Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

VineBrook Homes Trust, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

April 26, 2024

Dear VineBrook Stockholder:

You are cordially invited to attend the annual meeting of stockholders of VineBrook Homes Trust, Inc. The meeting will be held on Tuesday, June 11, 2024, beginning at 10:00 a.m. Central Time. The annual meeting will be held exclusively through a virtual format. You will not be able to attend the annual meeting in person.

If your shares are held by a financial intermediary (such as a broker-dealer), and you want to participate in, but not vote at the annual meeting, please email Equiniti Fund Solutions, LLC (“EQ”) at attendameeting@equiniti.com, with “VineBrook Meeting” in the subject line and provide your full name, address and proof of ownership as of April 1, 2024 from your financial intermediary. EQ will then email you the annual meeting registration link. Please be aware if your shares are held through a financial intermediary, and you wish to vote at the annual meeting, you must first obtain a legal proxy from your financial intermediary. You may forward an email from your financial intermediary containing the legal proxy or attach an image of the legal proxy via email to EQ at attendameeting@equiniti.com and put “VineBrook Legal Proxy” in the subject line. EQ will then email you the registration link along with a proxy voting control number.

If you are a stockholder of record and wish to attend and vote at the annual meeting, please send an email to EQ at attendameeting@equiniti.com with “VineBrook Meeting” in the subject line and provide your name and address in the body of the email. EQ will then email you the registration link for the annual meeting. If you would like to vote during the annual meeting, you may do so by entering the control number found on your proxy card.

Requests to attend the annual meeting must be received by EQ no later than 2:00 p.m. Central Time on June 10, 2024. On the date of the annual meeting, stockholders are encouraged to log on 15 minutes before the meeting start time. Please contact EQ at (888) 869-7406 with any questions regarding accessing the annual meeting.

Information about the meeting, nominees for the election of directors and the other matters to be voted on at the meeting is presented in the following notice of annual meeting and proxy statement. We hope that you will plan to virtually attend the annual meeting.

It is important that your shares be represented. Whether or not you plan to virtually attend the meeting, please vote using the internet or telephone procedures described on the proxy card or sign, date and promptly mail a proxy card in the provided pre-addressed, postage‑paid envelope. If you would like to vote during the annual meeting, you may do so by entering the control number found on your proxy card.

Sincerely, |

|

| |

Brian Mitts |

President, Chief Executive Officer, Chief Financial Officer,

Treasurer and Assistant Secretary |

VINEBROOK HOMES TRUST, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 11, 2024

The 2024 annual meeting of stockholders of VineBrook Homes Trust, Inc., a Maryland corporation (the “Company”), will be held on June 11, 2024, beginning at 10:00 a.m., Central Time. The annual meeting will be held exclusively through a virtual format. You will not be able to attend the annual meeting in person. The meeting will be held for the following purposes:

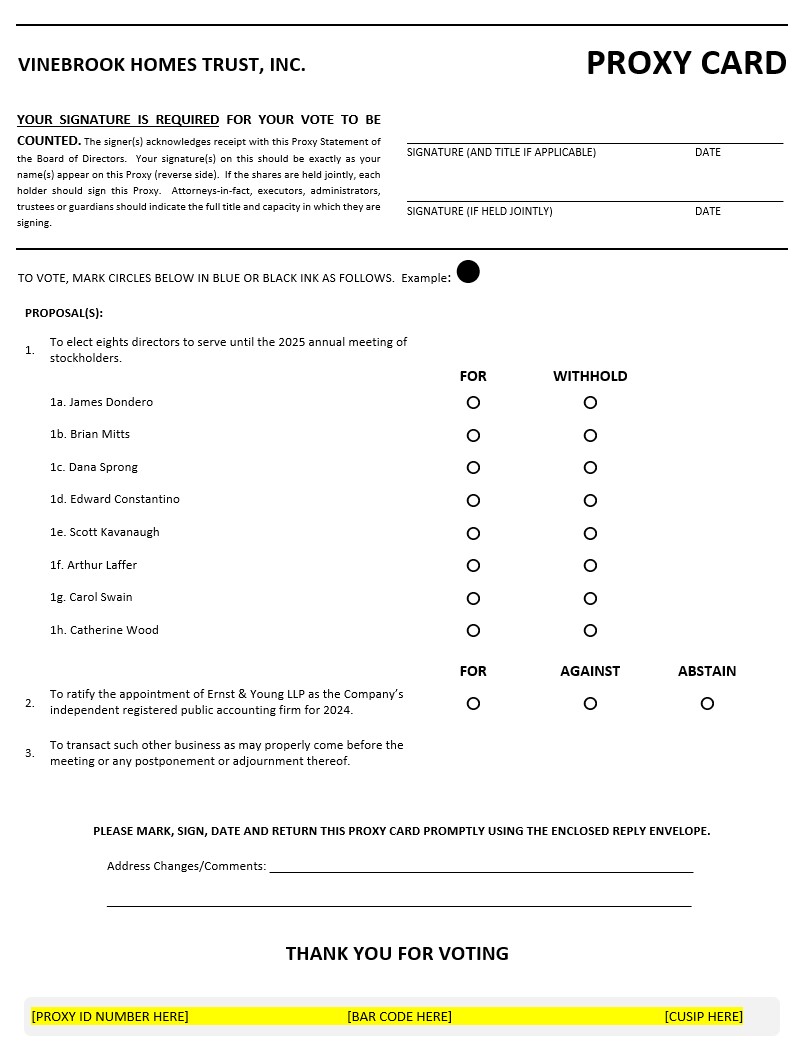

1. | to elect eight directors to serve until the 2025 annual meeting of stockholders; |

2. | to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024; and |

3. | to transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

Information concerning the matters to be voted upon at the meeting is set forth in the accompanying proxy statement. We have also provided you or made available to you the Company’s 2023 annual report. Holders of record of the Company’s common stock as of the close of business on April 1, 2024 are entitled to notice of, and to vote at, the meeting.

While you will not be able to attend the annual meeting in person, we have structured our virtual annual meeting to provide stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting. To promote fairness and efficient conduct of the meeting, we will respond to no more than two questions from any single stockholder.

If your shares in the Company are held by a financial intermediary (such as a broker-dealer), and you want to participate in, but not vote at the annual meeting, please email Equiniti Fund Solutions, LLC (“EQ”) at attendameeting@equiniti.com, with “VineBrook Meeting” in the subject line and provide your full name, address and proof of ownership as of April 1, 2024 from your financial intermediary. EQ will then email you the annual meeting registration link. Please be aware if your shares are held through a financial intermediary, and you wish to vote at the annual meeting, you must first obtain a legal proxy from your financial intermediary. You may forward an email from your financial intermediary containing the legal proxy or attach an image of the legal proxy via email to EQ at attendameeting@equiniti.com and put “VineBrook Legal Proxy” in the subject line. EQ will then email you the registration link along with a proxy voting control number.

If you are a stockholder of record of the Company and wish to attend and vote at the annual meeting, please send an email to EQ at attendameeting@equiniti.com with “VineBrook Meeting” in the subject line and provide your name and address in the body of the email. EQ will then email to you the registration link for the annual meeting. If you would like to vote during the annual meeting, you may do so by entering the control number found on the enclosed proxy card.

Requests to attend the annual meeting must be received by EQ no later than 2:00 p.m. Central Time on June 10, 2024. On the date of the annual meeting, stockholders are encouraged to log on 15 minutes before the meeting start time. Please contact EQ at (888) 869-7406 with any questions regarding accessing the annual meeting.

Your vote is very important. Whether or not you plan to virtually attend the meeting, please vote using the internet or telephone procedures described on the proxy card or sign, date and promptly mail a proxy card in the provided pre-addressed, postage-paid envelope. If you would like to vote during the annual meeting, you may do so by entering the control number found on your proxy card.

| | By order of the Board of Directors, |

| |

|

| | |

| | Brian Mitts |

| | President, Chief Executive Officer, Chief Financial Officer,

Treasurer and Assistant Secretary |

Dallas, Texas

April 26, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 11, 2024. The Company’s Notice of Annual Meeting, Proxy Statement and 2023 Annual Report to Stockholders are available on the internet at www.proxyonline.com. |

VINEBROOK HOMES TRUST, INC.

300 CRESCENT COURT, SUITE 700

DALLAS, TEXAS 75201

PROXY STATEMENT

This proxy statement provides information in connection with the solicitation of proxies by the board of directors (the “Board”) of VineBrook Homes Trust, Inc., a Maryland corporation (the “Company”), for use at the Company’s 2024 annual meeting of stockholders or any postponement or adjournment thereof (the “Annual Meeting”). This proxy statement also provides information you will need in order to consider and act upon the matters specified in the accompanying notice of annual meeting. This proxy statement and proxy card are being mailed to stockholders on or about May 6, 2024.

Record holders of the Company’s Class A common stock, par value $0.01 (“common stock”) as of the close of business on April 1, 2024 are entitled to vote at the Annual Meeting. Each record holder of common stock on that date is entitled to one vote at the Annual Meeting for each share of common stock held. As of April 1, 2024, there were 25,152,244 shares of common stock outstanding.

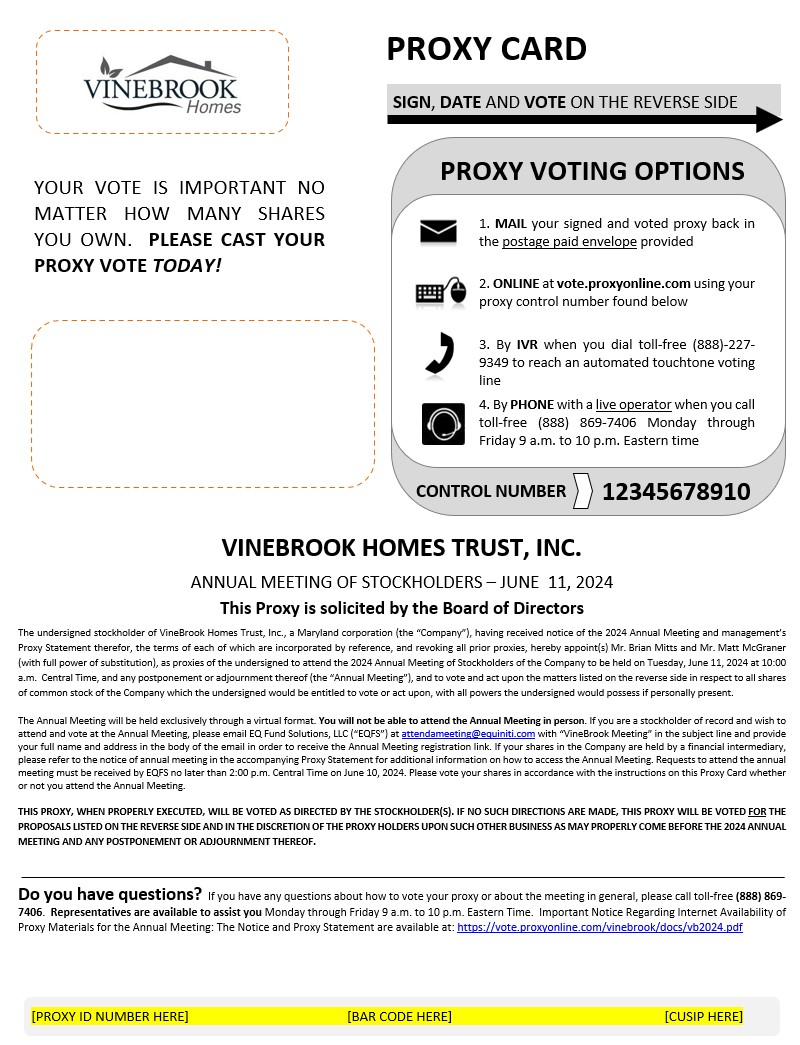

You cannot vote your shares unless you virtually attend the Annual Meeting or you have previously given your proxy. You can vote by proxy in one of three convenient ways:

• by internet: visit the website shown on your proxy card and follow the instructions;

• by telephone: dial the toll-free number shown on your proxy card and follow the instructions; or

• in writing: sign, date, and return a proxy card in the provided pre-addressed, postage paid envelope.

You may revoke your proxy at any time prior to the vote at the Annual Meeting by:

• delivering a written notice revoking your proxy to the Company’s Secretary at the address above;

• delivering a new proxy bearing a date after the date of the proxy being revoked; or

• virtually attending the Annual Meeting and entering the control number found on your proxy card.

Unless revoked as described above, all properly executed proxies will be voted at the Annual Meeting in accordance with your directions on the proxy. If you hold your shares through a broker, bank, trust or other nominee, please refer to the information forwarded by your broker, bank, trust or other nominee for procedures on revoking your proxy. If a properly executed proxy gives no specific instructions, the shares of common stock represented by your proxy will be voted:

• FOR the election of the eight nominees to serve as directors until the 2025 annual meeting of stockholders;

• FOR the ratification of the appointment of Ernst & Young LLP (“EY”) as the Company’s independent registered public accounting firm for 2024; and

• at the discretion of the proxy holders with regard to any other matter that is properly presented at the Annual Meeting.

If you own shares of common stock held in “street name” and you do not instruct your broker how to vote your shares using the instructions your broker provides you, your shares will be voted in the ratification of the appointment of EY as the Company’s independent registered public accounting firm for 2024, but not for any other proposal. To be sure your shares are voted in the manner you desire, you should instruct your broker on how to vote your shares.

Holders of a majority of the outstanding shares of the Company’s common stock must be present, either in person (virtually) or by proxy, to constitute a quorum necessary to conduct the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining the presence of a quorum.

The following table sets forth the voting requirements, whether broker discretionary voting is allowed and the treatment of abstentions and broker non-votes for each of the matters to be voted on at the Annual Meeting.

Proposal | Vote Necessary to

Approve Proposal | Broker

Discretionary

Voting Allowed? | Treatment of

Abstentions and

Broker Non-Votes |

No. 1 - Election of Directors | Plurality (that is, the largest number) of all votes cast (1) | No | Abstentions and broker non-votes are not considered votes cast and will have no effect |

| | | | |

No. 2 - Ratification of the appointment of EY | Affirmative vote of a majority of the votes cast | Yes | Abstentions are not considered votes cast and will have no effect |

| | | | |

(1) Stockholders may vote “FOR” or “WITHHOLD” in the election of directors. Because directors need only be elected by a plurality of the vote, in an uncontested election withhold votes will not affect whether any particular nominee has received sufficient votes to be elected.

Attendance at the Annual Meeting will be limited to stockholders of record and beneficial owners who provide proof of beneficial ownership as of the record date in the manner described in the accompanying notice of annual meeting.

While you will not be able to attend the Annual Meeting in person, we have structured our virtual Annual Meeting to provide stockholders the same rights as if the Annual Meeting were held in person, including the ability to vote shares electronically during the Annual Meeting and ask questions in accordance with the rules of conduct for the meeting. To promote fairness and efficient conduct of the Annual Meeting, we will respond to no more than two questions from any single stockholder.

The Company pays the costs of soliciting proxies. We have engaged Equiniti Fund Solutions, LLC (our “Proxy Solicitor”) to serve as our proxy solicitor for the Annual Meeting at a base fee of $3,500 plus reimbursement of reasonable expenses. Our Proxy Solicitor will provide advice relating to the content of solicitation materials, solicit banks, brokers, institutional investors, and hedge funds to determine voting instructions, monitor voting, and deliver executed proxies to our voting tabulator. The Company may request banks, brokers, and other custodians, nominees, and fiduciaries to forward copies of these proxy materials to the beneficial holders and to request instructions for the execution of proxies. The Company may reimburse these persons for their related expenses. Proxies are solicited to provide all record holders of the Company’s common stock an opportunity to vote on the matters to be presented at the Annual Meeting, even if they cannot attend the meeting in person.

The Annual Meeting will be held exclusively through a virtual format. Please see the other information herein, including the accompanying notice of annual meeting, about how to access the Annual Meeting. As always, we encourage you to vote your shares prior to the Annual Meeting.

PROPOSAL 1 - ELECTION OF DIRECTORS

At the Annual Meeting, eight directors will be elected to serve one-year terms expiring at our annual stockholders meeting in 2025 and until their respective successors are duly elected and qualified. This section contains information relating to the eight director nominees. The director nominees were selected by our nominating and corporate governance committee and approved by the Board for submission to the stockholders. The nominees for election are Messrs. Constantino, Dondero, Kavanaugh, Mitts and Sprong, Dr. Laffer, Dr. Swain and Ms. Wood. All eight currently serve as directors.

The Board unanimously recommends a vote FOR the election of each of the nominees.

Nominees to be elected for terms expiring at the Annual Meeting in 2025

Edward Constantino, age 77, has served as a member of our Board since February 2019. Mr. Constantino has also served as a member of the board of directors of NexPoint Residential Trust, Inc. (“NXRT”), a publicly traded multi family real estate investment trust (“REIT”), since March 2015, as a member of the board of directors of NexPoint Real Estate Finance, Inc. (“NREF”), a publicly traded commercial mortgage REIT, since February 2020, a member of the board of directors of NexPoint Homes Trust, Inc. (“NexPoint Homes”), a single family rental REIT since June 2022, and as a member of the board of trustees of NexPoint Diversified Real Estate Trust (“NXDT”), a publicly traded diversified REIT, since March 2020. Mr. Constantino has over 40 years of audit, advisory and tax experience working for two major accounting firms, Arthur Andersen LLP and KPMG LLP (“KPMG”). Mr. Constantino retired from KPMG in late 2009, where he was an audit partner in charge of the firm’s real estate and asset management businesses. Mr. Constantino is, and since 2010 has been, a member of the board of directors of Patriot National Bancorp, Inc. Mr. Constantino has also served as a consultant for the law firm Skadden, Arps, Slate, Meagher & Flom LLP. He is a licensed CPA, a member of the American Institute of Certified Public Accountants and a member of the New York State Society of Public Accountants. He is currently a member of the board of trustees and part of the Finance and Investment Committee at St. Francis College in Brooklyn Heights, New York. He is also a board member and audit committee chair of ARC Trust, Inc. and ARC Trust III, Inc. Mr. Constantino was selected to serve on our Board because of his extensive accounting experience, particularly in the real estate field.

James Dondero, age 61, has served as chairman of the Board since August 2022. Mr. Dondero was President and a member of our Board from February 2019 to August 2021. Mr. Dondero has also served as the President and chairman of the board of directors of NXRT since May 2015 and as President and chairman of the board of directors of NREF since February 2020. He also has served as President of NXDT since May 2015 and has served as chairman of the board of trustees of NXDT since July 2022, as well as member of the of directors of NexPoint Homes since June 2022. Mr. Dondero is also: founder and president of NexPoint Advisors, L.P. (“NexPoint”), an investment advisor registered with the Securities and Exchange Commission (the “SEC”); and chairman of NexBank (“NexBank”). Mr. Dondero co-founded Highland Capital Management, L.P. (“Highland”) in 1993 with Mark Okada and served as President from 2004 to 2020. Mr. Dondero has over 30 years of experience investing in credit and equity markets and has helped pioneer credit asset classes. Mr. Dondero has also served as the Chief Executive Officer of NexPoint Hospitality Trust, Inc. (“NHT”), a publicly traded hospitality REIT listed on the TSX Venture Exchange since December 2019. Mr. Dondero also served as a director of Jernigan Capital, Inc., a self-storage lending REIT, from August 2016 to November 2020. He also serves as president of NexPoint Capital, Inc. (“NexPoint Capital”) and NexPoint Real Estate Strategies Fund (“NRESF”), both of which are affiliates of NexPoint Real Estate Advisors V, L.P. (our “Adviser”). NREF, NXRT, NXDT, NexPoint Homes, our Adviser, NexBank, NHT, NexPoint Capital and NRESF are all affiliates of the Company. On October 16, 2019, Highland filed for Chapter 11 bankruptcy protection with the United States Bankruptcy Court for the District of Delaware. On April 13, 2018, the Bankruptcy Court for the Northern District of Texas entered orders for relief placing Acis Capital Management, L.P. and Acis Capital Management GP, LLC in involuntary bankruptcy. Mr. Dondero served as President of Acis Capital Management GP, LLC, which was the general partner of Acis Capital Management, L.P. On January 31, 2019, the court confirmed Acis’s plan of reorganization. Mr. Dondero was selected to serve on our Board because of his prior service as a director and his experience as an executive officer.

Scott Kavanaugh, age 63, has served as a member of our Board since December 2018. Mr. Kavanaugh has also served as a member of the board of directors of NXRT since March 2015, as a member of the board of directors of NREF since February 2020 and as a member of the board of trustees of NXDT since July 2022. He has also served as a member of the board of directors of NexPoint Homes since June 2022. Mr. Kavanaugh is, and since December 2009 has been, the CEO of First Foundation Inc. (“FFI”), a financial services company. From June 2007 until December 2009, he served as President and Chief Operating Officer of FFI. Mr. Kavanaugh has been the Vice-Chairman of FFI since June 2007. He also is, and since September 2007 has been, the Chairman and CEO of FFI’s wholly owned banking subsidiary, First Foundation Bank. Mr. Kavanaugh was a founding stockholder and served as an Executive Vice President and Chief Administrative Officer and a member of the board of directors of Commercial Capital Bancorp, Inc., the parent holding company of Commercial Capital Bank, from 1999 until 2003. From 1998 until 2003, Mr. Kavanaugh served as the Executive Vice President and Chief Operating Officer and a director of Commercial Capital Mortgage. From 1993 to 1998, Mr. Kavanaugh was a partner and head of trading for fixed income and equity securities at Great Pacific Securities, Inc., a west coast-based regional securities firm. Mr. Kavanaugh is, and since 2009 has been, a member of the board of directors of Colorado Federal Savings Bank and its parent holding company, Silver Queen Financial Services, Inc. Mr. Kavanaugh was selected to serve on our Board because of his expertise in investment management and his experience as both an executive officer and a director of multiple companies.

Dr. Arthur Laffer, age 83, has served as a member of our Board since December 2018. Dr. Laffer has also served as a member of the board of directors of NXRT since May 2015, as a member of the board of directors of NREF since February 2020 and as a member of the board of trustees of NXDT since July 2022. He has also served as a member of the board of directors of NexPoint Homes since June 2022. Dr. Laffer is the founder and chairman of Laffer Associates, an economic research and consulting firm and served as the chairman and director of Laffer Investments, a registered investment advisor, from 1999 to 2019. Dr. Laffer served as a director of GEE Group, Inc., a provider of specialized staffing solutions, from 2014 to 2020. Dr. Laffer also served as a director of EVO Transportation and Energy Services Inc. from 2018 to 2019. A former member of President Reagan’s Economic Policy Advisory Board during the 1980s, Dr. Laffer’s economic acumen and influence have earned him the distinction in many publications as the Father of Supply-Side Economics. He has served on several boards of directors of public and private companies, including staffing company MPS Group, Inc., which was sold to Adecco Group for $1.3 billion in 2009. Dr. Laffer has served as a director of VerifyMe, Inc. since 2019. Dr. Laffer was previously a consultant to Secretary of the Treasury William Simon, Secretary of Defense Donald Rumsfeld, and Secretary of the Treasury George Shultz. In the early 1970s, Dr. Laffer was the first to hold the title of Chief Economist at the Office of Management and Budget under Dr. Shultz. Additionally, Dr. Laffer was formerly the Distinguished University Professor at Pepperdine University and a member of the Pepperdine University board of directors. He also served as Charles B. Thornton Professor of Business Economics at the University of Southern California and as Associate Professor of Business Economics at the University of Chicago. Dr. Laffer was selected to serve on our Board because of his expertise in economics and his experience as a director of multiple companies.

Brian Mitts, age 53, has served as a member of our Board since July 2018, as our President since February 2023, Chief Executive Officer since February 2024 and Chief Financial Officer, Treasurer and Assistant Secretary since November 2018. Mr. Mitts also served as our President and Treasurer from July 2018 until October 2018 and our Interim President from September 2021 to February 2023. Mr. Mitts co-founded NexPoint Real Estate Advisors, L.P. (“NREA”), which is the parent of our Adviser, as well as NXRT, NREF and other real estate businesses with Mr. McGraner and Mr. Dondero. Currently, Mr. Mitts leads our financial reporting and accounting teams and is integral in financing and capital allocation decisions. Prior to co-founding NREA, NXRT and NREF, Mr. Mitts was Chief Operations Officer of Highland Funds Asset Manager, L.P., the external advisor of open-end and closed-end funds where he managed the operations of these funds and helped develop new products. Mr. Mitts was also a co-founder of NexPoint, the parent of NREA. He has worked for NREA or its affiliates since 2007. Mr. Mitts has also served as a director of NXRT since September 2014 and as the Chief Financial Officer, Executive Vice President-Finance and Treasurer of NXRT since March 2015. In February 2019, Mr. Mitts was also appointed Secretary of NXRT. From September 2014 to March 2015, Mr. Mitts served as President and Treasurer of NXRT. Mr. Mitts has also served as the Chief Financial Officer, Executive VP-Finance, Treasurer and Corporate Secretary of NHT since December 2018, as the Chief Financial Officer, Executive VP-Finance, Secretary and Treasurer of NREF since February 2020, and as a member of the board of directors of NREF since June 2019. Mr. Mitts also served as the President and Treasurer of NREF from June 2019 until February 2020. Since November 2020, Mr. Mitts has also served as Chief Financial Officer, Secretary and Treasurer of NexPoint Storage Partners, Inc. (“NSP”), a self-storage REIT, and as a member of the board of directors since March 2023. Mr. Mitts has also served as Chief Financial Officer, Executive VP-Finance, Treasurer and Assistant Secretary and a member of the board of trustees of NXDT since July 2022. Mr. Mitts has also served as President and Treasurer of NexPoint Homes since February 2022 and additionally as Chief Executive Officer, Chief Financial Officer, and Assistant Secretary and as a member of the board of directors of NexPoint Homes since June 2022. NREF, NXRT, NXDT, NexPoint Homes, NSP and NHT are all affiliates of the Company. Mr. Mitts was selected to serve on our Board because of his prior service as a director and his experience as an executive officer.

Dana Sprong, age 45, has served as a member of the Board since November 2018 and has served as our Senior Vice President of Acquisitions and Dispositions since 2018. He has served as the Chief Executive Officer of VineBrook Homes, LLC (the “Manager”), which served as the external property manager of our primary reportable segment comprised of 21,843 homes as of December 31, 2023 (the “VineBrook Portfolio”) prior to the Internalization (as defined below), since the formation event in 2018 and continues to serve as the Chief Executive Officer and Managing Partner of the Manager, which following the Internalization is now a wholly-owned subsidiary of the Company. Mr. Sprong founded our predecessor, purchased our first rental home in December of 2007, and led the due diligence, acquisition, and management of over 16,500 single family rental (“SFR”) homes. Prior to founding our predecessor, Mr. Sprong was a senior manager at JW Construction (“JWC”), an eastern Massachusetts residential construction and development firm. Prior to JWC, he was a senior manager at DJ Dowling Inc., a builder on the San Francisco Peninsula. Mr. Sprong is a licensed General Contractor and Real Estate Broker. He is also an Auxiliary On-Call Firefighter. He graduated with honors from Harvard University. Mr. Sprong also serves as a member of the investment committee our operating partnership, VineBrook Homes Operating Partnership, L.P. (the “OP”) (“Investment Committee”). Mr. Sprong was selected to serve on our Board because of his prior service as a director and his experience as an executive officer.

Dr. Carol Swain, age 70, has served as a member of our Board since August 2022. In addition, she has served as a member of the board of directors of NXRT, as a member of the board of directors of NREF and as a member of the board of trustees of NXDT since August 2022. She has also served as a member of the board of directors of NexPoint Homes since August 2022. Dr. Swain is an author, speaker, political commentator and entrepreneur. She founded Unity Training Solutions LLC in November 2020 and founded Carol Swain Enterprises, LLC in October 2014. Dr. Swain previously was a professor at Vanderbilt University from August 1999 to 2017. Dr. Swain has also served on the Tennessee Advisory Committee to the U.S. Civil Rights Commission, the National Endowment for the Humanities, and the 1776 Commission. Dr. Swain received her Bachelor of Arts from Roanoke College, a master’s degree in political science from Virginia Tech, a Ph.D. in political science from the University of North Carolina at Chapel Hill and a Master of Legal Studies from Yale Law School. Dr. Swain was selected to serve on our Board because of her experience in the fields of political science, law and government.

Catherine Wood, age 68, has served as a member of our Board since July 2020. In addition, she has served as a member of the board of directors of NXRT and as a member of the board of directors of NREF since July 2020 and as a member of the board of trustees of NXDT since August 2022. She has also served as a member of the board of directors of NexPoint Homes since June 2022. Ms. Wood is currently Chief Executive Officer, Chief Investment Officer and a board member of ARK Investment Management LLC (“ARK”), an SEC registered investment advisor, which she founded in January 2014. Ms. Wood is also currently Chief Executive Officer, Chief Investment Officer and a board member of ARK ETF Trust. Prior to ARK, Ms. Wood spent 12 years at AllianceBernstein as Chief Investment Officer of Global Thematic Strategies. Ms. Wood joined AllianceBernstein from Tupelo Capital Management, a hedge fund she co-founded. Prior to her tenure at Tupelo Capital Management, Ms. Wood worked for 18 years at Jennison Associates LLC as Chief Economic Officer and several other positions. Ms. Wood started her career in Los Angeles at The Capital Group as an Assistant Economist. Ms. Wood received her Bachelor of Science, summa cum laude, in Finance and Economics from the University of Southern California. Ms. Wood was selected to serve on our Board because of her experience as it relates to disruptive technologies, business models and processes, which provides an important perspective to the Board.

PROPOSAL 2 - RATIFICATION OF APPOINTMENT OF

ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR 2024

The audit committee has appointed EY as the Company’s independent registered public accounting firm for 2024. The Board is asking stockholders to ratify this appointment. SEC regulations require the Company’s independent registered public accounting firm to be engaged, retained and supervised by the audit committee. However, the Board considers the selection of an independent registered public accounting firm to be an important matter to stockholders. Accordingly, the Board considers a proposal for stockholders to ratify this appointment to be an opportunity for stockholders to provide input to the audit committee and the Board on a key corporate governance issue.

Representatives of EY are expected to virtually attend the Annual Meeting and will have the opportunity to make a statement. They will also be available to respond to appropriate questions.

Selection. EY served as the Company’s independent registered public accounting firm for 2023 and has been selected by the audit committee to serve as the Company’s independent registered public accounting firm for 2024.

Audit and Non-Audit Fees. The following table presents fees for audit services rendered by EY for the audit of the Company’s annual financial statements for 2023 and 2022, and fees billed for other services rendered by EY.

| | | DECEMBER 31, 2023 | | | DECEMBER 31, 2022 | |

Audit Fees (1) | | $ | 2,094,590 | | | $ | 1,324,500 | |

Audit-Related Fees | | | - | | | | - | |

Tax Fees (2) | | | 405,000 | | | | 193,250 | |

All Other Fees | | | - | | | | - | |

Total | | $ | 2,499,590 | | | $ | 1,517,750 | |

(1) | Includes fees for audits of our annual financial statements, reviews of the related quarterly financial statements, and services that are normally provided by the independent accountants in connection with statutory and regulatory filings or engagements, including comfort letters and consents issued in connection with SEC filings and reviews of documents filed with the SEC. |

(2) | Includes tax fees related to professional services rendered for tax compliance, tax return review and preparation and related tax advice. |

Pursuant to the charter of the audit committee, the audit committee is responsible for the oversight of our accounting, reporting and financial practices. The audit committee has the responsibility to select, appoint, engage, oversee, retain, evaluate and terminate our external auditors; pre-approve all audit and non-audit services to be provided, consistent with all applicable laws, to us by our external auditors; and establish the fees and other compensation to be paid to our external auditors.

The audit committee has adopted a policy to pre-approve all audit and permitted non-audit services provided by our principal independent accountants. All audit and non-audit services for 2023 were pre-approved by the audit committee.

The Board unanimously recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024.

THE BOARD, ITS COMMITTEES AND ITS COMPENSATION

Board of Directors

The Board presently consists of eight members, five of whom are non-management directors. Each director serves a one-year term expiring at each annual meeting of stockholders and lasting until his or her respective successor is duly elected and qualified.

Pursuant to the terms of the Advisory Agreement, our Adviser has the right to designate individuals (the “Adviser Designees”) to be nominated for election (or re-election) to our Board, such that, if elected, there shall be two Adviser Designees serving on our Board, and we will take all reasonably necessary action to nominate and include the Adviser Designees in the slate of nominees recommended by our Board for election as directors at each applicable annual meeting of stockholders or special meeting of stockholders at which directors are to be elected. To the extent the Adviser Designees are not elected, our Adviser may terminate the Advisory Agreement and receive the Adviser Termination Fee (as defined below). Messrs. Dondero and Mitts were nominated by our Adviser as Adviser Designees pursuant to the terms of the Advisory Agreement.

Director Compensation in 2023

Directors who are officers of the Company do not receive compensation for their service as directors.

We provide the following compensation for non-management directors:

| | • | each non-management director receives an annual director’s fee payable in cash equal to $20,000 and an annual grant of restricted stock units; |

| | • | the chair of our audit committee receives an additional annual fee payable in cash equal to $15,000; |

| | • | the chair of our compensation committee receives an additional annual fee payable in cash equal to $7,500; |

| | • | the chair of our nominating and corporate governance committee receives an additional annual fee payable in cash equal to $7,500; and |

| | • | the lead independent director receives an additional annual fee payable in cash equal to $10,000. |

We also reimburse directors for all expenses incurred in attending Board and committee meetings.

Director Compensation Table

The following table provides information regarding the compensation of directors for the year ended December 31, 2023.

NAME | | FEES EARNED OR

PAID IN CASH | | | STOCK

AWARDS | | | TOTAL | |

James Dondero (1) | | | - | | | | - | | | | - | |

Brian Mitts (2) | | | - | | | | - | | | | - | |

Dana Sprong (2) | | | - | | | | - | | | | - | |

Edward Constantino | | $ | 35,000 | | | $ | 99,981.44 | (3) | | $ | 134,981.44 | |

Scott Kavanaugh | | $ | 37,500 | | | $ | 99,981.44 | (3) | | $ | 137,481.44 | |

Dr. Arthur Laffer | | $ | 27,500 | | | $ | 99,981.44 | (3) | | $ | 127,481.44 | |

Dr. Carol Swain | | $ | 20,000 | | | $ | 99,981.44 | (3) | | $ | 119,981.44 | |

Catherine Wood | | $ | 20,000 | | | | 99,981.44 | (3) | | $ | 119,981.44 | |

(1) | Mr. Dondero, who serves as a director and is an Adviser Designee, does not receive any specific direct compensation for services provided as a director. |

(2) | These directors do not receive specific director compensation but rather receive executive compensation, which is discussed in the executive compensation discussion below. |

(3) | These restricted stock units were granted on April 11, 2023 and vested on April 11, 2024, the first anniversary of the grant date. The grant date fair value of each award was equal to the Net Asset Value (“NAV”) of our common stock on the date of the grant as calculated in accordance with Financial Accounting Standards Board’s Accounting Standards Codification (“ASC”) Topic 718. Pursuant to the rules of the SEC, the amounts shown in this column exclude the impact of estimated forfeitures related to service-based vesting conditions. See Note 9 and Note 10 to our consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for information regarding the assumptions made in determining these values. As of December 31, 2023, our non-management directors each held 1,586 restricted stock units. |

Director Independence

The Board will review at least annually the independence of each director. During these reviews, the Board will consider transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine whether any such transactions or relationships are inconsistent with a determination that the director is independent. This review will be based primarily on responses of the directors to questions in a directors’ and officers’ questionnaire regarding employment, business, familial, compensation and other relationships with the Company and our management. Our Board has determined that each of Edward Constantino, Scott Kavanaugh, Dr. Arthur Laffer, Dr. Carol Swain, and Catherine Wood is independent in accordance with NYSE rules. Generally, all actions by our Board require the affirmative approval or consent of a majority of the directors present at a meeting at which a quorum is present. Based on the composition of our Board, all actions taken by our Board require the approval or consent of at least two of the directors who are independent. In regard to actions impacting our Adviser, our Adviser’s Board representatives (James Dondero and Brian Mitts) abstain from voting on those matters.

Corporate Governance

We believe that good corporate governance is important to ensure that we will be managed for the long-term benefit of our stockholders. We and our Board have reviewed the corporate governance policies and practices of other public companies, as well as those suggested by various authorities in corporate governance. We have also considered the provisions of the Sarbanes-Oxley Act and SEC and NYSE rules.

Based on this review, we have established and adopted charters for the audit committee, compensation committee and nominating and corporate governance committee, as well as corporate governance guidelines and a code of business conduct and ethics applicable to all of our directors, officers and employees.

Our committee charters, code of business conduct and ethics and corporate governance guidelines are available on our website www.investors.vinebrookhomes.com in the Governance section. Copies of these documents are also available upon written request to our Corporate Secretary at c/o VineBrook Homes Trust, Inc., 300 Crescent Court, Suite 700, Dallas, Texas 75201, Attn: Corporate Secretary. We will post information regarding any amendment to, or waiver from, our code of business conduct and ethics on our website in the Governance section.

Furthermore, our insider trading policy, which is reasonably designed to promote compliance with insider trading laws, rules and regulations (i) governs the purchase, sale and/or other disposition of the Company’s securities by directors, officers and employees of the Company and (ii) prohibits our directors and certain employees, including all of our executive officers, from engaging in hedging transactions with respect to our securities, including entering into options, warrants, puts, calls or similar instruments or selling our securities short.

The Board periodically reviews its corporate governance policies and practices. Based on these reviews, the Board may adopt changes to policies and practices that are in the best interest of our stockholders and as appropriate to comply with any new SEC rules.

Board Leadership Structure and Board’s Role in Risk Oversight

James Dondero serves as Chairman of the Board. As President of the Adviser, Mr. Dondero is involved in day-to-day operations and is familiar with the opportunities and challenges that the Company faces at any given time. With this insight, he is able to assist the Board in setting strategic priorities, lead the discussion of business and strategic issues and translate Board recommendations into Company operations and policies. The Board believes that having an employee of the Adviser as Chairman of the Board is the most effective leadership structure for the Company at this time.

The Board has appointed Scott Kavanaugh as its lead independent director. His key responsibilities in this role include:

• developing agendas for, and presiding over, the executive sessions of the non-management or independent directors;

• reporting the results of the executive sessions to the Chairman;

• providing feedback from executive sessions to the Chairman;

• serving as a liaison between the independent directors and the Chairman (provided that each director will also be afforded direct and complete access to the Chairman at any such time such director deems necessary or appropriate);

• presiding at all meetings of the Board at which the Chairman is not present;

• approving information sent to the Board;

• approving agendas for Board meetings;

• approving Board meeting schedules to ensure that there is sufficient time for discussion of all agenda items;

• calling meetings of the independent directors; and

• if requested by major stockholders, ensuring that he is available for consultation and direct communication.

Risk is inherent with every business and we face a number of risks. Management is responsible for the day-to-day management of risks, while the Board, as a whole and through our audit committee, is responsible for overseeing our business and affairs, including overseeing its risk assessment and risk management functions. The Board has delegated responsibility for reviewing our policies with respect to risk assessment and risk management to our audit committee through its charter. The Board has determined that this oversight responsibility can be most efficiently performed by our audit committee as part of its overall responsibility for providing independent, objective oversight with respect to our accounting and financial reporting functions, internal and external audit functions, systems of internal controls over financial reporting and legal, ethical and regulatory compliance. Our Board has also delegated the oversight of risks related to cybersecurity to our audit committee and risks related to environmental, social and governance matters to our nominating and corporate governance committee. Our audit and nominating and corporate governance committees regularly report to the Board with respect to their oversight of these areas.

Board Meetings

The Board held five meetings during the fiscal year ended December 31, 2023. All directors serving on the Board in 2023 attended at least 75% of the total number of meetings of the Board and the total number of meetings of the committees on which he or she served during the time they served on the Board. Under our corporate governance guidelines, each director is expected to devote the time necessary to appropriately discharge his or her responsibilities and to prepare for and, to the extent possible, attend and participate in all Board meetings and meetings of committees on which he or she serves.

Director Attendance at Annual Meetings of Stockholders

Under our corporate governance guidelines, each director is expected to attend our annual meeting of stockholders. None of the Company’s directors at the time of the 2023 annual meeting of stockholders attended the 2023 annual meeting.

Board Committees

Our Board has an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by the Board.

Audit Committee

Our audit committee consists of Mr. Constantino, Mr. Kavanaugh, Dr. Laffer, Dr. Swain and Ms. Wood, with Mr. Constantino serving as chair of the committee. The Board has determined that each of Mr. Constantino, Mr. Kavanaugh, Dr. Laffer, and Dr. Swain qualify as an “audit committee financial expert” as that term is defined by the applicable SEC regulations. The Board has also determined that each of Mr. Constantino, Mr. Kavanaugh, Dr. Laffer, Dr. Swain and Ms. Wood is “financially literate” as required by NYSE rules and is independent as defined by NYSE rules and SEC requirements relating to the independence of audit committee members. Our Board has determined that Mr. Constantino’s, Mr. Kavanaugh’s, Dr. Laffer’s, Dr. Swain’s and Ms. Wood’s simultaneous service on the audit committees of more than three public companies would not impair his or her ability to effectively serve on our audit committee. The audit committee met five times during the fiscal year ended December 31, 2023. Our audit committee charter details the principal functions of the audit committee, including oversight related to:

• our accounting and financial reporting processes;

• the integrity of our consolidated financial statements;

• our systems of disclosure controls and procedures and internal control over financial reporting;

• our compliance with financial, legal and regulatory requirements;

• the performance of our internal audit function;

• our overall risk assessment and management; and

• our process for assessing, identifying and managing risks from cybersecurity threats as well as any material effects, or reasonably likely material effects, of risks from cybersecurity threats and previous cybersecurity incidents.

The audit committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The audit committee also prepares the audit committee report required by SEC regulations to be included in our annual proxy statement. A copy of the audit committee charter is available under the Governance section of the Company’s website at www.investors.vinebrookhomes.com.

Compensation Committee

Our compensation committee consists of Dr. Laffer, Mr. Kavanaugh, Mr. Constantino, Dr. Swain and Ms. Wood, with Dr. Laffer serving as chair of the committee. The Board has determined that each of Dr. Laffer, Mr. Kavanaugh, Mr. Constantino, Dr. Swain and Ms. Wood is independent as defined by NYSE rules and SEC requirements relating to the independence of compensation committee members. The compensation committee met five times during the fiscal year ended December 31, 2023. Our compensation committee charter details the principal functions of the compensation committee, including:

• reviewing our compensation policies and plans;

• implementing and administering a long-term incentive plan;

• evaluating the terms of the Advisory Agreement and the performance of the Adviser;

• assisting management in complying with our proxy statement and annual report disclosure requirements;

• producing a report on compensation to be included in our annual proxy statement, as required; and

• reviewing, evaluating and recommending changes, if appropriate, to the compensation for directors.

The compensation committee has the sole authority to retain and terminate compensation consultants to assist in the evaluation of our compensation and the sole authority to approve the fees and other retention terms of such compensation consultants. The committee may, in its discretion, delegate specific duties and responsibilities to a subcommittee or an individual committee member, to the extent permitted by applicable law. The committee is also able to retain independent counsel and other independent advisors to assist it in carrying out its responsibilities. A copy of the compensation committee charter is available under the Governance section of the Company’s website at www.investors.vinebrookhomes.com.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Mr. Kavanaugh, Mr. Constantino, Dr. Laffer, Dr. Swain and Ms. Wood, with Mr. Kavanaugh serving as chair of the committee. The Board has determined that each of Mr. Kavanaugh, Mr. Constantino, Dr. Laffer, Dr. Swain and Ms. Wood is independent as defined by NYSE rules. The nominating and corporate governance committee met five times during the fiscal year ended December 31, 2023. Our nominating and corporate governance committee charter details the principal functions of the nominating and corporate governance committee, including:

• reviewing the characteristics of current Board members, including diversity characteristics and determining if any characteristics are lacking and using these measures in identifying and recommending to the full Board qualified candidates for election as directors;

• developing and recommending to the Board corporate governance guidelines and implementing and monitoring such guidelines;

• reviewing and making recommendations on matters involving the general operation of the Board, including board size and composition, and committee composition and structure;

• recommending to the Board nominees for each committee of the Board;

• annually facilitating the assessment of the Board’s performance, as required by applicable law, regulations and NYSE corporate governance listing standards;

• annually reviewing and making recommendations to the Board regarding revisions to the corporate governance guidelines and the code of business conduct and ethics;

• overseeing succession planning; and

• overseeing the Company’s strategy, initiatives, risks, opportunities and reporting on material environmental, social and governance matters.

The nominating and corporate governance committee has the sole authority to retain and terminate any search firm to assist in the identification of director candidates and the sole authority to set the fees and other retention terms of such search firms. The committee is also able to retain independent counsel and other independent advisors to assist it in carrying out its responsibilities. A copy of the nominating and corporate governance committee charter is available under the Governance section of the Company’s website at www.investors.vinebrookhomes.com.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2023, Dr. Laffer, Mr. Constantino, Mr. Kavanaugh, Dr. Swain and Ms. Wood served on the compensation committee. During the fiscal year ended December 31, 2023:

| | ● | none of the members of our compensation committee is, or has ever been, one of our officers or employees; |

| | ● | none of the members of our compensation committee had any relationships with us requiring disclosure under “Certain Relationships and Related Party Transactions”; |

| | ● | none of our executive officers served as a member of the compensation committee of another entity, one of whose executive officers served on our compensation committee; |

| | ● | none of our executive officers served as a director of another entity, one of whose executive officers served on our compensation committee; and |

| | ● | none of our executive officers served as a member of the compensation committee of another entity, one of whose executive officers served as one of our directors. |

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Among other matters, our code of business conduct and ethics is designed to deter wrongdoing and to promote:

• honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

• full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications;

• compliance with laws, rules and regulations;

• prompt internal reporting of violations of the code to appropriate persons identified in the code; and

• accountability for adherence to the code of business conduct and ethics.

A copy of our code of business conduct and ethics is available under the Governance section of the Company’s website at www.investors.vinebrookhomes.com. We will post information regarding any amendment to, or waiver from, our code of business conduct and ethics on our website under the Governance section.

Qualifications for Director Nominees

The nominating and corporate governance committee is responsible for reviewing with the Board, at least annually, the appropriate skills and experience required for members of the Board. This assessment includes factors such as judgment, skill, diversity, integrity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board.

In connection with this assessment, the nominating and corporate governance committee will identify individuals believed to be qualified to become Board members and recommend candidates to the Board to fill new or vacant positions. The nominating and corporate governance committee will also review the qualifications of, and make recommendations to the Board regarding, director nominations submitted to the Company by stockholders in accordance with the Company’s bylaws or otherwise using the same assessment process described above. In addition, the nominating and corporate governance committee will evaluate whether an incumbent director should be nominated for re-election to the Board as part of its annual review and selection process. The nominating and corporate governance committee will use the same factors established for new director candidates to make its evaluation and will also take into account the incumbent director’s performance as a Board member.

Board Diversity

The nominating and corporate governance committee does not have a formal policy regarding the consideration of diversity for director candidates. The nominating and corporate governance committee does, however, consider diversity as part of its overall selection strategy. The nominating and corporate governance committee considers diversity in its broadest sense, including diversity in professional and life experiences, education, skills, perspectives and leadership, as well as other individual qualities and attributes that contribute to Board heterogeneity, such as race, ethnicity, sexual orientation, gender and national origin. Importantly, the nominating and corporate governance committee focuses on how the experiences and skill sets of each director nominee complements those of fellow directors and director nominees to create a balanced Board with diverse viewpoints and deep expertise. The Company believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Company's goal of creating a board of directors that best serves our needs and those of our stockholders.

The Company added diversity-related questions to its director and officer questionnaires in 2022 to help the nominating and corporate governance committee identify whether there are areas, including with respect to diversity of thought, background, experience, gender, race and age, the nominating and corporate governance committee should consider in connection with its review of board composition and board refreshment.

Below is a summary of the experience and skills, gender, age and tenure of our directors, and whether the directors are racially or ethnically diverse.

| | Mr. Dondero | Mr. Mitts | Mr. Constantino | Mr. Kavanaugh | Dr. Laffer | Mr. Sprong | Dr. Swain | Ms. Wood |

Executive Leadership | X | X | | X | X | X | X | X |

| | | | | | | | | |

Real Estate/REIT Experience | X | X | | X | X | X | X | X |

| | | | | | | | | |

Business Operations | X | X | | X | X | X | X | X |

| | | | | | | | | |

Strategic Development/Planning | X | X | | X | X | X | X | X |

| | | | | | | | | |

Corporate Governance | X | X | X | X | X | X | X | X |

| | | | | | | | | |

Financial and Accounting | X | X | X | X | X | X | | X |

| | | | | | | | | |

Risk Management | X | X | X | X | X | X | | X |

| | | | | | | | | |

Capital Markets/Financial Services | X | X | | X | X | X | | X |

| | | | | | | | | |

Technology, Information Security and Innovation | X | | | X | X | X | | X |

| | | | | | | | | |

Cybersecurity | X | | | X | X | X | | X |

| | | | | | | | | |

Environmental Issues, including Climate Change | X | | | X | X | X | X | X |

| | | | | | | | | |

Social Issues, including Diversity and Inclusion | X | | | X | X | X | X | X |

| | | | | | | | | |

Human Capital | X | | | X | X | X | X | X |

| | Mr. Dondero | Mr. Mitts | Mr. Constantino | Mr. Kavanaugh | Dr. Laffer | Mr. Sprong | Dr. Swain | Ms. Wood |

Independent | | | | | | | | |

| | | | | | | | | |

Independent | | | X | X | X | | X | X |

| | | | | | | | | |

Diversity | | | | | | | | |

| | | | | | | | | |

Gender | M | M | M | M | M | M | F | F |

| | | | | | | | | |

Racially or Ethnically Diverse† | W | W | W | W | W | W | B | W |

| | | | | | | | | |

Age Range | | | | | | | | |

| | | | | | | | | |

59 and under | | X | | | | X | | |

| | | | | | | | | |

60-64 | X | | | X | | | | |

| | | | | | | | | |

65-69 | | | | | | | | X |

| | | | | | | | | |

70 and older | | | X | | X | | X | |

| | | | | | | | | |

Tenure on Board | | | | | | | | |

| | | | | | | | | |

0-5 years | X | X | X | X | X | X | X | X |

| | | | | | | | | |

6-10 years | | | | | | | | |

†

B= Black/ African American

W= White

The composition of our Board also reflects our belief that multiple and varied points of view facilitate more balanced, wide-ranging discussion in the boardroom, and contribute to a more effective decision-making process.

Director Candidate Recommendations by Stockholders

The nominating and corporate governance committee will review and evaluate any director nominations submitted by stockholders, including reviewing the qualifications of, and making recommendations to the Board regarding, director nominations submitted by stockholders in the same manner as described under “Qualifications for Director Nominees.” See “Communications with the Board of Directors” below for additional information on how to submit a director nomination to the Board.

Communications with the Board of Directors

Any stockholder or other interested party who wishes to communicate directly with the Board or any of its members may do so by writing to: Board of Directors, c/o VineBrook Homes Trust, Inc., 300 Crescent Court, Suite 700, Dallas, Texas 75201, Attn: Corporate Secretary. The mailing envelope should clearly indicate whether the communication is intended for the Board as a group, the non-management directors or a specific director.

Stockholder Nominations

The Company’s bylaws provide that, with respect to an annual meeting of our stockholders, nominations of individuals for election to the Board may be made only (a) pursuant to our notice of the meeting, (b) by or at the direction of the Board or (c) by any stockholder who was a stockholder of record both at the time of giving the notice required by our bylaws and at the time of the meeting, who is entitled to vote at the meeting in the election of such nominee and has provided notice to us within the time period, and containing the information, certifications and other materials, specified in the advance notice provisions of our bylaws and who has complied with the other procedural requirements set forth in our bylaws.

With respect to special meetings of stockholders, only the business specified in our notice of meeting may be brought before the meeting. Nominations of individuals for election to the Board may be made only (a) by or at the direction of the Board or (b) if the meeting has been called for the purpose of electing directors, by any stockholder who was a stockholder of record both at the time of giving the notice required by our bylaws and at the time of the meeting, who is entitled to vote at the meeting in the election of such nominee and who has provided notice to us within the time period, and containing the information, certifications and other materials, specified in the advance notice provisions of our bylaws and who has complied with the other procedural requirements set forth in our bylaws. See “Stockholder Proposals for the 2025 Annual Meeting of Stockholders” below for how to submit a timely notice.

EXECUTIVE OFFICERS & SIGNIFICANT EMPLOYEES

The following sets forth information regarding the executive officers of the Company as of April 1, 2024:

Name | Age | Position(s) |

Executive Officers | | |

Brian Mitts | 53 | Director, President, Chief Executive Officer, Chief Financial Officer, Assistant Secretary and Treasurer |

Dana Sprong | 45 | Director, Senior Vice President of Acquisitions & Dispositions and member of Investment Committee |

Matt McGraner | 40 | Executive Vice President, Chief Investment Officer, Secretary and member of Investment Committee |

Ryan McGarry | 38 | Senior Vice President of Asset Management and member of Investment Committee |

| | | |

Significant Employees | | |

Paul Richards | 35 | Vice President of Asset Management and Financing |

David Willmore | 36 | Chief Accounting Officer for NexPoint |

Tom Chapline | 33 | Vice President of Finance |

Graham Strong | 52 | Chief Financial Officer of the Manager |

Information regarding Mr. Mitts and Mr. Sprong is included above under “Proposal 1-Election of Directors.”

Matt McGraner has served as our Executive VP, Chief Investment Officer and Secretary and as a member of the Investment Committee of our OP since February 2019. From October 2018 to February 2019, Mr. McGraner served as our Chief Executive Officer, President and Secretary. Mr. McGraner co-founded NREA as well as NXRT, NREF and other real estate businesses with Mr. Mitts and Mr. Dondero. Mr. McGraner has also served as the Executive VP and Chief Investment Officer of NXRT since March 2015 and has served as the Executive VP and Chief Investment Officer of NREF since February 2020 and as a member of the board of directors and President of NSP since November 2020. From September 2014 to March 2015, Mr. McGraner served as NXRT’s Secretary. Mr. McGraner has also served as Chief Investment Officer of NHT since December 2018 and as a Managing Director at NexPoint since 2016. Mr. McGraner also has served as Executive VP, Chief Investment Officer and Secretary of NXDT since July 2022 and as Chief Investment Officer and Secretary of NexPoint Homes since June 2022. NREF, NXRT, NXDT, NexPoint Homes, NSP, NHT and our Adviser are all affiliates of the Company. With over ten years of real estate, private equity and legal experience, his primary responsibilities are to lead the operations of the real estate platform at NexPoint, as well as source and execute investments, manage risk and develop potential business opportunities, including fundraising, private investments and joint ventures. Mr. McGraner is also a licensed attorney and was formerly an associate at Jones Day from 2011 to 2013, with a practice primarily focused on private equity, real estate and mergers and acquisitions. While at Jones Day, Mr. McGraner led the acquisition and financing of over $200 million of real estate investments and advised on $16.3 billion of M&A and private equity transactions. Since 2013 through April 7, 2023, Mr. McGraner has led the acquisition and financing of over $19.9 billion of real estate investments.

Ryan McGarry has served as our Senior Vice President of Asset Management since the formation event in 2018. He also serves as the Managing Partner and Chief Operating Officer of our Manager. He served as the Chief Operating Officer of the legacy entities throughout our history. Mr. McGarry leads business development, strategy, and the operations groups managing the confluence of people, process, and technology to deliver durable and consistent results across geographically dispersed assets. Mr. McGarry joined our predecessor in 2010 and has focused on enhancing analytical capabilities to drive efficiency and scale. Today, he maintains responsibility for the property management, property operations, construction management, information technology and human resources groups, providing direction with a focus on the net operating income (“NOI”) margin enhancement. His focus is on driving efficiency and transparency via task-based management solutions and a robust, metric-based reporting infrastructure. Prior to joining our predecessor, Mr. McGarry worked at a national investment consulting firm, focused on investment policy direction and manager evaluation and selection. Mr. McGarry is a CFA Charterholder and a CAIA Charterholder. Mr. McGarry also serves as a member of the Investment Committee.

Paul Richards has served as our Vice President of Asset Management and Financing since 2018. Mr. Richards has also served as Vice President of Asset Management of NHT since March 2019 and as VP of Originations and Investments of NREF since February 2020. His primary responsibilities are to research and conduct due diligence on new investment ideas, perform valuation and benchmark analysis, monitor and manage investments in the existing real estate portfolio, and provide industry support for NexPoint’s real estate team. Mr. Richards has served as a director for NREA since 2019 and joined in 2017. From 2016 to 2017, Mr. Richards served as a Product Strategy Associate at NexPoint Asset Management, L.P. (“NexPoint Asset Management”), formerly known as Highland Capital Management Fund Advisors, L.P., where he was responsible for evaluating and optimizing the registered product lineup. NHT, NREF, NREA and NexPoint Asset Management are all affiliates of the Company. Previously, Mr. Richards was also employed with Deloitte & Touche LLP’s state and local tax practice where he served as a tax consultant specializing in state strategic tax reviews, voluntary disclosure agreements, state tax exposure research, and overall state tax compliance.

David Willmore, has served as the Chief Accounting Officer for NexPoint since 2021. Mr. Willmore has also served as the VP of Finance for NREF and NXRT since February 2020. Mr. Willmore has also served as Senior Manager at NXRT since March 2019 and Senior Vice President of Accounting and Finance of NexPoint Homes since June 2022. He was previously Senior Manager at NXRT from April 2019 to February 2020 and a Senior Manager at a former NexPoint affiliate from February 2017 to March 2019. NexPoint, NREF, NXRT and NexPoint Homes are all affiliates of the Company. With over ten years of accounting, auditing, and financial reporting experience, his primary responsibilities are to implement the financial and operational strategies of NexPoint’s public and private REITs and registered investment funds as well as ensure timely and accurate accounting and reporting. Before joining in October 2011, Mr. Willmore began his career at Deloitte & Touche LLP as an auditor in the Audit and Enterprise Risk Services Group.

Tom Chapline, has served as the Vice President of Finance of our Company since February 2023, was a Senior Fund Analyst at NexPoint from 2017 to 2022 and has served as a Senior Manager at NexPoint since 2022. With seven years of financial reporting experience, Mr. Chapline’s responsibilities include managing our consolidated financial reporting, accounting and operations. Mr. Chapline also manages the financial reporting, accounting and operations of NexPoint Homes and private REITs on the NexPoint platform. NexPoint is an affiliate of the Company. Prior to joining NexPoint in 2017, Mr. Chapline was a Senior Associate at KPMG. Over his three years at KPMG, Mr. Chapline was responsible for leading teams on hedge fund and private equity audit engagements. Mr. Chapline received his MS and BBA in Accounting from Southern Methodist University and is a licensed Certified Public Accountant in the state of Texas.

Graham Strong, has served as our Manager’s Chief Financial Officer since 2018 and is responsible for administrative, financial and risk management functions including, but not limited to, the development of financial and operational strategies, metrics tied to strategy, and the ongoing development and monitoring of control systems designed to facilitate growth, preserve company assets and report accurate and timely financial results. Prior to joining our Manager, Mr. Strong served for several years on the management team of one of the largest independent, middle market equipment and technology lessors in North America. Within that organization, Mr. Strong was charged with the management of the corporate treasury, accounting and tax functions. Prior to Mr. Strong’s stint within the equipment and technology leasing industry, he served as Vice President of Finance for a large, regional originator of residential mortgages. Mr. Strong received his Master of Business Administration with a Concentration in Finance from the Williams College of Business at Xavier University. Additionally, he received his Bachelor of Business Administration, Major in Accounting, from the Carl H. Lindner College of Business at the University of Cincinnati. He is a Certified Public Accountant (CPA) and a Chartered Global Management Accountant (CGMA).

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10% of the shares of our common stock to file an initial report of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC. The SEC rules require us to disclose late filings of initial reports of stock ownership and changes in stock ownership by our directors, executive officers and 10% stockholders.

Based solely on a review of copies of Forms 3, 4 and 5 filed with the SEC, we believe that during the fiscal year ended December 31, 2023, all Section 16(a) filing requirements applicable to our directors, executive officers and 10% stockholders were completed in a timely manner, except the following reports: (i) one Form 4 filed in April 2023 (reporting 9 transactions) for Dana Sprong, (ii) one Form 4 filed in April 2023 (reporting 9 transactions) for Ryan McGarry, (iii) one Form 4 filed in August 2023 (reporting 6 transactions) for Dana Sprong, (iv) one Form 4 filed in August 2023 (reporting 6 transactions) for Ryan McGarry, (v) a Form 4 reporting two transactions for Dana Sprong and (vi) a Form 4 reporting two transactions for Ryan McGarry.

EXECUTIVE COMPENSATION

Overview of Executive Compensation Program

We are externally managed by our Adviser pursuant to the Advisory Agreement. In addition, prior to the Internalization our properties were externally managed by our Manager pursuant to management agreements between the Manager and subsidiaries of our OP (the “Management Agreements”) and the amended and restated side letter, dated July 31, 2020, among our Manager, our OP and other parties thereto (as amended from time to time, the “Side Letter”).

Because our officers are employed by our Adviser or were employed by our Manager prior to the Internalization, our officers have not historically received any cash compensation from us for their services as our officers and we do not expect our officers that are employed by our Adviser to receive cash compensation from us for their services as our officers so long as our officers are employed by our Adviser. The Company does not reimburse and does not plan to reimburse our Adviser for salary or benefits paid to the Company’s named executive officers. Instead, we pay our Adviser the fees described under “Certain Relationships and Related Transactions, and Director Independence-Transactions with Related Persons-Advisory Agreement.” For the year ended December 31, 2023, we paid approximately $19 million in fees to our Adviser. Prior to the Internalization, the Company did not reimburse our Manager for salary or benefits paid to the Company’s named executive officers. Instead, we paid our Manager the fees described under “Certain Relationships and Related Transactions, and Director Independence-Transactions with Related Persons-Management Agreements and Side Letter.” For the year ended December 31, 2023, we paid approximately $13.8 million in fees to our Manager, which, following the Internalization, are eliminated in consolidation.

On August 3, 2023, the OP, VineBrook Management, LLC, VineBrook Development Corporation, VineBrook Homes Property Management Company, Inc., VineBrook Homes Realty Company, Inc., VineBrook Homes Services Company, Inc. and certain individuals set forth therein (collectively, the “Contributors”) and Dana Sprong, solely in his capacity as the representative of the Contributors (the “Contributors Representative”) entered into a contribution agreement (the “Contribution Agreement”) pursuant to which, among other things, the OP acquired all of the outstanding equity interests in the Manager (the “Internalization”). Following the closing of the Internalization, the Manager is a wholly owned subsidiary of the OP and the Manager’s internalized employees continue to manage the day-to-day operations of the VineBrook Portfolio. See “Certain Relationships and Related Transactions, and Director Independence-Transactions with Related Persons-The Internalization.”

Executive Compensation in 2023

As described above, during the year ended December 31, 2023, our executive officers were employed by our Adviser or, prior to the Internalization, our Manager. Neither we, nor our compensation committee, makes any decisions regarding the executive officer’s compensation, employee benefits, or other types of compensation paid to our executive officers by our Adviser or its affiliates or, prior to the Internalization, by the Manager or its affiliates. For the year ended December 31, 2023, our compensation committee only reviewed and approved the equity-based awards to be paid or made by us to our executive officers who are officers of the Adviser. As such, we did not provide any of our executive officers who are officers of the Adviser with any cash compensation, pension benefits or nonqualified deferred compensation plans during the year ended December 31, 2023.

In connection with the Internalization, on August 3, 2023, the Manager entered into offer letters (the “Offer Letters”) with Mr. Sprong and Mr. McGarry to retain their services following the Internalization. Under the Offer Letters, Mr. Sprong serves as Managing Partner and Chief Executive Officer of the Manager and Mr. McGarry serves as Managing Partner and Chief Operating Officer of the Manager. Pursuant to the terms of the Offer Letter, Mr. Sprong and Mr. McGarry will each receive a salary at an annual rate of $550,000 per year in exchange for their services and will be eligible for cash bonuses and to participate in the Company’s 2023 Long Term Incentive Plan (the “2023 LTIP”). For each of Mr. Sprong and Mr. McGarry, the cash bonus for 2023 had a target of $400,000 pursuant to the achievement of annual growth of rehabilitations of properties in the VineBrook Portfolio, integration of the Manager following the Internalization and succession planning. Bonus amounts paid in 2023 are reported in the “Non-Equity Incentive Plan Compensation” column of the summary compensation table below. In addition, on the closing date of the Internalization, Mr. Sprong and Mr. McGarry were each granted performance shares under the 2023 LTIP with a target value of $2 million pursuant to performance share award agreements. Vesting of the performance shares is based on the achievement of annual Company portfolio growth, annual growth of rehabilitations of properties in the VineBrook Portfolio, net operating income growth over the next three years and core funds from operations per share growth over three years. In addition, Mr. Sprong and Mr. McGarry each received a one-time grant of profits interest units under the 2023 LTIP with a value of $15 million, which will vest in full on February 28, 2026, subject to continued employment.