PART II - OFFERING CIRCULAR

Dated October 30, 2019

PURSUANT TO REGULATION A

OF THE SECURITIES ACT OF 1933

NOCERA, INC.

2030 Powers Ferry Road SE, Suite #212

Atlanta, GA 30339

(404) 816-8240

info@nocera.company

$10,593,900

Rights Offering

3,531,300 Units

each consisting of 1 Share of Common Stock and 1 Warrant exercisable at approximately 150% of the market price of shares at the time of Rights Offering

Minimum Investment: 100 Units ($300)

FORM 1-A: TIER 2

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A For general information on investing, we encourage you to refer to www.investor.gov.

| | | Price to public | | Underwriting discountand commissions (1) | | Proceeds to Company (2) | | Proceeds to other persons |

| | | | | | | | | |

| Per Unit | | $ | 3.00 | | | | (1 | )$0.24 | | $ | 2.76 | | | $ | 0 | |

| Total (3): | | $ | 10,593,900 | | | | (1 | )$847,512 | | $ | 9,746,388 | | | $ | 0 | |

This offering commenced on ___________________. As of October __, 2019, we raised $____________ in this offering, issuing 3,351,300 units each consisting of 1 share of common stock and 1 warrant. The minimum investment amount is 100 units or $300. The offering has been made and initially is expected to continue to be made directly to investors on a best efforts basis. In the future, the units may be offered through broker-dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”), or through other independent referral sources. This offering will terminate on __________________, 20__ unless extended by us for up to an additional 90 days or terminated sooner by us in our discretion regardless of the amount of capital raised (the “Sales Termination Date”). There is no minimum capital required from this offering and therefore no subscription escrow account will be established for it. The proceeds of this offering may be deposited directly into the Company’s operating account for immediate use by it, with no obligation to refund subscriptions.

___________________________

| (1) | We have entered into service agreements with Network 1 Financial Securities, Inc., a member of FINRA, to provide subscription and administrative services for the offering. Network 1 Financial Services is not an underwriter and is not paid selling commissions or underwriting fees but is paid service fees. |

| (2) | The amounts shown are before deducting organization and offering costs to us, which include legal, accounting, printing, due diligence, marketing, consulting, referral fees, selling and other costs incurred in the offering of the shares. See “USE OF PROCEEDS” and “PLAN OF DISTRIBUTION.” |

| (3) | The shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings. The shares are only issued to purchasers who satisfy the requirements set forth in Regulation A. We have the option in our sole discretion to accept less than the minimum investment from a limited number of subscribers. “TERMS OF THE OFFERING.” |

THIS OFFERING CIRCULAR IS NOT KNOWN TO CONTAIN AN UNTRUE STATEMENT OF A MATERIAL FACT, NOR TO OMIT MATERIAL FACTS WHICH IF OMITTED, WOULD MAKE THE STATEMENTS HEREIN MISLEADING. IT CONTAINS A FAIR SUMMARY OF THE MATERIAL TERMS OF DOCUMENTS PURPORTED TO BE SUMMARIZED HEREIN. HOWEVER, THIS IS A SUMMARY ONLY AND DOES NOT PURPORT TO BE COMPLETE. ACCORDINGLY, REFERENCE SHOULD BE MADE TO THE CERTIFICATION OF RIGHTS, PREFERENCES AND PRIVILEGES AND OTHER DOCUMENTS REFERRED TO HEREIN, COPIES OF WHICH ARE ATTACHED HERETO OR WILL BE SUPPLIED UPON REQUEST, FOR THE EXACT TERMS OF SUCH AGREEMENTS AND DOCUMENTS.

_____________________________________

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

_____________________________________

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE. EACH INVESTOR SHOULD CONSULT HIS OWN COUNSEL, ACCOUNTANT AND OTHER PROFESSIONAL ADVISORS AS TO LEGAL, TAX AND OTHER RELATED MATTERS CONCERNING HIS INVESTMENT.

JURISDICTIONAL (NASAA) LEGENDS

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED "BLUE SKY" LAWS).

TABLE OF CONTENTS

SUMMARY OF RISK FACTORS

The purchase of units containing shares of our common stock and warrants involves substantial risks. Each prospective investor should carefully consider the following risk factors, in addition to any other risks associated with this investment and should consult with his/her own legal and financial advisors.

Cautionary Statements

The discussions and information in this Offering Circular may contain both historical and forward-looking statements. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of our business, please be advised that our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by us in forward-looking statements. We have attempted to identify, in context, certain of the factors we currently believe may cause actual future experience and results to differ from our current expectations. The differences may be caused by a variety of factors, including but not limited to:

| · | Lack of market acceptance of our product. |

| · | Inability to finance the construction of land-based recirculating aquaculture systems due to a lack of private capital and cash flow. |

| · | Inability to find suitable sites for our planned aquaculture systems. |

| · | Delays in obtaining critical components from suppliers, causing delays in aquaculture station construction. |

| · | Heavy design, construction and development expenditures by us without revenue, resulting in substantial operating deficits, especially in the early years of operation. |

| · | Intense competition, including entry of new competitors. |

| · | Lack of demand for fish farming. |

| · | Adverse federal, state, and local government regulation. |

| · | Unexpected costs and operating deficits. |

| · | Lower sales and revenue than forecast. |

| · | Default on leases or other indebtedness. |

| · | Loss of suppliers and supply. |

| · | Price increases for capital, supplies and materials. |

| · | Inadequate capital and financing. |

| · | Failure to obtain customers, loss of customers and failure to obtain new customers. |

| · | The risk of litigation and administrative proceedings involving us or our employees. |

| · | Loss of or inability to obtain government licenses and permits. |

| · | Adverse publicity and news coverage. |

| · | Inability to carry out marketing and sales plans. |

| · | Losses from theft that cannot be recovered. |

| · | Other specific risks that may be alluded to in this Offering Circular or in other reports issued by us or third-party publishers. |

| · | Our operating history makes it difficult to evaluate our future business prospects and to make decisions based on our historical performance. |

| · | We may not be successful in implementing important strategic initiatives, which may have a material adverse impact on our business and financial results. |

| · | Effectively managing our growth into new geographic areas will be challenging. |

| · | Key employees are essential to growing our business. |

| · | Our operations and assets in China are subject to significant political and economic uncertainties. |

| · | We may have limited legal recourse under PRC laws if disputes arise under our contracts with third parties. |

| · | We must comply with the Foreign Corrupt Practices Act. |

| · | The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. |

| · | We may have difficulty establishing adequate management, legal and financial controls in the PRC. |

| · | The enforcement of labor contract law and an increase in labor costs in the PRC may adversely affect our business and our profitability. |

| · | Insiders have substantial control over us, and they could delay or prevent a change in our corporate control even if our other stockholders wanted it to occur. |

| · | There may not be sufficient liquidity in the market for our securities in order for investors to sell their securities. |

INVESTMENT SUMMARY

The following summary is qualified in its entirety by the more detailed information and financial statements appearing elsewhere or incorporated by reference in this Offering Circular.

Nocera, Inc.

Business Overview

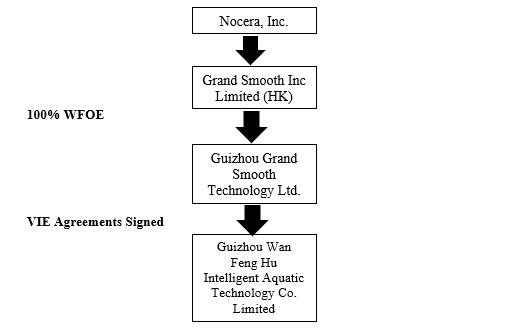

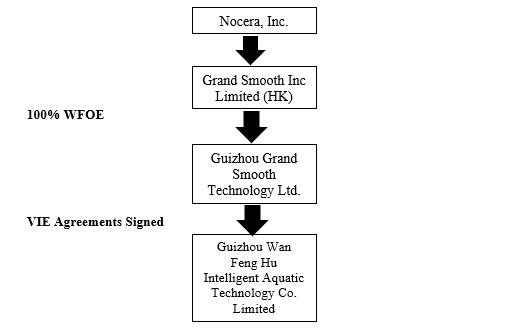

With respect to this discussion, the terms, the “Company” “we,” “us,” and “our” refer to Nocera, Inc. (“Nocera”), and its 100%-owned subsidiary Grand Smooth Inc Limited. (“GSI”), GSI’s wholly-owned subsidiary Guizhou Grand Smooth Technology Ltd. (“GZ GST”) and its Variable Interest Entity (“VIE”), Guizhou Wan Feng Hu Intelligent Aquatic Technology Co. Limited. (“GZ WFH”).

Effective December 31, 2018, we completed an Agreement and Plan of Merger (the “Agreement”), with (i) Grand Smooth Inc Limited, a company organized under the laws of Hong Kong, China (“GSI”), (ii) GSI’s shareholders, Yin-Chieh Cheng and Bi Zhang, who together owned shares constituting 100% of the issued and outstanding ordinary shares of GSI (the “GSI Shares”) and (iii) GSI Acquisition Corp. Under the terms of the Agreement, the GSI Shareholders transferred to us all of the GSI Shares in exchange for the issuance of 10,000,000 shares (the “Shares”) of our common stock (the “Share Exchange”). As a result of the Share Exchange, we are a public company holding a subsidiary in the People’s Republic of China (the “PRC”) engaged in aquaculture consulting and management business. We did not cancel or retire any shares of our issued and outstanding common stock and as a result, we had 12,349,200 shares of common stock issued and outstanding following the Share Exchange.

As of the Effective Date of December 31, 2018 of the Agreement and Plan of Merger, we are deemed to have consummated the transactions contemplated by the Agreement, pursuant to which we acquired all of the GSI Shares in exchange for the issuance of the shares to the GSI Shareholders. As a result of the Share Exchange, we emerged from shell status with our subsidiary, GSI, in Hong Kong engaged in the aquaculture consulting and management business through VIE in PRC under legal and accounting principles.

We are providing consulting services and solutions in aquaculture projects in China to increase revenues, reduce costs, operate more efficiently, increase production, provide expertise, advise on operating more strategically with new diversified aquaculture species, and importantly, to reduce water pollution and decrease the disease problems of fisheries.

Our principal executive offices are located at 2030 Powers Ferry Road SE, Suite #212, Atlanta, GA 30339. Our telephone number at this address is (404) 816-8240. Our website address is www.nocera.company and our e-mail address is info@nocera.company.

Investment Analysis

Management believes that we have strong economic prospects by virtue of the following dynamics of the industry and us:

| 1. | Management believes that the trends for growth in the aquaculture industry are favorable as aquaculture solutions are expected to continue to be popular. |

| 2. | Management believes that fish farming will achieve market acceptance and demand for land-based recirculating aquaculture systems will increase in the future. |

| 3. | Management believes that our aquaculture solution is innovative and environmentally friendly by using a state-of-the-art water recycling and filtration system. We estimate the domestic demand in China could be over 10,000 containers, both cylinder and rectangular, in the next 5 years and globally. We believe that there could be a demand for 15,000 containers. |

There is no assurance that we will be profitable, or that the industry’s favorable dynamics will not be outweighed in the future by unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors before investing in the shares. Commerce in the aquaculture industry is extremely competitive, inherently speculative and highly regulated. See “RISK FACTORS.”

The Offering

| Units offered by us | 3,531,300 units |

| Common Stock | 3,531,300 shares |

| Common Stock outstanding | 12,354,200 shares |

| Common Stock to be outstanding after the offering (1) | 15,885,500 shares |

| (1) | The total number of shares of our common stock outstanding assumes that the maximum number of units each containing shares of our common stock and warrants is sold in this offering. |

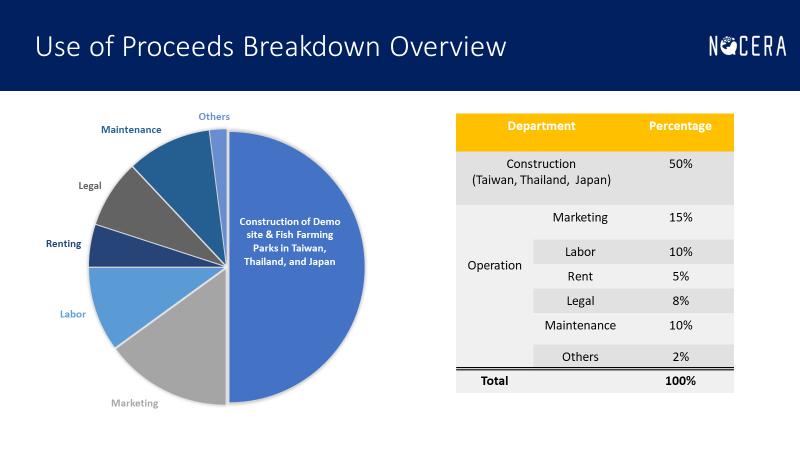

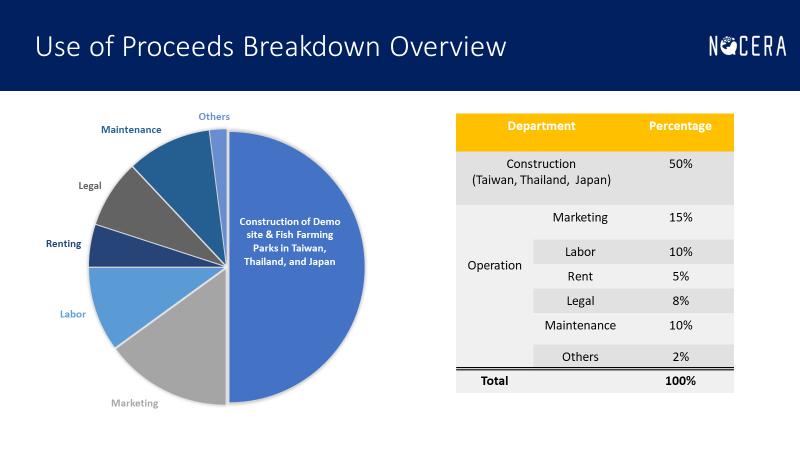

USE OF PROCEEDS

The maximum gross proceeds from the sale of the units each containing one share of our common stock and one warrant are $10.6 million. The net proceeds from the total offering are expected to be approximately $9.9 million, after the payment of offering costs including printing, mailing, legal and accounting costs, filing fees, potential selling commissions, and expense reimbursements that may be incurred. The estimate of the budget for offering costs is an estimate only and the actual offering costs may differ from those expected by management. The estimated use of the net proceeds of this offering is as follows, assuming 100%, 75%, 50% and 25% of this offering is subscribed, as illustrated in the following table for different levels of total capital from this offering:

Summarized Estimated Use of Net Proceeds

| | | | 100 | % | | | 75 | % | | | 50 | % | | | 25 | % |

| Operating Costs and Working Capital | | | $1.8 mil | | | | $2.5 mil | | | | $1.8 mil | | | | $0.5 mil | |

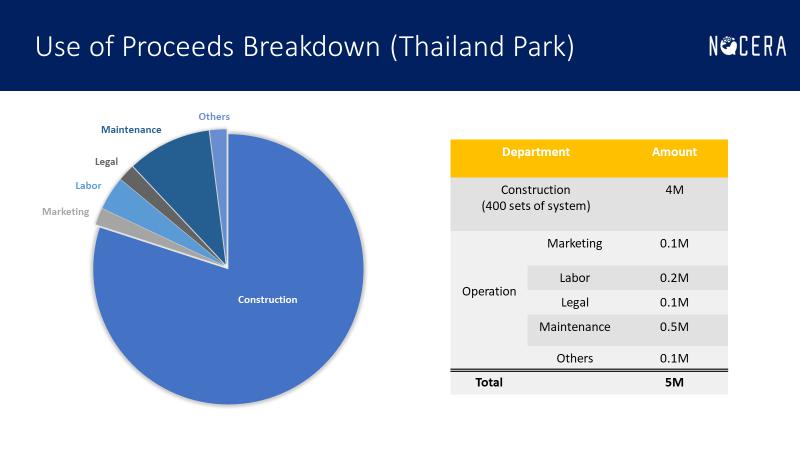

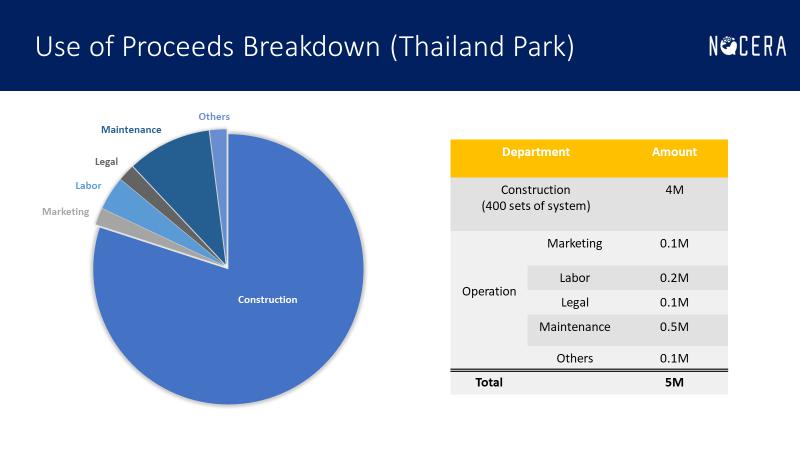

| Thailand Fish Farm | | | $5.0 mil | | | | | | | | | | | | | |

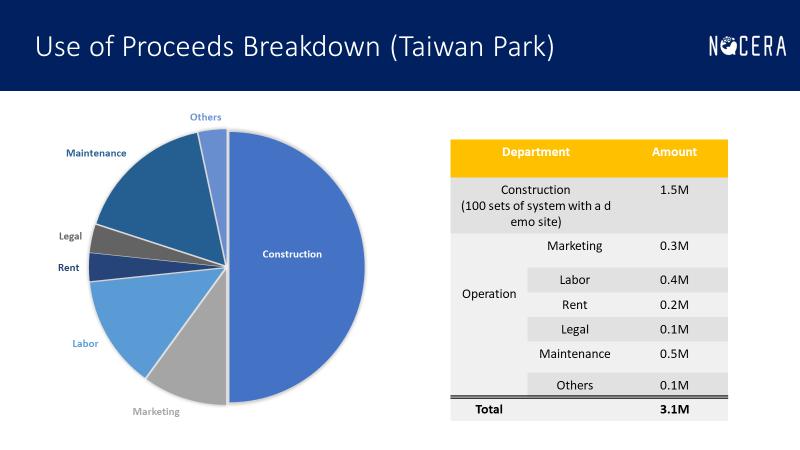

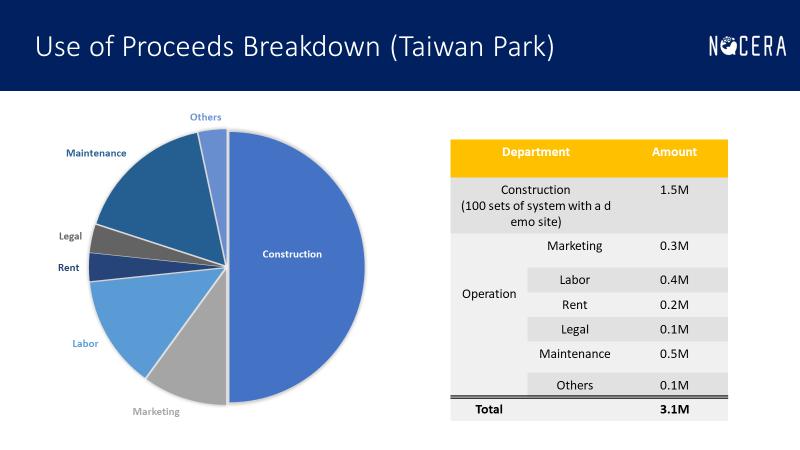

| Taiwan Fish Farm Development | | | $3.1 mil | | | | $3.1 mil | | | | $3.1 mil | | | | | |

| Japanese Fish Farm Development | | | | | | | $1.9 mil | | | | | | | | $1.9 mil | |

| Total Net Offering Proceeds (1) | | | $9.9 mil | | | | $7.5 mil | | | | $5.0 mil | | | | $2.5 mil | |

| (1) | Includes all fees paid to Network 1 for placement services. |

Summarized Estimated Use of Net Proceeds for Asia

We may reallocate the estimated use of proceeds among the various categories or for other uses if management deems such a reallocation to be appropriate. We cannot assure that the capital budget will be sufficient to satisfy our operational needs, or that we will have sufficient capital to fund our business. See “BUSINESS” and “RISK FACTORS.”

BUSINESS

With respect to this discussion, the terms, the “Company” “we,” “us,” and “our” refer to Nocera, Inc. (“Nocera”), and its 100%-owned subsidiary Grand Smooth Inc Limited. (“GSI”), GSI’s wholly-owned subsidiary Guizhou Grand Smooth Technology Ltd. (“GZ GST”) and its Variable Interest Entity (“VIE”), Guizhou Wan Feng Hu Intelligent Aquatic Technology Co. Limited. (“GZ WFH”).

Our History

Nocera, Inc. was organized on February 1, 2002 under the laws of the State of Nevada.

On February 12, 2002, we acquired Felice Conserve, an Italian corporation, as a wholly- owned subsidiary in exchange for 20 million shares of our common stock. The principal business of Felice Conserve was the production and processing of agricultural products in Italy. The principal product was canned tomatoes.

In 2003, we established two subsidiaries in Uruguay; Sontemar, SA (“Sontemar”), and Noldicor, SA (“Noldicor”). The principal business of Noldicor was the production of tomatoes. The principal business of Sontemar was the processing and sale of packaged tomatoes. On April 23, 2004, we paid a 4 for 1 stock dividend to our shareholders.

The Company abandoned operations in 2005. In 2006, due to financial difficulties, Noldicor and Sontemar ceased operations. As a result of this, our operations in Uruguay ceased. Additionally, during 2006, Felice Conserve was divested back to its original shareholders. This resulted in our returning to development stage status.

On approximately November 3, 2017, we effected a reverse-split of our common stock as follows:

| | · | A 1 for 40,000 reverse-split of the Company’s common stock, followed immediately by; |

| | · | All fractional shares shall be rounded upwards to the nearest whole share, followed immediately by; |

| | · | A 200 for 1 forward stock split. |

The net effect of these actions was a 1 for 200 reverse-split of the Company’s common stock, with no shareholder being reduced below 200 shares. All shareholders who prior to the reverse-split had 40,000 or less of the pre-split shares received 200 of the new, post-split shares.

Effective December 31, 2018, we completed an Agreement and Plan of Merger (the “Agreement”), with (i) Grand Smooth Inc Limited, a company organized under the laws of Hong Kong, China (“GSI”), (ii) GSI’s shareholders, Yin-Chieh Cheng and Bi Zhang, who together owned shares constituting 100% of the issued and outstanding ordinary shares of GSI (the “GSI Shares”) and (iii) GSI Acquisition Corp. Under the terms of the Agreement, the GSI Shareholders transferred to us all of the GSI Shares in exchange for the issuance of 10,000,000 shares (the “Shares”) of our common stock (the “Share Exchange”). As a result of the Share Exchange, we are a public company holding a subsidiary in the People’s Republic of China (the “PRC”) engaged in aquaculture consulting and management business. We did not cancel or retire any shares of our issued and outstanding common stock and as a result, we have 12,349,200 shares of common stock issued and outstanding following the Share Exchange.

As of the Effective Date of December 31, 2018 of the Agreement and Plan of Merger, we are deemed to have consummated the transactions contemplated by the Agreement, pursuant to which we acquired all of the GSI Shares in exchange for the issuance of the shares to the GSI Shareholders. As a result of the Share Exchange, we emerged from shell status with our subsidiary, GSI, in Hong Kong engaged in the aquaculture consulting and management business through VIE in PRC under legal and accounting principles.

Corporate Structure

Our current corporate structure is set forth below:

Until we consummated on the Agreement and Plan of Merger effective December 31, 2018, we were a shell company that had no or nominal operations and either no or nominal assets. Our wholly owned subsidiary, GSI, was incorporated in Hong Kong, China on August 1, 2014. GSI is the parent holding company of GZ GST, which was established on November 13, 2018 as a wholly foreign-owned enterprise (“WFOE”) established in the People’s Republic of China. GZ WFH, the VIE, was established on October 25, 2017, which was contractually controlled by the WFOE through VIE agreements. We will operate our business in China through both the WFOE and its VIE.

The WFOE is the primary beneficiary of the VIE – namely has the majority interest in the VIE and through execution of VIE contracts, the WFOE has contract commitments that the financial information of the VIE should be consolidated based on the Variable Interest Ownership percentage owned by the WFOE. The VIE structure was adopted mainly because the China operating company may in the future engage in business that may require special licenses in China and which can be an industry that prohibits foreign investment. The VIE structure will bypass the licensing and prohibition requirements in China.

VIE contracts are as follows:

| | 1. | Voting Rights Proxy Agreement |

| | 2. | Equity Pledge Agreement |

| | 3. | Exclusive Business Cooperation Agreement |

| | 4. | Exclusive Call Option Agreement |

Services

We intend to provide consulting services and solutions in aquaculture projects in China to increase revenues, reduce costs, operate more efficiently, increase production, provide expertise, advise on operating more strategically with new diversified aquaculture species, and importantly, to reduce water pollution and decrease the disease problems of fisheries.

We believe that our offerings of Services provide the following:

| | i. | Design, install, build and manage aquaculture investment and projects for qualified investors or part of an investment group who is interested in the great potential of the aquaculture industry and whom want to develop or take part of a new commercial fish farming or shrimp farming project but lack the experience. |

| | ii. | A full range of pilot and management services to aquaculture companies and new aquaculture projects throughout China and potentially international. From the fish farm to the table, we intend to encourage and support clean water and clean fish products. |

| | iii. | We intend to offer some equipment and materials from suppliers as part of our services offerings, which we will markup a reasonable amount. |

We believe our experience and innovation from working closely with our clients in the aquaculture industry in China gives us the competitive advantages to provide innovative aquaculture management solutions that will generate positive results for our future client companies, however, there can be no assurances we will be successful.

Market Overview

The fish farming industry in China was predominately regulated by state and local government allowing local fish farmers to set up fish nests in public water including water dams, rivers, lakes and etc. It is the dominant source of freshwater fish for both domestic demands and exports. Since the clean water policy was implemented in China in 2017 by the central government, the state and local governments are tasked with cleaning up local water sources and banning all fish nets and fish nests in public waters. The City of Xing Yi, for example, used to produce 15,000 tons of freshwater fish a year, however, that has been all banned and the government subsidy terminated so that now the 300 million pounds of freshwater fish are no longer produced.

This is a countrywide effort where some ponds or lakes are removed immediately and some will phase out gradually in 2 to 3 years. Nevertheless, under China’s government clean water policy of “retreating from lakes to lands” for fish farming, we believe that this presents to us a great opportunity for introducing fish farming in containers (both rectangular and cylinder) on lands. It was introduced in 2015 as a new and extremely simple way for local farmers to breed fish in China. It is also known as “container fish-farming for dummies”. Generating up to 35 times of fish harvest per square meter compared to traditional fish farms in the pond, it also conserves the ecosystem of lakes, reduces local poverty, and protects the species from natural disasters.

Domestic demand in China is increasing the number of aquaculture projects and investment, therein. Our Aquaculture solution is innovative and environmentally friendly using a state-of-the-art water recycling and filtration system. We estimate the domestic demand in China could be over 10,000 containers, both cylinder and rectangular, in the next 5 years and globally. We believe that there could be a demand for 15,000 containers.

Today, China is faced with the growing challenge of reducing and controlling water pollution that presents serious health risks to its population and damages the environment. We believe that our Aquaculture container fish farm represents a large-scale, environmentally friendly and economically feasible form for bringing clean fish to the table and bringing clean water back to the people. In our opinion, our service is cost competitive, reduces water pollution and recycles fish waste and will help make for a greener China and better world in the years to come.

Strategy

We aim to become a global leader, starting from China, in the field of land-based aquaculture business. We believe following strategies are the critical to achieve this goal:

Continue to cooperate with China International Marine Container Corporation (“CIMC”)

On October 25, 2017, Guizhou Wan Feng Hu Intelligent Aquatic Technology Co., Ltd. was established with 5% shares held by Dongguan China International Marine Container Corporation, a subsidiary of CIMC. This is a strategic alliance where CIMC subcontracted to us to design, manufacture and install our recirculating aquaculture systems (“RAS”).

Focus on the countries with growing population and growing demand for food

By 2050 we’ll need to double the global food supply to feed the world’s growing population. There is a growing need for new ways to produce high-quality local fish without putting more pressure on our natural ecosystems. Like China, there are also many countries with growing population and growing demand for high-protein food. We plan to go global through building demo sites promoting our RAS and selling our price-competitive systems in these countries for their demand for food and greener environment.

Customers

Currently we have a firm order to build 800 sets of 2 meters high by 8 meters wide cylindrical fish farming containers that we received from Dongguan CIMC Intelligent Technology Co., Ltd (“DG CIMC”), which holds 5% non-controlling interest of GZ WFH, and Shen Zhen CIMC Intelligent Technology Co. Ltd (“SZ CIMC”) in 2018. Both DG CIMC and SZ CIMC are subsidiaries of China International Marine Container Corporation (“CIMC”). We estimate this order to be valued at approximately $8.2 million and we have already delivered 473 sets during the year ended December 31, 2018. We expect to deliver these sets throughout 2019.

In July 2019, we entered into a sales agreement of 400 sets RAS tanks with DG CIMC, amounting to approximately $5.7 million (RMB 40 million). According to the agreement, the customer shall make 40% of the consideration as down payment before we start the manufacturing. We expect to receive the down payment in the fourth quarter of 2019, and target to complete the manufacturing of the 400 sets in the first quarter of 2020. The agreement is attached hereto as Exhibit 6.4.

In September 2019, we entered into an exclusive distribution agreement (“distribution agreement”) with JC Development, Co. Ltd. in Taiwan, which is an independent third party company. JC Development Co, Ltd. agrees to pay Nocera a total amount of $5 million over 5 years starting September 2019 to be our perpetual exclusive sales agent in Asia Pacific. We agreed to pay 8% commission of total sales excluding sales made by CIMC Smart Science & Technology CO., Ltd. (“CIMC SSC”) in China. The distribution agreement is attached hereto as Exhibit 6.5.

In 2019, we intend to target customers in a variety of markets, such as individual investors, government supported or funded companies and international customers. We have received interest from areas like Japan, Taiwan, Thailand, and the United States. In addition, an increasing amount of Chinese state and local offices are faced with environmental challenges in public waters and are under regulatory directives and political pressure to reduce water pollution, so our potential target customers are significant. During the year ended December 31, 2018 and 2017, the net sales were $4.8 million and nil, respectively.

Suppliers

We intend to purchase raw materials and electrical parts and equipment from third parties in the PRC and resell and install to customers. We are not directly involved in the production or manufacturing of this equipment and we do not take a risk in the repair and maintenance of this equipment because of the manufacturer’s maintenance policy but may provide maintenance personnel. Three suppliers accounted for 49.0% in total, and no supplier accounted for over 10% of our total purchase amount during the years ended December 31, 2018 and 2017, respectively. Presently, our relationships with suppliers are generally good and we expect that our suppliers will be able to meet the anticipated demand for our products in the future.

Products

Following are examples of the land-based recirculating aquaculture systems:

Competition

The market for aquaculture projects and services is highly competitive. Many of the producers and sellers are large entities that have significantly greater resources than we have. Therefore, we are partnering with CIMC to use their labor and customer relationships and hopefully gain a more competitive advantage. We also compete with small suppliers which provide smaller alternative aquaculture solutions regionally but due to the size of our projects, we believe that we should have a better price point.

Trademarks and Patents

Currently, we have three patent applications pending approval in China:

1. An invention patent for a mechanical filter for water purification system. *

2. An invention patent for a preparation method technology for cultured water. *

3. A utility model patent for an oxygen-enhancing device..*

We currently do not have any trademarks registered in China.

* To be filed by Amendment once translated from Chinese to English.

Government Regulation

Our business depends in part on environmental regulations and programs in China that promote cleaner water sources to restore clean water back to people. Our customers may be encouraged with incentives by the local governments relating to aquaculture investment. The approvals of land, licenses or permits, are required from relevant central and local government authorities. In addition, from time to time, relevant government authorities may impose new regulations at a local level regulating fish farming. We believe that we have skills to help our customers obtain all necessary licenses, registrations, and permits to comply with all requirements necessary to allow our customers and investors to conduct aquaculture business in the PRC.

Legal Proceedings

We are currently not a party to any legal or administrative proceedings and are not aware of any pending or threatened legal or administrative proceedings against us in all material aspects. We may from time to time become a party to various legal or administrative proceedings arising in the ordinary course of our business.

Seasonality

Since we have a strategic alliance with the China International Marine Container Corporation (“CIMC”) and our fish farming systems provide a controlled and traceable environment for species, our business rarely suffers a seasonal impact.

Employees

As of October 28, 2019, we have 13 full-time employees and 2 part-time employees. We are compliant with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees.

Properties

Our headquarter is located at 2030 Powers Ferry Road, Suite #212 in Atlanta, Georgia. The office is rented by Coral Capital Partners and Mountain Share Transfer, LLC, companies 100% controlled by Erik S. Nelson, our former CEO and our current corporate secretary. Mr. Nelson sub-leases this space to us free.

We also lease approximately 370 square meters of space in Xing Yi City, Guizhou Qian Xi Nan, PRC, with a period of 10 years, which will expire on May 10, 2028. The rental expense is approximately $245 per month for the first five years, and it is subject to a market adjustment for the second five years. We believe that our existing facilities are adequate for our current requirements and we will be able to enter into lease arrangements on commercially reasonable terms for future expansion. We do not own any real property.

RISK FACTORS

The purchase of shares of our common stock involves substantial risks. Each prospective investor should carefully consider the following risk factors, in addition to any other risks associated with this investment and should consult with his/her own legal and financial advisors.

Cautionary Statements

The discussions and information in this Offering Circular may contain both historical and forward-looking statements. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of our business, please be advised that our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by us in forward-looking statements. We have attempted to identify, in context, certain of the factors we currently believe may cause actual future experience and results to differ from our current expectations. The differences may be caused by a variety of factors, including but not limited to adverse economic conditions, lack of market acceptance of our aquaculture solutions, unrecoverable losses from theft, intense competition for customers, supplies, and government grants, including entry of new competitors, lack of demand for fish farming, adverse federal, state, and local government regulation, absence of suitable, unexpected costs and operating deficits, lower sales and revenues than forecast, default on leases or other indebtedness, loss of suppliers, loss of supply, loss of distribution and service contracts, price increases for capital, supplies and materials, inadequate capital, inability to raise capital or financing, failure to obtain customers, loss of customers and failure to obtain new customers, the risk of litigation and administrative proceedings involving us or our employees, loss of government licenses and permits or failure to obtain them, higher than anticipated labor costs, the possible acquisition of new businesses or products that result in operating losses or that do not perform as anticipated, resulting in unanticipated losses, the possible fluctuation and volatility of

our operating results and financial condition, adverse publicity and news coverage, the failure of business acquisitions to be successful or profitable, inability to carry out marketing and sales plans, loss of key executives, changes in interest rates, inflationary factors, and other specific risks that may be alluded to in this Offering Circular or in other reports issued us or third party publishers.

Risks Related to Our Business

Our operating history makes it difficult to evaluate our future business prospects and to make decisions based on our historical performance.

We have a very short operating history, which makes it difficult to evaluate our business on the basis of historical operations. As a consequence, it is difficult to forecast our future results based upon our limited historical data. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, services costs or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could incur greater losses, which may result in a negative effect on our stock price.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly, year-to-date and annual expenses as a percentage of our revenues may differ significantly from our historical or projected rates. Our operating results in future quarters may fall below expectations. Any of these events could cause our stock price to fall. Each of the risk factors listed in this section and the following factors may affect our operating results:

| | · | Our ability to continue to attract customers; |

| | · | Our ability to generate revenue from the services we offer; |

| | · | The amount and timing of operating costs and capital expenditures related to the maintenance and expansion of our businesses; and |

| | · | Our focus on long-term goals over short-term results. |

Because our business is changing and evolving, our historical operating results may not be useful to you in predicting our future operating results.

We may not be successful in implementing important strategic initiatives, which may have a material adverse impact on our business and financial results.

There is no assurance that we will be able to implement important strategic initiatives in accordance with our expectations, which may result in a material adverse impact on our business and financial results. These strategic initiatives are designed to drive long-term shareholder value and improve our Company’s results of operations.

Our success depends substantially on the value of our reputation.

Reputation value is based in part on client perceptions as to a variety of subjective qualities. Even isolated business incidents that erode client trust, particularly if the incidents receive considerable publicity or result in litigation, can significantly reduce our reputation. Demand for our services could diminish significantly if we fail to preserve quality or fail to deliver a consistently positive client experience.

Effectively managing our growth into new geographic areas will be challenging.

Effectively managing growth can be challenging, particularly as we expand into new markets geographically where we must balance the need for flexibility and a degree of autonomy for local management against the need for consistency with our goals, philosophy, and standards. Growth can make it increasingly difficult to locate and hire sufficient numbers of key employees to meet our financial targets, to maintain an effective system of internal controls, and to train employees nationally to deliver a consistently high-quality service and customer experience.

We face significant competition, and if we do not compete successfully against new and existing competitors, we may lose our market share, and our profitability may be adversely affected.

Increased competition could reduce our profitability and result in the inability to achieve any market share. Some of our existing and potential competitors may have competitive advantages, such as significantly greater financial, marketing or other resources, and may successfully mimic and adopt our business models. We cannot assure you that we will be able to successfully compete against new or existing competitors.

Failure to manage our growth could strain our management, operational and other resources, which could materially and adversely affect our business and prospects.

We intend to expand our operations and plan to expand in China and outside of China. The continued growth of our business will result in, substantial demand on our management, operational and other resources. In particular, the management of our growth will require, among other things:

| | · | increased sales and sales support activities; |

| | · | improved administrative and operational systems; |

| | · | enhancements to our information technology system; |

| | · | stringent cost controls and sufficient working capital; |

| | · | strengthening of financial and management controls; and |

| | · | hiring and training of new personnel. |

As we continue this effort, we may incur substantial costs and expend substantial resources. We may not be able to manage our current or future operations effectively and efficiently or compete effectively in new markets we enter. If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

Key employees are essential to growing our business.

Because of our small size, we require the continued service and performance of our management team, sales and technology employees, all of whom we consider to be key employees. Competition for highly qualified employees in the financial services and healthcare industry is intense. Our success will depend to a significant degree upon our ability to attract, train, and retain highly skilled directors, officers, management, business, financial, legal, marketing, sales, and technical personnel and upon the continued contributions of such people. In addition, we may not be able to retain our current key employees. The loss of the services of one or more of our key personnel and our failure to attract additional highly qualified personnel could impair our ability to expand our operations and provide service to our customers.

Mr. Yin-Chieh Cheng and Mr. Bi Zhang are essential to our ability to continue to grow our business. They have established relationships within the industries in which we will operate. If they were to leave us, our growth strategy might be hindered, which could limit our ability to increase revenue.

In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

We may need additional capital and we may not be able to obtain it at acceptable terms, or at all, which could adversely affect our liquidity and financial position.

We may need additional cash resources due to changed business conditions or other future developments. If these sources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The occurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations and liquidity.

Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| | · | investors’ perception of, and demand for, our securities; |

| | · | conditions of the U.S. and other capital markets in which we may seek to raise funds; |

| | · | our future results of operations, financial condition, and cash flow; |

| | · | PRC governmental regulation of foreign investment in China; |

| | · | economic, political and other conditions in China; and |

| | · | PRC governmental policies relating to foreign currency borrowings. |

We may be dependent on various suppliers which may be unable to supply our orders, from time to time, and which may affect our ability to complete our client contracts timely.

We will not obtain our raw materials and electrical equipment and parts from only one local primary supplier. Our ability to deliver the services to the end user is dependent on a sufficient supply and better price point and if we cannot obtain a sufficient supply from several sources, we may be prevented from making timely deliveries to our customers. Any failure to obtain supplies of equipment for implementation of aquaculture installations could prevent us from delivering our services to our customers on a timely basis, or an economic basis, and could have a material adverse effect on our business and financial conditions.

We do not have a majority of independent directors serving on our board of directors, which could present the potential for conflicts of interest.

We do not have a majority of independent directors serving on our board of directors. In the absence of a majority of independent directors, our executive officers could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between us and our stockholders, generally, and the controlling officers, stockholders or directors.

We have limited insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited insurance services. We have determined that the risks of disruption or liability from our business, the loss or damage to our property, including our facilities, equipment, and office furniture, the cost of insuring for these risks, and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not have any business liability, disruption, litigation or property insurance coverage for our operations in China except for insurance on some company-owned vehicles. Any uninsured occurrence of loss or damage to property, or litigation or business disruption may result in the incurrence of substantial costs and the diversion of resources, which could have an adverse effect on our operating results.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Since we recently completed the acquisition of GSI effective on December 31, 2018, we have not yet completed an evaluation of GSI and its consolidated subsidiaries’ internal control systems in order to allow our management to report on our internal controls on a consolidated basis as required by the requirements of SOX 404. We will be required to complete such evaluation and include a report of management in our annual report for the fiscal year ended December 31, 2018.

As a public company, we will have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Lack of experienced officers of publicly-traded companies may hinder our ability to comply with the Sarbanes-Oxley Act.

We do not have highly experienced officers in the financial operations of publicly traded companies, and it may be time-consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff or consultants in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with internal controls requirements, we may not be able to obtain the independent auditor certifications that the Securities Exchange Act of 1934 requires publicly-traded companies to obtain, for each fiscal year.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act, as well as new rules subsequently implemented by the Securities and Exchange Commission (the “SEC”), has required changes in corporate governance practices of public companies. Our foreign operations involving audits of the WFOE and the VIE will involve substantial additional time and expense, due to our being a public company. We expect these rules and regulations to increase our legal, accounting and financial compliance costs and to make public corporate activities more time-consuming and costly.

Risks Associated With Doing Business in China

Our operations and assets in China are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under its current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice. This presents a continuing potential uncertainty for our investors

The primary substantial portion of our revenues initially will be derived from China.

We anticipate that sales of our services in China will represent our primary revenues in the near future. Any significant decline in the condition of the PRC economy could adversely affect consumer demand of our services, among other things, which in turn would have a material adverse effect on our business and financial condition.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese Renminbi into foreign currencies and, if Chinese Renminbi were to decline in value, reducing our revenue in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in China use their local currency as their functional currencies. Substantially, all of our revenue and expenses are in Chinese Renminbi. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the Renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of Renminbi to the U.S. dollar had generally been stable and the Renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of the Chinese Renminbi to the U.S. dollar. Under the new policy, Chinese Renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese Renminbi against the U.S. dollar. We can offer no assurance that the Chinese Renminbi will be stable against the U.S. dollar or any other foreign currency.

The income statements of our operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transaction may be limited, and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of Chinese Renminbi into foreign currency for current account items, conversion of Chinese Renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or the SAFE. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or

that Chinese regulatory authorities will not impose greater restrictions on the convertibility of Chinese Renminbi in the future. Because a significant amount of our future revenue may be in the form of Chinese Renminbi, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in Chinese Renminbi to fund our business activities outside of China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations.

We may rely on dividends and other distributions from our PRC subsidiary to fund our cash and financing requirements and any limitation on the ability of our subsidiary to make payments to us could materially and adversely affect our ability to conduct our business.

As an offshore holding company (based in the USA), we will rely principally on dividends from the WFOE, our PRC subsidiary, for our cash requirements, dividends payments and other distributions to our shareholders, and to service any debt that we may incur and pay our operating expenses. The payment of dividends by entities organized in China is subject to limitations. In particular, PRC regulations permit the WFOE to pay dividends only out of its accumulated profits, if any, as determined in accordance with Chinese accounting standards and regulations. In addition, the WFOE is required each year to set aside at least 10% of its annual after-tax profits (as determined under PRC accounting standards) into its statutory reserve fund until the aggregate amount of that reserve reaches 50% of such entity’s registered capital. These reserves are not distributable as cash dividends.

If the WFOE incurs debt on its own behalf, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us. Any limitation on the ability of the WFOE to distribute dividends or other payments to us could materially and adversely limit our ability to grow, make investments or acquisitions, pay dividends and otherwise fund and conduct our business.

We may be subject to product liability claims if people or properties are harmed by the services sold by us.

The products intended to be sold by us, as part of our services, are manufactured by third parties. The products may be defectively designed or manufactured. As a result, sales of the products could expose us to liability claims relating to personal injury or property damage and may require products recalls or other actions. Third parties subject to such injury or damage may bring claims or legal proceedings against us as the reseller of the products. We do not currently maintain any third-party liability insurance or products liability insurance in relation to products we intend to sell in conjunction with our services. As a result, any material products liability claim or litigation could have a material and adverse effect on our business, financial condition and results of operations. Even unsuccessful claims could result in the expenditure of funds and managerial efforts in defending them and could have a negative impact on our reputation.

We may have limited legal recourse under PRC laws if disputes arise under our contracts with third parties.

The Chinese government has enacted laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation, and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our new business ventures are unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under PRC law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or

retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Changes in foreign exchange regulations in the PRC may affect our ability to pay dividends in foreign currency or conduct other foreign exchange business.

The Renminbi is not a freely convertible currency currently, and the restrictions on currency exchanges may limit our ability to use revenues generated in Renminbi to fund our business activities outside the PRC or to make dividends or other payments in United States dollars. The PRC government strictly regulates the conversion of Renminbi into foreign currencies. Over the years, foreign exchange regulations in the PRC have significantly reduced the government’s control over routine foreign exchange transactions under current accounts. In the PRC, the SAFE regulates the conversion of the Renminbi into foreign currencies. Pursuant to applicable PRC laws and regulations, foreign-invested enterprises incorporated in the PRC are required to apply for foreign exchange registration. Currently, conversion within the scope of the “current account” (e.g. remittance of foreign currencies for payment of dividends, etc.) can be effected without requiring the approval of SAFE. However, conversion of currency in the “capital account” (e.g. for capital items such as direct investments, loans, securities, etc.) still requires the approval of SAFE.

PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the proceeds of any offering to make loans or capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and ability to fund and expand our business.

We may transfer funds to or finance the WFOE, our PRC subsidiary, by means of shareholder’s loans or capital contributions. Any loans to the WFOE, which is a foreign-invested enterprise, cannot exceed statutory limits based on the amount of our investments in the WFOE, and shall be registered with the SAFE or its local counterparts. Furthermore, any capital contributions we make to the WFOE shall be approved by the Ministry of Commerce, or the MOFCOM, or its local counterparts. We may not be able to obtain these government registrations or approvals on a timely basis, if at all. If we fail to receive such registrations or approvals, our ability to provide loans or capital contributions to the WFOE may be negatively affected, which could adversely affect our liquidity and our ability to fund and expand our business.

In addition, the SAFE promulgated the Circular on the Relevant Operating Issues concerning Administration Improvement of Payment and Settlement of Foreign Currency Capital of Foreign-invested Enterprises, or SAFE Circular No. 142, on August 29, 2008. Under SAFE Circular No. 142, registered capital of a foreign-invested company settled in Renminbi converted from foreign currencies may only be used within the business scope approved by the applicable governmental authority and may not be used for equity investments in the PRC, unless otherwise provided by other PRC laws or regulations. In addition, foreign-invested enterprises may not change how they use such capital without SAFE’s approval and may not, in any case, use such capital to repay Renminbi loans if they have not used the proceeds of such loans. SAFE further promulgated the Circular on Further Clarification and Regulation of the Issues Concerning the Administration of Certain Capital Account Foreign Exchange Businesses, or SAFE Circular No. 45, on November 16, 2011, which expressly prohibits foreign-invested enterprises from using the registered capital settled in Renminbi converted from foreign currencies to grant loans through entrustment arrangements with a bank, repay inter-company loans or repay bank loans that have been transferred to a third party. SAFE Circular No. 142 and SAFE Circular No. 45 may significantly limit our ability to transfer the net proceeds from an offshore offering to the WFOE and convert the net proceeds into Renminbi to invest in or acquire any other PRC companies, which may adversely affect our liquidity and our ability to fund and expand our business in the PRC.

A failure by the beneficial owners of our shares who are PRC residents to comply with certain PRC foreign exchange regulations could restrict our ability to distribute profits, restrict our overseas and cross-border investment activities and subject us to liability under PRC law.

The SAFE has promulgated regulations, including the Notice on Relevant Issues Relating to Domestic Residents’ Investment and Financing and Round-Trip Investment through Special Purpose Vehicles, or SAFE Circular No. 37, effective on July 14, 2018, and its appendixes, that require PRC residents, including PRC institutions and individuals, to register with local branches of the SAFE in connection with their direct establishment or indirect control of an offshore entity, for the purpose of overseas investment and financing, with such PRC residents’ legally owned assets or equity interests in domestic enterprises or offshore assets or interests, referred to in SAFE Circular No. 37 as a “special purpose vehicle.” SAFE Circular No. 37 further requires an amendment to the registration in the event of any significant changes with respect to the special purpose vehicle, such as an increase or decrease of capital contributed by PRC individuals, share transfer or exchange, merger, division or another material event. In the event that a PRC shareholder holding interests in a special purpose vehicle fails to fulfill the required SAFE registration, the PRC subsidiaries of that special purpose vehicle may be prohibited from making profit distributions to the offshore parent and from carrying out subsequent cross-border foreign exchange activities, and the special purpose vehicle may be restricted in their ability to contribute additional capital into its PRC subsidiary. Further, failure to comply with the various SAFE registration requirements described above could result in liability under PRC law for foreign exchange evasion.

These regulations apply to our direct and indirect shareholders who are PRC residents and may apply to any offshore acquisitions or share transfers that we make in the future if our shares are issued to PRC residents. Mr. Bi Zhang is a PRC resident, and if he is deemed to be beneficially holding interests in us without making appropriate registration pursuant to SAFE Circular No. 37, the WFOE, as our PRC subsidiary, could be subject to fines and legal penalties, and the SAFE could restrict our cross-border investment activities and our foreign exchange activities, including restricting the WFOE’s ability to distribute dividends to or obtain loans denominated in foreign currencies from us, or prevent us from paying dividends. As a result, our business operations and our profitability could be materially and adversely affected.

PRC regulations relating to mergers and acquisitions and overseas listings of domestic enterprises by foreign investors may increase the administrative burden we face and create regulatory uncertainties.

The Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule, which became effective in September 2006 and were further amended in June 2009, requires that if an overseas company is established or controlled by PRC domestic companies or citizens intends to acquire equity interests or assets of any other PRC domestic company affiliated with the PRC domestic companies or citizens, such acquisition must be submitted to the MOFCOM, rather than local regulators, for approval. In addition, the M&A Rule requires that an overseas company controlled directly or indirectly by PRC companies or citizens and holding equity interests of PRC domestic companies needs to obtain the approval of the China Securities Regulatory Commission, or CSRC, prior to listing its securities on an overseas stock exchange. On September 21, 2006, the CSRC published a notice on its official website specifying the documents and materials required to be submitted by overseas special purpose companies seeking CSRC’s approval of their overseas listings.

While the application of the M&A Rule remains unclear, based on our understanding of current PRC laws, regulations, and the notice published on September 21, 2006, since the WFOE, our operating entity, was established by means of direct investment, rather than by merger or acquisition of the equity interest or assets of any “domestic company” as defined under the M&A Rules, we believe we are not required to submit an application to the MOFCOM or the CSRC for its approval for any of our transactions.

However, we cannot assure you that PRC governmental authorities, including the MOFCOM and the CSRC, will reach the same conclusion as us. If the MOFCOM, the CSRC and/or other PRC regulatory agencies subsequently determine that the approvals from the MOFCOM and/or CSRC and/or other PRC regulatory agencies were required, our PRC business could be challenged, and we may need to apply for a remedial approval and may be subject to certain administrative punishments or other sanctions from PRC regulatory agencies. The regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of our foreign currency in our offshore bank accounts into the PRC, or take other actions that could

materially and adversely affect our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ordinary shares.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

China only recently has permitted provincial and local economic autonomy and private economic activities, and, as a result, we are dependent on our relationship with the local government in the province in which we operate our business. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, product liabilities, environmental regulations, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in PRC subsidiaries.

Future inflation in China may inhibit our activity to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our services.

We may have difficulty establishing adequate management, legal and financial controls in the PRC.

We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. We may have difficulty establishing adequate management, legal and financial controls in the PRC.

We may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on the United States or other foreign laws against us and our management.

We conduct substantially all our operations in China and substantially all our assets are located in China. In addition, some of our directors and executive officers reside in China. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon some of our directors and senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. It would also be difficult for investors to bring an original lawsuit against us or our directors or executive officers before a Chinese court based on U.S. federal securities laws or otherwise. Moreover, China does not have treaties with the United States or any other countries providing for the reciprocal recognition and enforcement of the judgment of courts.

Under the EIT Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and holders of our securities.

Under the EIT Law, an enterprise established outside of China with its “de facto management body” in China is considered a “resident enterprise,” meaning that it can be treated the same as a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define “de facto management body” as an organization that exercises “substantial and overall management and control over the services and operations, personnel, accounting, and properties” of an enterprise. On April 22, 2009, the SAT, issued a circular, or SAT Circular No. 82,

providing certain specific criteria for determining whether the “de facto management body” of a PRC-controlled enterprise that is incorporated offshore is located in China, which include all of the following conditions: (a) the location where senior management members responsible for an enterprise’s daily operations discharge their duties; (b) the location where financial and human resource decisions are made or approved by organizations or persons; (c) the location where the major assets and corporate documents are kept, and (d) the location where more than half (inclusive) of all directors with voting rights or senior management have their habitual residence.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we will be subject to enterprise income tax at a rate of 25% on our worldwide income as well as PRC enterprise income tax reporting obligations. This would mean that income such as interest in offering proceeds and other non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us by our PRC subsidiaries would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that a 10% withholding tax is imposed on dividends we pay to our non-PRC enterprise shareholders and with respect to gains derived by our non-PRC enterprise shareholders from transferring our shares, and a 20% withholding tax is imposed on dividends we pay to our non-PRC individual shareholders and with respect to gains derived by our non-PRC individual shareholders from transferring our shares.

We face uncertainties with respect to the application of the Circular on Strengthening the Administration of Enterprise Income Tax for Share Transfer by Non-PRC Resident Enterprises.