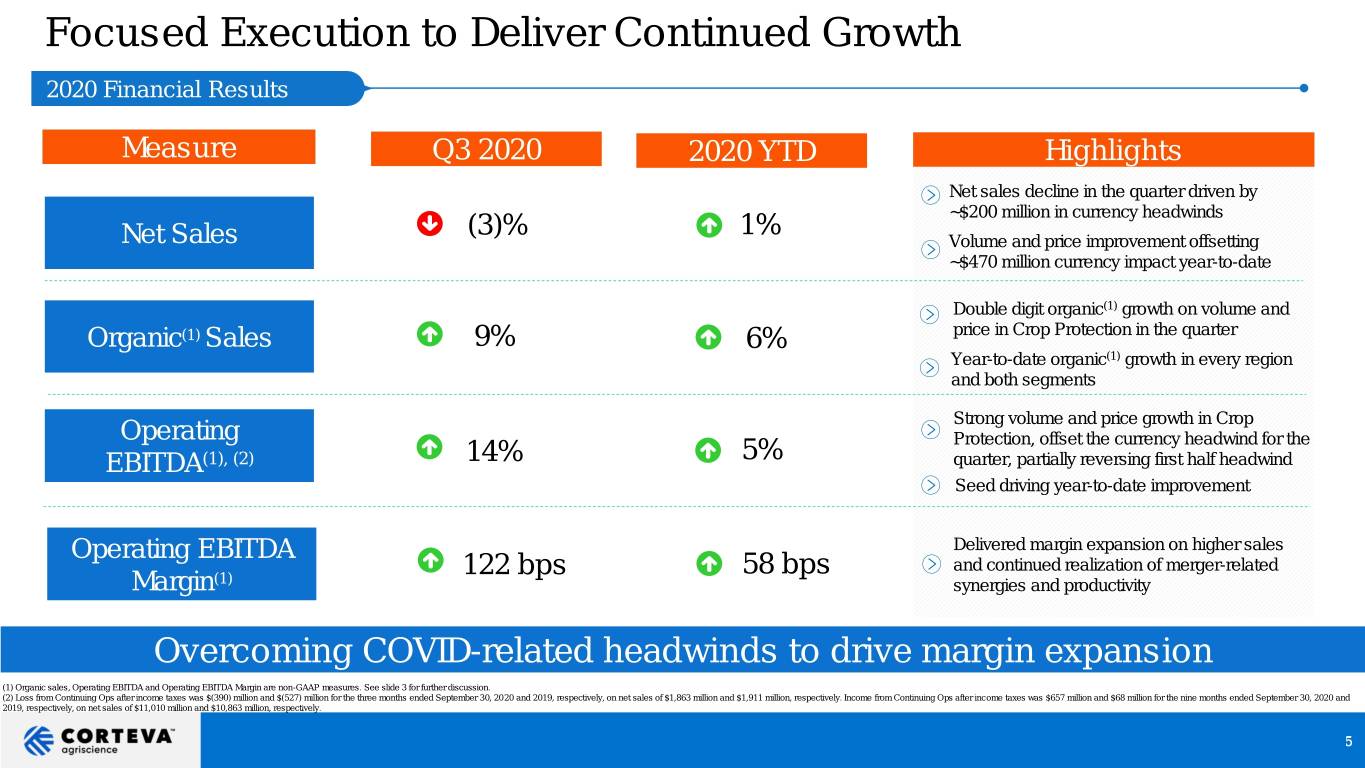

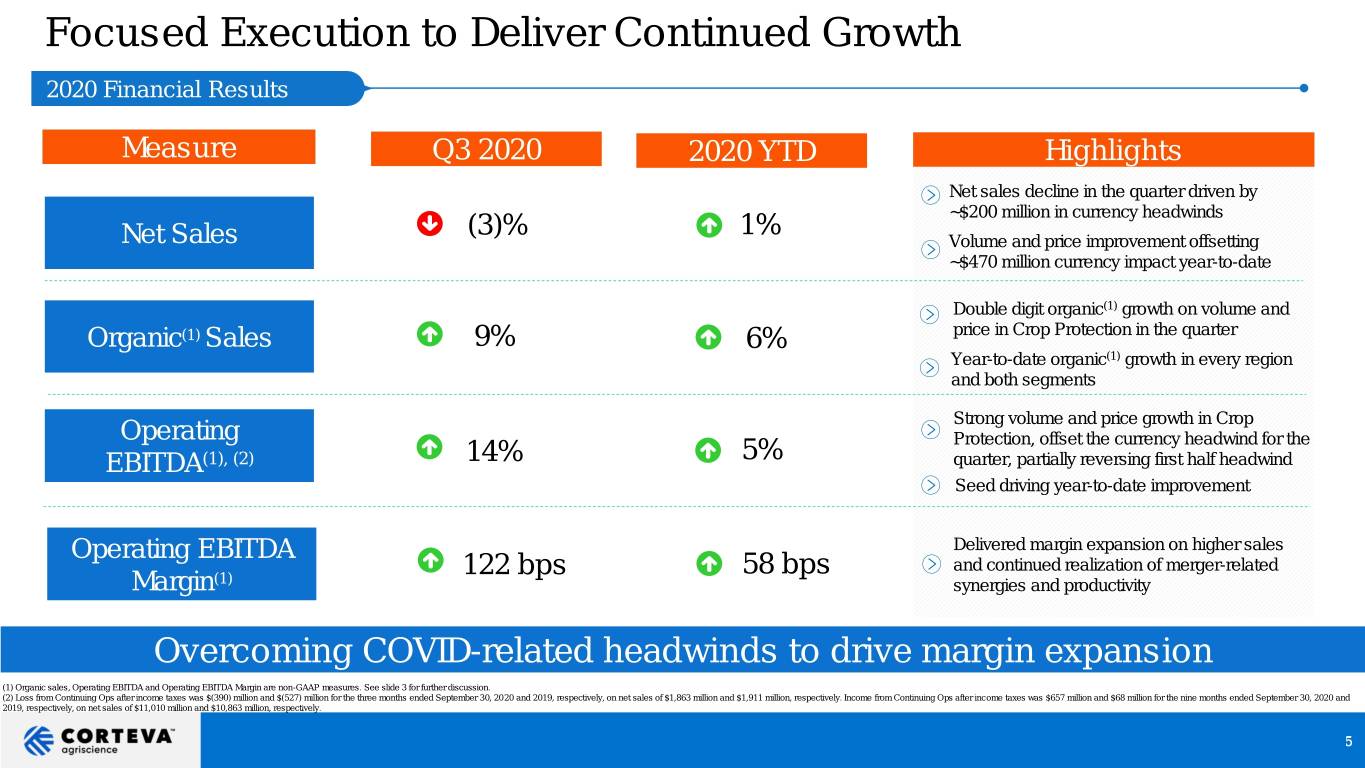

Focused Execution to Deliver Continued Growth 2020 Financial Results Measure Q3 2020 2020 YTD Highlights Net sales decline in the quarter driven by (3)% 1% ~$200 million in currency headwinds Net Sales Volume and price improvement offsetting ~$470 million currency impact year-to-date Double digit organic(1) growth on volume and Organic(1) Sales 9% 6% price in Crop Protection in the quarter Year-to-date organic(1) growth in every region and both segments Strong volume and price growth in Crop Operating Protection, offset the currency headwind for the EBITDA(1), (2) 14% 5% quarter, partially reversing first half headwind Seed driving year-to-date improvement Operating EBITDA Delivered margin expansion on higher sales 122 bps 58 bps and continued realization of merger-related Margin(1) synergies and productivity Overcoming COVID-related headwinds to drive margin expansion (1) Organic sales, Operating EBITDA and Operating EBITDA Margin are non-GAAP measures. See slide 3 for further discussion. (2) Loss from Continuing Ops after income taxes was $(390) million and $(527) million for the three months ended September 30, 2020 and 2019, respectively, on net sales of $1,863 million and $1,911 million, respectively. Income from Continuing Ops after income taxes was $657 million and $68 million for the nine months ended September 30, 2020 and 2019, respectively, on net sales of $11,010 million and $10,863 million, respectively. 5

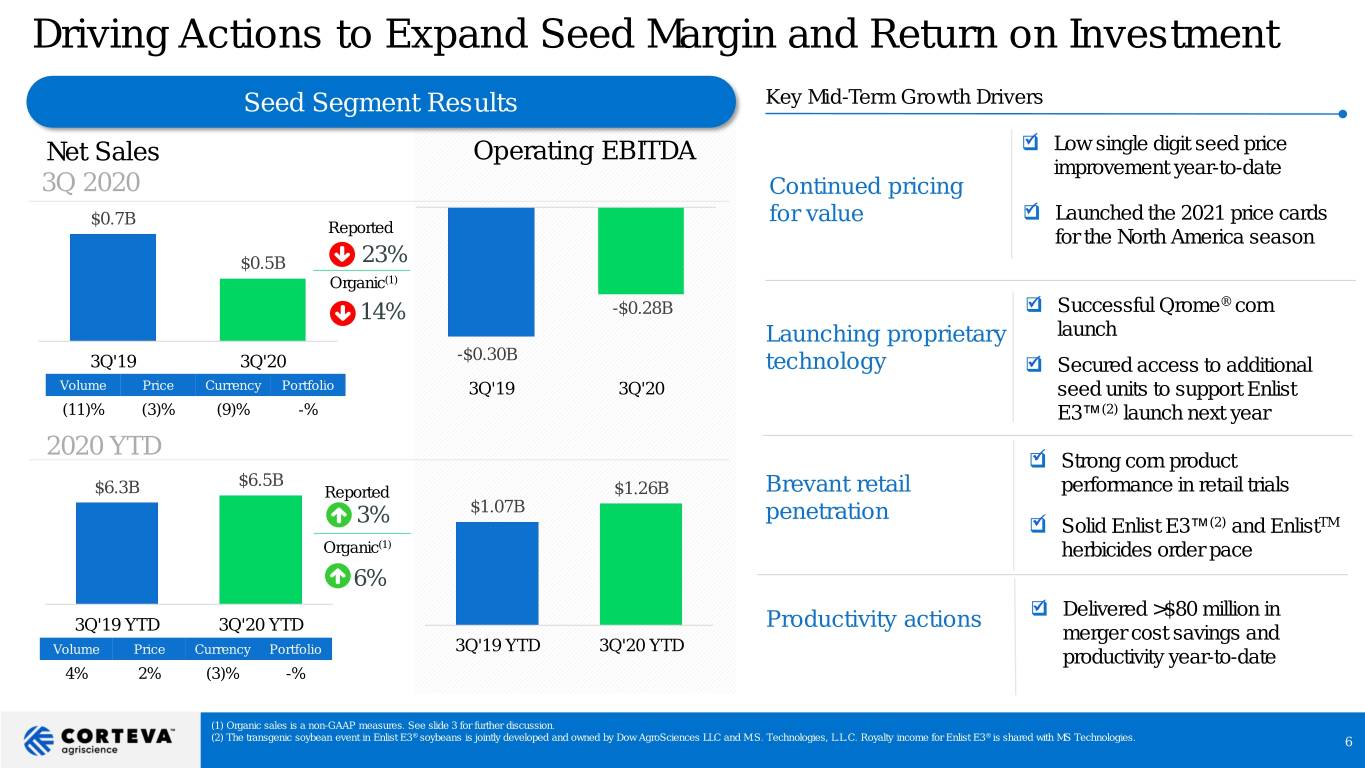

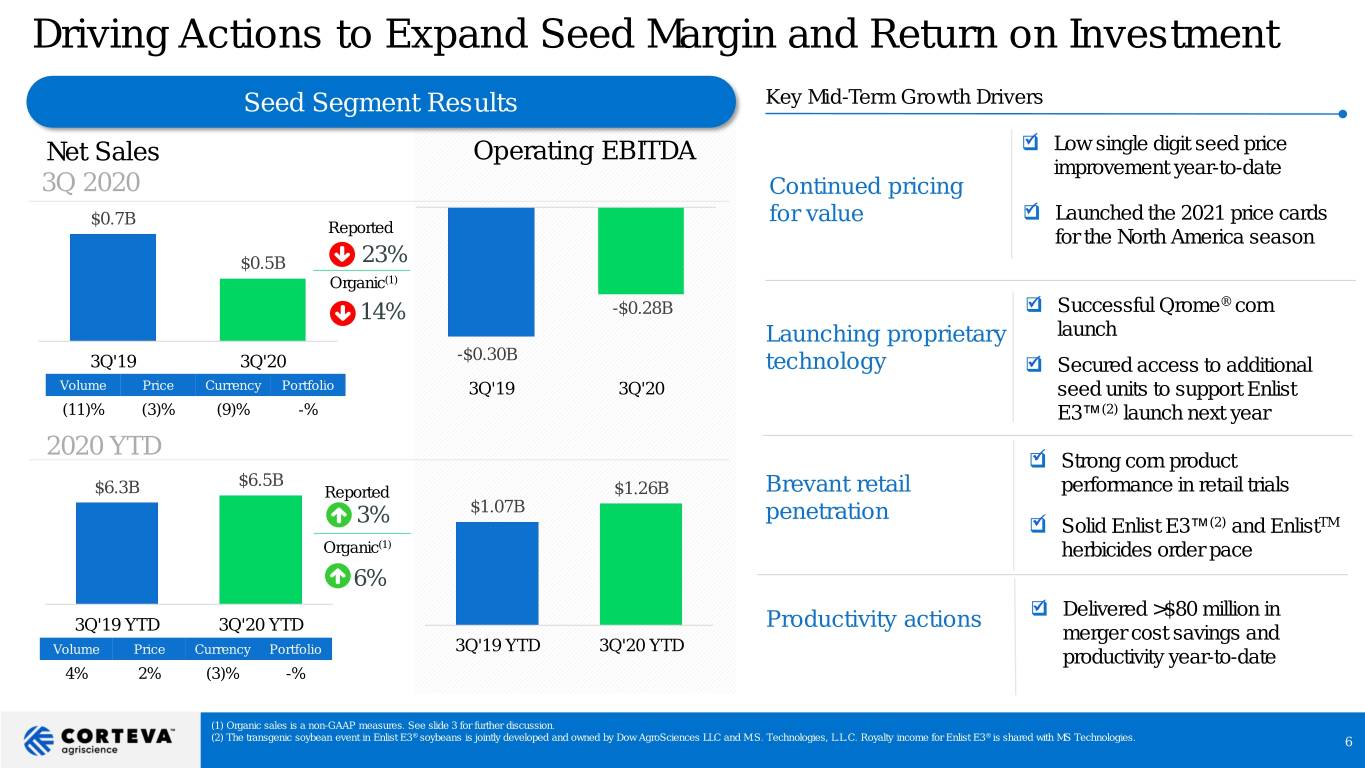

Driving Actions to Expand Seed Margin and Return on Investment Seed Segment Results Key Mid-Term Growth Drivers Net Sales Operating EBITDA ❑✓ Low single digit seed price improvement year-to-date 3Q 2020 Continued pricing ✓ $0.7B for value ❑ Launched the 2021 price cards Reported for the North America season $0.5B 23% Organic(1) 14% -$0.28B ❑✓ Successful Qrome® corn Launching proprietary launch -$0.30B 3Q'19 3Q'20 technology ❑✓ Secured access to additional Volume Price Currency Portfolio 3Q'19 3Q'20 seed units to support Enlist (11)% (3)% (9)% -% E3™(2) launch next year 2020 YTD ❑✓ Strong corn product $6.5B $6.3B Reported $1.26B Brevant retail performance in retail trials $1.07B penetration 3% ❑✓ Solid Enlist E3™(2) and EnlistTM Organic(1) herbicides order pace 6% ✓ Productivity actions ❑ Delivered >$80 million in 3Q'19 YTD 3Q'20 YTD merger cost savings and 3Q'19 YTD 3Q'20 YTD Volume Price Currency Portfolio productivity year-to-date 4% 2% (3)% -% (1) Organic sales is a non-GAAP measures. See slide 3 for further discussion. ® ® (2) The transgenic soybean event in Enlist E3 soybeans is jointly developed and owned by Dow AgroSciences LLC and M.S. Technologies, L.L.C. Royalty income for Enlist E3 is shared with MS Technologies. 6

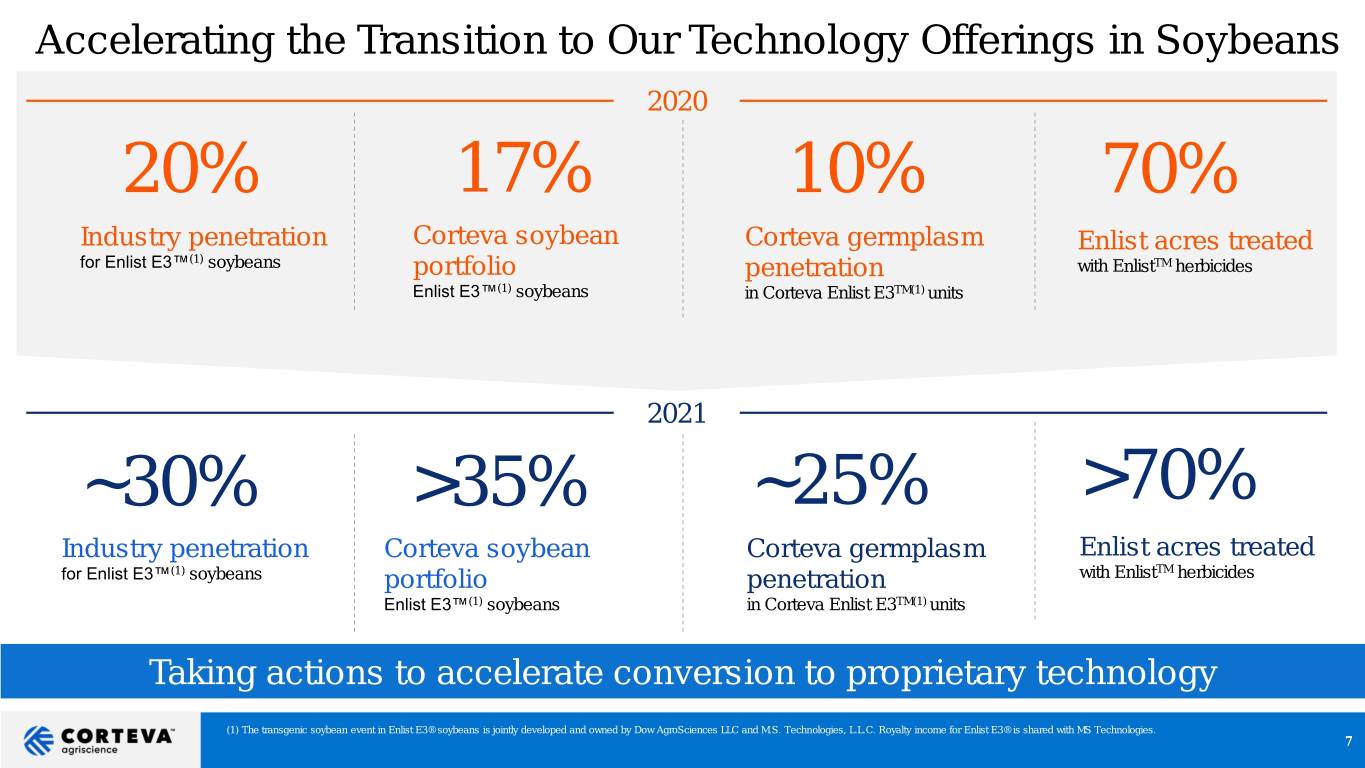

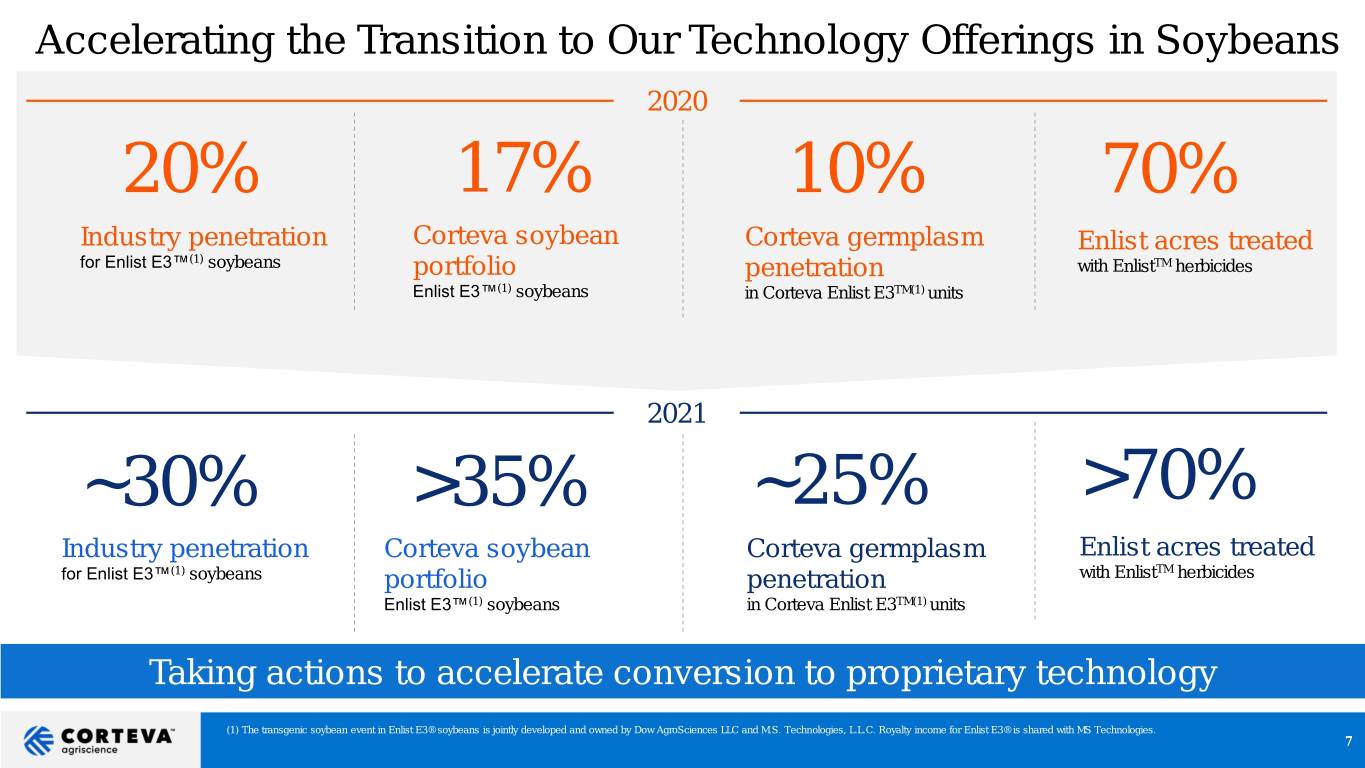

Accelerating the Transition to Our Technology Offerings in Soybeans 2020 20% 17% 10% 70% Industry penetration Corteva soybean Corteva germplasm Enlist acres treated for Enlist E3™(1) soybeans portfolio penetration with EnlistTM herbicides Enlist E3™(1) soybeans in Corteva Enlist E3TM(1) units 2021 ~30% >35% ~25% >70% Industry penetration Corteva soybean Corteva germplasm Enlist acres treated for Enlist E3™(1) soybeans portfolio penetration with EnlistTM herbicides Enlist E3™(1) soybeans in Corteva Enlist E3TM(1) units Taking actions to accelerate conversion to proprietary technology (1) The transgenic soybean event in Enlist E3® soybeans is jointly developed and owned by Dow AgroSciences LLC and M.S. Technologies, L.L.C. Royalty income for Enlist E3® is shared with MS Technologies. 7

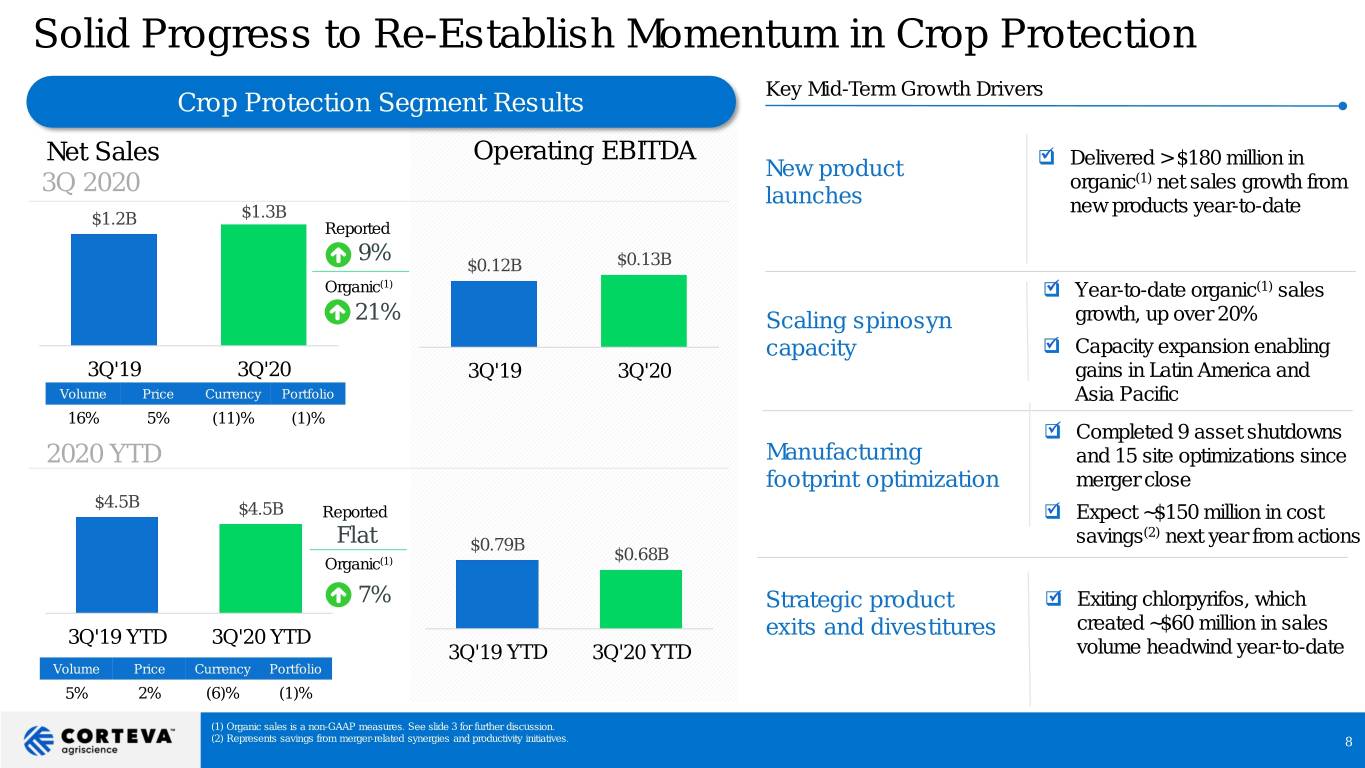

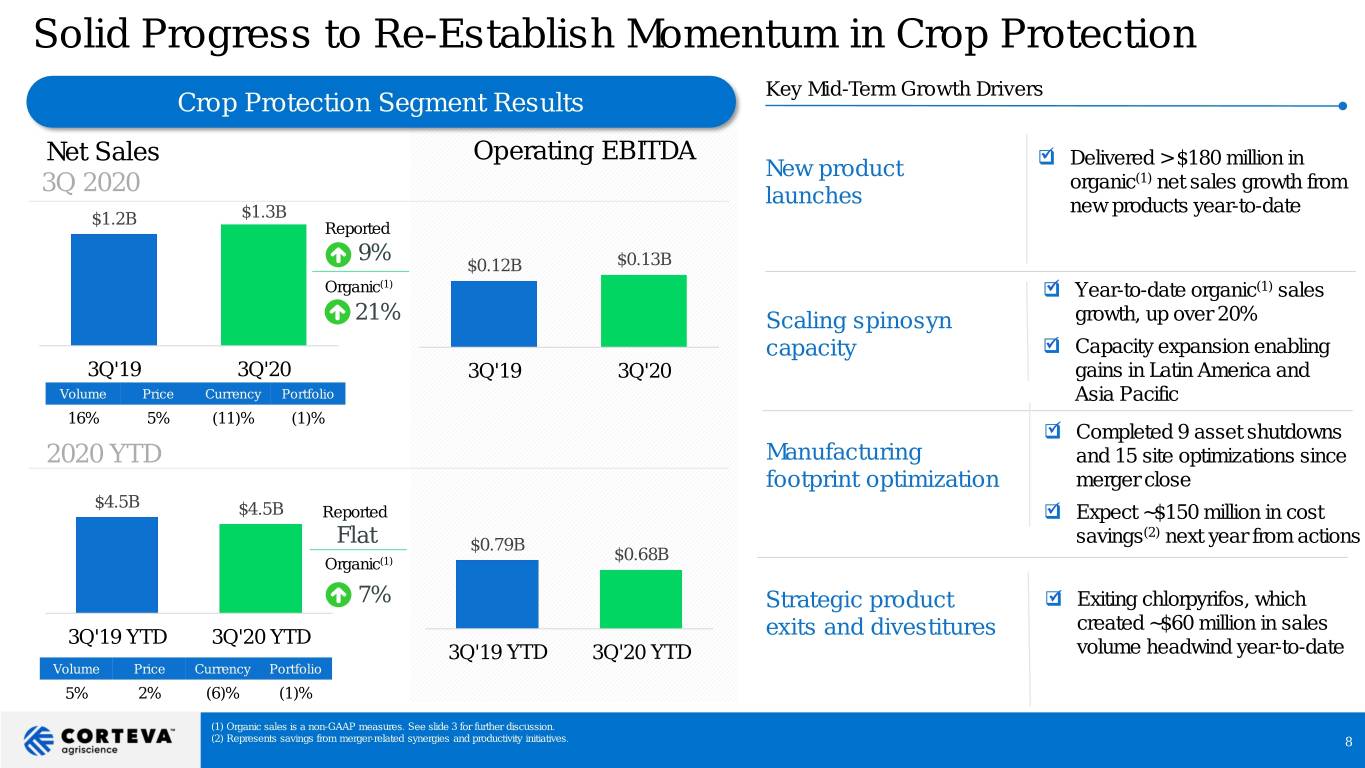

Solid Progress to Re-Establish Momentum in Crop Protection Key Mid-Term Growth Drivers Crop Protection Segment Results Net Sales Operating EBITDA ✓ New product ❑ Delivered > $180 million in 3Q 2020 organic(1) net sales growth from launches new products year-to-date $1.2B $1.3B Reported 9% $0.12B $0.13B Organic(1) ❑✓ Year-to-date organic(1) sales 21% Scaling spinosyn growth, up over 20% capacity ❑✓ Capacity expansion enabling 3Q'19 3Q'20 3Q'19 3Q'20 gains in Latin America and Volume Price Currency Portfolio Asia Pacific 16% 5% (11)% (1)% ❑✓ Completed 9 asset shutdowns 2020 YTD Manufacturing and 15 site optimizations since footprint optimization merger close $4.5B $4.5B Reported ❑✓ Expect ~$150 million in cost (2) Flat $0.79B savings next year from actions $0.68B Organic(1) 7% Strategic product ❑✓ Exiting chlorpyrifos, which created ~$60 million in sales 3Q'19 YTD 3Q'20 YTD exits and divestitures 3Q'19 YTD 3Q'20 YTD volume headwind year-to-date Volume Price Currency Portfolio 5% 2% (6)% (1)% (1) Organic sales is a non-GAAP measures. See slide 3 for further discussion. (2) Represents savings from merger-related synergies and productivity initiatives. 8

Streamlining the CP Manufacturing Assets Inherited at Spin 2017 29 Strong Bias Toward Formulation & Manufacturing Assets Inherited Structure Internal Active Ingredient Workforce changes necessary to Packaging Centralized inherited from legacy companies Manufacturing support new operating model F&P manufacturing footprint reflected combined footprint at merger close cost-improvement opportunities in active ingredient manufacturing at merger close 2020 20 De-Centralized Optimized Streamlined Formulation & Active Ingredient Manufacturing Assets Manufacturing Roles Packaging after completed and targeted Manufacturing Achieved 25% reduction as a result of Close to end-use markets to enhance shutdowns merger synergies customer responsiveness and capitalize Increase external active ingredient on local currency manufacturing while balancing IP protection Taking actions to deliver incremental savings in CP manufacturing 9

Scanning the Market Backdrop for Constructive Signals Commodity Trade Supply & Strong China Demand purchases of U.S. Corn and soybean corn and soybeans prices above pre- Monitoring trade COVID levels flows in other key Monitoring markets ethanol recovery Currency Farm Income Monitoring Government Brazilian Real payments in and European U.S. have lifted currencies farm income Monitoring market fundamentals amidst persistent uncertainty 10

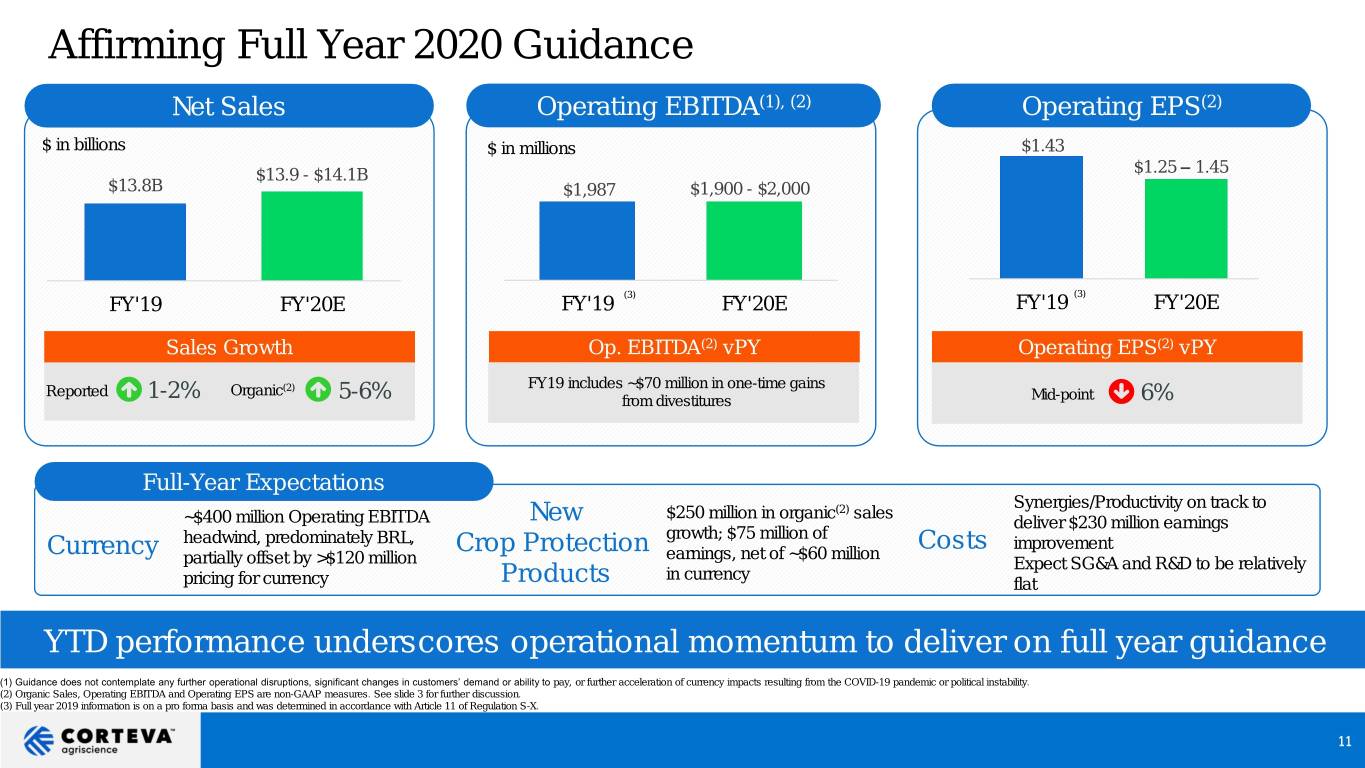

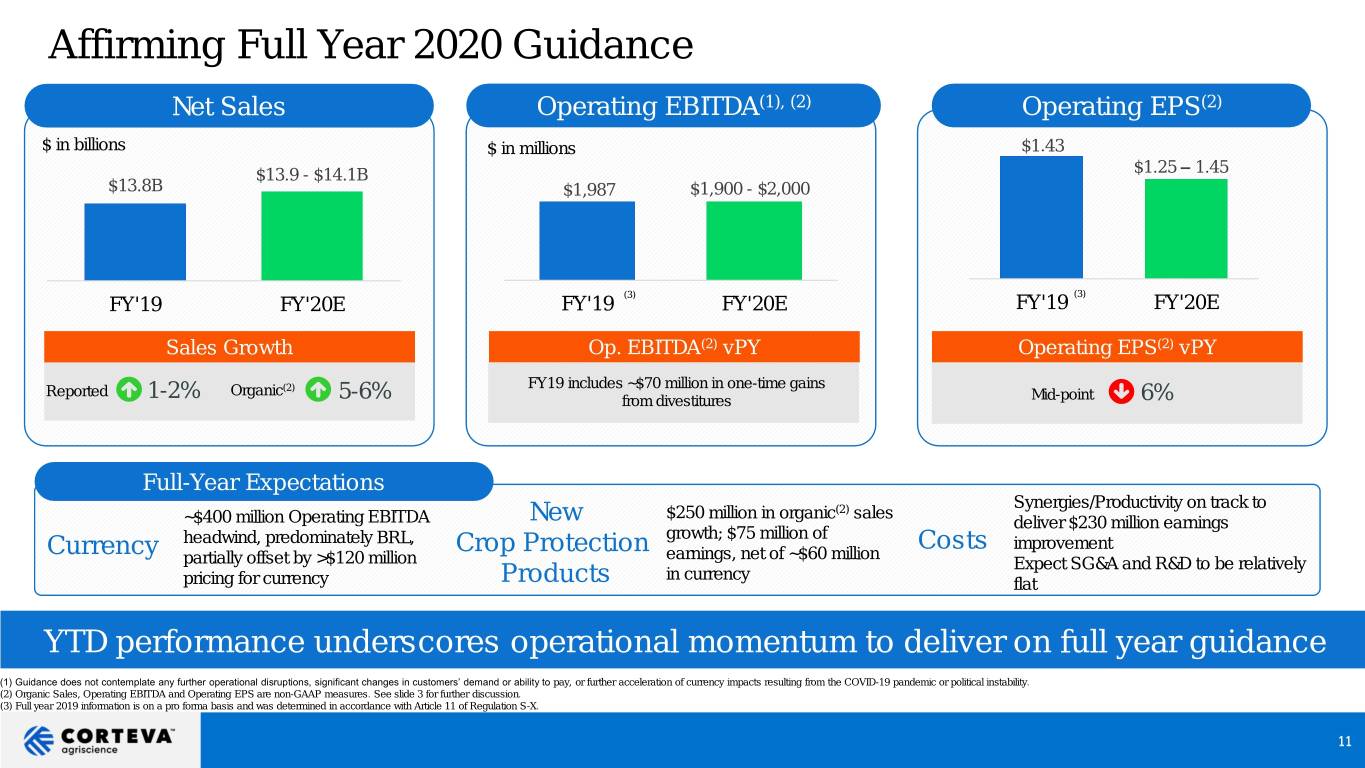

Affirming Full Year 2020 Guidance Net Sales Operating EBITDA(1), (2) Operating EPS(2) $ in billions $ in millions $1.43 $13.9 - $14.1B $1.25 – 1.45 $13.8B $1,987 $1,900 - $2,000 (3) (3) FY'19 FY'20E FY'19 FY'20E FY'19 FY'20E Sales Growth Op. EBITDA(2) vPY Operating EPS(2) vPY FY19 includes ~$70 million in one-time gains Reported Organic(2) 1-2% 5-6% from divestitures Mid-point 6% Full-Year Expectations Synergies/Productivity on track to $250 million in organic(2) sales ~$400 million Operating EBITDA New deliver $230 million earnings growth; $75 million of headwind, predominately BRL, Costs improvement Currency Crop Protection earnings, net of ~$60 million partially offset by >$120 million Expect SG&A and R&D to be relatively in currency pricing for currency Products flat YTD performance underscores operational momentum to deliver on full year guidance (1) Guidance does not contemplate any further operational disruptions, significant changes in customers’ demand or ability to pay, or further acceleration of currency impacts resulting from the COVID-19 pandemic or political instability. (2) Organic Sales, Operating EBITDA and Operating EPS are non-GAAP measures. See slide 3 for further discussion. (3) Full year 2019 information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X. 11

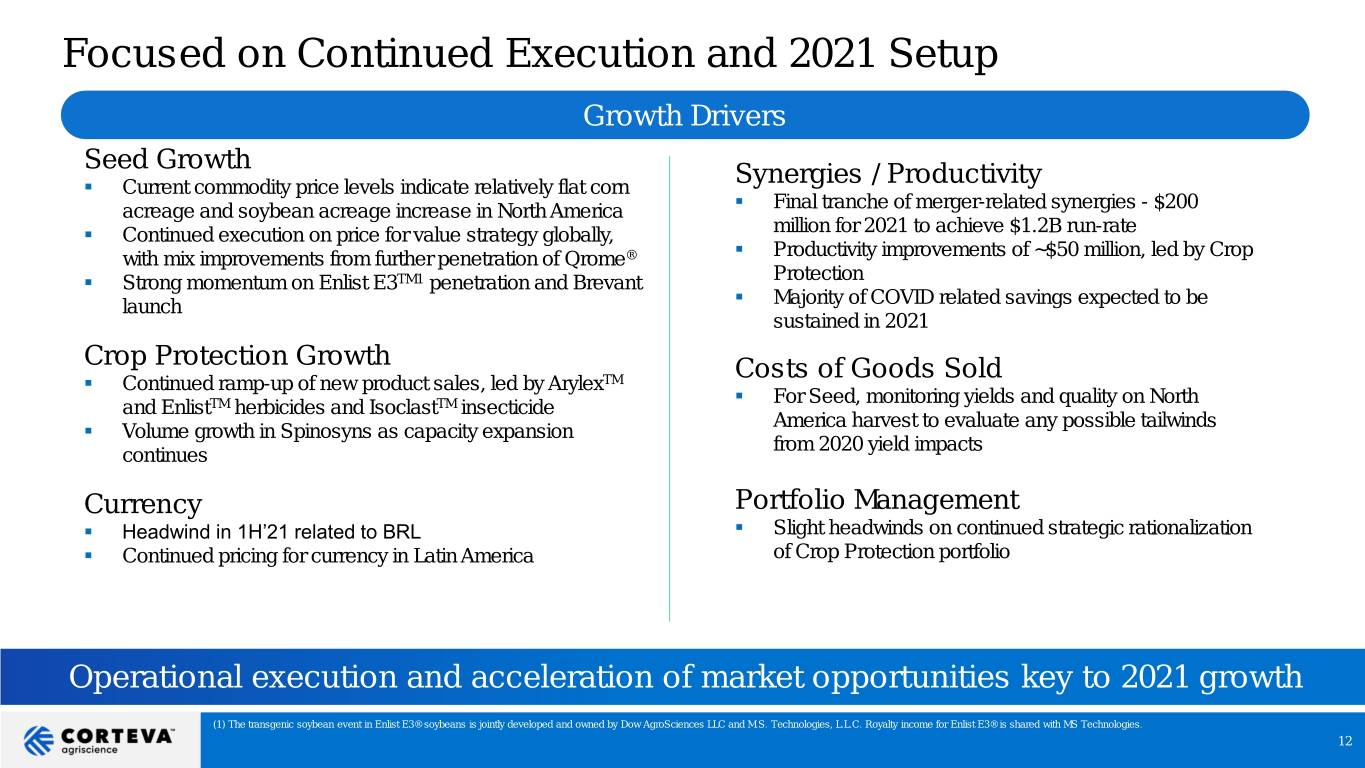

Focused on Continued Execution and 2021 Setup Growth Drivers Seed Growth ▪ Current commodity price levels indicate relatively flat corn Synergies / Productivity acreage and soybean acreage increase in North America ▪ Final tranche of merger-related synergies - $200 ▪ Continued execution on price for value strategy globally, million for 2021 to achieve $1.2B run-rate with mix improvements from further penetration of Qrome® ▪ Productivity improvements of ~$50 million, led by Crop ▪ Strong momentum on Enlist E3TM1 penetration and Brevant Protection launch ▪ Majority of COVID related savings expected to be sustained in 2021 Crop Protection Growth Costs of Goods Sold ▪ Continued ramp-up of new product sales, led by ArylexTM ▪ For Seed, monitoring yields and quality on North and EnlistTM herbicides and IsoclastTM insecticide America harvest to evaluate any possible tailwinds ▪ Volume growth in Spinosyns as capacity expansion from 2020 yield impacts continues Currency Portfolio Management ▪ Headwind in 1H’21 related to BRL ▪ Slight headwinds on continued strategic rationalization ▪ Continued pricing for currency in Latin America of Crop Protection portfolio Operational execution and acceleration of market opportunities key to 2021 growth (1) The transgenic soybean event in Enlist E3® soybeans is jointly developed and owned by Dow AgroSciences LLC and M.S. Technologies, L.L.C. Royalty income for Enlist E3® is shared with MS Technologies. 12

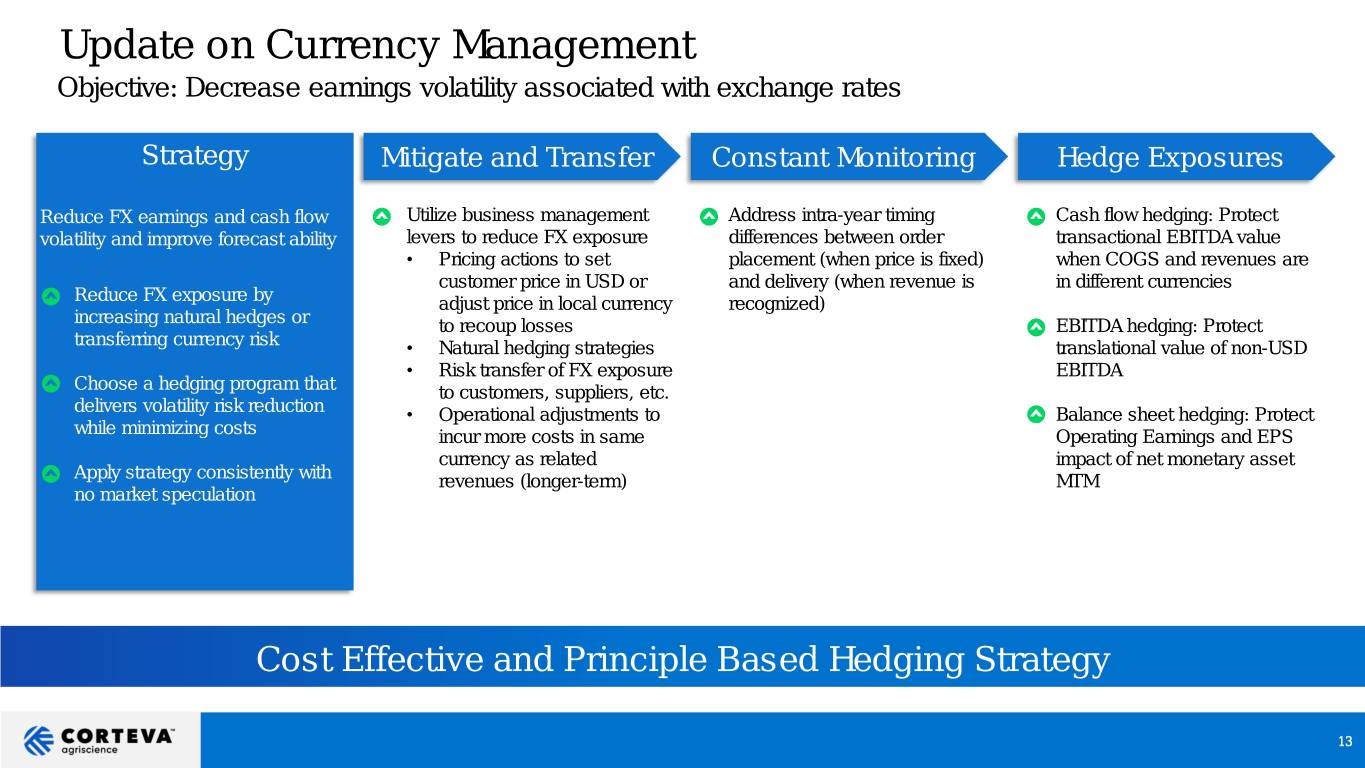

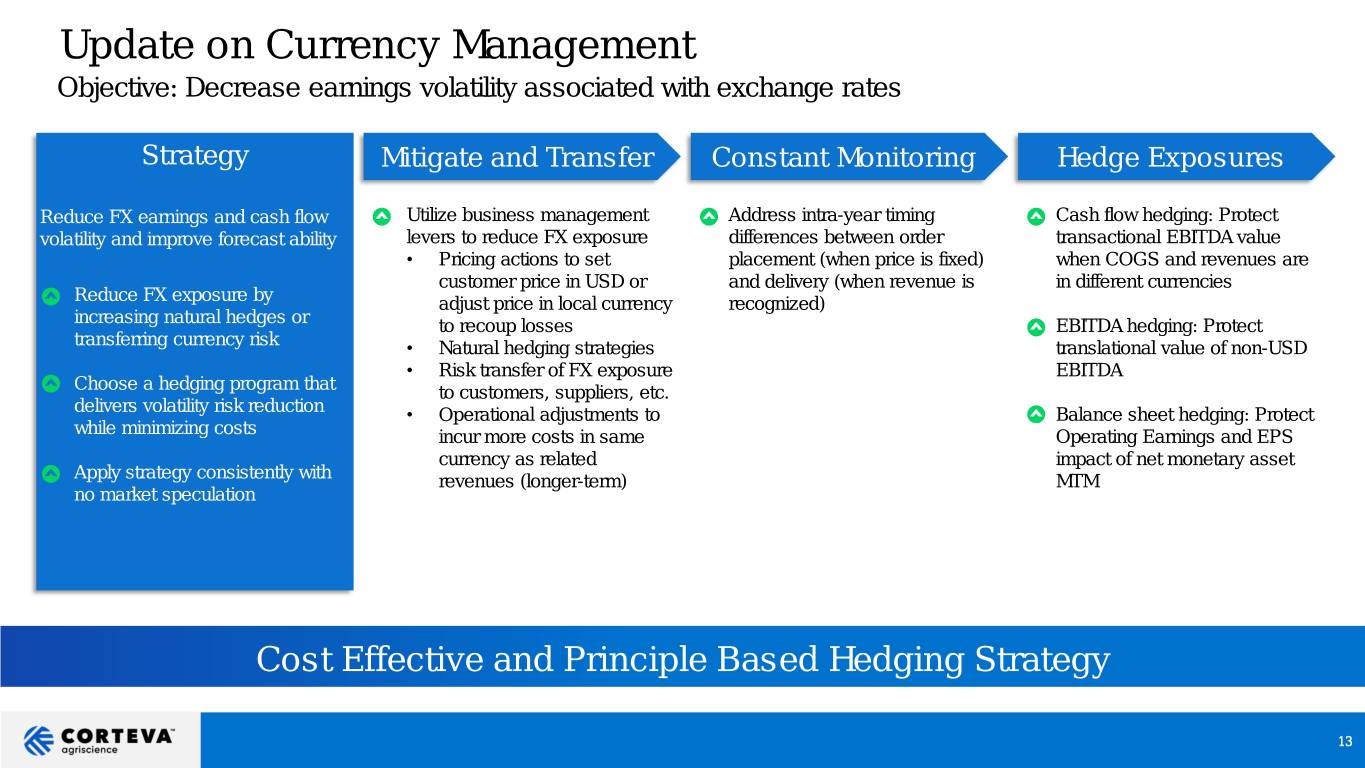

Update on Currency Management Objective: Decrease earnings volatility associated with exchange rates Strategy Mitigate and Transfer Constant Monitoring Hedge Exposures Reduce FX earnings and cash flow Utilize business management Address intra-year timing Cash flow hedging: Protect volatility and improve forecast ability levers to reduce FX exposure differences between order transactional EBITDA value • Pricing actions to set placement (when price is fixed) when COGS and revenues are customer price in USD or and delivery (when revenue is in different currencies Reduce FX exposure by adjust price in local currency recognized) increasing natural hedges or to recoup losses EBITDA hedging: Protect transferring currency risk • Natural hedging strategies translational value of non-USD • Risk transfer of FX exposure EBITDA Choose a hedging program that to customers, suppliers, etc. delivers volatility risk reduction • Operational adjustments to Balance sheet hedging: Protect while minimizing costs incur more costs in same Operating Earnings and EPS currency as related impact of net monetary asset Apply strategy consistently with revenues (longer-term) MTM no market speculation Cost Effective and Principle Based Hedging Strategy 13

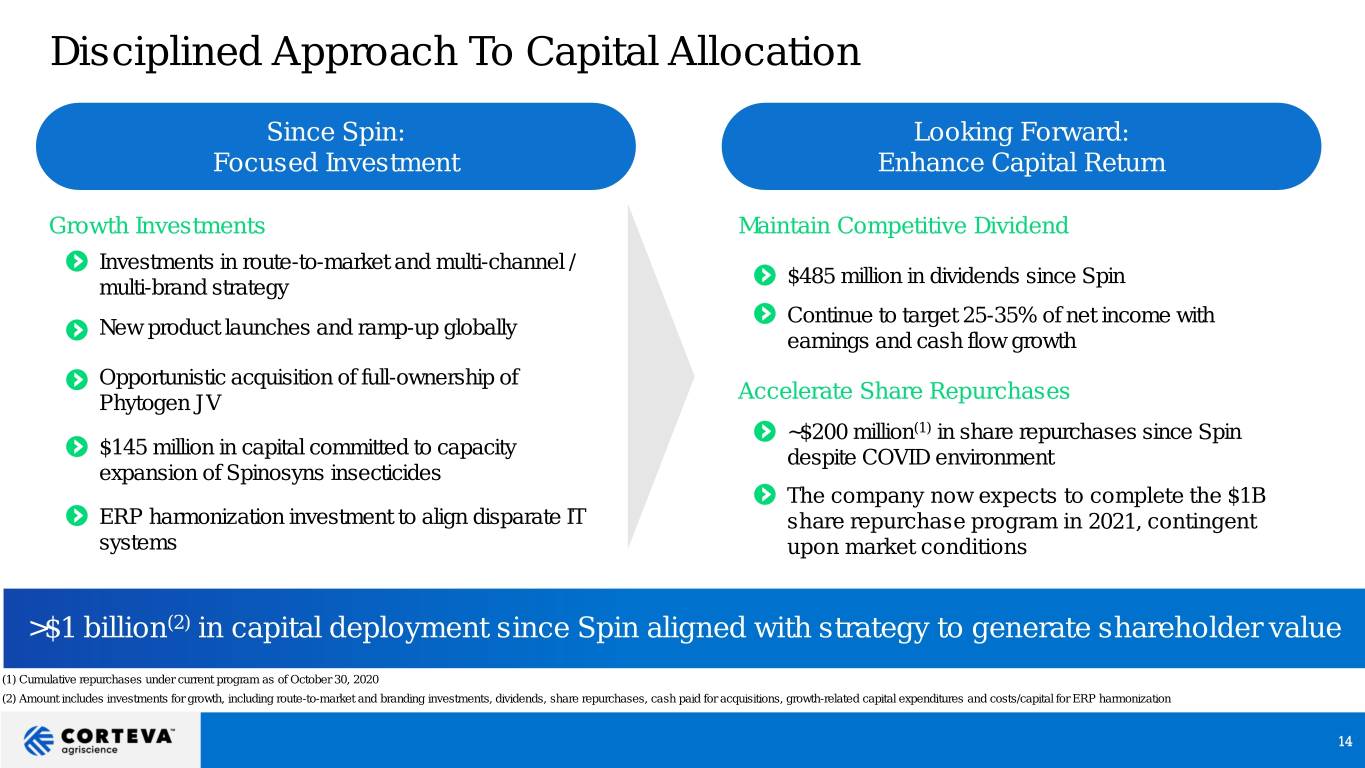

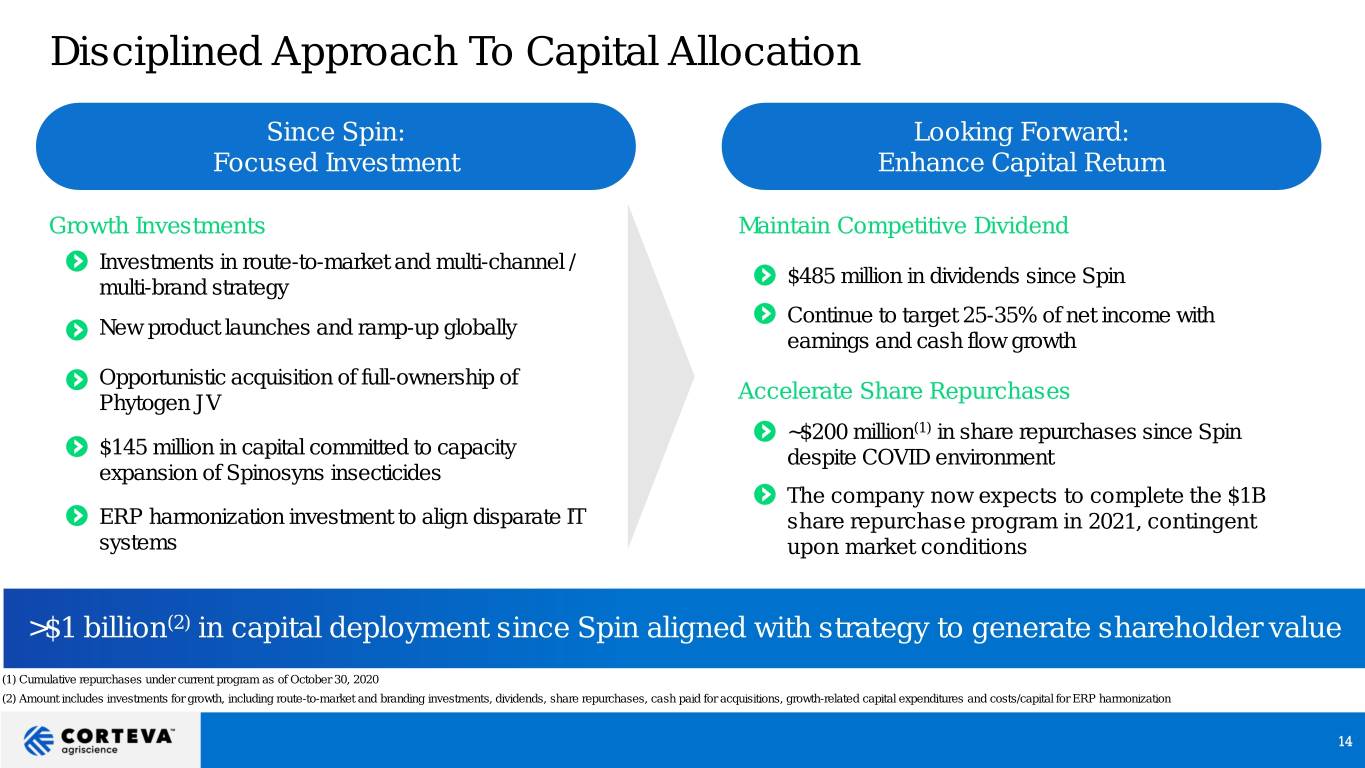

Disciplined Approach To Capital Allocation Since Spin: Looking Forward: Focused Investment Enhance Capital Return Growth Investments Maintain Competitive Dividend Investments in route-to-market and multi-channel / $485 million in dividends since Spin multi-brand strategy Continue to target 25-35% of net income with New product launches and ramp-up globally earnings and cash flow growth Opportunistic acquisition of full-ownership of Accelerate Share Repurchases Phytogen JV ~$200 million(1) in share repurchases since Spin $145 million in capital committed to capacity despite COVID environment expansion of Spinosyns insecticides The company now expects to complete the $1B ERP harmonization investment to align disparate IT share repurchase program in 2021, contingent systems upon market conditions >$1 billion(2) in capital deployment since Spin aligned with strategy to generate shareholder value (1) Cumulative repurchases under current program as of October 30, 2020 (2) Amount includes investments for growth, including route-to-market and branding investments, dividends, share repurchases, cash paid for acquisitions, growth-related capital expenditures and costs/capital for ERP harmonization 14

3Q 2020 Highlights ($’s in millions, except EPS) 3Q 2019 3Q 2020 Change Net Sales $1,911 $1,863 (3)% GAAP Loss from Continuing Operations After Income Taxes $(527) $(390) 26% Operating EBITDA(1) $(207) $(179) 14% Operating EBITDA Margin(1) (10.8)% (9.6)% 122 bps GAAP EPS from Continuing Operations $(0.69) $(0.52) 25% Operating EPS(1) $(0.39) $(0.39) Flat 3Q 2020 Net Sales Bridge ($ in millions) 3Q 2020 Operating EBITDA (1) Bridge ($ in millions) $(207) $(179) $1,911 $1,863 Non- North Latin (1) Asia 3Q 2019 Currency Price Production Other 3Q 2020 3Q 2019 (1) (1) EMEA (1) Portfolio Currency 3Q 2020 Portfolio Volume Production America America Pacific Costs(2) Costs(3) Operating EBITDA margin expansion despite currency headwinds and seasonal shifts (1) Organic sales, Operating EBITDA, Operating EBITDA margin and Operating earnings per share are non-GAAP measures. See slide 3 for further discussion. (2) Production costs are net of synergies realized in the period. (3) Non-Production Costs includes costs such as selling, leveraged function costs and product development, net of synergies realized in the period. 16

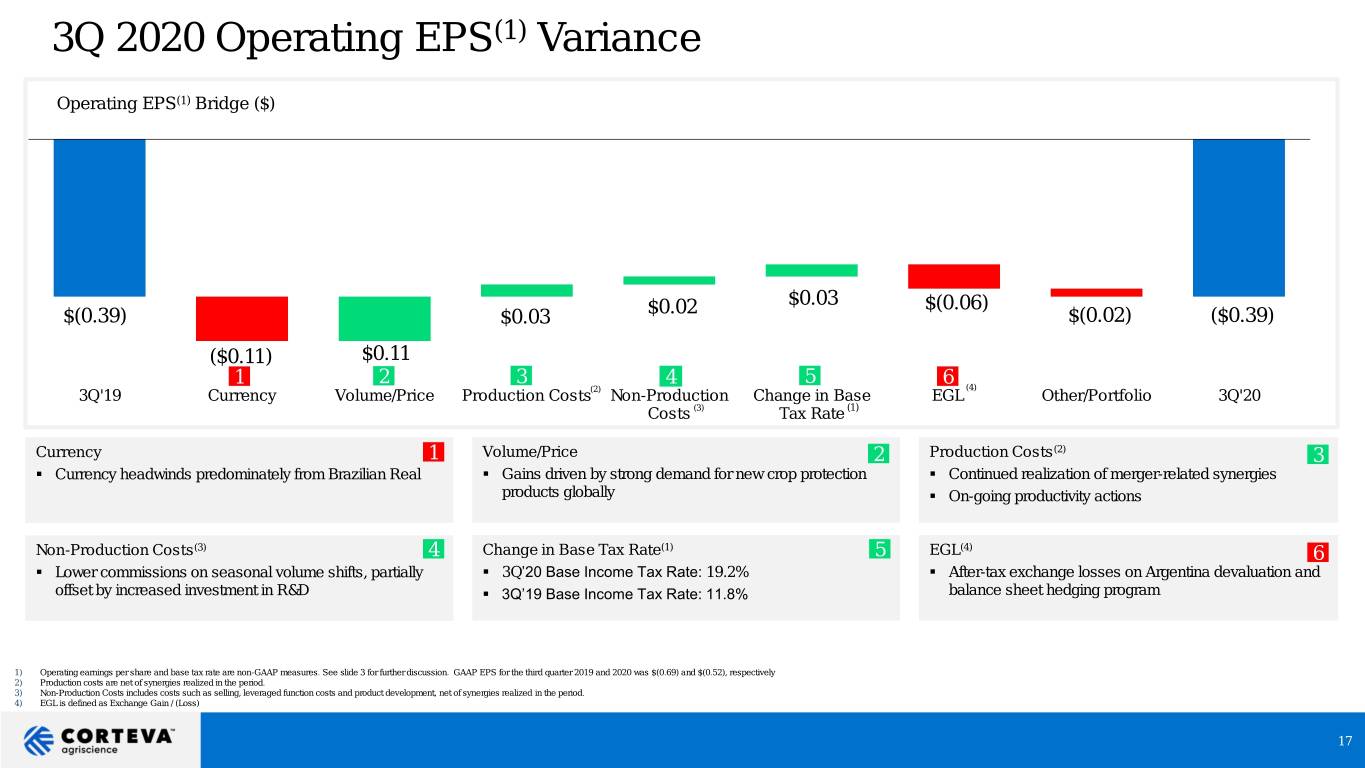

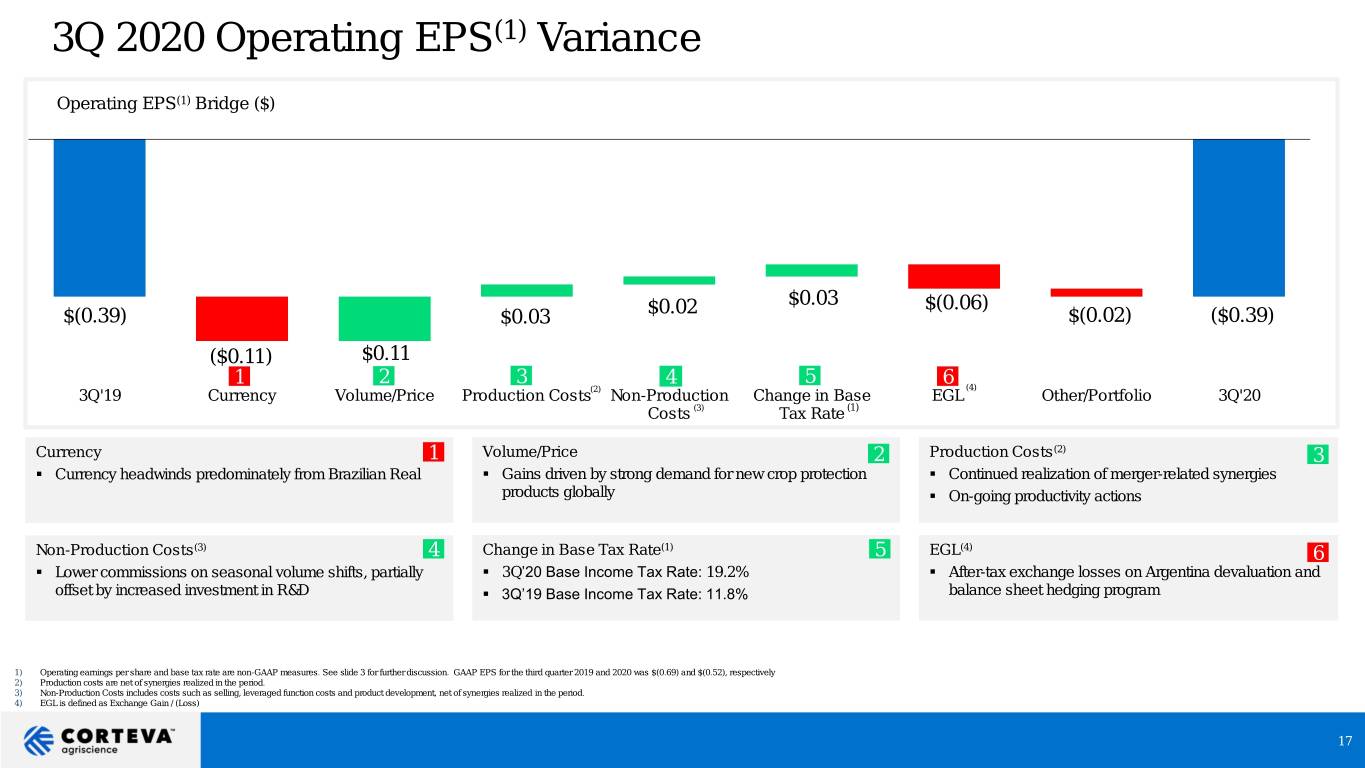

3Q 2020 Operating EPS(1) Variance Operating EPS(1) Bridge ($) $0.02 $0.03 $(0.06) $(0.39) $0.03 $(0.02) ($0.39) ($0.11) $0.11 2 3 5 1 4 6 (4) 3Q'19 Currency Volume/Price Production Costs(2) Non-Production Change in Base EGL Other/Portfolio 3Q'20 Costs (3) Tax Rate (1) Currency 1 Volume/Price 2 Production Costs(2) 3 ▪ Currency headwinds predominately from Brazilian Real ▪ Gains driven by strong demand for new crop protection ▪ Continued realization of merger-related synergies products globally ▪ On-going productivity actions Non-Production Costs(3) 4 Change in Base Tax Rate(1) 5 EGL(4) 6 ▪ Lower commissions on seasonal volume shifts, partially ▪ 3Q’20 Base Income Tax Rate: 19.2% ▪ After-tax exchange losses on Argentina devaluation and offset by increased investment in R&D ▪ 3Q’19 Base Income Tax Rate: 11.8% balance sheet hedging program 1) Operating earnings per share and base tax rate are non-GAAP measures. See slide 3 for further discussion. GAAP EPS for the third quarter 2019 and 2020 was $(0.69) and $(0.52), respectively 2) Production costs are net of synergies realized in the period. 3) Non-Production Costs includes costs such as selling, leveraged function costs and product development, net of synergies realized in the period. 4) EGL is defined as Exchange Gain / (Loss) 17

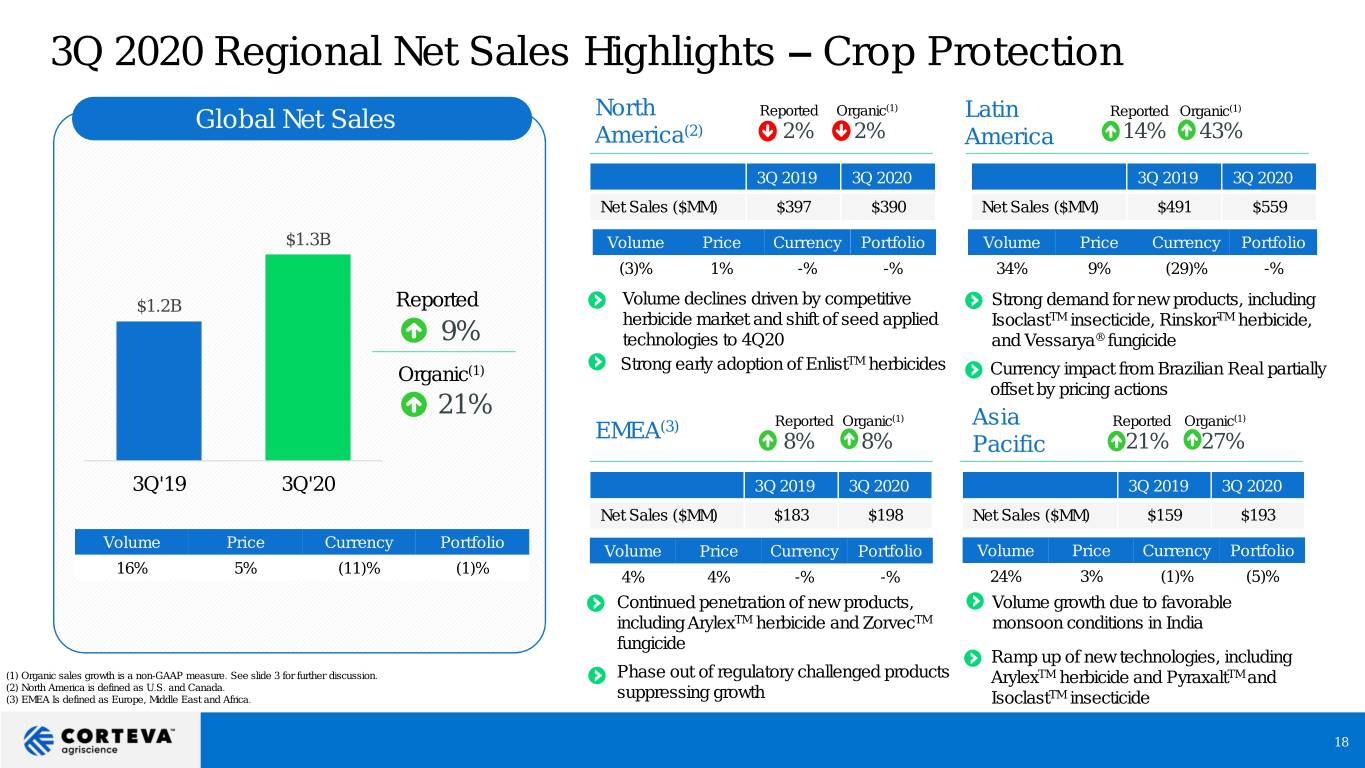

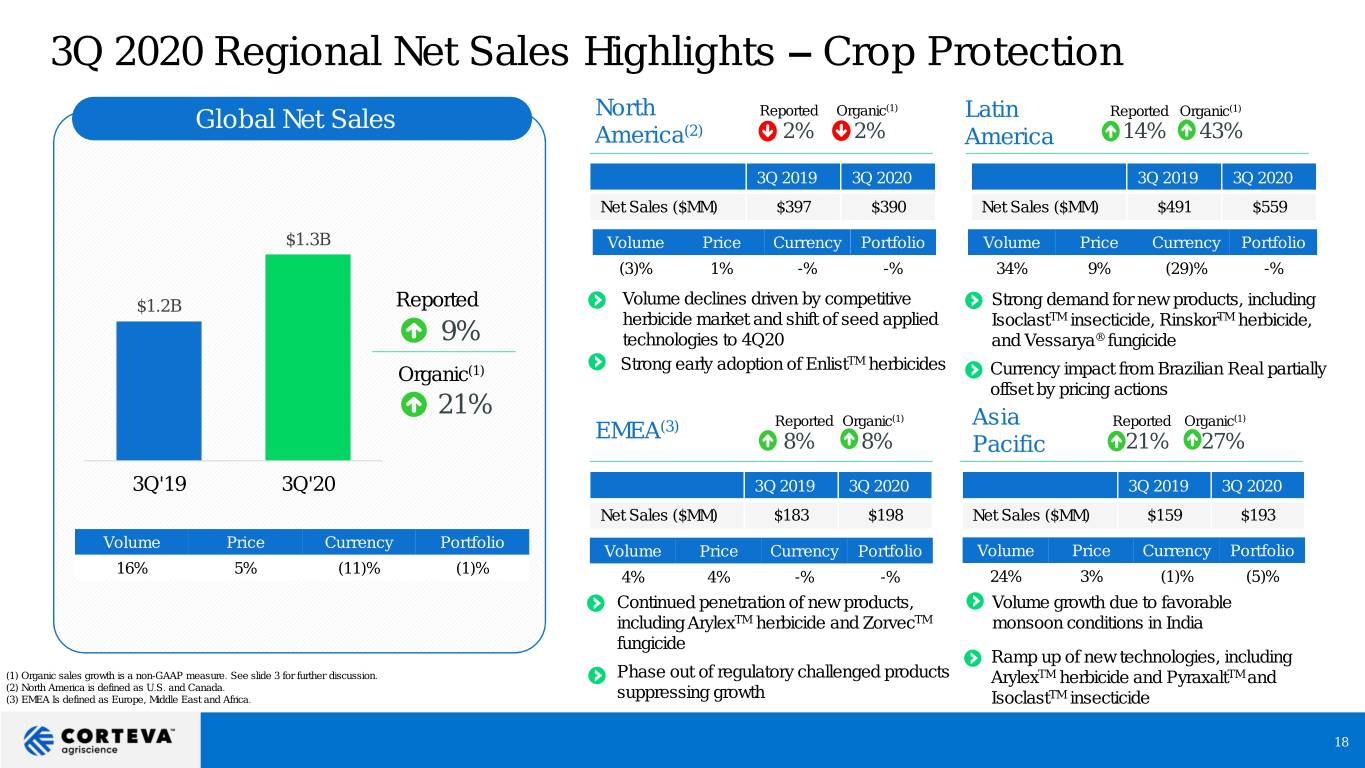

3Q 2020 Regional Net Sales Highlights – Crop Protection Global Net Sales North Reported Organic(1) Latin Reported Organic(1) America(2) 2% 2% America 14% 43% 3Q 2019 3Q 2020 3Q 2019 3Q 2020 Net Sales ($MM) $397 $390 Net Sales ($MM) $491 $559 $1.3B Volume Price Currency Portfolio Volume Price Currency Portfolio (3)% 1% -% -% 34% 9% (29)% -% $1.2B Reported Volume declines driven by competitive Strong demand for new products, including herbicide market and shift of seed applied IsoclastTM insecticide, RinskorTM herbicide, 9% technologies to 4Q20 and Vessarya® fungicide Strong early adoption of EnlistTM herbicides Organic(1) Currency impact from Brazilian Real partially offset by pricing actions 21% Reported Organic(1) Asia Reported Organic(1) EMEA(3) 8% 8% Pacific 21% 27% 3Q'19 3Q'20 3Q 2019 3Q 2020 3Q 2019 3Q 2020 Net Sales ($MM) $183 $198 Net Sales ($MM) $159 $193 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio 16% 5% (11)% (1)% 4% 4% -% -% 24% 3% (1)% (5)% Continued penetration of new products, Volume growth due to favorable including ArylexTM herbicide and ZorvecTM monsoon conditions in India fungicide Ramp up of new technologies, including (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. Phase out of regulatory challenged products ArylexTM herbicide and PyraxaltTM and (2) North America is defined as U.S. and Canada. TM (3) EMEA Is defined as Europe, Middle East and Africa. suppressing growth Isoclast insecticide 18

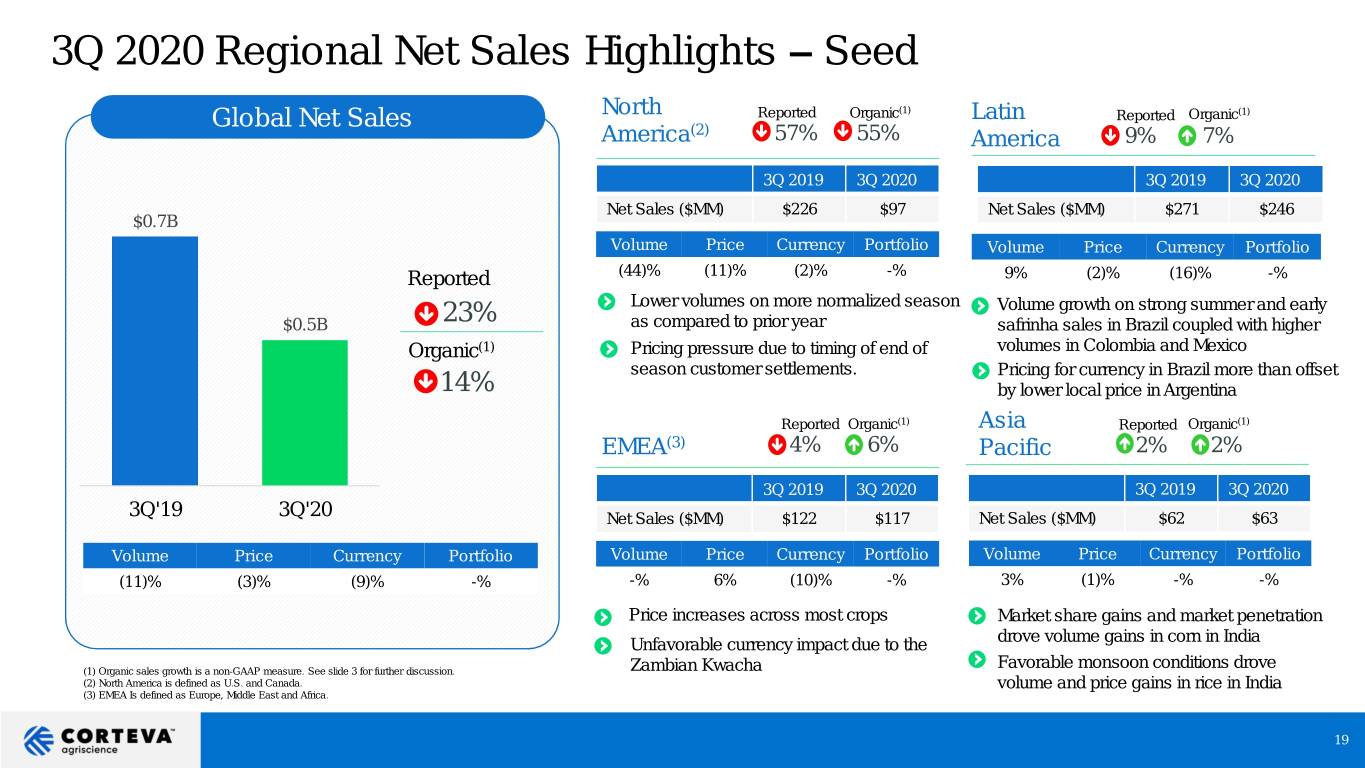

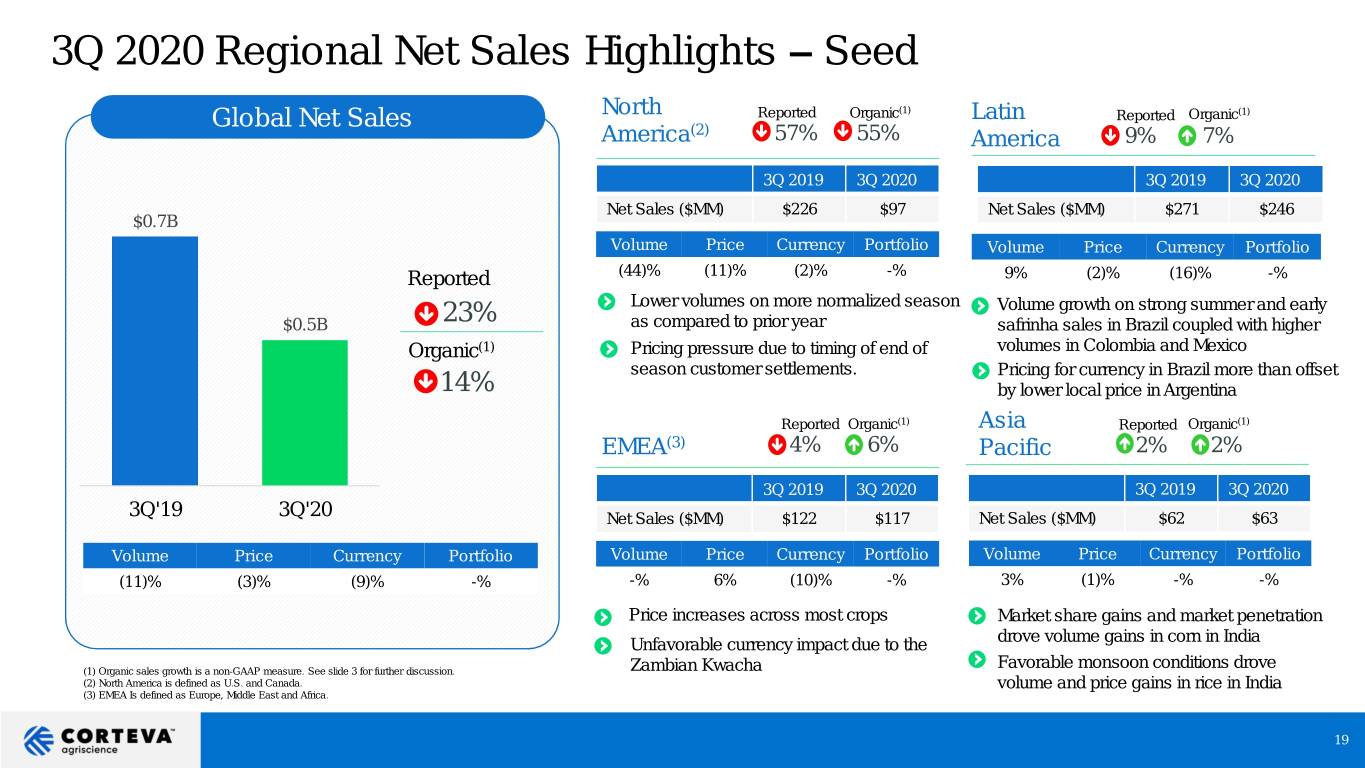

3Q 2020 Regional Net Sales Highlights – Seed North (1) (1) Global Net Sales Reported Organic Latin Reported Organic America(2) 57% 55% America 9% 7% 3Q 2019 3Q 2020 3Q 2019 3Q 2020 Net Sales ($MM) $226 $97 Net Sales ($MM) $271 $246 $0.7B Volume Price Currency Portfolio Volume Price Currency Portfolio Reported (44)% (11)% (2)% -% 9% (2)% (16)% -% Lower volumes on more normalized season Volume growth on strong summer and early $0.5B 23% as compared to prior year safrinha sales in Brazil coupled with higher Organic(1) Pricing pressure due to timing of end of volumes in Colombia and Mexico season customer settlements. Pricing for currency in Brazil more than offset 14% by lower local price in Argentina Reported Organic(1) Asia Reported Organic(1) EMEA(3) 4% 6% Pacific 2% 2% 3Q 2019 3Q 2020 3Q 2019 3Q 2020 3Q'19 3Q'20 Net Sales ($MM) $122 $117 Net Sales ($MM) $62 $63 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio (11)% (3)% (9)% -% -% 6% (10)% -% 3% (1)% -% -% Price increases across most crops Market share gains and market penetration drove volume gains in corn in India Unfavorable currency impact due to the Favorable monsoon conditions drove (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. Zambian Kwacha (2) North America is defined as U.S. and Canada. volume and price gains in rice in India (3) EMEA Is defined as Europe, Middle East and Africa. 19

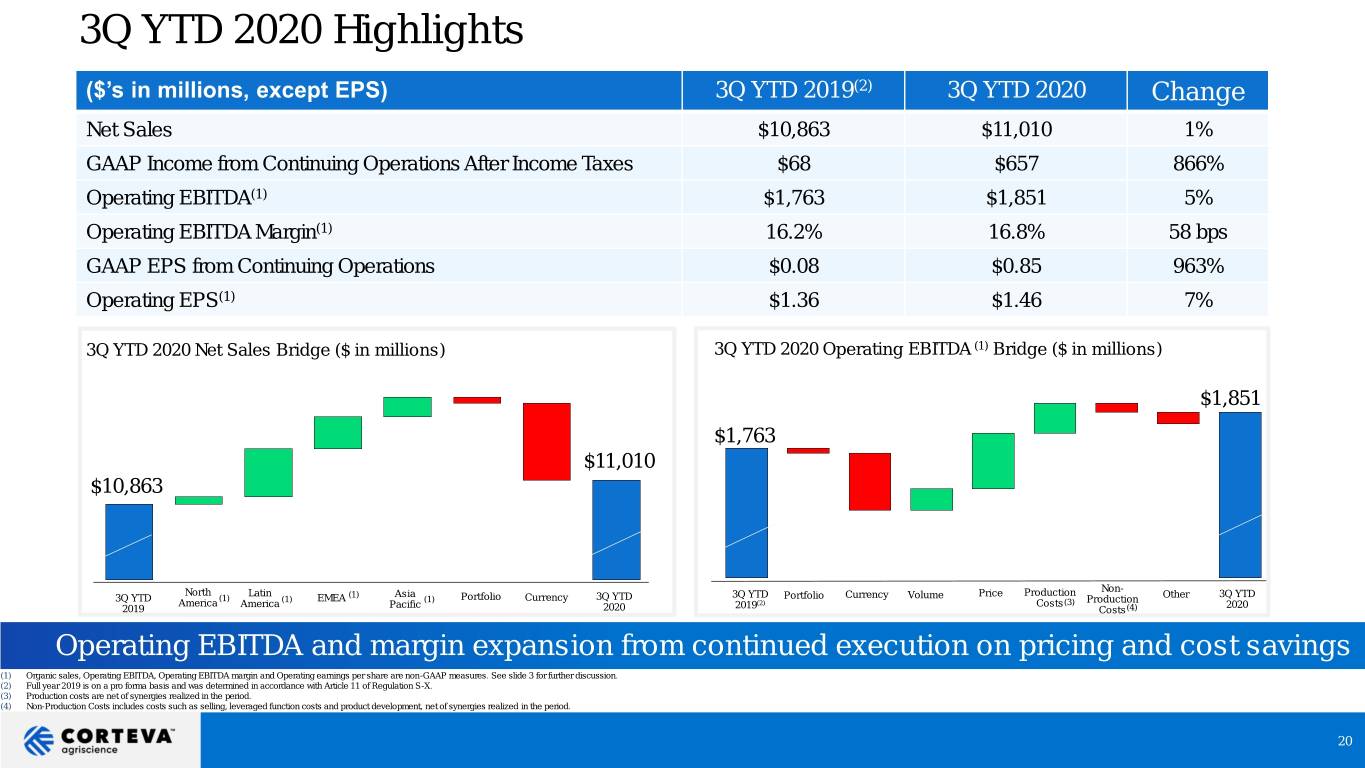

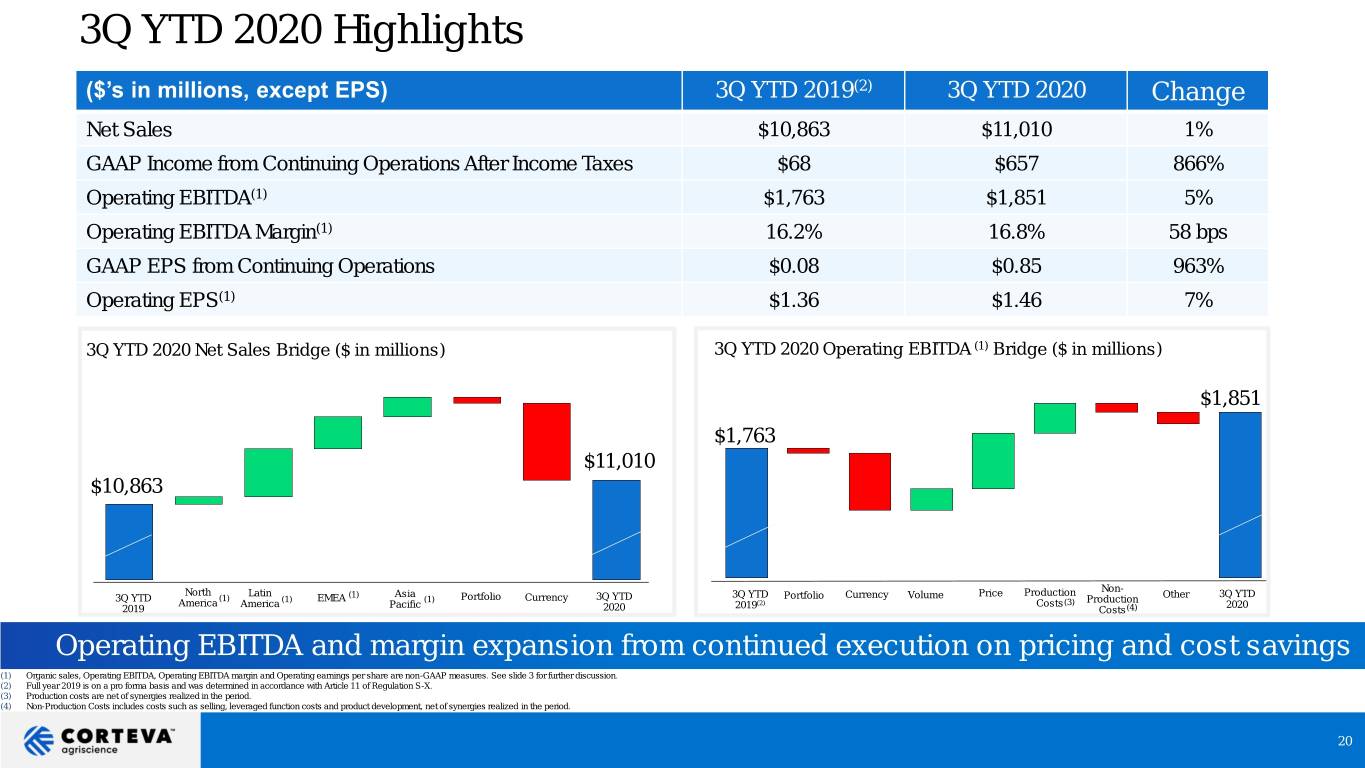

3Q YTD 2020 Highlights ($’s in millions, except EPS) 3Q YTD 2019(2) 3Q YTD 2020 Change Net Sales $10,863 $11,010 1% GAAP Income from Continuing Operations After Income Taxes $68 $657 866% Operating EBITDA(1) $1,763 $1,851 5% Operating EBITDA Margin(1) 16.2% 16.8% 58 bps GAAP EPS from Continuing Operations $0.08 $0.85 963% Operating EPS(1) $1.36 $1.46 7% 3Q YTD 2020 Net Sales Bridge ($ in millions) 3Q YTD 2020 Operating EBITDA (1) Bridge ($ in millions) $1,851 $1,763 $11,010 $10,863 Non- North Latin (1) Asia 3Q YTD Currency Price Production Other 3Q YTD 3Q YTD (1) (1) EMEA (1) Portfolio Currency 3Q YTD Portfolio Volume Production America America Pacific (2) Costs(3) 2020 2019 2020 2019 Costs(4) Operating EBITDA and margin expansion from continued execution on pricing and cost savings (1) Organic sales, Operating EBITDA, Operating EBITDA margin and Operating earnings per share are non-GAAP measures. See slide 3 for further discussion. (2) Full year 2019 is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X. (3) Production costs are net of synergies realized in the period. (4) Non-Production Costs includes costs such as selling, leveraged function costs and product development, net of synergies realized in the period. 20

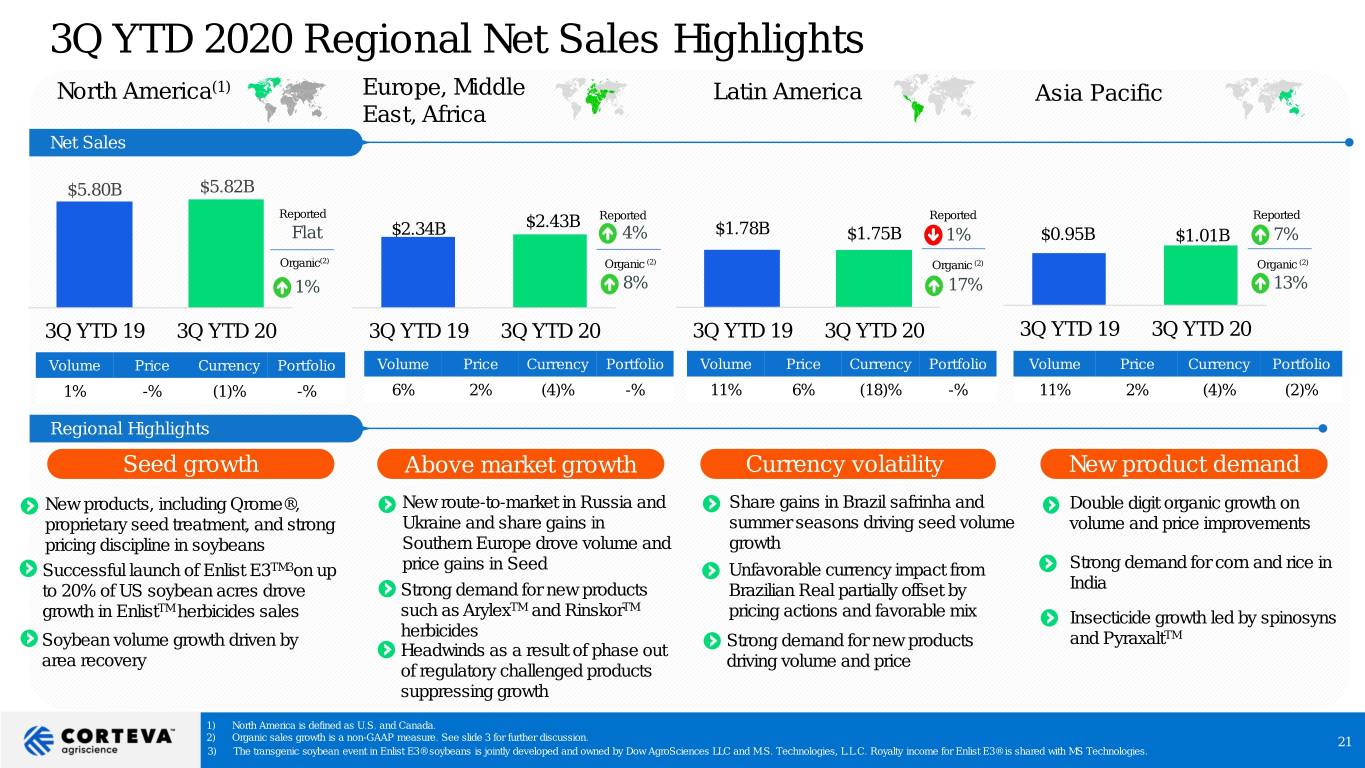

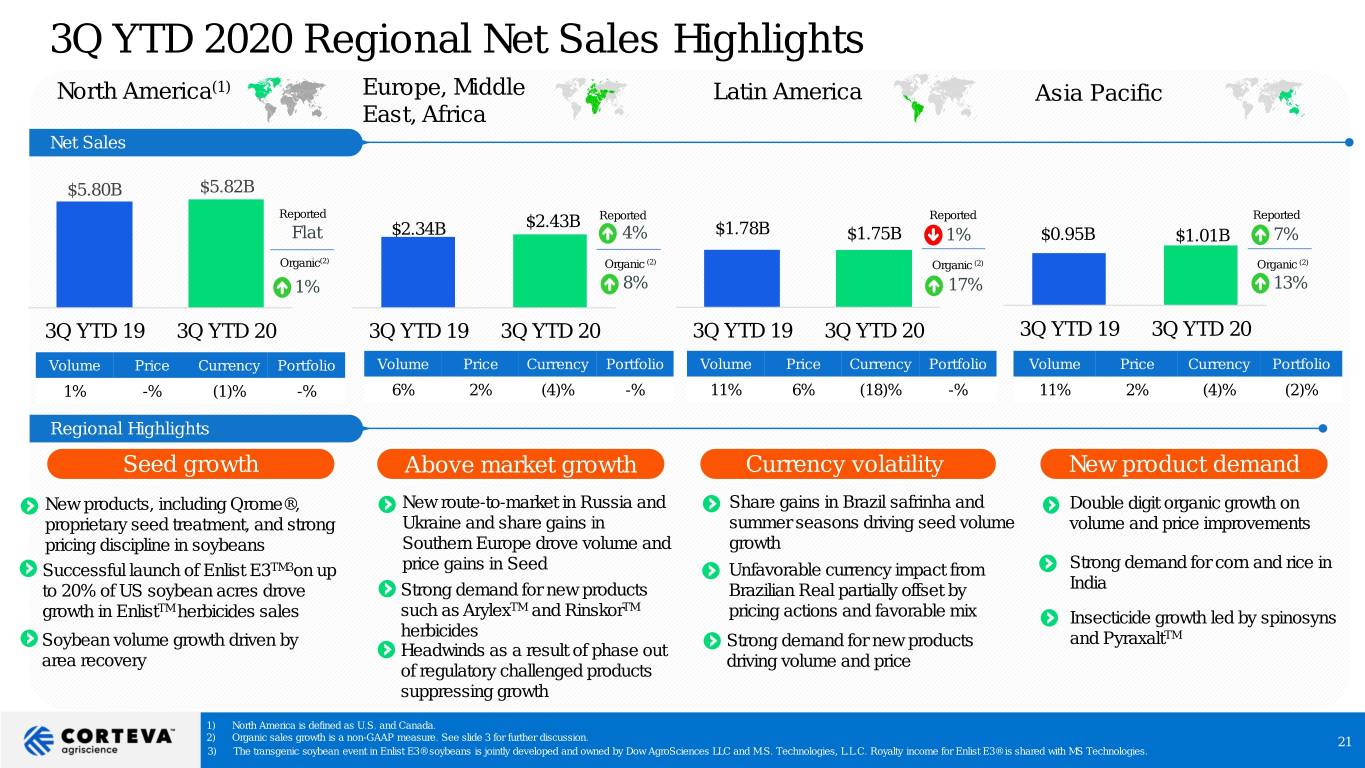

3Q YTD 2020 Regional Net Sales Highlights North America(1) Europe, Middle Latin America Asia Pacific East, Africa Net Sales $5.80B $5.82B Reported $2.43B Reported Reported Reported Flat $2.34B 4% $1.78B $1.75B 1% $0.95B $1.01B 7% Organic(2) Organic (2) Organic (2) Organic (2) 1% 8% 17% 13% 3Q YTD 19 3Q YTD 20 3Q YTD 19 3Q YTD 20 3Q YTD 19 3Q YTD 20 3Q YTD 19 3Q YTD 20 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio 1% -% (1)% -% 6% 2% (4)% -% 11% 6% (18)% -% 11% 2% (4)% (2)% Regional Highlights Seed growth Above market growth Currency volatility New product demand New products, including Qrome®, New route-to-market in Russia and Share gains in Brazil safrinha and Double digit organic growth on proprietary seed treatment, and strong Ukraine and share gains in summer seasons driving seed volume volume and price improvements pricing discipline in soybeans Southern Europe drove volume and growth Successful launch of Enlist E3TM3on up price gains in Seed Unfavorable currency impact from Strong demand for corn and rice in to 20% of US soybean acres drove Strong demand for new products Brazilian Real partially offset by India TM TM TM growth in Enlist herbicides sales such as Arylex and Rinskor pricing actions and favorable mix Insecticide growth led by spinosyns herbicides Soybean volume growth driven by Strong demand for new products and PyraxaltTM Headwinds as a result of phase out area recovery driving volume and price of regulatory challenged products suppressing growth 1) North America is defined as U.S. and Canada. 2) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. 21 3) The transgenic soybean event in Enlist E3® soybeans is jointly developed and owned by Dow AgroSciences LLC and M.S. Technologies, L.L.C. Royalty income for Enlist E3® is shared with MS Technologies.

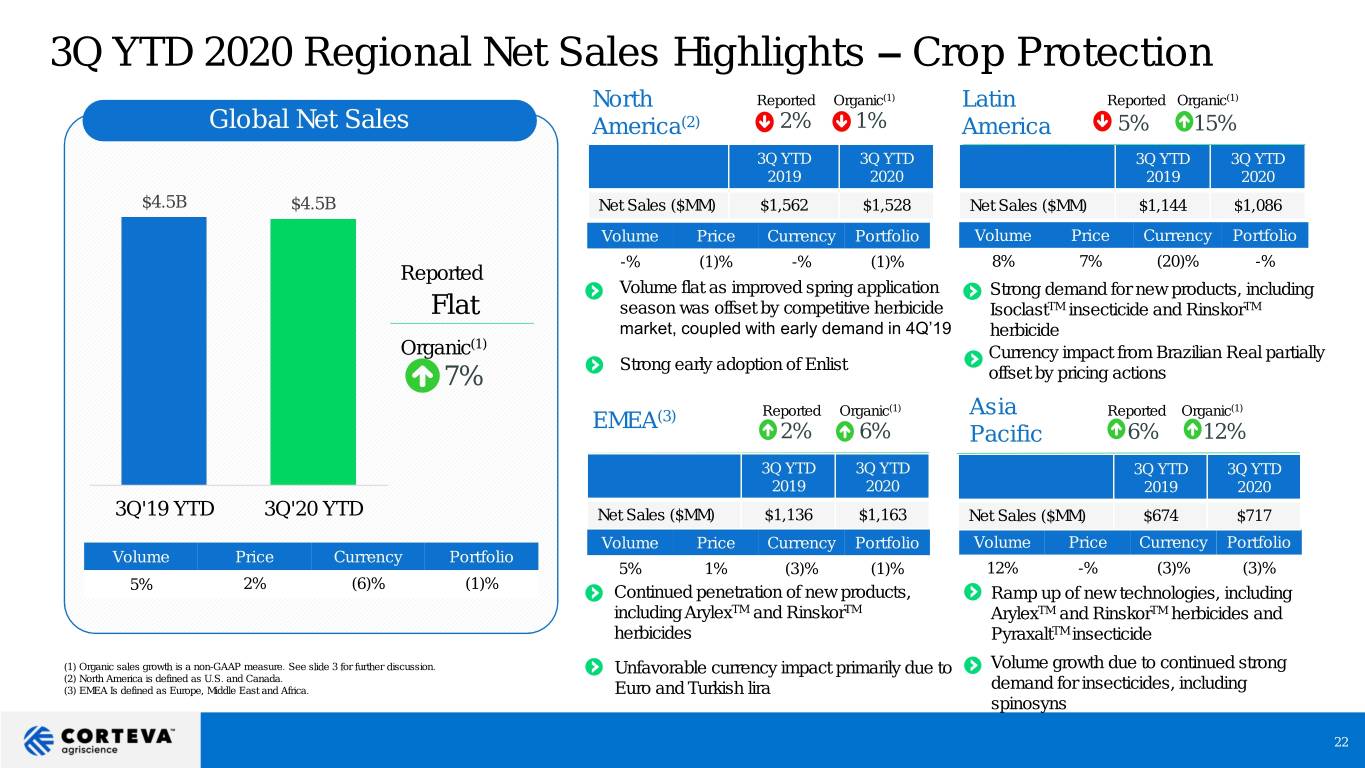

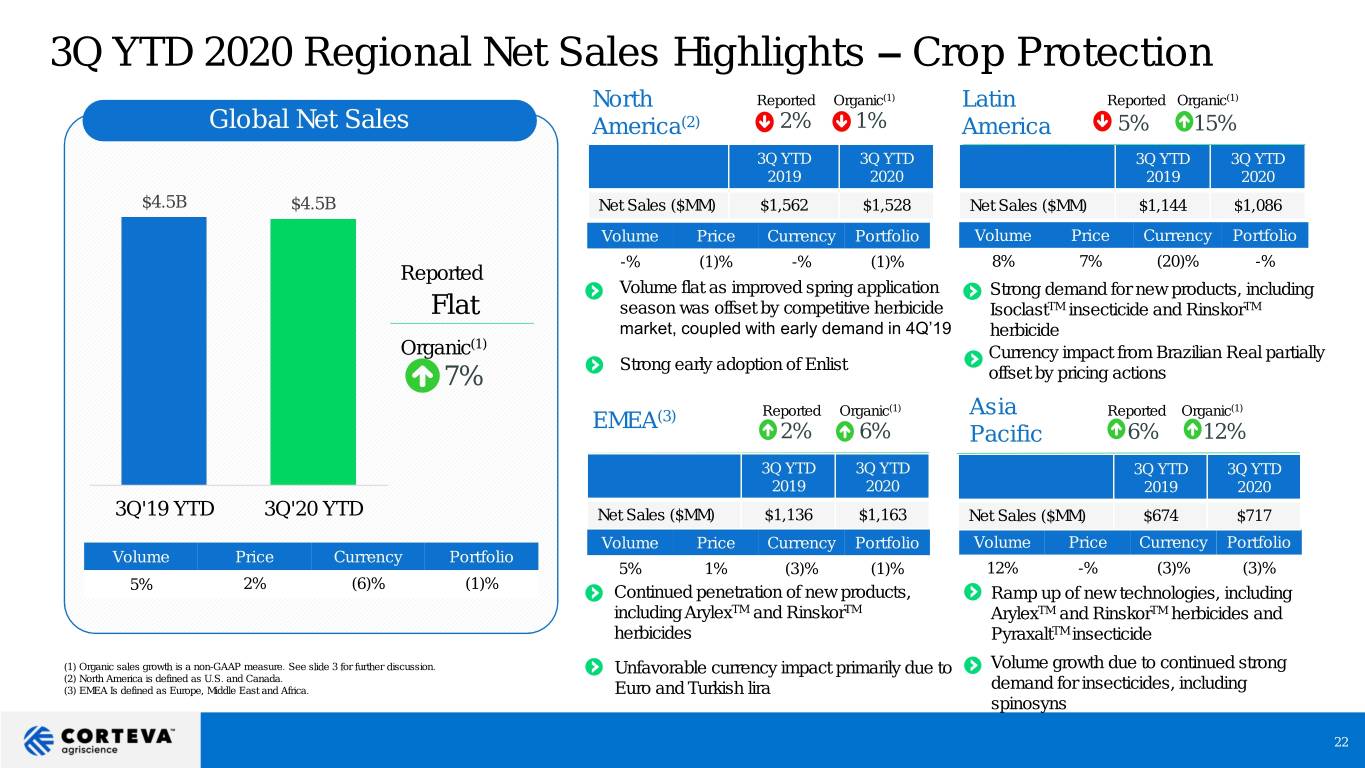

3Q YTD 2020 Regional Net Sales Highlights – Crop Protection North Reported Organic(1) Latin Reported Organic(1) Global Net Sales America(2) 2% 1% America 5% 15% 3Q YTD 3Q YTD 3Q YTD 3Q YTD 2019 2020 2019 2020 $4.5B $4.5B Net Sales ($MM) $1,562 $1,528 Net Sales ($MM) $1,144 $1,086 Volume Price Currency Portfolio Volume Price Currency Portfolio -% (1)% -% (1)% 8% 7% (20)% -% Reported Volume flat as improved spring application Strong demand for new products, including Flat season was offset by competitive herbicide IsoclastTM insecticide and RinskorTM market, coupled with early demand in 4Q’19 herbicide (1) Organic Currency impact from Brazilian Real partially Strong early adoption of Enlist 7% offset by pricing actions Reported Organic(1) Asia Reported Organic(1) EMEA(3) 2% 6% Pacific 6% 12% 3Q YTD 3Q YTD 3Q YTD 3Q YTD 2019 2020 2019 2020 3Q'19 YTD 3Q'20 YTD Net Sales ($MM) $1,136 $1,163 Net Sales ($MM) $674 $717 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio 5% 1% (3)% (1)% 12% -% (3)% (3)% 2% (6)% (1)% 5% Continued penetration of new products, Ramp up of new technologies, including including ArylexTM and RinskorTM ArylexTM and RinskorTM herbicides and herbicides PyraxaltTM insecticide (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. Unfavorable currency impact primarily due to Volume growth due to continued strong (2) North America is defined as U.S. and Canada. (3) EMEA Is defined as Europe, Middle East and Africa. Euro and Turkish lira demand for insecticides, including spinosyns 22

3Q YTD 2020 Regional Net Sales Highlights – Seed North Reported Organic(1) Latin Reported Organic(1) Global Net Sales America(2) 1% 2% America 5% 20% 3Q YTD 3Q YTD 3Q YTD 3Q YTD 2019 2020 2019 2020 $6.5B Net Sales ($MM) $4,238 $4,290 Net Sales ($MM) $636 $668 $6.3B Volume Price Currency Portfolio Volume Price Currency Portfolio 1% 1% (1)% -% 15% 5% (15)% -% Reported Higher soybean volume on recovery of Volume growth on strong summer and early 3% planted area safrinha sales in Brazil coupled with higher New products, including Qrome®, volumes in Colombia and Mexico (1) Organic proprietary seed treatment, and strong Currency impact from Brazilian Real partially 6% pricing discipline, partially offset by higher offset by pricing actions and improved mix sample Reported Organic(1) Asia Reported Organic(1) EMEA(3) 5% 11% Pacific 8% 14% 3Q YTD 3Q YTD 3Q YTD 3Q YTD 2019 2020 2019 2020 3Q'19 YTD 3Q'20 YTD Net Sales ($MM) $1,200 $1,262 Net Sales ($MM) $273 $296 Volume Price Currency Portfolio Volume Price Currency Portfolio Volume Price Currency Portfolio 7% 4% (6)% -% 8% 6% (6)% -% 2% (3)% -% 4% Volume growth on record corn sales driven Market share gains and market by route-to-market in Eastern Europe and penetration drove volume gains in corn share gains in Southern Europe in India and Pakistan (1) Organic sales growth is a non-GAAP measure. See slide 3 for further discussion. Improved pricing from route-to-market Favorable monsoon conditions drove (2) North America is defined as U.S. and Canada. changes offset by currency (3) EMEA Is defined as Europe, Middle East and Africa. volume and price gains in rice in India 23

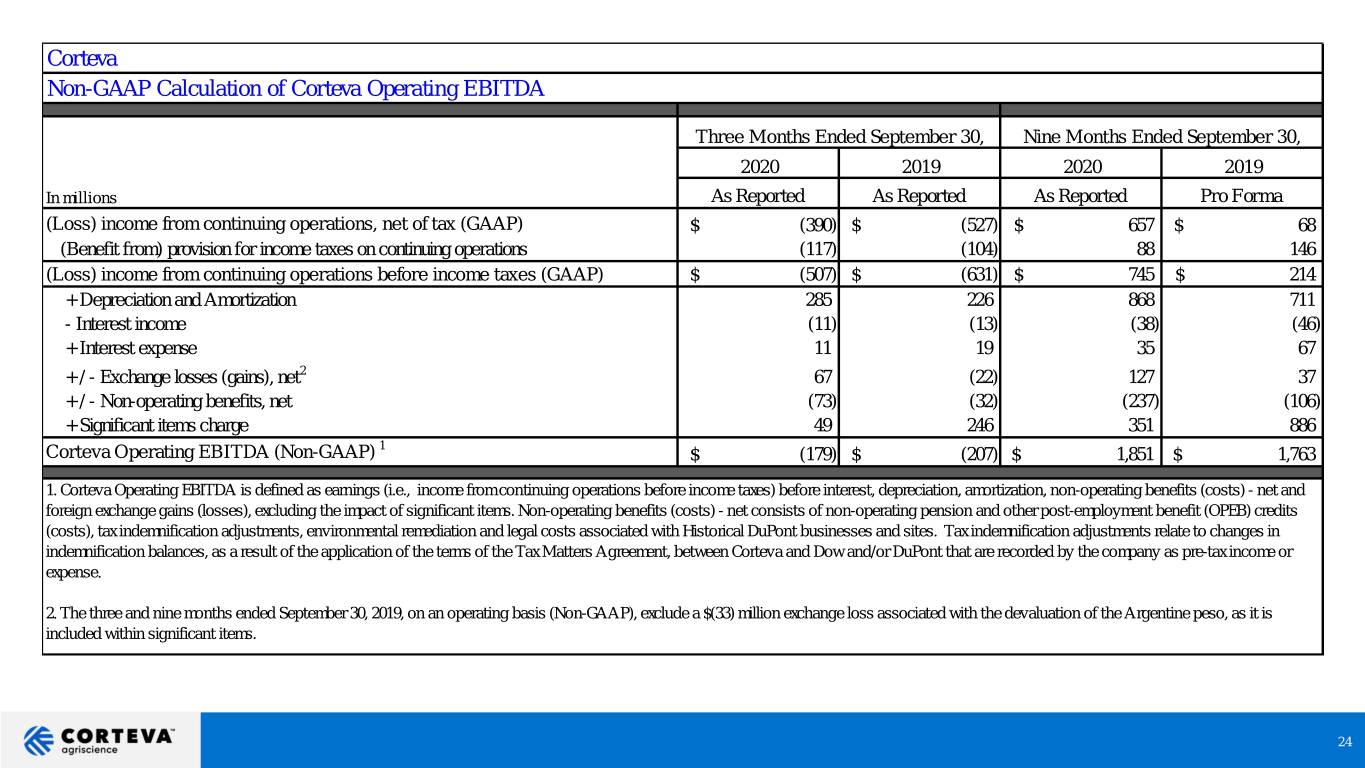

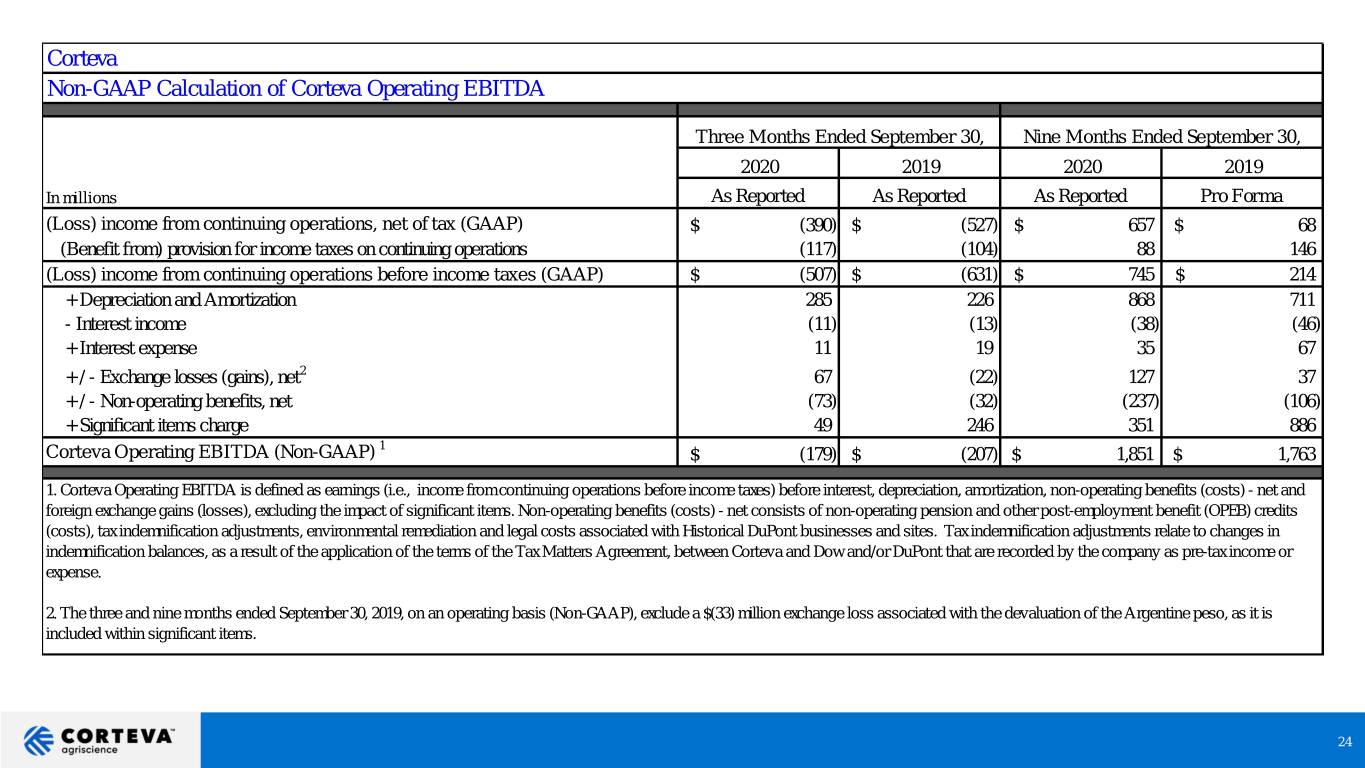

Corteva Non-GAAP Calculation of Corteva Operating EBITDA Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 In millions As Reported As Reported As Reported Pro Forma (Loss) income from continuing operations, net of tax (GAAP) $ (390) $ (527) $ 657 $ 68 (Benefit from) provision for income taxes on continuing operations (117) (104) 88 146 (Loss) income from continuing operations before income taxes (GAAP) $ (507) $ (631) $ 745 $ 214 + Depreciation and Amortization 285 226 868 711 - Interest income (11) (13) (38) (46) + Interest expense 11 19 35 67 + / - Exchange losses (gains), net2 67 (22) 127 37 + / - Non-operating benefits, net (73) (32) (237) (106) + Significant items charge 49 246 351 886 1 Corteva Operating EBITDA (Non-GAAP) $ (179) $ (207) $ 1,851 $ 1,763 1. Corteva Operating EBITDA is defined as earnings (i.e., income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits (costs) - net and foreign exchange gains (losses), excluding the impact of significant items. Non-operating benefits (costs) - net consists of non-operating pension and other post-employment benefit (OPEB) credits (costs), tax indemnification adjustments, environmental remediation and legal costs associated with Historical DuPont businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense. 2. The three and nine months ended September 30, 2019, on an operating basis (Non-GAAP), exclude a $(33) million exchange loss associated with the devaluation of the Argentine peso, as it is included within significant items. 24

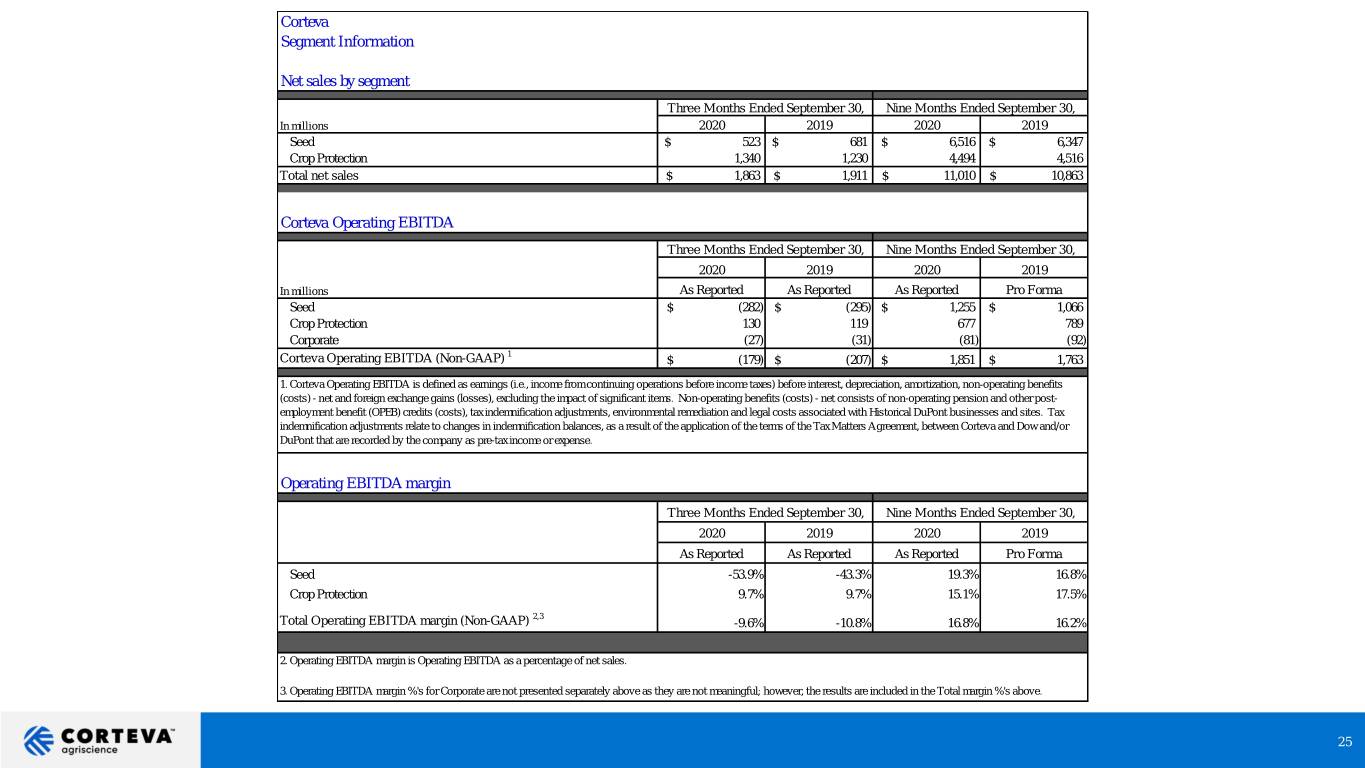

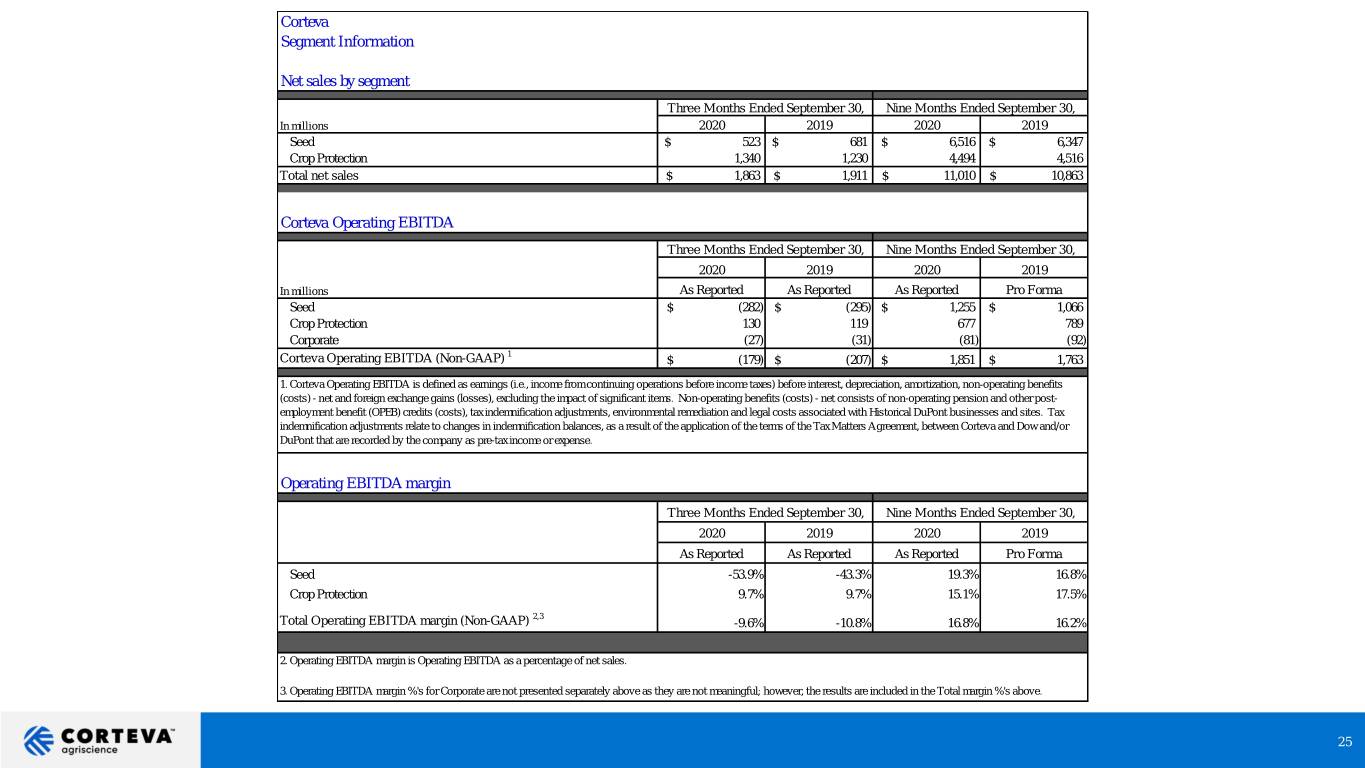

Corteva Segment Information Net sales by segment Three Months Ended September 30, Nine Months Ended September 30, In millions 2020 2019 2020 2019 Seed $ 523 $ 681 $ 6,516 $ 6,347 Crop Protection 1,340 1,230 4,494 4,516 Total net sales $ 1,863 $ 1,911 $ 11,010 $ 10,863 Corteva Operating EBITDA Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 In millions As Reported As Reported As Reported Pro Forma Seed $ (282) $ (295) $ 1,255 $ 1,066 Crop Protection 130 119 677 789 Corporate (27) (31) (81) (92) 1 Corteva Operating EBITDA (Non-GAAP) $ (179) $ (207) $ 1,851 $ 1,763 1. Corteva Operating EBITDA is defined as earnings (i.e., income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits (costs) - net and foreign exchange gains (losses), excluding the impact of significant items. Non-operating benefits (costs) - net consists of non-operating pension and other post- employment benefit (OPEB) credits (costs), tax indemnification adjustments, environmental remediation and legal costs associated with Historical DuPont businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense. Operating EBITDA margin Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 As Reported As Reported As Reported Pro Forma Seed -53.9% -43.3% 19.3% 16.8% Crop Protection 9.7% 9.7% 15.1% 17.5% 2,3 Total Operating EBITDA margin (Non-GAAP) -9.6% -10.8% 16.8% 16.2% 2. Operating EBITDA margin is Operating EBITDA as a percentage of net sales. 3. Operating EBITDA margin %'s for Corporate are not presented separately above as they are not meaningful; however, the results are included in the Total margin %'s above. 25

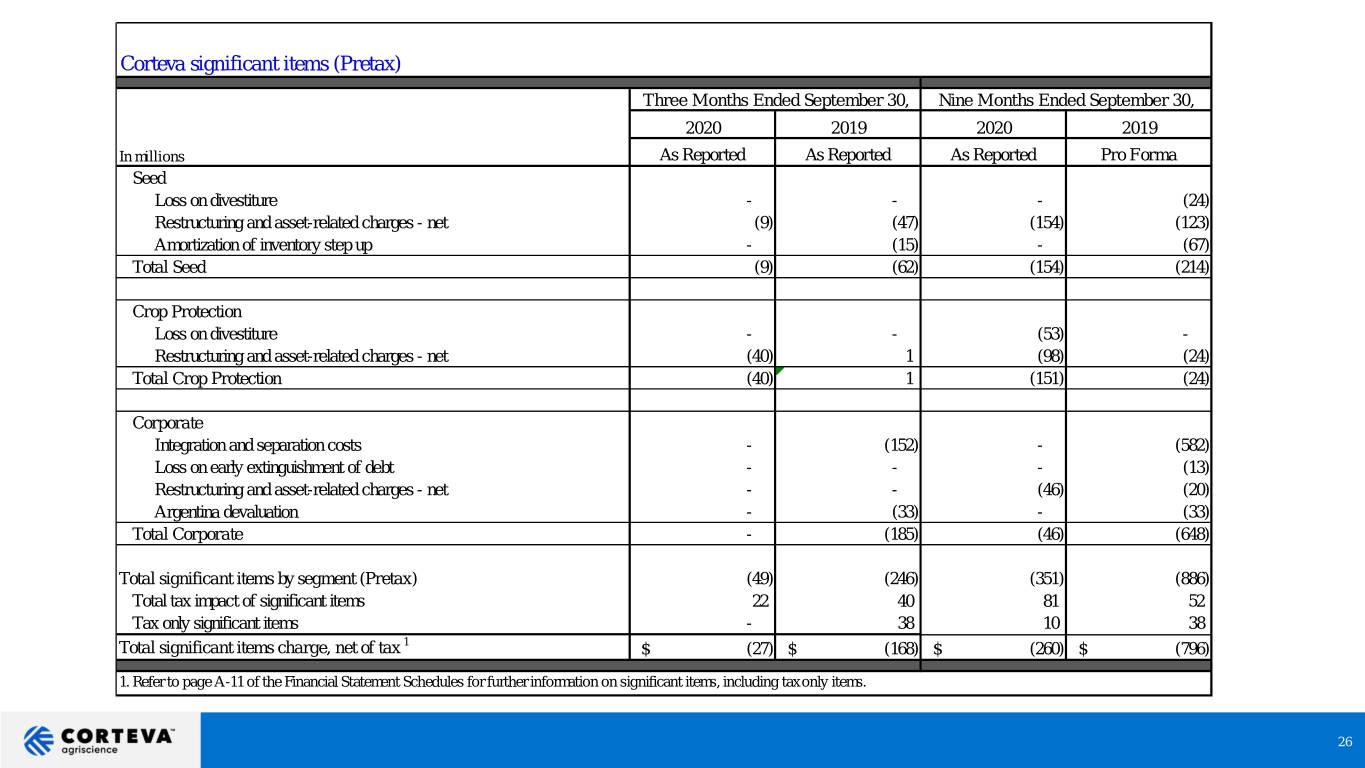

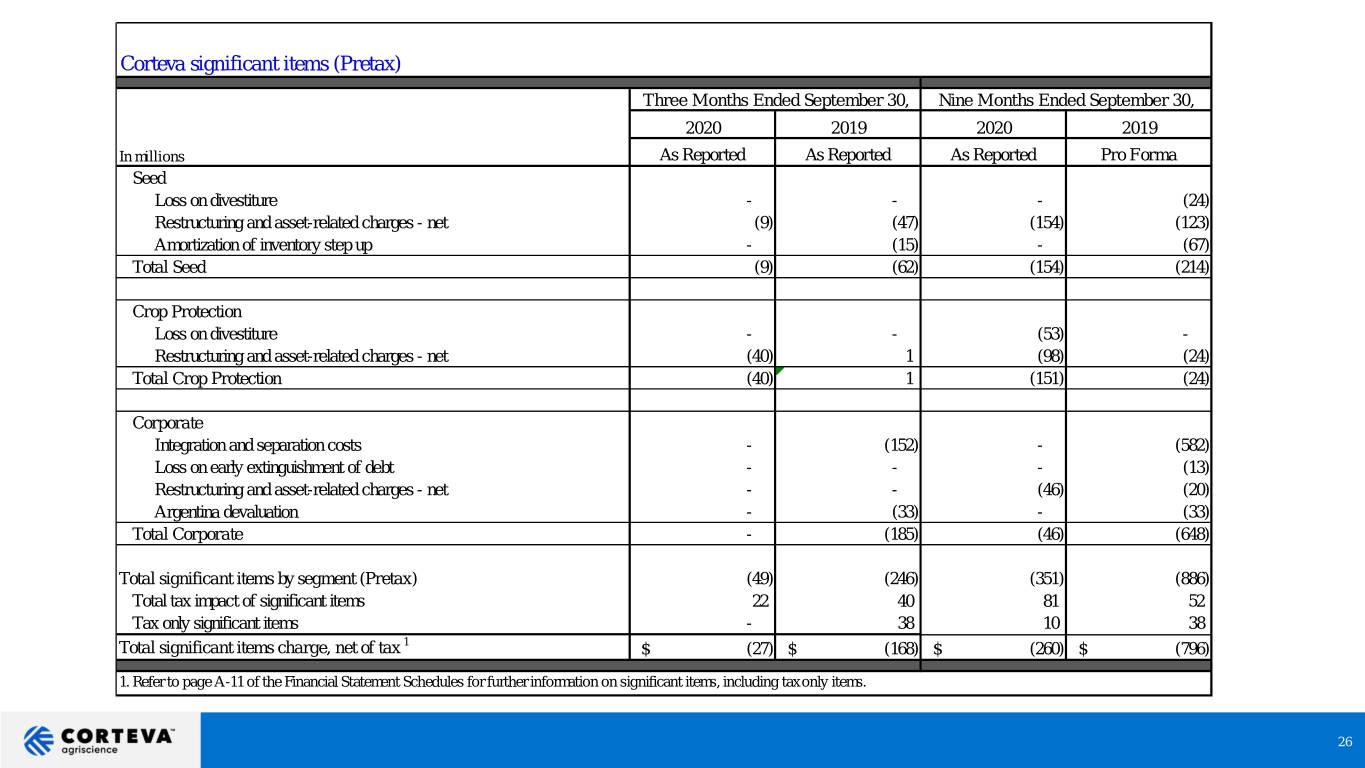

Corteva significant items (Pretax) Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 In millions As Reported As Reported As Reported Pro Forma Seed Loss on divestiture - - - (24) Restructuring and asset-related charges - net (9) (47) (154) (123) Amortization of inventory step up - (15) - (67) Total Seed (9) (62) (154) (214) Crop Protection Loss on divestiture - - (53) - Restructuring and asset-related charges - net (40) 1 (98) (24) Total Crop Protection (40) 1 (151) (24) Corporate Integration and separation costs - (152) - (582) Loss on early extinguishment of debt - - - (13) Restructuring and asset-related charges - net - - (46) (20) Argentina devaluation - (33) - (33) Total Corporate - (185) (46) (648) Total significant items by segment (Pretax) (49) (246) (351) (886) Total tax impact of significant items 22 40 81 52 Tax only significant items - 38 10 38 Total significant items charge, net of tax 1 $ (27) $ (168) $ (260) $ (796) 1. Refer to page A-11 of the Financial Statement Schedules for further information on significant items, including tax only items. 26

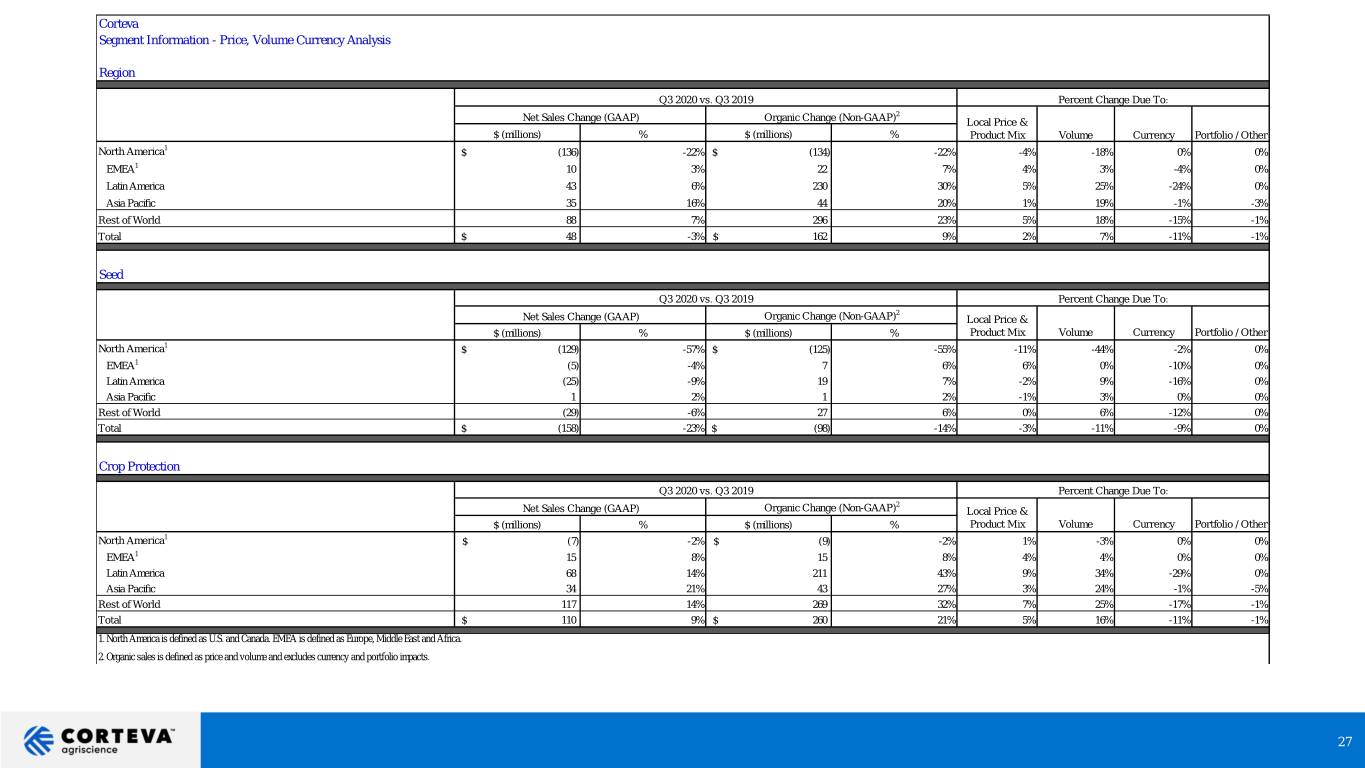

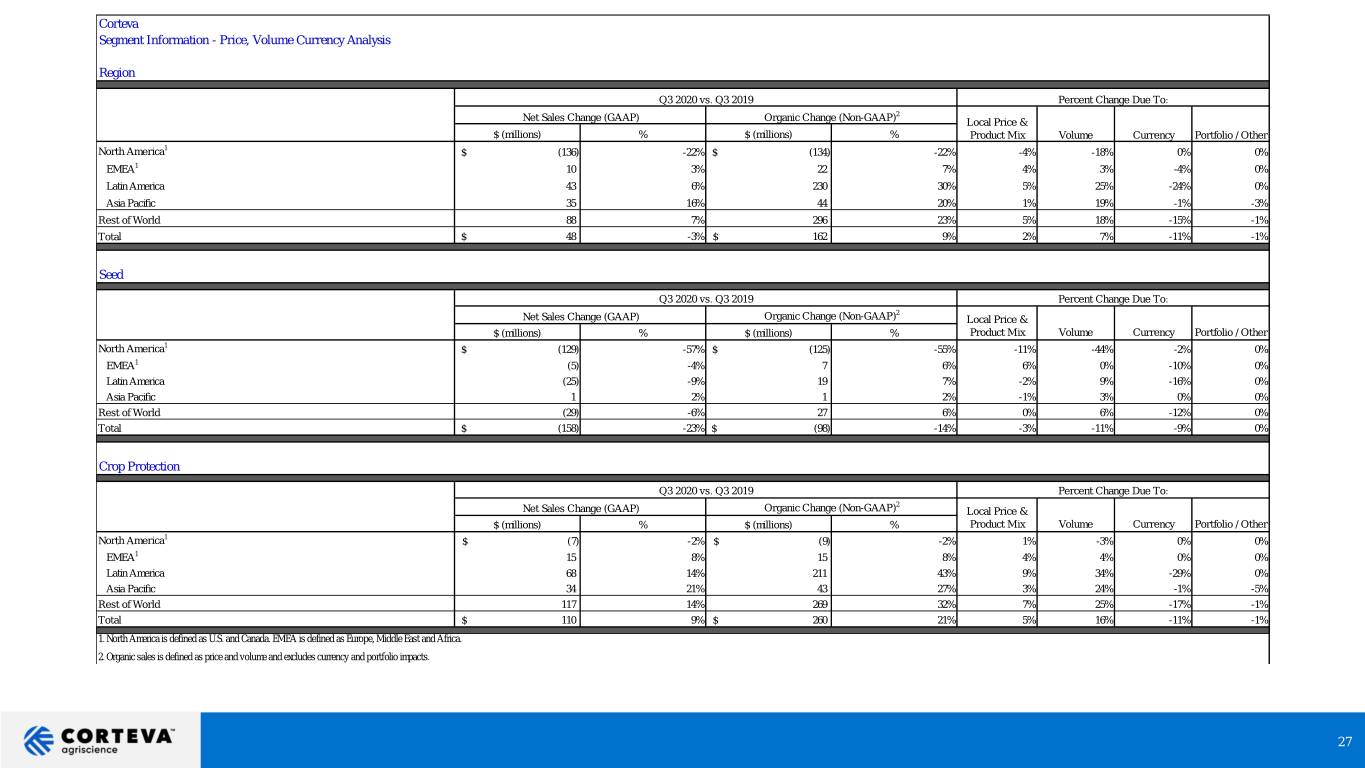

Corteva Segment Information - Price, Volume Currency Analysis Region Q3 2020 vs. Q3 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other North America1 $ (136) -22% $ (134) -22% -4% -18% 0% 0% EMEA1 10 3% 22 7% 4% 3% -4% 0% Latin America 43 6% 230 30% 5% 25% -24% 0% Asia Pacific 35 16% 44 20% 1% 19% -1% -3% Rest of World 88 7% 296 23% 5% 18% -15% -1% Total $ 48 -3% $ 162 9% 2% 7% -11% -1% Seed Q3 2020 vs. Q3 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other North America1 $ (129) -57% $ (125) -55% -11% -44% -2% 0% EMEA1 (5) -4% 7 6% 6% 0% -10% 0% Latin America (25) -9% 19 7% -2% 9% -16% 0% Asia Pacific 1 2% 1 2% -1% 3% 0% 0% Rest of World (29) -6% 27 6% 0% 6% -12% 0% Total $ (158) -23% $ (98) -14% -3% -11% -9% 0% Crop Protection Q3 2020 vs. Q3 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other North America1 $ (7) -2% $ (9) -2% 1% -3% 0% 0% EMEA1 15 8% 15 8% 4% 4% 0% 0% Latin America 68 14% 211 43% 9% 34% -29% 0% Asia Pacific 34 21% 43 27% 3% 24% -1% -5% Rest of World 117 14% 269 32% 7% 25% -17% -1% Total $ 110 9% $ 260 21% 5% 16% -11% -1% 1. North America is defined as U.S. and Canada. EMEA is defined as Europe, Middle East and Africa. 2. Organic sales is defined as price and volume and excludes currency and portfolio impacts. 27

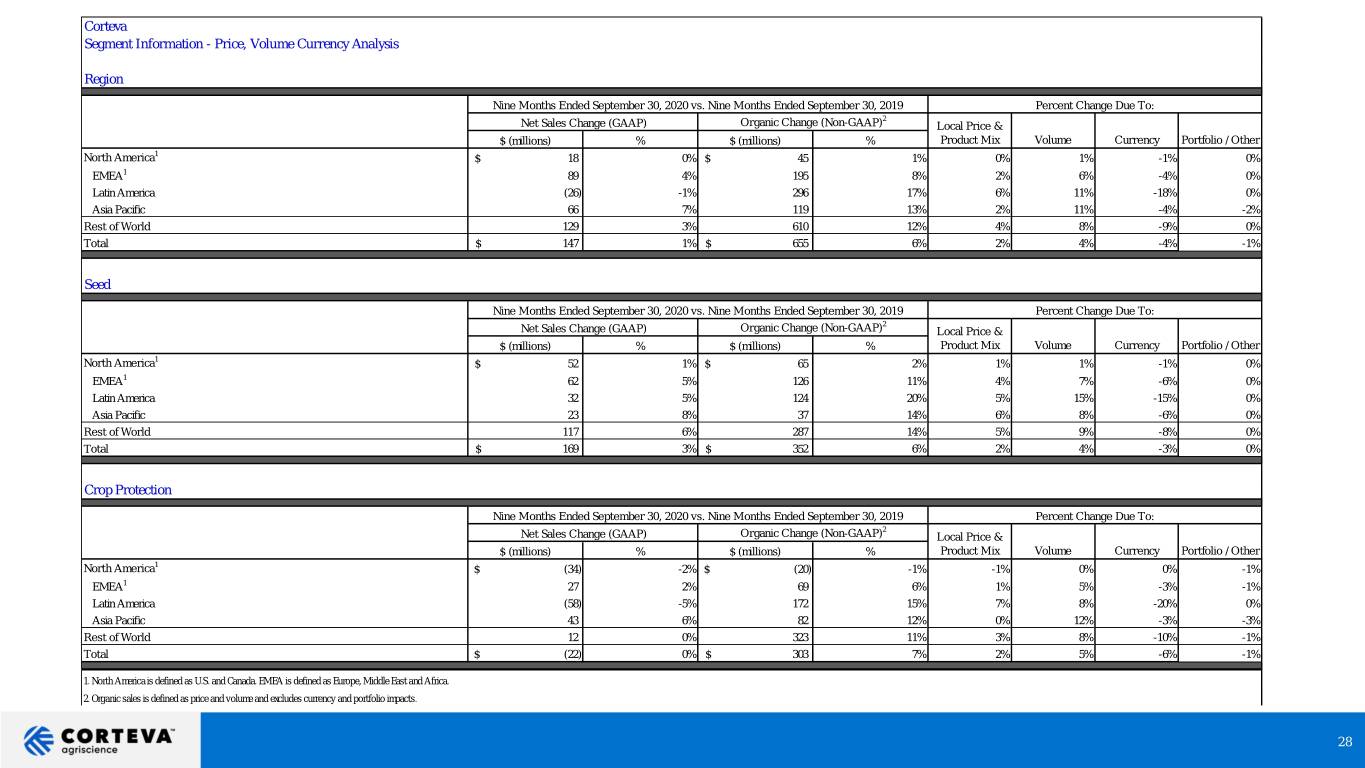

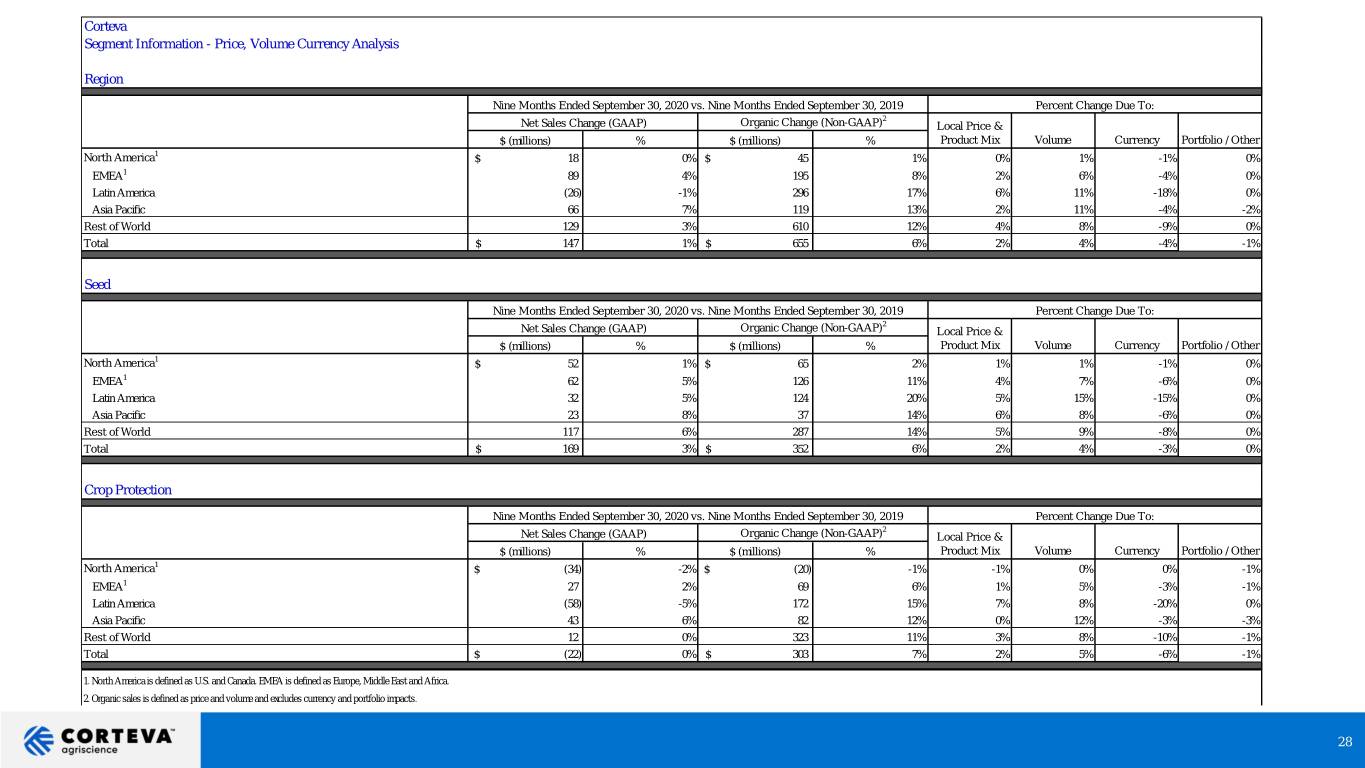

Corteva Segment Information - Price, Volume Currency Analysis Region Nine Months Ended September 30, 2020 vs. Nine Months Ended September 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other North America1 $ 18 0% $ 45 1% 0% 1% -1% 0% EMEA1 89 4% 195 8% 2% 6% -4% 0% Latin America (26) -1% 296 17% 6% 11% -18% 0% Asia Pacific 66 7% 119 13% 2% 11% -4% -2% Rest of World 129 3% 610 12% 4% 8% -9% 0% Total $ 147 1% $ 655 6% 2% 4% -4% -1% Seed Nine Months Ended September 30, 2020 vs. Nine Months Ended September 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other North America1 $ 52 1% $ 65 2% 1% 1% -1% 0% EMEA1 62 5% 126 11% 4% 7% -6% 0% Latin America 32 5% 124 20% 5% 15% -15% 0% Asia Pacific 23 8% 37 14% 6% 8% -6% 0% Rest of World 117 6% 287 14% 5% 9% -8% 0% Total $ 169 3% $ 352 6% 2% 4% -3% 0% Crop Protection Nine Months Ended September 30, 2020 vs. Nine Months Ended September 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other North America1 $ (34) -2% $ (20) -1% -1% 0% 0% -1% EMEA1 27 2% 69 6% 1% 5% -3% -1% Latin America (58) -5% 172 15% 7% 8% -20% 0% Asia Pacific 43 6% 82 12% 0% 12% -3% -3% Rest of World 12 0% 323 11% 3% 8% -10% -1% Total $ (22) 0% $ 303 7% 2% 5% -6% -1% 1. North America is defined as U.S. and Canada. EMEA is defined as Europe, Middle East and Africa. 2. Organic sales is defined as price and volume and excludes currency and portfolio impacts. 28

Corteva Segment Information - Price, Volume Currency Analysis Seed Product Line Q3 2020 vs. Q3 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other Corn $ (69) -18% $ (30) -8% -2% -6% -10% 0% Soybeans (52) -31% (33) -20% 14% -34% -11% 0% Other oilseeds 18 41% 20 45% 36% 9% -4% 0% Other oilseeds (55) -57% (55) -56% -58% 2% -1% 0% Total $ (158) -23% $ (98) -14% -3% -11% -9% 0% Crop Protection Product Line Q3 2020 vs. Q3 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other Herbicides3 $ 9 2% $ 62 11% 0% 11% -8% -1% Insecticides3 65 20% 99 30% 4% 26% -10% 0% Fungicides3 16 7% 74 30% 10% 20% -23% 0% Other3 20 25% 25 31% 24% 7% -6% 0% Total $ 110 9% $ 260 21% 5% 16% -11% -1% 2. Organic sales is defined as price and volume and excludes currency and portfolio impacts. 3. Prior periods have been reclassified to conform to current period presentation. 29

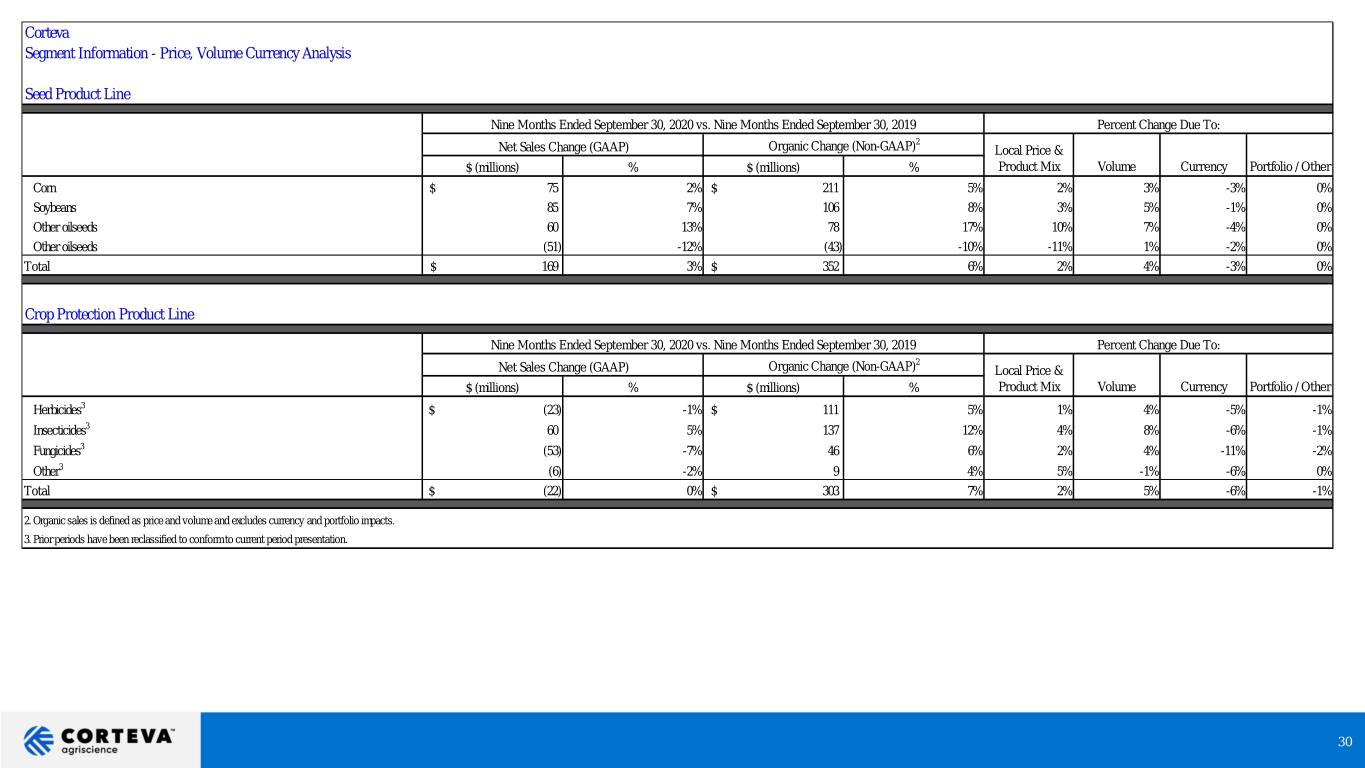

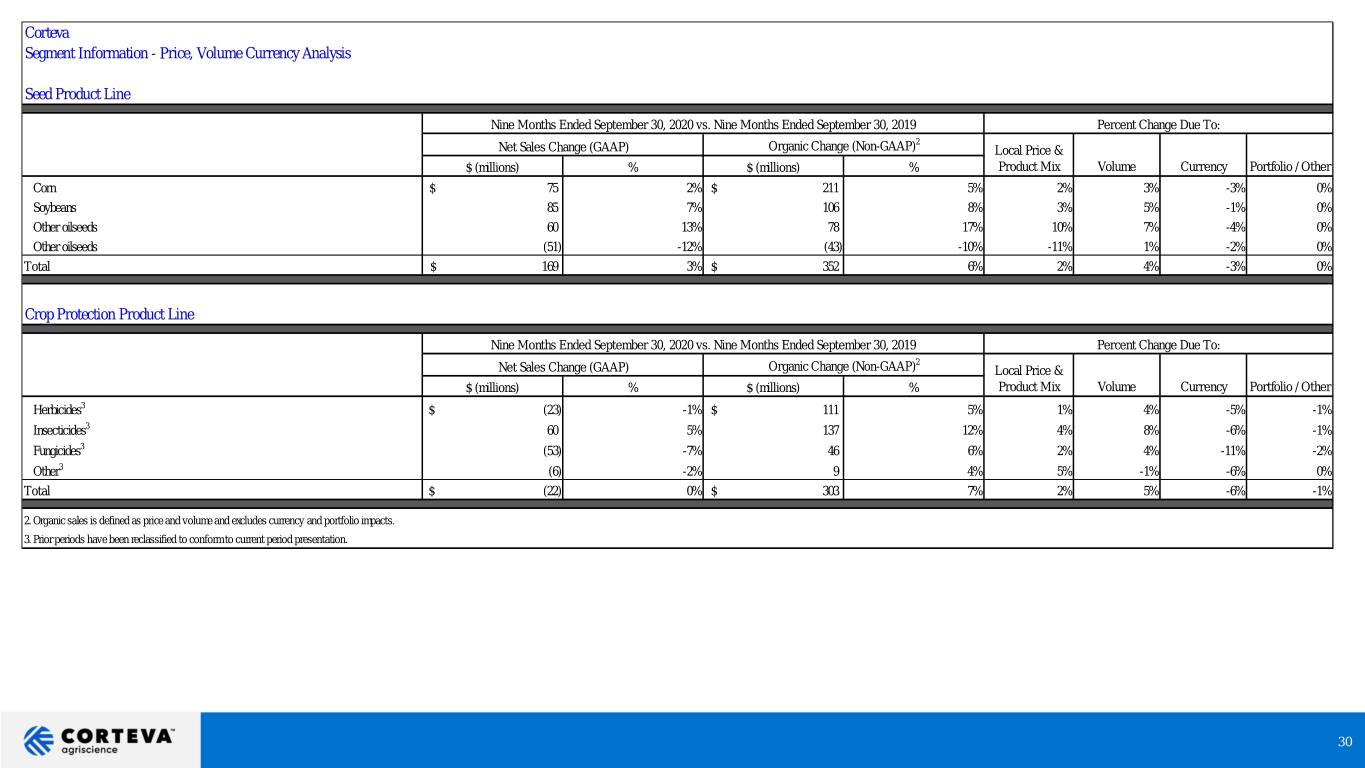

Corteva Segment Information - Price, Volume Currency Analysis Seed Product Line Nine Months Ended September 30, 2020 vs. Nine Months Ended September 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other Corn $ 75 2% $ 211 5% 2% 3% -3% 0% Soybeans 85 7% 106 8% 3% 5% -1% 0% Other oilseeds 60 13% 78 17% 10% 7% -4% 0% Other oilseeds (51) -12% (43) -10% -11% 1% -2% 0% Total $ 169 3% $ 352 6% 2% 4% -3% 0% Crop Protection Product Line Nine Months Ended September 30, 2020 vs. Nine Months Ended September 30, 2019 Percent Change Due To: 2 Net Sales Change (GAAP) Organic Change (Non-GAAP) Local Price & $ (millions) % $ (millions) % Product Mix Volume Currency Portfolio / Other Herbicides3 $ (23) -1% $ 111 5% 1% 4% -5% -1% Insecticides3 60 5% 137 12% 4% 8% -6% -1% Fungicides3 (53) -7% 46 6% 2% 4% -11% -2% Other3 (6) -2% 9 4% 5% -1% -6% 0% Total $ (22) 0% $ 303 7% 2% 5% -6% -1% 2. Organic sales is defined as price and volume and excludes currency and portfolio impacts. 3. Prior periods have been reclassified to conform to current period presentation. 30

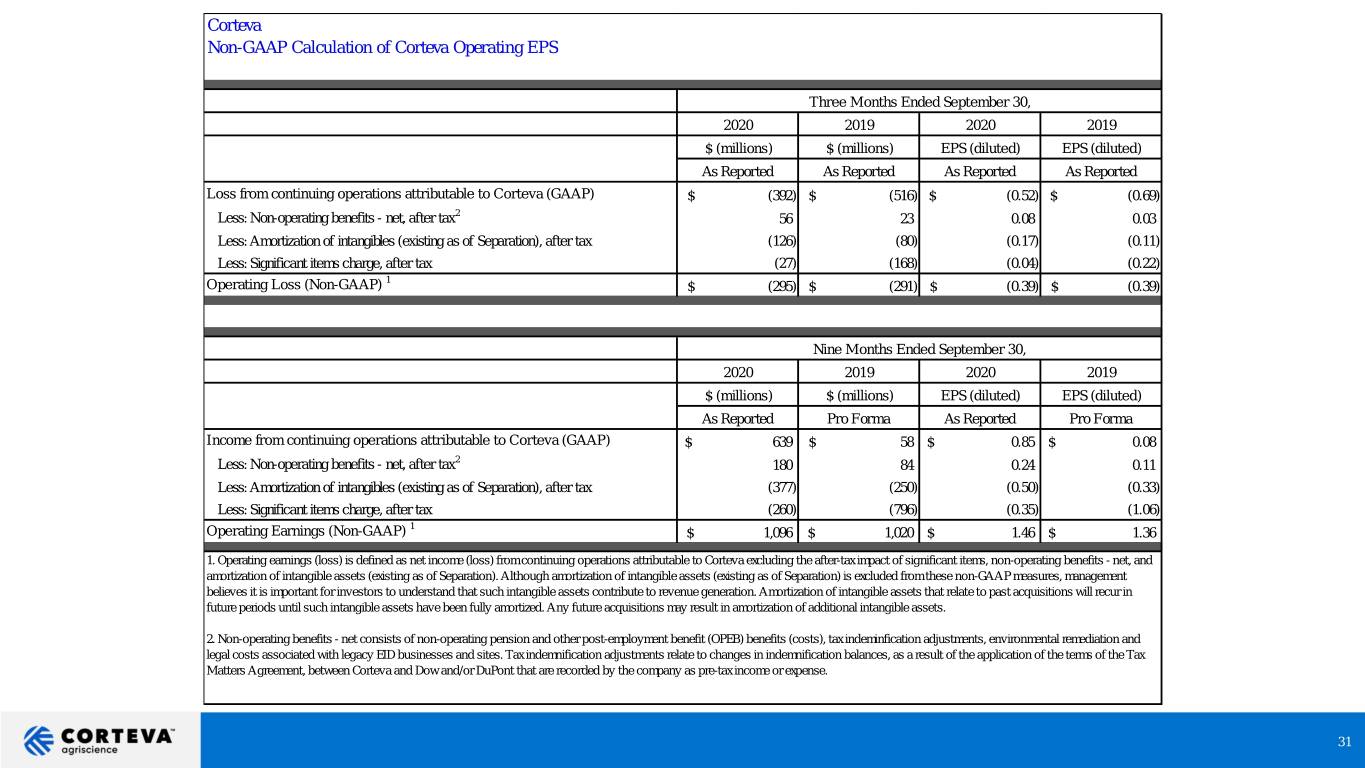

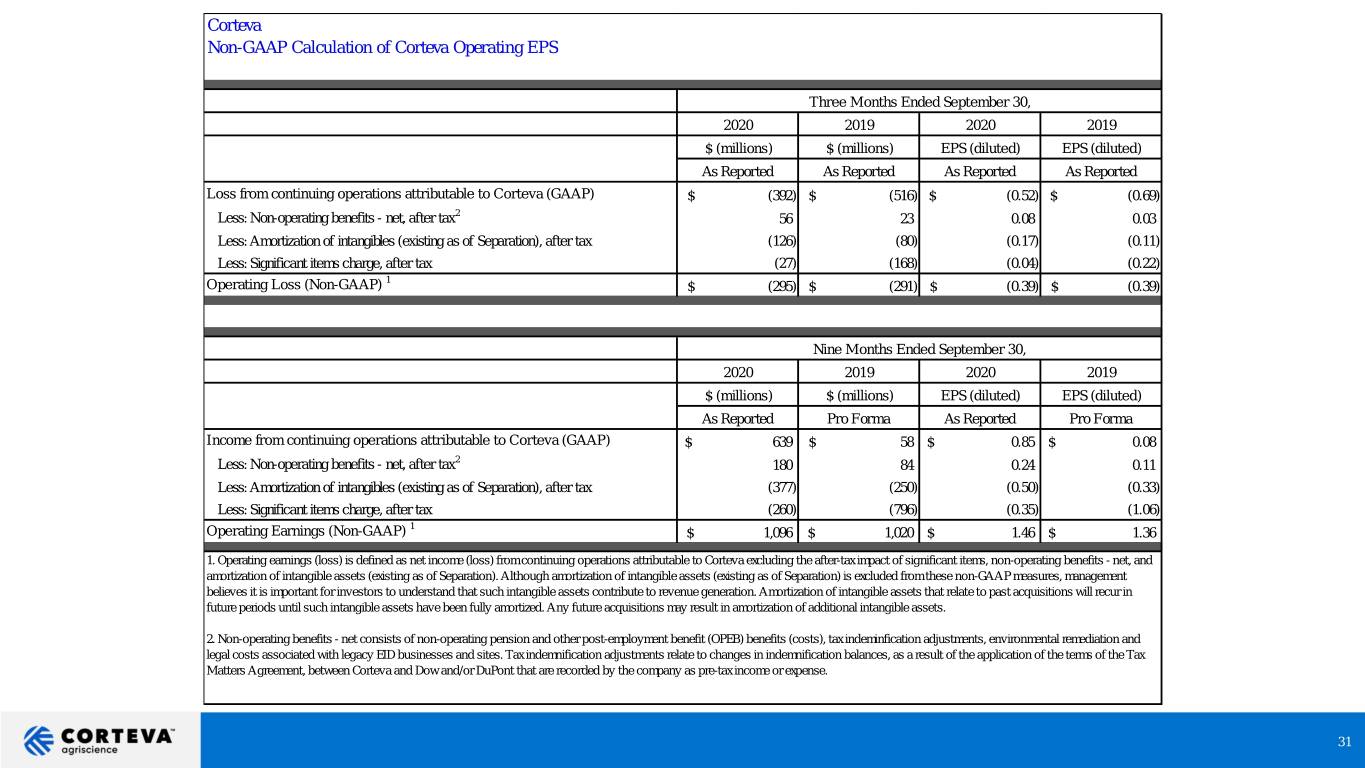

Corteva Non-GAAP Calculation of Corteva Operating EPS Three Months Ended September 30, 2020 2019 2020 2019 $ (millions) $ (millions) EPS (diluted) EPS (diluted) As Reported As Reported As Reported As Reported Loss from continuing operations attributable to Corteva (GAAP) $ (392) $ (516) $ (0.52) $ (0.69) Less: Non-operating benefits - net, after tax2 56 23 0.08 0.03 Less: Amortization of intangibles (existing as of Separation), after tax (126) (80) (0.17) (0.11) Less: Significant items charge, after tax (27) (168) (0.04) (0.22) 1 Operating Loss (Non-GAAP) $ (295) $ (291) $ (0.39) $ (0.39) Nine Months Ended September 30, 2020 2019 2020 2019 $ (millions) $ (millions) EPS (diluted) EPS (diluted) As Reported Pro Forma As Reported Pro Forma Income from continuing operations attributable to Corteva (GAAP) $ 639 $ 58 $ 0.85 $ 0.08 Less: Non-operating benefits - net, after tax2 180 84 0.24 0.11 Less: Amortization of intangibles (existing as of Separation), after tax (377) (250) (0.50) (0.33) Less: Significant items charge, after tax (260) (796) (0.35) (1.06) 1 Operating Earnings (Non-GAAP) $ 1,096 $ 1,020 $ 1.46 $ 1.36 1. Operating earnings (loss) is defined as net income (loss) from continuing operations attributable to Corteva excluding the after-tax impact of significant items, non-operating benefits - net, and amortization of intangible assets (existing as of Separation). Although amortization of intangible assets (existing as of Separation) is excluded from these non-GAAP measures, management believes it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in amortization of additional intangible assets. 2. Non-operating benefits - net consists of non-operating pension and other post-employment benefit (OPEB) benefits (costs), tax indeminfication adjustments, environmental remediation and legal costs associated with legacy EID businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense. 31

Corteva Non-GAAP Calculation of Corteva Base Tax Rate Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 As Reported As Reported As Reported Pro Forma (Loss) income from continuing operations before income taxes (GAAP) $ (507) $ (631) $ 745 $ 214 Add: Significant items - charge 49 246 351 886 Non-operating benefits - net (73) (32) (237) (106) Amortization of intangibles (existing as of Separation) 162 100 501 314 2,3 Less: Exchange (losses) gains, net (67) 22 (127) (37) (Loss) income from continuing operations before income taxes, significant items, non-operating benefits - net, amortization of intangibles (existing as of Separation), and exchange (losses) gains, net (Non-GAAP) $ (302) $ (339) $ 1,487 $ 1,345 (Benefit from) provision for income taxes on continuing operations (GAAP) $ (117) $ (104) $ 88 $ 146 Add: Tax benefits on significant items charge 22 78 91 90 Tax expenses on non-operating benefits - net (17) (9) (57) (22) Tax benefits on amortization of intangibles (existing as of Separation) 36 20 124 64 Tax benefits (expenses) on exchange (losses) gains, net 18 (25) 3 (13) (Benefit from) provision for income taxes on continuing operations before significant items, non-operating benefits - net, amortization of intangibles (existing as of Separation), and exchange (losses) gains, net (Non-GAAP) $ (58) $ (40) $ 249 $ 265 Effective income tax rate (GAAP) 23.1% 16.5% 11.8% 68.2% Significant items, non-operating benefits, and amortization of intangibles (existing as of Separation) effect -2.5% -11.8% 6.3% -46.9% Tax rate from continuing operations before significant items, non-operating benefits - net, and amortization of intangibles (existing as of Separation) 20.6% 4.7% 18.1% 21.3% Exchange (losses) gains, net effect -1.4% 7.1% -1.4% -1.6% Base income tax rate from continuing operations (Non-GAAP)1 19.2% 11.8% 16.7% 19.7% 1. Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), significant items, amortization of intangibles (existing as of Separation), and non- operating benefits - net. 2. Refer to page A-16 of the Financial Statement Schedules for further information on exchange gains (losses). 3. Pre-tax exchange gains (losses), net for the three and nine months ended September 30, 2019, on an operating basis (Non-GAAP), excludes a $(33) million exchange loss associated with the devaluation of the Argentine peso, as it is included within significant items. 32